This document will continue to evolve as existing sections change and new information is added. All updates are logged below, with the most recent updates at the top.

The new functionality referenced in this document may not be immediately available to you if your organization has chosen not to receive optional monthly updates. Rest assured you will receive the new functionality in the next quarterly update which is required and cumulative. Quarterly updates are applied in February, May, August, and November. As a one-off exception the February 2017 Quarterly update will be applied in March 2017.

.

| Date |

Feature |

Notes |

|---|---|---|

| The following features were included in the May Quarterly update. |

||

| 27 APR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: P11D- Employee Benefits and Expenses Reporting |

Delivered new feature in update 17, the May quarterly update. |

| 27 APR 2018 |

Oracle Fusion Global Human Resources for the United States: Tax Withholding Card Enhancement for Guam |

Delivered new feature in update 17, the May quarterly update. |

| 27 APR 2018 |

Oracle Fusion Global Human Resources for the United States: e-IWO Inbound Process Enhancement |

Delivered new feature in update 17, the May quarterly update. |

| 30 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Gender Pay Gap Reporting |

Delivered new feature in update 16 (April), which will also be included in the May quarterly update. |

| 30 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Scottish Income Tax Rates and Bands |

Delivered new feature in update 16 (April), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Strategic Workforce Planning: Strategic Workforce Planning |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Benefits for the United States: e-IWO Audit Report Enhancement |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Legislative Updates |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Support for XML Format Submission for all RTI Outgoing Files |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Full Payment Submission (FPS) Breakdown to Smaller Files |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| The following features were included in the February Quarterly update. |

||

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: e-IWO Enhanced Search Capabilities |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: Third-Party Periodic Tax Filing Extract Inclusion of Payroll Frequency |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: Involuntary Deduction Fee Priority |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Legislative Updates for Tax Year 2018-19 |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: XML Format for RTI Outgoing Files |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Benefits in Kind – Car and Car Fuel Rates for Tax Year 2018-19 |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for Canada: Reporting Mode: Draft and Final Mode for End-of-Year Reports Process |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: Involuntary Deduction Disposable Income Recalculation |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: XML Message Retrieval Support from HMRC Data Provisioning System |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

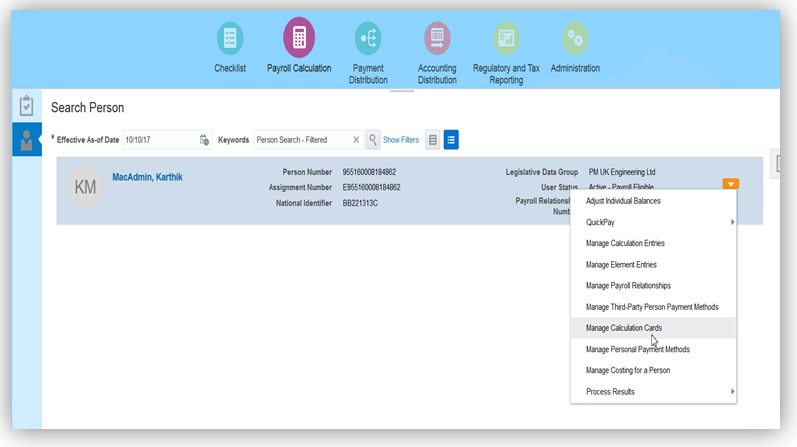

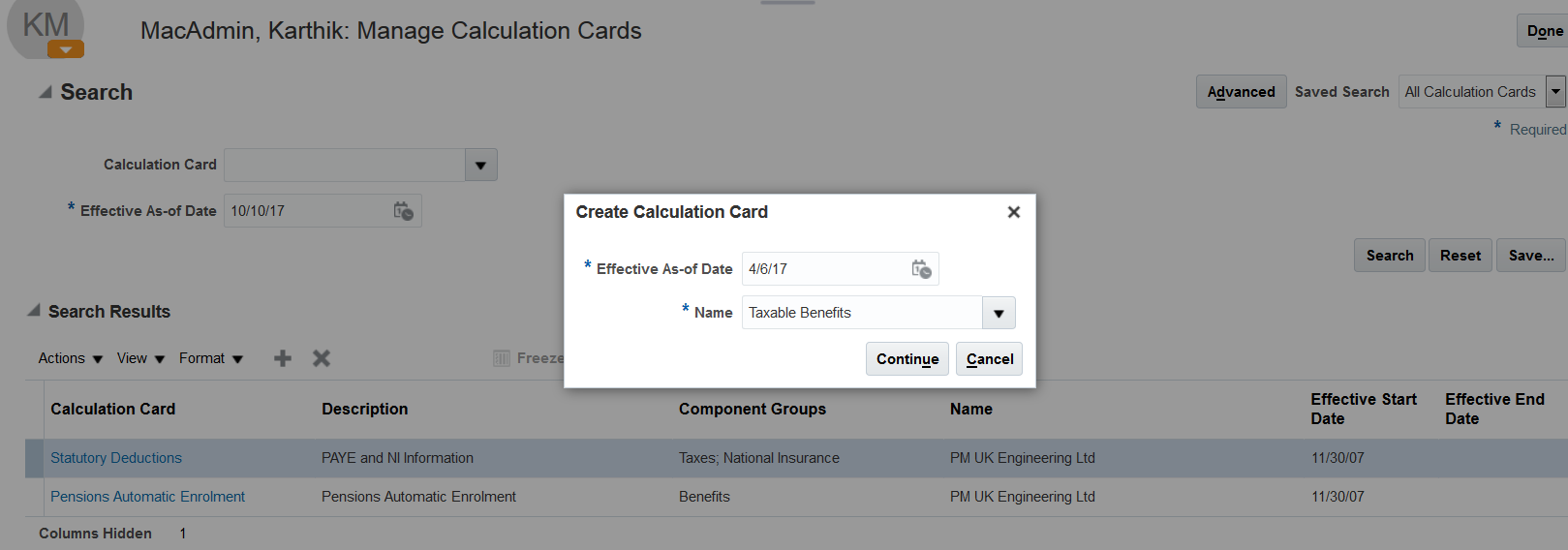

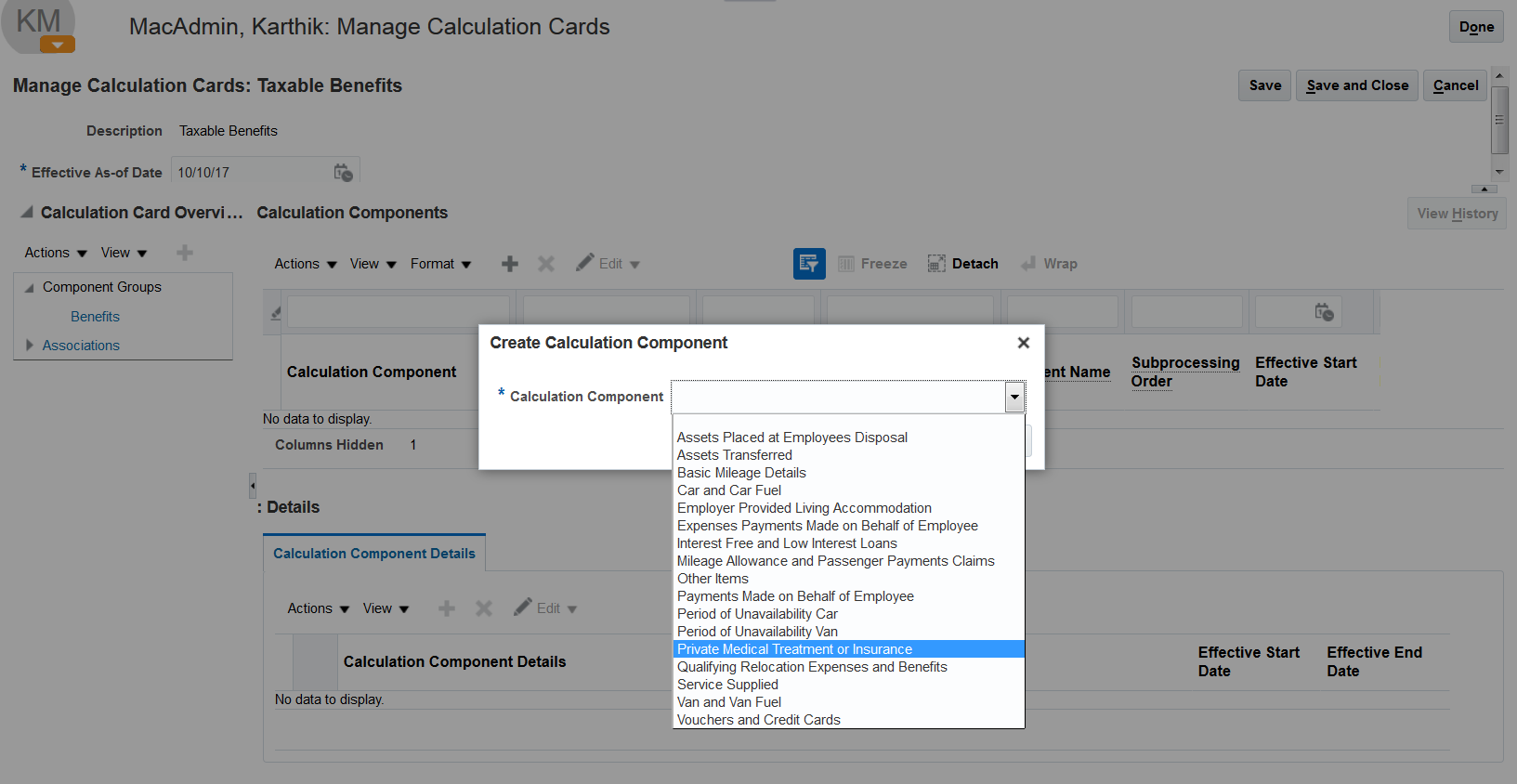

Oracle Fusion Global Human Resources for the United Kingdom: Processing Benefits in Kind Through Payroll |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Human Capital Management for Luxembourg: Enhanced Postal Code Validation |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Human Capital Management for the United States: Affordable Care Act Override Upload (United States Customers only) |

Delivered new feature in update 1 (February 2017). |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: New York Family Leave Insurance Support |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Guam Support |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

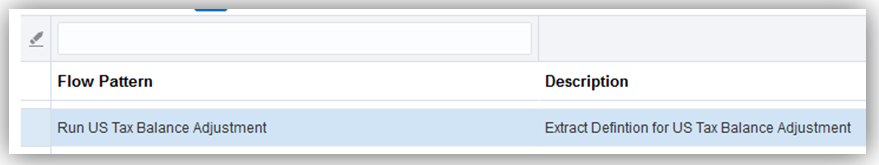

Oracle Fusion Human Capital Management for the United States: Run US Tax Balance Adjustment Process |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

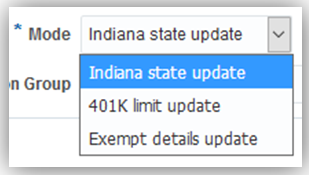

Oracle Fusion Human Capital Management for the United States: Enhanced Year-Begin Process |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Enhanced Ohio School District Tax Calculation |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Puerto Rico Young Entrepreneurs Act |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Global Human Resources for Canada: Employee Active Payroll Balance Report |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

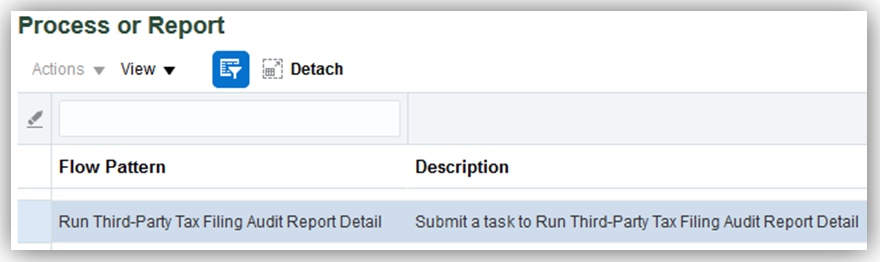

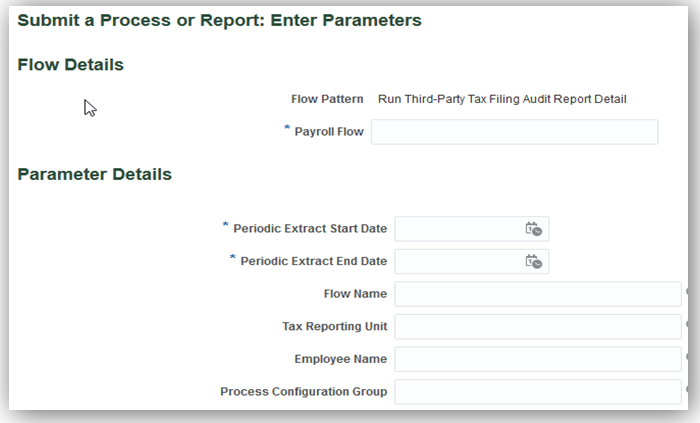

Oracle Fusion Global Human Resources for the United States: Third-Party Periodic Tax Filing Audit Report Detail Enhancements |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

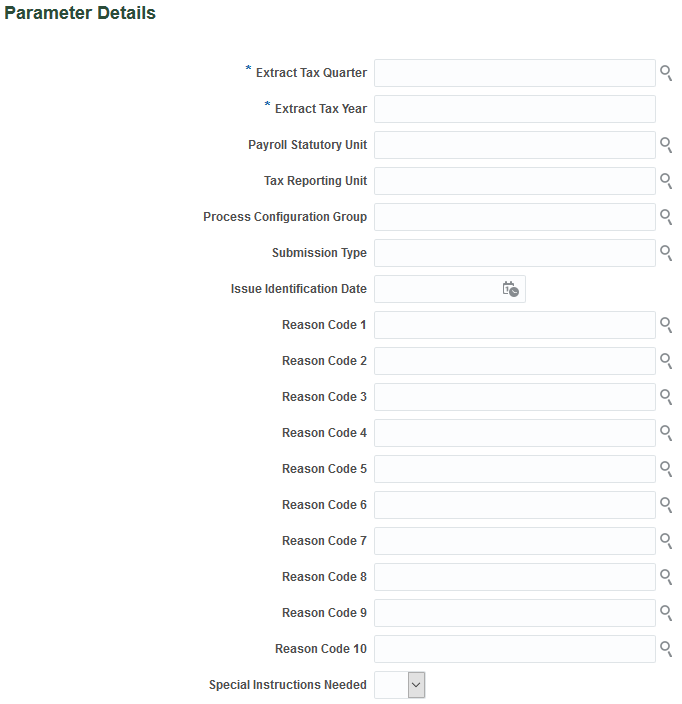

Oracle Fusion Global Human Resources for the United States: Third-Party Quarterly Tax Filing Extract Enhancement for Amended Quarter Filings |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Global Human Resources for the United States: Third-Party Quarterly Tax Filing Extract Vendor Enhancements for Fourth Quarter |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Global Human Resources for the United States: Employee Active Balance Report Enhancements to Include New Balances |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Payroll Interface: Deleted Data Report |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| The following features were included in the November Quarterly update. |

||

| 03 NOV 2017 |

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders Reference Code Enhancement |

Delivered new feature in update 11, the November quarterly update. |

| 03 NOV 2017 |

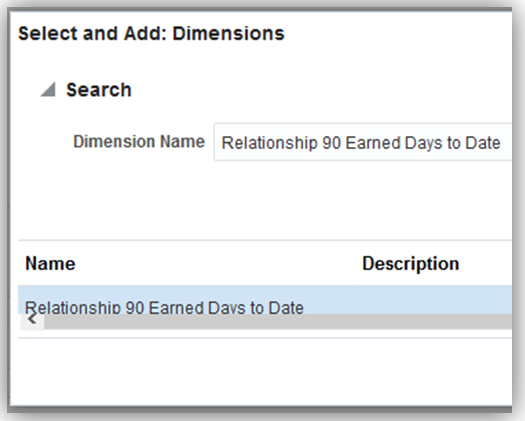

Oracle Fusion Global Human Resources for the United States: New Ninety Day Balance Dimension |

Delivered new feature in update 11, the November quarterly update. |

| 03 NOV 2017 |

Oracle Fusion Global Human Resources for the United States: Involuntary Deductions Processing Fee Enhancement |

Delivered new feature in update 7 (July), which was included in the August quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources/ HCM Cloud Mobile: Edit Person Information |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources/ HCM Cloud Mobile: Enhanced Directory Search |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for Australia: Identification of Working Holiday Makers |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for Australia: Identification of Trade Support Loan Participation Separately From Higher Education Loan Program |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for China: Supplementary Public Housing Fund |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Alabaster Ruling for Statutory Maternity – pay Rise During Leave |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders Inbound Process Enhancements |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for the United States: Absence Element Template Enhancements |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for Argentina: Enhanced Postal Code Validation |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

Oracle Fusion Global Human Resources for China: Enhanced Social Security Account Information Page |

Update document. Delivered new feature in update 3 (March). |

| 01 SEP 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Sexual Orientation and Gender Identity |

Delivered new feature in update 9 (September), which will also be included in the November quarterly update. |

| 01 SEP 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Errors and Warnings Report in Pension Automatic Enrolment Flow |

Delivered new feature in update 9 (September), which will also be included in the November quarterly update. |

| 01 SEP 2017 |

Oracle Fusion Global Human Resources: Display NonWorkers in My Team and Directory |

Delivered new feature in update 9 (September), which will also be included in the November quarterly update. |

| The following features were included in the August Quarterly update. |

||

| 04 AUG 2017 |

Oracle Fusion Global Human Resources: Populate the Context of the Document Records DFF Based on the Document Type |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle HCM Cloud Mobile: Exporting Contact Information |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle HCM Cloud Mobile: Profile Options to Show or Hide Worker Information |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle HCM Cloud Mobile: View Personal Information |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle HCM Cloud Mobile: Edit Areas of Expertise |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for South Africa: New Values for the National Identifier and Visa or Permit Type |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for South Africa: Enhanced National Identifier Validation |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Canada: Absence Elements: Discretionary and Final Disbursement Absence Payments |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources: New Hidden Fields in My Team and Directory |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources: Persistency in My Team and Directory |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Court Orders – DEO Reference Number Output on BACS File |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Payroll Validation Report – Change to Excel Output |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Organization Setup |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Person and Employment |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Payroll Base Data |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Payroll Data Capture |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Automatic Calculation Card Creation |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Social Insurance Calculations |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Gratuity Calculations |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Involuntary Deduction Element Template |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Statement of Earnings |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Payroll Interface: Integration with ADP Global Payroll |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United States: Involuntary Deductions Subprocessing Order Defaults |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United States: New VETS-4212 Audit Report |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

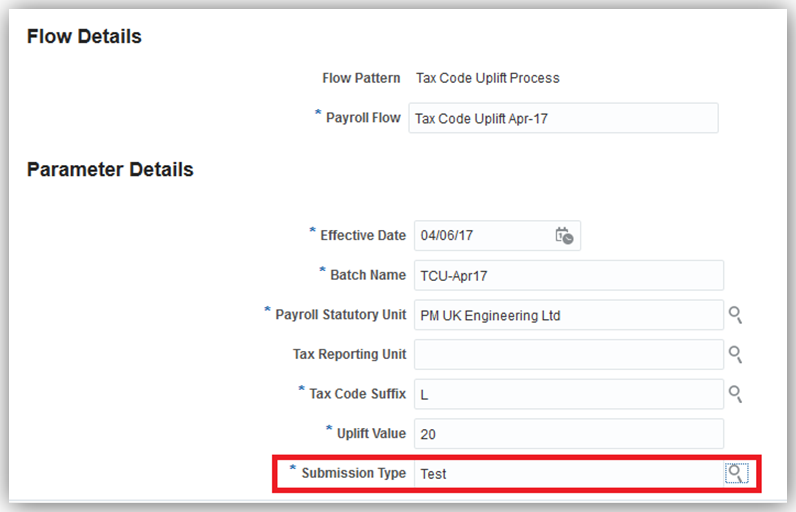

Oracle Fusion Global Human Resources for the United Kingdom: Test Mode for Start of Year and Tax Code Uplift Processes |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update. |

| 07 JUL 2017 |

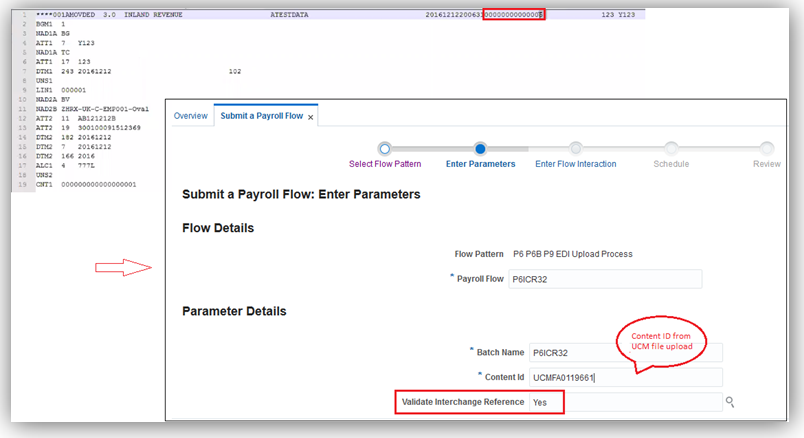

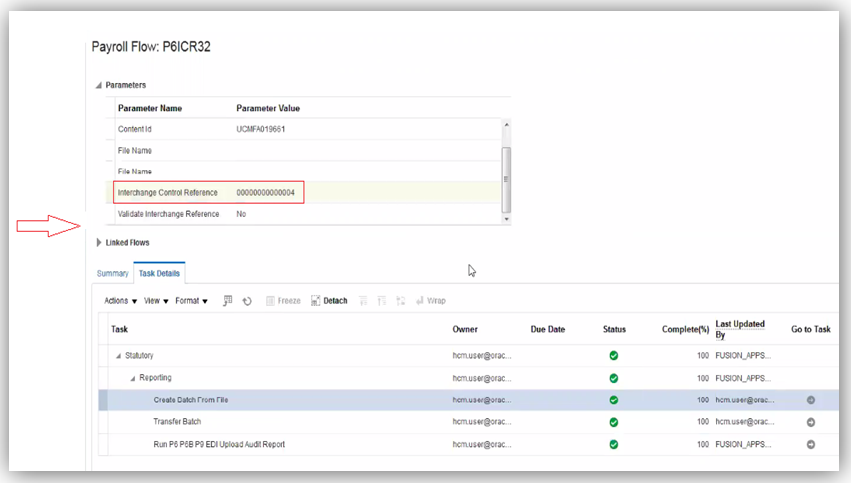

Oracle Fusion Global Human Resources for the United Kingdom: Interchange Reference Control Number for Incoming Messages |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Unique Reporting Reference for New Court Orders |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Sick Pay for Employees Working Overnight Shifts |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Configure Average Weekly Earnings |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources: Worker User Accounts No Longer Created Automatically for Users Loaded in Bulk |

Removed feature. |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources for the United States: Enhanced Deductions At Time of Writ Support |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources for the United States: Enhanced Form 1494 Exemption Amount Derivation |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources for Chile: Enhanced Validation of the RUT |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 02 JUN 2017 |

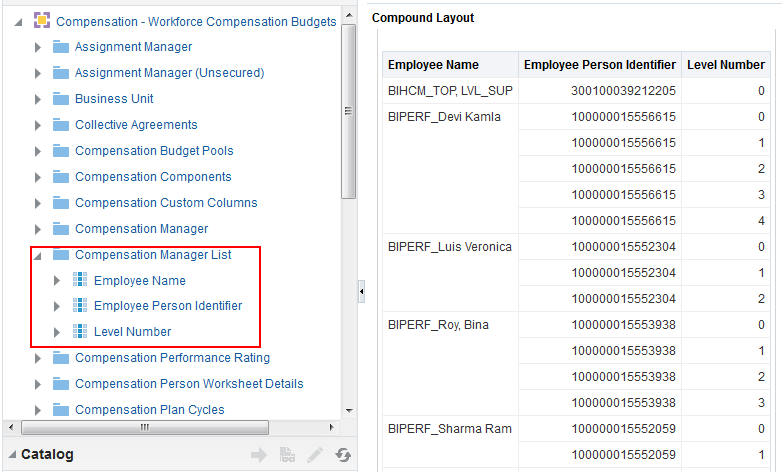

Oracle Fusion Transactional Business Intelligence: Compensation Manager List |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources: Navigate to Person Spotlight from Internal Information Sharing |

Delivered new feature in update 6 (June), documented in Update 7, and will also be included in the August quarterly update |

| The following features are included in the May Quarterly update. |

||

| 02 JUN 2017 |

Oracle Fusion Global Human Resources: Areas of Responsibility Enhancements |

Delivered new feature in update 5, the May quarterly update. |

| 02 JUN 2017 |

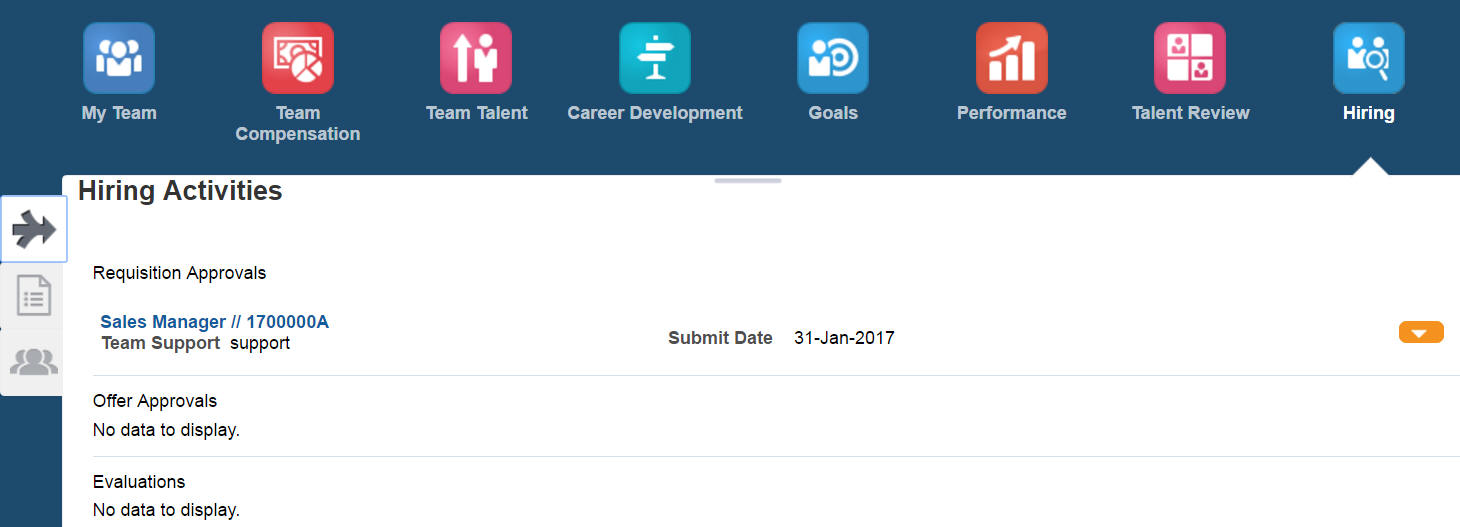

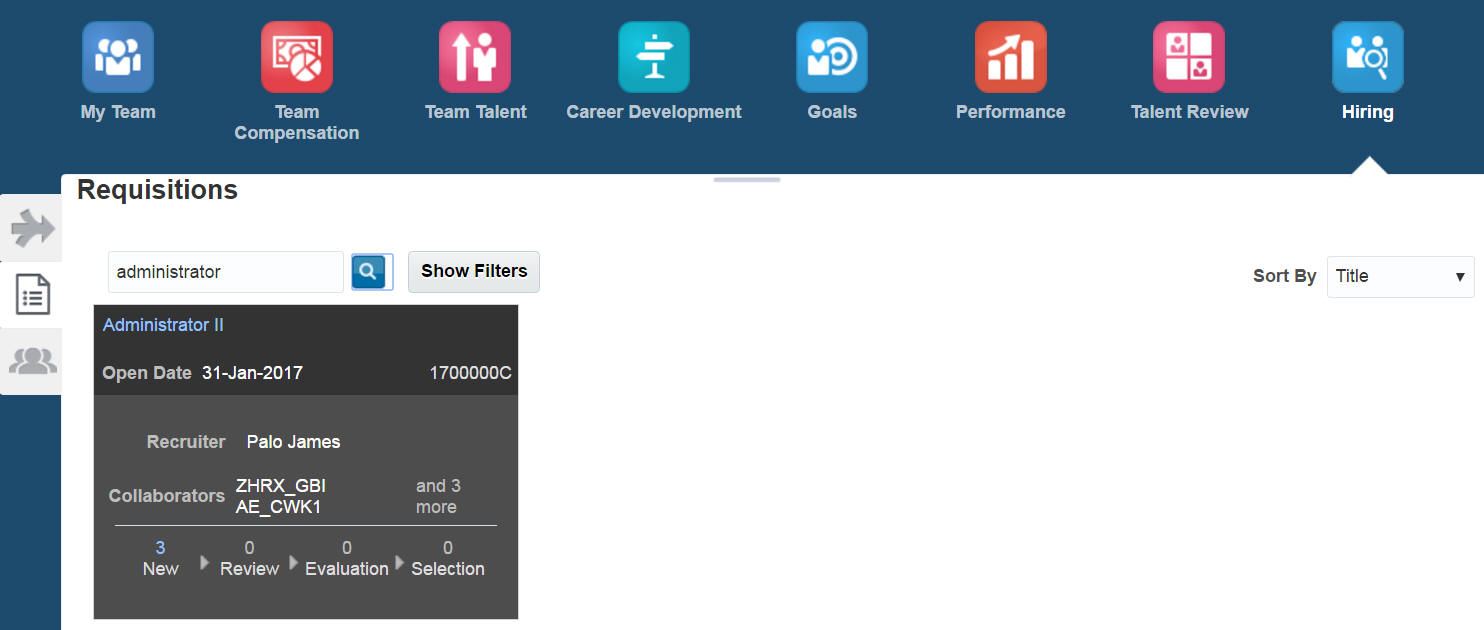

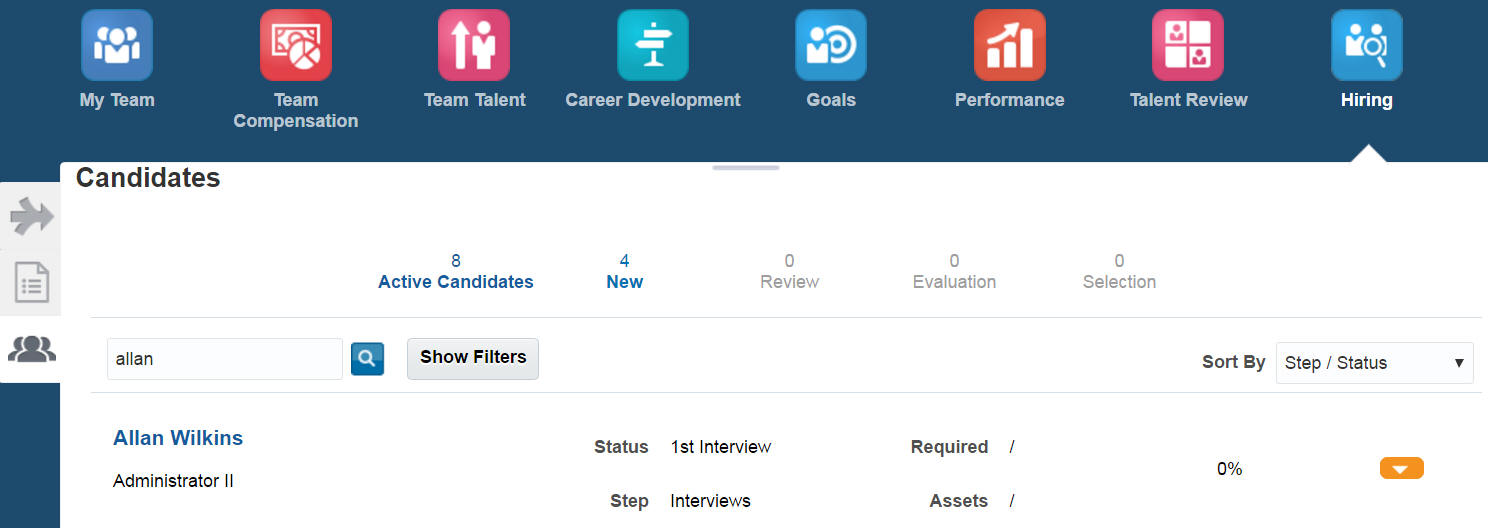

Oracle Fusion Hiring Manager Experience: Hiring Manager Experience |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Add Support for BACS Processing Date to BACS Flow |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Court Orders Reference List of Values Available |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources/ HCM Cloud Mobile: Using Directory Search |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources/ HCM Cloud Mobile: New My Day Format |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources/ HCM Cloud Mobile: Consistent User Experience in Mobile and Web Application |

Delivered new feature in update 5, the May quarterly update. |

| 05 MAY 2017 |

Oracle Fusion Global Human Resources: Enhanced Manage Direct Reports |

Feature was included in the base release; with this update we have added information on the feature. |

| 07 APR 2017 |

Oracle Fusion Global Human Resources for the United States: EFT Payments Now Include A Reference ID |

Delivered new feature in update 4 (April), which will also be included in the May quarterly update. |

| 07 APR 2017 |

Oracle Fusion Global Human Resources: Streamlined Navigation |

Feature was included in the base release. However, there are two new options that were added to this feature in Update 4 (April). |

| The following features are included in the March Quarterly update. |

||

| 07 APR 2017 |

Oracle Fusion Global Human Resources: Enhanced Document Records |

Delivered new feature in update 3, the March quarterly update. |

| 07 APR 2017 |

Oracle Fusion Global Human Resources: Enhanced Document Records |

Delivered new feature in update 3, the March quarterly update. |

| 07 APR 2017 |

Oracle Fusion Global Human Resources: Enhanced Document Delivery Preferences |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Involuntary Deductions: Enhanced Protected Pay Rules |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Reporting Information Card |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Global Absence Element Uptake |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

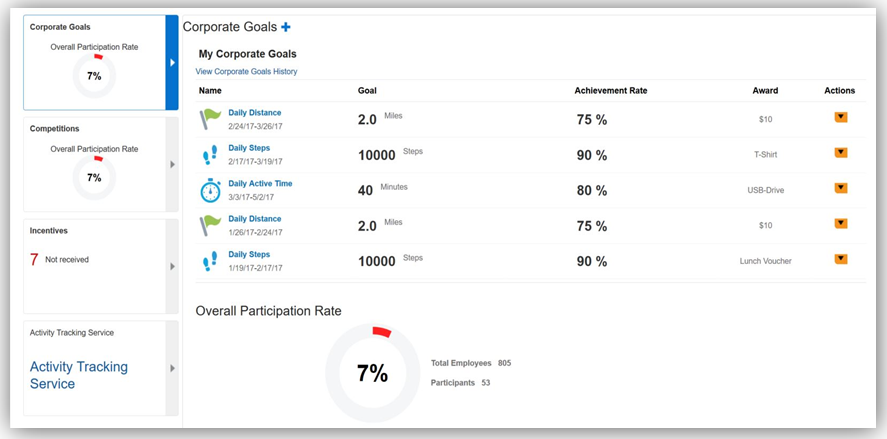

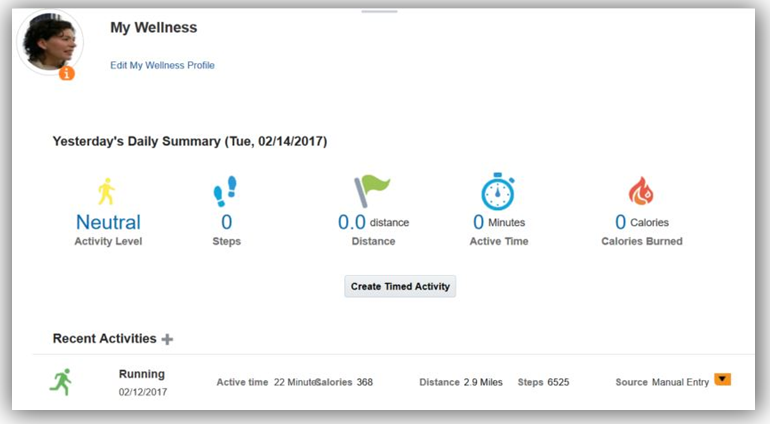

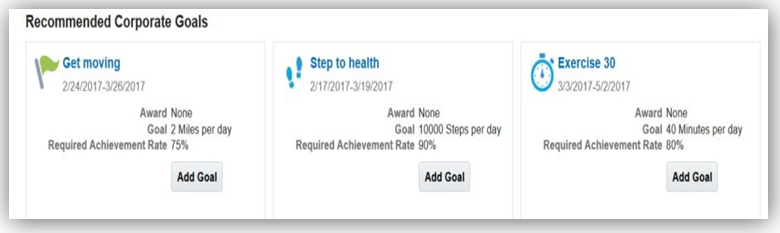

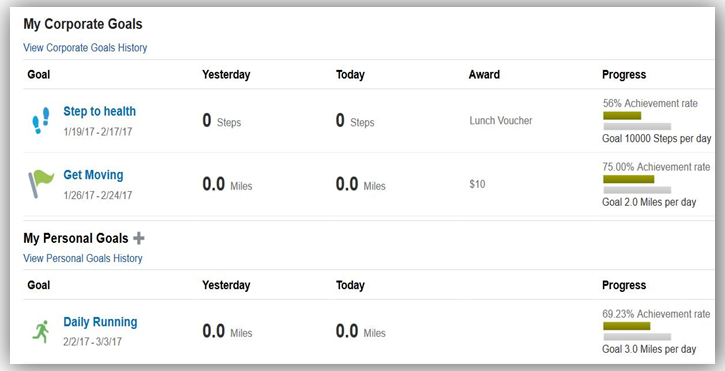

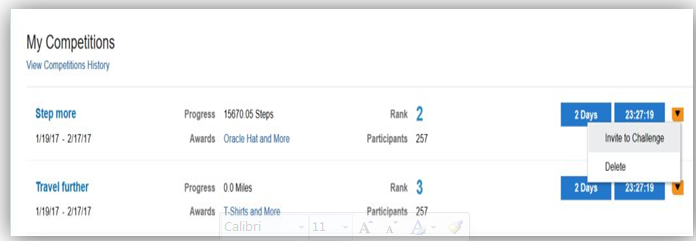

Oracle Fusion HCM Employee Wellness: Wellness Administration Experience Improvements |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion HCM Employee Wellness: Employee Experience Improvements |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion HCM Employee Wellness: Invitations |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

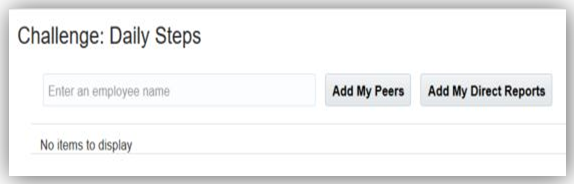

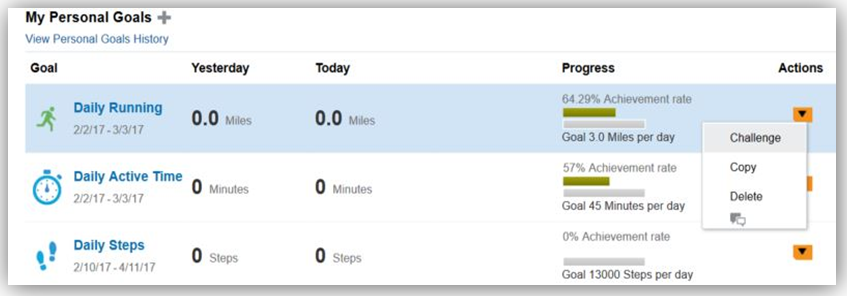

Oracle Fusion HCM Employee Wellness: Individual Challenges |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

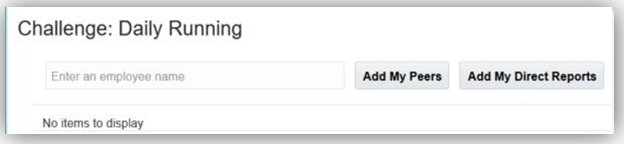

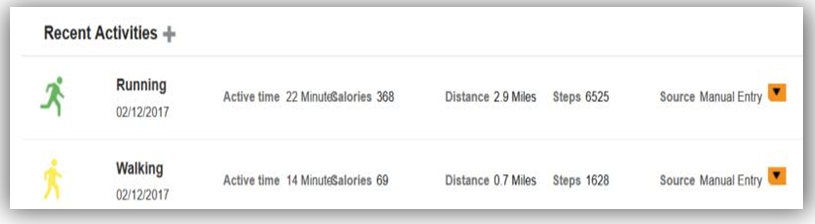

Oracle Fusion HCM Employee Wellness: Timed Activities |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

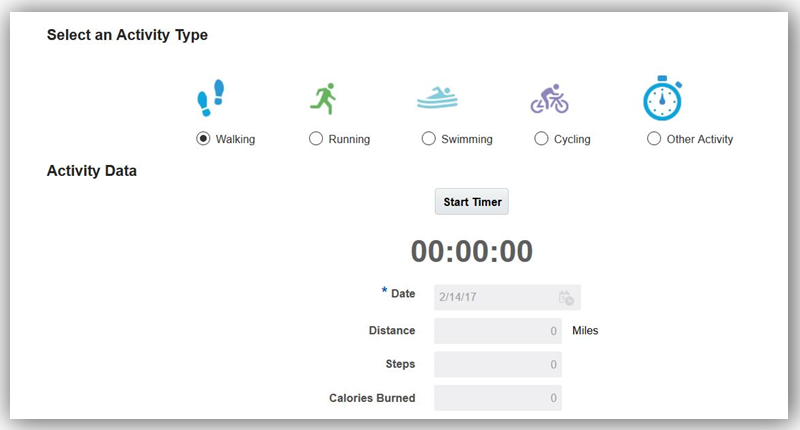

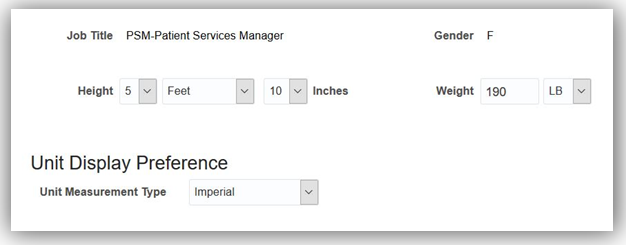

Oracle Fusion HCM Employee Wellness: Individual Measurement Preference |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

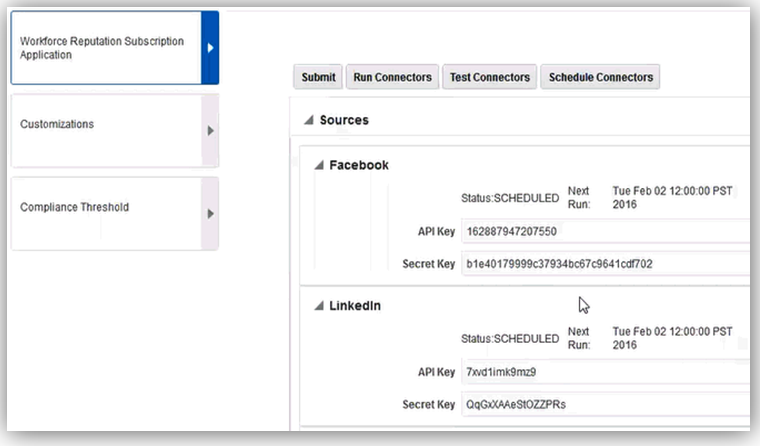

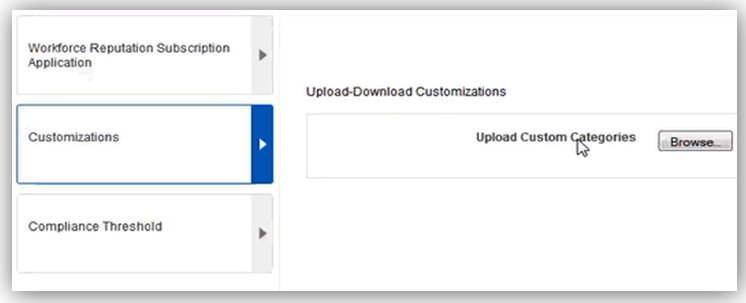

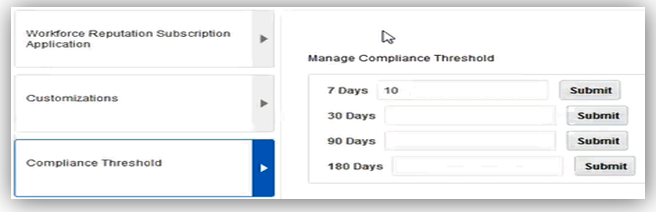

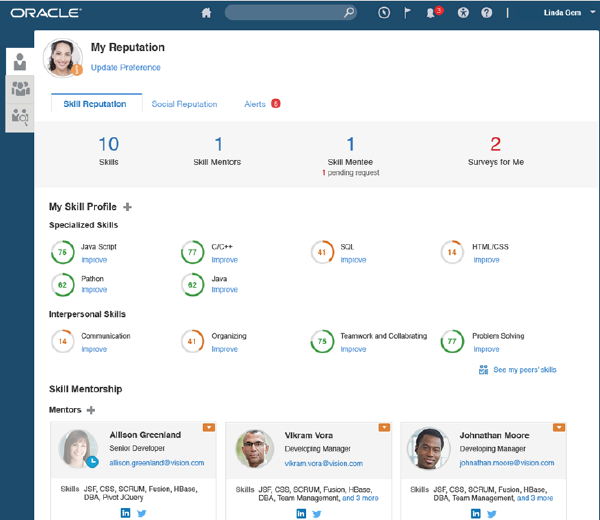

Oracle Fusion Reputation Management: Improved Employee Experience |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

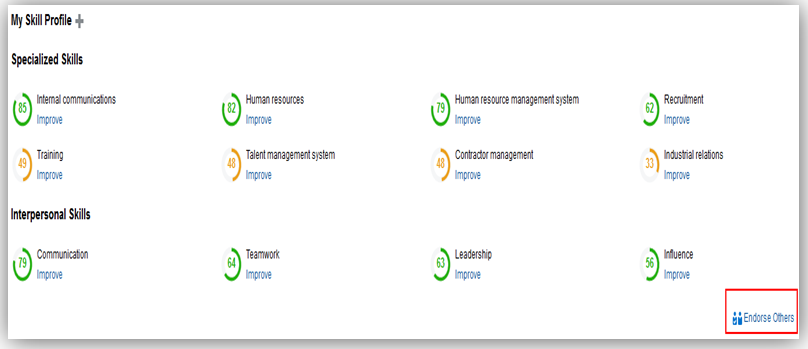

Oracle Fusion Reputation Management: Build Skill Profile and Ratings |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Reputation Management: Recognize Others Using Endorsements |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

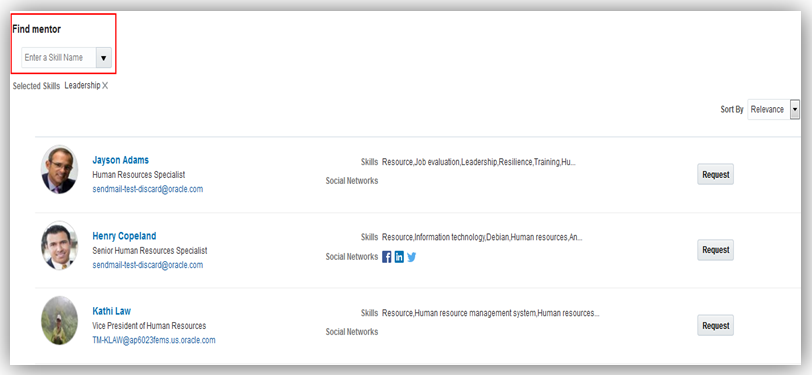

Oracle Fusion Reputation Management: Request for Mentoring |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

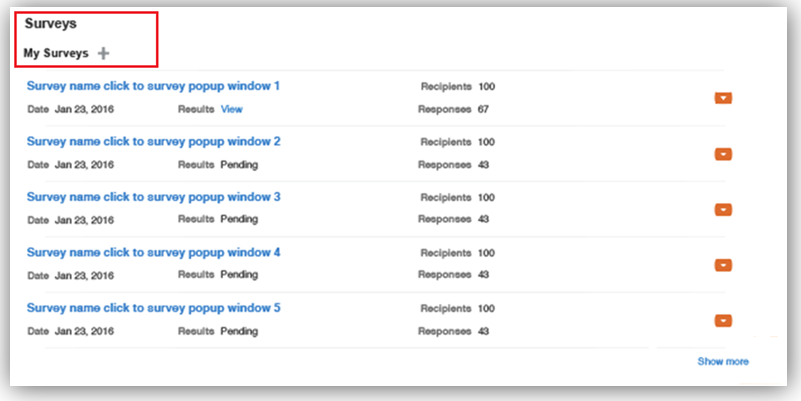

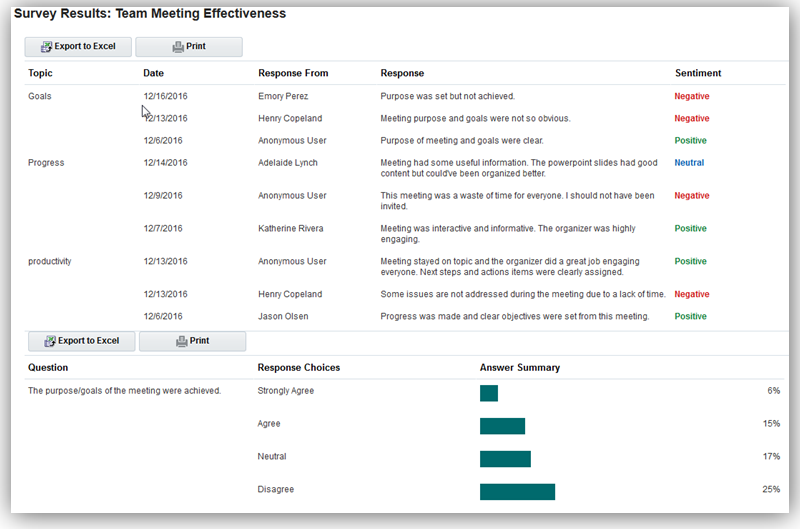

Oracle Fusion Reputation Management: Seek Feedback Using Surveys |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

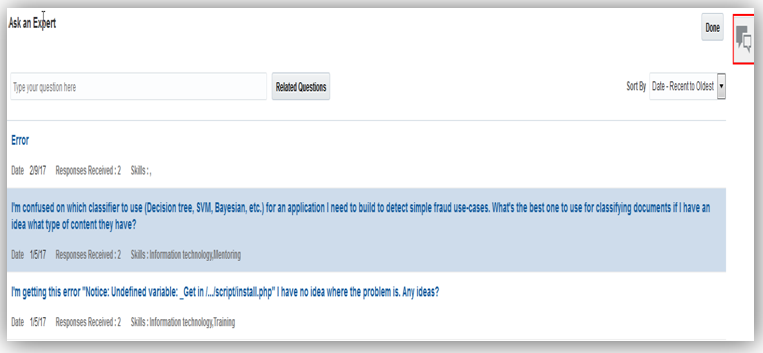

Oracle Fusion Reputation Management: Ask an Expert |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

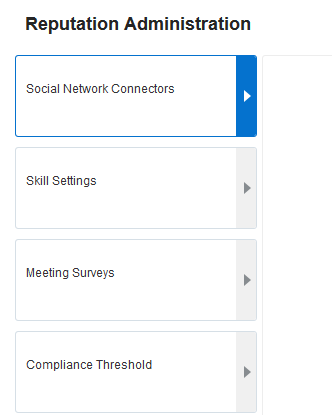

Oracle Fusion Reputation Management: Simplified Administration User Experience |

Delivered new feature in update 3, the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders Inbound Process |

Delivered new feature in update 3, the March quarterly update. |

| The following features were delivered via monthly updates. |

||

| 14 FEB 2017 |

Oracle Fusion Global Human Resources: Job Family Code Added To Job Family Pages |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources: Employment Model Simplification |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders (e-IWO) Inbound Process |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Sick Pay |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Adoption Pay |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Paternity Pay |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Maternity Pay |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Shared Parental Leave |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

All Oracle Fusion HCM Applications: Streamlined Navigation |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: Streamlined Navigation to Infolets and OTBI Reports |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for Australia: Manage Australian Features |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: Display Flexfield Information on Review Pages for Jobs, Positions, Grades, and Locations |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: Synchronization of Grade Ladder from Position |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: Changed Rules for Populating Grades and Grade Ladders in Assignments |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: New Position Attribute - Standard Working Hours |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Global Human Resources: New Scheduled Process for Position Synchronization |

Delivered new feature in update 1 (February). |

| 14 FEB 2017 |

Oracle Fusion Transactional Business Intelligence: New Subject Area: Human Capital Management - Approval Notification Archival Real Time |

Feature was included in the base release. However, just made a documentation adjustment. |

| 14 FEB 2017 |

Oracle Fusion Employee Wellness: Wellness Assessment |

Feature was included in the base release. However, just made a documentation adjustment. |

| 17 JAN 2017 |

Created initial document. |

|

This guide outlines the information you need to know about new or improved functionality in Oracle HCM Cloud Release 12. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools).

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products).

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the Global HR Cloud What’s New for Release 12 in the body or title of the email.

Some of the new Release 12 features are automatically available to users after the upgrade and some require action from the user, the company administrator, or Oracle.

The table below offers a quick view of the actions required to enable each of the Release 12 features.

Oracle Fusion Global Human Resources enables your organization to plan, manage and optimize all workforce segments using flexible and extensible best practices to realize extraordinary gains while ensuring compliance and increasing total workforce engagement.

The Add Person flows are enhanced for capturing employment, compensation, and roles information. The earlier Employment Information page is split into two train stops: Employment Information, and Compensation and Other Information to avoid scrolling down the page.

You can also add direct reports to the person in the same transaction from the Manage Direct Reports section in the Employment Information page.

Employment Information Train Stop Split Into Employment Information, and Compensation and Other Information Train Stops

There are no steps necessary to enable this feature.

Enhanced Manage Direct Reports

Manage direct reports functionality now supports matrix management. You can now add direct reports or reassign both direct and other types of reports to different manager types on the Manage Direct Reports page. You can either select or deselect the direct reports in a single click.

Add Direct Reports to Different Manger Types on the Manage Direct Reports Page

You can also add direct reports and reassign line reports from the following manager self-service pages: Hire, Add Contingent Worker, Promote, Transfer, Change Working Hours, and Change Manager. In addition the manage direct reports functionality is also included in the following human resource specialist processes: Hire, Add Contingent Worker, Create Work Relationship, Global Transfer, Global Temporary Assignment, Temporary Assignment, Add Assignment, Add Work Terms, End Assignment, and End Work Terms.

However, on the Terminate page, you can manage only direct line reports because terminations may involve multiple assignments.

Add Direct Reports Included in Promote Page

Steps to Enable

There are no steps needed to enable the feature.

Use the Reassign Direct Reports section embedded on the Employment pages if the proposed manager is different from the manager's manager.

Key Resources

For more information, go to Applications Help for the following topics:

- Managing Direct Reports: Explained

- Adding and Reassigning Direct Reports for Global Transfers and Global Temporary Assignments: Explained

Changes from Extensible to User for Specific Person Lookup Types

You can now customize your own values for the following lookup types as they are converted from a customization level of extensible to user:

- CONTACT

- MAR_STATUS

- PER_HIGHEST_EDUCATION_LEVEL

- PER_NATIONAL_IDENTIFIER_TYPE

- PER_ETHNICITY

- PER_VISA_PERMIT_TYPE

You can add lookup codes or change the tags for the user lookup type to suit your business requirements.

Customization Level for Contact Lookup Type is User

There are no steps necessary to enable this feature.

A new system-level lookup type now exists for each of the above user-level lookup types. Predefined legislative and statutory reports use the system-level lookup types, which are as follows:

- ORA_PER_CONTACT

- ORA_PER_MAR_STATUS

- ORA_PER_HIGHEST_EDUCATION_LEVE

- ORA_PER_NATIONAL_IDENTIFIER_TY

- ORA_PER_ETHNICITY

- ORA_PER_VISA_PERMIT_TYPE

You must create an extended lookup mapping to add a new lookup code that needs to be included in reports delivered by Oracle localization teams. You map the extended lookups using the Manage Extended Lookups task.

Mapping Highest Education Level System Lookup Code

For example, if you add 'HUSB' and 'WIFE' as new lookup codes for country US, and 'PART' as a new lookup code for country 'GB', the extended lookup for 'ORA_PER_CONTACT' will be as follows.

| Lookup Type |

Country |

Lookup Code |

Extended Code |

Extended Meaning |

| ORA_PER_CONTACT |

SPOUSE |

SPOUSE |

Husband/Wife/Partner for China |

|

| ORA_PER_CONTACT |

US |

SPOUSE |

HUSB |

Husband (US only) |

| ORA_PER_CONTACT |

US |

SPOUSE |

WIFE |

Wife (US only) |

| ORA_PER_CONTACT |

GB |

SPOUSE |

PART |

Life Partner (GB only) |

If you change any of the details in an Oracle delivered lookup code in the user lookup types, you take ownership of the lookup code. The lookup code will not be updated when Oracle delivers any updates to that lookup code. But, if you delete the lookup code in the user lookup type, it will be replaced when Oracle delivers updates to the lookup type.

Enhanced Duplicate Person Validation

The prevention of adding duplicate people functionality in the Add Person flows is extended to the Worker service. A new option, Person Creation Service Duplicate Check is added on the Manage Enterprise HCM Information page. This option is referenced when creating workers though the Worker service. You must update this option to specify your preferred level of duplicate person validation. This option checks for matches between person name, date of birth, gender and national ID. The validation generates an error and prevents creation of a duplicate person if there are any conflicts.

Person Creation Service Duplicate Check Field Added on the Manage Enterprise HCM Information Page

By default, the Person Creation Service Duplicate Check option is disabled to avoid regression issues. You must specify a value for this option to enable the validation and the level of check in the Worker service.

Salary Update when Changing Working Hours

Enhance line manager’s ability to update the salary of part-time workers when changing their working hours. You can now update the salary by using the Change Working Hours task in Manager Self Service.

Update Salary Based on Working Hours

There are no steps necessary to enable this feature.

Areas of Responsibility Enhanced to Include Additional Attributes and Responsibility

Provide greater flexibility in defining the scope of areas of responsibility. You can now define scope based on job families and job functions. The Areas of Responsibility page also shows a new Recruiting responsibility type and new scope attributes based on recruiting type and hierarchies. The recruiting responsibility type and recruiting attributes are for use with a future enhancement.

- You can access the new scope attributes using the Manage Areas of Responsibility task in the Person Management work area.

New Attributes in the Scope Definition

There are no steps necessary to enable this feature.

Job Family Code Added to Job Family Pages

The Job Family Code is a new field added on the Manage Job Family and Create Job Family page. The job family code facilitates tighter integration with other external applications that have this attribute and require the value to be passed to Oracle Fusion Human Capital Management (HCM). The attribute value is automatically populated from the job family name after formatting it into capitals and replacing blank spaces with underscores. Although you can change the job family code, the changes aren’t tracked.

Job Family Code on the Create Job Family Page

Steps to Enable

There are no steps necessary to enable this feature.

Employment Model Simplification

The employment model is now simplified to only include the following 2 Tier options for new customers:

- 2 Tier – Multiple Assignment

- 2 Tier – Single Assignment

- 2 Tier – Single Contract – Single Assignment

Existing customers can also continue to use the following 3 Tier options:

- 3 Tier – Multiple Employment Terms – Multiple Assignment

- 3 Tier – Multiple Employment Terms – Single Assignment

- 3 Tier – Single Employment Terms – Multiple Assignment

- 3 Tier – Single Employment Terms – Single Assignment

NOTE: For existing customers using only the 2 Tier options, we recommend that you don’t use the 3 Tier options because of the employment model simplification.

You can access the employment model options using the Manage Legal Entity HCM Information or Manage Enterprise HCM Information task in the Setup and Maintenance work area.

2 Tier Employment Model Options for a Legal Entity

The following screen capture shows the employment model options when using the Manage Enterprise HCM Information task.

2 Tier Employment Model Options for an Enterprise

There are no steps necessary to enable this feature.

For more information, go to Applications Help for the following topics:

- Employment Model: Explained

- Selecting the Employment Model: Critical Choices

To simplify navigation for users and encourage usage of new user interface components, our delivered menu structures are changing.

The following menu items are moved from the Navigator and springboard to the simplified navigation:

- Directory > Person Gallery

- About Me > My Portrait

- About Me > Talent Profile

New menu items available are:

- About Me > Skills and Qualifications

- About Me > Career Planning

Beginning with release 7, Oracle HCM Cloud has delivered enhanced pages and navigation to replace functionality available within the Person Gallery work area and the portrait pages.

The new Directory provides a robust search and an updated organization chart, replacing similar features which were available from Person Gallery. You can access additional worker details from the View More Details icon in the card view. The expanded card shows the same information available in the person Smart Navigation. The expanded card contains an additional subtab that includes the direct reports of the person you are viewing.

Actions previously available from Person Gallery are easily accessible from the Actions menu in Smart Navigation.

Actions Available from Smart Navigation

Worker details previously available from the Portrait pages are consolidated in the new feature, Person Spotlight. You can access Person Spotlight by clicking the name of a person in Directory, Smart Navigation, My Team, Team Talent, and Team Compensation pages.

Person Spotlight includes the following tabs:

- Public Information

- Employment Details

- Skills and Qualifications

- Career Planning

- Goals

- Performance

- Succession Planning

- Compensation

- Documents

Person Spotlight

Additional private details available such as addresses, payslips, benefit enrollments, compensation, and documents are available from About Me > Personal Information.

Personal Information

The following table details recommended navigation for information previously available on Portrait cards.

| Portrait Card |

Replacement Manager Navigation |

Replacement Worker Navigation |

|---|---|---|

| Activities and Interests |

Person Spotlight > <Person Name>: Public Information |

Directory > Person Spotlight > Public Person |

| Availability |

Manager Dashboard > Worker Availability Time Management > Manage Planned Schedule For more information, see the Role Information section in this document. |

About Me > Time > Calendar |

| Benefits |

N/A |

About Me > Personal Information > Benefits |

| Career Planning |

Person Spotlight > Career Planning |

About Me > Career Planning |

| Contact Information |

Person Spotlight > Public Person Smart Navigation > Information |

About Me > Personal Information > My Details |

| Compensation |

Person Spotlight > Compensation My Team > Team Compensation |

About Me > Personal Information > Compensation |

| Development and Growth |

Person Spotlight > Skills and Qualifications Person Spotlight > Goals My Team > Career Development My Team > Goals |

About Me > Skills and Qualifications About Me > Goals About Me > Career Development |

| Employment |

Person Spotlight > Employment |

About Me > Personal Information > Employment |

| Experience and Qualifications |

Person Spotlight > Skills and Qualifications Person Spotlight > Career Planning Person Spotlight > Performance |

About Me > Skills and Qualifications About Me > Career Planning About Me > Career Development |

| Payroll |

N/A |

About Me > Personal Information > Payroll |

| Personal Information |

N/A |

About Me > Personal Information > My Details |

| Personal Information |

N/A |

About Me > Personal Information > My Documents |

| Personal Information |

N/A |

About Me > Personal Information > Document Delivery Preferences (right hand panel drawer) |

| User Account Details |

My Team > Manage Users |

About Me > My Account |

Steps to Enable

There are no steps necessary to enable this feature.

Role Information

The following table provides a summarized list of security privileges that grant access to Person Spotlight tabs and related navigation. Additional information about security changes for release 12 is available in the Upgrade Guide for Oracle HCM Cloud Release 12. The New in Release 12 column identifies privileges that were newly added in Release 12.

| Tab |

Required Role or Aggregate Privilege |

New |

Details |

|---|---|---|---|

| Public Person |

Access Person Gallery |

Grants access to the Public Person page |

|

| Career Planning |

View Person Career Planning Edit Person Career Planning |

Yes |

View privilege grants access to the Career Planning page Edit privilege provides access to Edit button on page |

| Compensation |

View Compensation Details for Worker |

Grants access to the Compensation page |

|

| Employment Information |

View Employment Information Summary |

Grants access to the Employment Information page |

|

| Documents |

Manage Person Documentation Person Management |

Grants access to Manage Document Records page for line managers and HR specialists |

|

| Manage Person Documentation by Worker |

Grants access to Manage Document Records page for employees and contingent workers |

||

| Human Resource Analyst – Person View |

Grants access to View Document Records page for page HR analysts |

||

| Goals |

Manage Performance Goal by Worker |

Yes |

Grants access to Goals page for employees and contingent workers |

| Manage Performance Goal by Manager |

Yes |

Grants access to Goals page for line managers |

|

| Manage Performance Goal by HR |

Yes |

Grants access to Goals page for HR specialists |

|

| Performance |

View Performance Summary |

Yes |

Grants access to Performance Summary page |

| Skills and Qualifications |

View Person Skills and Qualifications Edit Person Skills and Qualifications |

Yes |

View privilege grants access to Skills and Qualifications page Edit privilege provides access to Edit button on page |

| Time Management > Manage Planned Schedule |

Time and Labor Manager |

Grants access to both view and manage a worker’s availability |

Tips and Considerations

For customers who require a period of transition to the new navigation structure, access to Person Gallery and My Portrait can be configured through the Structure administration tool.

Select the Create Page Entry.

Create Page Entry

Enter the following information for each menu item.

| Name |

Person Gallery |

My Portrait |

| Category |

Directory |

About Me |

| Link Type |

Application Page |

Application Page |

| Focus View ID |

/PersonGallery |

/MyPortrait |

| Web Application |

hcmCore |

hcmCore |

| Secured Resource Name |

oracle.apps.hcm.people.gallery.ui.page.PeopleGalleryPageDef |

oracle.apps.hcm.people.portrait.ui.page.MyPortraitPageDef |

| Application Stripe |

hcm |

hcm |

Support for Person Gallery and My Portrait will be deprecated in the release following Release 12. If you have configured the Person Gallery pages, you should review each of the replacement navigation pages above to include similar configurations.

Key Resources

For more information, go to Applications Help for the following guides and topic:

- Person Spotlight: Explained

Streamlined Navigation to Infolets and OTBI Reports

To streamline navigation to new user interface components like infolets and encourage use of highly flexible analytics in Oracle Transaction Business Intelligence (OTBI), the following menus items are removed from the Navigator and springboard:

- My Workforce > Human Resources Dashboard

- My Team > Manager Resources Dashboard

Enhanced pages and navigation now replace functionality available from the Human Resources Dashboard and the Manager Resources Dashboard.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

You can customize the Navigator and springboard to access the Human Resources Dashboard and Manager Resources Dashboard pages using the Structure page.

To display a menu item on the Navigator:

- From the Navigator menu, select Tools - Structure

- Select Create > Create Page Entry

Select the Create Page Entry

- On the Create Page Entry page, enter the following information for each menu item.

- Click Save and Close

Enter Details on the Create Page Entry Page

| Field |

Human Resources Dashboard |

Manager Resources Dashboard |

| Category |

My Workforce |

My Team |

| Link Type |

Application Page |

Application Page |

| Focus View ID |

/DashHrSpecialist |

/DashLineManager |

| Web Application |

hcmCore |

hcmCore |

| Secured Resource Name |

oracle.apps.hcm.dashboards.hrSpecialist.publicUi.page.HrSpecialistDashboardPageDef |

oracle.apps.hcm.dashboards.lineManager.publicUi.page.DashLineManagerPageDef |

| Application Stripe |

hcm |

hcm |

Key Resources

The Report Sharing Center on Oracle Applications Customer Connect has many sample reports that are free to download. Some of those reports are OTBI examples of some of the analytics that previously appeared on these dashboards.

https://appsconnect.custhelp.com/pages/111909f106

Display Flexfield Information on Review Pages for Jobs, Positions, Grades, and Locations

You can now see flexfield information on the Review page when you create or edit jobs, positions, grades, and locations.

Flexfield Information Displayed on the Edit Job: Review Page

Steps to Enable

There are no steps to enable this feature.

Synchronization of Grade Ladder from Position

Grade ladder option is added to the Position Synchronization Configuration section on the Manage Enterprise HCM Information page. If you select this option grade ladder in the assignment is synchronized with the grade ladder defined in the position.

Grade Ladder Option Added to Position Synchronization Configuration Section

- In the Setup and Maintenance work area, search for and click the Manage Enterprise HCM Information task.

- Select Grade Ladder in the Position Synchronization Configuration section to synchronize the grade ladder.

NOTE: If you want to enable position synchronization for a legal entity, in the Setup and Maintenance work area, search for and click the Manage Legal Entity HCM Information task.

Changed Rules for Populating Grades and Grade Ladders in Assignments

The rules for populating the grades and grade ladders in an assignment are now changed. You can now use the Default Valid Grades profile option independent of the Enforce Valid Grades profile option, to populate valid grades in an assignment. The Default Valid Grades profile option populates the grade in a new assignment, while the Enforce Valid Grades profile option also restricts the Grade LOV in the assignment to allow only the selection of a grade that is valid for the job or position.

Valid grades are now populated from the position, even if no entry grade is specified in the position. If valid grades are enforced or configured to be synchronized from the position and the enforced valid grade is not part of the selected grade ladder, a warning is shown in the assignment.

Some of the other rules for populating the grade and grade ladder are as follows:

- Grades specified in a position always take precedence over grades specified in a job. If valid grades are specified for a job and position, then the grades for the jobs would be ignored and the position grades would be used in an assignment if a position exists.

- If an entry grade is captured at the position, then this is always used for populating in a new assignment, even if the profile option to default valid grades is not enabled.

- Synchronization of a grade from the position takes precedence over the profile option to default or enforce valid grades.

- If the grade or the grade ladder is selected for position synchronization, the value is inherited from the position and is displayed as read-only in the assignment. But if no value exists at the position for these attributes, the attribute remains editable in the assignment. If multiple valid grades exist, the entry grade will be the default and the attribute remains editable in the assignment but is restricted to only valid grades of the position.

Steps to Enable

There are no steps to enable this feature.

New Position Attribute - Standard Working Hours

Use the new Standard Working Hours field on the Create and Edit Position pages to capture standard working hours, which can be different from working hours to support part-time positions. This value is now used to calculate the FTE (Full Time Equivalent) in the assignment. So, even if a value for the FTE exists at the position it won’t be copied in an assignment that uses that position. Instead, the assignment FTE value is calculated as a ratio of working hours to standard working hours. For example, if there are 3 incumbents in a position working 20 hours each, the information displayed in the position and assignment is as follows:

| Field |

Position |

Assignment |

| Working Hours |

20 Weekly |

20 Weekly |

| Standard Working Hours |

40 Weekly |

40 Weekly |

| Headcount |

3 |

1 |

| FTE |

1.5 |

0.5 (20/40) |

Standard Working Hours Added to the Create and Edit Position Pages

There are no steps to enable this feature.

Tips and Considerations

- After an upgrade, the Standard Working Hours field is populated with the same value as the working hours in existing positions.

- The value for the FTE (Full Time Equivalent) in an assignment is not synchronized from the position. Instead the FTE value is calculated as a ratio of working hours to standard working hours. The FTE is used for validating the number of incumbents where hiring for a position is allowed only if sufficient vacant FTE and headcount is available for the position.

New Scheduled Process for Position Synchronization

A new process, Synchronize Person Assignment from Position is introduced. You must run this process to:

- Update impacted assignments in the enterprise or legal entities when position synchronization is enabled for the first time or changed later.

- Update impacted assignments when you upload changes in the position using HCM Data Loader.

The current function of the Initialize Position Synchronization process is now incorporated into the new process and hence, the Initialize Position Synchronization process is now obsolete.

There are no steps needed to enable the feature.

Schedule this process to run daily.

Improve the usability of document records by now managing it in the simplified user interface. The changes to the document records user interface include:

- Redesigning the Manage Document Records page that is now part of the worker's documents in the Personal Information work area.

- Listing of all worker document records on the Manage Document Records page so that you don’t have to search for any particular record.

- Populating the required document code attribute as an auto generated value in the Create Document Record page based on the document type and timestamp.

- Redesigning the Manage Document Records page in the Document Records work area for Line Managers and HR Specialists to provide a consistent user experience.

- Adding the Document Record tab to the worker’s person spotlight that is accessible from the directory and My Team work area.

Workers can access the Manage Document Records page from the My Documents tab in the Personal Information work area or the person smart navigation window.

Line Managers and HR Specialists can access the Manage Document Records page from the Document Records work area.

Redesigned Manage Document Records Page in the Personal Information Work Area for Workers

Redesigned Create Document Record Page with Document Code Auto Generated

Redesigned Manage Document Records Page in the Document Records Work Area for Line Managers and HR Specialists

Person Spotlight Containing the Document Record Tab

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

- Document Types, Categories, and Statuses: Explained

Enhanced Document Delivery Preferences

Improve the usability of document delivery preferences by now managing it in the simplified user interface. The document delivery preferences user interface is redesigned and is now part of the worker's Personal Information work area and the person smart navigation window.

You can access the Document Delivery Preferences task from the Related Links panel in the Personal Information work area or the person smart navigation window.

Redesigned Page in the Simplified User Interface

Person Smart Navigation Window

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topic:

- Document Delivery Preferences: Explained

Navigate to Person Spotlight from Internal Information Sharing

The Information Sharing task is enhanced to provide access to a worker’s person spotlight rather than the worker’s Portrait, when information is shared internally. When a worker or his manager shares the worker’s information with an internal recipient, the recipient will receive a notification with a link to view the shared information.

Notification Sent to Recipient of Shared Information

When the recipient clicks the link, the worker’s person spotlight is displayed, with access to employment, talent, and compensation information.

Recipient of Shared Information Accesses Person Spotlight

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

When clicking the link in the notification, the user will only see the public person, employment, talent and compensation pages. The user may see additional pages when accessing person spotlight from other areas of the application, depending on their role.

Key Resources

For more information, go to Applications Help for the following guides and topic:

Areas of Responsibility Enhancements

Enhance the user experience by securing access to the following Areas of Responsibility (AOR) tasks:

- Manage Areas of Responsibility

- Maintain Areas of Responsibility

The access to manage or view a worker’s responsibility is now secured separately using new aggregate privileges. You can easily add or remove responsibility-related functions when defining custom roles to better suit your business requirements.

HR Analysts can view responsibilities by responsibility type, responsibility name, or person using the Maintain Areas of Responsibility task in the Workforce Structures work area. The HR Analyst has view-only access to the Maintain Areas of Responsibility page whereas the HR Specialist can reassign responsibilities using the same page. HR Analysts can view responsibilities by person using the Manage Areas of Responsibility task in the Person Management work area. HR Specialists can manage responsibilities by person using the Manage Areas of Responsibility task in the Person Management work area.

HR Analysts Can View Responsibilities by Person and HR Specialists Can Manage Responsibilities by Person

HR Analysts Can View Responsibilities by Type, Name, or Person and HR Specialists Can Manage Responsibilities by Type

Steps to Enable

To enable view-only access for the Maintain Areas of Responsibility page, your custom HR Analyst job roles must have access to the Workforce Structures work area. The seeded HR Analyst job role will not have access to the Maintain Areas of Responsibility page until Bug 24704097 is resolved. As a workaround, you can add the duty role ORA_PER_WORKFORCE_STRUCTURES_MANAGEMENT_DUTY for the HR Analyst job role.

Role Information

Four new aggregate privileges are provided and delivered out-of-the-box to HR Specialists and HR Analysts. The following table shows the new aggregate privileges, the pages they secure, and the roles that inherit them by default.

| Aggregate Privilege Name |

Secures Page |

Work Area |

Inherited By |

| Manage Areas of Responsibility by Responsibility Type ORA_PER_MAINTAIN_AREAS_OF_RESPONSIBILITY |

Maintain Areas of Responsibility |

Workforce Structures |

Human Resource Specialist |

| Manage Areas of Responsibility by Person ORA_PER_MANAGE_AREAS_OF_RESPONSIBILITY |

Manage Areas of Responsibility |

Person Management |

Human Resource Specialist |

| View Areas of Responsibility by Responsibility Type ORA_VIEW_AREAS_OF_RESPONSIBILITY |

Maintain Areas of Responsibility |

Workforce Structures |

Human Resource Analyst |

| View Areas of Responsibility by Person ORA_VIEW_AREAS_OF_RESPONSIBILITY_BY_PERSON |

Manage Areas of Responsibility |

Person Management |

Human Resource Analyst |

The Manage Areas of Responsibility and Maintain Areas of Responsibility pages are now secured independently of other pages, and you can separate any changes.

If you have custom roles that access the Maintain Areas of Responsibility or Manage Areas of Responsibility page using the aggregate privileges, you must:

- Add the appropriate new aggregate privileges shown in the table above to your custom roles.

- Regenerate any data roles that inherit your custom job roles or predefined job roles that are used to access the AOR pages.

NOTE: If you don’t make these updates, users will no longer be able to manage or maintain areas of responsibility.

Key Resources

For more information, see the following guides and topics:

- Upgrade Guide for Oracle HCM Cloud Applications Security Release 12 (available from My Oracle Support Document ID 2023523.1)

- Areas of Responsibility: Explained

New Hidden Fields in My Team and Directory

New hidden fields are added to the Directory organization chart and My Team pages.

The following attributes are added to Directory organization chart:

- Business Unit

- Cost Center

- Grade Code

- Job Code

- Location Code

- Location Name

- Person Number

- Preferred Name

The following attributes are added to the My Team page:

- Cost Center

- Legal Employer

- Preferred Name

Steps to Enable

Use standard customization to enable the new fields.

Persistency in My Team and Directory

You can now save the filters in the Directory organization chart and in the My Team pages as a default setting. The filters that you save will be automatically applied the next time you open either Directory or the My Team pages.

Grade Filter is Removed from the My Team Page

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

You can also set the default filters for all users who have not personalized their filters, by customizing the page at the site level and changing the filter settings in design mode.

Populate the Context of the Document Records DFF Based on the Document Type

Improve the usability of document records by now automatically populating the context of the document records descriptive flexfield (DFF) when you create a document record. The context is populated based on the selected document type. This enhancement will automatically control the display of the flexfield segments for the populated context based on the configuration.

You can populate the context by configuring the context code for the document records DFF to be the same as the system document type. You manually enter the context code based on the document type when you create the context. The context will be automatically populated when the context code matches the internally generated system document type. You can create the context by using the Manage Descriptive Flexfields task in the Setup and Maintenance work area.

The system document type is an internal code that is not currently shown on the UI, but stored in the HR_DOCUMENT_TYPES_B table. The value of the system document type is derived by the application using the following logic:

- The document type is applicable for a specific country or legislation: In this case, the system document type is derived using the country code + '_' + document type name converted to upper case. The spaces ( ) and hyphens (-) in the document type name are replaced with underscores (_). For example, if the document type name is 'Loan Request' and the document type is specific to the Indian legislation; the system document type value will be 'IN_ LOAN_REQUEST'.

- The document type is applicable for all countries (global): In this case, the system document type is derived using 'GLB' + '_' + document type name converted to upper case. The spaces and hyphens in the document type name are replaced with underscores. For example, if the document type name is 'Loan Request' and the document type is defined for all countries (global); the system document type value will be 'GLB_ LOAN_REQUEST'.

Create the Context by Entering the Display Name and the Context Code

Create the Document Record with the Context Defaulted and Segments Displayed Accordingly

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information, go to Applications Help for the following topics:

Display NonWorkers in My Team and Directory

Nonworkers are now displayed in the Directory organization chart and My Team pages similar to contingent workers and employees. This gives a complete view of the team.

Display of Nonworker in Directory

The Nonworker check box is also added to the employee and contingent worker filter. You can hide this field through customization at the site or user level.

Steps to Enable

There are no steps required to enable this feature.

Search for peers, directs, managers in your organization by entering the name, job title, location, telephone number or any other criteria.

The search results display a list that you can refine and sort according to your preferences.

Directory Search

There are no steps necessary to enable this feature.

TIPS AND CONSIDERATIONS

- Employees and managers can view the Public Profiles of workers.

- Tap the person’s details to contact them. If you tap e-mail address, it will create an e-mail with the person’s e-mail id.

Key Resources

For additional information see the following topics in Application Help:

- Using Search on Your Mobile Device: Explained

With My Day you are now notified of upcoming meetings and events. You can also view corporate announcements and Talent Ticker spotlights for employment milestones and important dates.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For additional information see the following topics in Application Help:

- Setting Up Your Calendar on Your Mobile Device: Explained

Consistent User Experience in Mobile and Web Application

You can now leverage the new user experience that aligns the user experience in mobile devices and the web application. This consistent user experience is evident when you connect the mobile application to the Release 12 HCM Cloud environment.

Steps to Enable

There are no steps necessary to enable this feature.

Consistent User Experience in Mobile Device and Web Application

ROLE INFORMATION

This table identifies the required security privileges and suggests target job and abstract roles to access Oracle Tap.

| Functional Security Privilege |

Job Role |

| Access Tap Application |

Line Manager Employee |

A new profile option, Tap Enable Export Contacts (TAP_ENABLE_EXPORT_CONTACTS) is added to enable or disable export of contact information for a colleague, direct report, or for a selected worker using the Export Public Profile option.

The default value is No, select Yes to enable the Export Public Profile option.

Steps to Enable

To set the profile option, perform the following steps:

- Navigate to the Setup and Maintenance work area in the HCM application server.

- Select Search from the panel drawer.

- Search for and select the task Manage Administrator Profile Values.

- In the Application field, select Tap for Oracle Applications.

- Click Search.

- Select the TAP_ENABLE_EXPORT_CONTACTS profile option.

- In the TAP_ENABLE_EXPORT_CONTACTS: Profile Values section, set the profile value to Yes, to enable the Export Contacts option, or set it to No to disable the option.

Key Resources

For more information, go to Applications Help for the following topics:

- Profile Options for HCM Mobile Features: Explained

- Exporting Contacts, Workers, Colleagues, and Directs on Your Mobile Device: Procedure

Profile Options to Show or Hide Worker Information

You can now show or hide a worker’s information on the Public Profile page. The following profile options are added to display or hide a worker's job, grade, position, primary phone number, primary email address, and length of service on the Public Profile page.

- Tap Display Primary Phone Number (TAP_SHOW_PHONE_PUBLIC_PROF)

- Tap Display Primary E-mail (TAP_SHOW_EMAIL_PUBLIC_PROF)

- Tap Display Length of Service (TAP_SHOW_LEN_OF_SERV_PUBLIC_PROF)

- Tap Display Grade (TAP_SHOW_GRADE_PUBLIC_PROF)

- Tap Display Position (TAP_SHOW_POSITION_PUBLIC_PROF)

- Tap Display Job (TAP_SHOW_JOB_PUBLIC_PROF)

Set the profile options to Yes to display the information on the Public Profile page and No to hide the data for all workers.

Steps to Enable

To set the profile options, perform the following steps:

- Navigate to the Setup and Maintenance work area in the HCM application server.

- Select Search from the panel drawer.

- Search for and select the task Manage Administrator Profile Values.

- In the Application field, select Tap for Oracle Applications.

- Click Search.

- Select the profile option for which you want to show or hide information.

- In the <Profile Option Name>: Profile Values section set the profile value to Yes, to show the information, or set it to No to hide the information.

Key Resources

For more information, go to Applications Help for the following topics:

- Profile Options for HCM Mobile Features: Explained

- Viewing Your Public Profile and Team on Your Mobile Device: Explained

You can now view your contact information, emergency contacts, and documents on your mobile device.

View Contact Information, Contacts, and Documents

The ability to edit or update contact details will be added in a phased manner in future releases, for now you can only view details related to:

- Contact Information - you can view your mailing address specified in the web application.

- Contacts – you can view contacts on the mobile device.

- My Documents – you can view government-related identification such as citizenship, driver’s licenses, passports, and visas and permits.

Steps to Enable

There are no steps necessary to enable this feature.

ROLES

| Aggregate Privilege Name and Code |

Job Role |

| Access Tap Application FTA_ACCESS_TAP_APPLICATION_PRIV |

Employee |

Key Resources

For more information, go to Applications Help for the following topic:

- Updating Personal Information on Your Mobile Device: Explained

You can now edit areas of expertise displayed on your talent profile. Use the Edit Skills and Qualifications page to add or edit areas of expertise.

Areas of Expertise Displayed for a Talent Profile

Areas of Expertise on the Edit Skills and Qualifications Page

Edit Areas of Expertise Page

Steps to Enable

There are no steps necessary to enable this feature.

ROLES

| Aggregate Privilege Name and Code |

Job Role |

| Access Tap Application FTA_ACCESS_TAP_APPLICATION_PRIV |

Employee |

You can now edit your personal information in addition to your biographical information such as contact information, contacts, and documents. You can only view your addresses when editing your personal contact information or creating a new emergency contact. Use the web application to update addresses. You can only view the personal information when there is a pending change that requires approval.

By default, edit capabilities are enabled. You can disable these actions for all users by changing the corresponding profile options to No.

- Tap Enable Edit Biographical Information (TAP_ENABLE_WORKERBIO)

- Tap Enable Edit Contact Information (TAP_ENABLE_CONTACT_INFO)

- Tap Enable Edit Contacts (TAP_ENABLE_CONTACTS)

- Tap Enable Edit Documents (TAP_ENABLE_MY_DOCS)

Steps to Enable

There are no steps necessary to enable this feature.

The Directory search logic is improved to mimic the logic used in the Directory in the web application. The search results are not limited to just displaying the values cached on the mobile device.

Disable the profile option TAPENABLESYNCALLWORKERS for this feature to work.

Steps to Enable

If you have the TAPENABLESYNCALLWORKERS profile option set to Y, change it to N.

Key Resources

For more information, go to the Applications help for the following topics:

- Profile Options for Oracle HCM Mobile: Explained

- Using the Directory on Your Mobile Device: Explained

Human Capital Management for Argentina

Oracle Fusion HRMS (Argentina) supports country specific features and functions for Argentina. It enables users to follow Argentina’s business practices and comply with its statutory requirements.

Enhanced Postal Code Validation

The Argentine postal code validation is enhanced to accept both the ANNNNAAA and NNNN formats, where A is an upper case letter and N is a number. When entering a postal code using the old NNNN format, a warning message is displayed to notify users that using this old postal code format might impact statutory reporting or filing.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information on address format and validation, go to My Oracle Support for the following document:

- Oracle Fusion HCM: HCM Address Validation (Document ID 2140848.1)

Human Capital Management for Australia

Oracle Fusion HRMS (Australia) supports country specific features and functions for Australia. It enables users to follow Australia’s business practices and comply with its statutory requirements.

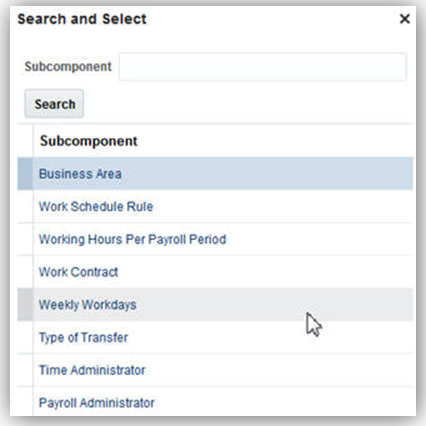

The Manage Australian Features flow enables users to activate or deactivate select features delivered for Australia. Features that can be activated or deactivated through this flow are defined by Oracle.

Starting Release 12.1, users who wish to use Workplace Gender Profile Reporting can use the Manage Australian Features flow to activate the Workplace Gender Profile Information Capture feature.

NOTE: Users who have already activated the Workplace Gender Profile Information Capture feature and are currently using it do not have any additional tasks to perform.

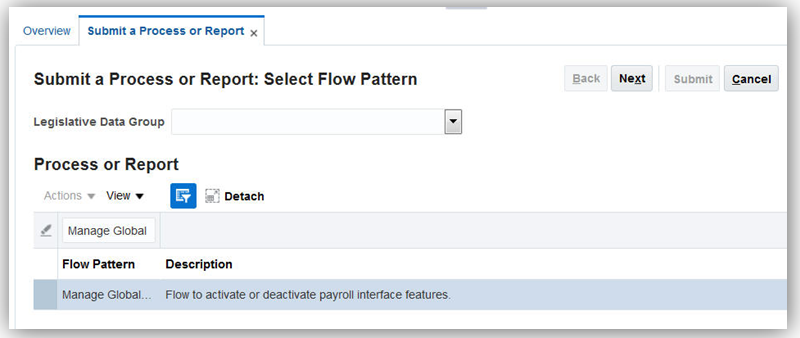

The Manage Australian Features flow can be accessed as follows:

- Navigate to the Payroll Checklist work area.

- Click on the Submit a Process or Report task.

- Select an Australian legislative data group. The Manage Australian Features flow is displayed under flow patterns.

- Select the flow and click Next.

- In the parameters section, provide the following details:

- Payroll Flow: A unique name that can be used to track this submission

- Australian Feature: Workplace Gender Profile Information Capture

- Activate Usage: Yes

- Click Submit. The run results are displayed on successful completion of the process flow.

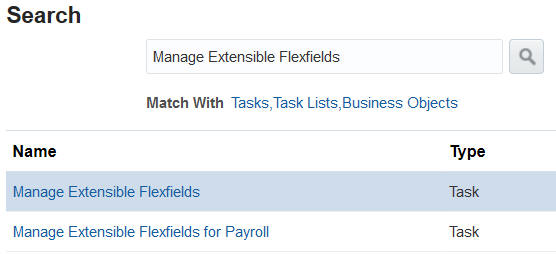

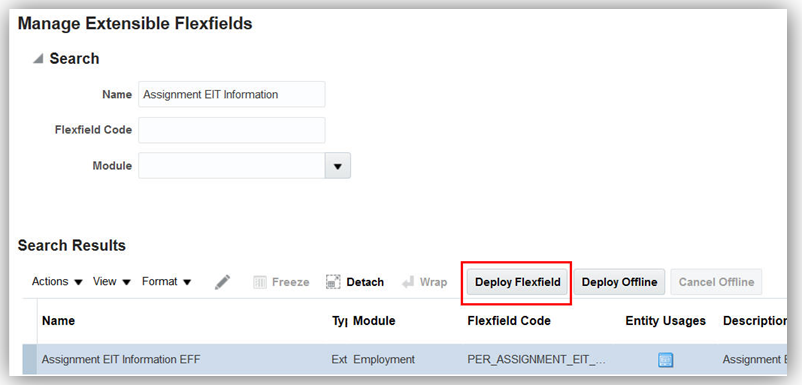

- Deploy the extensible flexfield Assignment EIT Information EFF. For more information, see the Key Resources section.

Navigation

Payroll Flows and Patterns

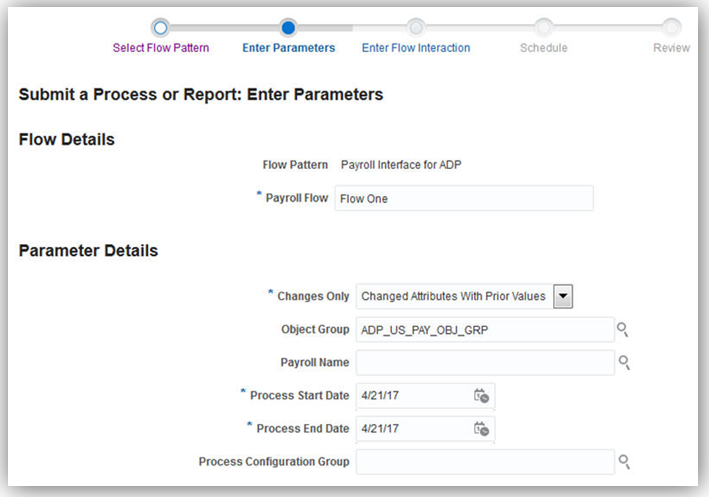

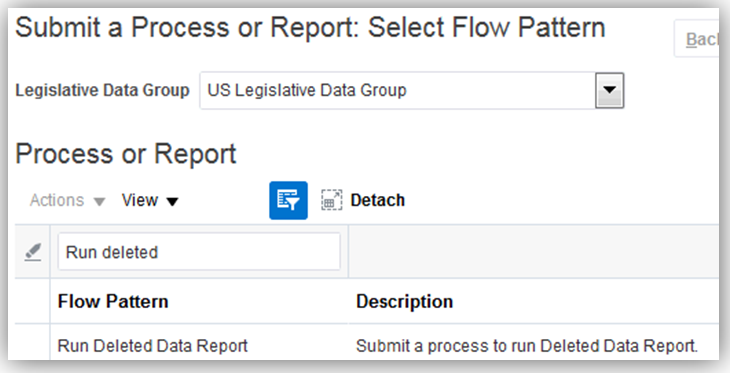

Submit a Process or Report: Select Flow Pattern Page

Submit a Process or Report: Enter Parameters Page

Run Results Page

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information on extensible flexfields and how to deploy them, go to Applications Help for the following topics:

- Extensible Flexfields: Explained

- Planning Extensible Flexfields: Points to Consider

- Managing Extensible Flexfields: Points to Consider

- Deploying Flexfields Prerequisites: Explained

- Deploying Flexfields: Explained

Identification of Working Holiday Makers

The Working Holiday Maker program enables young adults between 18 and 30 years of age from eligible partner countries to work in Australia during an extended holiday. The person must have the appropriate visa to enroll in this program.

To identify participants who have enrolled in this program, a new checkbox has been introduced under Basis of Payment in the Tax File Number Declaration group on the Manage Calculation Cards: Statutory Deductions page.

Working Holiday Maker on the Manage Calculation Cards: Statutory Deductions Page

Steps to Enable

There are no steps necessary to enable this feature.

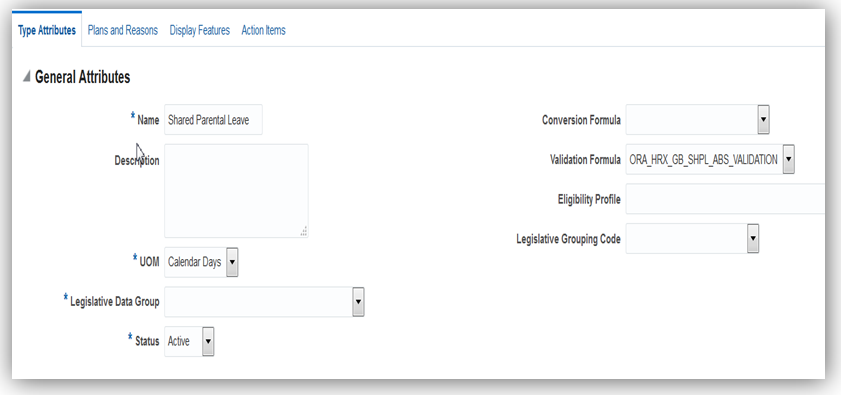

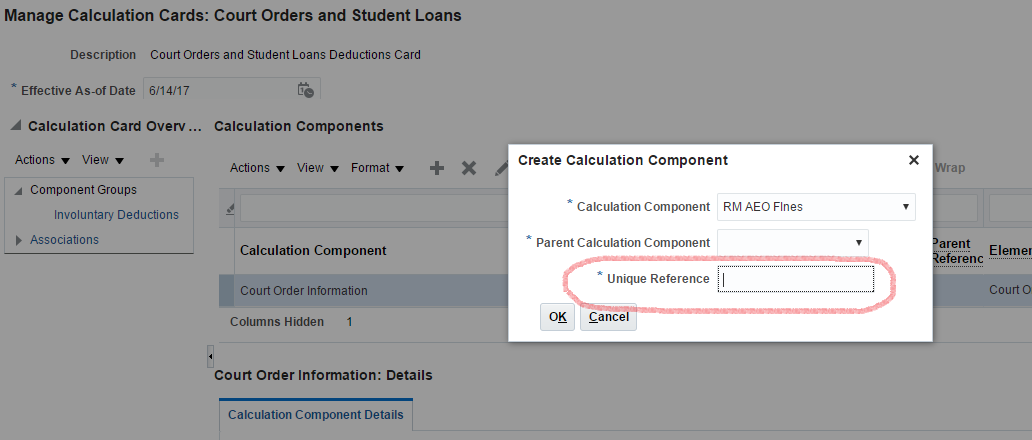

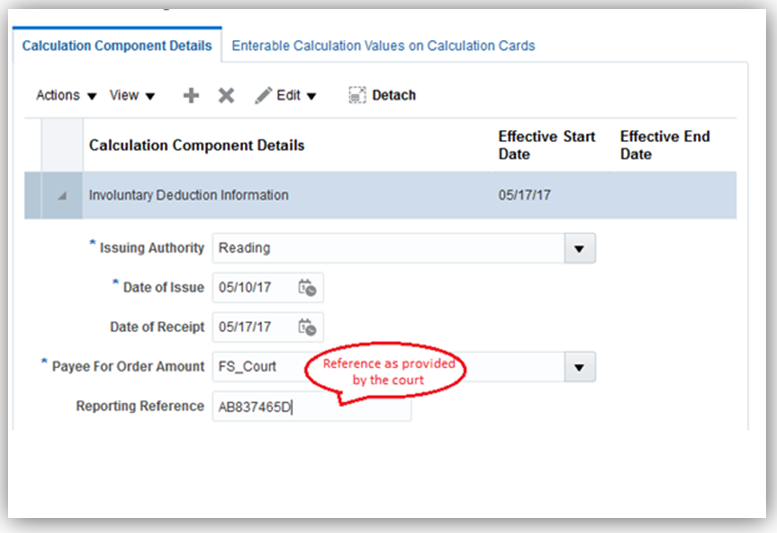

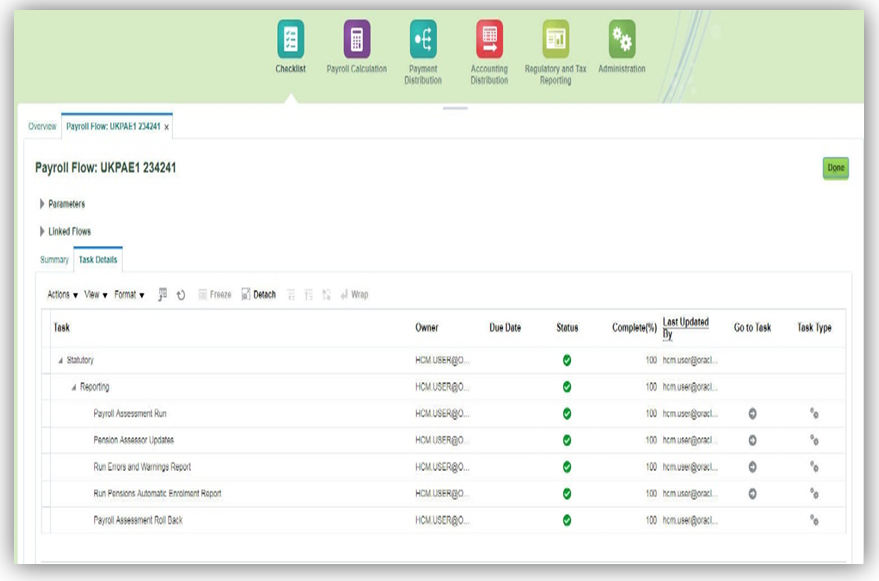

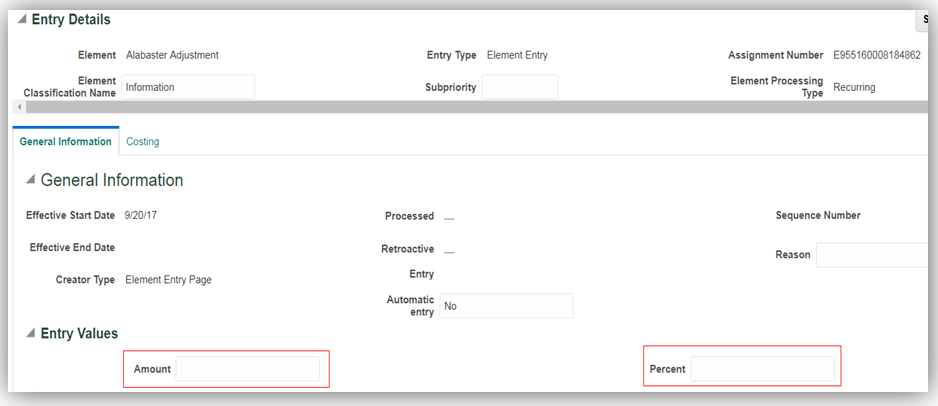

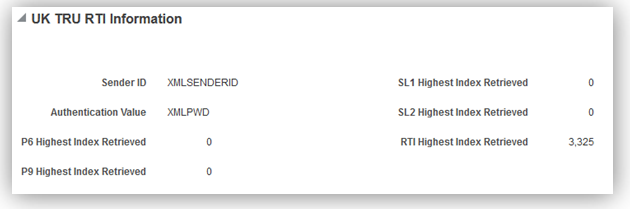

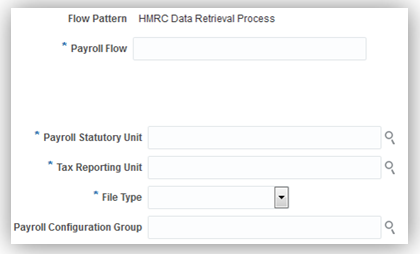

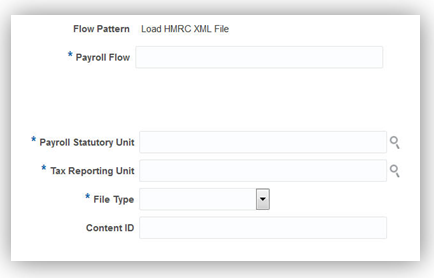

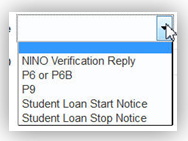

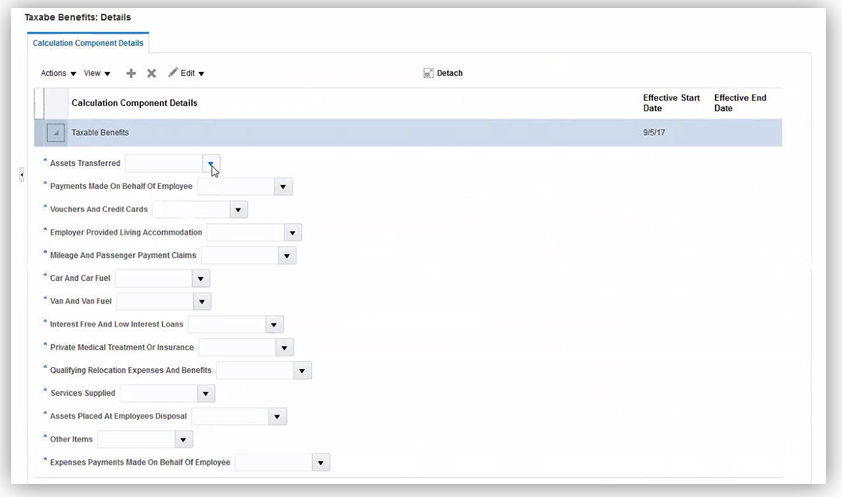

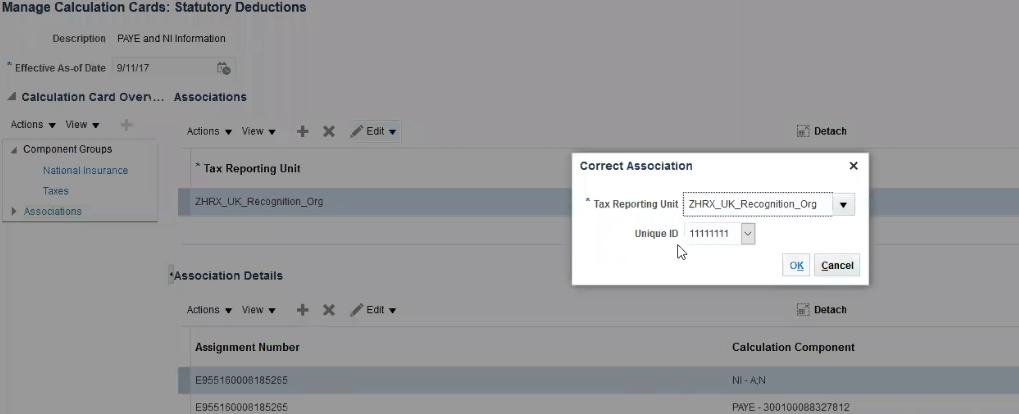

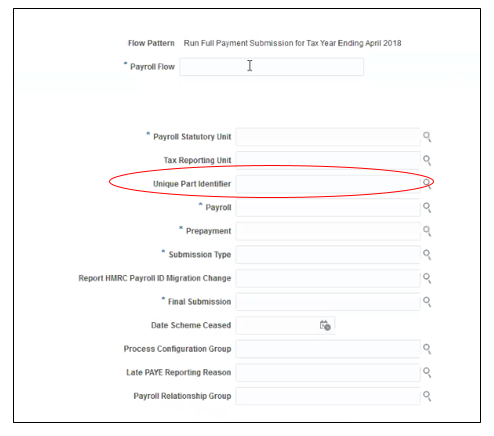

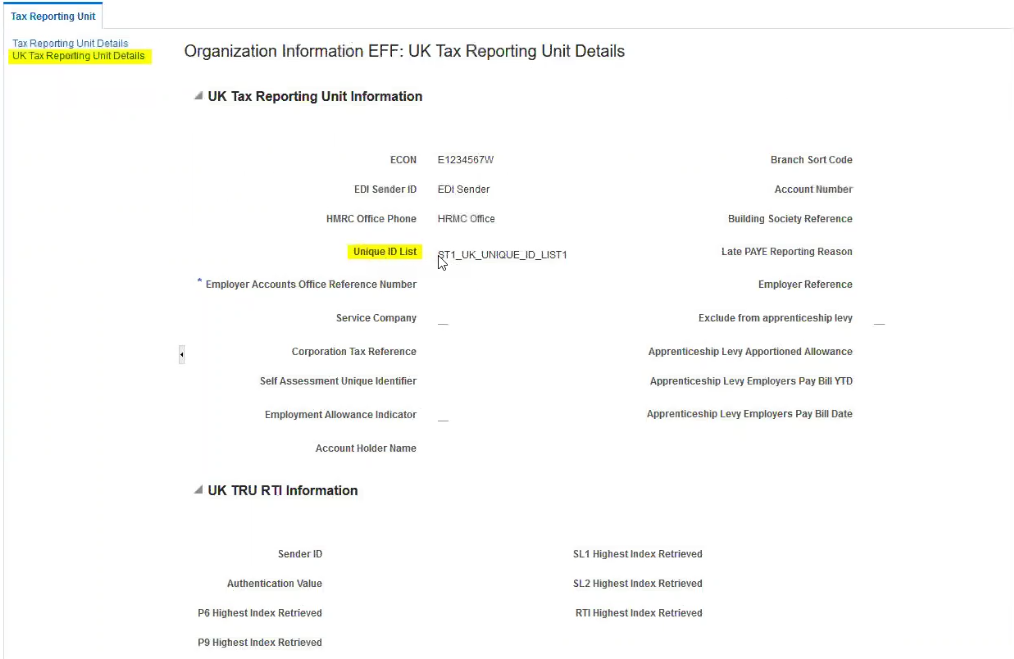

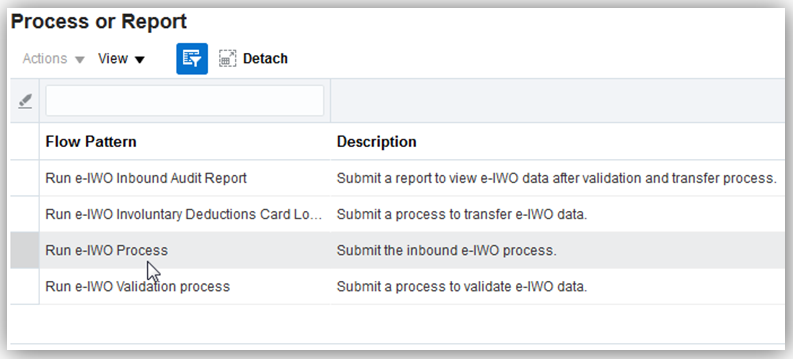

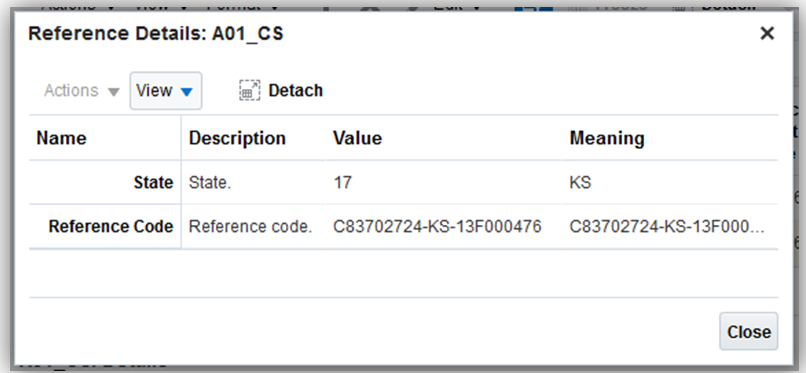

Identification of Trade Support Loan Participation Separately From Higher Education Loan Program