Agile Finance in Banking

Contents

|

0

|

Introduction

When banking CFOs get a chance to meet for lunch, there’s more

than daily specials on the menu.

|

|

1

|

The Case for Change in the Office of the CFO:

Toward Agile Finance

The banking industry is unique and under extreme pressure for

change, so how do you measure success?

|

|

2

|

Technology for Agile Finance

As a decision maker in the banking industry, you’re probably

already taking a hard look at your on-premises ERP system—and if

you aren’t, you should be.

|

|

3

|

Is the Time Right for You to Modernize?

Has your organization reached a key inflection point—that point

where you’re facing substantial upgrades to your on-premises

ERP software and hardware just so you can support evolving

operational goals?

|

|

4

|

What to Look For:

“Must Haves” for the Modern ERP System Regardless of your specific needs, there are some common

characteristics that should be considered for any ERP modernization.

|

|

5

|

Oracle and Modern ERP in Banking

Oracle’s enterprise-grade cloud is a complete system that lets

you connect to other clouds and on-premises systems for true

integration. It’s a modular solution so you can modernize your ERP

on your timeline.

|

|

6

|

Planning and Deploying Modern ERP

The steps for planning a modern ERP strategy for banking includes

a comprehensive statement of intended outcome, but must also

consider the process.

|

|

7

|

Get Started with Your Agile Finance Modernization

Accomplish your modernization goals with Oracle ERP cloud:

Manage costs, achieve operational efficiency and service excellence,

and focus on the innovation that distinguishes your institution.

|

Introduction

When chief financial officers (CFOs) from leading banking institutions finally take the time to do lunch, daily specials aren’t the only thing on the menu.

The conversation starts with trading snapshots of latest financial results, but soon turns to an earnest discussion of shared challenges—crazy-like-a-fox competition, persistent change, and burgeoning compliance requirements.

But one hungry CFO is among those who are already making the leap to agile finance with cloud-based ERP solutions.

“We’re already seeing the benefits from integrating data, processes, and analytics to support all aspects of our finance ecosystem— including compliance,” she confirms. “We’ve reduced the costs of maintaining shared services, we have more transparency and more control, and we’re responding faster to regulatory changes. We’ve also been able to move resources from transactional tasks to more-strategic positions.”

Taking a sip of sparkling water, she smiles and adds, “Lunch is on me.”

From “Capital One: Think More Like a Tech Company, Less Like a Bank,” Bank Innovation.

Read the ArticleThe Case for Change in the Office of the CFO: Toward Agile Finance

The challenges are clear: Your bank is under extreme pressures, including tightening margins and increased competition—not to mention a plethora of regulations and a fast-moving market for new offerings and delivery channels.

Emerging technologies will significantly transform businesses over the next five years—especially in the office of the CFO—and savvy boards and CEOs are looking at a new way to operate in this ever-changing environment.

It’s called Agile Finance. It’s resilient, responsive, and predictive, and corporate leaders understand that it’s a game changer.

What Drives Agile Finance?

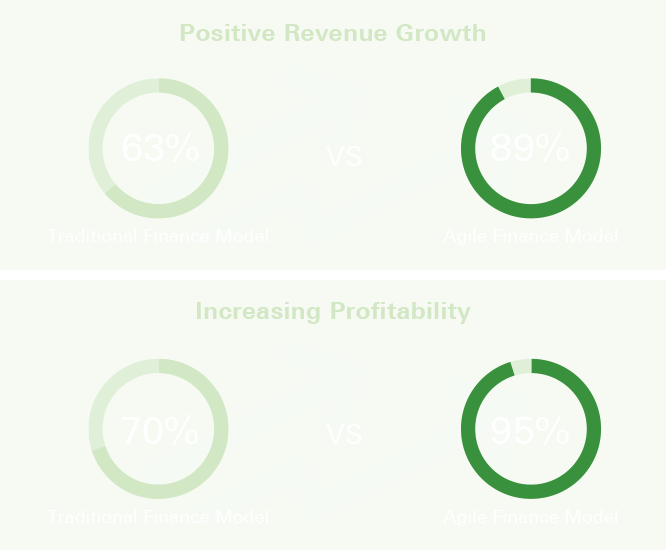

The Benefits of Agile Finance

Leading the Way to Agile Finance

Agile Finance leaders work differently from their more traditional counterparts.

|

The New Operating Model for Modern Finance

Read more about Agile Finance in this new report from AICPA

and Oracle.

|

Technology for Agile Finance

As a decision maker in the banking industry, you’re probably already taking a hard look at your on-premises ERP system—and if you aren’t, you should be.

The challenges and industry pressures in your organization are exacerbated by the disproportionately high costs of internal operations associated with financial, management, external, and regulatory reporting—reporting that’s often linked to outdated legacy technology systems.

| 90% of banks have unsustainable efficiency ratios |

Traditional, on-premises ERP systems focus on integrating core business processes and require substantial customization—particularly true for banking institutions, whose needs can be significantly different from other industries.

These systems don’t offer “anytime, anywhere, any device” access, and—given the capital expense associated with updating on-premises systems and the specialized, internal staff needed to maintain them—legacy, on-premises ERP has proven to be a costly model.

A New Definition of Success: What Changed?

Whether you’re talking about the boardroom or the back office, the factors driving you to modernize your ERP are essentially the same:

| Enabling Greater Business Agility |

From On-Premises to Cloud—Making the Move to Modern ERP

Cloud ERP solutions meet the digital requirements that today’s users expect. They offer sophisticated data access and analysis along with built-in collaboration and social features. By turning to modern, cloud-based solutions, banking institutions are seeing benefits that include:

Cloud-based ERP also eliminates the need for budget-killing, multiyear IT projects and heavy customization—letting you move your IT resources to focus on the mission of your institution.

Is the Time Right for You to Modernize?

Has your organization reached a key inflection point—that turning point where you’re facing substantial upgrades to your on-premises ERP software and hardware just so you can effectively support changing operational goals and the basic needs of your organization? If so, then maybe it’s time to modernize.

Chances are that your existing system has been customized to the point where upgrades and additions will require significant resources and significant time—sometimes 18-24 months. This is the point where many organizations turn to cloud-based ERP because it can provide faster delivery of the modernized systems you need to achieve your goals.

Clearly, there are benefits to ERP cloud, but when is the right time to make the move, and what steps do you need to take? Just as important, how do you find the right vendor/partner and solution for your institution?

Comparing Financial Models Cap-Ex vs Op-Ex

For many institutions, it’s the capital versus operating expense math that makes the decision easier.

Instead of investing capital in on-premises ERP systems that will continue to need significant resource investments for software and hardware upgrades, maintenance, and database expenses, you can eliminate most of these costs using the cloud subscription model.

The bottom line?

Your organization can reallocate funds that were previously designated for the back office and use them for growth, innovation, and the more mission-specific goals of your institution.

Top 10 Signs It’s Time to Deploy Modern ERP

Do you see any of these signs in your institution? Select all that apply and then check what your score means at the bottom.

|

1

|

Increased ERP maintenance costs. to your on-premises ERP system are adding to overall IT costs. |

|

2

|

Required upgrades to legacy ERP. Your on-premises system is past due for expensive upgrades for both software and hardware. |

|

3

|

Shadow systems and disparate data. Other groups are establishing their own systems. Multiple sources of truth mean conflicting answers to critical operational questions. |

|

4

|

Adopting best practices. Your institution is realizing that adopting cross-industry best practices can help it thrive. |

|

5

|

Dissatisfied users. Your employees are complaining about usability and complex processes because they expect the same ease of use and responsiveness they get from their social apps. |

|

6

|

Expansion plans. Your institution is expanding—for example, through mergers and acquisitions or by partnering with other groups and institutions. |

|

7

|

New sources of revenue. Your institution is considering alternative revenue streams and business models, but doesn’t have the system capabilities to model scenarios and make timely decisions. |

|

8

|

Data analysis paralysis. You’re pushing the limits of your ERP data analysis capabilities and, as a result, hindering the work of your managers and analysts. |

|

9

|

Increased reporting challenges. Your legacy ERP system can’t support the increasing reporting requirements or provide the insight necessary to make informed decisions. |

|

10

|

New compliance requirements. Increased requirements for financial and regulatory compliance are testing the limits of your ERP system. |

How many signs do you see in your institution?

|

0-3

|

Start investigating options for moving to a modern,

cloud-based ERP system.

|

|

4-6

|

You should be crafting a modernization plan and looking

at vendors.

|

|

7+

|

You’re probably already on your way to moving to a modern,

cloud-based ERP system.

|

What to Look for: “Must Haves” for the Modern ERP System

Regardless of your specific needs, there are some common characteristics that should be considered for any ERP modernization. In addition to a comprehensive statement of intended outcome, the steps for planning a modern ERP strategy must consider a thoughtful process of transformation.

Modern Platform

|

|

Configurability

Use a standards-based platform for “upgrade safe” enhancements that replace customization requirements with “in-app” personalization and configuration. Extend apps using the cloud platform. |

|

|

Security

Dedicated financial services cloud environment offers secure data isolation, segregation of duties, end-to-end encryption, a Bastion security model, and data residency aligned with FINRA. |

|

|

Integration

One standards-based integration platform for finance, management reporting, and servicing systems lets you connect with other clouds, on-premises systems, and third-party systems and have all your connections in one secure place. |

|

|

Analytics

Embedded analytics for real-time, multi-dimensional analysis. Unified financial and planning data as well as advanced analytics and visualizations for big data. |

Modern Set of Complete Cloud Financial Applications

Head of Finance Data and Architecture, Lloyds Banking Group

Oracle and Modern ERP in Banking

Oracle’s financial cloud is a complete system that lets you connect to other clouds and to on-premises systems for true integration. It’s a modular solution, so you can modernize your ERP on your timeline, in the solution order that aligns with the goals of your organization.

With Oracle ERP cloud, built-in functionality meets the unique needs of banking, including tools that improve time to financial close and more-refined cost analytics and financial sub-ledger reporting.

Planning and Deploying Modern ERP

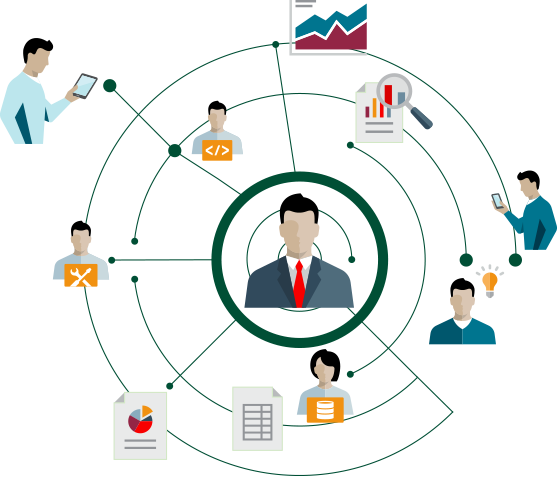

Planning a modern ERP strategy includes considering the internal and external players, the process, as well as your intended outcome.

| Better, Faster Information with Oracle ERP Cloud |

Get Started

with Your Agile

Finance

Modernization

Accomplish your modernization goals with Oracle ERP cloud: Manage costs, achieve operational efficiency and service excellence, and focus on the innovation that distinguishes your institution.

With more than 40 financial services cloud customers in more than 10 countries around the world, Oracle’s global sales team and partners are ready to get you started on your journey to ERP modernization.