This document will continue to evolve as existing sections change and new information is added. All updates are logged below, with the most recent updates at the top.

The new functionality referenced in this document may not be immediately available to you if your organization has chosen not to receive optional monthly updates. Rest assured you will receive the new functionality in the next quarterly update which is required and cumulative. Quarterly updates are applied in February, May, August, and November. As a one-off exception the February 2017 Quarterly update will be applied in March 2017.

.

| Date |

Feature |

Notes |

|---|---|---|

| The following features were included in the May Quarterly update. |

||

| 27 APR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: P11D- Employee Benefits and Expenses Reporting |

Delivered new feature in update 17, the May quarterly update. |

| 27 APR 2018 |

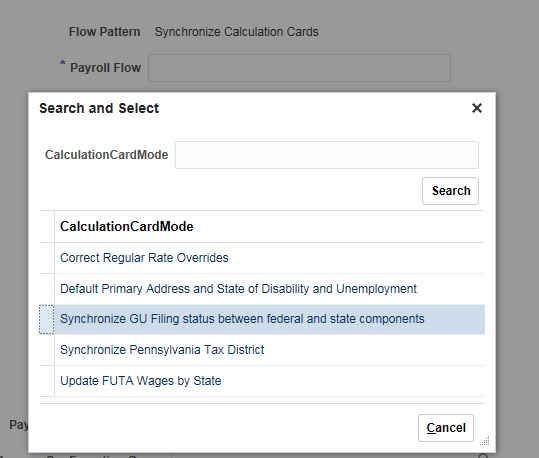

Oracle Fusion Global Human Resources for the United States: Tax Withholding Card Enhancement for Guam |

Delivered new feature in update 17, the May quarterly update. |

| 27 APR 2018 |

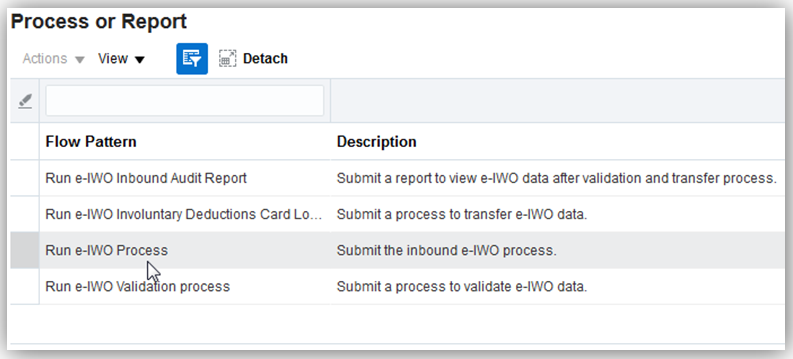

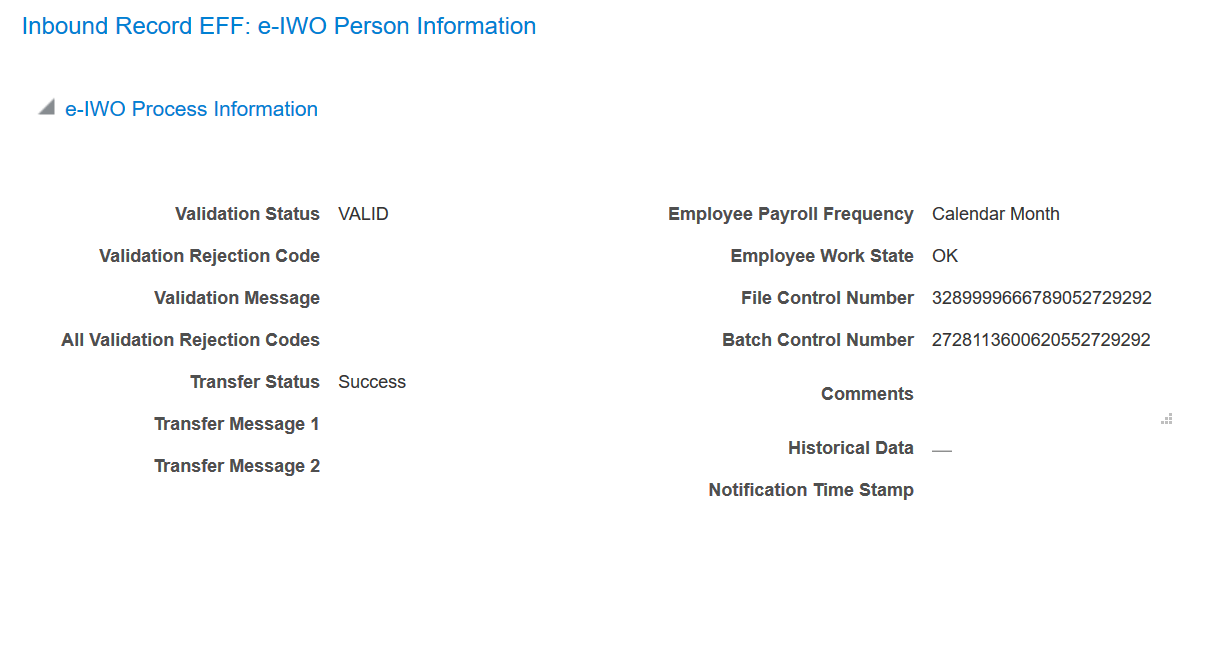

Oracle Fusion Global Human Resources for the United States: e-IWO Inbound Process Enhancement |

Delivered new feature in update 17, the May quarterly update. |

| 30 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Gender Pay Gap Reporting |

Delivered new feature in update 16 (April), which will also be included in the May quarterly update. |

| 30 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Scottish Income Tax Rates and Bands |

Delivered new feature in update 16 (April), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Benefits for the United States: e-IWO Audit Report Enhancement |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Legislative Updates |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Support for XML Format Submission for all RTI Outgoing Files |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| 02 MAR 2018 |

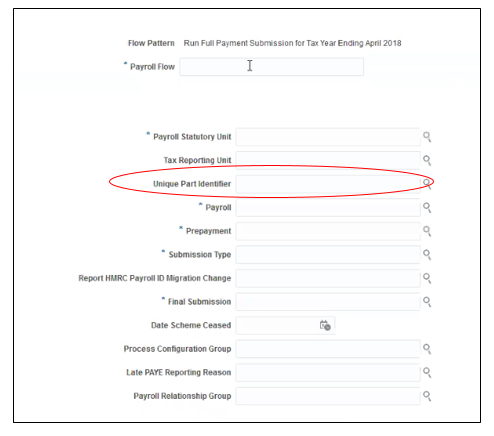

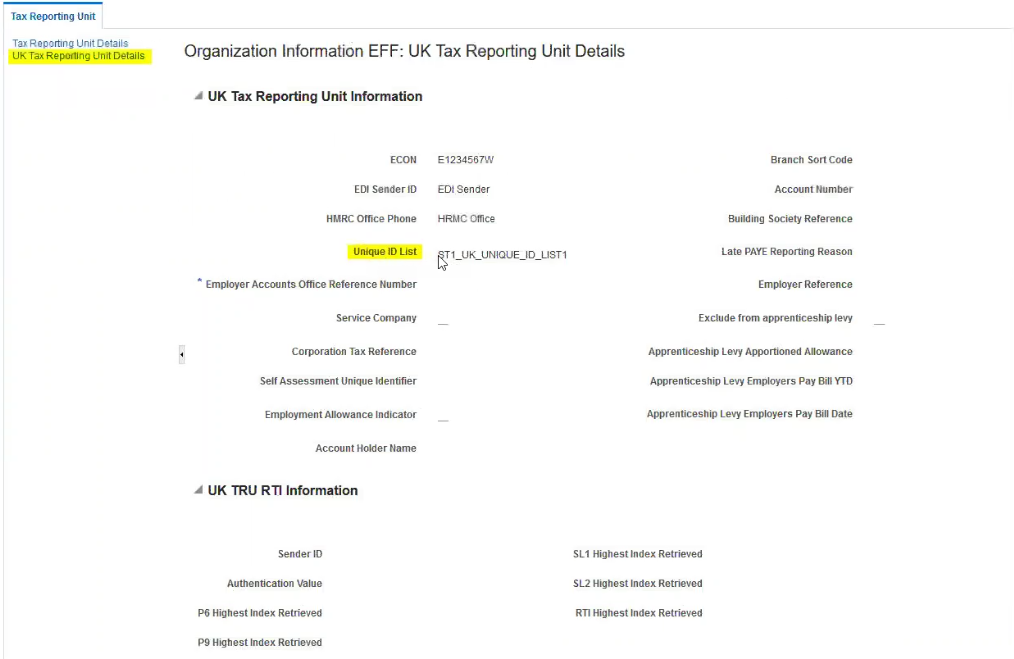

Oracle Fusion Global Human Resources for the United Kingdom: Full Payment Submission (FPS) Breakdown to Smaller Files |

Delivered new feature in update 15 (March), which will also be included in the May quarterly update. |

| The following features were included in the February Quarterly update. |

||

| 02 FEB 2018 |

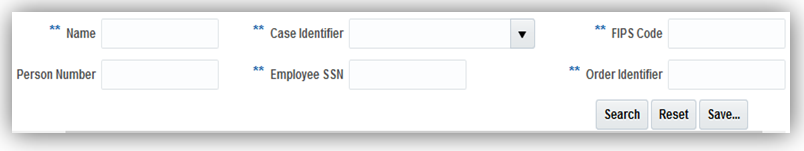

Oracle Fusion Benefits for the United States: e-IWO Enhanced Search Capabilities |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: Third-Party Periodic Tax Filing Extract Inclusion of Payroll Frequency |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

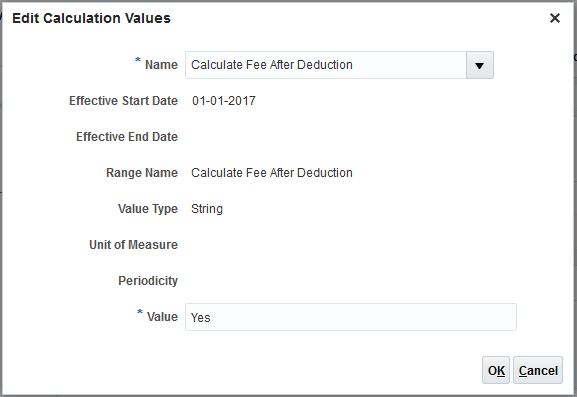

Oracle Fusion Benefits for the United States: Involuntary Deduction Fee Priority |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Legislative Updates for Tax Year 2018-19 |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: XML Format for RTI Outgoing Files |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Benefits in Kind – Car and Car Fuel Rates for Tax Year 2018-19 |

Delivered new feature in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for Canada: Reporting Mode: Draft and Final Mode for End-of-Year Reports Process |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 02 FEB 2018 |

Oracle Fusion Benefits for the United States: Involuntary Deduction Disposable Income Recalculation |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 05 JAN 2018 |

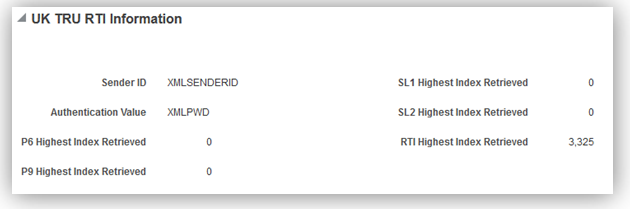

Oracle Fusion Global Human Resources for the United Kingdom: XML Message Retrieval Support from HMRC Data Provisioning System |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Global Human Resources for the United Kingdom: Processing Benefits in Kind Through Payroll |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Global Payroll: New Configuration Options for Personal Payment Method Page |

Delivered new feature in update 13 (January), which will also be included in the February quarterly update. |

| 05 JAN 2018 |

Oracle Fusion Benefits for the United States: Affordable Care Act Override Upload (United States Customers only) |

Delivered new feature in update 1 (February 2017). |

| 08 DEC 2017 |

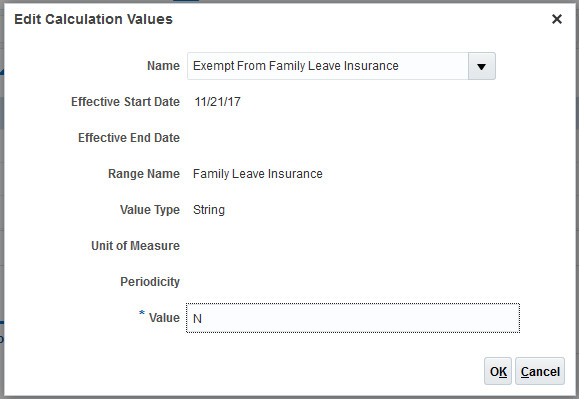

Oracle Fusion Human Capital Management for the United States: New York Family Leave Insurance Support |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Guam Support |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

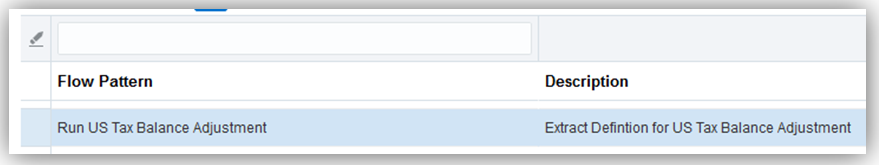

Oracle Fusion Human Capital Management for the United States: Run US Tax Balance Adjustment Process |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

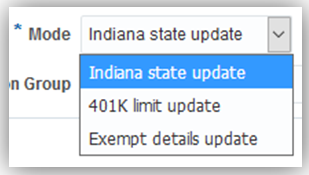

Oracle Fusion Human Capital Management for the United States: Enhanced Year-Begin Process |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Enhanced Ohio School District Tax Calculation |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Human Capital Management for the United States: Puerto Rico Young Entrepreneurs Act |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 08 DEC 2017 |

Oracle Fusion Global Human Resources for Canada: Employee Active Payroll Balance Report |

Delivered new feature in the Statutory Update 12.2 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

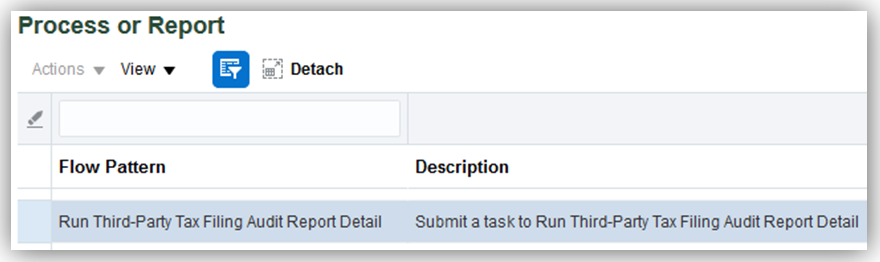

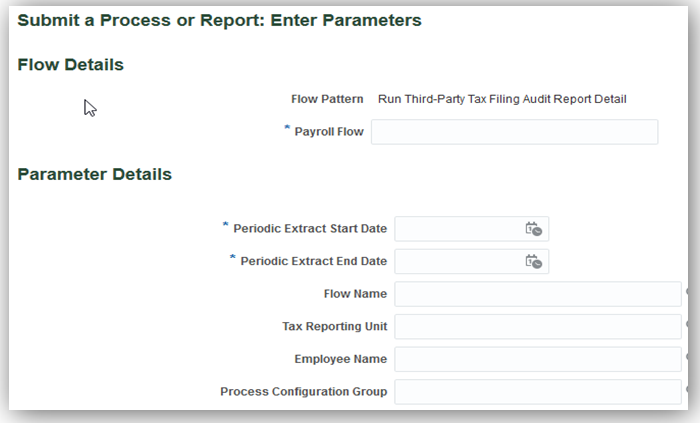

Oracle Fusion Global Human Resources for the United States: Third-Party Periodic Tax Filing Audit Report Detail Enhancements |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

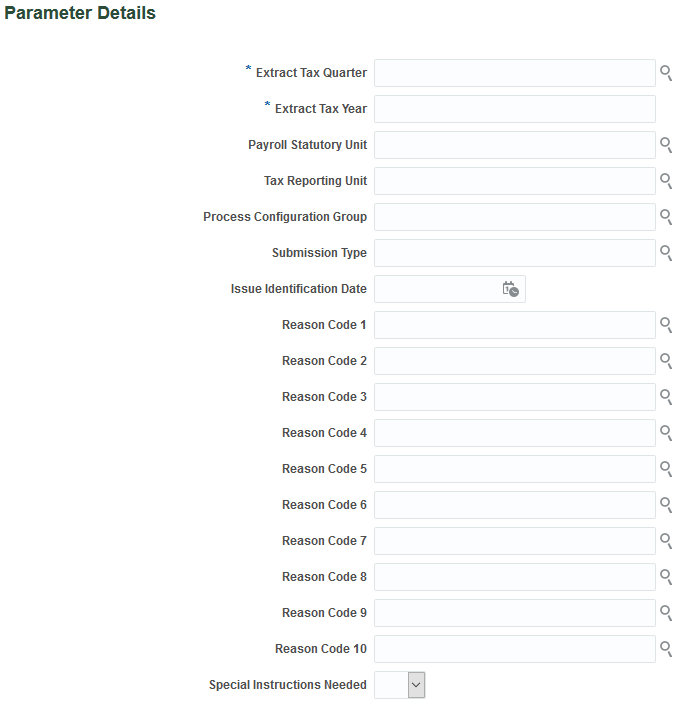

Oracle Fusion Global Human Resources for the United States: Third-Party Quarterly Tax Filing Extract Enhancement for Amended Quarter Filings |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Global Human Resources for the United States: Third-Party Quarterly Tax Filing Extract Vendor Enhancements for Fourth Quarter |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Global Human Resources for the United States: Employee Active Balance Report Enhancements to Include New Balances |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| 01 DEC 2017 |

Oracle Fusion Payroll Interface: Deleted Data Report |

Delivered new feature in update 12 (December), which will also be included in the February quarterly update. |

| The following features were included in the November Quarterly update. |

||

| 03 NOV 2017 |

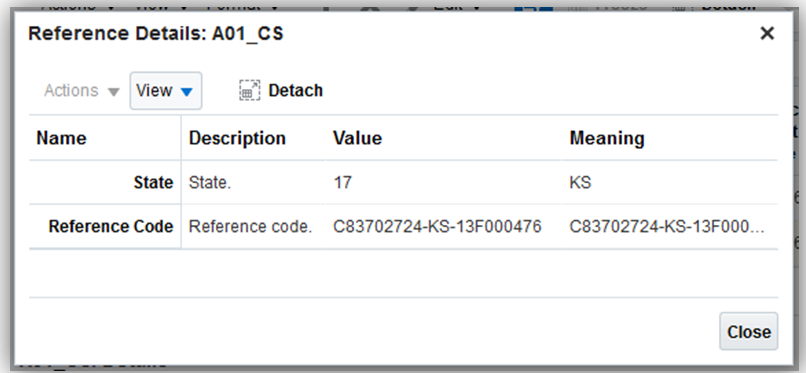

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders Reference Code Enhancement |

Delivered new feature in update 11, the November quarterly update. |

| 03 NOV 2017 |

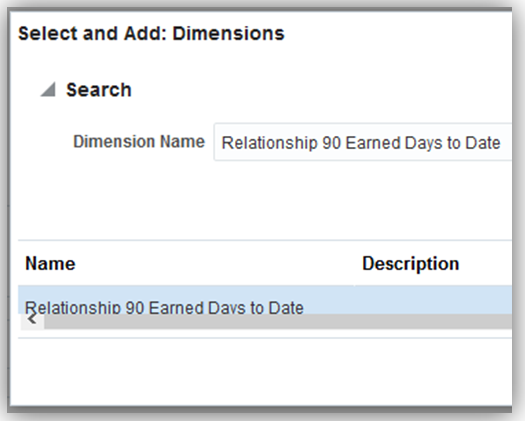

Oracle Fusion Global Human Resources for the United States: New Ninety Day Balance Dimension |

Delivered new feature in update 11, the November quarterly update. |

| 03 NOV 2017 |

Oracle Fusion Global Human Resources for the United States: Involuntary Deductions Processing Fee Enhancement |

Delivered new feature in update 7 (July), which was included in the August quarterly update. |

| 06 OCT 2017 |

Oracle HCM Cloud Global Payroll: Enable Reports to Process Following an Errored Task |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 06 OCT 2017 |

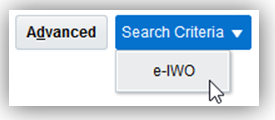

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders Inbound Process Enhancements |

Delivered new feature in update 10 (October), which will also be included in the November quarterly update. |

| 01 SEP 2017 |

Oracle Fusion Compensation Management: View Salary Components |

Document updated. Revised feature description. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Canada: Absence Elements: Discretionary and Final Disbursement Absence Payments |

Delivered new feature in the August quarterly update. |

| 04 AUG 2017 |

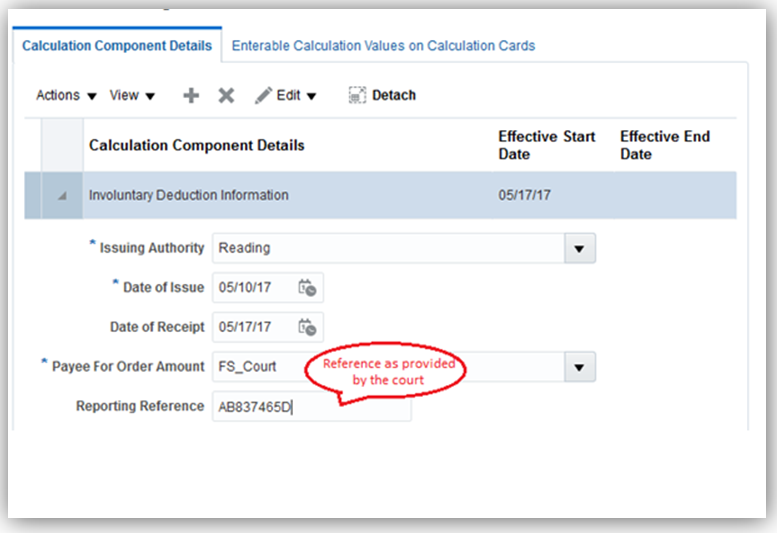

Oracle Fusion Global Human Resources for the United Kingdom: Court Orders – DEO Reference Number Output on BACS File |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Payroll Validation Report – Change to Excel Output |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Payroll Base Data |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Payroll Data Capture |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Automatic Calculation Card Creation |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Social Insurance Calculations |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Gratuity Calculations |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Involuntary Deduction Element Template |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 04 AUG 2017 |

Oracle Fusion Global Human Resources for Qatar: Statement of Earnings |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Compensation Management: Salary Range Differentials |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

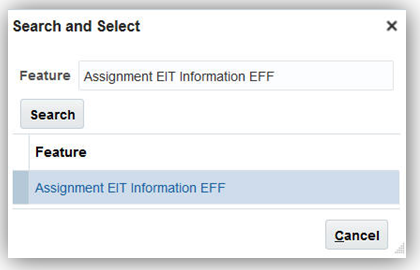

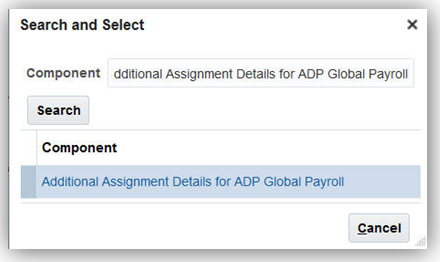

Oracle Fusion Global Payroll Interface: Integration with ADP Global Payroll |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United States: Involuntary Deductions Subprocessing Order Defaults |

Delivered new feature in update 7 (July), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

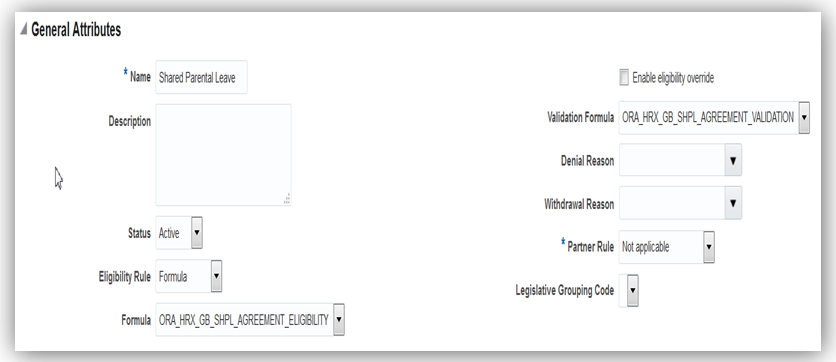

Oracle Fusion Global Human Resources for the United Kingdom: Test Mode for Start of Year and Tax Code Uplift Processes |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

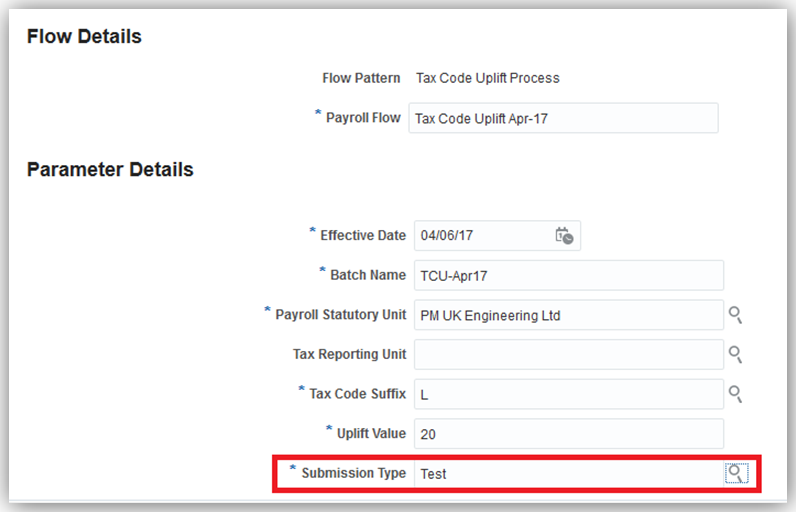

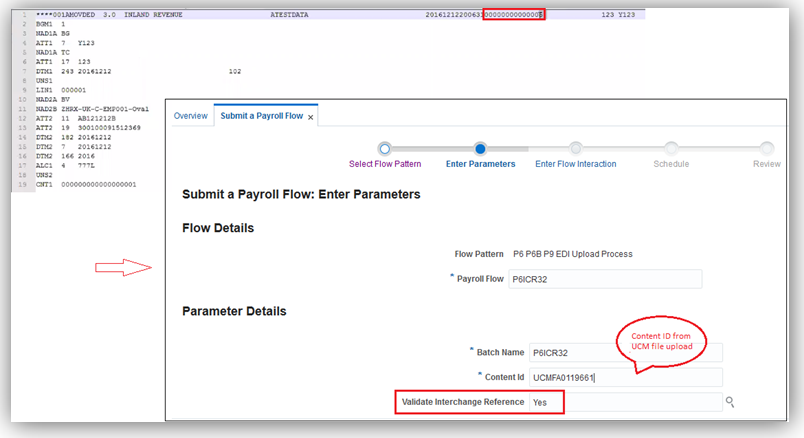

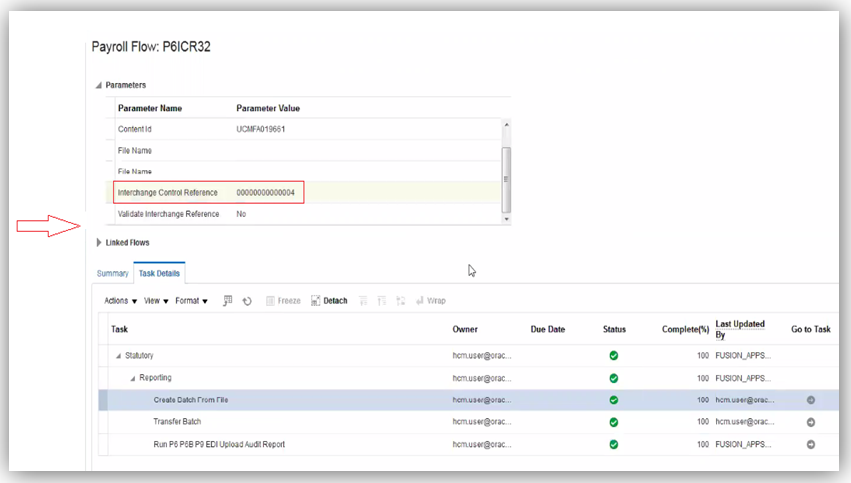

Oracle Fusion Global Human Resources for the United Kingdom: Interchange Reference Control Number for Incoming Messages |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

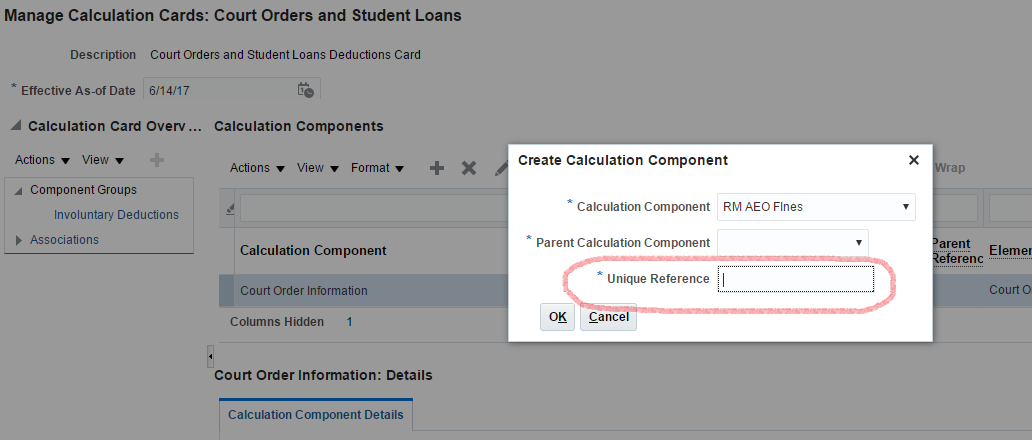

Oracle Fusion Global Human Resources for the United Kingdom: Unique Reporting Reference for New Court Orders |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Sick Pay for Employees Working Overnight Shifts |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 07 JUL 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Configure Average Weekly Earnings |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources for the United States: Enhanced Deductions At Time of Writ Support |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Global Human Resources for the United States: Enhanced Form 1494 Exemption Amount Derivation |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 02 JUN 2017 |

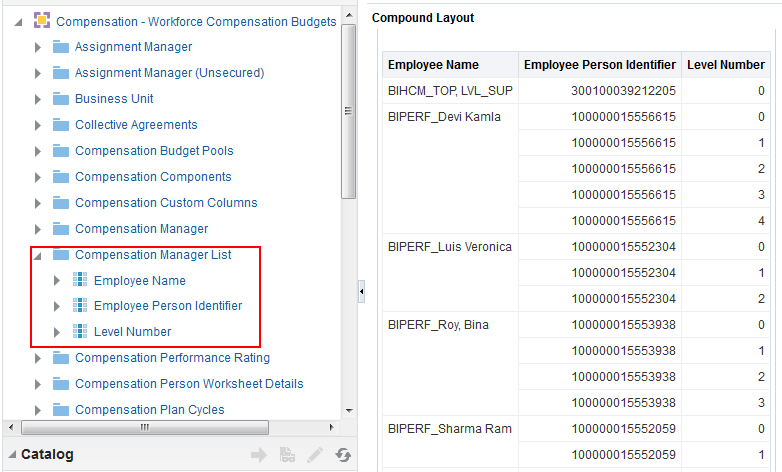

Oracle Fusion Transactional Business Intelligence: Compensation Manager List |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| 02 JUN 2017 |

Oracle Fusion Compensation Management: Manage Progression Grade Ladder Formula Selection Filter |

Delivered new feature in update 6 (June), which will also be included in the August quarterly update. |

| The following features are included in the May Quarterly update. |

||

| 02 JUN 2017 |

Oracle Fusion Global Payroll: Payroll Costing Report by Element Classification |

Delivered new feature in the May quarterly update. |

| The following features are included in the March Quarterly update. |

||

| 02 JUN 2017 |

Oracle Fusion Compensation Management: New Attributes and Performance Enhancements for Compensation OTBI |

Delivered new feature in the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Global Absence Element Uptake |

Delivered new feature in the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Involuntary Deductions: Enhanced Protected Pay Rules |

Delivered new feature in the March quarterly update. |

| 17 MAR 2017 |

Oracle Fusion Global Human Resources for Canada: Reporting Information Card |

Delivered new feature in the March quarterly update. |

| The following features were delivered via monthly updates. |

||

| 17 MAR 2017 |

Oracle Fusion Global Payroll: Manage BackFeed Data |

Document Updated. Revised feature description. |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United States: Electronic Income Withholding Orders (e-IWO) Inbound Process |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Sick Pay |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

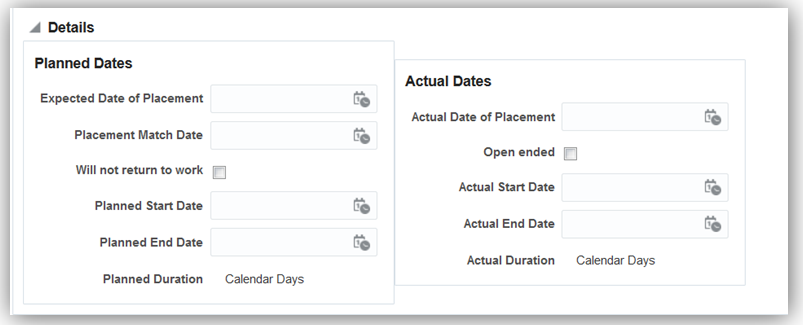

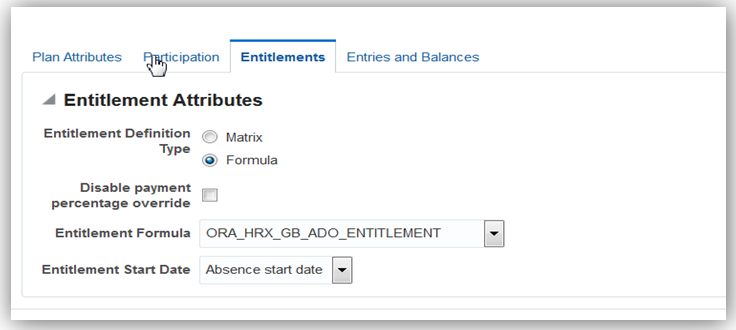

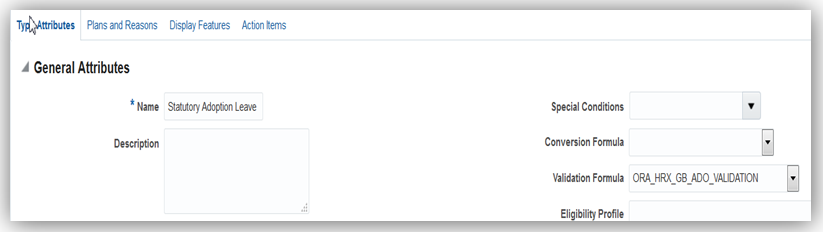

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Adoption Pay |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

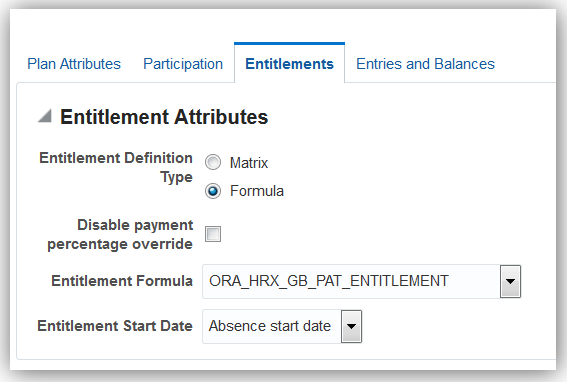

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Paternity Pay |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

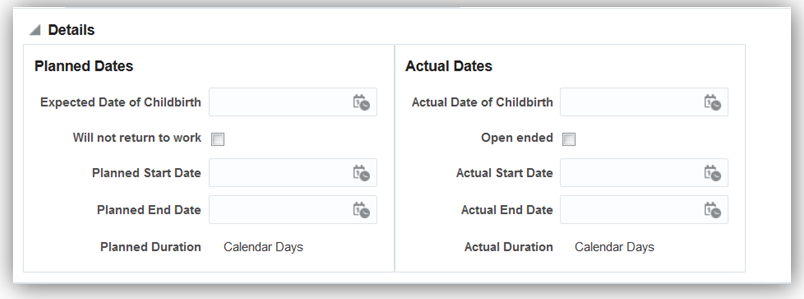

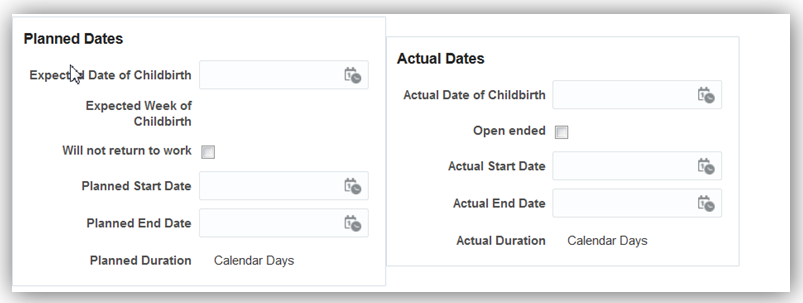

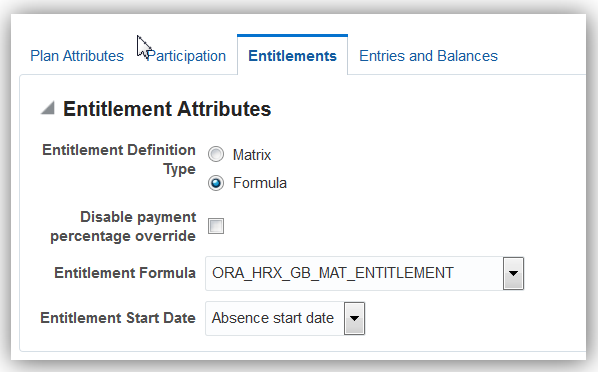

Oracle Fusion Global Human Resources for the United Kingdom: Statutory Maternity Pay |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

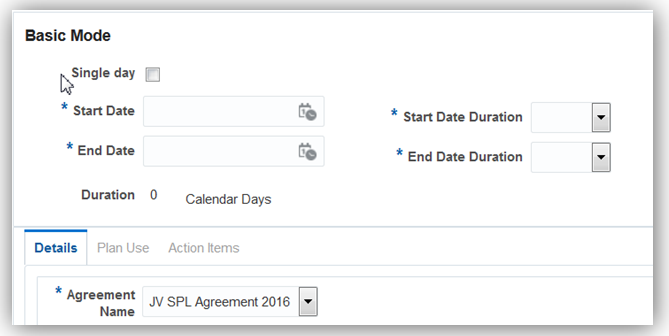

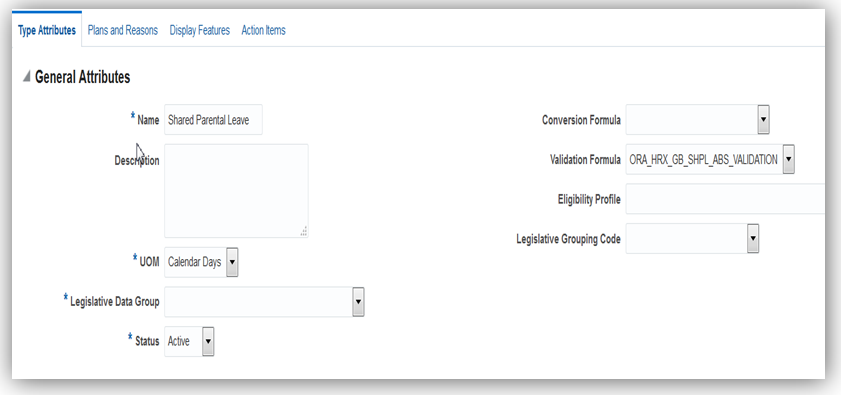

Oracle Fusion Global Human Resources for the United Kingdom: Shared Parental Leave |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 14 FEB 2017 |

Oracle Fusion Global Payroll: Manage BackFeed Data |

Delivered new feature in update 1 (February), which will also be included in the March quarterly update. |

| 17 JAN 2017 |

Created initial document |

|

This guide outlines the information you need to know about new or improved functionality in Oracle HCM Cloud Release 12. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools).

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented, you may want to see the new features for Global Human Resources that could impact your products).

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the Global HR Cloud What’s New for Release 12 in the body or title of the email.

Some of the new Release 12 features are automatically available to users after the upgrade and some require action from the user, the company administrator, or Oracle.

The table below offers a quick view of the actions required to enable each of the Release 12 features.

Compensation and Total Compensation Statement

Oracle Fusion Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

You can now view salary components from compensation history, when a worker’s salary basis is configured to use components to itemize the salary adjustment. Previously, it did not display components when a worker’s salary basis used components.

There are no steps necessary to enable this feature.

Route Individual Compensation Approvals Based on Salary

You can now use attributes of the worker’s salary record to route approvals for individual compensation awards. The compensation administrator or HCM application administrator role configures the approval rules.

There are no steps necessary to enable this feature.

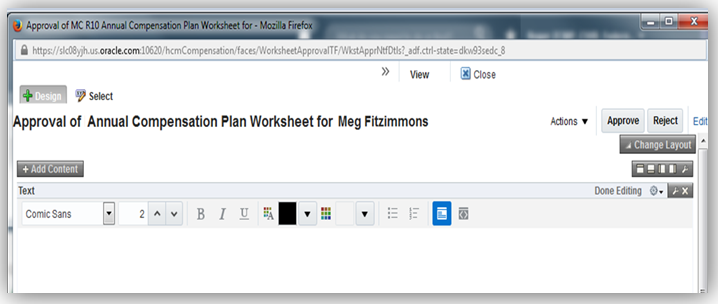

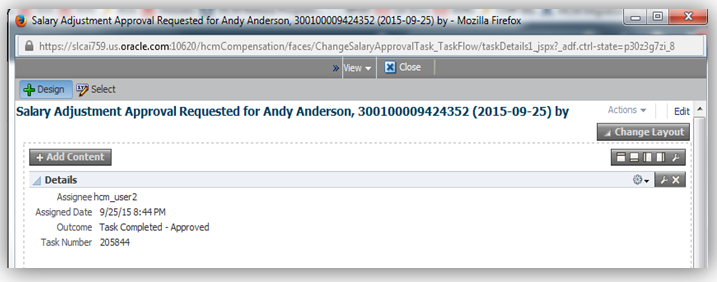

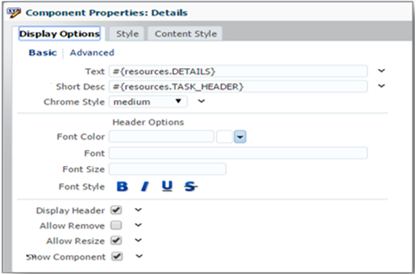

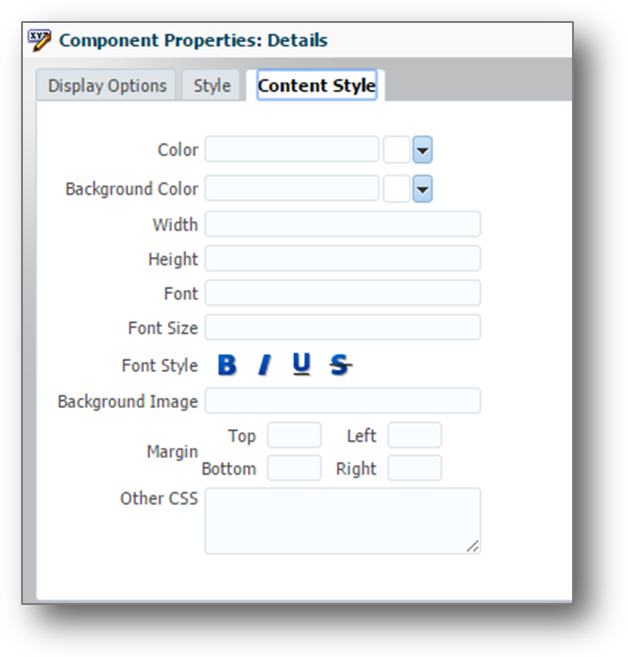

Workforce Compensation Notification Personalization

As a Human Resources (HR) or Compensation Administrator, you can now personalize workforce compensation notifications.

Personalizing Workforce Compensation Notifications

Using the Oracle Page Composer, you can selectively show and hide various components of the notification, including fields, labels, and regions.

Personalizing Salary and Compensation Approval Notifications

Using the Oracle Page Composer, you can selectively show and hide various components of the notification, including fields, labels and regions.

Edit Labels, Color, and the Page Layout

Custom Text and External Links to the Page

Steps To Enable

There are no steps necessary to enable this feature.

Manage Progression Grade Ladder Formula Selection Filter

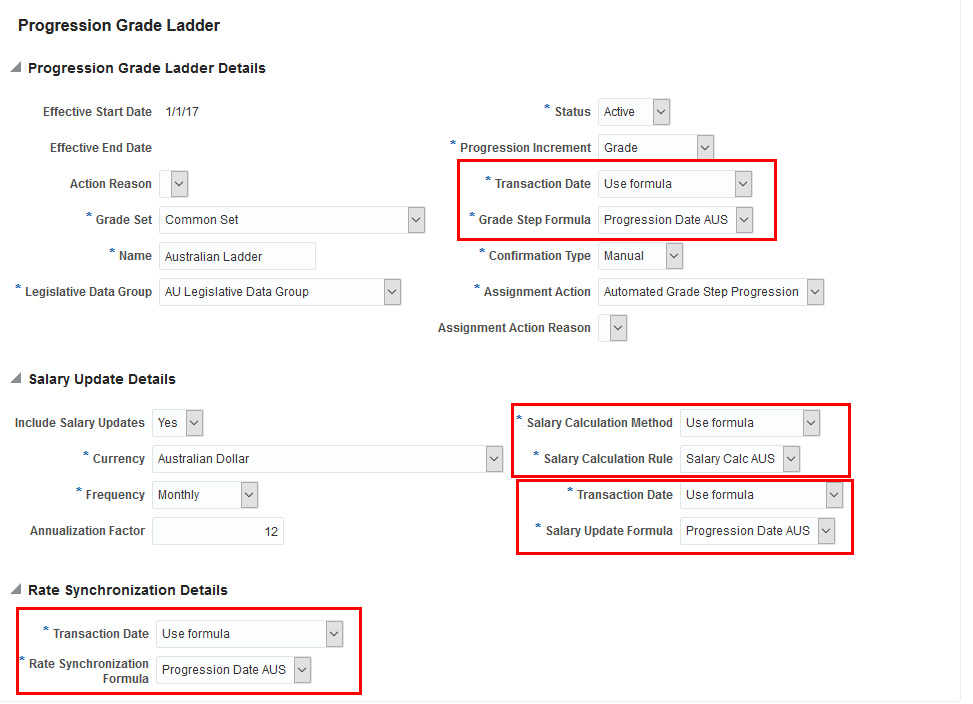

When you enter formulas on the Manage Progression Grade Ladders page, you can optionally define the transaction dates and the salary calculation method to use a formula. You are prompted to select the formula to use. The list of formulas is now filtered by formula type. The grade step formula, salary update formula and rate synchronization formula fields allow you to select from formulas with type Salary Progression Date Determination Rule. The salary calculation rule formula field allows you to select from formulas with type Salary Progression Rate Determination Rule.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

- When you define new formulas for use with progression grade ladders, make sure to choose the appropriate formula type.

- If you have any existing formulas in your progression grade ladder definitions, you must recreate them using the appropriate formula type.

Key Resources

For more information, go to Applications Help for the following topic:

- Progression Grade Ladders: Explained

Create salary rate differentials in the compensation work area. Configure the salary range differential profile by location and vary it over time using date effectivity.

Steps to Enable

There are no steps necessary to enable this feature.

Oracle Fusion Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with a ready to use intuitive guided enrollment process with contextual information and embedded analytics.

Benefits administrators can bill retirees, dependents or employees on unpaid leave of absence directly for benefit plan costs instead of charging through the payroll deduction process. They can:

- Prepare and generate charges in bulk or individually

- Record payments, including exact payments, under or over payments, or several payments against the same bill

- Record payment without a bill being previously generated

- Make manual adjustments

Prepare and Generate Charges Individually

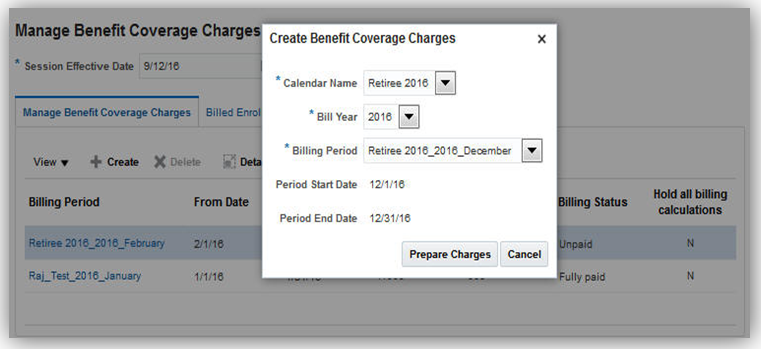

To prepare and generate charges for an individual, go to the Enrollment work area, enter the effective date and search for the person, and select them. The Benefits Service Center page appears. From the Tasks panel tab, select the Manage Benefit Coverage Charges task available in the Manage Billing section.

- Click Create. A window appears to enable you to select the billing year and the billing calendar for the charges. What you see depends upon your organization’s business practices, for example, they may have set up different calendars and schedules for several years.

- Select or retain the calendar and billing year to prepare the charges for your selected participant.

- Select the period from when to start generating the billing charges. For example, if you want to start billing from January, select January as the billing period. Charges and bills are generated until you stop billing for the participant.

- Click Prepare Charges and you receive a message that the bill has been prepared for the period, so click OK. The application prepares the charges for the plan type or plans and options the participant is enrolled in.

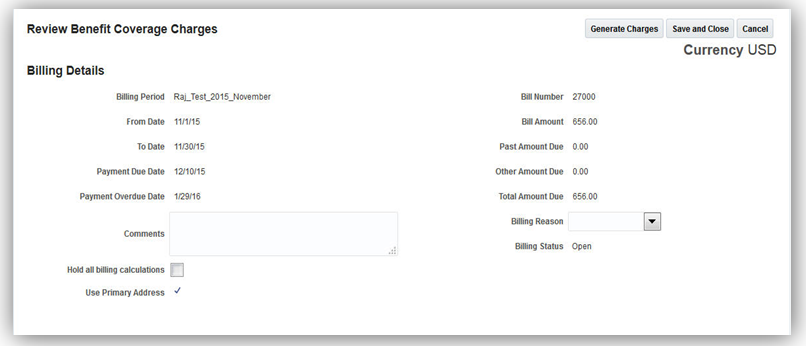

- Click the billing period link to open the Review Benefit Coverage Charges page, enabling you to check the detail and make any edits, if required.

- Make any edits required before generating the bill, such as changing the overall amount due or the amount due for a plan.

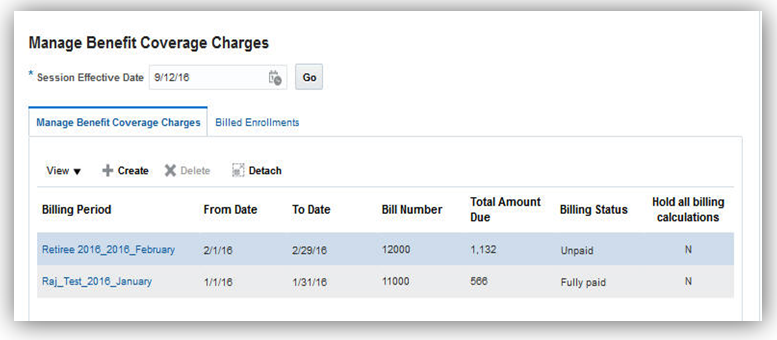

- Click Generate Charges when you are satisfied with the prepared charges, and you receive a message that bill generation is complete for that period, so click OK. You are returned to the Manage Benefit Coverage Charges page.

- The billing status changes from open to unpaid, and you can no longer make edits to this bill. Once the participant pays the bill, the status changes to Fully Paid.

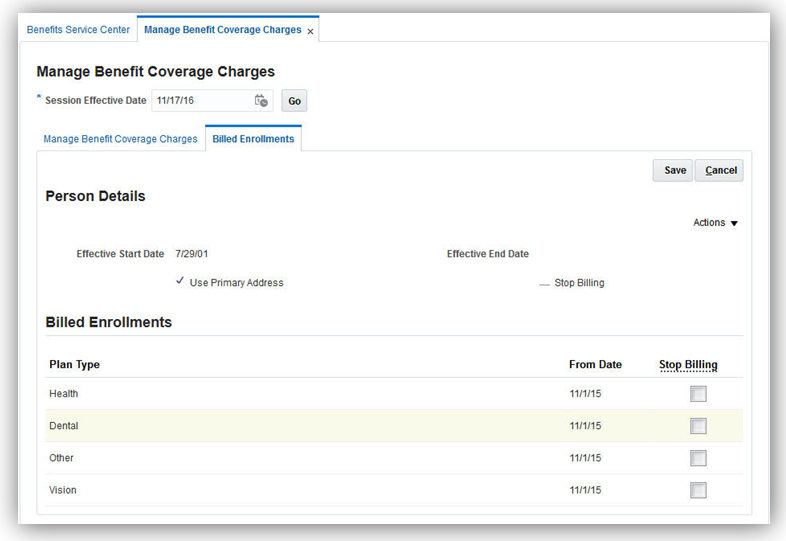

- Select the Billed Enrollments tab if you want to see the detail, or if you want to change the address the bill is sent to, or to stop the bill being sent.

- Select Update from the Actions menu to make any changes required such as to the billing address or to stop billing for an individual plan. For example, you might want to stop a plan being included in the bill, or stop the whole bill.

- The primary address is used to prepare the charges by default, but if you want to use an alternative address, deselect the Use primary address check box, and enter the alternative address in the address fields.

- If you want to exclude an individual plan from the bill, select the appropriate check box alongside the plan. If you don’t want to send the bill, check the Stop Billing check box under Person Details. (If you have only just generated the charges, however, it is unlikely you’ll want to take this action.)

- Save your changes.

Create Benefit Coverage Charges Window

You can see that the charges have been prepared as they appear in the Billing Period table. You can see the billing period the charge is prepared for, which is for January in the example, and you can also see the dates the billing period covers, the bill number, the total amount due, and that the billing status is open. While the status is open you can make edits to the charges right up to generating the charges. After that, you’ll no longer be able to edit the details.

The Link to the Review Benefit Coverage Charges Page

Review Benefit Coverage Charges Page, Billing Details Region

Review Benefit Coverage Charges Page, Coverage Region

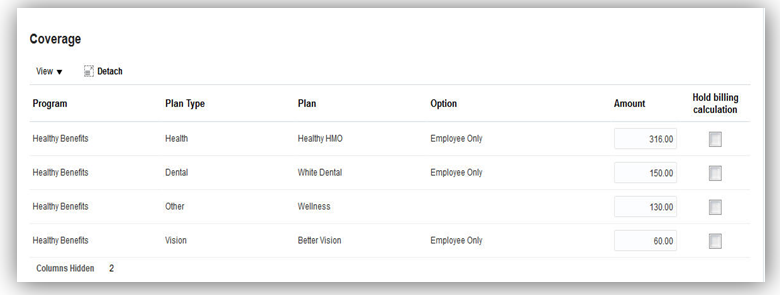

You can see the detail of the prepared charges in the Coverage region, including the prepared charges for the program, plan type or plans the participant is enrolled in and the option, such as Employee only, and the amount due for each row. For example, in the first row you can see the amount due for the plan and option is $316.00.

You can also see the total amounts included in the bill in the Billing Details region, along with the bill number. You can see the bill amount is $656.00 in our example. This is the current amount due which is the total of all the amounts due per plan: $316.00 for the Healthy HMO plan, Employee only, $150.00 for White Dental, Employee only, $130.00 Wellness and $60.00 for Better Vision, Employee Only. You can also see the past amounts due, such as any outstanding amounts from a previous bill, or any other amounts due – such as an amount owing from a legacy system. These bill amounts, past amount due and other amount are totaled and appear in Total Amount Due. In our example, as the only amounts to be billed are for the plans, the Bill Amount and the Total Amount Due are the same, which is $656.00.

Billed Enrollments Tab

Prepare and Generate Charges in Bulk

Before you run the processes, you need to add the participant to a benefits group.

To prepare and generate charges in bulk, go to the Evaluation and Reporting work area. From the Overview page, select the Processes tab, and select the Prepare Benefit Coverage Charge Data process from the Billing Processes section. Click Submit.

- Select the effective date.

- Select or retain the billing year and period.

- Select the benefits group. Alternatively, if you want to run the preparation process for one person, select the person’s name from the Person Name list.

- Click Submit. Once the job has completed successfully, you can view the details using the report.

- Select the effective date, billing year, billing period, and benefits group or person you selected in the previous parameters.

- Click Submit. Once the job has completed successfully, you can view the details using the report.

Select the Prepare Benefit Coverage Charge Data process from the Billing Processes section. Click Submit.

Irrespective of whether you prepared and generated the coverage charges individually through the user interface or created them in bulk using these processes, you can now send the bill to the participant.

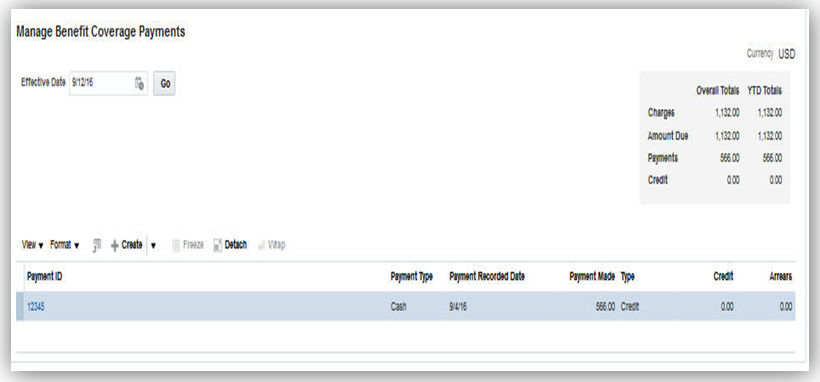

Once the participant sends the payment for their benefits coverage, you need to record the payment. You can record payment, and also drill down and view details of any previous payments the person has made in that calendar year. Select the Manage Benefit Coverage Payments task, available from the Enrollments work area.

The page displays the year-to-date total at the top of the page, including the year-to-date charges, payments made and the current amount due. If the participant phones up and wants to know further details, such as the total amount due or the balance they owe, you can see the detail at a glance and answer their queries.

Manage Benefit Coverage Charges Payments Page

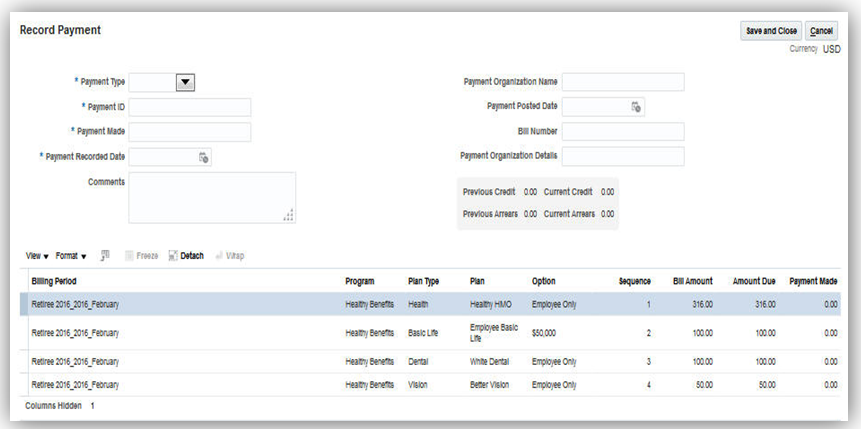

- Click Create to open the Record Payment page.

- Enter the basic payment details such as the type of payment received, for example a cheque/check or postal order and enter the number, such as the cheque or check number, in the Payment ID field.

- Enter the bill number, the date the payment is recorded, the payment organization details, such as the name of the bank and any comments, if required.

- Enter the amount paid and press TAB.

- Save and close. If the participant has sent several payments for the same bill, you can also record the next payment against the same bill number. If the participant has under- or over-paid, the application handles these different scenarios by subtracting or adding the under- or over-paid amounts to the next charges and bill generated.

Record Payments Page

The Bill Amount and Amount Due fields show what the participant owes for each plan type or plan and option. The Payment Made field is zero for each plan type or plan and option.

Once you tab out of the field, the application subtracts the payment made from the bill amounts and amounts due, and updates the payment made. The application settles the oldest bills first, and the highest cost option, which is most likely Medical, until it has allocated the payment made fully. You can see the sequence in which the application allocates the payment in the Sequence column.

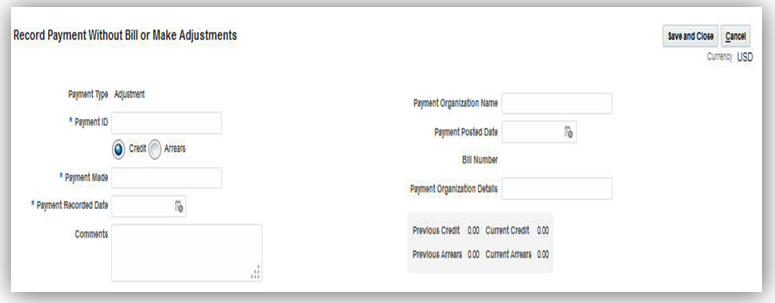

The participant can make payments without a bill being generated or sent. Select the Manage Benefit Coverage Payments task, available from Tasks panel tab in the Enrollments work area.

- To record payment without a bill, click Create and then the Record Payment Without Bill option.

- Enter the payment details such as the unique payment identification, the payment amount made, the date the payment is recorded, payment organization name and any comments.

- Ensure that you select the Credit option, if you want the amount to be credited to the person.

- Save your changes. The application subtracts the amount paid from the next bill when the charges are generated. If the person pays in full for that period, there will be no charge or bill generated. If the participant under or over pays, that amount will be added to or subtracted from the coverage charges and bill the next time.

This page is similar to the Record Payments page, but the programs, plan types, plan and options don’t display, because at this point in time, the participant’s charges or bill have not yet been generated.

Record Payments Without Bill or Make Manual Adjustments Page

You can also make any manual adjustments using this option too. For example, if the person is due a credit, or if you have entered a payment against the wrong person or entered an incorrect amount.

- To make an adjustment, click Create, then select the Record Payment Without Bill option.

- Enter the adjustment details such as the adjustment amount made, the date the adjustment is recorded and the organization name.

- Ensure that you select the Credit option if the amount is to be credited to the person, or select the Arrears option to increase the due amount. If the amount is to be deducted.

- Enter any comments to support the adjustment, especially for arrears, such as “Entered the amount against the wrong person so adjusting it out", or "Entered the wrong amount so changing to the correct amount".

- Save your changes.

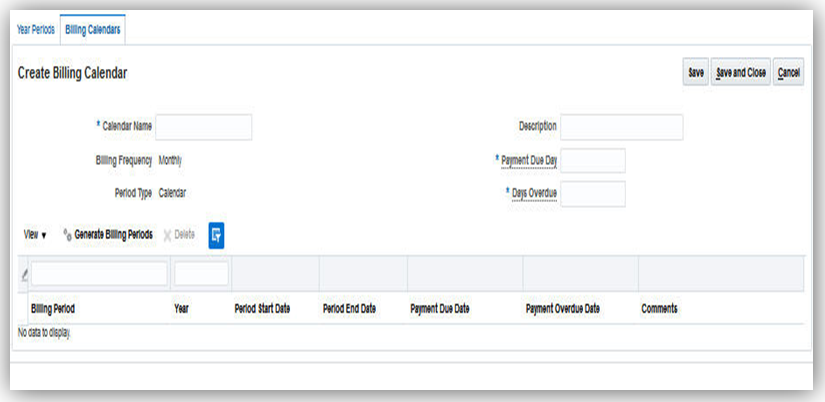

Steps to Enable

Before you can use the benefits billing, you need to set up at least one billing calendar to schedule when the charges are generated, and the day on which the payments are due and payments become overdue. Select the Manage Year Periods and Billing Calendars task, which used to be called Manage Year Periods, from the Setup and Maintenance work area or from the Plan Configuration work area. A new tab called Billing Calendars is now available.

- Select the Billing Calendars tab and click Create to open the Billing Calendars page.

- Enter the basic details, such as the calendar name and select Monthly as the billing frequency, as we only deliver monthly billing in this release.

- Enter the period type, such as Calendar for a calendar year, and enter a description of the billing calendar.

- Enter the number of days past the payment due date that qualify a payment as overdue, and also enter the number of days after the billing period begin date that the payment is due.

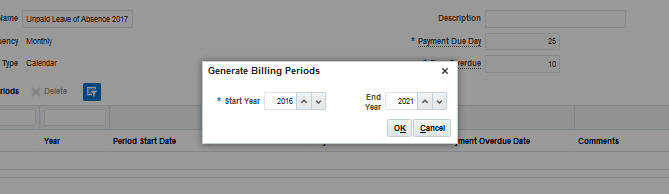

- Click Generate Billing Periods, and the Generate Billing Periods popup appears.

- Select the start and end year within which to generate the billing periods. For example, if you want to create billing periods for five years, you could select 2016 as the start year and 2021 as the end year. Select OK and the application creates and displays the generated billing periods.

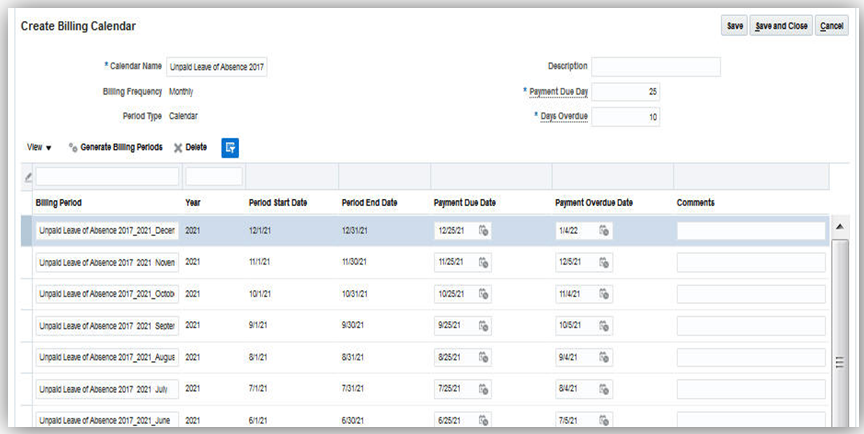

- Edit the billing period names, payment due or payment overdue dates, if required. You overtype the generated billing period name if you want to change it, or you select a different payment due date or overdue date from the calendar if you want to change one of those. For example, you might want to change the payment due date or overdue date for a specific billing period around public holidays.

- Click Save and Close. You can now use the calendars and billing periods to prepare and generate charges.

Create Billing Calendar Page

Generate Billing Periods Window

The right numbers of billing periods are generated and appear for the start and end years you previously selected. The billing period name is generated from the calendar name, appended by the billing period. For example, if you had a calendar name of ‘Any Company Retirees’ , then the billing periods would be named Any Company Retirees_2016_January, Any Company Retirees_2016_February, and so on. The periods start and end dates, payment due date and payment overdue dates are generated.

Create Billing Calendar Page

Role Information

If you are not using the predefined reference roles, then you need to ensure that the transaction analysis duty role that secures the new subject area is mapped to relevant job roles. This table identifies the required transaction analysis duty role and suggests target job and abstract roles. You can add the duty role to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Transaction Analysis Duty Role |

Job or Abstract Role |

| Benefits Enrollment Maintenance Duty ORA_BEN_BENEFITS_ENROLLMENT_MAINTENANCE_DUTY |

Employee, Benefits Administrator and Benefits Manager |

Improved Self-Service Benefits Pages

Participants can now use the improved self-service overview pages to perform these functions:

- Filter plans and options

- View additional information about each step during enrollment

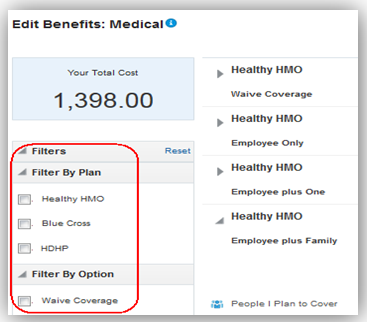

Participants can now filter the offerings, by plan and option, in each enrollment step to show only what's relevant to them and hide what isn't.

Plan and Option Filters in an Enrollment Step

Steps to Enable

To enable filters, administrators must perform the following steps:

- In the Plan Configuration work area, open the Configure Plan Type Grouping Display task.

- On the Self-Service Usage tab, select the Show Filters check box for a plan group to display filters for that group's offerings on the self-service pages.

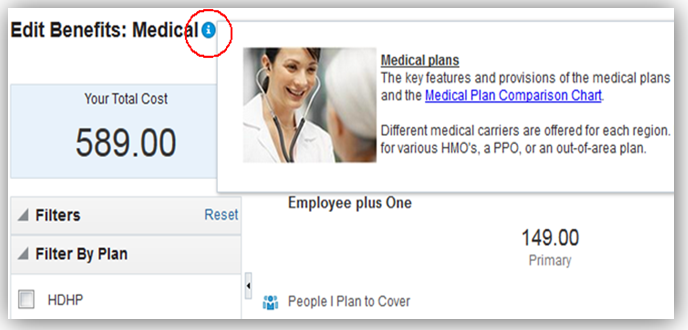

Additional Information About Each Enrollment Step

An information icon available in each train stop enables participants to learn more about the offerings before deciding to enroll. Administrators enter the information in the Plan Configuration work area.

Information Icon in an Enrollment Step

To enter information, administrators must perform the following steps:

- In the Plan Configuration work area, open the Configure Plan Type Grouping Display task.

- On the Self-Service Usage tab, select the plan group.

- In the Self Service Description Text section, enter the information for the selected plan group.

Benefits for the United States

Affordable Care Act Override Upload (United States Customers only)

You generate your 1095-C report for employees once a year in the United States, at the end of the year, but if you implemented Benefits midyear some of the data required for reporting might not be available in the Benefits application. That’s because some of it might still exist in the legacy application. That means that your report might be inaccurate and not show what was offered for a proportion of a year. We now deliver a spreadsheet that enables you to add any missing benefits that you provided in your previous legacy application, and override any incorrect values so you can generate your 1095-C report.

To override or add missing values required in the 1095-C report, go to the Evaluation and Reporting work area, and select the Person Data Loaders tab. A new task called ACA Override Report is available. This task launches a new spreadsheet for you to upload the missing or incorrect data.

- Enter the effective date, which is usually the last day in the year for which you are generating the report, such as 31st December.

- Enter the details for the people missing data, such as the person number, person name and so on. The ACA Report Line Number corresponds to lines in the ACA report that you want to override. For example, Line 14 is Offer of Coverage Line 15 is Employee share of lowest cost, and so on.

- Select the data pertaining to the missing years that you want to upload, and then enter the appropriate values in the months.

- Upload the spreadsheet to apply the changes.

If you need to delete the override, you launch the spreadsheet again, enter the details, such as the person number, person name, ACA report line number, and the year. Then select Yes and upload the spreadsheet.

Steps to Enable

There are no steps necessary to enable this feature.

Role Information

If you are not using the predefined reference roles, then you need to ensure that the transaction analysis duty role that secures the new subject area is mapped to relevant job roles. This table identifies the required transaction analysis duty role and suggests target job and abstract roles. You can add the duty role to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

|

Transaction Analysis Duty Role |

Job or Abstract Role |

| Manage ACA Upload (BEN_ACA_UPLOAD_PRIV), added to the Benefits Process and Report Administration Duty (ORA_BEN_BENEFITS_PROCESS_AND_REPORT_ADMINISTRATION_DUTY) |

Benefits Administrator and Benefits Manager |

Key Resources

For more information, go to Applications Help for the following topic:

- How do I override or add missing values in the 1095-C benefits report?

Oracle Fusion Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. Global Payroll operates consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Calculate Accrual Balances in a Payroll Flow

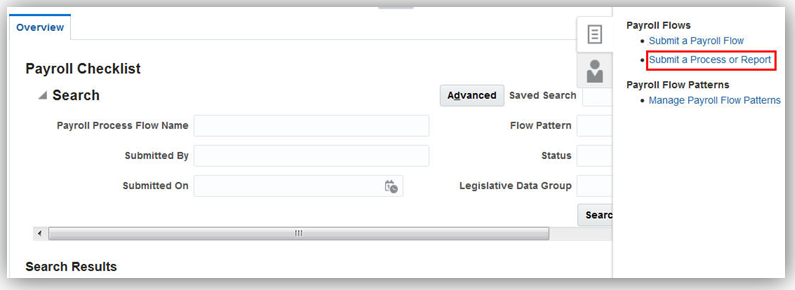

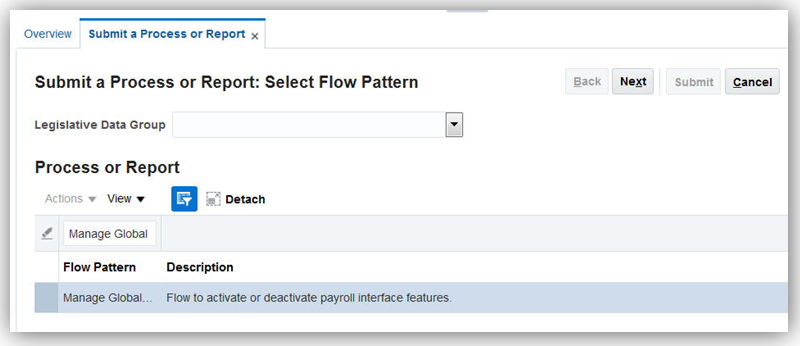

Simplify payroll preparation by submitting a process to calculate accrual balances for workers assigned to accrual plans. You can now submit the same task used by Oracle Fusion Absence Management, Calculate Accruals and Balances, from the Payroll Checklist or Payroll Calculation work areas. Incorporate this task in your standard payroll run by adding it to your flow pattern.

When you submit the process you complete the parameters shown in the following table.

| Submission Parameters |

Parameter Descriptions |

| Effective Date |

The only required field, the effective date identifies the accruals and balances to calculate for the accrual period. |

| Person |

Name of the worker whose accrual is calculated. |

| Business Unit |

Name of the business unit for the workers whose accrual is calculated. |

| Legal Employer |

Name of the legal employer of the workers whose accrual is calculated. |

| Person Selection Rule |

Name of the rule that limits processing to a specific group of workers. |

| Payroll |

Name of the payroll assigned to workers whose accrual is calculated. |

| Changes Since Last Run |

List of values include:

|

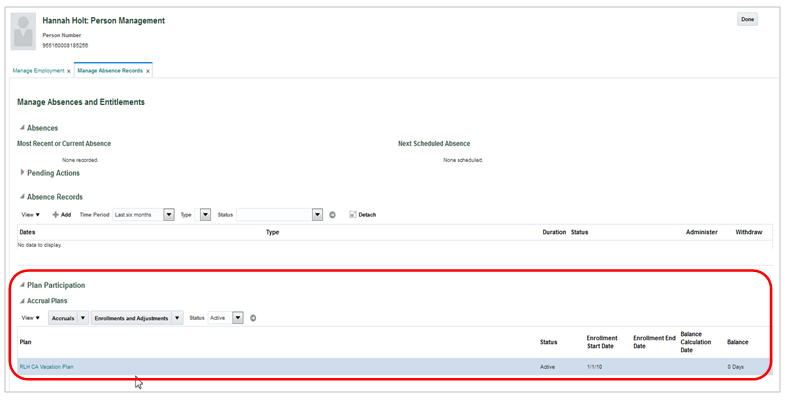

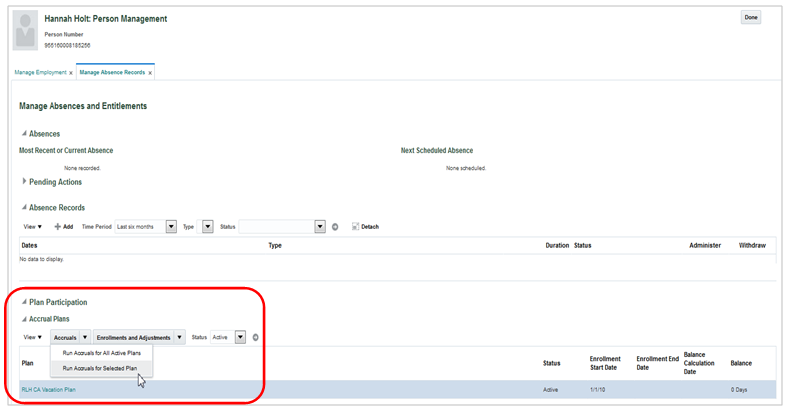

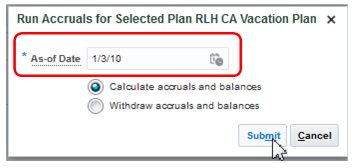

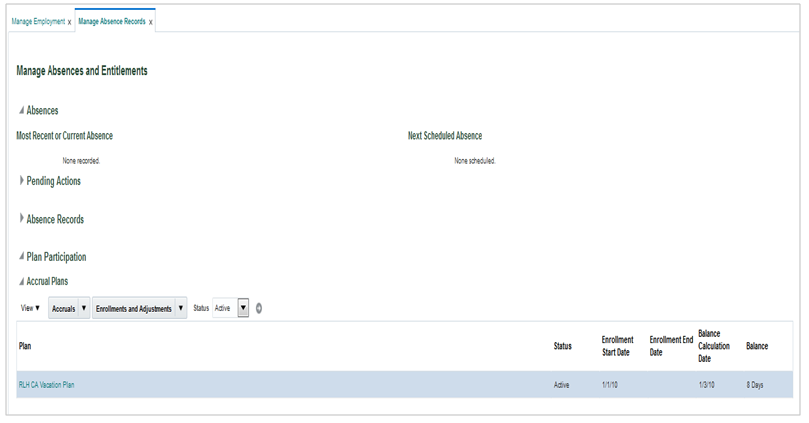

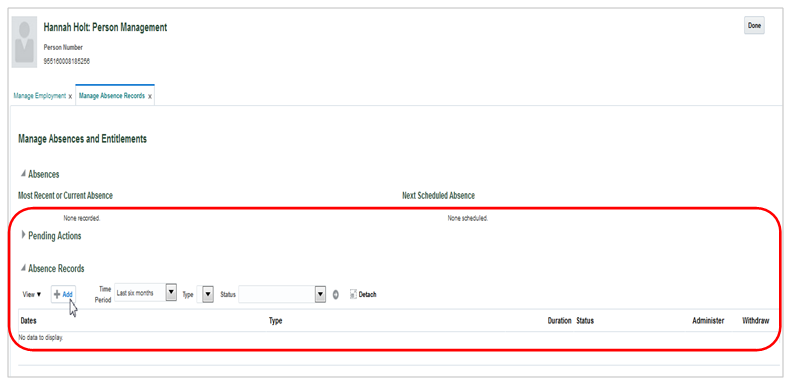

After the Calculate Accruals and Balances process completes, search for the person in the Person Management work area, and use the Manage Absence Records to verify the updated value.

To include the Calculate Accruals and Balances task to your standard payroll run, add it to your flow pattern, following the usual steps.

For more information about flow patterns, go to Applications Help for the following topic:

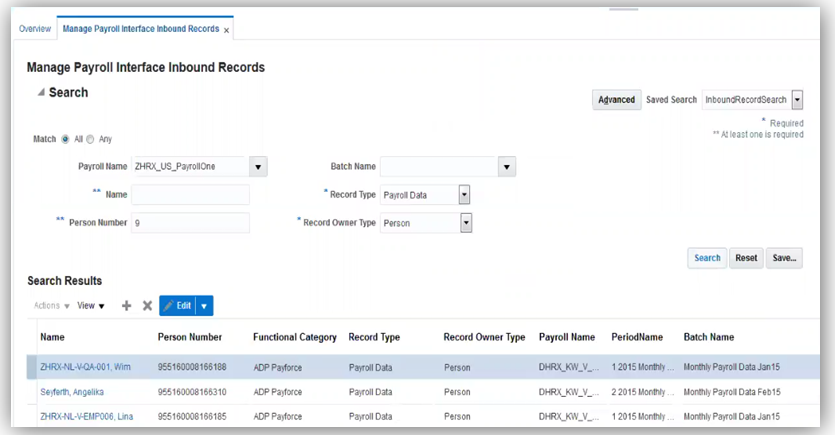

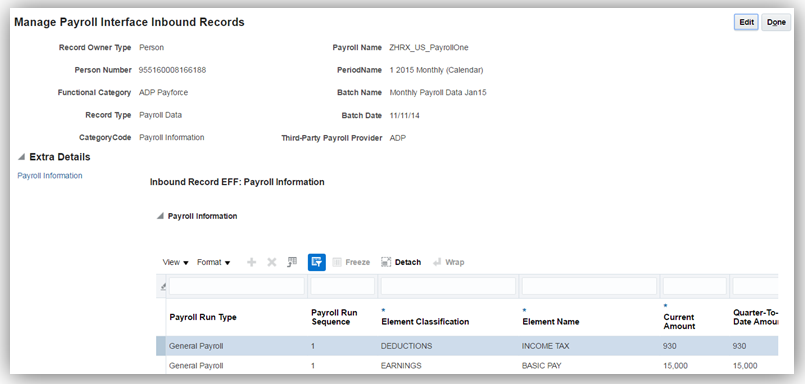

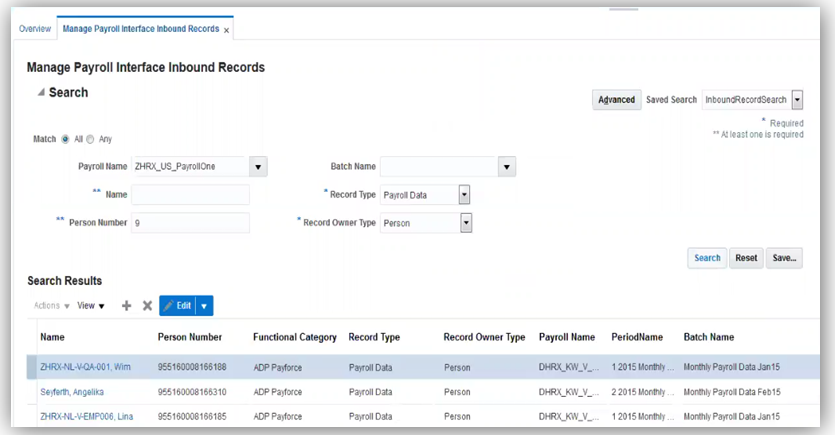

Use the Manage Payroll Interface Inbound Records task in the Payroll Administration work area to view, edit, and delete imported data including payslip data.

On the Manage Payroll Interface Inbound Records page:

- Filter imported data by using one or more of the following criteria:

- Payroll Name

- Batch Name

- Name

- Record Type

- Person Number

- Record Owner Type

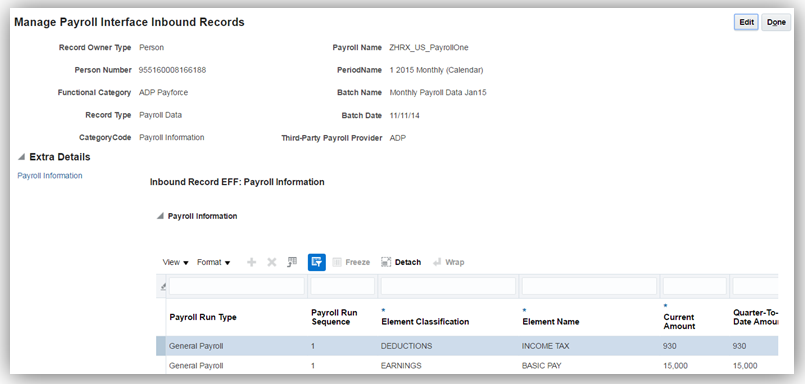

- Select Payroll Data in the Record Type field to view, add, edit, and delete the following information:

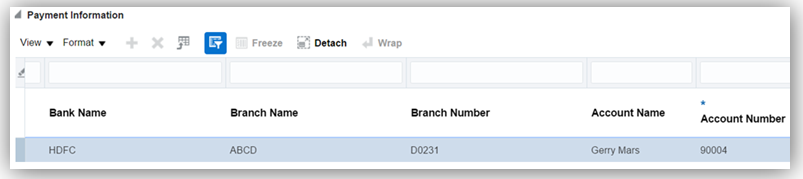

- Payroll

- Payment

- Leave

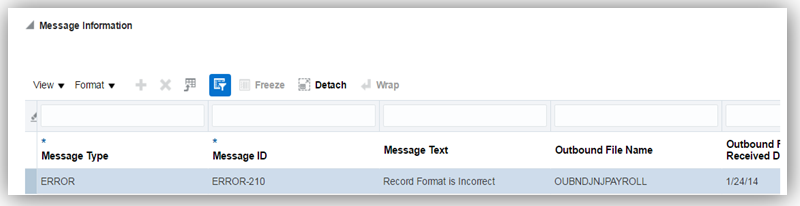

- Messages received from third-party payroll providers

- Select Payslip Data in the Record Type field to view payslip data.

Filter Imported Data

Select Payroll Data in the Record Type field to View, Add, Edit, and Delete

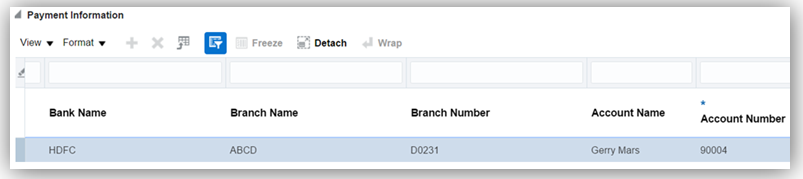

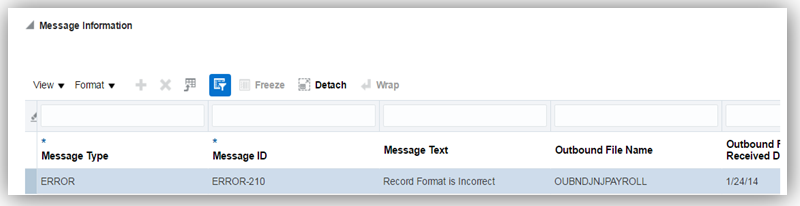

Payment Information

Message Information

Manage Payroll Interface Inbound Records

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about inbound records, go to Applications Help for the following topics:

- Payroll Interface Inbound Records: Explained

- Configuring Extensible Flexfields and Lookups for Inbound Payroll Interface: Procedure

Payroll Costing Report by Element Classification

This enhancement to the detail scope of the Payroll Costing Report displays the primary element classification in report output. The addition of this data item to the report allows total payroll costs verification by element classification, such as earnings cost, voluntary deductions cost and tax deductions cost.

Steps to Enable

There are no steps necessary to enable this feature.

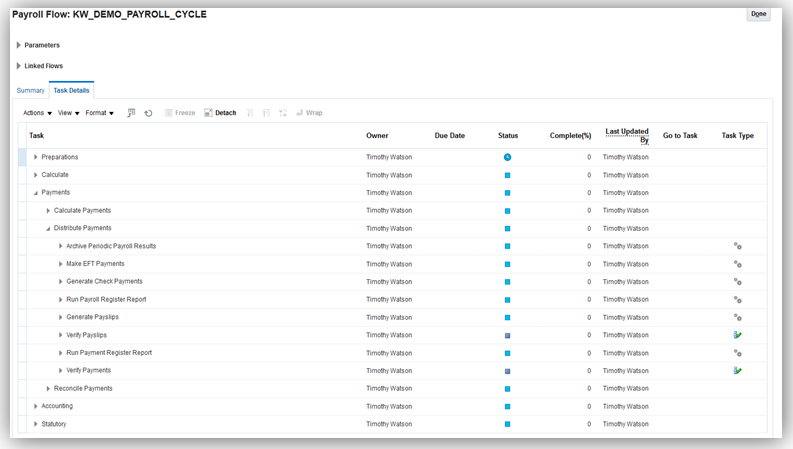

Enable Reports to Process Following an Errored Task

You can now define a flow pattern and allow reports to process within the flow, even if the proceeding task completed in error. You can now allow them to process. All reports which need to be executed irrespective of a previous task error, should have the new ‘Process After Error’ checkbox selected.

Manage Pattern Flows Setup Page with Process After Error Checkbox

Steps to Enable

To use the functionality, administrators must perform the following steps:

- Select the Manage Payroll Flow Patterns task in the Payroll Checklist work area, and search for your flow pattern.

- Click Edit.

- Select the Tasks tab. For each report, select the flow task and select the checkbox in the ‘Process After Error’ column.

- Click Save to save the changes.

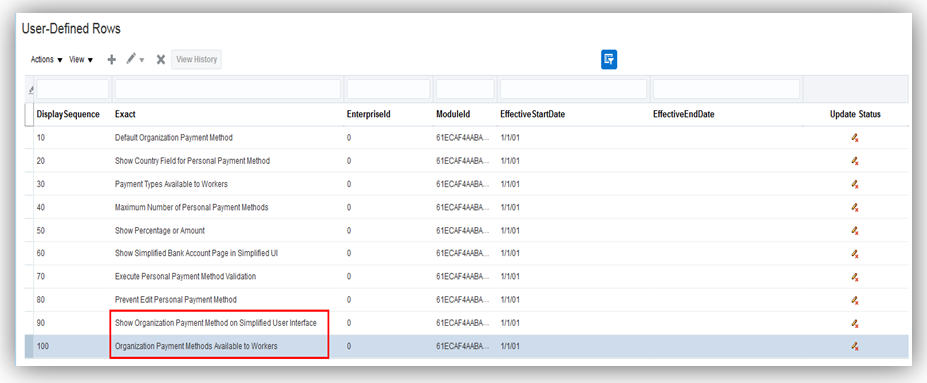

New Configuration Options for Personal Payment Method Page

You can now use the Payroll User Interface Configuration formula type to display the Organization Payment Method list of values on the Personal Payment Method page. When this list of values is displayed, you also have the ability to limit the values available to employees when Personal Payment Methods are being created. Once you create the formulas, you can attach the formula names to their corresponding preferences in the Payroll User Interface Configuration user-defined table.

The following two formulas for Organization Payment Methods have been added:

| Formula Name |

Purpose |

| Show Organization Payment Method on Simplified User Interface |

Allows the choice to display the Organization Payment Method list of values on the Personal Payment Methods page. |

| Organization Payment Methods Available to Workers |

Allows the values in the Organization Payment Method list of values to be restricted and only applies when the Show Organization Payment Method on Simplified User Interface formula is set to display the Organization Payment Method. |

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

For more information about personal payment methods, go to Applications Help for the following topics:

- Configuring Payment Method Preferences: Procedure

- Payroll User Interface Configuration Formula Type

Payroll for Canada supports country specific features and functions for Canada. It enables users to follow Canada’s business practices and comply with its statutory requirements.

Involuntary Deductions: Enhanced Protected Pay Rules

Additional Protected Pay functionality is introduced to specify how the employee’s protected pay is calculated.

Protected Pay functionality for involuntary deductions was initially introduced in release 10, bundle 17. It was also previously enhanced in release 11, bundle 8. Several new rules are introduced with this release.

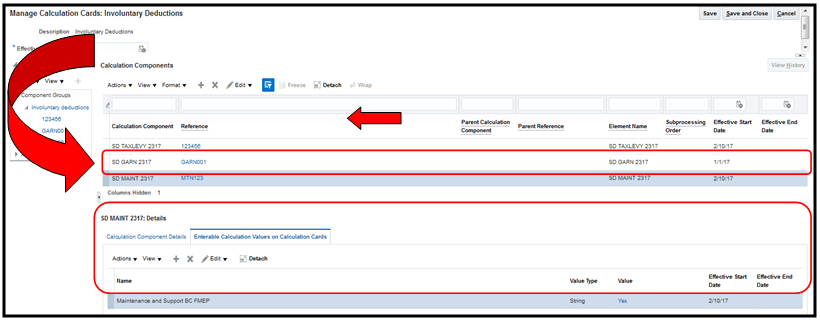

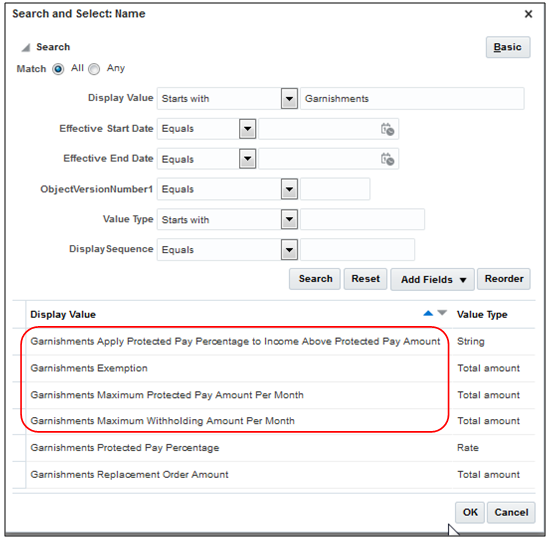

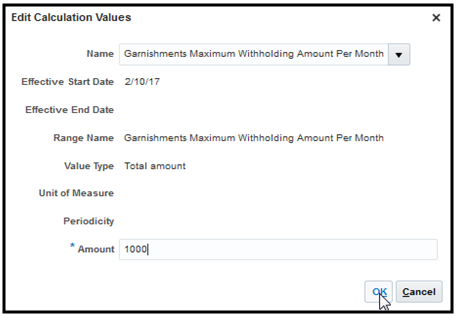

You can configure protected pay rules for each individual deduction on the involuntary deduction card for the employee. The payroll process calculates the protected pay amount based on the rules configured on the involuntary deduction card for the employee. Use the Enterable Calculation Values on Calculation Cards tab on the Manage Calculation Cards page, to create individual entries and define the rules.

Enterable Calculation Values on Calculation Cards

You can create entries using the following new rules:

New Rules

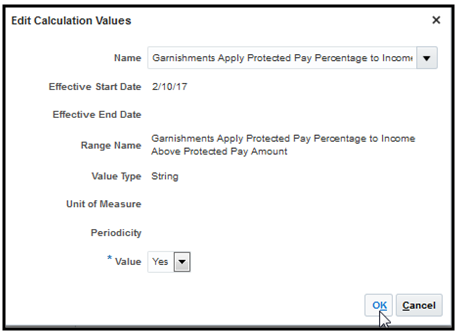

- Apply Protected Pay Percentage to Income Above Protected Pay Amount

This is a Yes or No option that specifies how the protected pay calculation applies the percentage.

For example, if the court order specifies a Protected Pay exemption of $X, plus 50% of the wages above that exemption, then you would use this rule.

If your selection is:

- Yes, the protected pay percentage is calculated on the disposable income over the protected pay amount, and then added to the protected pay amount.

- No, the protected pay is the maximum of the protected pay percentage or the protected pay amount.

For example, PP= (Disposable Income - PP Amount) * PP % + PP Amount.

PP – Protected Pay

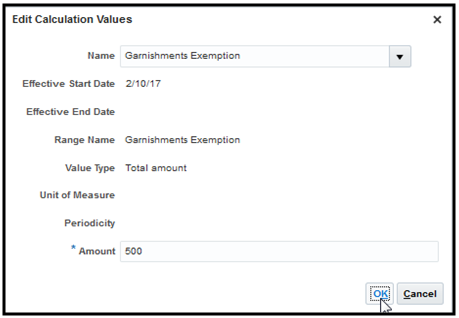

Exemption

This is an exemption amount used to reduce the gross or net prior to applying the deduction percentage in the calculation.

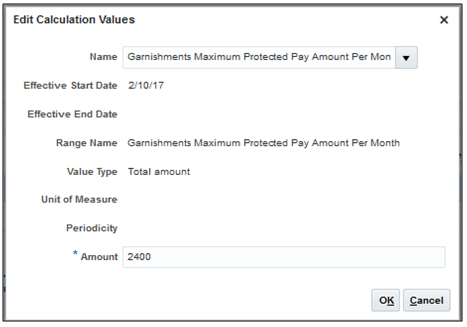

Maximum Protected Pay Amount Per Month

This is an amount that specifies a maximum value for the protected pay amount for each deduction in a month. If there are multiple deductions of the same type (for example, 2 garnishments), this serves as the maximum value for all deductions of the same deduction type.

Maximum Withholding Amount Per Month

This is an amount that specifies a maximum withholding value for the deduction in a month.

Configure these rules for any of the deduction types: Garnishment, Maintenance and Support, and Tax Levy. You can use a combination of these rules to meet the requirements in the court order.

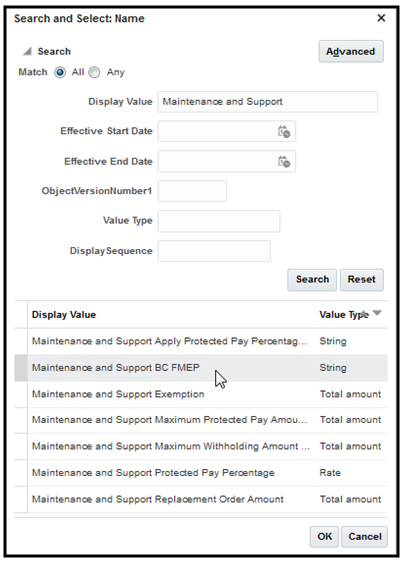

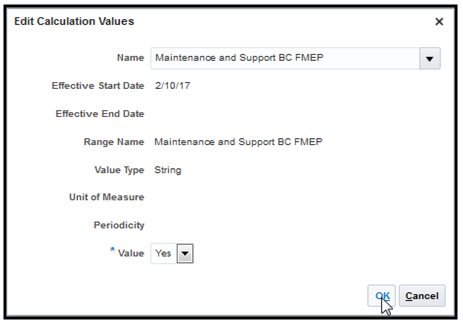

The British Columbia Family Maintenance Enforcement Program (BC FMEP) has a prescribed rate for protected pay based on the amount of wages paid per period. This is only for maintenance and support deductions and is addressed by configuring the following rule:

Maintenance and Support BC FMEP

This is a Yes or No option that specifies whether the protected pay calculation for British Columbia FMEP is enabled.

- If your selection is Yes, the British Columbia FMEP protected pay calculations are performed.

- If your selection is No, the British Columbia FMEP protected pay calculations are not performed.

If you configure other protected pay rules, the British Columbia FMEP protected pay calculations are overridden and the other protected pay rules are used in the calculations.

The requirements for British Columbia FMEP are preconfigured by Oracle.

Some important items to note regarding the Disposable Income Calculation Rule are:

- If the Disposable Income Calculation Rule is not defined, the default value is Percentage of Net Pay. This means that employee’s net pay is used in the protected pay calculations.

- The Disposable Income Calculation Rule works in the same way for the Deduction Percentage as it does for the Protected Pay Percentage rule, in that:

- If the rule is Percentage of Gross, the percentage entered on Calculation Values is the percentage of gross pay

- If the rule is Percentage of Net, the percentage entered on Calculation Values is the percentage of net pay

- If rule is Percentage of Net Pay Less Specific Deductions, the percentage entered on Calculation Values is the percentage of net pay less specific deductions

The protected pay amount calculated for the deduction, as well as additional details, is displayed in the run results for the Results and element’s shadow elements.

Any amounts in arrears will also observe the protected pay limits.

Use the Manage Calculation Cards task from the Payroll Calculation or the Person Management work areas to create the involuntary deduction card.

Steps to Enable

There are no steps necessary to enable this feature.

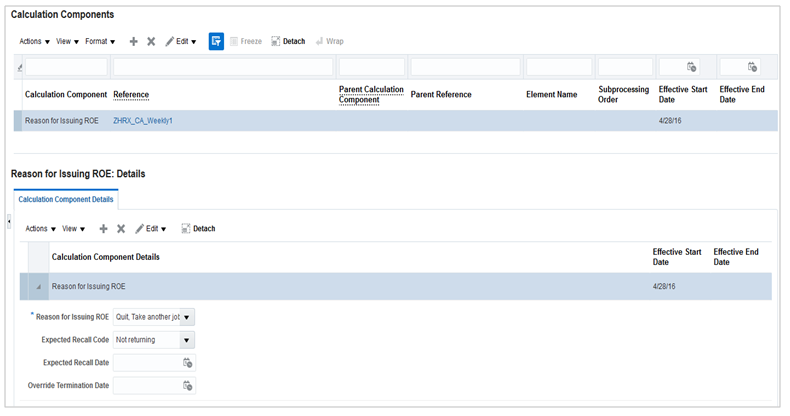

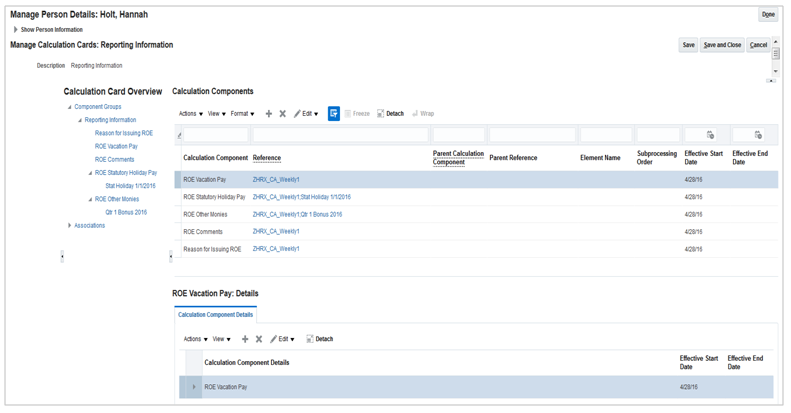

Use the reporting information card to capture values required for the Record of Employment (ROE).

ROE information is captured by creating calculation components and their associated component details. For example, the calculation component of ‘Reason for Issuing ROE’ corresponds to its component details of the valid reasons as per Service Canada.

The information captured is used to report ROE information in the following blocks:

- Reason for Issuing ROE (Block 16)

- ROE Vacation Pay (Block 17A)

- ROE Statutory Holiday Pay (Block 17B)

- ROE Other Monies (Block 17C)

- ROE Comments (Block 18)

- ROE Special Payments (Block 19)

Additionally, several items are now defaulted and automatically created. The enhancements to the UI include:

- The TRU association is now created automatically based on the employee’s payroll relationship. Previously you had to manually create this association.

- The payroll associated with the payroll relationship is now defaulted when creating a calculation component. Previously you had to manually select a payroll.

- The component details are now enabled by default for the related calculation component. Previously you had to manually select and add it before being able to enter any values.

- The Federal heading under the component group section is renamed to Reporting Information and the components and component details are displayed in that section.

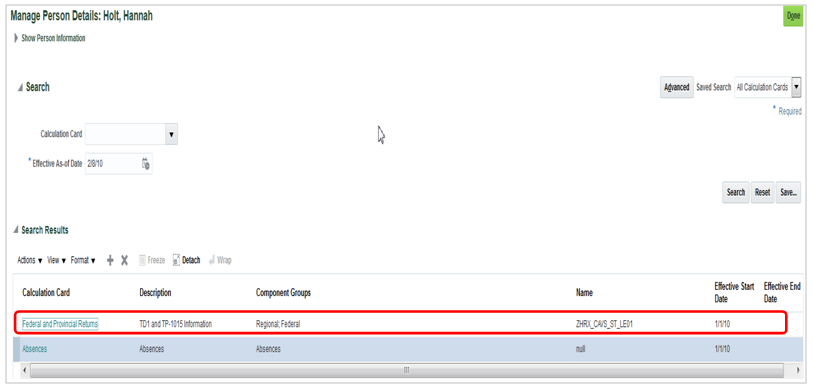

Use the Manage Calculation Cards task from the Payroll Calculation and the Person Management work areas to create a Reporting Information card.

Calculation Component for “Reason for Issuing ROE” and its Related Calculation Component Details

The image below displays additional calculation components created for an employee and the related calculation component details for the component “ROE Vacation Pay”.

Additional Calculation Components

Steps to Enable

There are no steps necessary to enable this feature.

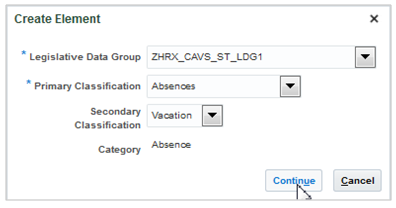

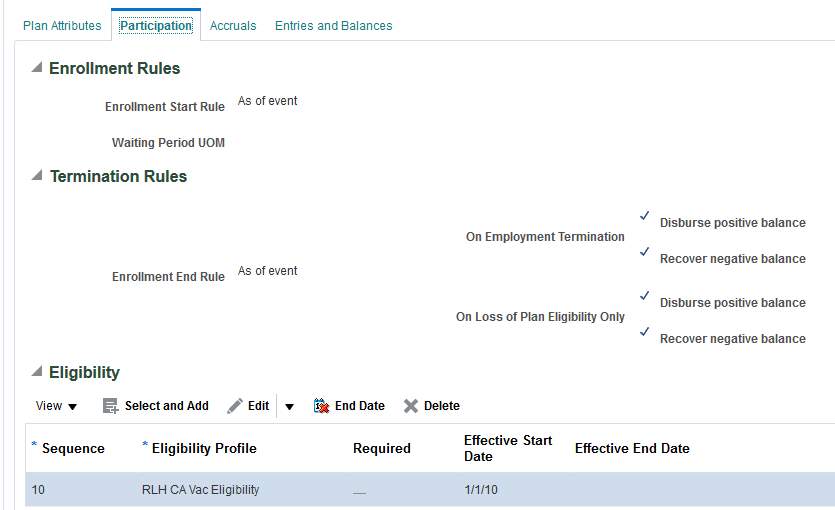

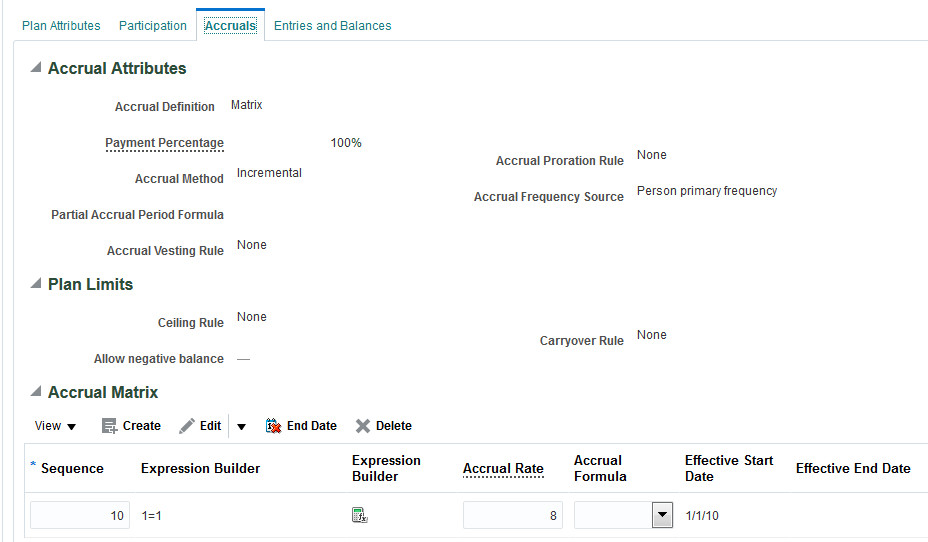

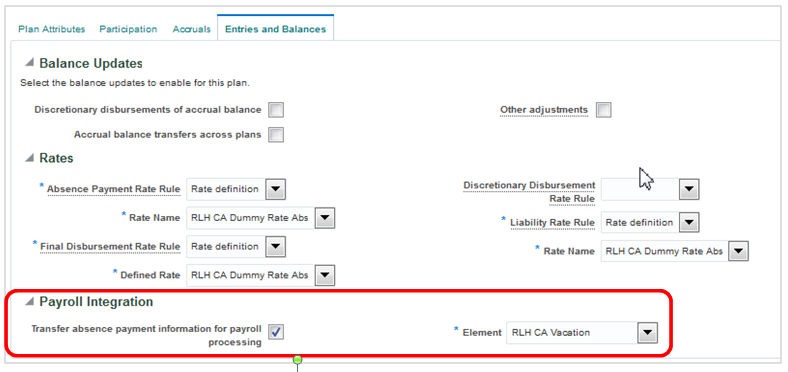

There is integration between the absence management system and payroll. The information passed from absences to payroll is used to calculate the absence payment in payroll.

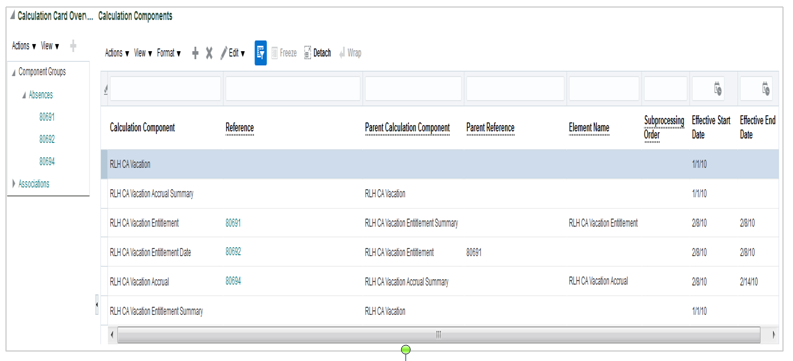

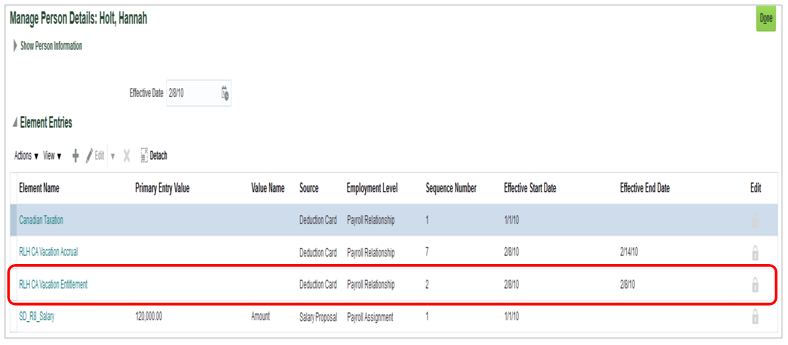

The absence element is created in payroll. When defining the absence plan, the absence element is associated to the plan, which serves as the connection between the absence and payroll systems. When an absence is recorded for the employee, the person’s absence calculation card is created and the absence plan is linked to the calculation component on the person's calculation card. Also, the daily and summary breakdown information is automatically transferred to payroll.

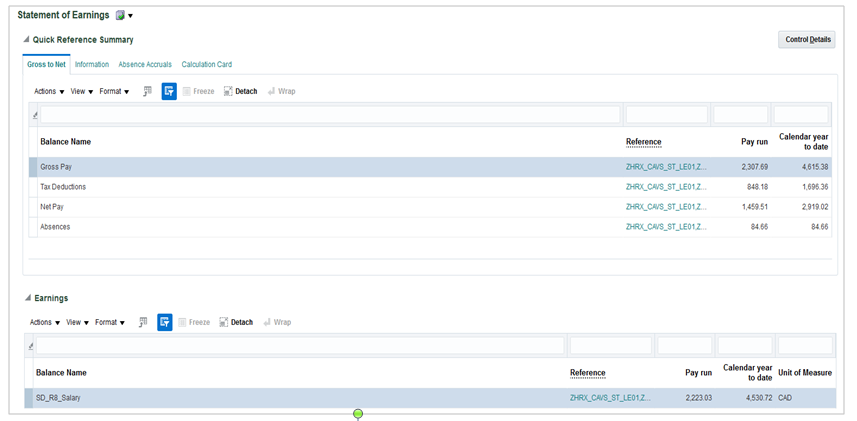

You can process the payroll that includes these absence entries and view the resulting absence balances on the person's Statement of Earnings (SOE). After you process and archive payments, you can also view the resulting absence balances on the person's payslip.

Rules and leave plans for absences vary throughout Canada. In general, they are defined by provincial Employment Standards, although employers can also define their own rules. Uptake of the global absence template will provide the primary classification of Absence and the additional secondary classifications of the following absence types:

- Vacation

- Sickness

- Maternity

- Other

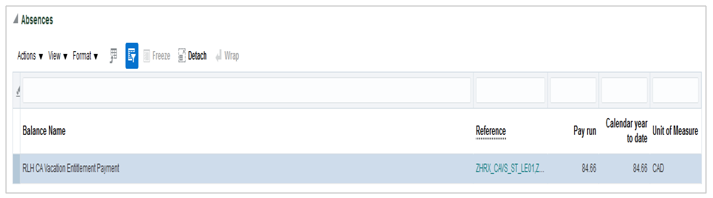

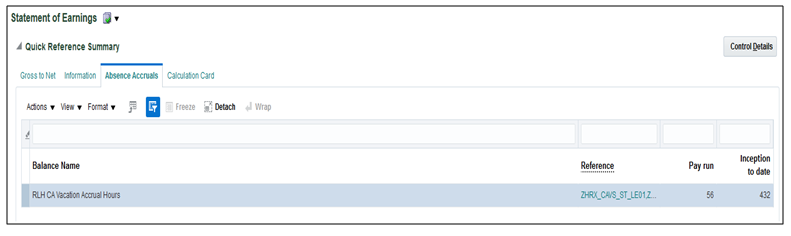

Absence and accrual balances are displayed in the following:

- Payslip

- Cheque advice

- SOE

- Global reports

- Payroll Activity Report

- Payroll Balance Report

- Payroll Gross-to-Net Report

- Payroll Register Report

- Element Result Report

As a summary, the high-level list of the steps involved in processing absences is noted below. These are in sequential order, as some of the setup may be used in a subsequent step. A number of the steps show the related pages displaying the configuration or results of the processing.

- Create rate definitions to use in calculating accrual and liability balances.

- Create absence element and eligibility.

- Create derived factors, if applicable.

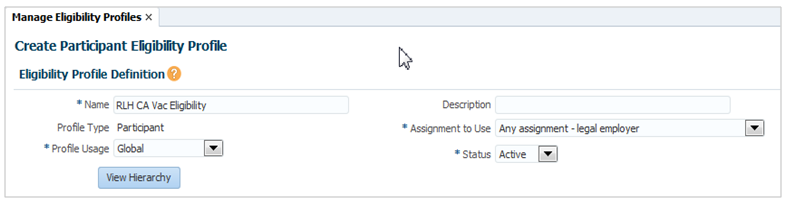

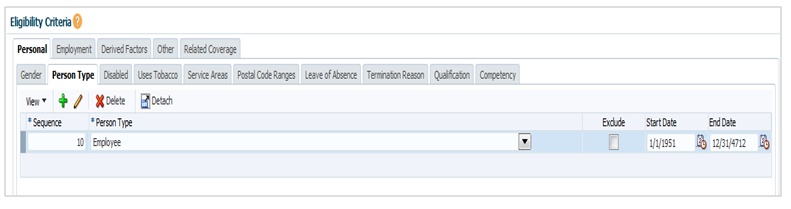

- Create eligibility profile.

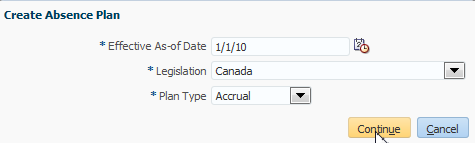

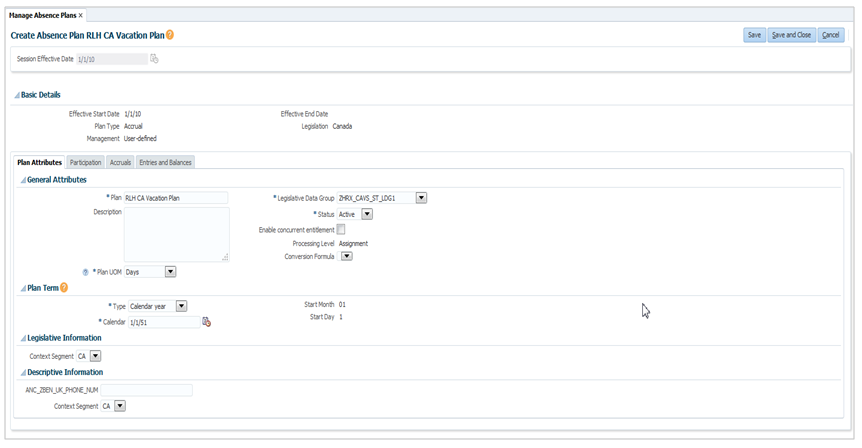

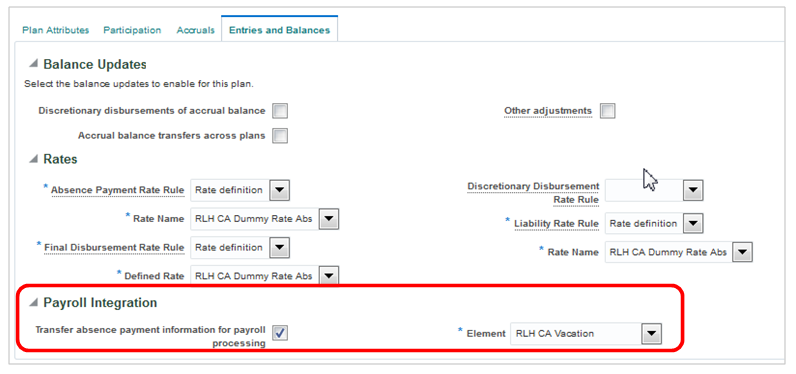

- Create an absence plan and ensure the following is defined for payroll:

- You select the transfer absence payment information for payroll processing check box.

- You select the element for the plan in the Element field.

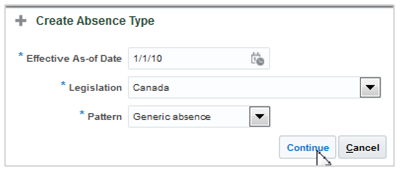

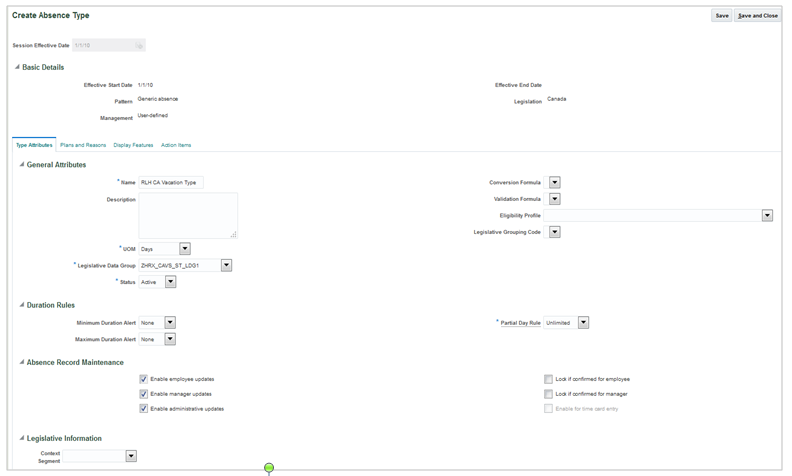

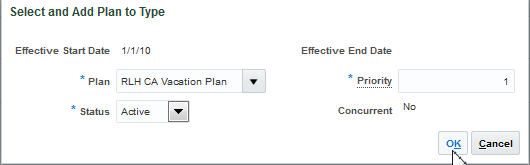

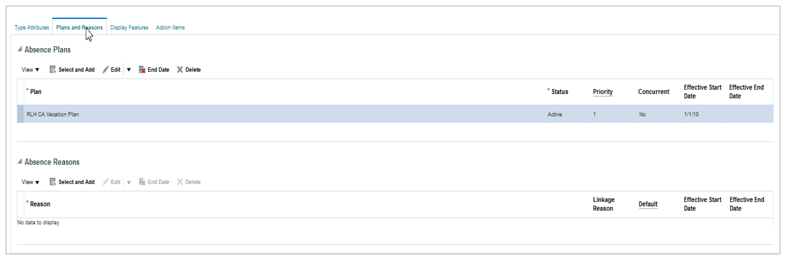

- Create absence types and associate them to the absence plans.

- Enroll employees in the absence plan.

- Process the Run Accruals for Selected Plan task action (for approvals).

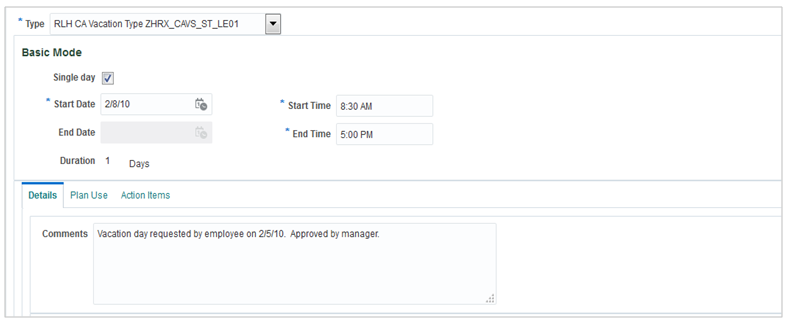

- Record an absence for the employee.

- Process payroll.

- View absence balances in the SOE.

- Process payslip and other reports.

You must create the eligibility for the following elements:

<base element (for example, RLH CA Vacation)

<base element> accrual (for example, RLH CA Vacation Accrual)

<base element> entitlement (for example, RLH CA Vacation Entitlement)

NOTE: When the absence accrual is run or absence record is recorded, an absence card is automatically created and the daily and summary breakdown information is automatically transferred to payroll.

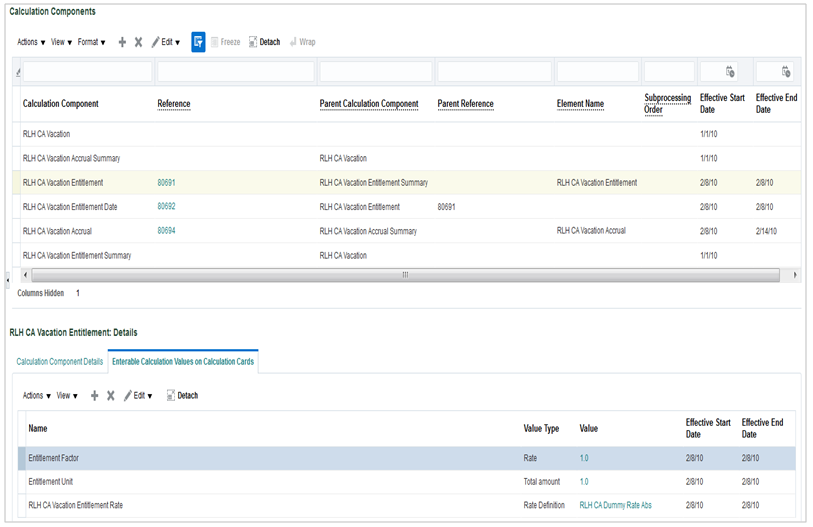

NOTE: The capture above is the entitlement component that displays its related component details. It is an example of an absence entitlement payment.

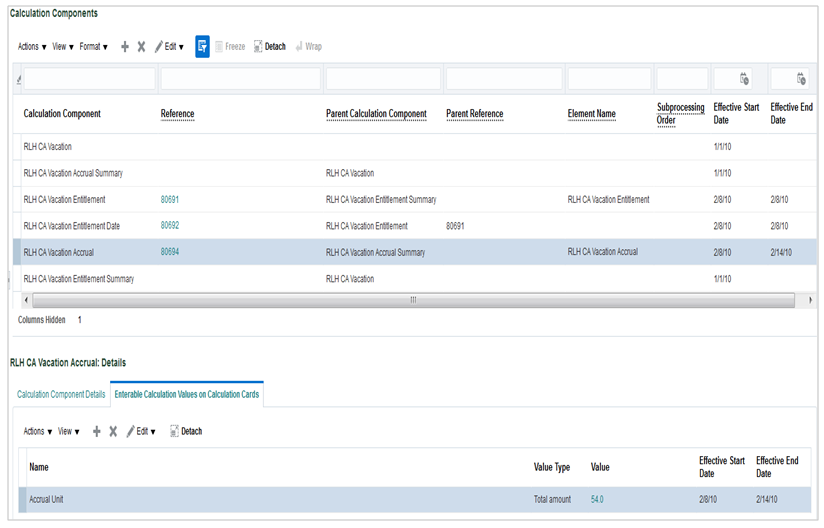

NOTE: The capture above is the accrual component that displays its related component details. It is an example of an absence accrual balance.

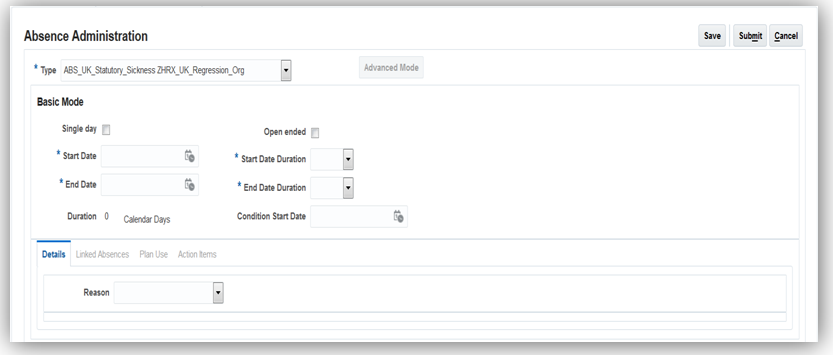

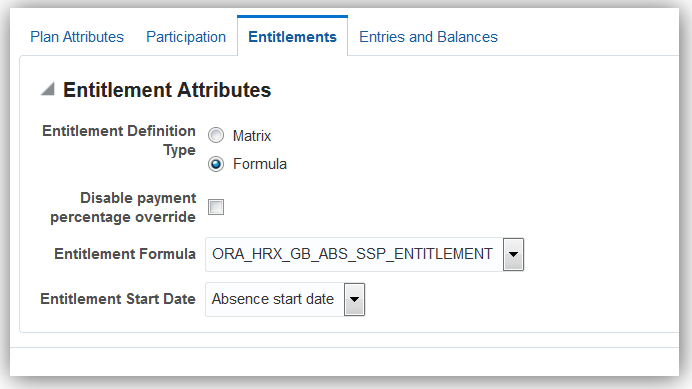

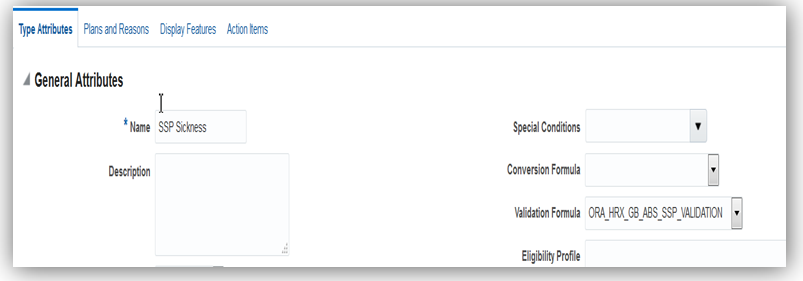

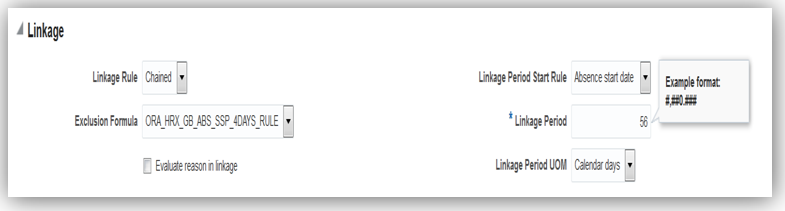

The absence information is configured in the Absence Administration work area.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

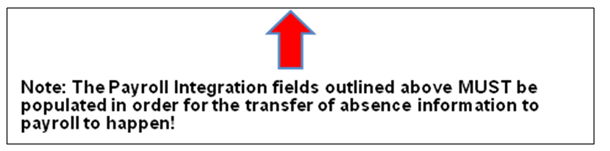

Within the absence plan, you must ensure the following is defined for the absence information to transfer to payroll for processing.

- Select the transfer absence payment information for payroll processing check box.

- Select the element for the plan in the Element field (this element is the absence element created in payroll).

- Canada Information Center (Document ID 2102586.2)

- CA – Absence tab > Product Documentation > White Papers

- CA – Absence tab > Product Documentation > Other Documents

Key Resources

For more information on absences in Canada, go to My Oracle Support for the following White Papers:

Absence Elements: Discretionary and Final Disbursement Absence Payments

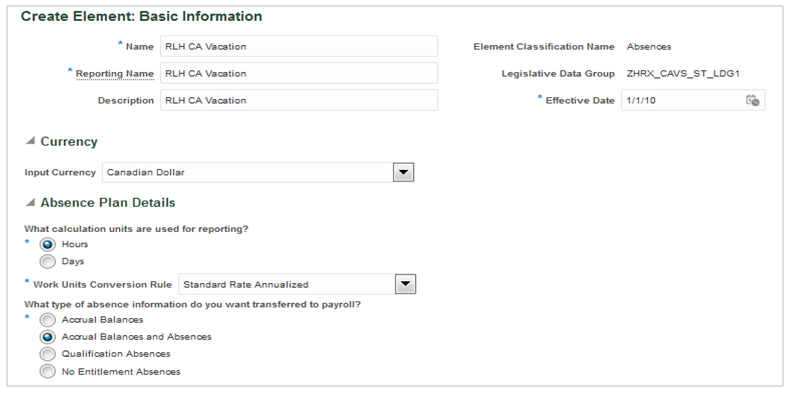

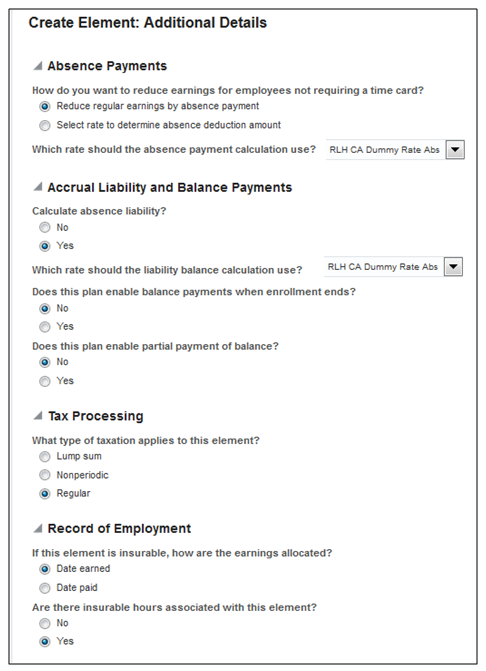

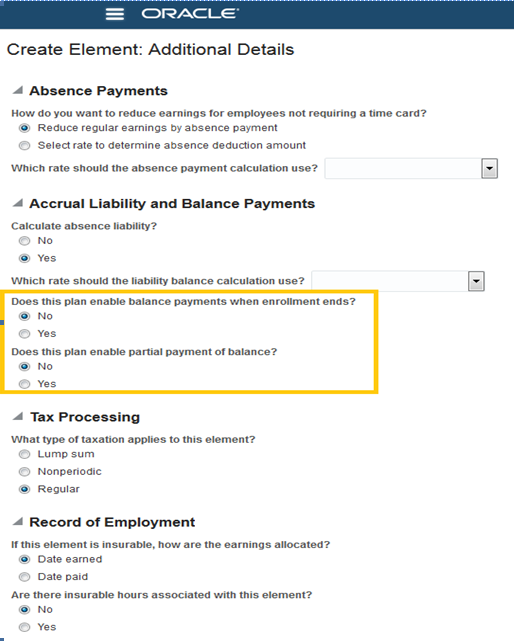

Oracle Fusion Human Capital Management for Canada provides the ability to select different options for taxation, EI allocation, and EI hours for discretionary and final disbursement payments. Because these types of payments may be taxed differently than regular absence payments, this functionality was introduced to designate different values when creating the absence element.

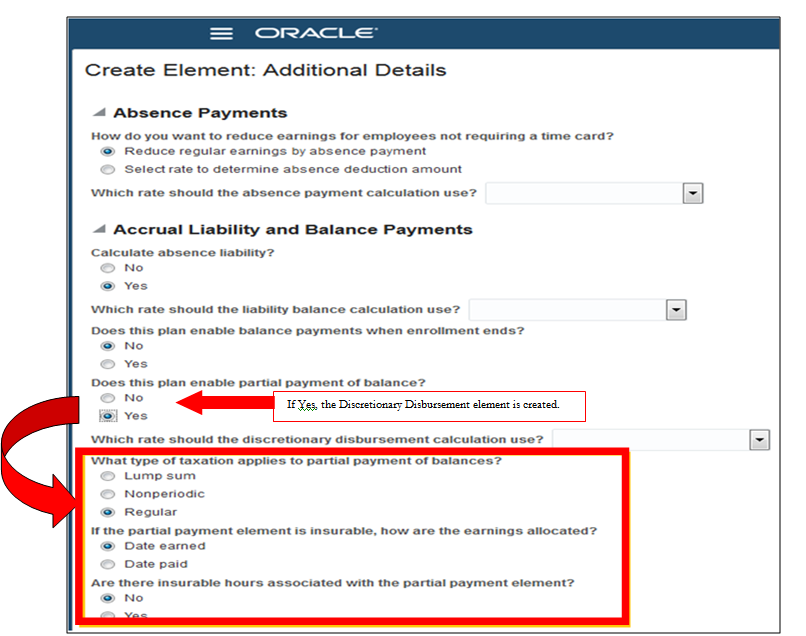

When the absence element is created, two questions exist on the element template that creates additional shadow elements, based on the input to the question. The existing questions on the absence template are:

- Does this plan enable balance payments when enrollment ends?

- This creates the Final Disbursement shadow element, if the value selected is Yes. If No, the element is not created.

- Does this plan enable partial payment of balance?

- This creates the Discretionary Disbursement shadow element if the value selected is Yes. If No, the element is not created.

When you select Yes to either question, you are presented with additional questions related to Tax Processing and Record of Employment. Previously, you could only select those options for the base element, but you are now able to select those options for both the Final and Discretionary Disbursement elements that are automatically created. You may select different values for each element if you choose to.

When you select Yes for the question, Does this plan enable balance payments when enrollment ends?, you are now presented with the additional options to specify the tax method, EI allocation and EI hours for the final disbursement payments. If you select No, the element is not created.

When you select Yes for the question, Does this plan enable partial payment of balance?, you are now presented with the additional options to specify the tax method, EI allocation and EI hours for the discretionary disbursement payments. If you select No, the element is not created.

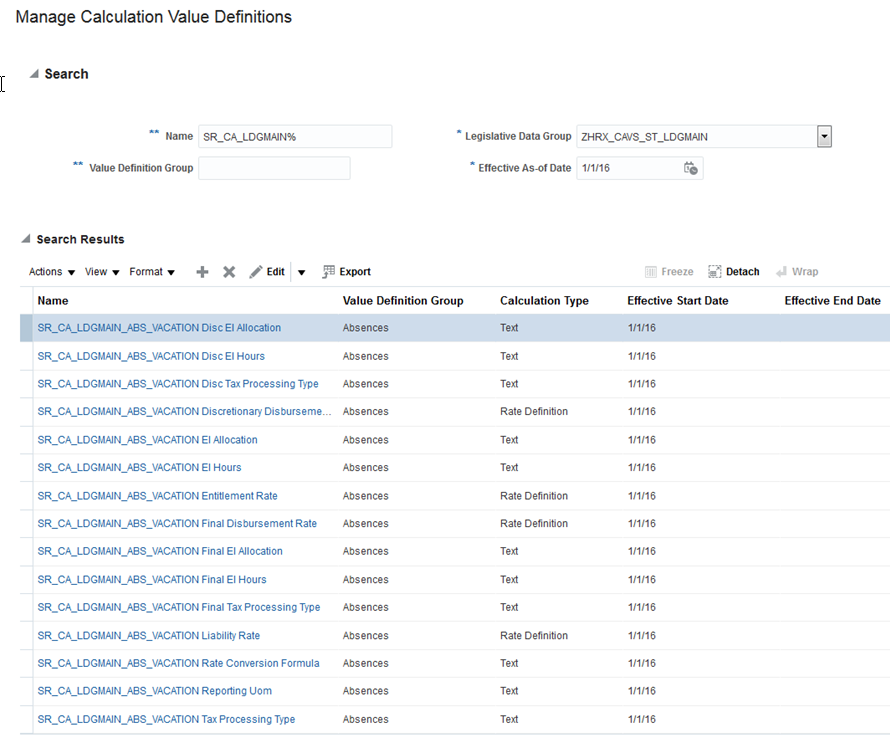

Additionally, you may override the values selected during element creation for the tax method, EI hours and EI allocation for any of the shadow elements that are created (entitlement, discretionary disbursement and final disbursement). These values are stored as value definitions, so you override them using the Manage Calculation Value Definitions task.

The naming convention of the value definitions created for each shadow element is as given below:

Entitlement Element

- <Element Name> Tax Processing Type

- <Element Name> EI Allocation

- <Element Name> EI Hours

Discretionary Disbursement Element

- <Element Name> Disc Tax Processing Type

- <Element Name> Disc EI Allocation

- <Element Name> Disc EI Hours

Final Disbursement Element

- <Element Name> Final Tax Processing Type

- <Element Name> Final EI Allocation

- <Element Name> Final EI Hours

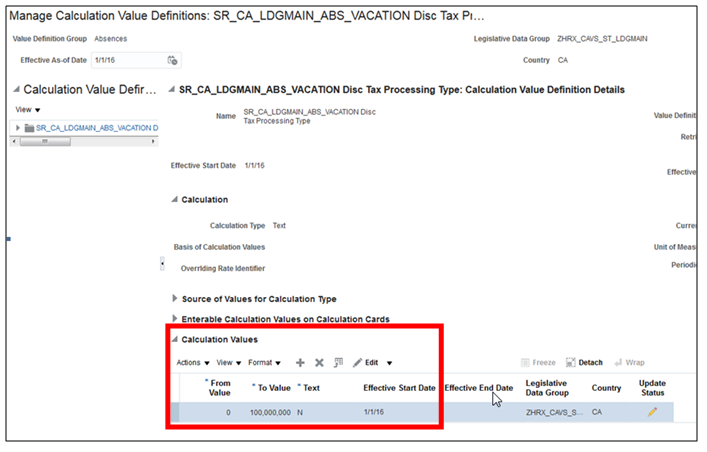

To override the value, use the Manage Calculation Value Definitions task, select the value definition name to edit, and make the change to the value definition. This overridden value is used during the payroll process, instead of the value initially configured at element creation.

If you override the values, they must be valid. The text values you must use to override the various types of value definitions are as given below:

Tax Processing

- Regular: R

- Nonperiodic: N

- Lump Sum: L

EI Allocation

- Date earned: DATE_EARNED

- Date paid: DATE_PAID

EI Hours

- Yes: Y

- No: N

The following is an example of where an override to the tax processing type is entered. The ‘N’ noted in the text column indicates that the tax will be calculated using the nonperiodic method.

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

This functionality is only applicable for new absence elements that you create. Previously configured absence elements will not support this functionality.

Key Resources

Refer to the Canada Information Center in My Oracle Support at the links below for additional information on absences:

- Canada Information Center (Document ID 2102586.2)

- Configuring Oracle Fusion Absence Management for the US and Canada (Document ID 2102835.1)

Employee Active Payroll Balance Report

Run the Employee Active Payroll Balance report to reconcile your balances prior to periodic or year-end reporting. The Employee Active Payroll Balance Report displays current and year-to-date values for employee balances without the need to process the payroll archive. This report assists in determining if any tax balances are over the statutory limits and if any of the tax liability balances are improperly calculated. To assist with year-end reconciliation and balancing of your year-end box balance data, run this report throughout the year to make year-end balancing easier.

The report is a pipe delimited text file of live payroll balances for an employee filtered by various parameters. You can easily convert the output text file into an Excel spreadsheet for further totaling and manipulation to meet your specific requirements. Select a dimension of run or year, and a balance group usage to display all balances defined for that group.

You can configure this report to return balances for the following:

- Individual employees

- Members of a payroll relationship group

- All employees in a Tax Reporting Unit (TRU)

- Employees associated with a specific payroll run

- Year-end employee balances

- Pay-period employee balances

The parameters of the Employee Active Payroll Balance report are:

- Start Date

- Required

- End Date

- Required

- Payroll

- If blank, all payrolls are reported

- Consolidation Group

- Tax Reporting Unit

- If blank, all TRUs are reported

- Payroll Relationship Group

- Employee Name

- If blank, all employees are reported

- Balance Dimension

- Required

- Select either Run or Year

- Balance Group Usages

- Required

- The LOV values are dynamically determined based on Balance Dimension parameter value

- Process Configuration Group

The Balance Group Usage parameter is a defined group of balances used for reporting. There are six usages preconfigured by Oracle:

- Canadian T4 Balance Group

- Canadian T4A Balance Group

- Canadian RL-1 Balance Group

- Canadian RL-2 Balance Group

- Canadian Tax Remittance Balance Group

- Canadian Employer Liabilities Balance Group

The individual balances reported for each of the preconfigured balance groups are listed in the order they are displayed on the report. Please see the End-of-Year Processing Guide on the Canada Information Center for a complete list of balances defined for each balance group.

If the preconfigured balance groups do not meet your specific reporting needs, you may create additional balance group usages to use for reporting.

For Canada, we have certain contexts associated with some balances, which may cause multiple lines on the report for one employee’s balance. Some balances may have province, statutory reporting type, or reference code contexts associated with them, although not all balances contain contexts.

The statutory reporting type context is the year-end form that the balances are associated with. The statutory reporting type is associated with an element's secondary classification and determines how that element is used in the payroll calculation, as well as how it is reported at the end of the year.

The reference code context is for Worker’s Compensation and Provincial Medical balances and contain the relevant account information.

The only prerequisite to running the report is that a valid payroll action must exist, like a payroll run, quickpay, or balance initialization. Processing the payroll archive is not required prior to running the report.

You may access the Run Employee Active Payroll Balance Report from the following work areas:

- Checklist

- Payroll Calculation

The Output Displays the Balances for the Canadian T4 Year to Date Balance Group Usage After Importing the Data into Excel

Steps to Enable

There are no steps necessary to enable this feature.

Tips and Considerations

The output of this report is purely a balance-based record of an employee’s live balances. If an employee has any of the balances defined in the balance group usage selected as a parameter, within the date range specified, they are included in this report. As noted, certain balances require certain contexts (province, statutory report type, reference code) and are stored that way in the application. As a consequence of this, the report may display multiple lines for each balance for each dimension and context for that employee. A row with a blank context value may also appear as a total. You can restrict the output of the data by selecting specific report parameters to pick up the relevant employees for each balance group usage. For example, if you want to restrict the output for only those employees to receive an RL-2, you may create a group that contains only those RL-2 employees and select that group using the parameters.

Additionally, you can import the data into Excel or another similar spreadsheet tool and manipulate the data as per your requirements. Once the report completes, use the steps below to import the data into Excel.

- Click the txt file created by the process and save it.

- Open Excel.

- Click the Data tab, and then click From Text.

- Navigate to the saved txt file and select it. This will engage the Text Import Wizard.

- Select Delimited.

- Click the My data has headers checkbox, and then click Next.

- During this step, you are able to preview your data and how it is going to appear in Excel as you make changes to ensure it is correctly displayed in the spreadsheet. You may also format the data in each column using this method by clicking each column and selecting the desired format. Alternatively, you may format the data in the spreadsheet itself. The default format is General for each column, which converts numeric values to Numbers, date values to Dates and all others to Text.

- When you are happy with the results, click Finish.

- Name the worksheet, and then click OK.

If the pre-defined balance groups do not meet the customer’s specific reporting needs, they may create additional balance group usages to use for reporting. To create a user-defined balance, balance group and group usage, use the steps below.

To create a new balance:

- Navigate to Payroll Calculation > Manage Balance Definitions. If you want to use pre-defined balances, skip these steps and create the new balance group.

- Click Create.

- Select the Legislative Data Group, and click Continue.

- Add the Payroll Balance details, and click Next.

- On the Balance Dimensions page, click Select and Add.

- Search for and select the Dimension Name (for example, Relationship Tax Unit Run or Relationship Tax Unit Year to Date).

- Click Apply, and then Done.

- Click Next, Submit, and then OK.

To create a new balance group:

- Navigate to Payroll Calculation > Manage Balance Groups.

- Click Create.

- Select the Legislative Data Group, enter a Name, and then click Continue.

- Click Submit.

- In the Balance Group Overview pane, click Balance Definitions, and then click Select and Add.

- Search for and select the desired balance definitions. Click Apply to add each balance definition you require, and then click OK. You may select pre-defined balances or a newly created balance.

- Note: If the context level balance values are required for Reference Code and Year End Forms (Statutory Report Type) contexts, then you must add the balances with dimensions that include that context (for example Relationship Tax Unit, Province, Reference Code Year to Date or Relationship Tax Unit, Statutory Report Type Run).

- Click Submit.

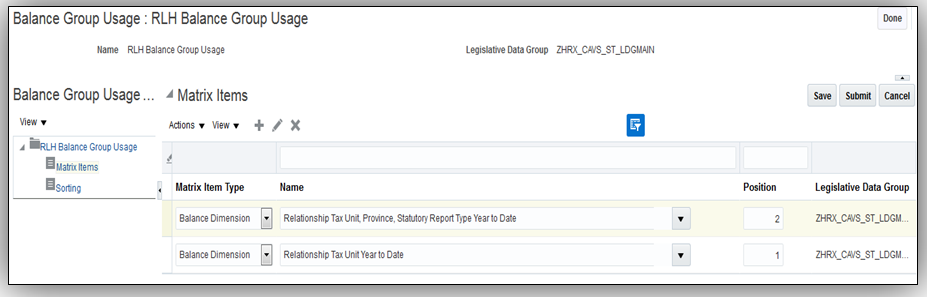

To create a new balance group usage:

- Navigate to Payroll Calculation > Manage Balance Group Usages.

- Click Create.

- Select the Legislative Data Group, enter a Name, select the newly added Balance Group, and select Matrix.

- Click Continue.

- In the Balance Group Usages pane, select Matrix Items.

- In Matrix Items, click Create.

- Search for and select the Balance Dimension Name, and enter a Position value. Continue this step until you have created all desired usages. You may create multiple usages for each combination of contexts required.

- To sort the balances in the group, select Sorting to define the sequencing.

- Click Submit.

NOTE: Each Balance Group Usage should only contain one period type of balance dimensions (for example, all Run, or all Year to Date, or all Month to Date).

You may now select your newly added Balance Group Usage as a parameter of the report.

Key Resources

Refer to the Canada Information Center at the link below for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

CA – Payroll tab > Product Documentation > White Papers > Payroll Reconciliation

CA – Payroll tab > End-of-Year Processing > End-of-Year Processing Guide

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support.

See My Oracle Support Document ID 2102586.2 (Information Center: Fusion Human Capital Management - Canada) for further details, and access the content at the location below.

CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

Reporting Mode: Draft and Final Mode for End-of-Year Reports Process

Use the Format parameter to run the year-end slips in draft or final mode. The mode applies to all year-end report types of T4, T4A, RL-1, and RL-2 and is available for the Original, Amended, and Cancelled Report Type options.

The Format parameter contains the following new options:

- PDF Draft

- PDF Final

The PDF Draft option generates a draft version of the year-end slips as they would appear in final form. This allows you to perform data verification prior to distributing the final versions to the employees. Additionally, it allows you to verify and ensure that you are satisfied with the results and how it will appear in the final versions of the employee’s slips. This option does not publish them to the Document of Record (DOR), so they are not visible by the employee. This option creates one PDF that contains all the employee’s slips included in the process. You can run the year-end slips in draft mode multiple times without the need to roll back the process. Additionally, you can roll back the the end-of-year archive without having to rollback the draft PDF process.

The PDF Final option generates a final version of the individual year-end slips to distribute to the employees and publishes them to the DOR. Additionally, it creates one PDF that contains all the employee’s slips included in the process. After you have run the process in PDF Final mode, you must roll back the process if you require changes.

Steps to Enable

There are no steps necessary to enable this feature.

Key Resources

Refer to the Canada Information Center at the link below for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

CA – Payroll tab > End-of-Year Processing > End-of-Year Processing Guide

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support.

See My Oracle Support Document ID 2102586.2 (Information Center: Fusion Human Capital Management - Canada) for further details, and access the content at the location below.

CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

Payroll for China supports country specific features and functions for China. It enables users to follow China’s business practices and comply with its statutory requirements.

Nontaxable Employee and Employer Contribution Threshhold Amounts

Comply with the regulation on taxable social security contribution calculations in Shenzhen and Shanghai by capturing nontaxable employee and employer contribution threshold amounts and using them in monthly individual income tax calculations.

Steps to Enable

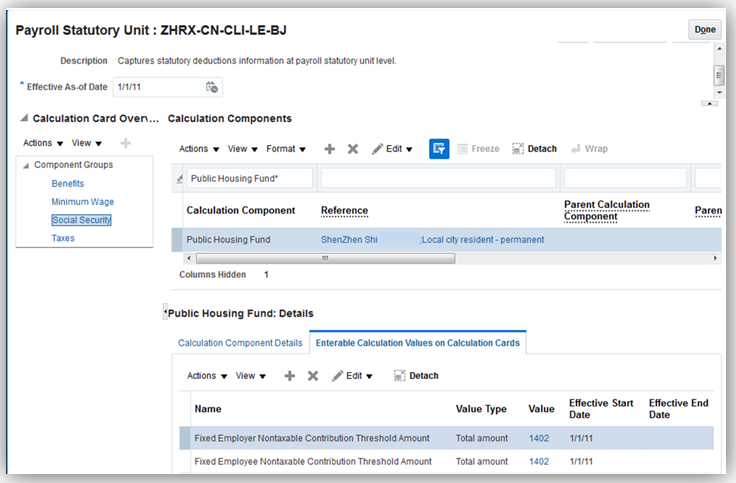

Set up the employee and employer nontaxable contribution threshold amounts by social security item, territory and contribution type as needed. This setup should occur at the payroll statutory unit level, on the Statutory Deductions calculation card, under the Social Security group.

Set Up Nontaxable Contribution Threshold Amounts at Payroll Statutory Unit Calculation Card Level

You may also set up the threshold amounts at tax reporting unit level and/or payroll relationship level.

Tips and Considerations

Amounts set up at payroll statutory unit level apply to everyone in a territory of a contribution type, if no overriding value is provided at tax reporting unit level or payroll relationship level. Amounts set up at tax reporting unit level apply to everyone making contribution via the tax reporting unit if no overriding value is provided at payroll relationship level. Amounts set up at payroll relationship level are used in the tax calculation for a particular employee if available.

For the taxable social security contribution calculation, data set up at Payroll Relationship level always takes precedent, followed by the data set up at Tax Reporting Unit level and then the data at Payroll Statutory Unit level.

The non taxable contribution threshold amounts will be used in the calculations, if, apart from nontaxable contribution threshold amounts, the nontaxable contribution rates and/or non taxable contribution base amounts are set up at the Payroll Statutory Unit, Tax Reporting Unit and the Payroll Relationship level.

Payroll for Kuwait supports country specific features and functions for Kuwait. It enables users to follow Kuwait’s business practices and comply with its statutory requirements.

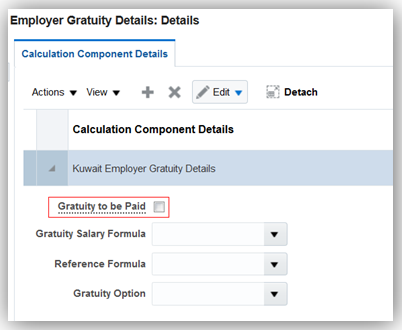

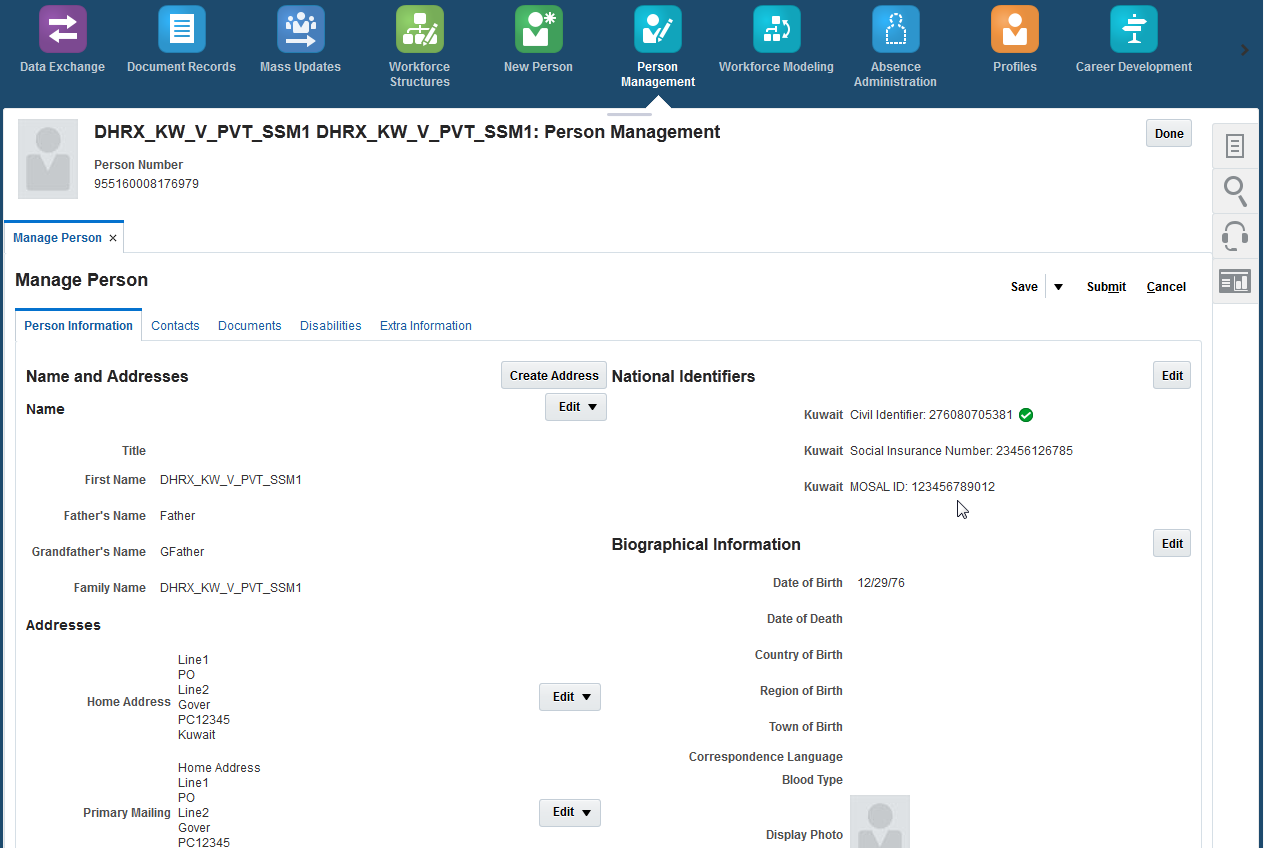

Social Insurance 2015 Enhancement

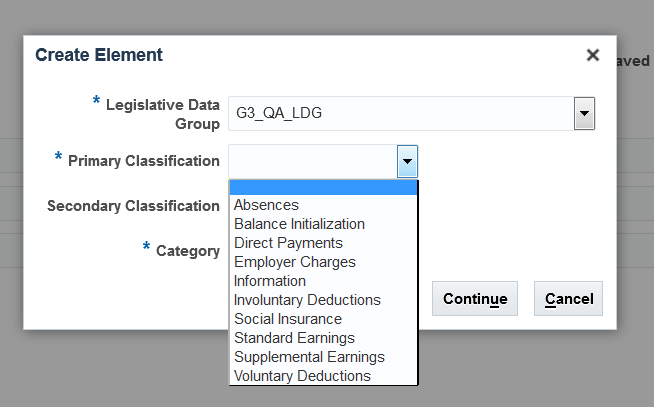

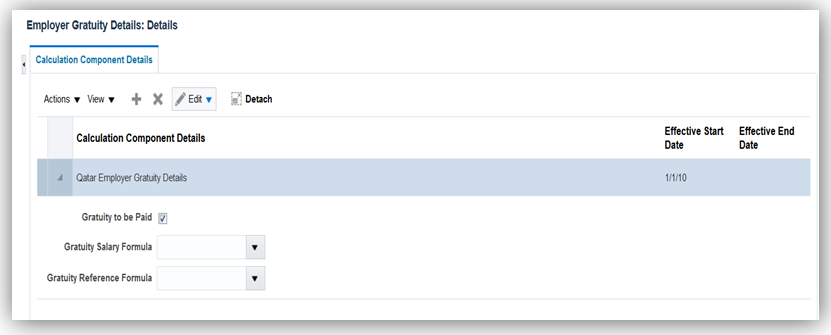

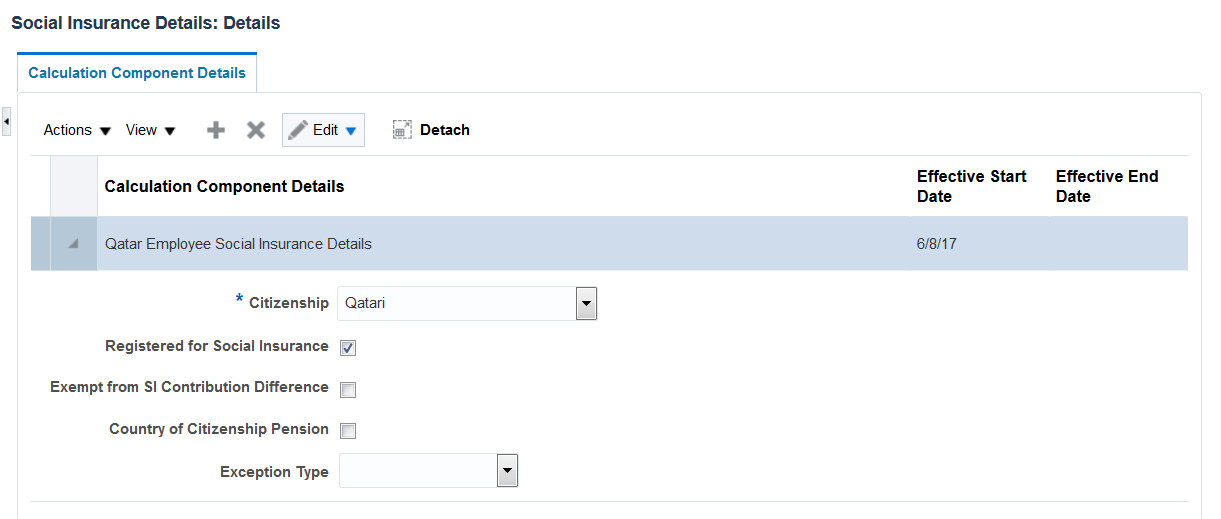

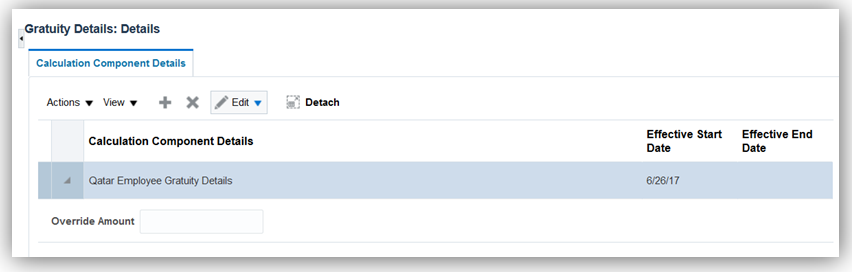

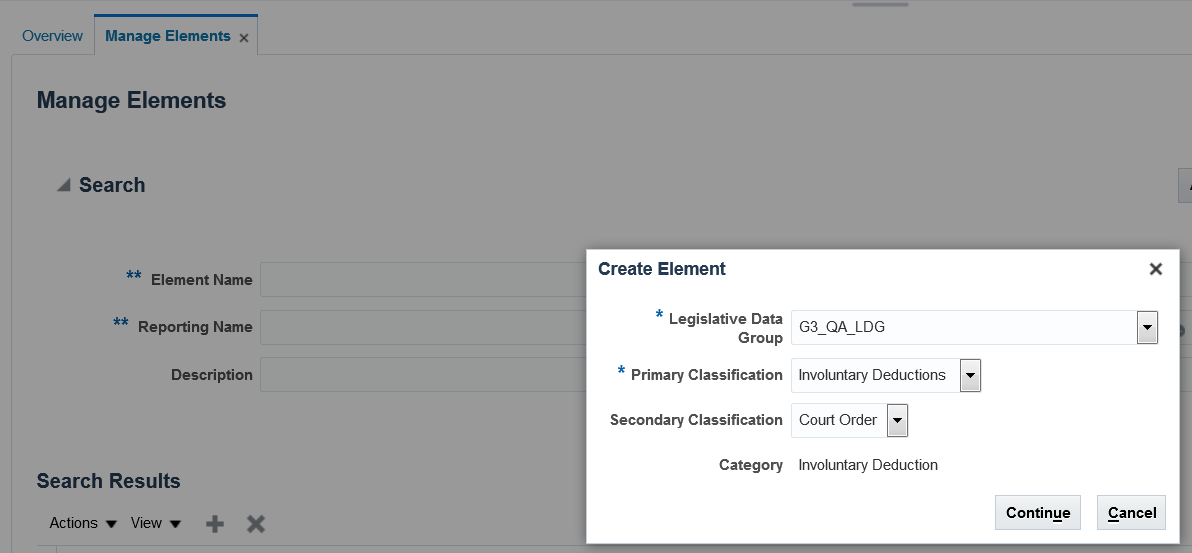

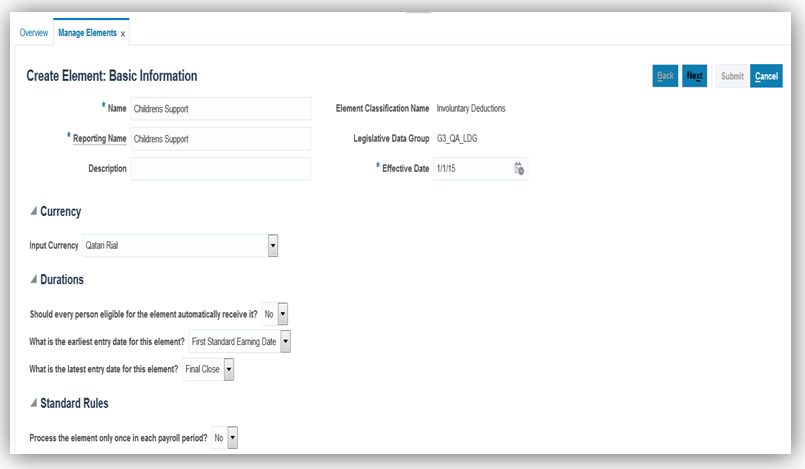

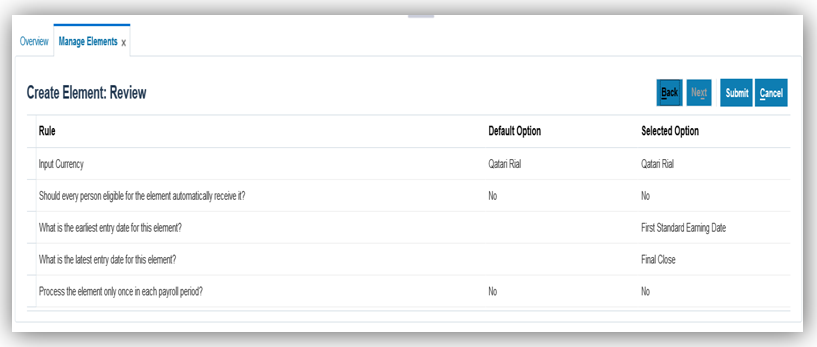

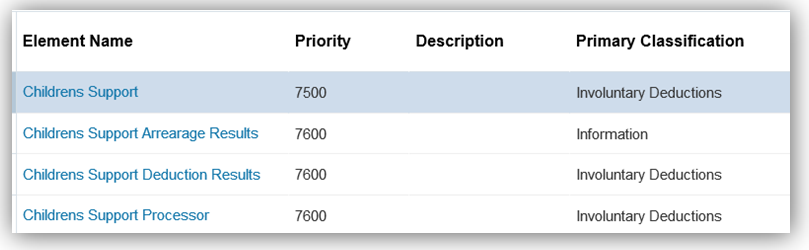

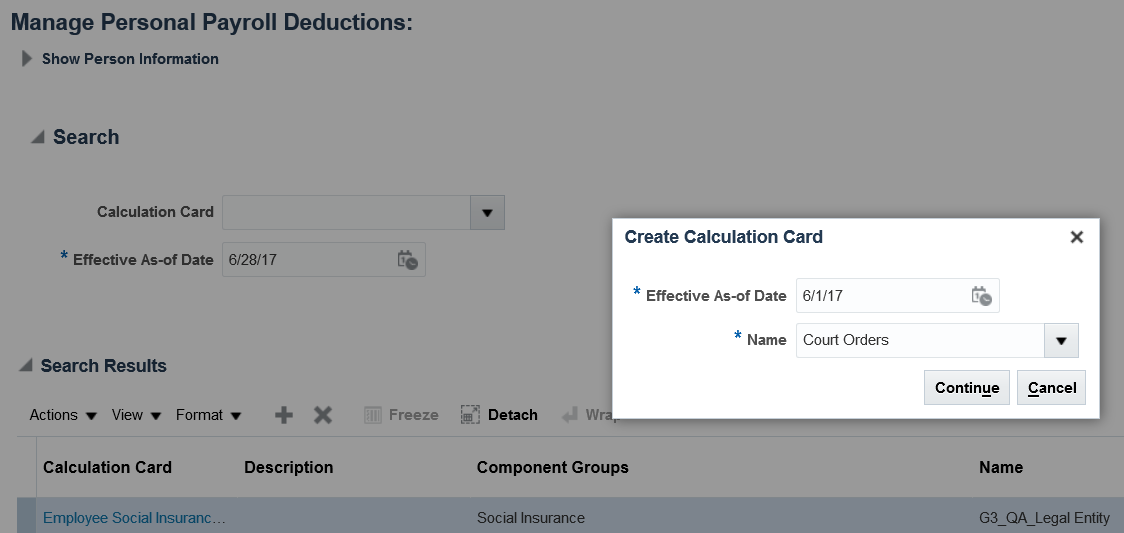

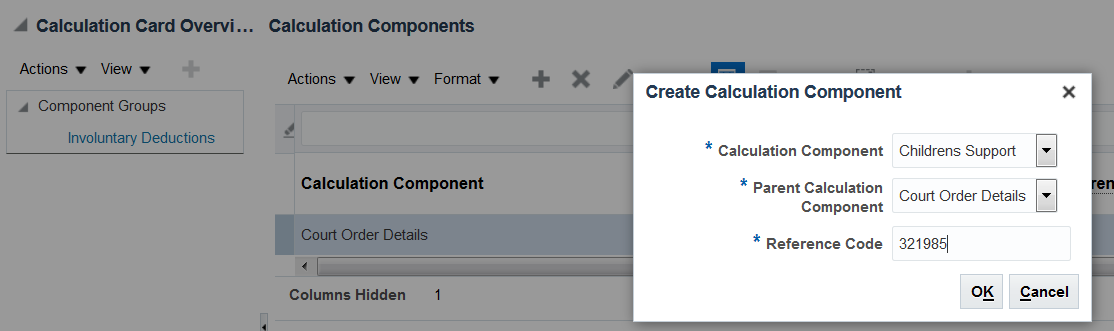

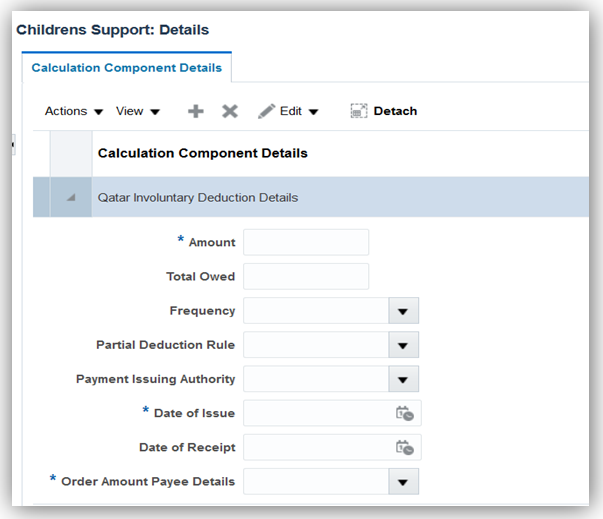

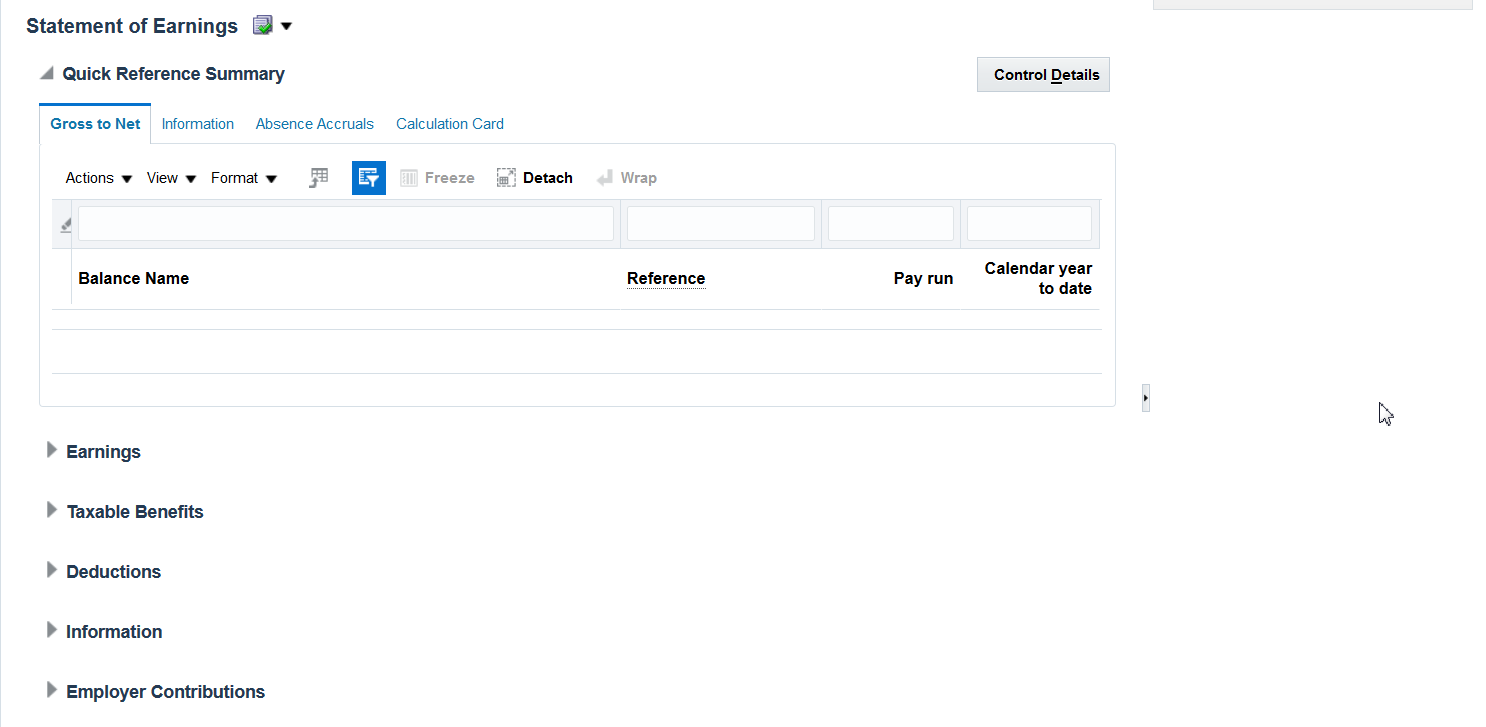

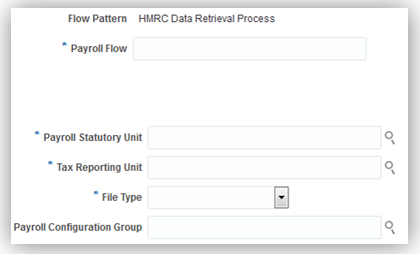

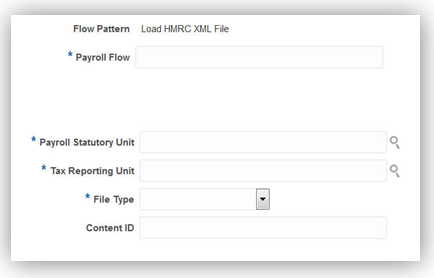

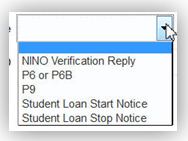

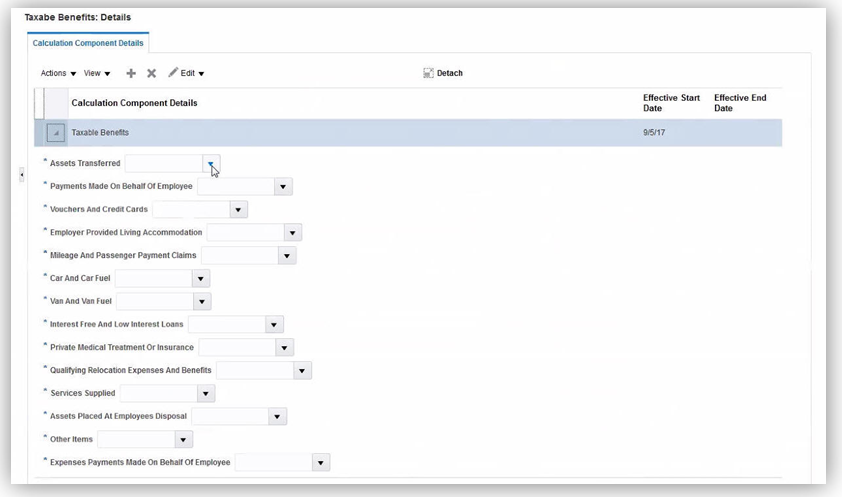

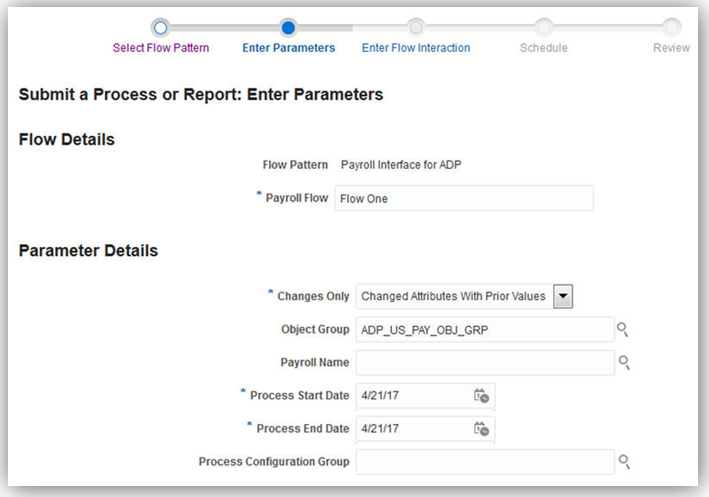

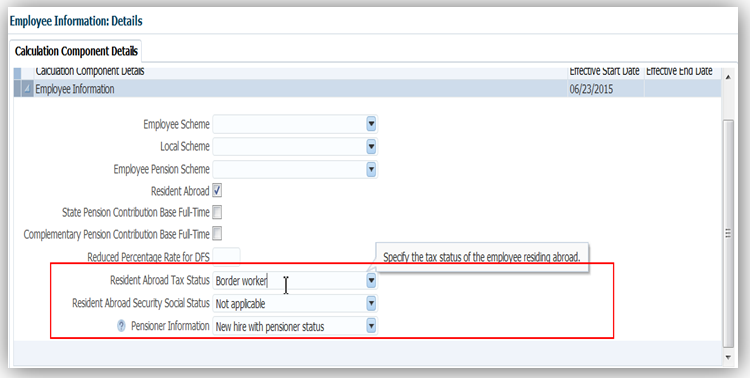

A new component for gratuity contributions has been added to the Social Insurance calculation. The additional employee contribution is applicable to all Kuwaiti workers employed in the Private sector and some Government sector workers, depending on their hire date. Employers can record whether or not they are going to pay the gratuity amount due to an employee on termination. In addition, they can record whether an employee has received a gratuity payment in the past, and the date when that payment was received.