- Revision History

- Overview

- Feature Summary

- Optional Uptake of New Features (Opt-In)

- Common Technology and User Experience

- Financials

-

- Advanced Collections

- Assets

- Budgetary Control

- Cash Management

- Expenses

- General Ledger

- Payables

- Payments

- Receivables

- Revenue Management

-

- Automatically Clear Residual Contract Account Balances for Fully Satisfied Contracts

- Estimating Standalone Selling Price Using Residual Approach per ASC 606 and IFRS 15

- Import Additional Satisfaction Events for Period-Based Revenue Contracts for Fixed and Variable Schedules

- Oracle Transactional Business Intelligence: Open Performance Obligation Report Dashboard

-

- Subledger Accounting

- Tax

- Transactional Business Intelligence for Financials

- Regional and Country-Specific Features

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 20 JAN 2020 | Receivables: REST APIs for Receivables Credit Memos | Updated document. Revised feature information. |

| 26 APR 2019 | General Ledger: Performance Enhancement in Journals Work Area | Updated document. Delivered feature in update 19A. |

| 22 FEB 2019 | Expenses: Support for Mileage Expenses with Location or Zone | Updated document. Delivered feature in update 19A. |

| 22 FEB 2019 | General Ledger: Change in Transaction Count Display | Updated document. Delivered feature in update 19A. |

| 22 FEB 2019 | Transactional Business Intelligence for Financials: Enhancements to OTBI Payables Subject Areas |

Updated document. Revised feature information. |

| 23 JAN 2019 | Cash Management: Manual Reconciliation Enhancements | Updated document. Revised feature information. |

| 21 DEC 2018 | Payables: Audit History Enablement | Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 | General Ledger: Audit History Enablement | Updated document. Revised feature information. |

| 07 DEC 2018 | Created initial document. |

This guide outlines the information you need to know about new or improved functionality in this update, and describes any tasks you might need to perform for the update. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

JOIN ORACLE CLOUD CUSTOMER CONNECT

Please take a moment to join the Cloud Customer Connect forums for Financials Cloud. Oracle Cloud Customer Connect is a community gathering place for members to interact and collaborate on common goals and objectives. This is where you will find the latest release information, upcoming events, or answers to use-case questions. Joining takes just a few minutes. Join now!

https://cloud.oracle.com/community

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Optional Uptake of New Features (Opt-In)

We continue to add many new features to the Oracle Cloud Applications, and for some features, you can take advantage of new functionality at a pace that suits you by “opting in” to the feature when you’re ready. You can opt-in to a feature in two ways: by using the New Features work area, or by using the Setup and Maintenance work area.

To opt-in using the New Features work area:

- Click the Navigator, and then click New Features (under the My Enterprise heading).

- On the New Features page, select the offering that includes new features you’d like to review.

- Click Opt-In for any feature that you want to opt-in to.

- On the Edit Features page, select the Enable option for the feature, and then click Done.

To opt-in using the Setup and Maintenance work area:

- Click the Navigator, and then click Setup and Maintenance.

- On the Setup page, select your offering, and then click Change Feature Opt-In.

- On the Opt-In page, click the Edit Features icon.

- On the Edit Features page, select the Enable option for any feature you want to opt-in to. If the Enable column includes an Edit icon instead of a check box, then click the icon, select your feature options, and click Save and Close.

- Click Done.

Common Technology and User Experience

Simplified Workflow Rules Configuration

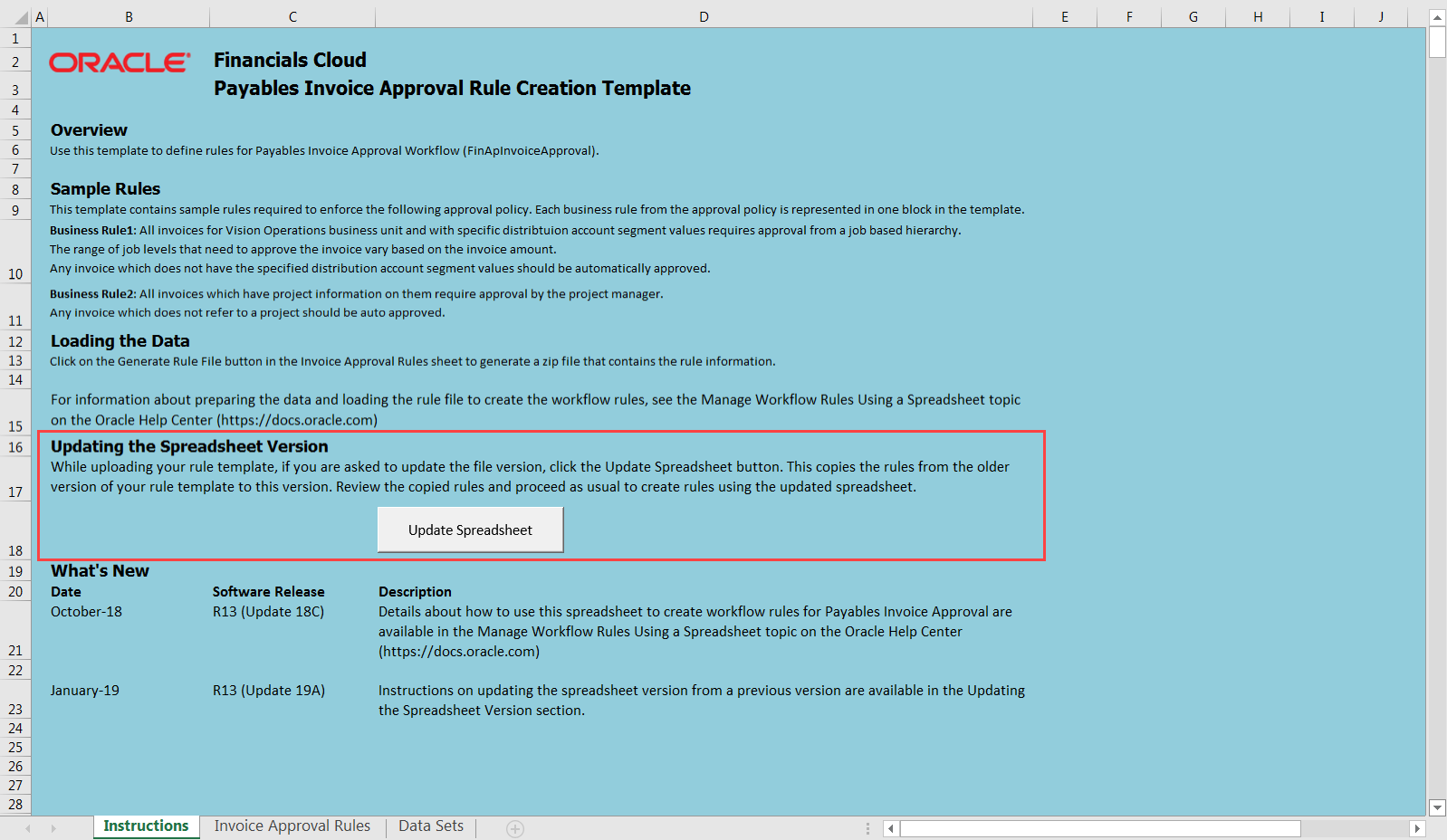

For the Simplified Workflow Rules Configuration feature, updated versions of rule templates for Payables Invoice Approval and General Ledger Journal Approval Workflows are available for download on the Manage Workflow Rules in Spreadsheet page.

If you want to modify rules that were created using an earlier version of the spreadsheet, you must download the latest version from the Manage Workflow Rules in Spreadsheet page. On the Instructions sheet of the latest version of the rule template, click the Update Spreadsheet button to copy rules from the earlier version of the rule template to the latest version. You can then proceed as usual for creation or modification of rules.

Instructions Sheet for Payables Invoice Approval Rules Template

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

When updating the spreadsheet version, download the latest version of any of the available templates for that workflow from the Manage Workflow Rules in Spreadsheet page.

Key Resources

- For an overview of the Simplified Workflow Rules Configuration feature, refer to the Manage Workflow Rules Using a Spreadsheet topic on the Oracle Help Center (http://docs.oracle.com).

Role Information

- No new role access is needed to use this feature.

Configurable Workflow Notifications

Oracle Financials Cloud lets you use Business Intelligence Publisher for workflow notifications. The templates are optimized for mobile devices and are easily configurable. Choose from a comprehensive list of attributes to modify the workflow notifications according to your requirements. You can change both layout and content – add images, change colors and styling, add or remove attributes or modify text. Support for additional Bank Transfer Approval notifications is added in this release.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

The feature needs to be enabled using the Feature Opt In page in Functional Setup Manager. It is not enabled by default.To enable the feature, complete these steps:

- Go to the Setup and Maintenance work area.

- Select Financials from the Setup drop down.

- Click on the Change Feature Opt In.

- On the Opt In: Financials page, click the Features icon for the product for which you wish to enable the feature (Cash Management).

- On the Edit Features page, select the Enable option for each type of notification that you want to enable the feature for.

- Click on Done to go back to the Setup: Financials page.

Tips And Considerations

- Use the predefined email templates with no additional changes or modify them according to your business requirements.

- Preview your changed email templates before publishing.

- Revert to the classic approval notifications at any time by disabling the feature using the Feature Opt In page in Functional Setup Manager.

Key Resources

- Financials Configurable Workflow Notifications: Overview

- Configurable Workflow Notifications: Implementation Considerations (Doc ID 2215570.1) on My Oracle Support

REST APIs for Advanced Collections Promise to Pay Details

Use the Advanced Collections REST API resource to create promises to pay for debit transactions. You can:

- Create a single promise to pay for an invoice, debit memo, chargeback, or bill receivable that has an outstanding balance.

- Create multiple promises to pay for debit transactions that have an outstanding balance.

- Migrate promises to pay from a legacy system to Advanced Collections.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

Use the Cash Advances REST APIs to retrieve cash advances in all statuses for the signed in user. You can retrieve cash advances individually or in batches.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

Role Information

- To use cash advances REST APIs, you must have the Employee role.

Use the Ledger Balances REST API resource to retrieve general ledger balances for accounts defined as part of your account groups.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

Use the Payables Payments REST API resource to create manual payments as a way of recording external payments. You can build integrations based on your PaaS application requirements or for importing paid invoices after your Oracle Financials Cloud upgrade.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Tips And Considerations

Additionally, you can build integrations to:

- Retrieve payment and paid invoice information.

- Void a payment.

NOTE: Currently these resources do not support Global Descriptive Flexfields.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Supplier Invoices

Use the Invoices and Invoice Holds REST API resources to create and manage purchase orders, receipt and consumption advice matched supplier invoices, and unmatched supplier invoices.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Tips And Considerations

Additionally, you can build integrations based on your PaaS application requirements such as retainage, revere factoring arrangements, or placing invoices on hold.

NOTE: Currently these resources do not support Global Descriptive Flexfields.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Debit Authorizations

Use the Debit Authorization REST API resource to manage details about customer debit authorizations. You can:

- Create and manage debit authorizations under customer bank accounts.

- Perform amendments and view the version history of debit authorizations.

- Retrieve debit authorization information.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Payment Process Requests

Use the Payment Process Request REST API resource to perform action on payment process requests. You can:

- Resume or terminate a payment process request when its status is ‘Pending proposed payment review’.

- Retrieve payment process request information.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Receipt Method Assignments

Use the Receipt Method Assignment REST API resource to assign a new receipt method to a customer account or site and to find, update, and delete existing receipt methods of a customer account or site. You can:

- Assign one or more new receipt methods to a customer account or site.

- Update one or more existing receipt methods of a customer account or site.

- Get and Find details of one or more receipt methods of a customer account or site.

- Delete a receipt method of a customer account or site.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Receivables Adjustments

Use the Receivables Adjustments REST API resource to retrieve adjustments against a transaction. Adjustment information includes adjustment type, adjustment reason, and details of the transaction that was adjusted.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Receivables Credit Memos

Use the Receivables Credit Memos REST API resource to retrieve customer on-account credit memos. Review credit memo header information, including transaction type, credit reason, and customer reference details, and credit memo line information concerning the goods and services credited back to the customer.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

REST APIs for Receivables Invoices

Use the Receivables Invoices REST API resource to complete or incomplete invoices, update invoice installments, and create tax lines for invoice lines. You can:

- Create one or more manual tax lines to apply taxes to individual invoice lines.

- Complete or incomplete an invoice.

- Update the payment terms on an invoice to modify the number of installments.

- Update the due date or the original amount due on one or more installments on an invoice.

- Capture additional information for an invoice installment using global descriptive flexfields and notes.

- Get and Find details of one or more Receivables invoices, including structured payment reference details.

Steps to Enable

Review the REST service definition in the REST API guides to leverage (available from the Oracle Help Center > your apps service area of interest > REST API) . If you are new to Oracle's REST services you may want to begin with the Quick Start section.

Tips And Considerations

- Change the payment terms to update the number of installments on an invoice; change the due date or open amount on an individual installment.

- All tax attributes are validated against your tax setup.

Key Resources

- For an overview of REST APIs and the technical details, see the REST API for Oracle Financials Cloud guide in the Oracle Help Center (http://docs.oracle.com).

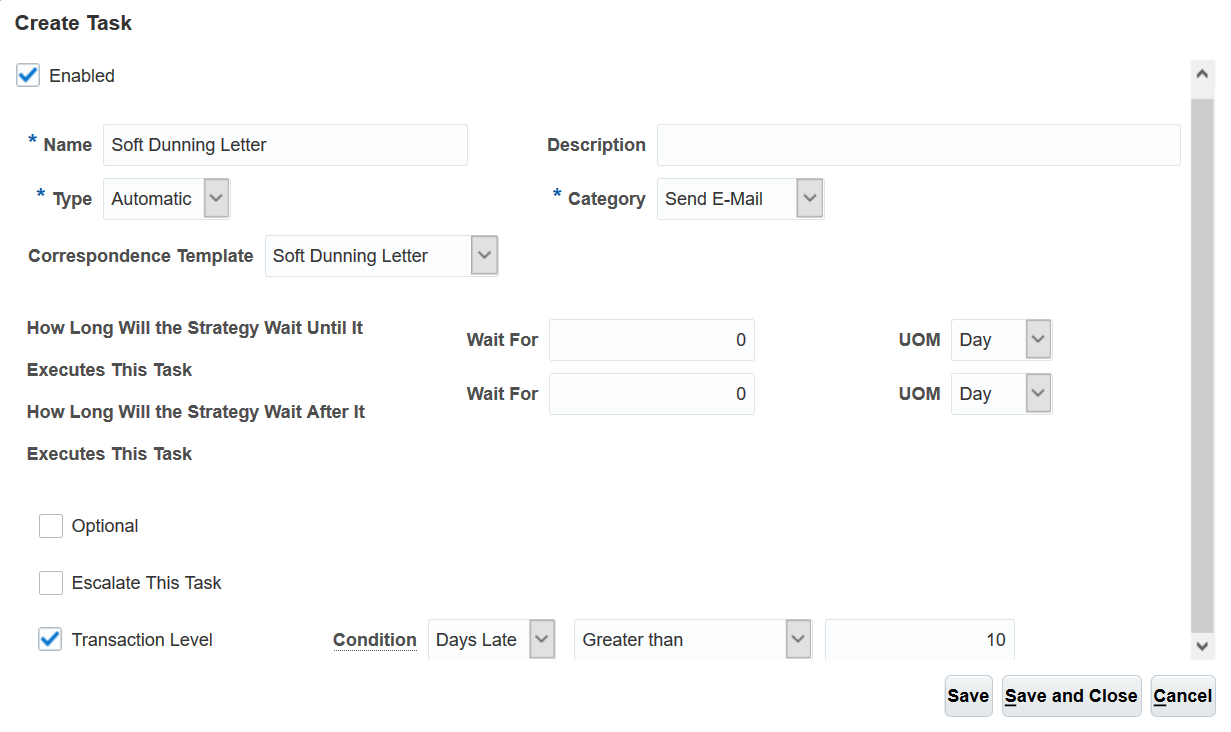

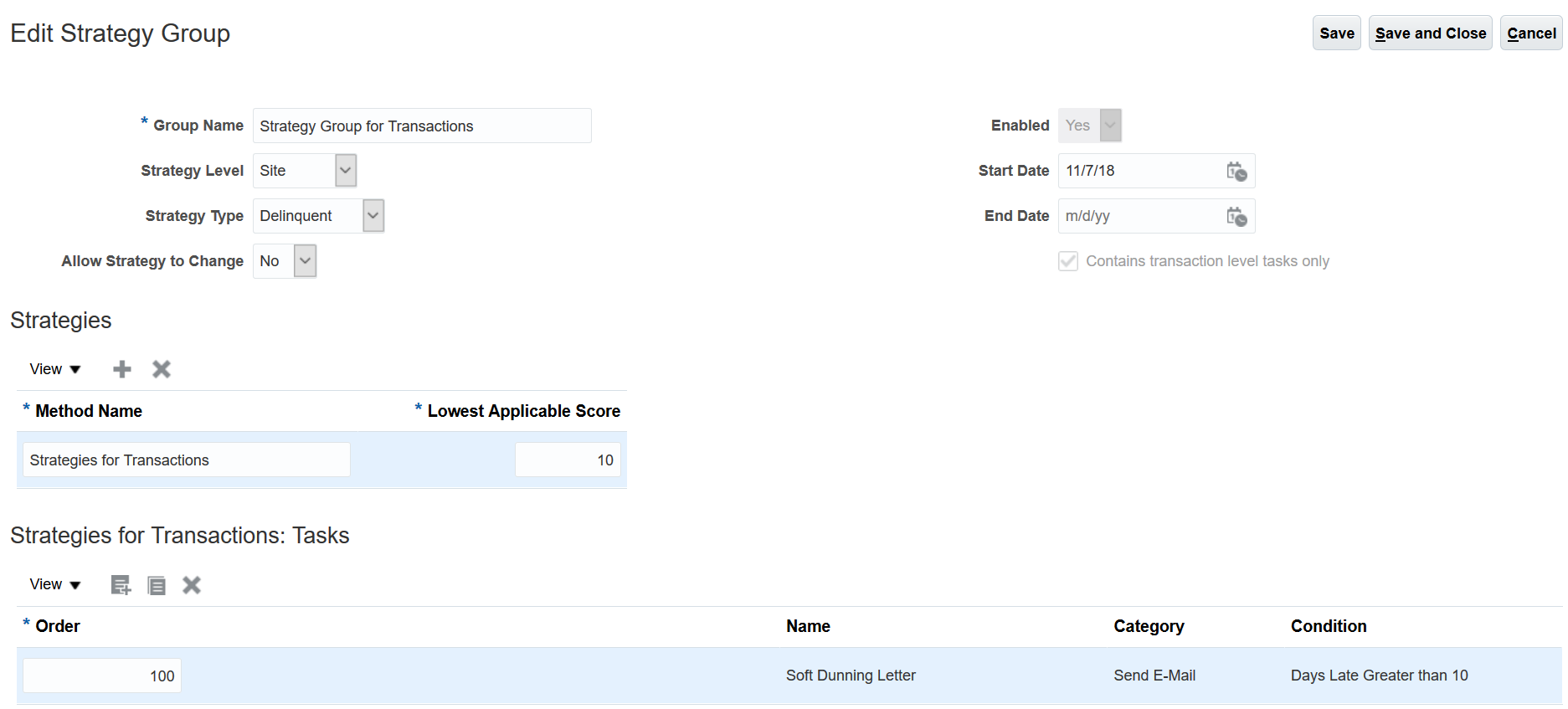

Collections Strategies for Individual Transactions

You can define and run strategies and strategy tasks for individual transactions. Use the Manage Strategy Tasks page to specify the conditions when the strategy task is applicable to a transaction. For example, you can define one strategy task, Send Soft Dunning Letter, to run for transactions that are more than 10 days late, and another task, Send Medium Dunning Letter, to run for transactions more than 30 days late. The strategy processing background process evaluates if a transaction meets the conditions defined in the strategy task definition and runs the strategy tasks for the transaction accordingly. If a transaction is disputed, the number of days that it is in dispute will be subtracted from the number of days late when the condition is evaluated.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

I. Enable Feature

- Click Navigator > My Enterprise > Offerings.

- On the Offerings page, select Financials.

- Click the Opt In Features button.

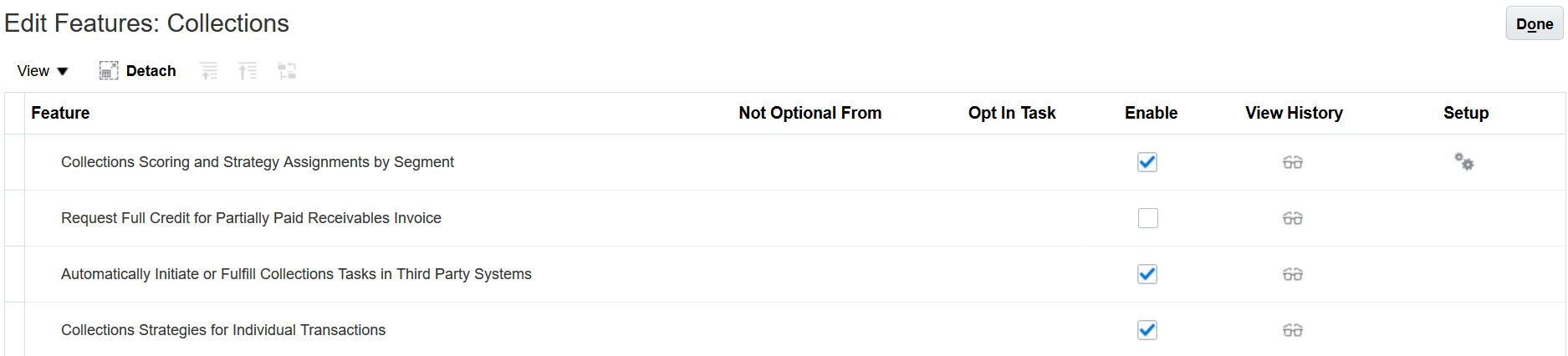

- On the Opt In: Financials page, click the Features icon for Collections. A list of Collections features is displayed.

- Select the Enable check box for the Collections Strategies for Individual Transactions feature and save the changes. Note: Ensure the prerequisite features Collections Scoring and Strategy Assignments by Segment and Automatically Initiate or Fulfill Collections Tasks in Third Party Systems are enabled.

II. Define Transaction Level Strategy Task

- From the Setup and Maintenance work area, access the Manage Collections Strategy Tasks task.

- Use the Create Task page to create a strategy task. Specify the condition when the strategy task should run for a transaction.

III. Define Transaction Level Strategy Group

- From the Setup and Maintenance work area, access the Manage Collections Strategies task.

- Use the Create or Edit Strategy Group page to create a strategy group with transaction level tasks.

Tips And Considerations

- The following Collections features need to be enabled as prerequisite:

- Collections Scoring and Strategy Assignments by Segment

- Automatically Initiate or Fulfill Collections Tasks in Third Party Systems

- Only enable this feature when you have a business need to run collections strategies for individual transactions. Collections strategies can continue to be run at customer, account, and site levels.

New Era Name on Japanese Depreciable Assets Tax Reports

The Japanese Depreciable Assets Tax Reports now display the new Era Name as of 1 May, 2019.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Configure the new Imperial Era using a lookup from the Manage Asset Lookups page.

Role Information

- The Asset Accounting Manager and Asset Accountant job roles are automatically updated.

Control Budget Definition Report

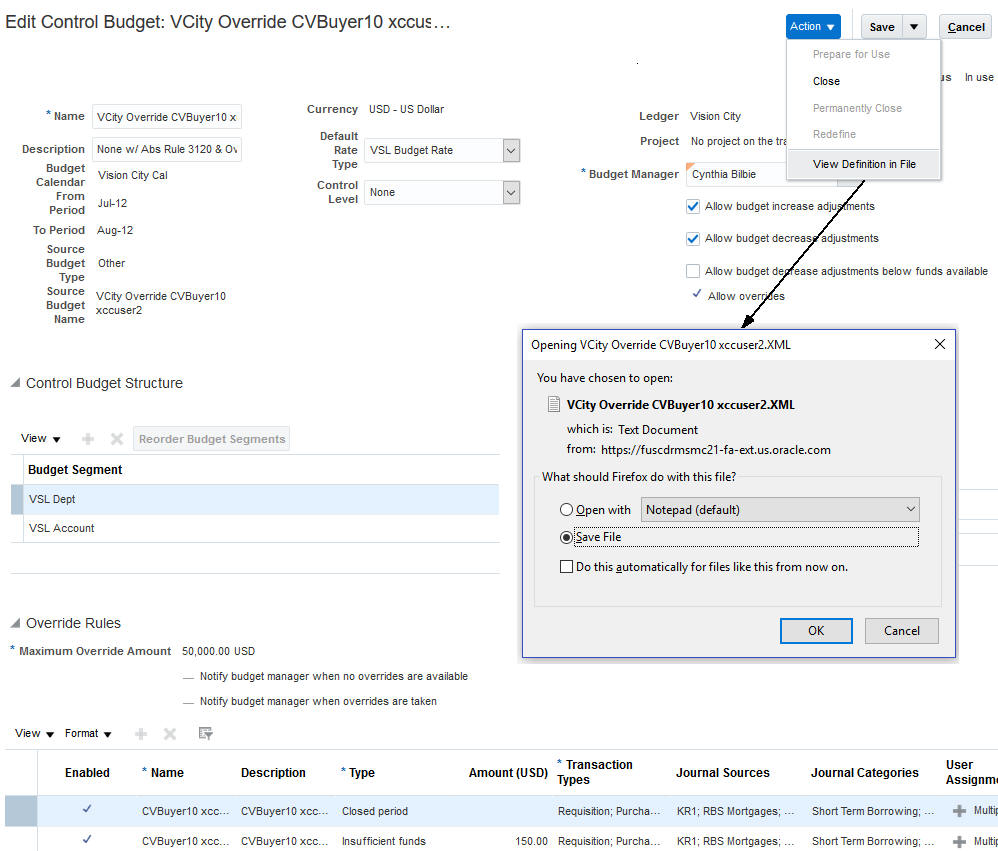

Use these steps to review the Control Budget Definition Report:

- From the Manage Control Budget page, query the desired control budget.

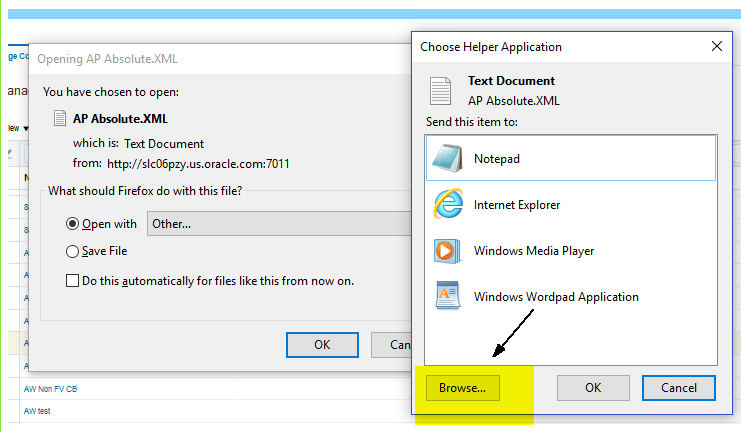

- In the Edit Control Budget page, click Action > View Definition in File to download the control budget definition XML file to a spreadsheet.

Download Control Budget Definition to File

- Select Save File and click OK to save the file to the desired location. The default file name is the control budget name.XML.

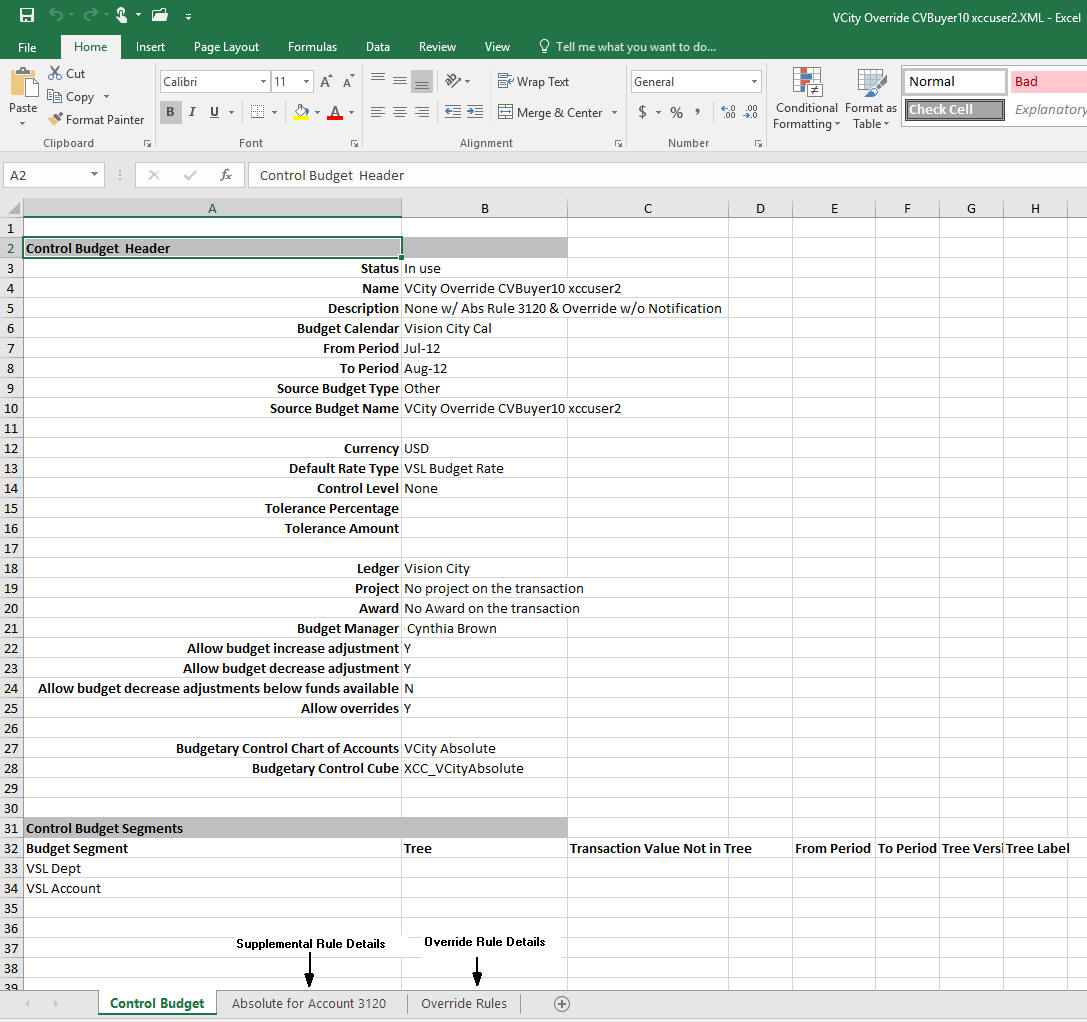

- Open the saved file to see the details of the control budget. The first tab will be the overall control budget definition including control budget segment details. The details of supplemental and override rules are in separate tabs. The following image is an example of a control budget tab.

Control Budget Definition Report Example

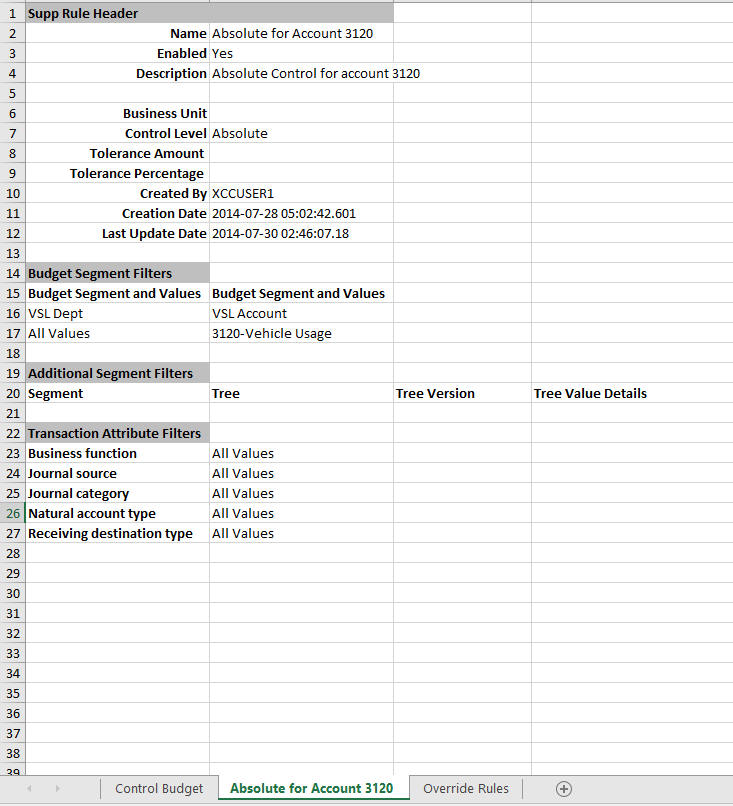

The following image is an example of a Supplemental Rule tab details:

Supplemental Rule

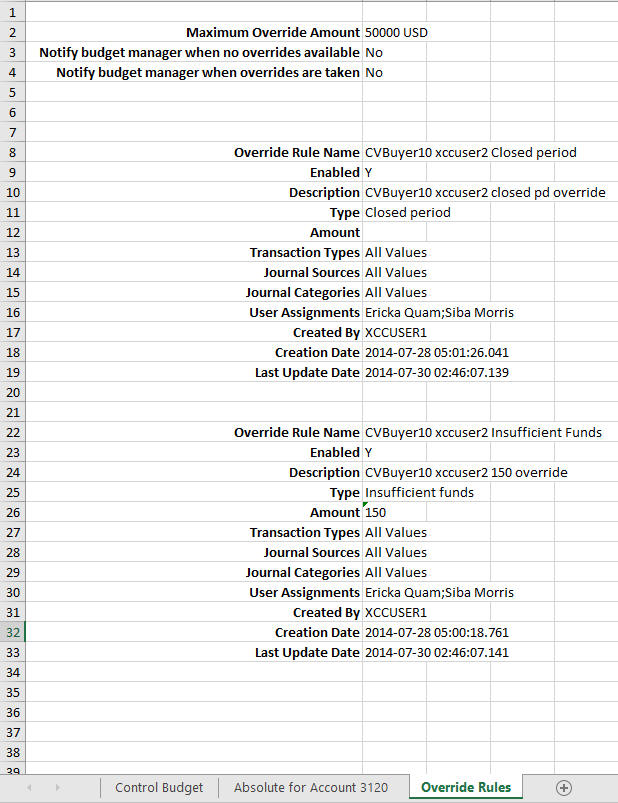

The following image is an example of an Override Rule tab details:

Override Rules

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

If your file doesn't open correctly consider the following tips:

- Associate the Excel application to open the XML file.

- If Excel is not immediately available for selection as a Helper Application, browse your file structure to manually associate.

- After completing the association, save the downloaded file to your computer.

Enhanced User Experience of Bank Statements Handling Features

The enhanced bank statements handling features can improve your efficiency and user experience by:

- Exporting bank statement line information to a spreadsheet.

- Editing imported bank statements, and updating relevant attributes for reconciliation, such as reconciliation reference and transaction code.

- Saving search criteria on the Manage Bank Statements page.

- Importing BAI2 bank statement files that contain non-monetary information.

- Troubleshooting issues when bank statements are imported.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information on Manage Bank Statements, refer to Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash on the Oracle Help Center (http://docs.oracle.com)

Role Information

- No new role access is needed to use this feature.

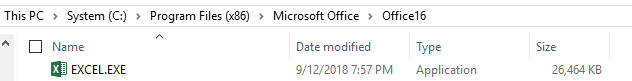

You can now attach one or more documents to manual bank statements.

These documents can provide additional reference information and can be used for audit purposes when bank statements are not imported from files.

Attachments may be added or deleted any time for unreconciled bank statements.

Option to Upload Attachments for Bank Statements

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Consider the following when attaching documents to bank statements:

- You cannot add or delete attachments on reconciled Bank Statements.

- Once the bank statement is reconciled, the attachments are available as read-only.

- The attachment feature is available on the Create and Edit Bank Statements pages, at the bank statement header level.

Users who can currently create or edit bank statements will be able to upload attachments to Bank Statements.

Key Resources

- For more information on Manage Bank Statements, refer to Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash on the Oracle Help Center (http://docs.oracle.com)

Role Information

- No new role access is needed to use this feature.

- The Manage Bank Statements page is controlled by the existing privileges.

Manual Reconciliation Enhancements

The enhancements to Manual Reconciliation provide improvements to the reconciliation process. In the Manual Reconciliation page, you can now export reconciliation search results to a spreadsheet, for both bank statement lines and system transactions, add additional columns to the bank statement line and system transaction table results, and experience performance improvements.

Screenshot of Manual Reconciliation Page

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information on Manage Bank Statements and Reconciliation, refer to Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash on the Oracle Help Center (http://docs.oracle.com)

Role Information

- No new role access is needed to use this feature.

- The Manual Reconciliation page is controlled by the existing privileges

Bank Account Validation Improvements

You can now validate the domestic and international bank account numbers of additional countries based on country-specific validation rules. Incorporated are the revised country-specific validation rules for existing countries.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information on Bank Account Validations, refer to Oracle Financials Cloud Using Payables Invoice to Pay, or Oracle Financials Cloud Using Receivables Credit to Cash on the Oracle Help Center (http://docs.oracle.com)

Support for Mileage Expenses with Location or Zone

You can now enter mileage expenses that are based on locations or zones from your mobile Expenses application and then upload and submit them in expense reports. When a reimbursable rate for a mileage expense is based on the location of the expense, the application defaults your current location. When the mileage expense is based on the zone, you can select the zone from a list. The list displays only the zones that are applicable for the mileage expense type.The location and the zone are used to derive the mileage reimbursement rate.

Steps to Enable

This feature is already available in the Expenses online application. For setup steps, refer to the Setting Up a Mileage Expense Policy: Explained topic in the Oracle Applications online help.

Key Resources

For more information about mileage rates based on determinants, refer to the following topics in Oracle Applications online help:

-

Setting Up a Mileage Expense Policy: Explained

-

Completing a Mileage Rate Spreadsheet: Worked Example

Role Information

To setup mileage policies in Expenses, you must have one of the the following roles:

- Expense Manager

- Application Implementation Consultant

- Financials Administrator

Oracle Financials Cloud currently supports audit history on several key business objects. You can individually configure and enable auditing of each business object. With this release, we have expanded the list of supported business objects to include General Ledger journal batches, journal headers, journal lines, and period statuses.

Steps to Enable

You must configure the business objects and select the attributes before enabling audit. If you enable audit without configuring the business objects, auditing remains inactive. By default, auditing is disabled for all applications.

To enable and manage audit, use the Manage Audit Policies task from the Application Extensions functional area within your offering. Ensure that you have a role with the assigned privilege Manage Audit Policies.

To view the history or to create a report, you must have a role with the assigned privilege View Audit History. To open the Audit History work area, from the Navigator menu, select Audit Reports.

Tips And Considerations

Audit enables tracking the change history of particular attributes of a business object. However, those objects and their attributes must be selected for audit and auditing must be enabled for that application. Your configuration settings determine which attributes to audit for a given object, and when the audit starts and ends. Auditing takes into account all the operations performed on an object and its attributes, such as create, update, and delete.

Change in Transaction Count Display

Transaction counts are no longer displayed in the Journals section to ensure the General Ledger work areas and dashboards render more quickly.

Steps to Enable

You don't need to do anything to enable this feature.

Display Error Message in Separate Column in Create Journals Spreadsheet

When journals are created using the ADFdi Create Journals spreadsheet and some transactions fail, a new Error column will display the error message that indicates the reason for the failure.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Install the latest version of the ADF Desktop Integration Add-In for Excel.

Improvements to GL Setup Data Export Services

You can now create a configuration package using your implementation project to export only a subset of GL setup data based on the primary ledger scope that you specify. The primary ledgers, associated secondary ledgers and reporting currencies based on the primary ledger scopes that you specify, will be included in the export file. In cases where GL setup data does not explicitly refer to a ledger name, the ledger name in the scope will be used by the export services to derive another attribute, such as the chart of accounts or calendar, to filter the setup data to be included in the configuration package.

The following table provides more details.

SCOPE SPECIFIED - PRIMARY LEDGER

The list of General Ledger setup data exported

| Setup Tasks Selected |

Exported Data |

|---|---|

| Manage Primary Ledgers Specify Ledger Options Manage Secondary Ledgers Complete Primary to Secondary Ledger Mapping Manage Reporting Currencies Assign Legal Entities Assign Balancing Segment Values to Legal Entities Assign Balancing Segment Values to Ledger Review and Submit Accounting Configuration View Accounting Configuration Summary |

The related setup data based on the scoped primary ledger and the associated secondary ledgers and reporting currencies. |

| Manage Ledger Sets |

The ledger sets where the scoped primary ledger is referenced. In addition, those ledger sets containing the associated secondary ledgers and reporting currencies will also be included. |

| Manage Suspense Accounts |

Suspense accounts setup, based on the scoped primary ledger, associated secondary ledgers and reporting currencies. Also the suspense account setup defined based on a ledger set that references the scoped primary ledger, associated secondary ledgers or the reporting currencies will be included. |

| Manage AutoPost Criteria Sets |

AutoPost criteria sets, based on the scoped primary ledger, and associated secondary ledgers and reporting currencies. Besides these, those criteria sets with ALL ledgers assigned will also be included. |

| Manage Data Access Sets |

Data access sets, based on the scoped primary ledger, and associated secondary ledgers and reporting currencies. Also the data access sets defined based on a ledger set that references the scoped primary ledger, associated secondary ledgers or the reporting currencies will be included. |

| Manage Close Monitor Setup |

Close Monitor setup, based on the scoped primary ledger, associated secondary ledgers and reporting currencies. Also the close monitor setup defined based on a ledger set that references the scoped primary ledger, associated secondary ledgers or the reporting currencies will be included. |

| Manage Accounting and Reporting Sequences |

Accounting and Reporting sequences setup, based on the scoped primary ledger, associated secondary ledgers and reporting currencies. |

| Manage Intercompany Balancing Rules |

Primary Balancing Segment, Legal Entity, Ledger and Chart of Accounts related intercompany balancing rules, based on the scoped primary ledger, associated secondary ledgers and reporting currencies. |

| Manage Additional Intercompany Balancing and Clearing Options |

Additional Intercompany balancing and Clearing Company options, based on the scoped primary ledger, associated secondary ledgers and reporting currencies. |

| Manage Clearing Accounts Reconciliation |

Clearing Accounts Reconciliation Types, based on the scoped primary ledger and the associated secondary ledgers. Both the ledgers-specific and the associated chart of accounts-specific rules will be exported. |

| Manage Revaluations |

Revaluations setup, based on the chart of accounts associated with the scoped primary ledger and its associated secondary ledgers. |

| Manage General Ledger Encumbrance Carry Forward Rules |

Encumbrance Carry forward rules, based on the chart of accounts associated with the scoped primary ledger and its associated secondary ledgers. |

| Manage Chart of Accounts Mappings |

Chart of Accounts Mapping rules that reference the chart of accounts associated with the scoped primary ledger and the associated secondary ledgers. |

| Manage Shorthand Aliases |

Shorthand aliases, based on the chart of accounts associated with the scoped primary ledger and the associated secondary ledgers. |

| Manage Statistical Units of Measure |

Statistical Units of Measure setup, based on the chart of accounts associated with the scoped primary ledger and the associated secondary ledgers. |

| Manage Journal Reversal Criteria Sets |

Journal Reversal Criteria sets, based on the assignments to the scoped primary ledger and the associated secondary ledgers and the reporting currencies. |

| Manage Processing Schedules |

Process schedules setup, based on the accounting calendars used in the scoped primary ledger and associated secondary ledgers. |

| Manage Accounting Calendars |

Accounting Calendars setup, based on the assignments to the scoped primary ledger and the associated secondary ledgers. |

| Manage Transaction Calendars |

Transaction Calendars setup, based on the scoped primary ledgers and the associated secondary ledgers. |

| Manage Accounting Automation |

Accounting Automation setup, based on the scoped primary ledgers. Also included are the accounting automation setup with ALL ledgers and No ledger. |

| Other remaining setup tasks, if selected for export. |

All setup data will be exported, regardless of the scope specified. Example: All Encumbrance Types setup, Storage parameters, Journal Sources and Categories, Currencies, Allocation definitions, Financial Reporting Studio reports, will be exported. |

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

If you create a configuration package without including the scope of a primary ledger, then all the GL setup data will be exported without applying any scope-based filter. For example, if you only include the Manage Ledger Sets task without also including the Manage Primary Ledgers task in the configuration package, this means that you want to export all the ledger sets defined in the source.

Key Resources

- For information on exporting and importing setup data, see the Using Functional Setup Manager guide in the Oracle Help Center (http://docs.oracle.com).

Performance Enhancement in Journals Work Area

To ensure the work area renders faster, approval-related Approve and Reject buttons will always display in the Journals section, regardless of whether the user is the approver. If the user cannot approve or reject the transaction, an appropriate message will be displayed.

Steps to Enable

You don't need to do anything to enable this feature.

Oracle Financials Cloud currently supports audit history on several key business objects. You can individually configure and enable auditing of each business object. With this release, we have expanded the list of supported Payables business objects to include the following transaction business objects:

- Correct Import Errors Invoice Headers

- Correct Import Errors Invoice Lines

- Invoice

- Invoice Lines

- Invoice Distributions

- Invoice Installments

Steps to Enable

You must configure the business objects and select the attributes before enabling audit. If you enable audit without configuring the business objects, auditing remains inactive. By default, auditing is disabled for all applications.

To enable and manage audit, use the Manage Audit Policies task from the Application Extensions functional area within your offering. Ensure that you have a role with the assigned privilege Manage Audit Policies.

To view the history or to create a report, you must have a role with the assigned privilege View Audit History. To open the Audit History work area, from the Navigator menu, select Audit Reports.

Tips And Considerations

Audit enables tracking the change history of particular attributes of a business object. However, those objects and their attributes must be selected for audit and auditing must be enabled for that application. Your configuration settings determine which attributes to audit for a given object, and when the audit starts and ends. Auditing takes into account all the operations performed on an object and its attributes, such as create, update, and delete.

NOTE: For transaction entities, auditing takes into account update and delete operations only.

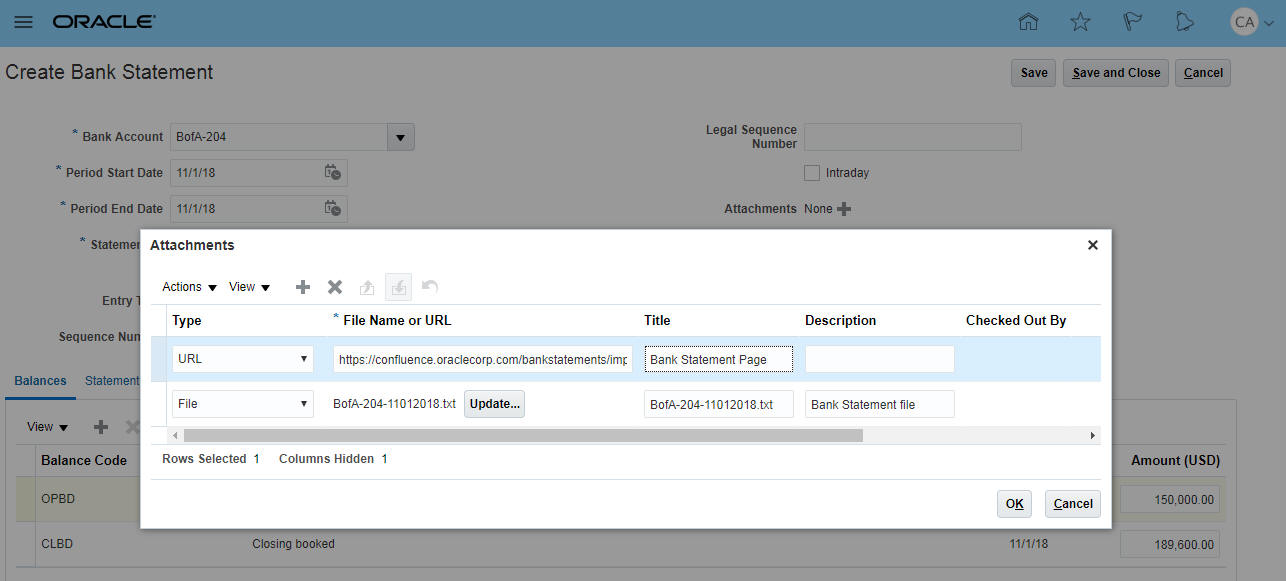

Consolidated Workflow Notification for Similar Matched Holds

Use this feature to generate a consolidated hold notification when similar matching holds are applied on an invoice. You can acknowledge or release multiple holds in the Consolidated Hold Notification.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

- In the Offerings work area, enable the Consolidated Workflow Notification for Similar Matched Holds feature as follows:

- Offering: Financials

- Functional Area: Payables Feature: Consolidated Workflow Notification for Similar Matched Holds

- Enable the checkbox

- Click Done to return the New Features page.

There is a list of predetermined holds considered for grouping and generating a consolidated hold notification.

The holds are grouped together and a consolidated notification is generated for each group.

The following table lists the predetermined holds:

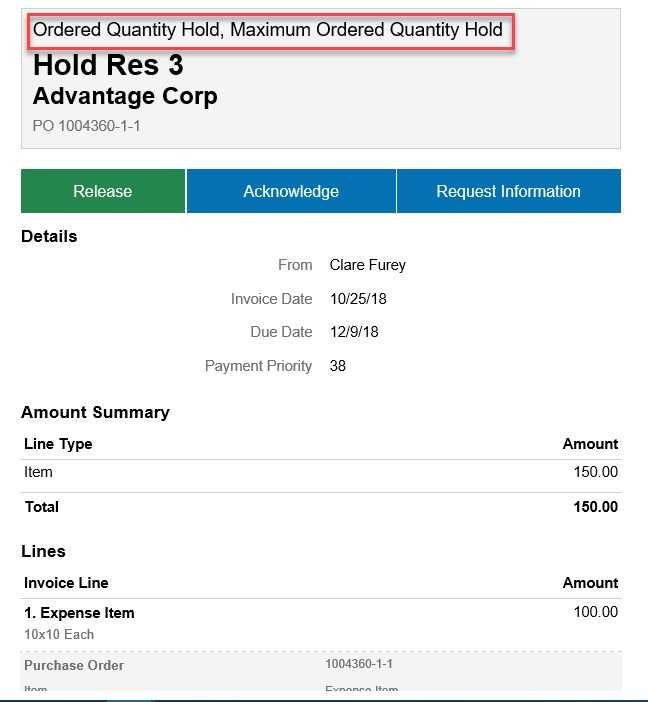

For example, an invoice is matched to a receipt and placed on the Ordered Quantity, Maximum Ordered Quantity, Received Quantity, Maximum Received Quantity, Consumed Quantity, and Maximum Consumed Quantity holds. In this case, the holds belong to three different hold groups and hence, three hold notifications are generated.

The following image displays the BPM online hold notification:

BPM Notification

The following image displays the BIP email notification:

BIP Notification

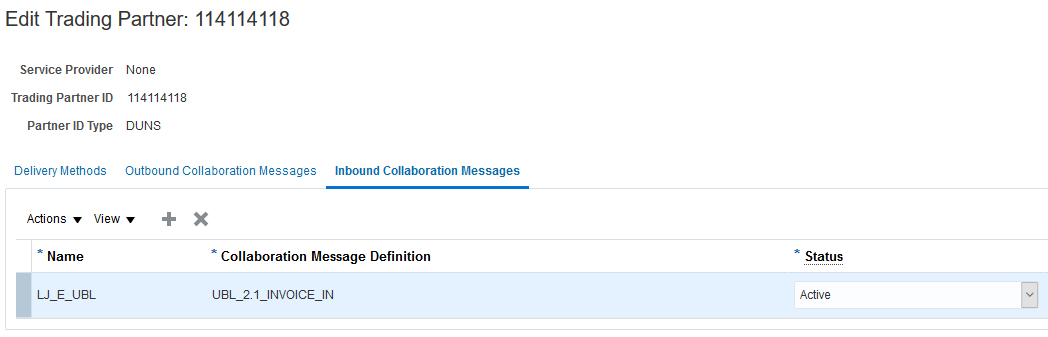

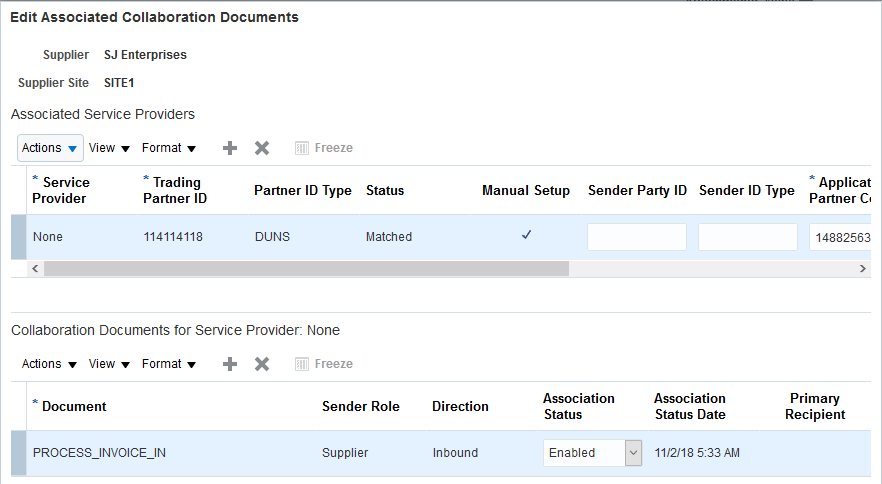

Payables Invoices in the Universal Business Language 2.1 XML Format

The Universal Business Language (UBL) 2.1 XML format has seen widespread adoption in Europe, with many countries making it mandatory for business-to-government transactions. This feature enables you to receive electronic invoices from suppliers in UBL 2.1 format using Collaboration Messaging Framework (CMK).

A new Collaboration Message, UBL_2.1_INVOICE_IN, has been seeded in CMK for receiving and converting UBL 2.1 invoices. UBL 2.1 invoices sent by suppliers are received by CMK and saved in the Payables interface tables. You can then import the invoices by running the Import Payables Invoices process.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- This is an example of how to set up a supplier for UBL 2.1 XML. In order to receive UBL 2.1 invoices, assign the seeded collaboration message definition UBL_2.1_INVOICE_IN to the trading partner created in CMK.

- In supplier site setup, select the trading partner and add PROCESS_INVOICE_IN under Associated Collaboration Documents.

- UBL 2.1 invoices can be received through CMK web service or B2B adapter.

- The invoices can be imported from the interface by running the Import Payables Invoices process with source "B2B XML Invoice".

-

You can use the UBL Extensions area to map additional attributes specific to your business requirements. This can be done by modifying the delivered UBL 2.1 XSLT using the Manage Collaboration Message Definitions task, available from the Collaboration Messaging Framework work area.

Role Information

- Users with the Accounts Payable Manager or Accounts Payable Supervisor role can access the Collaboration Messaging Framework work area to view message history and trading partners setup.

- Users with the Accounts Payable Manager or Accounts Payable Supervisor role can access the Manage Collaboration Messaging Configuration and Manage Collaboration Messaging Service Providers tasks under the Setup and Maintenance work area.

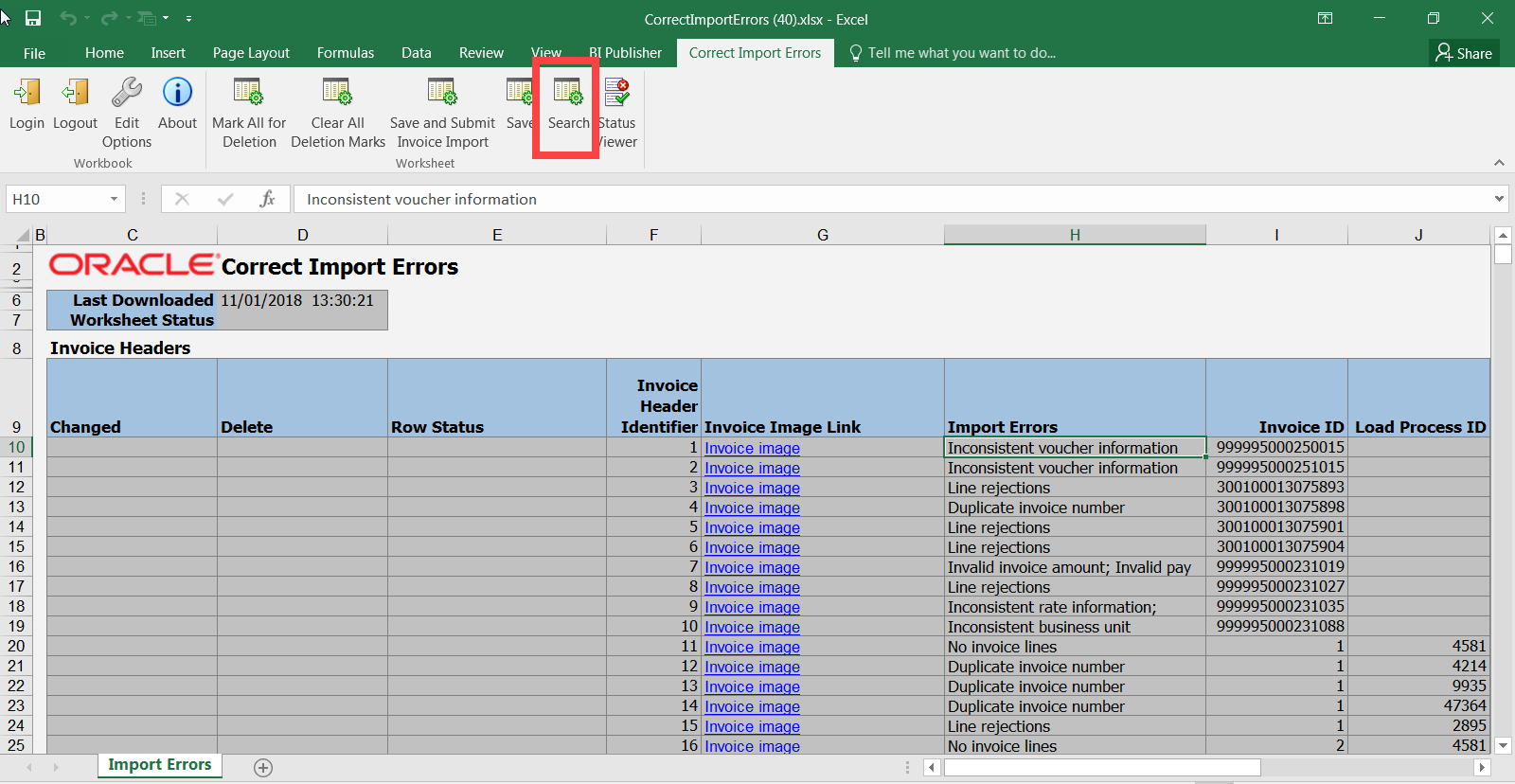

Search in Payables Correct Import Errors Spreadsheet

You can now search and filter records when correcting invoice import errors using the new Search feature in the Payables Correct Import Errors Spreadsheet.

The feature is accessible through the Search button on the Correct Import Errors tab of the Correct Import Errors Spreadsheet.

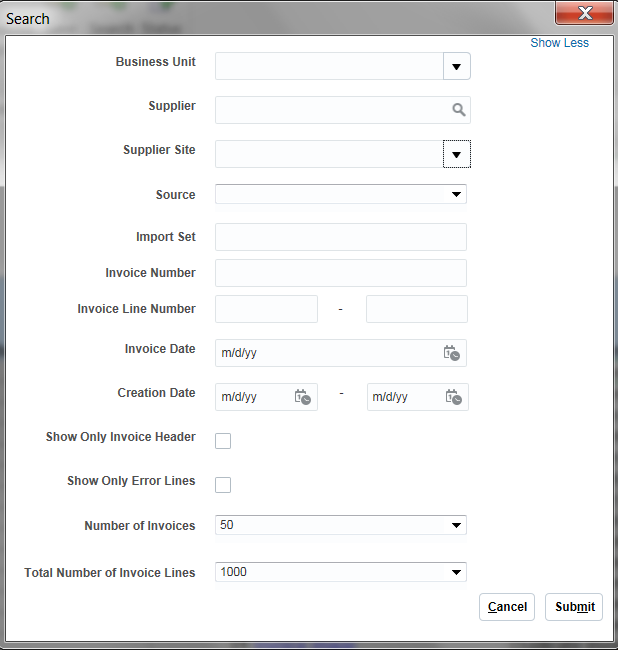

Correct Import Errors Spreadsheet

You can provide values for the search parameters and click Submit to retrieve records that satisfy your search criteria.

Search UI

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Consider the following when using the Payables Correct Import Errors Spreadsheet:

- When you use the search feature, by default a total of 50 invoices and 1000 invoice lines are displayed in the results. You can change the default values for the parameters for Number of Invoices and Total Number of Invoice Lines to limit or increase the results.

- You have the option of viewing only invoice headers by enabling the Show Only Invoice Headers checkbox. When checked, only the invoice headers are displayed.

- Enable the Show Only Error Lines checkbox to get search results where only those invoice lines that have import errors are displayed for each invoice.

Role Information

- No new role access is needed to access this feature.

Supplier Portal Invoicing Enhancement

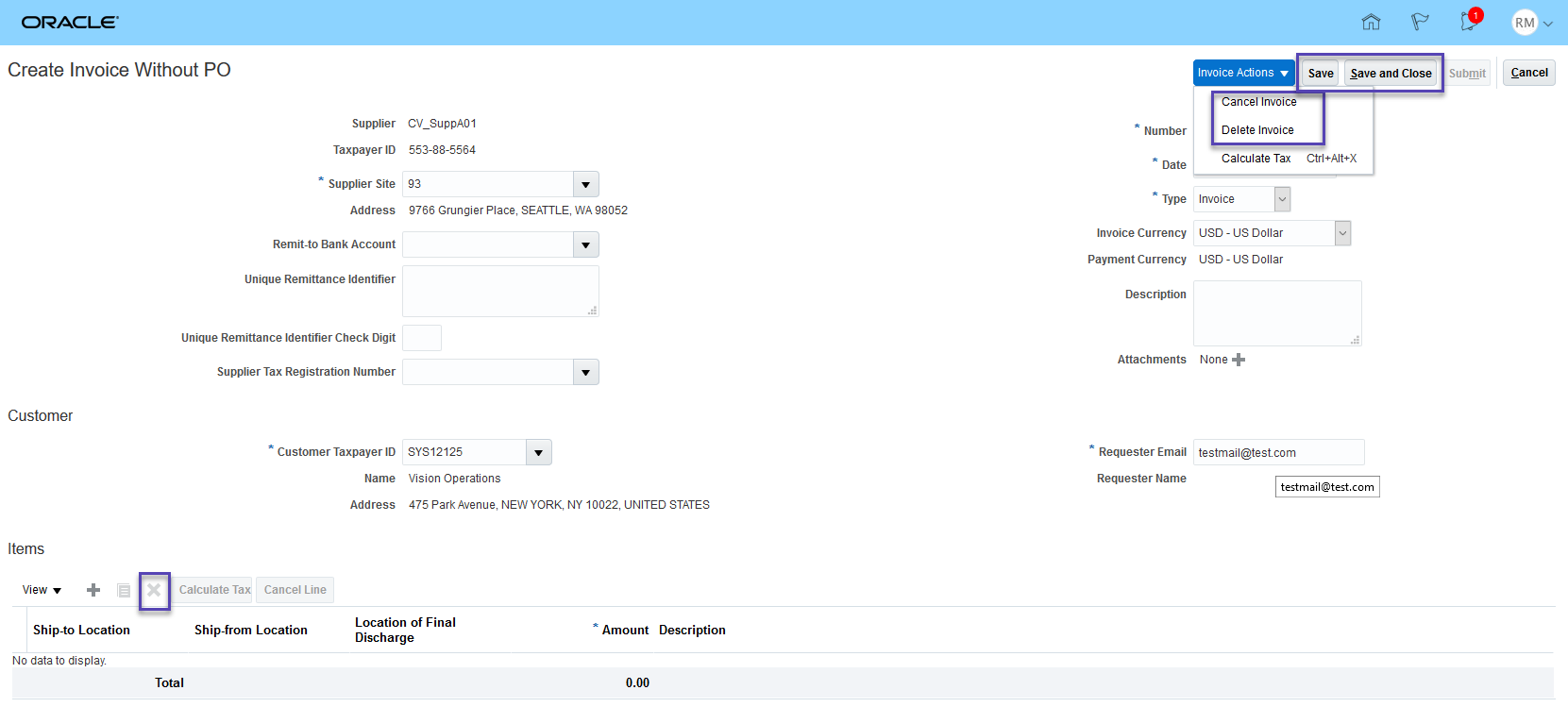

The Supplier Portal Invoicing Enhancement lets you save and update invoices created through the supplier portal before submitting them for processing. You can perform these updates on saved invoices:.

- Delete Invoice: Invoice is removed from the application and you cannot query it back.

- Cancel Invoice: All invoice amounts are set to zero, and the invoice cannot be edited or submitted for processing.

- Recalculate Tax: Modify invoice data and recalculate the taxes on the invoice.

- Delete an invoice line.

New Features for Supplier Portal Invoices

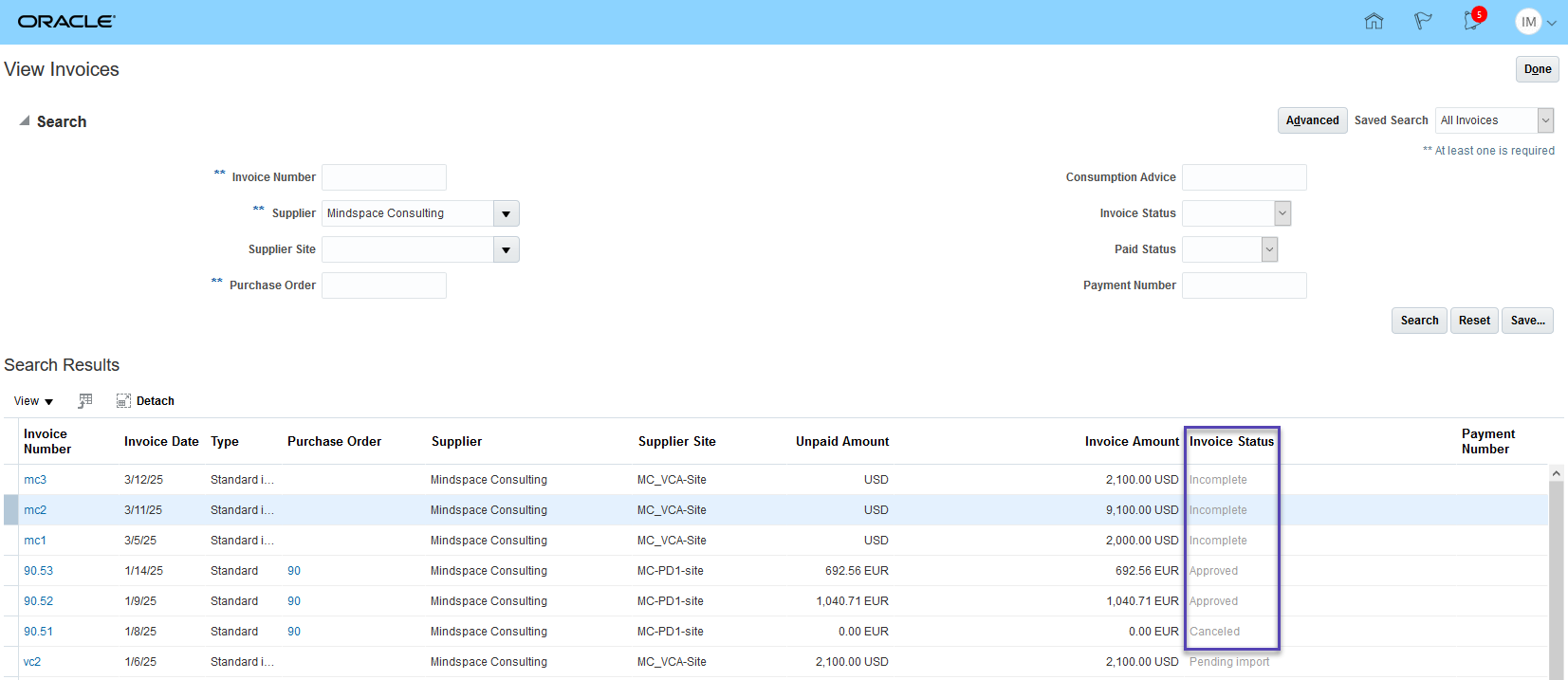

Saved invoices are assigned the status Incomplete. To edit an invoice, click the invoice number hyperlink in View Invoices: Search Results. This opens an Edit Invoice page for an unmatched invoice or matched invoices. Edit the invoice and either save for further editing or save and submit for processing.

Saved Invoices in Incomplete Status

NOTE: If the status of the invoice is other than Incomplete, clicking the invoice number hyperlink opens the Invoice Details page.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Tips And Considerations

Consider the following when working with invoices from the Supplier Portal:

- Saved invoices have the status Incomplete.

- You will not be able to update the invoice number on canceled invoices. To re-use the invoice number you can consider modifying it before invoice cancellation.

- You cannot delete order-matched invoices or the invoices with document sequence assigned.

- You cannot delete order-matched lines. In addition, you cannot delete invoice lines after tax calculation is attempted.

- Saved supplier portal invoices will block the period close. You would need to sweep them and then close the period.

- Payables users cannot edit saved Supplier Portal invoices from the Payables workbench and pages. Payables users can only work on these invoices after Supplier Portal users submit the invoices.

No setups are required to enable this feature. You only need to enable the feature Opt-in “Supplier Portal Invoicing Enhancement”.

Role Information

- No additional roles are required to work on this feature.

Customer and Supplier Balance Netting

Use the Generate Netting Settlements process to create netting settlements for a Legal Entity or Business Unit.

The following parameters are available:

- Business Unit

- Legal Entity

- Netting Group

- Agreement Name

- Settlement Date

- Settlement Name

- Settle Without Review

- Transaction Due Date

- Accounting Date

- Conversion Rate Type

You can also create settlements from the Manage Netting Settlements page. However, from the Generate Netting Settlements process you can submit for your business unit in addition to the legal entity. You can also schedule the process to run at a time that is convenient for your business operations.

Watch a Demo

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Consider if you wish to run the process for your Business Unit or your Legal Entity. If you opt to run by business unit, all Legal Entities linked to your Business Unit will be eligible for selection.

Also, consider if you wish to Settle Without Review. When you Settle Without Review, then all the settlements are settled automatically, without the option to fine tune your settlements in the spreadsheet.

***IMPORTANT THIS SECTION USED TO BE STEPS TO ENABLE****

Refer to the Customer and Supplier Balance Netting Topical Essay for detailed implementation guidance: https://cloud.oracle.com/en_US/opc/financials-cloud/implementationresources

Key Resources

Customer and Supplier Balance Netting Topical Essay: https://cloud.oracle.com/en_US/financials-cloud/implementationresources

Watch Customer and Supplier Balance Netting Readiness Training

Role Information

- The Generate Netting Settlements job is automatically made available to you if you have already completed the Netting Security Setup Steps.

- Details of the setup can be found here: https://cloud.oracle.com/opc/saas/datasheets/loc-sec-topical-essay.pdf

You can now import netting agreements. This allows you to create agreements more quickly. The Netting Agreement Import function will allow you to create your netting agreements in a spreadsheet. The agreements can then be imported into the application using the Import Netting Agreements process.

Watch a Demo

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

***IMPORTANT THIS SECTION USED TO BE STEPS TO ENABLE****

The steps to import agreements follow standard import procedures.

- Create netting agreements in a spreadsheet. This is useful if you have very large volumes of agreements to be created. The agreements are defined in the spreadsheet. Help text exists for each column to explain what to enter and where to populate the values from.

- The file is then converted to a zip file for the File Import process. The file can then be loaded to the netting interface table. The final step is to run the Import Netting Agreements process. This lets you import the agreements that you created in the spreadsheet and are visible in the Manage Netting Agreements page, ready for settlement creation.

Key Resources

Watch Customer and Supplier Balance Netting Readiness Training

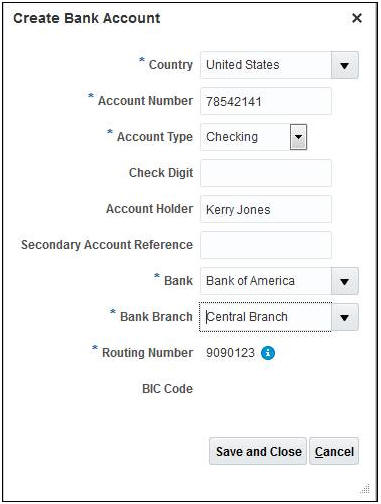

Bank Account Number and Bank, Branch Update on External Bank Accounts

You can now edit the bank account number field of external bank accounts in these pages:

- Suppliers

- Customers

- Expenses

- Payroll

- Bill management

- Higher Education and

- Human Capital Management

In the simplified bank account page, you can also update the bank and branch details.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You can update the bank and branch of an external bank account in the simplified bank account page if you created the bank account using the Oracle Cash Management profile option named Use Existing Banks and Branches and set it to Yes. When you update the bank and branch, you must select the same profile option.

Beginning with 19C, customers using the Approve Internal Changes on Supplier Bank Accounts feature in Procurement can edit the bank account number.

Simplified Bank Account Page

Customer and Supplier Balance Netting

Excluding Receivables Transactions from Netting

You can now exclude a Receivables transaction from being selected by the netting process by selecting the Exclude From Netting checkbox on the Receivables transaction. This lets you exclude transactions during selection.

Watch a Demo

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

***IMPORTANT THIS SECTION USED TO BE STEPS TO ENABLE****

To exclude a receivables transaction from being selected by the netting process, perform the following steps:

- Search for your transaction in Manage Transactions page.

- Navigate to the Miscellaneous tab

- Select Exclude from Netting.

When the netting process starts, any transaction that has the Exclude from Netting checkbox selected, will not be picked up for netting.

Key Resources

Watch Customer and Supplier Balance Netting Readiness Training

Use the Generate Netting Settlements process to create netting settlements for a Legal Entity or Business Unit.

The following parameters are available:

- Business Unit

- Legal Entity

- Netting Group

- Agreement Name

- Settlement Date

- Settlement Name

- Settle Without Review

- Transaction Due Date

- Accounting Date

- Conversion Rate Type

You can also create settlements from the Manage Netting Settlements page. However, from the Generate Netting Settlements process you can submit for your business unit in addition to the legal entity. You can also schedule the process to run at a time that is convenient for your business operations.

Watch a Demo

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Consider if you wish to run the process for your Business Unit or your Legal Entity. If you opt to run by business unit, all Legal Entities linked to your Business Unit will be eligible for selection.

Also, consider if you wish to Settle Without Review. When you Settle Without Review, then all the settlements are settled automatically, without the option to fine tune your settlements in the spreadsheet.

***IMPORTANT THIS SECTION USED TO BE STEPS TO ENABLE****

Refer to the Customer and Supplier Balance Netting Topical Essay for detailed implementation guidance: https://cloud.oracle.com/en_US/opc/financials-cloud/implementationresources

Key Resources

Customer and Supplier Balance Netting Topical Essay: https://cloud.oracle.com/en_US/financials-cloud/implementationresources

Watch Customer and Supplier Balance Netting Readiness Training

Role Information

- The Generate Netting Settlements job is automatically made available to you if you have already completed the Netting Security Setup Steps.

- Details of the setup can be found here: https://cloud.oracle.com/opc/saas/datasheets/loc-sec-topical-essay.pdf

You can now import netting agreements. This allows you to create agreements more quickly. The Netting Agreement Import function will allow you to create your netting agreements in a spreadsheet. The agreements can then be imported into the application using the Import Netting Agreements process.

Watch a Demo

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

***IMPORTANT THIS SECTION USED TO BE STEPS TO ENABLE****

The steps to import agreements follow standard import procedures.

- Create netting agreements in a spreadsheet. This is useful if you have very large volumes of agreements to be created. The agreements are defined in the spreadsheet. Help text exists for each column to explain what to enter and where to populate the values from.

- The file is then converted to a zip file for the File Import process. The file can then be loaded to the netting interface table. The final step is to run the Import Netting Agreements process. This lets you import the agreements that you created in the spreadsheet and are visible in the Manage Netting Agreements page, ready for settlement creation.

Key Resources

Watch Customer and Supplier Balance Netting Readiness Training

Automatically Clear Residual Contract Account Balances for Fully Satisfied Contracts

The Automatically Clear Residual Contract Account Balances for Fully Satisfied Contracts feature allows you to identify and write off residual contract account balances on contracts that are fully satisfied and expired naturally.

Residual balances in the contract asset, contract liability and contract discount accounts of naturally expired contracts may arise due to issues such as differences in the billed amount and transaction price and rounding issues. Such balances are written off by creating the necessary accounting journals to clear the account balances. A Revenue Write-off account facilitates tracking of the impact of clearing the account balances on revenue.

Using this feature, you can write off residual balances of contracts if all of the following conditions apply to the contract:

- Fully satisfied

- Has a residual balance adjustment status of Eligible for final adjustment

- Has the Exclude from Automatic Write-off option set to No or blank in the Edit Customer Contracts page

Billing applications or contract modifications are not accommodated on a contract after the residual balances on the contract are written off.

MANAGE SYSTEM OPTIONS FOR REVENUE MANAGEMENT

To use the Clear Residual Account Balances on Fully Satisfied Contracts feature, you must first define the Revenue Write-Off account on the Manage System Options for Revenue Management page.

Manage System Options for Revenue Management

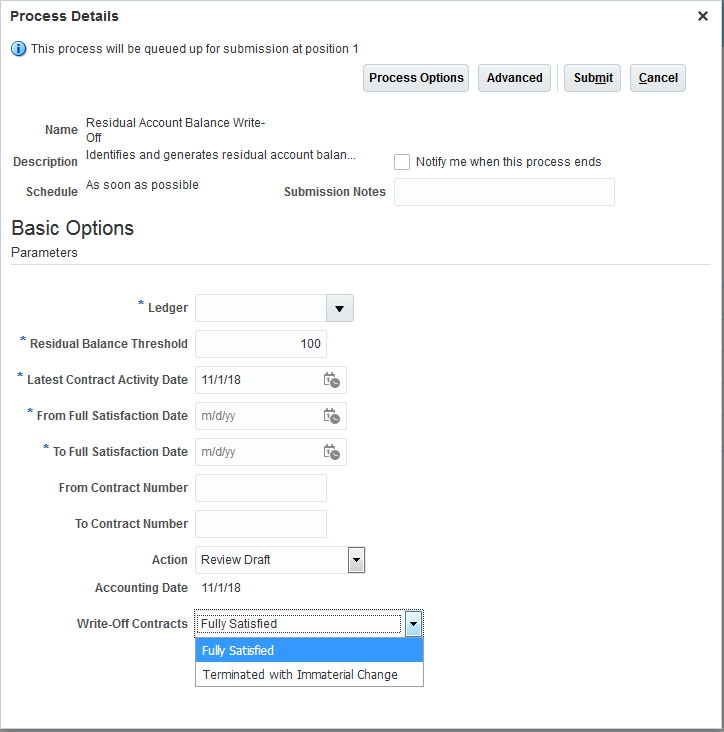

RESIDUAL ACCOUNT BALANCE WRITE-OFF PROCESS

Execute the Residual Account Balance Write-Off process to:

- Identify contracts with residual balances

- Generate write-off balances for the identified contracts by creating adjustment journal entries

Residual Account Balance Write-Off Process

The Residual Account Balance Write-Off process now has the following additional parameter:

Write-Off Contracts – Which indicates the contracts that will be written-off by the Residual Account Balance Write-Off process. Fully Satisfied indicates that all contracts that are fully satisfied will be considered for write-off by this process. Terminated with Immaterial Change indicates that only contracts that are fully satisfied and are terminated with immaterial change will be considered by this process.

MANAGE CUSTOMER CONTRACTS PAGE

The values for the Residual balance adjustment status of a contract is displayed as:

- Not eligible for final adjustment - Initial status upon contract identification

- No residual balance - Contract is marked No residual balance when it is fully satisfied and does not have residual balance in contract asset, contract liability or contract discount accounts

- Eligible for final adjustment - Contract is marked Eligible for final adjustment when it is fully satisfied and has residual balance in contract asset, contract liability or contract discount accounts

- Final adjusted - Contract is marked Final adjusted after the Residual Account Balances Write-Off process creates write-off journals for the contract

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

This feature is available automatically only for customers who have enabled the Residual Account Balance Clearing feature of 13.18.10.

Key Resources

- Refer to the documentation on Residual Account Balance Clearing feature.

Role Information

- No new role access is needed to use this feature.

Estimating Standalone Selling Price Using Residual Approach per ASC 606 and IFRS 15

You can now estimate the standalone selling price for performance obligations using the residual approach in accordance with the Revenue from Contracts with Customers accounting standard (ASC 606 and IFRS 15).

The use of the residual approach to estimate the standalone selling price of a promised good or service is appropriate only when a promised good or service is sold at a broad range of prices or is not yet established.

This feature provides the ability to:

- Identify the performance obligation for which a standalone selling price must be estimated using the residual method. The performance obligation can be created using a performance obligation identification rule or a performance obligation template.

- View the computed residual standalone selling price for the performance obligation within the Manage Customer Contracts UI.

Revenue Management estimates the standalone selling price for the performance obligation when an order line within the obligation consists of a Use Residual Approach designation.

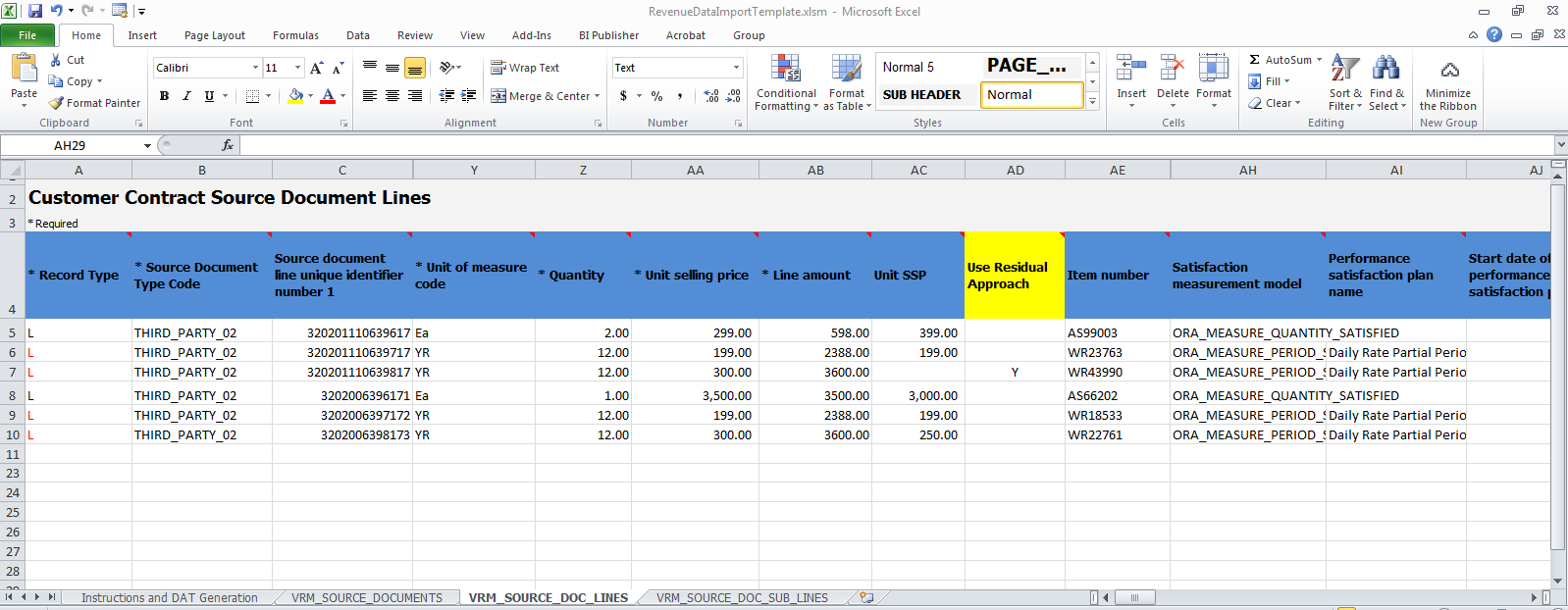

Revenue Basis Data Import File Based Data Import (FBDI)

When the Use Residual Approach attribute = Y:

- The standalone selling price is to be estimated using the residual approach

- The order line is excluded from existing standalone selling price validations

- The unit standalone selling price provided on the transaction line is ignored.

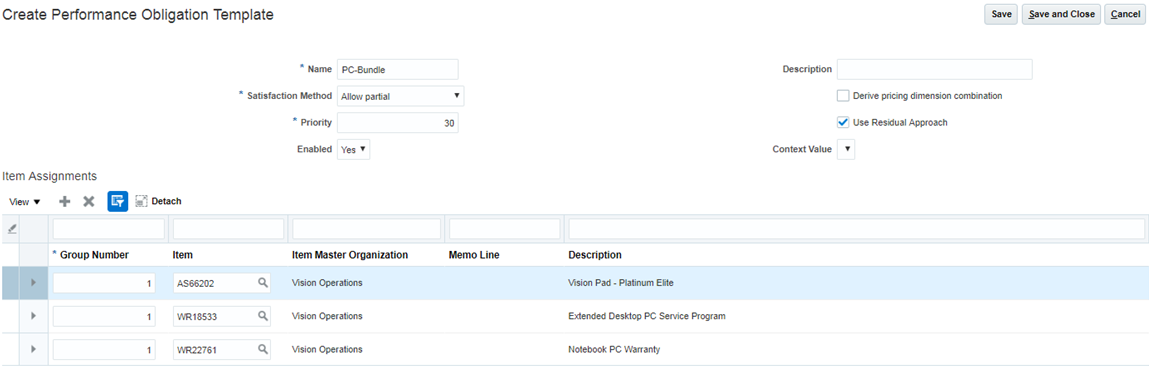

Performance Obligation Template

When the Use Residual Approach check box is enabled:

- The standalone selling price is to be estimated by the residual approach

- The performance obligation is excluded from standalone selling price validations.

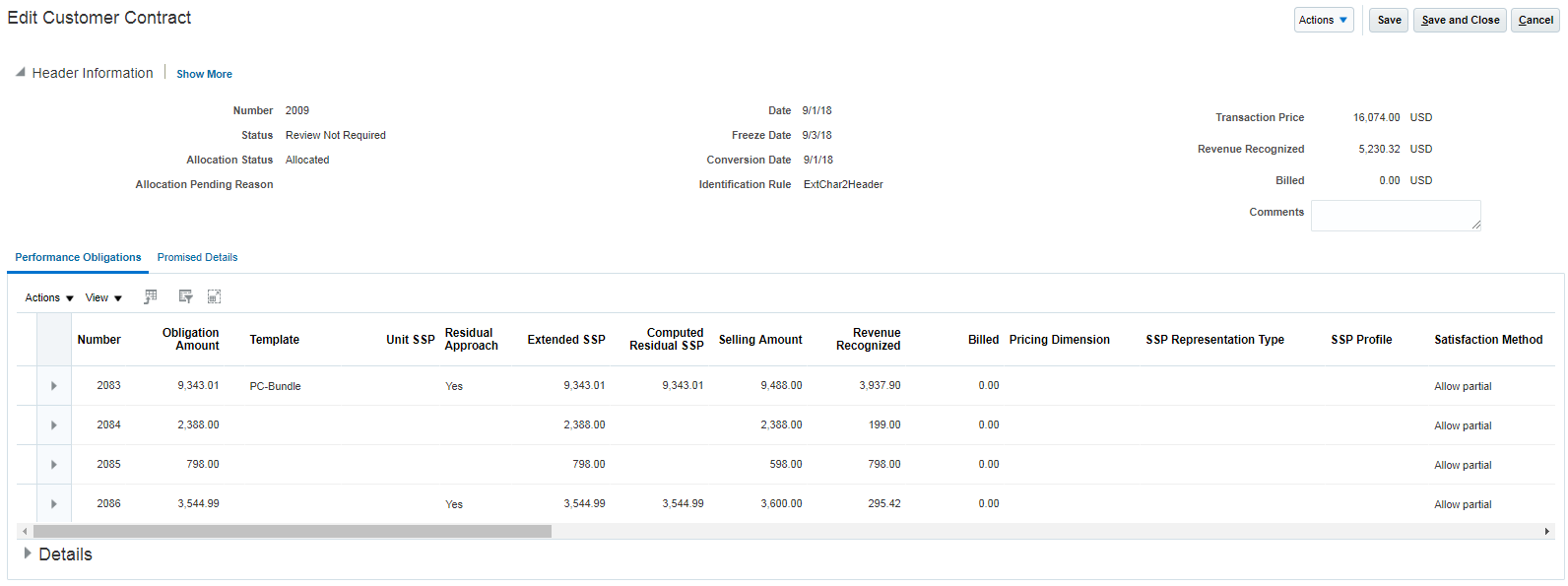

Manage or Edit Customer Contracts User Interface

When you submit the Identify Customer Contracts process and the performance obligation consists of an order line or is identified in a performance obligation template designated as Use Residual Approach, the process estimates the standalone selling price for the resulting performance obligation.

The computed residual standalone selling price represents the standalone selling price that Revenue Management estimated using the residual standalone selling price estimation method. It is calculated as the total transaction price minus the sum of the known standalone selling price of other goods or services promised in the contract.

When two or more performance obligations within the contract require standalone selling price to be estimated using the residual approach, the computed residual standalone selling price is allocated to the residual obligations based on the obligation’s selling prices.

The extended standalone selling price is set to the computed residual standalone selling price and is used to allocate the contract revenue across the performance obligations. In the event the computed residual standalone selling price is negative, the negative result is displayed in the computed residual standalone selling price and the extended standalone selling price is set to zero.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

When using Residual Approach standalone selling price feature:

- FBDI transaction lines:

- Residual Approach standalone selling price takes priority over unit standalone selling price. Unit standalone selling price will be ignored.

- Performance Obligation Templates:

- The Derive Pricing Dimension combination functionality is only used as a secondary grouping mechanism and has no impact on the residual estimate calculation

- Contract modification:

- Only Material contract modifications are allowed. Immaterial change setting will be ignored.

- For adding new lines to an existing contract, set Action Code = Create New PO.

Key Resources

- Refer to the Revenue Management documentation for further information on how to import revenue data using Revenue Basis Data Import file-based data import and how to define Performance Obligation Templates.

Role Information

- No new role access is needed to use this feature.

Import Additional Satisfaction Events for Period-Based Revenue Contracts for Fixed and Variable Schedules

The Import Additional Satisfaction Events for Period-Based Revenue Contracts for Fixed and Variable Schedules feature allows you to temporarily hold revenue recognition without the need to cancel or terminate the existing contract and to recreate a new contract when the satisfaction plan is either Fixed Schedule or Variable Schedule.

You can send details of the suspension or reinstatement through the Period Satisfaction Event Action Type and the Period Satisfaction Event Effective Date attributes on the VRM_SOURCE_DOC_SUB_LINES worksheet in the Revenue Basis Data Import file-based data import template.

To prevent revenue from being recognized, enter Reverse in the Period Satisfaction Event Action Type column, and the effective date for that action under the Period Satisfaction Event Effective Date column on the VRM_SOURCE_DOC_SUB_LINES worksheet in the Revenue Basis Data Import file-based data import template. When this subline is processed, Revenue Management reverses the satisfaction events and the revenue recognized from the period in which the period satisfaction event effective date falls.

To resume revenue recognition, enter Reinstate under the Period Satisfaction Event Action Type column, and the date of reinstatement for that action under the Period Satisfaction Event Effective Date column on the VRM_SOURCE_DOC_SUB_LINES worksheet in the Revenue Basis Data Import file-based data import template. When this subline is processed, Revenue Management creates satisfaction events for that service and recognizes revenue from the period in which the period satisfaction event effective date falls. Revenue is recognized from this period onwards for the remaining number of periods as per the schedule.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

A contract update that is material in nature triggers a reversal of the existing allocation and accounting, and the contract is reallocated and accounted even if the contract has undergone a hold on the revenue recognition.

Use the Correct Contract Document Errors in Spreadsheet to view sublines that fail validation, along with the relevant error message. You can rectify the errors and upload them for further processing.

Key Resources

- Refer to Revenue Management documentation on Import Additional Satisfaction Events for Period-Based Revenue Contracts feature in Revenue Management.

Role Information

- No new role access is needed to use this feature.

Oracle Transactional Business Intelligence: Open Performance Obligation Report Dashboard

Use the Oracle Transactional Business Intelligence (OTBI) Open Performance Obligation Report Dashboard to analyze the open performance obligations for a selected ledger. The dashboard aids in the analysis of your open performance obligations and it heir expected settlement and revenue recognition.

Use the Open Performance Obligation report for to analyze open performance obligations. You can also copy the report and create your own version to meet your unique reporting needs.

Navigator

To access the Open Performance Obligation Report, click the Reports and Analytics link under Tools in the Navigator.

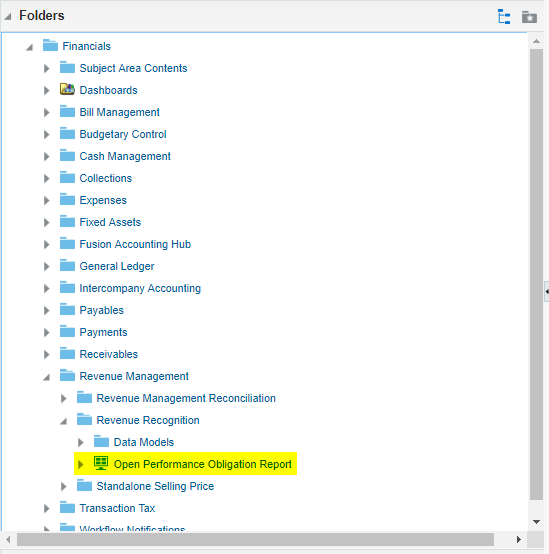

Select the prebuilt Open Performance Obligation Report from the Revenue Recognition folder under Revenue Management.

The Open Performance Obligation Report enables you to review the open performance obligations and their expected settlement and revenue for the selected ledger. You can filter the report output by attributes such as legal entity and customer name.

Open Performance Obligation Report Output Sample

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Report can be edited or modified after copying or saving the report from the shared folder to your personal folder.

On installation of the release, the dashboard and report is available to you.

Subledger Journals in Adjusting Periods

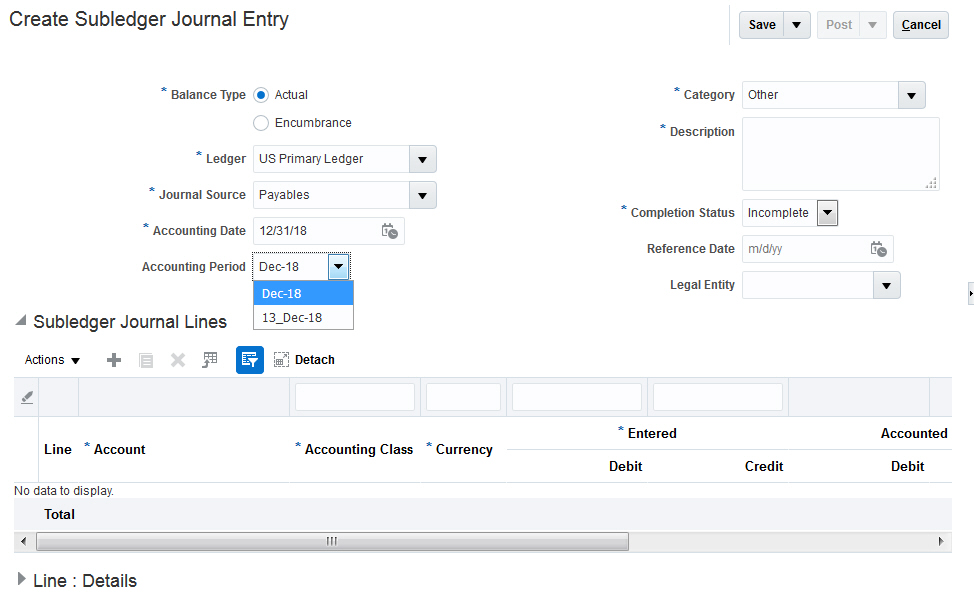

You can now enter subledger journals in adjusting periods using the application interface or ADFDi spreadsheets.

If the accounting date falls in both the non-adjustment and adjustment periods, the value of accounting period on the Create Subledger Journal Entry page defaults to the non-adjustment period. You can overwrite it with the adjustment period if required.

Similarly, the Create Subledger Journals spreadsheet provides you the option to post a subledger journal in the adjustment or non-adjustment period.

Steps to Enable

You don't need to do anything to enable this feature.

Computation of GST Tax Liability on Receipt of Payment in Advance

The Computation of GST Tax Liability on Receipt of Payment in Advance feature enables you to calculate inclusive tax. You can use this feature for countries in addition to India.

Steps to Enable

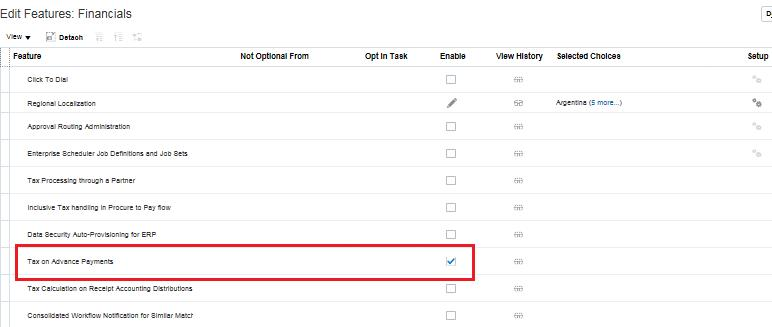

You need to opt-in this feature from the offerings page. Once you have opted-in, the feature becomes automatically available.

- Click Navigator > Setup and Maintenance > Setup: Financials > Change Feature Opt in.

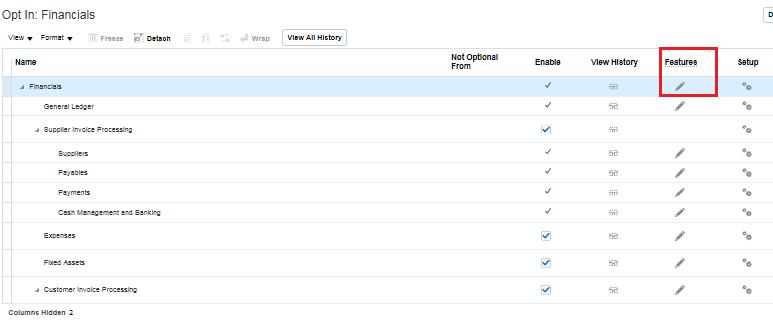

- On the Opt In: Financials page, click the Features icon for Financials.

-

Select the Enable check box for the Tax on Advance Payments feature and save the changes.

Tips And Considerations

- The feature only handles the receipt with the receipt method which belongs to a receipt class with GDF attribute 'Advance Receipt = Yes'.

- The feature isn't applicable to the countries where prepayment invoice needs to be issued before actual receipt is received.

Tax Calculation on Receipt Accounting Distributions

The Tax Calculation on Receipt Accounting Distributions feature lets you calculate transaction taxes on receipt accounting distributions as per the tax determinants and tax rates prevailing on receipt of goods. You can view detail tax lines on receipt accounting distributions, including for Tax point basis (TPB) as Invoice.

You can update tax determinants, such as Intended use on receipt of goods, and taxes are calculated according to the updated tax determinants on receipt accounting distributions.

The Tax Calculation on Receipt Accounting Distributions feature provides these capabilities:

- Update tax determinants copied from purchase order to receipt lines. Taxes are calculated according to the updated tax determinants on receipt accounting distributions, rather than prorated from the Purchase order distributions.

- View Recoverable and Non- recoverable detail tax lines and accrue Non- recoverable taxes on receiving distributions.

- Update tax determinants copied from receiving lines to payables invoice lines upon receipt matching. Taxes are calculated according to the updated tax determinants on the payables invoice.

- Recoverable taxes are accounted on payables invoice.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

Use the Opt-In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials

To enable the feature from the Functional Setup Manager Opt In page, follow these steps:

- Navigate to the Setup and Maintenance work area.

- Select Financials from the choice list at the top of the page.

- Click the Change Feature Opt In link.

- On the Opt In: Financials page, click the Features icon for financials.

- On the Edit Features: Financials, select the Enable check box for the feature named Tax Calculation on Receipt Accounting Distributions.

- Click Done.

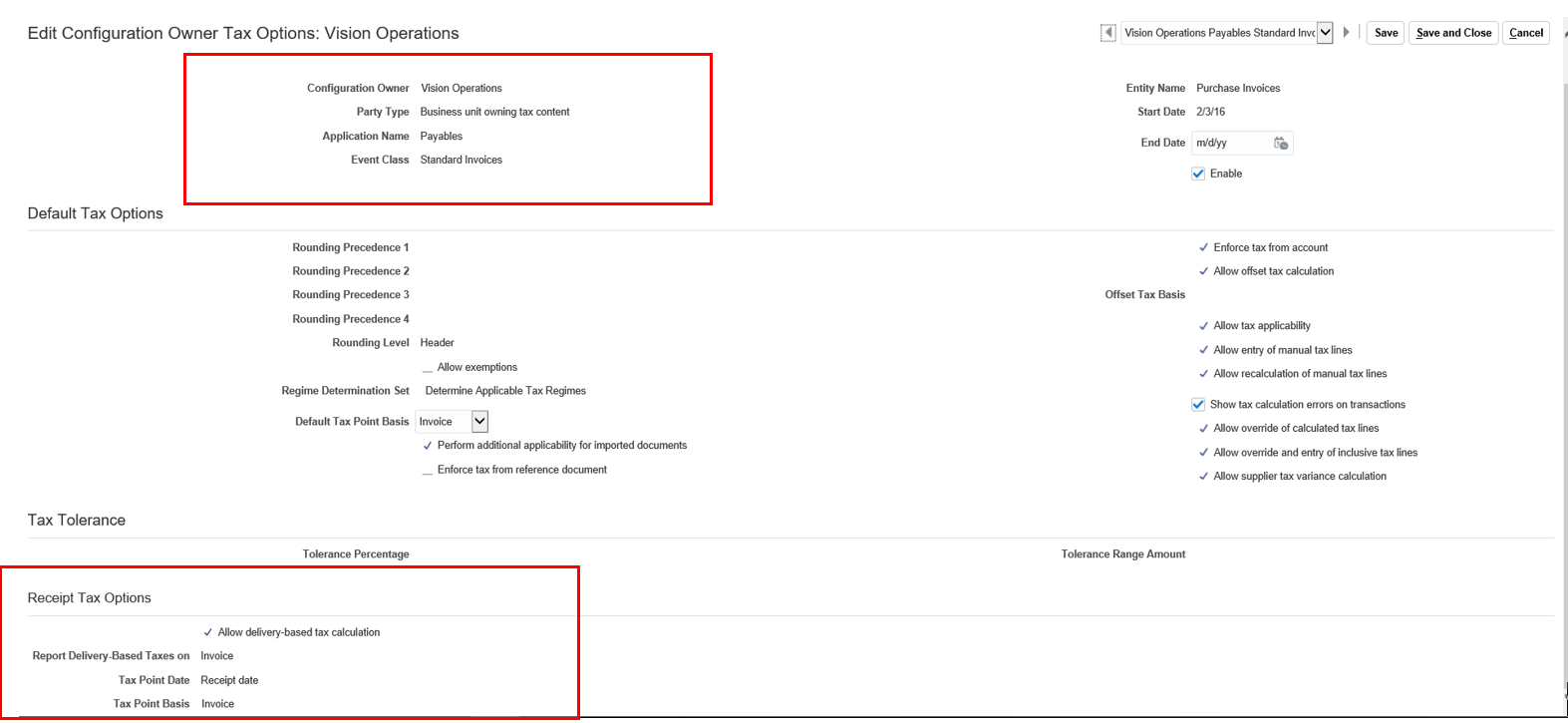

To apply this feature, setup Configuration Owner Tax Options as follows:

- Sign in as a Tax Manager.

- Click Navigator > Setup and Maintenance.

- Search for the task Manage Configuration Owner Tax Options.

- Click the create (+) icon.

- Choose the Configuration Owner to which you want to apply this feature.

- Choose standard Invoices/Payables as the Event Class.

- In the Receipt Tax Options section, enable "Allow delivery-based tax calculation" with these settings:

- Report Delivery-Based taxes on : Invoice

- Tax Point Date : Receipt date

- Tax Point Basis : Invoice

Configuration Owner Tax Options

NOTE: If you have configured " Receipt Tax Options" with different options, end date the existing setup and create new one as shown above.

Transactional Business Intelligence for Financials

Drill Down from OTBI Fixed Assets Reports to Asset Details

The action link framework in Oracle Business Intelligence Enterprise Edition (OBIEE) allows users to click on an object and navigate directly to the source application. Using this framework, Oracle Transactional Business Intelligence (OTBI) for Financials provides the capability to drill from an OTBI ad hoc report based on a Fixed Assets subject area to Asset details in Oracle Assets.

Links can be configured in the ad hoc Asset OTBI reports to drill down to the following pages:

- View Asset Details

- View Transaction Journal Entries

- View Depreciation Journal Entries

Steps to Enable

Leverage new subject area(s) by adding to existing reports or using in new reports. For details about creating and editing reports, see the Creating and Administering Analytics and Reports book (available from the Oracle Help Center > your apps service area of interest > Books > Administration).

Receipt Accounting Support in Budgetary Control Subject Area

Receipt Accounting information is now available for reporting in the Budgetary Control - Transactions Real Time subject area.

Steps to Enable

Leverage new subject area(s) by adding to existing reports or using in new reports. For details about creating and editing reports, see the Creating and Administering Analytics and Reports book (available from the Oracle Help Center > your apps service area of interest > Books > Administration).

Enhancements to Cash Management Subject Areas

Cash Management subject areas have been enhanced with the new folders Legal Entity and Fiscal Period. The additional folders enable you to slice and dice the Cash Management KPIs by Legal Entity and Fiscal Period. Additionally, attributes such as Bank Account Active, Transaction Date, Clearing Date have been added to already existing Cash Management subject areas folders.

Steps to Enable

Leverage new subject area(s) by adding to existing reports or using in new reports. For details about creating and editing reports, see the Creating and Administering Analytics and Reports book (available from the Oracle Help Center > your apps service area of interest > Books > Administration).

Enhancements to Expense Subject Area

The Expense Transactions Real Time subject area has been enhanced with credit card transaction and expense report approval notes information.

Steps to Enable

Leverage new subject area(s) by adding to existing reports or using in new reports. For details about creating and editing reports, see the Creating and Administering Analytics and Reports book (available from the Oracle Help Center > your apps service area of interest > Books > Administration).

Enhancements to OTBI Payables Subject Areas

Oracle Transactional Business Intelligence (OTBI) Payables subject areas have been enhanced with new attributes, as follows:

- Payables Invoices - Installments Real Time has been enhanced with header batch identifier and supplier alternate name information.

- Payables Invoices - Prepayment Applications Real Time has been enhanced with header batch identifier, purchase order status and supplier alternate name information.

- Payables Invoices - Disbursements Real Time and Payables Invoices - Trial Balance Real Time - have been enhanced with header batch identifier and supplier alternate name information.

- Payables Invoices - Holds Real Time has been enhanced with header batch identifier, purchase order status and supplier alternate name information.

- Payables Invoices - Transactions Real Time has been enhanced with purchase order status and header batch identifier information.

- Payables Invoices - Withholding Real Time has been enhanced with Supplier Alternate Name column.

Steps to Enable

No steps are required to enable this feature.

Drill Down from OTBI Receivables Reports to Transaction and Customer Account Details

The action link framework in Oracle Business Intelligence Enterprise Edition (OBIEE) allows you to click on an object and navigate directly to the source application. Using this framework, OTBI for Financials provides the capability to drill down from an OTBI ad hoc report based on a Receivables OTBI subject area to the Invoice and Customer Details in Oracle Receivables Cloud.

Hyperlinks can be configured in the ad hoc Receivables OTBI reports to drill down to the following:

- Review Transaction/Edit Transaction/Manage Transactions

- Create Adjustment/Manage Adjustments

- Edit Customer Account/Edit Site

Steps to Enable

The high level steps to configure a drill down from OTBI ad hoc reports to Invoice transaction details are:

- Create an ad hoc report using the appropriate Receivables Transactions subject area.

- Select the column for which you wish to configure the drill down to transaction details.

- In Column Properties, set up an Action hyperlink to drill down to the required transaction details.

Key Resources

- For details on specific drill downs and examples, search for 'How to drill down from OTBI ad hoc reports to transaction details in Oracle Fusion Applications' white paper, soon to be available on Customer Connect.

Enhancements to Revenue Management Subject Areas

OTBI Revenue Management - Customer Contracts Real Time subject area has been enhanced with new columns and folders:

- Revision Intent

- Promised Details new columns additions to source document line details, line reference details and source document line details: Manual review required flag, add to existing contract flag, add to contract action code, revision intent type code, latest version date, latest revision intent code

- Performance obligations new columns additions: latest version date, latest revision intent code

- Customer Contracts new columns additions: latest revision intent code, latest version date

- Contract and Performance Obligation References

- Columns Copy reference flag and Reference prefix were added to Contract Identification Rules Details and Performance Obligation Template folders

- Unit Selling price from source

- Unit SSP and Net Unit SSP columns were added to Promised detail source document line and Source document line reference folders

- Clear Residual Account Balances

- Contract Details folder has been enhanced with the following attributes: residual balance adjustment status, exclude from

- automatic

- write-off, last activity date,

- satisfaction

- status, contract full satisfaction date

- Contract Details folder has been enhanced with the following attributes: residual balance adjustment status, exclude from

- Contract Group Number

- Contract group number added to Contract details folder and Use as group number flag column has been added to Contract Identification Rules Details folder.

Steps to Enable