This document will continue to evolve as existing sections change and new information is added. All updates are logged below, with the most recent updates at the top.

The new functionality referenced in this document may not be immediately available to you if your organization has chosen not to receive optional monthly updates. Rest assured you will receive the new functionality in the next quarterly update which is required and cumulative. Quarterly updates are applied in February, May, August, and November.

.

| Date |

What's Changed |

Notes |

|---|---|---|

| 01 SEP 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax File Enhancements |

New feature delivered in Update 21 (September). |

| 02 JUN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax Filing Enhancements For PA Act 32 |

New feature delivered in Update 18 (June), which will also be included in the August Quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Enhancements For PA Act 32 |

New feature delivered in Update 18 (June), which will also be included in the August Quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Compensation Management: New Attributes and Performance Enhancements for Compensation |

New feature delivered in Update 12 (December), which was also included in the February Quarterly update. |

| The following features are included in the May Quarterly update. |

||

| 02 JUN 2017 |

Oracle Fusion Global Payroll: Payroll Costing Report by Element Classification |

New feature delivered in Update 15 (March), which was also included in the May Quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Payroll: Settlement Date for Deduction Element Entry |

New feature delivered in Update 17, the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: P60 Template Updates |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United Kingdom: P60 Replacement Option |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Extract Enhancement: New Jersey FLI Tax Code |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| 03 MAR 2017 |

Oracle Fusion Global Payroll: Enhance Payroll Costing Report |

New feature delivered in Update 15 (March), which will also be included in the May Quarterly update. |

| The following features are included in the February Quarterly update. |

||

| 03 FEB 2017 |

Oracle Fusion Payroll for the United States: Enhanced Employee Form W-2 |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Periodic Tax Filing Extract Enhancement |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Payroll for the United Kingdom: Legislative Updates |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

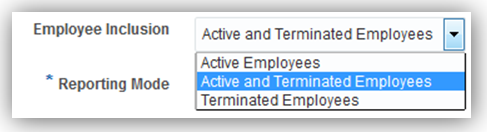

Oracle Fusion Payroll for the United Kingdom: Real Time Information |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

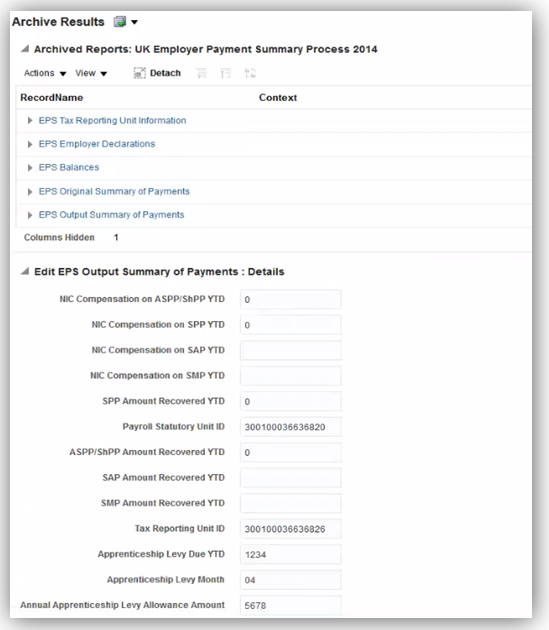

Oracle Fusion Payroll for the United Kingdom: Apprenticeship Levy |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Payroll for the United Kingdom: Foreign Tax Credit Relief |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Payroll for the United Kingdom: Full Support of Balance Adjustments |

New feature delivered in Update 14, the February Quarterly update. |

| 03 FEB 2017 |

Oracle Fusion Global Payroll: Excel Output Support for Payroll Reports |

Feature was included in Update 4 (April), however just made a documentation adjustment. |

| 06 JAN 2017 |

Oracle Fusion Human Capital Management for the United States: Third-Party Quarterly Tax File Enhancements |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Human Capital Management for the United States: New Start-of-Year ESS Process for Year Begin |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Human Capital Management for the United States: PA ACT 32 Support for Employee W-2 and W-2 Register Reports |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Payroll for Canada: End-of-Year Reporting (RL-2 Only) |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Global Payroll: New Task Action for PBL: Customize Bank Account Details |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 06 JAN 2017 |

Oracle Fusion Global Payroll: New Rules for Personal Payment Methods |

New feature delivered in Update 13 (January), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Payroll Batch Loader Enhancements for Involuntary Deductions |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: W-2 Employee Report Enhancements |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: W-2 Register Report Enhancements |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| 02 DEC 2016 |

Oracle Fusion Payroll for Canada: End-of-Year Exception Report |

New feature delivered in Update 12 (December), which will also be included in the February Quarterly update. |

| The following features were delivered via monthly updates. |

||

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Form W-2 Box 20 Enhancements for Ohio Employees |

Feature was included in Update 10 (October), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Wage Balance Enhancement for Periodic Tax Filing |

Feature was included in Update 10 (October), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Automatically Update Employee Withholding Certificates for Rehires and Assignment Changes |

Feature was included in Update 10 (October), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Include Resident and Nonresident City and County Tax Balances on Periodic Tax Filing |

Feature was included in Update 9 (September), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Refined Data Selection for W-2 Employee Report |

Feature was included in Update 9 (September), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for Canada: Involuntary Deductions: Protected Pay Rules |

Feature was included in Update 8 (August), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Display Accrual Balances on Employee Checks |

Feature was included in Update 7 (July), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Automatically Synchronize Employee Withholding Certificates With HR Data |

Feature was included in Update 7 (July), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for Canada: End-of-Year Reporting: Amendments for T4, T4A, and RL-1 |

Feature was included in Update 7 (July), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Payroll for the United States: Default Check Numbering for US Simplified Payroll Cycle Flow |

Feature was included in Update 5 (May), however just made a documentation adjustment. |

| 02 DEC 2016 |

Oracle Fusion Global Payroll: Excel Output Support for Payroll Reports |

Feature was included in Update 4 (April), however just made a documentation adjustment. |

| 04 NOV 2016 |

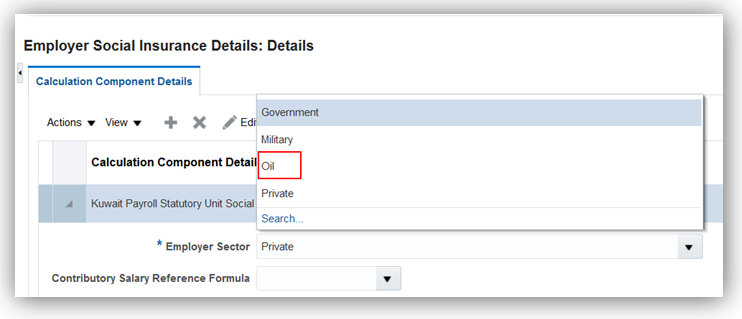

Oracle Fusion Payroll for Kuwait: Social Insurance Calculation for Fully State Owned Oil Companies |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Payroll Interface for the United States: Additional Third-Party Periodic Tax Filing Auditing |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Payroll for the United States: Set SUI Wage Limit Overrides for Eligible Employers |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Payroll for the United States: Specify Company Entry Descriptions for EFT Payments |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Payroll Interface for the United States: Include Provider-Specific Fields on the Third-party Quarterly Tax Filing Interface |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Global Payroll: Enhanced Calculation Rules for Earnings Elements |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Global Payroll: Batch Loader Tasks for Payroll Relationship Groups |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Global Payroll: Enhanced Data Exchange Work Area |

Feature information delivered in Update 11 (November). |

| 04 NOV 2016 |

Oracle Fusion Payroll for Kuwait: Social Insurance 2015 Enhancement |

Added new feature information delivered in Release 11 base Upgrade. |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Additional Flow Parameter for Create Batch for an Object |

Feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Enhancement for Generate Run Balances |

Feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Enhancement in Payroll Costing Report |

Feature information delivered in Update 8 (August). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Dynamic Payroll Relationship Group Support for Payroll Activity Report |

Feature information delivered in Update 6 (June). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Information Balances in the Payroll Balance Report |

Feature information delivered in Update 6 (June). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Edit Payroll Period Names |

Feature information delivered in Update 5 (May). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Void Payment Action in Prepayments |

Feature information delivered in Update 4 (April). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Excel Output Support for Payroll Reports |

Feature information delivered in Update 4 (April). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: HCM Data Loader Support for Calculation Cards |

Feature information delivered in Update 3 (March). |

| 05 AUG 2016 |

Oracle Fusion Global Payroll: Value Sets Usage in Flow Parameters |

Feature information delivered in Update 3 (March). |

| 01 JUL 2016 |

Oracle Fusion Global Payroll: Information Balances in the Payroll Balance Report |

Feature information delivered in Update 7 (July). |

| 01 JUL 2016 |

Oracle Fusion Global Payroll: Balance Exception Formula and Variance Type Enhancements |

Feature information delivered in Update 7 (July). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Information Balances in the Payroll Balance Report |

Feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Person and Payroll Relationship Group Parameters for Run Deduction Report |

Feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Payroll for the United States: Employee Active Payroll Balance Report Enhancement |

Feature information delivered in Update 6 (June). |

| 03 JUN 2016 |

Oracle Fusion Global Payroll: Deduction Category and Deduction Parameters for Run Deduction Report |

Feature information delivered in Update 5 (May). |

| 06 MAY 2016 |

Oracle Fusion Compensation: Automate Salary Updates Using Grade Step Progression |

Feature information delivered in Update 5 (May). |

| 01 MAR 2016 |

Initial Document Creation |

|

This guide outlines the information you need to know about new or improved functionality in Oracle HCM Release 11. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for the base Talent and Compensation stand alone applications.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management (All Talent applications)

- Workforce Rewards (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Please indicate you are inquiring or providing feedback regarding the Global HR Cloud What’s New for Release 11 in the body or title of the email.

Some of the new Release 11 features are automatically available to users after the upgrade and some require action from the user, the company administrator, or Oracle.

The table below offers a quick view of the actions required to enable each of the Release 11 features.

Compensation and Total Compensation Statement

Oracle Fusion Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

Test Fast Formula Used to Determine Worksheet Column Default Values

Test the Compensation Default and Override formula that you select when you configure the Workforce Compensation plan column properties. You use the new test tool on the Default Values tab to test the formula for a sample person and to verify that the formula returns the expected results. You see the results immediately and can troubleshoot issues before you start the plan cycle. Previously, you had to run the Start Compensation Cycle process to know if you wrote the formula correctly.

Test Condition and Column Results Tool

Enter Test Parameters

There are no steps necessary to enable this feature.

Configure Shading, Width, and Text Wrapping for Worksheet Columns

Add custom color shading, set column width in pixels from 50 to 200, and wrap text for any worksheet column. Color shading applies to the worksheet cells, not the column header. Previously, shading was not available, and managers had to manually stretch columns when the content was longer than the column width each time that they entered the worksheet.

Wrap Text, Set Column Width, and Apply Shading

See Column Shading on the Worksheet

There are no steps necessary to enable this feature.

Tips and Considerations

Examples are:

- Apply the same shade to a set of adjacent columns so they appear related on the worksheet.

- Shade columns that require entry or attention by managers.

- Increase or decrease the column width to better display the contents of each column.

- Set a column to wrap text so managers can see all text without having to expand the column.

Configure Dynamic Calculations, Alerts, and Advanced Filters Conditions

You can more easily build conditions for dynamic calculations, alerts, and advanced filters when using translatable columns. When using the condition builder, select a value from a choice list to build your condition instead of using an internal ID or non-translatable code. For example, you can build the condition as Performance Management Overall Rating equals “Outstanding”. The condition still uses the internal ID or code. If you create the condition manually, you must use the internal ID or code.

Previously, you had to use the internal ID or non-translatable code of the value in the condition. For example, you had to build the condition as Performance Management Overall Rating Equals “4005”.

Text of the Value Appears in the Choice List

Condition Uses Numeric Value

There are no steps necessary to enable this feature.

Configure Different Due Dates for Different Hierarchy Levels

Configure different due dates for up to seven levels of the approval hierarchy when you configure the plan cycle. Enable higher-level managers to change due dates for lower managers using a new action called Change Due Dates for All Managers. Managers can see the due dates for their lower-level managers on the Manager Status report and on the approvals tab.

There are two new batch processes that can be run from the Run Batch Process page to notify managers when:

- Dues dates are past, due today, or are due in X number of days

- The cycle opens or closes

Decide whether to notify lower-level managers when higher-level managers change their due dates by setting the Due Date Changed notification on the Configure Global Settings page.

Previously, there was one due date for all manager levels and no notification of date changes.

Configure Different Due Dates for Up to Seven Manager Levels

Managers Can Change the Due Dates for Lower-Level Managers

There are no steps necessary to enable this feature.

Set earlier due dates for managers lower down in the hierarchy so that they do not hold up the approval process. Due dates are informational only.

Configure Worksheet and Reporting Filters

Create custom filters that managers use to filter their worksheet and reports. In plan setup, you use the Configure Filters task, renamed from Configure Report Filters, to enable filters, including the advanced filters. In addition to Name and Team, two additional filters appear in the worksheet toolbar. Managers can access additional filters using the View More Filters button. The enabled filters appear only when you enable the corresponding column. The worksheet summary table recalculates when managers apply the filters. Previously, worksheet filters only included Name, Team, Eligibility Status, Country, and Job Title.

View More Filters

There are no steps necessary to enable this feature.

Navigate Between the Worksheet and Reports More Easily

Return to your starting point easily after reviewing manager reports during the workforce compensation cycle. Just click the Done button on the reports page. Previously you had to manually navigate to your starting point.

There are no steps necessary to enable this feature.

Display Static Budget Amounts In the Worksheet Summary

Enable three new columns in the compensation tab type summary to display Overall Budget, Overall Available Budget, and Overall Compensation Amount, which do not change when you apply filters. Managers can see their overall budget amounts at all times, even when they apply filters. Three existing columns are renamed as follows:

- Overall Budget Amount is now Budget - Filtered by Team

- Available Budget is now Available Budget - Filtered by Team

- Compensation Amount is now Compensation Amount - Filtered by Team

There are no steps necessary to enable this feature.

The three new columns are initially disabled so there is no visual impact on the worksheet when you upgrade. If you use the three existing renamed columns, you might want to rename them accordingly.

Configure Worksheet Display Default Options

Configure worksheet default display options by plan. You use a new task included in plan setup called Configure Default Worksheet Display where you can set the following options:

- Team Filter

- Number of Visible Rows

- Table View (list or tree)

- Number of Frozen Columns

Line managers can continue to use the Manage Default Worksheet Display action to save default settings on their worksheet. The default display settings saved by managers are honored. If managers do not save their default settings, plan-level display options apply. Previously, individual managers had to save their default display options. You could not configure options at the plan level.

Set Default Page Settings at the Plan Level

There are no steps necessary to enable this feature.

Disable the Submit Option On the Worksheet

Hide the Submit button on the worksheet and only enable managers to save their worksheets. Use the new Disable Submit option, in the Configure Approvals task to disable the Submit button. This action also hides the Approve and Return for Correction buttons on the approval tab. You had to hide the Submit button using customization, previously.

Disable the Worksheet Submit Button

There are no steps necessary to enable this feature.

Disable the Submit option to simplify the compensation cycle. Managers just allocate and save.

View Individual Compensation History When Managing Compensation

View a worker’s full individual compensation history on the Manage Compensation page. The prior compensation section shows up to five years of previous compensation, with the option to display all years. Recurring awards appear as prior compensation when their end date is earlier than the current date. These plans are view-only. Previously, you did not see historic awards on the Manage Compensation page. The Manage Compensation page only displayed active plans whose award end dates were greater than or equal to the current date.

View Prior Compensation When Making a Compensation Decision

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

The Other Compensation section differs in that it includes all current individual compensation plans for a worker, including active recurring plans. Managers can take action on these plans, including awarding compensation.

Salary and Individual Compensation Approval Notification Personalization

As a Human Resources (HR) or Compensation Administrator, you can now personalize salary and individual compensation approval notifications.

Personalizing Salary and Compensation Approval Notifications

Using the Oracle Page Composer, you can selectively show and hide various components of the notification, including fields, labels and regions.

Edit Labels, Color, and the Page Layout

Custom Text and External Links to the Page

Steps To Enable

There are no steps necessary to enable this feature.

Configure Options for the Printable Total Compensation Statement

Generate the printable statement in each worker’s local currency or in another currency. Make the statement available to administers, workers, or both. The statement contains a currency switcher you can use to switch between multiple currencies. Previously, the printable statement was generated in each worker’s local currency and was available to both administrators and workers.

Generate Printable Statements in Worker’s Local Currency

Steps to Enable

There are no steps necessary to enable this feature.

Route Individual Compensation Approvals Based on Salary

You can now use attributes of the worker’s salary record to route approvals for the Manage Individual Compensation process using Manage Approval Transactions for Human Capital Management or the VariableAllocationTask using BPM Worklist.

Steps to Enable

You must configure or modify your approval rules to take advantage of the new payload attributes.

Key Resources

For more information compensation approvals, go to Applications Help for the following topic:

- Salary and Individual Compensation Approval Tasks: Explained

Automate Salary Updates Using Grade Step Progression

You can now update salaries automatically using grade step progression. You define progression rules and associate them with your grade ladders. The new grade step progression batch process evaluates the rules to move workers to the next grade or step and update their salaries accordingly. You can optionally review changes before the application applies them to the worker’s assignment and salary record. When it comes time to update the underlying salary values, you can run the new rate synchronization process to automatically update the salaries for all affected workers. You access the new grade step progression pages in the Compensation work area.

The grade step progression capabilities are available immediately after upgrade. To use the process for your workforce, you want to do the following:

- Define additional parameters for your grade ladders

- Associate your workers with the appropriate grade ladder

- Mark the workers eligible for grade step progression

- Schedule and run the process.

Manage Grade Step Progression in the Compensation Work Area

Create or Edit Progression Grade Ladder

View Proposed Progressions and Salary Updates

Steps to Enable

There are no steps necessary to enable this feature.

Role Information

If you plan to use the new grade step progression process and do not use the delivered Compensation Manager and Compensation Administrator roles, you must add the Manage Progression Grade Ladder privilege.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

Tips and Considerations

After upgrade, the delivered compensation administrator role sees the new Manage Progression Grade Ladders page. Use this page to create and manage ladders that use grade step progression. The old Manage Grade Ladders page is still available in the Workforce Structures work area and from Setup and Maintenance. Grade ladders created in the old Manage Grade Ladders page are available to maintain in the new Manage Progression Grade Ladders page, if you plan to use the grade step progression process. You enter additional parameters for your old grade ladders in the new page.

Oracle Fusion Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

Batch Process to Assign and Update Benefits Relationships

Use the new Assign and Update Benefits Relationships process to assign and update benefits relationships for workers using the default configuration. You run the process from the Evaluation and Reporting work area, Processes tab, Maintenance Processes sub tab.

Location of the Assign and Update Benefits Relationships Process in the Processes Tab

This process synchronizes worker benefits data with existing human resources data. Typically, you run this process when you go live with Benefits after other modules.

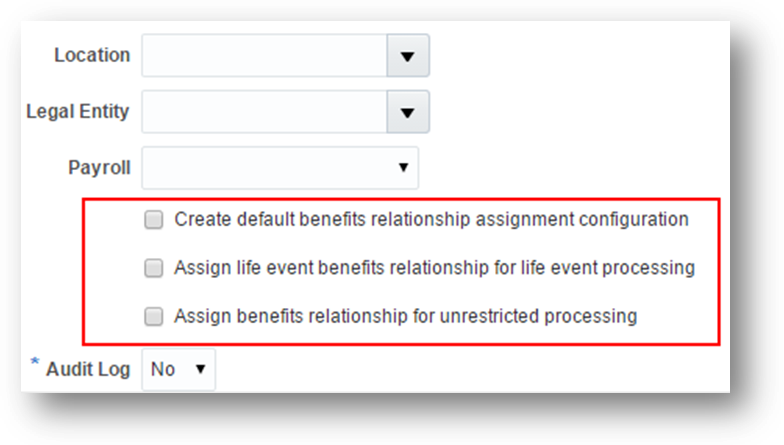

Key Parameters of the Assign and Update Benefits Relationships Process

If the default configuration does not exist for the worker's country, you can configure the process to create the configuration. Configure the process to assign benefits relationships to the worker for life event processing and unrestricted life event processing.

There are no steps necessary to enable this feature.

New Fields for Oracle Transactional Business Intelligence (OTBI)

The following new benefits fields are now available for reporting in OTBI:

- Suspended

- Required

- Action Type Name

- Due Date

- Completion Date

- Enrollment Coverage Start Date

- Enrollment Coverage Through Date

- Received Date

- Denied Date

New OTBI Reporting Fields in a Sample Report

There are no steps necessary to enable this feature.

Improved Self-Service Benefits Pages

Participants can now use the improved self-service overview page to perform these functions more quickly and easily:

- Enroll in plans

- Review and update contacts information

- View current and future benefits

- Record life events

- View pending actions

Context Sensitive Overview Page

The Overview page is context-specific and appears differently depending on the participants who use it. For example, existing participants see additional tasks, such as the ability to view current and future enrollments and view pending actions. Participants who are ready to enroll in benefits for the first time only see the task to make enrollments. Tasks, such as the ability to update primary care physicians or record life events, appear on the overview page only if administrators enable existing setup options. These options continue to be available in the Manage Self-Service Configuration page in the Plan Configuration work area.

Enroll Now Section of the Overview Page.

Reviewing and Updating Contacts Before Enrollment

The page to review or update contacts now always appears before participants start the enrollments process. Previously, administrators had to enable an option for participants to review their contacts before the enrollment process. That configuration option no longer exists.

People I Plan to Cover Page that Participants See before they Start the Enrollment Process

Configuration to Improve Visual Appeal of Self-Service Pages

Administrators can improve the visual appeal of the offering selection process for participants. They can configure the self-service pages to use custom images for programs, plan-not-in-programs, and the overview page. Administrators can also add instruction text, change welcome text, and add specific documents in the self-service pages using Page Composer.

Images on the Program Selection Page

Improved Report a Life Event Page

The Report a Life Event page is now simpler to use for participants. Administrators can continue to use the Self-Assigned checkbox to configure specific life events that participants can create for themselves on the Report a Life Event page. Administrators can now take advantage of the new Self-Service Grouping field when they select the Self-Assigned checkbox on the Create or Edit Life Event page. This field enables administrators to group events under the following categories that display on the Report a Life Event page:

- Child events

- Employee events

- Spouse or domestic partner events

Report a Life Event Page that Participants Use in the Self-Service Pages

Self-Service Grouping Field on the Create or Edit Life Event Page in the Plan Configuration Work Area

Open Enrollment Reminder On Overview Page

Participants can take advantage of the improved overview page during an open enrollment period. When administrators start open enrollment, a notice appears on the self-service overview page to remind participants about the end date of the open enrollment period.

Open Enrollment Duration Notice on the Self-Service Pages

When participants finish making enrollments, the Confirmation page now displays for each offering the coverage start date and any pending actions. The page also displays the date until when participants can continue to change their enrollments.

Benefits Confirmation Page that Displays Coverage Start Date and Any Pending Actions

As an administrator, you add the required images for any offerings that you want to enable for enrollment in the self- service pages. No predefined images are available as you might want to add images that are specific to your enterprise.

Steps to Enable

The following table shows you the setup locations that enable you to upload images for various self-service pages.

| Self-Service Page that Displays Images |

Corresponding Page in Plan Configuration Work Area To Upload Images |

|---|---|

| Program selection page |

To upload images for programs, navigate to the Create or Edit Program page, Additional Details step, Image section |

| Confirmation page |

To upload images for plan-not-in-programs, navigate to the Create or Edit Plan page, Additional Details step, Image section |

| View Current and Future Benefits option on the Overview page |

Create or Edit Plan Type page, Image section |

NOTE: If you do not add images, blank placeholders for images appear in the self-service pages.

For optimum performance, ensure that you do not use high resolution images in the self-service pages.

Oracle Fusion Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. Global Payroll operates consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

The Element Result Report now displays results for payroll processes based on run results, not balances. To view balances generated by the payroll run, you can continue to use the Payroll Balance Report. You submit the Run Element Results Register flow from the Payroll Calculation or Payroll Checklist work areas. The report lists the elements and their primary output for processes that generate run results, such as the Calculate Payroll and Calculate QuickPay tasks.

Element Result Report Displays Results Generated by the Payroll Run

There are no steps necessary to enable this feature.

Use the pivot table feature in Microsoft Excel to obtain totals by element and person. For example, to create a pivot table that displays totals for the Run Element Result Report flow, complete the following steps.

- Open the Element Result Report in Microsoft Excel.

- Select the range of cells in the spreadsheet that contain data.

- Click PivotTable from the Insert menu.

- In the Create Pivot Table dialog, select New Worksheet. Click OK.

- Click the following fields from the Pivot Table Field List: Person Name, Payroll Statutory Unit, Tax Reporting Unit, Payroll, Run Type, Element Name, and Value.

- Drag the fields to the following areas:

- Refresh the page to display the populated columns and rows, and the summed totals.

- Filter to view different results.

| Area |

Fields |

|---|---|

| Report Filter |

Payroll Statutory Unit, Tax Reporting Unit, Run Type, Payroll |

| Column Labels |

Element Name |

| Row Labels |

Person Name |

| Values |

Sum of Value |

Balance Exception Report Enhancements

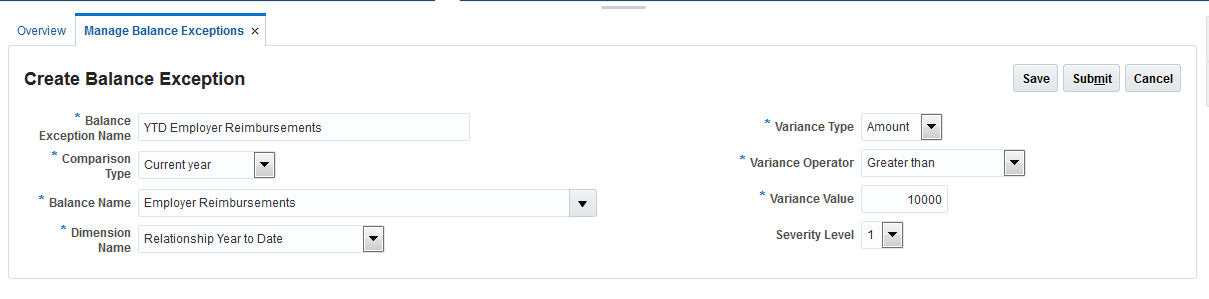

Expand your options for balance comparisons in balance exception reporting using the new Current quarter or Current year comparison types.

For example, you might want to run a balance exception report for the current year and specify balance payments for employer reimbursements that exceed 10,000. When you run the report, all employer reimbursements that exceed 10,000 appear on the report.

The Current year comparison type does not use any previous period as a basis for comparison.

Create Balance Exception Page Showing the Current year as the Comparison Type

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about balance exception reports, go to Applications Help for the following topics:

- Balance Exception Reports: Explained

- Comparison Types and Variance Operators for Balance Exceptions: Explained

- Creating a Balance Exception Report: Worked Example

Enhancements to Third-Party Payment Method Search

Search for third-party organizations or persons using separate tasks in the Payment Distribution work area in the Manage Third-Party Organization Payment Methods.

Additional enhancements simplify locating person third-party details, as shown in the following table:

| View Third-Party Payment Details |

Task |

Enhancement |

Action to Take |

|---|---|---|---|

| Third-party persons that a person in your enterprise pays |

Manage Third-Party Person Payment Methods |

Search navigation reversed to start by searching for the person to view the third-party payees. This enables viewing multiple payees for a single person. |

On the Manage Third-Party Person Payment Methods page, search for and select a person in your enterprise. Click the person’s name to view a list of the third parties the person pays. Select a third-party name, and click the Edit button to view or update the payment details. |

| Persons who pay the third-party |

Manage Third Parties |

Manage Third-Party Payment Details button takes you directly to the Manage Third-Party Payment Methods page for the person |

On the Manage Third Parties page, search for and select a third-party person. |

Search Results for Third-Party Person Payment Methods

Third-Party Person Payees for the Selected Person

New Third-Party Payments Button on the Manage Third Parties Page for Person Payees

Steps to Enable

If you use the predefined reference roles, then no steps are necessary to enable this feature.

Otherwise, you must assign relevant security privileges to your roles to enable this feature. See Role Information (below) for details.

Role Information

If you are not using the predefined reference roles, then you need to add security privileges to relevant job roles to use this feature. This table identifies the required aggregate privileges and suggests target job roles. You can add the privileges to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege Name and Code |

Job Role |

|---|---|

| Manage Payroll Third-Party Person Payment Method ORA_PAY_MANAGE_PAYROLL_THIRD_PARTY_PERSON_PAYMENT_METHOD |

Payroll Administrator Payroll Manager Payroll Coordinator |

For more information about third-party payments, go to Applications Help for the following topics:

- Creating Third-Party Payment Methods: Procedure

- Creating Third Parties: Points to Consider

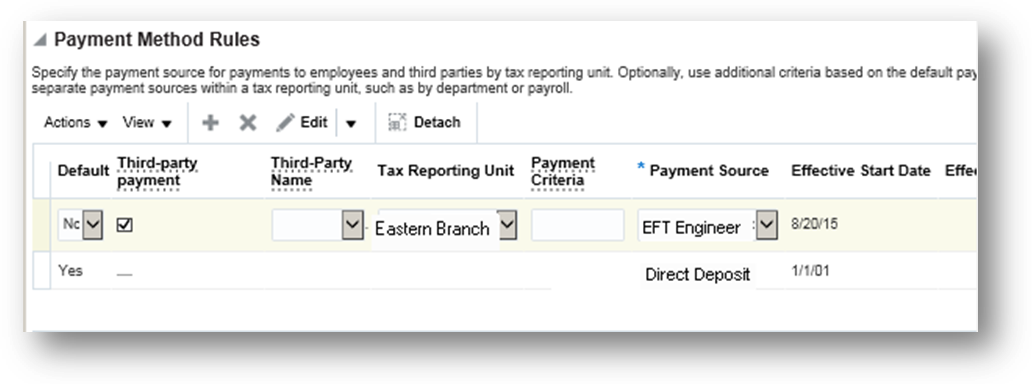

Enhancements to Payment Method Rules

Pay persons and third parties from different bank accounts within the same organization payment method. The Manage Organization Payment Methods page includes two new columns in the Payment Method Rules section to support third-party payments.

IMPORTANT: If you select Third-Party Payment check box, you must select a third-party name or the tax reporting unit.

For example, you might create the following rules.

| Pay |

Actions |

|---|---|

| Third parties from persons in a specified TRU |

Select the Third-Party Payment check box. Select the TRU. Select the payment source. |

| Specific third parties using different payment sources |

Create a rule for each combination. For each row, select the following fields: Third-Party Payment check box Third-Party Name Payment Source |

| All third parties and employees in a TRU from the same payment source |

Leave the Third-Party Payment check box blank. Select the TRU. Select the payment source. |

Complete these steps to define the rules:

- Use the Manage Organization Payment Methods task in the Payment Distribution work area.

- Create an organization payment method for each combination of payment type and currency.

- In the Payment Sources section, add payment sources.

- In the Payment Method Rules section, add rules for different payment sources. For example, specify the TRU, the third-party name, and the payment criteria.

Payment Method Rules

There are no steps necessary to enable this feature.

For more information about third-party payments, go to Applications Help for the following topics:

- Creating Third-Party Payment Methods: Procedure

- Creating Third Parties: Points to Consider

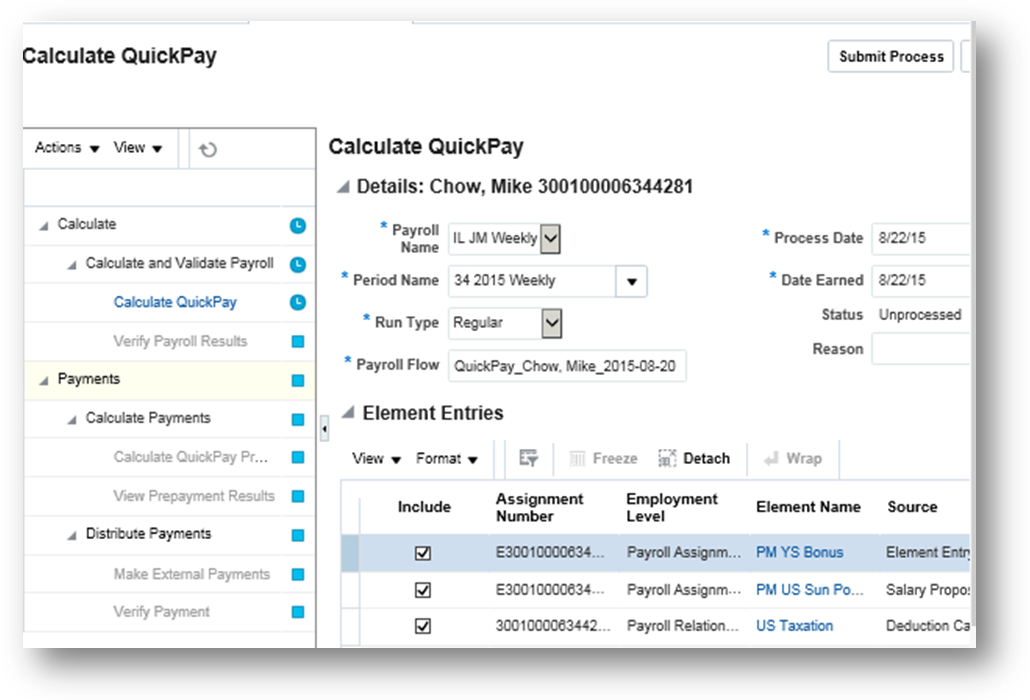

Submit the Calculate QuickPay task to calculate payroll and payment results for a person from a single page using a checklist. Submit the task from the Payroll Calculation work area, or from the Actions menu of the Manage Person Details page when updating a person’s earnings and deductions. The Calculate QuickPay task automatically populates parameters based on the person selected and the effective date.

New commands on the page-level Actions menu simplify working with a QuickPay process, as shown in the following table.

| Actions |

Purpose |

|---|---|

| Next |

Submit QuickPay flows for consecutive payroll periods |

| Flow Interaction |

Process a QuickPay flow for a later payroll period |

Calculate QuickPay Page

There are no steps necessary to enable this feature.

If you want to replace the predefined QuickPay flow pattern with a customized flow pattern, follow these steps.

Create a customized flow pattern

- Use the Manage Flow Pattern task in the Payroll Checklist work area.

- Copy the predefined QuickPay flow pattern, and specify its legislative data group.

- Update the new flow pattern with the tasks to include in your QuickPay flow.

Complete the following steps for the FLOW_NAME column

- Use the Manage User-Defined Tables task in the Payroll Calculation work area. Specify the legislative data group for the search criteria. Search for and open the FLOW_DEFINITION table. Each legislative data group can have only one flow pattern specified for the Calculate QuickPay task.

- Click the Edit button at the top of the page.

- Specify the Effective As-Of Date.

- In the User-Defined Columns section, select Flow_Name.

- In the User-Defined Rows section, click Create.

- In the Sequence field, enter the number 1.

- In the Exact field, enter a name, such as Enter Flow Name.

- Click Next.

- On the Edit User-Defined Table page in the User Defined Table Values section, click Create.

- In the Add User-Defined Table Values dialog, select the name you specified for the Exact field.

- In the Value field, enter QUICK_PAY.

- Save your work.

- Click Back to return to the Edit User-Defined Table page.

Complete the following steps for the FLOW_NAME_OVERRIDE column

- On the Edit User-Defined Table page, in the User-Defined Columns section, select FLOW_QUICKPAY_OVERRIDE.

- Click Next.

- On the Edit User-Defined Table page in the User Defined Table Values section, click Create.

- In the Add User-Defined Table Values dialog, select the name you specified for the Exact field.

- In the Value field, enter the name of your customized QuickPay flow pattern.

- Click Submit.

For more information about QuickPay, go to Applications Help for the following topics:

- QuickPay: How It's Processed

- Customizing the QuickPay Flow Pattern: Procedure

- Working with QuickPay Flows: Explained

- Submitting a QuickPay Flow to Correct a Payroll Calculation Error: Worked Example

Support for Values Defined by Criteria

Use the Manage Values Defined by Criteria task to generate rates or values that are based on one or more criteria. For example, you can calculate:

- Annual salaries based on employee position

- Bonus payments based on employee department, years of service, and annual salary

- Rates of pay based on employee state, county, and profession

Each calculation value definition requires you to specify one or more evaluation conditions. These conditions are evaluated in the order in which they appear in the tree structure that you define.

You can have multiple evaluation conditions in each branch of the tree. You can also set up default criteria that are used in cases where no evaluation conditions are met.

Create Criteria Page Showing the Conditions that Must Be Met to Receive a Bonus

Criteria and Values Section Showing the Flat Rate Bonus Defined for 5 or More Years Service

There are no steps necessary to enable this feature.

In most calculation value definitions there should be at least one default criteria definition to cover all conditions.

If you specify a unique value identifier for each value, you can enter multiple values for a single criterion. The tree structure shows this identifier instead of the value definition name.

For more information about values defined by criteria, go to Applications Help for the following topics:

- Manage Values Defined by Criteria: Examples

- Values Defined by Criteria: Explained

- Using Values Defined by Criteria to Pay Bonuses Based on Age and Location: Worked Example

Simplified Bank Account Page Enabled by Default

A new simplified page for creating bank account information was introduced in Release 10. The What's New in Release 10 document explains how to enable that page. Now, the simplified page is enabled by default. As before, you can restrict selection to only preloaded banks and branches by setting Use Existing Banks and Branches profile option to Yes. If set to No, persons enter text directly in the bank and branch fields. The following screen capture illustrates the simplified bank account page that displays if you set the profile option to Yes. A person selects from a list of values the bank and branch information.

Simplified Bank Account Page

There are no steps necessary to enable this feature.

Key Resources

For more information about managing bank data related to personal payment methods, go to Applications Help for the following topics:

- Entering Bank Information for Personal Payment Methods: Critical Choices

- Payroll Batch Loader Workbooks for Bank Data

Fast Formula Support for Expression and Text Editors

Switch to the text editor when you need to build more complex formulas for formula types previously restricted to the expression editor easily. For example, you can use the text editor for the payroll relationship group formula type to write rules for validations or building criteria to define the group. The Create Formula window provides an option to switch formula editor types. If you select a formula type that uses the text editor there is no change. If you select a formula type where the expression editor is used, the Type of Editor field provides you with the option to select the Text editor.

Create Fast Formula Pop-Up Window Showing the Formula Editor Options

IMPORTANT: Once the formula is saved, you cannot change the editor type.

There are no steps necessary to enable this feature.

For more information about the Fast Formula editors, go to Applications Help for the following topics:

- Writing a Fast Formula Using Expression Editor: Worked Example

- Writing a Fast Formula Using Formula Text: Worked Example

Deduction Category and Deduction Parameters for Run Deduction Report

You can now run the Deduction Report for all deduction categories and deductions including the deduction balances you define. Use the Deduction Category and Deduction parameters to run the report for specific deduction categories or deductions.

Deduction Category and Deduction Parameters

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- Deduction Report

Person and Payroll Relationship Group Parameters for Run Deduction Report

You can now run the Deduction Report for a single person or a static payroll relationship group with payroll relationship numbers to verify deduction balances.

Steps to Enable

There are no steps necessary to enable this feature.

Information Balances in the Payroll Balance Report

You can now configure the balance group usage item to display information balances in the Payroll Balance Report.

To configure the balance group usage item:

Select the Manage Balance Group Usages task from the Payroll Calculation work area.

- Select Global Payroll Run Result Report (Payroll Balance Report) from the Report Type drop-down list.

- Select the desired legislative data group.

- Click Search. The search results display all the applicable balance group usages for the Payroll Balance Report.

- Select the Global Information Balances for Payroll Balance Report row and click the Edit icon.

- Select Matrix Items on the left panel, in the Balance Group Usage: Global Information Balances for Payroll Balance Report page.

- Click the Add icon to create a new matrix item.

- In the Matrix Item section, select the Balance Dimension matrix item type, select the name of the desired balance dimension, and enter a position value.

- Click Save.

- Click Submit.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about the Payroll Balance Report, go to Applications Help for the following Topic:

- Payroll Calculation Report: Overview

Balance Exception Formula and Variance Type Enhancements

Use the Balance Exception formula type to create formulas to return reference values and information for comparison in balance exception reports. On the Create Balance Exception page enter Formula in the Variance Type field and then enter the name of the formula that you create using this formula type in the Formula Name field.

These contexts are available when you use the Balance Exception formula type to write a formula:

- EFFECTIVE_DATE

- PERSON_ID

- HR_ASSIGNMENT_ID

- TAX_UNIT_ID

- PAYROLL_RELATIONSHIP_ID

- PAYROLL_REL_ACTION_ID

- PAYROLL_TERM_ID

- PAYROLL_ASSIGNMENT_ID

- LEGISLATIVE_DATA_GROUP_ID

- PAYROLL_ID

- CALC_BREAKDOWN_ID

You can reference any database item in the fast formula that uses any of the listed contexts.

You can’t use input variables for this formula type, however. This formula is run by the balance exception report for each person record. It returns the reference value for that employee for comparison with the balance value as configured in the respective balance exception.

These return values are available when you use the Balance Exception formula type to write a formula:

| Return Value |

Data Type |

Required |

Description |

| REFERENCE_VALUE |

Text |

Y |

Returns a reference value for comparing in the balance exception report. |

| REFERENCE_INFO |

Text |

Y |

Returns the text for display in the Reference field on the balance exception report. |

After you write a fast formula using the Balance Exception formula type, select the Formula variance type on the Create Balance Exception page and then select the formula that you created from the Formula ID field.

This formula multiplies the year-to-date gross earnings by 15 percent and returns the value when the balance exception report to which it is associated is run.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about balance exception reports, go to Applications Help for the following topics:

- Balance Exception Formula Type

- Balance Exception Reports: Explained

- Comparison Types and Variance Operators for Balance Exceptions: Explained

- Creating a Balance Exception Report: Worked Example

Value Sets Usage in Flow Parameters

Use value sets for flow parameters to define and control which values display when submitting a flow. You might add a flow parameter that uses a value set to select a person, a flow instance, or a legislative data group. You can also create dependent value sets to filter the list of values. For example, the value set for payroll period might depend on the value selected for the payroll parameter.

The SQL query you specify when you create the value set determines the values that populate the flow parameter.

Steps to Enable

The following steps explain how to:

- Create a value set

- Update your flow pattern

Create a Value Set

To define a value set for a flow parameter:

- Use the Manage Value Sets task in the Setup and Maintenance work area.

- Click the Create icon to create a value set. Complete the following required fields:

- Value Set Code: Specify a name for your value set.

Tip: Use a prefix such as XX_ before the name, to more easily identify it from the predefined value set names. - Module: Select the module that uses the value set, such as Payroll Flow.

- Validation Type: Select Table.

- Value Data Type: Specify the data type of the displayed column.

If the value set is dependent on another parameter value, specify the parameter name as the bind value in the Where clause. As an example, to bind the payroll parameter, specify the following text for the Where clause: payroll_id = :{PARAMETER.PAYROLL} - Complete the Definition section of the Create Value Set page to create a SQL query for the value views. The Column Type and Column Length for each column are populated based on its definition in the database.

- FROM Clause: Specify the table names used for the query.

- Value Column Name: Specify the attribute.

This field holds the column value displayed for the flow submission parameter. - ID Column Name: Specify the attribute used to store the value in the database table.

This field holds the column value that processes and reports expect as a value, such as an ID. - WHERE Clause: Specify the SQL query you created to build the list of values.

- ORDER BY Clause: Specify the query used to order the list of values.

Example of Value Set Definition that Displays Flow Instances by Date Earned

Update Your Flow Pattern

To use the value set for a flow parameter:

Use the Manage Payroll Flow Patterns task in the Payroll Checklist work area.

- Search for and edit your customized payroll flow.

- Click the Parameters tab.

- Click the Add button to create a new flow parameter.

- Click the Edit button and enter the parameter details:

- Flow Parameter: Parameter name

- Description: Name to display

- Use for Searches: No

- Display Format column: Value Set

- Lookup column: Text entered in your value set definition for Value Set Code

- Click Submit.

When you submit the payroll flow the submission flow parameter displays the list of values based on the value set you created.

Tips and Considerations

If the query includes a date field, you must use the appropriate date format. For example, if the date field is date earned, you must use the following format: to_char (date_earned,'yyyy-MM-dd').

Key Resources

For more information about flow patterns, go to Applications Help for the following topic:

- Flow Pattern Parameters: Explained

HCM Data Loader Support for Calculation Cards

You can now use HCM Data Loader to create or update calculation cards for the Australia localization.

All business objects related to the calculation card, such as calculation component, component details, and associations are available through HCM Data Loader. You can carry out actions such as Insert, Delete, or Update on these objects.

User keys are currently not supported to identify business objects; instead it uses the combination of SourceSystemOwner and SourceSystemID. Reports can be setup in Business Intelligence Publisher to retrieve the required ID.

Using this information, you can prepare the data for loading. The file must be in data file format (.dat), with a METADATA line declaring what objects are being created or uploaded or deleted in the file, followed by one MERGE line for each record you wish to create or update.

For example, to update Tax information on employee’s PAYG component:

You can then upload the file in the Data Exchange Work Area under HCM Data Loader and Import and Load data.

If the upload is unsuccessful, you can view the list of error messages using the Message icon.

To verify that the data has been updated, use the Manage Calculation Card task in the Payroll Calculation Work Area:

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

User keys are not currently supported, either Source System id, GUID or Surrogate Id can be used to identify records.

It is possible to combine all business objects into a single file. The HCM Data Loader works out the order in which objects must be created. For example, if you are creating a new statutory deduction card, you can include all of the following business objects into a single .dat file:

- Calculation Card

- Superannuation Guarantee Contributions component

- Additional Employer Superannuation Contributions component

- Employee Superannuation Contributions component

- PAYG Withholding component

- Payroll Tax component

- TFN Declaration component details

- Medicare Levy Variation component details

- Withholding Variation component details

- Payroll Tax Information component details

- Superannuation Guarantee Contribution component details

- Additional Employer Superannuation Contribution component details

- Employee Superannuation Contribution component details

- Card association

Excel Output Support for Payroll Reports

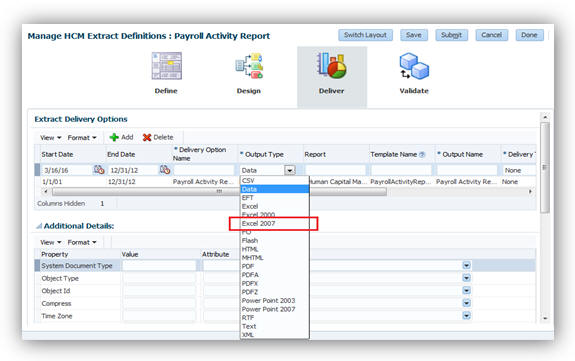

You can now configure the delivery option to generate the output of payroll reports in Excel format.

Excel Output Support for Payroll Reports

The following reports can be configured to generate the Excel output:

- Payroll Balance Report

- Payroll Activity Report

- Payroll Register

- Statutory Deduction Register

- Deduction Report

- Payment Register

- Gross-to-Net Report

- Third-Party Payment Register

Steps to Enable

Repeat these steps for each payroll report listed above, as necessary.

NOTE: Enabling Excel output for the Payment Register requires an additional step as noted below.

- In the Data Exchange work area, click the Manage Extract Definitions task.

- Search for and select the extract definition name for the payroll report to edit, as listed in this table.

- Open the report.

- Click the Deliver icon.

- Click Add to create a new row to point to your new template for Excel output.

- Enter a Start Date and End Date. For example, 1/1/01 and 12/31/4712.

- Enter the Delivery Option Name and the Output Name.

- Select Excel 2007 in the Output Type field.

- Enter the Report and Template Name field. Ensure that the .xdo file name you enter in the Report field and template name matches the name of your template, as given in the table below.

- Select the Delivery Type. For example, Documents of Record or Fax.

- Optionally, to override the default layout (PDF file), select the predefined delivery option of Excel output in the Overriding Delivery Mode field. This would result in only generating the Excel file.

- Otherwise, keep the default value to generate both the Excel and PDF files.

- Click Save.

- For the Payment Register, you must perform the following additional steps to add the report category details.

- In the Additional Details section, click Add.

- In the Deliver Output Name field, click Search.

- In the Search field, enter Extract Delivery Mode, and then click Search.

- Select Payment Register Results, and then click OK.

- Click Save.

- Click Submit.

| Report Name |

Extract Definition Name |

| Deduction Report |

Deduction Report |

| Gross-to-Net Report |

Gross to Net Summary Archive |

| Payment Register |

Global Payment Register |

| Payroll Activity Report |

Payroll Activity Report |

| Payroll Balance Report |

Payroll Run Result Report |

| Payroll Register |

Global Payroll Register |

| Statutory Deduction Register |

Statutory Deduction Register |

| Third-Party Payment Register |

Global Third Party Payment Register |

| Report Name |

XDO File |

Excel Template Name |

| Deduction Report |

/Human Capital Management/Payroll/Payroll Calculations/Deduction Report.xdo |

Deduction Report Results |

| Gross-to-Net Report |

/Human Capital Management/Payroll/Payroll Calculations/Gross to Net Summary Report.xdo |

Gross-to-Net Report Results |

| Payment Register Report |

/Human Capital Management/Payroll/Payroll Calculations/Payment Register.xdo |

Payment Register Results |

| Payroll Activity Report |

/Human Capital Management/Payroll/Payroll Calculations/Payroll Activity Report.xdo |

Payroll Activity Report Results |

| Payroll Balance Report |

/Human Capital Management/Payroll/Payroll Calculations/Payroll Balance Report.xdo |

Payroll Balance Report Results |

| Payroll Register Report |

/Human Capital Management/Payroll/Payroll Calculations/Payroll Register Report.xdo |

Payroll Register Results |

| Statutory Deduction Register |

/Human Capital Management/Payroll/Payroll Calculations/Statutory Deduction Register.xdo |

Statutory Deduction Register Results |

| Third-Party Payment Register |

/Human Capital Management/Payroll/Payroll Calculations/Third-Party Payment Register.xdo |

Third-Party Payment Register Results |

Dynamic Payroll Relationship Group Support for Payroll Activity Report

You can now specify a payroll relationship group as a submission parameter when running the Payroll Activity Report.

Payroll Relationship Group Flow Submission Parameter

A new formula type is available so you can create a formula with specific criteria to indicate whether to include a specific payroll relationship ID. Use the same formula for dynamically creating a payroll relationship group. You can then submit the report and the report will use the payroll relationship group derived by the formula. The formula type to use is named Payroll Relationship Group.

Payroll Relationship Group Formula Type

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

The dynamic payroll relationship group parameter functionality works only for Payroll Activity Report with respect to payroll reporting. The relationship group is available for selection in several reports, but only the Payroll Activity Report displays results that use the dynamic payroll relationship group parameter functionality.

Void Payment Action in Prepayments

The Actions menu in the Prepayments Results section now includes the Void action. You view prepayments results for the Calculate Prepayments task and from there can make or void payments. For example, if an employee requested a replacement for a damaged check you can use the Void action to void the check and then use the Make Payment action to reissue another check.

New Action Menu Item for Void Payment

Steps to Enable

There are no steps necessary to enable this feature.

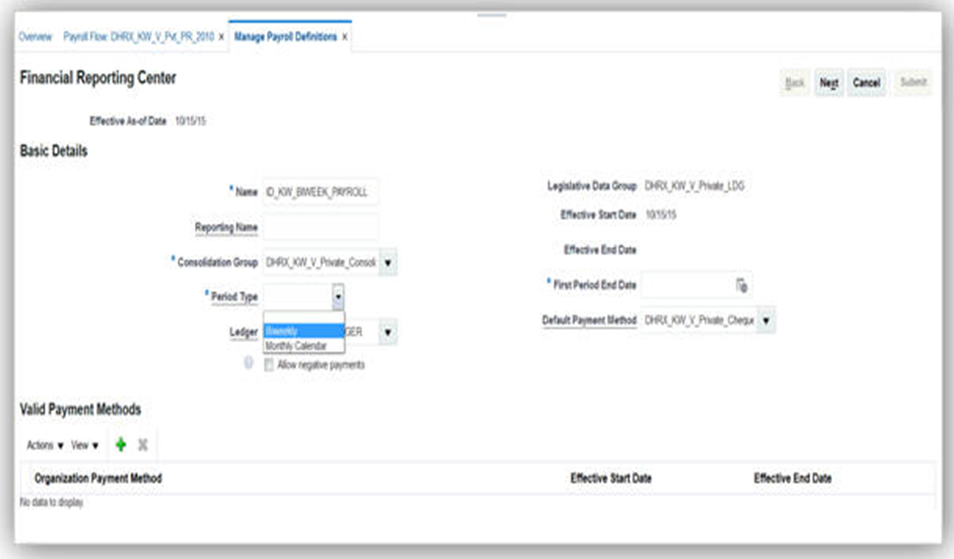

When you create a payroll definition or extend the number of years for it, the application automatically generates payroll periods. You can view these payroll periods on the Time Periods tab of the Manage Payroll Definitions page. The system-generated names are numbered in sequence based on the period type you selected when creating the payroll definition. You can now click the Edit button and revise the system-generated names as needed.

Edit System-Generated Payroll Period Names

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

If you edit the payroll period names, ensure that they remain unique within the payroll definition.

Key Resources

For more information about payroll definitions, go to Applications Help for the following topic:

- Payroll Definitions: Explained

Information Balances in the Payroll Balance Report

You can now configure the balance group usage item to display information balances in the Payroll Balance Report.

To configure the balance group usage item:

Select the Manage Balance Group Usages task from the Payroll Calculation work area.

- Select Global Payroll Run Result Report (Payroll Balance Report) from the Report Type drop-down list.

- Select the desired legislative data group.

- Click Search. The search results display all the applicable balance group usages for the Payroll Balance Report.

- Select the Global Information Balances for Payroll Balance Report row and click the Edit icon.

- Select Matrix Items on the left panel, in the Balance Group Usage: Global Information Balances for Payroll Balance Report page.

- Click the Add icon to create a new matrix item.

- In the Matrix Item section, select the Balance Dimension matrix item type, select the name of the desired balance dimension, and enter a position value.

- Click Save.

- Click Submit.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about the Payroll Balance Report, go to Applications Help for the following Topic:

- Payroll Calculation Report: Overview

Deduction Category and Deduction Parameters for Run Deduction Report

You can now run the Deduction Report for all deduction categories and deductions including the deduction balances you define. Use the Deduction Category and Deduction parameters to run the report for specific deduction categories or deductions.

Deduction Category and Deduction Parameters

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- Deduction Report

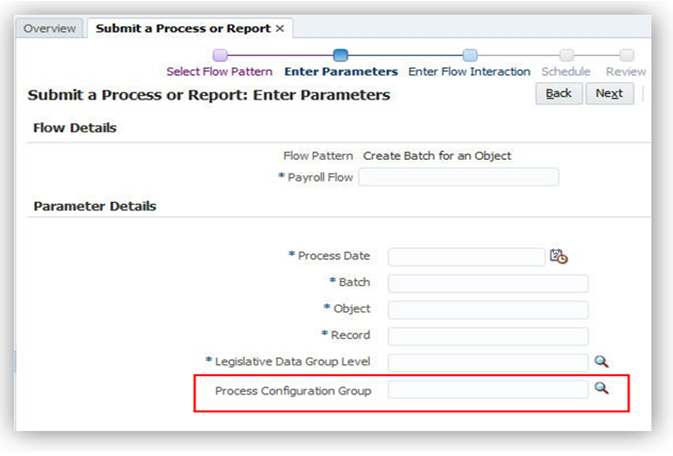

Additional Flow Parameter for Create Batch for an Object

You can now select a process configuration group when running the Create Batch for an Object process to migrate elements and formulas from one environment to another. The name you specify in the Process Configuration Group list enables any processing parameters that are defined for that group, such as logging.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about balance exception reports, go to Applications Help for the following topics:

- Migrating Objects Using the Payroll Batch Loader: Procedure

- Payroll Batch Loader Task Actions for Migrating Elements: Explained

Enhancement for Generate Run Balances

Creating or updating balance definitions and balance feeds can impact balance calculations and stored balance values for run balance dimensions. When stored balance dimensions are no longer accurate, the Save Run Balances column on the Manage Balance Definitions page displays the status of the balance dimensions as invalid.

Reports and processes continue to obtain accurate values from the summed run results, but summing run results can slow performance. To improve performance you can recalculate the balance values by submitting the Generate Run Balances process from the Payroll Checklist or Payroll Calculation work areas.

Parameters you Complete When you Submit the Process

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

If you select a single balance to include in the process, you must specify a balance and dimension name, or the process errors because of insufficient information.

Key Resources

For more information about balance exception reports, go to Applications Help for the following topic:

- Payroll Balance Definitions: Explained

Enhancement in Payroll Costing Report

You can now view the Accounting Date, Cost ID and Source ID in the Payroll Costing Report when the report is run with a Scope parameter of Detail Report. Processes, such as Calculate Payroll and QuickPay, will populate Accounting Date with Process Date and generate Cost ID.

Calculate Partial Period Accruals process will populate the accrual entry Accounting Date with Process Date, Accounting Date for reverse entries with the next Payroll Period End Date, and Source ID with the corresponding Cost ID from the related accrual entry.

Source ID is used to identify partial period reverse entries after the Calculate Partial Period Accrual process is run.

For example, Calculate Partial Period Accruals process for weekly payroll period ending 28-Jan-2011 processed on 31-Jan-2011 will populate the following:

- Accounting Date for accrual entry with Process Date of 31-Jan-2011

- Accounting Date for reverse entry with next Payroll Period End Date of 05-Feb-2011

- Source ID for the reverse entry with the Cost ID from the corresponding accrual entry

Steps to Enable

There are no steps necessary to enable this feature.

Batch Loader Tasks for Payroll Relationship Groups

The payroll batch loader supports four new task actions for object groups, which are described in the following table:

| Task |

Task Action |

Purpose |

| Object Group |

Create Payroll Relationship Group |

Create an object group to use when submitting a process for a subset of records. The object group categorizes people by payroll relationship |

| Delete Payroll Relationship Group |

Delete an existing payroll relationship group that is no longer needed. |

|

| Add Payroll Relationship Inclusions and Exclusions |

Add a relationship inclusion or exclusion to an existing payroll relationship group. |

|

| Remove Payroll Relationship Inclusions and Exclusions |

Remove a relationship inclusion or exclusion from an existing payroll relationship group. |

Steps to Enable

There are no steps necessary to enable this feature.

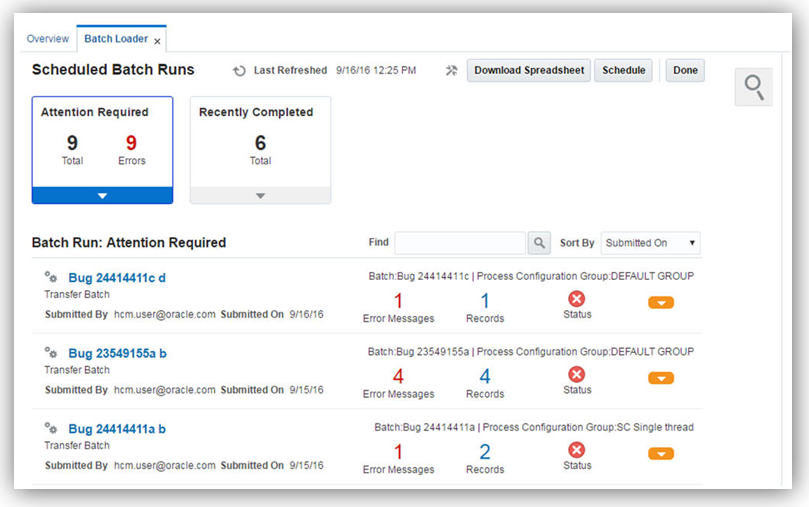

Enhanced Data Exchange Work Area

The enhanced Data Exchange work area enables you to submit, monitor, and troubleshoot processes and batches and to resolve the errors.

Apart from running extracts and batch loader processes, you can perform the following actions:

- Monitor the process runs, including the number and type of records processed, archived and extracted.

- Group process results by status, such as Completed and Requires Attention or by type of process.

- Download the log file, correct the erroneous processes, and resubmit them.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

- Payroll Batch Loader Tasks: Explained

- Importing Data: Procedure

New Rules for Personal Payment Methods

Control conversion rules for the earnings elements, including standard, supplemental, absence, and time elements. You can select a conversion rule for periodicity, work units, and proration calculations. You can control the calculation and display of the work units; such as work hours or workdays in the payslip and the reports. You also have the flexibility to select Assignment Working Hours or Standard Working Hours for conversion calculations instead of automatically using the work schedule when one exists.

The element template lists the new rules for standard working hours, working hours, and work schedules, and includes a new question for proration units. The same rules are displayed for the periodicity, work units, and proration conversion rules.

Conversion Rules Used for Periodicity, Work Units, and Proration

This release renames the display names for the existing rate conversion rules. The base names and actual calculations remain the same, as shown in the following table.

| Base Names |

New Display Names |

Description |

Example |

| Annualized Rate Calculation |

Standard Rate Annualized |

Calculates the annual rate using the input periodicity and converts the amount to an output periodicity and rate. Uses default values, such as 2080 hours or 260 working days to calculate the annual rate. |

To convert a weekly amount to a semimonthly periodicity, the formula: 1. Multiplies the weekly amount by 52. 2. Divides the result by 24. |

| Daily Rate Conversion |

Standard Rate Daily |

Calculates the daily rate using the input periodicity and converts the amount to an output periodicity and rate. Uses a default value such as 260 working days a year to calculate the daily rate. |

To convert an annual amount to daily periodicity, the formula: 1. Divides the annual amount by 365. 2. Multiplies the result by the number of days in the payroll period. |

The new predefined rate conversion rules support the conversions described in the following table.

| Rate Conversion Rule |

Description |

Example |

| Standard Working Hours Rate Annualized |

Uses the employee’s standard working hours to convert the monetary value and working hours to an annual value before calculating the rate. |

Employee works 40 hours a week with a monthly salary of 1000 pounds: ((1000*12)/(40.00*52) = 5.77 an hour |

| Assignment Working Hours Rate Annualized |

Uses the employees working hours to convert the monetary value and working hours to an annual value before calculating the rate. |

Employee works 40 hours a week, with a 37.5 standard working hours a week, and a monthly salary of 1000 pounds:

|

| Periodic Work Schedule Rate Annualized |

Uses the employee’s work schedule for the payroll period for daily and hourly conversions. |

Employee has a monthly salary of 1000 pounds, and is assigned a monthly payroll. The formula checks the work schedule details for the month. For a daily conversion: 1000 a month/20 days in the month = 50 Note: For compensation calculations where the employee is not assigned a payroll, the rate is calculated using the weekly rate calculation. The amount is converted to an annual figure and divided by the number of days or hours in that week based on the work schedule. |

The following list summarizes the changes to the element template for periodicity, work units, and proration.

Periodicity

The conversion rule for periodicity applies to Flat Amount, Hours X Rate, and Days X Rate calculation rules. You can override the periodicity used as the default for the element definition at the element entry level.

Work Units

The Work Units conversion rule applies only to flat amount calculation rules for standard and supplemental earnings elements.

The selection of which work units to use in reports and payslips determines the conversion calculation. The application creates the element input values using the default values of the rate conversion formulas. In this example, the employee is on a semi-monthly payroll that has 24 payroll periods in a year.

| Work Units Selected |

Example |

| Hours |

2080/24 = 86.67 |

| Days |

260/24 = 10.83 |

| None |

No input values are created |

Proration