- Revision History

- Overview

- Feature Summary

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

-

- Retrospective Transaction Proposals by Line Managers and Workers

- Restrict Individual Compensation Plans to Power Users Only

- Stock - Advanced Search and Create

- Transfer Data Using Different Actions and Action Reasons

- Create Advanced Filters

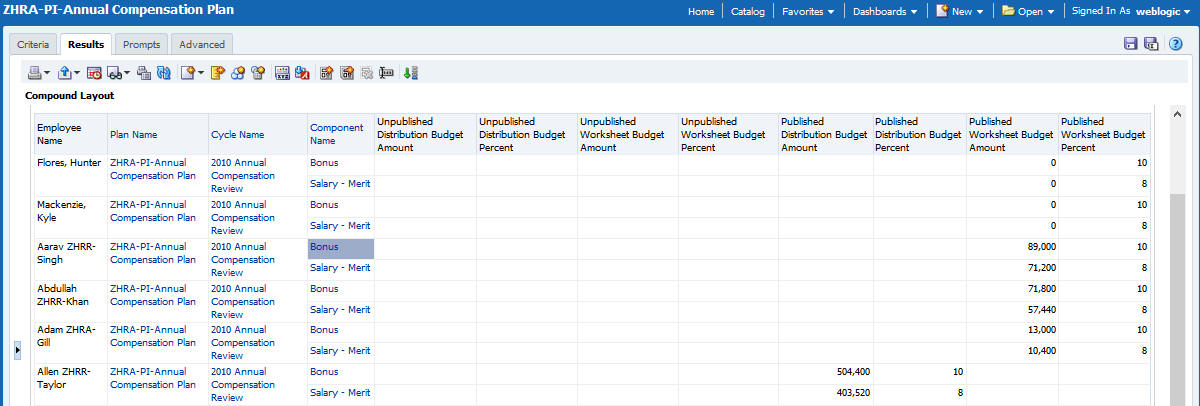

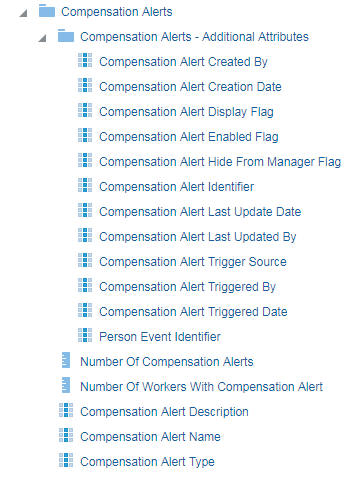

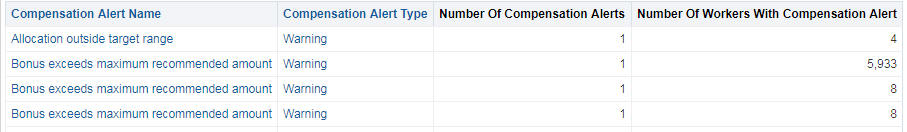

- Use Alerts to Filter the Worksheet

- Enable Worksheet Exports for Secondary and Review Managers

- Individual Compensation Approval Notification Header Change

- Set Currency Rounding Rule by Plan

- Print Compensation Change Statements in Bulk

- Differentiate Between Manager Assignments

- Market Data HSDL

- Filter Positions by Business Unit

- Data Security for Reviewing Grade Step Progression Results

- Receive Warning When Changing Currency Conversion Rates

- Compensation Redesigned User Experience/Responsive Pages

-

- Responsive Salary Pages for Power Users

- Enhanced Employee Compensation Spotlight with Recurring and One-Time Payments

- Responsive Compensation Spotlight Pages for Power Users

- Responsive Individual Compensation Pages for Power Users

- Spotlight - Enhance Shares Section Includes Estimated Values

- Deep Links for Responsive Compensation Pages

- Design Studio Support for Responsive Compensation Pages

-

- Compensation

- Payroll

-

- Global Payroll

-

- Enhanced Security for SmartNav and Actions Menus on HR and Payroll Person Search

- Prorate Elements Entries Based on Compensation Salary Changes

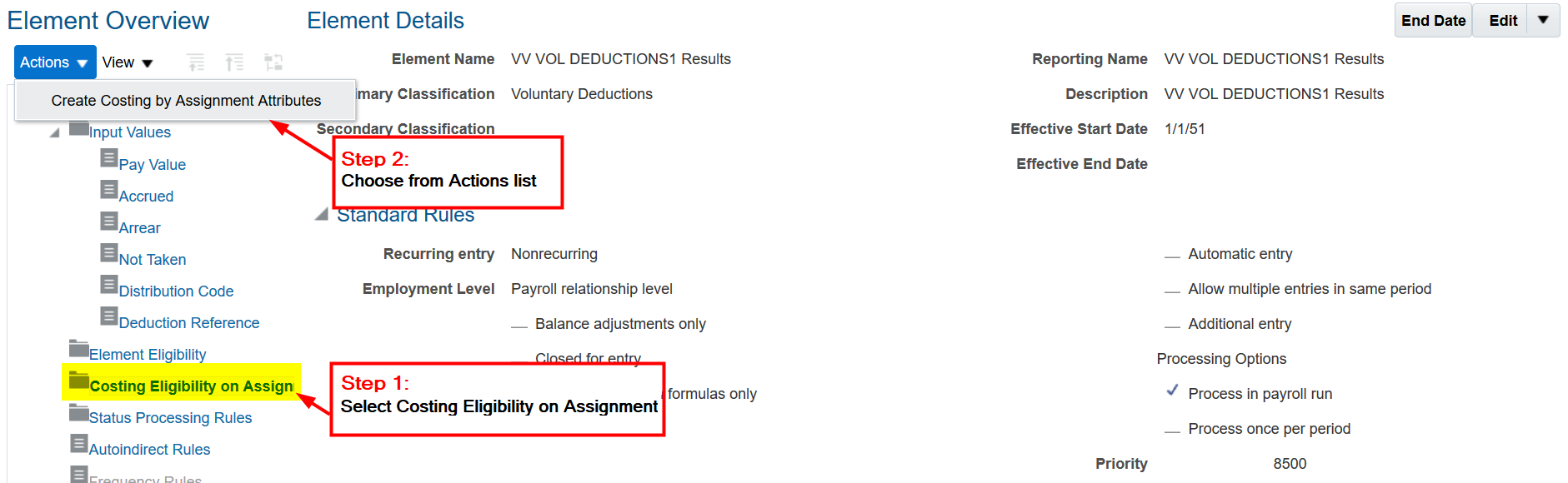

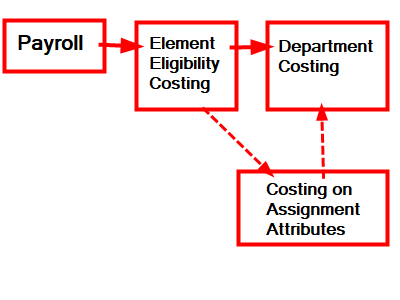

- Cost the Payroll Relationship Level Elements Using Assignment Attributes

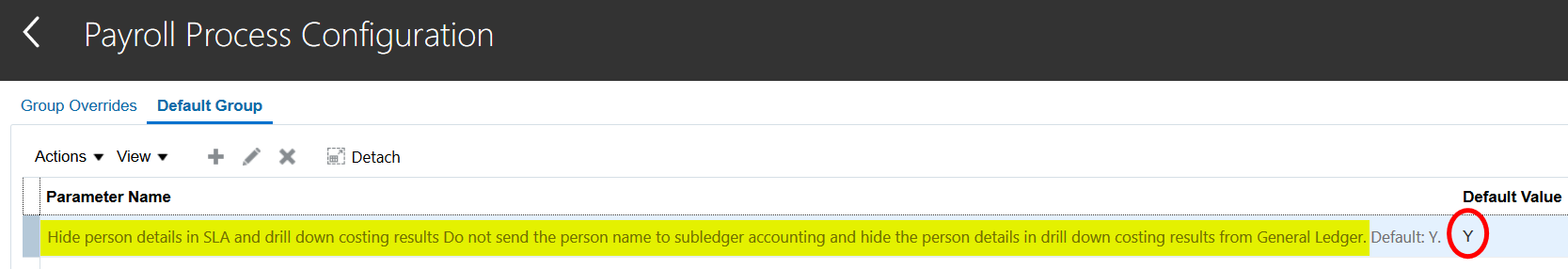

- Hide Person Name in Subledger Accounting

- Values Defined by Criteria Value Set Characters

- Manage Payroll Relationships Using REST API

- Personal Payment Method Payroll Relationship Switcher

-

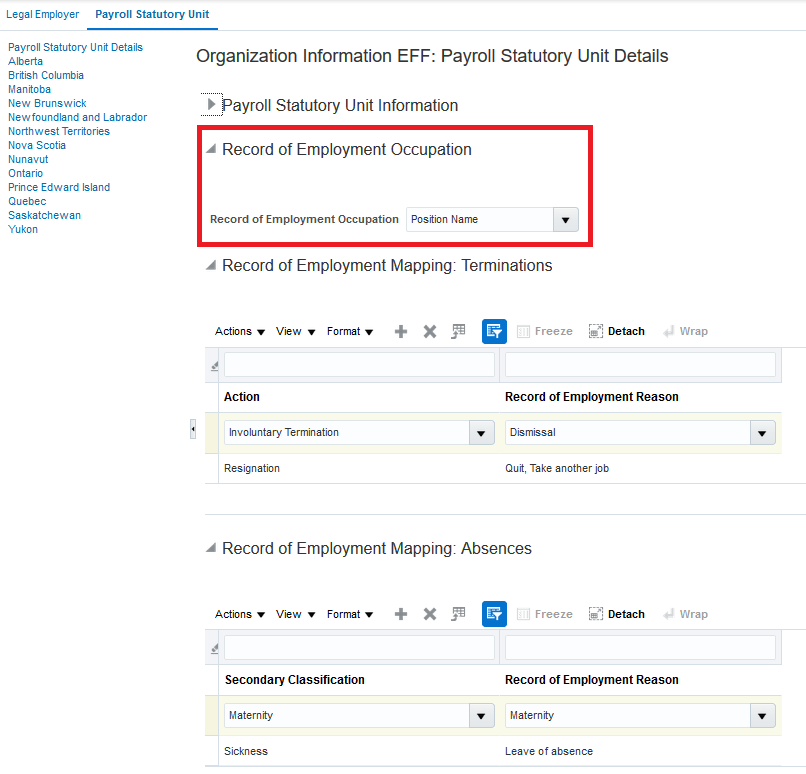

- Payroll for Canada

- Payroll for China

- Payroll for Qatar

- Payroll for the United Arab Emirates

- Payroll for the United Kingdom

- Payroll for the United States

- Global Payroll

- HR Optimization

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 28 JUN 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Customer Action Required = You MUST take action before these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

Customer Action Required |

||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Enhance Payroll Costing Results Report

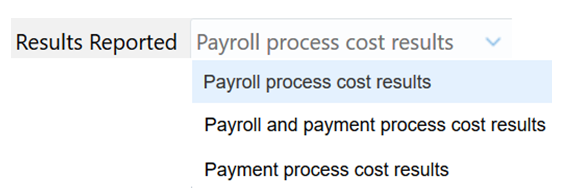

You can now run the Payroll Costing Results Report to filter and view the costing results for smaller volumes of data, thereby enhancing the performance of the report. While generating the report, use the delivered Reported Results parameter to generate the report and include any of the following details:

- Payroll processes cost results

- Payment process cost results

- Payroll and payment process cost results

Reported Results Parameter

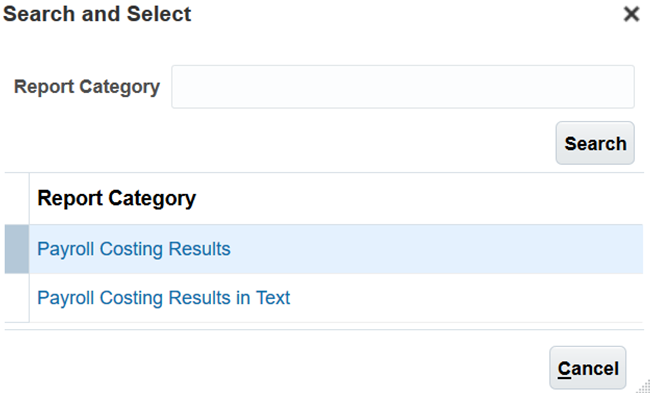

You can also use the Report Category parameter to generate the report output in excel as it exists today or in a text file with # separator.

Report Category Parameter

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Please refer the following topics for more information:

- Payroll Costing Results Report

- View Payroll Costing Results

| Date | Feature | Notes |

|---|---|---|

| 31 MAY 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Customer Action Required = You MUST take action before these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

Customer Action Required |

||

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

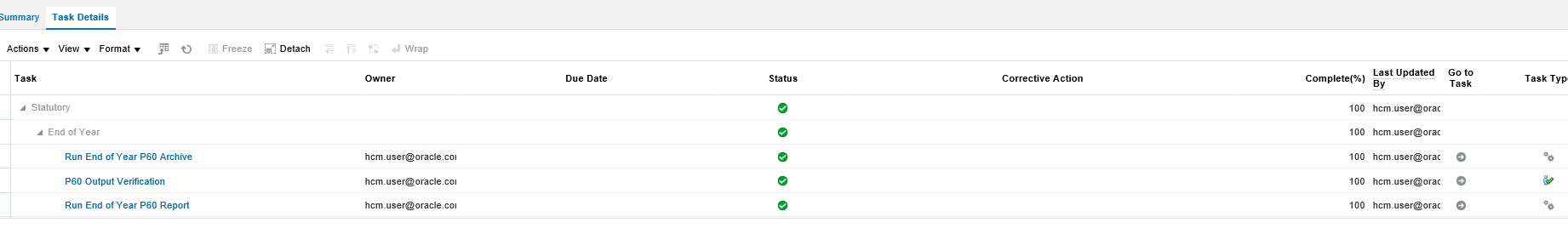

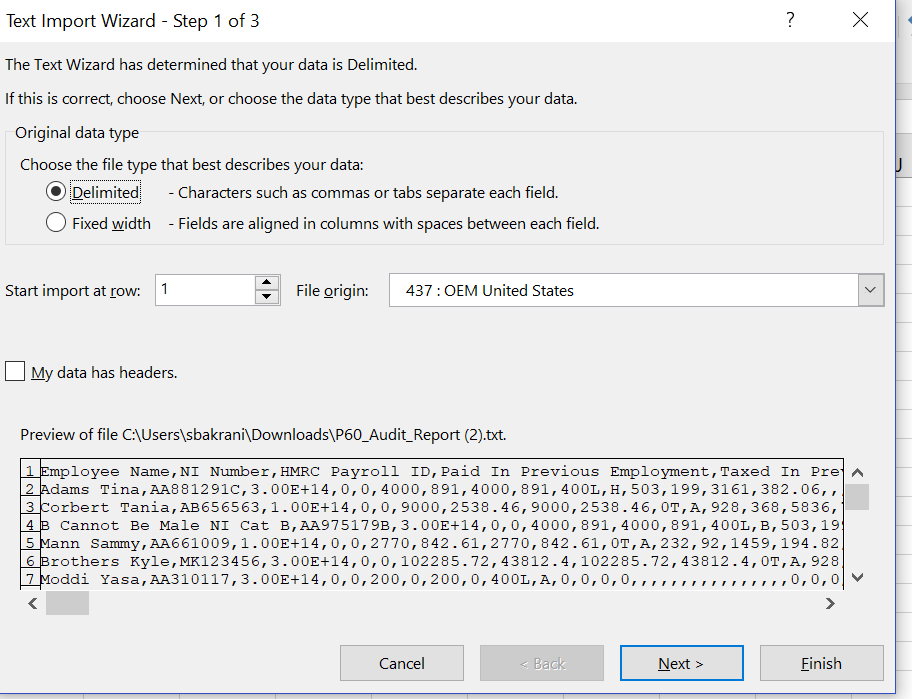

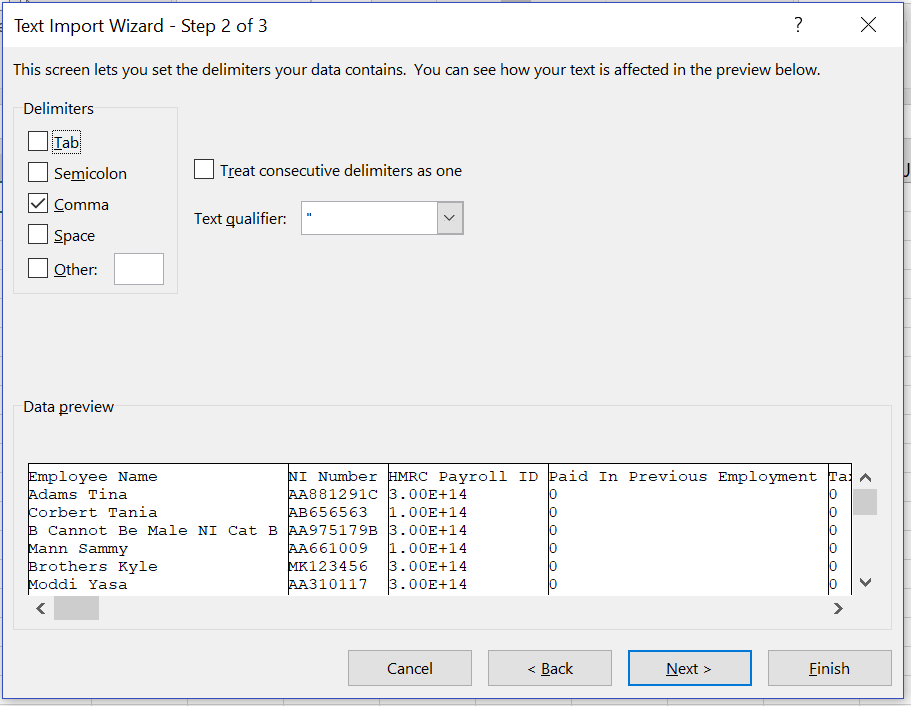

When you run the End of Year P60 Report process, the application creates the P60 audit file in text format. Save this file and open it using applications that support files with comma separated values.

Run End of Year P60 Report

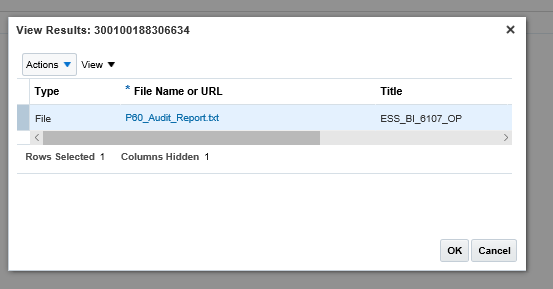

P60 Audit File Created as .txt File

You can open the .txt fie in Excel for example and follow the dialogue to create the spreadsheet version of the file:

Open File in Excel

Follow Instructions Using Option as CSV

File Content Presented in Excel Spreadsheet

Steps to Enable

You don't need to do anything to enable this feature.

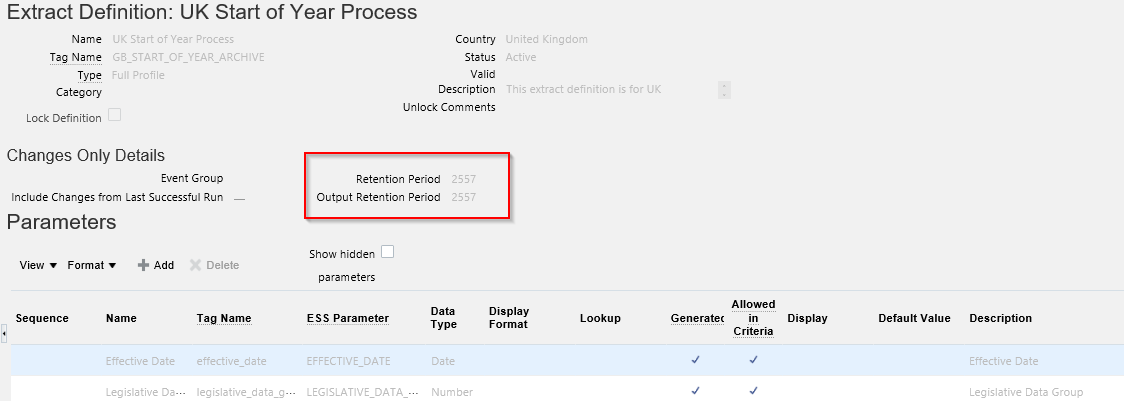

Archive and Reports Retention Period

When you run processes that extract data to create an archive, the retention period for the output has been restricted for some of the processes. Retention period and output retention period for these processes is set to 2557 days. The number of days equate to 7 years. The following processes have been set with the retention period:

- NINO Verification Request

- NI Category Update Archive Process

- Start of Year Archive Process

- Tax Code Uplift Archive Process

- Payroll Validation Archive Report

Retention Period (7 Years in Days) Added to Some Selected Extracts

You can use the Purge option provided in Release 12 to further assist in performance and storage efficiency, if you wish to delete the archives where they are not required for 7 years. For more details, see the Whats New for Cloud Readiness for HCM Cloud Common Features Release 12.

Steps to Enable

You don't need to do anything to enable this feature.

| Date | Feature | Notes |

|---|---|---|

| 31 MAY 2019 | Payroll for the UK: Pensions Automatic Enrolment Enhancement to Support Multiple Assignments | Updated document. Delivered feature in May Maintenance Pack for 19B. |

| 26 APR 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Customer Action Required = You MUST take action before these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

Customer Action Required |

||

Pensions Automatic Enrolment Enhancement to Support Multiple Assignments |

||||||

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

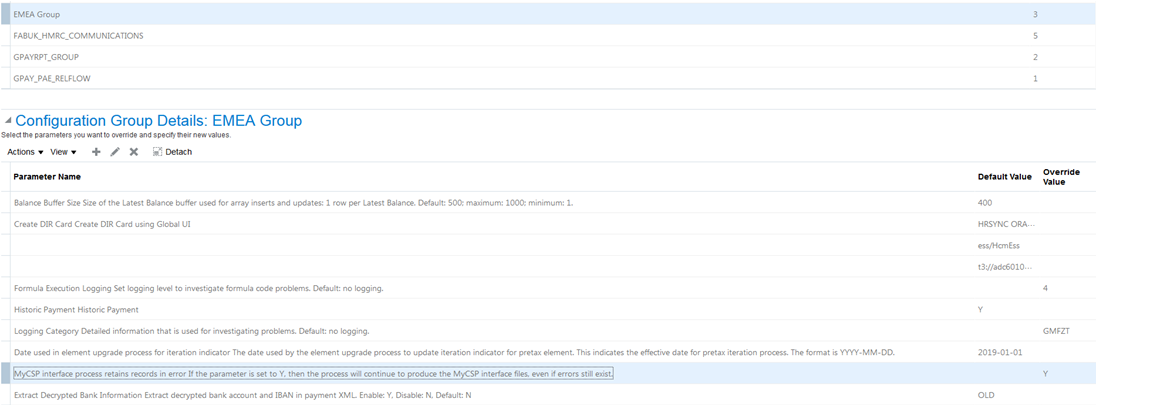

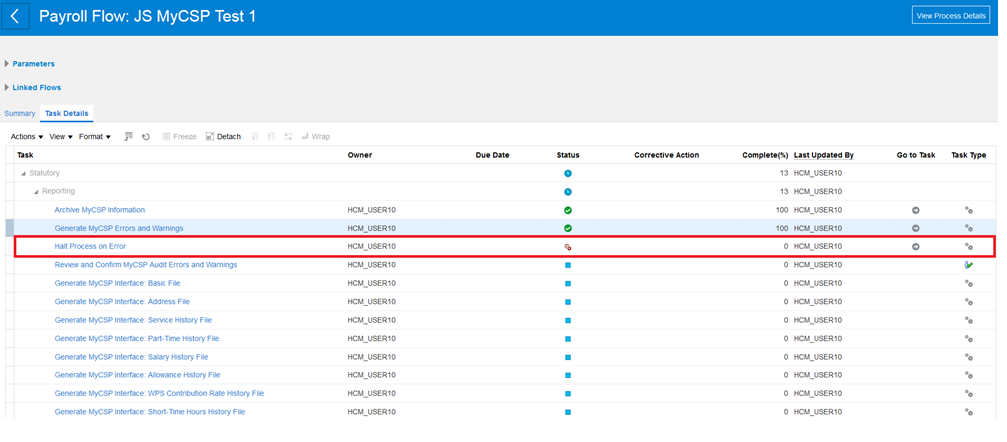

MYCSP Process to Halt on Error

Use the new process configuration parameter to indicate whether the MyCSP process should retain any records in error. If you set the parameter to Y, then the process will continue to generate the MyCSP interface files, even if any errors still exist.

Here's how you can set the parameter value:

- From My Client Groups > More Actions then under Payroll select Manage Payroll Process Configuration.

- Add this parameter to your configuration group as shown below:

Configuration Group

If there are errors found within the Archive MyCSP Information task, depending on the value of the parameter you set, the flow behaviour varies.

- When you set the parameter to N (which is also the default value), here's what happens in the MyCSP process:

- The Archive MyCSP Information task has the status Complete. But for any archive records in error, the top-level person action is marked as such on the View Process Results page allowing you to identify those employees’ records that are in error.

- The application process marks the Halt Process on Error task as in error.

- You can review the Errors and Warnings report and correct the employee’s erroneous records in the live system.

- After correcting the errors, you can retry the archive process (without having to manually mark the records for retry). This automatically reprocesses all person actions marked for retry. Before you run the Retry process, you can also update other employee’s records and manually mark them for retry; this will result in their records also being included in the Retry process.

This is an iterative process, and you can retry as many times as required until there are no errors. Once there are no errors, you can mark the task Review and Confirm MyCSP Audit Errors and Warnings as complete. The process then starts generating the interface files.

NOTE: It is not recommended to skip the Halt Process on Error task as the MyCSP files will be incomplete. Instead, you can set the parameter to Y and retry the archive process:

MyCSP Flow

- When you set the parameter to Y or set to the effective date of the process (in YYYYMM format), here's what happens in the MyCSP process:

- The Archive MyCSP Information task has a status of Complete. For any archive records in error, the person actions are not marked in error.

- The Halt Process on Error task is marked as Complete.

- You can review the Errors and Warnings report.

- Once you mark the Review and confirm MyCSP Errors and Warnings task as complete, the process will continue to produce the MyCSP interface files, even if errors still exists. Employees that have errors will be included in the files.

NOTE: If you wish to correct any errors when the parameter is set to Y, the archive record for the employee needs to be identified and marked for retry manually, before you run the Retry process.

It is recommended to initially run the MyCSP process every month with the parameter set to N so that you can identify all records in errors. After this, you can make corrections and retry without having to mark them for retry manually. If there are any exceptions where you find errors that you aren't able to fix prior to generating the MyCSP Interface files, you can update the parameter to Y as this will allow you to generate the files as expected by MyCSP.

Steps to Enable

You need to create a Process Configuration Group including MyCSP parameter. Once you create this, you can select this as parameter in the Process Configuration Group field when you run the process and submit the Generate MyCSP Interface files.

If no Process Configuration Group are specified when submitting the flow, by default the flow behaves as if the parameter was set to N.

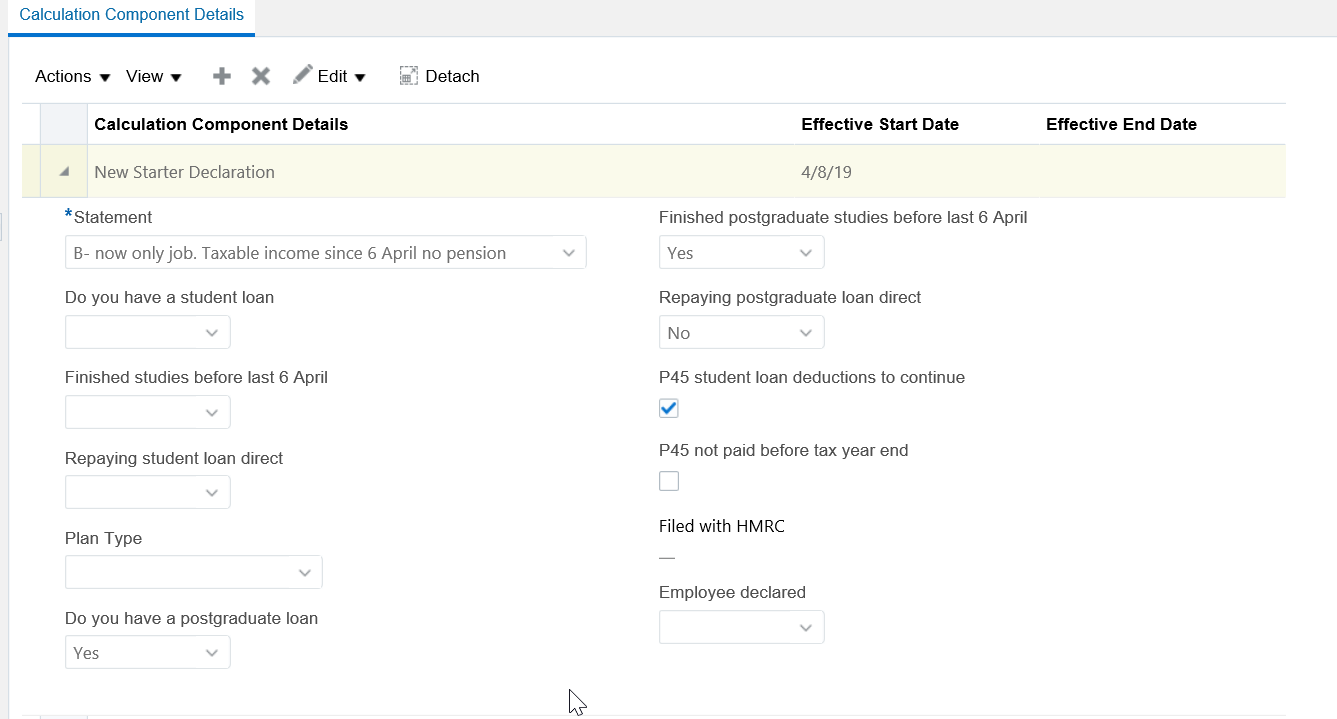

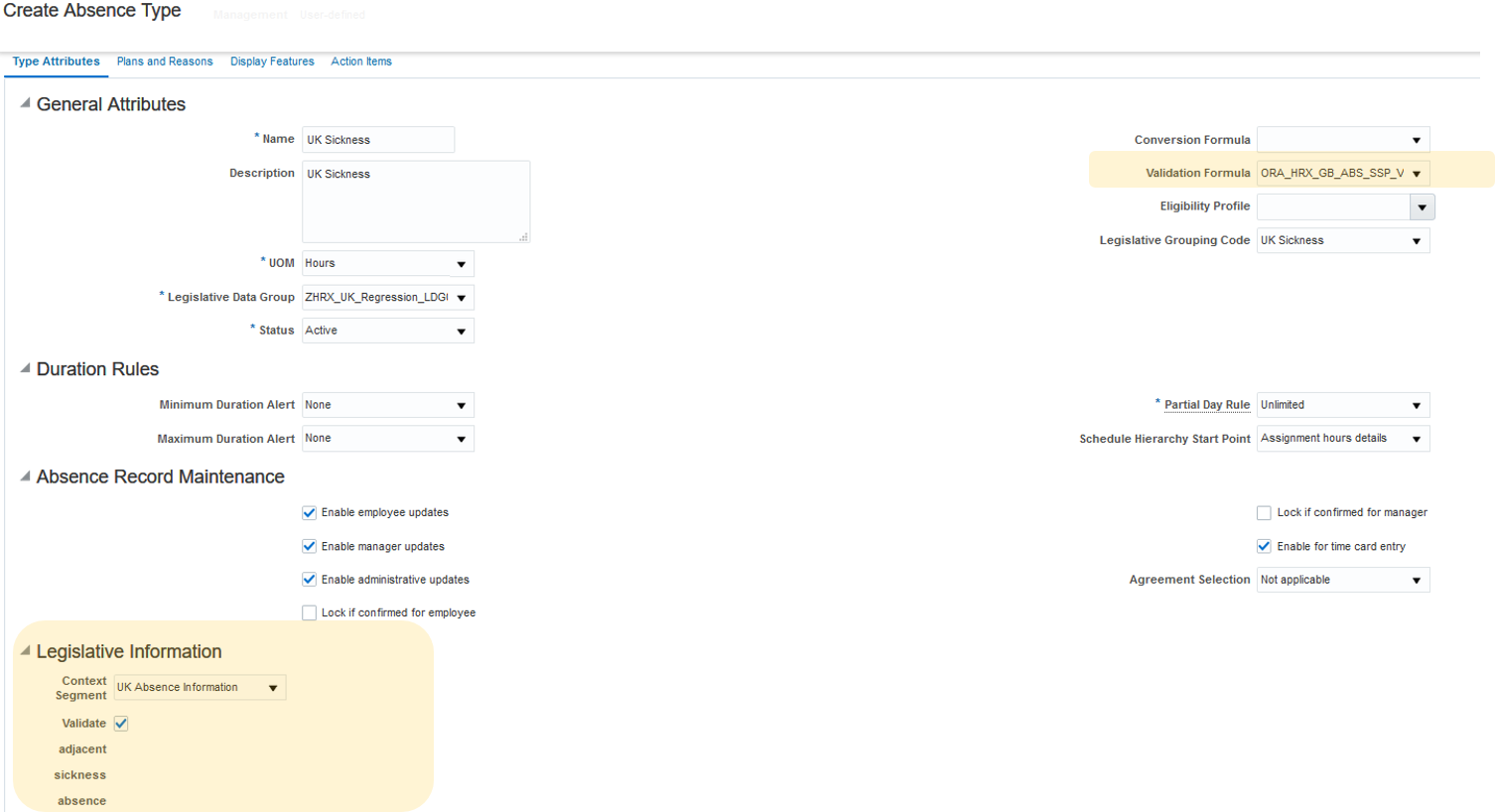

New Starter Declaration Enhancement

The New Starter Declaration is enhanced to include postgraduate loans to comply with the changes published by HMRC. Your employees can enter Postgraduate Loan information on the New starter Declaration Form using the employee self service application. These are the changes in the form:

- Changes to student loan questions order sequence

- Text changes to reflect the revised version of the New Starter Declaration published by HMRC

- Validation of Student Loan Plan Type, which is based on the new sequence and order of the questions presented

- Addition of postgraduate loan information to the form with the required validation

When your employees enter and submit this information, the application automatically creates the court order and student loans calculation card with the relevant information. You don't need to manually create the calculation card.

Court Order and Student Loans Calculation Card Gets Automatically Created with the Relevant Data.

NOTE: If the component for New Starter Declaration exists for the employee in the calculation card, the application updates the component with this information. If the component does not exist for current employees, you must manually create this component.

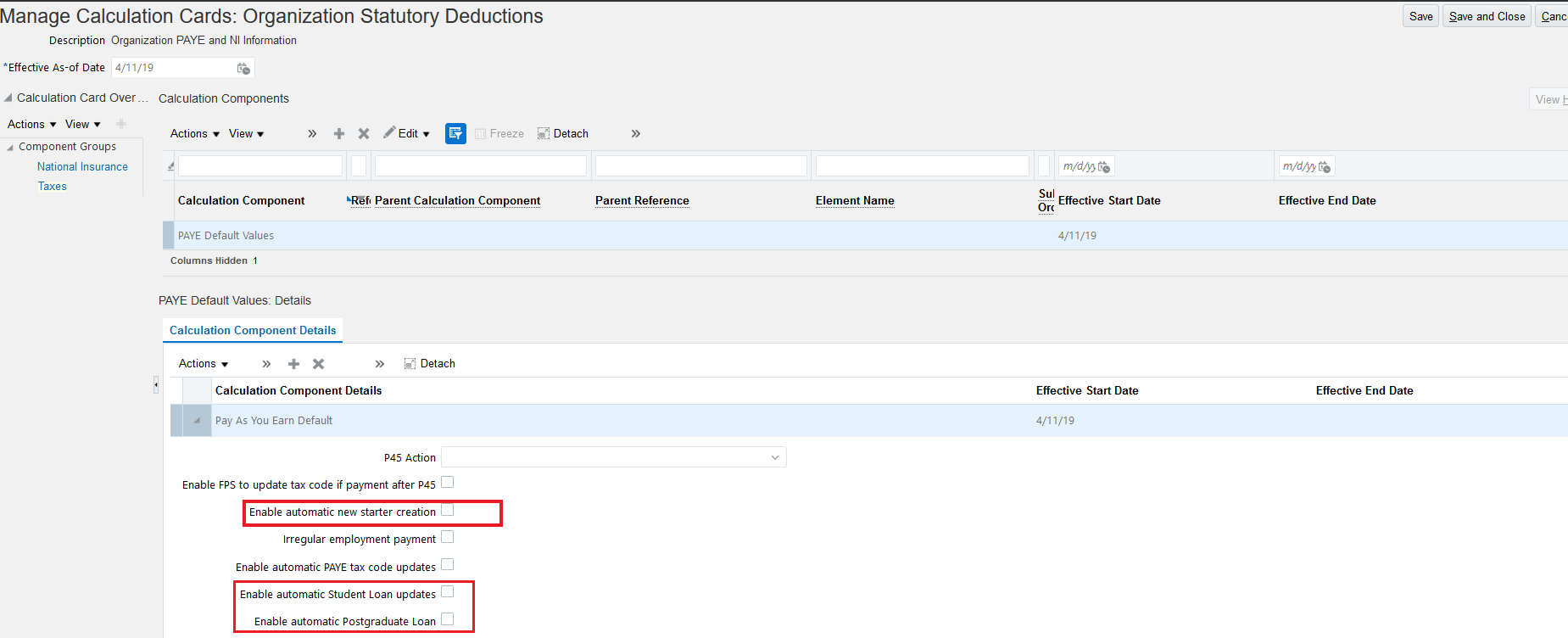

Steps to Enable

For new hires, the New Starter Declaration component is automatically created only if you have enabled this option at the payroll statutory unit (PSU) or tax reporting unit (TRU) level. Here’s how you can set this in the organization-level Statutory Deductions calculation card:

- Use the Manage Legal Reporting Unit Calculation Cards task and select Organization Statutory Deductions calculation card

- Add or update the PAYE Default Values component and Pay As You Earn Default calculation component details

- Select the Enable automatic new starter creation check box

- Select the Enable automatic Student Loan updates check box. This enables automatic creation of the Court Orders and Student Loan calculation card and a Student Loan component, when the employee completes the relevant section and submits the New Starter Declaration.

- Select Enable automatic Post Graduate Loan check box. This enables automatic creation of the Court Orders and Student Loan calculation card and a Post Graduate Loan component, when the employee completes the relevant section and submits the New Starter Declaration.

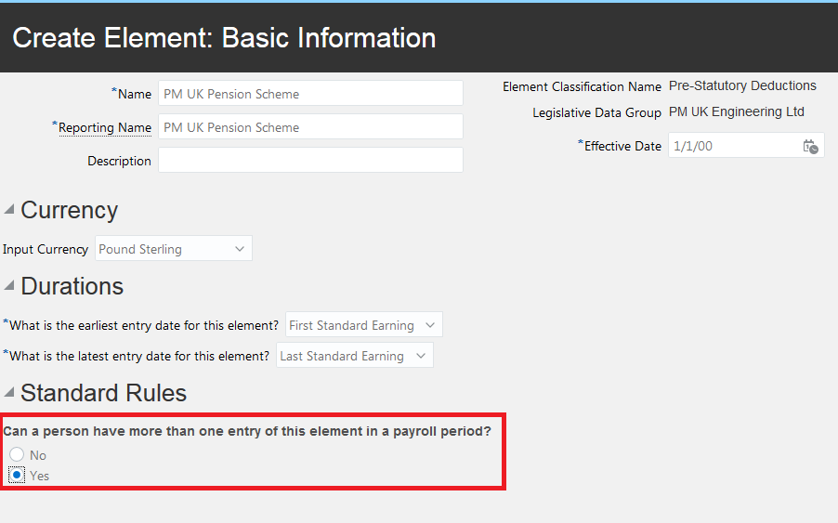

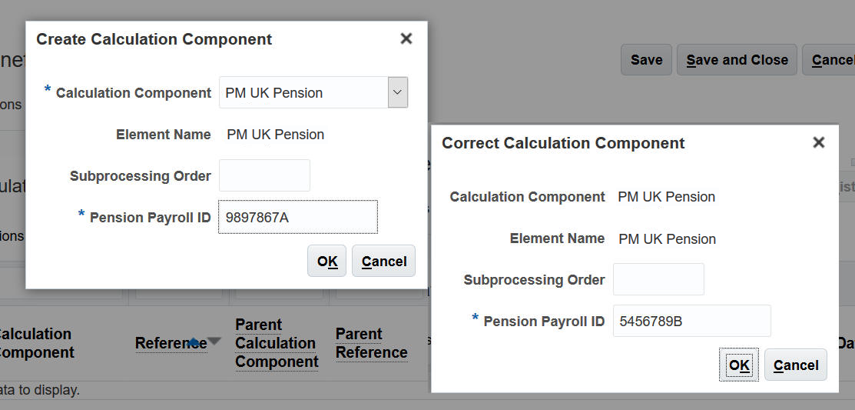

Pensions Automatic Enrolment Enhancement to Support Multiple Assignments

You can define pension elements to allow for multiple entries. This means that you can create multiple components of the same type, one for each assignment.

Use the Manage Element task in the Payroll Administration work area to set this value when you create the pension element, under Standard Rules on the Create Element page.

The element template creates a new calculation component attribute for a Pension Payroll ID on the Benefits and Pension Calculation Card. This applies to elements with these secondary classifications:

- Pre-Statutory Deductions Pension Plan Pre-Statutory

- Voluntary Deductions Pension Plan After Tax

This ID must be unique, and is automatically generated by the Pensions Automatic Enrolment process. Or, you can enter this manually when adding a new pensions component on the Benefits and Pension card.

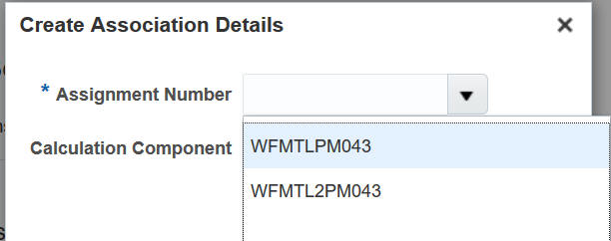

On the Benefits and Pensions calculation card, you can select the assignment number and the appropriate Payroll Pension ID to associate the same pension with multiple assignments. When you create the association detail, the list of values displays both the component and Pension Payroll ID.

On the Pensions Automatic Enrolment calculation card, the list of values to select the Qualifying Scheme component also displays both the component and Pension Payroll ID.

Steps to Enable

You don't need to do anything to enable this feature.

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 27 SEP 2019 | Global Payroll: Hide Person Name in Subledger Accounting | Updated document. Revised feature information. |

| 26 APR 2019 | Compensation Management: Receive Warning When Changing Currency Conversion Rates | Updated document. Delivered feature in update 19B. |

| 26 APR 2019 |

Global Payroll: Enhanced Security for SmartNav and Actions Menus on HR and Payroll Person Search | Updated document. Revised feature information. |

| 26 APR 2019 |

Payroll for China: Enhanced Flat Amount Calculation Rule of the Earnings Element Template | Updated document. Revised feature information. |

| 26 APR 2019 |

Payroll for the US: PA Act 32 Data Enhancements for Third-Party Monthly Tax Filing Extract | Updated document. Delivered feature in update 19B. |

| 26 APR 2019 |

OTBI/Compensation: Workforce Compensation - Alerts | Updated document. Revised feature information. |

| 29 MAR 2019 | Benefits: Purge Benefits Staging Data | Updated document. Revised feature information. |

| 29 MAR 2019 |

Compensation Management: Data Security for Reviewing Grade Step Progression Results | Updated document. Delivered feature in update 19B. |

| 29 MAR 2019 |

Compensation Management: Filter Positions by Business Unit |

Updated document. Delivered feature in update 19B. |

| 29 MAR 2019 |

Global Payroll: Personal Payment Method Payroll Relationship Switcher | Updated document. Delivered feature in update 19B. |

| 01 MAR 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (19A, 19B, 19C, and 19D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found on the Oracle Help Center at: https://cloud.oracle.com/saasreadiness/hcm under Human Capital Management Release Readiness.

Give Us Feedback

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Customer Action Required = You MUST take action before these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

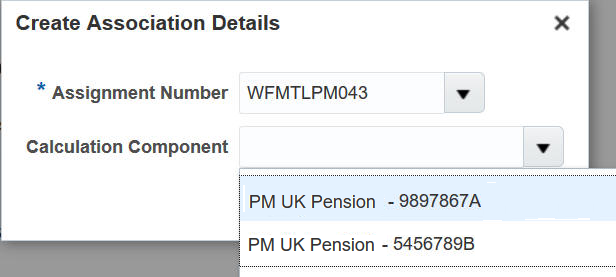

Administrators can now use the new Purge Stage Data process to permanently delete benefits extract and spreadsheet loader staging data. The new process is available in the Evaluation and Reporting work area, Processes tab, Maintenance Processes section.

Process Page

You can purge the data by batch number, name, or by date range.

To purge the benefits data, select either Benefits Extract or Spreadsheet Loader from the Source Type field. If you want to purge the data by batch, select the Request ID or Batch Name in the Source Key field, and submit the process. Alternatively, enter a specific time period between which you want to purge the data. You can track the progress and view the log file through the usual way.

You can only purge data that is older than 6 months old from today's date to prevent you from purging data that you might still require. For example, if today's date is 1st Jan 2019, and the From Date is 1 Jan 2018 and the To date is 31st Dec 2018, the process only purges extract data up to 30th June 2018.

If you enter both the Batch Name or Request ID and a time period, the process ignores the time period and processes only the Batch Name or Request ID.

You cannot recover data once you purge it.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Upload Documents to Fulfill Pending Actions

Participants can now upload supporting documents for their enrollment more easily. Suppose a program or plan that participants have enrolled in requires supporting documents. They can upload those documents directly from the Pending Actions page without the need to navigate elsewhere. In addition, participants don’t need to worry about selecting the correct document type as the application already determines that information. All they need to do is to upload the correct document.

Participants can continue to use the Documents of Record functionality to upload supporting documents, but they won’t be able to close pending actions easily. Also, participants will need to ensure they select the correct document type for each upload and depend on the administrator to provide an approval status. The new functionality provides greater control on pending actions, enabling them to easily upload the document from the Pending Actions page and keep track of the status.

A participant can upload documents for themselves, or for their dependents or beneficiaries. They can even provide a hyperlink to a file. When the administrator approves the supporting document, the pending action no longer appears.

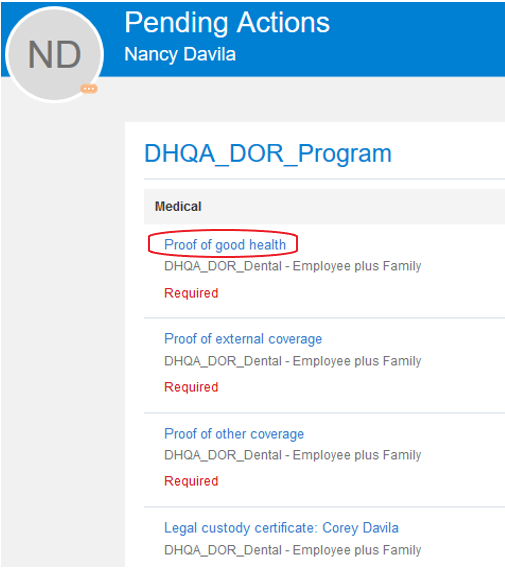

Pending Actions Page

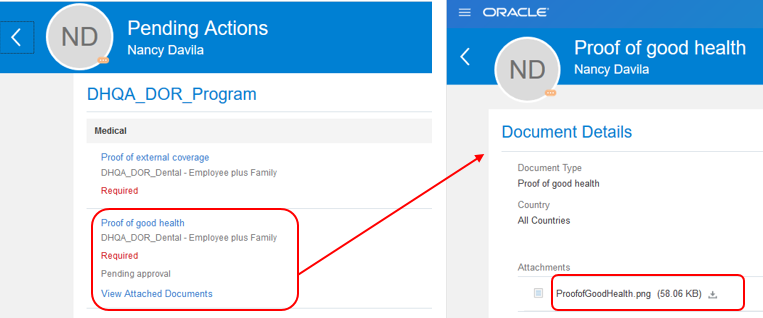

In this example, the participant needs to click the Proof of Good Health link to open a page where they can upload a supporting document. Once participants upload a document, they can see the status back on the Pending Actions page.

Using the Pending Actions Page to Upload Supporting Documents

In this example, the status is Pending approval. Participants can view and download the document they attached. They can click Edit to make changes if required.

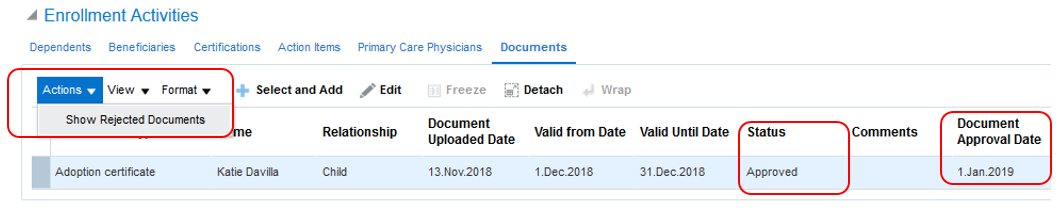

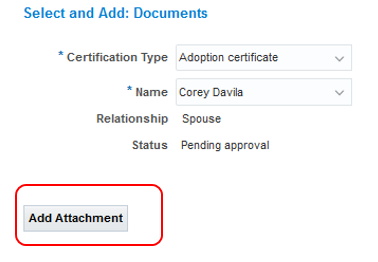

The Document Details page provides other info too, such as when the document was uploaded and by whom. For example, the administrator could have uploaded the document on behalf of the participant previously, so it is useful for the participant to know the additional details. When a participant uploads a document, the administrator can approve or reject the document using the new Documents tab that is available on the Manage Action Items page, in the Enrollment work area.

The administrator can see at a glance the certificate type, and the person’s name for whom the document needs approving. To approve or reject, the administrator needs to click Edit. In the Edit page that appears, administrators can click the document to review it. If everything’s in order, they can change the status to Approved. Once an administrator approves or rejects a document and saves it, they cannot change the status again.

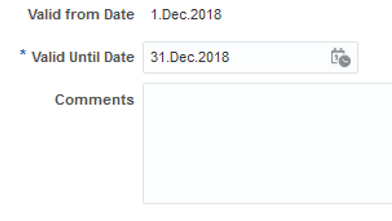

In certain circumstances, the administrator might need to change the Valid Until date, for a variety of reasons. For example, if the same document is valid for a longer time, administrators might want to extend the validity of the current document, thus avoiding the need to request for a fresh document.

Valid Until Date Field

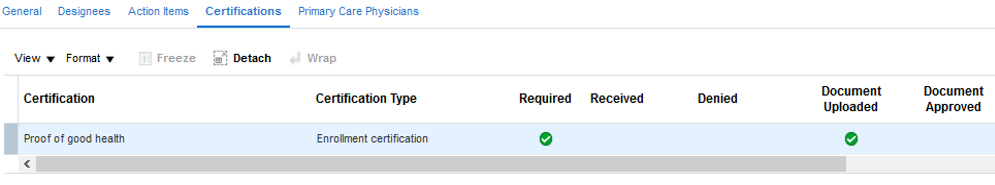

The administrator can see that the uploaded document has been approved in the Status column, and the date when the document was approved in the Document Approved Date column. This is useful information in case the administrator has queries in the future, especially if the document was rejected.

Enrollment Activities Section

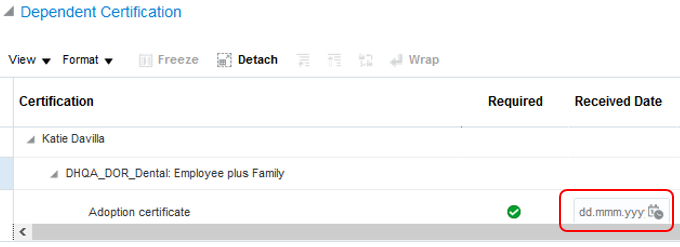

After the administrator has actioned the document, they need to navigate to the Certifications tab. They need to manually enter the date in the Received Date field to complete the pending action, or alternatively, run the Mass Upload process.

Dependent Certification Section

Sometimes, when participants cannot upload documents themselves, the administrator might need to do it for them. They can do this from the Documents tab.

Documents Page

When administrators add an attachment, they need to click Edit and approve that document. Administrators can also view the details of the uploaded documents in the Enrollments Results page, Certifications and Designees tabs. This is especially useful if the administrator is looking at all the enrollment details for a participant.

Certifications Tab

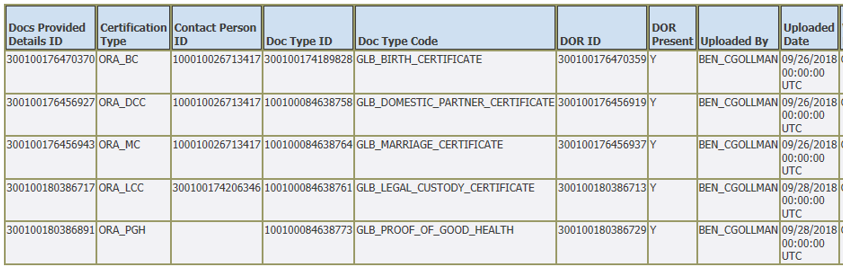

Administrators can also view diagnostic reports to resolve questions or issues relating to document uploads for certification. The Person Benefits diagnostic report helps the administrator to see the entire list of documents uploaded for a person across life events.

Person Benefits Diagnostic Report

Steps to Enable

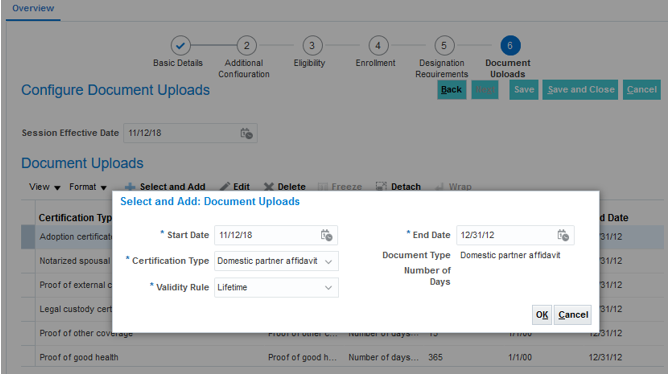

This feature is requires some setup in the Plan Configuration work area.

To use this functionality, you map the required document types to the program or plan-not-in-program. You can do this using the new Document Uploads train stop when you create or edit a program or plan.

Document Uploads Window

In the Document Uploads window, the administrator can define the type of document to map to the program or plan-not-in-program. Participants can upload the document if the life event that triggers the pending action is within the start and end dates that you specified.

You can enter the length of time the document is valid for, such as lifetime. You can even enter a specific number of days you want the document to be valid. For example, if you want the document to be valid up to 30 days after the participant uploaded the document, select Number of Days from the Validity Rule field, and enter 30.

Depending on your plan configuration, if you set up document mapping at the program level, participants need to upload a particular document only once. That document will be available for all offerings in that program and doesn’t need to be approved multiple times. For example, if multiple plans in a program require a birth certificate, the participant needs to upload the document only once. That document will then be available across the program. The administrator needs to approve the document only once.

You can delete a document mapping if required. There is no need to reprocess the life event. Any documents that have already been uploaded will still be valid, and participants and administrators can view them. However, they can’t upload any of those specific certificate types for that program or plan after you delete the mapping.

Key Resources

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

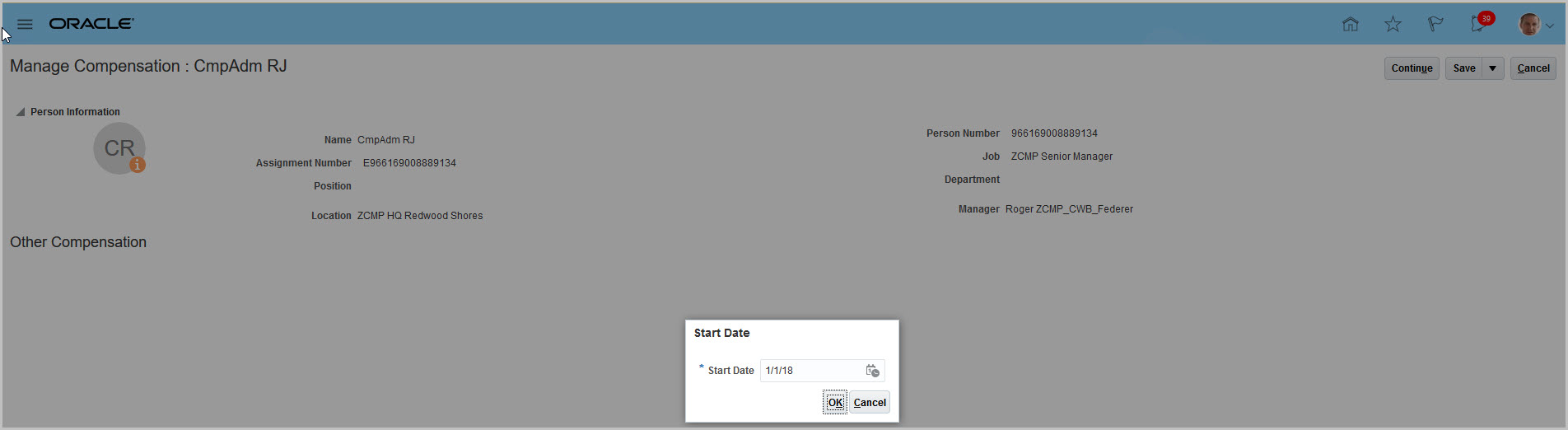

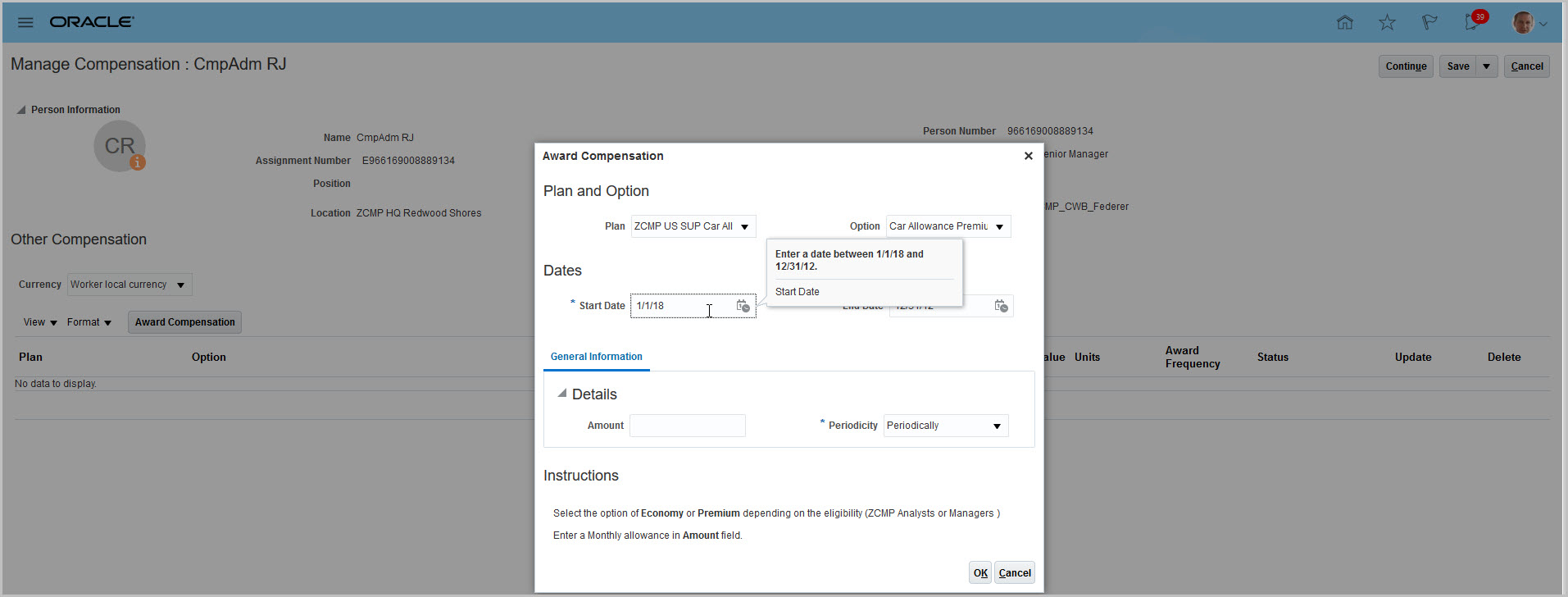

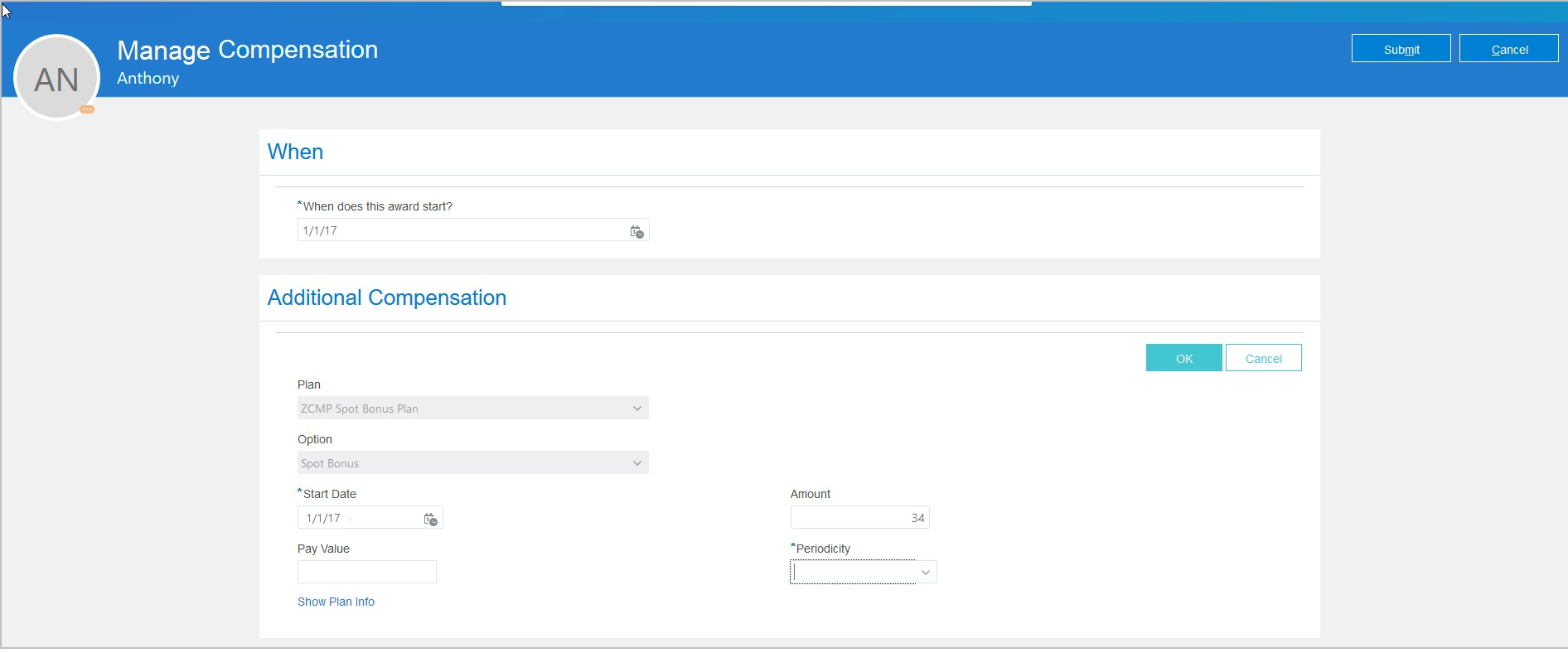

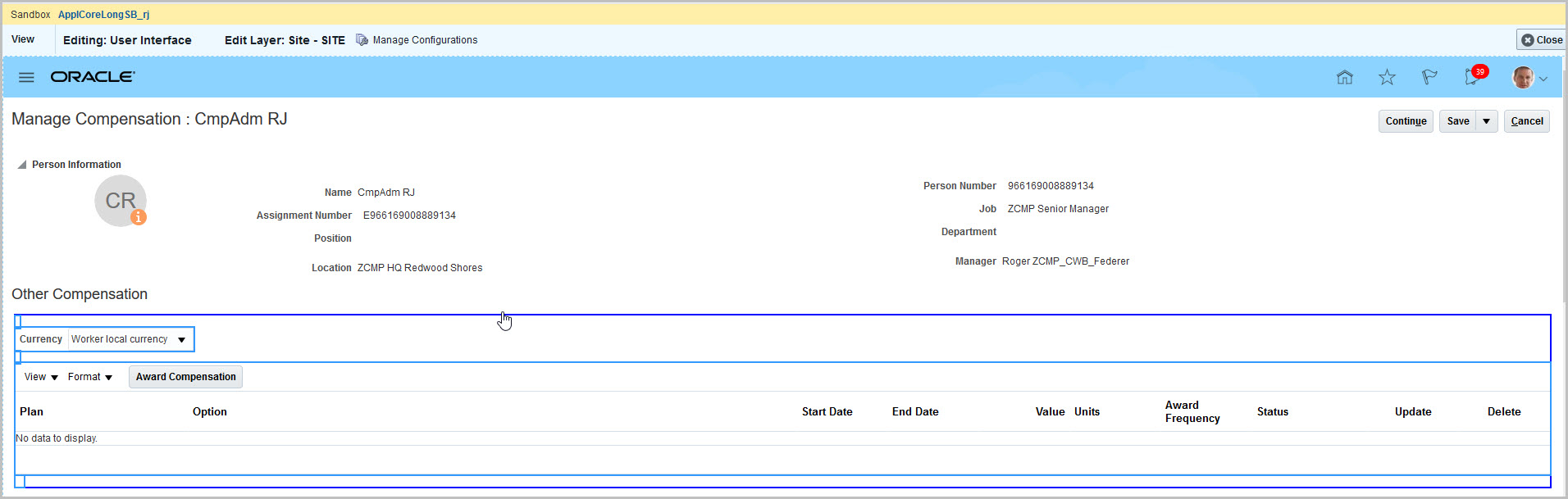

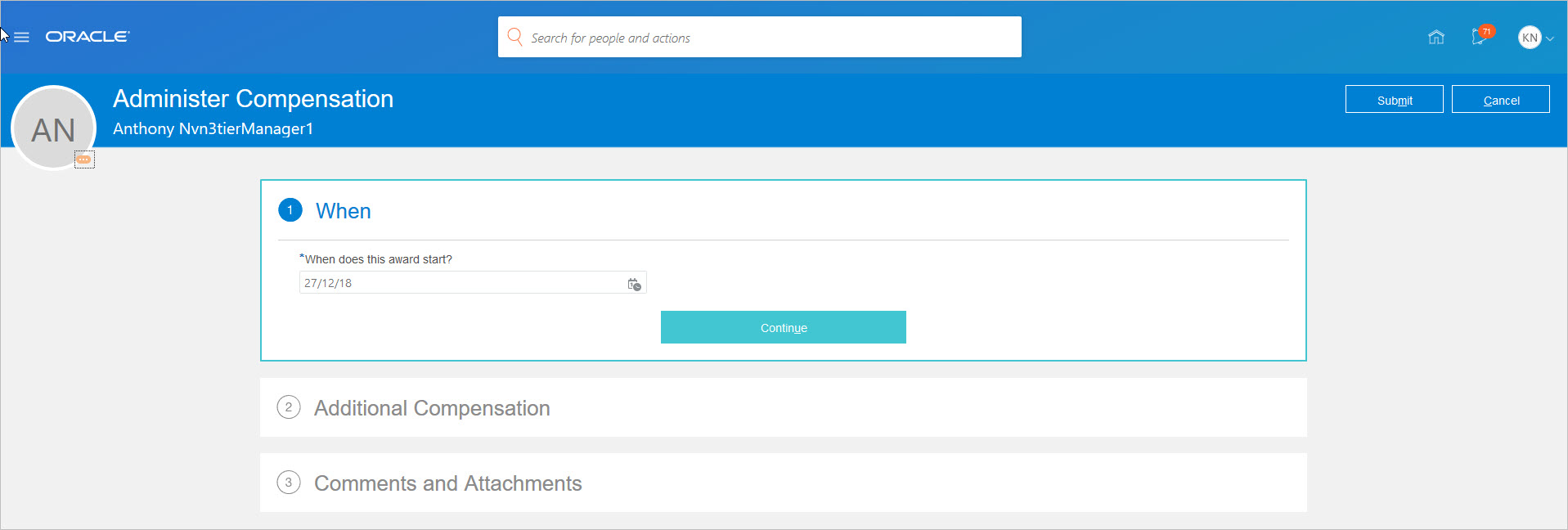

Retrospective Transaction Proposals by Line Managers and Workers

You can now enable employees to propose contributions, and managers to award individual compensations, that start earlier than today, such as starting on January 1, 2018.

On the Classic Pages:

Award or Contribute Amounts by Selecting the Start Date, Which Can Be Before Today's Date, Such as January 1, 2018

Select a Past Start Date, Such as January 1, 2018

On the Responsive Pages

In the When Section, Select a Past Start Date, Such as January 1, 2017

Steps to Enable

You enable the functionality differently for the classic and the responsive pages.

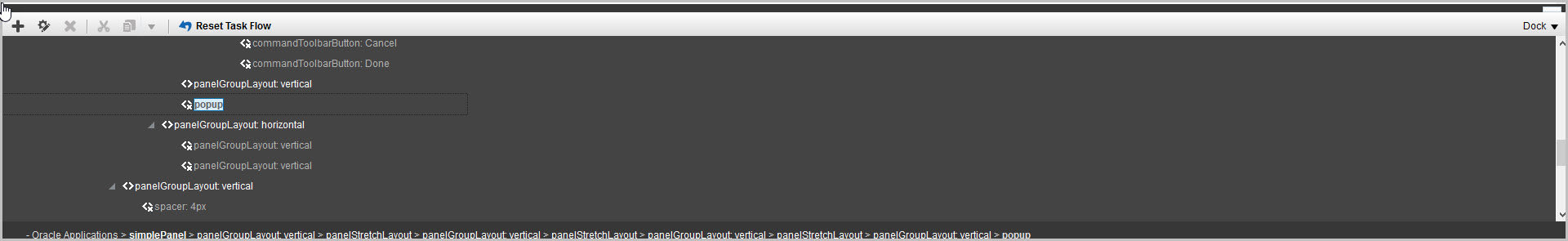

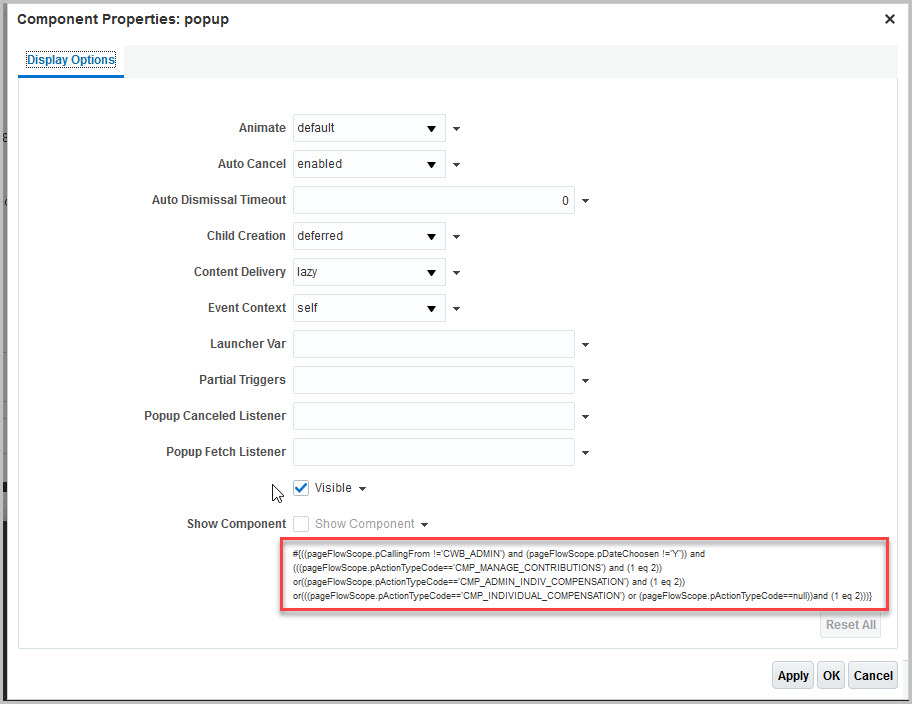

To Enable for the Classic Pages

Complete these steps to enable the Start Date dialog box.

- Create and enable a sandbox.

- Click the Compensation WA link.

- Select Manage Compensation.

- Search for an employee and click the employee's name.

- On the Manage Compensation page of the employee, click Customize Page.

- Set the layer as Site level.

- Select the Other Compensation section.

- Search for popup.

- Update the rendered property.

- If you're enabling the functionality for line managers, then for the 4th line, which has ‘CMP_INDIVIDUAL_COMPENSATION’, change (1 eq 2) to (1 eq 1).

- If you're enabling the functionality for employees, then for the 2nd line, which has ‘CMP_MANAGE_CONTRIBUTIONS’, change (1 eq 2) to (1 eq 1).

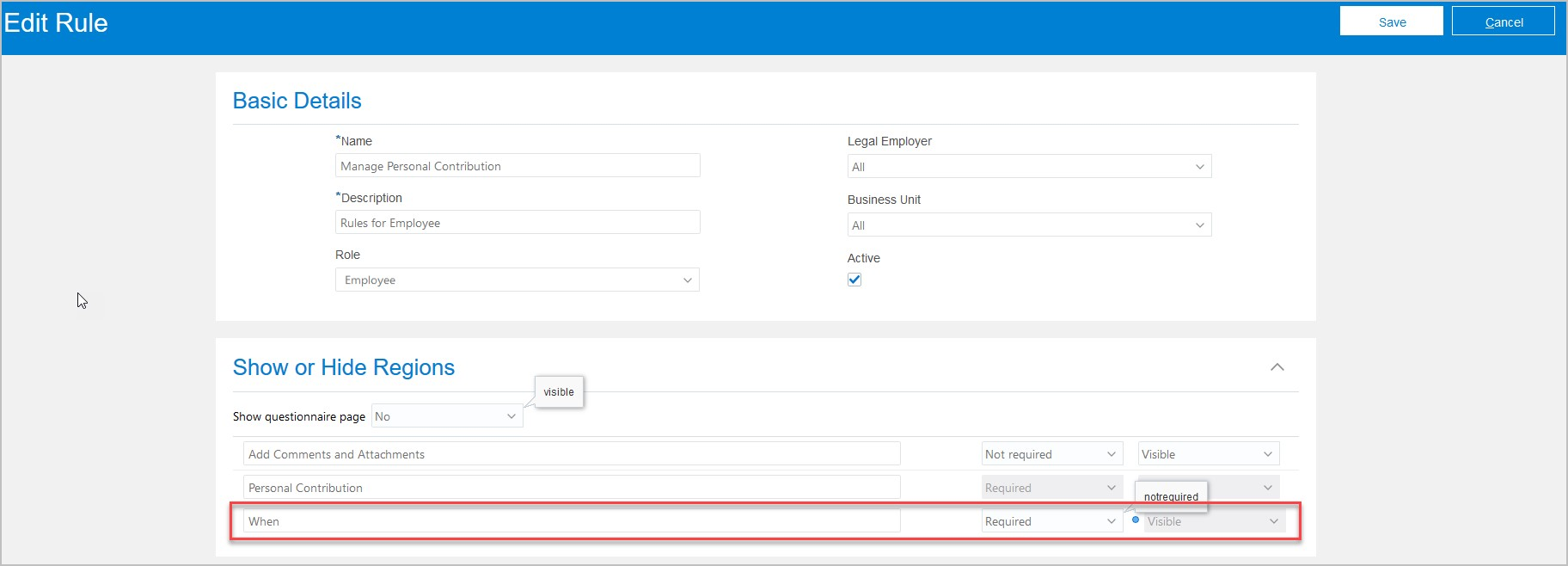

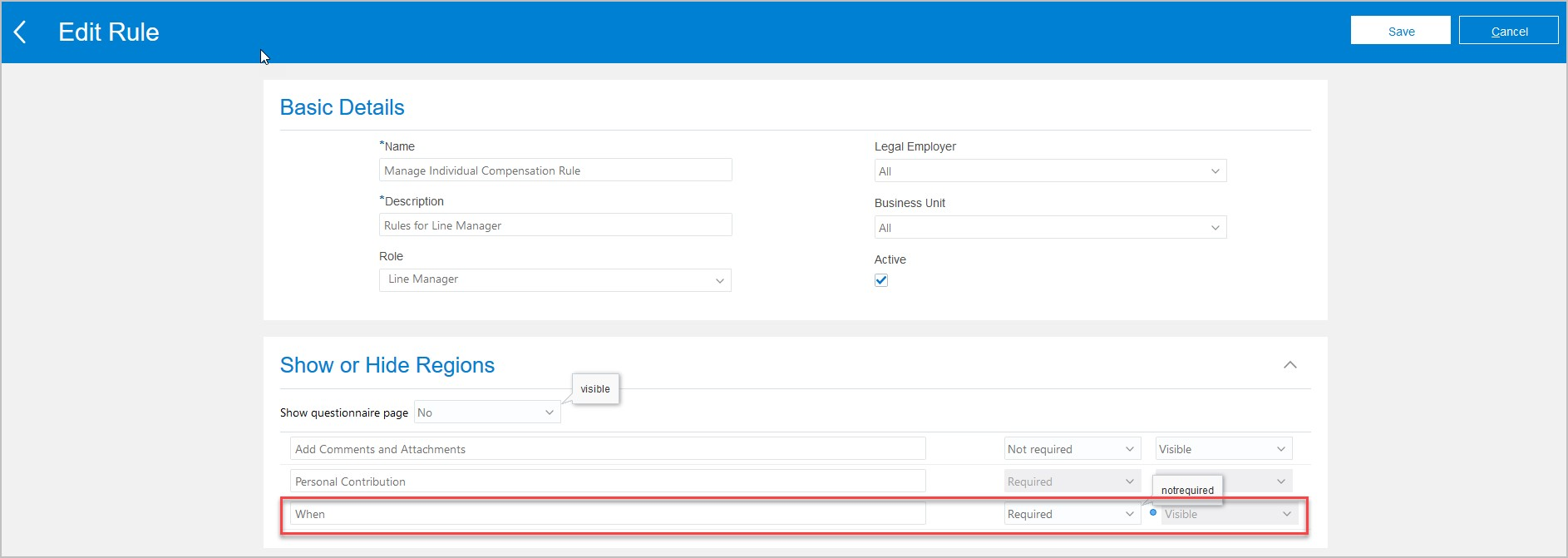

Enable for the Responsive Pages

Complete these steps to enable the When section.

- Create and enable a sandbox.

- Click Edit Pages.

- Select Site level.

- On the My Client Group tab, click Quick Actions > Show More.

- Search for HCM Experience Design Studio and click the action.

- On the HCM Experience Design Studio page, select 1 of these 2 options:

- Manage Personal Contribution: Enable the When section in personal contribution action.

- Manage Compensation: Enable the When section in individual compensation action.

- Specify the basic details.

- Select the role, legal employer, and business unit, as applicable.

- In the Show or Hide Regions section, When row, select Required.

Enable the When Section for Employees

Enable the When Section for Line Managers

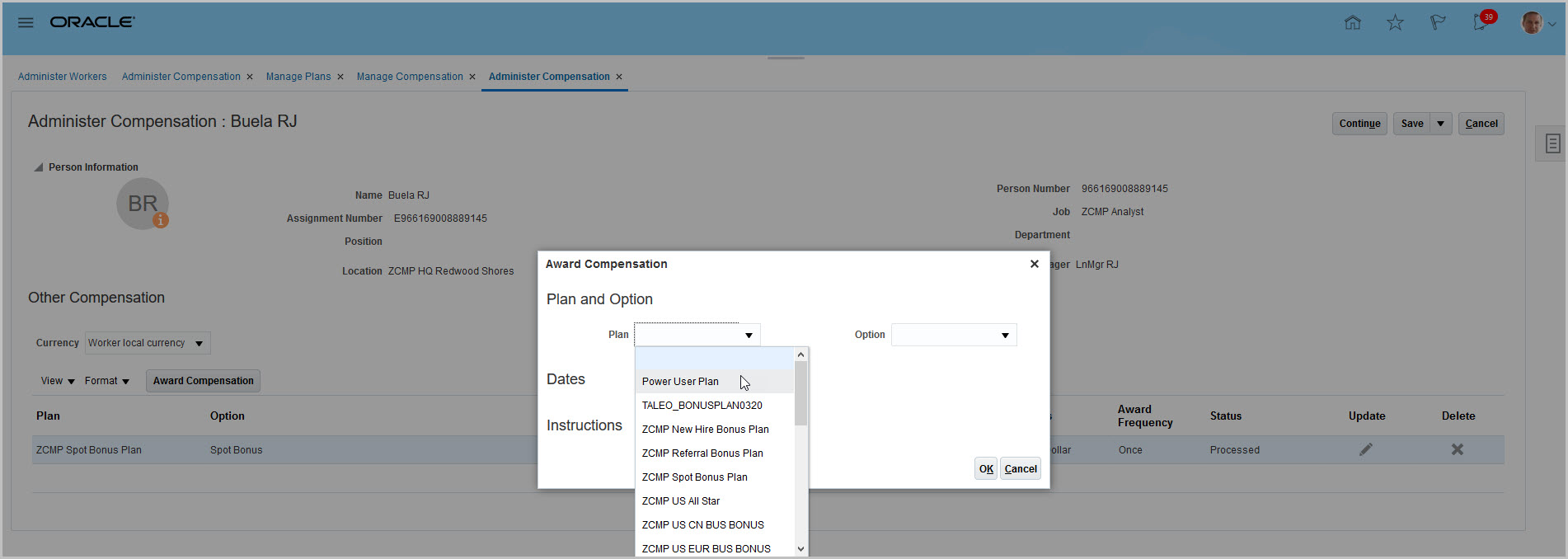

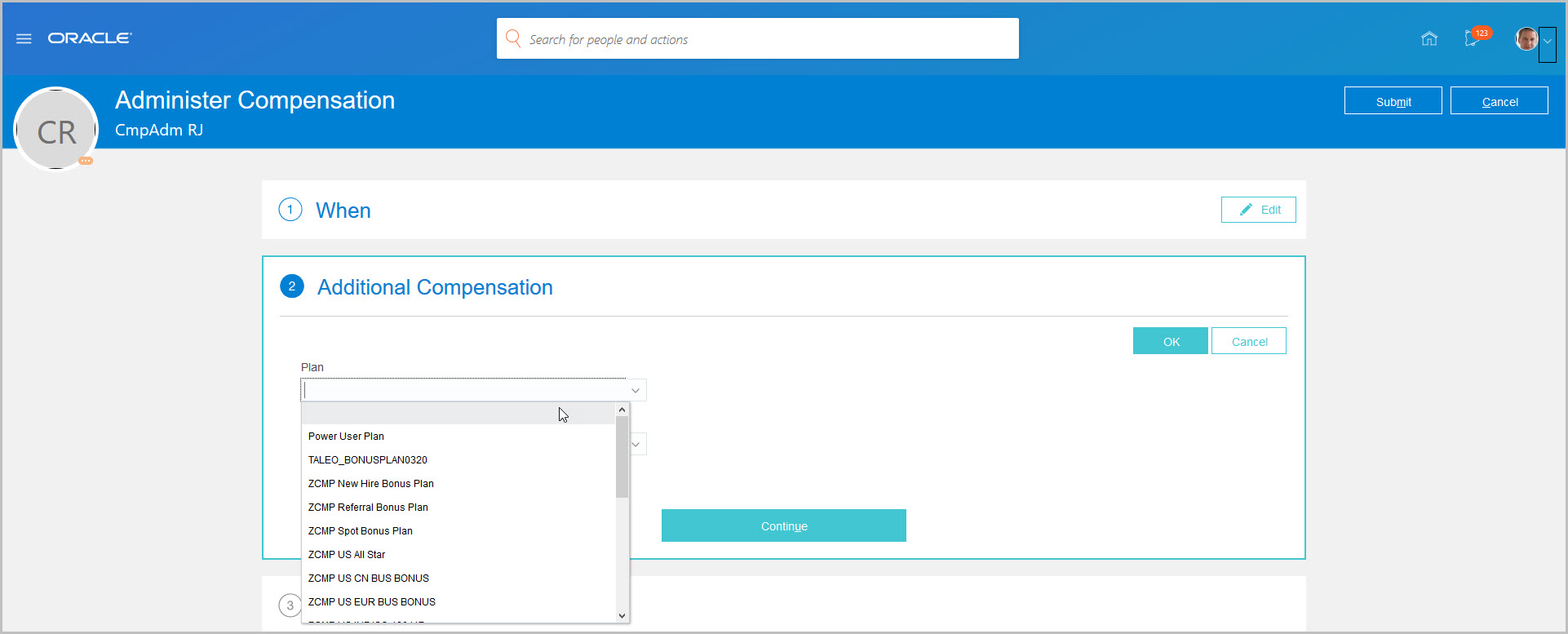

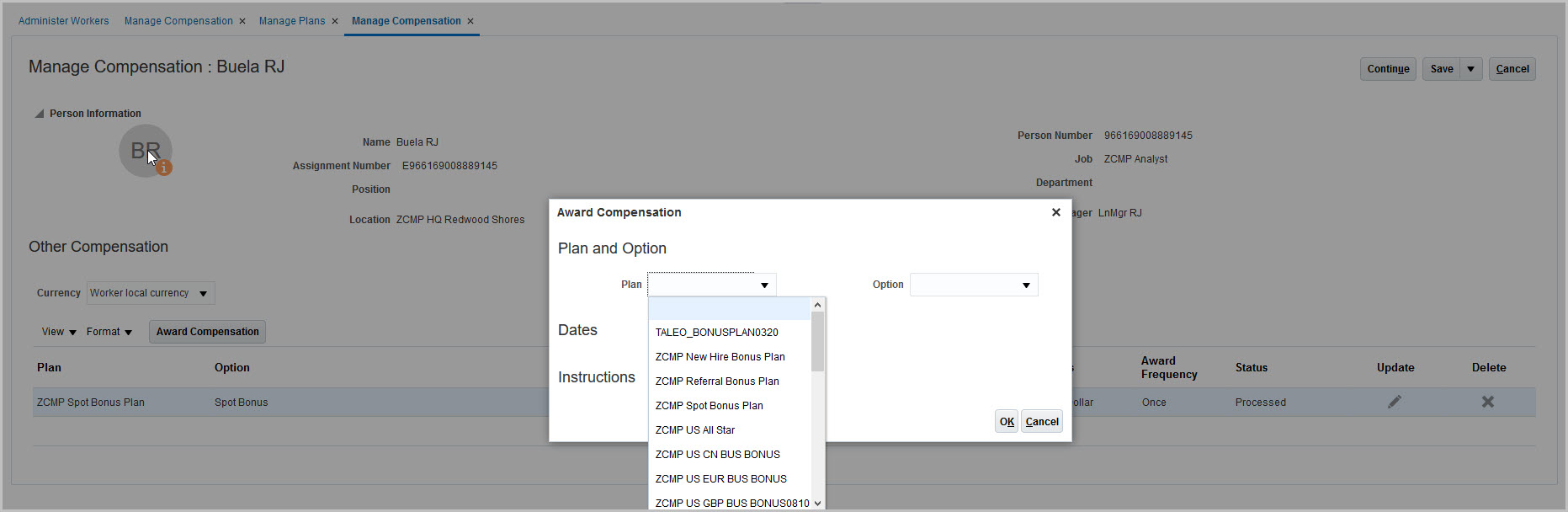

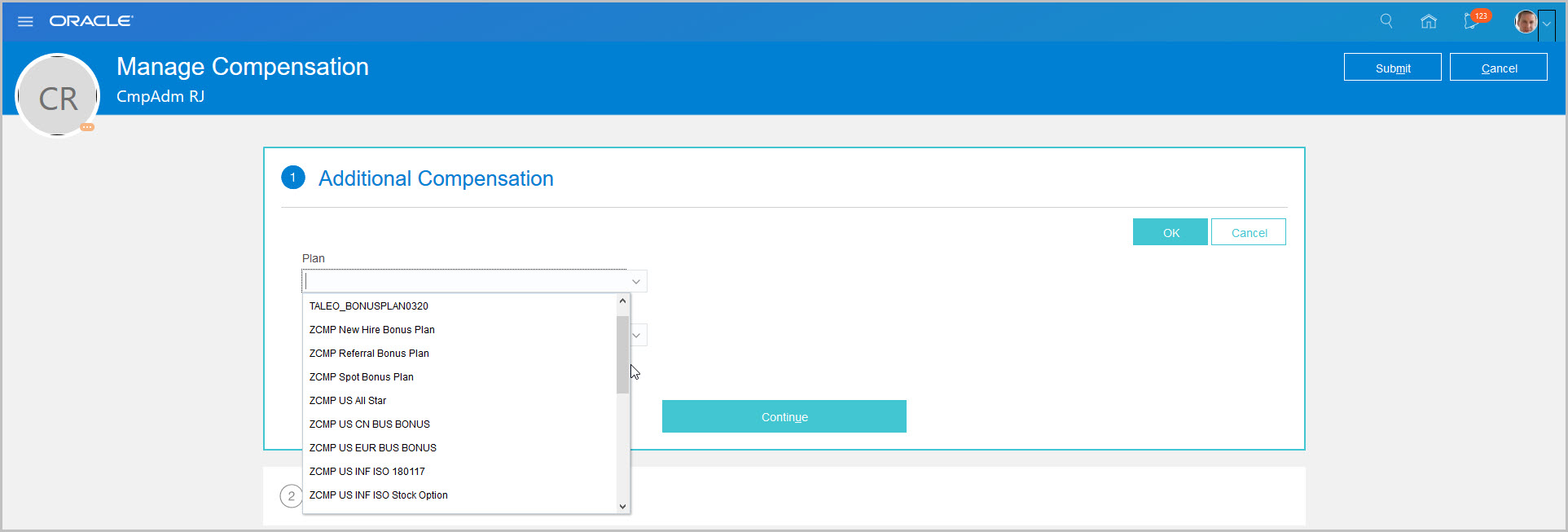

Restrict Individual Compensation Plans to Power Users Only

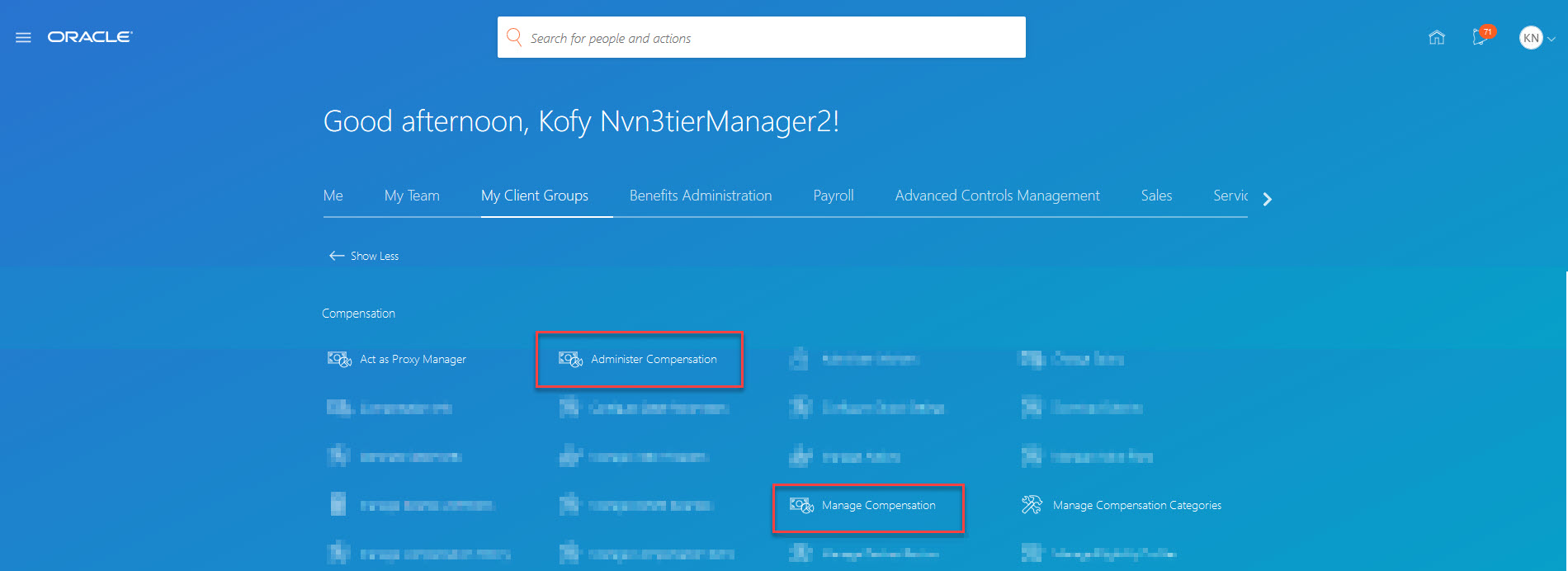

Sometimes, you want certain plans to be available to only HR specialists, compensation specialists, and compensation managers. The new task, Administer Compensation, enables them, and only them, to create and manage plans configured with access to the Administer Individual Compensation action.

Classic Page Plan Choice Lists for HR Specialists, Compensation Specialists, and Compensation Managers Include Plans with Access to the Administer Individual Compensation Action

Responsive Page Plan Choice Lists for HR Specialists, Compensation Specialists, and Compensation Managers Include Plans with Access to the Administer Individual Compensation Action

Classic Page Plan Choice Lists for Line Managers Don't Include Plans with Access to the Administer Individual Compensation Action

Responsive Page Plan Choice Lists for Line Managers Don't Include Plans with Access to the Administer Individual Compensation Action

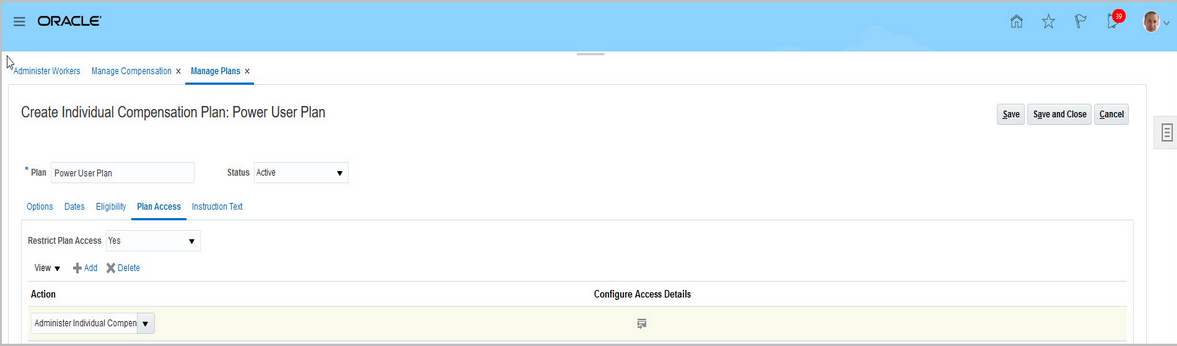

Steps to Enable

To limit individual compensation plan access to only HR specialists, compensation specialists, and compensation managers, when you configure plans:

- Enable plan access

- Select the Administer Individual Compensation action.

Plan Access

The new task is available for both classic and responsive pages. When responsive pages are enabled, you use quick actions to open the responsive Administer Compensation page. Open the classic page using the Tasks panel tab of the Compensation work area.

The new task uses the new Administer Individual Compensation action. Individual compensation plans with access set to No or the action set to Administer Individual Compensation appear on the Administer Compensation page.

We recommend that HR specialists, compensation specialists, and compensation managers use the new Administer Compensation task. Line managers can continue to use the Manage Compensation task.

Tips And Considerations

If you have not enabled the Redesigned Responsive pages through the profile options you will have the classic pages. The responsive pages require enabling the HCM_RESPONSIVE_PAGES_ENABLED profile option, as well as the CMP_COMPENSATION_RESPONSIVE_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information- Profile Options and Displayed Fields (Document 2399671.1).

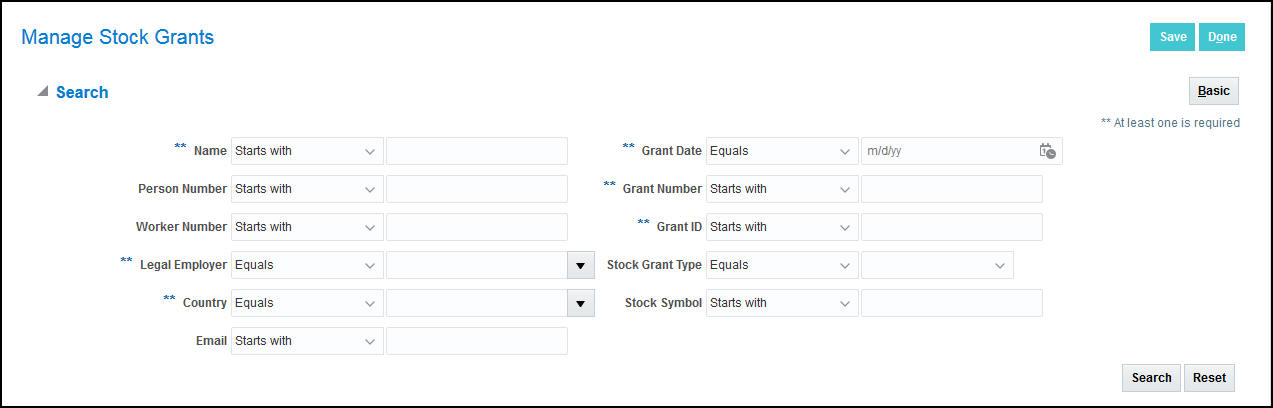

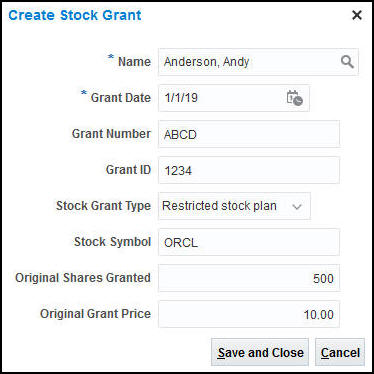

Stock - Advanced Search and Create

Extend your ability to search in the Manage Stock Grants task by using the newly created Advanced Search. Additional fields have been added to the search dialog display. Useful additional fields have been added to the Create Stock Grants action.

Advanced Search

Create Shares

Steps to Enable

You don't need to do anything to enable this feature.

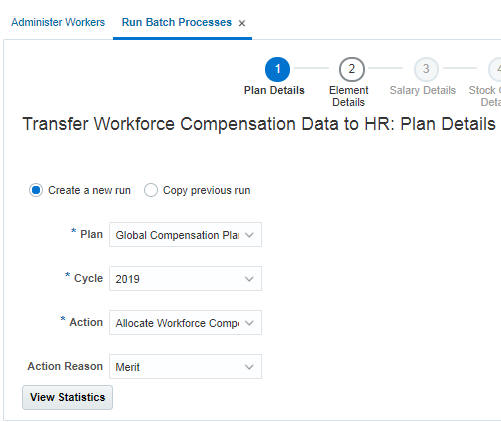

Transfer Data Using Different Actions and Action Reasons

You can now use a different Action and Action Reason when transferring data back into HR from a Workforce Compensation plan. Previously, you were only able to do so through a workaround.

Steps to Enable

Administrators must choose an Action and Action Reason on the Plan Details page of the Transfer Workforce Compensation Data to HR batch process.

New Action and Action Reasons Parameters on the Transfer Process

Tips And Considerations

You must transfer all data associated with a worker in the same batch.

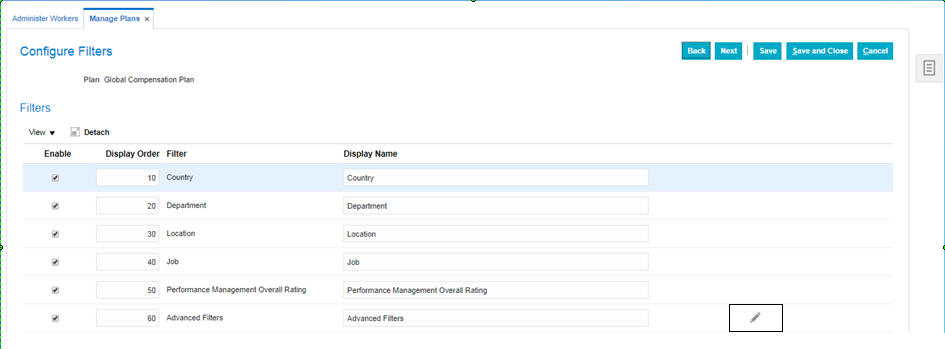

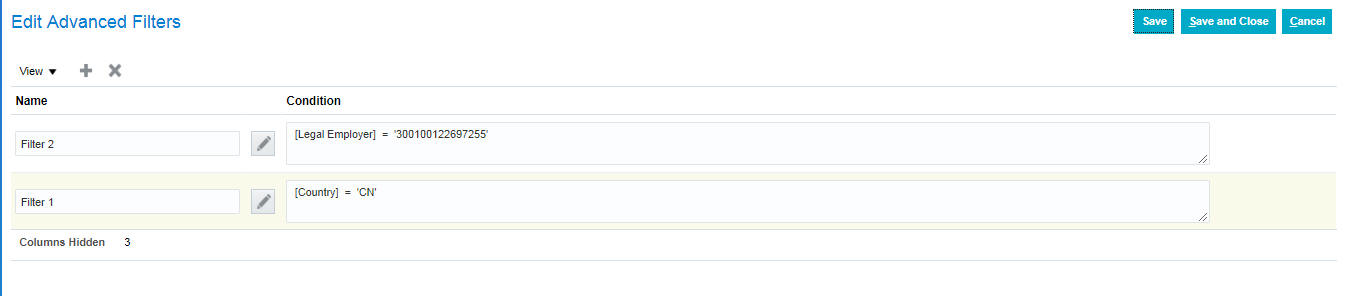

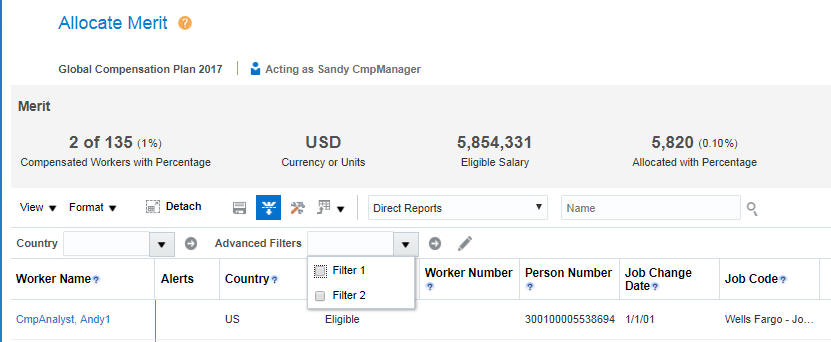

You can now create an Advanced Filter for Line Managers to use in the worksheet. Previously, managers had to create advanced filters themselves.

Steps to Enable

To enable an Advanced Filter for managers, navigate to Configure Filters in plan setup.

Create Advanced Filter

You configure the Advanced Filter as needed.

Created Advanced Filters

Managers can use the Advanced Filter immediately.

Worksheet View of Created Filters

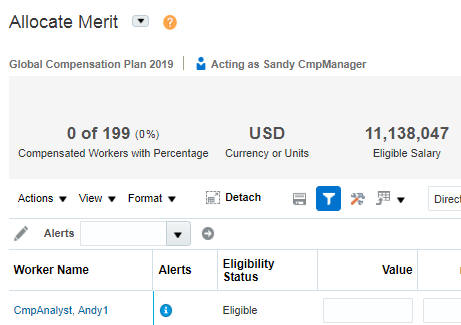

Use Alerts to Filter the Worksheet

Line Managers can now filter the worksheet by alert through the filter on the toolbar.

Toolbar Alert Filter

Or they can hover over an alert and choose to filter.

Alert Filter

Steps to Enable

Administrators must enable the Alert filter in Configure Filters in plan setup to use this feature.

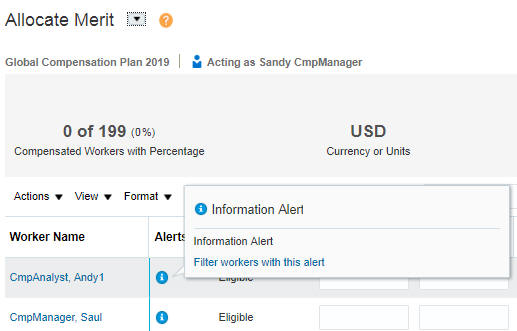

Enable Worksheet Exports for Secondary and Review Managers

Administrators can now enable View in Workbook or Manage in Workbook for managers in Secondary or Review hierarchies. Previously, this option was not available.

Steps to Enable

The Administrator must enable the export option for each configured Compensation task type.

- Click Manage Plans task

- Click Configure Worksheet Display

- Select the task

- Select the Actions tab

- Enable the desired options in Export to Workbook

Export Options

Tips And Considerations

You must configure the export options for each Compensation task type.

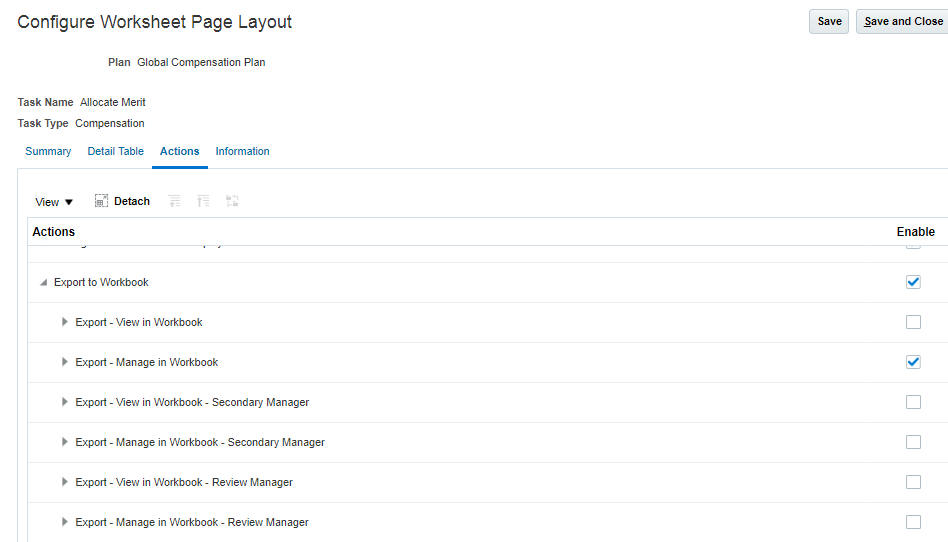

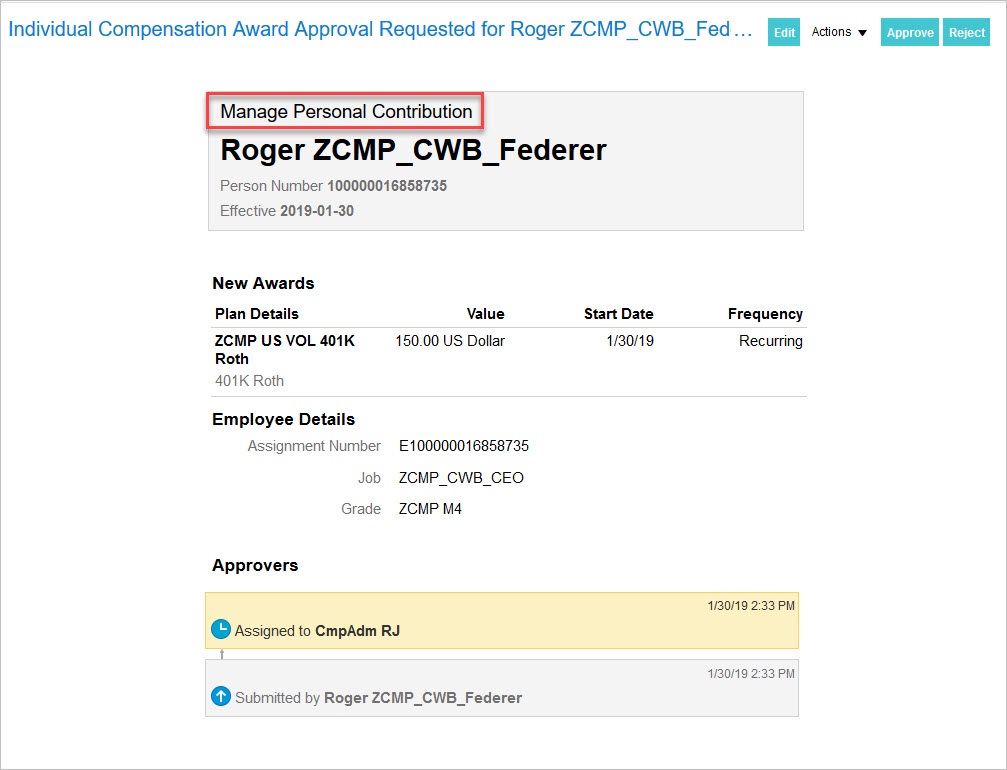

Individual Compensation Approval Notification Header Change

You can now see the action used to submit the individual compensation transaction. The actions Manage Personal Contribution, Manage Compensation, or Administer Compensation are included in the person header of approval notifications created with Oracle Business Intelligence Publisher.

Person Header in the Approval Notification

Steps to Enable

To use this feature you will need to use Oracle Business Intelligence Publisher to create your approvals.

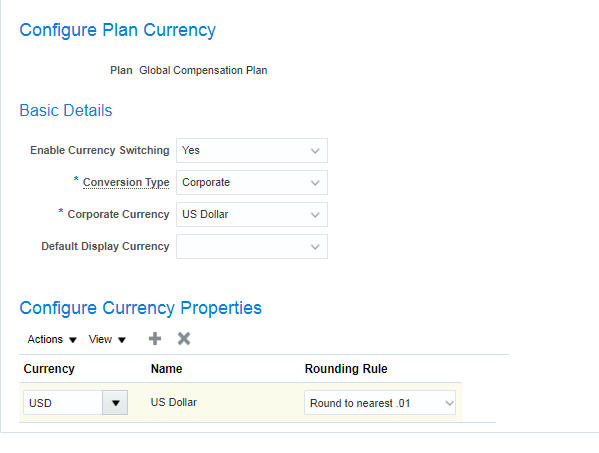

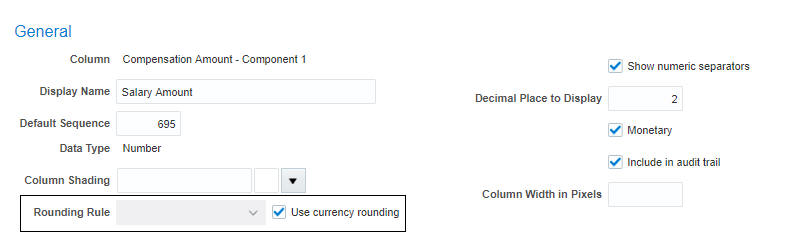

Set Currency Rounding Rule by Plan

You can now configure rounding rules by currency by plan. Previously, you could only configure rounding rules at the column level, that were applied plan-wide.

Steps to Enable

Administrators must configure each currency's rounding rule within the plan. If you don't configure a rounding rule, the application applies the rounding at the column level.

Rounding Rule Configuration

Administrators must also check "Use currency rounding" for each column that uses the currency rounding.

Column Properties

Tips And Considerations

To use the feature, you must configure a rounding rule for each currency. You must also check the "Use currency rounding" property for each column within plan setup.

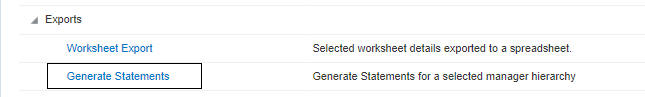

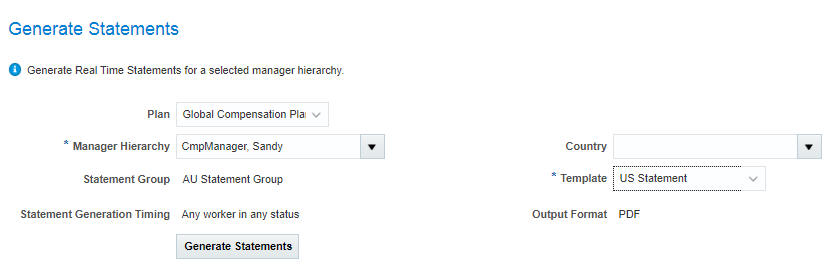

Print Compensation Change Statements in Bulk

You can now print all statements for workers within a plan hierarchy. Previously, you were limited to 10 workers per generation. There's a new option to generate statements within View Administration Reports:

New Report in View Administration Reports

To generate statements, the Administrator must select a manager within the plan hierarchy and a template.

Generate Statements Parameters

Once the process has completed, you're able to download the file.

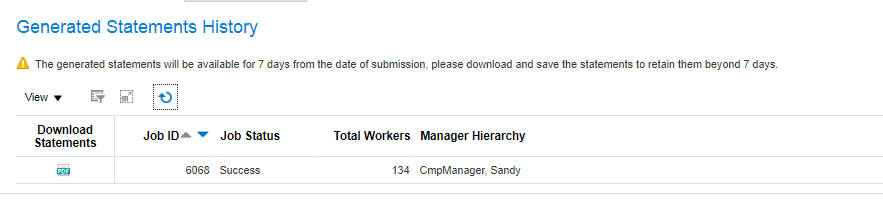

Completed Statement Generation

Note that generated files are only available for the time shown on the page. The system currently sets the availablity to 7 days.

Steps to Enable

You don't need to do anything to enable this feature.

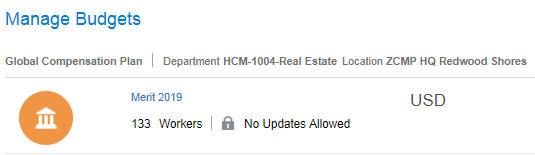

Differentiate Between Manager Assignments

We made it easier for managers with multiple assignments who have worksheets for each assignment to differentiate between them. Administrators can now configure up to two properties that are displayed throughout Workforce Compensation, allowing managers to understand which worksheet they are accessing.

Steps to Enable

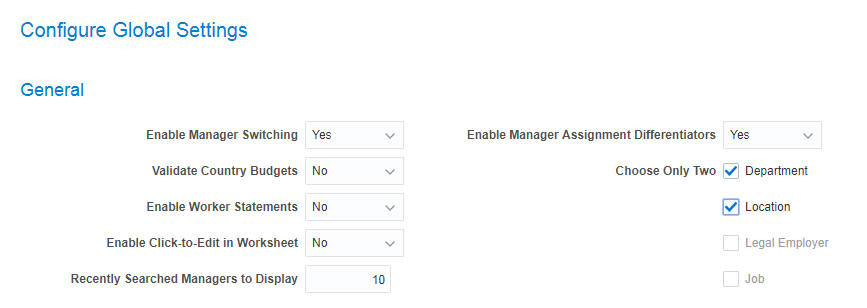

In Configure Global Settings, the Administrator selects "Yes" in Enable Manager Assignment Differentiators.

Configuration for Manager Assignment Differentiators

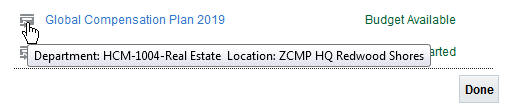

Once configured, managers are able to see the respective assignment information in the plan switcher.

Plan Switcher

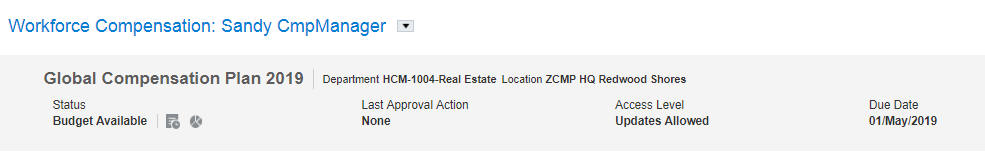

The landing page:

Landing Page

Budget pages:

Manage Budgets

And worksheet pages:

Worksheet Page

Tips And Considerations

After you configure the global setting, all managers see this information for all plans.

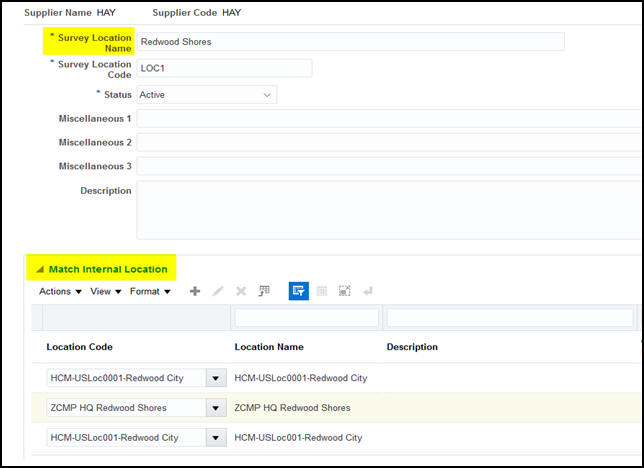

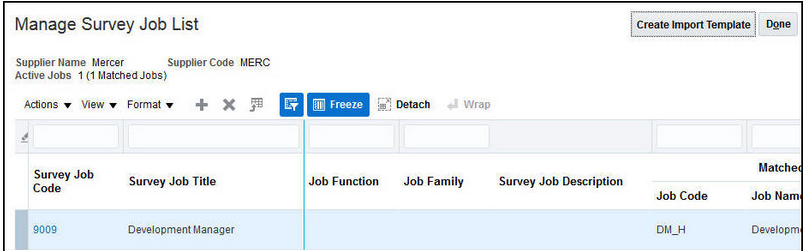

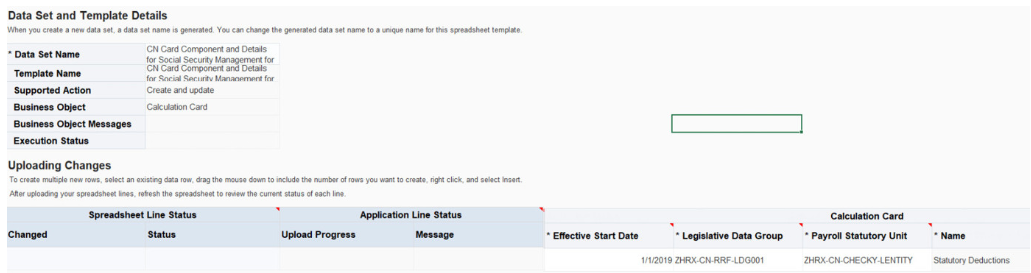

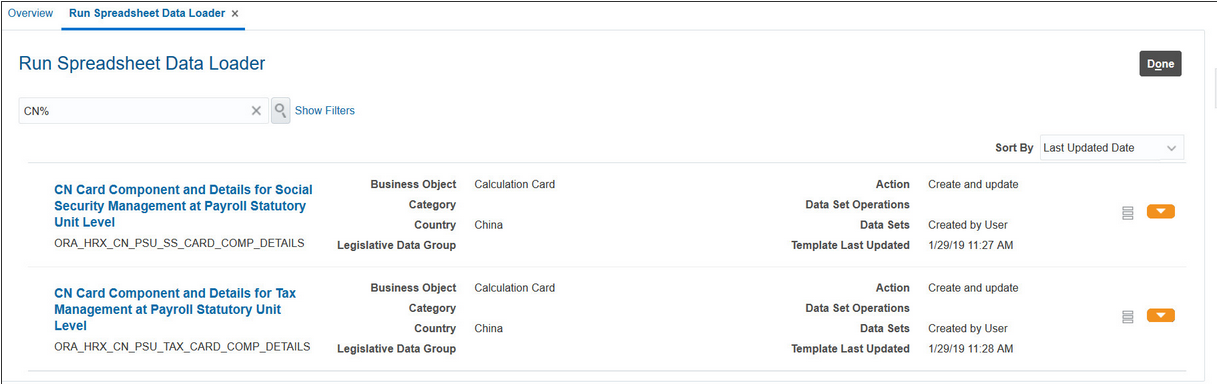

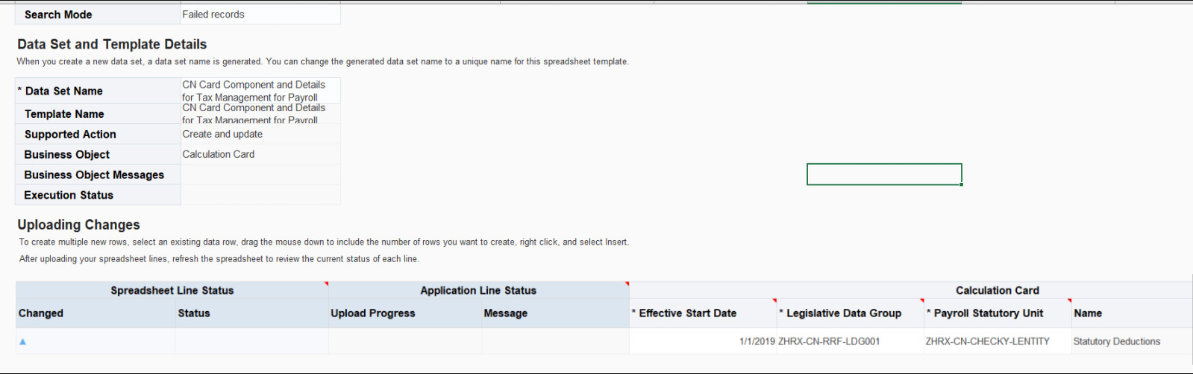

Create market data using the new HCM Spreadsheet Data Loader (HSDL) technology. We've enabled loading compensation surveys using HSDL within the HCM Data Loader (HDL) framework, so now you will be able to load data via our newly created spreadsheet templates. We've also added some exciting new features for loading and mapping locations, as well as additional percentile points from the tenth to the hundredth percentile. You will also see that we have added Market Targets to the Compensation Types page. At this time the enhancements are still informational within Market Data.

Map Survey Locations to internal locations on a new mapping page. Survey locations can be loaded via HSDL.

Location Mapping

Identify the Market Target by Compensation Type.

Market Targets on Compensation Types

Steps to Enable

HSDL is launched from the same pages.

Example of Create Import Template Button

Filter Positions by Business Unit

We made it easier for you to select a new position for a worker by adding a worker business unit filter on the worksheet. Previously, all available positions appeared.

Steps to Enable

You don't need to do anything to enable this feature.

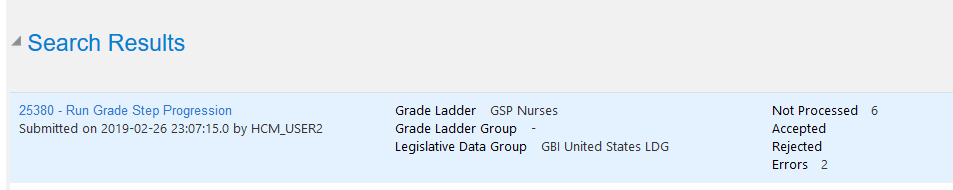

Data Security for Reviewing Grade Step Progression Results

The Review Proposed Progressions and Salary Updates page is enhanced to secure the transactions that a person sees when reviewing process results.

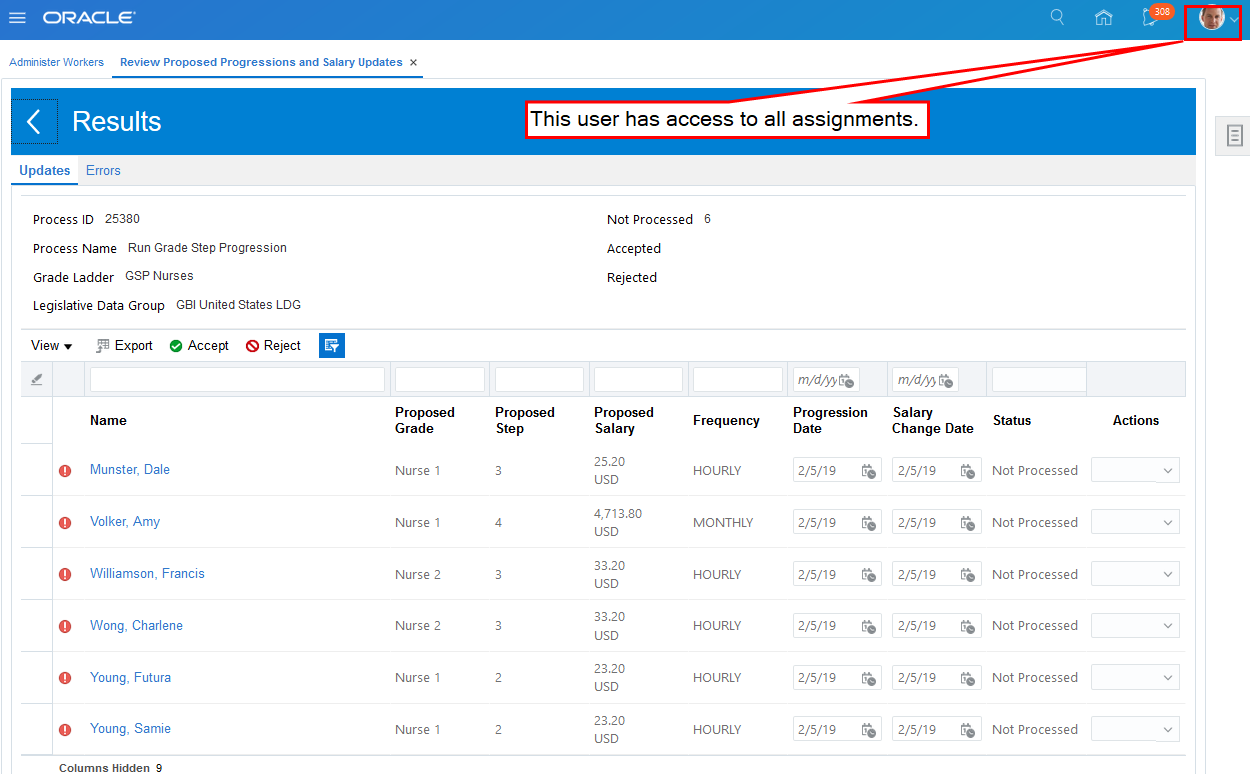

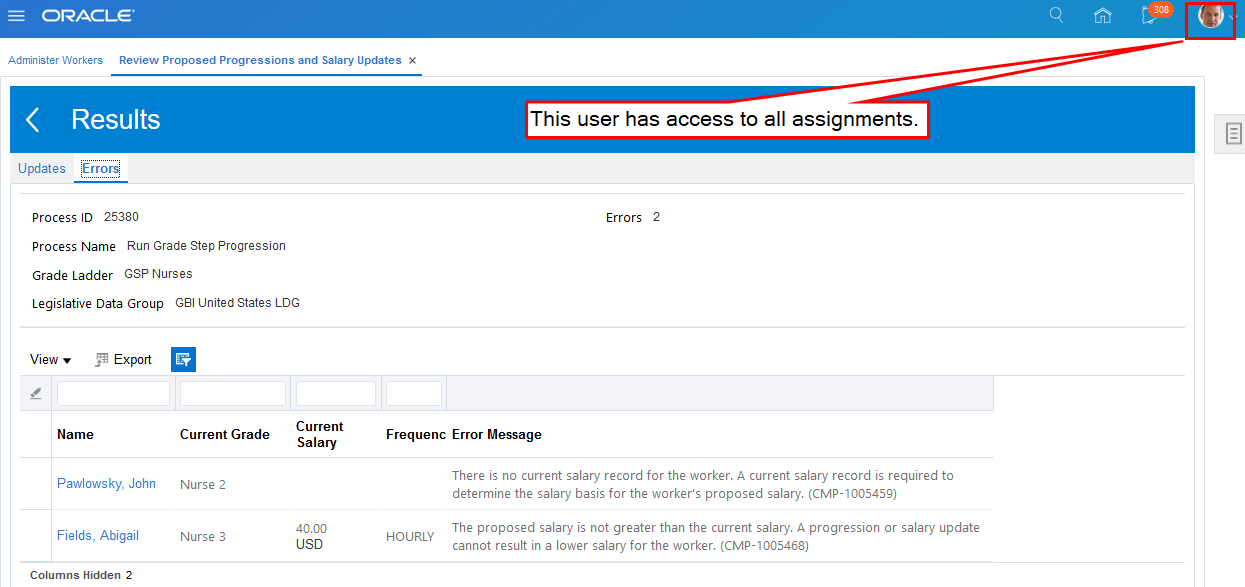

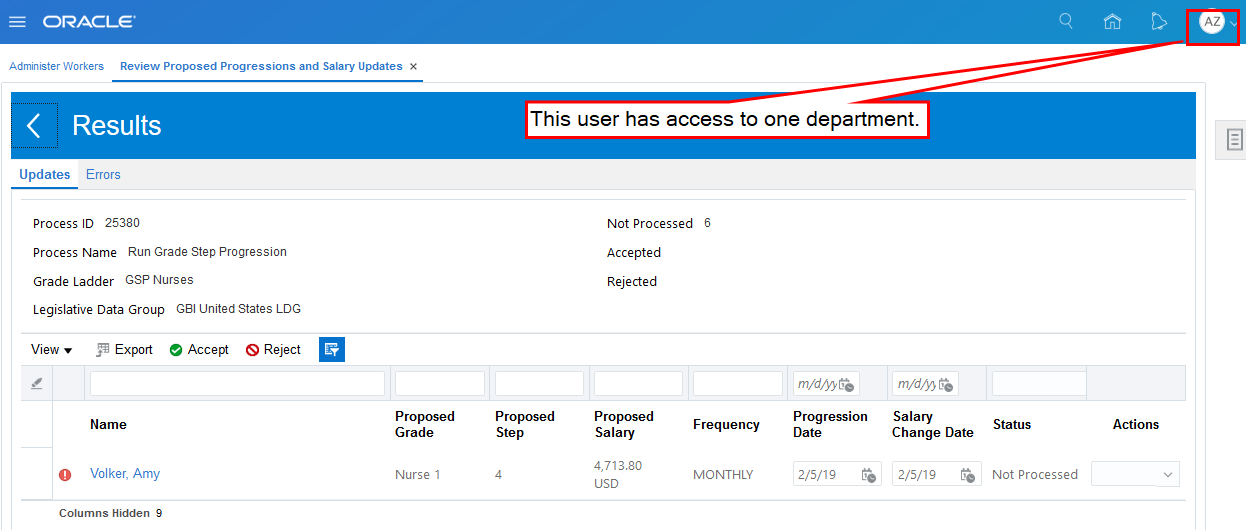

Everyone sees the same total transaction count on the search page, which reflects all the assignments that were processed in the batch. In this example, six rows weren't processed and two rows are in error.

Progression Results: 6 Not Processed and 2 Errors

The information on the Updates and Errors pages varies based on each person's data security. In this example, the person has access to all assignments and so sees all six rows set to Not Processed on the Updates page, and both of the rows on the Errors page.

Updates: Person Has Access to All Assignments

Errors: Person Has Access to All Assignments

In the next example, the person has access to only one department and so sees only the assignments that her data security allows. Note that the totals still reflect the entire population, even though the person can see only one row. This count is an indication that additional rows exist, that she doesn't have access to.

Updates: Person Has Access to One Department

Errors: Person Has Access to One Department

Steps to Enable

- Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role Information section below.

- The security will apply to results for both Run Grade Step Progression and Synchronize Grade Step Rate processes.

Role Information

The following table shows the aggregate privilege that supports this feature and the predefined role that inherits the privilege. This privilege is not new with this update, but the data security is newly enabled with this update.

| Aggregate Privilege Name and Code |

Job Role Name |

|---|---|

| Approve Proposed Progressions and Salary Updates ORA_CMP_APPROVE_PROPOSED_PROGRESSIONS_AND_SALARY_UPDATES |

Compensation Manager |

If you are using the predefined roles, no action is necessary. However, if you are using custom versions of these roles, you must add these aggregate privileges to your custom roles to use this feature. See the Release 13 Oracle Human Capital Management Cloud Security Upgrade Guide on My Oracle Support (Document ID 2023523.1) for instructions on implementing new functions in existing roles.

Receive Warning When Changing Currency Conversion Rates

We made it easier for you to remember to run the required refresh process after you make changes to the currency conversion rates in Manage Plans. Now you receive a warning message after you make the changes and save.

Steps to Enable

You don't need to do anything to enable this feature.

Compensation Redesigned User Experience/Responsive Pages

Increase user satisfaction with the redesigned pages that now have the same look and feel on desktop and mobile devices. These redesigned pages are both responsive and easy to use on any device, with a modern look and conversational language. Clutter-free pages, with clean lines and just the essential fields, can be personalized to suit.

Responsive Salary Pages for Power Users

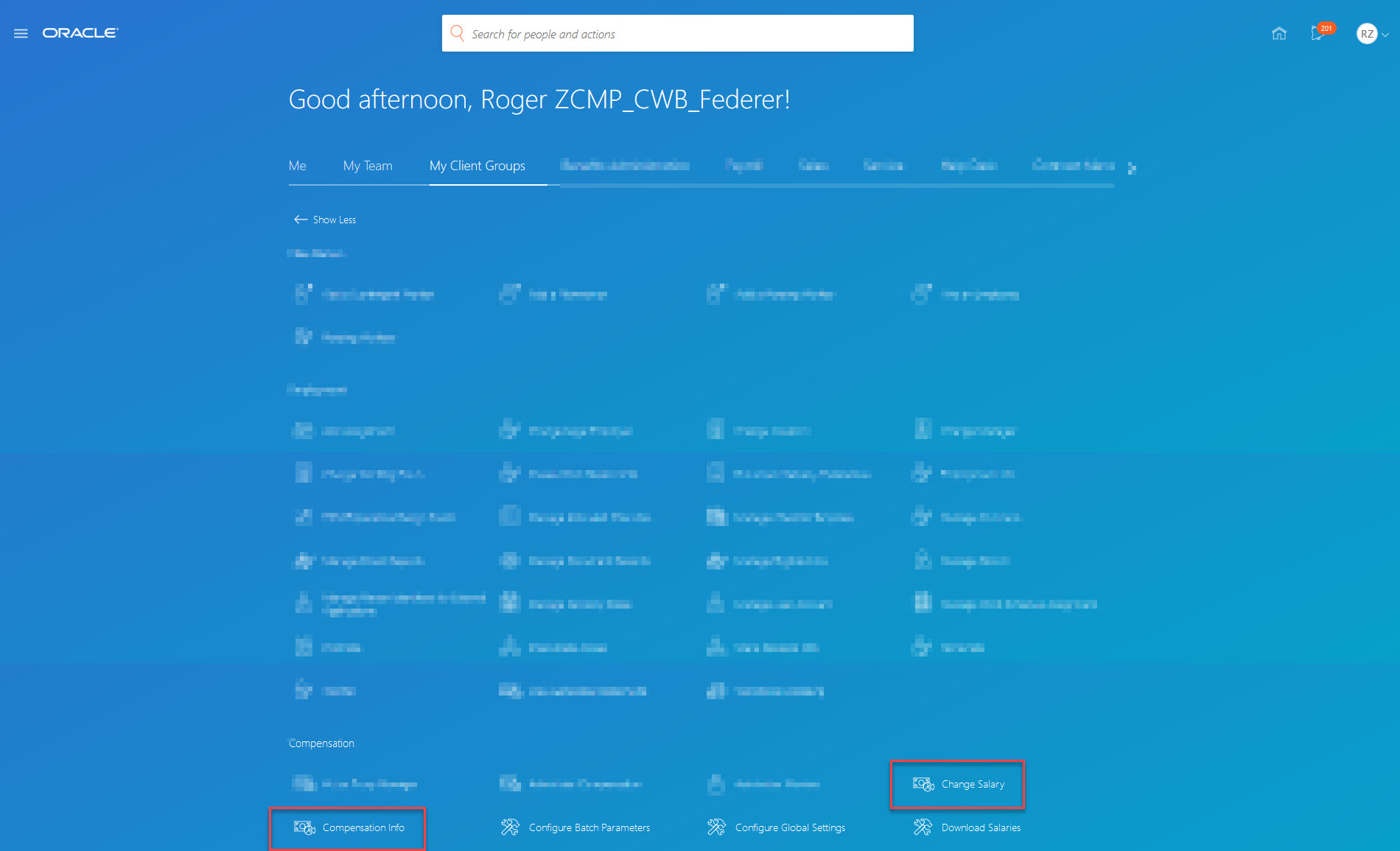

Power users, such as compensation managers and HR specialists, can now make salary changes using responsive pages. To propose new salary, use the Change Salary quick action. To edit any salary record and delete the latest salary record, use the compensation spotlight page opened with the Compensation Info quick action.

To propose new salary:

- On the home page, click My Client Groups.

- Click Show More.

- Under Compensation, click Change Salary.

- Search for a worker and click their name.

- On the Change Salary page, enter the relevant details.

- Click Submit.

To edit or delete current salary:

- On the home page, click My Client Groups.

- Click Show More.

- Under Compensation, click Compensation Info.

- Search for a worker and click their name.

- On the Compensation Info page, in the salary section, click Edit.

- Either make the relevant changes and click Submit or click Delete.

To edit past salary:

- On the home page, click My Client Groups.

- Click Show More.

- Under Compensation, click Compensation Info.

- Search for a worker and click their name.

- On the Compensation Info page, in the salary section, click Show Prior Salary.

- Click the salary record that you want to edit.

- In the Salary Details section, click Edit.

- On the Edit Historic Salary page, make the relevant changes.

- Click Submit.

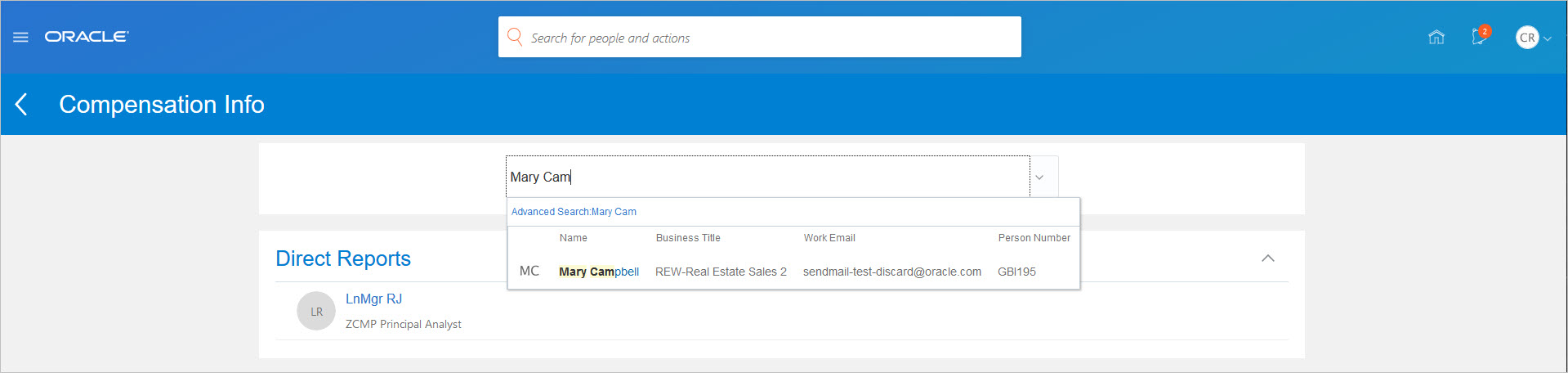

Change Salary and Compensation Info Quick Actions in My Client Groups

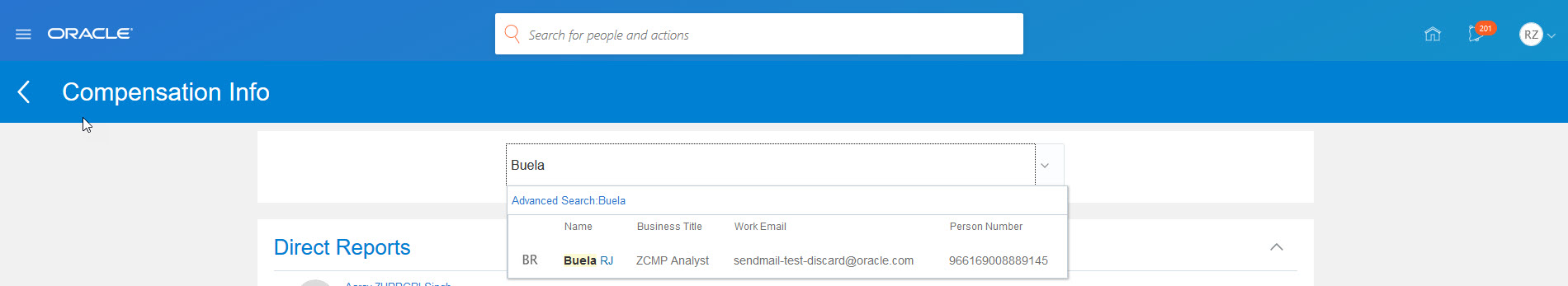

Search for and Click the Employee

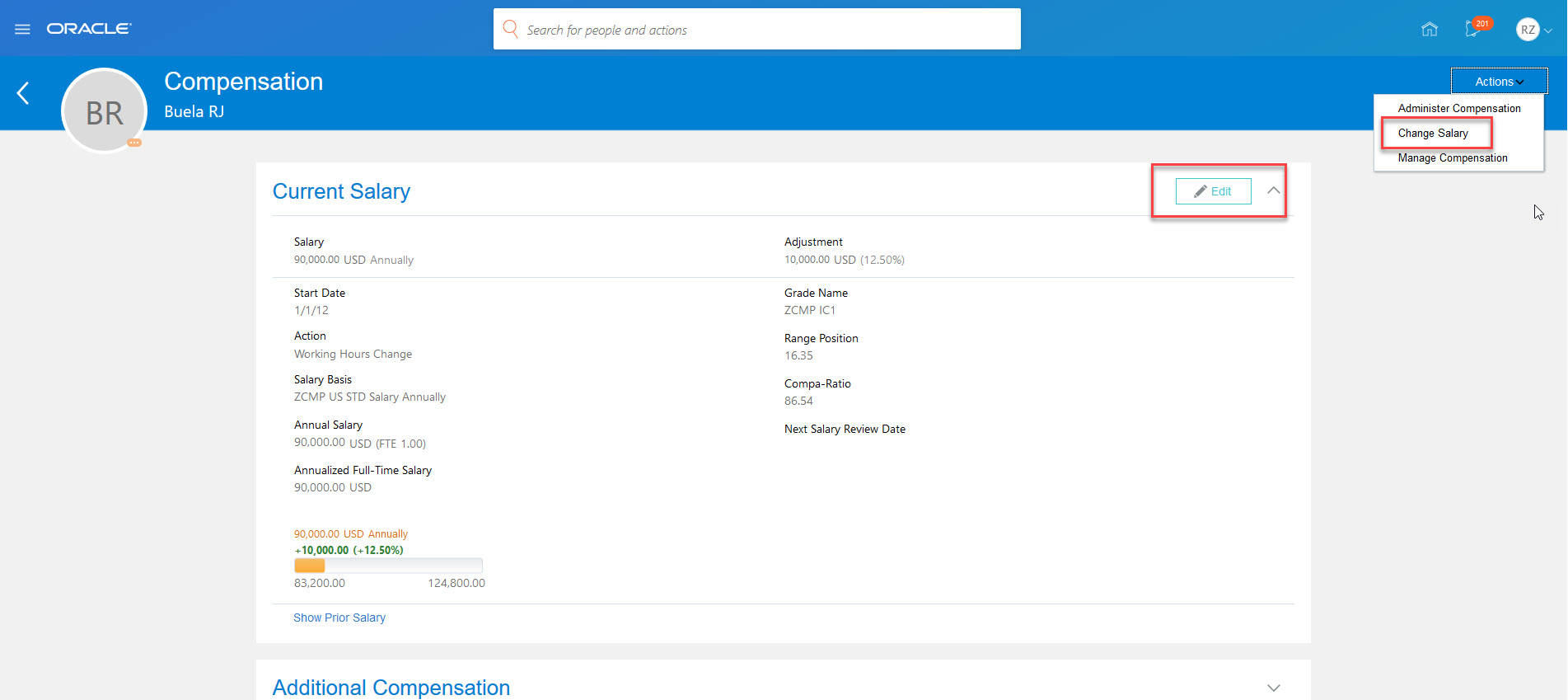

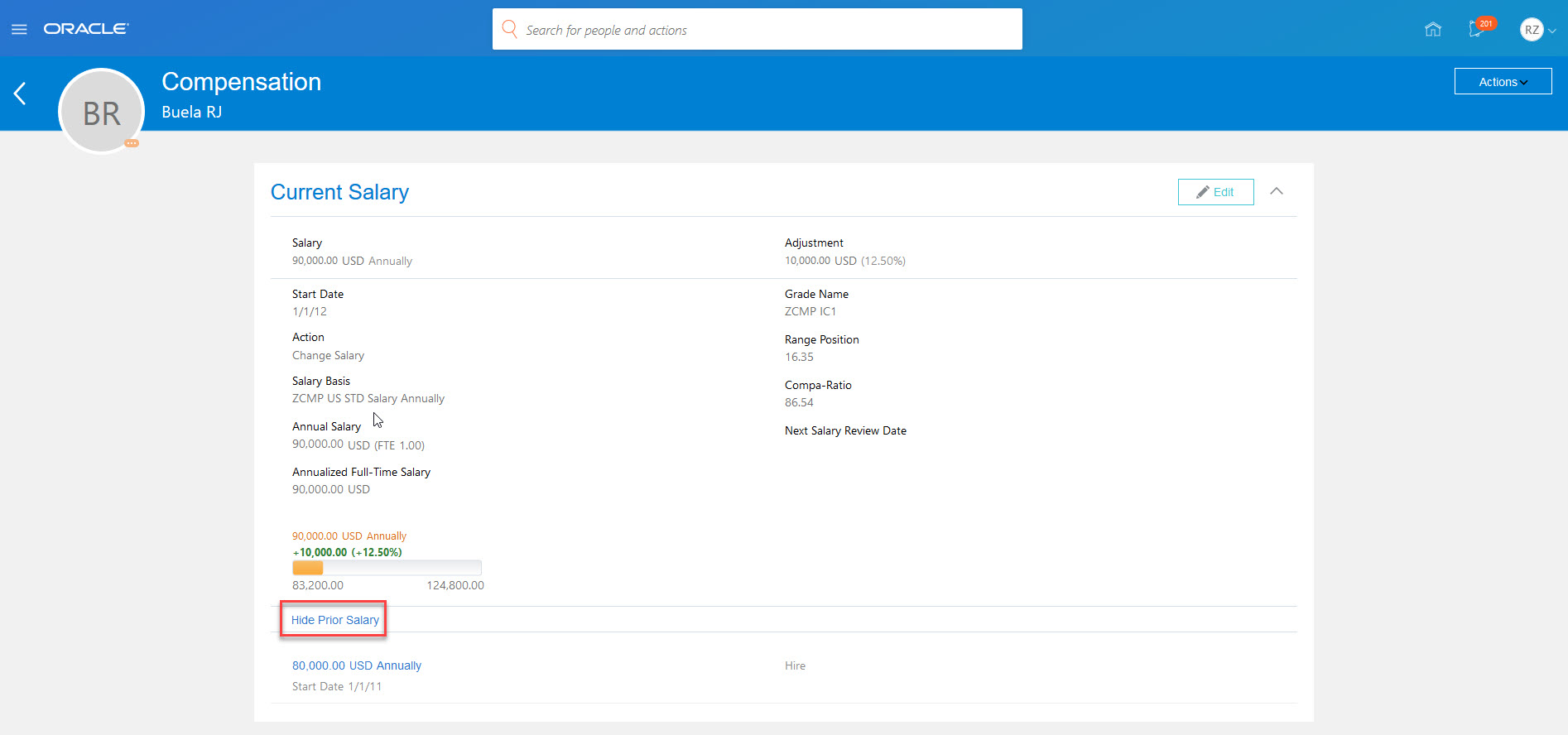

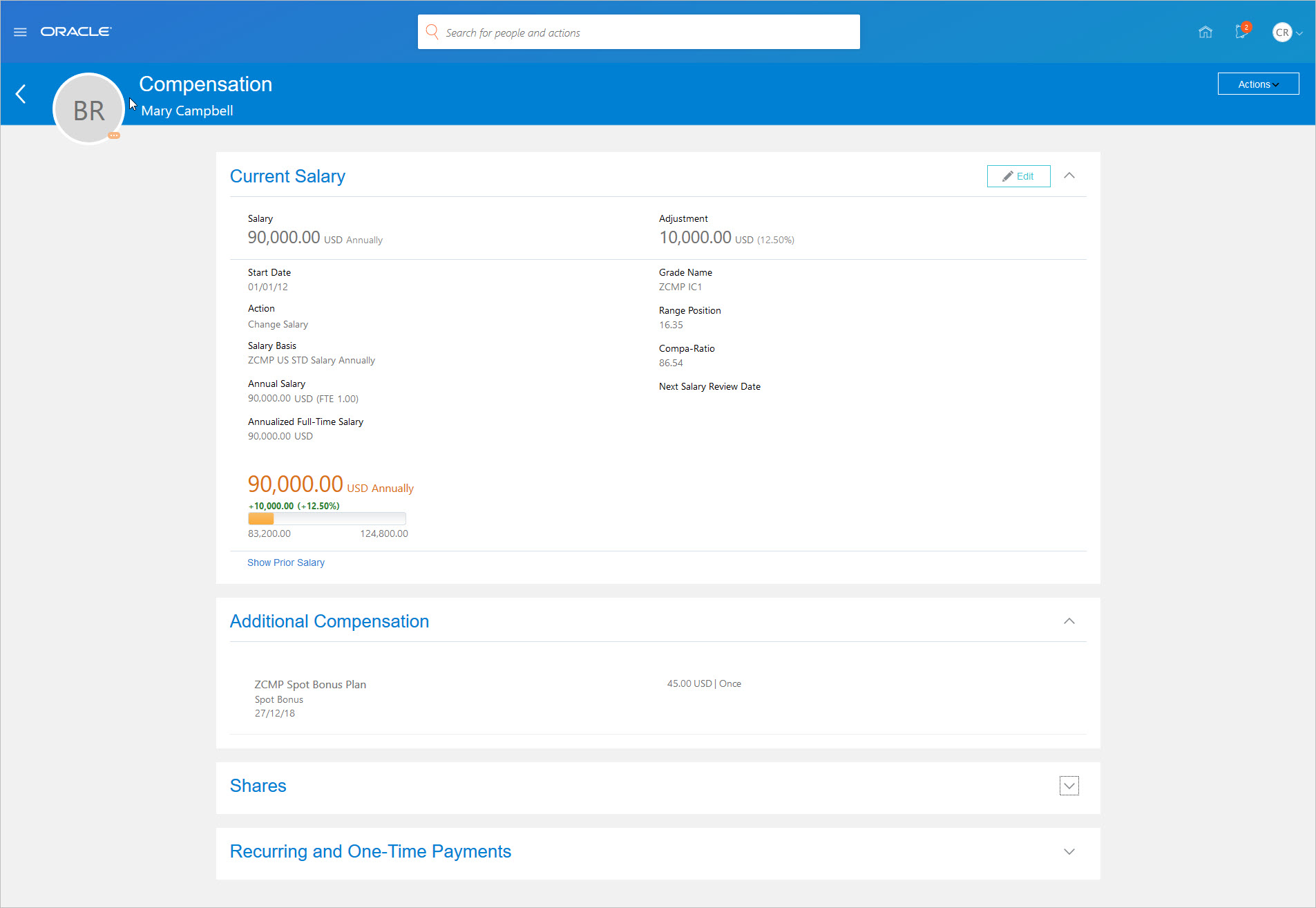

On the Compensation Spotlight Page, You Can Edit or Delete the Current Salary, Change Prior Salaries or Create a New Salary

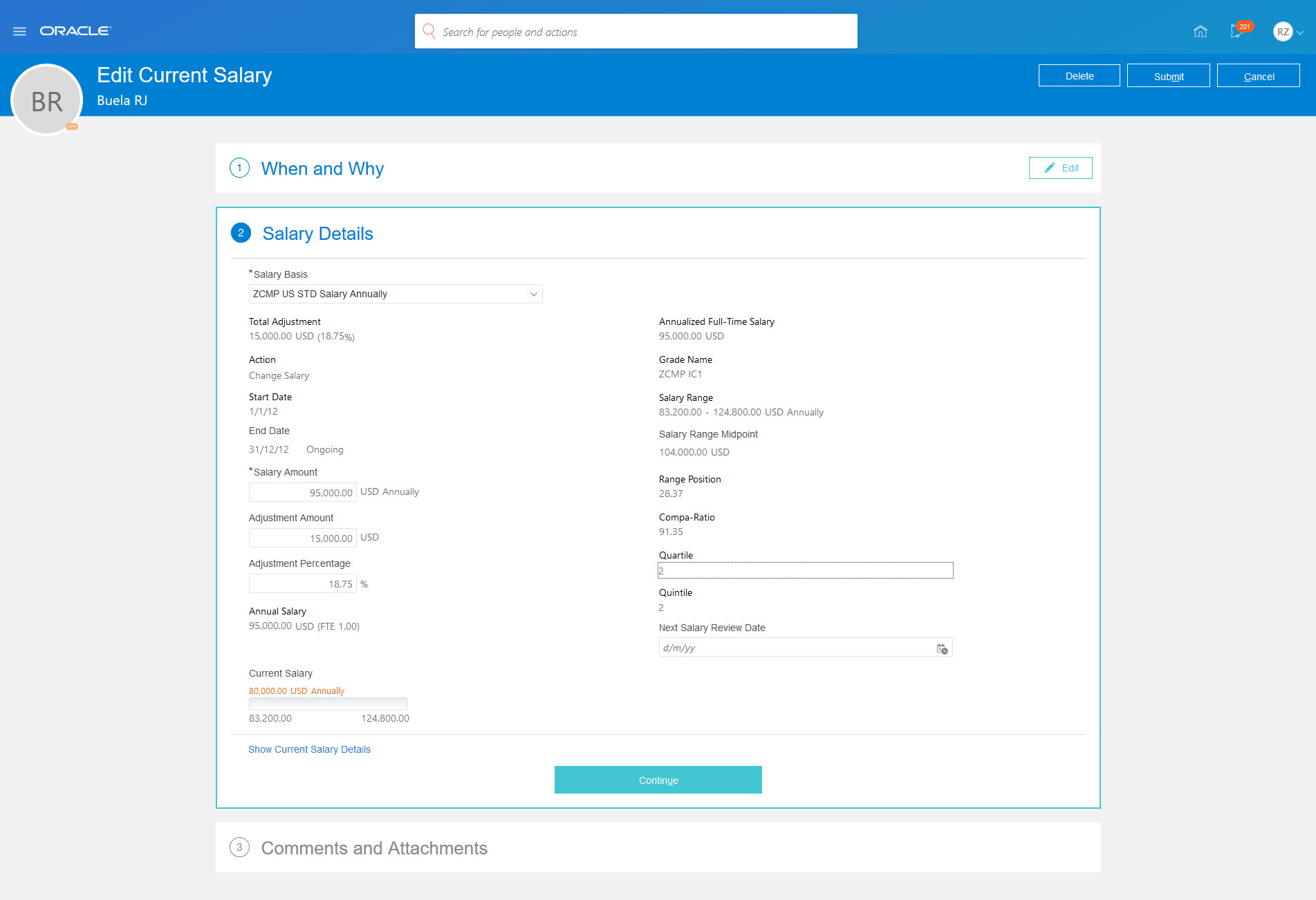

Use the Responsive Edit Current Salary Page to Change the Current Salary and Submit the Changes

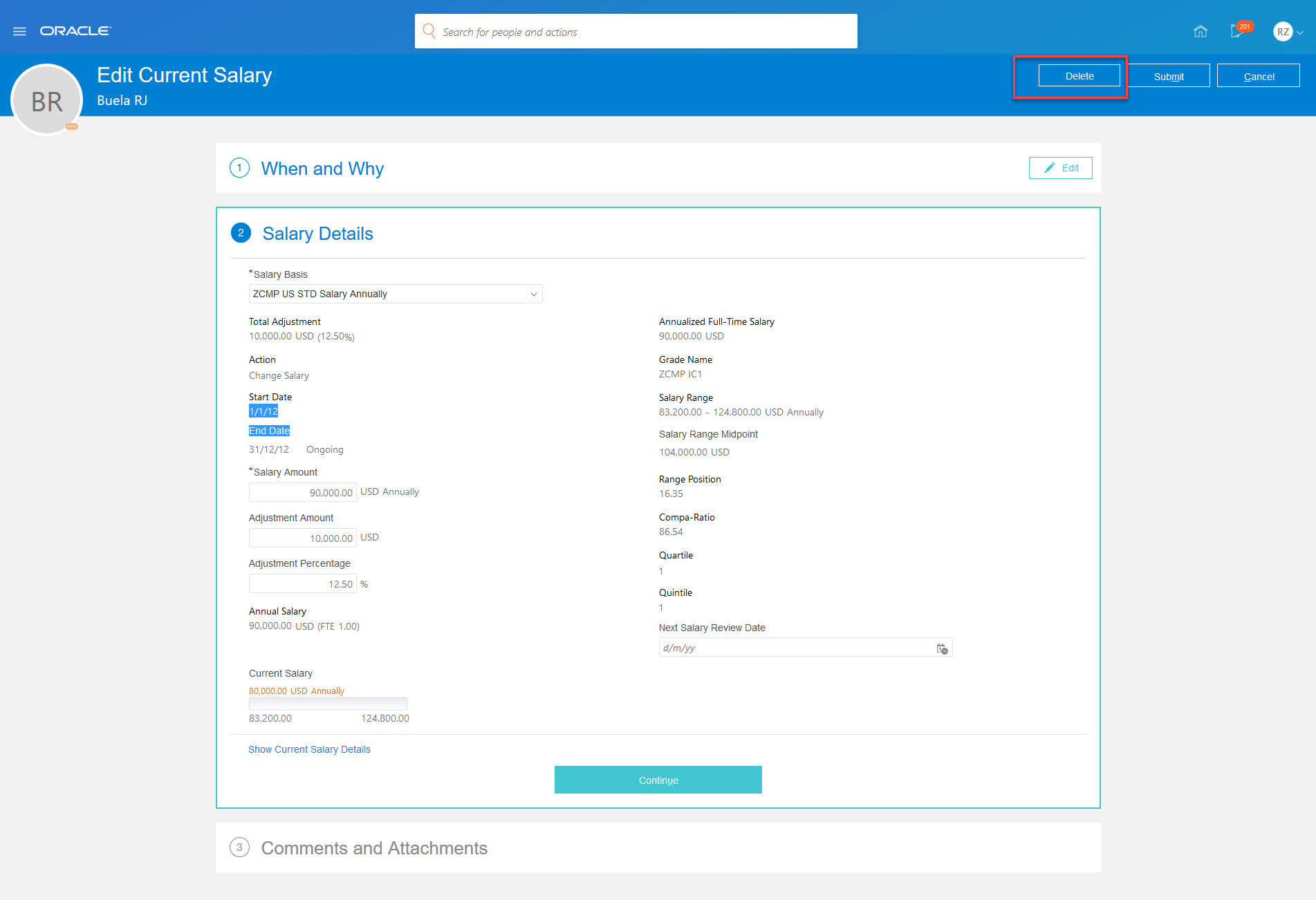

Use the Responsive Edit Current Salary Page to Delete the Current Salary

On the Compensation Spotlight Page, Show Prior Salaries and Click the One You Want to Change

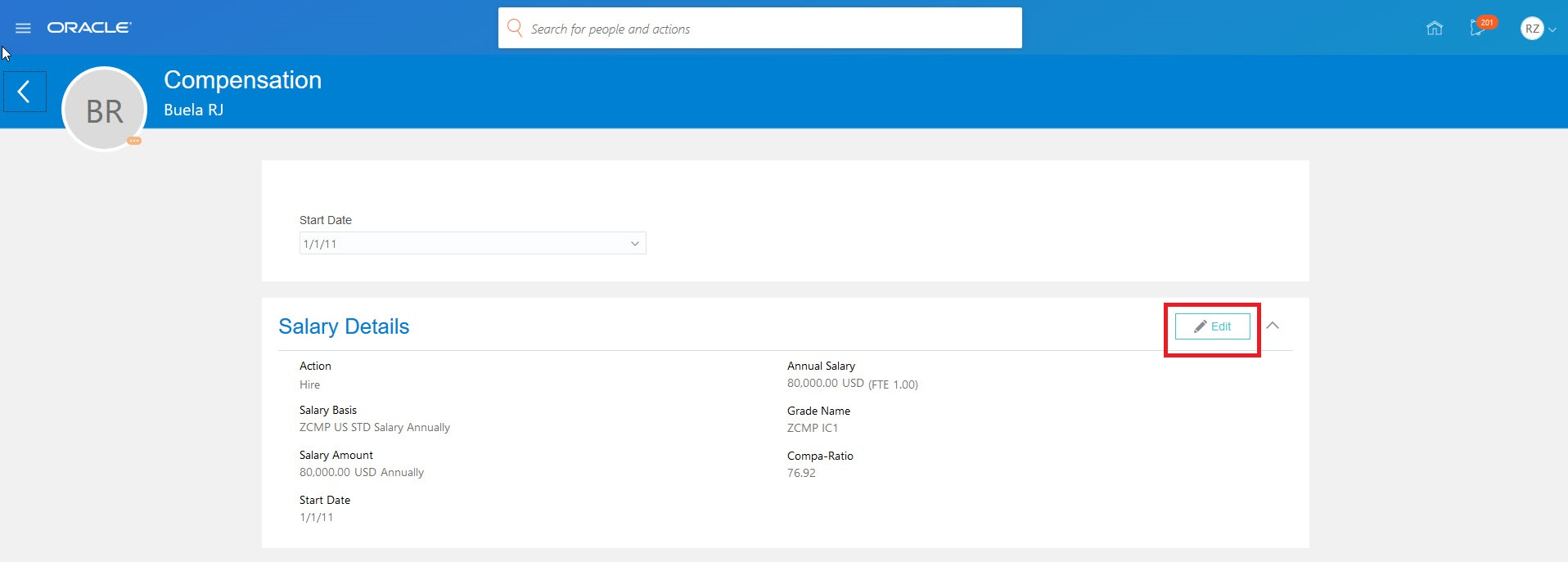

Make Changes to the Prior Salary in the Salary Details Section

Steps to Enable

In order to enable the new salary pages, you must enable the following profile option and have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information (Document 2399671.1).

| Field | Value |

|---|---|

| Profile Option Code | CMP_COMPENSATION_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

As a one-time action, you need to regenerate grants for all of your power user roles using the Regenerate Grants process. You can find more details on how to regenerate grants in cloud documentation.

Tips And Considerations

Power users can continue to open classic salary pages in the Person Management and Compensation work areas.

Editing and deleting salary records:

- Only power users can edit any salary record and delete the latest salary record. Line manager aren't considered power users, so they won't see the Edit or Delete buttons on salary records.

- If a user is both a line manager and a compensation manager for the employee, then the Edit button is visible even when the user opens responsive salary pages from My Team. But, approval process will initialize based on whether they opened the salary record on the My Team or My Client Group tab.

Security:

- If you created custom compensation manager, HR specialist, or compensation analyst type roles and you enabled responsive pages, then you also need to add the new aggregate privileges to these custom roles so that they can use all relevant functionality.

Approvals:

- When the user initiates a salary change, or edits or deletes a salary record on the My Client Group tab, the module identifier is initialized as Administer Salary and the approval rules defined for that module are applied. This behavior enables you to set approval rules specific to this module, such as Auto Approve.

- Using the module identifier, you can continue to identify whether the transaction is initiated from responsive pages on either the My Team or My Client Groups tab.

For information on configuring quick actions, refer to the Configure Quick Actions on Me, My Team, and My Client Groups feature in the What's New for release 18C.

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1 )

For more information on personalizing pages, refer to the following:

- Chapter 3, Page Modification in the Oracle Applications Cloud: Configuring and Extending Applications guide.

- The Developer Relations Page Composer Oracle YouTube channel.

For more information on comparing classic and responsive features, refer to the following document on My Oracle Support:

- Comparing Classic and Responsive Features in Oracle Fusion Compensation (Document ID 2504450.1)

Enhanced Employee Compensation Spotlight with Recurring and One-Time Payments

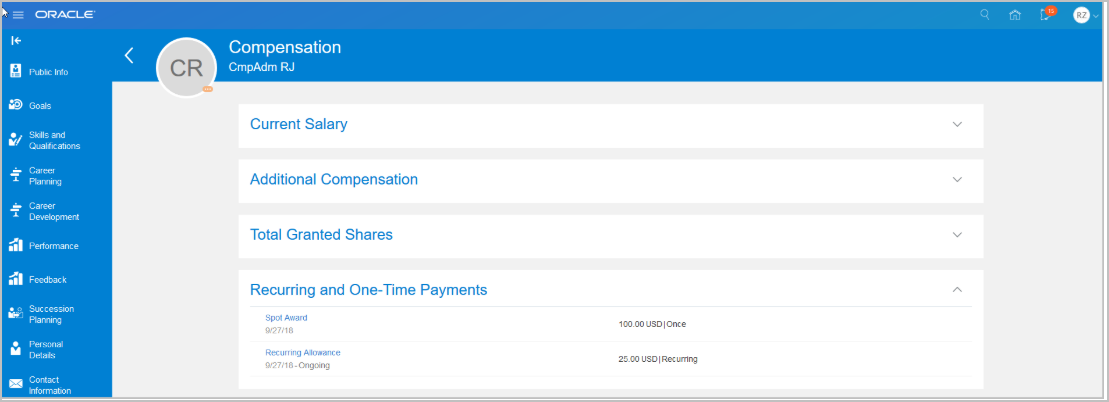

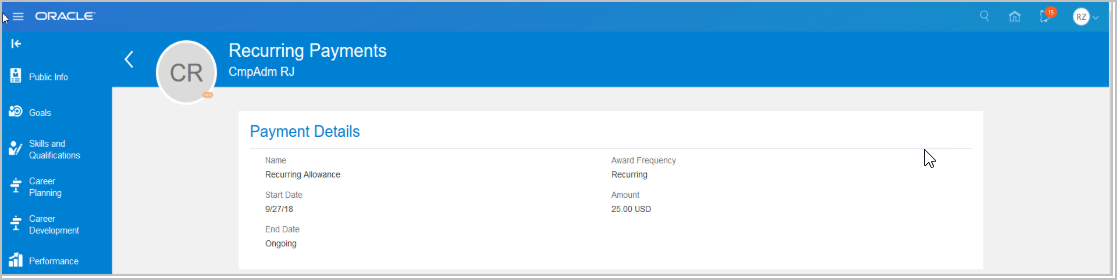

Employees viewing their compensation details can now also easily review recurring and one-time payments, because they are grouped in their own section. This section displays the employee's entries for elements configured to show on the Manage Compensation History page, but not linked to any individual compensation plan. Employees can click a payment name to view the element entry values.

Recurring and One-Time Payments Section

Drill Down Details

Steps to Enable

In order to enable the new compensation pages, you must enable the following profile option and have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information (Document 2399671.1).

| Field | Value |

|---|---|

| Profile Option Code | CMP_COMPENSATION_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

The Recurring and One-Time Payments section can be made visible or hidden, using HCM Experience Design Studio or Page Composer.

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1)

For more information on personalizing pages, refer to the following:

- Chapter 3, Page Modification in the Oracle Applications Cloud: Configuring and Extending Applications guide.

- The Developer Relations Page Composer Oracle YouTube channel.

Responsive Compensation Spotlight Pages for Power Users

Power users, such as compensation managers and HR specialists, can now view an employee's compensation information on the responsive compensation spotlight page. To view the details, use the Compensation Info quick action.

Compensation Info Quick Action in My Client Groups

Search for and Click the Employee

Responsive Compensation Spotlight Page Shows Current Salary Info as Well as Additional Compensation, Shares, and Payments

Steps to Enable

In order to enable the new compensation pages, you must enable the following profile option and have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information (Document 2399671.1).

| Field | Value |

|---|---|

| Profile Option Code | CMP_COMPENSATION_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1 )

For more information on personalizing pages, refer to the following:

- Chapter 3, Page Modification in the Oracle Applications Cloud: Configuring and Extending Applications guide.

- The Developer Relations Page Composer Oracle YouTube channel.

For more information on comparing classic and responsive features, refer to the following document on My Oracle Support:

- Comparing Classic and Responsive Features in Oracle Fusion Compensation (Document ID 2504450.1)

For information on configuring quick actions, refer to the R18C Configure Quick Actions on Me, My Team, and My Client Groups What’s New feature.

Role Information

The View Compensation Details for Worker aggregate privilege is now granted out-of-the-box to compensation administrators, compensation managers, compensation analysts, and HR specialists. As a one-time action, you need to regenerate grants for all of your power user roles using the Regenerate Grants process. You can find more details on how to regenerate grants in cloud documentation.

| Existing Aggregate Privilege Name |

Details |

|---|---|

| View Compensation Details for Worker |

Contains all functional and data security privileges required to access the Compensation spotlight page. This privilege is now granted out-of-the-box to compensation administrators, compensation managers, compensation analysts, and HR specialists. |

If you have custom roles set up for power users, such as HR specialists and compensation managers, you need to grant the aggregate privilege to those roles when you start using responsive compensation pages.

Responsive Individual Compensation Pages for Power Users

Power users, such as compensation managers and HR specialists, can now use manage individual compensation using responsive pages. Open these pages on the My Client Groups tab using the Manage Compensation and Administer Compensation quick actions.

Administer Compensation and Manage Compensation Quick Actions in My Client Groups

Administer Compensation Page, When Section Where You Specify When the Award Starts. You Can Use It View and Make Changes in the Past Too.

Steps to Enable

In order to enable the new Personal Information pages, you must enable the following profile option and have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information (Document 2399671.1).

| Field | Value |

|---|---|

| Profile Option Code | CMP_COMPENSATION_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

Tips And Considerations

- Open classic individual compensation pages in the Person Management or Compensation work areas.

- Use the responsive Manage Compensation page to manage individual compensation awards with a plan access of All actions or Manage Individual Compensation action.

- Use the Administer Compensation page to manage individual compensation awards with a plan access of All actions or Administer Individual Compensation action.

- Enable the When section for either or both of these actions using HCM Experience Design Studio. Enabling this section lets power users set the effective date of the transaction and manage past individual compensation awards.

- For information on configuring quick actions, refer the R18C Configure Quick Actions on Me, My Team, and My Client Groups feature in the What's New for release 18C.

Individual Compensation Plan Setup and Effect Illustration

-

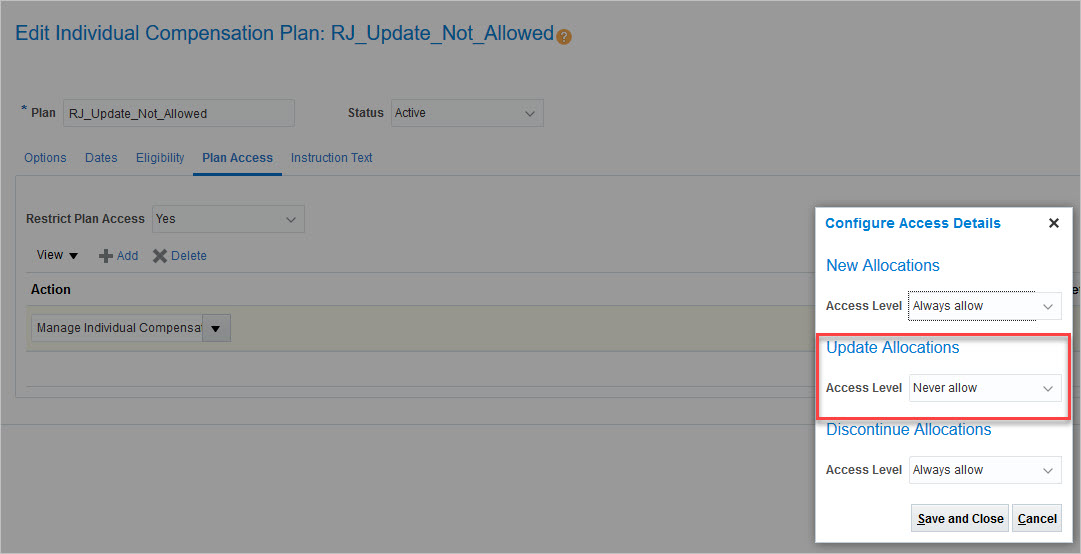

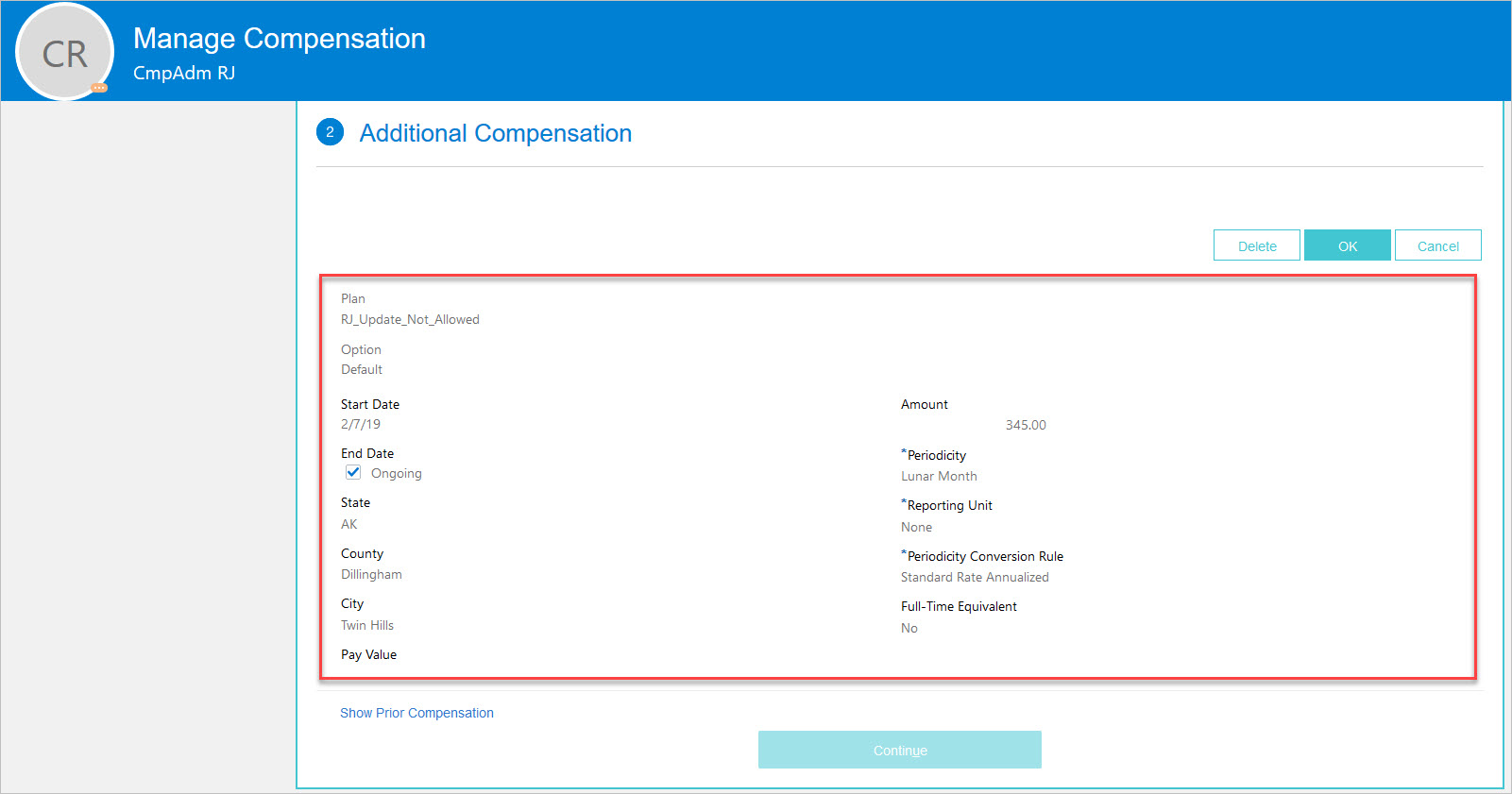

Scenario 1: Update Not Allowed

Setup: Update Not Allowed

Row Becomes Read-Only

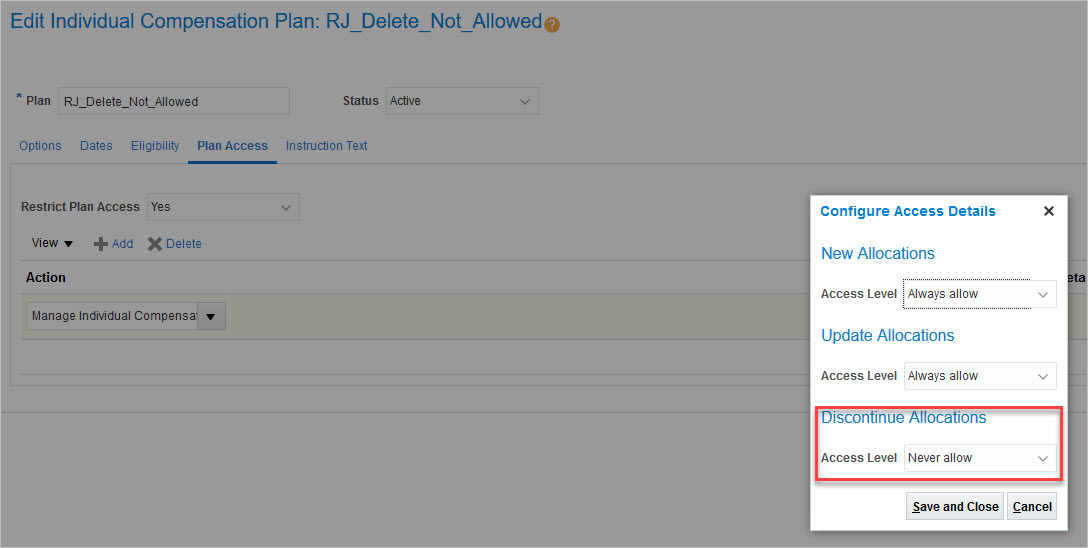

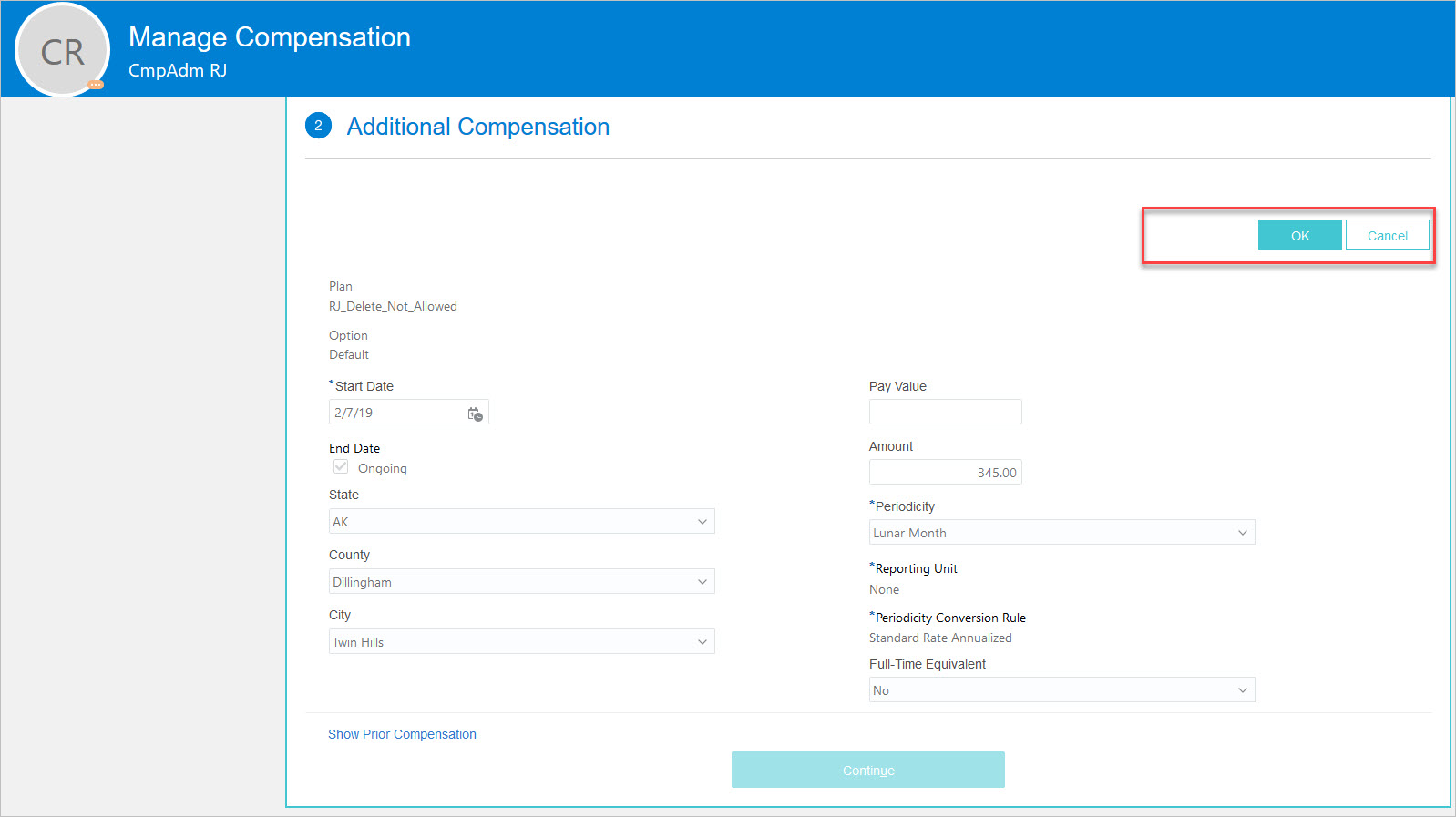

- Scenario 2: Delete Not Allowed

Setup: Delete Not Allowed

Delete Button Is Not Available

- Scenario 3: Add Not Allowed

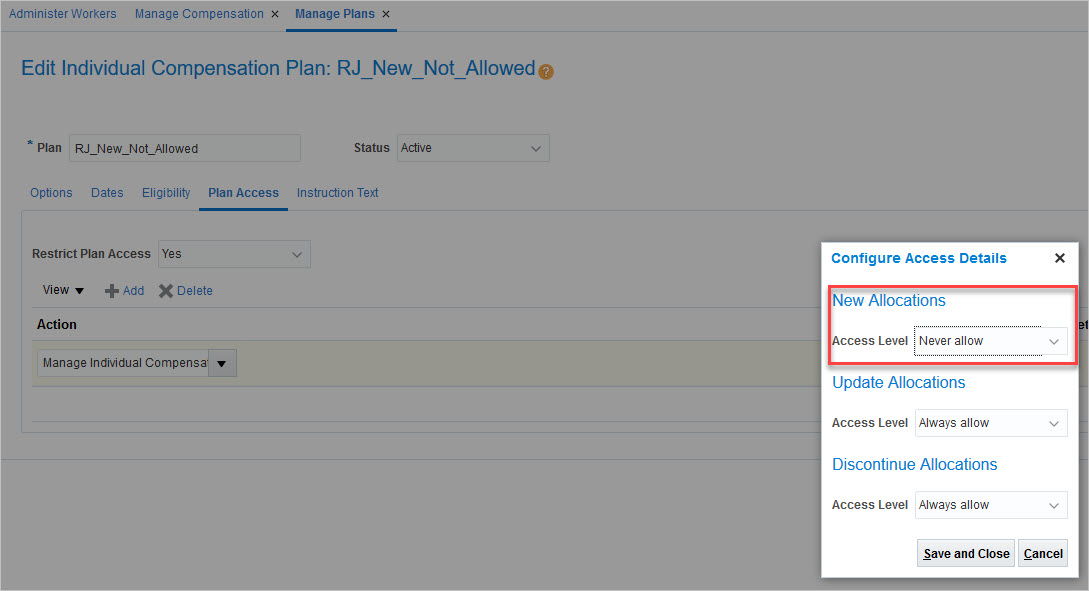

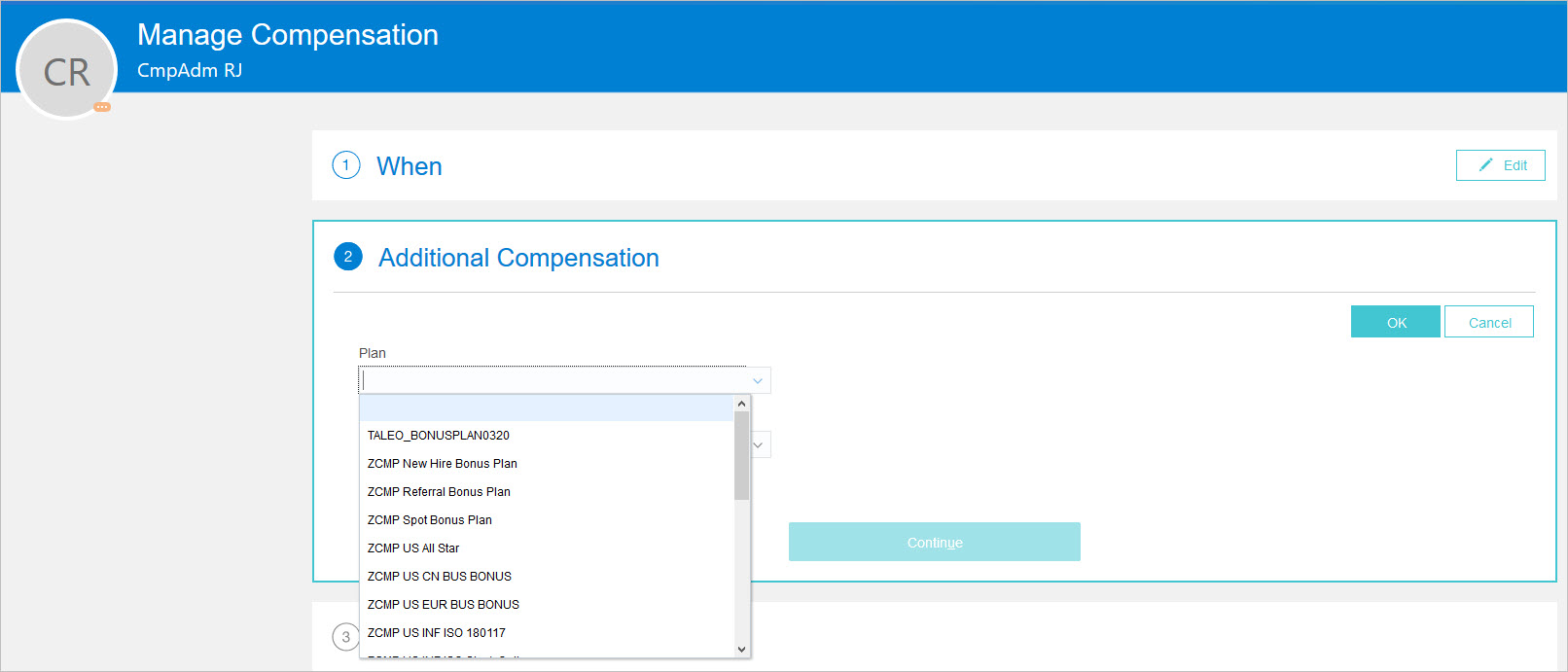

Setup: New Not Allowed

Plan Not Displayed

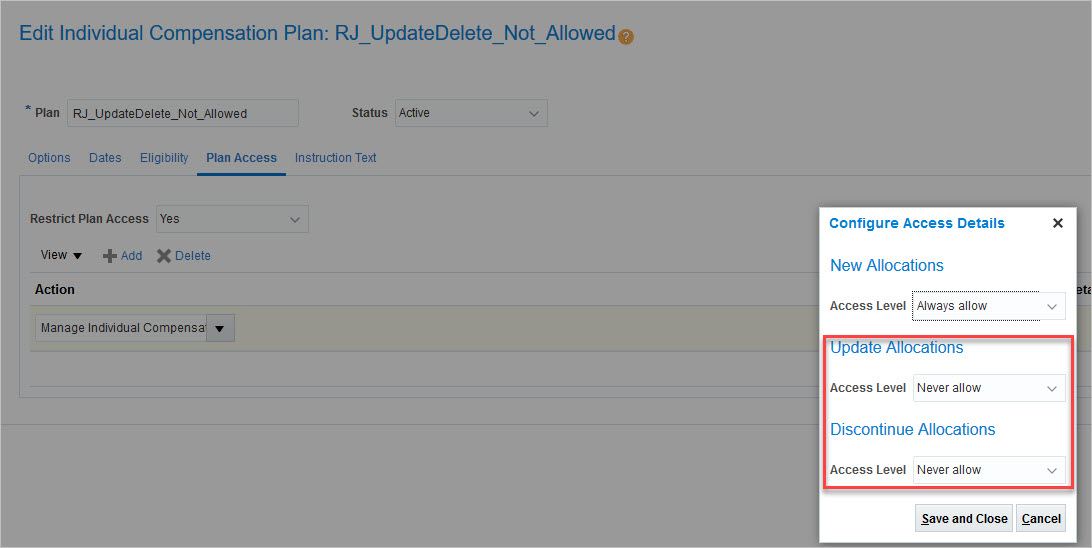

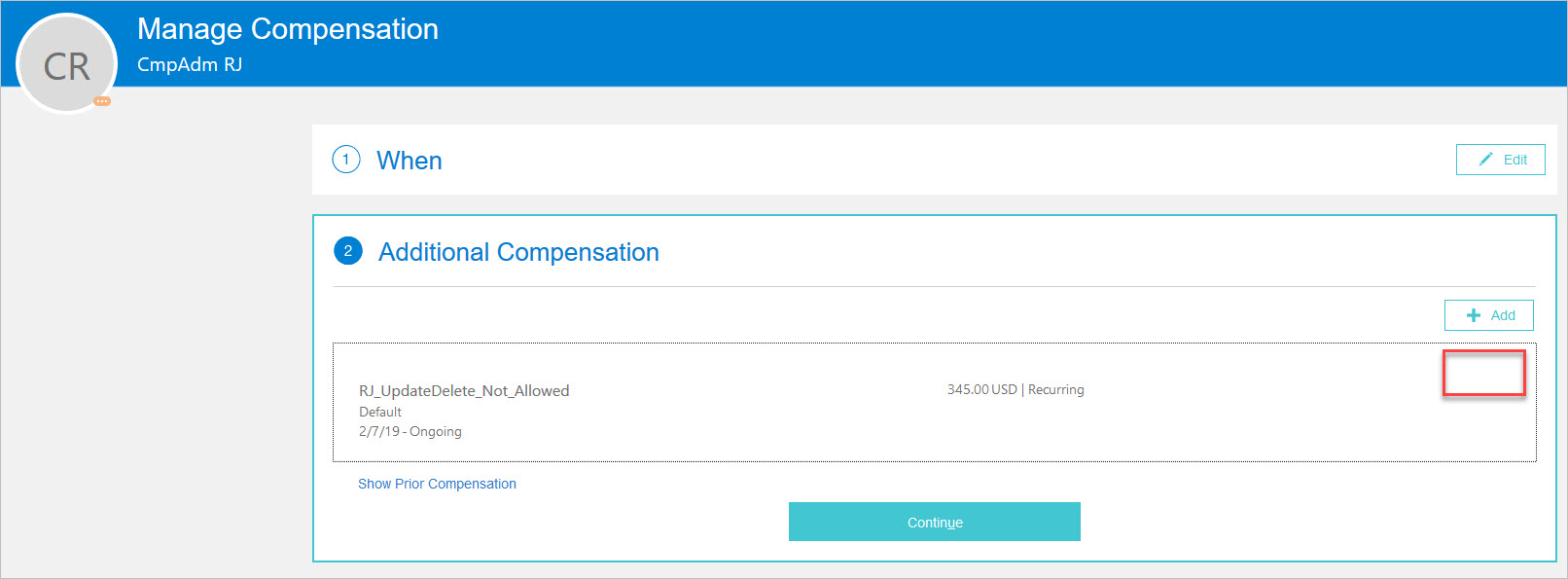

Scenario 4: Update and Delete Not Allowed

Setup: Update and Delete Not Allowed

Edit Button Is Not Available

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1)

For more information on personalizing pages, refer to the following:

- Chapter 3, Page Modification in the Oracle Applications Cloud: Configuring and Extending Applications guide.

- The Developer Relations Page Composer Oracle YouTube channel.

For information on comparing classic and responsive features refer to the following document on My Oracle Support:

- Comparing Classic and Responsive Features in Oracle Fusion Compensation (Document ID 2504450.1)

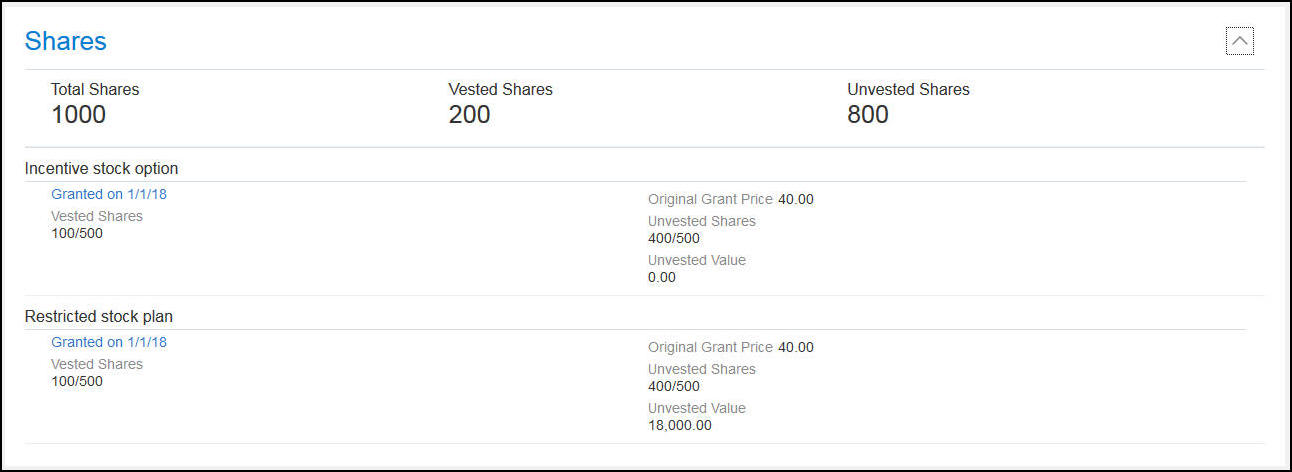

Spotlight - Enhance Shares Section Includes Estimated Values

Employees can now view shares and estimated values of shares on the enhanced Compensation Spotlight page. The responsive user experience pages display the frequently used fields by default and hide the less frequently used fields. If there are hidden fields your company wants to display, you can personalize the responsive pages.

The Compensation Spotlight page displays shares information from Manage Stock Grants.

| Attribute | Displayed | Note |

|---|---|---|

| Total Shares | Yes | |

| Vested Shares | Yes | |

| Unvested Shares | Yes | |

| Granted | Yes | |

| Original Grant Price | Yes | |

| Estimated Stock Price | No | This field is hidden out-of-the-box. |

| Estimated Value of Vested Shares | No | This field is hidden out-of-the-box. |

| Estimated Value of Unvested Shares | No | This field is hidden out-of-the-box. |

| Unvested Value | Yes |

Illustration of Shares Out-of-the-Box

Estimated Fields Unhidden

Steps to Enable

In order to enable the new compensation pages, you must enable the following profile option and have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see following white paper: HCM Responsive User Experience Setup Information (Document 2399671.1).

| Field | Value |

|---|---|

| Profile Option Code | CMP_COMPENSATION_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1)

For more information on personalizing pages, refer to the following:

- Chapter 3, Page Modification in the Oracle Applications Cloud: Configuring and Extending Applications guide.

- The Developer Relations Page Composer Oracle YouTube channel.

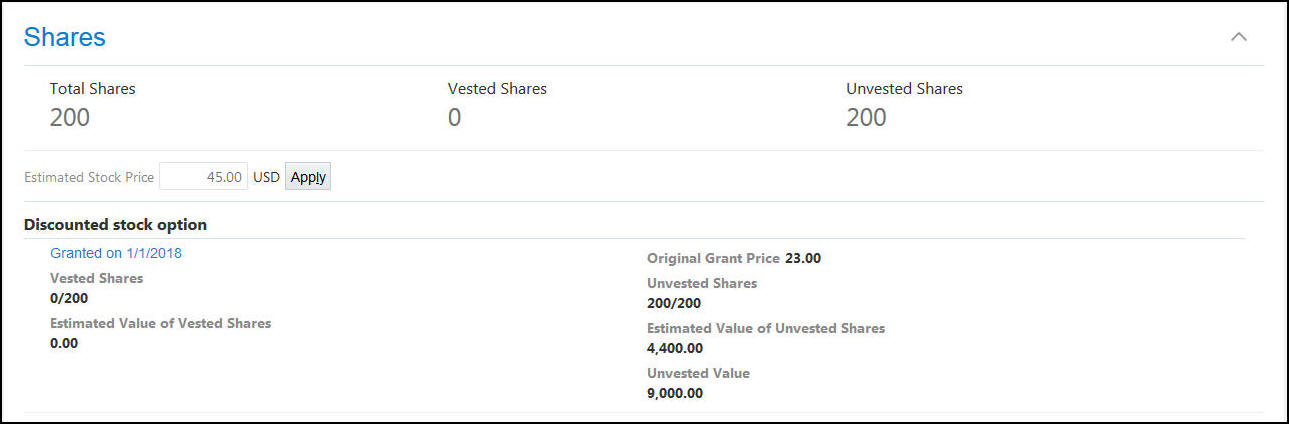

Deep Links for Responsive Compensation Pages

You can now use deep links to open responsive pages, such as Change Salary and Manage Compensation, directly from external sites.

| Deep Link |

Details |

|---|---|

| HR_PERSON_SPOTLIGHT_CMP |

Compensation Info for HR User |

| MGR_PERSON_SPOTLIGHT_CMP |

Compensation Info for Line Manager |

| PERSON_SPOTLIGHT_CMP |

My Compensation |

| HR_CHANGE_SALARY |

Change Salary for HR User |

| MGR_CHANGE_SALARY |

Change Salary for Line Manager |

| ADMINISTER_COMPENSATION |

Administer Compensation |

| MANAGE_COMPENSATION |

Manage Compensation |

| NFX_MANAGE_MY_PER_CONTRIBUTION |

Manage Personal Contributions |

Deep Link for Managing Personal Contributions

Steps to Enable

To access deep links:

- Open the main menu.

- Go to Tools > Deep links.

- Copy the URL for a deep link.

- Paste the URL into the desired location.

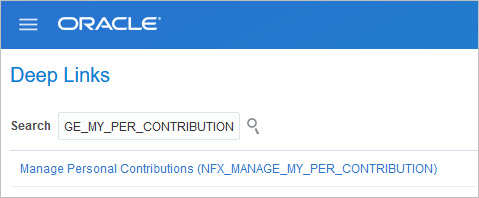

Design Studio Support for Responsive Compensation Pages

You can now use Design Studio to configure responsive pages, such as Change Salary and Manage Compensation.

These are the supported Compensation actions in the Design Studio:

- Manage Personal Contribution

- My Compensation

- Change Salary

- Compensation Info

- Manage Individual Compensation

- Administer Individual Compensation

Manage Compensation Action in the Design Studio

Steps to Enable

To access the HCM Experience Design Studio:

- Activate a sandbox.

- Navigate to the My Client Groups tab.

- Click Show More to open the quick actions.

- Select HCM Experience Design Studio in the Employment group.

- Under your Settings and Actions, select Edit Pages.

- Select Site layer and click OK.

- Click Continue.

See the Enhanced HCM Experience Design Studio to Simplify Page Configurations What's New feature in 19A for more information on how to configure pages.

Key Resources

For more information on the Transaction Design Studio, refer to My Oracle Support for the following document:

-

Transaction Design Studio – What It Is and How It Works (Document ID 2504404.1)

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Enhanced Security for SmartNav and Actions Menus on HR and Payroll Person Search

The privileges that secure tasks on SmartNav and Actions Menus on HR and Payroll Person Search have changed. The following tasks are affected:

- Adjust Individual Balances

- Manage Costing for Persons

- Manage Element Entries

- Manage Calculation Cards

- Manage Payroll Relationships

- View Process Results

- Calculate QuickPay

- View Payment Results

The same privileges now secure the Quick Actions and the SmartNav and Actions Menus on HR and Payroll Person Search tasks.

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role Information section below.

Tips And Considerations

NOTE: If you are using the predefined Payroll Administrator and Payroll Manager job roles and are not seeing the tasks within SmartNav, and HR and Payroll Search Actions Menus, regenerate the data roles for these job roles.

Key Resources

For instructions on implementing new features in existing roles, refer to My Oracle Support for the following document:

-

Upgrade Guide for Oracle HCM Cloud Applications Security (Document ID 2023523.1)

Role Information

The following table shows the aggregate privileges that secure the payroll tasks within SmartNav, and HR and Payroll Search Actions Menus, and the predefined roles that inherit them:

| SmartNav Task, HR Search Task, Payroll Search Task |

Aggregate Privilege |

Job Role |

|---|---|---|

| Adjust Individual Balances |

Adjust Individual Payroll Balance ORA_PAY_PAYROLL_PERSON_LEVEL_ADMINISTRATION_DUTY |

Payroll Administrator Payroll Manager |

| Manage Costing for Persons |

Manage Costing for a Person ORA_PAY_PERSON_COSTING_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Element Entries |

Manage Payroll Element Entry ORA_PAY_ELEMENT_ENTRY_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Calculation Cards |

Manage Payroll Calculation Cards ORA_PAY_PERSONAL_DEDUCTION_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| Manage Payroll Relationships |

Manage Payroll Relationship ORA_PAY_PERSONAL_PAYROLL_RELATIONSHIP_MANAGEMENT_DUTY |

Payroll Administrator Payroll Manager |

| View Process Results |

View Person Process Results ORA_PAY_VIEW_PERSON_PROCESS_RESULTS_DUTY |

Payroll Administrator Payroll Manager |

| Calculate QuickPay |

Calculate QuickPay ORA_PAY_CALCULATE_QUICKPAY_DUTY |

Payroll Administrator Payroll Manager |

| View Payment Results |

Manage Payroll Payment Results ORA_PAY_MANAGE_PAYROLL_PAYMENTS_RESULTS_DUTY |

Payroll Administrator Payroll Manager |

NOTE: The aggregate privileges that secure these tasks were first delivered in 18C. If you are using the predefined roles, no action is necessary. However, if you are using custom versions of these roles, you must ensure that your custom job roles have the aggregate privileges that secure the tasks that your custom roles need to access within SmartNav, and HR and Payroll Search Actions Menus.

Prorate Elements Entries Based on Compensation Salary Changes

You can track event changes to an employee’s payroll record by enabling the SalaryEO object to capture salary events for retropay and proration purposes. These salary events being captured are then used to calculate retropay and proration:

- Create/ Insert of salary record

- Update of salary record

- End salary record

- Remove end date from salary record

- Delete salary records

Steps to Enable

Standard proration element entry configuration.

Key Resources

For more information, see the following topics in Applications Help:

- Setting Up Element Proration: Procedure

- Retroactive Pay: How It Is Calculated

- Creating Conversion Formulas for Proration: Procedure