This document will continue to evolve as existing sections change and new information is added. All updates are logged below, with the most recent updates at the top.

| Date |

What’s Changed |

Notes |

|---|---|---|

| 02 SEP 2016 |

Oracle Fusion Absence Management: Configuration Option for Integration with Time and Labor |

Added new feature information delivered in Update 21 (August). |

| 02 SEP 2016 |

Oracle Fusion Absence Management: Improved Absence Certifications Process |

Added new feature information delivered in Update 15 (March). |

| 02 SEP 2016 |

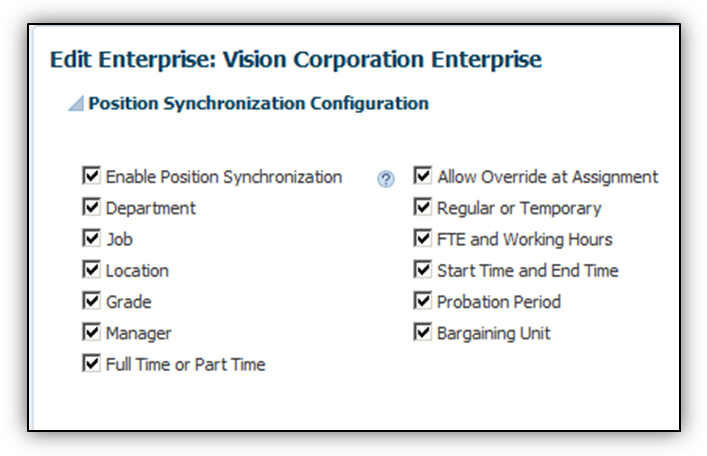

Oracle Fusion Global Human Resources: Position Synchronization When Using HCM Data Loader to Load Position Changes |

Added new feature information delivered in Update 10 (October 15). |

| 02 SEP 2016 |

Oracle Fusion Absence Management: Provide Additional Flexibility for Accrual Calculations |

Added new feature information delivered in Update 7 (July 15). |

| 02 SEP 2016 |

Oracle Fusion Absence Management: Provide Rolling Forward Periods for Qualification Plans |

Added new feature information delivered in Update 7 (July 15). |

| 02 SEP 2016 |

Oracle Fusion Absence Management: New Attributes for Calculation of Qualified Entitlements |

Added new feature information delivered in Update 7 (July 15). |

| 05 AUG 2016 |

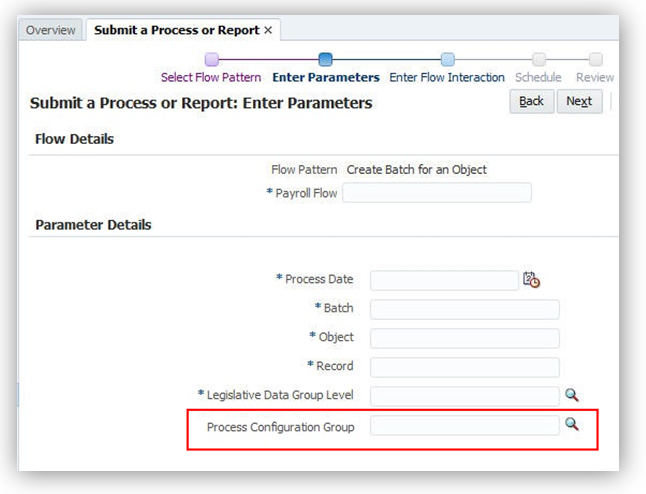

Oracle Fusion Global Payroll: Additional Flow Parameter for Create Batch for an Object |

Added new feature information delivered in Update 20 (August). |

| 05 AUG 2016 |

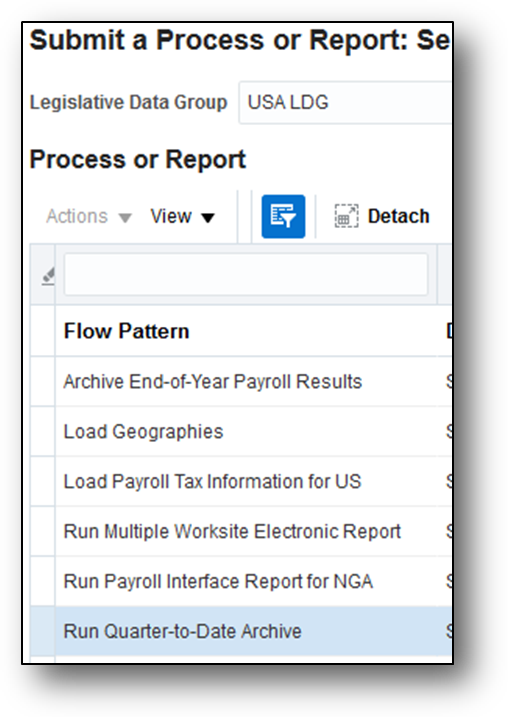

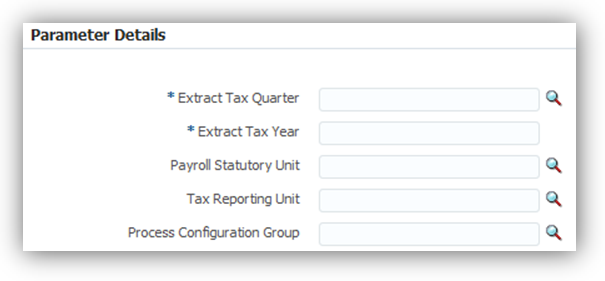

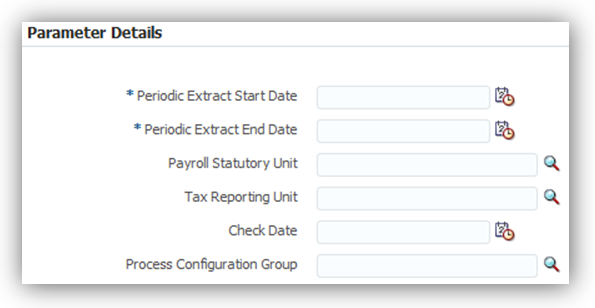

Oracle Fusion Global Human Resources for the United States: Refined Data Selection for Third-Party Tax Filing Extracts |

Added new feature information delivered in Update 20 (August). |

| 05 AUG 2016 |

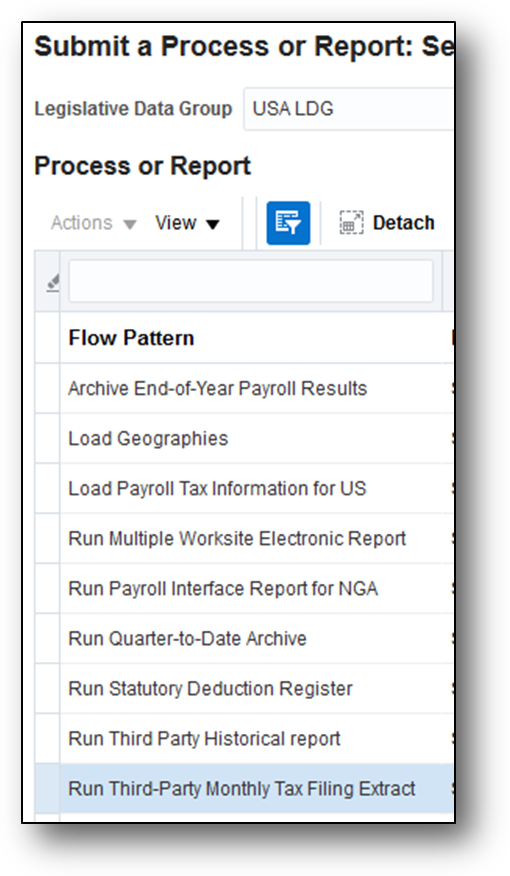

Oracle Fusion Global Human Resources for the United States: Set Check Date on Third-Party Periodic Tax Filing Extract |

Added new feature information delivered in Update 20 (August). |

| 05 AUG 2016 |

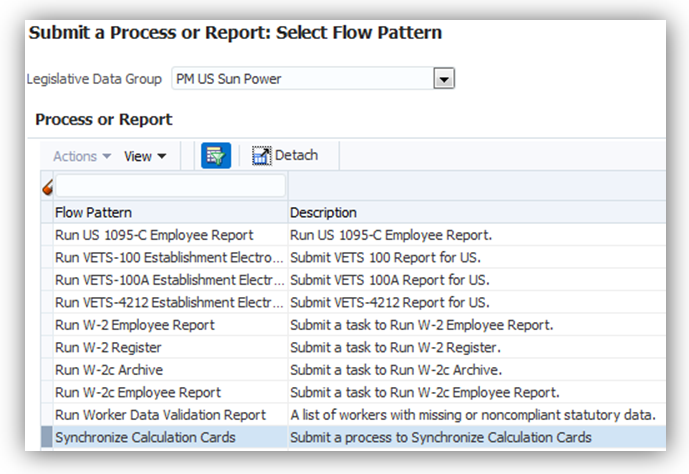

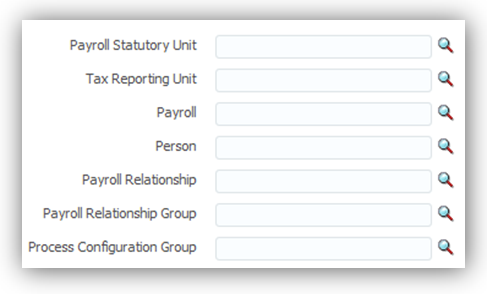

Oracle Fusion Global Human Resources for the United States: Synchronize Employee Withholding Certificates With HR Data |

Updated documentation delivered in Update 19 (July). |

| 05 AUG 2016 |

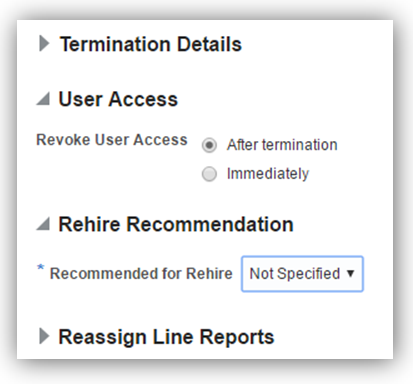

Oracle Fusion Global Human Resources: Additional Option for Rehire Recommendation |

Feature information delivered in Update 20 (August). |

| 05 AUG 2016 |

Oracle Fusion Absence Management: View Accrued Entitlements |

Feature information delivered in Update 10 (October). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources- HCM Data Loader: User-Key Support for Multirow Extensible Key Flexfields |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

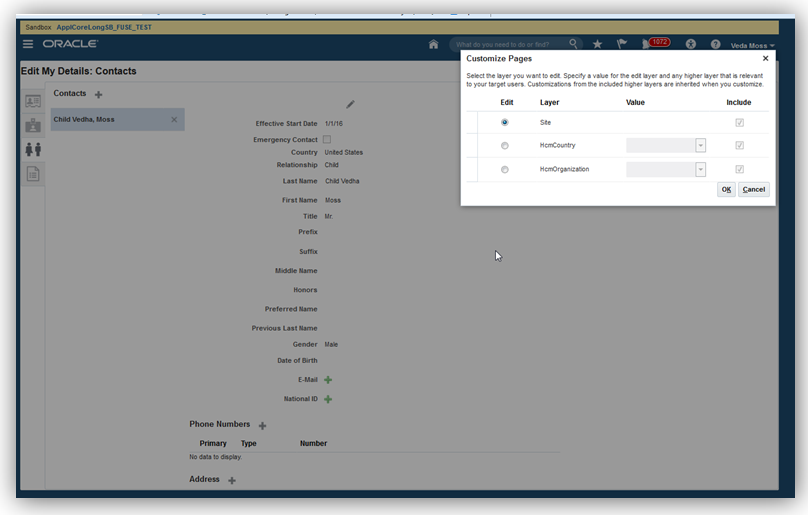

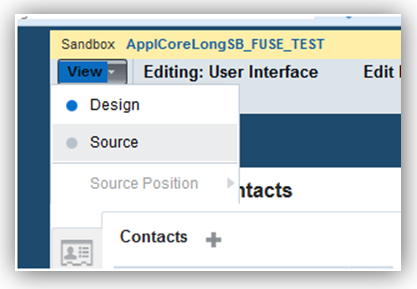

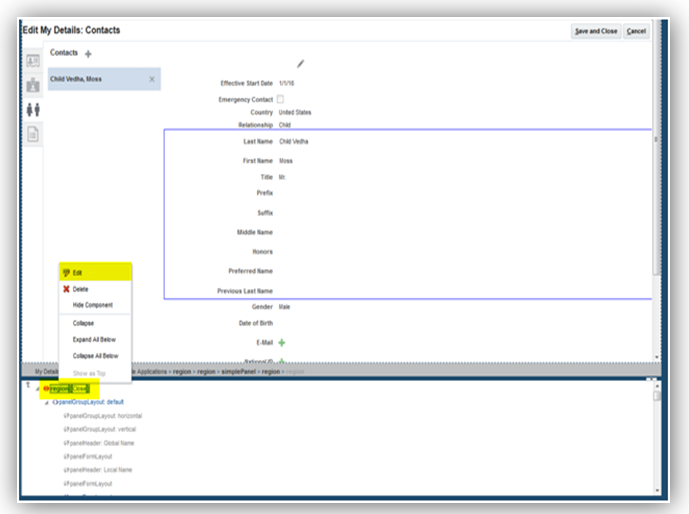

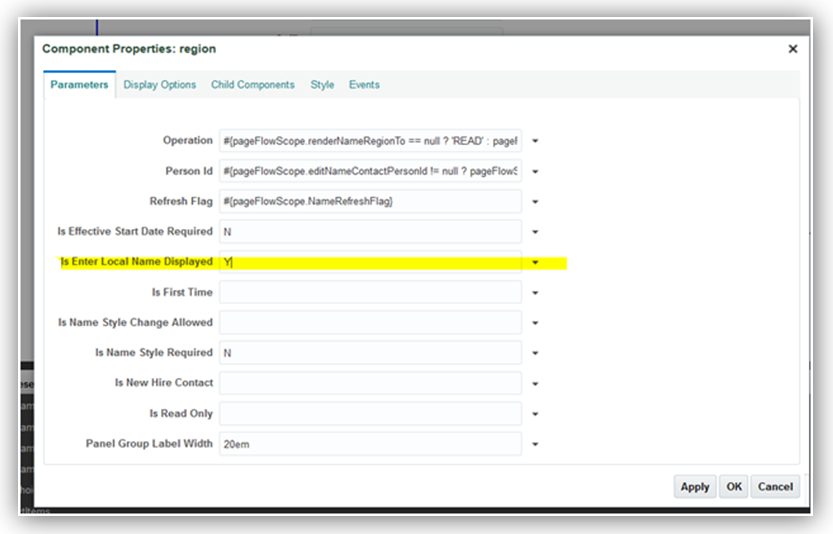

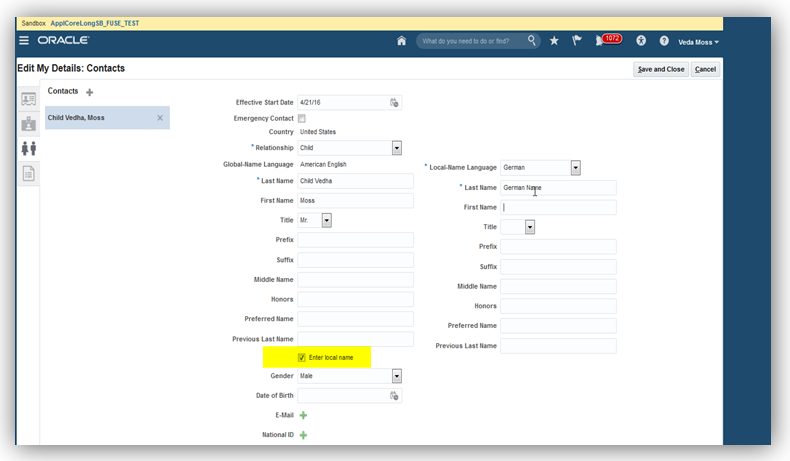

Oracle Fusion Global Human Resources: Local Name Support on Edit My Details Page |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

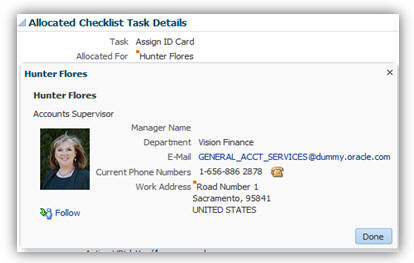

Oracle Fusion Global Human Resources: Worklist Management – Checklist Real Time |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

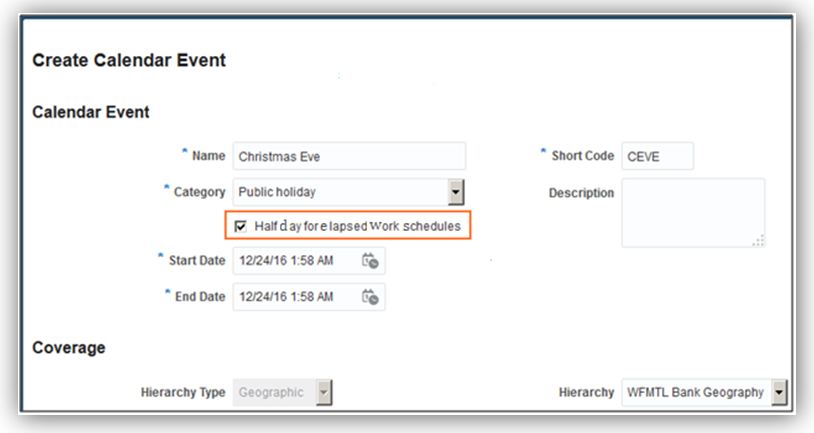

Oracle Fusion Global Human Resources: Half Day Calendar Events for Elapsed Work Schedules |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

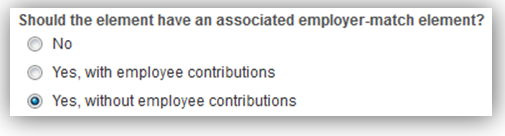

Oracle Fusion Global Human Resources for the United States: Enhanced Employer Matching for 401 (k) Deferred Compensation Plans |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources for the United States: Synchronize Employee Withholding Certificates With HR Data |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources for the United States: Include Resident and Nonresident City and County Tax Balances on Quarterly Tax Filing |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

Oracle HCM Common Features- HCM Data Loader: Simplify Global Transfers Performed by Data Upload |

Feature information delivered in Update 19 (July). |

| 01 JUL 2016 |

Oracle HCM Common Features- HCM Data Loader: Upload of Assignment Records with Effective Dates That Are Later Than the Termination Date |

Feature information delivered in Update 17 (May). |

| 01 JUL 2016 |

Oracle HCM Common Features- HCM Data Loader: Enhanced Validation of Worker Records by HCM Data Loader |

Feature information delivered in Update 17 (May). |

| 03 JUN 2016 |

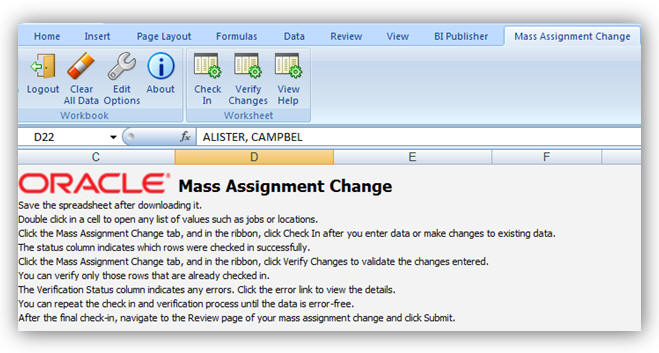

Oracle Fusion Global Human Resources: Buttons Relocated to Ribbon in Mass Assignment Change Spreadsheet |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Information Balances in the Payroll Balance Report |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Person and Payroll Relationship Group Parameters for Run Deduction Report |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

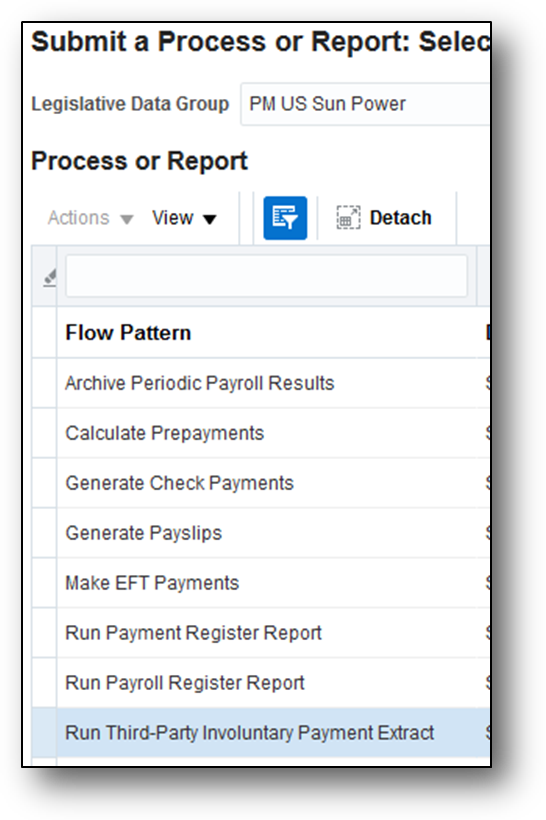

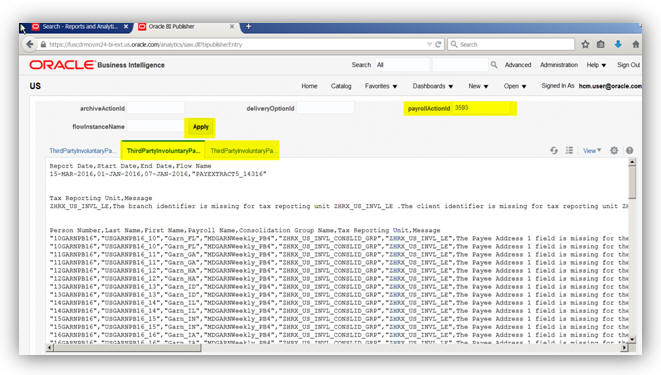

Oracle Fusion Global Human Resources for the United States: Third-Party Involuntary Payment Extract Reports |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources for the United States: Courtesy Tax Implementation |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources for the United States: Support for Resident and Nonresident Balances in Third-Party Quarterly Tax Filing |

Feature information delivered in Update 18 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Deduction Category and Deduction Parameters for Run Deduction Report |

Feature information delivered in Update 17 (May). |

| 03 JUN 2016 |

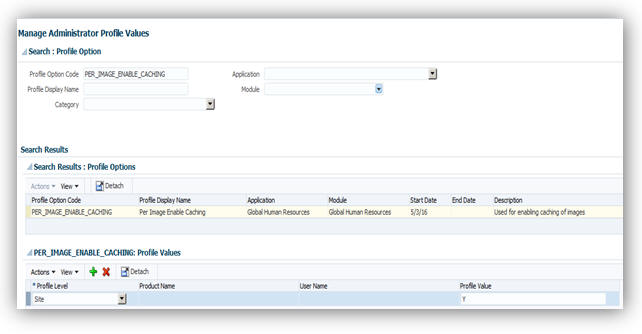

Oracle Fusion Global Human Resources: New Profile Option to Cache Person Images |

Feature information delivered in Update 17 (May). |

| 03 JUN 2016 |

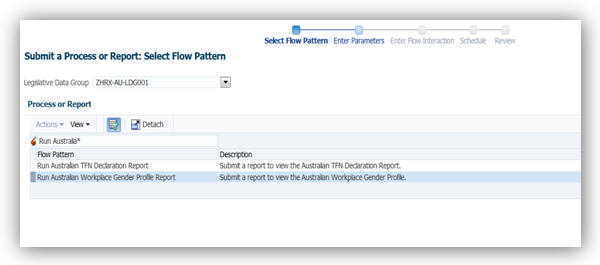

Oracle Fusion Global Human Resources for Australia: Capture Of Non-Specific Gender |

Feature information delivered in Update 17 (May). |

| 03 JUN 2016 |

Oracle HCM Cloud Common - HCM Data Loader: Purge Person Data |

Feature information delivered in Update 17 (May). |

| 03 JUN 2016 |

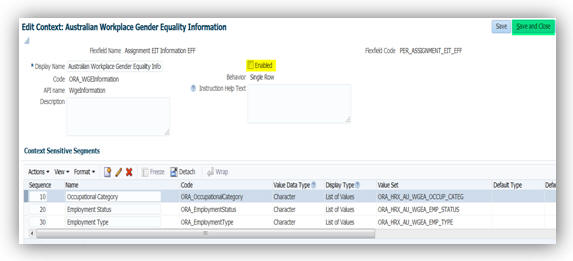

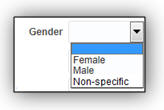

Oracle Fusion Global Human Resources for Australia: Workplace Gender Equality Profile Report |

Feature information delivered in Update 13 (January). |

| 06 MAY 2016 |

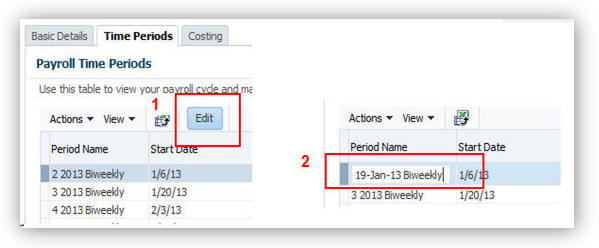

Oracle Fusion Global Payroll: Edit Payroll Period Names |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

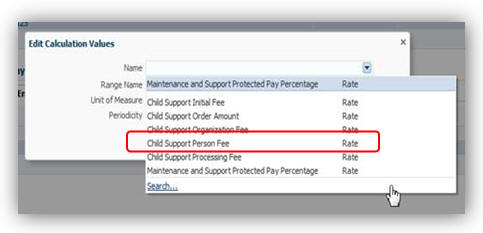

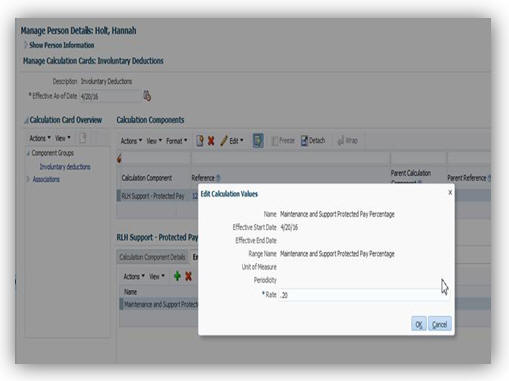

Oracle Fusion Global Human Resources for Canada: Involuntary Deductions: Protected Pay Percentage |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for the United States: Third-Party Tax Filing Interface Support for User-Defined Taxes |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for the United States: Payroll Payment Date Override |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for the United States: Payroll Batch Loader Support for Regional Tax Levies |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

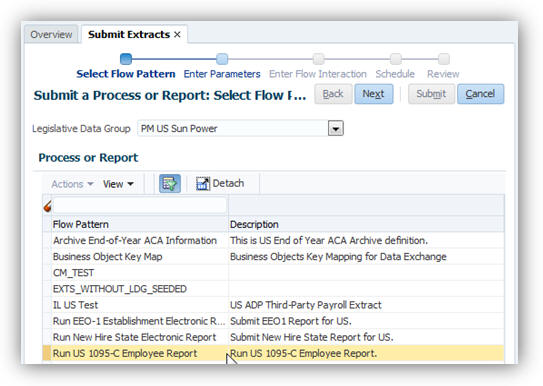

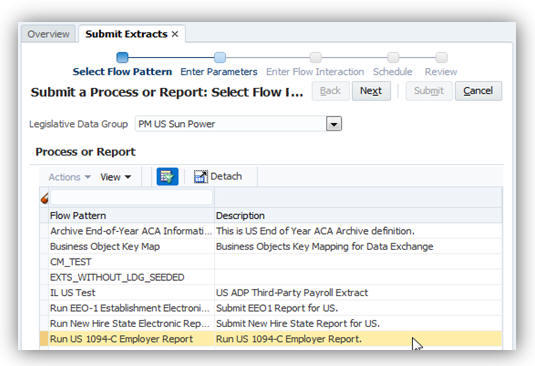

Oracle Fusion Global Human Resources for the United States: ACA 1094-c Employer Report |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for the United States: ACA 1094-c Employer Audit Report |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for the United States: Payroll Batch Loader Support for School District Codes |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

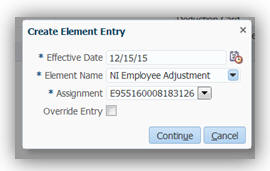

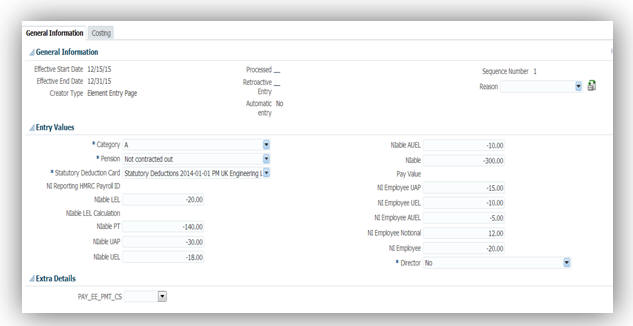

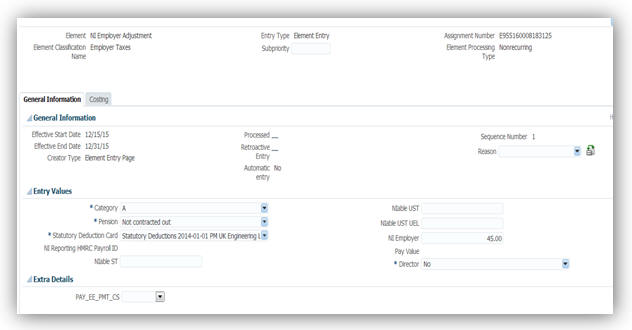

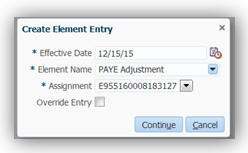

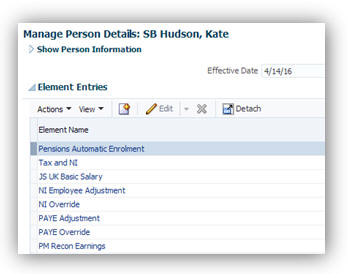

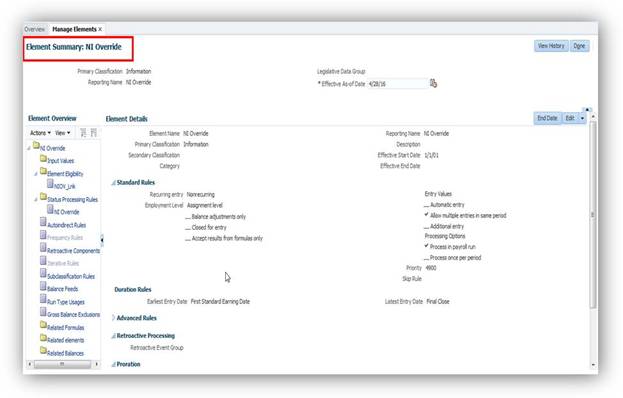

Oracle Fusion Global Human Resources for the United Kingdom: Override PAYE and NI Calculations for the Period |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for Sweden: Enhanced Post Number Validation |

Feature information delivered in Update 17 (May). |

| 06 MAY 2016 |

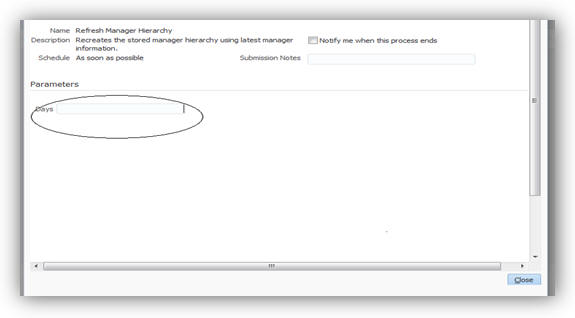

Oracle Fusion Global Human Resources: Directory Management – Incremental Refresh of Manager Hierarchy |

Feature information delivered in Update 17 (May). |

| 01 APR 2016 |

Oracle Fusion Global Payroll: Excel Output Support for Payroll Reports |

Feature information delivered in Update 16 (April). |

| 01 APR 2016 |

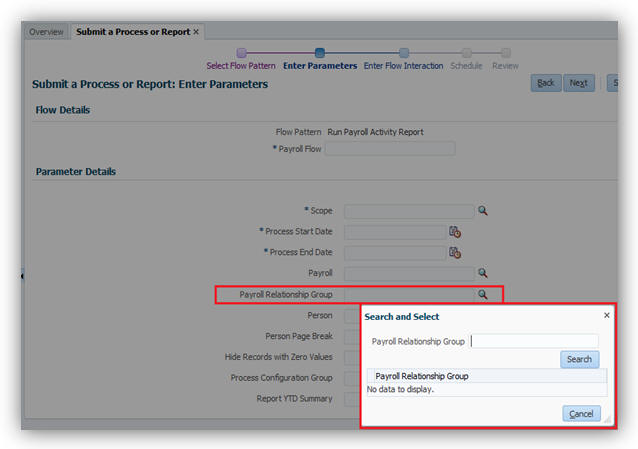

Oracle Fusion Global Payroll: Dynamic Payroll Relationship Group Support for Payroll Activity Report |

Feature information delivered in Update 16 (April). |

| 01 APR 2016 |

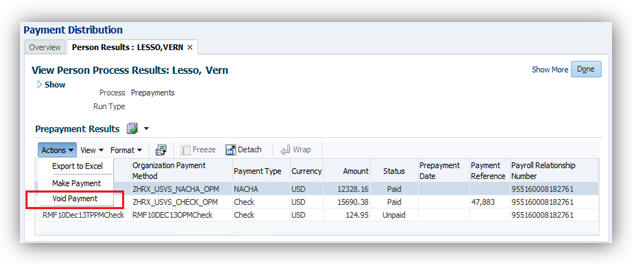

Oracle Fusion Global Payroll: Void Payment Action in Prepayments |

Feature information delivered in Update 16 (April). |

| 01 APR 2016 |

Oracle Fusion Global Human Resources: Automated Reassigning of Pending Approvals and Correcting Invalid Supervisor Assignments |

Feature information delivered in Update 14 (February). |

| 01 APR 2016 |

Oracle Fusion Human Capital Management for Mexico: National Identifier Validation |

Feature information delivered in Update 14 (February). |

| 01 APR 2016 |

Oracle Fusion Human Capital Management for the United States: PA Act 32 Support for Third-Party Quarterly Tax Filing |

Feature information delivered in Update 16 (April). |

| 04 MAR 2016 |

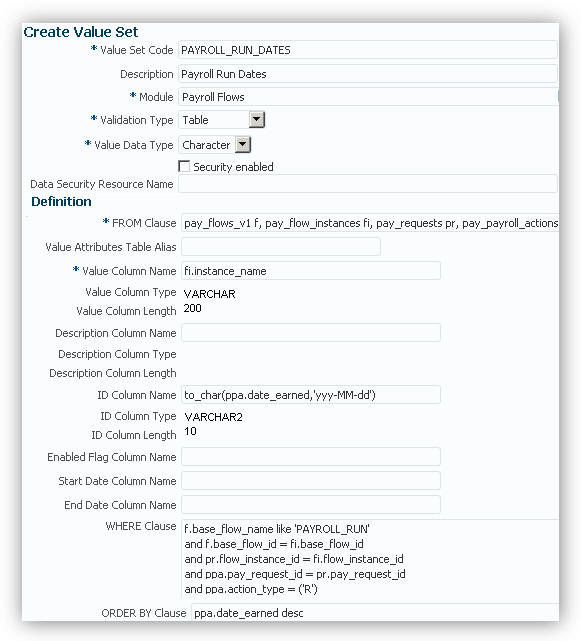

Oracle Fusion Global Payroll: Value Set Usage in Flow Parameters |

Feature information delivered in Update 15 (March). |

| 04 MAR 2016 |

Oracle Fusion Human Capital Management for the United States: Regional Tax Levy Support |

Feature information delivered in Update 15 (March). |

| 04 MAR 2016 |

Oracle Fusion Human Capital Management for the United States: PA Act 32 Support for Third-Party Periodic Tax Filing |

Feature information delivered in Update 15 (March). |

| 04 MAR 2016 |

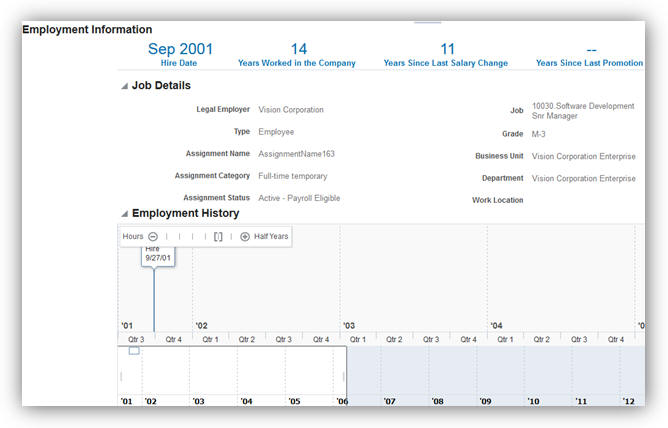

Oracle Fusion Global Human Resources: Worker View of Employment Information in Simplified User Interface |

Feature information delivered in Update 13 (January). |

| 04 MAR 2016 |

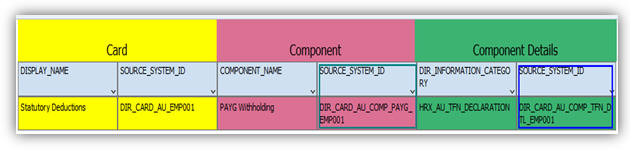

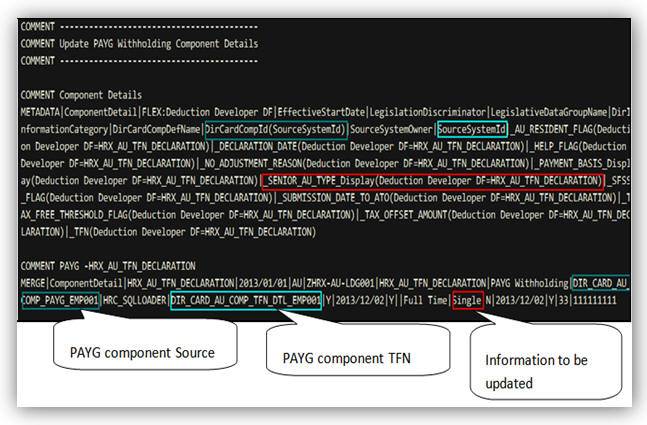

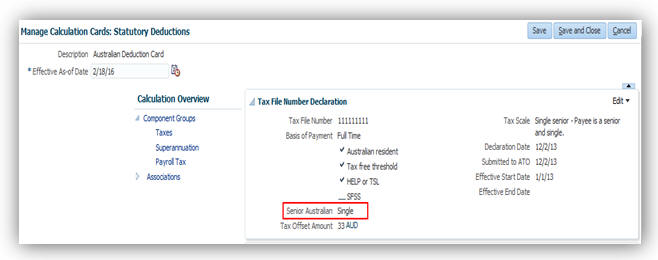

Oracle Fusion Human Capital Management for Australia: HCM Data Loader Support for Calculation Cards |

Feature information delivered in Update 15 (March). |

| 05 FEB 2016 |

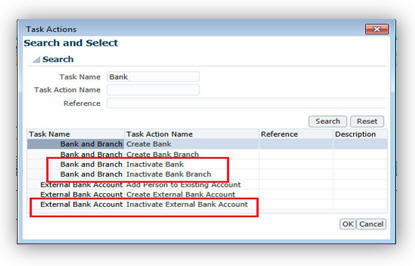

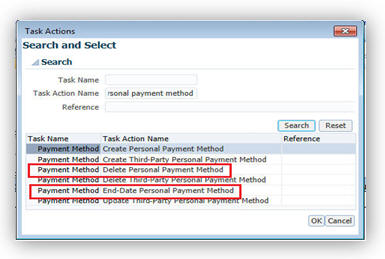

Oracle Fusion Global Payroll: Payment Method Batch Loader Tasks |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

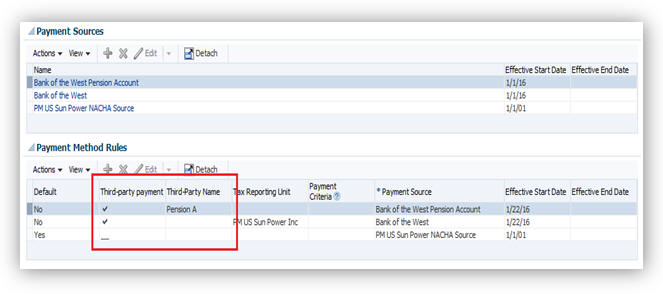

Oracle Fusion Global Payroll: Enhancements to Payment Method Rules |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Global Payroll: Calling a Flow Within a Flow |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United States: Archive End-of-Year ACA Information |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United States: ACA 10-95-C Employee Report |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Australia: Workplace Gender Equality Profile Report |

Feature information delivered in Update 11 (November). This update provides more details. |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Australia: Capture of Non-Specific Gender |

Feature information delivered in Update 13 (January). This update provides more details. |

| 05 FEB 2016 |

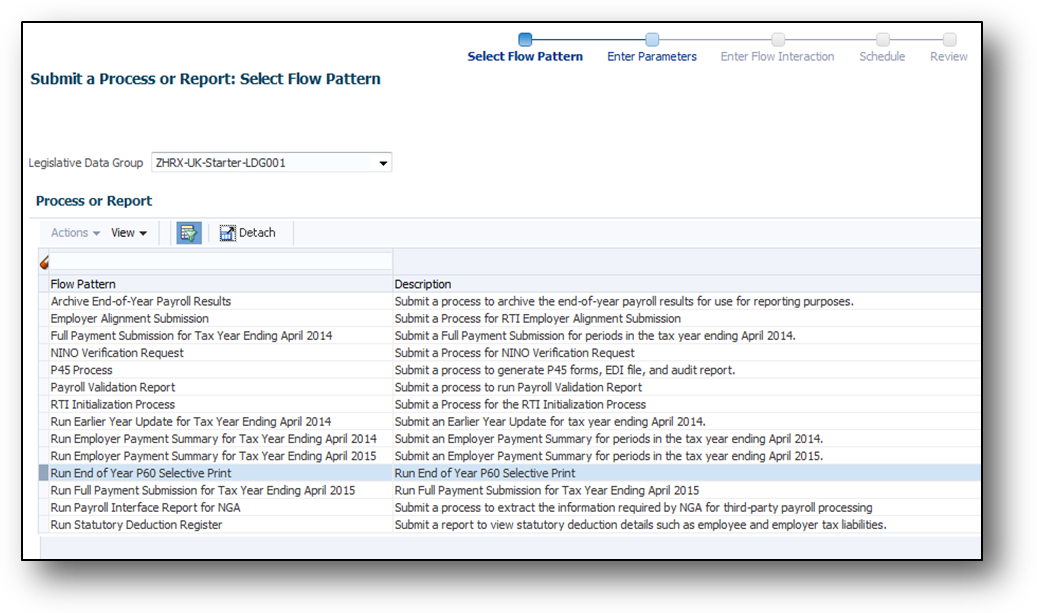

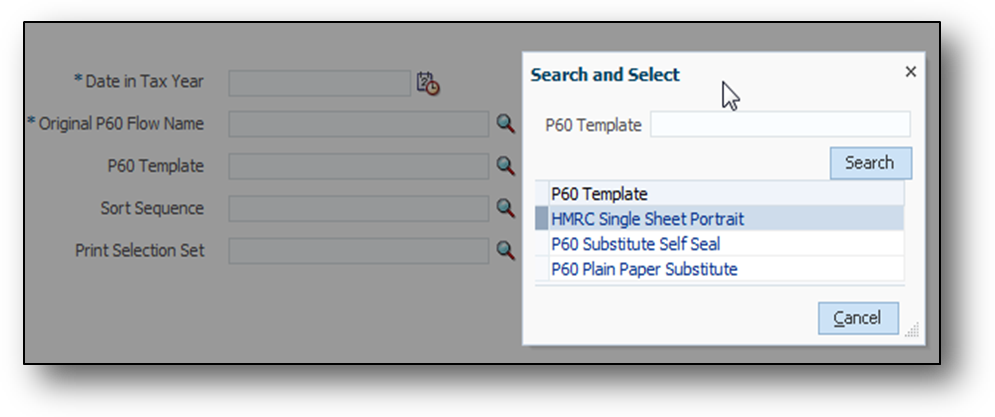

Oracle Fusion Human Capital Management for the United Kingdom: Legislative Changes for Tax Year End 2015 -16 |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: Legislative Changes for Tax Year End 2016 -17 |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: National Insurance Calculations for Apprentices Under 25 |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: Scottish Legislative Changes |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: Legislative Updates to Real Time Information Reporting |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: Court Orders |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: New Student Loan Type |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: EDI Incoming Message File Upload Method Change |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Japan: My Number |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Romania: National Identifier Validation |

Feature information delivered in Update 12 (December). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Serbia: Value Enabled for Highest Education Level |

Feature information delivered in Update 14 (February). |

| 05 FEB 2016 |

Oracle Fusion Human Capital Management for Spain: National Identifiers Validation |

Feature information delivered in Update 14 (February). |

| 01 JAN 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: PAYE and NI Adjustments |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

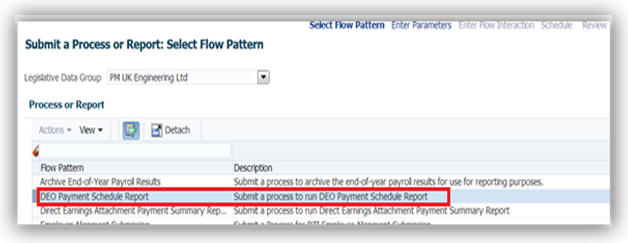

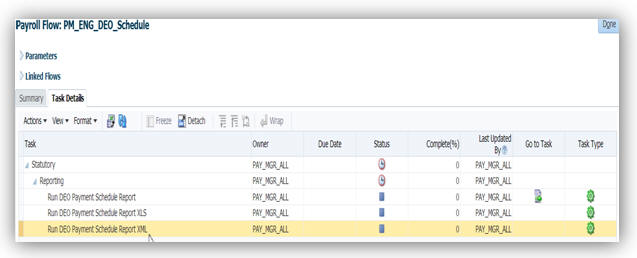

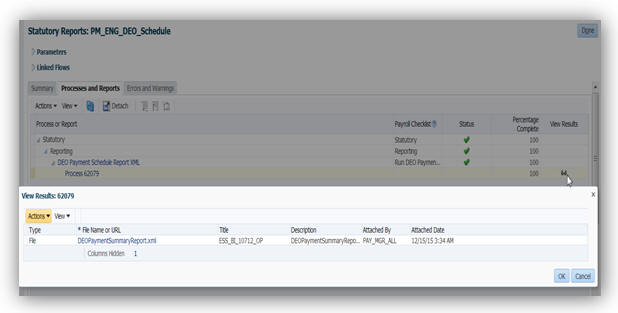

Oracle Fusion Human Capital Management for the United Kingdom: Uptake of XML format output for Deductions from earnings order (DEO) |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

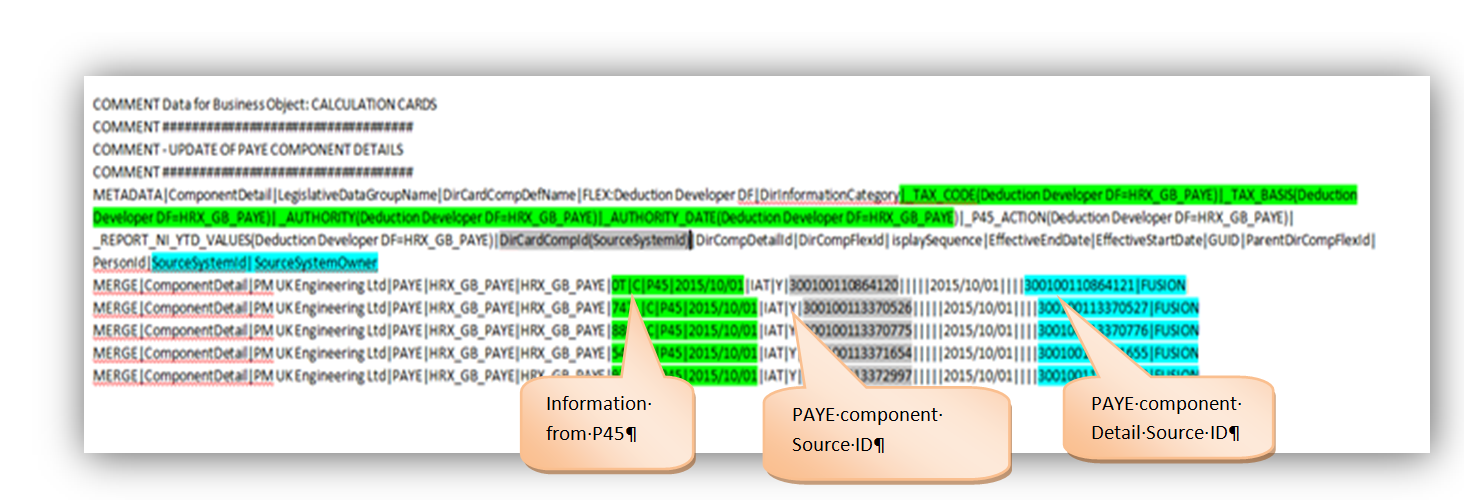

Oracle Fusion Human Capital Management for the United Kingdom: HCM Data loader support for calculation cards |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Benefits: Filter Data and Suppress Life Event Triggering |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Benefits: End Date a Benefit Group for the Whole Batch |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Global Payroll: Rolling 12 Month Balance Dimension |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Global Payroll: Display Year-to-Date Hours in Payroll Register Report |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

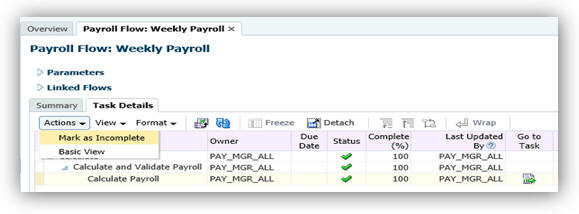

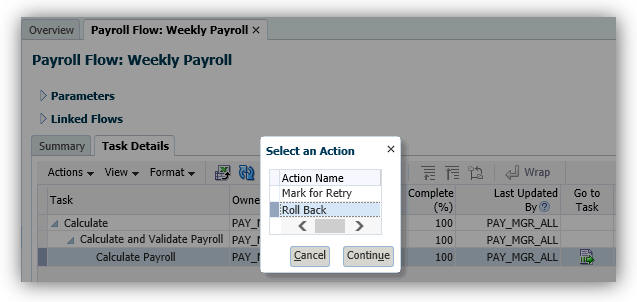

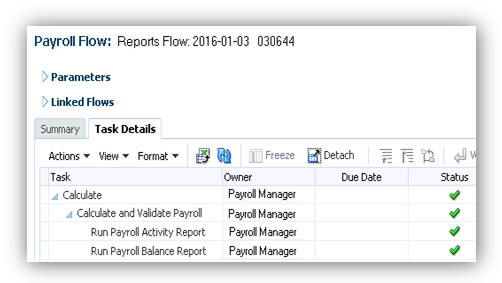

Oracle Fusion Global Payroll: Corrective Actions Available on Completed Flows |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Human Capital Management Transactional Business Intelligence: Reporting Establishment |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

Oracle Fusion Human Capital Management Transactional Business Intelligence: Worker Legislation - ‘Enabled’, ‘Obsolete’ Flags |

Feature information delivered in Update 13 (January). |

| 01 JAN 2016 |

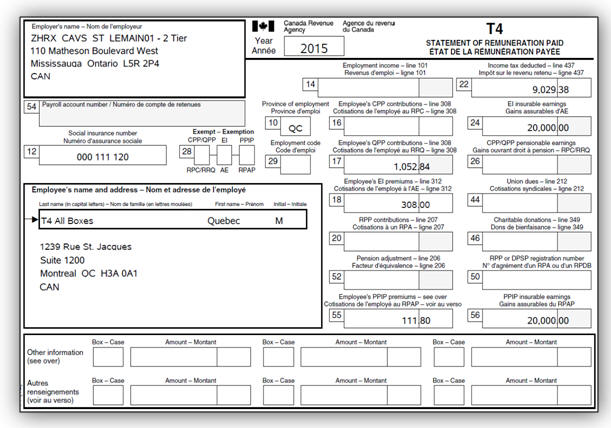

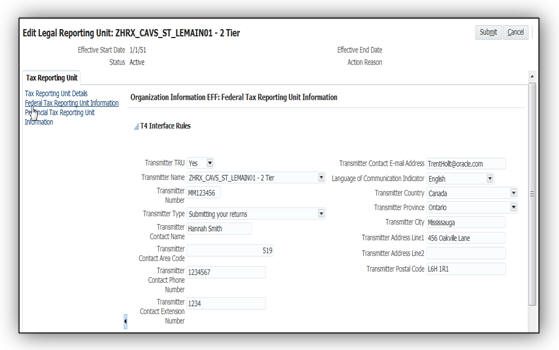

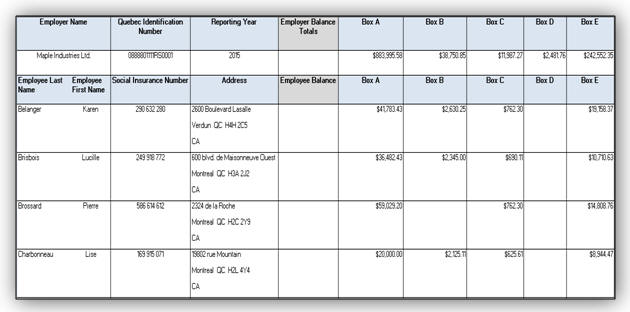

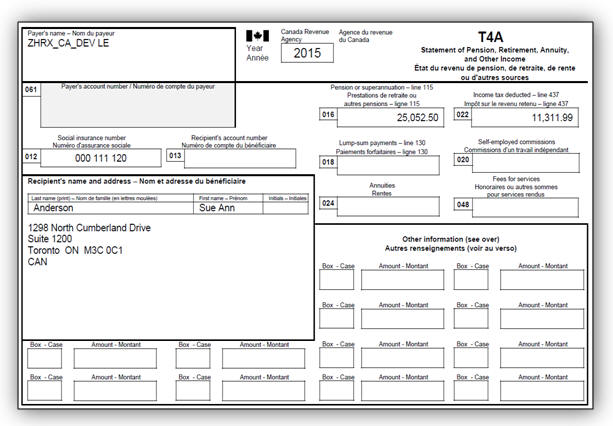

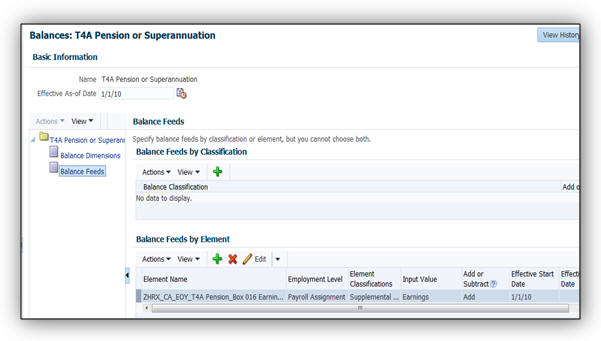

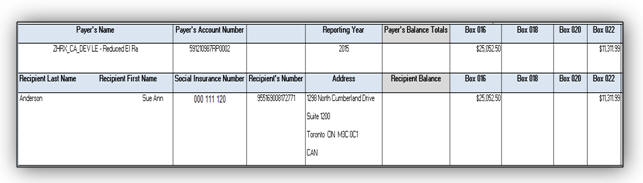

Oracle Fusion Human Capital Management for Canada: End-of-Year Reporting (T4A Only) |

Feature information delivered in Update 13 (January). |

| 04 DEC 2015 |

Oracle Fusion Human Capital Management for the United Arab Emirates: Abu Dhabi Retirement Pensions and Benefits Fund |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

Oracle Fusion Compensation and Total Compensation Statement: Workforce Compensation Supports Matrix Structures |

Changes were made to the documentation of this feature that was delivered in Release 10. |

| 04 DEC 2015 |

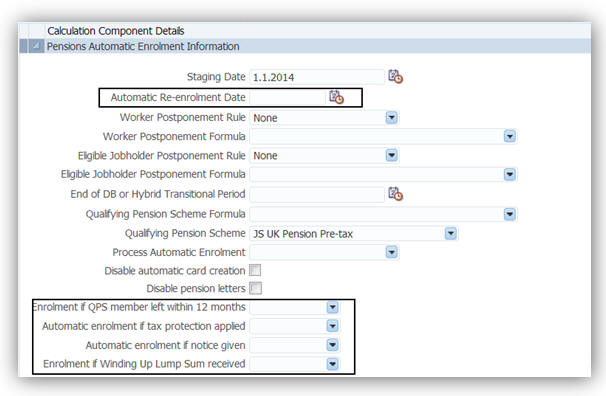

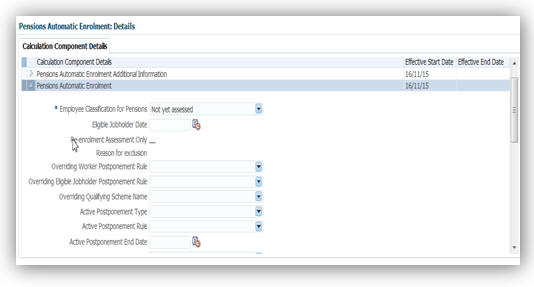

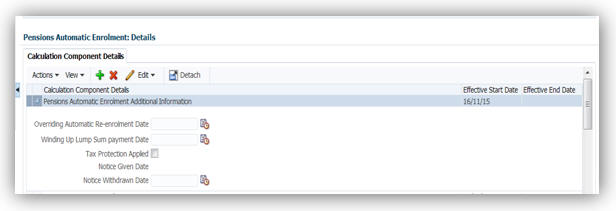

Oracle Fusion Human Capital Management for the United Kingdom: Pensions Automatic Enrolment and Re-enrolment Enhancement |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

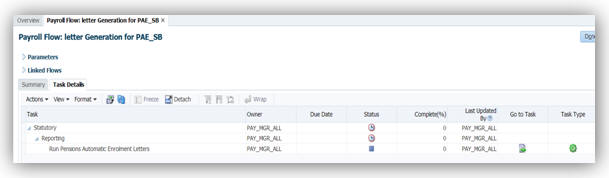

Oracle Fusion Human Capital Management for the United Kingdom: Generate Pensions Automatic Enrolment Notification Letters Process |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

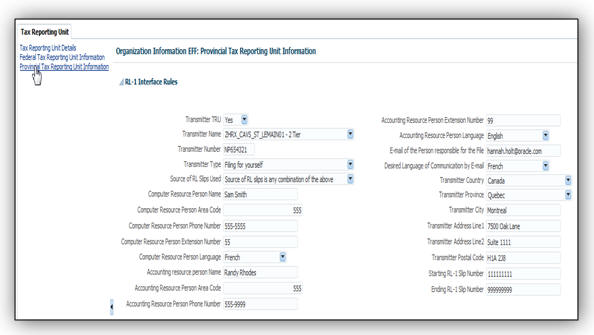

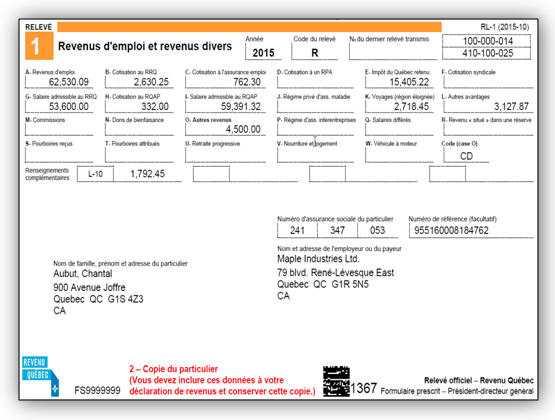

Oracle Fusion Human Capital Management for Canada: End-of-Year Reporting (RL-1 Only) |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

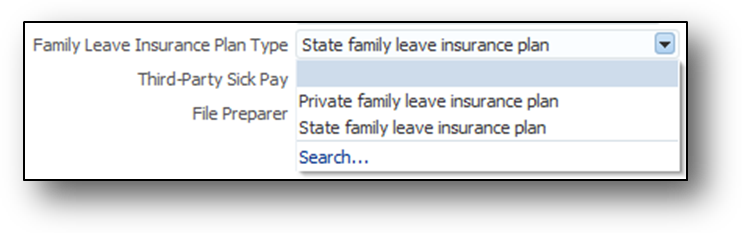

Oracle Fusion Human Capital Management for the United States: Batch Loader Support for New Jersey Family Leave Insurance Exemption |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

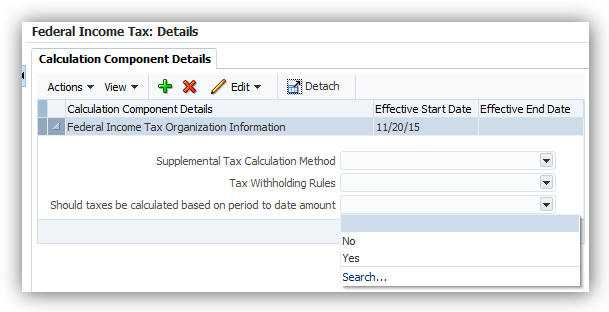

Oracle Fusion Human Capital Management for the United States: Calculate Federal Income Taxes Based on Period-to-Date Amount |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

HCM Common Features for Payroll: Flows: Multiple Tasks and Task Sequence Deletion |

Feature information delivered in Update 12 (December). |

| 04 DEC 2015 |

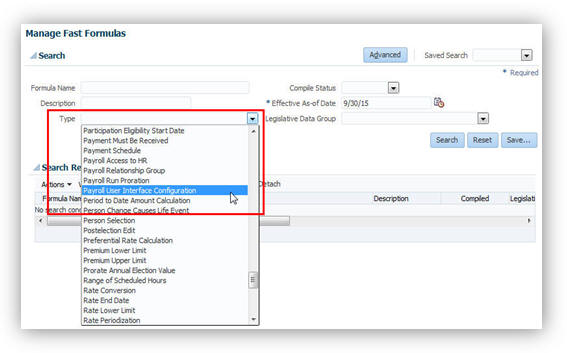

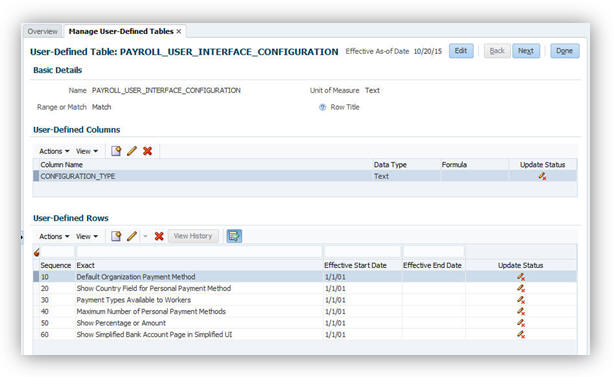

Oracle Fusion Global Payroll: Payroll User Interface Configuration |

Revised Documentation of feature information delivered in Update 11 (November). |

| 04 DEC 2015 |

Oracle Fusion Human Capital Management for Canada: End-of-Year Reporting (T4 Only) |

Feature information delivered in Update 11 (November). |

| 04 DEC 2015 |

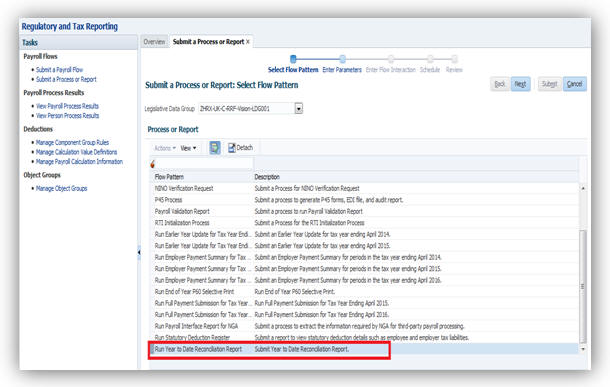

Oracle Fusion Human Capital Management for the United Kingdom: Year to Date Reconciliation Report |

This feature was delivered in Release 10, but was not documented, now updating the documentation. |

| 04 DEC 2015 |

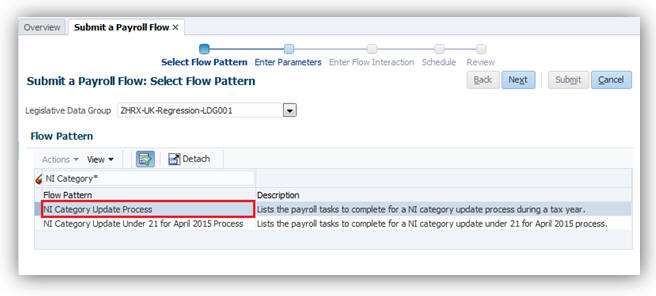

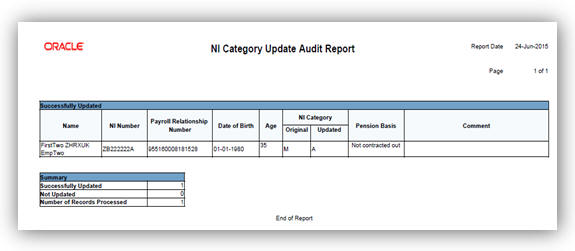

Oracle Fusion Human Capital Management for the United Kingdom: NI Category Update Process - Young Persons National Insurance Category Assessment |

This feature was delivered in Release 10, but was not documented, now updating the documentation. |

| 30 OCT 2015 |

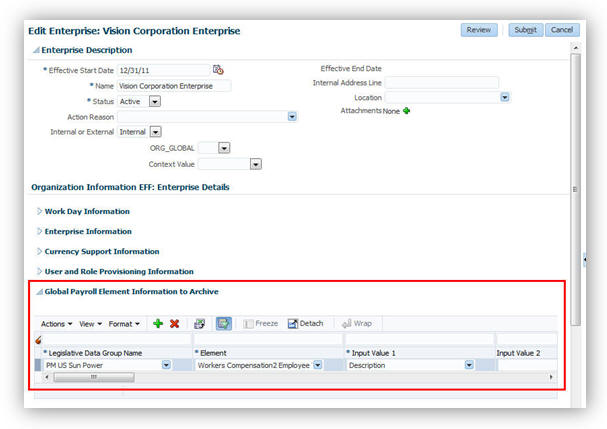

Oracle Fusion Human Capital Management for the United States: Assignment Enhancements for Affordable Care Act Support |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for the United States: Legal Employer Enhancement for Affordable Care Act Support |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for the United States: Tax Reporting Unit Enhancements for Affordable Care Act Support |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for the United States: Pennsylvania Residency Certificate Form Available from Portrait |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Global Payroll: Payroll User Interface Configuration |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Global Payroll: Display Additional Information on Payslips |

Feature information delivered in Update 10 (October). |

| 30 OCT 2015 |

Oracle Fusion Global Payroll: Enhanced Support for Rate Definitions |

Updated Feature documentation delivered in Update 7 (July). |

| 30 OCT 2015 |

Oracle Fusion Global Human Resources: New Approval Rule for Simplified User Interface Personal Information |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Finland: Enabled Value for Marital Status |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for New Zealand: Enabled Value for Marital Status |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Belgium: Added Value for Gender |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Australia: Workplace Gender Equality Profile Report |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Australia: Capture of Non-Specific Gender |

Feature information delivered in Update 11 (November). |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Canada: Ability to Change Display for Province to Full Name |

Feature information delivered in Release 10 base. |

| 30 OCT 2015 |

Oracle Fusion Human Capital Management for Canada: Time and Labor Calculation Component |

Feature information delivered in Release 10 base. |

| 23 SEP 2015 |

Oracle Fusion Compensation: Convert Worker-Level Budget Amounts into Local Currency |

Feature information delivered in Update 9 (September). |

| 23 SEP 2015 |

Oracle Fusion Human Capital Management for the United States: Employee Active Payroll Balance Report |

Feature information delivered in Update 10 (October). |

| 23 SEP 2015 |

Oracle Fusion Human Capital Management for the United States: PA Act 32 Calculation Enhancements |

Feature information delivered in Update 10 (October). |

| 27 AUG 2015 |

Oracle Fusion Global Payroll: Update User Defined Legislations |

Feature information delivered in Release 10 base. |

| 27 AUG 2015 |

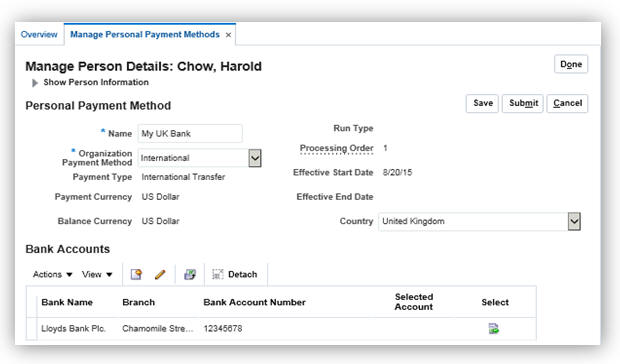

Oracle Fusion Global Payroll: New Country Field for Personal Payment Methods to Support International Payments |

Feature information delivered in Update 9 (September). |

| 27 AUG 2015 |

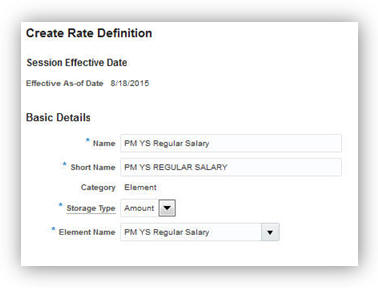

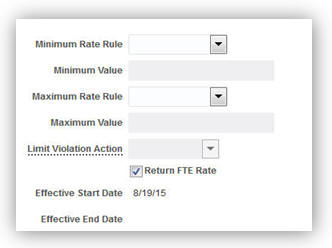

Oracle Fusion Global Payroll: Enhanced Support for Rate Definitions |

Feature information delivered in Update 7 (July). |

| 27 AUG 2015 |

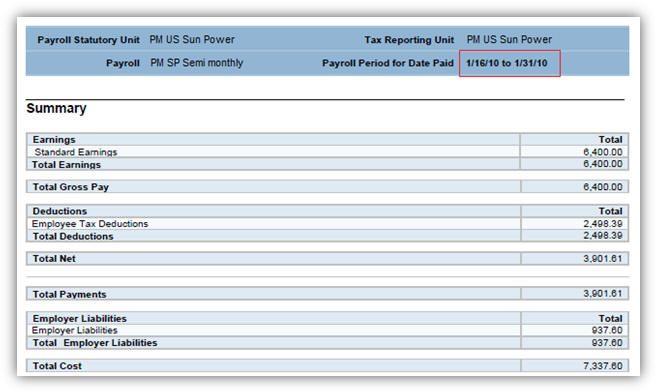

Oracle Fusion Global Payroll: Gross-to-Net Report Based on Process Date |

Feature information delivered in Update 8 (August). |

| 27 AUG 2015 |

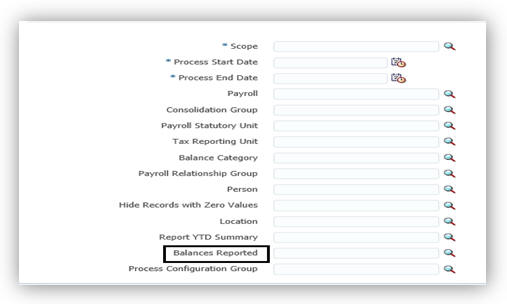

Oracle Fusion Global Payroll: Report Year-to-Date Summary |

Feature information delivered in Update 9 (September). |

| 27 AUG 2015 |

Oracle Fusion Global Payroll: Report Payment and Nonpayment Balances |

Feature information delivered in Update 9 (September). |

| 31 JUL 2015 |

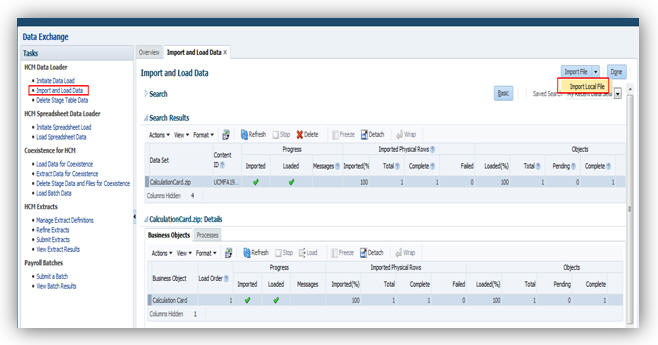

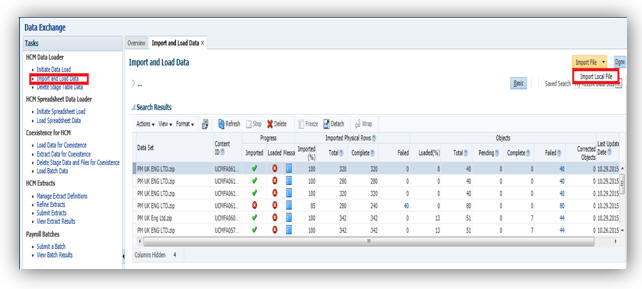

Oracle HCM Common Features- HCM Data Loader: Import Local File |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Fusion Human Capital Management for India: Nomination Information |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Fusion Human Capital Management for Australia: Trade Support Loan Support |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile- Language Support Enhancements |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Security Enhancements |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

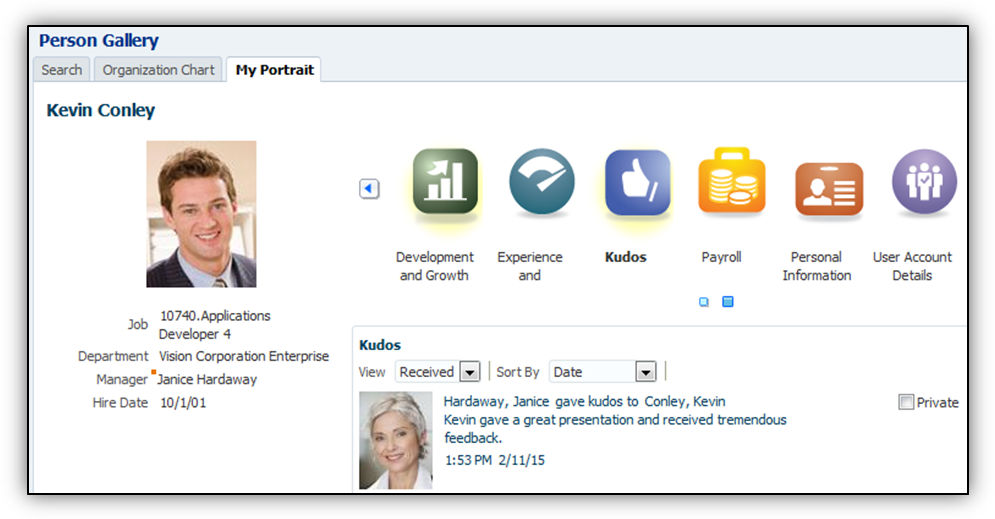

Oracle Tap (Mobile): Mobile - Worker Detail and Public Profile |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Access Worker Social Wall |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Organization Navigator |

Feature information delivered in Update 8 (August). |

| Oracle Tap (Mobile): Mobile - Schedule Absences |

Feature information delivered in Update 8 (August). |

|

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Update Biological Information |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - View Payslips |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Worklist and Notifications |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - Manger Self-Service Transactions |

Feature information delivered in Update 8 (August). |

| 31 JUL 2015 |

Oracle Tap (Mobile): Mobile - View Your Analytics |

Feature information delivered in Update 8 (August). |

This document outlines the information you need to know about new or improved functionality in Oracle Global Human Resources Cloud Release 10. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Please indicate you are inquiring or providing feedback regarding the Global HR Cloud What’s New for Release 10 in the body or title of the email.

Some of the new Release 10 features are automatically available to users after the upgrade and some require action from the user, the company administrator, or Oracle.

The table below offers a quick view of the actions required to enable each of the Release 10 features.

IMPORTANT NOTE: If you are upgrading from an earlier release to Oracle Global Human Resources Cloud Release 10, then the security upgrade must be completed first to enable new Release 10 features. See the document Upgrading Applications Security in Oracle HCM Cloud Release 10 (ID 2023523.1) on My Oracle Support for details.

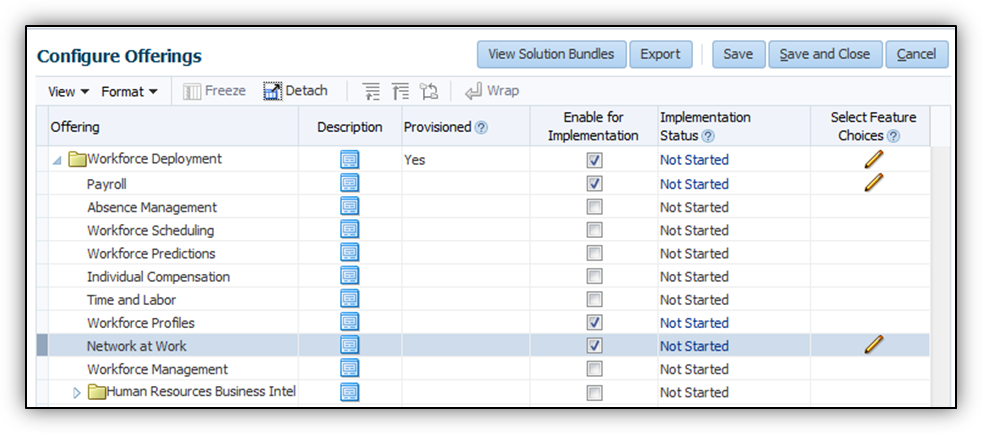

The following HCM common features include enhancements for Release 10:

HCM Data Loader is a flexible and comprehensive bulk-data-loading solution for business objects across multiple Oracle Fusion Human Capital Management products. You can use it for data-migration, ongoing inbound interfaces, and one-off bulk updates. It supports the bulk load of your configured descriptive and extensible flexfield data, translation data, tree hierarchies, person images, and Document of Record attachments.

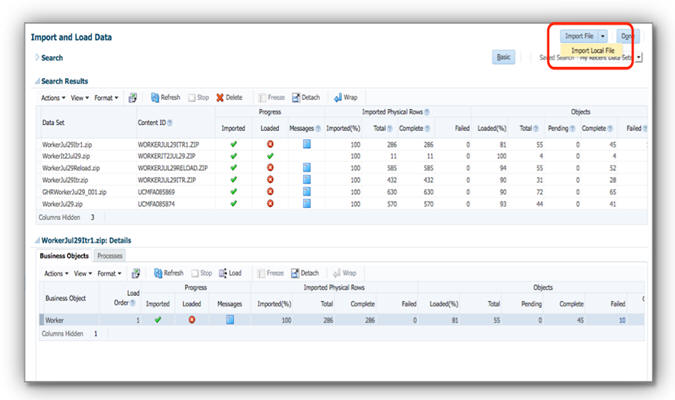

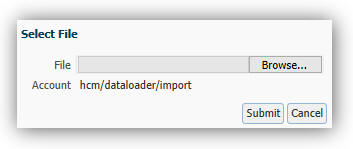

You can now select files for HCM Data Loader processing directly from your local machine, removing the need to upload your files first to the Oracle WebCenter Content server.

The existing Import File button displays unprocessed files available on the Oracle WebCenter Content server. The new Import Local File option allows you to either browse for a local file or drag and drop a file from your file explorer to the Browse button.

Your selected file is uploaded to the Oracle WebCenter Content server and the Schedule Request page opens. On this page, you can immediately submit your file for processing.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide (Document ID 1664133.1)

Flexible Pipe-Delimited File Format

You can now simplify your inbound integrations by including the business object components and attributes relevant to your use case, whether that be full date-effective history for data migration, or incremental changes for data maintenance. You can supply multiple business object specific files in one compressed zip file and process them together. HCM Data Loader understands the order in which the business object data must be loaded to ensure referenced data is loaded first.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about HCM Data Loader file formats, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide, (Document ID: 1664133.1)

You can now optionally deliver encrypted compressed zip files to Oracle’s WebCenter Content server secured by a specific HCM Data Loader account. The compressed zip file is then streamed from the WebCenter Content server and decrypted during import into stage tables before a multithreaded process loads valid objects into Oracle Fusion. You can use either the Oracle Fusion HCM File Import and Export interface, or the WebCenter Content web service to deliver a zip file to the WebCenter Content server.

Your compressed zip file is deleted by default from the WebCenter Content server as soon as HCM Data Loader has finished streaming it. You can change the default behavior by updating the Delete Source File parameter to No on the Configure HCM Data Loader page. Alternatively, you can choose to retain your source files for an individual file by setting the Delete Source File parameter to No on the Schedule Request window.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about delivering data files to the Oracle WebCenter Content server, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide, (Document ID: 1664133.1).

Automated or User-Managed Processing

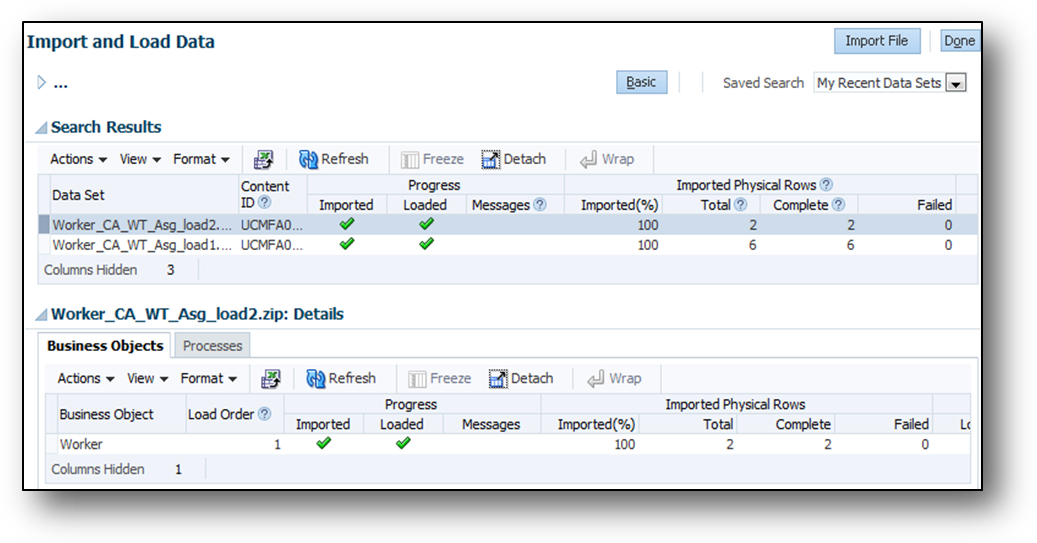

You can now automate inbound interfaces using the WebCenter Content and HCM Data Loader web services, or control the import and loading processes using the new Import and Load Data user interface.

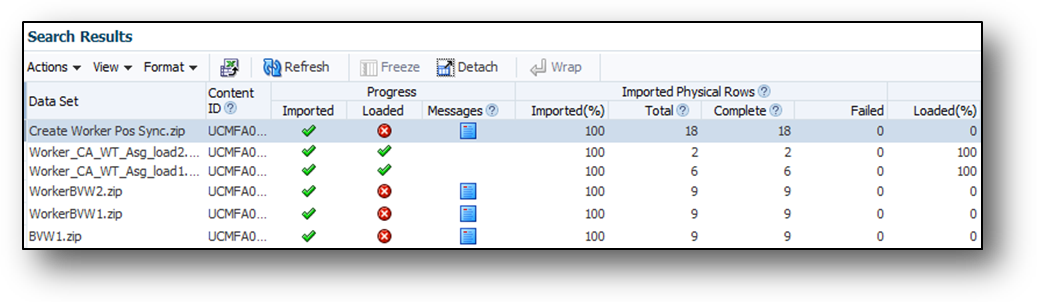

You can use the Import and Load Data user interface to manually initiate the import and optional load of a data set (zip file) and monitor the progress of that data set. The user interface includes a Data Set table and a Business Objects table. The Data Set table displays the data sets or zip files submitted for processing. The Business Objects table displays the business objects that were included in the zip file. On both the Data Set and Business Objects tables the Imported and Loaded Progress columns display the status of import and load.

Import and Load Data User Interface

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about HCM Data Loader automated or user managed imports, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide, (Document ID: 1664133.1).

You can use the following methods to review and monitor the status of your import and load requests:

- Import and Load Data user interface – Allows review of the progress of your files via the Import and Load Data user interface, with comprehensive status and record count information, message summary, and error management that allows you to review the details of failed records.

- HCM Extract - You can monitor the results of your data loading using the new HCM Extract output, which provides machine readable status and error information.

- Data Set Status - You can also diagnose complex errors using the new Data Set Status available from the Diagnostic framework.

The Data Set Table in the Import and Load Data User Interface

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about status and error handling with HCM Data Loader, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide (Document ID: 1664133.1).

HCM Data Loader supports the following four key types:

- Oracle Fusion GUID (Globally Unique Identifier)

- Oracle Fusion surrogate ID

- Source Key ID

- User key

You can create new objects specifying your source-system identifier and continue to maintain and reference that data in Oracle Fusion using your Source Key. Alternatively, supply the User Key information, for example Organization Name, Person Number, or Absence Type. In addition Oracle Fusion’s internal surrogate ID and Globally Unique ID (GUID) can be used.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about flexible key support with HCM Data Loader, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide (Document ID: 1664133.1)

The Purge Person process, available from the Diagnostic Framework, purges the following person-related data from your stage and test environments:

- Absences

- Benefits

- Compensation

- Documents and Attachments

- Performance Data

- Goals and Performance

- Talent Profile

- Payroll Relationships

- Element Entries

- Calculation Cards

- Addresses

- Assignments (including Extra Information Types )

- Work Relationships

- Contacts and Contact Relationships

- Worker Personal Information (including Passport, Citizenship, E-Mails, Licenses, National Identifiers, and Extra Information Types )

- Roles and User Details

The Purge Person process does not purge data that was created using HCM File-Based Loader, nor does it purge predefined person data.

You can specify which records to purge by supplying comma-delimited person numbers or person IDs. Alternatively, supply a SQL query to return the person IDs for all person records that you want to purge.

Steps to Enable

Raise a service request through My Oracle Support (MOS) to request enablement of the Purge Person process on your stage and test pods.

This process cannot be enabled in production environments.

Tips and Considerations

You can run the Purge Person process without committing the purge so that you can review the results before you delete the data permanently.

Key Resources

For more information on purging person data, see the following document on My Oracle Support (MOS):

- Purging HCM Data from Test and Stage Environments (Document ID 2132109.1)

Upload of Assignment Records with Effective Dates That Are Later Than the Termination Date

Prevent the upload of invalid assignment records using HCM Data Loaders new validation. Prior to this enhancement, it was possible to load an assignment record for a terminated work relationship where:

- The status of the assignment record was set to either ACTIVE or SUSPENDED.

- The effective dates of the assignment record were later than the termination date of the work relationship.

You can continue to load assignment records for a terminated work relationship where the effective dates are later than the work relationship termination date, provided that the assignment status is INACTIVE. No other assignment status is valid.

Steps to Enable

There are no steps necessary to enable this feature.

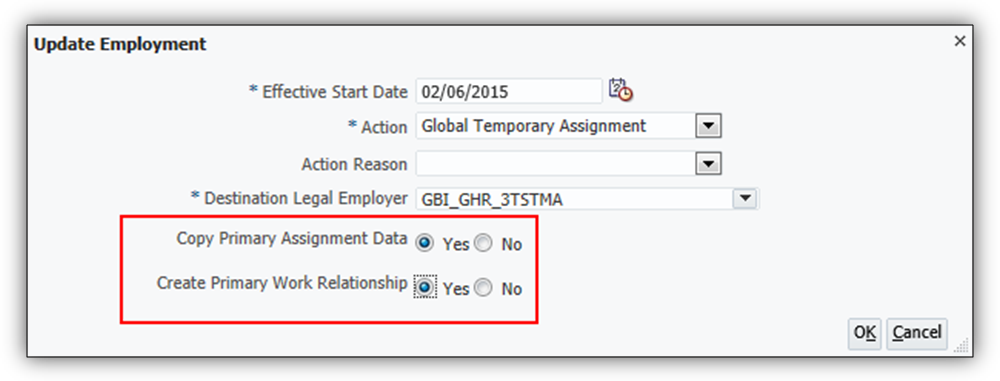

Simplify Global Transfers Performed by Data Upload

Perform global transfers efficiently. A global transfer involves the termination of an existing work relationship with one legal employer and the creation a new work relationship with a different legal employer. The addition of the GlobalTransferFlag attribute enables you to perform global transfers efficiently in uploaded work relationship records.

To perform a global transfer when the source work relationship is the worker’s primary work relationship, you load:

- The new work relationship record with the GlobalTransferFlag attribute set to Y and an action code from the EMPL_GLB_TRANSFER action type

- The child components of the new work relationship record

HCM Data Loader automatically terminates the existing primary work relationship and sets the termination date to the day before the start date of the new work relationship.

You can perform a global transfer of the primary work relationship only when no active secondary work relationships exist.

To perform a global transfer when the source work relationship is a nonprimary work relationship, you load:

- The new work relationship record with the GlobalTransferFlag attribute set to Y and an action code from the EMPL_GLB_TRANSFER action type

- The existing nonprimary work relationship record without the GlobalTransferFlag attribute

- The child components for the new work relationship record but not for the existing nonprimary work relationship record

- The parent worker record

HCM Data Loader automatically terminates the existing nonprimary work relationship and sets the termination date to the day before the start date of the new work relationship.

Steps to Enable

There are no steps necessary to enable this feature.

Enhanced Validation of Worker Records by HCM Data Loader

Include now only one row for each worker in the data file, when you create workers or update existing workers. As no date-effective attributes are exposed on the worker component, there is no functional reason for storing date-effective history in the PER_ALL_PEOPLE_F table. To correct any attribute of an existing worker record, you must perform a correction.

For new worker records created using HCM Data Loader, the Start Date and Effective Start Date attributes of the worker component must equal the start date of the worker’s earliest work relationship. Any mismatch in these dates now causes an error to be raised.

Steps to Enable

There are no steps necessary to enable this feature.

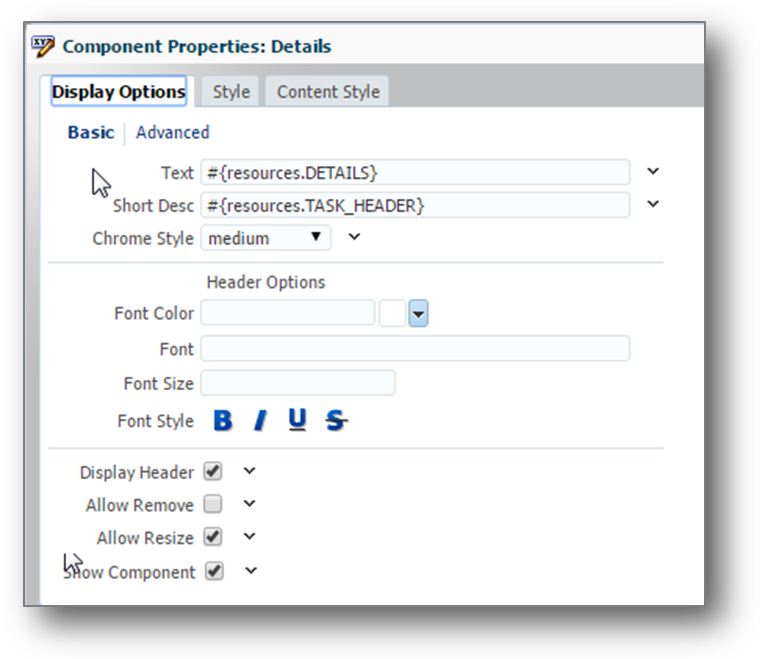

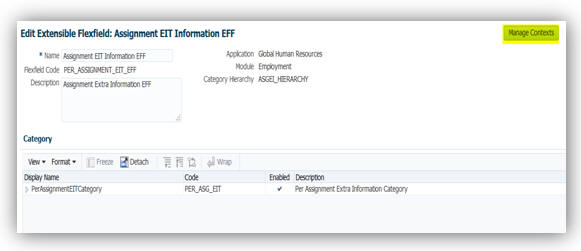

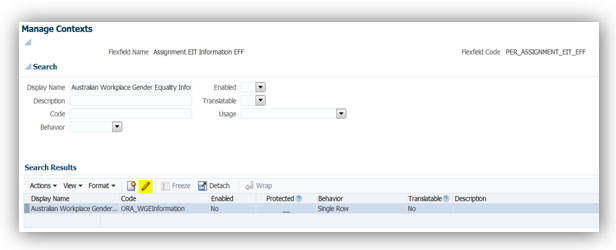

User-Key Support for Multirow Extensible Key Flexfields

When you configure a multirow extensible key flexfield, you can configure one or more segments as the key that uniquely identifies a single row of the multirow context. HCM Data Loader treats these segments as user-key attributes, which ensures that you can reference a single flexfield record using only user keys.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to My Oracle Support for the following guide:

- HCM Data Loader User’s Guide (document ID 1664133.1)

Oracle Fusion Global Human Resources enables your organization to plan, manage and optimize all workforce segments using flexible and extensible best practices to realize extraordinary gains while ensuring compliance and increasing total workforce engagement.

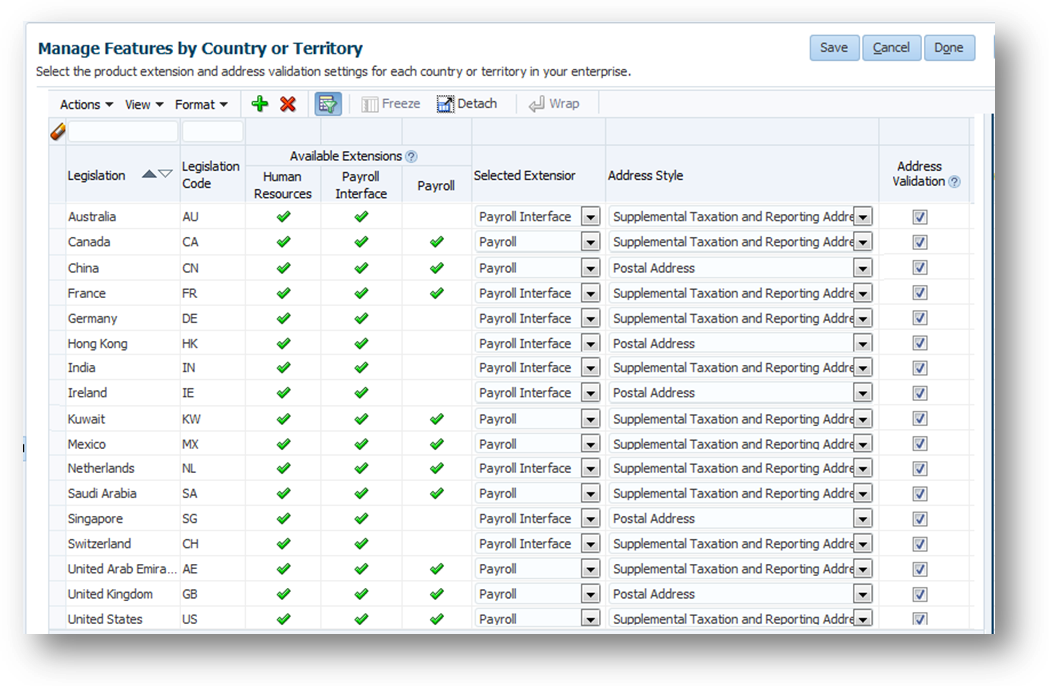

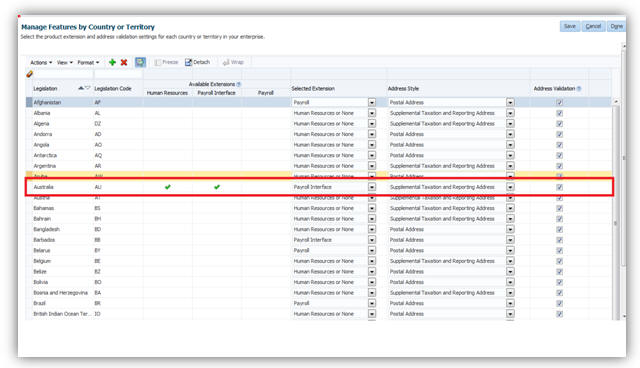

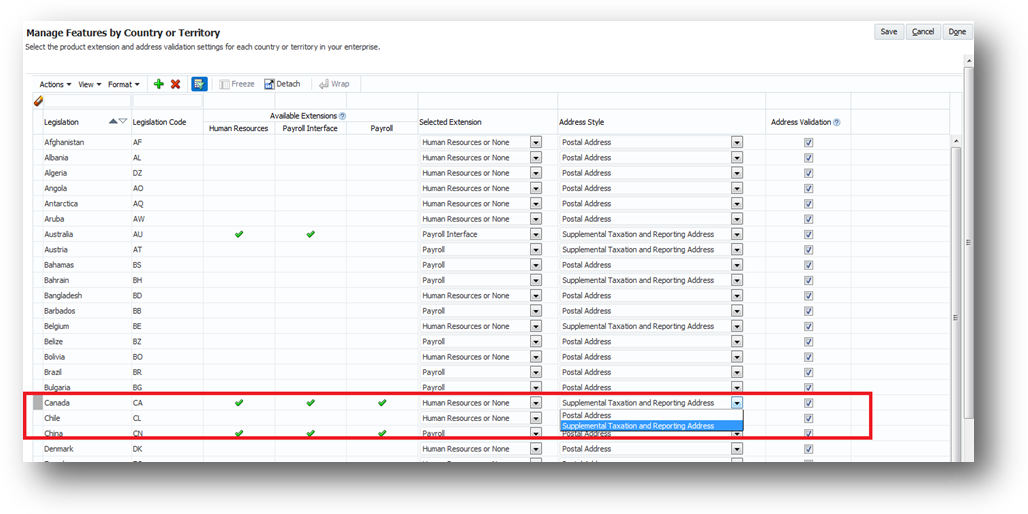

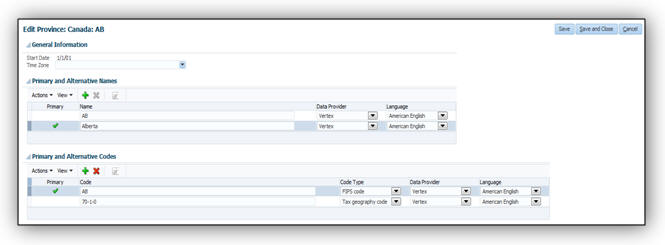

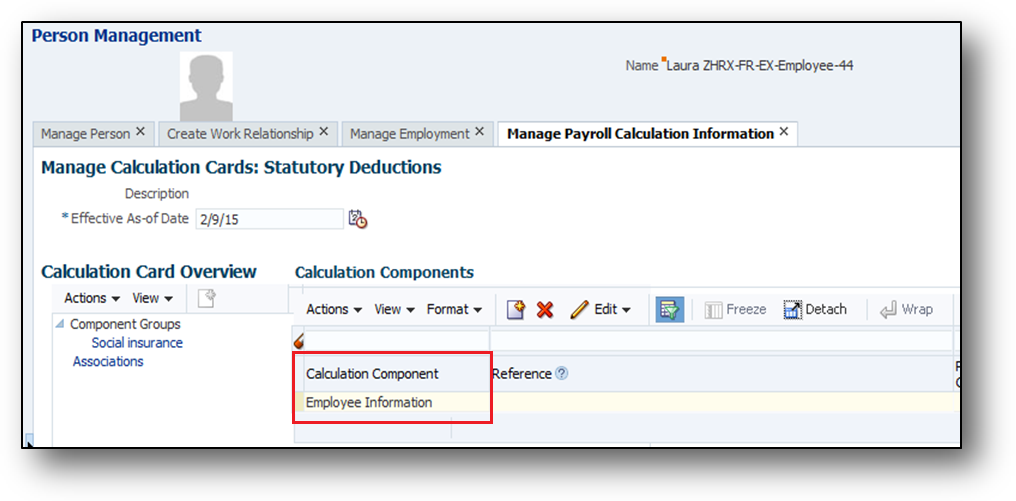

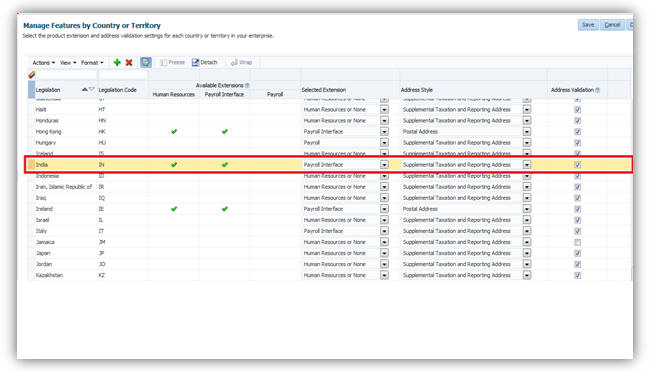

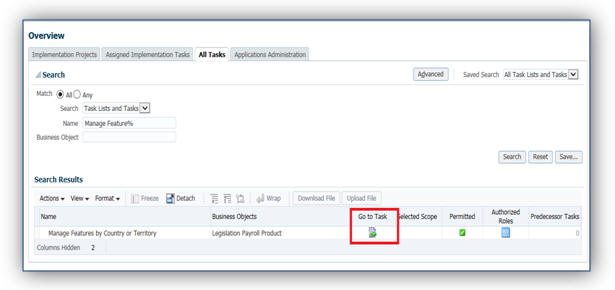

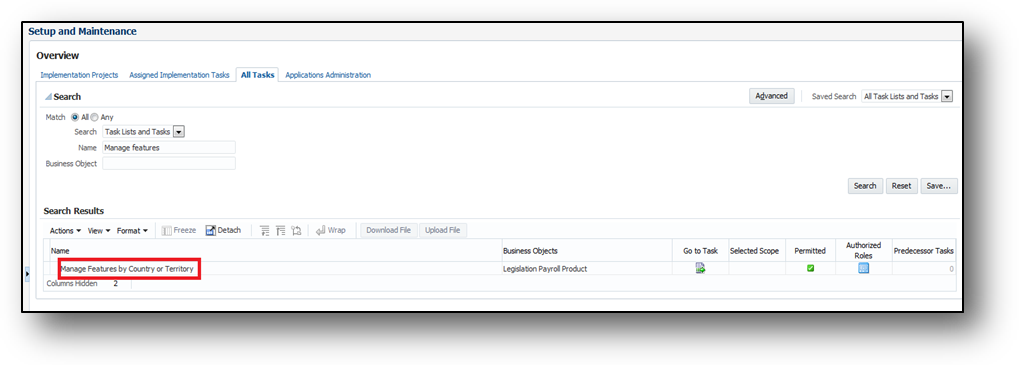

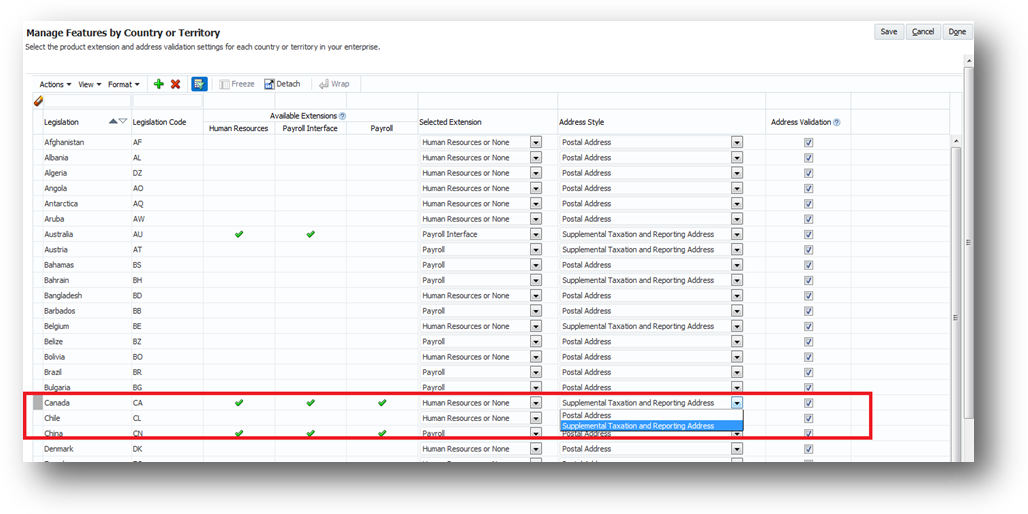

The Manage Features by Country or Territory task, formerly Manage Payroll Product Usage, now includes options for controlling the address style and the level of address validation. The address style determines which address attributes are available and maintained in the application. The address style can also affect validation, for example, if you specify that geography uses an address style to validate specific attributes. For example, in the United States, the address style can be defined to validate the State attribute.

The combination of address style and address validation determines the level of validation. The values you can select depend on the combination of the country or territory and the selected country extension. For example, for Canada, you can change the address style from its original value only when you set the country extension to Human Resources or None, not Payroll or Payroll Interface.

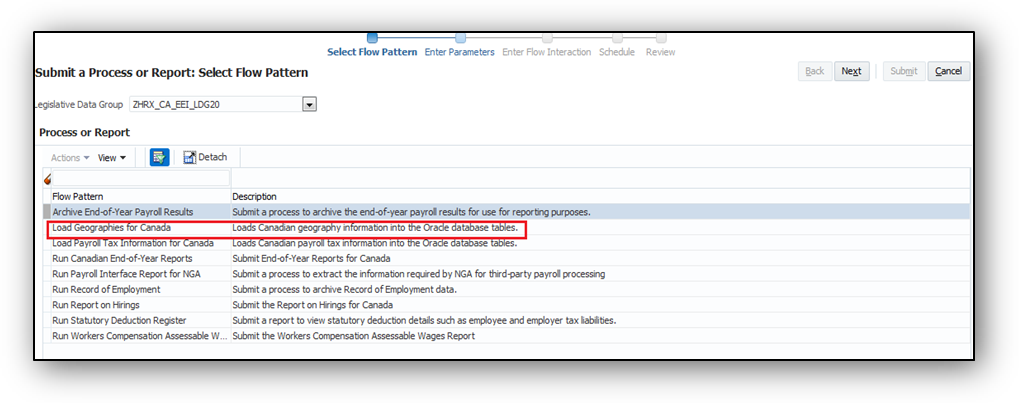

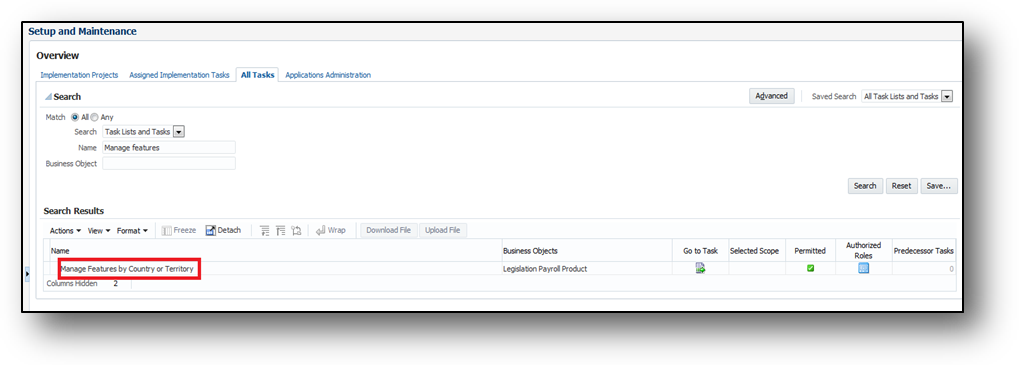

Manage Features by Country or Territory Page

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

- Changing address styles can affect validation rules and may lead to address data integrity and validation issues. If you provide data to a third party, such as a payroll or benefit provider, statutory recipients, or financial institutions, changes to validation or address styles may result in missing data or unrecognized data. Make sure to test any changes you make to the address style or validation for a country or territory before you implement them in a production environment.

- Disabling address validation disables only any country-specific programmatic validation rules created for a specific country or territory. Disabling address validation on the Manage Features by Country or Territory page does not have any impact on the validation you have set up on the Manage Geographies page.

Key Resources

For more information related to this feature, go to Applications Help for the following topics:

- Selecting Country Extensions: Worked Example

- Changing Address Styles and Address Validation for HCM: Critical Choices

This section describes new features that are relevant if you use features such as elements, formulas, payroll definitions and database items, even if you don’t use Global Payroll. Typical applications using payroll common features are Absence Management, Benefits, Compensation, Global Human Resources, Global Payroll Interface and Time and Labor.

Enhanced Element Template for Absences

You can easily create payroll elements for the plans you create in Oracle Fusion Absence Management. When you create an element, you complete questions that automatically create an absence element and its calculation components, related elements, balances, and formulas. For example, you select the type of information to transfer and the calculation units to use when reporting the absence. If you transfer accrual balances, you decide whether to:

- Calculate absence liability

- Enable partial payment of a balance

- Enable balance payments when enrollment ends

You can also select a method to reduce regular earnings if employees don’t complete a time card. You determine rates for your payments either in Absence Management or when you complete the element template questions. When processing absence entries in a payroll run, the formula associated to the absence element uses the global formula Rate Converter to convert rates.

Absences Element Template Questions

You associate the absence element to a plan in Absence Management, assign the plan to a person and decide whether to automatically transfer the absence information as it’s recorded and approved, or run a batch process. The daily breakdown and summary information transferred to the person’s calculation card is processed in the next payroll run. You can then view the person’s absence accrual balance, absence payments, and deductions on their statement of earnings and payslip.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

Select the rate to use for an absence element in your absence plan or in the element template. If you select the rate on both pages, ensure you select the same rate.

Key Resources

For more information about absence elements, go to Applications Help for the following topic:

- Creating Payroll Elements for Processing Absences: Procedure

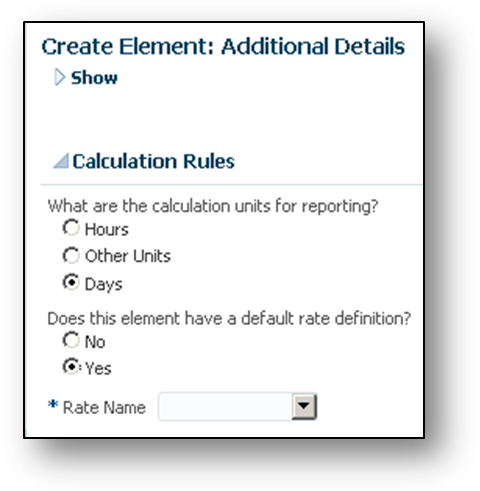

Enhanced Element Template for Time Cards

This feature only applies to user-defined legislations and predefined country extensions that have enabled the feature in this release.

You can create nonrecurring elements using the new Time Card category to process pay based on time card entries, such as elements for regular, overtime, and shift pay. Creating a time card element automatically generates all the related elements, balances, formulas, and calculation components required to calculate and process payments for reported time. When you create an element, you select a primary classification of standard or supplemental earnings and select the Time Card category. You can select the units to use to report calculated time, and also select a rate definition the formula uses to calculate time. After you submit the element definition, you create element eligibility records for the base, results, calculation, and retroactive elements generated by the element template.

Important: Do not create elements using the Time Card category if you are operating in a country where Oracle provides an HR, Payroll Interface, or Payroll Extension, as indicated on the Manage Features by Country or Territory page in the Setup and Maintenance work area.

Time Card Template Questions

Submit this process to convert a standard or supplemental element to a time card element only if you created the element. You only submit this process to convert standard and supplemental elements to time card elements if either of the following conditions applies. You created the element:

- Before this release and you didn’t submit the Create Time Card Calculation Components process to convert the element

- After upgrading to this release but without selecting the Time Card category

These elements must have a calculation rule of hours multiplied by rate. After running the process, you perform the following steps:

- Create element eligibility records for the elements generated by the process, typically the base element and the related elements: retroactive and results elements, and elements ending with a suffix of CIR.

- Compile the formulas used to calculate the time card element.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about time card elements, go to Applications Help for the following topic:

- Creating Elements for Time Card Entries: Explained

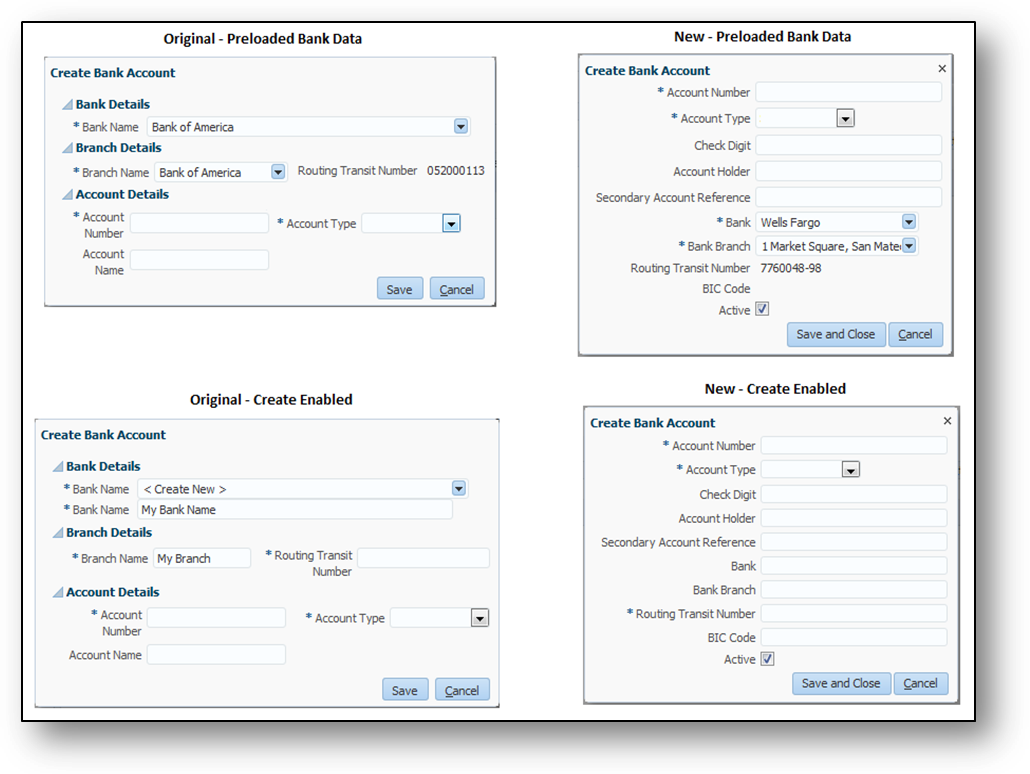

A new page for creating bank account information is now available that works with a new profile option to control whether employees and professional users can create bank and branch data. You can choose to use either the original page or the new page. You can enable the new page at the site, country, or legislative data group level.

The following screen captures show a comparison between the original and new versions of the Create Bank Account page. For each version, there are two screen captures of the page:

- When bank data is preloaded

- When the user can create bank and branch details

Comparison of Original and New Create Bank Account Pages

Differences between the original and new page are highlighted in the following table:

| Queries |

Original Page |

New Page |

| Can users enter different variations of the same bank and branch details? |

No |

Yes. There is no bank and branch details validation across personal payment methods |

| What controls user access to create bank and branch information? |

The Manage Bank and Manage Bank Branch privileges |

The Use Existing Banks and Branches profile option (at site or user level) By default, it's set to No at the site level, which enables employees or professional users to enter bank and branch data directly rather than selecting from a list of values. |

| Which global fields are required when Create is enabled? |

Account Number, Account Type, Bank Name, Branch Name, and Routing Transit Number |

Option of country-specific required fields. |

| Does bank and branch data entered by users on the Create Bank Account page appear on the Manage Bank and Manage Branch pages in Cash Management? |

Yes |

No |

Steps to Enable

NOTE: If you choose to use the original Create Bank Account page, you don’t need to enable this feature.

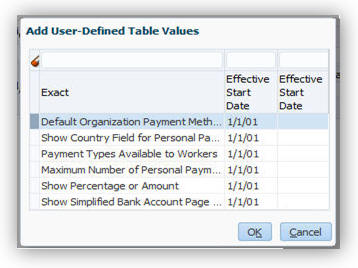

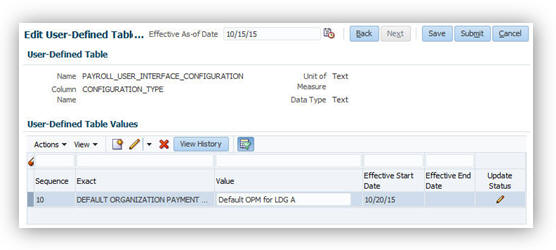

- Enable the simplified bank account page using the Payroll User Interface Configuration formula and the Show Simplified Bank Account preference in a user-defined table. For detailed steps, refer to the Payroll User Interface Configuration feature described elsewhere in this document.

NOTE: If you want users to select only the preloaded banks and branches ensure that you set the Use Existing Banks and Branches profile option to Yes. Refer to the next section for details.

- If you set the Use Existing Banks and Branches profile option to No, which enables employees or other roles to create banks and branches, provide guidance to use unique names and follow appropriate naming conventions.

- This profile option works with the new Create Bank Account page that employees and professional users see when creating personal payment methods. This profile option does not affect the original version of the Create Bank Account page.

Key Resources

For more information about banks information related to personal payment methods, go to Applications Help for the following topics:

- Entering Bank Information For Personal Payment Methods: Critical Choices

- Payroll Batch Loader Workbooks for Bank Data

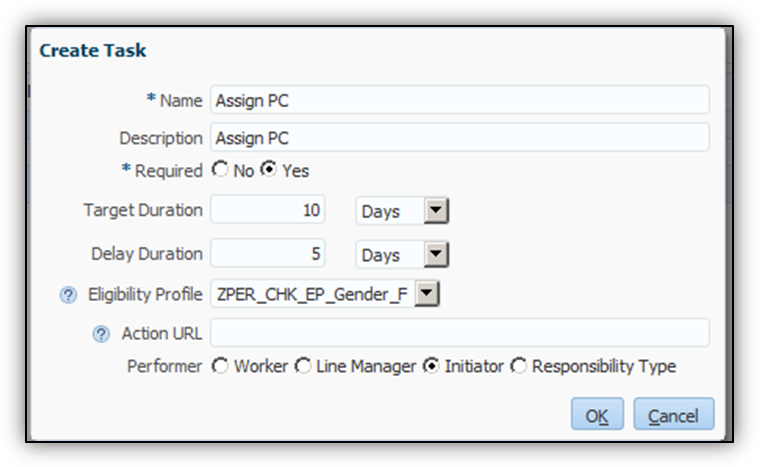

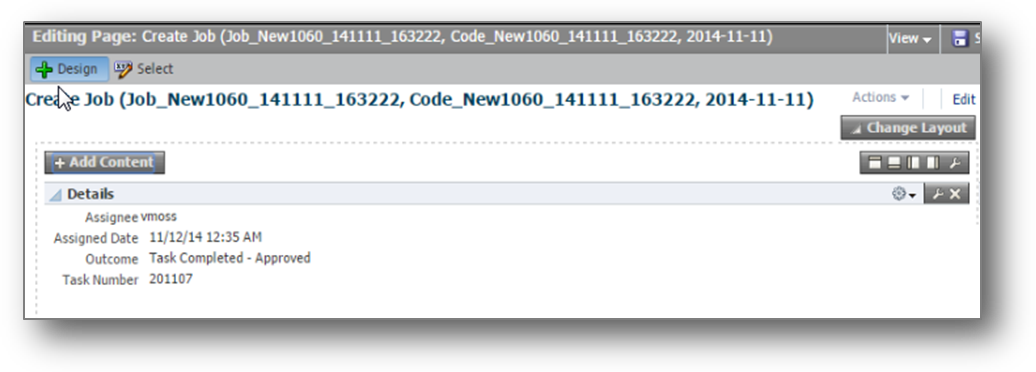

Support for BI Report Submission in Payroll Flows

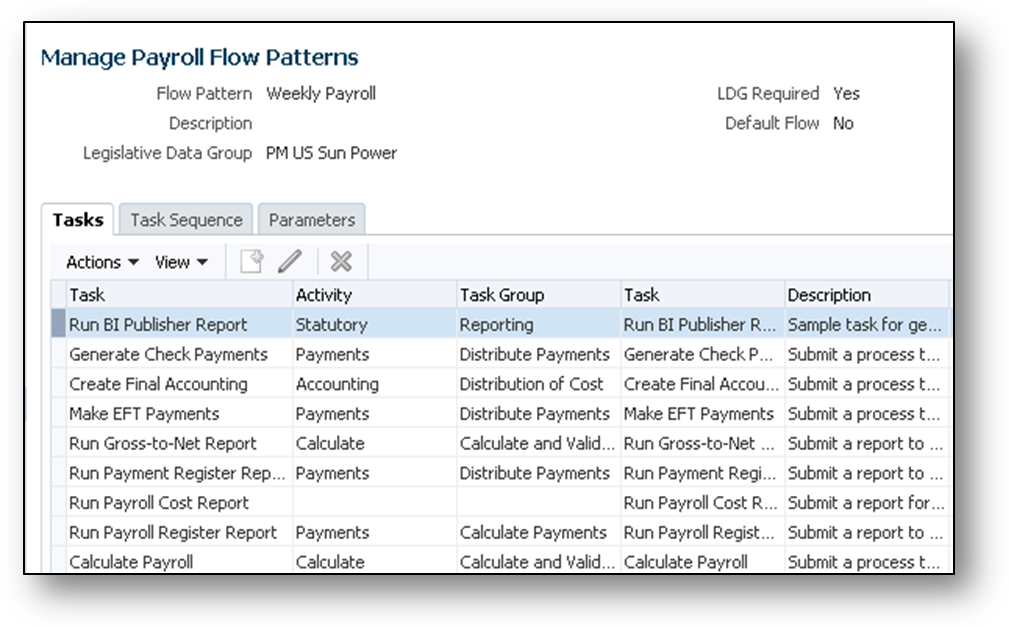

If you create or customize a BI Publisher report, you can run your report from a payroll flow by adding the Run BI Publisher Report task to your payroll flow pattern. When you submit the flow, the reporting automatically generates an output file that you can view. The output file is based on the template used for the BI Publisher report, such as an HTML template. Add single or multiple BI Publisher reports to your copied or user-defined flow pattern.

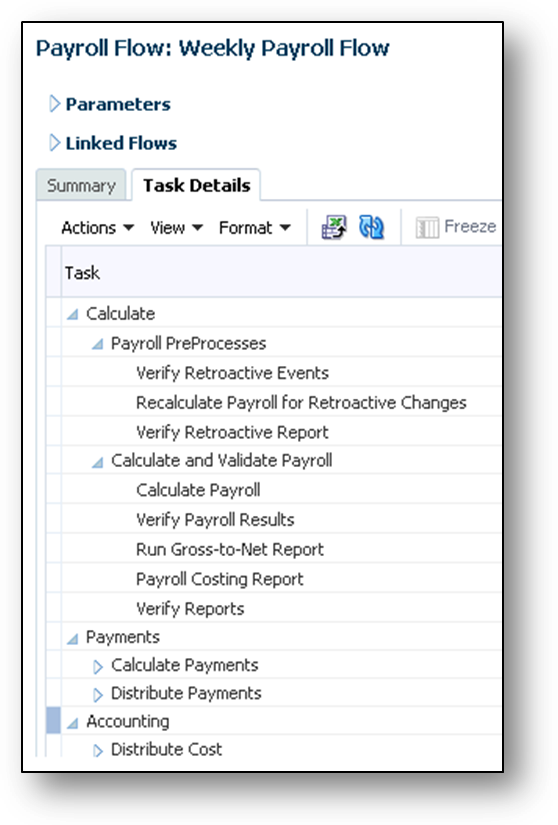

BI Publisher Reporting Task Added to the Weekly Payroll Flow Pattern

Steps to Enable

Follow these steps to add the task to a new flow pattern:

- Create a flow pattern on the Manage Payroll Flow Patterns page in the Payroll Checklist work area.

- Complete on the Create Payroll Flow Pattern page the basic information. Select the Statutory activity, and the run BI Publisher Report task.

- Edit on the Task page the selected task as required.

- Confirm on the Task Sequence page the sequence is correct.

- Add a required parameter for the first argument of the BI Publisher report on the Flow Parameter page. The flow parameters map to the BI Publisher arguments. For example, the first argument is the first bind variable of a SQL query data model. Optionally, rename the parameter to a more meaningful name.

- Confirm and specify in the Parameter Details section of the Task Parameters page the following:

- Confirm that the Parameter Basis for the First Argument value is Bind to Flow.

- Specify values for other arguments if required.

- Specify a value for the Report Name and Report Path parameters.

- Review the flow and submit it

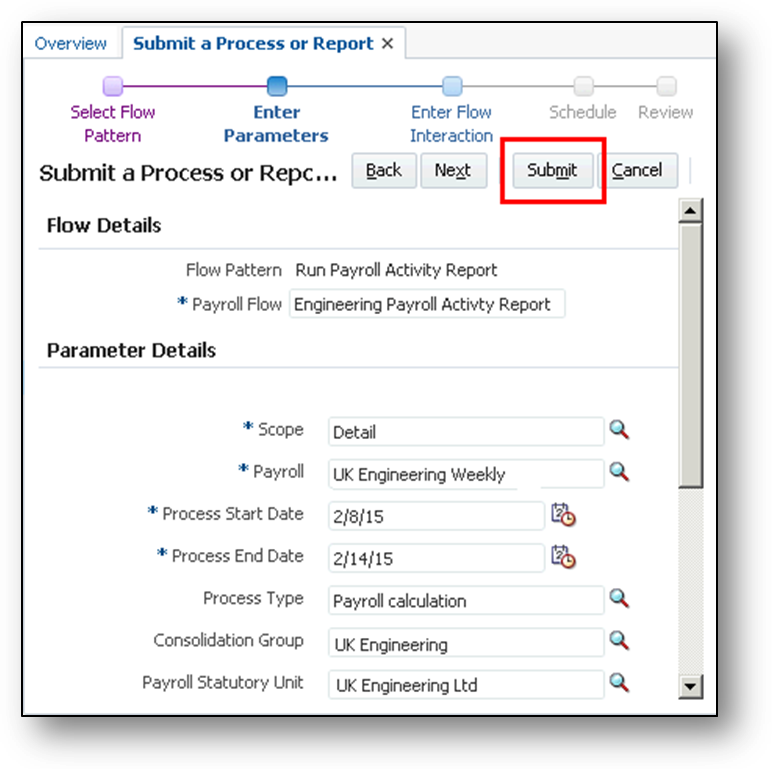

Quick Report, Process, and Flow Submission

Submit your HCM extract reports, payroll processes, and flows directly from the Enter Parameters page by clicking the Submit button. This method skips the remaining flow submission pages. You might choose this method to speed up submission, if you don’t want to:

- Connect other flows to the current flow

- Schedule a flow

- Review the flow before submitting it

Submit Button on the Enter Parameters Page

Steps to Enable

There are no steps necessary to enable this feature.

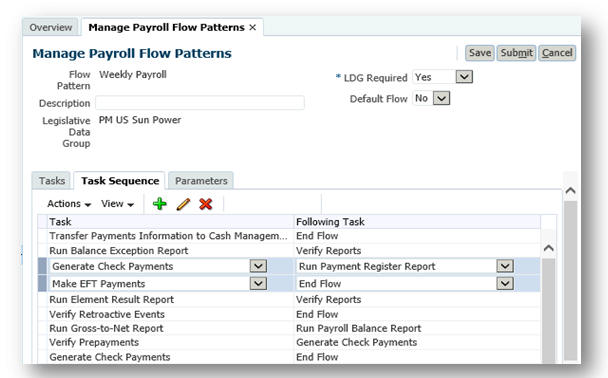

Flows: Multiple Tasks and Task Sequence Deletion

Previously you could only delete a single task or task sequence. Now when you create or edit a flow pattern, you can select contiguous or noncontiguous rows. Delete tasks in the Tasks or Task Sequence tab, and rearrange tasks in the Task Sequence tab. Review tasks by sorting them by task group before deciding which ones to delete.

For example, you might create a separate flow pattern for accounting tasks and delete those tasks from your weekly payroll.

Shows the Tasks Sorted by Task Group and the Selected Rows to Delete

Task Sequence Tab Showing the Selected Tasks to Reorder

Steps to Enable

There are no steps necessary to enable this feature.

This section describes new features that are relevant if you use Oracle Tap for HCM Mobile applications. Oracle Tap works on smart devises that have a web browser, such as smart phones and tablets.

Mobile - Language Support Enhancements

Oracle Tap mobile solutions supports the same languages available in Fusion HCM Cloud with the exception of languages that read from right to left.

Steps to Enable

There are no steps necessary to enable this feature.

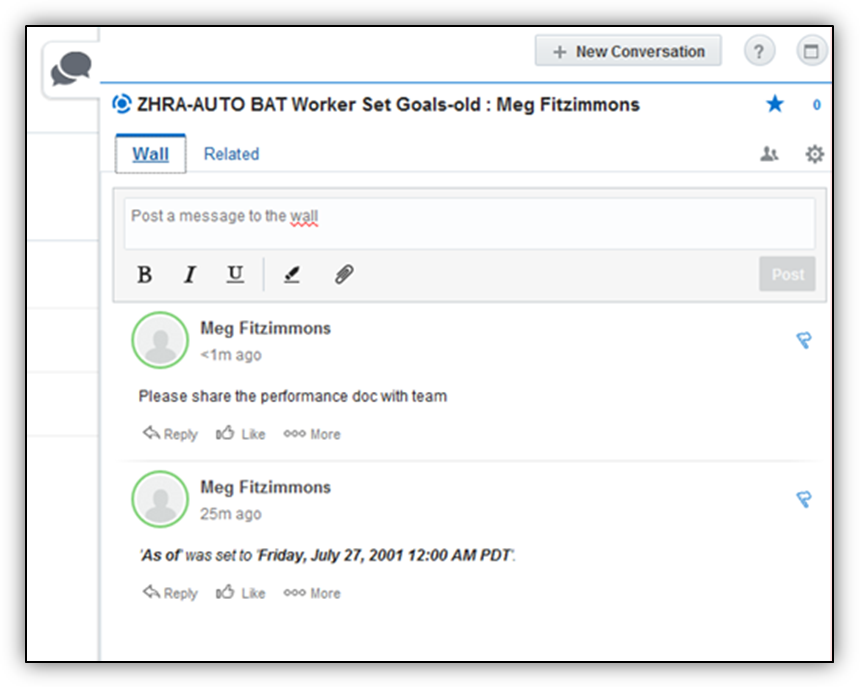

Mobile - Access Worker Social Wall

Within Oracle Tap, you can start an Oracle Social Network (OSN) conversation with a worker that you have selected. This feature requires that the OSN app is installed on the device because Oracle Tap uses punch-out integration with OSN to connect.

Steps to Enable

To connect with OSN, you need to install OSN on your mobile device and setup an appropriate OSN account. If you have an active account in both Fusion and OSN, then you can use this feature.

Mobile - Worklist and Notifications

You can view and act on workflow tasks on the Notification/Approvals page on your mobile device. As a manager, you can approve or reject a task and access the details task page. The details task page is a web view of the detail task view. Actions can only be done within the list view of the Notification page.

Steps to Enable

There are no steps necessary to enable this feature.

Role definitions for the security reference implementation are simplified. Many roles beneath the job level are eliminated. The privileges that are defined are assigned to job or abstract roles, either directly or as aggregate privileges (which are new to Release10). This reduces the complexity of role administration and customization. Some things to consider with the role simplification are:

- An aggregate privilege combines the functional privilege for an individual task or duty with the relevant data privileges. Oracle defines and delivers aggregate privileges, these cannot be customized.

- Privileges or aggregate privileges can be assigned directly to job or abstract roles. (In Release 9, privileges could be assigned only to duty roles.)

Every job or abstract role that existed in Release 9 also exists in the simplified role hierarchy for Release 10. Each of these job or abstract roles authorizes the same privileges in Release 10 as it did in Release 9. Release 10 adds some new job roles. The nodes in the hierarchy between a job and its privileges are reduced and simplified.

Release 10 will include both the hierarchy you are used to and the new simplified hierarchy. On upgrade, users will be members of the old hierarchy. You can move users to the new hierarchy at your discretion. Note that new functionality will exist under the new hierarchy.

Simplified Reference Role Model

Every job or abstract role that existed in Release 9 also exists in the simplified role hierarchy for Release 10. Each of these job or abstract roles authorizes the same privileges in Release 10, as it did in Release 9. Release 10 although, adds some new job roles. The nodes in the hierarchy between a job and its privileges are reduced and simplified.

Release 10 will include both the hierarchy you are used to and the new simplified hierarchy. On upgrade, users will be members of the old hierarchy. You can move users to the new hierarchy at your discretion. Note that new functionality will exist under the new hierarchy.

Steps to Enable

There are no steps necessary to enable this feature.

For existing customers who upgrade to Release 10, you can choose to move your users to the simplified hierarchy at your own discretion. Before beginning the move to the simplified hierarchy, please be sure to review the white papers on My Oracle Support to understand what is involved and how it will work.

Oracle Fusion Applications Security provides a single console in which security managers and security administrators can review, design, and modify roles in Oracle Fusion Applications. It enables users to visualize the relationship among roles, and to model applications-menu and task-pane entries for any role. Users can also manage certificates and review a set of security reports.

Copy Role and Inherited Hierarchy

You may create a new role by copying an existing role, then editing the copy. You have the option of copying only the "top" role (the role itself) or the top role and its inherited roles.

If you choose to copy only the top role, your copy shares its role hierarchy with the source role. That is, the source role inherits subordinate roles, and your copy inherits the same roles. Subsequent changes to those inherited roles will affect not only the source role, but also your copy.

If you choose to copy the top role and its inherited roles, the copied top role inherits new copies of all subordinate roles. This option insulates the copied role from any changes to the original versions of the inherited roles.

Copy Options for a Role Selected

There are no steps necessary to enable this feature.

Tips and Considerations

Enter the role name suffix to use during role copy in the Administration tab. This suffix will be used every time you copy inherited roles.

Analyze Roles by Role Category

A role belongs to a category, which describes the purpose the role shares in common with other roles. Typically a category contains a type of role configured for an application, such as "Financials — Duty Roles." You can review statistics about the categories themselves: the number of roles in each, the number of role memberships (roles belonging to other roles within the category), and the number of function and data security policies created for those roles. (Roles by Category pie chart compare the number of roles in each category with those in other categories.)

You can select a category and list the roles belonging to it. For each role, you can review its role memberships, function and data security policies, and users assigned to it.

The Security Console Analytics Page

Steps to Enable

There are no steps necessary to enable this feature.

Aggregate privileges are new in this release. Each aggregate privilege combines the functional privilege for an individual task or duty with the relevant data privileges. Oracle defines aggregate privileges, which cannot be customized. You can however, include them within job hierarchies that you define. When a job hierarchy uses aggregate privileges and you depict that hierarchy in the Security Console visualization, the aggregate privileges appear as distinct elements of the hierarchy.

Security Console Visualization of a Role Hierarchy with Aggregate Privileges, Which are Labeled “A”

Steps to Enable

There are no steps necessary to enable this feature.

A digital certificate establishes public and private keys for encrypting and decrypting data that Oracle Cloud applications exchange with other applications. You can now generate certificates in the X.509 format and/or continue to generate PGP formatted certificates. You can also export saved X.509 certificates for signing by a certifying authority or for use in other certificate systems.

Steps to Enable

There are no steps necessary to enable this feature.

Generate Certificate Signing Request for X.509 Certificate

When you generate an X.509 certificate it exists initially at a self-signed state. You transform it to a trusted state by having it digitally signed by a certificate authority. The Security Console enables you to create a Certificate Signing Request (CSR), a file that you would then send to a certificate authority. You would then import the response as a trusted certificate.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

Although the Security Console creates the CSR, you are expected to follow a process established by your organization to forward the CSR to a certificate authority. This process does not apply to PGP certificates.

Import Certificates From Keystore

You can import an X.509 certificate, typically belonging to an external source with which your system is to communicate. One or more X.509 certificates may be contained within a keystore and you have the option of importing certificates from a keystore. (Alternatively, you may import a certificate file on its own.)

Keystore Option Selected During X.509 Certificate Import

There are no steps necessary to enable this feature.

The Privilege Discoverer Report lists every secured action a user is authorized to within a work area.

Steps to Enable

There are no steps necessary to enable this feature.

The User Role Membership Report lists each user's job roles.

Steps to Enable

There are no steps necessary to enable this feature.

Mobile - Security Enhancements

To meet our customer’s needs related to security, Oracle Tap is providing support the following types of security capabilities:

- Federated SSO with a Customer’s External IDP

- Configured with IP addresses to allow and/or block access (i.e., blacklist or whitelist)

- A connection from a mobile device can utilize VPN from the device

- Supports 2-way authentication (NOTE: This functionality is only supported with iOS)

- App Containerization Support:

- Oracle Tap can be deployed with MDM solutions to secure the mobile device and/or the mobile applications on a device

- You will need to use the security archive that is posted on OTN: http://www.oracle.com/technetwork/topics/cloud/downloads/index.html. The company will need to define and implement a process to download the latest security archive, wrap it, re-deploy it via the enterprise app store and notify users. (NOTE: This functionality is only supported with iOS)

Steps to Enable

Each security capability requires specific information and steps to enable. Have your Administrator refer to the key resources section for more details.

Key Resources

For more information about configuring these security capabilities, go to My Oracle Support for the following documents:

- Oracle Tap User Authentication (Security) Approaches (Document ID 2025696.1)

- How To Prepare App for 2-Way Authentication – (Document ID 1955314.1)

- TECH NOTE - Oracle Tap for iOS - Wrapping with Good Technologies

(Document ID 1928088.1)

(Document ID 1928088.1)

Oracle Fusion Absence Management is a configurable and flexible global solution that enables organizations to manage absences of their workforce. The framework provides ability to define both complex and diverse absence plans. It integrates with the Oracle Fusion Global Payroll and Oracle Fusion Time and Labor products and provides dedicated work areas for the roles of Administrator and Employees. You can extract absence data for use with third-party payroll providers.

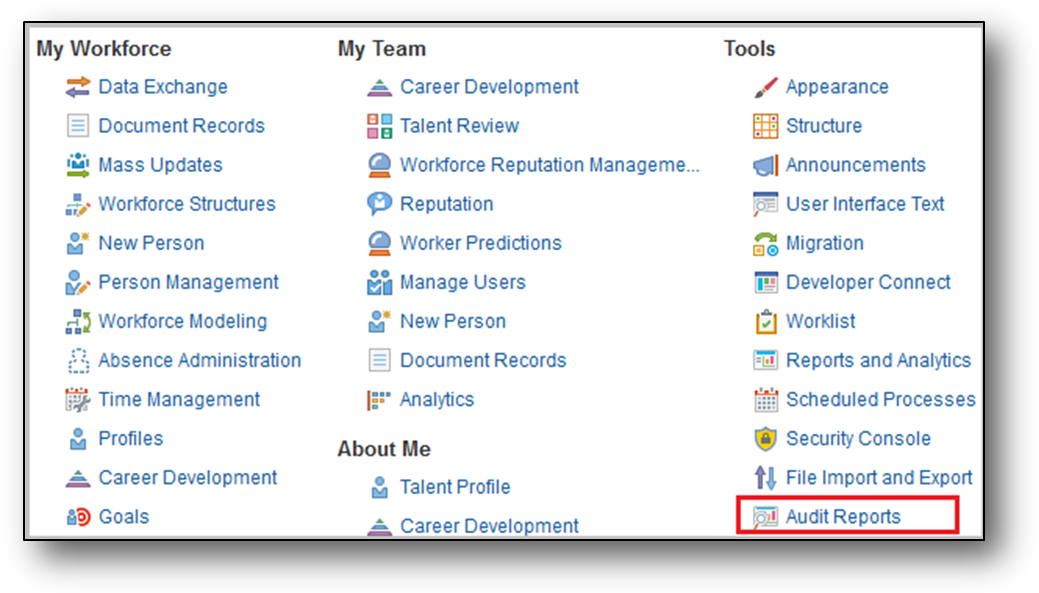

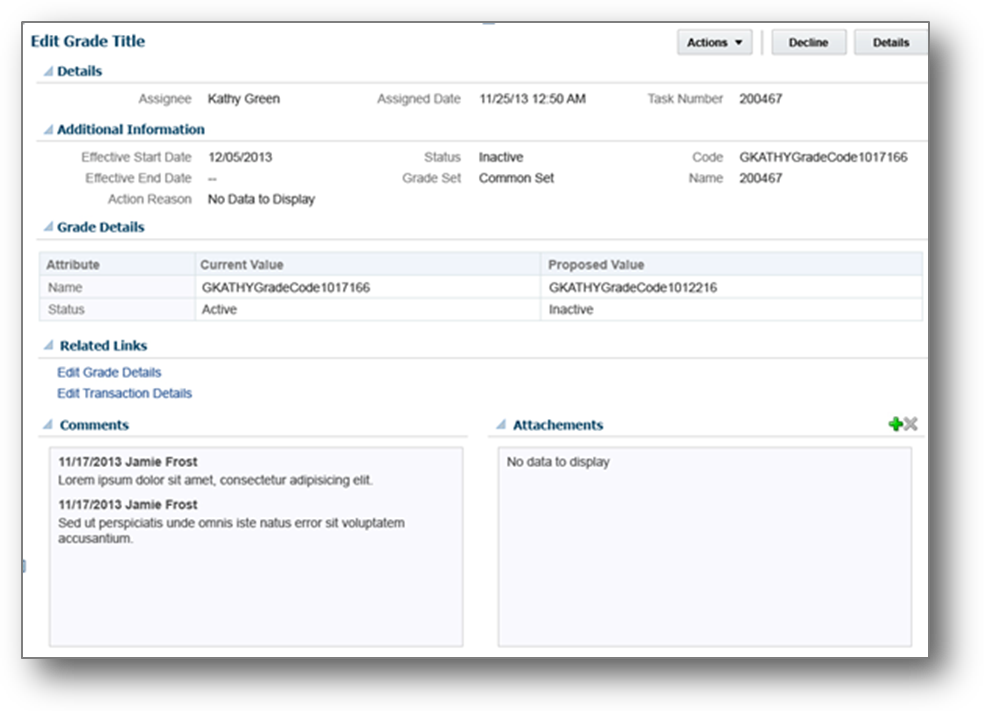

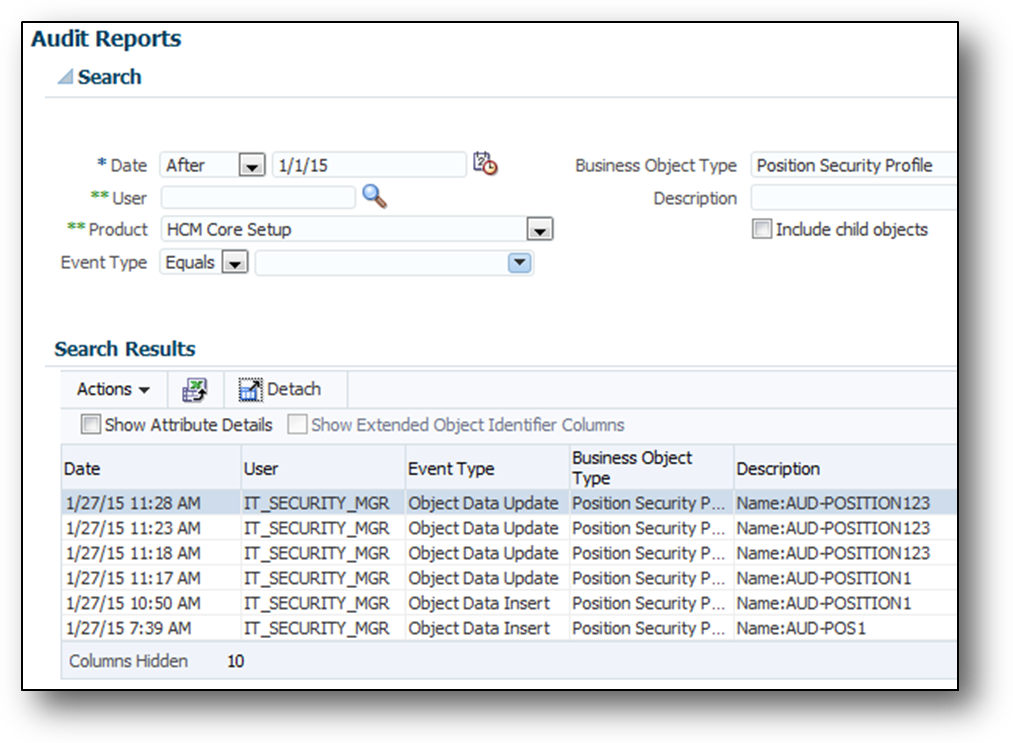

Audit Framework Includes Absence Record Data

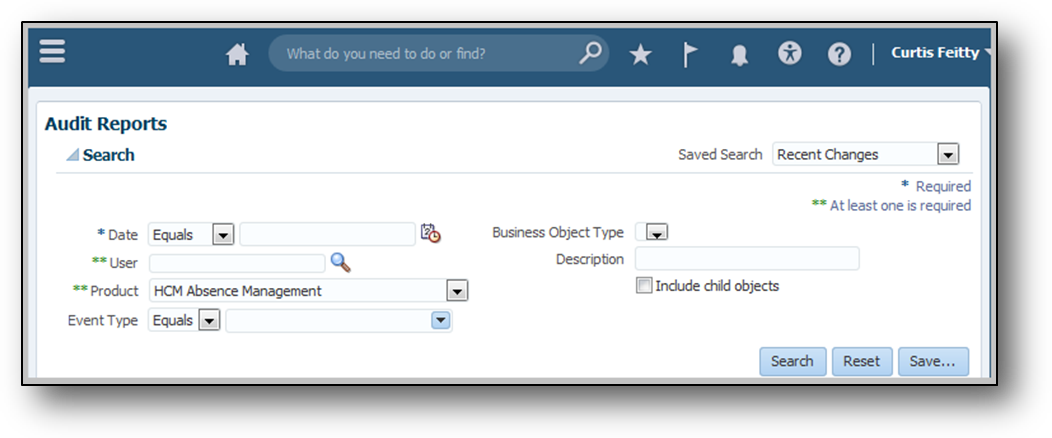

The audit framework includes absence records. If you have the Internal Auditor job role assigned, you can view audit reports for absence management.

Audit Reports Option on the Navigator

Audit Reports Page

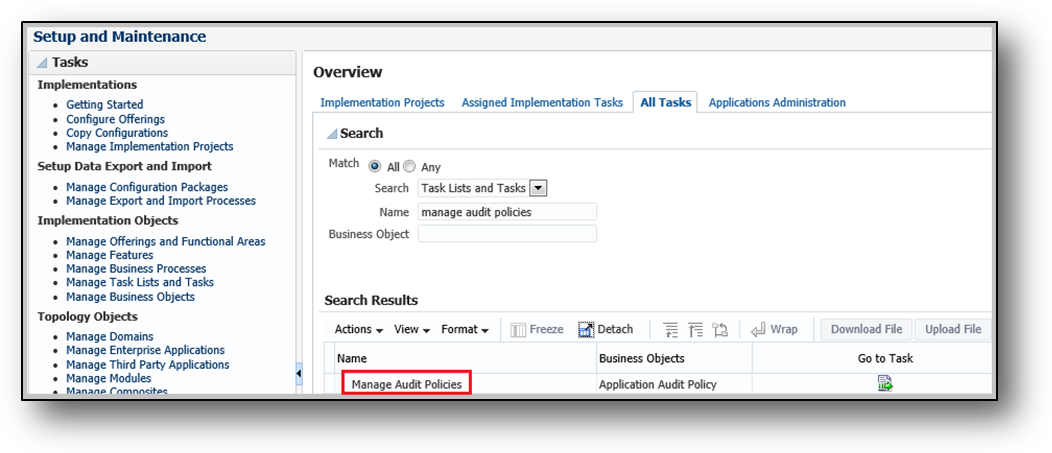

Steps to Enable

To enable audits for absence management, use the Manage Audit Policies task in the Setup and Maintenance work area.

Manage Audit Policies Task

HCM Extracts Includes Absence Record Data and Accrual Balances

HCM Extracts now includes absence records, use of entitlements, and accrual plan balances. The user entities added to integrate absence records, entitlement information, and accruals with third-party service providers and payrolls are:

- PER_EXT_SEC_PERSON_UE

- ABS_EXT_ABSENCE_ENTRY_UE

- ABS_EXT_ACCRUAL_UE

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

- Extracting Absence Data Using HCM Extracts: Points to Consider

- Defining an Extract: Worked Example

Approval Framework Enhancements

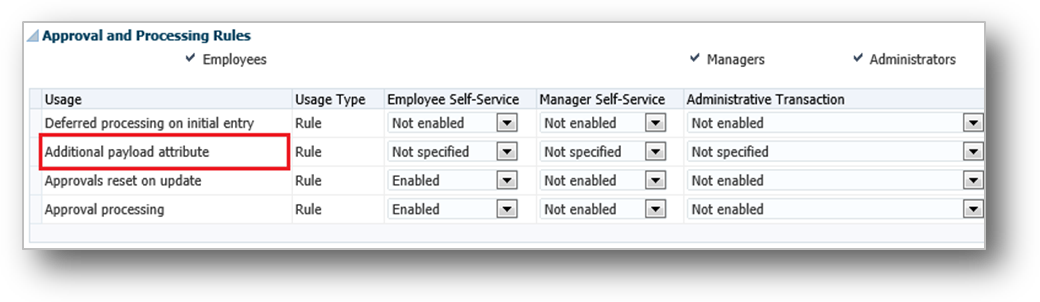

To expand the capabilities for approval business rules, you now have an optional, configurable Additional Payload attribute field to help you configure the absence approval flow according to your organization needs. This allows more flexibility in routing approvals within your organization.

The absence approvals task also has two new delivered functions:

The GetManager function automatically approves an absence if the requestor has no manager assigned in the hierarchy. This function is applicable in cases when the employee is a CEO or head of an organization.

- The GetRepresentative function automatically approves an absence if the requestor has no HR Representative assigned in the hierarchy.

Steps to Enable

Users with the Administrator role can configure approval rules. To enable the Additional Payload attribute rule:

- Click Manage Absence Types in the Absence Administration work area.

- Click Display Features on the Create Absence Type page.

- Select Specified in the Additional Payload attribute row in the Approval and Processing Rules section.

Additional Payload Attribute

Assignment Hours as Work Schedule Option

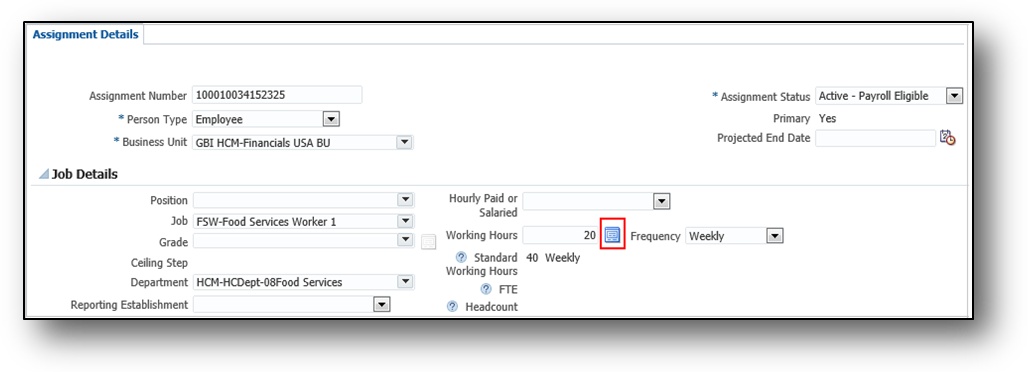

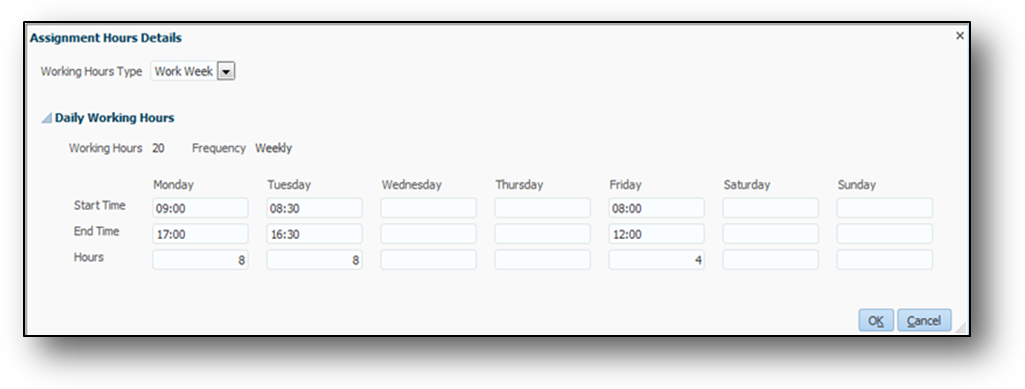

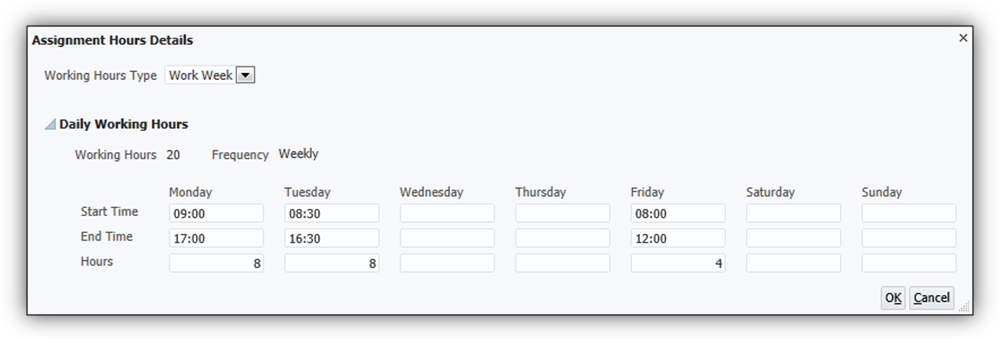

You can now specify a worker’s daily assignment hours where the start time, end time, and hours vary in the new Assignment Hours Details dialog box. Click the Assignment Hours Details button after the Working Hours field in assignment details to open the Assignment Hours Details dialog box. You can define the daily working hours for a worker. The availability calculation uses this work week schedule to calculate the worker’s availability by day.

Assignment Details Page Showing the Assignment Hours Details Button after the Working Hours Field

Assignment Hours Details

In Absence Management, when a worker schedules an absence, the work schedule timings and number of hours for that particular day are reflected on the absence request page.

For Example: A worker’s assignment hours are from 08:00 to 12:00 every Friday. When you schedule an absence for the worker on a Friday, the availability calculation uses the worker’s start and end times to determine the worker’s availability by day. So the total absence time calculated for the worker is four hours.

This feature is available in Global Human Resources. When a worker schedules an absence in Absence Management, the application automatically calculates the worker’s absence hours based on the work schedule.

Steps to Enable

There are no steps necessary to enable this feature.

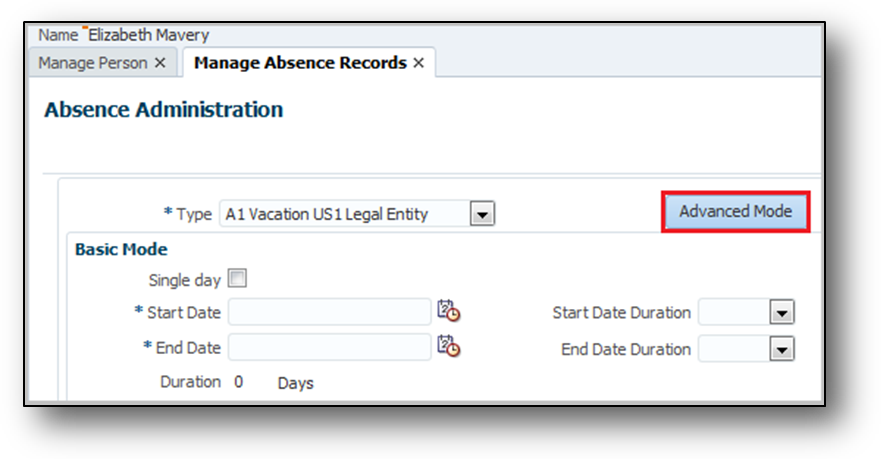

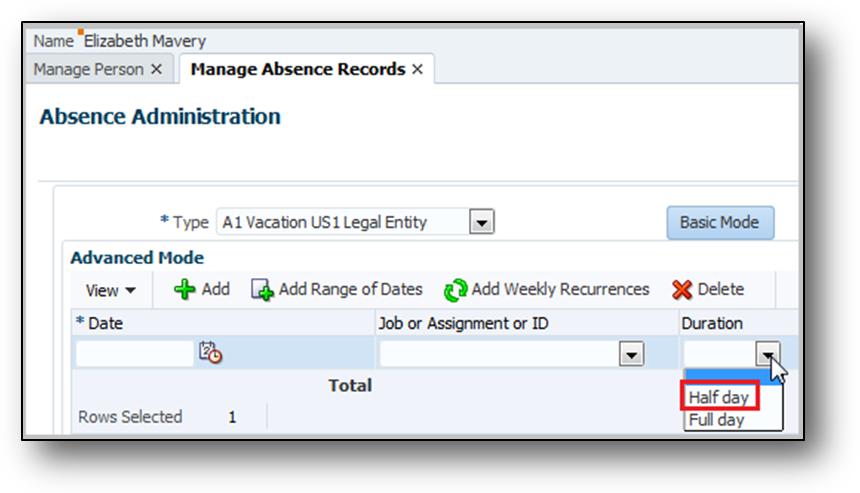

Schedule Half Days for Absences Measured in Calendar Days

You can now schedule a half day absence for absence types measured in calendar days.

To use this feature, when you schedule an absence, select the Advanced Mode.

Select Advanced Mode on the Manage Absence Records Page to Schedule a Half Day Absence

Select Half day in the Duration Field to Schedule a Half Day Absence

Steps to Enable

There are no steps necessary to enable this feature.

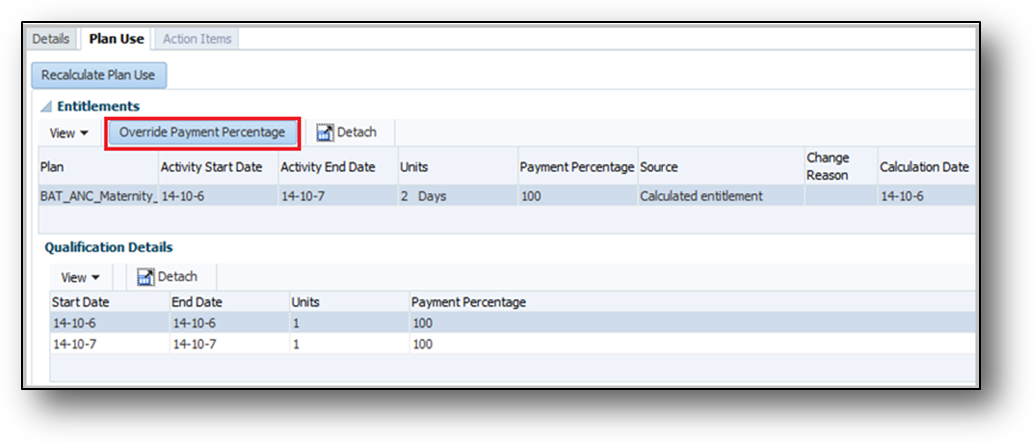

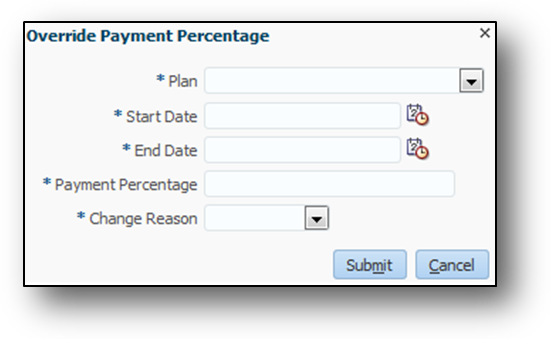

Override Payment Percentages for Calculated Entitlements

HR Specialists can now easily handle exception cases when processing employee leave transactions by changing the payment percentages for calculated qualified entitlements for a qualification absence.

Select the Override Payment Percentage Button on the Plan Use Tab

The Override Payment Percentage Dialog Box

Steps to Enable

There are no steps necessary to enable this feature.

Absence Records for Contingent Workers

Absence Management now supports absences for contingent workers. You can add the absences for contingent workers the same way as for employees and through the same user interfaces.

However, you may want to process your contingent worker absences differently from those of employees, and have separate absence types and absence plans for them. You can define the absence plans for contingent workers so that their absence information does not transfer to payroll for processing. Use eligibility profiles to restrict these Absence types for contingent workers.

Steps to Enable

There are no steps necessary to enable this feature.

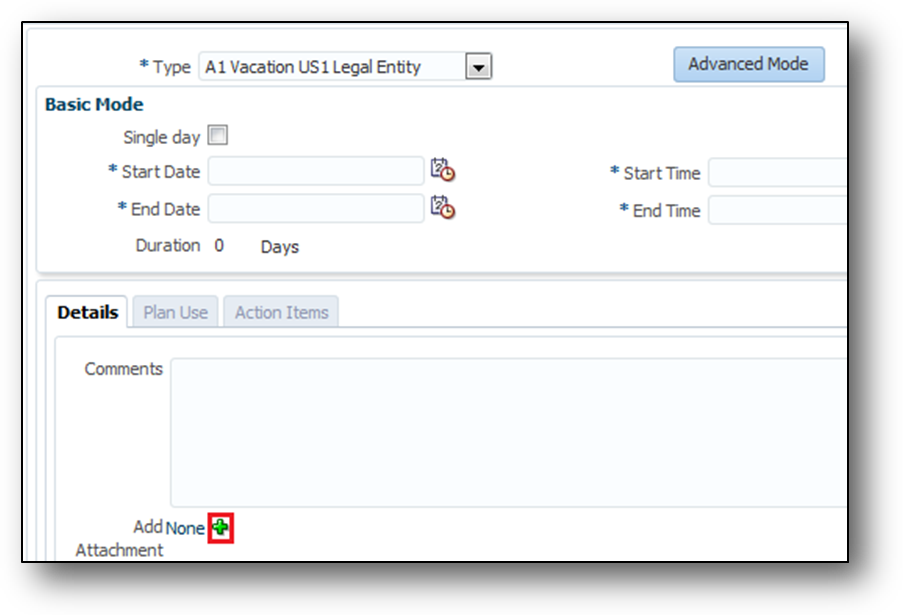

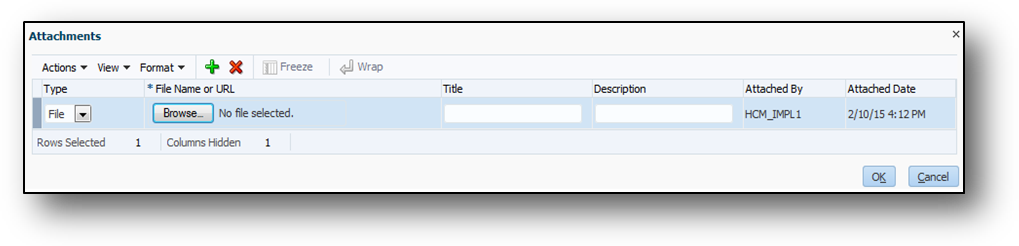

Attachments for Absence Records

The Attachments feature enables an Administrator, Manager, or Employee to attach files when recording an absence. An employee may need to submit documents for absence requests where proof is required, such as medical certificates for an extended sick leave. Attachments include files and links.

Select the Add Attachment Button on the Schedule Absences Page

Attachments Dialog Box

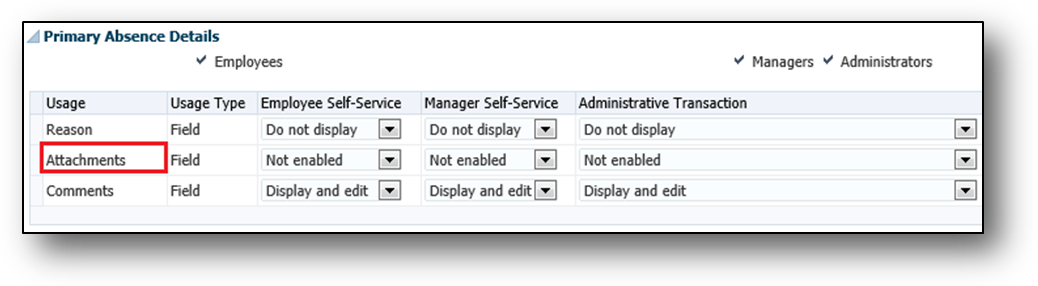

Steps to Enable

To enable the attachments feature on the absence recording pages for an employee, manager, or administrator:

- Click Manage Absence Types in the Absence Administration work area.

- Click Display Features on the Create Absence Type page.

- Select Enabled in the Attachments row, in the Primary Absence Details section.

Attachments

Tips and Considerations

You can attach any number of files. However, the combined file size must not exceed the maximum limit of 2 MB for an absence record.

You can now view current, historic, and projected accrual details at different points in the worker's history.

To view accrued entitlements:

- In the Person Management work area, select the worker whose entitlements you want to view.

- Click Manage Absence Records to open the Manage Absences and Entitlements page.

- In the Plan Participation section Accrual Plans subsection, click the accrual plan for which you want to view details to open the Accrual Plan Balance dialog box.

- Change the Balance Calculation Date to view the details of current, past or future-dated absences. The details displayed in the Summary and Details tab change according to the selected date.

View Absence Details by Changing the Balance Calculation Date

There are no steps necessary to enable this feature.

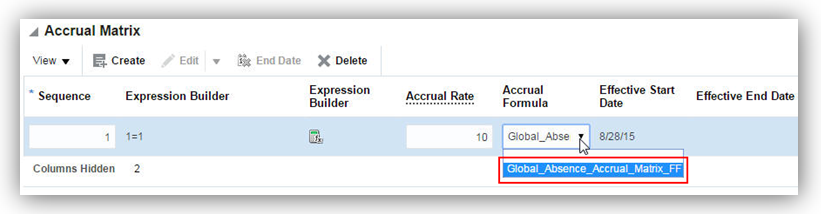

Provide Additional Flexibility for Accrual Calculations

Using the Global Absence Accrual Matrix fast formula, you can now define the hours worked to determine the paid time eligible workers accrue over the course of an accrual term.

Steps to Enable

To enable the accrual rate, use the Accrual Formula choice list in the Create or Edit Absence Plan page, Accruals tab to associate the appropriate formula with the absence plan.

Example Accrual Formula that you can Associate with Accrual Absence Plans

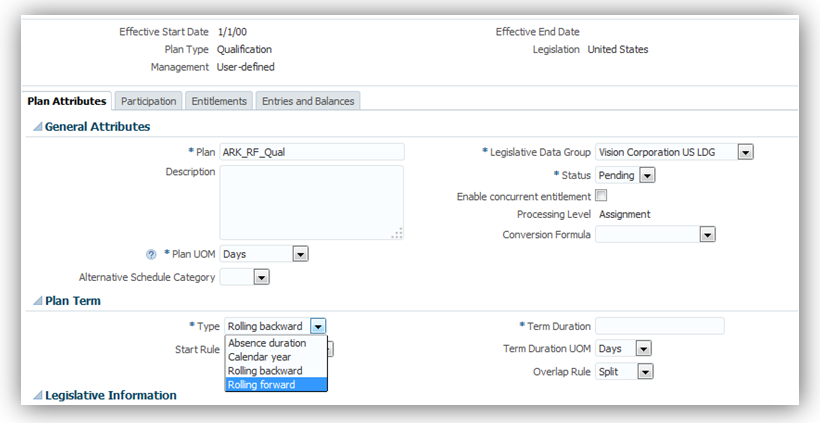

Provide Rolling Forward Periods for Qualification Plans

Absence Management now provides the option to track plan entitlements under a rolling forward period definition. A rolling forward period calculates the start date from the first date a worker's absence begins and calculates the end date by adding the term duration to the start date.

For example, if the term duration is 365 days and the absence start date is 10 Feb, then the end date will be 09 Feb of the following year. The rolling forward option evaluates absences between this start date and end date to track plan entitlements for that period.

To use the rolling forward option:

- In the Absence Administration work area, click Manage Absence Plans to open the Manage Absence Plans page.

- On the Search Results section toolbar, click Create to open the Create Absence Plan dialog box.

- In the Plan Type field, select Qualification.

- Click Continue.

On the Create Absence Plan page Plan Attributes tab Plan Term section, select Rolling Forward as the type.

Rolling Forward Plan Term Type for Qualification Plans

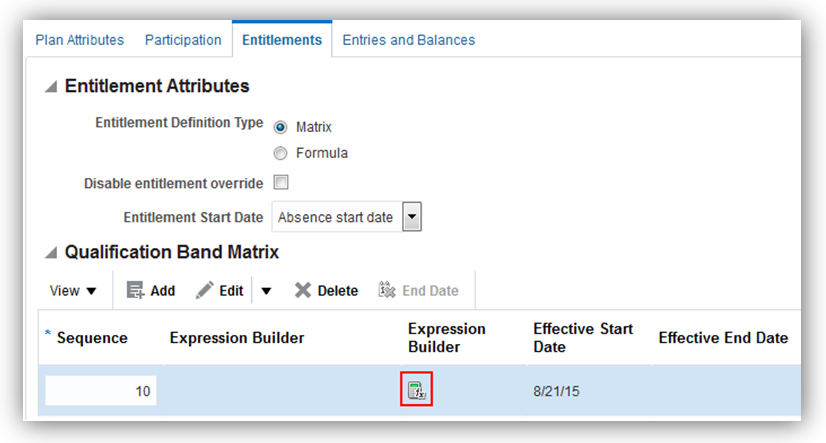

New Attributes for Calculation of Qualified Entitlements

When creating a qualification plan, you can now use the absence type and absence reason attributes and reference them in matrix-based calculations of entitlements.

To use these attributes:

- In the Absence Administration work area, click Manage Absence Plans to open the Manage Absence Plans page.

- On the Search Results section toolbar, click Create to open the Create Absence Plan dialog box.

- In the Plan Type field, select Qualification.

- Click Continue.

- On the Create Absence Plan page Plan Attributes tab, enter the required fields.

- Select the Entitlements tab.

- In the Qualification Band Matrix section, click Add to enter a new row.

- Enter the Sequence.

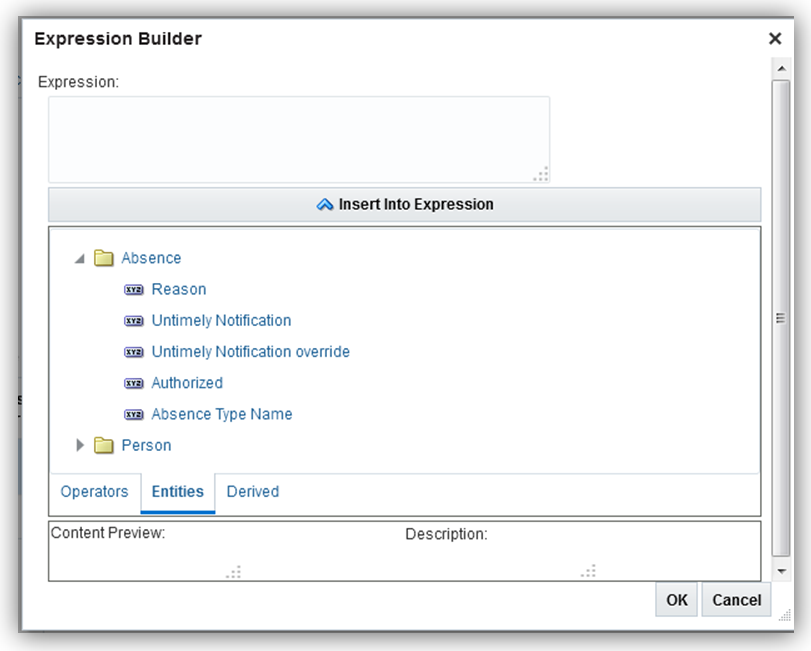

- Click Expression Builder. The Expression Builder dialog box appears.

- Click Entities.

- Expand the Absence folder to select an attribute.

Expression Builder in the Qualification Band Matrix Section

Select an Attribute from the Absence Folder

Steps to Enable

There are no steps necessary to enable this feature.

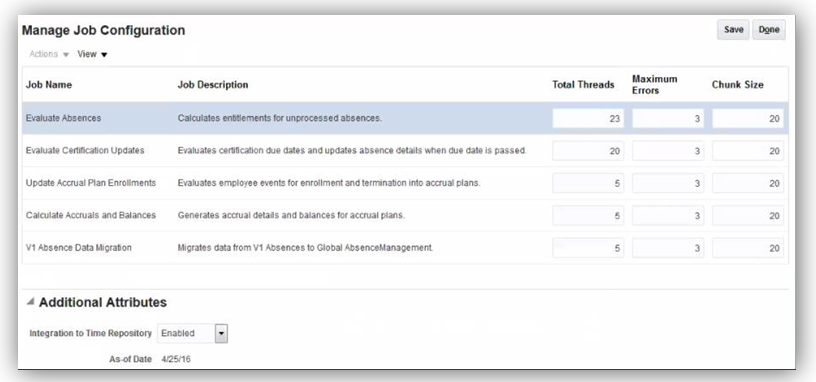

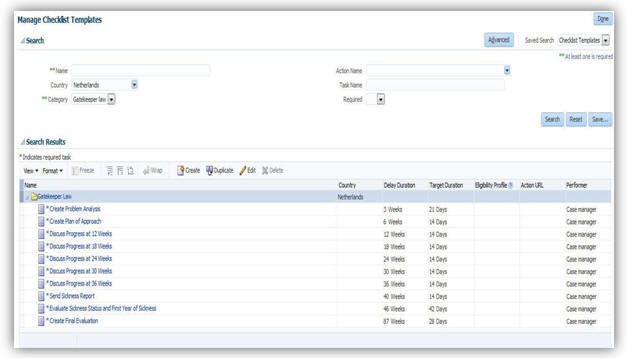

Configuration Option for Integration with Time and Labor

You can now enhance the performance of Absence Management by changing the default configuration for integration with the time repository. By default, the configuration option is enabled. However, you can now disable the option for customers who are not using Time and Labor.

To change the option, you can use the Integration to Time Repository option in the Manage Job Configuration page of the Absence Administration work area.

Configure Option for Integration with Time Repository

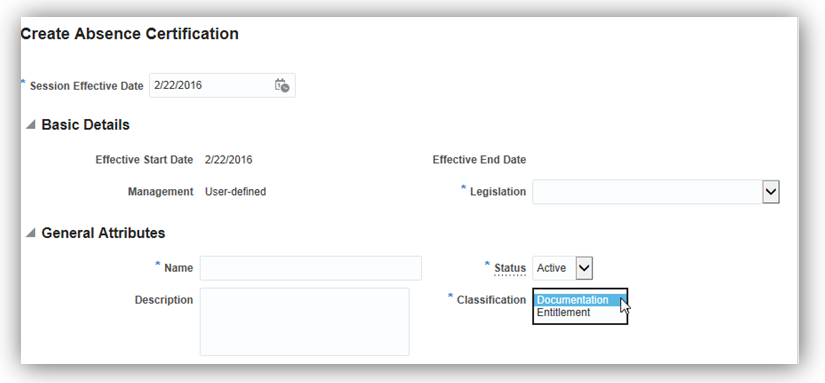

Improved Absence Certifications Process

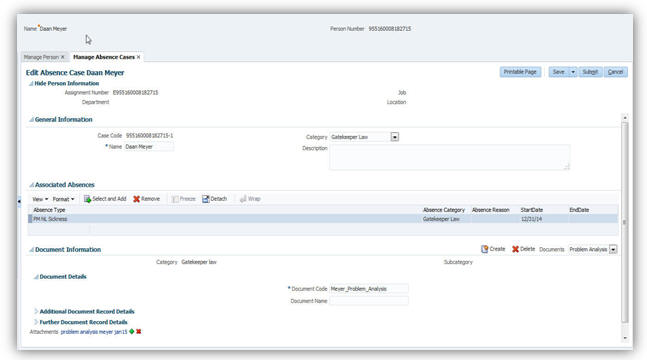

In order to streamline the documentation aspect, you can now use the Documentation feature to track documentation related to a worker’s absence.

Documentation Feature

Steps to Enable

There are no steps necessary to enable this feature.

You can view a list of the employee’s available balances and planned absences for the different absence types. Employees can also request an absence from the different absence types and frequencies.

Steps to Enable

There are no steps necessary to enable this feature.

Oracle Fusion Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

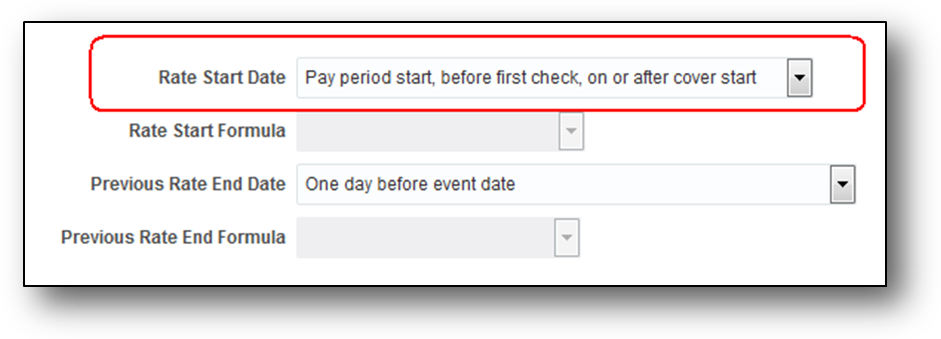

Control the rate start date based on the date of the first pay check on or after the enrollment start date without using a rate periodization formula.

You use the new Pay Period Start, Before First Check, on or After Coverage Start rule for plans with waiting periods or flexible spending accounts, for biweekly, weekly, or semi-monthly payroll participants.

You select the rule in the Coverage and Rate Date Ranges section of the Enrollment step in the Create or Edit Plan or Program page of the Plan Configuration work area.

The Rate Start Date field in the Plan Configuration Work Area

For example, your enterprise enforces a waiting period of 30 days for enrolling new hires on biweekly payrolls into a flexible spending plan. You want the flexible spending account rate to start on the first day of the pay period that precedes the date of the first pay check on or after the enrollment start date.

You hire a worker on November 1, 2014. The worker makes elections on November 12, 2014. In this case, the enrollment start date is December 1, 2014. The first check date after the enrollment start date is December 13, 2014. If you use this date rule, the rate starts November 30, 2014, which is the start of the pay period, in time for the next check date on December 13, 2014.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about the new rate start date rule, go to Applications Help for the following topic:

- Rate Start Date for Flexible Spending Account Plans: Critical Choices.

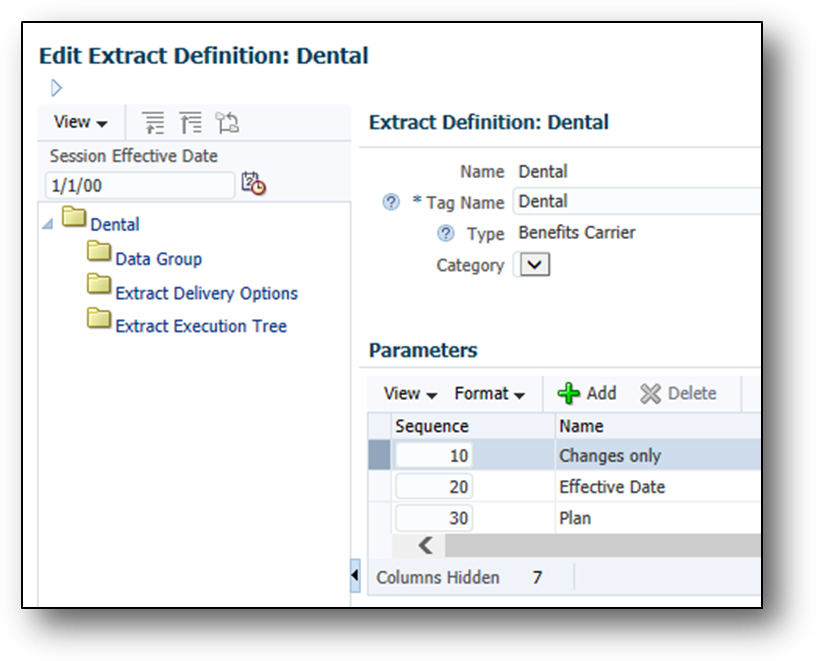

Extracting Benefits Data Using HCM Extracts

You now have an additional way of extracting benefits data. The existing Benefits Extract functionality produces an HR-XML standard formatted file of enrollment data for onward transmission to third-party benefits carriers. In addition to using the Benefits Extract for reporting purposes, you can also use the generic HCM Extracts functionality to extract benefits data using the available Benefits database items. Use HCM Extracts to create your own reports and extracts in different formats.

You create extracts using the Manage HCM Extracts page in the Data Exchange work area.

The Edit Extract Definition Page in the Data Exchange Work Area

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about extracting benefits data, go to Applications Help for the following topics:

- Extracting Benefits Data Using HCM Extracts: Points to Consider

- Defining an Extract: Worked Example

Check if your formula works as expected for a sample participant without any impact on existing data. Previously, a full-scale plan configuration was required before you could associate your formula with an appropriate object. Also, you had to necessarily use the participation evaluation process and enrollments to test the formula.

Now you can check to see if your formula works as expected even before you complete your plan configuration, thus reducing errors during implementation.

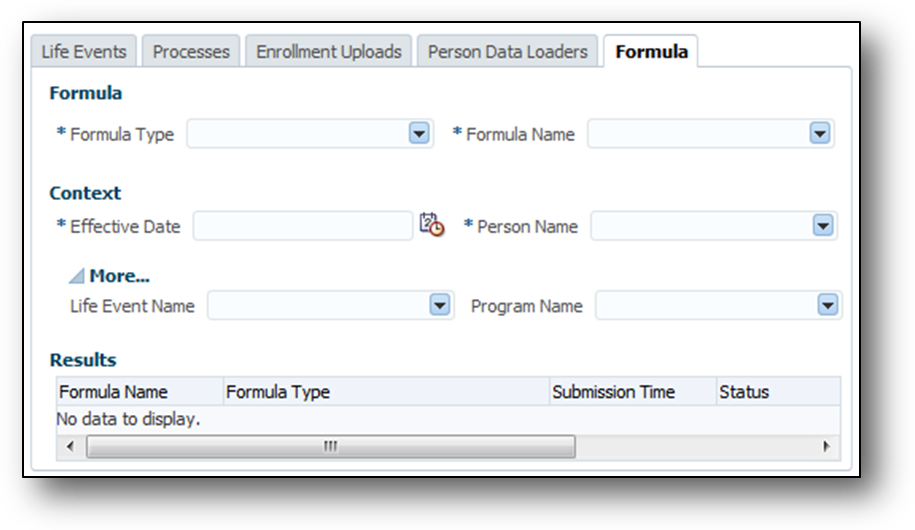

You test your formulas in the Formula tab of the Evaluation and Reporting work area.

The Formula Tab in the Evaluation and Reporting Work Area

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about testing benefits formulas, go to Applications Help for the following topic:

- Benefits Formula Evaluation: Points to Consider

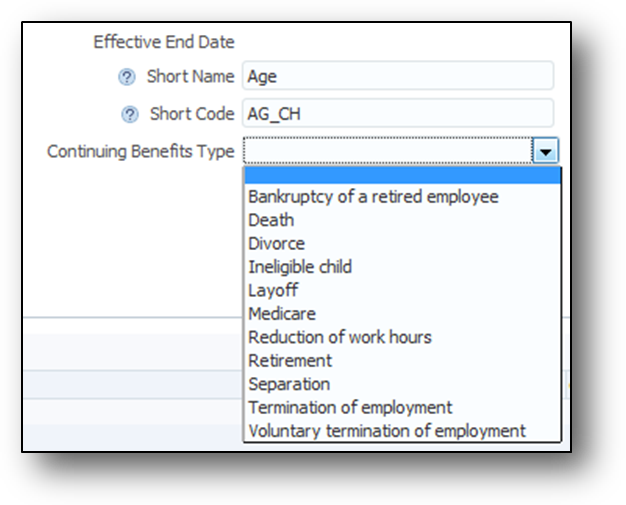

Report to benefits carriers when enrollments of a participant or dependent end. Some life events, such as termination, end the enrollment of compensation objects for participants or their dependents. When you define a life event, you can now specify to carriers about the existence of end-dated offerings and any associated dependents. You can comply with any reporting requirement associated with the continuation of benefits coverage to its next phase.

You specify the continuing benefits type in the Create or Edit Life Event page in the Plan Configuration work area.

Steps to Enable

There are no steps necessary to enable this feature.

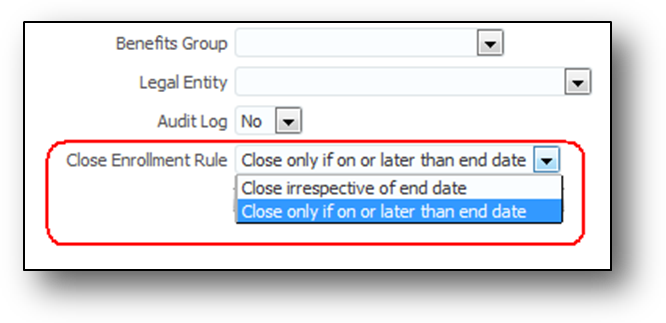

Use the new rule to control which life events must close or remain in the Started status when you run the Close Enrollment process. You can now configure the process to either close life events irrespective of their enrollment period end date or close the events only if the enrollment period end date is met.

The Close Enrollment Rule list is available as part of the parameters page of the Close Enrollment process in the Evaluation and Reporting work area.

Close Enrollment Rule

Steps to Enable

There are no steps necessary to enable this feature.

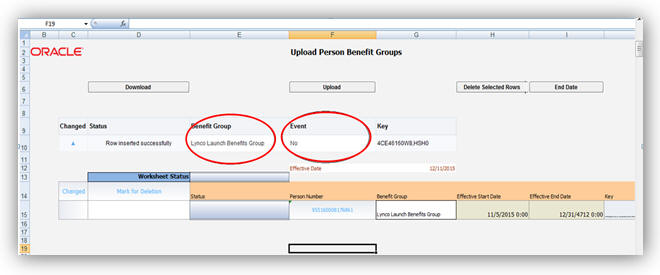

Filter Data and Suppress Life Event Triggering

The following workbooks contain new attributes to enable you to filter data, if required:

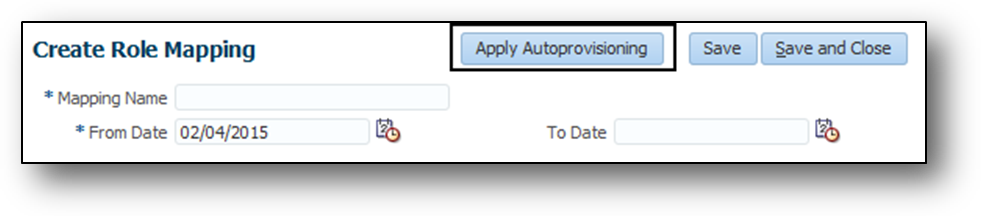

- Upload Person Benefit Balances

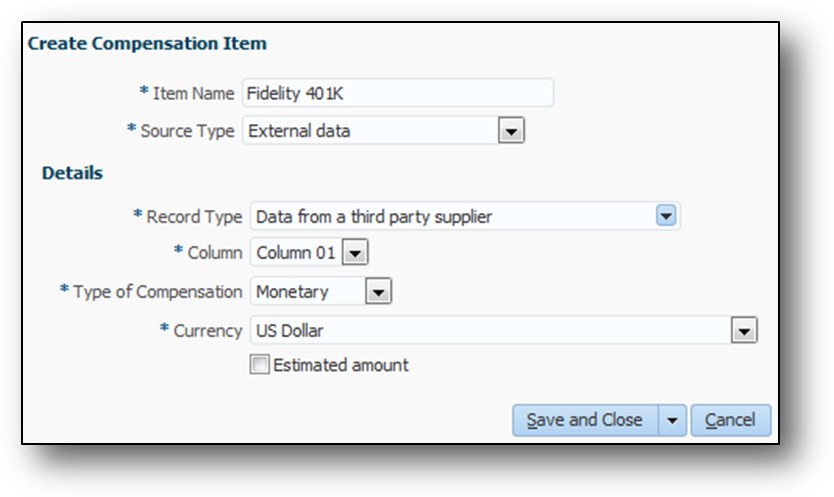

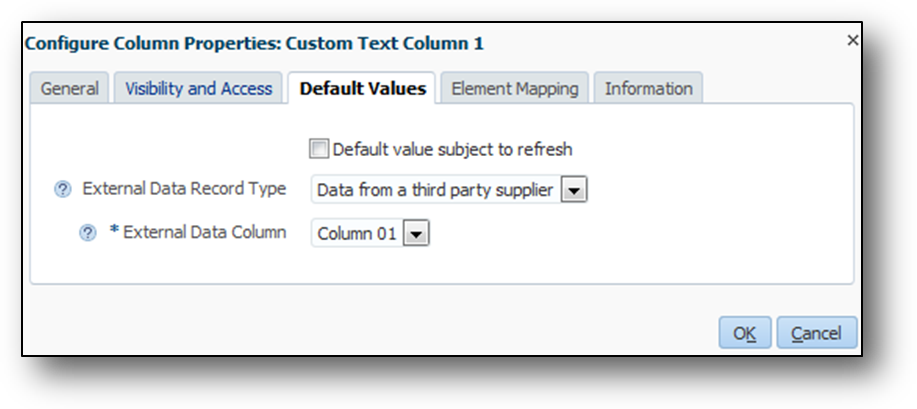

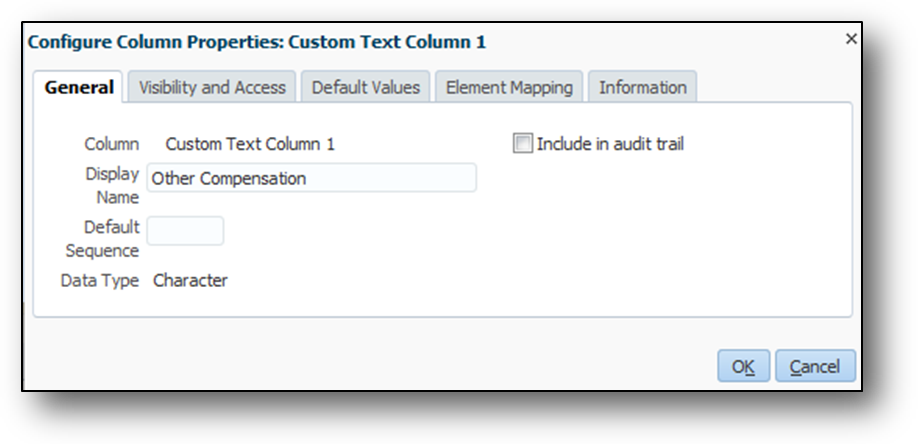

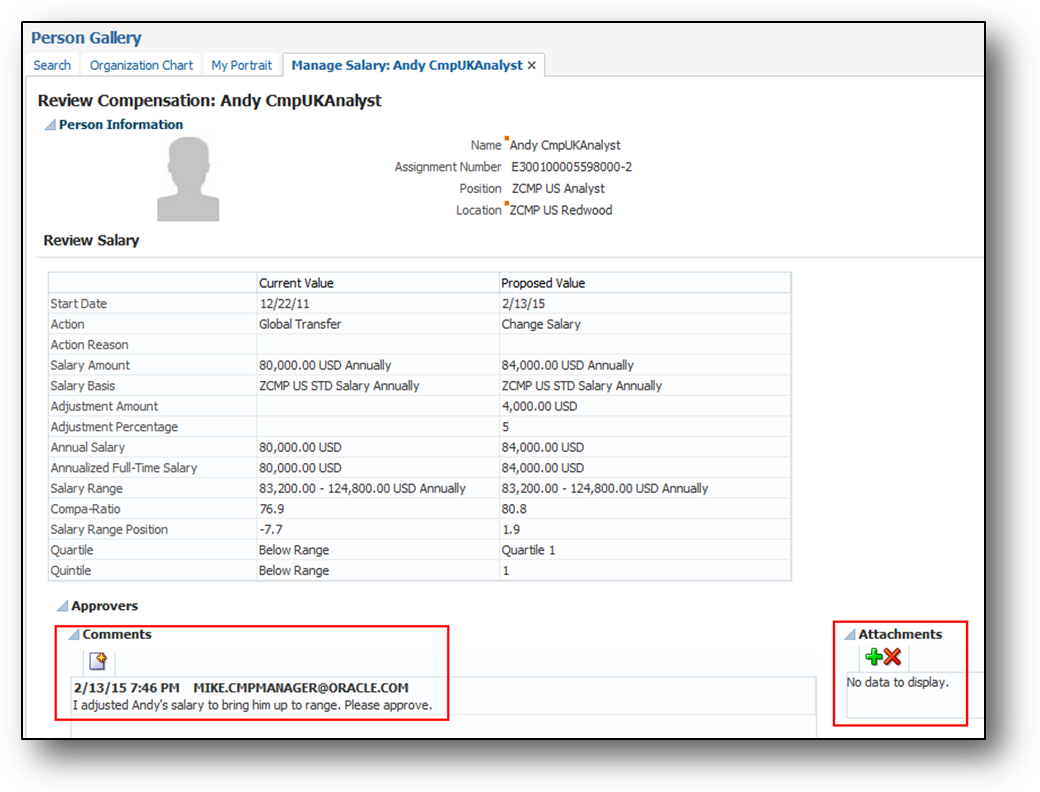

- Upload Person Benefit Groups