This document will continue to evolve as existing sections change and new information is added. All updates are logged below, with the most recent updates at the top.

The new functionality referenced in this document may not be immediately available to you if your organization has chosen not to receive optional monthly updates. Rest assured you will receive the new functionality in the next quarterly update which is required and cumulative. Quarterly updates are applied in February, May, August, and November.

.

| Date |

What's Changed |

Notes |

|---|---|---|

| 01 SEP 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax File Enhancements |

New feature delivered in Update 21 (September). |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources: New Page to Upload Person Photos |

Updated feature description delivered in Update 12 (December). |

| 04 AUG 2017 |

Oracle Fusion Human Capital Management for the United States: Exclude Employees from HR Reporting |

New feature delivered in Update 20, the August Quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax Filing Enhancements For PA Act 32 |

New feature delivered in Update 18 (June), which will also be included in the August Quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Enhancements For PA Act 32 |

New feature delivered in Update 18 (June), which will also be included in the August Quarterly update. |

| The following features were included in the May Quarterly update. |

||

| 07 APR 2017 |

Oracle Fusion Human Capital Management for the United States: Calculate Pennsylvania Resident Taxes for Out-of-State Work Locations |

New feature delivered in Update 16 (April), which will also be included in the May Quarterly update. |

| 07 APR 2017 |

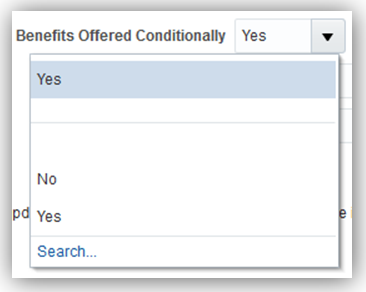

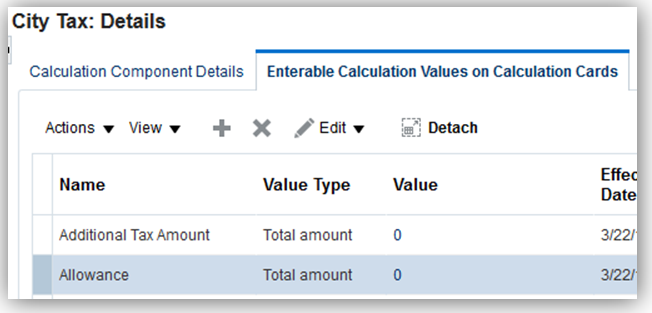

Oracle Fusion Human Capital Management for the United States: Claim Allowances for Ohio School Districts |

New feature delivered in Update 16 (April), which will also be included in the May Quarterly update. |

| 07 APR 2017 |

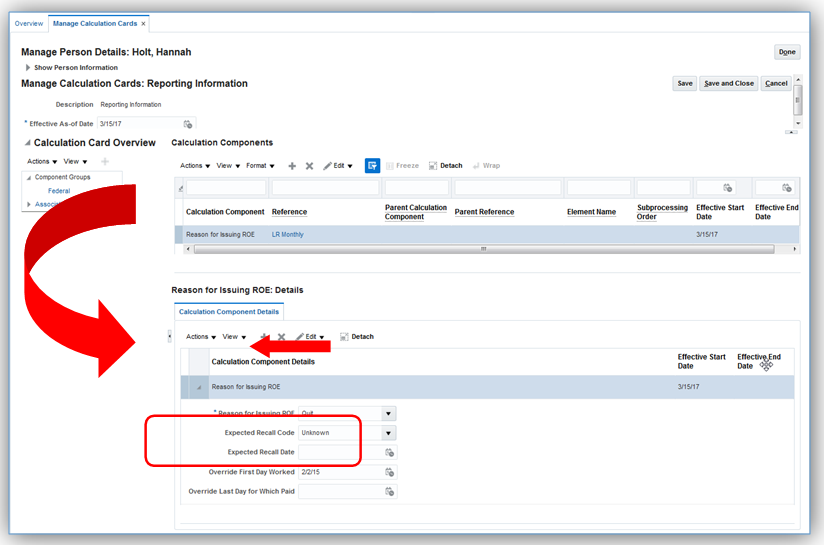

Oracle Fusion Human Capital Management for Canada: Involuntary Deductions: Record of Employment Override Dates |

New feature delivered in Update 16 (April), which will also be included in the May Quarterly update. |

| 07 APR 2017 |

Oracle Fusion Global Human Resources: Global Transfer Support for Future Terminated Workers |

Corrected information on this feature that was delivered in Update 12 (December). |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: P60 Template Updates |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: P60 Replacement Option |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United States: ACA Employee Eligibility Hours |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Extract Enhancement: New Jersey FLI Tax Code |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| The following features are included in the February Quarterly update. |

||

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the Netherlands: Statutory Updates 2017 |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

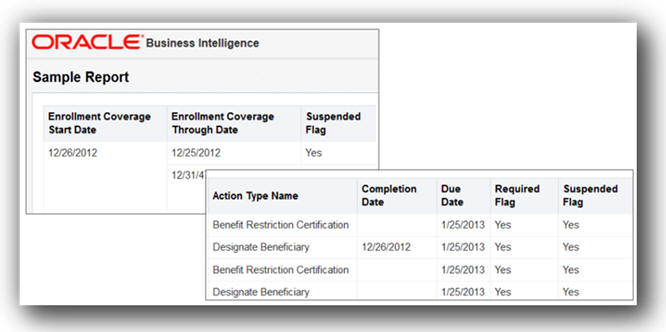

Oracle Fusion Human Capital Management for the United States: ACA Reporting Information Enhancement |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United States: ACA 1095-C Reporting Information Enhancement |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United States: ACA 1094-C Reporting Information Enhancement |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United States: Enhanced Employee Form W-2 |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Extract Enhancement |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: Legislative Updates |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: Real Time Information |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: Apprenticeship Levy |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: Foreign Tax Credit Relief |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: Full support of Balance Adjustments |

New feature delivered in Update 14, the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax File Enhancements |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

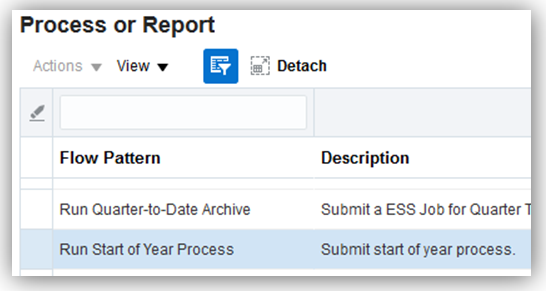

Oracle Fusion Human Capital Management for the United States: New Start-of-Year ESS Process for Year Begin |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Human Capital Management for the United States: PA ACT 32 Support for Employee W-2 and W-2 Register Reports |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Global Human Resources: Search Using Person Number in Keywords |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

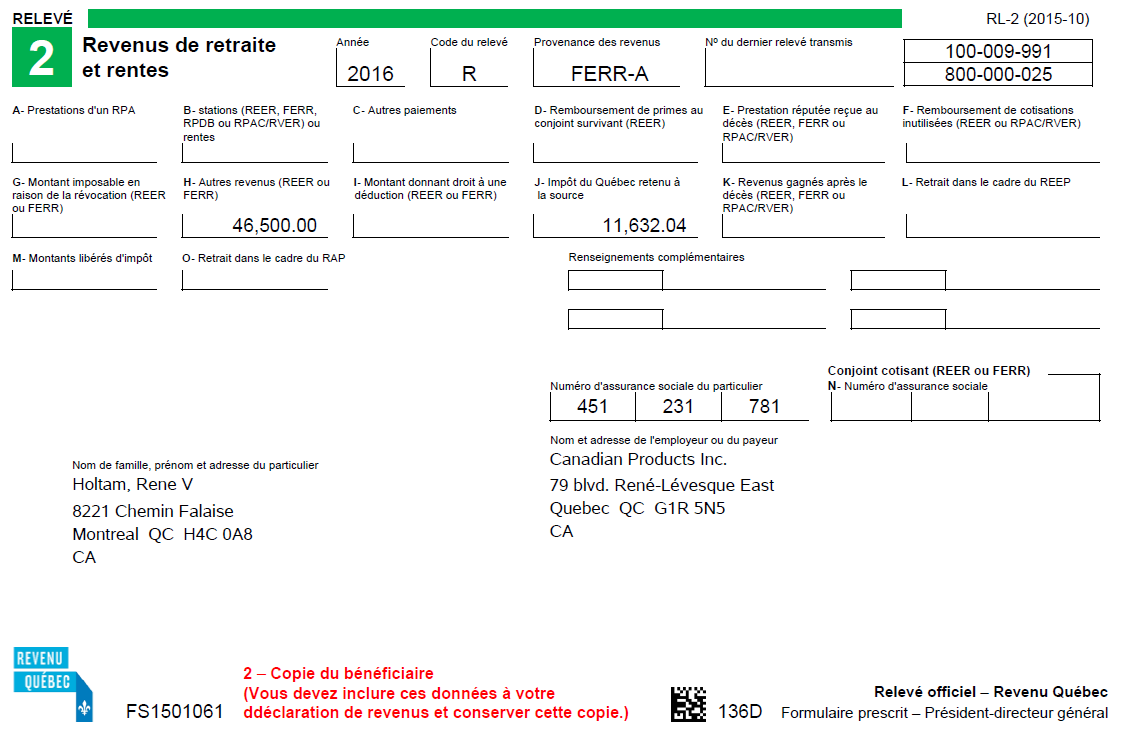

Oracle Fusion Human Capital Management for Canada: End-of-Year Reporting (RL-2 Only) |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: New Page to Upload Person Photos |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Global Transfer Support for Future Terminated Workers |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for the United States: ACA Manifest File Support |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for the United States: Payroll Batch Loader Enhancements for Involuntary Deductions |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for the United States: New Hire Reporting Enhancements |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for the United States: W-2 Employee Report Enhancements |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for the United States: W-2 Register Report Enhancements |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Human Capital Management for Canada: End-of-Year Reporting: End-of-Year Exception Report |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| The following features were delivered via monthly updates. |

||

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Correct Employment Data Integrity Issues |

Feature was included in the base release, however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Automated Reassigning of Pending Approvals and Correcting Invalid Supervisor Assignments |

Feature was included in the base release, however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Display of Flexfields on Transaction Review Page and Notifications |

Feature was included in the base release, however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Display Pending Transactions by Business Process |

Feature was included in the base release, however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Global Human Resources: Bypass Transactions Approvals by Business Process |

Feature was included in the base release, however just made a documentation adjustment. |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United States: Automatic Active Employee Count Calculation for VETS-4212 Reporting |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United States: Include Provider-Specific Fields on the Third-Party Quarterly Tax Filing Interface |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United States: Set SUI Wage Limit Overrides for Eligible Employers |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United States: Specify Company Entry Descriptions for EFT Payments |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United States: Additional Third-Party Periodic Tax Filing Auditing |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

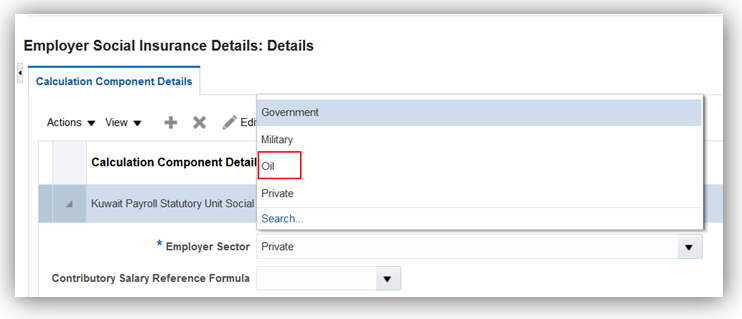

Oracle Fusion Human Capital Management for Kuwait: Social Insurance Calculation for Fully State Owned Oil Companies |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: National Insurance Number Prefix |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for the United Kingdom: National Insurance Category Change on Reaching State Pension Age |

Added new feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Human Capital Management for Kuwait: Social Insurance 2015 Enhancement |

Feature was included in the base release, however just made a documentation adjustment. |

| 07 OCT 2016 |

Oracle Transactional Business Intelligence: New Dimension: Person Disability |

Added role information on existing feature. |

| 07 OCT 2016 |

Oracle Fusion Human Capital Management for the United States: Form W-2 Box 20 Enhancement for Ohio Employees |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Global Human Resources for the United States: Wage Balance Enhancement for Periodic Tax Filing |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Human Capital Management for the United States: Automatically Update Employee Withholding Certificates for Rehires and Assignment Changes |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Global Human Resources for the Philippines: Added Value for Disability Category |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Global Human Resources for Egypt: Enhanced Validation of the Civil Identity Number |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Global Human Resources for New Zealand: Enabled Values for Disability Category |

Added new feature information delivered in Update 10 (October). |

| 07 OCT 2016 |

Oracle Fusion Human Capital Management for the United States: Automatically Synchronize Employee Withholding Certificates With HR Location Changes |

Update to Title and the Tips and Considerations for this feature delivered in Update 7 (July). |

| 07 OCT 2016 |

Oracle Fusion Human Capital Management for the United States: Default Check Numbering for US Simplified Payroll Cycle Flow |

Added new feature information delivered in Update 5 (May). |

| 02 SEP 2016 |

Oracle Fusion Global Human Resources for the United States: Include Resident and Nonresident City and County Tax Balances on Periodic Tax Filing |

Added new feature information delivered in Update 9 (September). |

| 02 SEP 2016 |

Oracle Fusion Global Human Resources for the United States: Refined Data Selection for W-2 Employee Report |

Added new feature information delivered in Update 9 (September). |

| 02 SEP 2016 |

Oracle Fusion Global Human Resources: Position Synchronization When Using HCM Data Loader to Load Position Changes |

Added new feature information delivered in Update 9 (September). |

| 02 SEP 2016 |

Oracle Fusion Global Human Resources: Enhanced Simplified User Interface with Display of Employment Details and Flexfields |

Updated feature with role information. |

| 02 SEP 2016 |

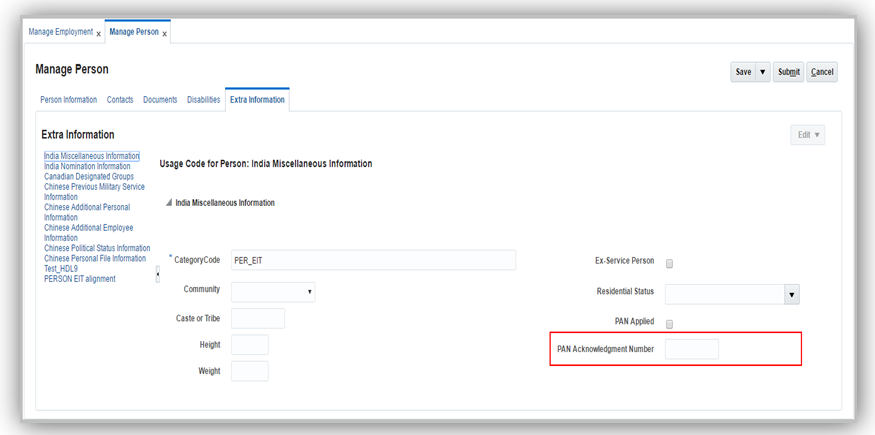

Oracle Fusion Global Human Resources for India: Permanent Account number (PAN) |

Added new feature information delivered in Update 3 (March). |

| 02 SEP 2016 |

Oracle Fusion Global Human Resources for India: PAN Acknowledgment Number |

Added new feature information delivered in Update 3 (March). |

| 02 SEP 2016 |

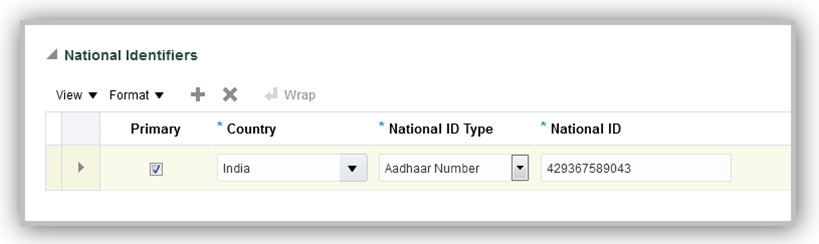

Oracle Fusion Global Human Resources for India: Aadhaar Number |

Added new feature information delivered in Update 3 (March). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources for Angola: Validation Added to NIF |

Added new feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources for Canada: Involuntary Deductions: Protected Pay Rules |

Added new feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources: Additional Option for Rehire Recommendation |

Added new feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources for the United States: Display Accrual Balances on Employee Checks |

Added new feature information delivered in Update 7 (July). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources for the United States: Automatically Synchronize Employee Withholding Certificates with HR Data |

Added new feature information delivered in Update 7 (July). |

| 05 AUG 2016 |

Oracle Fusion Global Human Resources for the United States: Voluntary Disability Self-Identification |

Added new feature information delivered in Update 1 (January). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources: Local Name Support on Edit My Details Page |

Added new feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources: Required Search Criteria for Document Records |

Added new feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources: View Attachments from the Document Records Approval Notification |

Added new feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources: Half Day Calendar Events for Elapsed Work Schedules |

Added new feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources for Angola: Value Added for the National Identifier |

Added new feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Human Resources for Canada: End-of-Year Reporting: Amendments for T4, T4A, And RL-1 |

Added new feature information delivered in Update 7 (July). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: New Profile Option to Cache Person Images |

Added new feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Person Contextual Actions (Smart Navigation) |

Changed title and wording on feature to make it easier to recognize. |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Redesigned Directory |

Added new feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Additional Features in My Team |

Added new feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources for the United States: Employee Active Payroll Balance Report Enhancement |

Added new feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Workforce Predictions: Support for Human Resource Specialists |

Added new feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Display Manager Names Without Assignment Numbers in Employment Processes |

Added new feature information delivered in Update 5 (May). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Employment Configuration Options |

Added new feature information delivered in Update 5 (May). |

| 03 JUN 2016 |

Oracle Fusion Global Human Resources: Worker Resignation Self Service in Simplified Interface |

Added new feature information delivered in Update 4 (April). |

| 03 JUN 2016 |

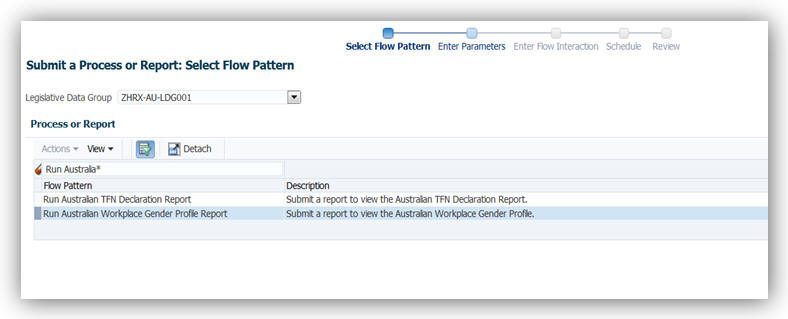

Oracle Fusion Global Human Resources for Australia: Workplace Gender Equality Profile Report |

Added new feature information delivered in Update 3 (March). |

| 03 JUN 2016 |

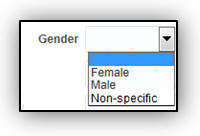

Oracle Fusion Global Human Resources for Australia: Capture Of Non-Specific Gender |

Added new feature information delivered in Update 3 (March). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources for Sweden: Enhanced Post Number Validation |

Added new feature information delivered in Update 5 (May). |

| 06 MAY 2016 |

Oracle Fusion Global Human Resources: Workforce Development - Incremental Refresh of Manager Hierarchy |

Added new feature information delivered in Update 5 (May). |

| 01 APR 2016 |

Oracle Fusion Global Human Resources: Worker View of Employment Information in Simplified User Interface |

Added new feature information delivered in Update 4 (April). |

| 01 APR 2016 |

Oracle Fusion Global Human Resources: Automated Reassigning of Pending Approvals and Correcting Invalid Supervisor Assignments |

Added new feature information delivered in Update 4 (April). |

| 01 APR 2016 |

Oracle Fusion Human Capital Management for Morocco: Address Format |

Added new feature information delivered in Update 4 (April). |

| 04 MAR 2016 |

Initial Document Creation |

|

This guide outlines the information you need to know about new or improved functionality in Oracle HCM Release 11. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for the base Talent and Compensation stand alone applications.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management (All Talent applications)

- Workforce Rewards (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Please indicate you are inquiring or providing feedback regarding the Global HR Cloud What’s New for Release 11 in the body or title of the email.

Some of the new Release 11 features are automatically available to users after the upgrade and some require action from the user, the company administrator, or Oracle.

The table below offers a quick view of the actions required to enable each of the Release 11 features.

| Action Required to Enable Feature |

||||

|---|---|---|---|---|

| Feature |

Automatically Available |

End User Action Required |

Administrator Action Required |

Oracle Service Request Required |

| Global Human Resources |

||||

|

|

||||

| People Group Key Flexfield Added to Manager Transactions and Portrait |

|

|||

| Change in Primary Work Relationship Propagated to Future Records |

|

|||

| Enhanced Simplified User Interface with Display of Employment Details and Flexfields |

|

|||

|

|

||||

| Person Flexfields in Simplified User Interface Personal Information |

|

|||

| Assignment Extra Information Flexfields on Add Pending Worker |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Reassign Direct Reports of Terminated Workers During Termination Flow |

|

|||

| Capture Talent and Succession Management Details in Organization Chart and Directory |

|

|||

|

|

||||

|

|

||||

|

|

||||

| Automated Reassigning of Pending Approvals and Correcting Invalid Supervisor Assignments |

|

|||

| Worker View of Employment Information in Simplified User Interface |

|

|||

| Workforce Directory - Incremental Refresh of Manager Hierarchy |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Display Manager Names Without Assignment Numbers in Employment Processes |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| View Attachments from the Document Records Approval Notification |

|

|||

|

|

||||

| Position Synchronization When Using HCM Data Loader to Load Position Changes |

|

|||

| Display of Flexfields on Transaction Review page and Notifications |

|

|||

| Display Pending Transactions by Business Process |

|

|||

| Bypass Transactions Approvals by Business Process |

|

|||

|

|

||||

| Global Transfer Support for Future Terminated Workers |

|

|||

|

|

||||

|

|

||||

| Global Payroll Interface |

||||

| New Country Extensions in Global Payroll Interface Extract Definition |

|

|||

|

|

||||

| Human Capital Management for Albania |

||||

|

|

||||

| Human Capital Management for Algeria |

||||

|

|

||||

| Human Capital Management for Angola |

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Argentina |

||||

|

|

||||

| Human Capital Management for Australia |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Austria |

||||

|

|

||||

|

|

||||

| Human Capital Management for Bahamas |

||||

|

|

||||

| Human Capital Management for Belarus |

||||

|

|

||||

| Human Capital Management for Belize |

||||

|

|

||||

| Human Capital Management for Bolivia |

||||

|

|

||||

| Human Capital Management for Bosnia and Herzegovina |

||||

|

|

||||

| Human Capital Management for Brazil |

||||

|

|

||||

|

|

||||

| Human Capital Management for Brunei |

||||

|

|

||||

| Human Capital Management for Bulgaria |

||||

|

|

||||

| Human Capital Management for Canada |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Chile |

||||

|

|

||||

| Human Capital Management for China |

||||

| New Rounding Methods for Social Security and Enterprise Annuity Calculation |

|

|||

|

|

||||

| Human Capital Management for Colombia |

||||

|

|

||||

| Human Capital Management for Costa Rica |

||||

|

|

||||

| Human Capital Management for Croatia |

||||

|

|

||||

| Human Capital Management for Cyprus |

||||

|

|

||||

| Human Capital Management for Czech Republic |

||||

|

|

||||

| Human Capital Management for Denmark |

||||

|

|

||||

| Human Capital Management for Dominican |

||||

|

|

||||

| Human Capital Management for Ecuador |

||||

|

|

||||

| Human Capital Management for Egypt |

||||

|

|

||||

|

|

||||

| Human Capital Management for El Salvador |

||||

|

|

||||

| Human Capital Management for Finland |

||||

|

|

||||

| Human Capital Management for France |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Germany |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Greece |

||||

|

|

||||

| Human Capital Management for Grenada |

||||

|

|

||||

| Human Capital Management for Guatemala |

||||

|

|

||||

| Human Capital Management for Haiti |

||||

|

|

||||

| Human Capital Management for Honduras |

||||

|

|

||||

| Human Capital Management for Iceland |

||||

|

|

||||

| Human Capital Management for India |

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Indonesia |

||||

|

|

||||

| Human Capital Management for Iran |

||||

|

|

||||

| Human Capital Management for Iraq |

||||

|

|

||||

| Human Capital Management for Ireland |

||||

|

|

||||

|

|

||||

| Human Capital Management for Israel |

||||

|

|

||||

| Human Capital Management for Italy |

||||

|

|

||||

| Human Capital Management for Jamaica |

||||

|

|

||||

| Human Capital Management for Jordan |

||||

|

|

||||

| Human Capital Management for Kazakhstan |

||||

|

|

||||

|

|

||||

| Human Capital Management for Kenya |

||||

|

|

||||

| Human Capital Management for Kuwait |

||||

|

|

||||

| Statutory Reporting: Update to Report 166 – Monthly Contributions |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Social Insurance Calculation for Fully State Owned Oil Companies |

|

|||

| Human Capital Management for Lebanon |

||||

|

|

||||

| Human Capital Management for Liechtenstein |

||||

|

|

||||

| Human Capital Management for Luxembourg |

||||

|

|

||||

| Human Capital Management for Macau |

||||

|

|

||||

| Human Capital Management for Morocco |

||||

|

|

||||

|

|

||||

| Human Capital Management for Mozambique |

||||

|

|

||||

| Human Capital Management for Namibia |

||||

|

|

||||

| Human Capital Management for the Netherlands |

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for New Zealand |

||||

|

|

||||

| Human Capital Management for Nicaragua |

||||

|

|

||||

| Human Capital Management for Nigeria |

||||

|

|

||||

| Human Capital Management for Norway |

||||

|

|

||||

| Human Capital Management for Pakistan |

||||

|

|

||||

| Human Capital Management for Panama |

||||

|

|

||||

| Human Capital Management for Paraguay |

||||

|

|

||||

| Human Capital Management for Peru |

||||

|

|

||||

| Human Capital Management for the Philippines |

||||

|

|

||||

|

|

||||

| Human Capital Management for Poland |

||||

|

|

||||

| Human Capital Management for Portugal |

||||

|

|

||||

| Human Capital Management for Romania |

||||

|

|

||||

| Human Capital Management for Russia |

||||

|

|

||||

| Human Capital Management for Saint Kitts and Nevis |

||||

|

|

||||

| Human Capital Management for Saint Lucia |

||||

|

|

||||

| Human Capital Management for Saint Vincent And the Grenadines |

||||

|

|

||||

| Human Capital Management for Saudi Arabia |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Serbia |

||||

|

|

||||

| Human Capital Management for Slovakia |

||||

|

|

||||

| Human Capital Management for Slovenia |

||||

|

|

||||

| Human Capital Management for South Africa |

||||

|

|

||||

| Human Capital Management for Spain |

||||

|

|

||||

| Human Capital Management for Sudan |

||||

|

|

||||

| Human Capital Management for Suriname |

||||

|

|

||||

| Human Capital Management for Sweden |

||||

|

|

||||

|

|

||||

| Human Capital Management for Syria |

||||

|

|

||||

| Human Capital Management for Thailand |

||||

|

|

||||

| Human Capital Management for Trinidad And Tobago |

||||

|

|

||||

| Human Capital Management for Turkey |

||||

|

|

||||

| Human Capital Management for The United Arab Emirates |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for the United Kingdom |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| National Insurance Category Change on Reaching State Pension Age |

|

|||

| Human Capital Management for the United States |

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Automatically Synchronize Employee Withholding Certificates with HR Location Changes |

|

|||

| Include Resident and Nonresident City and County Tax Balances on Periodic Tax Filing |

|

|||

|

|

||||

| Default Check Numbering for US Simplified Payroll Cycle Flow |

|

|||

|

|

||||

|

|

||||

| Automatically Update Employee Withholding Certificates for Rehires and Assignment Changes |

|

|||

| Automatic Active Employee Count Calculation for VETS-4212 Reporting |

|

|||

| Include Provider-Specific Fields on the Third-Party Quarterly Tax Filing Interface |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Payroll Batch Loader Enhancements for Involuntary Deductions |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Third-Party Periodic Tax Filing Extract Enhancement: New Jersey FLI Tax Code |

|

|||

| Calculate Pennsylvania Resident Taxes for Out-of-State Work Locations |

|

|||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

| Human Capital Management for Uruguay |

||||

|

|

||||

| Human Capital Management for Venezuela |

||||

|

|

||||

| Human Capital Management for Vietnam |

||||

|

|

||||

| Human Capital Management for Zambia |

||||

|

|

||||

| Global Human Resources Transactional Business Intelligence |

||||

|

|

||||

| New Subject Area: Payroll – Payroll Interface Inbound Records Real Time |

|

|||

| Enhanced Attribute: Displayed Input Value in Payroll Element Entries Real Time |

|

|||

| New Subject Area: Workforce Performance – Performance Document Eligibility Real Time |

|

|||

| Performance Document Evaluation Manager Added to Workforce Performance Subject Areas |

|

|||

| Performance Rating Dimension Added to Person Profile Subject Area |

|

|||

| New Subject Area: Workforce Career Development – Development Goal Overview Real Time |

|

|||

| New Subject Area: Workforce Succession Management – Position Plans Real Time |

|

|||

| New Subject Area: Workforce Management – Workforce Trend Real Time |

|

|||

| New Subject Areas for Reporting on Workforce Scheduling in Time and Labor |

|

|||

|

|

||||

| New Dimension: Time Attribute in Time and Labor Subject Areas |

|

|||

|

|

||||

| Employee Contact Details Enhancement in Person Real Time Subject Area |

|

|||

|

|

||||

|

|

||||

|

|

||||

| New Fields for Oracle Transactional Business Intelligence (OTBI) |

|

|||

|

|

||||

| Oracle Business Intelligence Enterprise Edition: New Alta User Interface |

|

|||

| Oracle Business Intelligence Answers: Enhanced Preview Option |

|

|||

| Workforce Modeling |

||||

|

|

||||

|

|

||||

| Workforce Predictions |

||||

|

|

||||

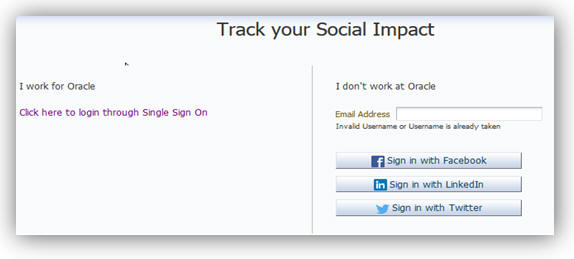

| Workforce Reputation Management |

||||

|

|

||||

Oracle Fusion Global Human Resources enables your organization to plan, manage and optimize all workforce segments using flexible and extensible best practices to realize extraordinary gains while ensuring compliance and increasing total workforce engagement.

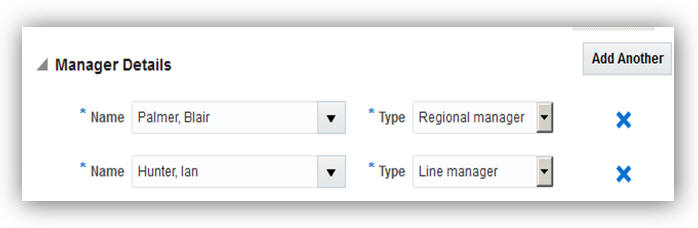

Add Multiple Managers in Add Person User Interface

Enhance the user experience with the Add Person user interface. Add multiple managers in the same transaction without initiating a separate transaction in the Manage Employment page.

Add Multiple Managers for a New Person

There are no steps necessary to enable this feature.

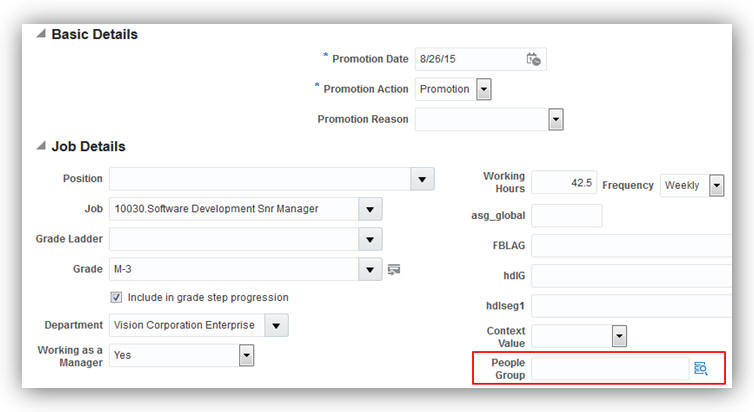

People Group Key Flexfield Added to Manager Transactions and Portrait

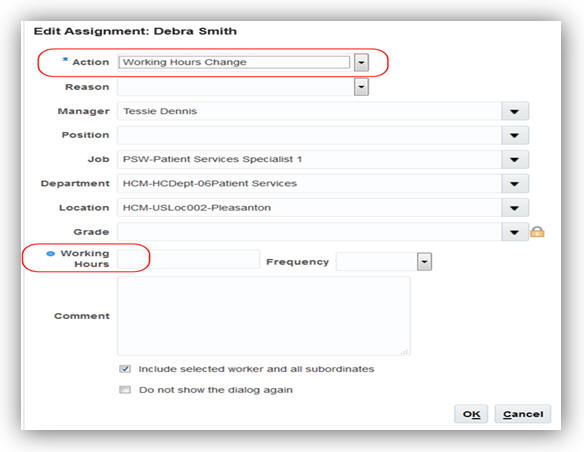

Improved user experience with the addition of the People Group key flexfield to the following manager self service pages: Promote, Transfer, Change Working Hours, and Portrait. The People Group key flexfield is added to the manager self service transactions so that the user does not need to manage the tasks separately using the Manage Employment page.

People Group Key Flexfield in Promotion Transaction Using Manager Self Service

There are no steps necessary to enable this feature.

Change in Primary Work Relationship Propagated to Future Records

The process has been enhanced for changing the primary work relationship to accommodate future-dated employment terms and assignments. If a new primary work relationship contains any future-dated records, the change in the primary status is propagated to the future records.

Steps to Enable

There are no steps necessary to enable this feature.

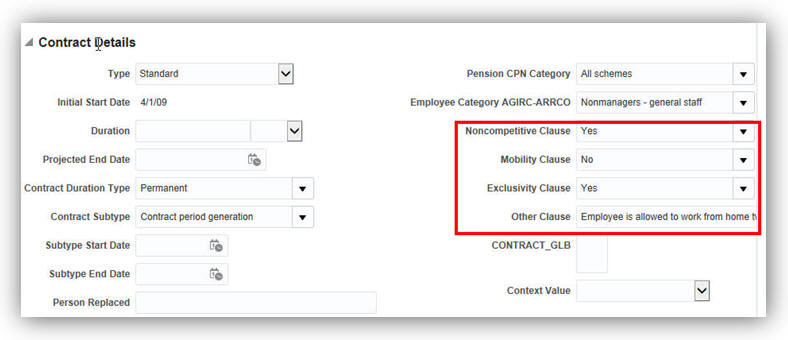

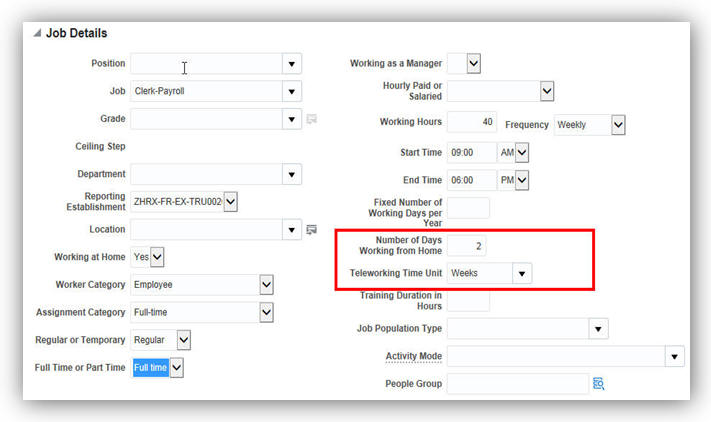

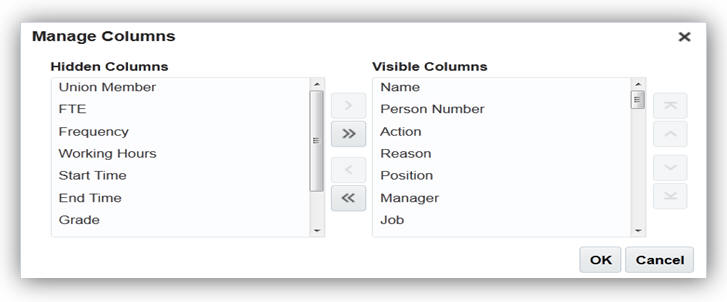

Enhanced Simplified User Interface with Display of Employment Details and Flexfields

Managers can now view the following employment and assignment details and flexfields when they drill down to a worker’s page from the My Team icon in the simplified user interface.

- Work Relationship Details: Legal Employer, Hire Date

- Assignment Details: Job, Grade, Business Unit

- Work Contacts: Contact Name, Contact Type

- Flex Fields: Work Relationship (PER_PPS_DF), Contract (PER_CONTRACT_DF), Assignment (PER_ASG_DF), Legislative Assignment (PER_ASG_LEG_DDF), People Group Flexfield (PPG), Contract Legislative Information (PER_CONTRACT_LEG_DDF), Work Relationship Legislative Information (PER_PPS_LEG_DDF)

- Employment History: A new page displays the employment history, showing a timeline of employment related events such as promotion and manager change. The information is available in graphical and tabular formats.

Enhanced Simplified User Interface with Employment Details and Flexfields

There are no steps necessary to enable this feature.

Role Information

If you are not using the predefined reference roles, then you need to add the function security privilege that secures access to the Employment Information page, which you access from the My Team and Team Compensation pages, to relevant custom job or abstract roles. This table identifies the required function security privilege and suggests a target abstract role.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Function Security Privilege Name and Code |

Custom Abstract Role |

| Access FUSE Performance and Career Planning Page HRT_FUSE_PERFORMANCE_AND_CAREER_PLANNING_PRIV |

Line Manager |

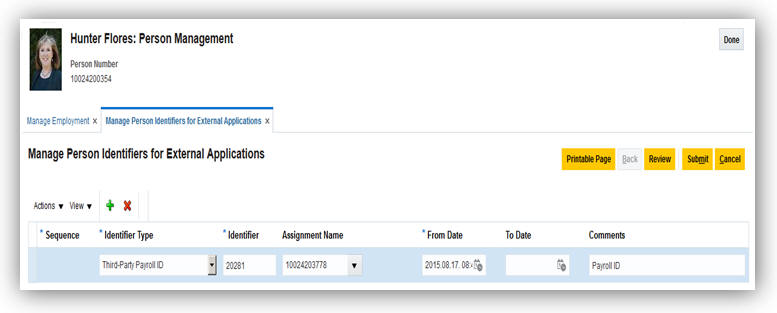

Manage Person Identifiers for External Applications

Capture third-party application identifiers such as time device badges, payroll identifiers, or any other person-related identifiers at the person or assignment levels. These identifiers assist in integrations between different applications or to proactively manage ownership of specific identifiers.

Manage Person Identifiers for External Applications Page

If you use the predefined reference roles, then no steps are necessary to enable this feature.

Otherwise, you must assign relevant security privileges to your roles to enable this feature. See Role Information (below) for details.

Role Information

If you are not using the predefined reference roles, then you need to add security privileges to relevant job and abstract roles to use this feature. This table identifies the required aggregate privileges and suggests target job and abstract roles. You can add the privileges to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege Name and Code |

Job or Abstract Role |

|---|---|

| View Person Identifiers for External Applications ORA_VIEW_PERSON_IDENTIFIERS_FOR_EXTERNAL_APPLICATIONS |

Human Resource Analyst |

| Manage Person Identifiers for External Applications ORA_PER_MANAGE_PERSON_IDENTIFIERS_FOR_EXTERNAL_APPLICATIONS |

Human Resource Specialist Line Manager |

Person Flexfields in Simplified User Interface Personal Information

The following person-specific flexfields are hidden out-of-the-box and are displayed on personalization in the read-only and editable Personal Information pages:

- Person Attributes (PER_PERSONS_DFF)

- Person Legislative Information (PER_PERSON_LEGISLATIVE_DATA_LEG_DDF)

- Religion Attributes (PER_RELIGIONS_DFF)

- Ethnicity Attributes (PER_ETHNICITIES_DFF)

- Person Address Usage Attributes (PER_PERSON_ADDR_USG_DFF)

- Contact Relationship Attributes (PER_CONTACT_RELSHIPS_DFF)

- Person Contact Relationship Information (PER_PERSON_CONTACT_RELATIONSHIP_DDF)

Enable the flexfields on the Personal Information simplified user interface through personalization.

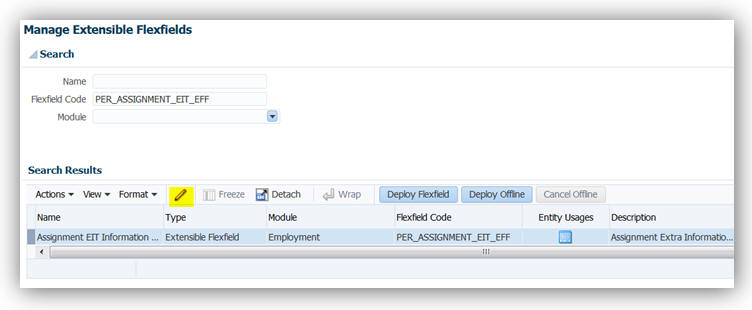

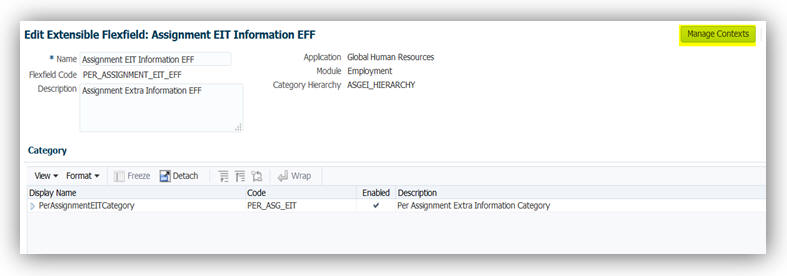

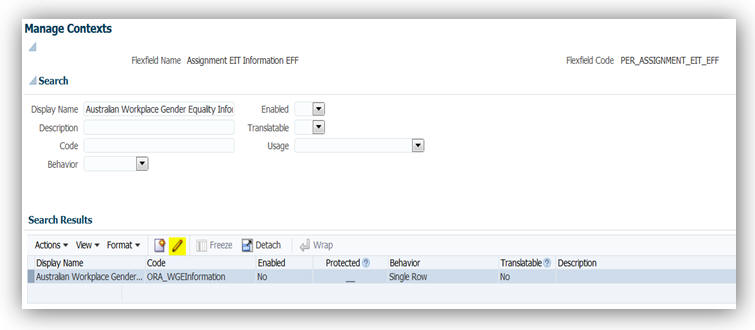

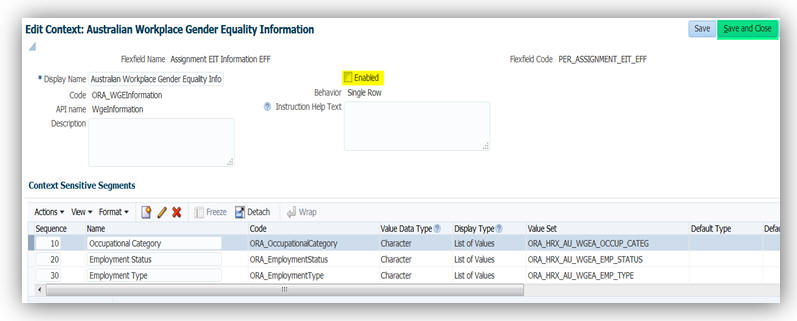

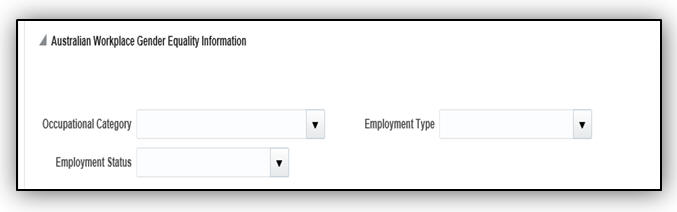

Assignment Extra Information Flexfields on Add Pending Worker

Capture extra information using the Assignment Extra Information flexfields while creating a pending worker. The flexfields are now displayed as a part of the pending worker process so that you don’t have to manage this data as a separate process using the Manage Employment page.

There are no steps necessary to enable this feature.

Assignment Descriptive Flexfield on Change Location

Capture additional information at the assignment level on the Change Location page. The assignment descriptive flexfield can be displayed as part of this process through personalization so that you don’t have to manage this data as a separate process using the Manage Employment page.

Steps to Enable

You must enable the assignment descriptive flexfield on the Change Location page using personalization.

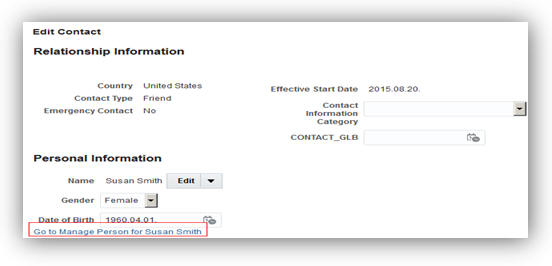

Editing Contacts When Excluded from Person Security Profile

Edit contacts even when they are excluded from the person security profile. When a person security profile excludes related contacts, you can still manage the contacts of a person. If you have access to a person, you can access the contact’s Manage Person page from the Edit Contact page.

Link to the Manage Person Page of a Contact

There are no steps necessary to enable this feature.

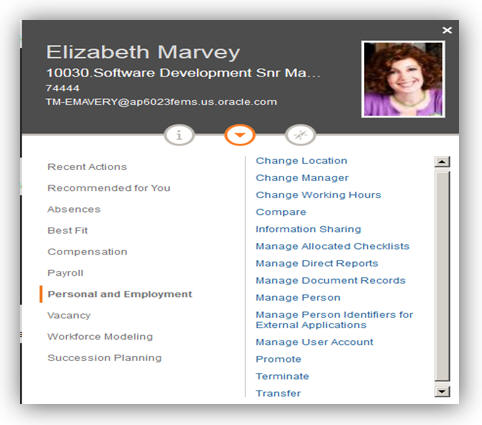

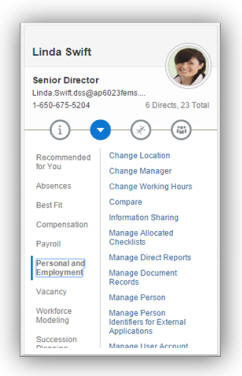

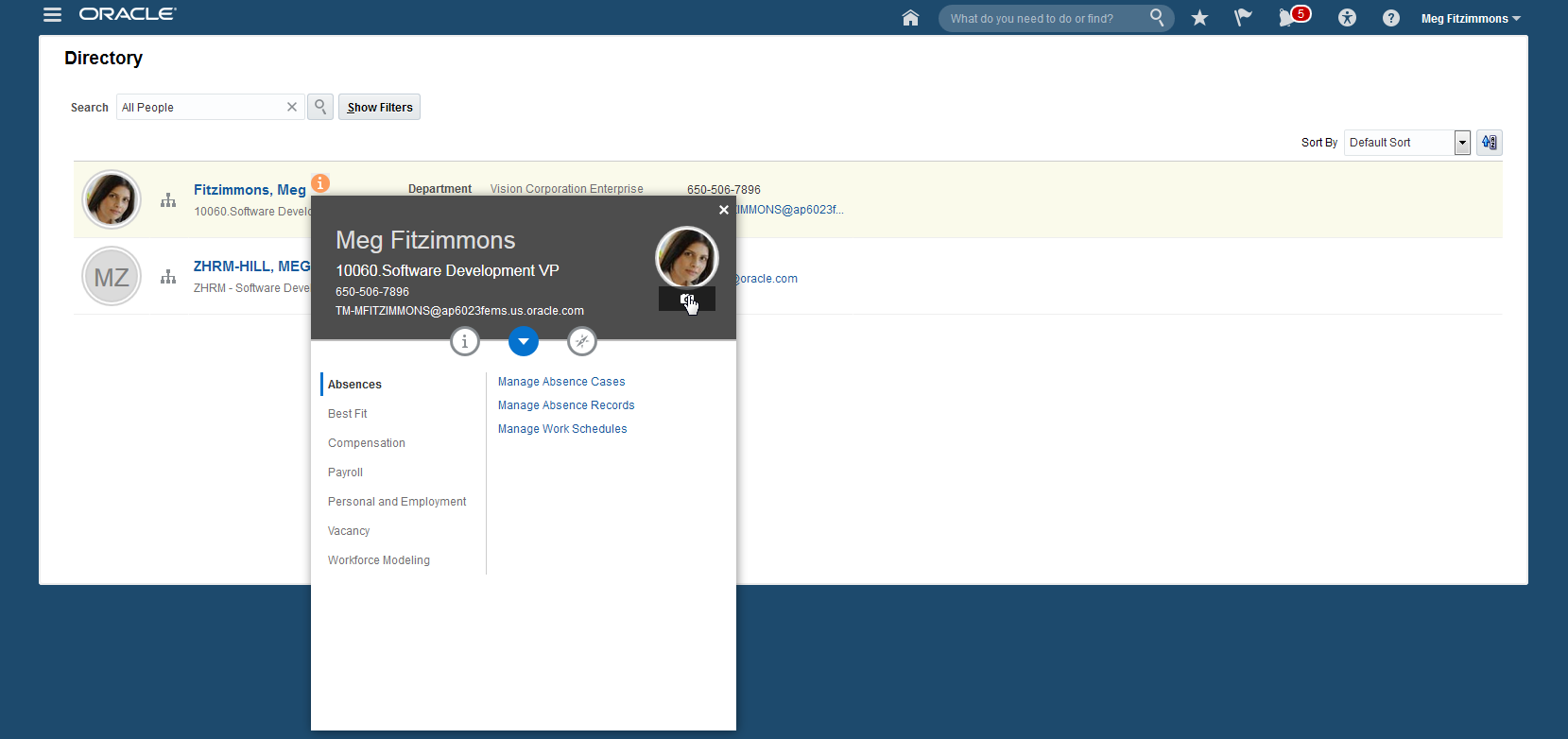

Person Contextual Actions (Smart Navigation)

Enhance user experience with the redesign of the person contextual actions, now referred to as Smart Navigation. Access available actions that can be taken on another person from anywhere in the system and navigate to other work areas easily. Control the Actions menu through personalization by hiding actions or marking them as recommended actions. This eliminates the need to modify the security hierarchy for roles if specific actions are hidden for all roles.

Person Contextual Actions Menu

There are no steps necessary to enable this feature.

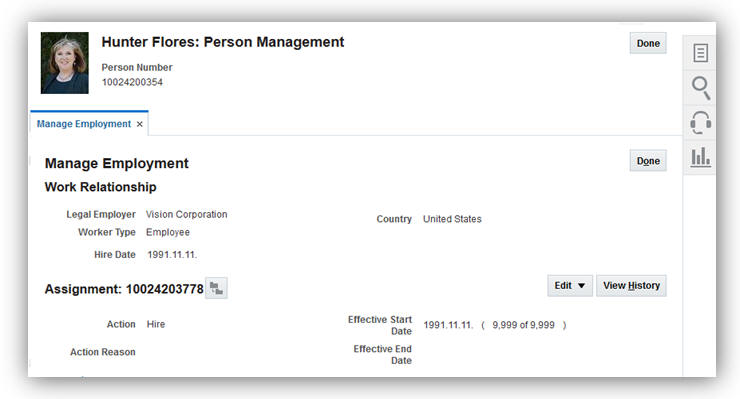

Updated Person Management Work Area

The Person Management work area is redesigned to provide a similar user experience as the simplified user interface. A new panel drawer is added for person search and work contacts to enhance user experience. The Manage Employment task, which is the most frequently used task, is now the default task when entering the work area.

Manage Employment is the Default Task

A new person quick search panel drawer simplifies the user experience so that the work area is refreshed rather than returning to the initial search.

There are no steps necessary to enable this feature.

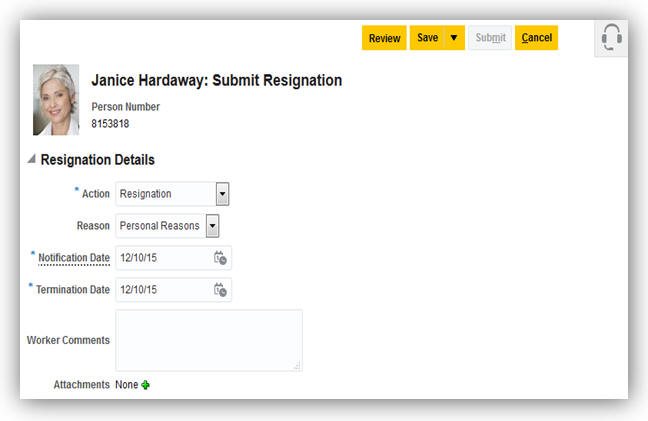

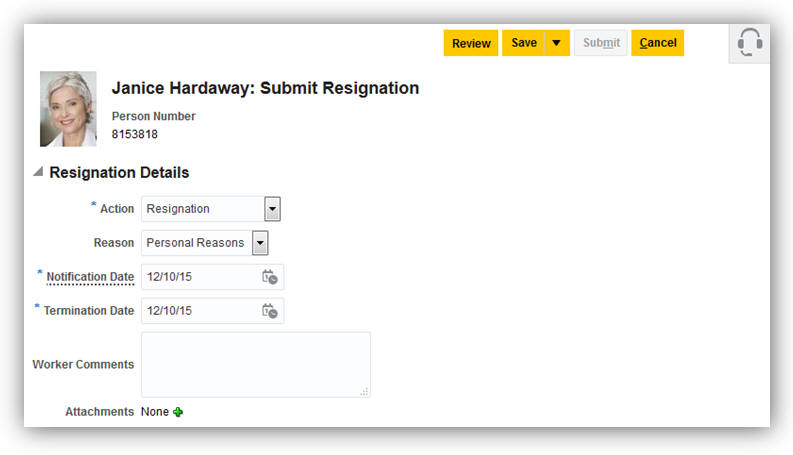

Worker Resignation Self-Service in Simplified Interface

Improved operational efficiency by allowing workers to submit their own resignations using self service in the simplified user interface. Additionally, line managers can review, edit, and approve the resignation requests of their direct reports in the simplified user interface. This feature improves:

- Transparency: Workers can provide their resignation comments which are stored in the application and can be reported.

- Compliance: Workers and line managers are alerted of any shortfall in the notice period for the resignation.

- Visibility: Workers can track the approval status of their resignation requests by using standard workflow features.

- Efficiency: Line managers can now reassign the direct reports of a resigning worker when editing the resignation request.

Worker Resignation Using Self Service

If you use the predefined reference roles, then no steps are necessary to enable this feature.

Otherwise, you must assign relevant security privileges to your roles to enable this feature. See Role Information (below) for details.

Role Information

If you are not using the predefined reference roles, then you need to add security privileges to relevant abstract roles to use this feature. This table identifies the required aggregate privilege and suggests target abstract roles. You can add the privileges to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege Name and Code |

Abstract Role |

| Submit Resignation ORA_PER_SUBMIT_RESIGNATION |

Employee Contingent Worker |

Workers will not be able to submit their resignations using this feature if they have:

- Future-dated transactions.

- Multiple work relationships active at the time of submitting their resignations, even if those work relationships are set to be terminated at a future date.

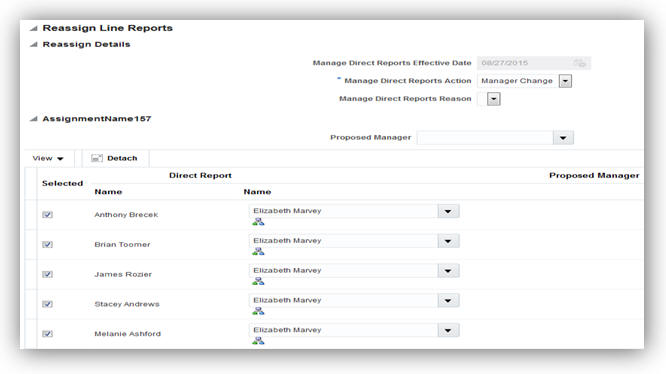

Reassign Direct Reports of Terminated Workers During Termination Flow

Simplified the worker termination process by allowing line managers and human resource (HR) specialists to reassign the direct reports of a worker during the termination flow.

Reassign Direct Reports of the Terminated Worker

Steps to Enable

There are no steps necessary to enable this feature.

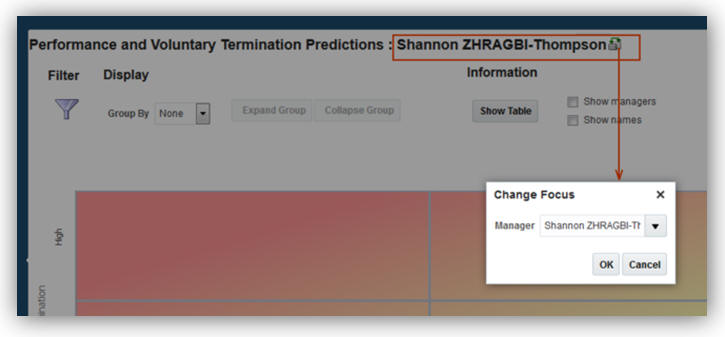

Capture Talent and Succession Management Details in Organization Chart and Directory

Track succession planning information right from the organization chart and drill from here to view more detailed information and take further actions. You can create succession plans and add candidates directly from where you view your workers' information.

No steps are necessary to enable this feature.

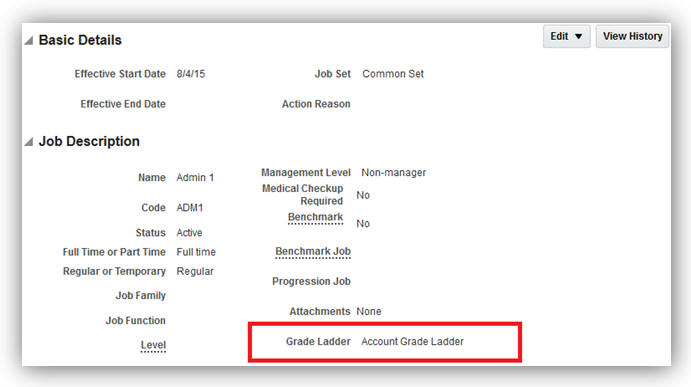

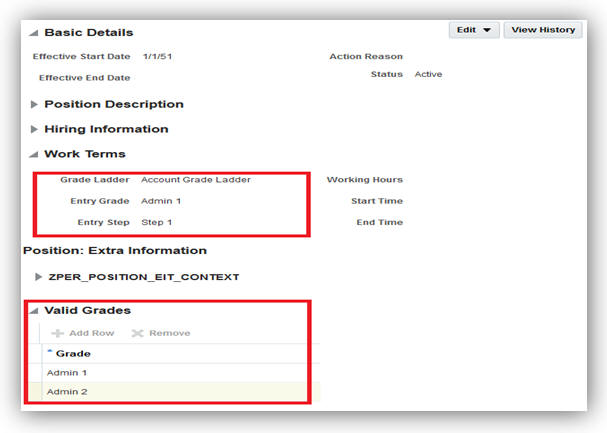

Define a Default Grade Ladder from Job and Position

We have made it easier for you to perform employment transactions by defining an optional default grade ladder for a job or position. The new default Grade Ladder field works with the existing Entry Grade and Entry Step fields on the position definition to ensure that the entry grade and step are valid for the default grade ladder. Additionally, the default grade ladder ensures data integrity by checking validity between the grades defined for a job or position and the chosen grade ladder.

Define a Default Grade Ladder for a Job

Define a Default Grade Ladder for a Position

There are no steps necessary to enable this feature.

Tips and Considerations

The grade ladder will be populated when a new assignment is created. However, there is no change to the grade ladder when an existing assignment is updated.

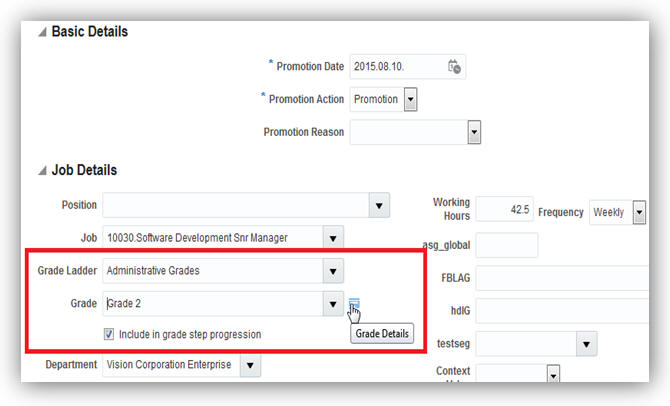

Updates to Grade Ladder Entry on Worker Assignment

We have made it easier for you to perform data entry by using grade ladders. To improve the data flow, the Grade Ladder field on the worker’s assignment is moved from the Grade Details window to the primary page. If a grade ladder is entered or populated from a job or position, you will be prompted to choose valid grades for the grade ladder when entering the grade. Additionally, the grade ladder and step are now available on the manager self-service transactions for promotion and transfer.

Grade Ladder Entry on Worker Assignment

Grade Ladder and Step in Promotion Transaction Using Manager Self-Service

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

The Grade Ladder field will not be displayed in the assignment flows unless you have at least one grade ladder defined in your organization.

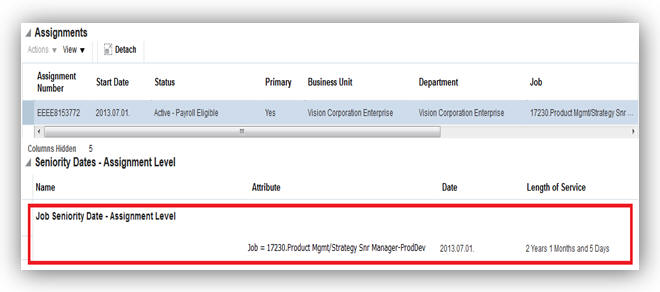

Support for Additional Seniority Dates

You can now capture additional seniority dates for your workers. The seniority dates feature now includes support for additional seniority dates, such as grade, step, job, position, union, and collective agreement. The ability to track additional seniority dates is available immediately after you upgrade.

Job Seniority Date

To start tracking a new seniority date, you will need to set it up in the Configure Seniority Date Rules component.

Automated Reassigning of Pending Approvals and Correcting Invalid Supervisor Assignments

You can reassign pending approvals and correct invalid supervisory assignments of terminated or globally transferred managers by scheduling the Run Reassign Pending Approvals for Terminations and Correct Invalid Supervisor Assignments Process. This process reassigns all unassigned reports to the manager’s manager.

Steps to Enable

There are no steps needed to enable the feature. The human resource specialist can schedule this process to run periodically or on an ad-hoc basis from the Scheduled Processes work area. However, it's strongly recommended that you schedule this process to run daily to avoid any unassigned workers.

For more information, go to Applications Help for the following topic:

- Pending Approvals and Invalid Supervisor Assignments: Explained

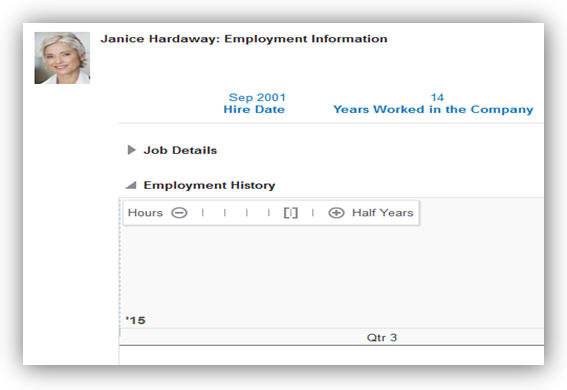

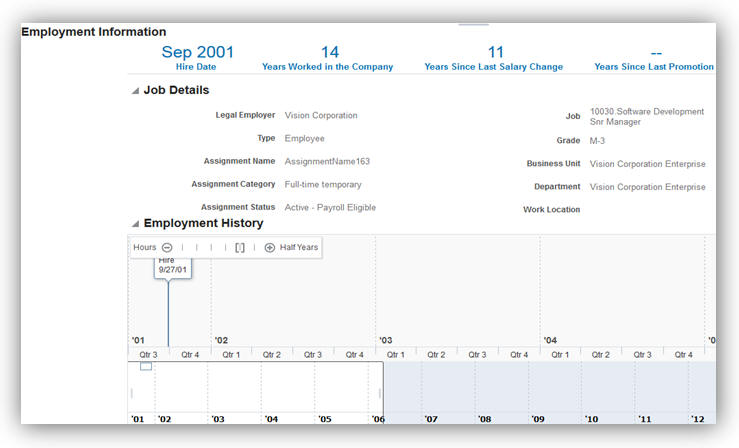

Worker View of Employment Information in Simplified User Interface

Provide workers a complete view of their employment information. Workers can now view their work relationship, contract and assignment details, and flexfields on the new Employment Details tab in the Personal Information work area. Additionally, workers can view their employment history on a timeline for employment related events, such as promotion and manager change.

The employment information includes the following:

- Work Relationship: Legal Employer, Hire Date, and others

- Assignment: Job, Grade, Business Unit, and others

- Flexfields: Work Relationship (PER_PPS_DF), Contract (PER_CONTRACT_DF), Assignment (PER_ASG_DF), Legislative Assignment (PER_ASG_LEG_DDF), People Group Flexfield (PPG), Contract Legislative Information (PER_CONTRACT_LEG_DDF), and Work Relationship Legislative Information (PER_PPS_LEG_DDF)

- Employment History: A new region displays the employment history on a timeline for employment related events, such as promotion and manager change. This information can be viewed in graphical and tabular formats.

Employment Information for Workers

Steps to Enable

The Employment Details tab is hidden out of the box. To enable this tab, you must configure the Visible property of the tab to 'Yes' using the Structure page in the Tools work area. Employment Details tab is part of the Personal Information page which is included in the About Me category.

If you use the predefined reference roles, no security related steps are necessary to enable this feature. Otherwise, you must assign relevant security privileges to your roles to enable this feature. See the Role Information section for more information. After assigning the new security privileges, you must regenerate the data roles which inherit these new security privileges.

For a worker having multiple assignments or work relationships, only the primary assignment details from the primary work relationship is displayed on the Employment Details tab.

Key Resources

For more information, go to Applications Help for the following topic:

- Managing Categories and Page Entries for the Navigator and Springboard: Procedure

ROLE INFORMATION

If you are not using the predefined reference roles, then you need to ensure that the below security privileges are mapped to the relevant abstract or job roles. This table identifies the required security privileges and suggests target job and abstract roles. You can add the security privileges to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege Name and Code |

Abstract Role |

| View Employment Information Summary ORA_PER_VIEW_EMPLOYMENT_INFORMATION_SUMMARY |

Employee Contingent Worker |

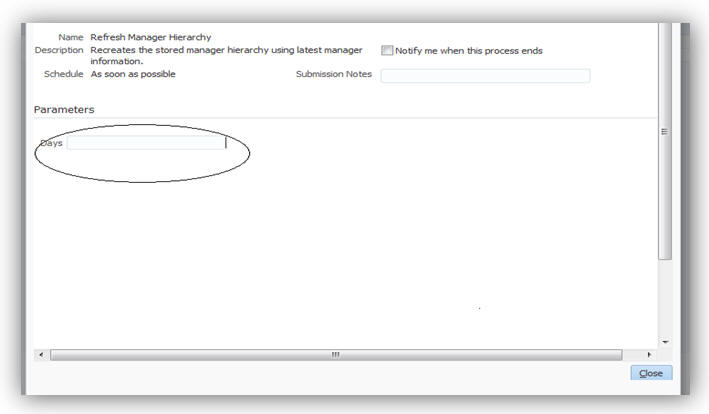

Workforce Directory - Incremental Refresh of Manager Hierarchy

In addition to performing full refreshes of the manager hierarchy, you can now perform incremental refreshes, refreshing the hierarchy based on supervisor changes occurring in the previous N days.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

Schedule a full refresh every month or quarter and also schedule an incremental refresh every day or week.

You can now search for people in your organization in a simple way using the directory search.

Directory Search

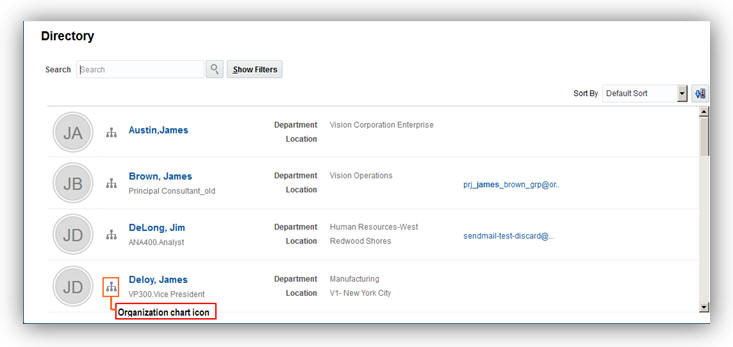

The search results have been redesigned to take advantage of the available space and enable filtering.

Organization Chart Icon in the Search Results

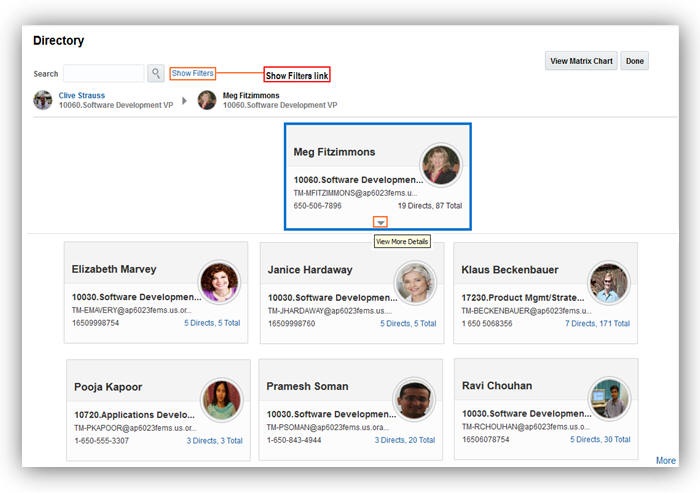

You can display the organization chart by clicking the organization chart icon in the search results. The organization chart provides public information based on the line manager hierarchy. You can view additional person information and perform actions by clicking the View More Details icon in the card.

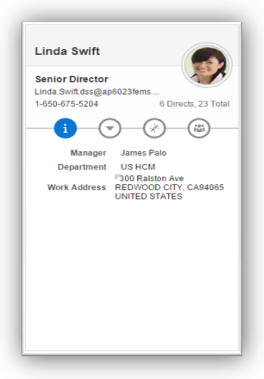

Click the View More Details Icon to View Public Information About the Person

The expanded card shows the same information that you see in the person smart navigation window on the other pages. This window displays a person’s public information, public hierarchy information (a worker’s direct reports), a list of actions, and navigation.

Person Smart Navigation Window: Information Person Smart Navigation Window: Actions

Person Smart Navigation Window: Navigation Person Smart Navigation Window: Direct Reports

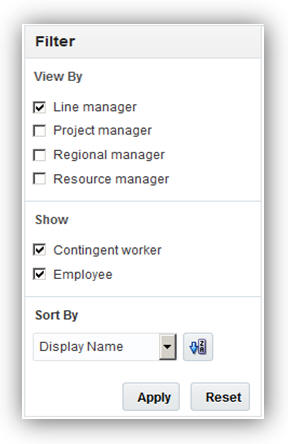

You may optionally display dotted line relationships by clicking the Show Filters link in the organization chart.

Filter Attributes in the Directory

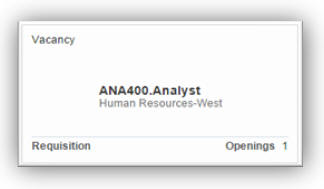

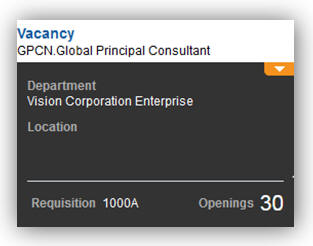

Vacancies and Taleo requisitions are also displayed in the organization chart.

Vacancy Card Displayed in the Organization Chart

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information on the Directory, go to Applications Help for the following topic:

- Searching for People in the Directory: Explained

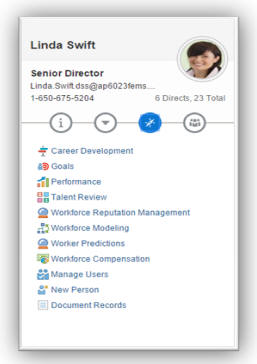

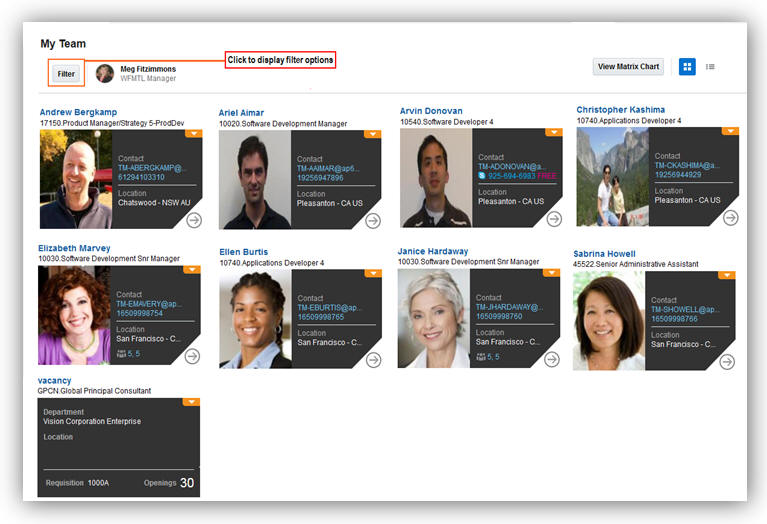

Additional Features in My Team

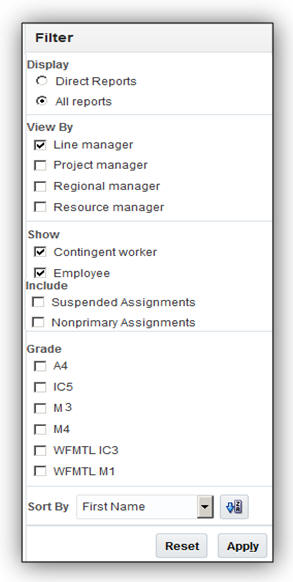

You can optionally display dotted line relationships in the My Team page by clicking the Filter button.

My Team Page

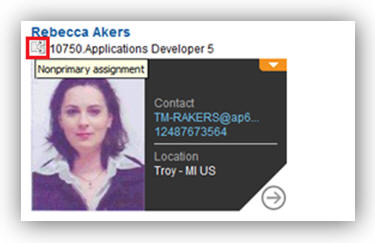

Filters are now in a side panel that you open by clicking the Filter button. You can filter by contingent workers, grades, suspended assignments, primary, and non-primary assignments.

Filter Attributes on the My Team Page

A Non-primary Assignment which is Shown When you Hover Over the Icon Next to Assignment

You can also display vacancies and requisitions and perform relevant actions by clicking on the vacancy or requisition.

Click on the Vacancy to Perform Actions

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information on My Team, go to Applications Help for the following topic:

- My Team: Overview

New Profile Option to Cache Person Images

Enhance the performance of pages that display person images (for example, organization chart) by caching person images. To enable browsers to store person images, create the PER_IMAGE_ENABLE_CACHING profile option. You must create the profile option and set the value to Y at the site level.

Steps to Enable

To enable caching, you must create the profile option and set the value to Y at the site level.

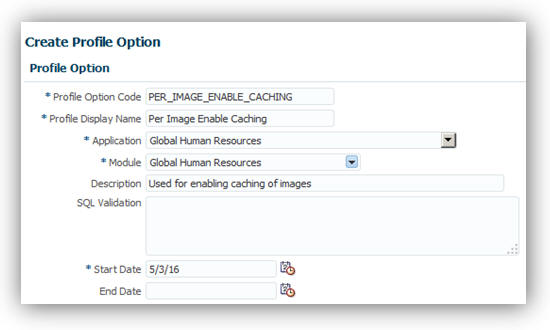

To create the profile option:

- Search for and select the Manage Profile Options task in the Setup and Maintenance page.

- Click the New icon, in the Manage Profile Options page.

- Enter the following details.

- Enter the start date.

- Click Save and Close.

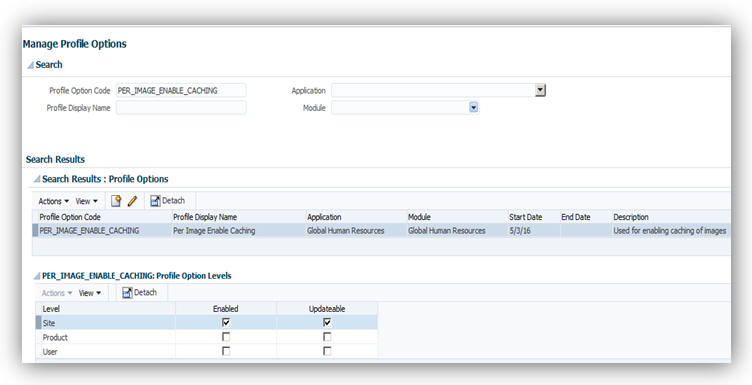

- Enter PER_IMAGE_ENABLE_CACHING as the Profile Option Code, In the Manage Profile Options page and then click Search.

- Select the Enabled and Updateable check boxes at the Site level In the PER_IMAGE_ENABLE_CACHING on the Profile Option Levels section.

- Click Save and Close.

| Field |

Value |

| Profile Option Code |

PER_IMAGE_ENABLE_CACHING |

| Profile Display Name |

Per Image Enable Caching |

| Application |

Global Human Resources |

| Module |

Global Human Resources |

Create the Profile Option

Enable the Profile Option at the Site Level

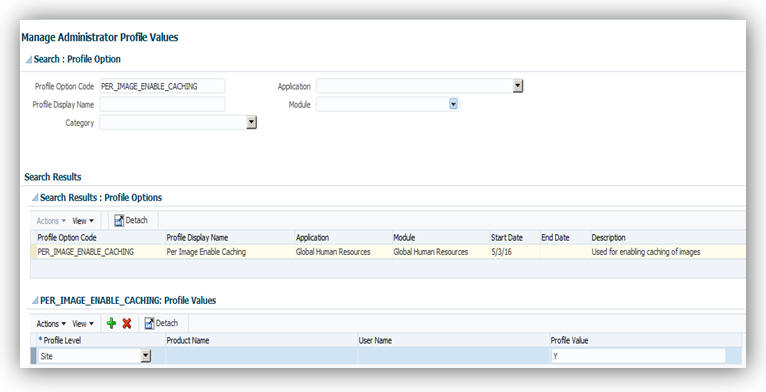

To set the value for the profile option:

- Search for and select the Manage Administrator Profile Values task in the Setup and Maintenance page.

- Enter PER_IMAGE_ENABLE_CACHING as the profile option code and click Search.

- In the PER_IMAGE_ENABLE_CACHING: Profile Option Values section, select Site from the Profile Level choice list.

- Enter Y as the profile value.

- Click Save and Close.

Set the Profile Value

Tips and Considerations

Don’t enable caching images if people at your site use kiosks to access the application.

Key Resources

For more information, go to Applications Help for the following topic:

- Caching Person Images: Explained

Worker Resignation Self Service in Simplified Interface

Improve operational efficiency by allowing workers to submit their own resignations. The new Submit Resignation link is displayed in the Related Links panel tab on the My Details page in the Personal Information work area. Additionally, line managers can review, edit, and approve the resignation requests of their direct reports in the simplified user interface. This feature improves:

- Transparency: Workers can provide their resignation comments which are stored in the application and can be reported.

- Compliance: Workers and line managers are alerted of any shortfall in the notice period for the resignation.

- Visibility: Workers can track the approval status of their resignation requests by using standard workflow features.

- Efficiency: Line managers can now reassign the direct reports of a resigning worker when editing the resignation request.

Worker Resignation Using Self Service

Steps to Enable

If you use the predefined reference roles, no steps are necessary to enable this feature. Otherwise, you must assign relevant security privileges to your roles to enable this feature. See Role Information section below for details.

Role Information

If you are not using the predefined reference roles, you must add security privileges to relevant abstract roles to use this feature. The following table identifies the required aggregate privilege and suggests target abstract roles. You can add the privileges to different roles if you prefer.

See Upgrading Applications Security in Oracle HCM Cloud Releases 10 and 11 (My Oracle Support Document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege Name and Code |

Abstract Role |

| Submit Resignation ORA_PER_SUBMIT_RESIGNATION |

Employee Contingent Worker |

Tips and Considerations

Workers cannot submit their resignations using this feature if they have:

- Future-dated transactions.

- Multiple work relationships active at the time of submitting their resignations, even if those work relationships are set to be terminated at a future date

Key Resources

For more information, go to Applications Help for the following topic:

- Worker Resignation: Explained

Display Manager Names Without Assignment Numbers in Employment Processes

Enhance performance of employment processes by changing the default behavior of displaying assignment numbers in the manager name list of values. By default, the assignment number is now not displayed. However, you can configure the PER_EMP_MANAGER_NAME_LOV site-level profile option to display the assignment numbers by updating the profile value to N. You can access the option by using the Manage Administrator Profile Values task in the Setup and Maintenance work area.

Configure Option to Conceal or Display Assignment Numbers

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- How can I display assignment numbers in the manager name list of values in employment flows?

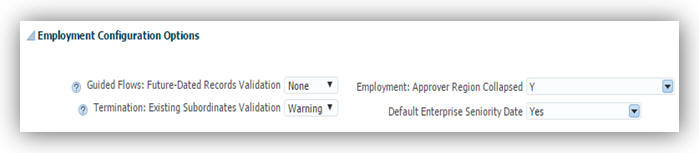

Employment Configuration Options

You can now use configuration options to perform validation, improve performance, or change default values in employment pages:

- Configure validation to stop or warn users from updating a future-dated assignment record using any manager self service pages, such as Promote and Transfer. By default, there is no validation. You can configure the validation as an error or warning message by using the Guided Flows: Future-Dated Records Validation employment configuration option.

- Configure validation to stop or warn users from terminating a manager with subordinates. By default, there is no validation. You can configure the validation as an error or warning message by using the Termination: Existing Subordinates Validation employment configuration option.

- Enhance performance of employment flows by changing the default behavior of the Approvers region in the Review page. By default, the Approvers region is now collapsed. However, you can change the default behavior by updating the Employment: Approver Region Collapsed employment configuration option to N for the enterprise.

- Control whether new work relationship records show a default value for the enterprise seniority date. If you change the Default Enterprise Seniority Date employment configuration option to No, there's no default date and users can enter a date manually.

You can access the options by using the Manage Enterprise HCM Information task in the Setup and Maintenance work area.

Configure Options to Change Default Behavior in Employment Pages

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- Seniority Dates: Explained

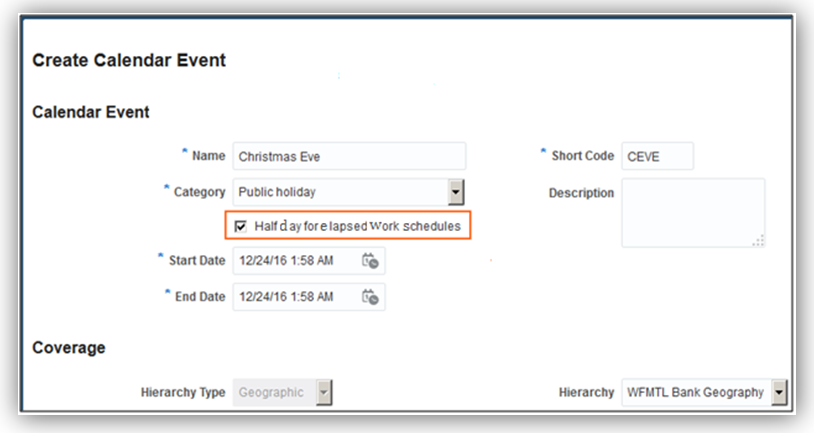

Half Day Calendar Events for Elapsed Work Schedules

You can specify a calendar event as a half day event for elapsed work schedules using the Create Calendar Event task in the Setup and Maintenance work area. A worker’s availability for the half day will be reduced by half and is shown for the first half of the day in the calendar availability. Calendar events defined as half day for elapsed work schedules must be defined within the same date.

Half Day Calendar Event for Elapsed Work Schedule

Steps to Enable

There are no steps necessary to enable this feature.

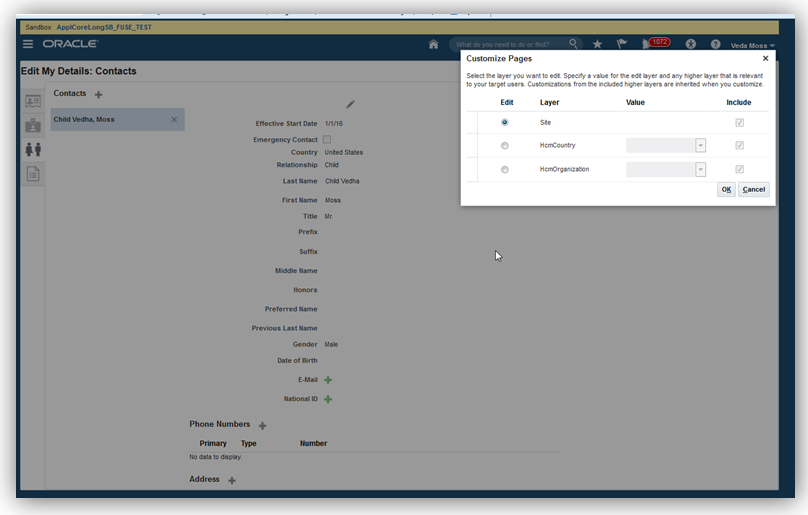

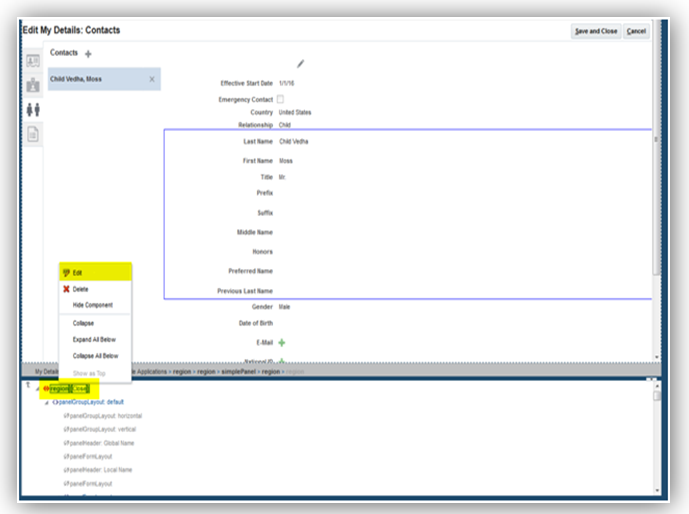

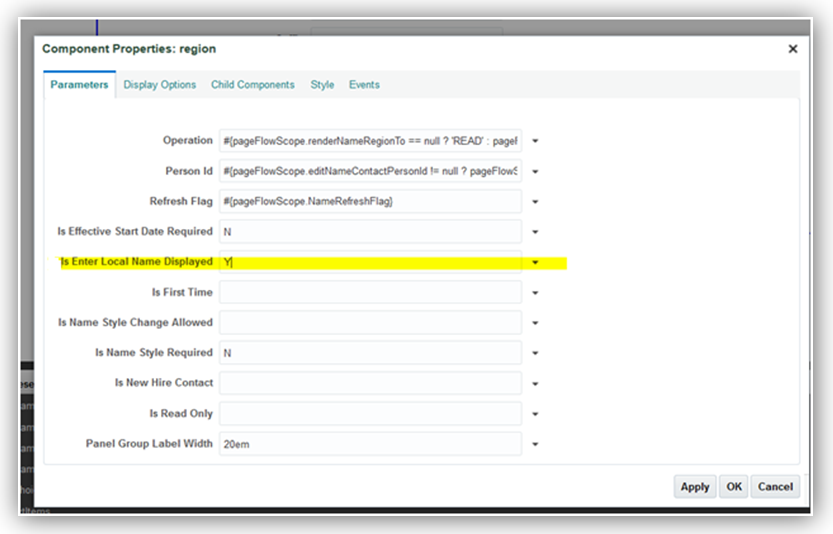

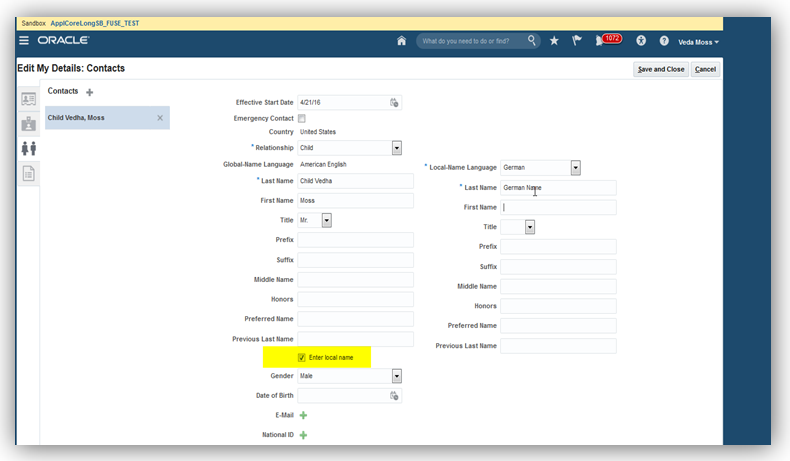

Local Name Support on Edit My Details Page

A new page composer property, Is Enter Local Name Displayed, is added to the Edit My Details page. You can set this property to ‘Y’ so that the Enter local name check box displays for both the signed in user and their contacts. If you select the Enter local name check box, the local name region is displayed in the employee self-service page. Its behavior is similar to the Manage Person page.

Steps To Enable

- Sign in to the application as a user who has page composer access.

- In the Settings and Actions menu, click Manage Sandboxes.

- Create a sandbox and activate it.

- Click the Navigator icon.

- In the About Me work area, click Personal Information.

- Click Edit to display the Edit My Details page.

- Click the Contacts tab.

- In the Settings and Actions menu, click Customize Pages.

- Select the Site layer.

- Click OK to display the page composer.

- Change the view to Source mode from the View menu.

- Select the last name or any component in the page to display the name region in the Source mode.

- Select the name region, right click to display the context menu, and click Edit to edit the name region.

- Change the value of the Is Enter Local Name Displayed to Y to enable the local name in the Contacts tab on the Personal Information page.

- Click Close to save the customization and display the pages in normal mode.

- Verify if the Enter Local Name check box is selected.

- In the Settings and Actions menu, click Manage Sandboxes, review and publish the customization to publish in the environment.

Depending on the requirement you can select the Enter Local Name check box and enter the local name in your preferred language. When this attribute is selected, workers can specify their local name and local name of their contacts.

Select the Customization at Site Layer

Set the View to Source

NOTE: If you are not able to find the source view in the page, select the source position appropriately and use the panel splitter to adjust the region appropriately.

Edit the Name Region

Set the Enter Local Name Displayed to Y

Verify if Enter Local Name Check Box is Selected

Tips and Considerations

You must consider if your workers must maintain a local name either for themselves or their contacts.

Key Resources

For more information, go to Applications Help for the following topics:

- Person Names: Explained

- How can I switch between local and global formats to display person names?

- What's the difference between global names and local names?

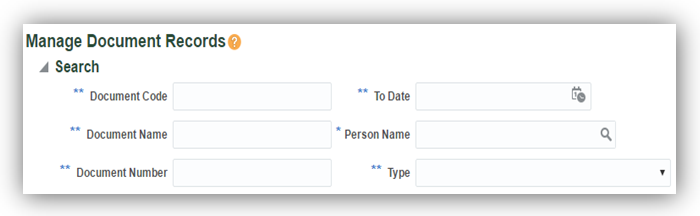

Required Search Criteria for Document Records

Enhance the search performance for document records by entering a person name, which is now a required search criteria on the Manage Document Records page. You can search for document records by using the Manage Document Records task in the Document Records work area.

Required Person Name Search Criteria

Steps to Enable

There are no steps necessary to enable this feature.

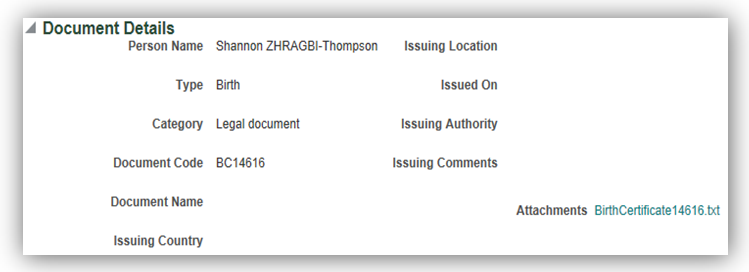

View Attachments from the Document Records Approval Notification

Approvers can now view attachments uploaded by the document record creator in the approval notification. You can click the Notifications icon in the global area to view notifications.

Attachments can be Viewed from the Approval Notification

Steps to Enable

There are no steps necessary to enable this feature.

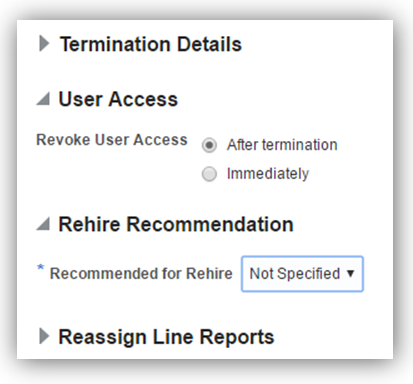

Additional Option for Rehire Recommendation

You now have an additional option for the rehire recommendation when you terminate a person’s work relationship. The Recommended for Rehire field is now a list and displays the additional value of “Not Specified” by default. You can terminate a work relationship using the Manage Work Relationship task in the Person Management work area or Terminate task in the My Team work area.

Additional option for Recommended for Rehire field

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- What’s the impact of entering a rehire recommendation?

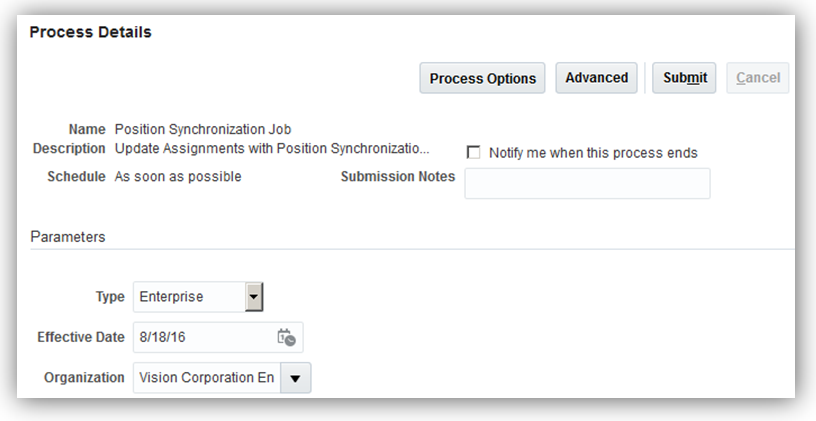

Position Synchronization When Using HCM Data Loader to Load Position Changes

Position synchronization is disabled when using HCM Data Loader (HDL) to load position changes, for performance reasons. This means that the load will not update the affected assignments even if position synchronization is enabled.

In order to synchronize, you can run the process, Position Synchronization Job to update the affected assignments using the Scheduled Processes work area. This process currently allows you to specify only one effective date. Therefore, the position changes will show date-effective assignment updates as of the same date even though the HDL load specifies position changes with different effective dates.

Run the Position Synchronization Job Process to Update Affected Assignments

The above behavior is applicable only to HDL. If you use the Manage Position UI to edit the position attributes, the changes will normally trigger updates to the affected assignments.

Steps to Enable

There are no steps necessary to enable this feature.

Display of Flexfields on Transaction Review Page and Notifications

Transaction review pages and notifications now display the flexfield information including DFFs, DDFs and EFFs related to the transaction.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

The following transactions support this feature:

| Add Employee |

Add PWK |

Add CWK |

| Add NWK |

Add Employment Term |

Add New Assignment |

| Add Work Relationship |

Manage Employment |

Promotion |

| Transfer |

Change Work Hours |

Change Location |

| Manage Work Relationship |

Terminations |

Display Pending Transactions by Business Process

The Manage Approval Transactions page has been enhanced to include a column to show the count of pending transactions for each business process. Users can drill down to the details page to see the basic details of a transaction, for example; the transaction description, initiator, creation date and age in days. An HCM Administrative user can also withdraw any stuck transactions listed on the details page without needing to log a support request.

Steps to Enable

There are no steps necessary to enable this feature.

Bypass Transactions Approvals by Business Process

The Manage Approval Transactions page has been enhanced to include a configuration option to bypass transaction approval processing at a business process level. The Employment, Person, Work Structure, and Compensation transactions support this feature.

Steps to Enable

There are no steps necessary to enable this feature.

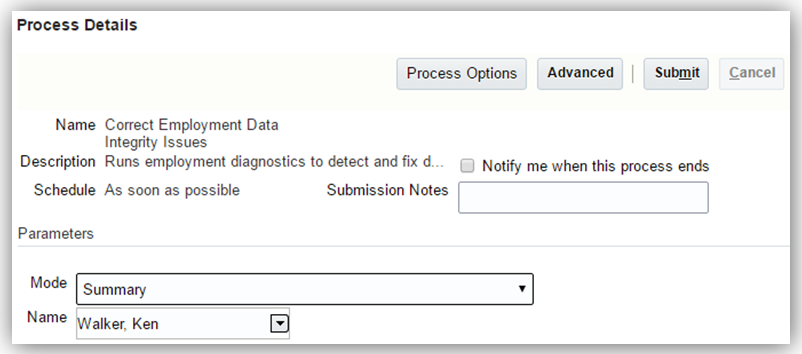

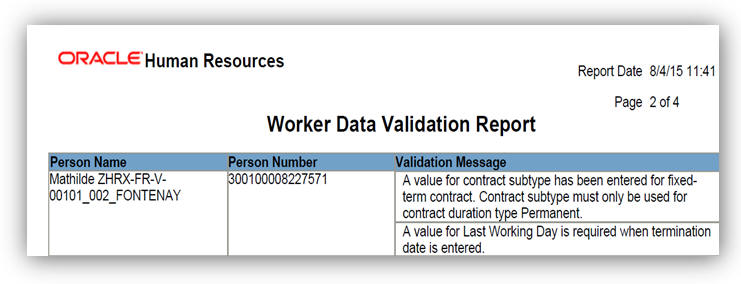

Correct Employment Data Integrity Issues

You can now use the Correct Employment Data Integrity Issues process to run a set of integrity checks to detect and correct employment data issues. Run the process for a person or set of people from the Scheduled Processes work area. You can run the process in the following 3 modes:

- Summary: Provides the count of the employment data issues, if any.

- Report: Provides details about the employment data issues, and the people affected by them.

- Update: Corrects the employment data issues.

Summary Mode Selected for a Person

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

- Checking and Correcting Employment Related Data Issues: Procedure

- Submitting Scheduled Processes and Process Sets: Procedure

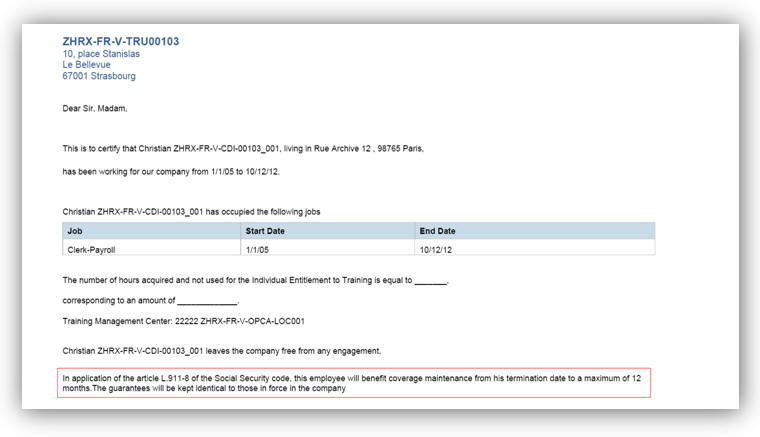

Global Transfer Support for Future Terminated Workers

You can now perform global transfer for a person with a future termination date from the Person Management work area or using HCM Data Loader. The global transfer terminates the existing work relationship a day before the start date of the new work relationship. To initiate a global transfer, select the Manage Employment task in the Person Management work area, then update the assignment and select the Global Transfer action from the Actions list.

Global Transfer for a Future Terminated Worker

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- Global Transfers and Temporary Assignments: How They are Processed

New Page to Upload Person Photos

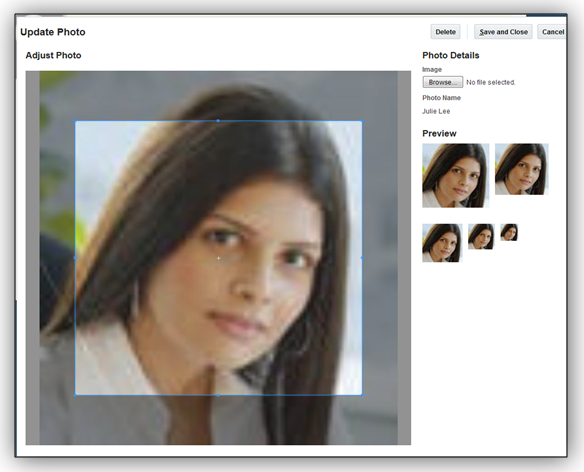

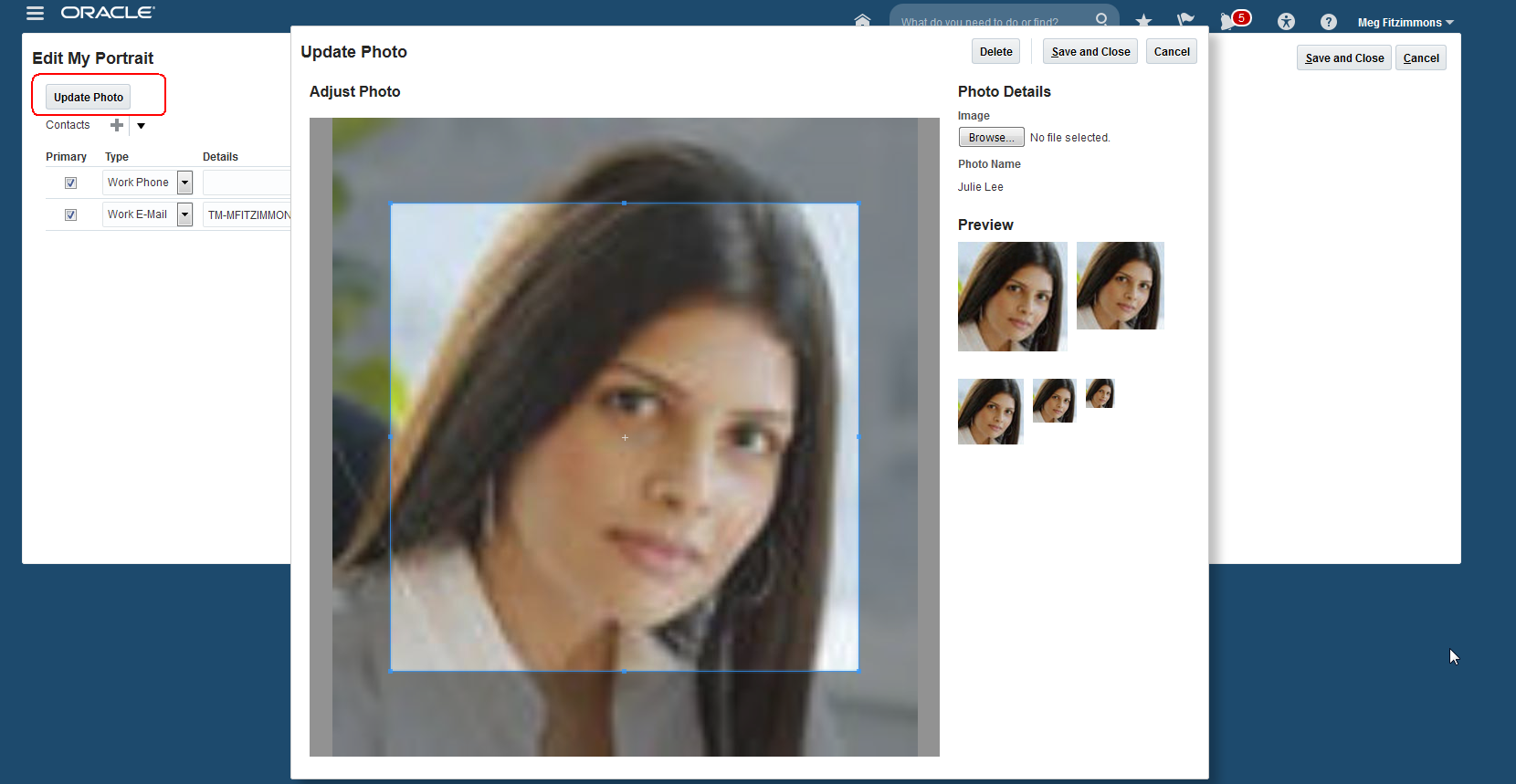

Workers can easily upload their photos using Update Photo page. This page appears when you click the camera icon when you are over the photo.

Click the Camera Icon to Upload Photo

Click the camera icon in the image to browse for and upload a photo. The cropping region enables you to focus on a specific region of the uploaded photo. The Preview region shows how the photo will appear in different sizes and formats that will be used throughout the application.

Crop photo to focus on a specific region

The public person and Mange Person pages now provide access to the new dialog for uploading a worker’s photo. When you use the Manage Person page to upload a photo, you can’t change the photo till the changes are approved.

Updated Edit Public Person Page

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

- Uploading My Photo: Procedure

- Loading Person Photos: Points to Consider

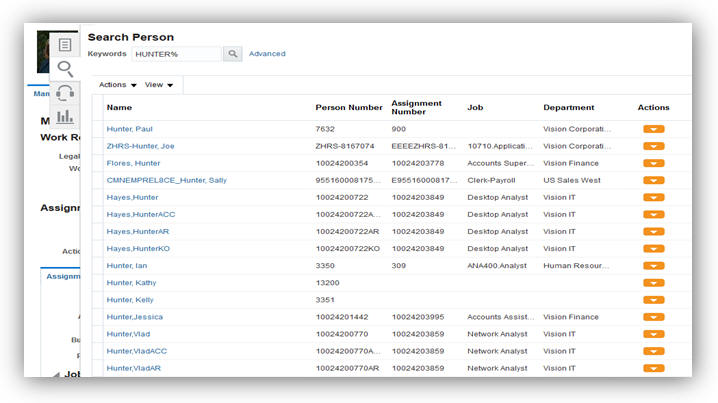

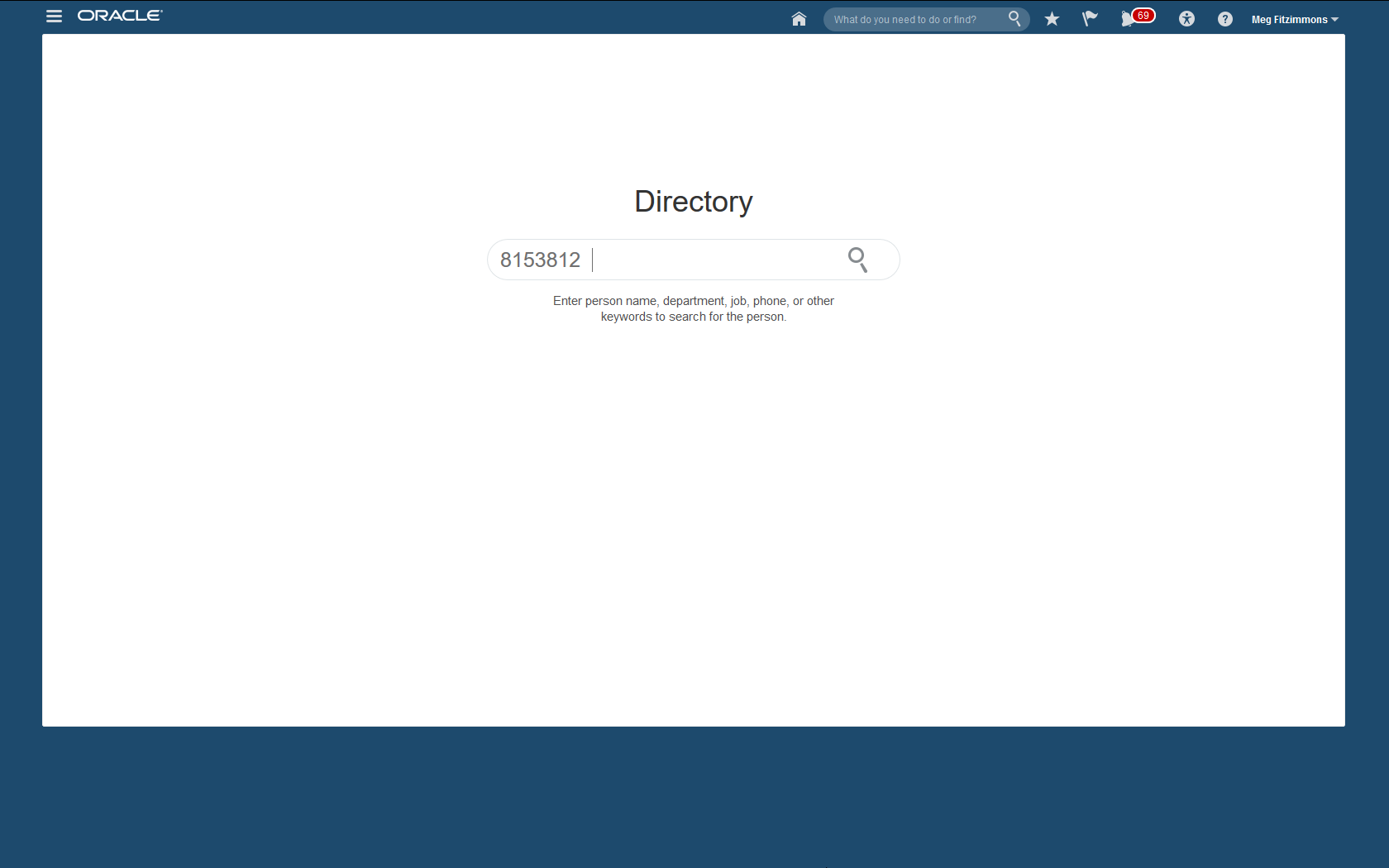

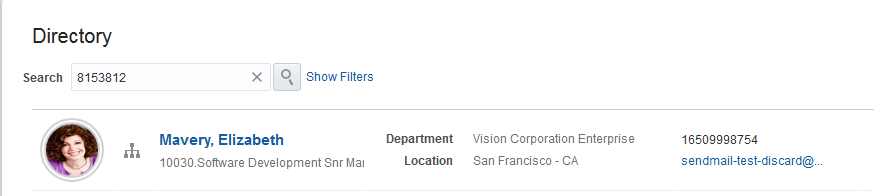

Search Using Person Number in Keywords

You can easily search for people using the person number in the Keywords field. For example, in the Directory, enter the person number to fetch the exact person record.

Directory Search Page

Search by Person Number

You can also use the person number in the Keywords field to search for people in the Person Management: Search page.

Steps to Enable

Run the Update Person Search Keyword process to update the keywords table with existing people’s person numbers.

Tips and Considerations

Not all users know a person’s HCM Cloud person number, but many Human Resource professionals know and prefer to use it to perform a search. So, you may choose to communicate with professional users only or all workers in the organization that they can use person numbers in keyword search.

Key Resources

For more information, go to Applications Help for the following guides and topic:

Oracle Fusion Global Payroll Interface supports extract details from HCM, such as earnings and deductions, to send to a third-party payroll provider. You can also import processed payroll data, including payslips, from your payroll provider.

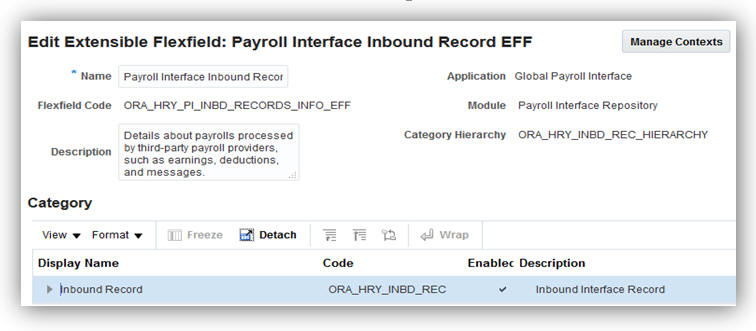

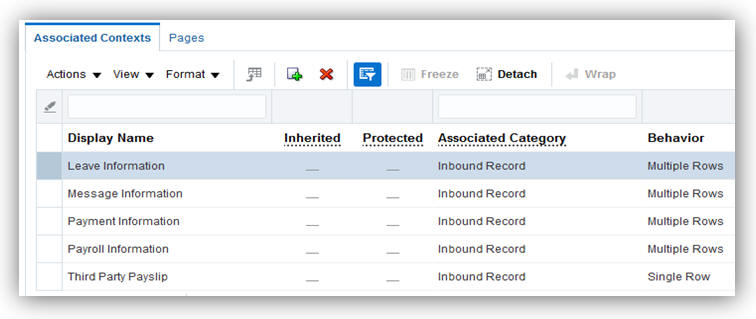

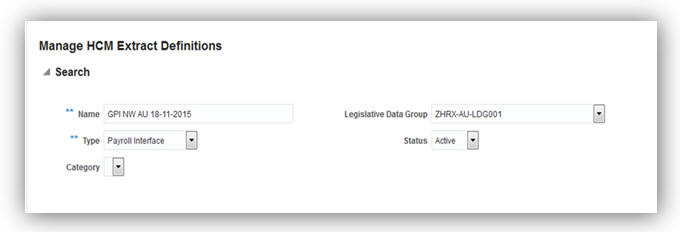

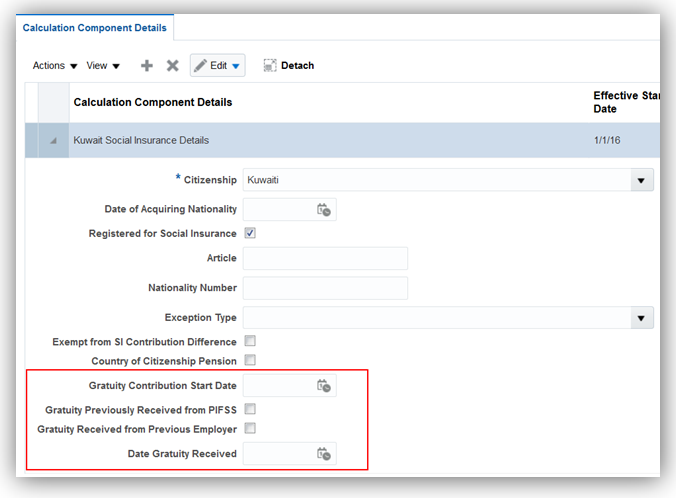

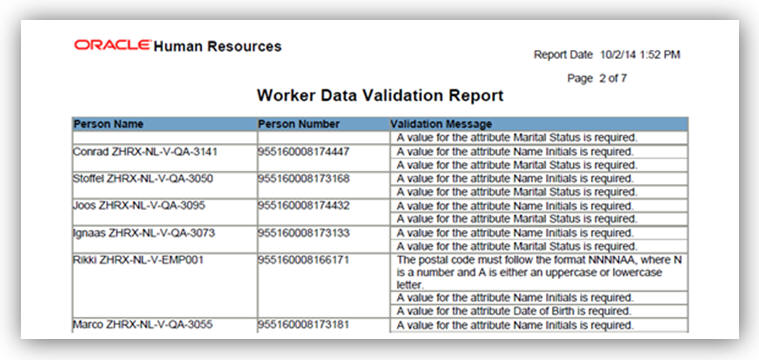

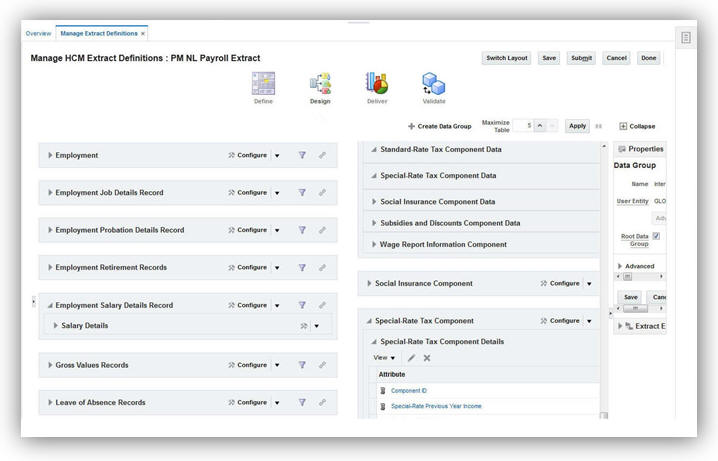

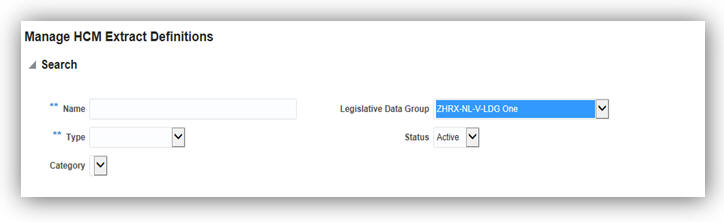

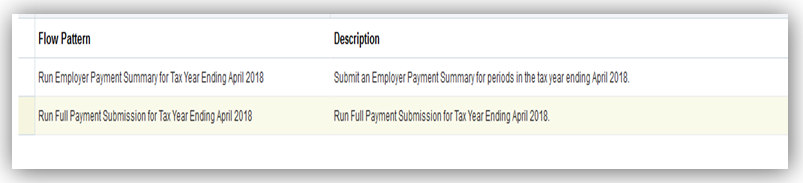

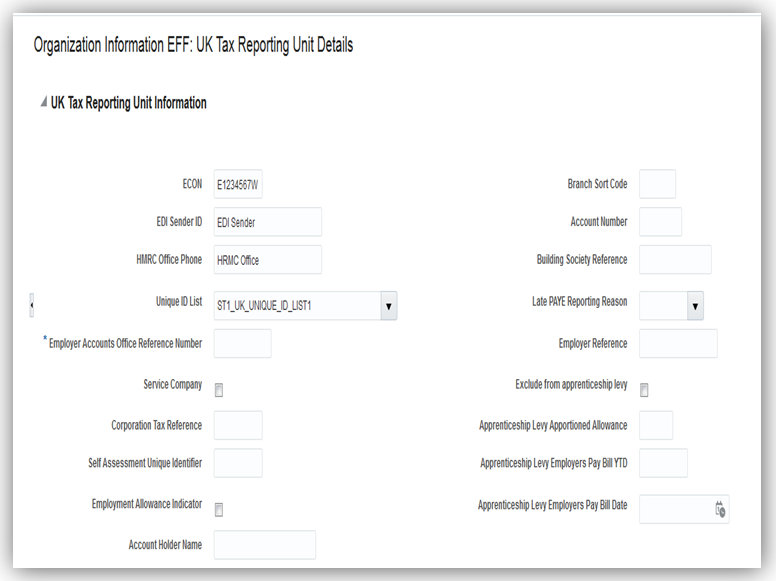

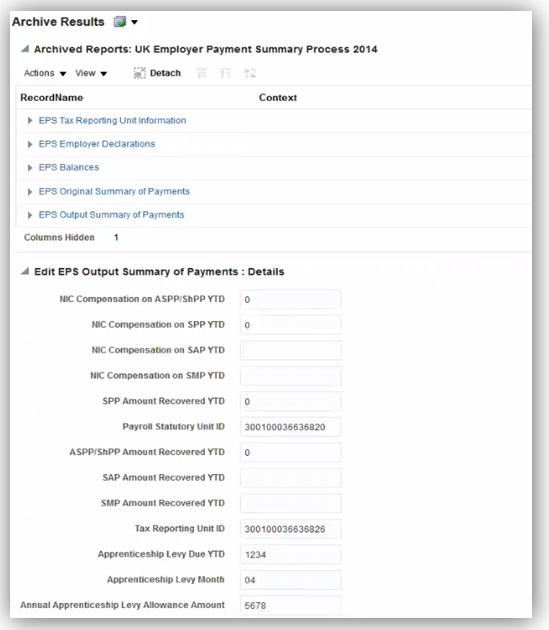

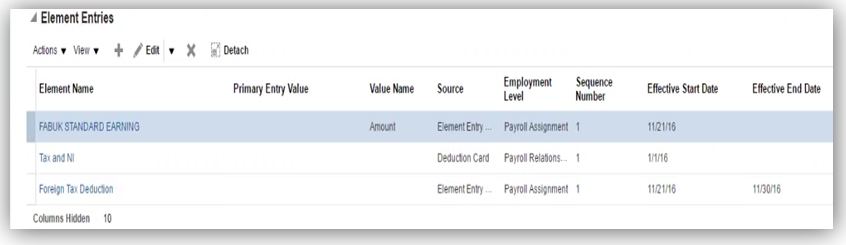

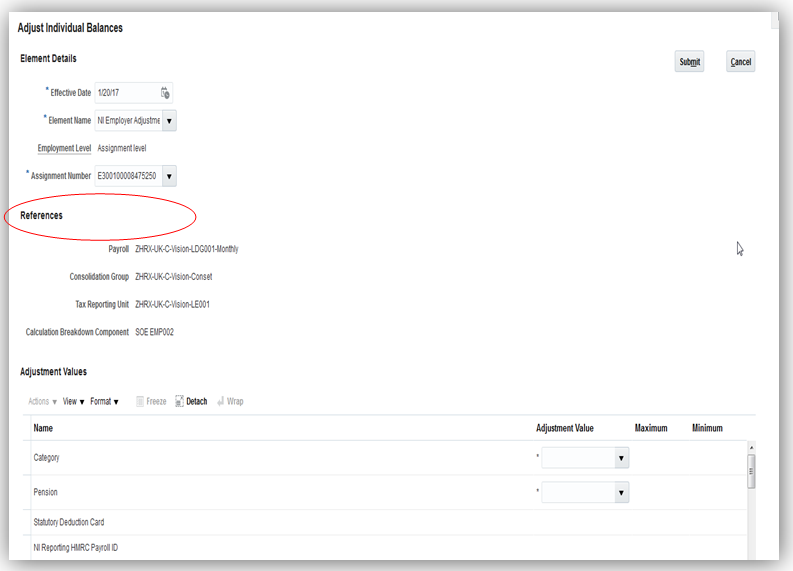

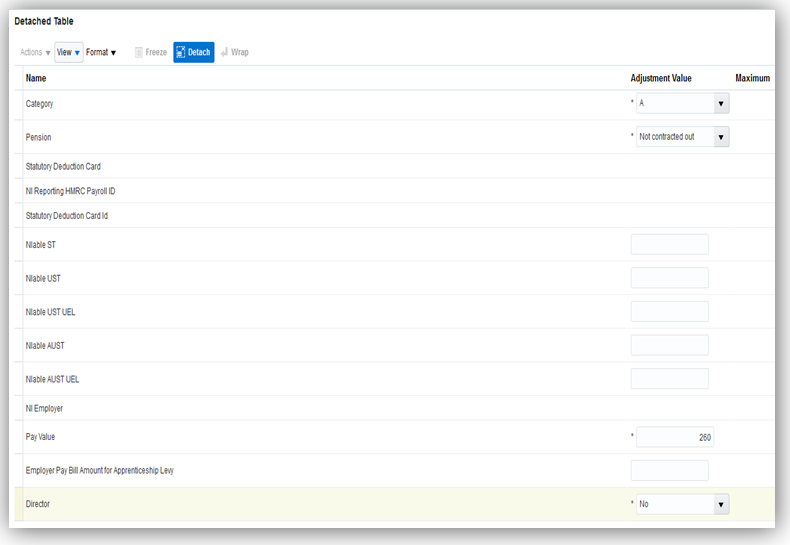

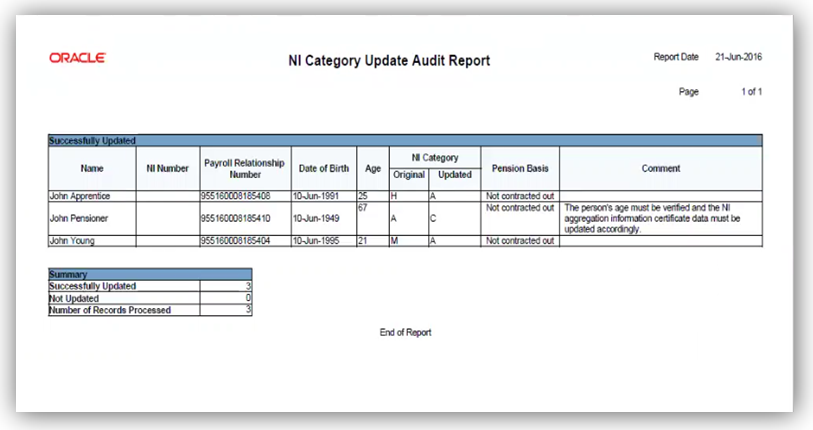

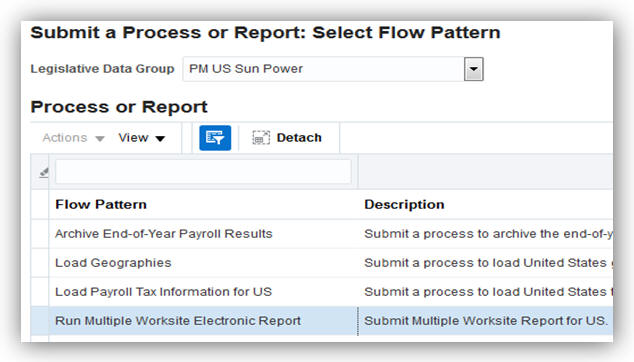

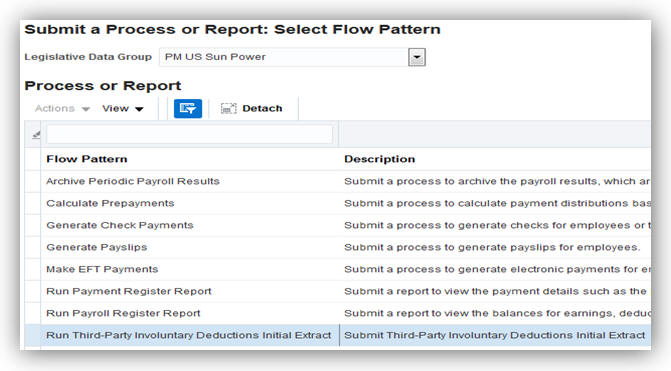

New Country Extensions in Global Payroll Interface Extract Definition