- Revision History

- Overview

- Feature Summary

- Payroll

-

- Payroll for the United Kingdom

-

- Real Time Information Tax Year 2019-2020 (FPS/EPS/EYU)

- P60 Enhancements for Tax Year 2018-2019

- Budget and Legislative Compliance for Tax Year 2019-2020

- Processing Benefits in Kind in Payroll: 2019-2020 Legislative Changes

- P11D for Tax Year 2018-2019

- Display or Hide Hours on Payslips

- Retry Full Payment Submission

- Automatic Associations Created for Global Transfers

- Pensions Automatic Enrolment: Align Pay Reference Period with Earnings Period

- Postgraduate Loan Deductions

- Errors and Warnings Report XML File

- HMRC Data Retrieval and Load XML Data Process Includes Postgraduate Loans

-

- Payroll for the United Kingdom

- Revision History

- Overview

- Feature Summary

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

-

- Process Suspended Assignments in Grade Step Progression

- Prorate Progression Grade Ladder Rates by Assignment FTE

- Round Annual Values

- Round Annual Amounts in Grade Step Progression

- Support Export and Import of Manage Salary Differentials

- Warn or Error When Over Budget

- Group Budget Amounts for Reporting or Enforcing

- Review Batch Processing Information

- Use User-Defined Lookups in List Columns

- Total Compensation Statement Ability to Reuse Embedded Fields

- Total Compensation Statement - Migration

- Transfer Data Back Into HR More Efficiently

- Compensation Redesigned User Experience

-

- Compensation

- Payroll

-

- Global Payroll

-

- Absence Entitlement Payments After Termination

- Enhanced Security for Quick Actions

- Enable Contexts for Costing Key Flexfield Segments

- Rate Definition Support for Live and Generated Rates

- Rate Definition Support for Values-by-Criteria with Multiple Values

- Generate HCM Rates Scope Expanded

- Element Upgrade Process

- Roll Back Multiple Tasks Within a Flow

- Process After Error - Report Restriction Removed

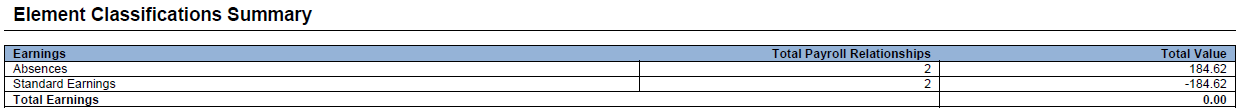

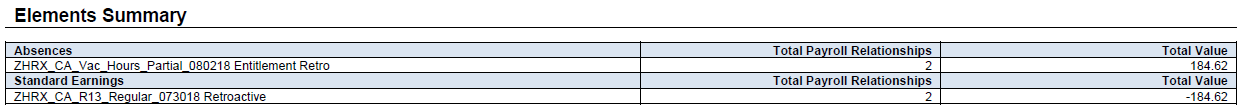

- Retroactive Entries Report

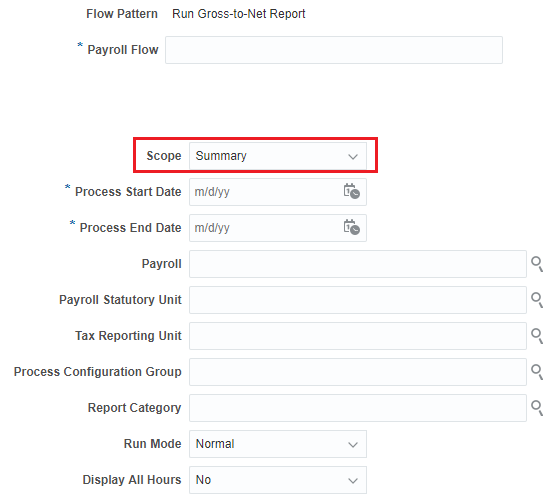

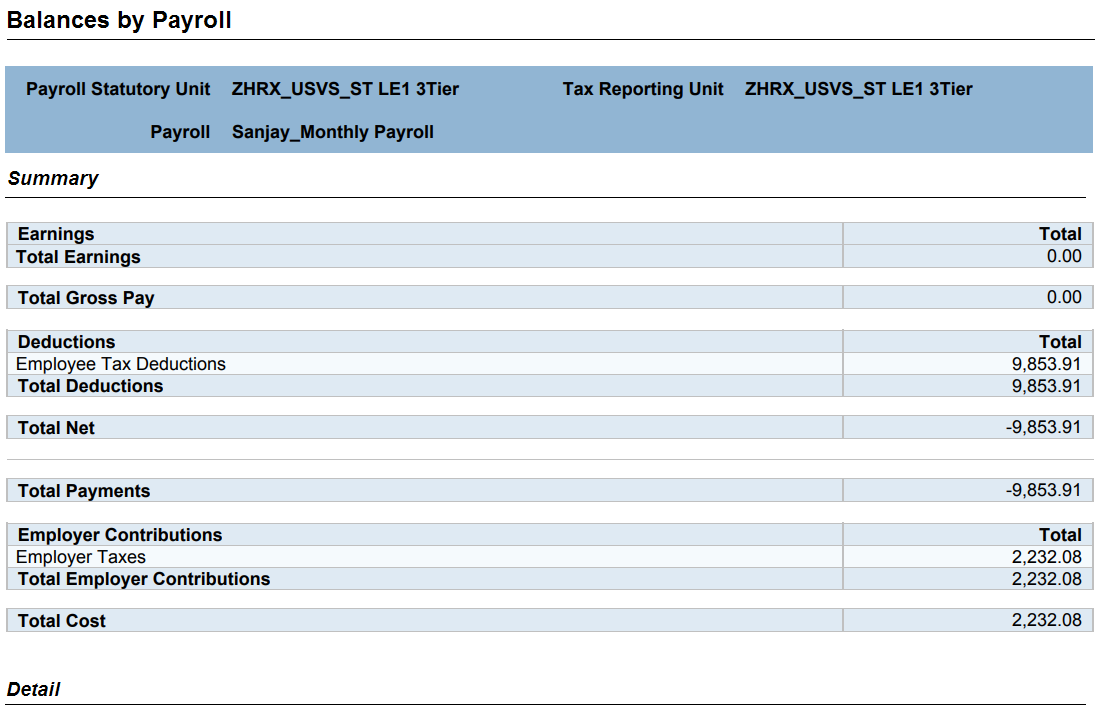

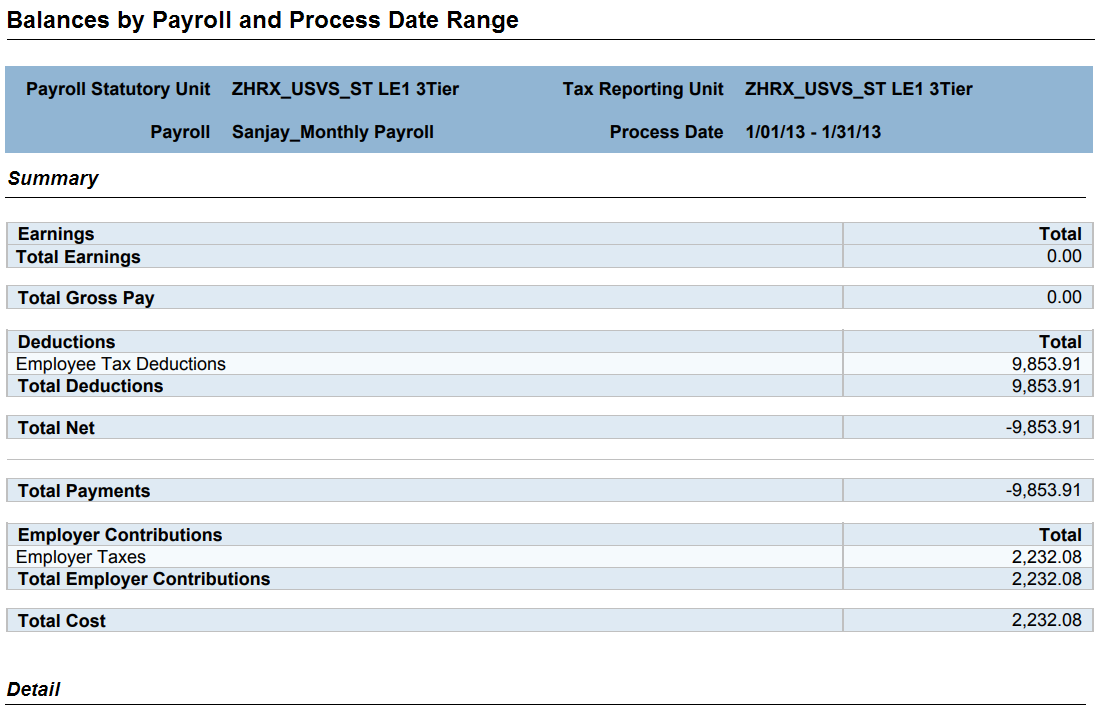

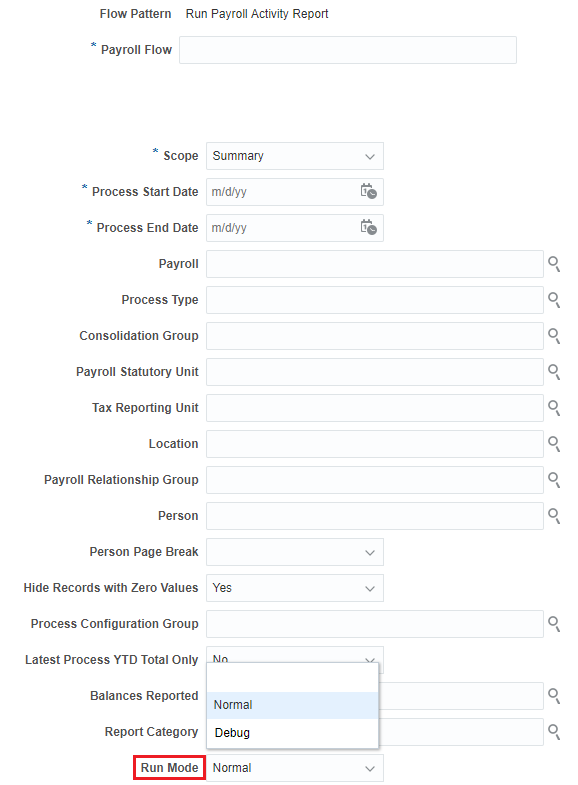

- Gross-to-Net Report in Summary Mode

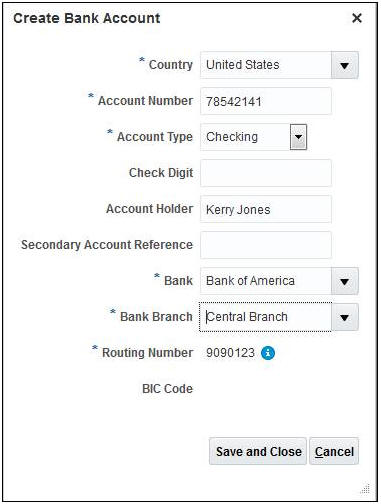

- Bank Account Number and Bank, Branch Update on External Bank Accounts

- Control Transient Data Retention in Payroll Extracts

- Global Payroll Redesigned User Experience

-

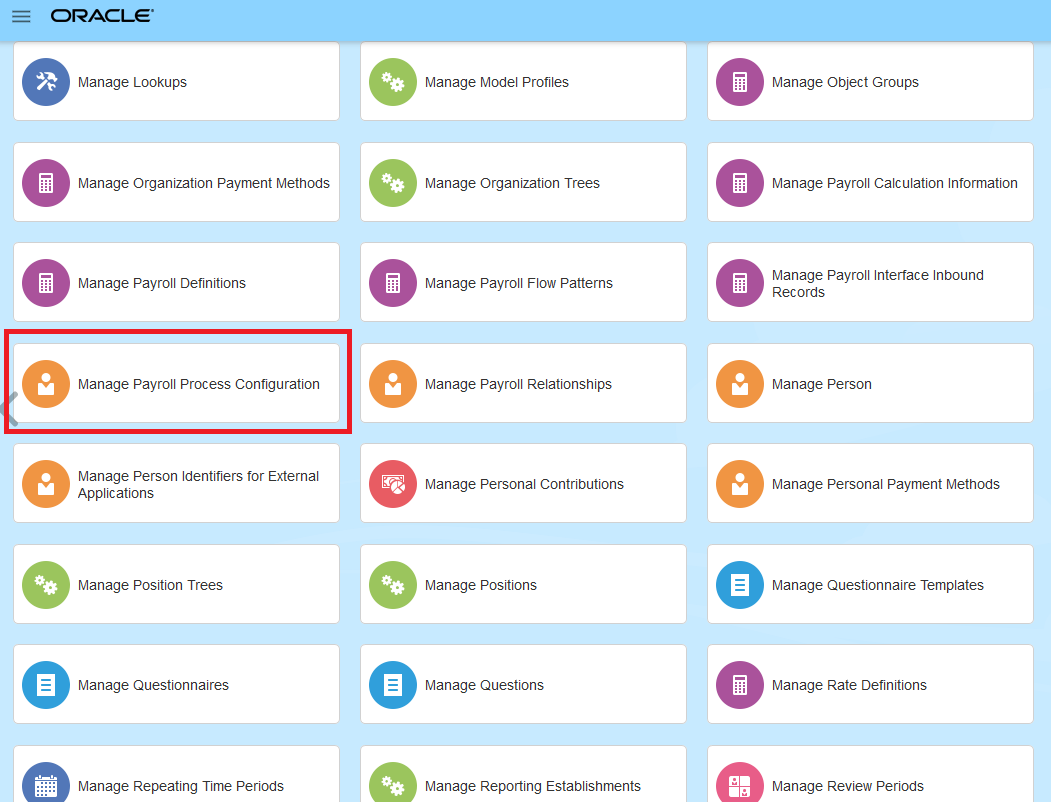

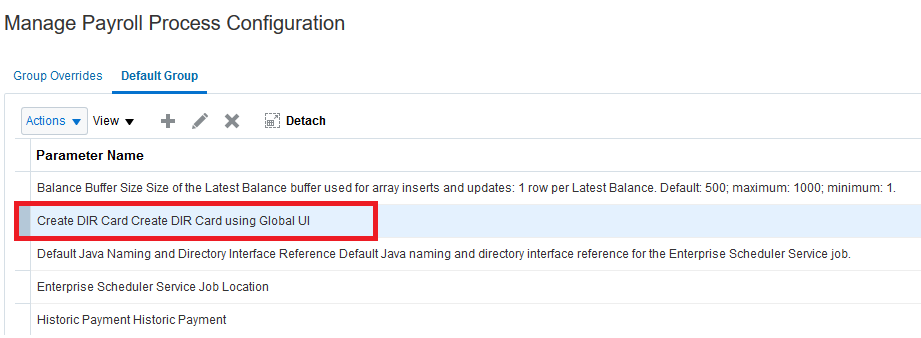

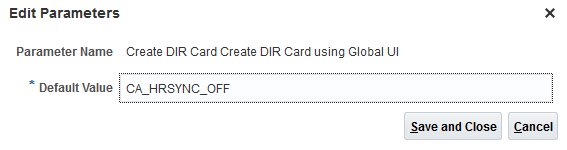

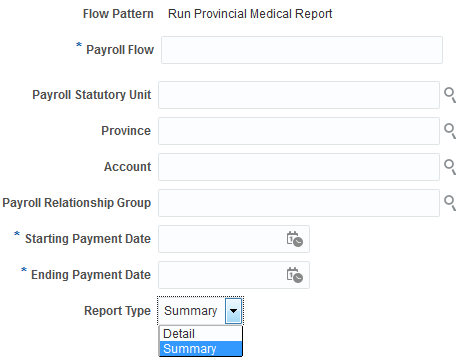

- Payroll for Canada

- Payroll for China

-

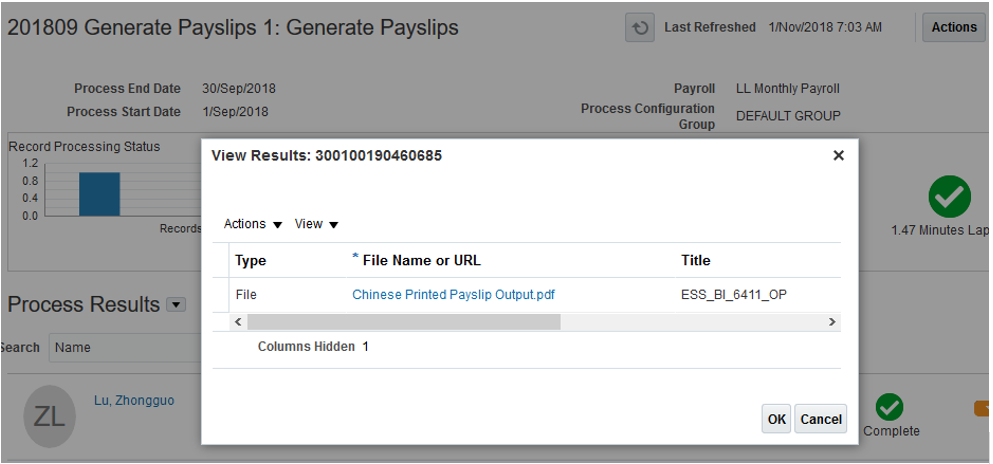

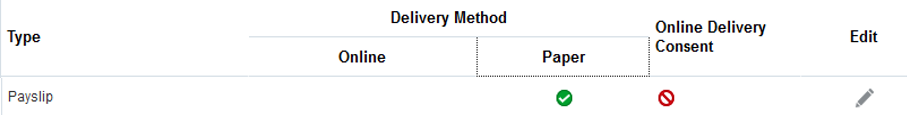

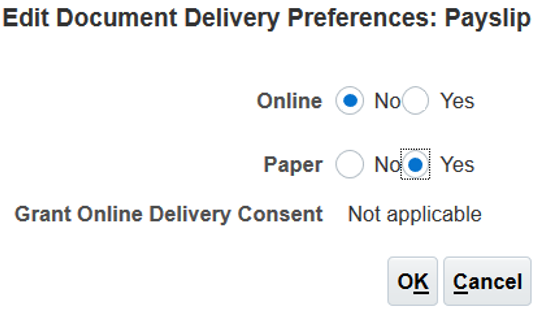

- Use the Generate Payslips Process to Produce Printed Payslips

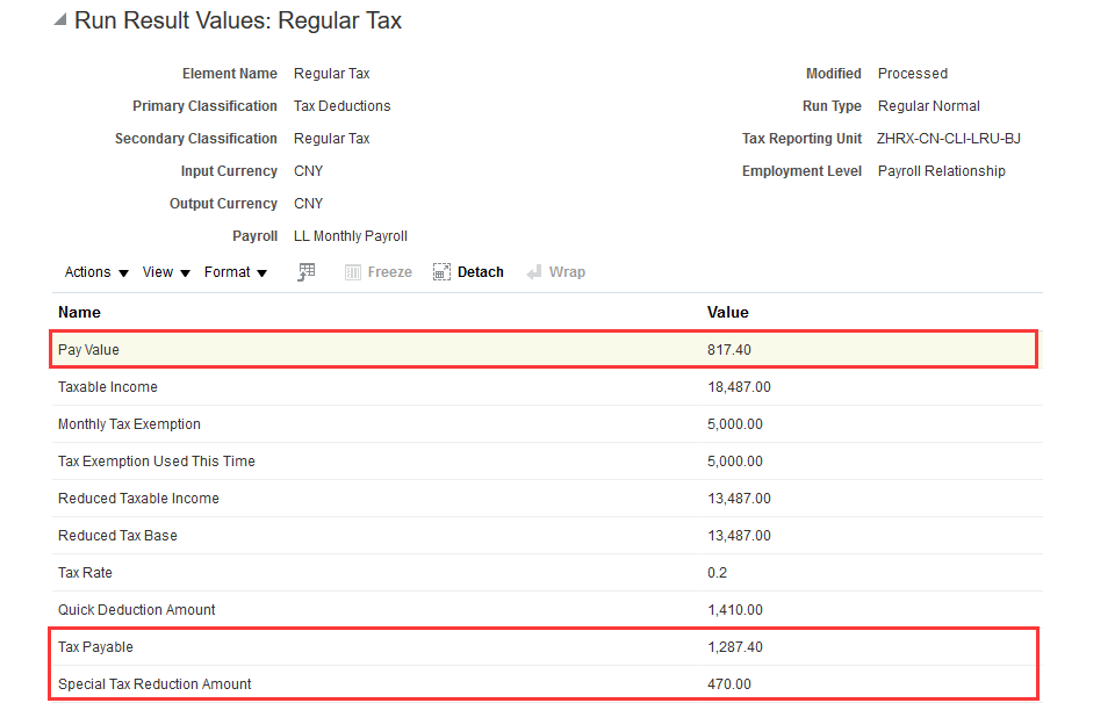

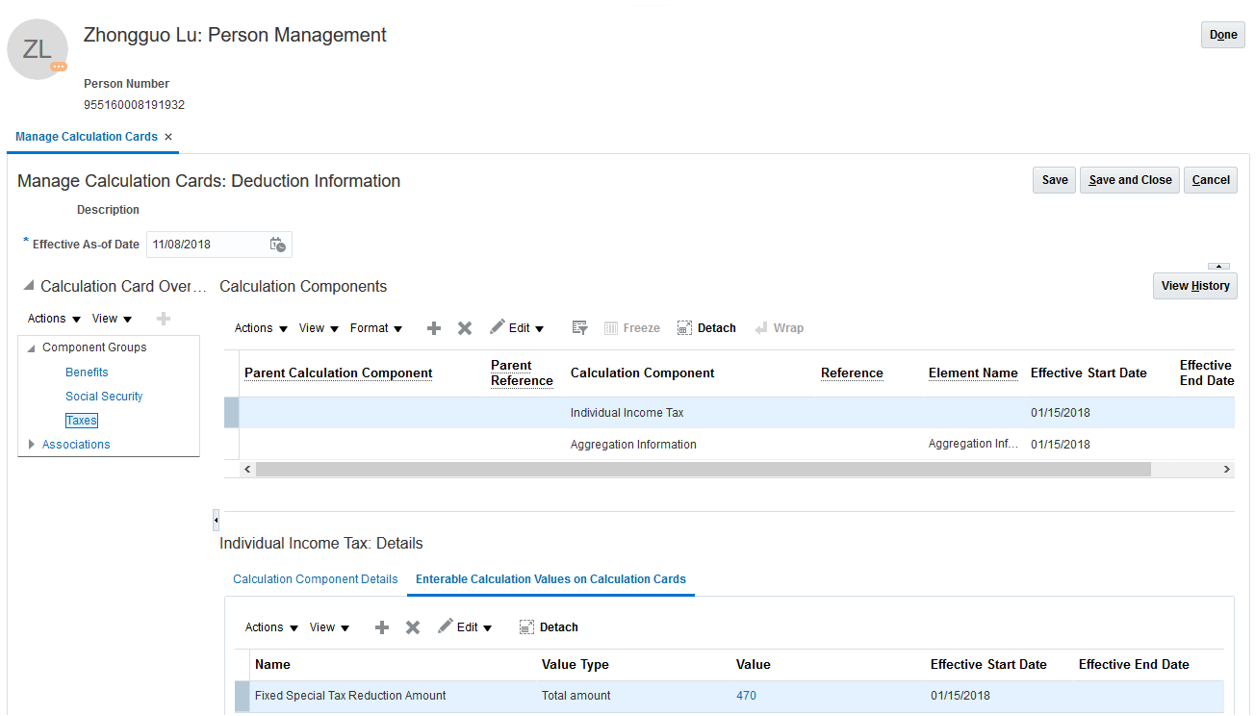

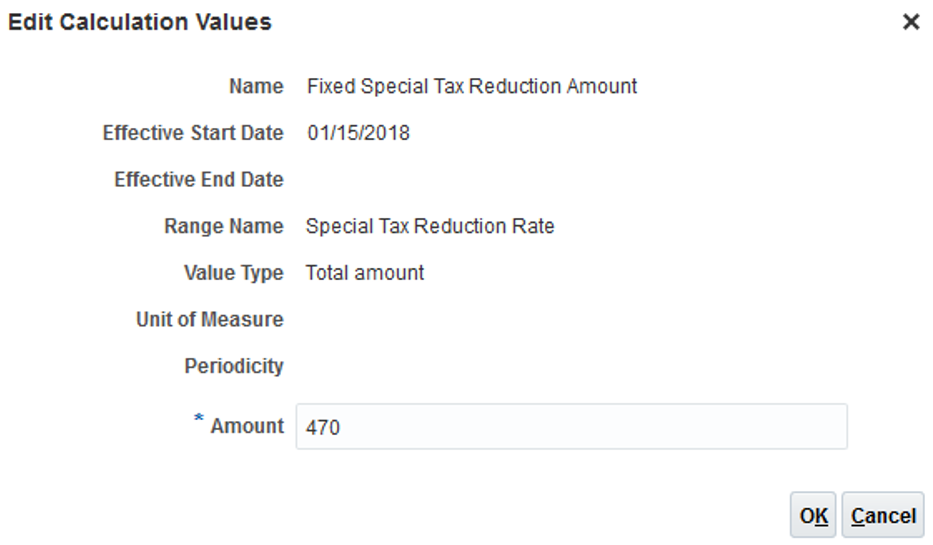

- Support Monthly Fixed Tax Reduction Amount for Qualified Persons

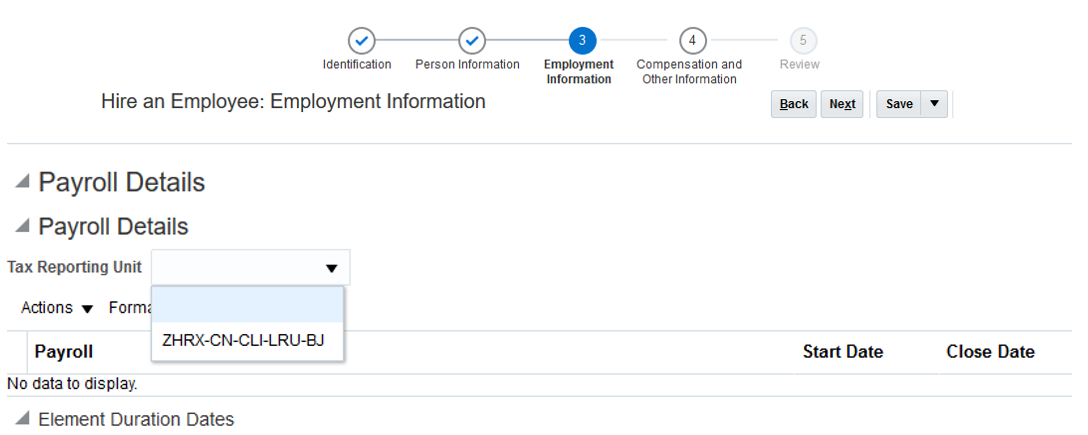

- Show Tax Reporting Units Relevant to the Hiring Legal Employer in the Hiring Flow

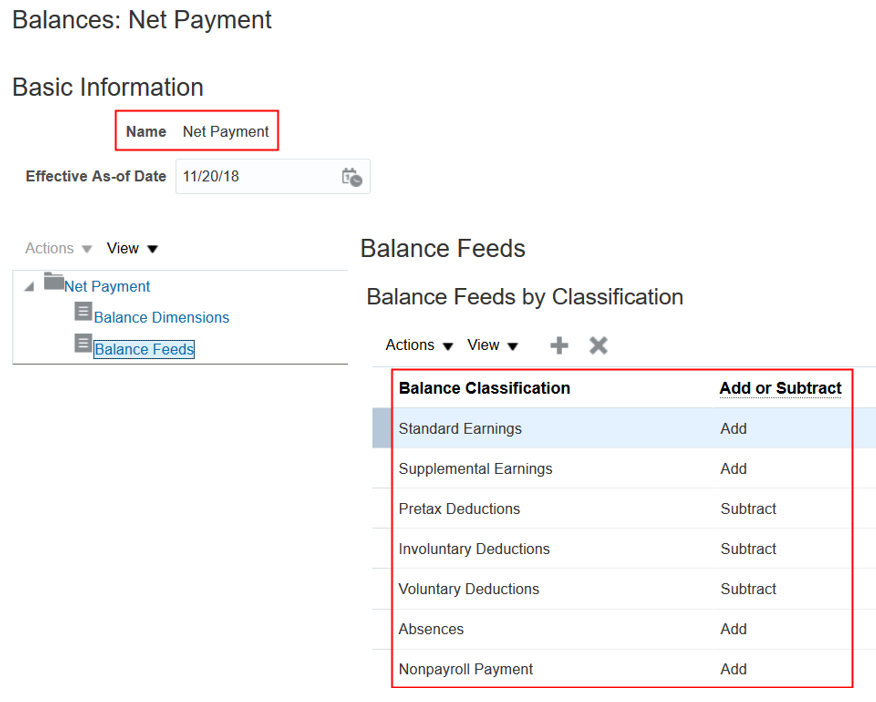

- Modified the 'NET' Balance

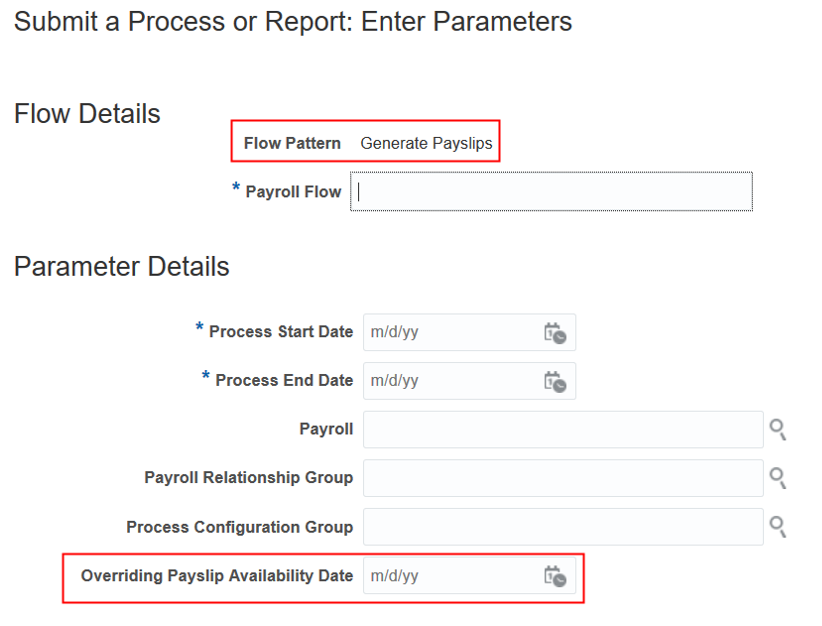

- Use the Overriding Payslip Availability Date Parameter for the Generate Payslips Process

-

- Payroll for Mexico

- Payroll for Qatar

- Payroll for the United Kingdom

- Payroll for the United States

-

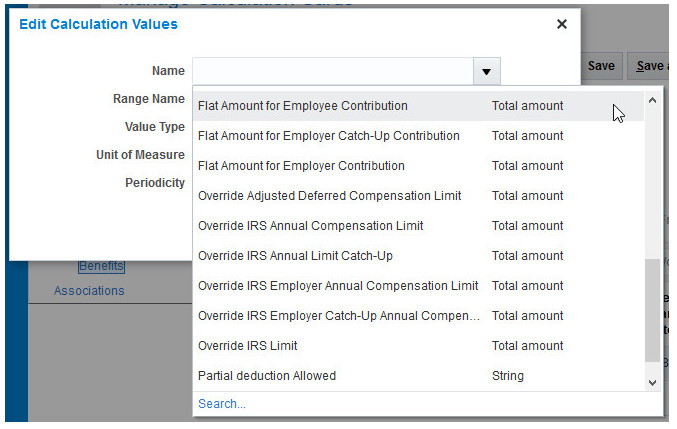

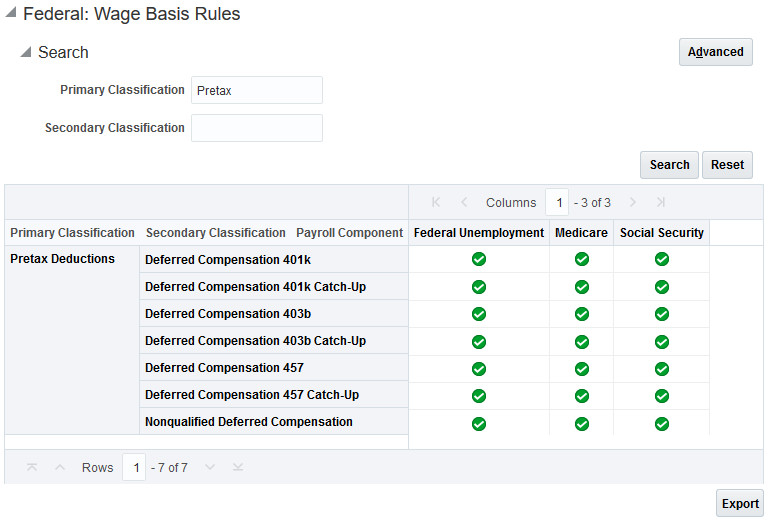

- Support for 403 (b) and 457 (b) Deferred Compensation Plans

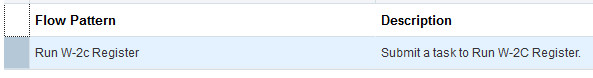

- W-2C Register Support

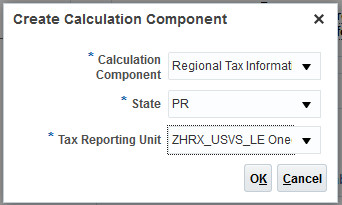

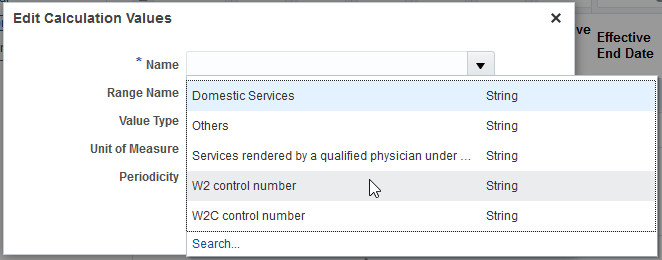

- Form W-2PR Control Number Support

- California VPDI Support

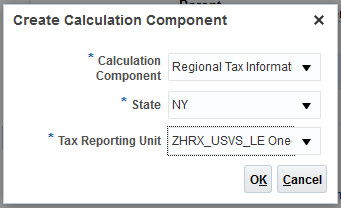

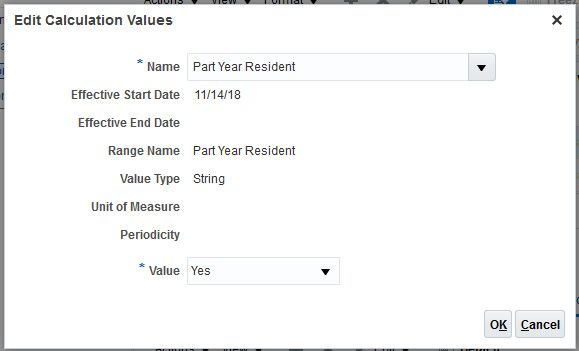

- New York City Part-Year Resident Support

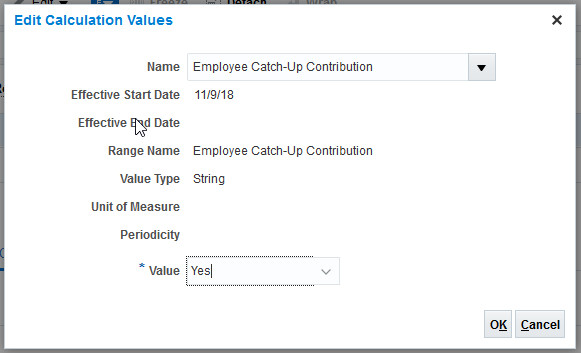

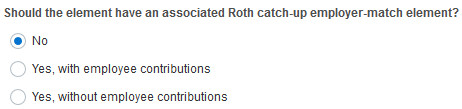

- 401(K) Employer Match Support for Catch-Up Deductions

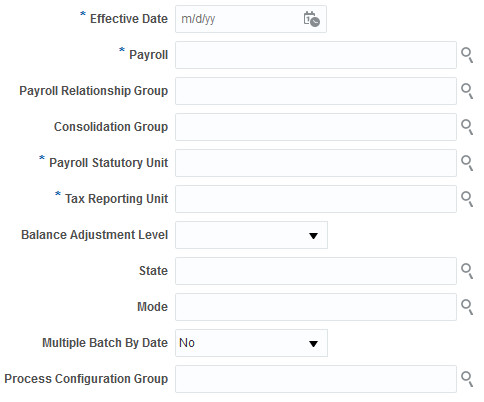

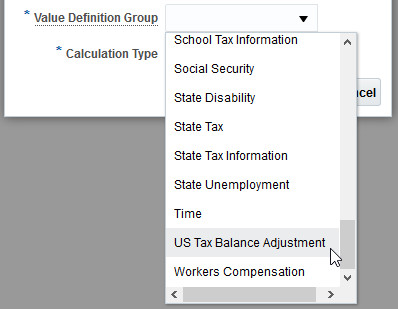

- Run US Tax Balance Adjustment Process Enhancement

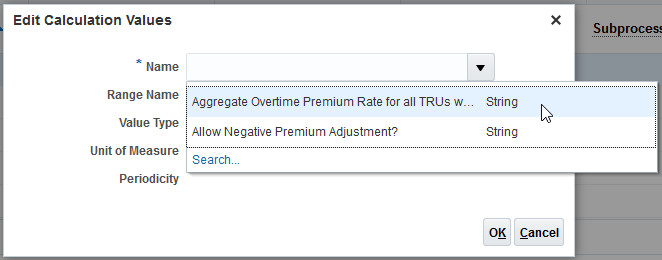

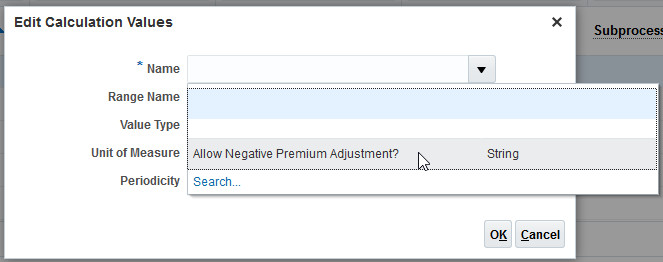

- Overtime Calculation Support for Common Paymasters

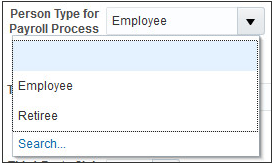

- Restricting TRUs by Person Type

- HCM Spreadsheet Data Loader for Organization Calculation Card

- Midday Period Support for Time Cards and Absences

-

- Global Payroll

- HR Optimization

-

- Workforce Rewards Transactional Business Intelligence

- Benefits

- Compensation

-

- New Attribute to Determine Compensation Plan Eligibility Status

- New Metric Added to Compensation - Stock Details Real Time

- New Performance Rating Attributes to Compensation Subject Areas

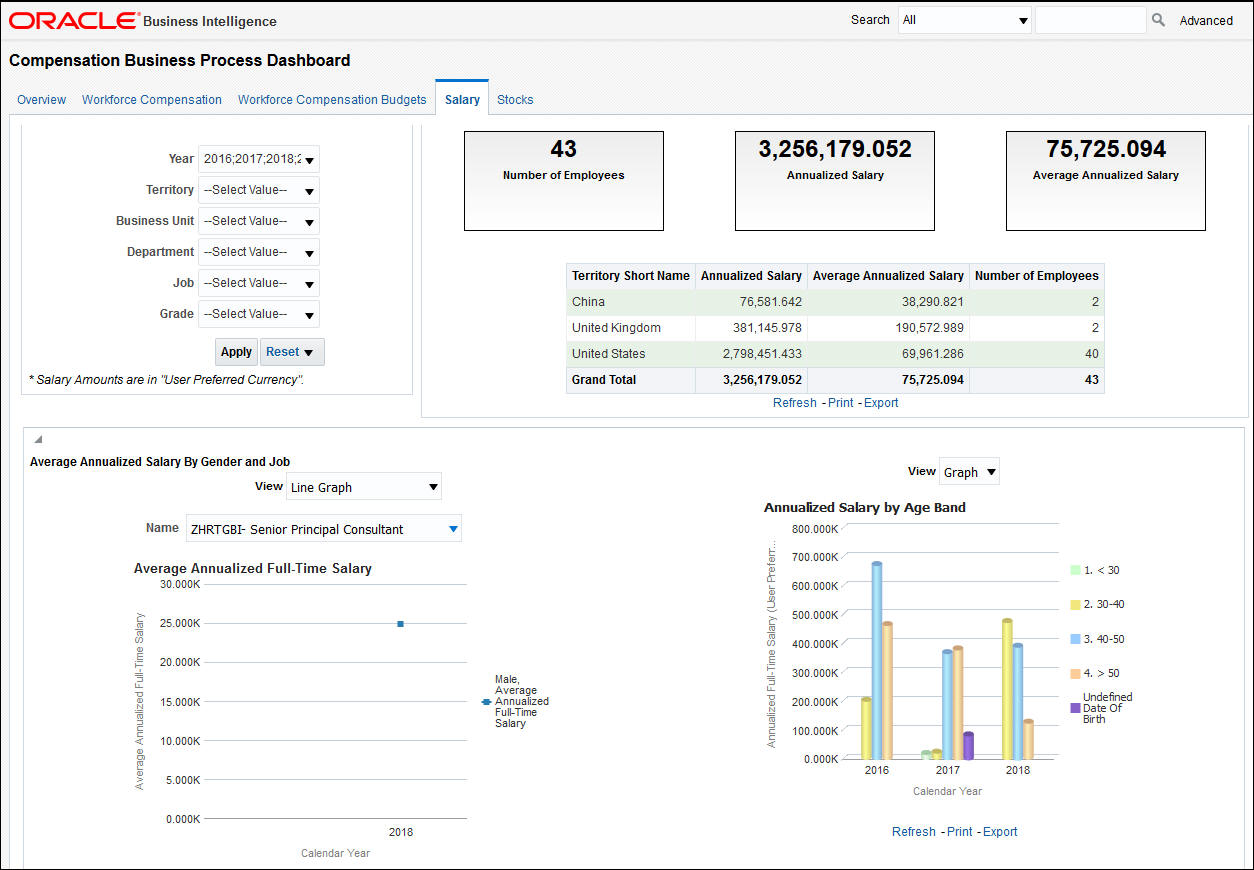

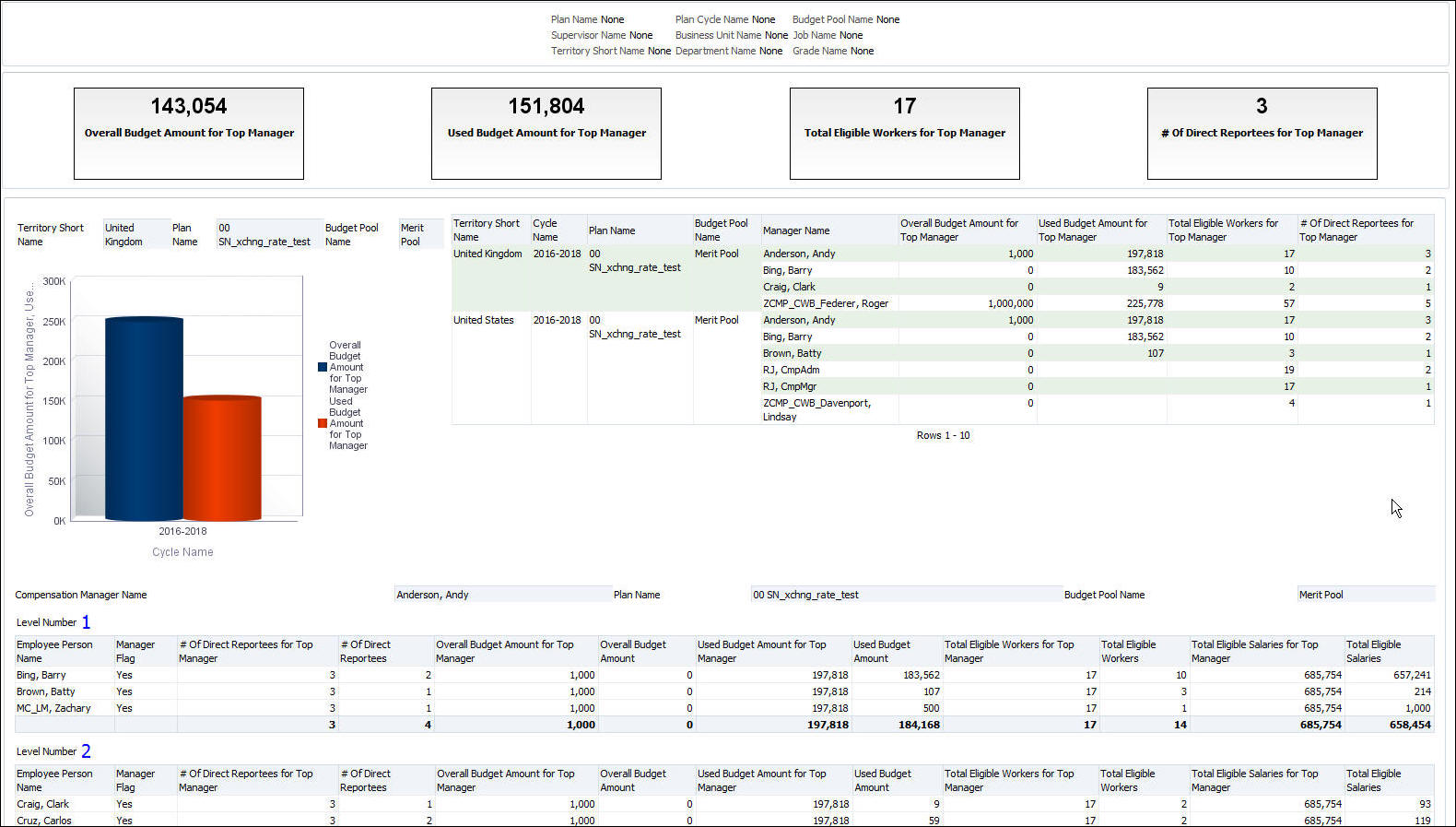

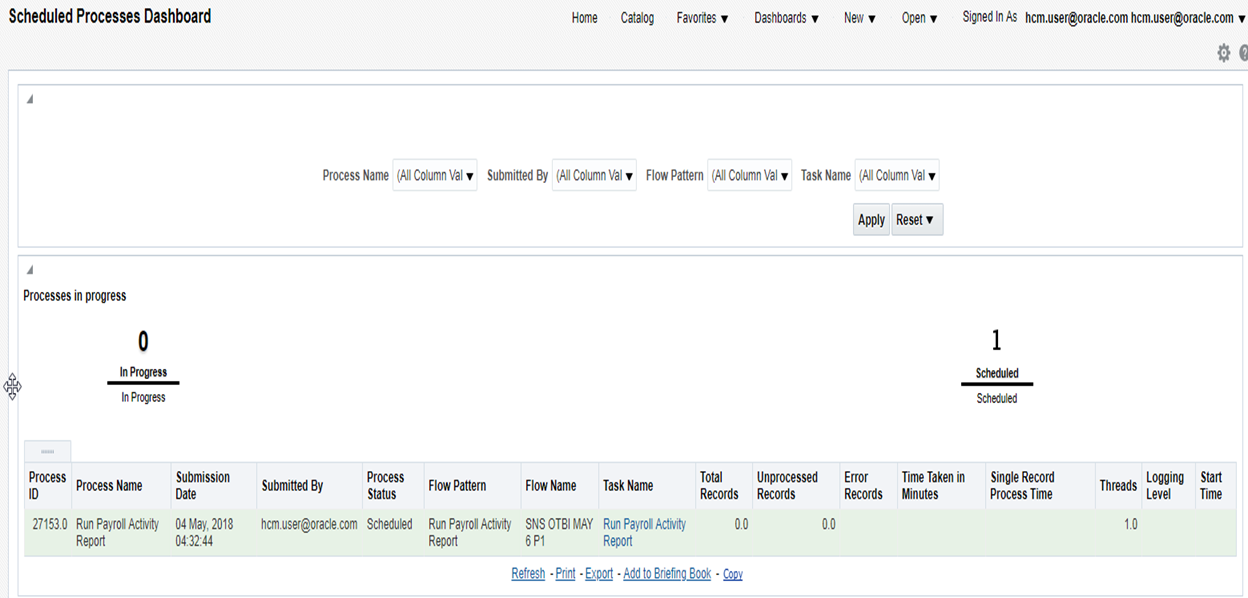

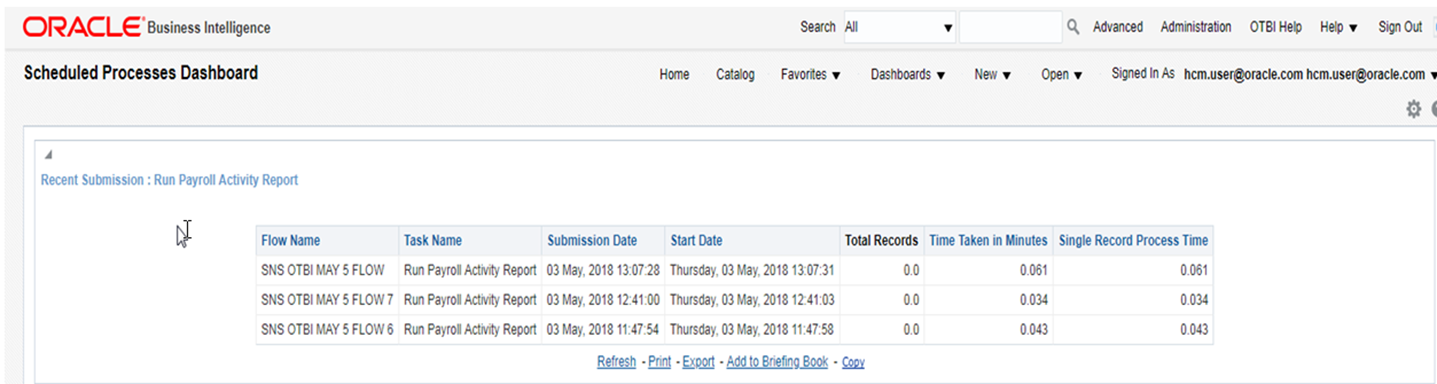

- New Dashboard - Compensation Business Process Dashboard for Worksheet Manager

- OTBI Segments 46-50 in Compensation and Compensation Budget Subject Areas

- Payroll

- Workforce Rewards Transactional Business Intelligence

| Date | Feature | Notes |

|---|---|---|

| 26 APR 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

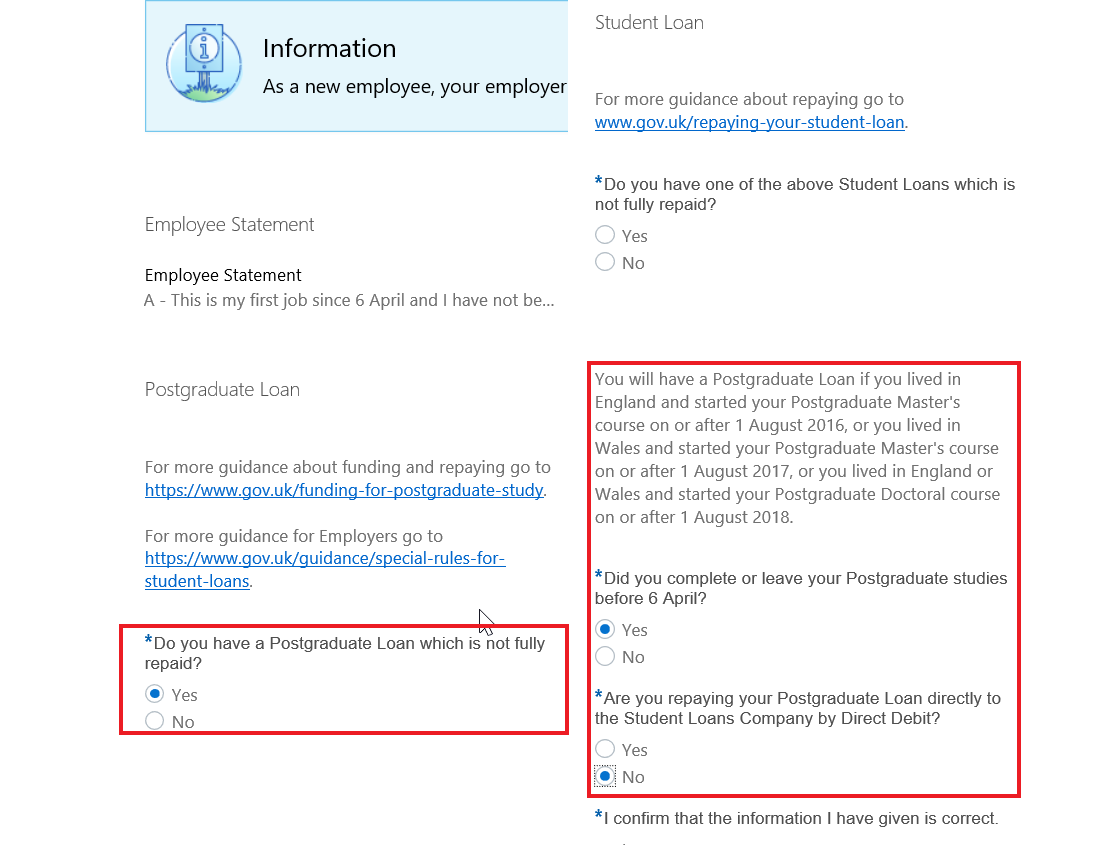

New Starter Declaration Enhancement

The New Starter Declaration is enhanced to include postgraduate loans to comply with the changes published by HMRC. Your employees can enter postgraduate loan information on the New starter Declaration Form using the employee self-service application. These are the changes in the form:

- Changes to student loan questions order sequence

- Text changes to reflect the revised version of the New Starter Declaration published by HMRC

- Validation of Student Loan plan type, which is based on the new sequence and order of the questions presented

- Addition of postgraduate loan information to the form with the required validation

When your employees enter and submit this information, the application automatically creates the court order and student loans calculation card with the relevant information. You don't need to manually create the calculation card.

NOTE: If the component for New Starter Declaration exists for the employee in the calculation card, the application updates the component with this information. If the component does not exist for current employees, you must manually create this component.

Steps to Enable

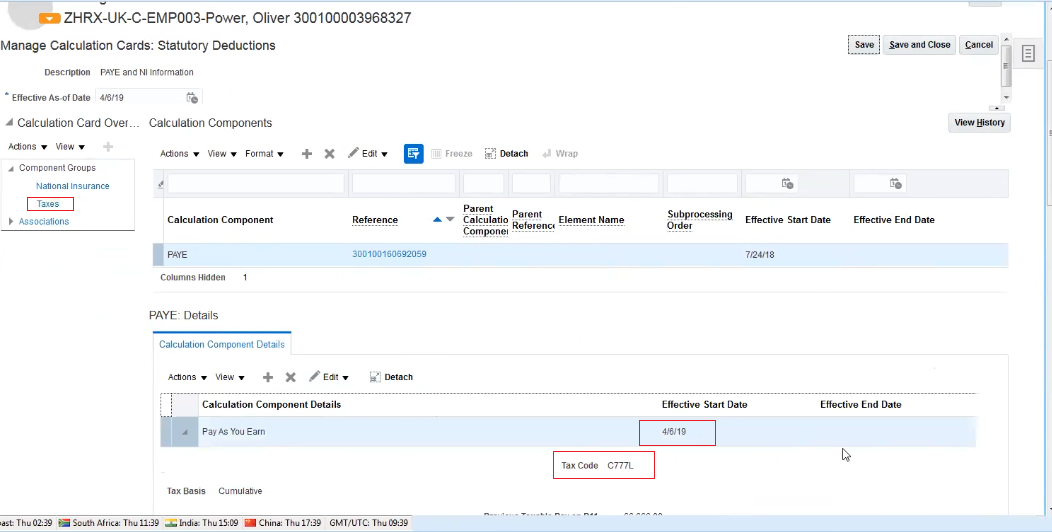

For new hires, the New Starter Declaration component is automatically created only if you have enabled this option at the payroll statutory unit (PSU) or tax reporting unit (TRU) level. Here’s how you can set this in the organization-level Statutory Deductions calculation card:

- Use the Manage Legal Reporting Unit Calculation Cards task and select Organization Statutory Deductions calculation card

- Add or update the PAYE Default Values component and Pay As You Earn Default calculation component details

- Select the Enable automatic new starter creation check box

- Select the Enable automatic Student Loan updates check box. This enables automatic creation of the Court Orders and Student Loan calculation card and a Student Loan component, when the employee completes the relevant section and submits the New Starter Declaration.

- Select Enable automatic Post Graduate Loan check box. This enables automatic creation of the Court Orders and Student Loan calculation card and a Post Graduate Loan component, when the employee completes the relevant section and submits the New Starter Declaration.

April Maintenance Pack for 19A

| Date | Feature | Notes |

|---|---|---|

| 29 MAR 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| New Features Delivered Ready to Use Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

New Features That Customer Must Take Action to Use (Delivered Disabled) Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

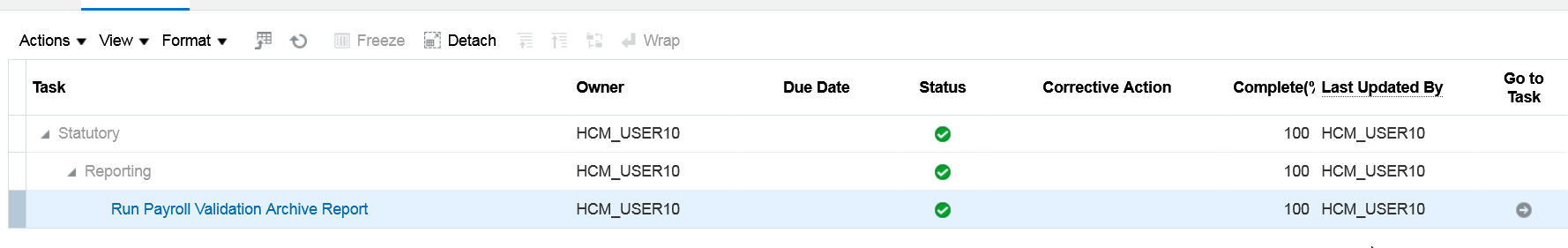

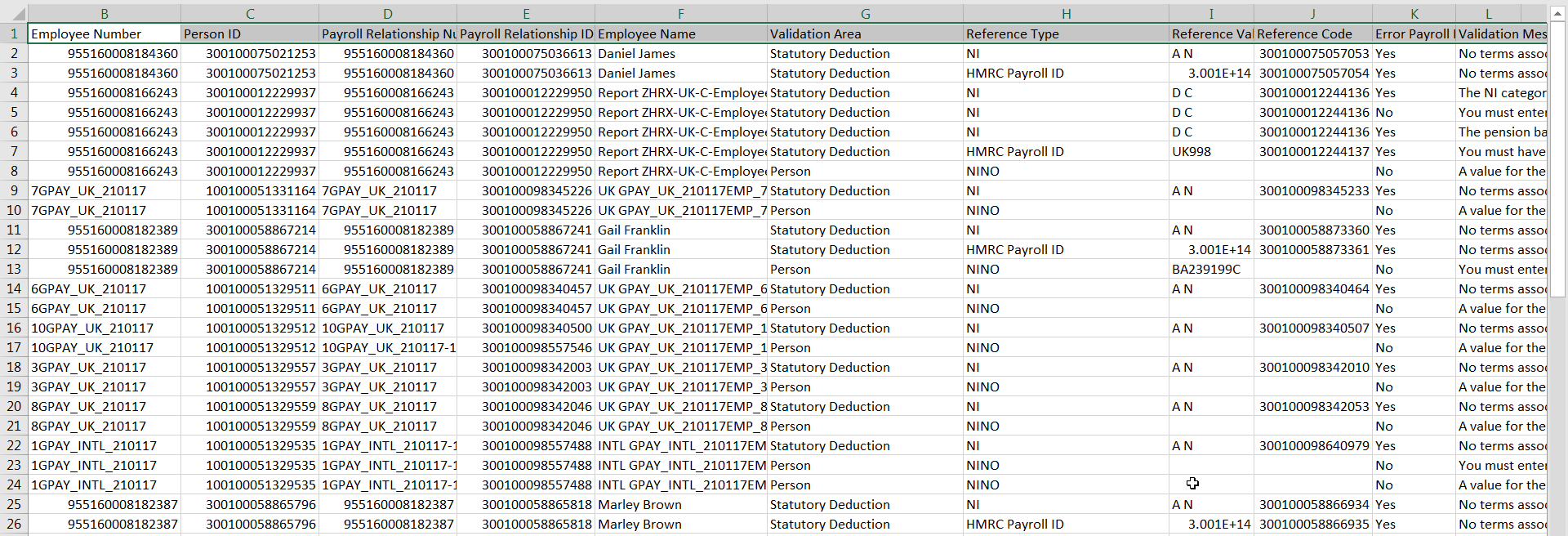

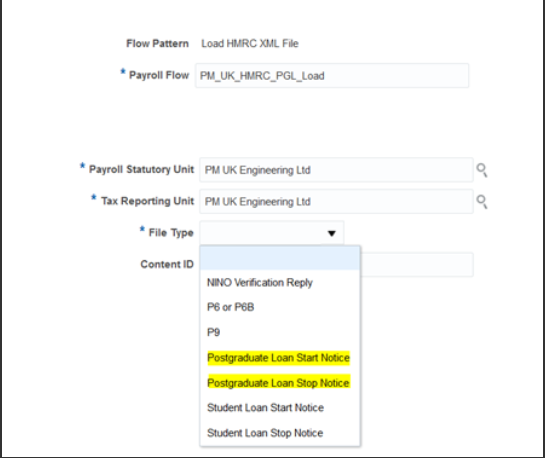

Improved Performance for Payroll Validation Report

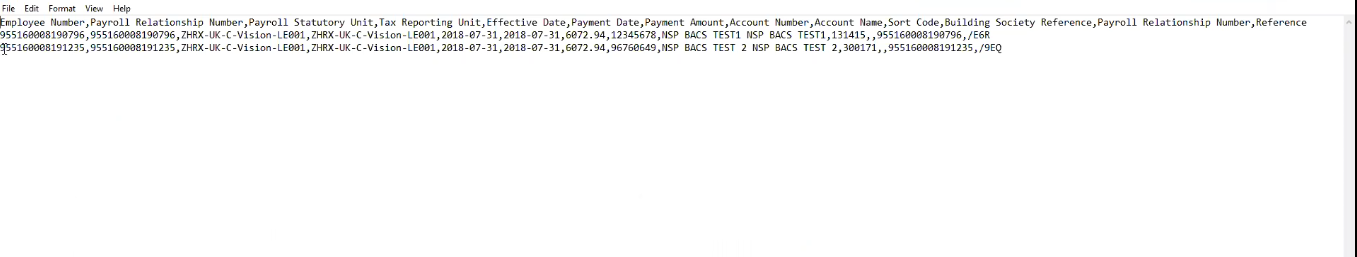

You can use the improved process to run the Payroll Validation Report. Use the Submit a Process or Report task, and select Run Payroll Validation Archive Process.

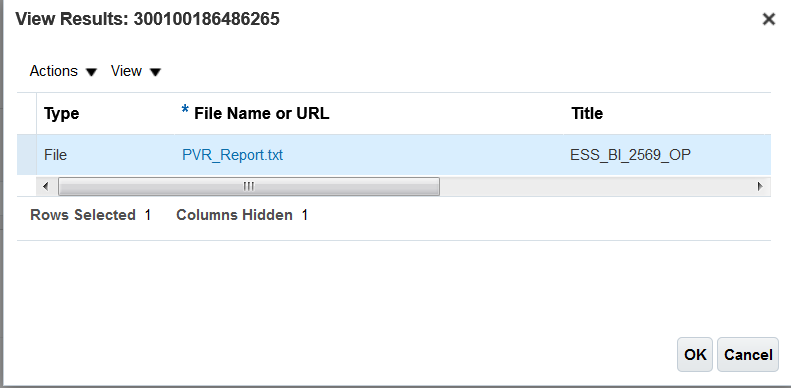

After you have run the process successfully, to view the results:

- Click Go to Task and Actions.

- Select View Results to access the output file created by the process.

Here, you can access the CSV file to view and download the output:

This output file is in text format. You can download and save it as a CSV file and open it in Microsoft Excel, or other compatible applications that support CSV format:

Steps to Enable

You don't need to do anything to enable this feature.

February Maintenance Pack for 19A

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 25 JAN 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| New Features Delivered Ready to Use Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

New Features That Customer Must Take Action to Use (Delivered Disabled) Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Processing Benefits in Kind in Payroll: 2019-2020 Legislative Changes |

||||||

Pensions Automatic Enrolment: Align Pay Reference Period with Earnings Period |

||||||

HMRC Data Retrieval and Load XML Data Process Includes Postgraduate Loans |

||||||

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

Real Time Information Tax Year 2019-2020 (FPS/EPS/EYU)

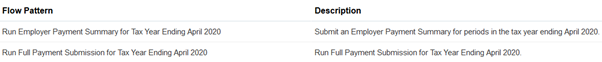

Full Payment Submission and Employer Payment Summary

You can create and send Real Time Information (RTI) data to HMRC for the tax year 2019-2020 using the new processes for Full Payment Submission (FPS) and Employer Payment Summary (EPS):

- Run Employer Payment Summary for Tax Year Ending April 2020

- Run Full Payment Submission for Tax Year Ending April 2020

The FPS includes the Postgraduate Loan data effecting from April 2019:

FPS and EPS

Earlier Year Update

Use the Run Earlier Year Update for Tax Year Ending (EYU) process to submit changes for previous tax years including 2018-19. You can run this process for any updates to be sent only after 19 April 2019. Until then, you can use the FPS to submit the data for 2018-2019.

Earlier Year Update

The previous tax years' processes are also available, if you require updates to be sent for those years.

Year to Date Reconciliation Report

Postgraduate loan deductions are included in this report for the relevant employees.

Steps to Enable

You don't need to do anything to enable this feature.

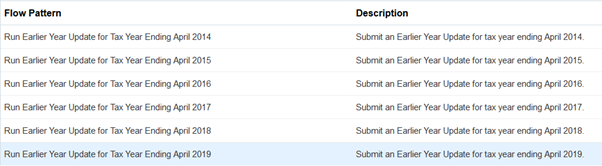

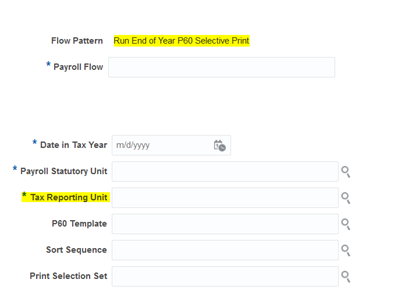

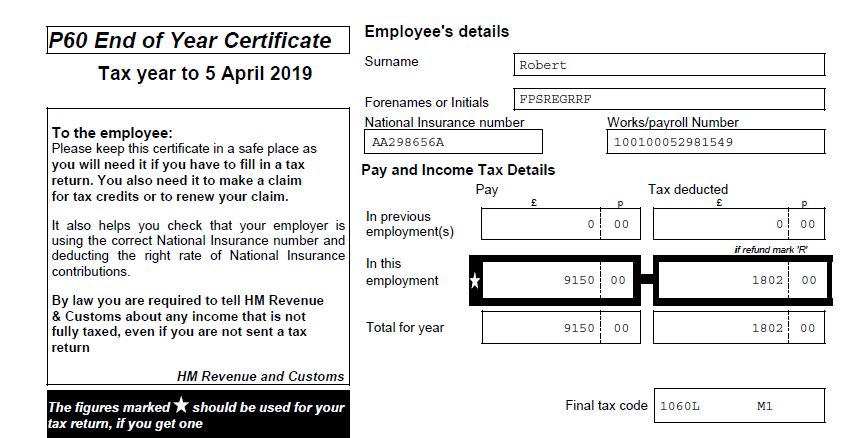

P60 Enhancements for Tax Year 2018-2019

You can deliver P60 End of Year Certificate to your employee using the new templates for the tax year 2018-2019.

To generate P60 for your employees, use the Submit a Payroll flow task for your legislative data group. Select either Run End of Year P60 flow pattern or Run End of Year P60 Selective Print flow pattern, as required.

Run End of Year P60 Report

The tax reporting unit (TRU) is a required parameter when generating or reprinting the P60.

TRU and Required Parameters

P60 End of Year Certificate

Steps to Enable

You don't need to do anything to enable this feature.

Budget and Legislative Compliance for Tax Year 2019-2020

Budget changes for the new tax year are:

- National Insurance Thresholds and Rates to be applied from April 2019

- NI Thresholds are as follows:

| Threshold/Limit | Weekly (£) | 2 Weekly (£) | 4 Weekly (£) | Monthly (£) | Annual (£) |

|---|---|---|---|---|---|

| Lower Earnings Limit (LEL) | 118 | 236 | 472 | 512 | 6,136 |

| Primary Threshold (PT) | 166 | 332 | 664 | 719 | 8,632 |

| Secondary Threshold (ST) | 166 | 332 | 664 | 719 | 8,632 |

| Upper Secondary Threshold (UST) | 962 | 1,924 | 3,847 | 4,167 | 50,000 |

| Apprentice Upper Secondary Threshold (AUST) | 962 | 1,924 | 3,847 | 4,167 | 50,000 |

| Upper Earnings Limit (UEL) | 962 | 1,924 | 3,847 | 4,167 | 50,000 |

- NI Rates applicable:

The percentages used to calculate employee and employer contributions are unchanged from 2018/2019.The rates which apply to each earnings band for 2019-2020 are as follows:

Employee Rate by NI Category

- Earnings < LEL band for Categories A, H, M, B, J, Z and C remain Nil;

- Earnings from LEL <= PT remain as

- Categories A, H, M, B, J and Z at 0%

- Category C as Nil

-

Earnings > PT <= UEL remain as:

- Categories A, H and M, at 12%

- Categories B at 5.85%

- Categories J and Z at 2%

- Category C as Nil

-

Earnings > UEL remain as:

- Categories A, H, M, B, J and Z at 2%

- Category C as Nil

Employer Rate by NI Category

- Earnings < LEL band for Categories A, H, M, B, J, Z and C remain Nil;;

- Earnings from LEL <= ST remain as

-

Categories A, H, M, B, J, Z and C remain at 0%

-

-

Earnings > ST <= UST/AUST remain as:

- Categories A, B and J, and C at 13.8%

- Categories H, M and Z at 0%

-

Earnings > UST/AUST <= UEL remain as:

-

Categories A, H, M, B, J, Z and C remain at 13.8%

-

-

Earnings > UEL remain as

-

Categories A, H, M, B, J, Z and C remain at 13.8%

-

- NIC Compensation Rate

The NICs Compensation Rate used for calculating NI compensation relating to the processing and payment of statutory payments is unchanged at 3%.

- PAYE for rUK

- PAYE Thresholds

The 2019-2020 income tax bandwidths and percentages effective from 6th April 2019 for the (excluding Wales and Scotland) are as follows:

| Rate |

Taxable Pay |

|---|---|

| Basic Rate at 20% | £0 - £37,499 |

| Higher Rate at 40% | £3500 - £149,999 |

| Additional Higher rate at 45% | Over £150,000 |

- Basic Personal Allowance

The basic personal allowance for tax year 2019-2020 has increased to £12,500.

- Emergency Tax Code for PAYE

The emergency tax code for the new tax year is set to 1250L.

- Statutory Pay Rates

The Statutory payment rates for the tax year 2019/2020 are set as follows:

| Rate | Weekly Rate | Effective Date |

|---|---|---|

| Statutory Sick Pay (SSP) |

£94.25 |

For absences on or after 6th April 2019 |

| Statutory Maternity Pay (SMP) |

£148.68 |

For payment weeks starting on or after 7th April 2019 |

| Statutory Adoption Pay (SAP) |

£148.68 |

For payment weeks starting on or after 7th April 2019 |

| Statutory Paternity Pay (SPP) |

£148.68 |

For payment weeks starting on or after 7th April 2019 |

| Shared Parental Pay (ShPP) |

£148.68 |

For payment weeks starting on or after 7th April 2019 |

- Other Statutory Rates (unchanged for tax year 2019-2020)

The Small Employers Relief threshold remains at £45,000

The NIC compensation rate remains at 3%

The standard recovery rate remains at 92%

- Student Loan Threshold

The thresholds used in the calculation for Student Loans have changed for tax year 2019/2020 as follows:

| Student Loan | Annual Threshold |

|---|---|

| Plan Type 1 | £18,935 |

| Plan Type 2 | £25,725 |

These thresholds are effective from 6th April 2019.

There is no change to the calculation method.

- Postgraduate Loan Thresholds and Rate

The new Postgraduate Loan deduction that comes into effect from 6th April 2019 has its own rates and threshold and are set as follows:

Annual Threshold = £21,000

Deduction Rate = 6%

- Pension Automatic Enrolment Thresholds

The thresholds set in the assessment of earnings to determine if an employee should be automatically enrolled and for calculating qualifying earnings for pensions purposes are set for the tax year 2019/2020 as follows:

| Period Type | Qualifying Earnings Lower Threshold (For Assessment of Jobholder Status) | Qualifying Earnings Upper Threshold | Earnings Trigger Threshold (Remains Unchanged) |

|---|---|---|---|

| Annual |

£6,136 | £50,000 | £10,000 |

| Weekly | £118 | £962 | £192 |

| Fortnightly (2 weeks) | £236 | £1924 | £384 |

| Lunar Month (4 weeks) | £472 | £3847 | £768 |

| Calendar Monthly | £512 | £4167 | £833 |

| Quarterly | £1,534 | £12,500 | £2,499 |

| Biannual (6 calendar monthly) | £3,016 | £25,000 | £4,998 |

Steps to Enable

You don't need to do anything to enable this feature.

Processing Benefits in Kind in Payroll: 2019-2020 Legislative Changes

You can comply with legislative changes for the tax year 2019-2020 to process your employees' benefits in kind through payroll.

The updates include:

- New Fuel Type F is introduced to identify diesel cars meeting Euro standard 6d.

- The following new set of values apply for cars registered on or after 1 January 1998 with approved CO2:

CO2

Fuel A/F

Fuel D

CO2

Fuel A/F

Fuel D

0 – 50

0.16

0.20

125

0.29

0.33

51 – 75

0.19

0.23 130 0.30 0.34 76 – 94

0.22 0.26 135 .031 0.35 95

0.23 0.27 140 0.32 0.36 100 0.24 0.28 145 0.33 0.37 105 0.25 0.29 150 0.34 0.37

110 0.26 0.30 155 0.35 0.37

115 0.27 0.31 160 0.36 0.37

120 0.28 0.32 165+ 0.37 0.37

- The following rates apply to cars registered on or after 1 January without approved CO2:

Engine Size

Fuel A/F

Fuel D

0 to 1400

0.23

0.27

1401 to 2000

0.34

0.37

Over 2000

0.37

0.37

All rotary engines

0.37

0.37

- The following rates apply to cars registered on or after 1 January without approved CO2:

Engine Size

Fuel A/F

Fuel D

0 to 1400

0.23

0.27

1401 to 2000

0.34

0.37

Over 2000

0.37

0.37

All rotary engines

0.37

0.37

- The following charges apply to car and car fuel, and van and van fuel benefits:

Benefit Charge

Value

Fuel Benefit Charge for Car

24100.00

Fuel Benefit Charge for Van

655.00

Van Benefit Standard Charge

3430.00

Van Benefit for zero-emission vans amount

3430.00

Steps to Enable

You don't need to do anything to enable this feature.

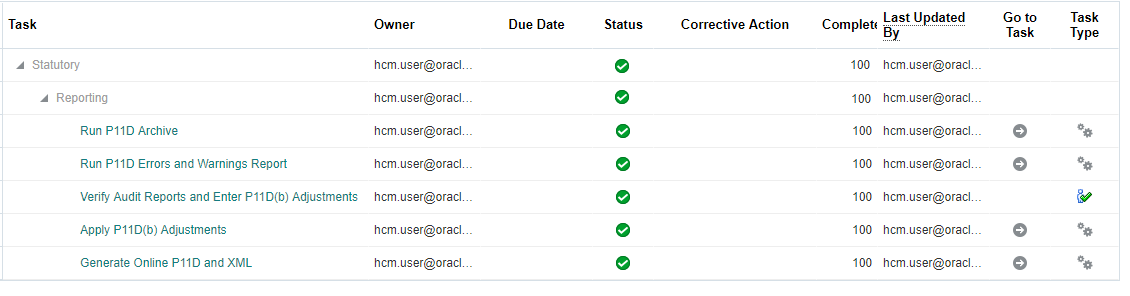

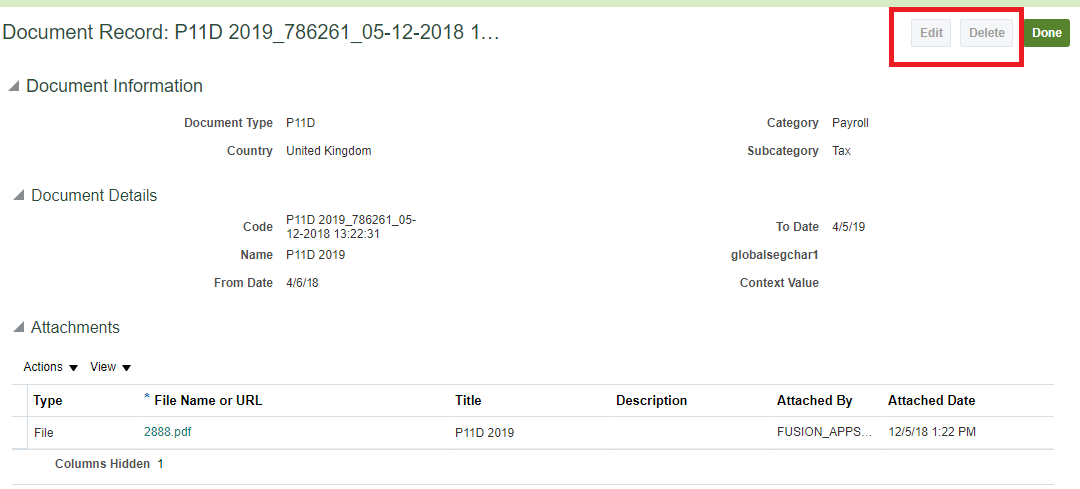

You can provide read-only access of end-of-year expenses and benefits statements to your employees for the tax year 2018-2019.

All the rates, CO2 emissions and charges applicable for the reporting of P11D for the tax year ending April 2019 have been applied.

Use the streamlined P11D process that combines tasks to archive data, generate Errors and Warnings report, apply the P11D(b) changes, and create the online P11D statement.

P11D Process

P11D PDF File

Access to employees is restricted to view only. Printing using normal PDF functionality also available.

Steps to Enable

You don't need to do anything to enable this feature.

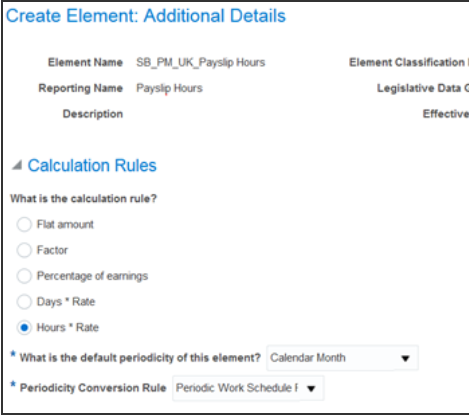

Display or Hide Hours on Payslips

You can set up the payslip template to show or hide hours, as required. Your employees can view the hours related to their earnings. You can override the default calculations provided for the number of hours used by the Earnings formula, or even set up your own calculation to display the hours on the payslip.

Steps to Enable

Use the balance category Hours to display hours on the payslip. Automatic balance feeds ensure the number of hours feed into the balance created. This balance is available in the payslip template under the Hours region.

You can do this in the Manage Elements task by creating the element using the Earnings element template:

Create Element Using the Manage Element Task

Use the element classification Regular Earnings and select the Hours*Rate option under calculation rules.

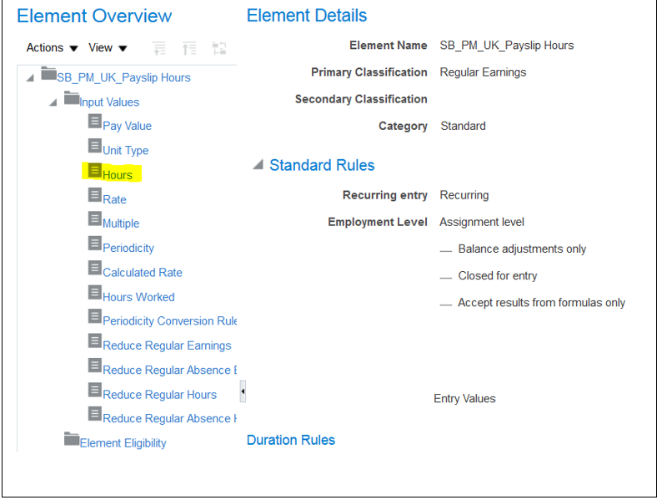

Element Overview

When using the earnings element template, the balance category of hours is automatically created for that element, if one of the inputs is Hours.

You can create your own calculations for the number of hours to display on the payslip or other archive based reports, for example, the Payroll Register report. To do this:

- Create your balance with the balance category Hours

- In the Manage Balance Definitions, use the balance category Hours

- Create a balance feed for the result of the calculation

- You can enter the element name as input value Hours

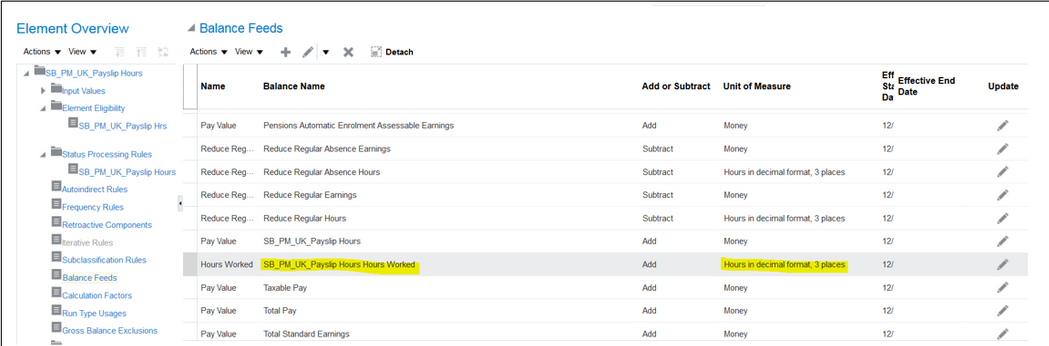

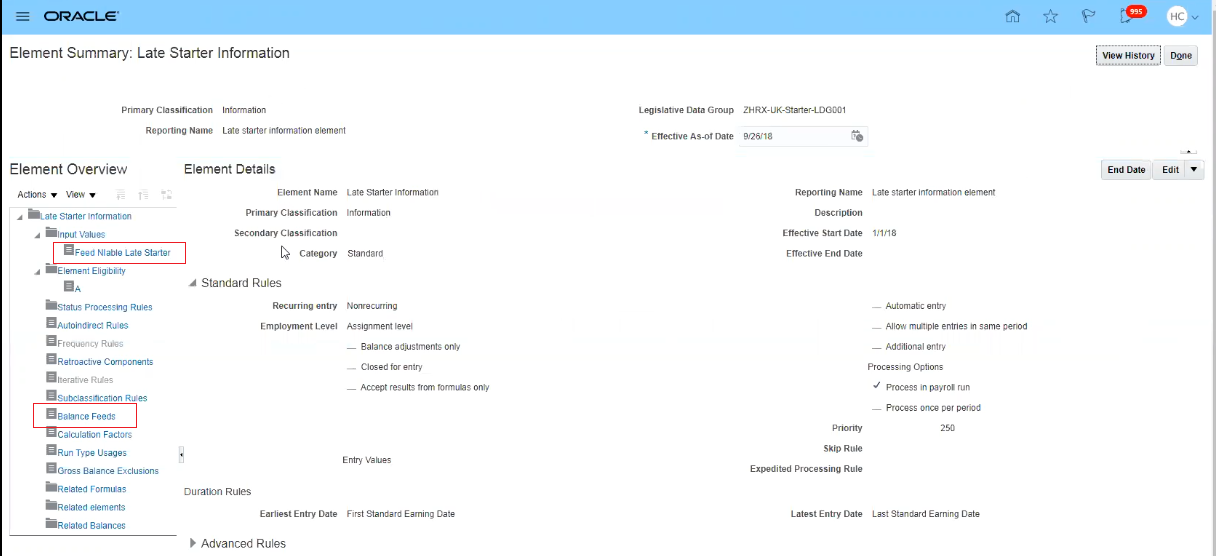

Element Overview: Balance Feeds

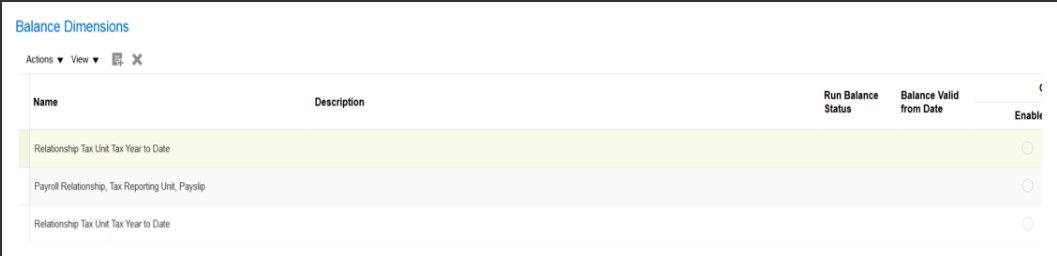

- Attach following dimensions to the balance:

- Relationship Tax Unit Tax Year to Date

- Payroll Relationship, Tax Reporting Unit, Payslip

- Relationship Tax Unit Run

Create Balance Definition

You can set up the payslip template to display or hide the hours balances in the Hours region as required.

| Description | Current | Year to Date |

|---|---|---|

| Payslip Hours | 180.00 | 569.00 |

| Total Hours Worked | 200.00 | 769.00 |

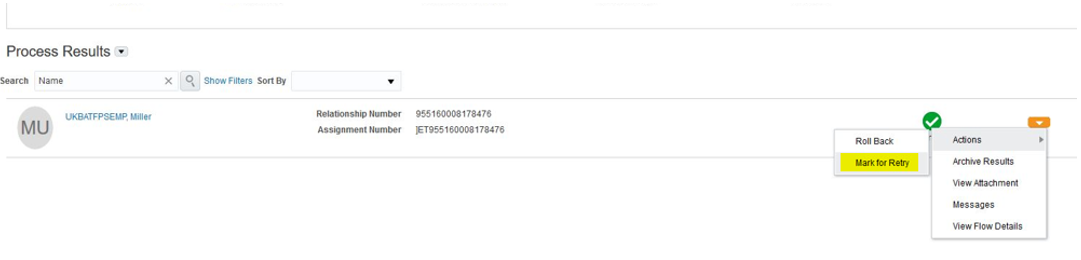

You can use the option Mark for Retry for employees who were successfully included in the original Full Payment Submission (FPS) process.

- The retry run only reprocesses employee records that are Marked for Retry or in Error status

- Successful records are not reprocessed resulting in significant time saving compared to rolling back and rerunning FPS

- You don't need to rollback and rerun a whole FPS batch due to only a few data validation errors

- Retried employee records are included in the FPS XML output file together with the original successful records.

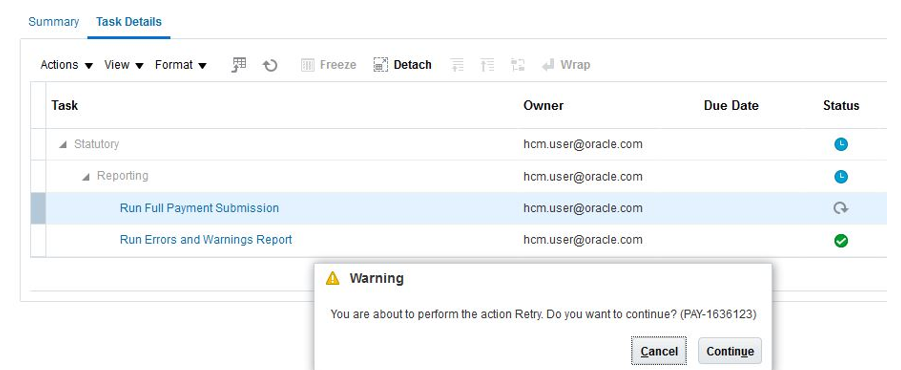

In the process results, you can select the Mark for Retry option for the employee as shown below:

Mark for Retry Option

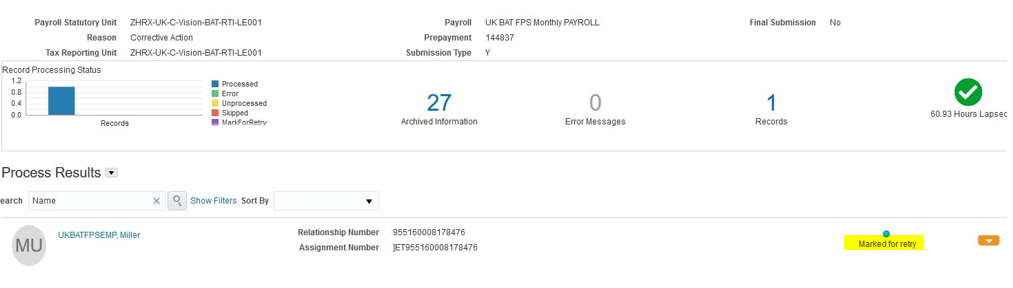

The employee status is updated.

Employee Status for Retry

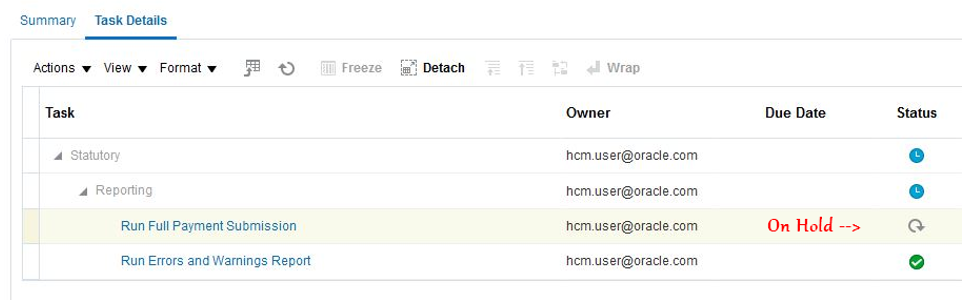

The FPS is marked as On Hold.

FPS Task On Hold

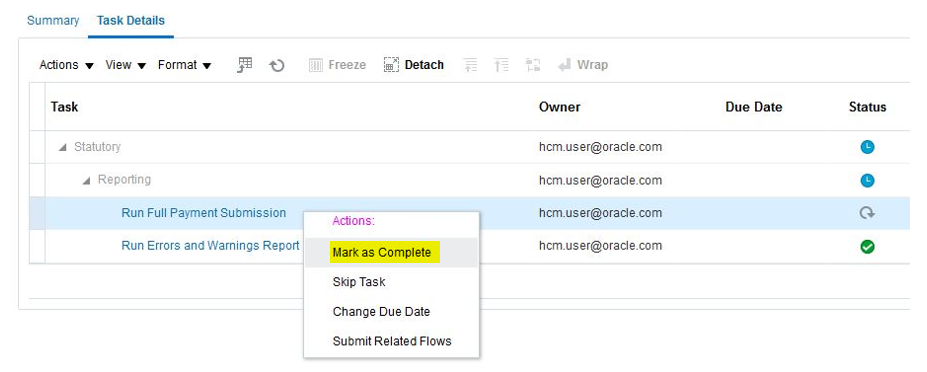

You will then need to select the action ‘Mark as Complete’ on this FPS Task. A warning message is generated. Select Continue to run the process.

FPS Retry

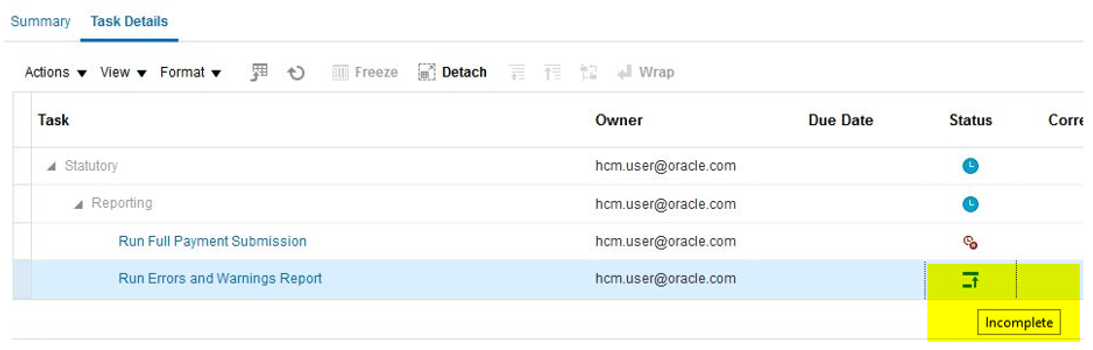

After correcting the data errors raised by the FPS process, to perform the retry after you have fixed errors:

- Select Mark as Incomplete for the the Errors and Warnings task

- Select Mark as Complete for this FPS task.

Mark as Incomplete Errors and Warnings Task

FPS Process Mark as Complete

The Retried employee records are included in the new FPS XML output file that is produced by the Mark as Complete option along with the original successful records.

Steps to Enable

You don't need to do anything to enable this feature.

Automatic Associations Created for Global Transfers

When you initiate a global transfer for an employee and select the tax reporting unit, the process automatically creates the associations for PAYE and NI with the assignment.

For the process to create the associations automatically, there must only be one PAYE and one NI component. If either NI or PAYE, or both NI and PAYE have multiple components, no associations are created.

Steps to Enable

You don't need to do anything to enable this feature.

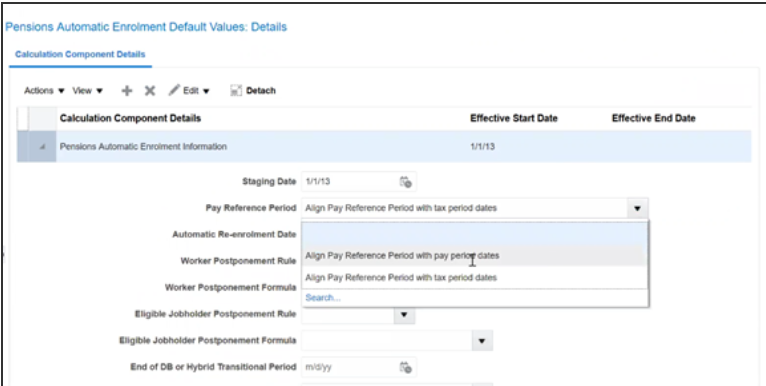

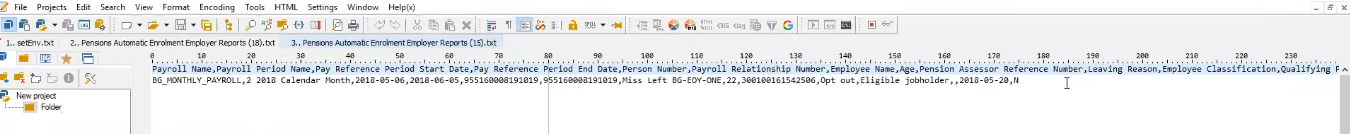

Pensions Automatic Enrolment: Align Pay Reference Period with Earnings Period

You can align your Pay Reference Period with pay periods for assessing employees using the Pensions Automatic Enrolment assessment process. The process supports both tax periods and earnings period.

Steps to Enable

You can set the values in the Organization Pensions Automatic Enrolment calculation card:

Pay Reference Period in Pensions Automatic Enrolment Default Values

- Align Pay Reference Period with tax period dates: Selecting this option aligns your pay reference period to the current tax periods, and is used for employee assessment.

- Align Pay Reference Period with pay period dates: Selecting this option aligns the pay reference period to the period when the employee is paid or the earnings period, and is used for employee assessment.

You can create and maintain postgraduate loan deductions for your employees using the Postgraduate Loan Start Notice (PGL1) or Postgraduate Loan Stop Notice (PGL2) notifications from HMRC. You can either manually enter the data, or run the HMRC Data Retrieval and Load HMRC XML File Processes to load PGL1 and PGL2. Postgraduate loan information will be reported to HMRC by the Full Payment Submission process, effective April 2019.

Steps to Enable

You can use the new element template to create postgraduate loan element. Use the element template for court orders and student loans to set up the Postgraduate Loan (PGL) element. This creates all the necessary calculation and results elements and the required balances. The element also automatically creates the calculation card component details for Post Graduate Loan.

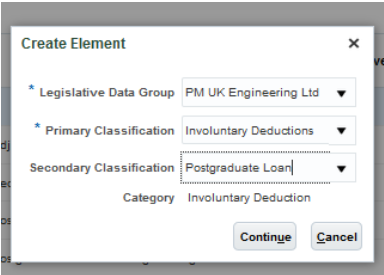

Use the Manage Elements task to create the Postgraduate Loan element with the following attributes:

- Primary Classification Involuntary Deductions

- Secondary Classification Postgraduate Loan

Create Element Postgraduate Loan

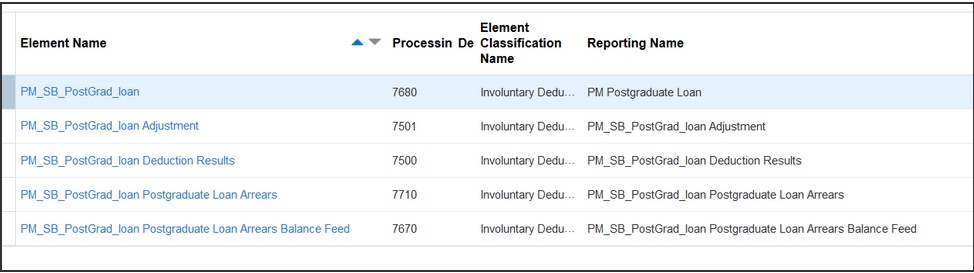

The template creates the following elements:

- <Element Name>_Adjustment

- <Element Name>_Deductions_Results

- <Element Name>_Loan_Arrears

- <Element Name>_Loan_Arrears_Repayment

- <Element Name>_ Loan_Arrears_Repayment_Balance_Feed

Automatically Created Elements

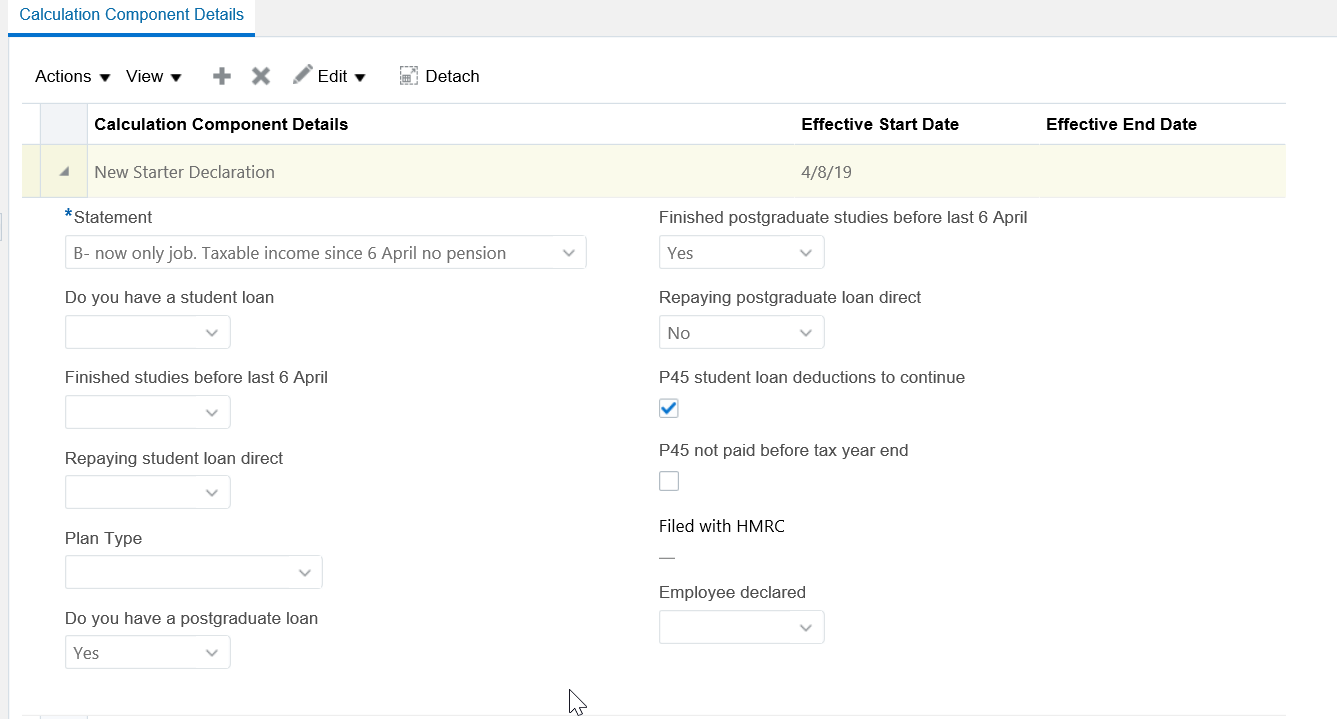

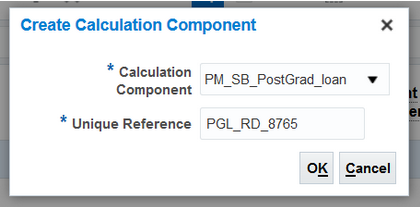

You must now create the postgraduate loan calculation card component for the employee in the Court Orders and Student Loans calculation card. If the employee does not have the calculation card automatically created, you can create the calculation card or use the automatically created calculation card.

In the calculation card, create the calculation component Postgraduate Loan and enter the unique reference.

Create Calculation Component for Postgraduate Loan

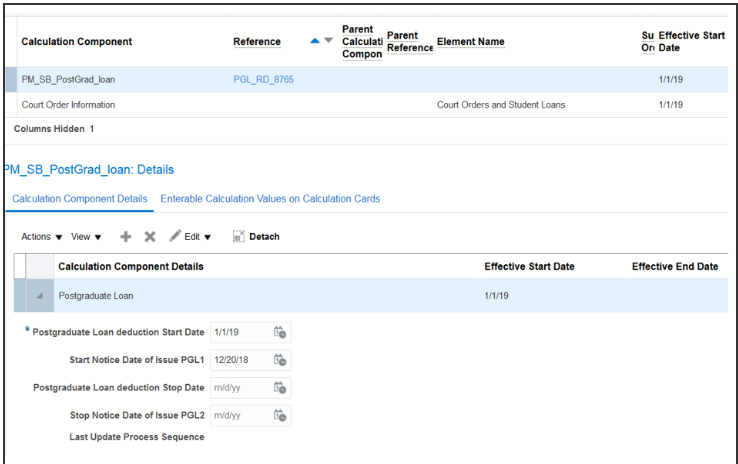

This creates the postgraduate loan calculation component and component details. Enter all the required data in the component details section.

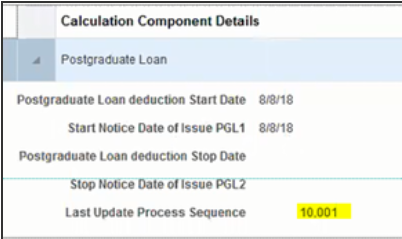

Postgraduate Loan Calculation Component Details

Create the required associations between the postgraduate loan calculation component and the tax reporting unit.

When you run the payroll, the postgraduate loan calculations are performed according to the statutory rules prescribed by HMRC. The deductions are processed for the employee in the effective period. Any amount not processed in the payroll will be added to the arrears balance and processed in subsequent payroll runs.

Postgraduate Loans deduction process is similar to processing Student Loans. If you do not use the HMRC Data Retrieval and Load HMRC XML File Processes for postgraduate loans, you must manually enter the dates required to start the postgraduate loan deductions for the employee.

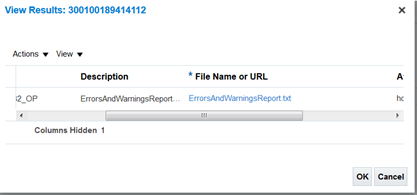

Errors and Warnings Report XML File

You can download the XML file created as part of processes that include a task for error and warnings report. Once you have run the process, you can view the file output from the task Run Errors and Warnings Report.

Save the file in CSV format and open it using the appropriate application.

Steps to Enable

You don't need to do anything to enable this feature.

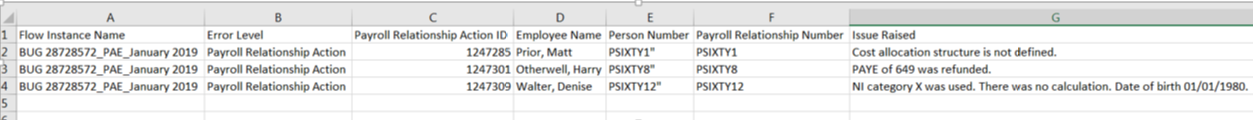

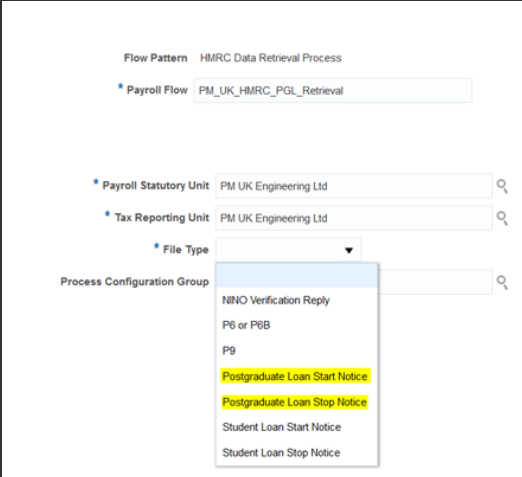

HMRC Data Retrieval and Load XML Data Process Includes Postgraduate Loans

You can retrieve and upload postgraduate loan deduction notification records sent from HMRC for your employees, using the HMRC Data Retrieval process and the Load XML Data process.

Steps to Enable

Prerequisites

- You must create an element for the Postgraduate Loan for your legislative data group retrieve and load from HMRC for Postgraduate Loan Start Notice (PGL1) and Postgraduate Loan Stop Notice (PGL2) received.

- The employee must have a Statutory Deduction card with the correct associations. This is required to match the employee with the PGL1 or PGL2 record to upload.

To retrieve the postgraduate loan records from HMRC, select the required Postgraduate Loan Start Notice or Stop Notice option in the File Type parameter for HMRC Data Retrieval Process.

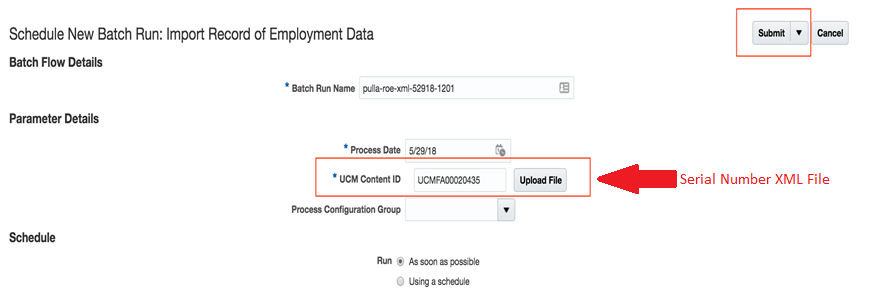

HMRC Data Retrieval Process

This data is stored in the UCM and ready to be processed by the HMRC XML File process.

Load HMRC XML File Process

The data is uploaded from the UCM and updates the component for Postgraduate Loan for the relevant employees. The Last Update Process Sequence field in the postgraduate loan component is used for audit.

Last Update Process Sequence Field

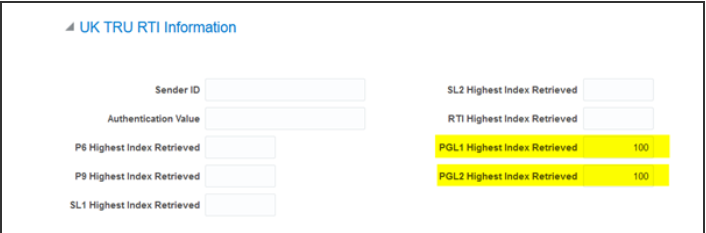

In the organization-level calculation card, there are two new fields in the Organization Information EFF for the UK TRU RTI Information:

- PGL1 Highest Index Retrieved

- PGL2 Highest Index Retrieved

You can set the number for the Highest Index Retrieved, as required.

UK TRU RTI Information

The previously set Sender ID and Authentication Value for your organization also applies to retrieving the postgraduate loans.

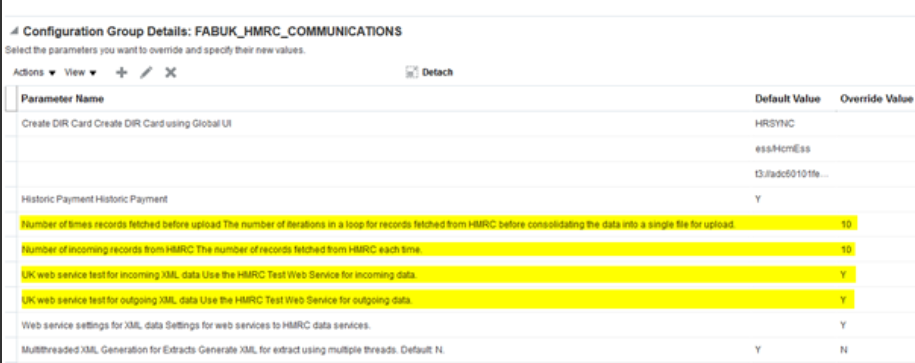

You can use the action parameters to set the maximum file size and number of retrievals to complete in a single run. To do this, create a configuration group and add the parameters values as required.

Configuration Group Details

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

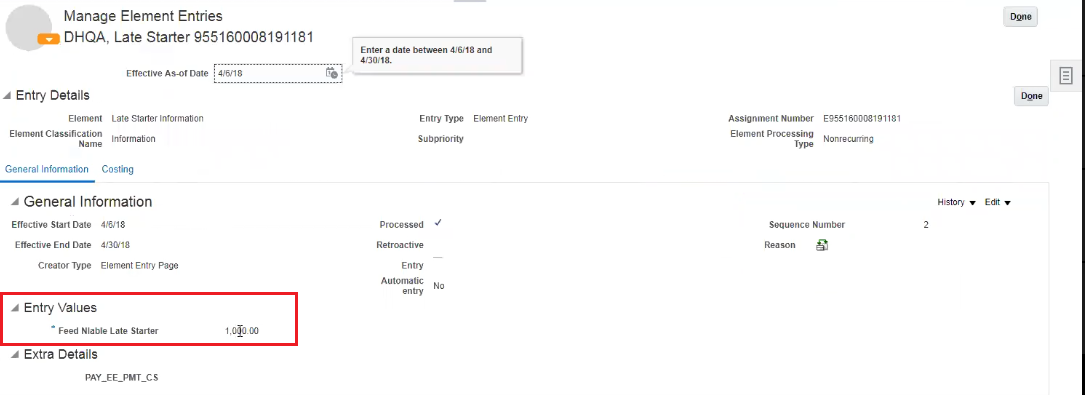

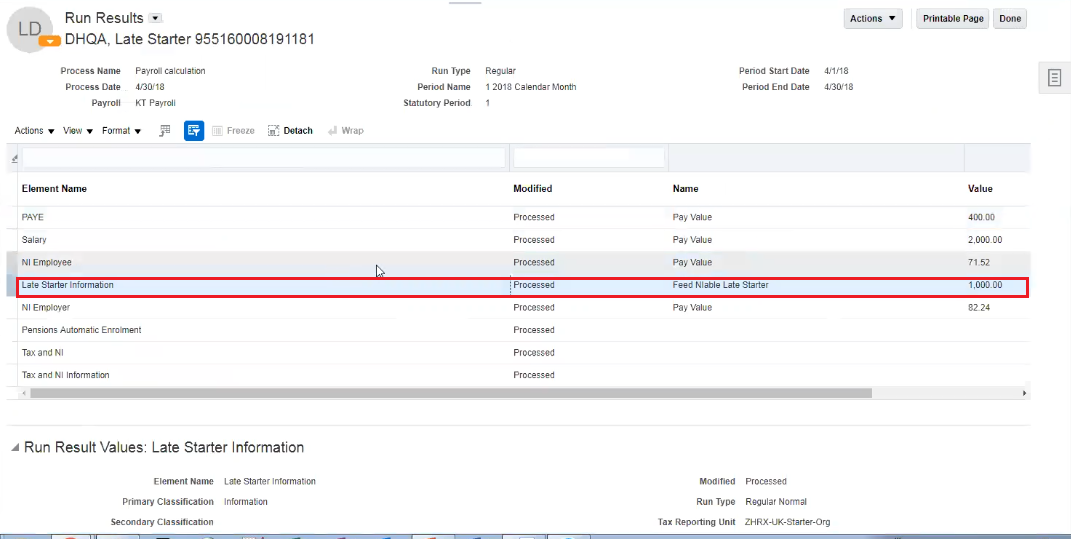

| 28 FEB 2020 | Payroll for the UK: Multiple Periods of NI for Late Hires |

Updated document. Revised feature information. |

| 25 OCT 2019 | Business Intelligence/Payroll: Active Processes Dashboard |

Updated document. Delivered feature in update 19A. |

| 26 APR 2019 | Payroll for the US: Support for 403 (b) and 457 (b) Deferred Compensation Plans |

Updated document. Revised feature information. |

| 29 MAR 2019 | Compensation: Transfer Data Back Into HR More Efficiently |

Updated document. Revised feature information. |

| 29 MAR 2019 |

Global Payroll: Enhanced Security for Quick Actions |

Updated document. Revised feature information. |

| 22 FEB 2019 |

Business Intelligence/Compensation: OTBI Segments 46-50 in Compensation and Compensation Budget Subject Areas |

Updated document. Delivered feature in update 19A. |

| 22 FEB 2019 | Global Payroll: Element Upgrade Process | Updated document. Revised feature information. |

| 25 JAN 2019 | Compensation: Transfer Data Back Into HR More Efficiently | Updated document. Delivered feature in update 19A. |

| 25 JAN 2019 |

Compensation: Total Compensation Statement - Migration |

Updated document. Delivered feature in update 19A. |

| 25 JAN 2019 |

Global Payroll: Control Transient Data Retention in Payroll Extracts | Updated document. Delivered feature in update 19A. |

| 25 JAN 2019 |

Payroll for the US: Midday Period Support for Time Cards and Absences | Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 | Payroll for Mexico: Income Tax Update | Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 |

Payroll for Mexico: Payroll State Tax |

Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 |

Payroll for Mexico: Support for INFONAVIT |

Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 |

Payroll for Mexico: Support for Internet Digital Fiscal Certificate (CFDI) |

Updated document. Delivered feature in update 19A. |

| 21 DEC 2018 |

Payroll for Mexico: Unit of Measure and Update (UMA) Support |

Updated document. Delivered feature in update 19A. |

| 07 DEC 2018 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

Benefits for the United States

The features below are Benefit features for the United States.

ACA 1095-C Report Enhancements

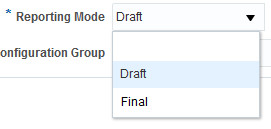

We have provided new review options for your ACA Form 1095-C reports. The Run US 1095-C Employee Report extract now includes a Reporting Mode parameter. This parameter allows you to select between Draft and Final versions of the report. Review your Form 1095-C in Draft mode before generating and submitting the final document. Generate it in Final mode to automatically post the report to the employee Document Records.

Reporting Mode Parameter

Steps to Enable

You don't need to do anything to enable this feature.

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

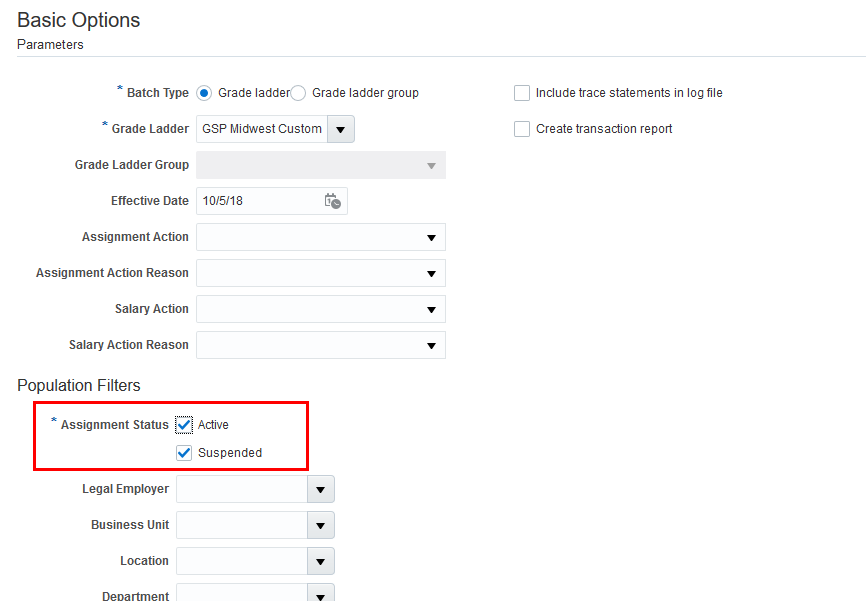

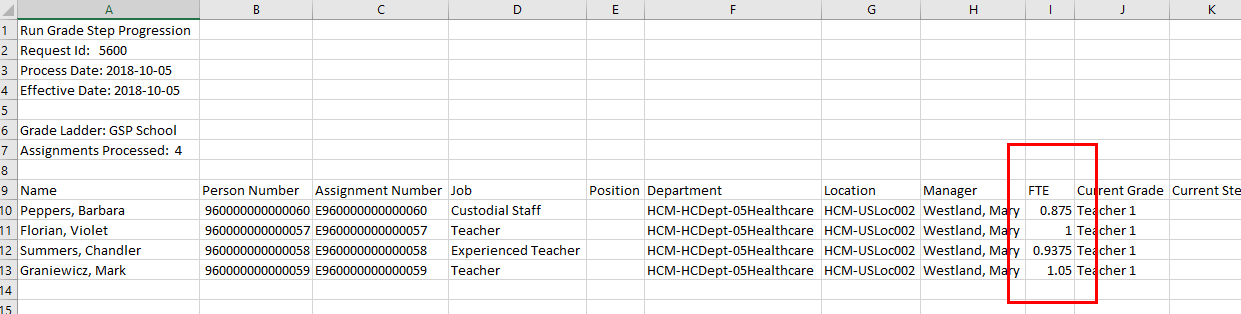

Process Suspended Assignments in Grade Step Progression

You can now include suspended assignments when submitting Run Grade Step Progression and Synchronize Grade Step Rates batch processes. Previously, only active assignments were included and you had to wait until an assignment returned to active status before processing progressions or synchronizing rates. Now, you can keep the assignments and salary records up-to-date with any changes, even while the assignment is suspended.

Both processes include a new Assignment Status parameter. This parameter enables you to include suspended assignments at any point during your processing cycle.

Assignment Status Parameter

Watch a Demo

Steps to Enable

In order to use this feature you need to update the Assignment Status to include suspended assignments when submitting your batch processes.

Tips And Considerations

- At least one Assignment Status value is required when submitting a process. The page defaults to 'Active'. If you want to include suspended assignments you must update the page to include the 'Suspended' value. Alternatively you can choose to run only suspended assignments by selecting only the 'Suspended' value.

- For troubleshooting purposes, the Assignment Status value will be captured in the batch summary log file

Key Resources

Watch Grade Step Progression Enhancements Readiness Training

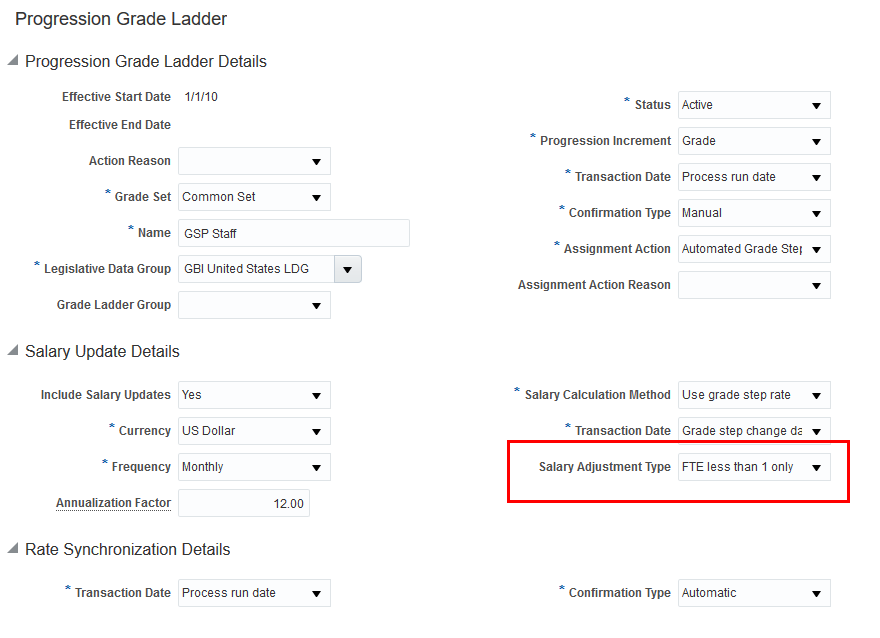

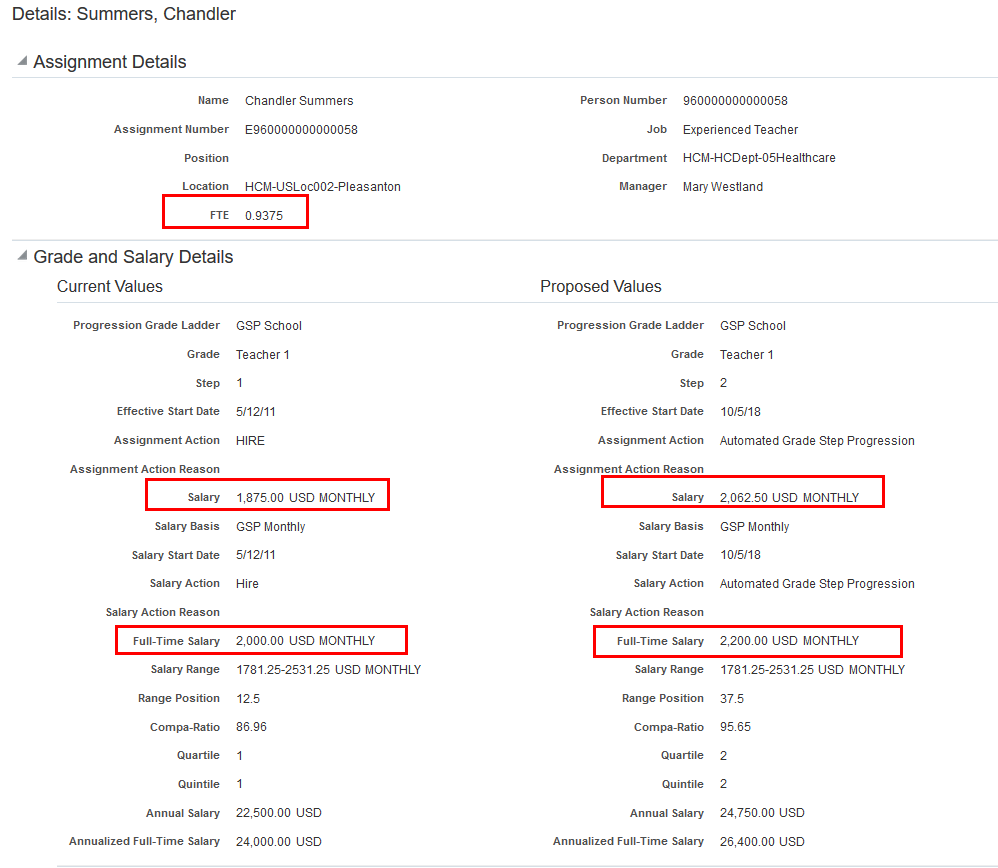

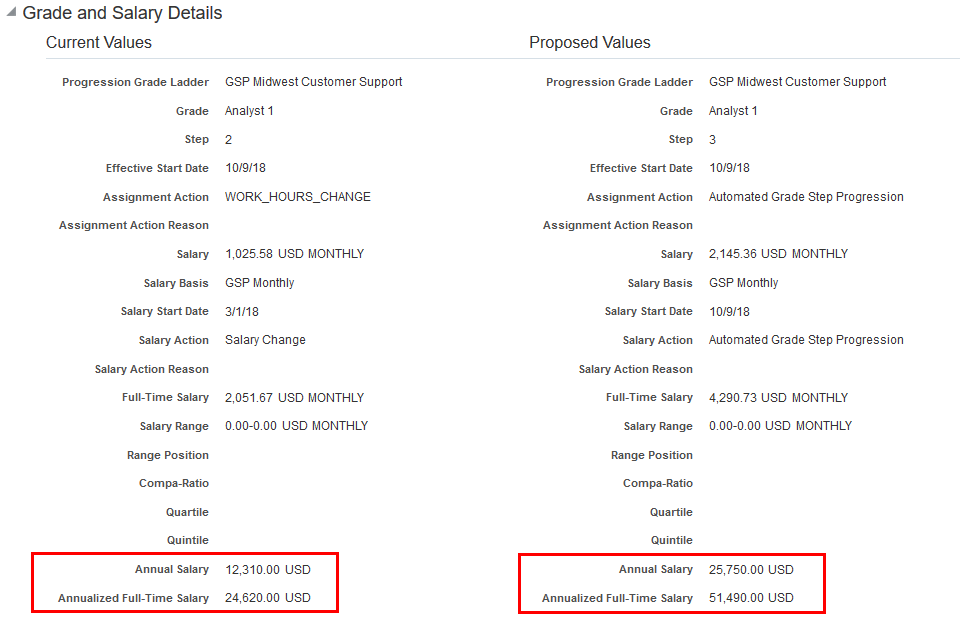

Prorate Progression Grade Ladder Rates by Assignment FTE

We added a new salary adjustment type attribute to the progression grade ladder definition. With this attribute you can specify whether the rates from the grade ladder are prorated based on the value of the FTE on the worker's assignment. You can adjust the salary for all values of FTE or only adjust salary if FTE is less than 1.

Salary Adjustment Type Attribute on Manage Progression Grade Ladders Page

The salary adjustment type you select affects salary amounts calculated during Run Grade Step Progression and Synchronize Grade Step Rates batch processes. It also affects salaries populated in online transactions, such as new hire, promotion, and transfer.

The Review Proposed Progressions and Salary updates page includes new fields that display the full-time salary amounts in current and proposed value columns. These fields are only displayed on the page if the salary is adjusted for FTE.

- The current full-time salary is calculated for comparison with the grade ladder rates to determine if a progression or salary update is warranted. This value may correspond to the grade ladder rate for the current step, it may be different if the salary record was overridden

- The proposed full-time salary is the grade ladder rate for the proposed step, before being pro-rated for FTE value.

The existing salary fields continue to represent the actual values stored on the salary record

- The current salary is the actual salary amount that is stored on the salary record.

- The proposed salary is the new salary to be written to the salary record. This amount includes proration by FTE and rounding if applicable.

Current and Proposed Salary Amounts Displayed in Review Proposed Progressions and Salary Updates Page

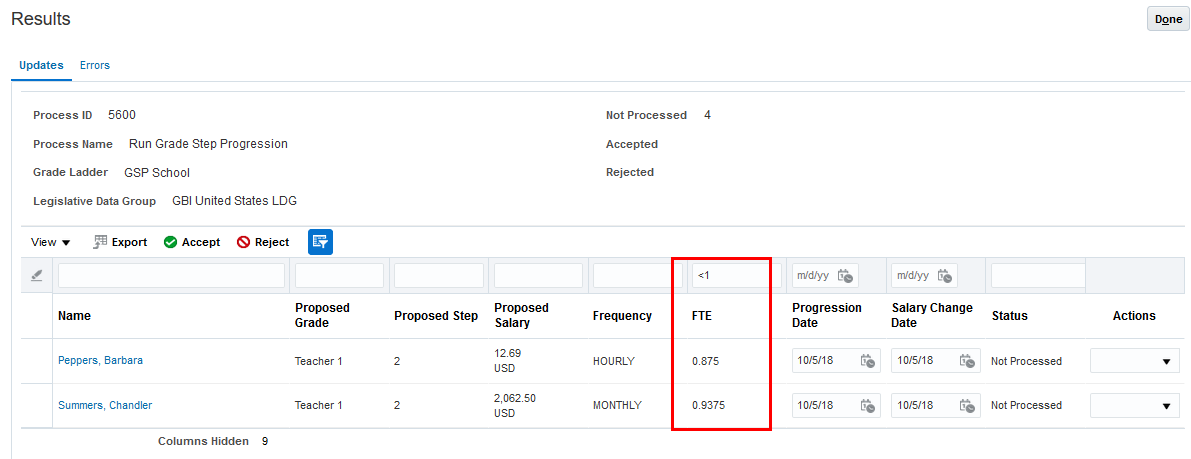

To help review and troubleshoot batch processes, we added the FTE attribute to the Results page. You may find it useful when verifying calculations to filter the results to only display FTE less than 1.

New FTE Column on Results Page

We also added the FTE attribute to the log file. This addition makes it easier to understand and confirm differences in proposed salaries for assignments that are on the same grade step.

New FTE Column on Log File

Watch a Demo

Steps to Enable

To use this feature you need to choose a salary adjustment type in your progression grade ladder definition. You can do this manually on the Manage Progression Grade Ladders page, or via HDL with the Progression Grade Ladder object.

Tips And Considerations

- There are some exceptions for hourly rates

- Salary rates are not adjusted for FTE when the worker's salary basis is hourly.

- Salary rates are adjusted for FTE if the worker's salary basis is not hourly (e.g. monthly or annual) and the frequency of the progression grade ladder is hourly. In this scenario, the hourly rate from the ladder is converted to the salary basis frequency and then adjusted according to the FTE value.

- Take care when updating working hours or FTE value in the same transaction where grade or grade step are updated. It is best to perform FTE/working hours updates in a separate transaction. Or if you do complete them in the same transaction, you should update the working hours/FTE first, prior to updating the grade or grade step.

- Since we are now capturing full-time salary amounts during batch processing, we have changed the way we calculate the annualized full-time salary amount when the salary is adjusted for FTE.

- If the salary is adjusted for FTE, then the Annualized Full-Time Salary is calculated by multiplying the Full-Time Salary amount by the annualization factor of the salary basis.

- If the salary is not adjusted for FTE, then the Annualized Full-Time Salary is calculated by dividing the Annual Salary by the FTE value. This approach is consistent with how the amount is calculated and displayed in the salary pages.

Key Resources

Watch Grade Step Progression Enhancements Readiness Training

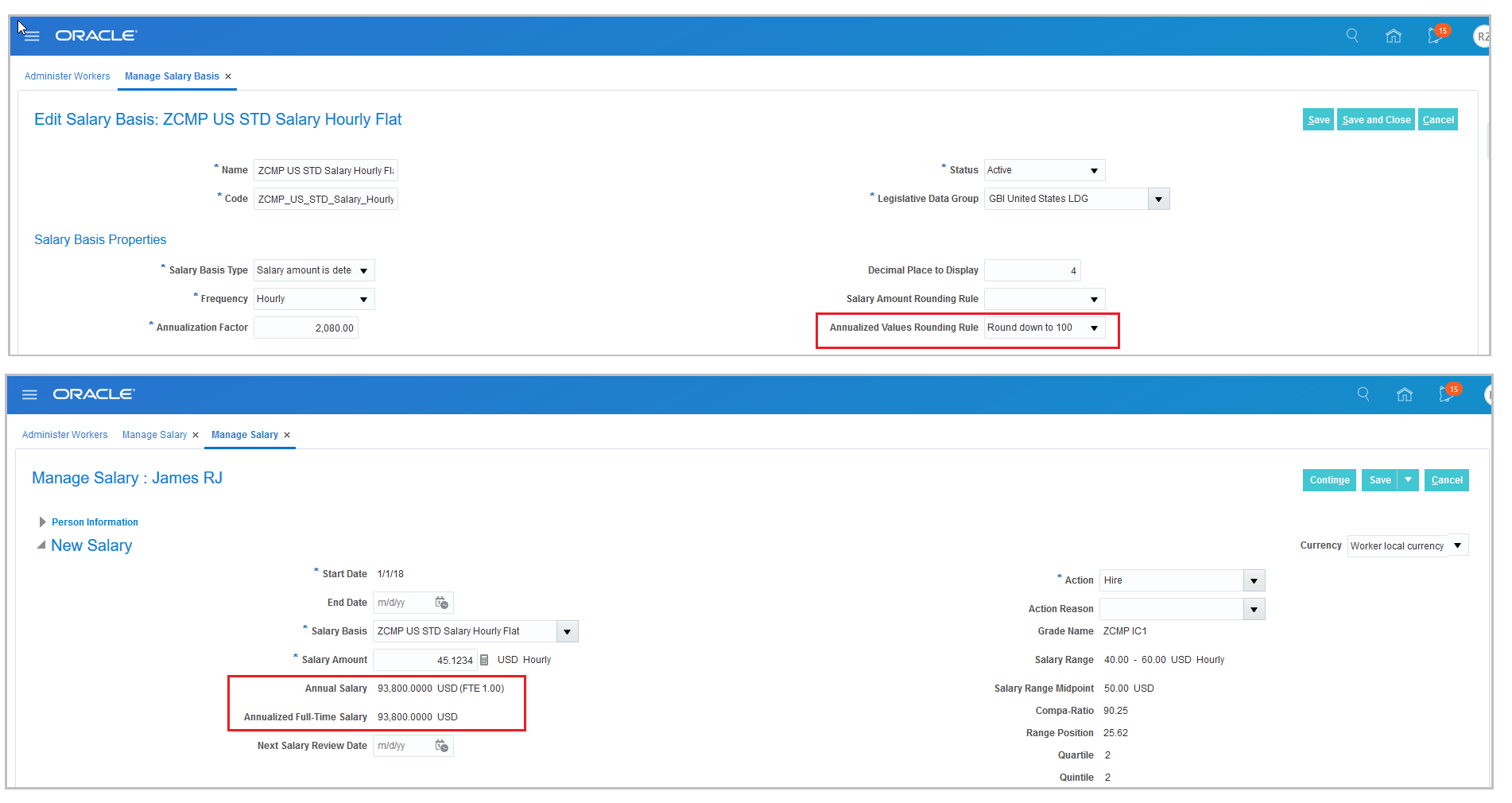

We enhanced the salary basis to give you the flexibility to define separate rounding rules for annual values.

$45.1234 * 2080 = 93856.672, but rounded down to nearest hundred 93,800

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information, see the following topic in Applications Help:

- Creating Salary Bases: Points to Consider

Round Annual Amounts in Grade Step Progression

The annual salary and annualized full-time salary are rounded according to the value of the annualized values rounding rule defined on the salary basis.

Annual Salary Amounts Displayed in Review Page When Annualized Values Rounding Rule Is 'Up to 10'

Watch a Demo

Steps to Enable

In order to use this feature you need to select a value for the annualized values rounding rule on the salary basis definition for each salary basis associated with the employees in your grade ladder.

Tips And Considerations

The annual amounts are calculated and stored during the batch run. These annual amounts are displayed here for reference only and are not included in the salary transaction. The annual amounts displayed in the salary record are calculated dynamically on that page, so in some cases you may see some differences in annual values. For example the annual amounts will be different on the salary page if the rounding rules are changed after the grade step progression process is run.

Key Resources

Watch Grade Step Progression Enhancements Readiness Training

Support Export and Import of Manage Salary Differentials

Export and import new or changed salary range differential values using a newly delivered service in Setup and Maintenance.

Steps to Enable

You don't need to do anything to enable this feature.

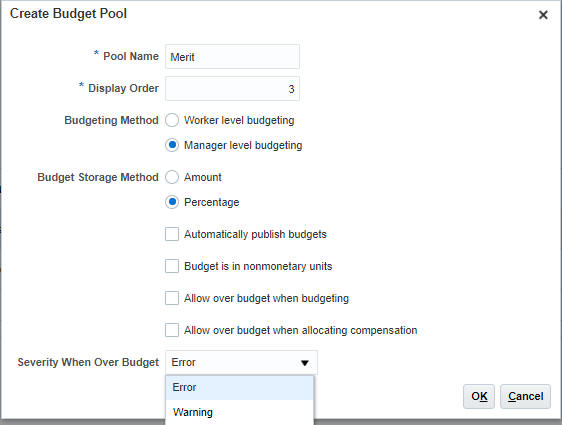

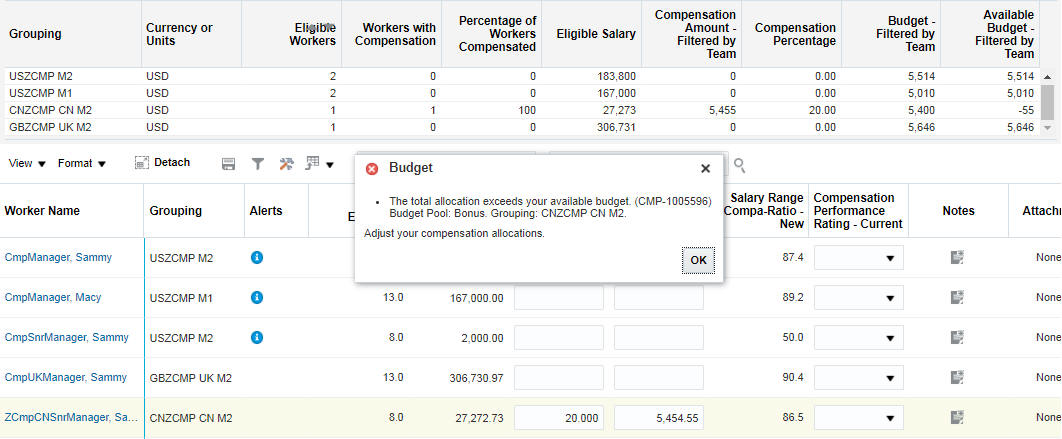

Warn or Error When Over Budget

You can now configure the over budget message to send either a warning or an error. Previously, you could only send an error message.

New Option in Severity When Over Budget

Steps to Enable

You don't need to do anything to enable this feature.

Group Budget Amounts for Reporting or Enforcing

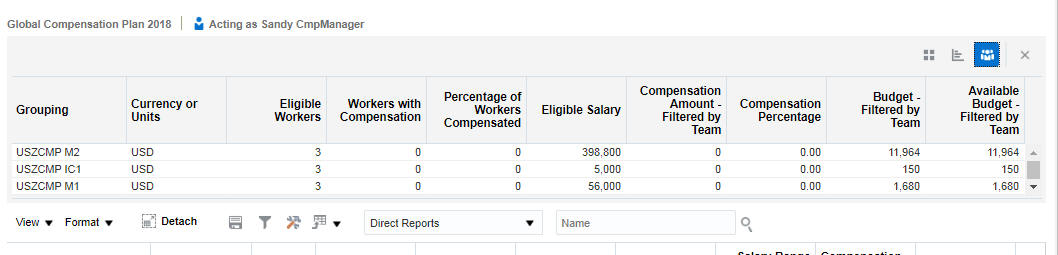

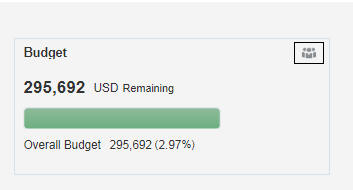

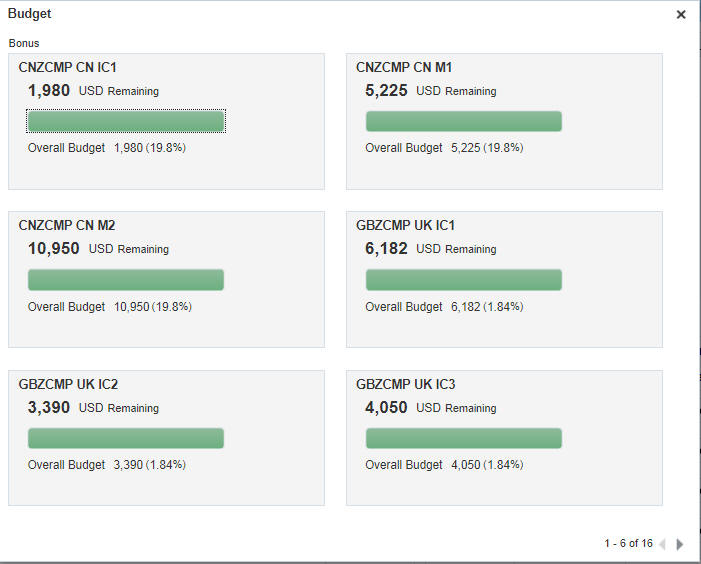

You can now use groups to track and monitor worker-level budgets. Previously, you had to use a report. In the screenshot below, the grouping is based on a user-defined text column. The values within the column are based on Country plus Grade, using a dynamic column calculation.

New Group View in the Worksheet Summary

We also added a Group view within the Analytic Summary view.

Analytic Showing the Group View Icon

When you click the icon, the analytic is broken out into the groups.

Expanded Analytic Group View

When you configure the budget pool to enforce by group and to send an error, you see the following message in the worksheet when a manager goes over budget:

Grouping Error When Over Budget

Steps to Enable

The Compensation Administrator must:

- Either choose or configure a column to use for Grouping:

- A stand-alone column, such as Country

- A user-defined text column that appends values from other worksheet columns (ex: Country + Grade)

- A text value from a fast formula or from External Data

- Configure the Budget Pool to use the column

The following are optional, but as a best practice you should enable at least one for managers:

- Enable Summary views in the Worksheet:

- Configure Worksheet Display> Compensation Task Type> Summary> Group View> Enable group view

- Configure Worksheet Display> Compensation Task Type> Analytic View > Enable group view

- Configure Worksheet Display>Approval Task Type>Columns> Compensation Overview

- Enable Group view for Manage Budgets:

- Configure Budget Display>Configure Budget Page Layout>Summary>Table View> Group View> Enable Group View

Tips And Considerations

- You must use worker level budgets for this feature.

- You can't use the following types of columns for grouping:

- Numeric columns

- Person Number

- Worker Number

- Worker Name

- Date columns

- Updated by columns

- Performance Management Rating columns

- Columns that contain a large amount of text only display the first 150 characters.

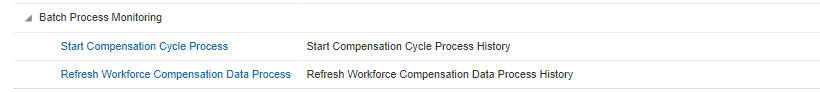

Review Batch Processing Information

We made it easier to understand the performance of our Start Compensation Cycle and Refresh Workforce Compensation Data batch processes with two new reports in View Administration Reports. The reports provide information such as number of workers processed, time taken, number of dynamic calculations evaluated, and the number of fast formula evaluated.

New Reports in View Administration Reports

Steps to Enable

You don't need to do anything to enable this feature.

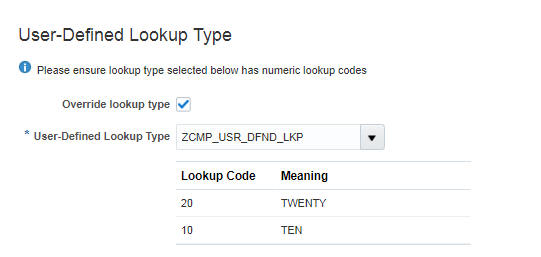

Use User-Defined Lookups in List Columns

We enhanced the user-defined list columns so you can now use user-defined lookups. Previously, you could use only the seeded lookup associated with the column.

List Column Configuration Using User-Defined Lookup

Steps to Enable

The Compensation Administrator must:

- Configure a lookup using numeric lookup codes

- Enable the "Override lookup type" option on the list column

- Choose the created lookup

- Save

Tips And Considerations

The user-defined lookup must use numeric lookup codes. Also, the plan must either be closed or not processed through the Start Compensation Cycle batch process to enable the configuration and attach the user-defined lookup.

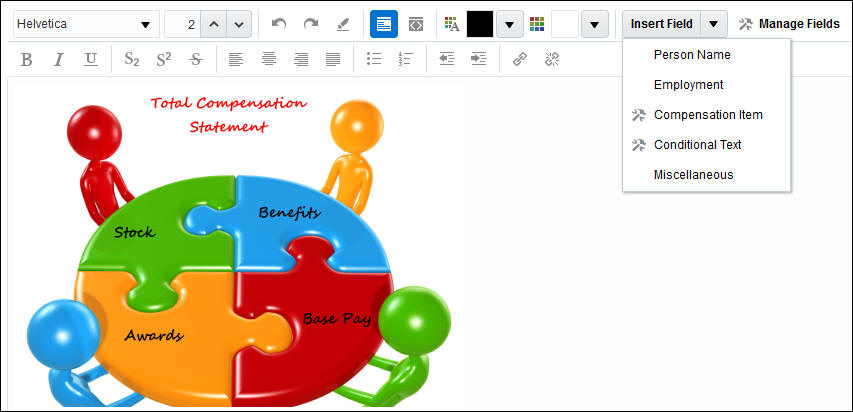

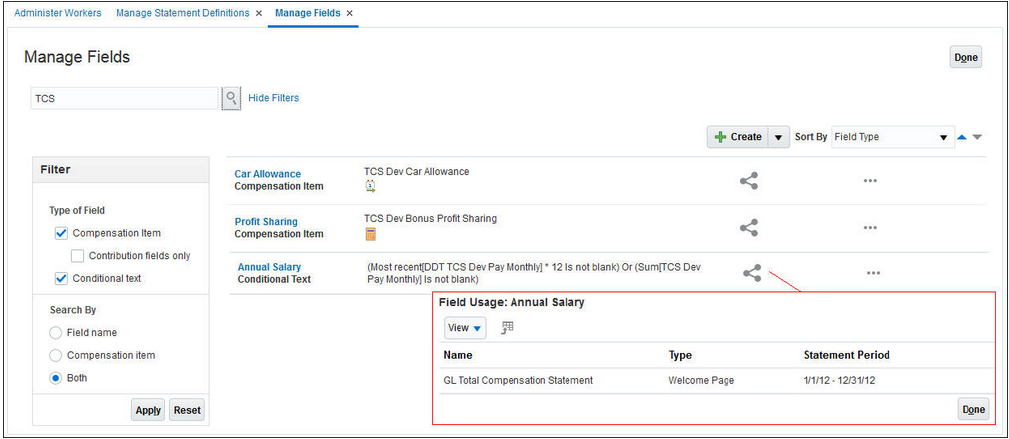

Total Compensation Statement Ability to Reuse Embedded Fields

Now you can reuse the compensation item fields and conditional text fields that you define in the Rich Text Editor. Previously, compensation item fields and conditional text fields embedded in rich text could not be reused outside of the particular Welcome, Summary section, or category in which you defined the fields. You can copy and paste from one category to another, or from one statement period’s Welcome to another.

Rich Text Editor Insert Field and Manage Fields Buttons

Steps to Enable

Use the new Manage Fields button available within the Rich Text Editor, to search, edit, create, duplicate, and delete fields. This makes it easy to find and manage all of your embedded fields.

Manage Fields and Field Usage

Manage Fields enables you to create, edit, and delete embedded fields. The Share icon allows you to see Field Usage for each of your fields so that you can easily determine where else the field is used.

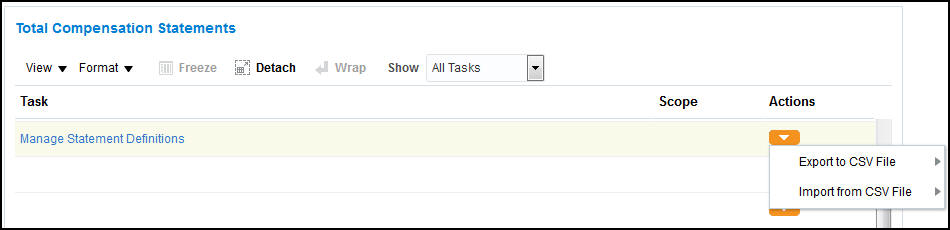

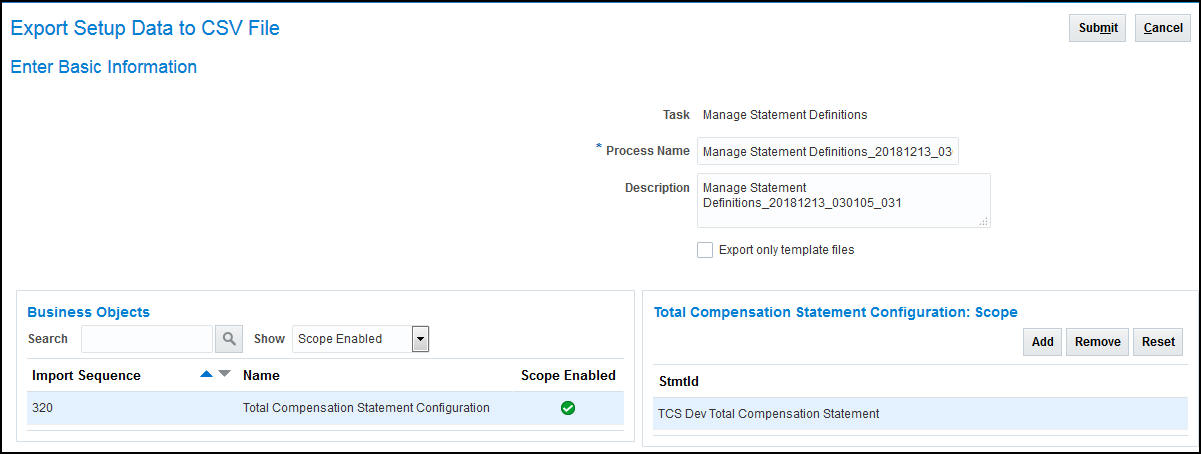

Total Compensation Statement - Migration

You can now use the Export to CSV File action within Functional Setup Manager (FSM) to migrate total compensation statement definitions. Previously, you could only migrate total compensation statement definitions via the configuration package method within FSM. In addition, we enabled scope to allow you to select the total compensation statement definitions to migrate. Previously you could only migrate all of the definitions.

CSV File Actions Enabled

Scope Enabled

Steps to Enable

You don't need to do anything to enable this feature.

Transfer Data Back Into HR More Efficiently

Transfer data back into HR more efficiently with multi-threading. The Transfer Workforce Compensation Data to HR process now updates HR data simultaneously, or in parallel, through multiple threads.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

To take advantage of multi-threading, configure threads for multi-threading as per your need.

Compensation Redesigned User Experience

Increase user satisfaction with the redesigned pages that now have the same look and feel on desktop and mobile devices. These redesigned pages are both responsive and easy to use on any device, with a modern look and conversational language. Clutter-free pages, with clean lines and just the essential fields, can be personalized to suit.

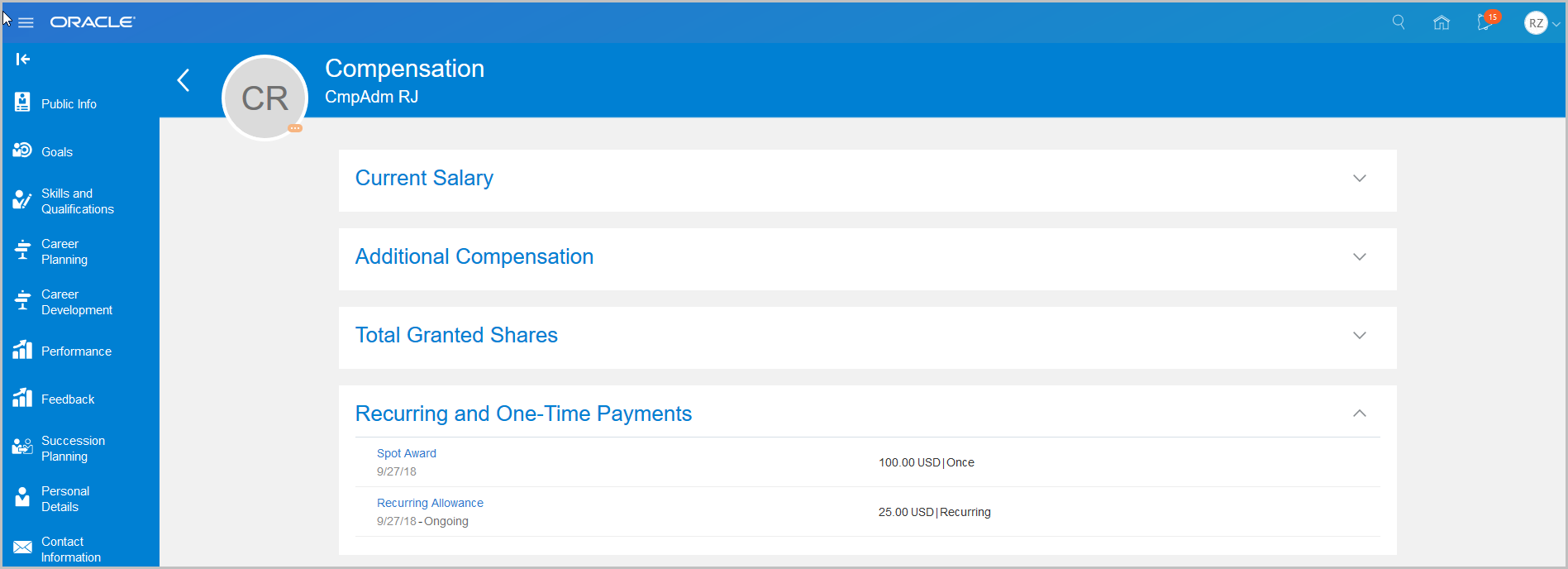

Enhanced Compensation Spotlight with Recurring and One-Time Payments

Line managers viewing compensation for employees can now easily review recurring and one-time payments, because they are grouped in their own section. This section displays the employee's entries for elements configured to display on the Manage Compensation History page. Managers can click a payment name to view the employee's element entry values.

Drill Down Details

Steps to Enable

- If you have not already enabled Compensation Spotlight, you will need to follow the Steps to Enable section on the Person Spotlight - Compensation Details - Worker View feature that is in 18C in the HCM Common What's New.

- The section is hidden by default and needs to be enabled or made visible using the HCM Experience Design Studio configuration or Page Composer.

Simplify the approval process on responsive salary pages by preventing new salary proposals when:

- A salary change is pending approval

- A line manager transaction that includes salary changes (such as promote) is pending approval

Steps to Enable

The Compensation Redesigned User Experience profile option CMP_COMPENSATION_RESPONSIVE_ENABLED must be enabled through the Profile Options, in order for this feature to work. If the profile option is enabled, then this feature will be available immediately.

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

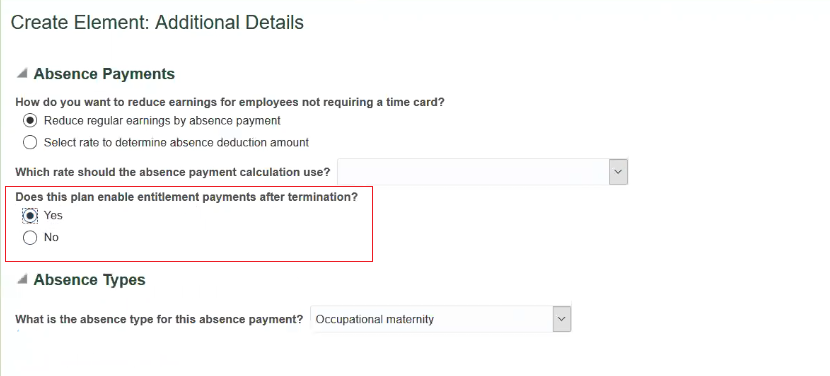

Absence Entitlement Payments After Termination

You can now ensure that absence entitlement payments are made to employees after terminations. Use the Does this plan enable entitlement payments after termination? question on the absence element template to set the entitlement element to Final Close.

Example: Amelia is due to be paid maternity payments after her termination. Select Yes to this newly-added question to set the latest entry date of the entitlement elements to final close. This ensures that the absence entitlement payments are made to Amelia after her termination.

Absence Entitlement

In addition to this, you will need to do the following:

- When Amelia is terminated, change her employment assignment status to Process When Earning.

- Set the TERM_INCLUDE_PR_LEVEL action parameter to Y so that payroll relationship level entries are considered for processing.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information about absence element template, go to Applications Help for the following topics:

- Setting End Dates for Terminations: Examples

- Using Time Definitions for Severance Pay: Example

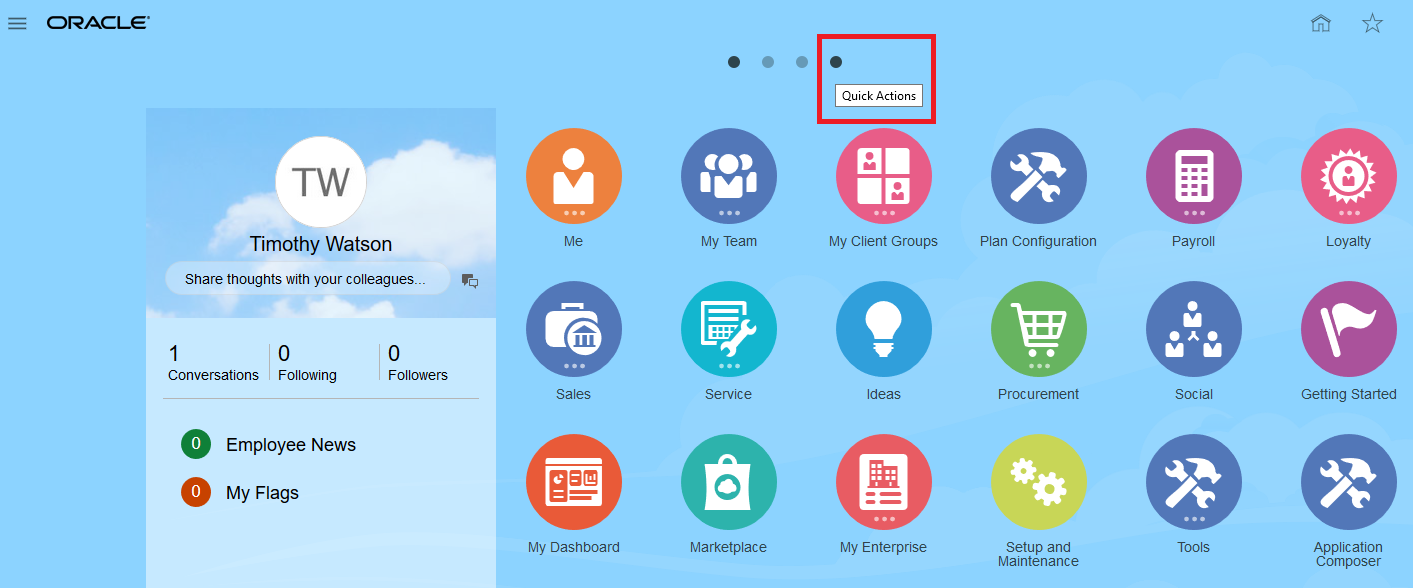

Enhanced Security for Quick Actions

The privileges that secure tasks on Quick Actions have changed. The following tasks are affected:

- Adjust Individual Balances

- Manage Costing for Persons

- Manage Element Entries

- Manage Calculation Cards

- Manage Payroll Relationships

- View Process Results

- Calculate QuickPay

- View Payment Results

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role Information section below.

Tips And Considerations

NOTE: If you are using the predefined Payroll Administrator and Payroll Manager job roles and are not seeing the tasks within Quick Actions, regenerate the data roles for these job roles.

Key Resources

For more information on roles or privileges refer to the following document on My Oracle Support:

- Upgrade Guide for Oracle HCM Cloud Applications Security (Document ID 2023523.1)

Role Information

The following table shows the aggregate privileges that secure the payroll tasks within Quick Actions, and the predefined roles that inherit them.

| Quick Actions Task |

Aggregate Privilege |

Job Role |

|---|---|---|

| Adjust Individual Balances |

Adjust Individual Payroll Balance ORA_PAY_PAYROLL_PERSON_LEVEL_ADMINISTRATION_DUTY |

Payroll Administrator Payroll Manager |

| Manage Costing for Persons |

Manage Costing for a Person ORA_PAY_PERSON_COSTING_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Element Entries |

Manage Payroll Element Entry ORA_PAY_ELEMENT_ENTRY_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Calculation Cards |

Manage Payroll Calculation Cards ORA_PAY_PERSONAL_DEDUCTION_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Payroll Relationships |

Manage Payroll Relationship ORA_PAY_PERSONAL_PAYROLL_RELATIONSHIP_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| View Process Results |

View Person Process Results ORA_PAY_VIEW_PERSON_PROCESS_RESULTS_DUTY |

Payroll Administrator Payroll Manager |

| Calculate QuickPay |

Calculate QuickPay ORA_PAY_CALCULATE_QUICKPAY_DUTY |

Payroll Administrator Payroll Manager |

| View Payment Results |

Manage Payroll Payment Results ORA_PAY_MANAGE_PAYROLL_PAYMENTS_RESULTS_DUTY |

Payroll Administrator Payroll Manager |

NOTE: The aggregate privileges that secure these tasks were first delivered in 18C. If you are using the predefined roles, no action is necessary. However, if you are using custom versions of these roles, you must ensure that your custom job roles have the aggregate privileges that secure the tasks that your custom roles need to access within Quick Actions.

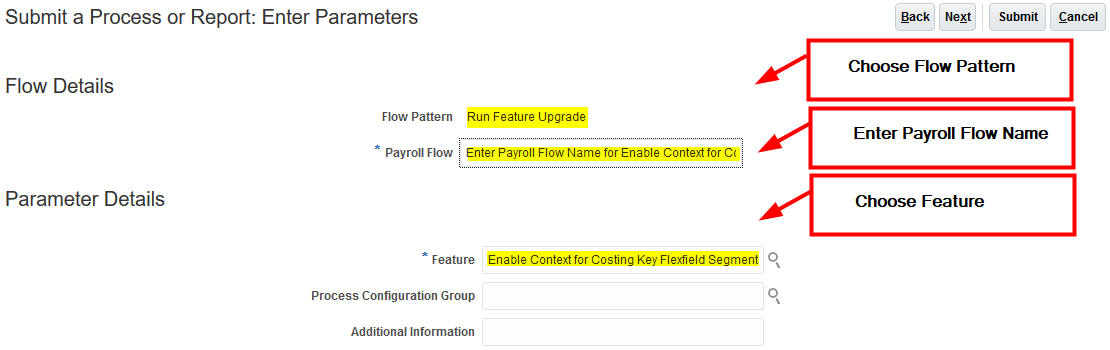

Enable Contexts for Costing Key Flexfield Segments

You can now enable contexts on costing key flexfield segments by running the Run Feature Upgrade flow with the feature name Enable Context for Costing Key Flexfield Segments.

Once you enable the context feature for a specific costing segment, you can write a fast formula to derive the costing segment value.

For example, your costing key flexfield includes two segments for which costing information is defined at the element eligibility level: Object and Natural Account. You have an employer liability element that uses distributed costing. The distribution set includes earnings elements that receive entry level costing overrides, which are entered on a timecard. Since element entry costing information is the highest level of the costing hierarchy, the costing process uses this information to populate the Object and Natural Account costing details for the set members. And, you have a costing distribution requirement for an employer liability element to use element entry overrides for the Object segment from set members but always use element eligibility costing details for the Natural Account segment from employer liability element.

You can meet this requirement by enabling the context feature for the Natural Account segment. You can then define a new input value on your employer liability element to capture the Natural Account costing information. Associate this new input value to the Natural Account segment context using the reference field feature. You can define rules to ensure the run result created for this new input value, as part of payroll processing, has the desired Natural Account value. The costing process will now consider this run result value for the Natural Account costing segment for employer liability element.

NOTE: You cannot create a new costing rule using this process for the existing elements, as you cannot add a new input value if the element is already used.

Steps to Enable

Enable contexts on costing key flexfield segments by running the Run Feature Upgrade flow using the feature name “Enable Context for Costing Key Flexfield Segments.

NOTE: You can remove the unused contexts with the same flow by selecting the feature name as Delete Context for Costing Key Flexfield Segments.

Rate Definition Support for Live and Generated Rates

You can now control if rate values are calculated live or retrieved based on the results of the generate HCM rates process.

For example, a payroll customer might use the generate HCM rates process to calculate compensation rates for reporting purposes. However, when using the rate definitions for payroll purposes the compensation rates should be re-calculated in the payroll run to ensure they are accurate when the payroll is processed.

Steps to Enable

You don't need to do anything to enable this feature.

Rate Definition Support for Values-by-Criteria with Multiple Values

You can now calculate rates based on a specific value-by-criteria value. Define a rate definition to retrieve car allowance values for employees based on their job, a second rate definition to retrieve the housing allowance values for employees based on their job, and a third rate definition to retrieve the car allowance values for employees based on their job. All rate definitions will be associated with the same value-by-criteria.

For example, define a value-by-criteria to capture car allowance, housing allowance and market supplement values based on an employee's job:

Criteria: Job A

- Car Allowance - $1,000

- Housing Allowance - $2,500

- Market Supplement - $300

Criteria: Assignment Job B

- Car Allowance - $2,000

- Housing Allowance -$3,500

- Market Supplement - $375

All rate definitions will refer to the same value-by-criteria.

Steps to Enable

You don't need to do anything to enable this feature.

Generate HCM Rates Scope Expanded

The original scope of the generate HCM rates process was limited to the calculation of salary rates. You can now use the generate HCM rates feature to calculate and store most types of rate definitions. The stored rate values can be used for reporting or retrieving for payroll calculation purposes. In addition to overall salary rates, this feature now supports:

- Rates that have a direct association to an element. For example, a salary rate definition is associated with a salary element. The generate rates process will calculate a salary rate value for all workers with a salary element entry.

- Rates associated with a value definition. Certain types of elements, such as time elements, use payroll calculation information rules and definitions. For example, a value definition is generated for an overtime element and this is associated with an overtime rate definition. The generate rates process will calculate an overtime rate value for all workers with an overtime element entry.

- Rates based on a value-by-criteria defined for an assignment level criteria such as a worker’s grade or location.

- Most formula-based rates can now be calculated by the Generate HCM Rates process. However, rates that include complex payroll formula contexts may need to be calculated in a payroll run.

- Rates that are derived. For example, a rate that is derived based on the sum car allowance and housing allowance rates. In this instance, the Generate HCM rates process will calculate; the car allowance rate, the housing allowance rate and the derived rate.

NOTE: If customers have a requirement to include non-recurring elements, such as time, in the rates calculated by the process they should run it in full mode so rates are recalculated on a daily basis.

Steps to Enable

You don't need to do anything to enable this feature.

This feature describes how an existing element can be upgraded to accommodate changes and enhancements. When we deliver changes to objects, such as input values, formulas, and balances as part of the bug fixes or enhancements to the existing functionality, the changes will be reflected only in the new elements that are created after the patches are applied. The new changes will not be available in the existing elements hence if the user would like to apply these changes in the existing elements, the below program/flow can be applied.

Note: Refer to the Element Upgrade Process White Paper for further information. You should run this process only after consultation/advice of the Oracle team through Service Request.

This flow upgrades the below objects with conditions as mentioned:

| Objects |

Conditions |

|---|---|

| Defined Balances |

No specific conditions are applied |

| Fast Formulas |

Based on the value selected for the Formula Upgrade Option parameter. |

| Formula Results |

No specific conditions unless the dependent object already exists |

| Status Processing Rules |

No specific conditions unless the dependent object already exists |

| Input Values |

There is a number of validations as mentioned below:

Note: The Retro condition check, mandatory flag check, default value check and default at run-time check are exempted for Pretax elements as they are required to enable the iteration functionality on Pretax Deduction elements. These conditions remain valid for all other element classifications. |

| Element Eligibility Input Values |

The input values should have been created before the element eligibility input values are added. |

| Balance Types |

No specific conditions unless the dependent object already exists. |

| Balance Feeds |

The input values should have been created before the balance feeds are created. |

| Element Entries |

The element entries get created for the new input values as applicable. It means, it creates the entry for all date effective records. |

| Calculation Unit |

No specific conditions are applied. |

| CIR Override Usages |

No specific conditions are applied. |

| CIR Comp Flex, CIR Comp Flex Usages, and CIR Comp Flex Relationships |

The upgrade of these 3 objects is to link the component details flex field with calculation components. |

All the changes to the existing objects will be done in correction mode, except the Iteration indicator in element object navigator that gets updated in update mode with effective date set in process configuration parameter as mentioned above. It means, whenever a formula is upgraded, it will be done in correction mode.

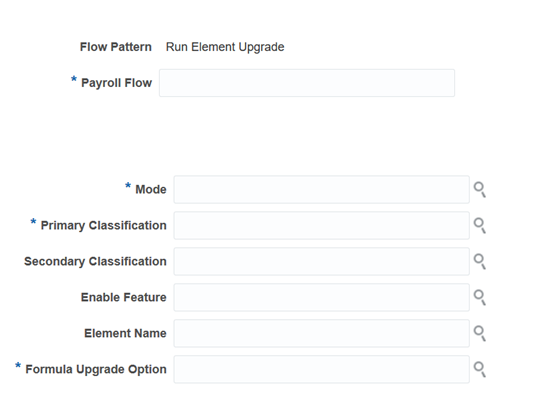

The seeded flow pattern name is “Run Element Upgrade” and shown below:

The parameters can be divided into a mandatory parameter and an optional parameter.

The descriptions for mandatory parameter include:

- The mode with two values, draft mode, and final mode. The draft mode allows you to evaluate the changes available and run the flow in a final mode that makes the actual changes.

- The primary classification of elements.

- The formula upgrade option should have the values as mentioned below:

- Display all formulas: This value is applicable in Draft mode only. When the user selects “Draft”, the user needs to select this value (this is the only value available in the list) to see all the impacted formulas.

- Override the existing formula: This option is available in Final mode only. This option will replace the existing formula with the new version of the formula and keeps the old formula as a backup.

- Do not make changes to the existing formula: This option will leave the existing formula as it is. The new formula will not be created in the system.

- If the value “Iteration on Pretax Element” is selected in Enable Feature parameter to enable the pretax iteration, the Formula Upgrade Option would show only one value “Override the existing formula”. Because the formulas of pretax elements have to be overridden to take effect of the latest changes for iteration functionality.

The descriptions for optional parameter include:

The secondary classification of elements.

Enable Feature: This will have one value – “Iteration on Pretax Element”.