- Revision History

- Overview

- Feature Summary

- Benefits

- Payroll

-

- Payroll for Canada

- Payroll for the United Kingdom

-

- Employer Class 1A NICs for Termination Payments

- Off-Payroll Worker

- P11D End of Year Expenses and Benefits Statements

- P60 End of Year Certificate for Tax Year 2019-2020

- Payrolling of Benefits for Tax Year 2020-2021

- Real-Time Information: Full Payment Submission for Tax Year 2020-2021

- Real Time Information - Employer Payment Summary for Tax Year 2020-2021

- Real Time Information - Full Payment Submission Supports Earlier Year Updates

- Reporting Enhancements: Tax Year to Date Reconciliation Report

- P46 (Car)

-

- Revision History

- Overview

- Feature Summary

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

-

- Preview Salary, Individual Compensation Approval Information in the Worklist

- Visibility of Comments and Attachment Section in Change Salary Flow

- View Individual Compensation Plan Details from Compensation Spotlight

- Dynamic Subject Includes the Action Used to Submit Individual Compensation

- Configure Global Compensation Settings Added to Base Pay Task List

- Validate Progression Grade Ladder During Setup

- Stock Grants

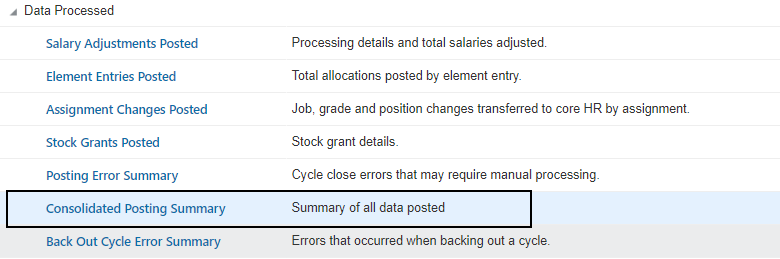

- View Consolidated Posting Data

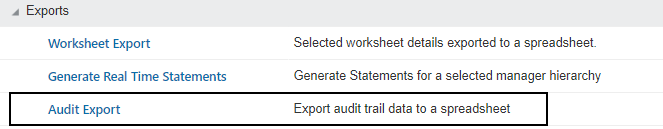

- Access Audit Trail Data in View Administration Reports

- Validate Plan Setup Moved to a Drill-Down Page

- View Budget Changes in the Audit Log When Workers Are Reassigned

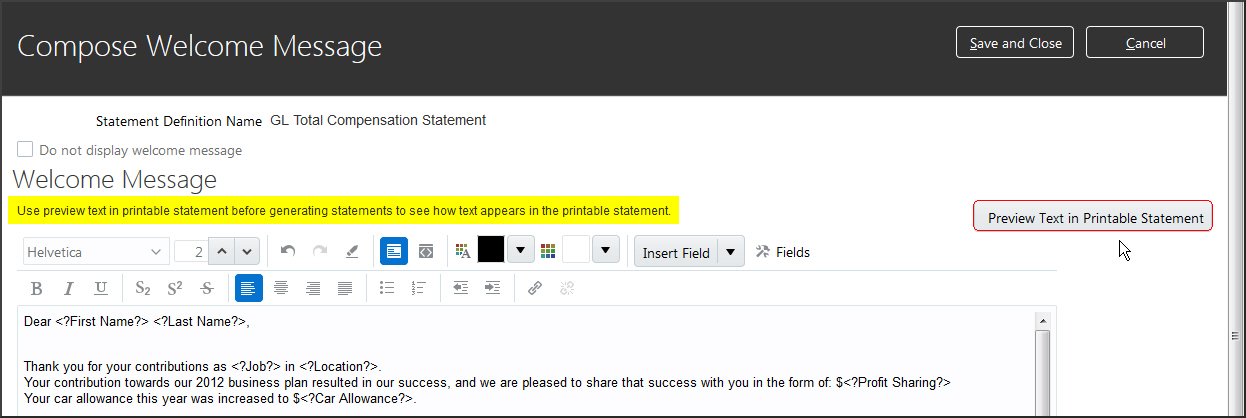

- Total Compensation Statements Preview Welcome Message

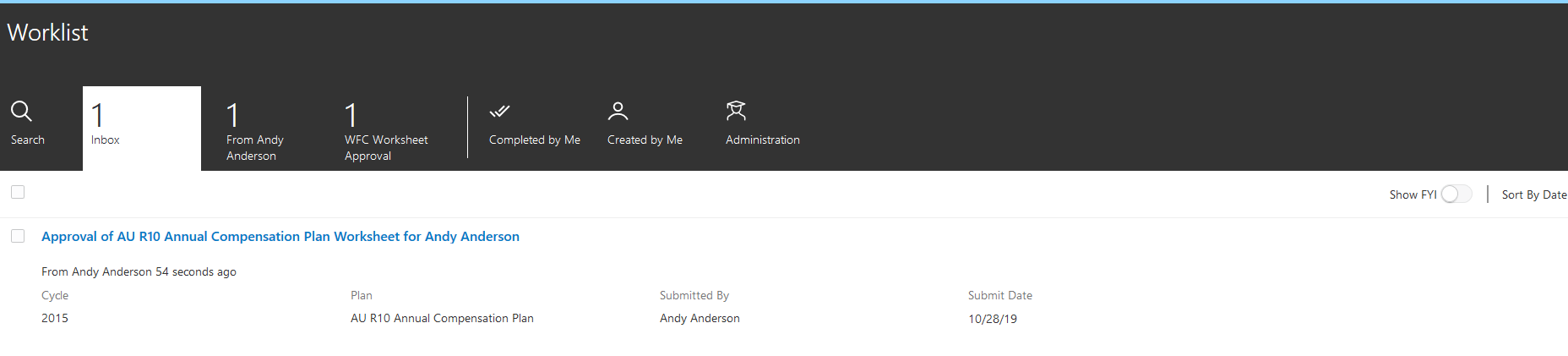

- Preview Worksheet Approval Information in the Worklist

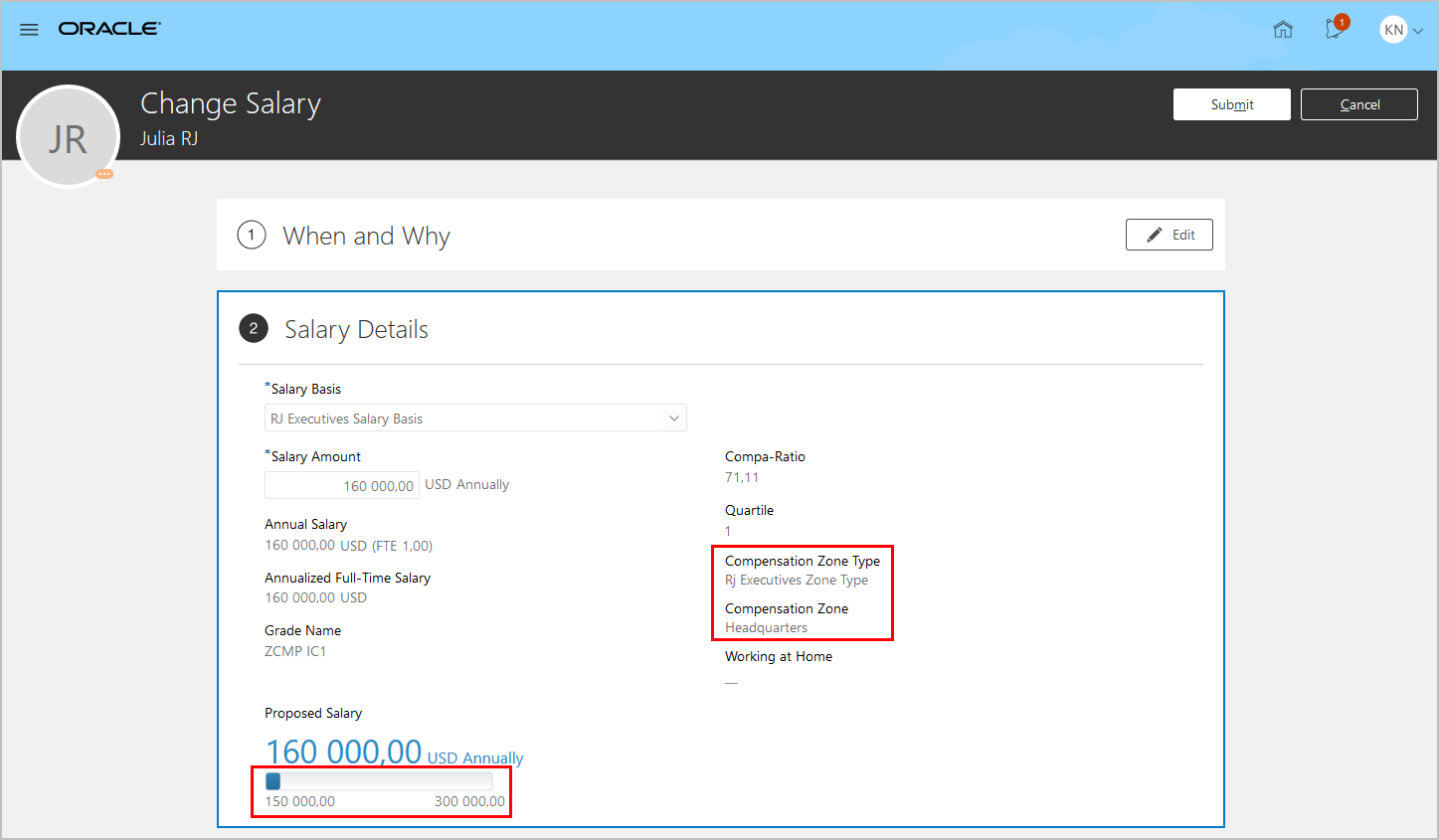

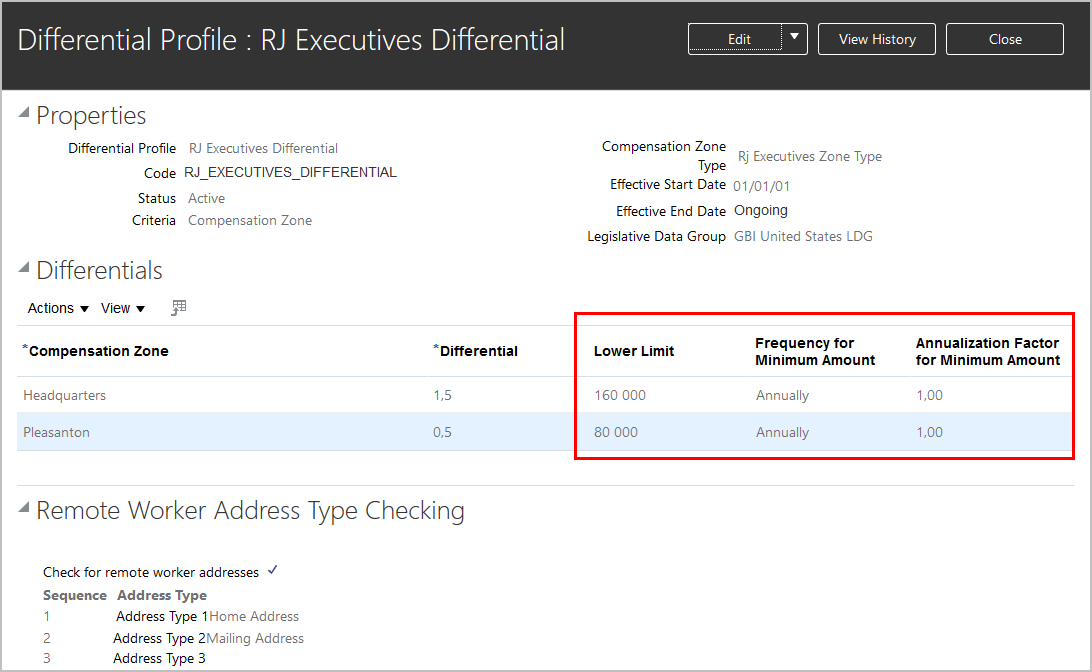

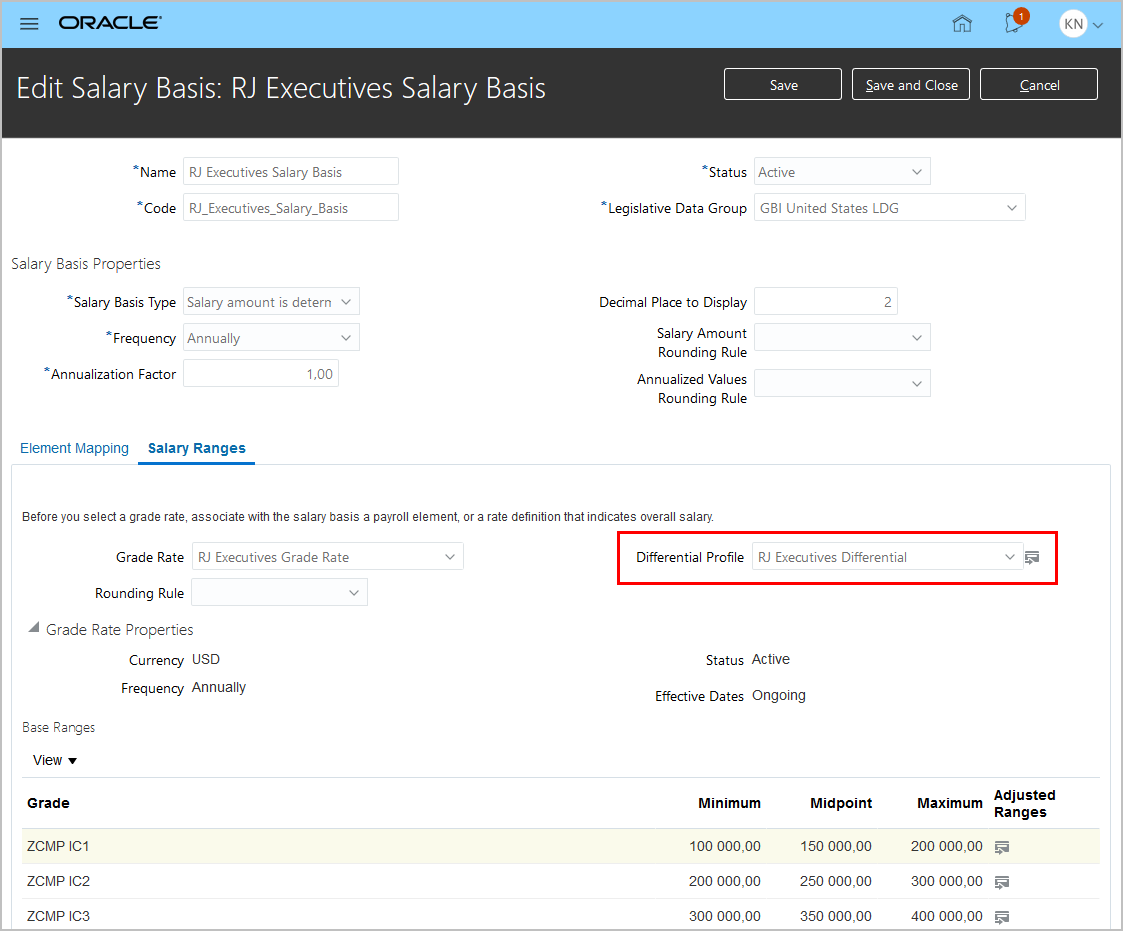

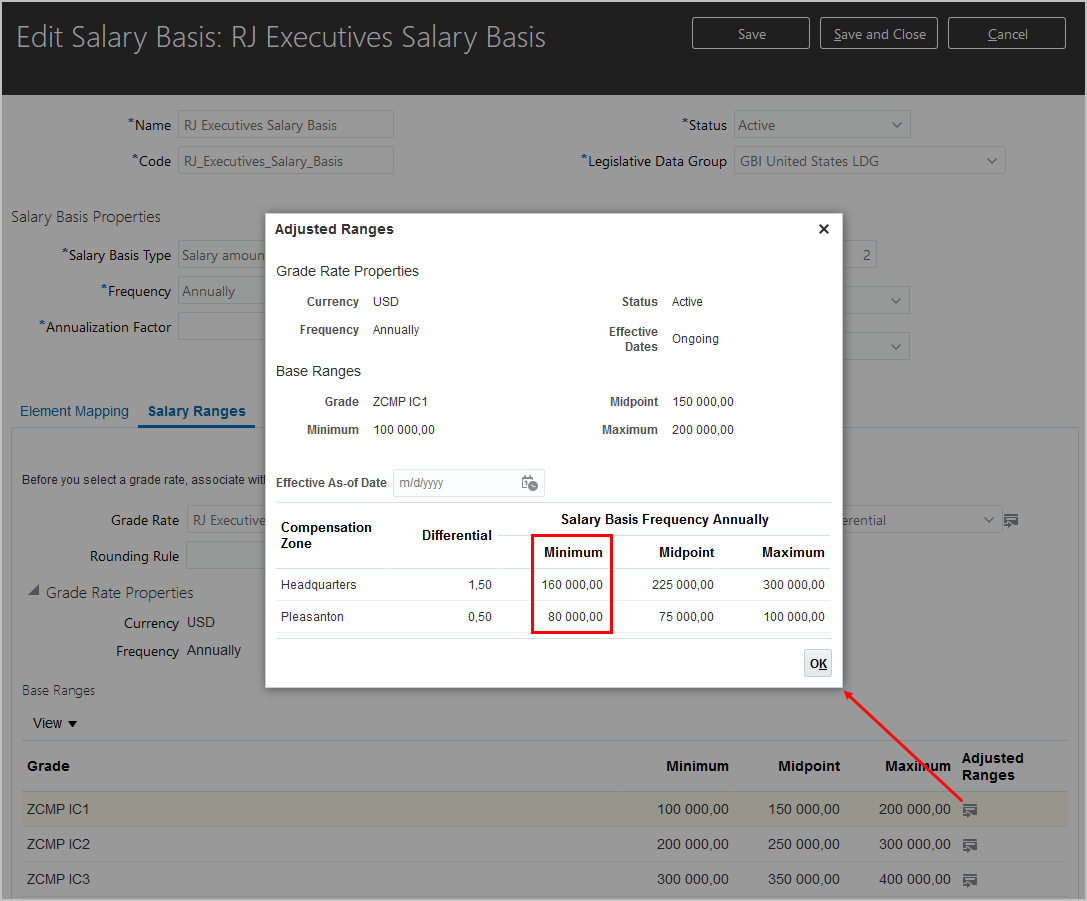

- Salary Range Differentials and Compensation Zones

- Compensation Replaced or Removed Features

-

- Compensation

- Payroll

- HR Optimizations

- IMPORTANT Actions and Considerations

March Maintenance Pack for 20A

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 28 FEB 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

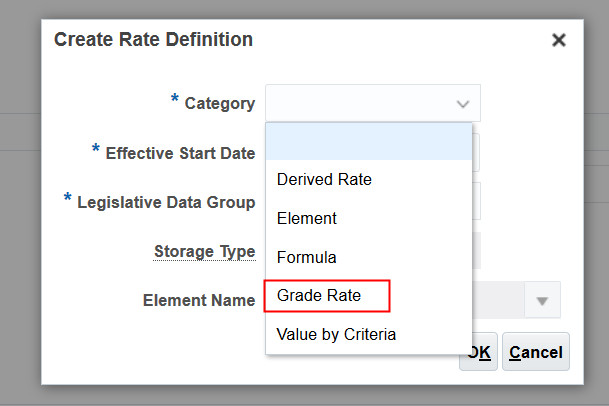

Rate Definition Support for Grades

You can calculate rates based on employee’s grade details. For example, you can calculate the annual salary rate based on the grade ladder, grade, and grade step information defined for an employee. When you define a rate definition, you can select a grade rate as a basis for the rate calculation and specify the employment level.

The default employment level is Payroll Assignment. The application retrieves the grade ladder details based on assigned grade that is held on an employee’s assignment record.

In your rate definition, you add a rate contributor of type Grade Ladder.

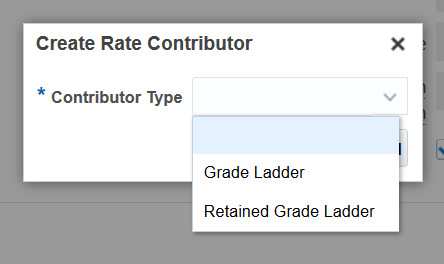

Calculate Rates Based On Grades

Follow these steps to calculate rates based on grades.

-

Set up grades, grade ladder, and rates for the given job to record the level of compensation for the employees.

-

Create a rate definition based on grade details. Add a rate contributor of type Grade Ladder.

-

Hire the employee and provide the required grade and step details.

-

Run the Generate HCM Rates process to calculate the rates based on the information held in the grade tables. Alternatively, view the calculated rate on the salary page.

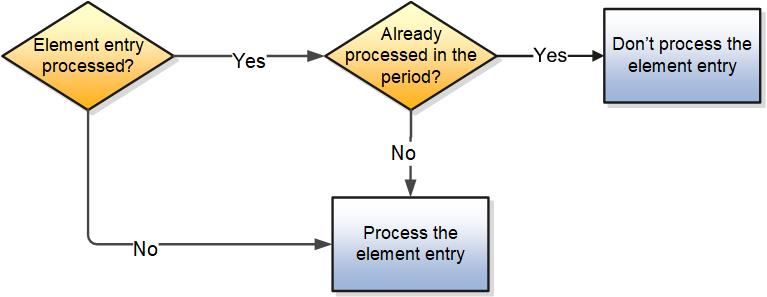

This flowchart describes the overall steps to calculate rates based on grade details.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information on how to calculate rates based on grade details, refer to Chapter 10 in the Implementing Payroll for Global guide.

February Maintenance Pack for 20A

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 27 MAR 2020 | Payroll for the UK: Enhancement to HMRC Automated File Upload |

Updated document. Removed feature from February Maintenance Pack for 20A. |

| 31 JAN 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness oracle.com/readiness under Human Capital Management or via the Oracle Help Center at: docs.oracle.com under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Real-Time Information: Full Payment Submission for Tax Year 2020-2021 |

||||||

Real Time Information - Employer Payment Summary for Tax Year 2020-2021 |

||||||

Real Time Information - Full Payment Submission Supports Earlier Year Updates |

||||||

Reporting Enhancements: Tax Year to Date Reconciliation Report |

||||||

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

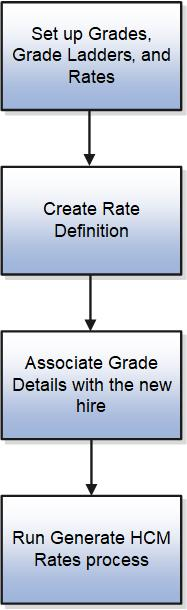

Enhanced Export and Import of Plan Configuration

Enhanced Export and Import of Plan Configuration

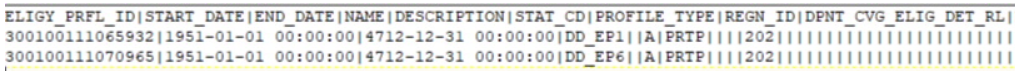

We have enhanced the functionality that lets you export and import programs, plans, and eligibility profiles. The functional and architectural changes introduced in this enhancement offer critical advantages in terms of migrating updated configurations across environments including date effective updates, error handling, and validations.

With this enhancement, you spend less time in setting up benefit configurations in new environments. The user interface remains the same as in earlier releases.

Illustration of the import and export process

The user interface for the import and export functionality in the application remain the same. You continue to access these tasks from both the Plan Configuration work area and the Setup and Maintenance work area.

IMPORTANT: You can switch back and forth with the new and the old version by turning off the lookup as detailed in the Steps to Enable section. However, we recommend that you turn on this new enhancement soon and experience the advantages that it offers over the existing version. The old functionality will be removed soon in a subsequent release.

How Does This Enhancement Compare with What Exists Currently

Here’s how the export and import features in the existing version compare with the enhanced version.

| Aspect | Existing Version | Enhanced Version |

|---|---|---|

| Migration of plan configuration updates to the destination environment during import | No | Yes |

| Migrate all historical data in program and plan configuration | No | Yes |

| File format of the export file | DAT | XML |

| Comparison of each row from source and target after the import | No | Yes |

| Improved and friendlier error reporting | No | Yes |

| Creation of plan configuration objects during import, where required | Yes | Yes |

| Export of all plan design objects in program and plan hierarchy | Yes | Yes |

| Ability to pick and choose plan configuration data to export | Yes | Yes |

| Ability to add prefix and suffix to named objects during import | Yes | Yes |

| Reuse of objects in destination environment during import | Yes | Yes |

| Mapping of source plan configuration objects to objects in destination environment during import | Yes | Yes |

| Review of object transactions after import? | Yes | Yes |

| Prerequisites, such as HR, Payroll, and Absence data needed in place prior to import | Yes | Yes |

| Support for MLS objects | Yes | Yes |

| Use of existing plan configuration security |

Yes | Yes |

NOTE: As before, the import doesn’t delete any plan configuration objects.

Exported Files and Compatibility with Previous Versions

When you enable the XML_MODE lookup (See Steps to Enable section) and run the export, the exported file is in XML. The XML format provides a more robust way to easily reuse and update benefit configurations in the destination environment.

The XML file looks like this:

Sample of Exported XML File

To import benefit objects using the enhanced version, you can use only zip files that contain an XML export file. The zip files that were exported before enabling the lookup aren’t compatible. For example, here’s a sample of an existing DAT file. This file format isn’t compatible with the newer import process.

Sample of Existing DAT File

How the Import Deals with Updates

The enhanced import functionality works with only the zip files that were exported after enabling the XML_MODE lookup code. See the Steps to Enable section.

If you updated a benefit object in the source environment after the import, you just need to run the export and import again to see the updates in the destination environment.

For example, you exported a plan that has date-effective updates. One of those updates is effective Jan 1, 2018 to Dec 31, 2018, and the other, from Jan 1, 2019 to Dec 31, 2019. After the export, suppose you changed the effective dates. When you run the export and import again, you can see all the date effective changes in the destination environment. However, for updates to regulatory bodies, a new object will be created during an import.

When you import a benefit object that doesn’t exist in the destination environment, the application creates the object. If the object that you’re importing is a plan or program, the process sets the status of the imported object to Pending. If an object already exists in the destination environment, the application will reuse and make necessary updates to the object based on information in the zip file.

Steps to Export and Import

NOTE: There are no changes to the overall steps to export and import. The user interface remains the same. Also, the prerequisite tasks that you need to complete before exporting benefit objects also remain the same, as in earlier releases.

See the product documentation for details. Here are the steps for a quick reference.

To export:

- Click Navigator > Benefits Administration > Plan Configuration.

- In the Actions panel, click Export Benefits Plan Configuration.

- Click Create.

- Enter the required fields, and click Submit.

- Back in the Search Results section, wait for the task to complete. Click Refresh to see the latest status.

- When the task is complete, click the Download link. You can download a zip file and a log file. You need the zip file to import the configuration into your destination environment. The log file contains the results of each benefit object that was exported.

CAUTION: Don't make any edits to the zip file. The import task doesn’t process edited zip files.

To import:

- In the Plan Configuration work area, click Import Benefits Plan Configuration.

- Click Create.

- In the Import Type list, select the type of benefit object to import.

- Click Browse to upload the ZIP file that you downloaded during the export step.

- Click Submit.

- In the Task List section, wait for the process to complete. Click Refresh to see the latest status.

- When the process is complete, click the Go to Task link in the Import Plan Configuration Data task row. Depending on the benefit object that you’re importing, you can see the related mapping section on the Import Benefits Plan Configuration page. Review the mappings and make changes if any.

- Click Submit when you’re done. In the Task List section, wait for the task to complete. You can click Refresh to see the latest status.

- When the task is complete, click Back.

- In the Search Results section, click the Download link for the import that you created to download the log file. The log file contains the results of each benefit object that was imported. See the How You Can Use the Log File to Review Imported Objects section for more information.

- Check the configuration page of the benefits object. For example, open the Manage Rate and Coverage User Values page to see if the data appears as expected.

How You Can Use the Log File to Review Imported Objects

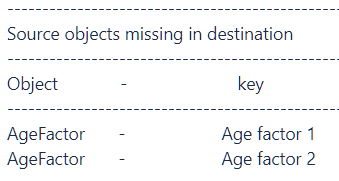

The import process generates a log file that provides a list of benefit objects that were imported. The log file also tells you any differences between the source and destination objects. For example, if both the source and destination objects have the same configuration, the log file says so.

If there are source objects missing in the destination, the log file will list those objects in the Source objects missing in destination section. This typically happens when you use prefixes and suffixes to distinguish the imported objects. The application creates these objects.

Sample Log File 1

If additional objects were found in the destination, but don’t exist in the source, the Additional objects in Destination section contains a list of such objects. This happens if you made any updates to these objects in the destination after an import, and you subsequently import another file.

Sample Log File 2

What's Included in the Export

As before, depending on the benefit object that you’re exporting, here are the details of each related benefit object that the application includes in the export.

| Benefit Object | Related Objects |

|---|---|

| Program | Associated plan types, plans, options, year periods, legal entities, reporting groups, organizations, eligibility profiles, life events, action items, formulas, rate, coverage, coverage across plan type, enrollment authorization, and dependent and beneficiary designation |

| Plan not in program | Associated plan types, options, year periods, legal entities, reporting groups, regulations, organizations, eligibility profiles, life events, action items, formulas, rate, coverage, enrollment authorization, and dependent and beneficiary designation |

| Eligibility Profile | Associated derived factors, service areas, and formulas |

Eligibility Profile Criteria That’s Excluded in the Import

Here’s a list of eligibility profile criteria that you can’t import. There have been no changes to this list from the earlier releases. This list is here only to serve as a reference.

| Eligibility Profile Category | Criteria that the Import Doesn’t Support |

|---|---|

| Personal | Leave of absence, qualification, and competency |

| Employment | Performance rating info |

| Other | Here’s the criteria that isn’t supported:

|

| Related Coverage | All criteria |

Status of Programs and Plans After Import

In this release, when the import creates a new plan or program in the destination environment, they are in the Pending status. When the import updates an existing plan, the status is updated on the basis of the export file.

Other Import Considerations

Here’s a list of aspects related to how the import works with programs and plans. There have been no changes to this list from the earlier releases. The list is here only to serve as a reference.

| Aspect | How the Import Works |

|---|---|

| User Values and Reporting Groups | The import doesn’t add prefixes and suffixes to user values. If the name of the user value is the same in both the export zip file and the destination environment, it will be reused in the destination environment. If the user value name is changed at source, and you export the configuration subsequently, the import creates an object in the destination environment.Likewise, if you change the name of a reporting group at source, the import creates a new object in the destination environment. |

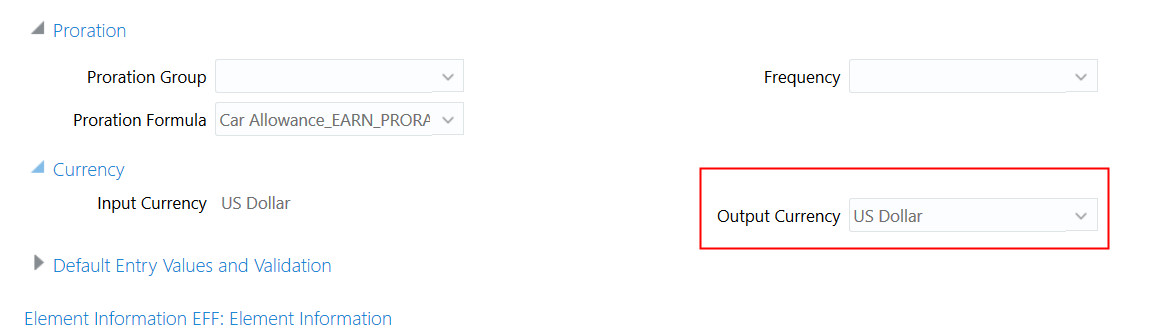

| Standard Rates and Payroll Elements | Proration details aren’t included in the import. All payroll elements and input values that are exported from the source should exist in the destination. |

| Flex Shell Plans | The import doesn’t add prefixes and suffixes to the flex shell plan and the plan type associated with it. |

Steps to Enable

You need to create and enable a lookup type to use the enhanced functionality. The lookup isn’t available out of the box.

- In the Setup and Maintenance work area, go to the Manage Common Lookups task.

- On the Manage Common Lookups page, create the lookup type with these details:

Lookup Type BEN_PL_COPY_MODE Meaning Plan Copy Mode Description Plan Copy Mode Module Benefits REST Access Secured Secure - Click Save.

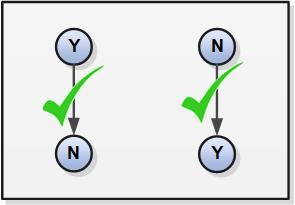

- Create the following lookup code for the lookup type you created.

Lookup Code XML_MODE Enabled Yes Meaning To activate the enhanced import and export functionality

Tips And Considerations

Troubleshooting Duplicate Sequencing Errors During an Import

When you import a benefit object, differences in the way you map the source and destination objects during the import might result in errors. For example, if you're importing an eligibility profile with the Employee eligibility criteria, you need to map the destination criteria to Employee in the mapping section, and not any other value. This is similar to the error you see when you create two different eligibility criteria with the same sequence number on the Create Eligibility Profile page.

Troubleshooting Absence Plan Errors During an IKmport

Before you import a benefit object configuration that contain vacation sale absence plans or sick-time sale plans, you need to make sure that these plans exist in the destination environment. Also, you can't specify prefixes or suffixes to these plans during the import.

Troubleshooting Payroll Element Errors During an Import

If the benefit object configuration you're importing contains standard rates that link to elements and input values, you need to make sure that these exist in the destination environment.

Troubleshooting Effective Date Errors During an Import

You need to make sure that the effective dates for the child benefit objects fall within the effective dates of the parent object. This applies to objects in both the source and destination environments. For example, suppose you import this configuration:

| Benefit Object | Effective Start Date | Effective End Date |

|---|---|---|

| Program A | January 1, 2020 | December 31, 2025 |

| Plan A | January 1, 2020 | December 31, 2025 |

| Plan B | January 1, 2020 | December 31, 2025 |

Subsequently, in the source environment, if you change the effective end date of Plan A to April 2026, the import won't succeed because the program in the destination environment ends earlier, on December 31, 2025. To resolve this, you need to change the effective date of the plan in the destination environment to the same date as of the source environment.

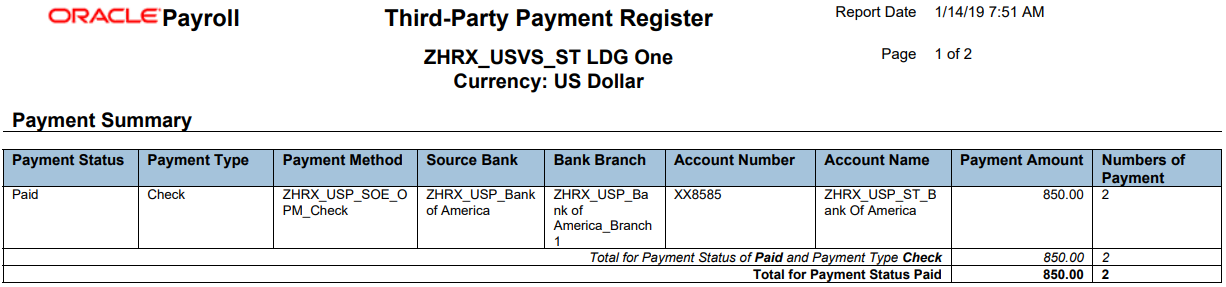

Payroll for Oracle Human Capital Management for Canada supports country specific features and functions for Canada. It enables users to follow Canada's business practices and comply with its statutory requirements.

International Transfer Payment Method

The International Transfer payment type is now enabled for Canada, enabling you to create an organization payment method for an international transfer and configure personal payment methods for bank accounts outside of Canada.

When you run the Generate Direct Deposit Payment process for an international transfer organization payment method, an XML file is automatically generated that contains the account and payment details of the international transfer. Customers can use the XML to create a custom interface to pay Canadian employees in another country's currency to a bank outside of Canada. The XML file is accessible on the BI server. The Generate Direct Deposit Payment process does not create any other output for this type of payment method.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The following contain international transfer payment details:

- Payment archive

- SOE

- Prepayments

- Payslip

- Payment Register

Key Resources

Refer to the document below on the Canada Information Center for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Product Documentation > White Papers > Vacation Liability

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

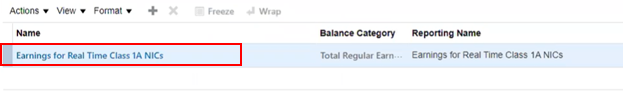

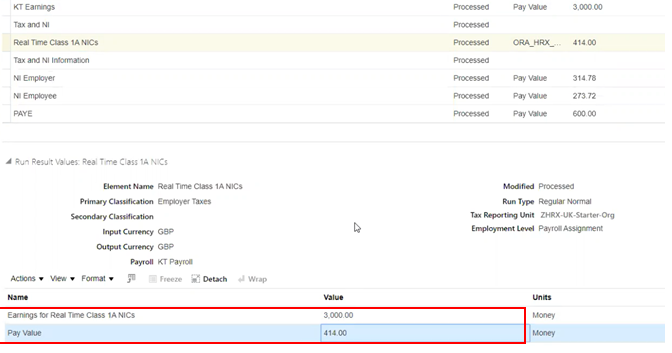

Employer Class 1A NICs for Termination Payments

You can now stay compliant when your employees receive termination award over the £30,000 limit and Class 1A Employer National Insurance is due on these payments.

Effective from April 2020, two new balances are available to enable you to record these earnings:

- Earnings for Real Time Class 1A NICs - Total Earnings

- Real Time Class 1A NICs – Employer Taxes

You must setup a balance feed from any earnings element to feed the Earnings for Real Time Class 1A NICs balance.

The results with the calculated values for the earnings are stored in the element element real Time Class 1A NICs.

The payroll process calculates the value on earnings over £30,000 at the prescribed percentage.

Steps to Enable

You don't need to do anything to enable this feature.

You can now record, administer, pay, and report those employees as off-payroll worker (deemed employee). Effective April 2020, you can use this for employees that are paid through service companies or intermediaries. Here are some benefits of using this feature:

- Separate totals for Off-Payroll Worker National Insurance

- NIC totals which you can offset against total NIC values

- Assists in calculating NIC’able Earnings of actual employees excluding those that are off-payroll worker

- Helps determine Employment Allowance Eligibility

These are the new balances available that hold the amount of National Insurance contributions for these employees.

- NI’able by Category for Off-payroll Worker

- NI Employee Off-payroll Worker

- NI Employer Off-payroll Worker

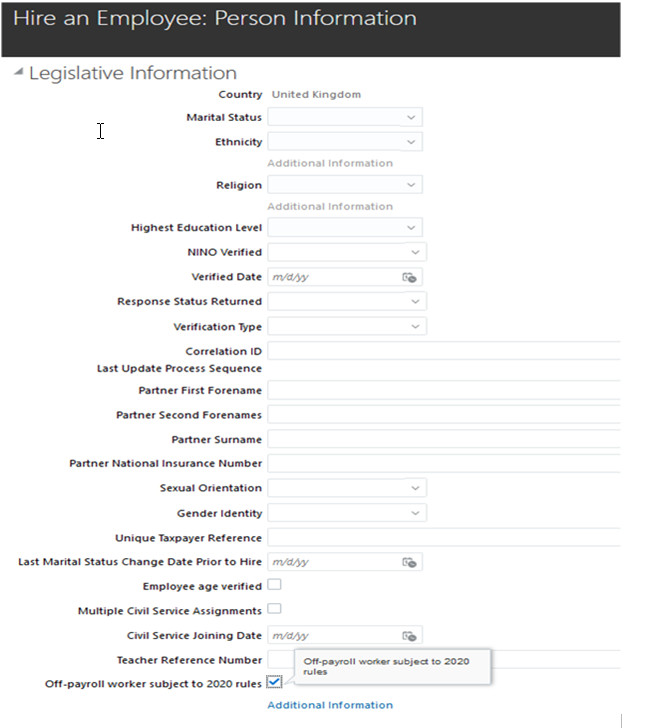

Use the new option Off-Payroll Worker Subject to 2020 Rules on the Hire an Employee page:

Select this option if the employee is an off-payroll worker. Off payroll workers aren't eligible for pensions automatic enrolment. The Pensions Automatic Enrolment calculation card won't be automatically created for these employees. The process Pensions Automatic Enrolment will generate an error, if the employee is an off-payroll worker.

Additionally, the Payroll Validation Archive Report is enhanced with these validations:

- PAE card exists for deemed employee

- Student Loan or Postgraduate Loan exists for deemed employee

- Statutory Absence exists for deemed employee

Steps to Enable

You don't need to do anything to enable this feature.

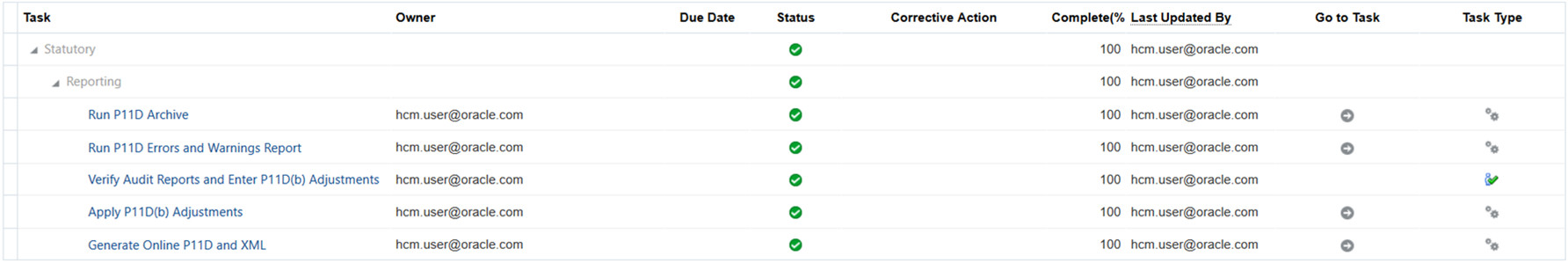

P11D End of Year Expenses and Benefits Statements

You can complete the Expenses and Benefits statements for your employees using the P11D process. These are the new templates for paper and online format relevant for tax years 2019-2020:

- P11D Expenses and Benefits

- All worksheets as prescribed by HMRC

The enhancements reflect the new tax year 2019-2020 on all the forms.

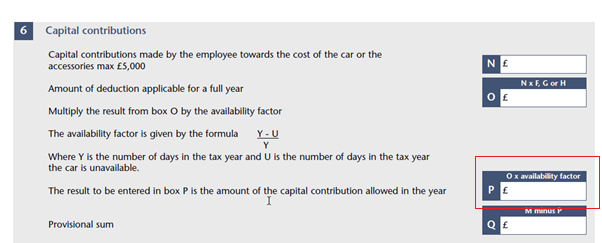

There is a new field introduced on Worksheet 2b ‘Capital Contribution Allowed in the Year’. The process also calculates the Availability Factor and uses the Availability Factor value for the new box P introduced on Worksheet 2b this year. This is for Capital Contribution Allowed in the Year.

The P11D process creates the output including all relevant worksheets for the employees.

Use the process Run P11D Archive and Generate Reports. The process will create the XML file for the submission of employee data and the P11D(b) summary. The archive and the printing processes remain unchanged.

Steps to Enable

You don't need to do anything to enable this feature.

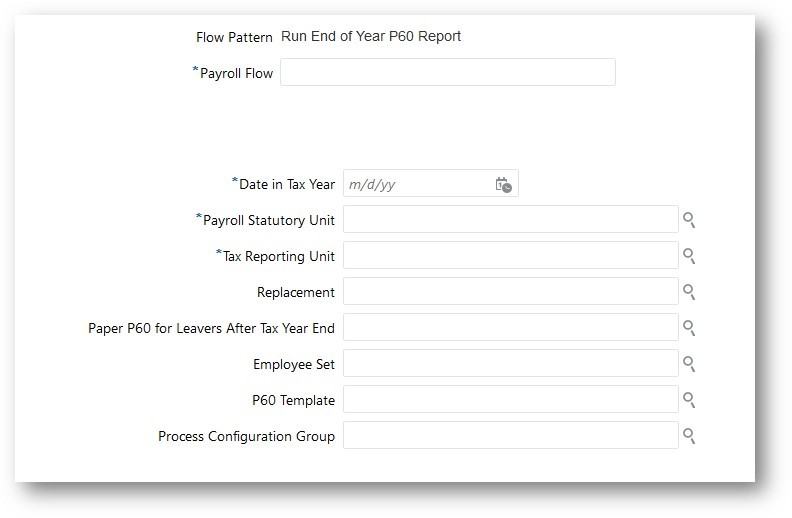

P60 End of Year Certificate for Tax Year 2019-2020

You can now provide P60 End of Year Certificates to your employees in the required format for the tax year 2019-2020 to comply with the legislative and statutory changes from HMRC.

These are the four revised templates available that support the P60 paper and online versions:

- HMRC (Single Sheet)

- eP60 (for SSHR)

- Paper P60 (Oracle Substitute)

- Data Graphic Self-Seal P60

You can use the same processes to run P60:

- Run End of Year P60

- Run End of Year P60 Selective Print

Steps to Enable

You don't need to do anything to enable this feature.

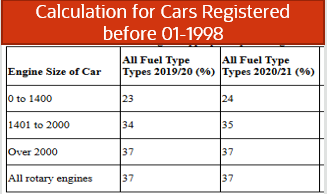

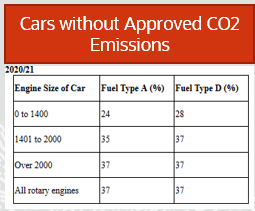

Payrolling of Benefits for Tax Year 2020-2021

The processing of employee benefits in payroll will use the new rates, thresholds, and calculations delivered for tax year 2020-2021.

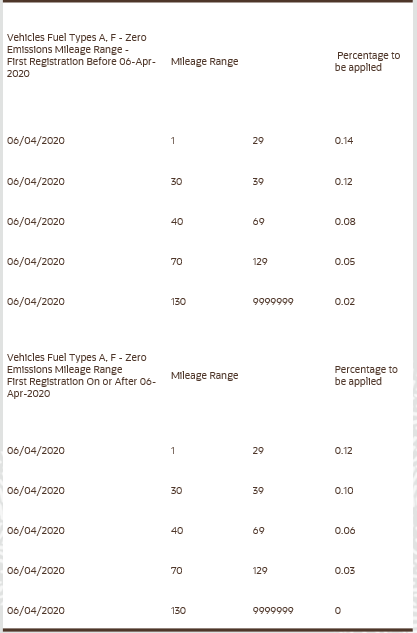

New rates are applied for cars with approved CO2 that are registered before 06 April 2020. And, new rates will be applied for cars with approved CO2 that are registered after 06 April 2020

The cars with approved CO2 below 50 use zero emission mileage. You can provide a value for zero emissions mileage in the field Low Emission Mileage, which enables the calculation for car and car fuel benefit to be completed.

For the tax year 2020-2021, the amended range and percentages for CO2 emissions rates are applied.

The percentage rates for all cars have been amended and separate columns are used to determine the rate depending on registration date of the car.

- Columns 1 and 2 for cars registered before 6th April 2020

- Columns 3 and 4 for cars registered after 6th April 2020

- An additional check is made for Electric Range introduced

- Using zero emission mileage entered for electric cars

Steps to Enable

You don't need to do anything to enable this feature.

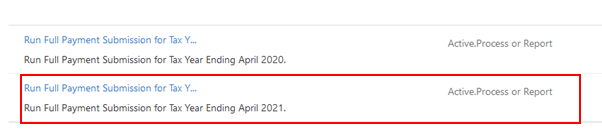

Real-Time Information: Full Payment Submission for Tax Year 2020-2021

Use the new process Run Full Payment Submission for Tax Year 2021 Ending 2021 for all submission for the new tax year of 2020-2021.

The process creates the archive to provide the Audit Report and the XML file for submission to HMRC.

You must also use this process to submit the Earlier Year Updates from April, 2020 according to the statutory requirements from HMRC.

The XML file output now includes these:

- Car Date First Registered

- Zero Emissions Mileage option

- Real Time Class 1A NICs on Termination awards

- Off-Payroll Worker option

- Statutory Parental Bereavement Pay (SPBP) Year to Date

NOTE: The SPBP YTD value is a balance that requires a balance feed from the user element for SPBP.

Steps to Enable

You don't need to do anything to enable this feature.

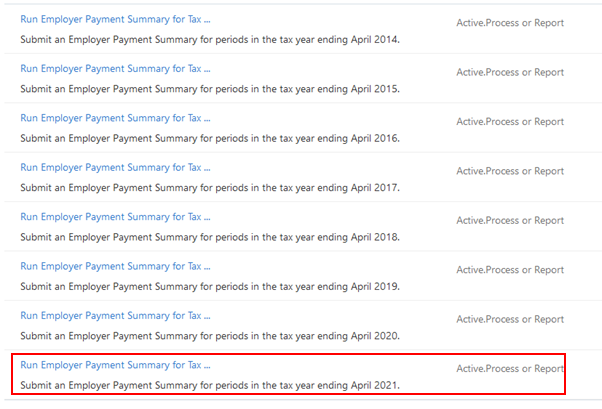

Real Time Information - Employer Payment Summary for Tax Year 2020-2021

You can use the new process Run Employer Payment Summary for Tax Year Ending April 2021 to submit your Employer Payment Summary for the tax year 2020-2021. The process parameters remain unchanged.

You can continue to use the previous year's processes for EPS for the relevant tax years, if required.

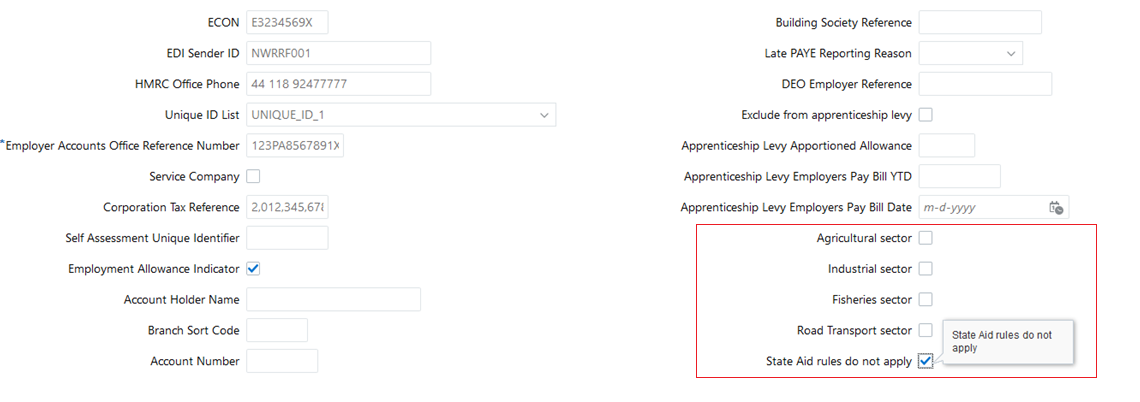

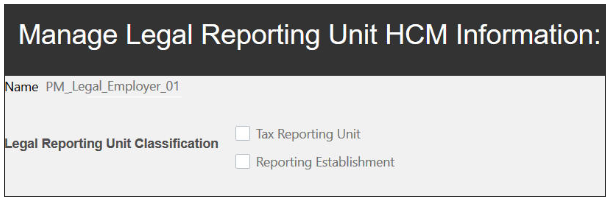

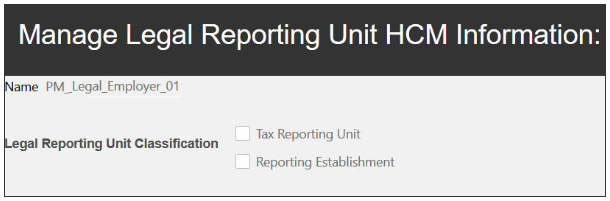

Use the task Manage Legal Reporting Unit HCM Information in Setup and Maintenance. These are the new fields available to capture data in the UK Tax Reporting Information page:

A validation is added for the Employment Allowance Indicator. If you select this, you must select at least one of the Industry sector fields. Or, select the State Aid rules do apply option. If you haven't set the Employement Allowance Indicator, you can't select the industry sectors or the State Aid rules do not apply option.

- *(Industry sector and State Aid rules are mutually exclusive)

- If Employment Allowance Indicator is not set, you can’t set any of the Industry sector or State Aid rules do not apply flags.

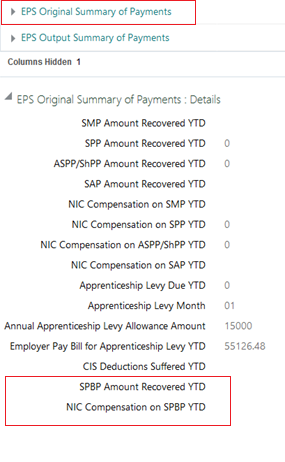

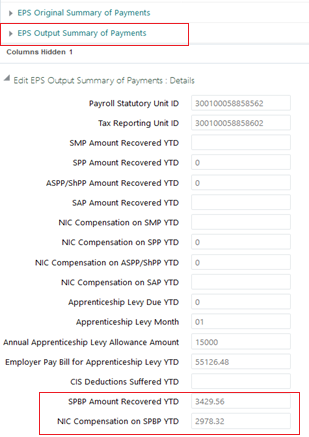

These are the new balances provided to support Statutory Parental Bereavement Pay (SPBP):

- Statutory Parental Bereavement Pay

- SPBP Recovery

- SPBP NIC Compensation

Employer Payment Summary Output

The SPBP values are available on the output on:

- EPS Original Summary of Payments

- EPS Output Summary of Payments

- Audit Report

- XML File for submission to HMRC

Steps to Enable

You don't need to do anything to enable this feature.

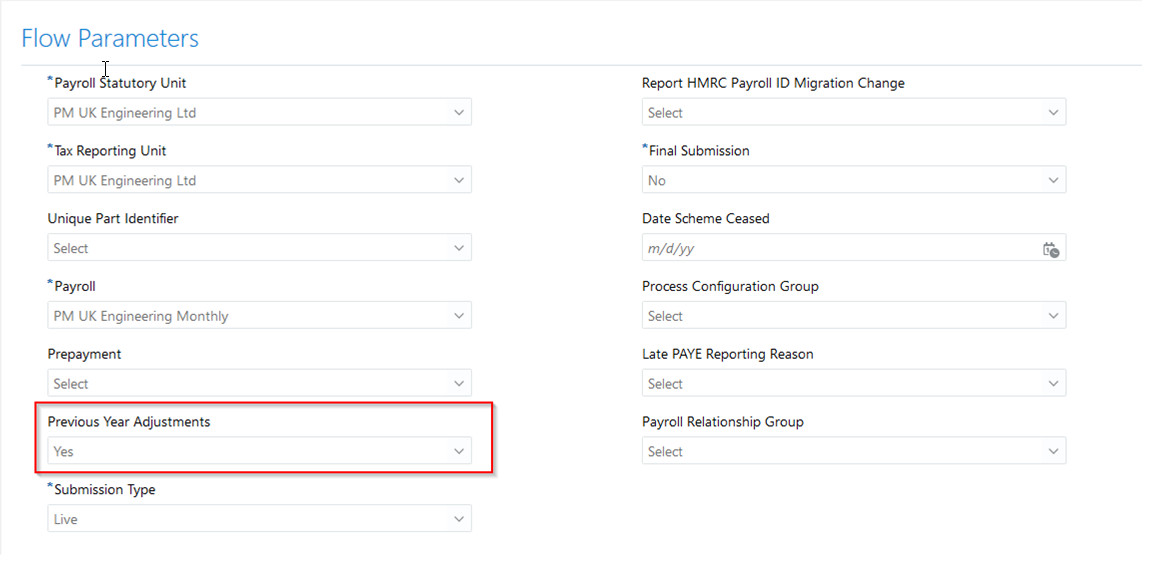

Real Time Information - Full Payment Submission Supports Earlier Year Updates

The Full Payment Submission process is enhanced to support Earlier Year Updates. You can report any earlier year changes to employee data using the process Run Full Payment Submission for Tax Year Ending 2021. This is because the HMRC will no longer support Earlier Year Updates process after April 2020.

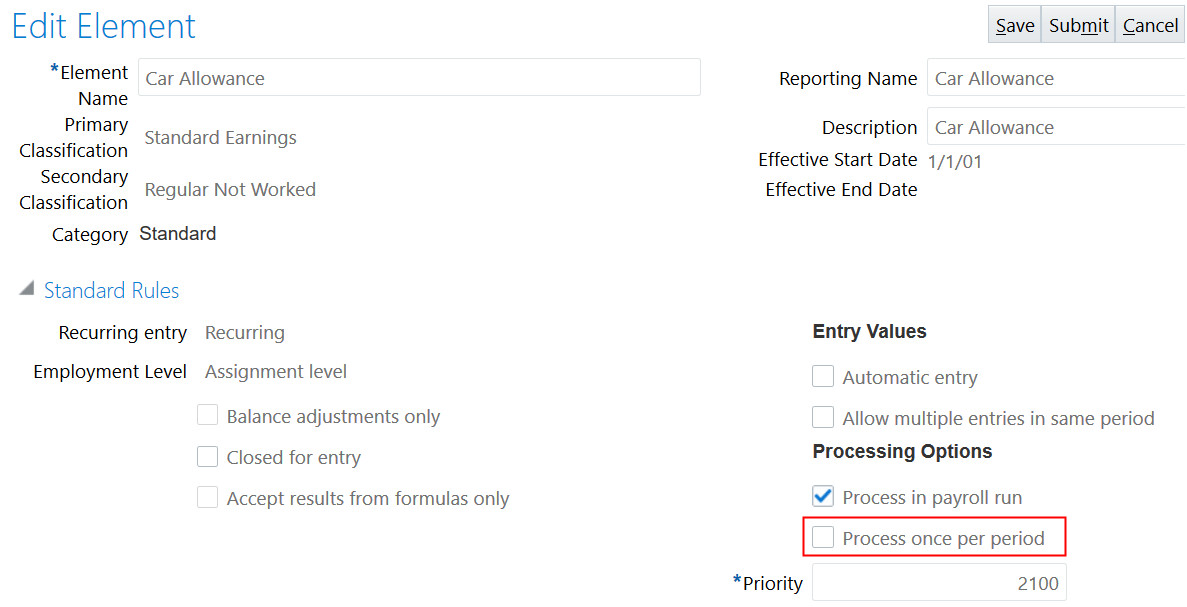

For any adjustments from previous years, you can use the new parameter Previous Year Adjustments in the flow. When you set this to Yes, it includes the earlier year updates. The parameter Prepayment is optional and not a required parameter any longer.

The XML file is updated to include the earlier year updates data.

You can still use Earlier Year Updates processes for tax years prior to 2019-2020.

Steps to Enable

You don't need to do anything to enable this feature.

Reporting Enhancements: Tax Year to Date Reconciliation Report

Use the Year to Date Reconciliation Report for reporting the Statutory Parental Bereavement Pay and Employer's Class 1A National Insurance introduced for the tax year 2020-2021, along with details of Earlier Year Updates using the Full Payment Submission process.

The report now includes these additional fields for new employees and statutory payments:

- Person Number

- NI Number

- Deduction Group

- Deduction Type

- Statutory Parental Bereavement Pay Values for Tax Year 2020-21

The report works in conjunction with the Full Payment Submission that now supports Earlier Year Updates from April 2020.

Steps to Enable

You don't need to do anything to enable this feature.

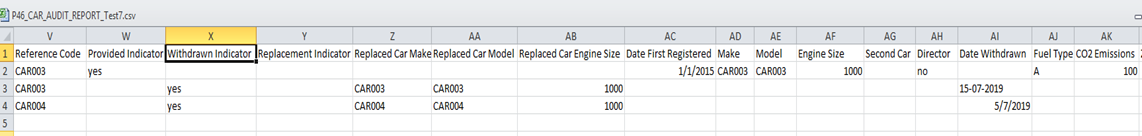

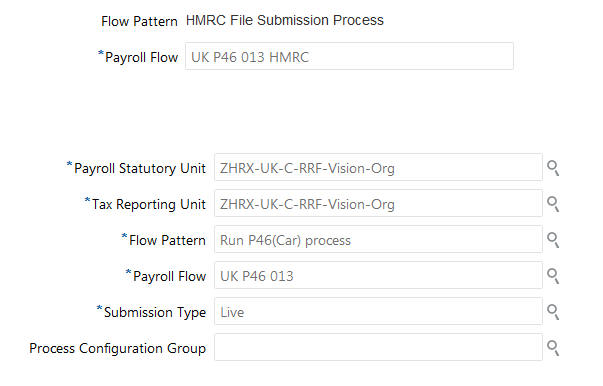

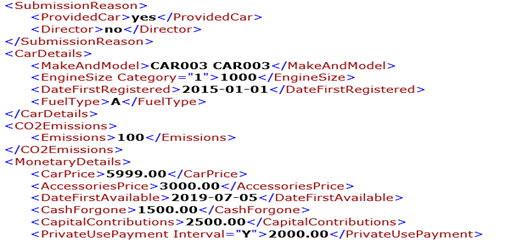

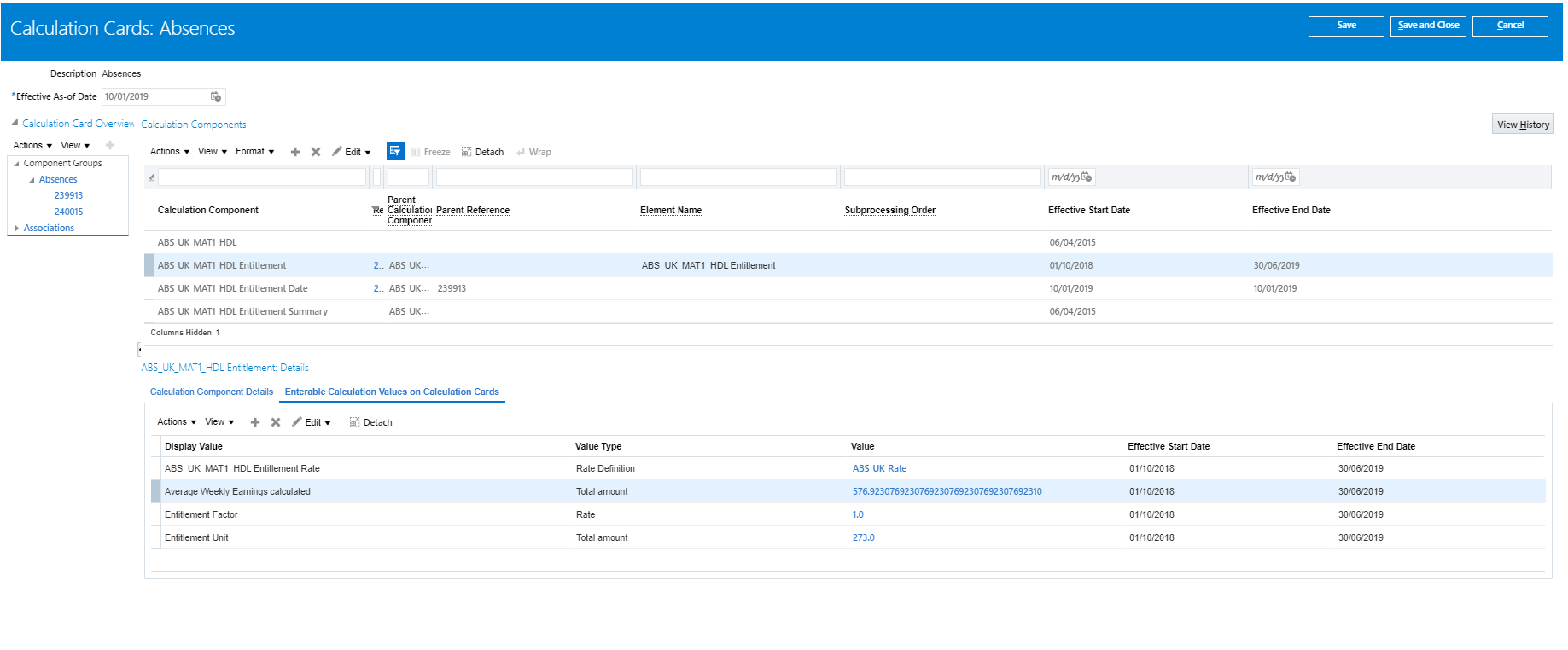

You can provide the required car data using the P11D's car and car fuel calculation card component, and report to HMRC.

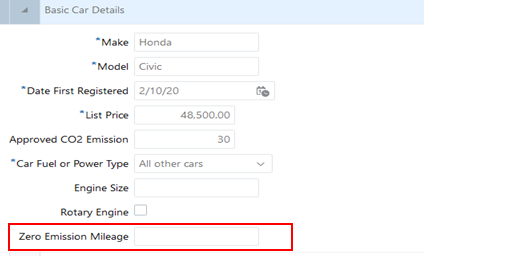

In the Basic Car Details calculation component, you can record the mileage for low or zero emission cars in the Zero Emission Mileage field. An error message is generated when no value is entered in this field:

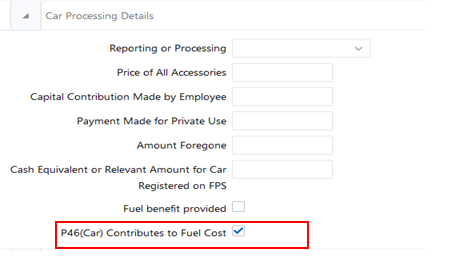

In the Car Processing Details component, record the employee's contribution to fuel in the P46 (Car) Contribution to Fuel Cost field:

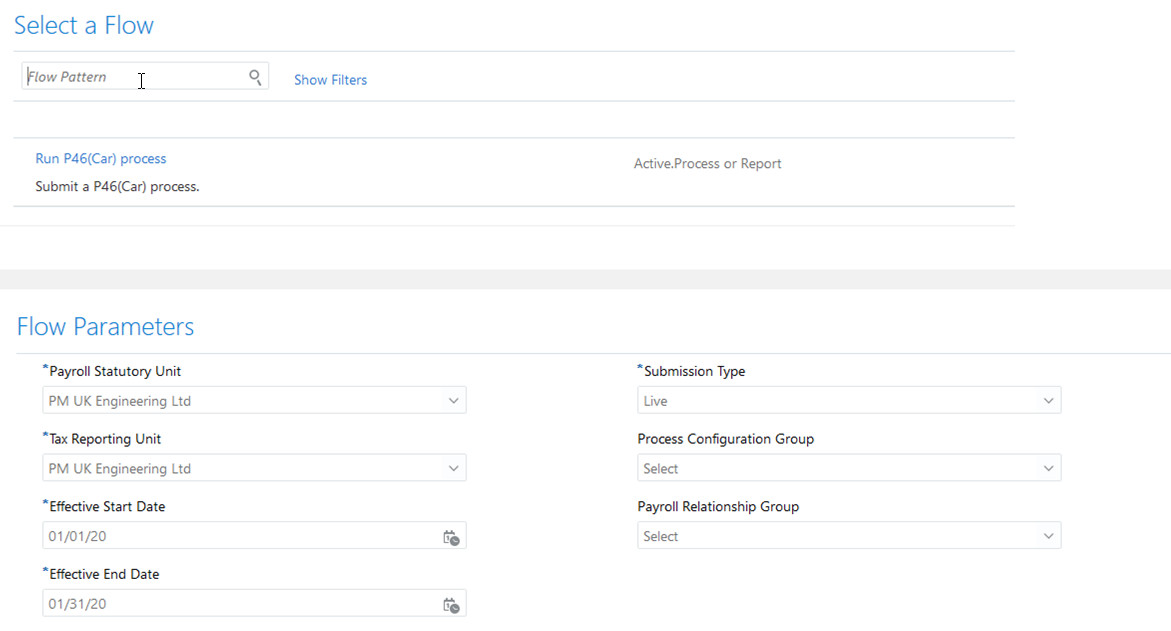

Use the new process P46(Car) to validate, archive, and create the XML data file for submission.

When you run this process, here's the output that's generated:

- .Errors and Warnings report with missing or incorrect data

- Audit report with car data processed

- Archive of P46(Car) data for the XM file

- XML file for submission to HMRC using the process HMRC File Submission with P46 parameters

Steps to Enable

You don't need to do anything to enable this feature.

January Maintenance Pack for 20A

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 31 JAN 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness oracle.com/readiness under Human Capital Management or via the Oracle Help Center at: docs.oracle.com under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Payroll for Oracle Human Capital Management for Canada supports country specific features and functions for Canada. It enables users to follow Canada's business practices and comply with its statutory requirements.

Employment Equity Reporting Eligibility

You may now designate specific jobs as eligible or ineligible for Employment Equity reporting.

If an employee is assigned to a job with the Employment Equity Eligible field values below, the related behavior applies:

- Yes: the employee is included

- No: the employee is not included

- Blank: the employee is included (this is the default behavior)

To update the Employment Equity Eligible field, use the Manage Job task in Setup and Maintenance: Workforce Structures. If the field is blank, by default the employees assigned to that job are not included in the report.

The screen capture below illustrates the new Employment Equity Eligible field in the Job UI.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Changes to the job’s Employment Equity Eligible field are date-effective.

By default, the Employment Equity Eligible field is blank. If the field is not updated, employees assigned to that job continue to appear in the report. To stop employees assigned to a particular job from appearing in the report, you must update the field to “No”.

Key Resources

Refer to the document below on the Canada Information Center for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Product Documentation > White Papers > Vacation Liability

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support.

See My Oracle Support Document ID 2102586.2 (Information Center: Fusion Human Capital Management - Canada) for further details, and access the content at the location below.

- CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

Vacation Liability Over Multiple Terms

You may now pay out all vacation liability accumulated over multiple terms. Additionally, employee absences will now reduce vacation liability balances accumulated over multiple terms starting with the earliest to the most current term.

When an employee is terminated or goes on a leave of absence and there are positive balances across multiple vacation plan years (terms), the vacation liability owed to the employee may be payed out at one time. The vacation payout can be across multiple terms or for a specific term. Partial payouts are also now available. To process a vacation pay out of the liability to an employee, note the following important points:

- A new vacation payout element must be created and assigned to the employee. The Entry Values section of the payout element contains the fields used for Vacation Liability processing.

- If the Vacation Accrual Reduction Date is left blank, the payout includes the accrued balance for all available vacation terms (with positive balances).

- If the Vacation Accrual Reduction Date is populated, the payout includes the accrued balance for a specific vacation term in which the reduction date falls.

- To payout a partial accrued balance amount for a specific vacation term, do the following:

- Populate the Vacation Accrual Reduction Date

- Populate the Amount

- If the accrued balance for the vacation term is negative, no payout occurs.

- If a negative value is entered in the Amount, it is ignored.

The screen capture below illustrates the Entry Values of the payout element.

Employee absences now reduce the vacation liability balances accumulated across multiple terms starting from the earliest vacation term (with a positive balance) to the current term. Note the following important points for reducing accrued vacation liability balances:

- If the absence is entered with a Vacation Accrual Reduction date, then the accrued balance is reduced for the vacation term in which the reduction date falls.

- If the absence is entered with no Vacation Accrual Reduction date, then the accrued balance is reduced from the earliest vacation term (with a positive balance) to the most current term.

- If any accrued balance remains after going through prior terms, then the accrued balance will reduce the current term's accrued balance.

- If the accrued balance is negative for a prior term, it is ignored and the accrued balance is not reduced.

- If the accrued balance is negative for the current term, the accrued balance is reduced.

Steps to Enable

No setup is required to enable the feature itself, although creation of a NEW vacation payout element is required. Existing vacation payout elements do not support the enhanced functionality.

Key Resources

Refer to the document below on the Canada Information Center for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Product Documentation > White Papers > Vacation Liability

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support.

See My Oracle Support Document ID 2102586.2 (Information Center: Fusion Human Capital Management - Canada) for further details, and access the content at the location below.

- CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Feature | Notes |

|---|---|---|

| 28 APR 2020 | Benefits: Close Enrollment Process Designation Validation | Updated document. Revised feature information. |

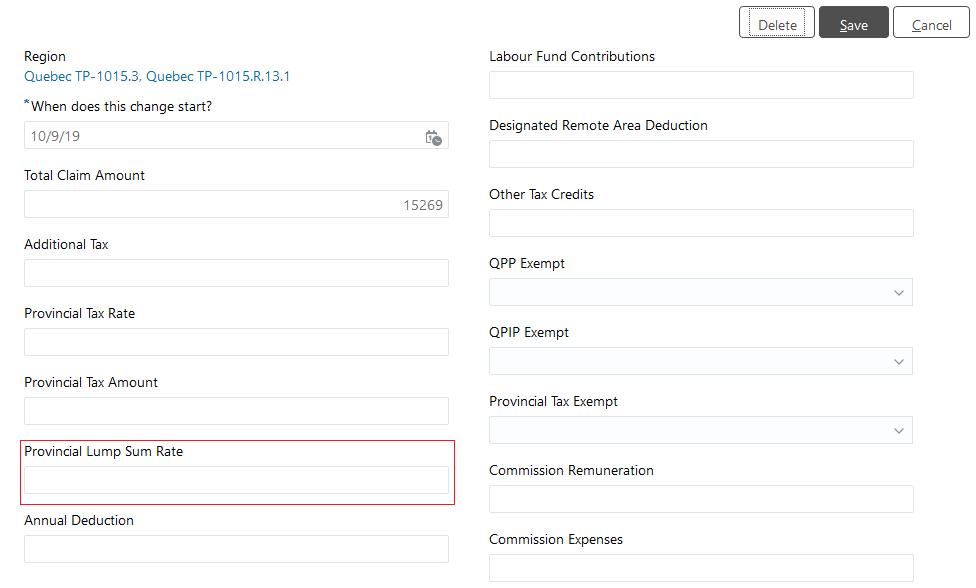

| 27 MAR 2020 | Payroll for Canada/Redesigned User Experience: Enhanced Professional Tax Card |

Updated document. Revised feature information. |

| 28 FEB 2020 |

Compensation: Preview Salary, Individual Compensation Approval Information in the Worklist | Updated document. Revised feature information. |

| 28 FEB 2020 |

Compensation: Preview Worksheet Approval Information in the Worklist | Updated document. Revised feature information. |

| 06 DEC 2019 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness oracle.com/readiness under Human Capital Management or via the Oracle Help Center at: docs.oracle.com under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

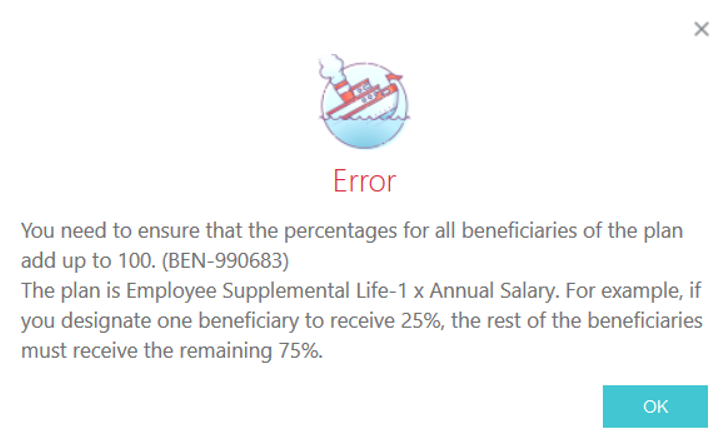

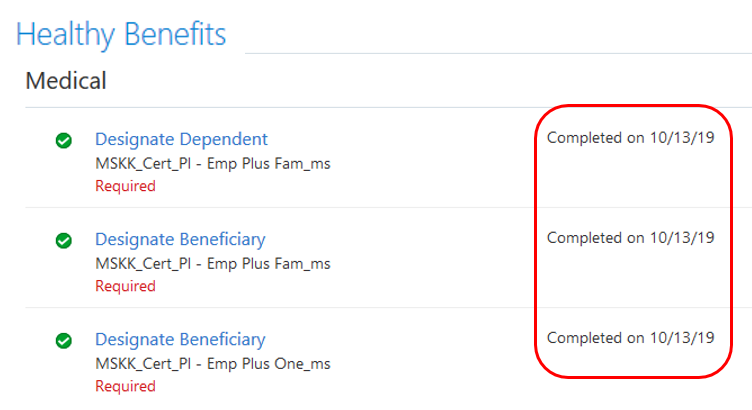

Close Enrollment Process Designation Validation

The Close Enrollment process now checks whether beneficiary designations add up to 100%. If they don’t add up, an error appears. For example, assume that a life event has occurred. Then, a contact relationship ends in between, such as a divorce or death, and a new life event occurs. In those instances, only partial designation is carried forward to the new event.

Message When Beneficiary Designations Don't Add Up

Previously, you wouldn’t know about this inconsistency until you back out the event. With this release, you can’t close the life event if the beneficiary designations don’t add up to 100%. You can then correct the designations for the participant because the life event’s enrollment window is still active.

This check is made even when you use the Close Enrollment process from the Evaluation and Reporting work area. When the process completes, and if there are errors, you can open the log file to see the details, as shown in this screenshot.

The Log File

The application, however, ignores this check if you don't have beneficiary designation requirements set up for your plans. So, if you don't want to store the beneficiary details, we recommend that you remove any beneficiary designation requirements that you configured.

The log file also tells you whether the primary beneficiary was designated in the plan, and identifies that plan. The administrator can correct the percentages as the life event’s enrollment window will still be open.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information watch:

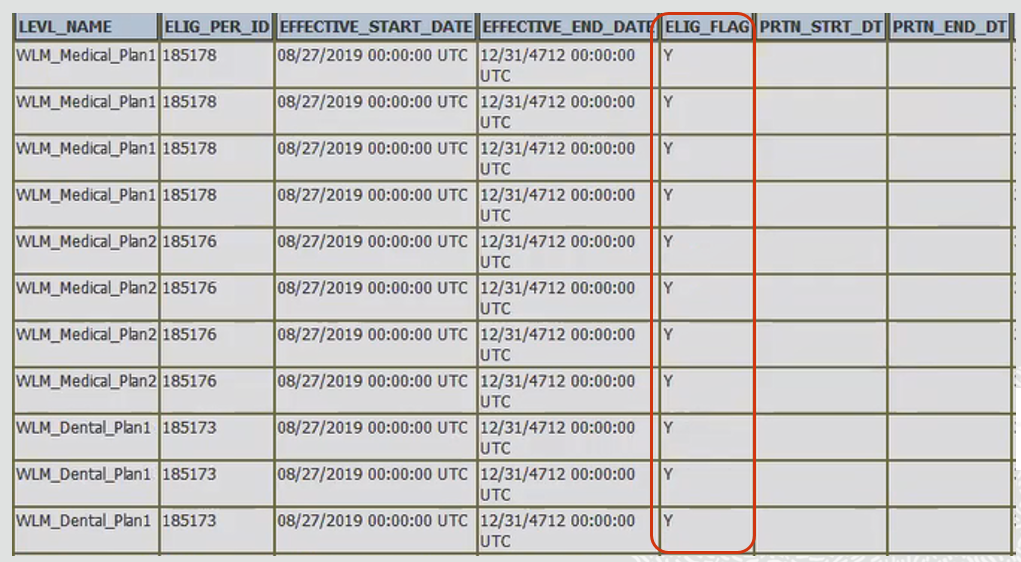

Person Benefits Eligibility Diagnostic Report

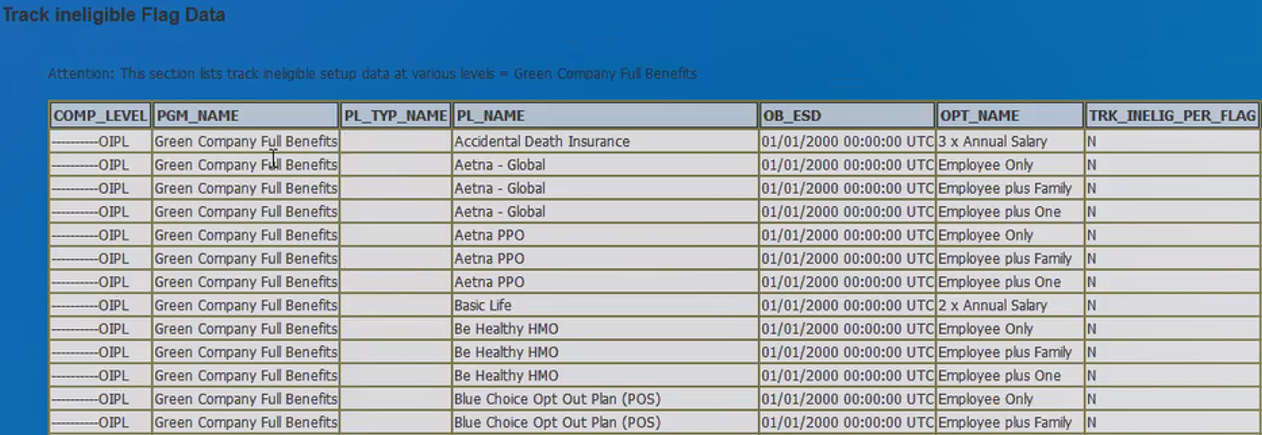

You can now use the new diagnostic report to address eligibility issues for individual participants more easily. For example, you can use the report to find out why a participant or dependent is ineligible for a specific offering. You can also use the report to resolve errors related with inconsistent configurations related to the Track ineligible persons option. You can share this report with Oracle Support to enable quicker investigations into eligibility issues.

You view the Person Benefits Eligibility diagnostic report from the Diagnostic Dashboard page. You get to this page from the global area. Open Settings and Actions > Run Diagnostic Tests. You run the report just like you do any other benefits diagnostic report.

The Person Benefits Eligibility Diagnostic Report

If you view this report for a program, you can see the details of all the offerings in that program. The report lists all the attributes used for eligibility, such as the person, location, job, and zip code. These are based on the setup and how you processed the life events.

The Elig_Flag column in the report indicates whether the person is eligible for a particular offering.

If you scroll down, you can see the benefits eligibility data at the option level. If you scroll down even further, you can see details regarding the Track Ineligible persons configuration. This column tell you whether you selected the check box, or whether you to set it lower down than at the program level. You can easily see at what level a person’s ineligibility is being tracked.

Participant Ineligibility Details

The administrator can then go back to the Plan Configuration work area and enable the check box at the correct benefit levels. The report also tells you if any of the age factors aren’t working for eligible candidates, and indicates what data impacts temporal detection.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Watch Benefits Service Centre Redesign and Enhanced Administrative Features Readiness Training

Benefits for the United States

The features below are Benefit features for the United States.

We improved the accuracy of your ACA Form 1095-C reporting by providing an override for the safe harbor settings. Use the ACA Report Line Number field when running the ACA Override Upload process. This changes the value displayed on Line 16 of the Form 1095-C for the employee’s eligible applicable period.

Steps to Enable

To override the safe harbor settings for Line 16:

- Start the ACA Override Upload process from the Evaluation and Reporting work area.

- Use ACA Report Line Number to enter an override for Line 16.

Key Resources

For further information, see Oracle Cloud Human Capital Management for United States: ACA Implementation and Use (2067360.1) on My Oracle Support.

ACA Offer-of-Coverage Override

We improved the accuracy of your ACA Form 1095-C reporting by providing an override for the offer-of-coverage settings. Use the new Offer of Coverage Override field at the legal entity level to override the offer-of-coverage value derived by the report process. This changes the value displayed on Line 14 of the Form 1095-C for the employee’s eligible applicable period.

Offer of Coverage Override

Steps to Enable

To enable this override:

- Start the Manage Legal Entity HCM Information task from your implementation project.

- Under Legal Employer, click Federal.

- Under Federal ACA Reporting Information, select a value for Offer of Coverage Override.

Tips And Considerations

When you run the Archive End-of-Year ACA Information process, it uses this hierarchy to determine the value for Line 14:

-

Setting an override when running the ACA Override Upload task.

When you run this task, you can set an override for Line 14 with the ACA Report Line Number field.

-

Offer of Coverage Override field.

This field sets a Line 14 override for all employees associated with the legal entity.

-

Value automatically derived by the report process based on the employee contacts.

This is the default behavior.

Key Resources

For further information, see Oracle Cloud Human Capital Management for United States: ACA Implementation and Use (2067360.1) on My Oracle Support.

Benefits Redesigned User Experience

Increase user satisfaction with the redesigned pages that now have the same look and feel on desktop and mobile devices. These redesigned pages are both responsive and easy to use on any device, with a modern look and conversational language. Clutter-free pages, with clean lines and just the essential fields, can be personalized to suit.

Benefits Service Center Redesign Completed

There are more benefits tasks you can now accomplish in the redesigned pages:

- View and update action items

- View enrollment opportunities

- View flex credit details

- View enrollment results

- Control display of hidden fields

Let’s take a look at each of these improvements in greater detail.

View and Update Action Items

You can now use filters to view action items more easily. On the Pending Actions page, you can select a filter from the View menu to view pending actions, completed actions, or all actions.

Filters on the View Menu

For example, if you marked an action item as complete by mistake, you can simply select Completed Actions from the View menu, and modify the relevant action item’s details.

Completed Actions

You can also see when the action item was completed. You click the action item link to open the details page. On the Details page, the action item’s status changes on the basis of what you change. For example, if you remove the received date, you can see that the action item appears as a pending item. On the Pending Actions page, select the Pending Actions filter on the View menu.

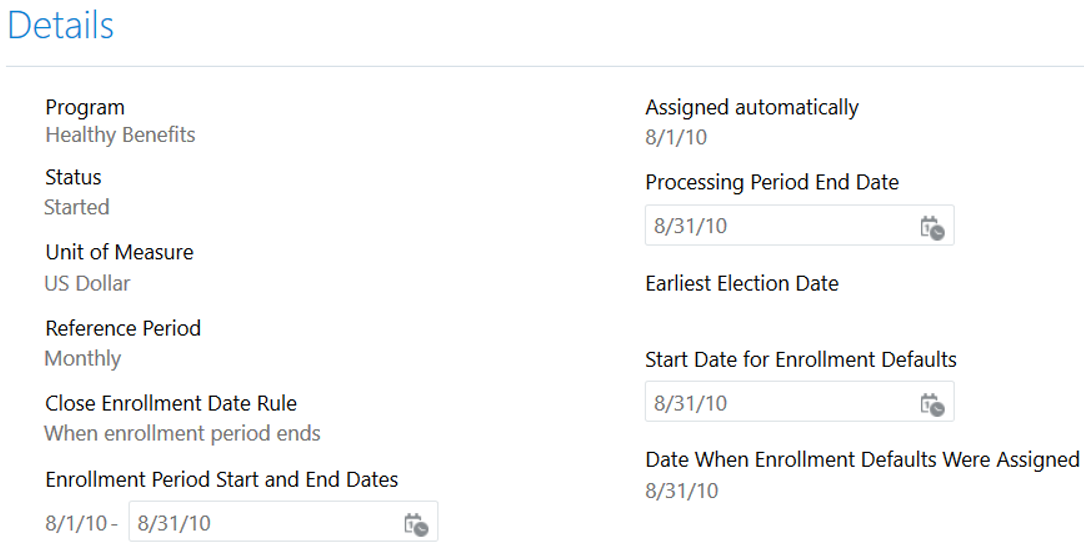

View Enrollment Opportunities

View enrollment opportunities for started and processed events. You can even update key enrollment dates for started events. For example, you can change the enrollment period end dates, and the processing and default enrollment dates.

To view the enrollment opportunities, on the Benefits Service Center page, you navigate to Benefits Summary > Evaluated Life Events > Actions > View Enrollment Opportunities.

Enrollment Opportunities

Click Edit to modify key dates, such as the enrollment period, processing period’s end date, the start date for the enrollment defaults, and the date when the defaults were assigned. There are inbuilt checks to ensure that you enter accurate dates.

Details of Enrollment Opportunities

For example, there are checks in place to ensure that the processing end date is on or before the enrollment period end date. In another example, there are checks to ensure that the enrollment period start date is on or before the enrollment period end date.

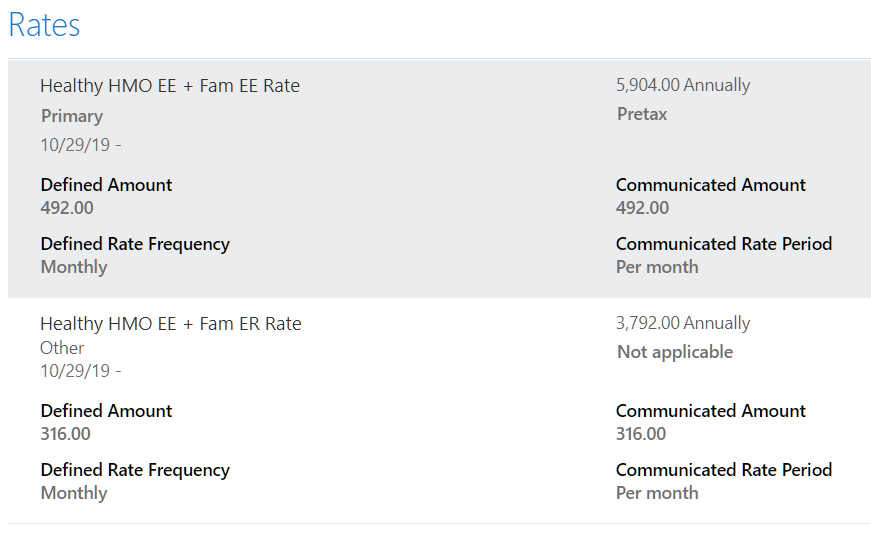

You can expand the Rates section to see the rate name and the activity type, defined and communicated amount, rate frequencies and other information.

The Benefits section shows the coverage during enrollment, including the minimum and maximum values, and other information.

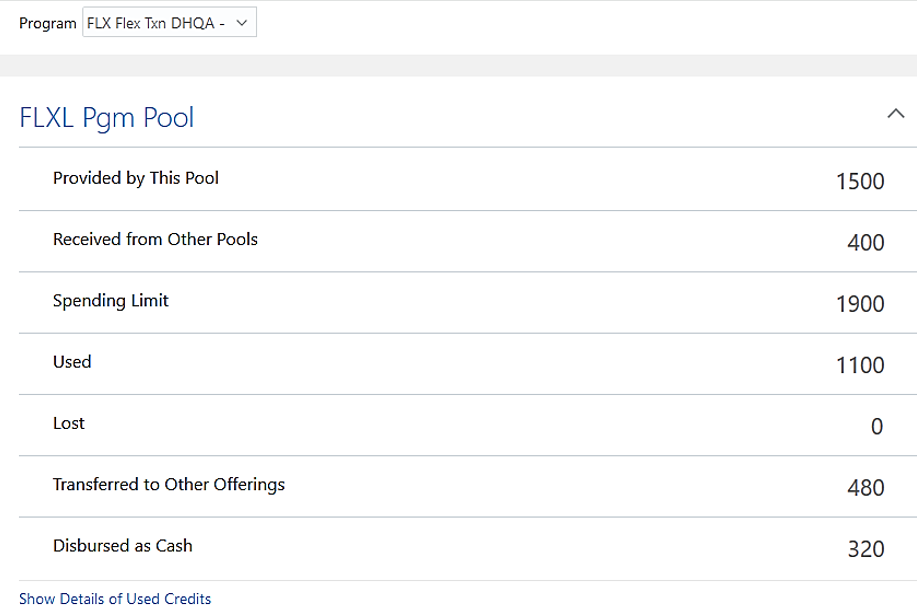

View Flex Credit Details

You can now view flex credit details for the participant’s enrollment. You can see details for both flex and imputed shell plans.

To view the flex credit details, you open Benefits Summary > Enrollments > Actions > View Flex Credits. On the page that appears, select a flex program to view its details.

View Flex Credits Page

The Show Details of Used Credits link opens a page that gives you a breakdown of the offerings that used the credits from the program pool.

View Enrollment Results

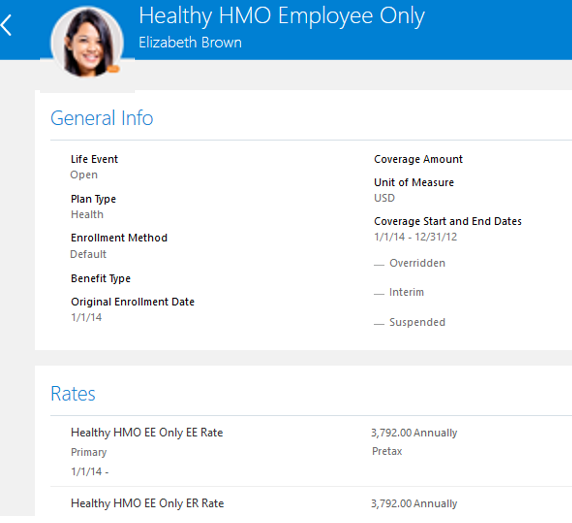

Navigate to Benefits Summary > Enrollments. Click any of the plans to get to the enrollment results page. This page has several sections, including General Information, Rates, Dependents, Beneficiaries, Documents, Action Items and Primary Care Physicians.

Enrollment Results

Here’s how the Rates section looks like, with all sub sections expanded.

Rates

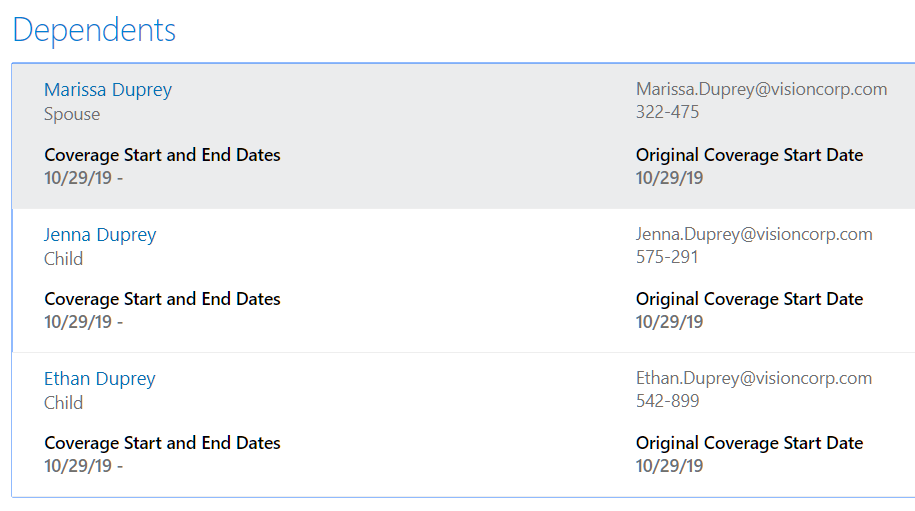

Here’s how the Dependents section looks like.

Dependents

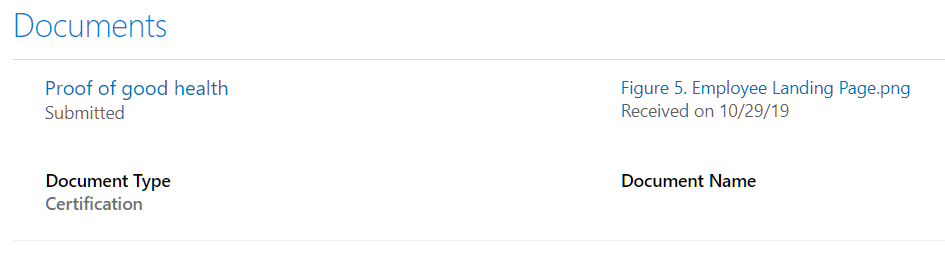

The Documents section lets you see the supporting documents that were uploaded for this enrollment.

Documents

Here’s how the Action Items section looks like. You can see that the section distinguishes between pending actions and completed actions.

Action Items

And here’s the Primary Physicians section.

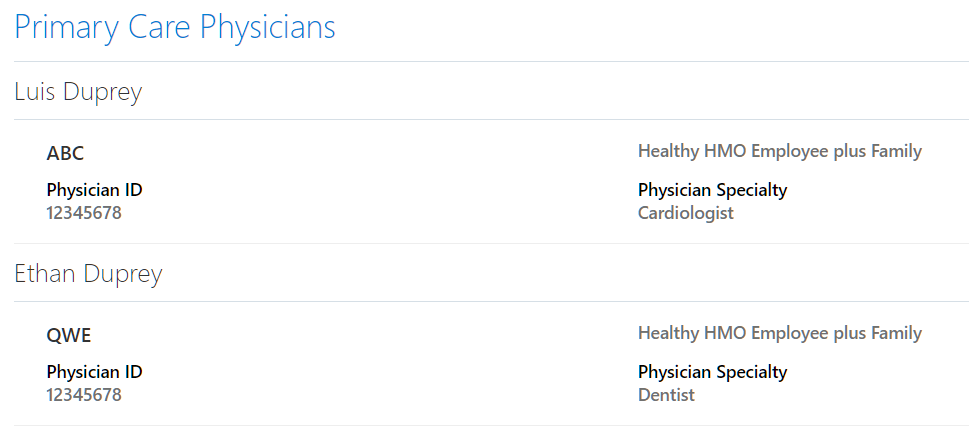

Primary Care Physicians

Use Transaction Design Studio to Show Hidden Fields

You can now use the Transaction Design Studio to personalize the Benefits Service Centre pages. You can display additional fields or hide entire pages, such as the My Dashboard page.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Watch Benefits Service Centre Redesign and Enhanced Administrative Features Readiness Training

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

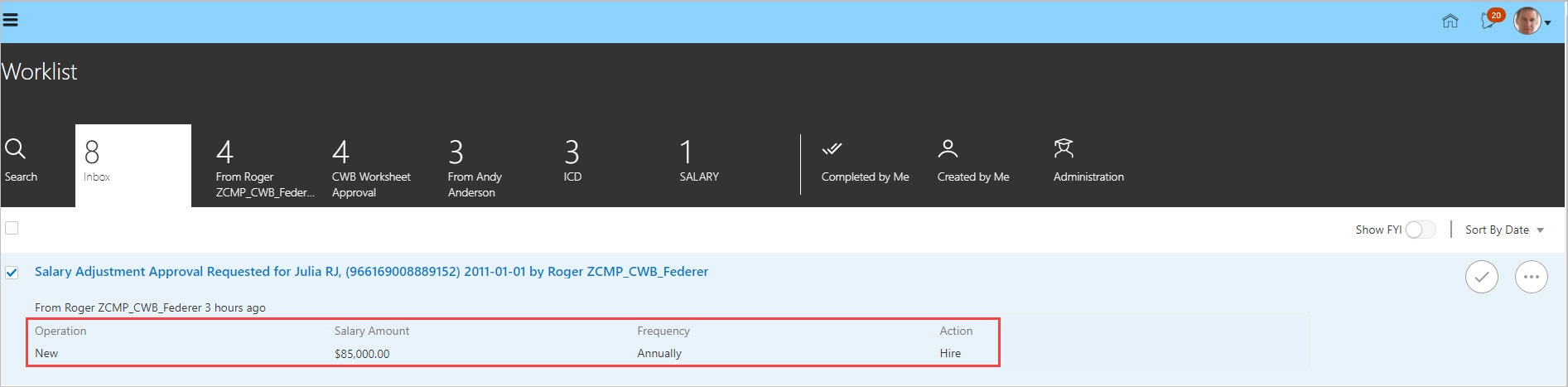

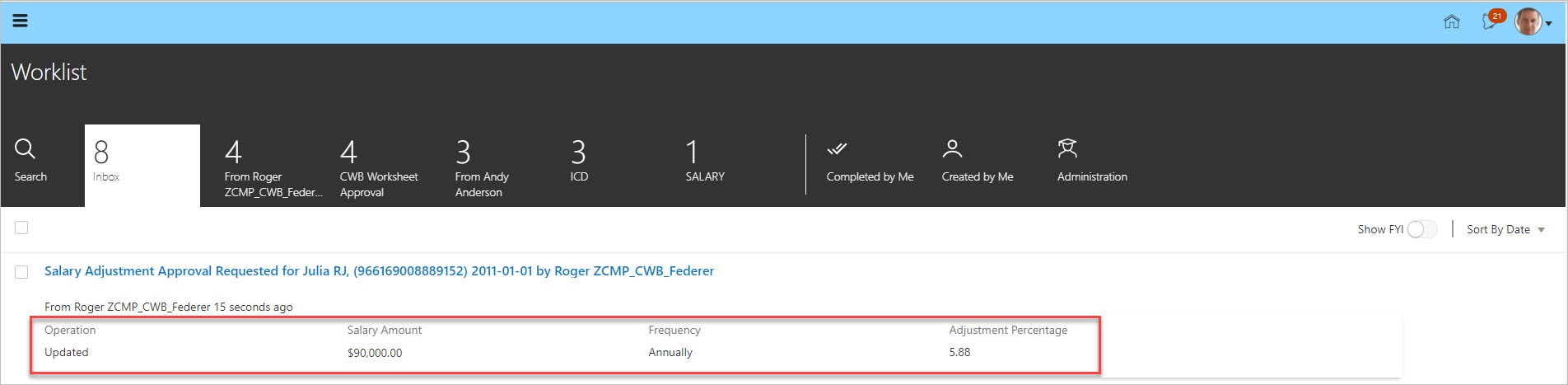

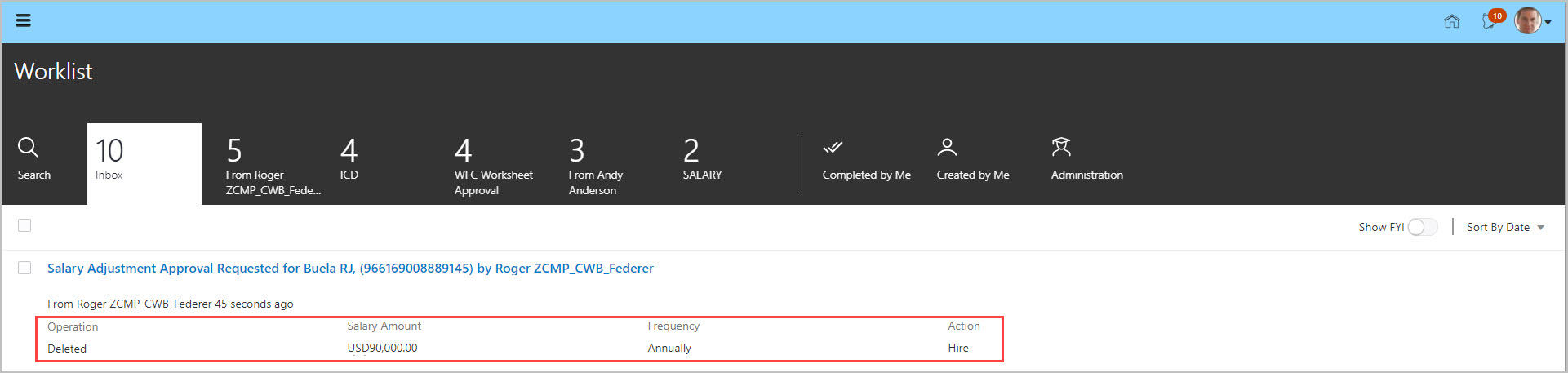

Preview Salary, Individual Compensation Approval Information in the Worklist

In the worklist, notifications awaiting your approval now include values for key attributes. For example, Admin Salary and Change Salary notifications now include these attributes: Operation, Salary Amount, Frequency, Adjustment Percentage, and Action. The values for the first five attributes are included.

Attributes and Values Shown When Creating Salary

Attributes and Values Shown When Updating Salary

Attributes and Values Shown When Deleting Salary

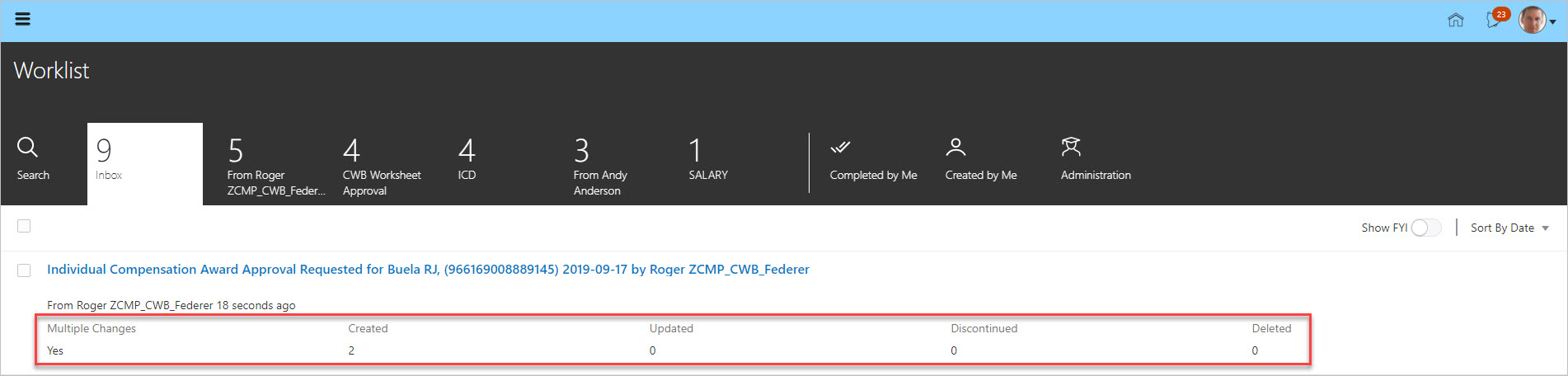

Personal Contribution, Individual Compensation, and Administer Compensation notifications show attributes according to these conditions:

- If only one award or contribution is created, updated, deleted or discontinued, you see the Operation, Plan, and Option attributes.

- If more than one award or contribution is created, updated, deleted, or discontinued, then you see the Multiple Changes indicator as Yes. You also see the possible operations--Created, Updated, Discontinued, and Deleted--and the total changes for each operation.

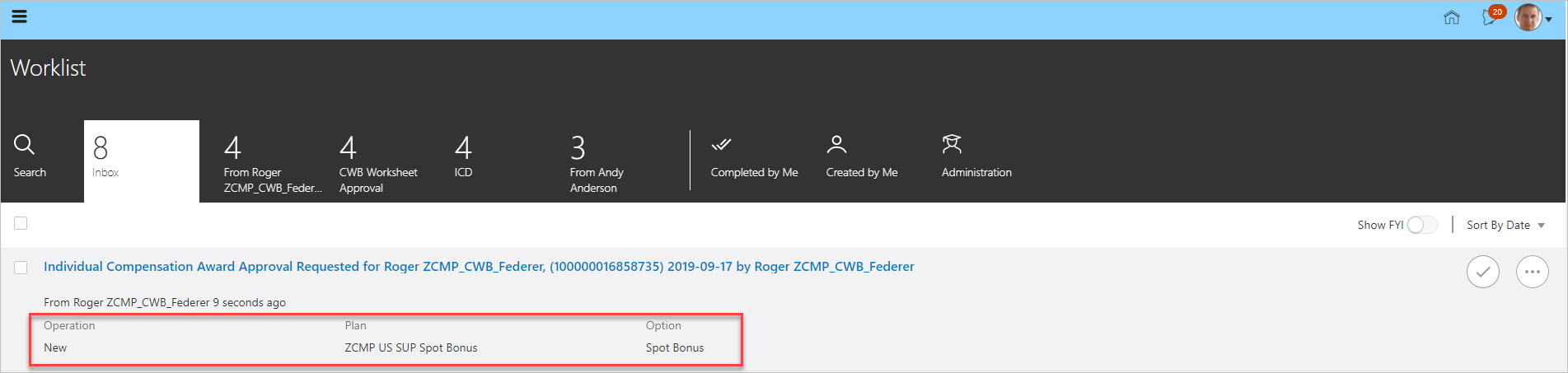

Individual Compensation for One New Transaction

Two New Awards

Individual Compensation with More than One Change

Steps to Enable

This feature requires the correct environment infrastructure in order to use this feature.

If you are interested in using this feature contact Andy McGhee at andy.mcghee@oracle.com. He can check to see if your environment has the correct infrastructure and provide you the instructions to enable.

This feature is expected to be available to all customer environments later this year. There will be another announcement when it is available for all.

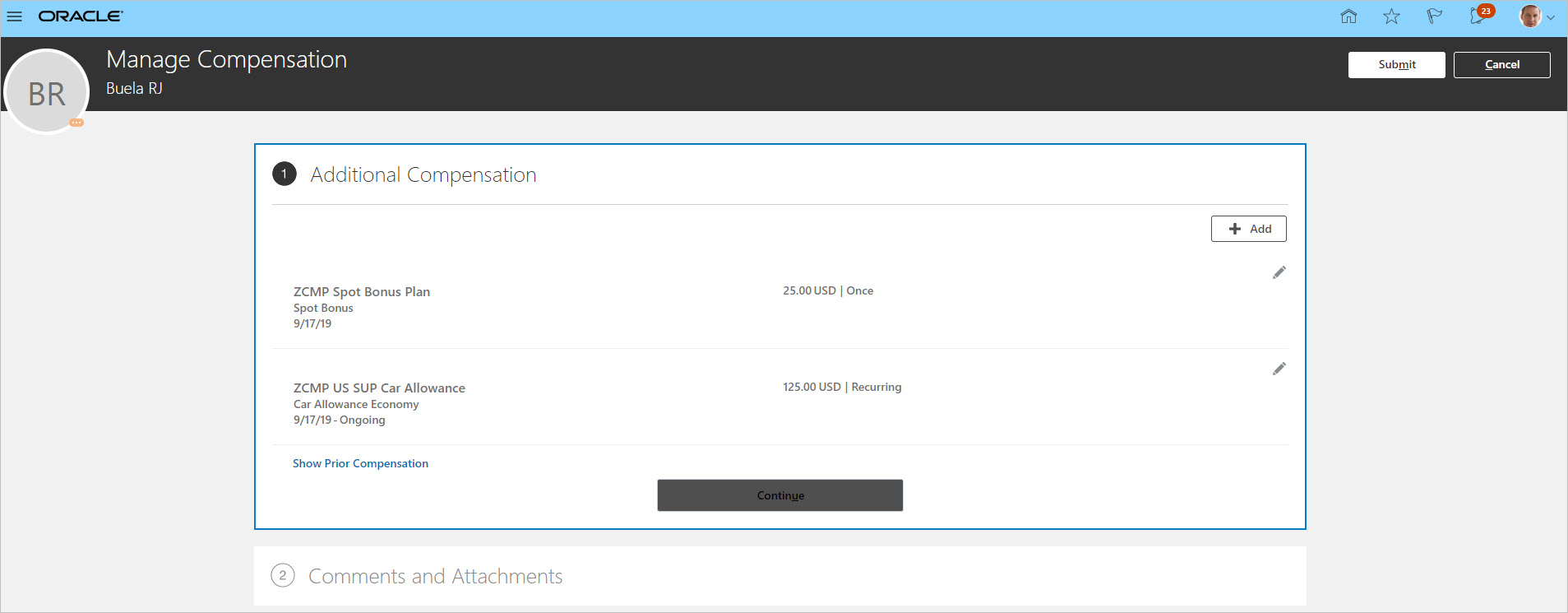

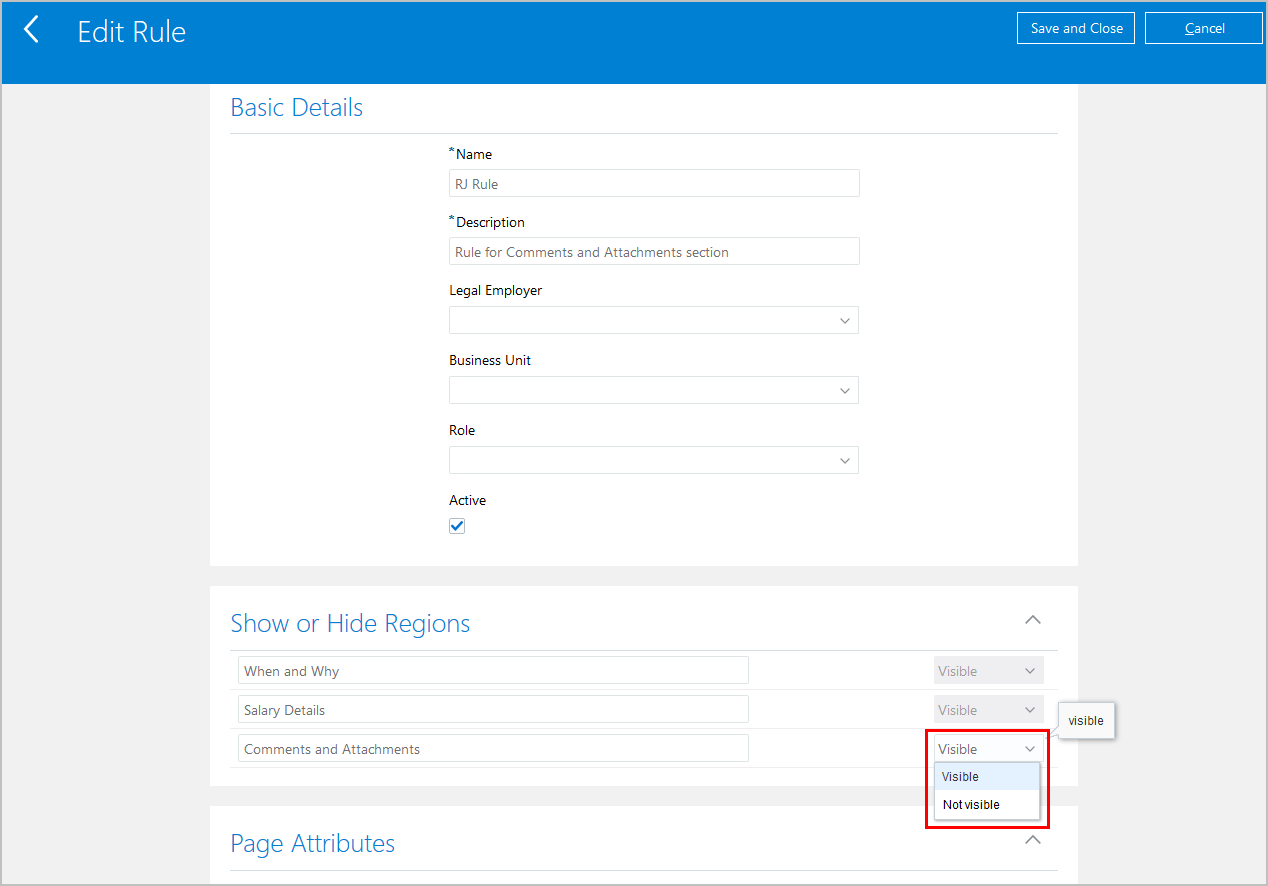

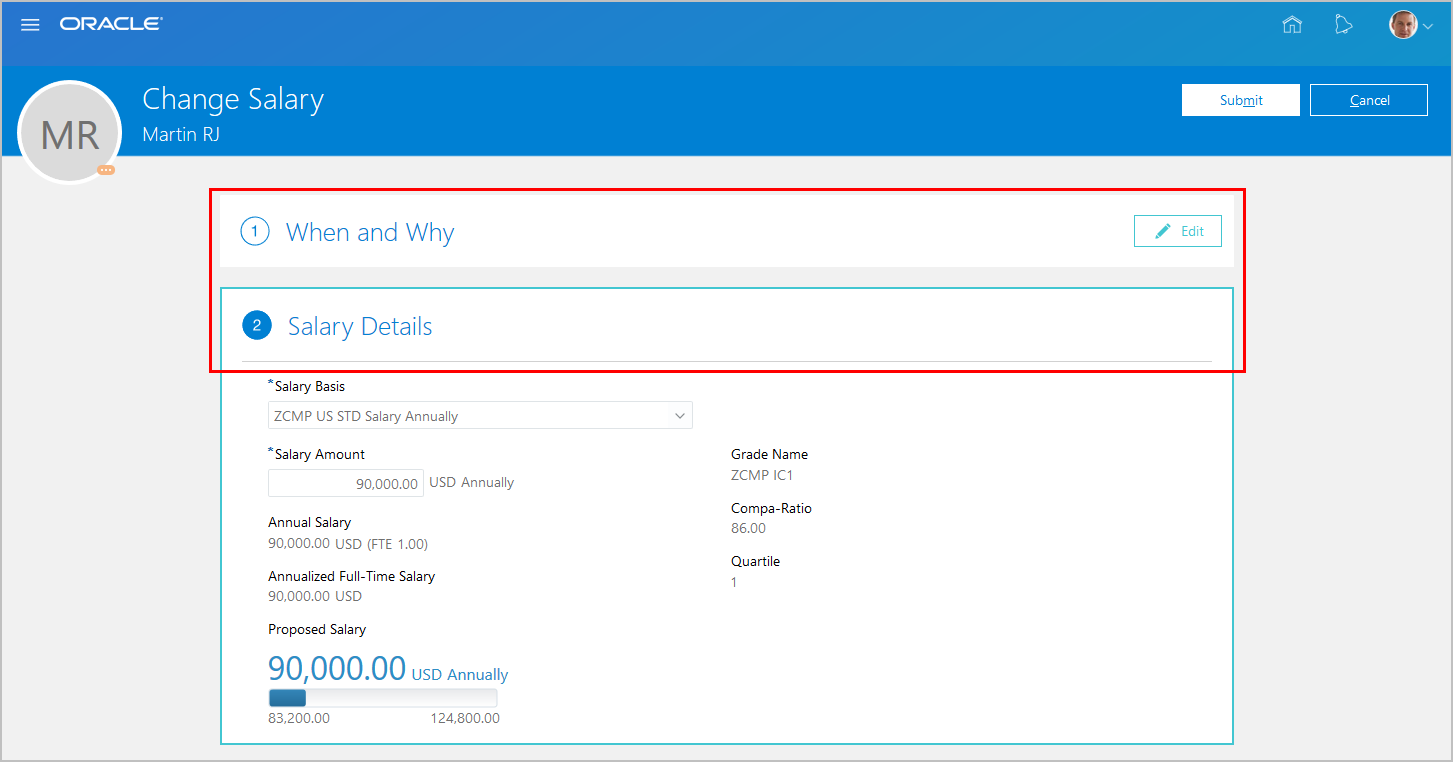

Visibility of Comments and Attachment Section in Change Salary Flow

Using HCM Design Studio, you can now control visibility of the Comments and Attachment section in the Change Salary flow.

Configure Visibility for Comments and Attachment Region

Comments and Attachment Section Is Not Visible

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The Questionnaire page can't be enabled for this flow.

- You need to create separate rules in HCM Design Studio when you want this section to show for certain roles but not for other roles.

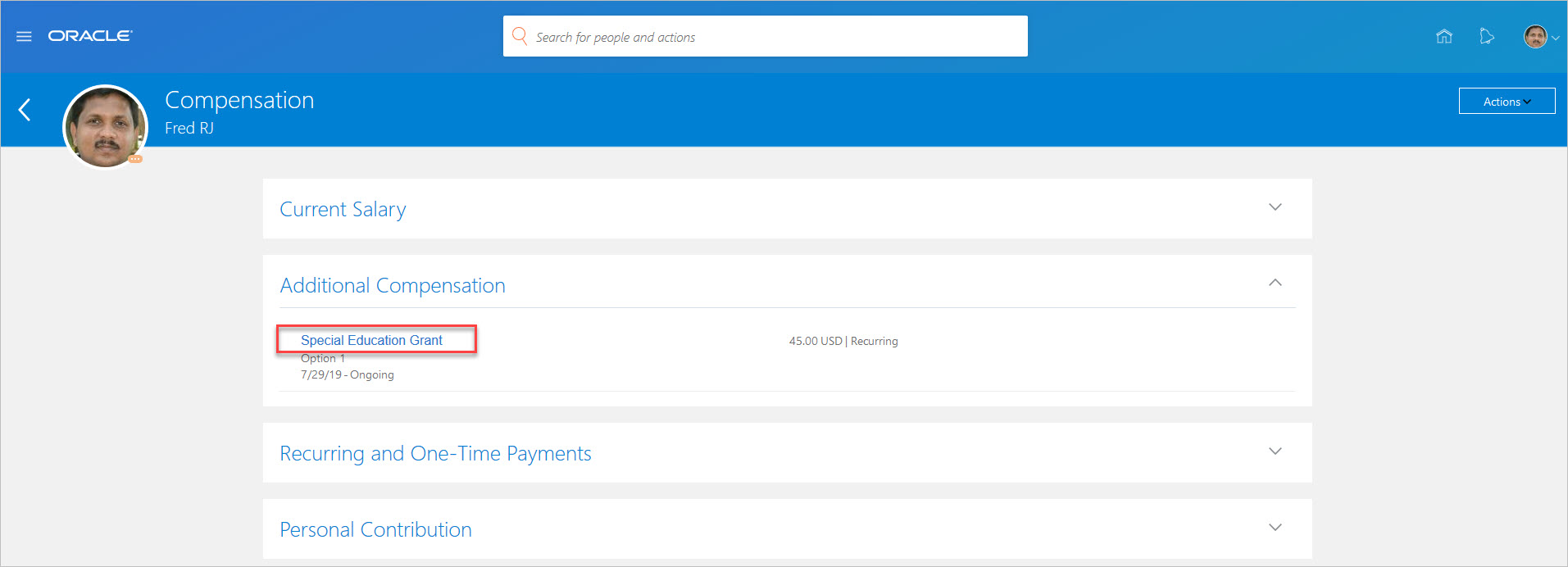

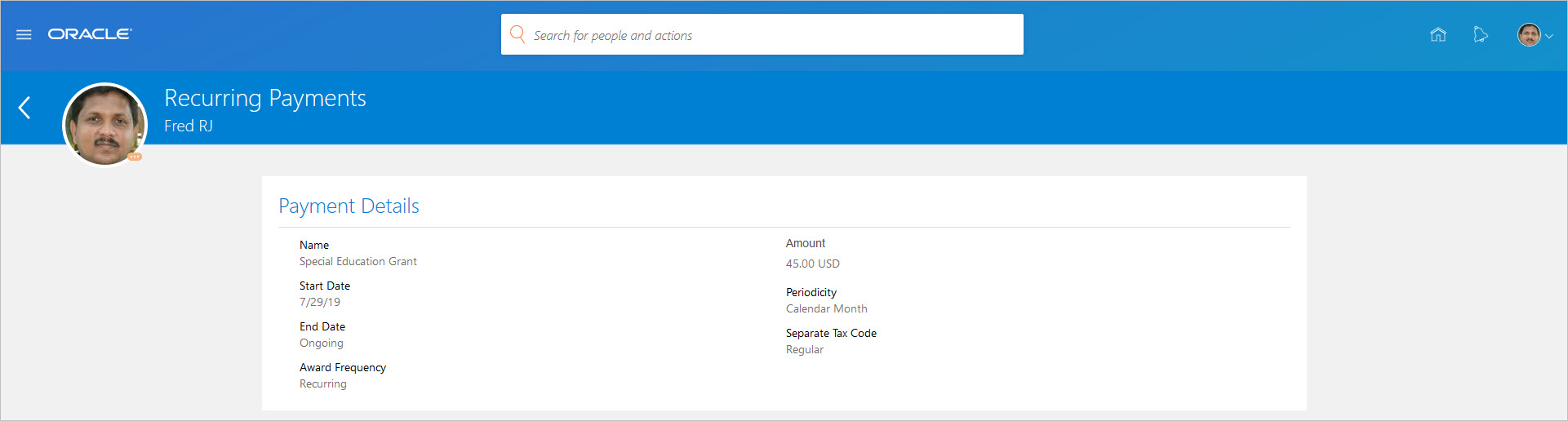

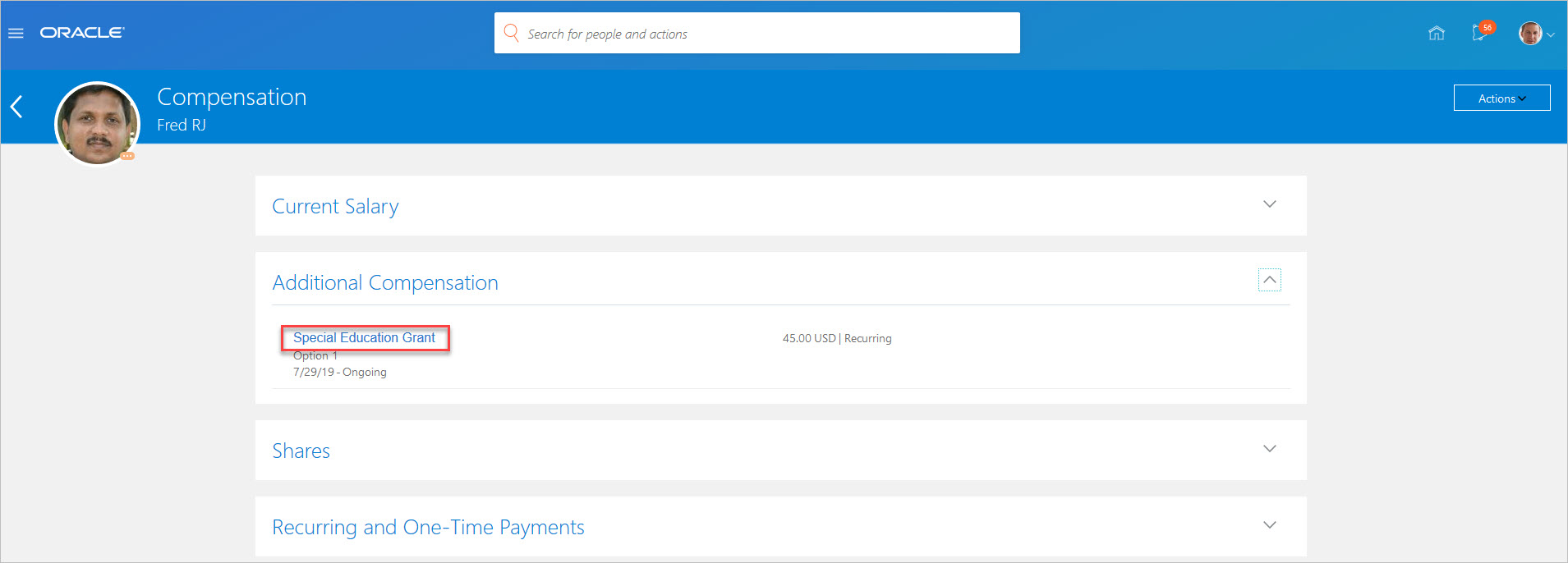

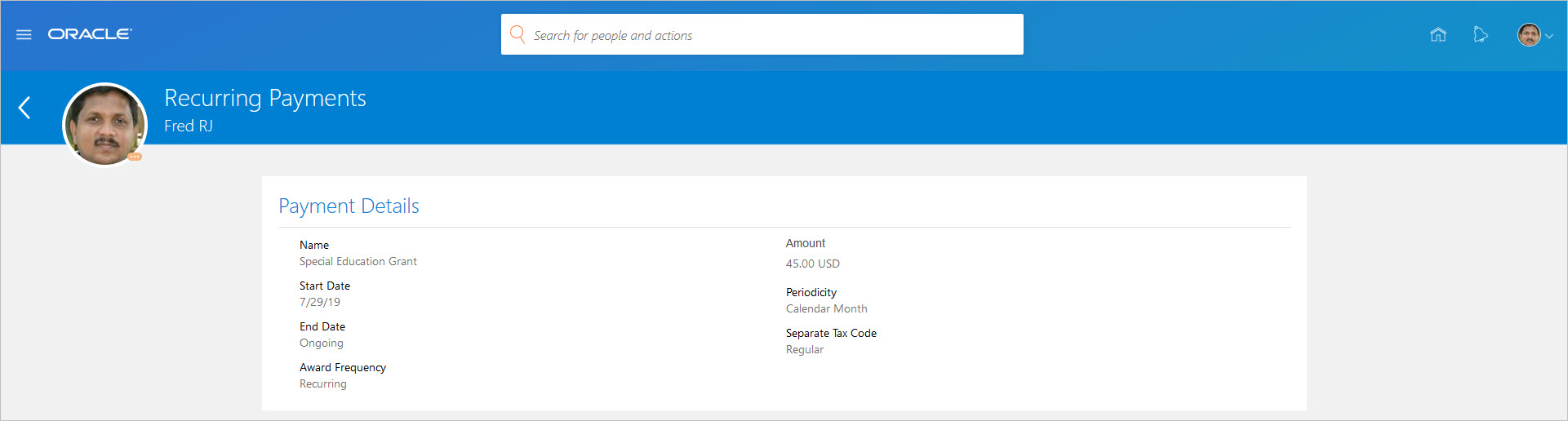

View Individual Compensation Plan Details from Compensation Spotlight

As an employee, when you look at your personal contribution details, additional compensation details or, recurring or one-time payment details in your compensation spotlight, you can now view all the other input values too.

My Compensation Info - Additional Compensation Section

Element Input Values

As a line manager, or HR specialist, when you look at a person's additional compensation details, recurring or one-time payment details in their compensation spotlight, you can now view all the other input values too.

Compensation Info - Additional Compensation Section

Element Input Values

Steps to Enable

You don't need to do anything to enable this feature.

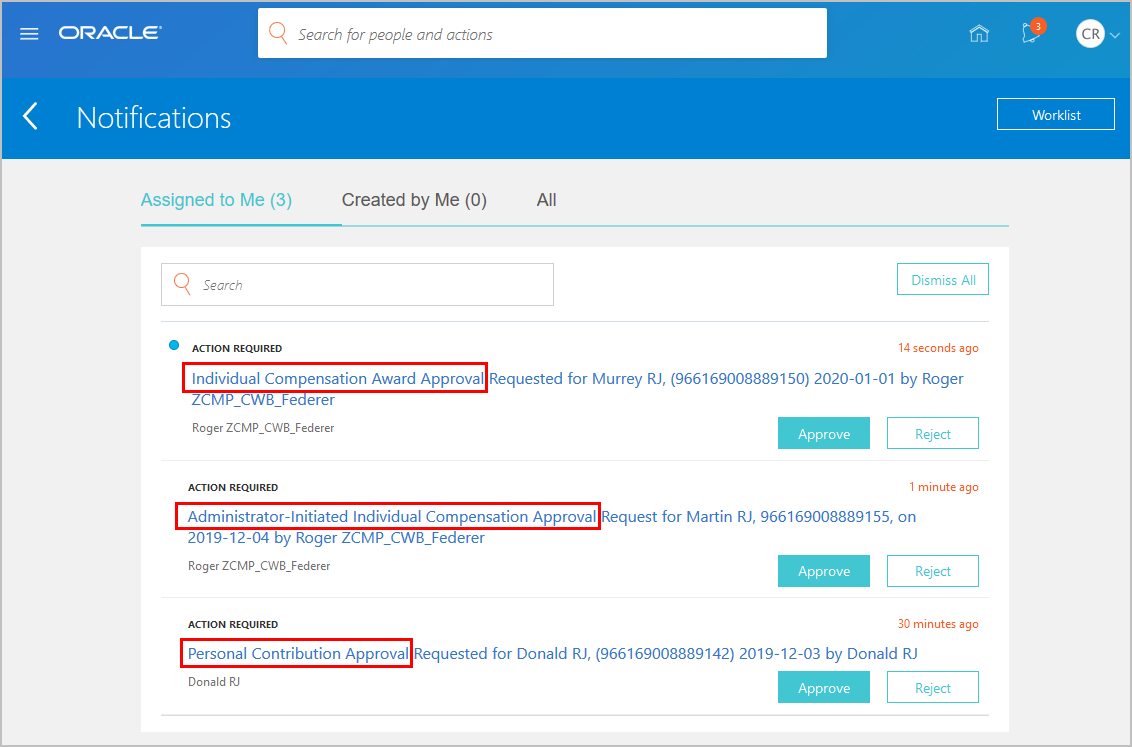

Dynamic Subject Includes the Action Used to Submit Individual Compensation

Depending on your role, you can submit individual compensation requests using one or more of these actions: Manage Personal Contributions, Individual Compensation, and Administer Individual Compensation. The subject line of the approval requests will now include the action used.

Notifications

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- This affects all transactions initiated from now on.

- Customized notification titles will be impacted, and you will have to consider redoing the customization.

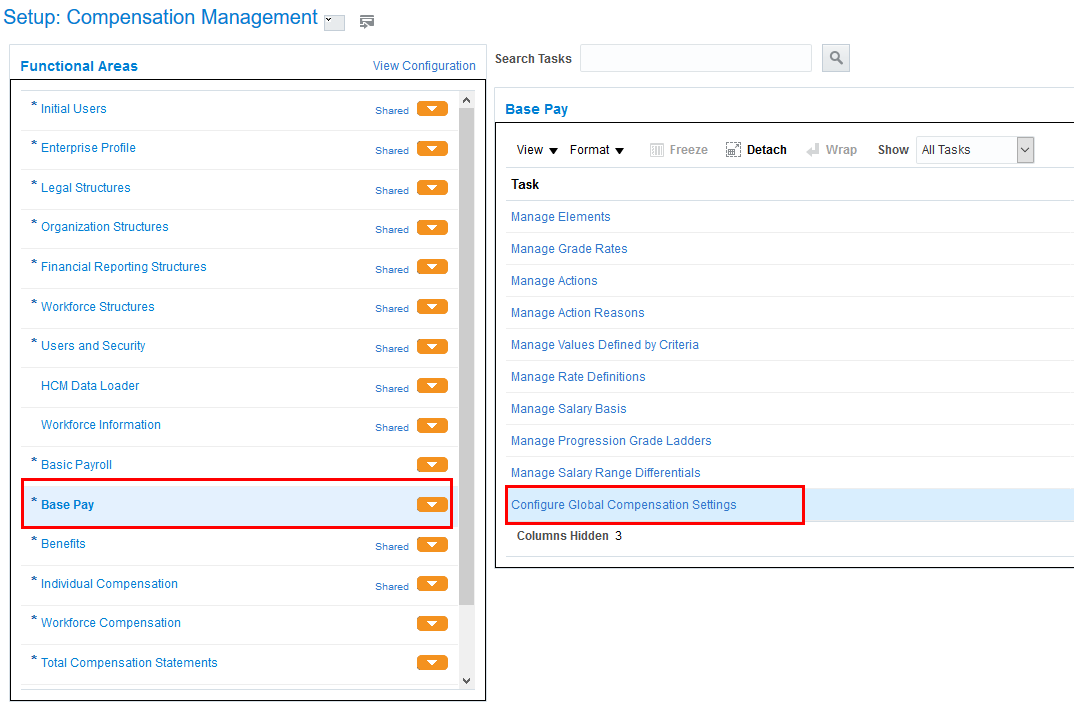

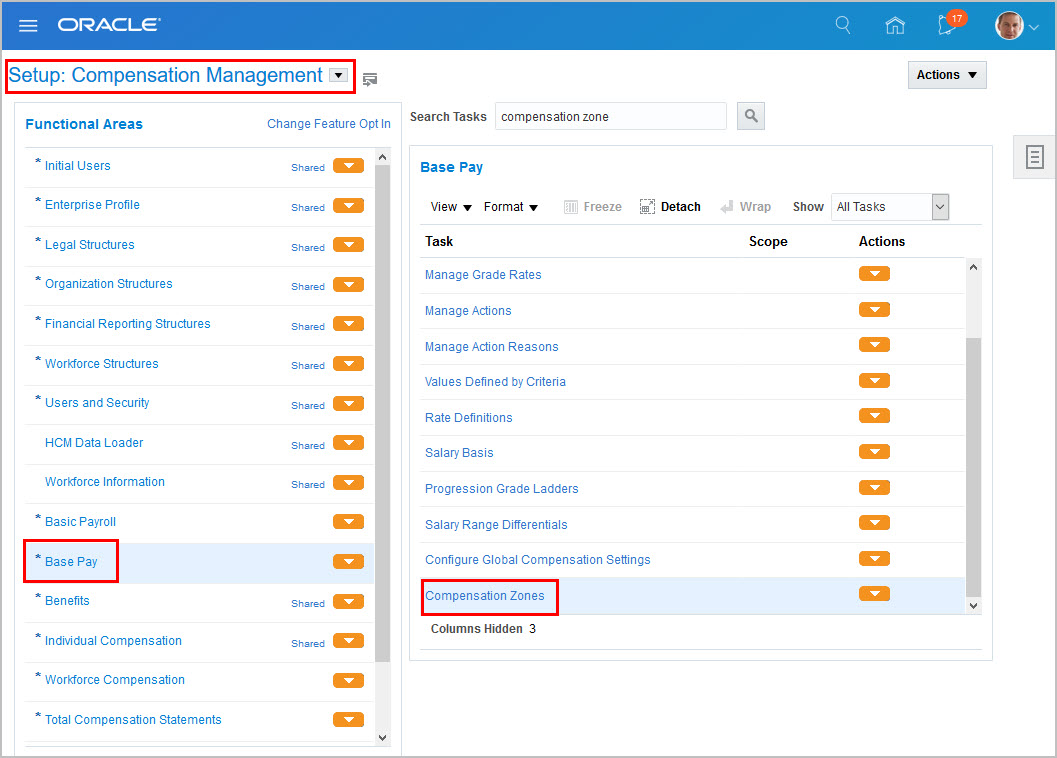

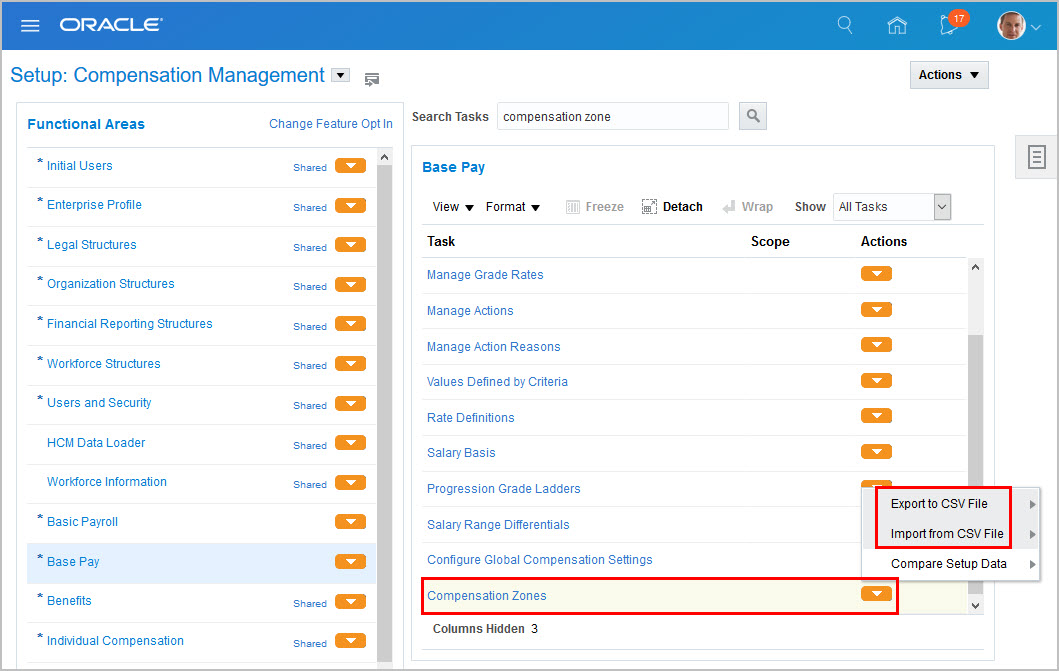

Configure Global Compensation Settings Added to Base Pay Task List

The Configure Global Compensation Settings task is now available in both the Base Pay and Workforce Compensation functional areas. Previously, it was only available in the Workforce Compensation functional area.

Tasks in the Base Pay Functional Area

Steps to Enable

You don't need to do anything to enable this feature.

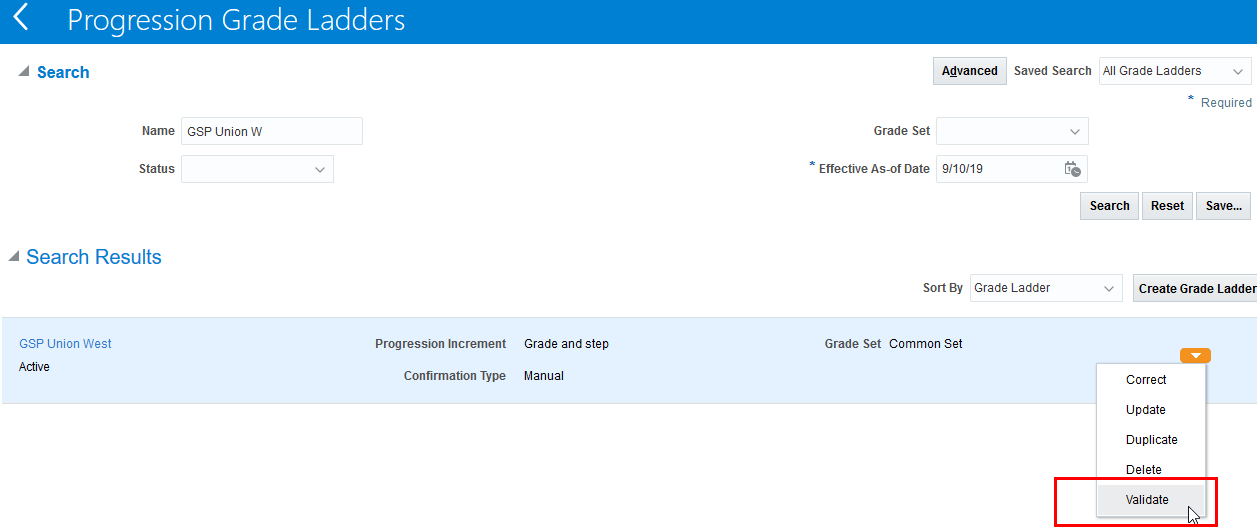

Validate Progression Grade Ladder During Setup

In update 19D, we added validation to the grade step progression batch processes that checks for errors in your progression grade ladder setup. You can now run the same validation directly on the Progression Grade Ladders page, using the new Validate action.

New Validate Action on the Progression Grade Ladders Page

Validation messages alert you to issues with your grade ladder definition that may be missing some values for the attributes required for grade step progression. If you don't fix the errors, you'll see the same messages in the batch log when you run your processes. You need to fix the errors before your grade ladder can be processed for progression or rate synchronization.

Example Validation Messages for Progression Grade Ladder

You can update a few of the attributes directly on the Progression Grade Ladders page. Others you need to update using HCM Data Loader or HCM Spreadsheet Data Loader. The Resources section contains information to help you make these updates.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The validation checks the progression grade ladder that's effective as of the date on the Progression Grade Ladder page. It doesn't check prior or future versions.

Key Resources

- For information about the batch validation messages, refer to the feature in the What's New for 19D called Validate Progression Grade Ladder During Batch Processing

- To update the attributes on your grade ladder using HCM Data Loader, refer to Integrating with HCM guide and the topics on Loading Compensation Objects/Guidelines for Loading Progression Grade Ladders.

- If your grades have steps, you need to update the Progression Grade Ladder object and the Progression Step Rate component of this object

- If your grades don't have steps, you need to update the Progression Grade Ladder object and the Progression Grade Rate object

- To update the attributes on your grade ladder using HCM Spreadsheet Data Loader, you can find sample templates and instructions in My Oracle Support Document ID 2569831.1

We've made it easier for you to see rows in Stock Grants. Previously only 2 rows of grants were visible on the page.

Steps to Enable

You don't need to do anything to enable this feature.

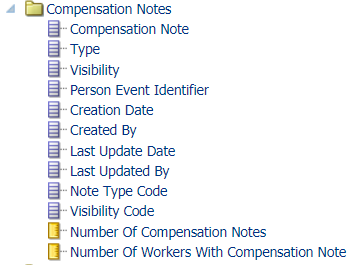

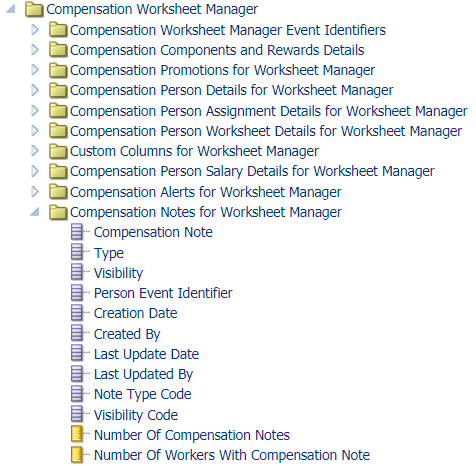

View Consolidated Posting Data

In release 19C, we provided the ability to post compensation allocations by type. To help administrators manage the posted data, we've added a new Consolidated Posting Summary Report in View Administration Reports. The new report is located in View Administration Reports>Data Processed

New Consolidated Posting Summary Report

Within the report, you are able to see the following for each batch run:

- Process ID

- Run Mode

- Run Start Time

- Run End Time

- Who submitted the batch process

- If unhidden, you can see if assignments were marked as "Processed"

For each allocation type (element, promotion, salary, stock) within the batches the following is available:

- How many were posted

- How many failed

- How many were backed out

- How many had no action taken

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

This report displays only overall data processed and if assignments are still marked to allow for more processing. You need to review the Posting Error Summary report to find out why data transfers fail.

Access Audit Trail Data in View Administration Reports

You can now access audit trail data in View Administration Reports. Previously, you had to navigate to the worksheet or view it by worker in Administer Workers. The new report is found in View Administration Reports>Export Data

New Audit Export Report

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

You must enable the "Include in audit trail" column property before you run the Start process. This is the same as with the Audit report on the worksheet.

Validate Plan Setup Moved to a Drill-Down Page

We changed the Validate Plan Setup pop-up to a drill-down page.

Steps to Enable

You don't need to do anything to enable this feature.

View Budget Changes in the Audit Log When Workers Are Reassigned

You can now view budget changes due to reassignments in the audit log when you use manager level budgets stored as percentages. Previously, this information was not written to the audit log.

Steps to Enable

You don't need to do anything to enable this feature.

Total Compensation Statements Preview Welcome Message

We've made it easier for you to see how the printable Total Compensation Statement will look. This feature will enable you to preview rich format descriptive text for the Welcome Message in the printable statement format, without having to generate statements.

Preview Printable Statement Welcome Message

Steps to Enable

You don't need to do anything to enable this feature.

Preview Worksheet Approval Information in the Worklist

In the worklist, you can now see additional attributes when you view notifications. For the Worksheet Approval notification, you now see which cycle, plan, who submitted the worksheet, and the date on which the worksheet was submitted.

Attributes and Values Shown When You Receive a Worksheet Approval Notification

Steps to Enable

This feature requires the correct environment infrastructure in order to use this feature.

If you are interested in using this feature contact Andy McGhee at andy.mcghee@oracle.com. He can check to see if your environment has the correct infrastructure and provide you the instructions to enable.

This feature is expected to be available to all customer environments later this year. There will be another announcement when it is available for all.

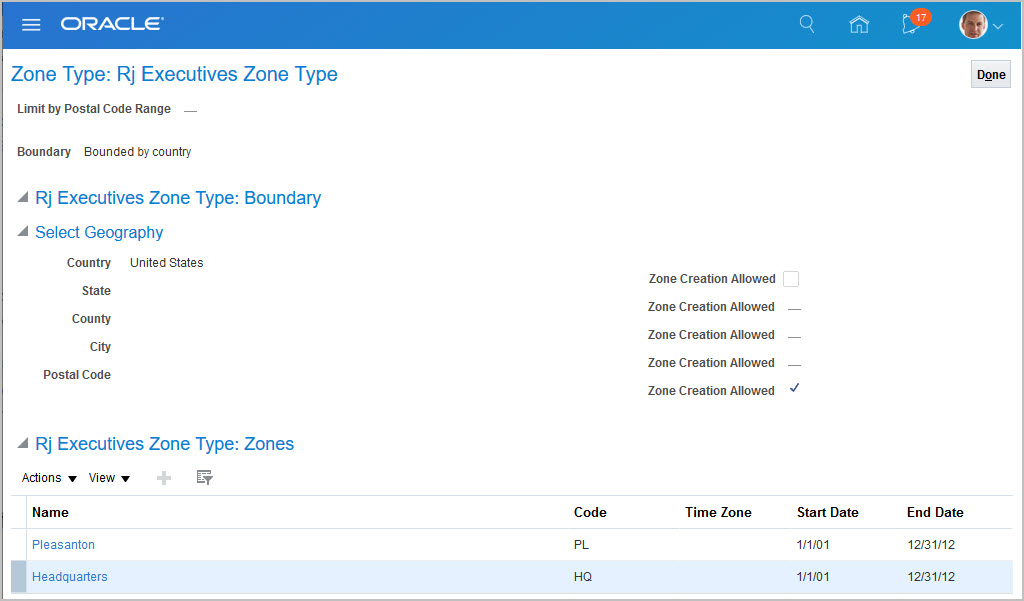

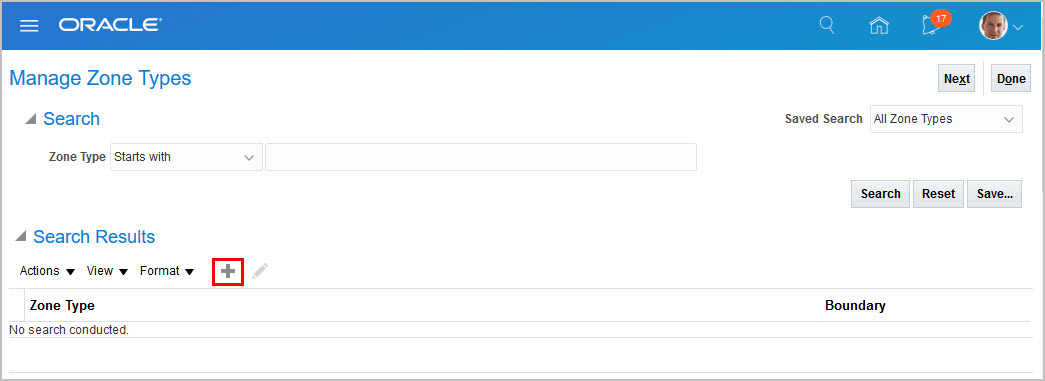

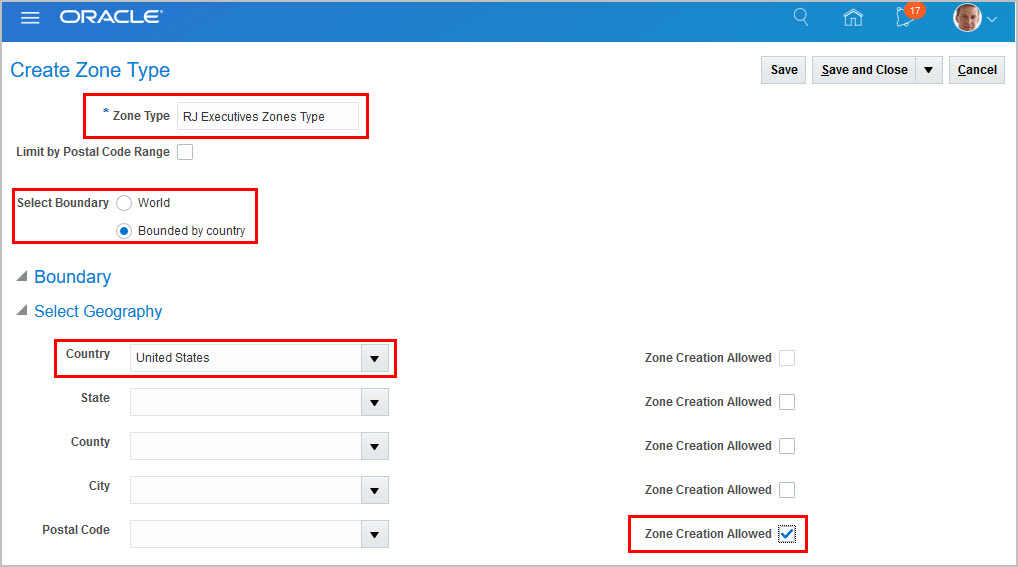

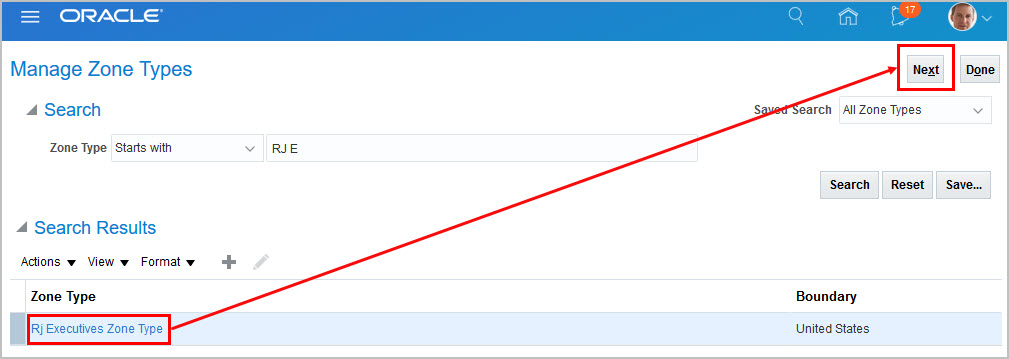

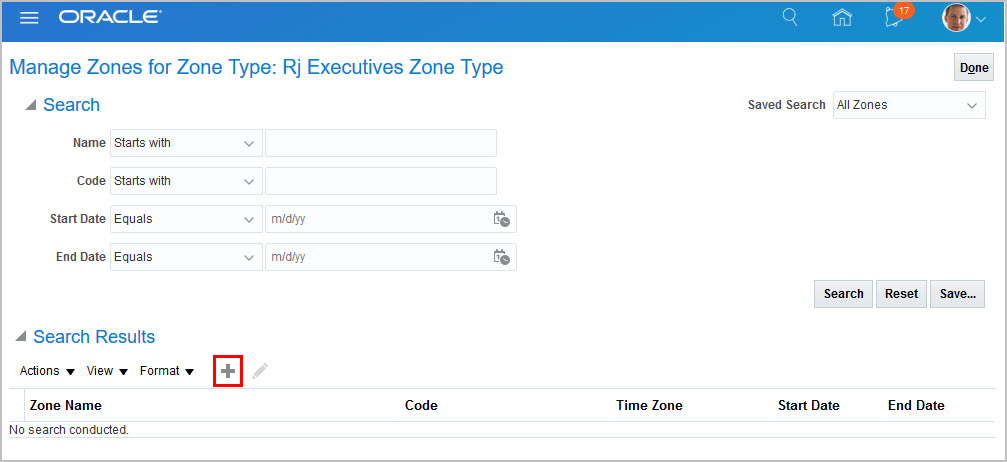

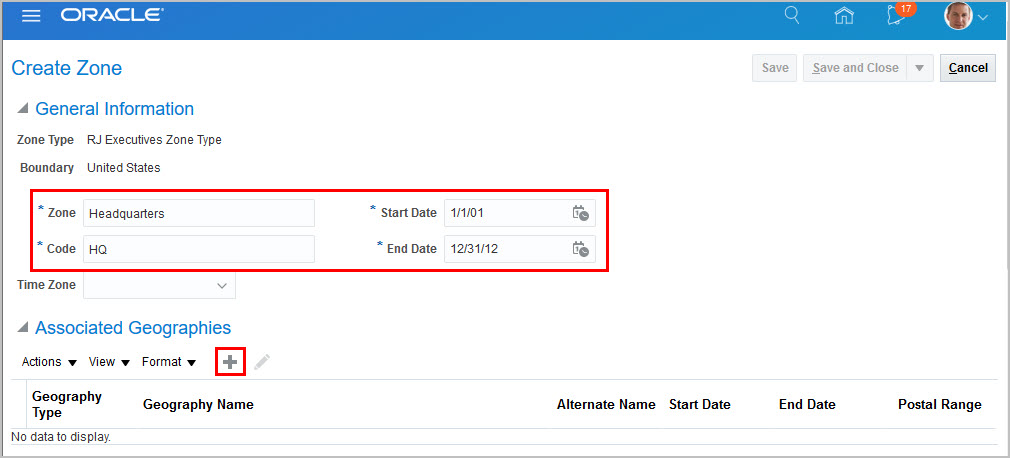

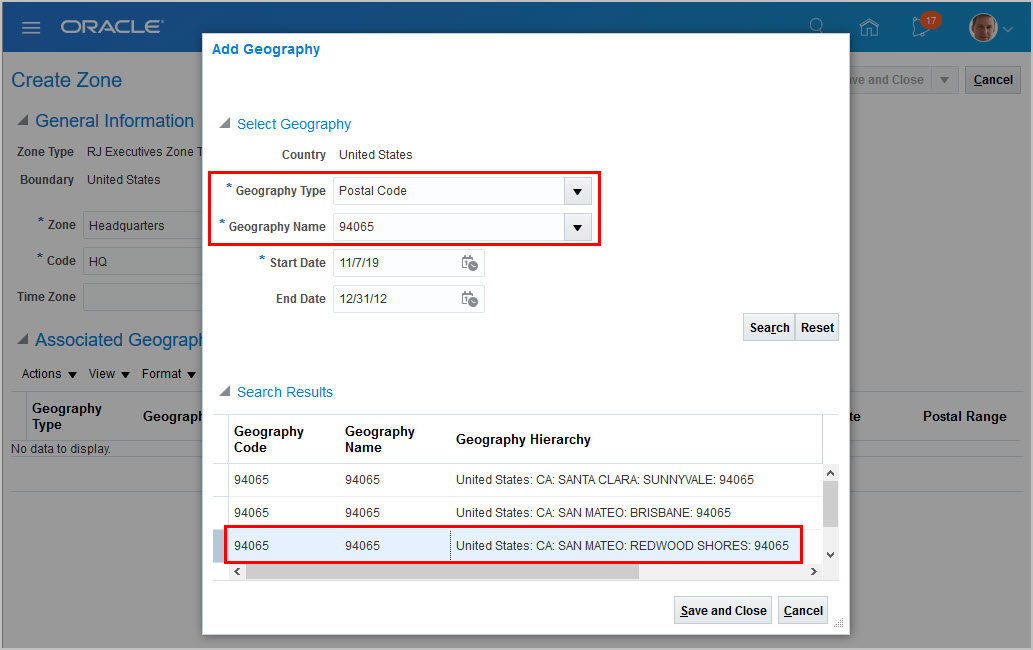

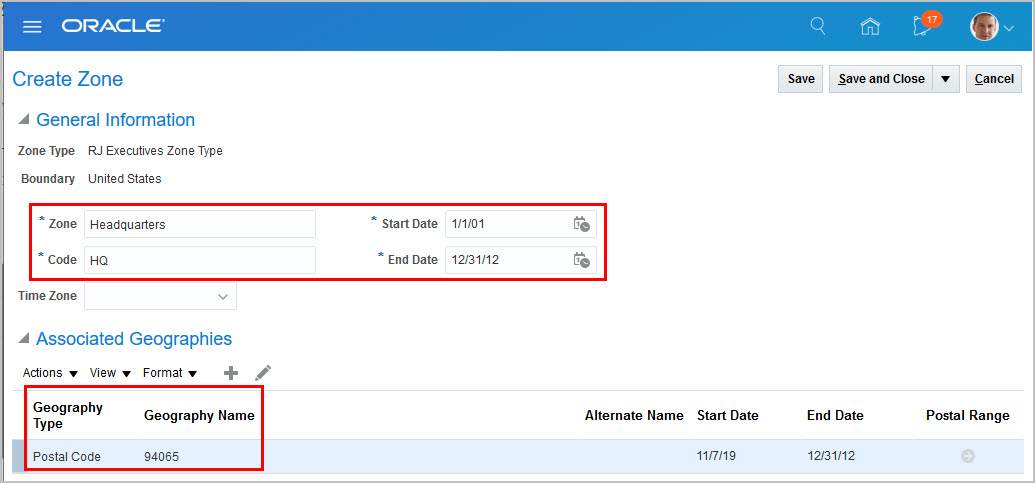

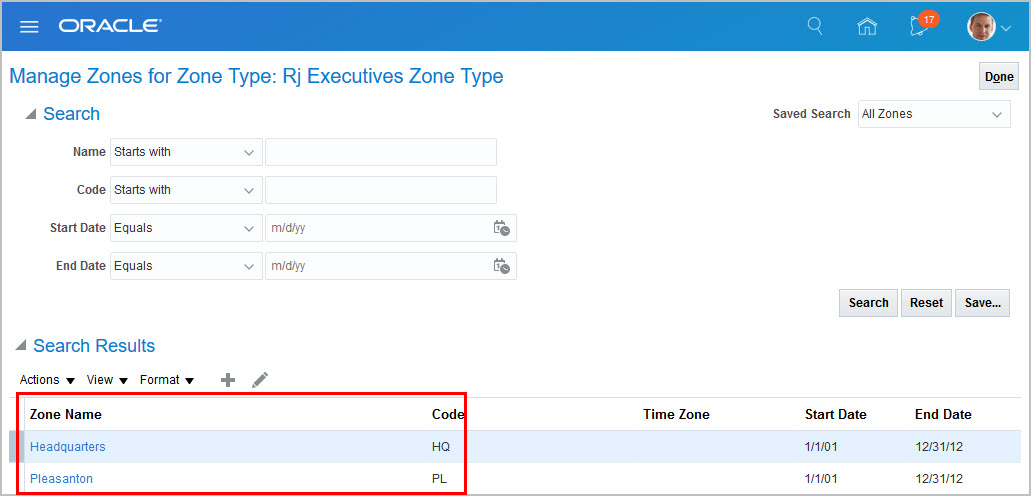

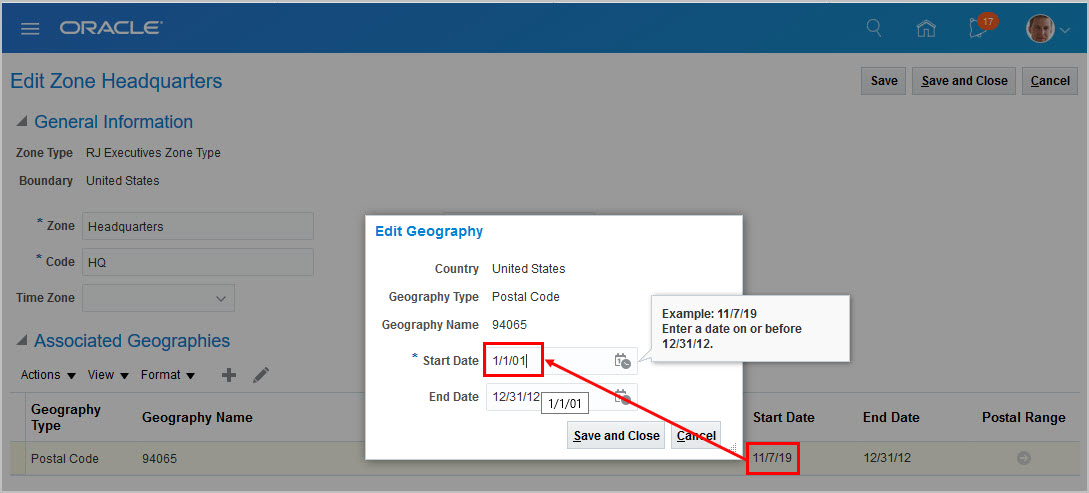

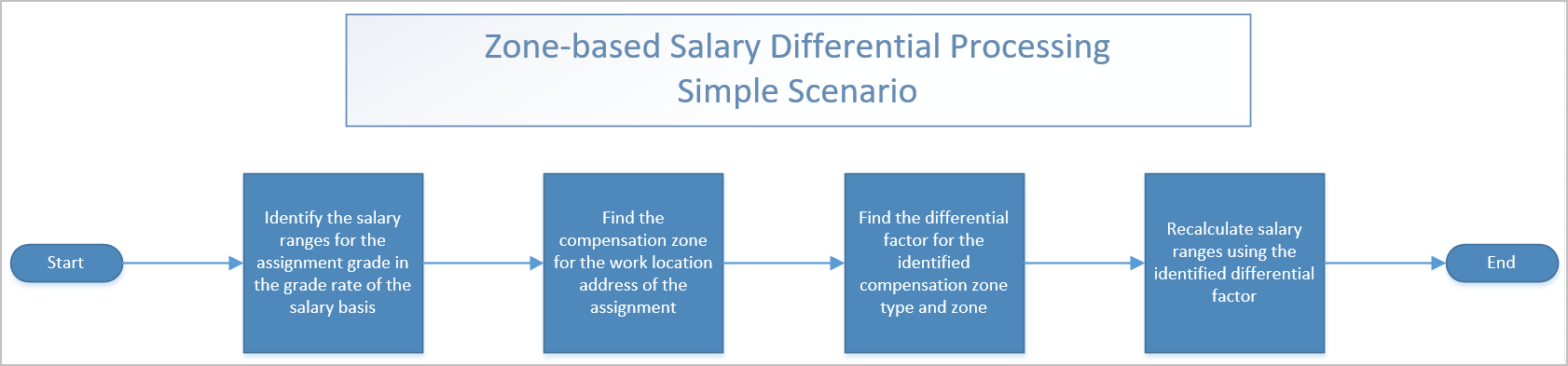

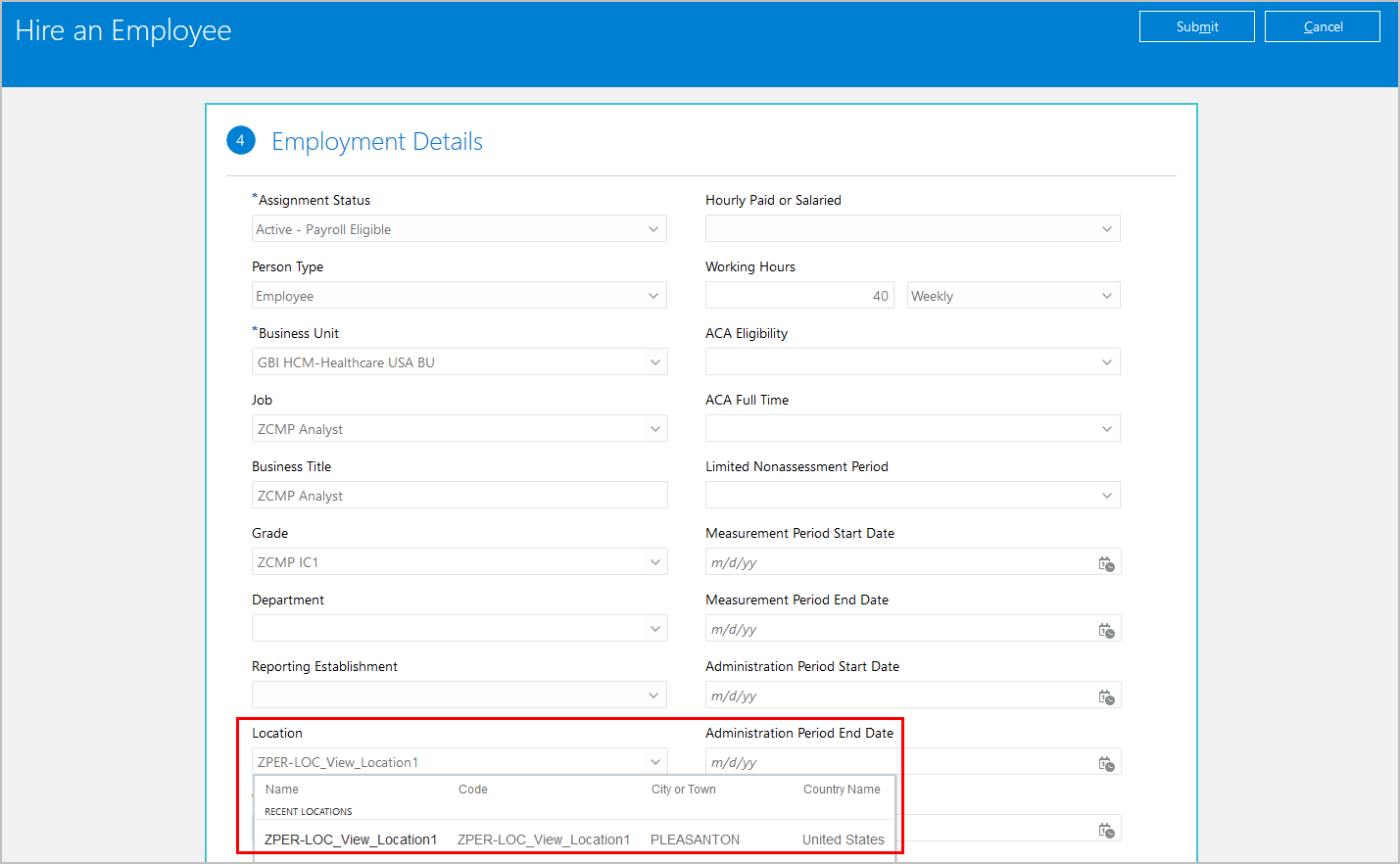

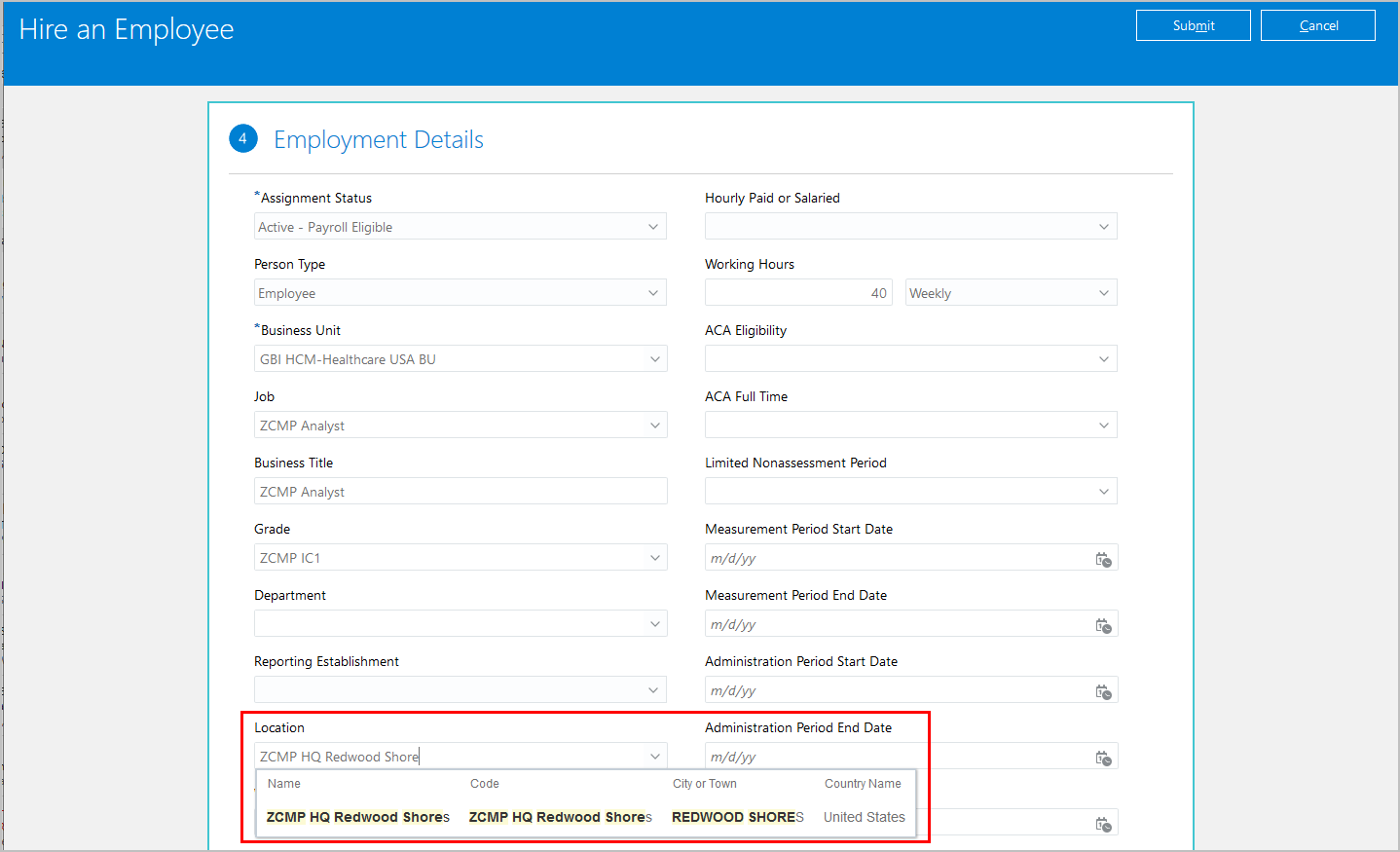

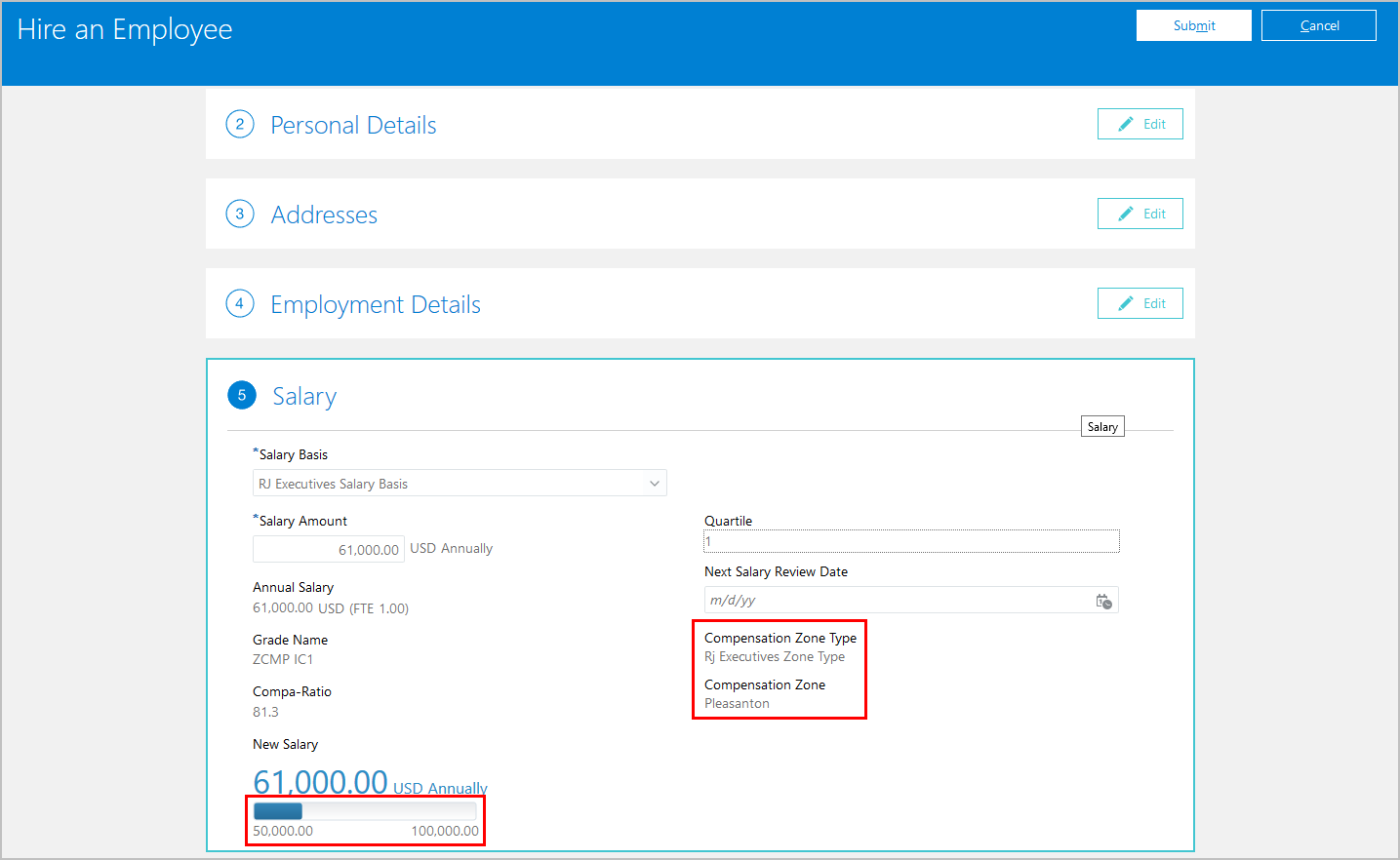

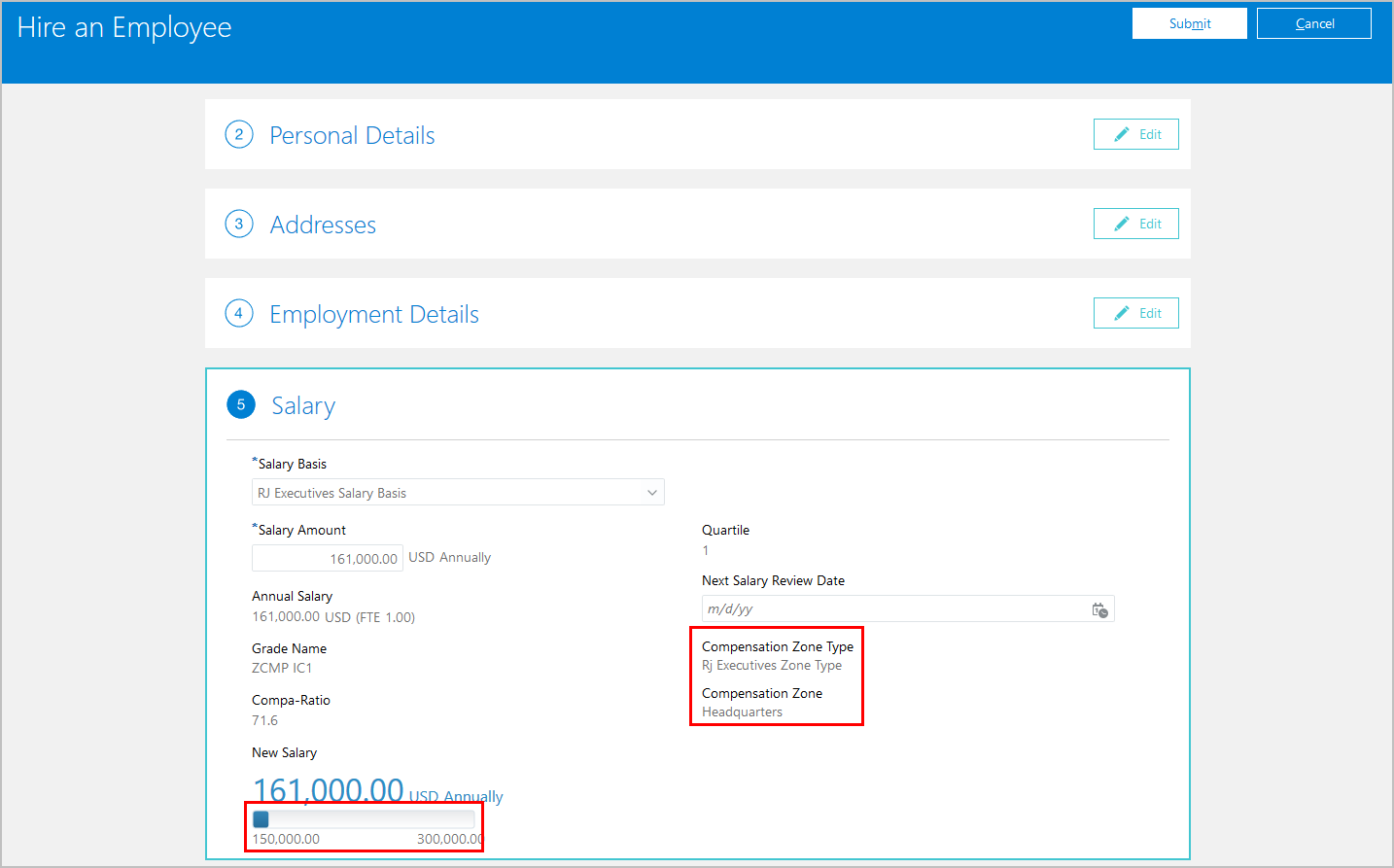

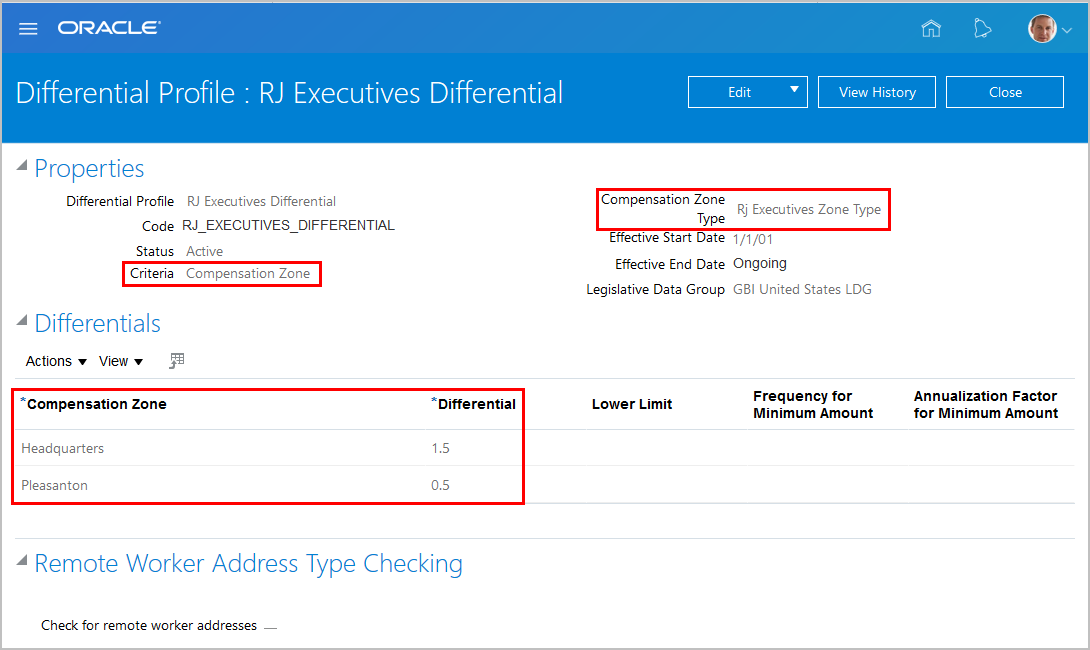

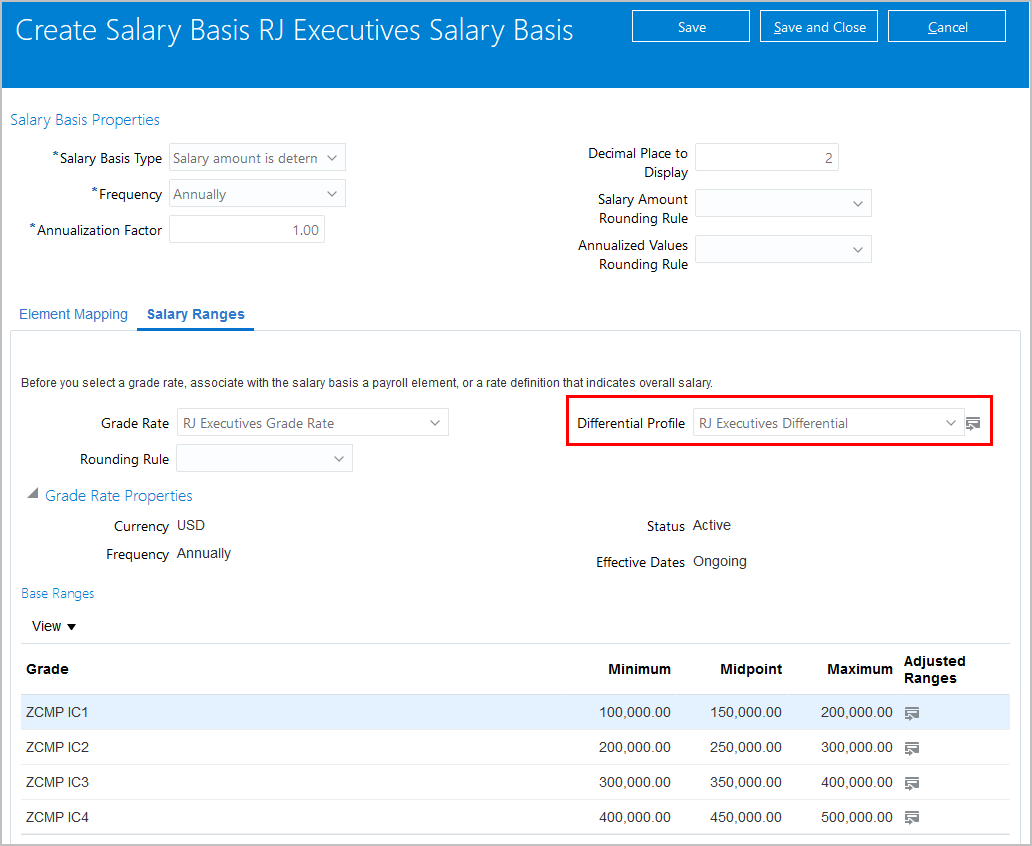

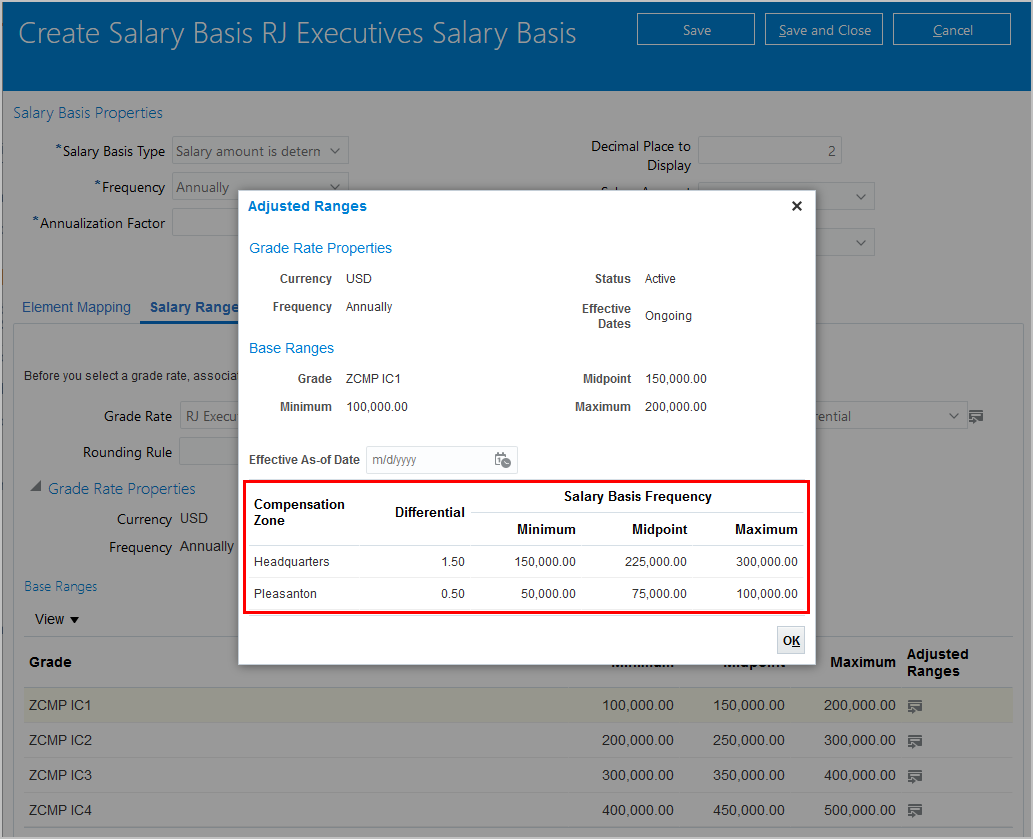

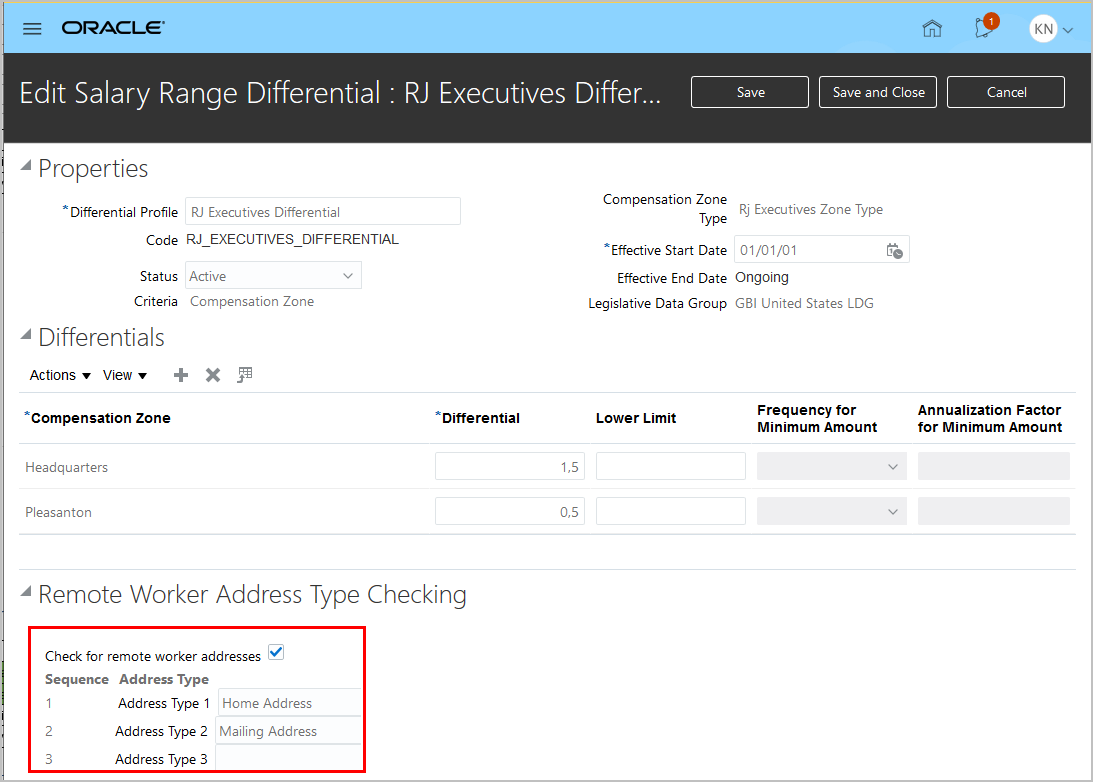

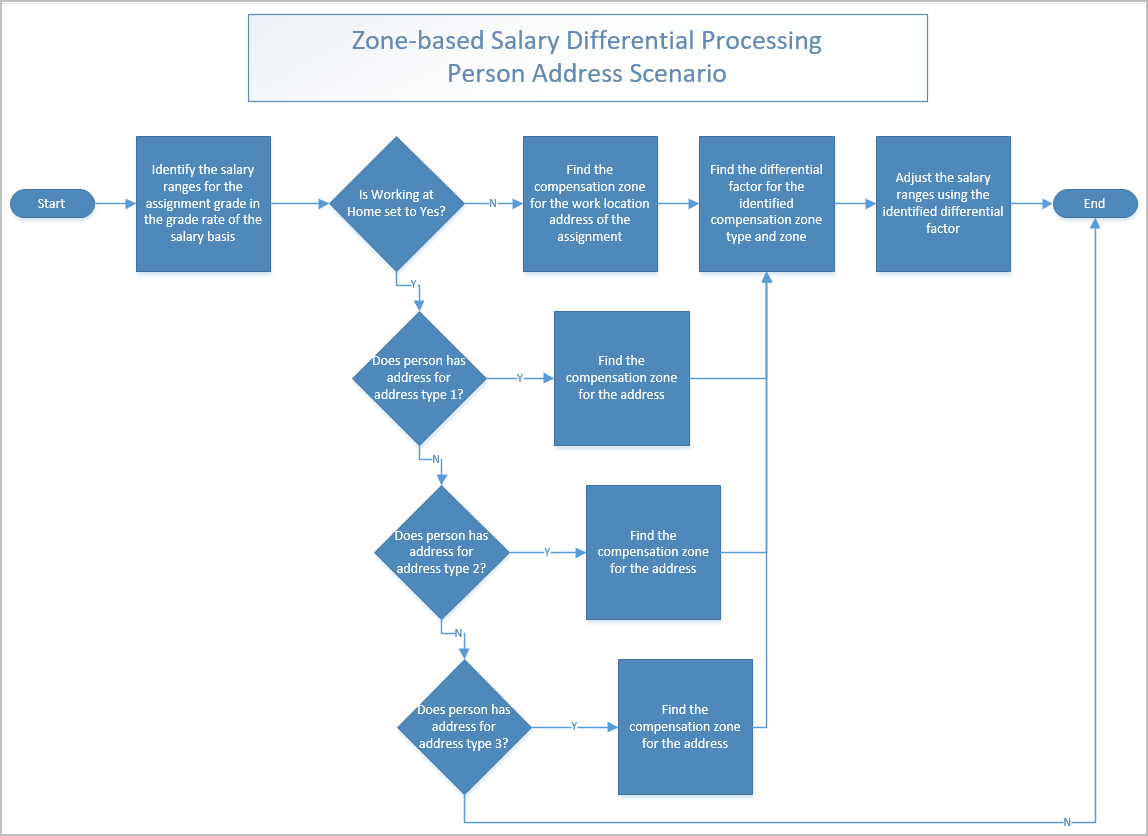

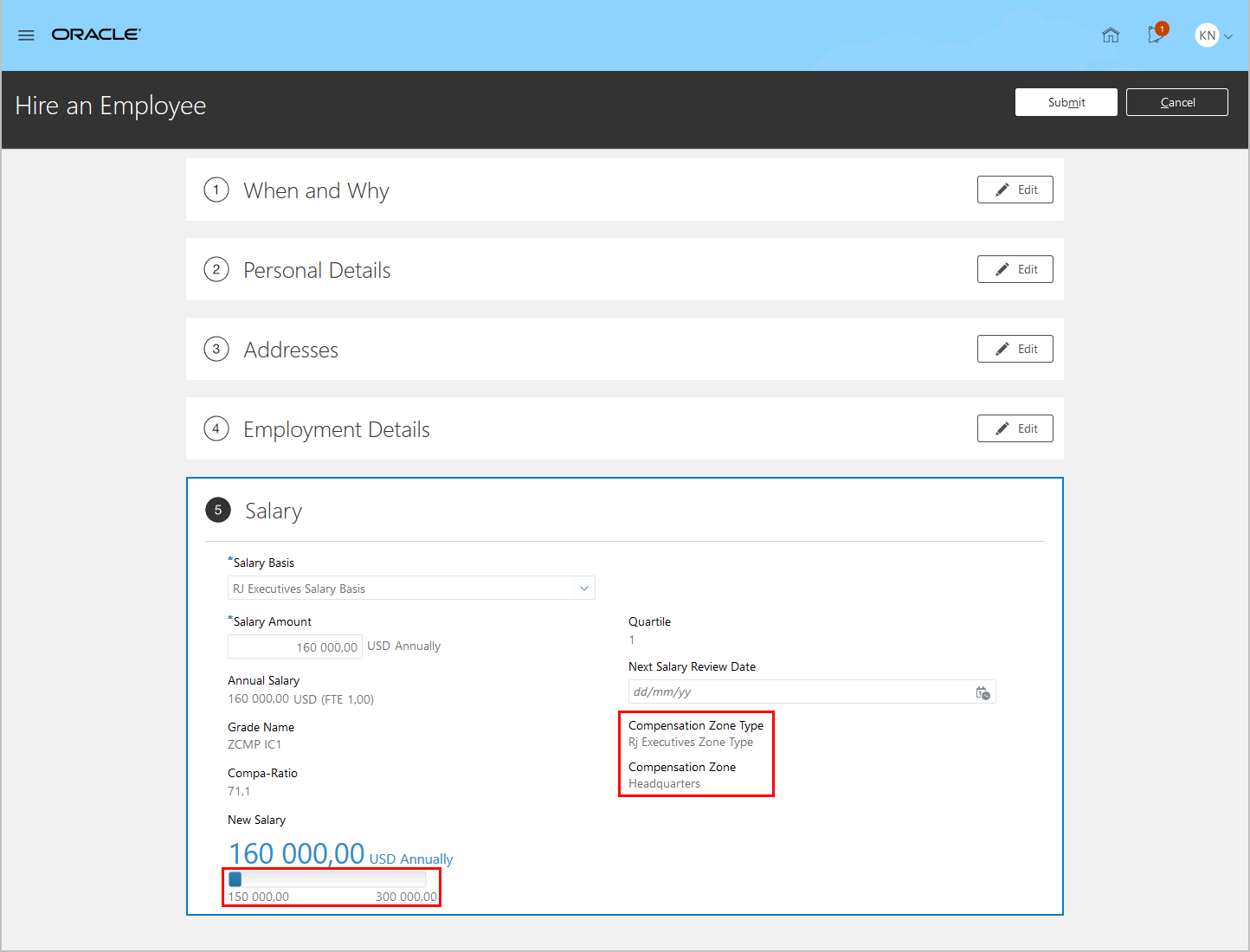

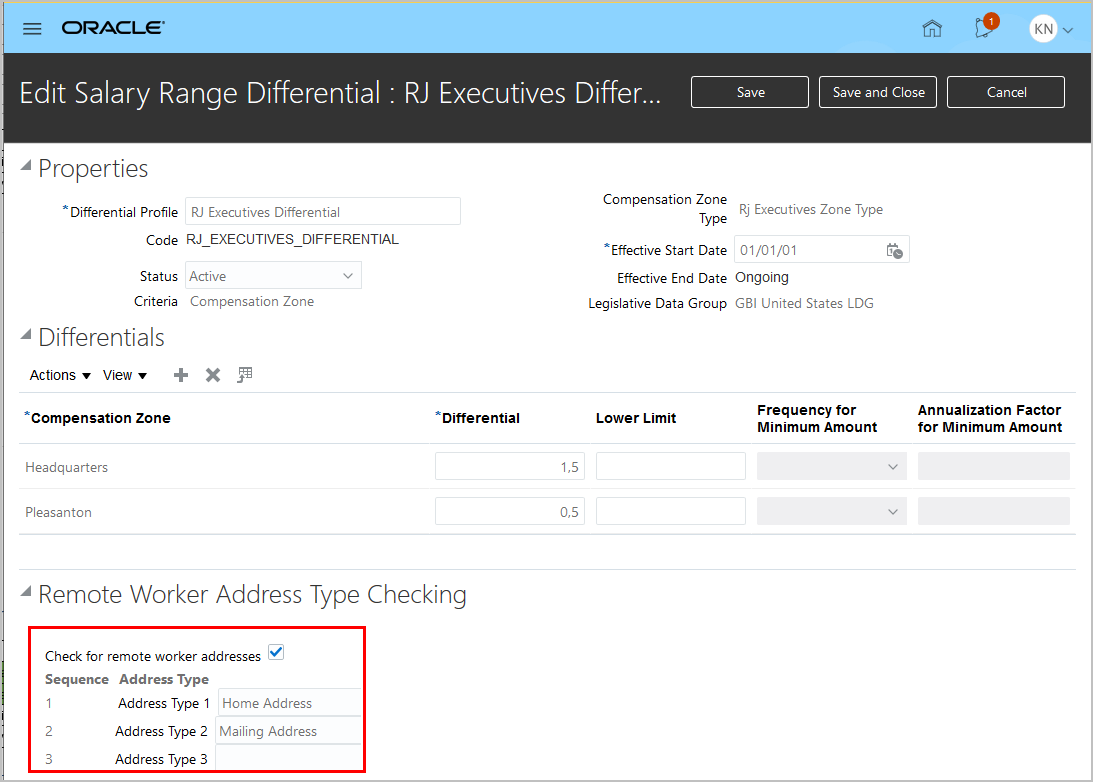

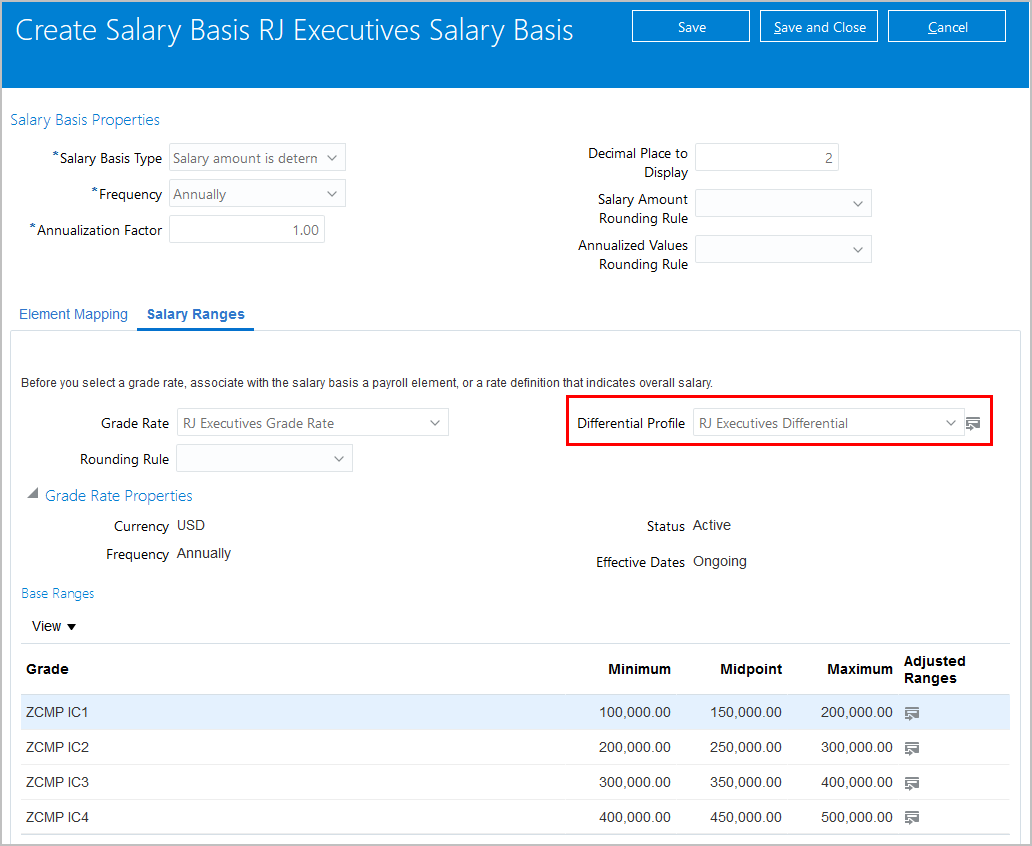

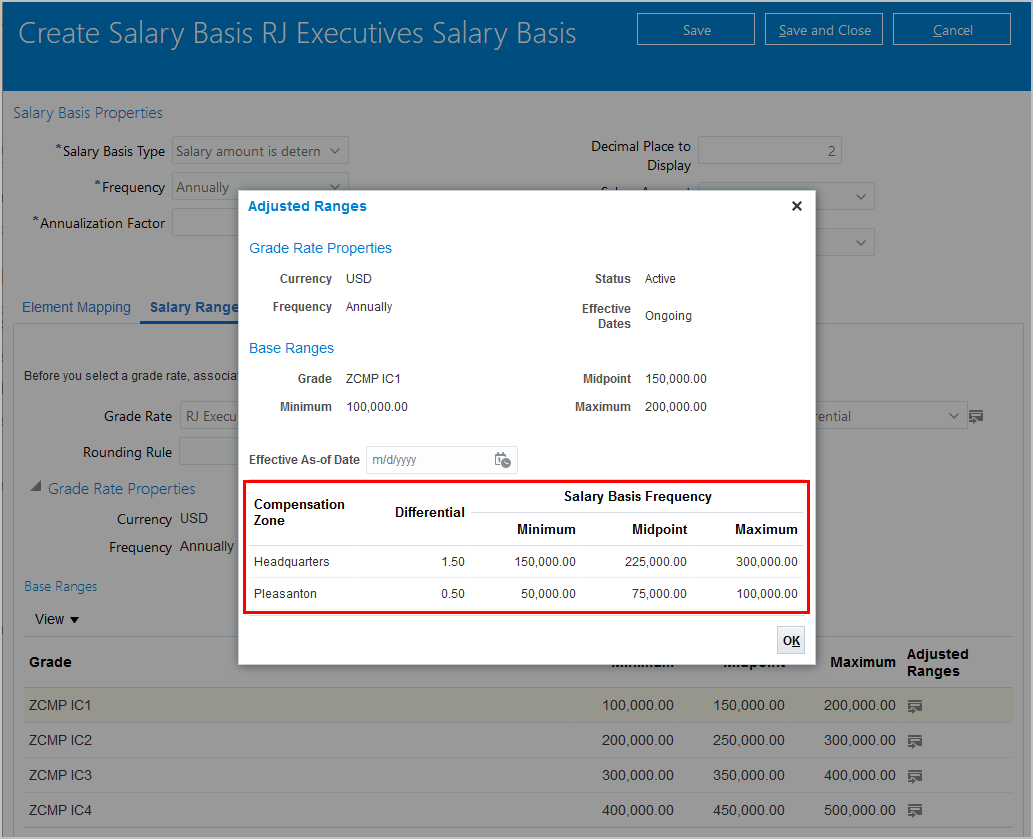

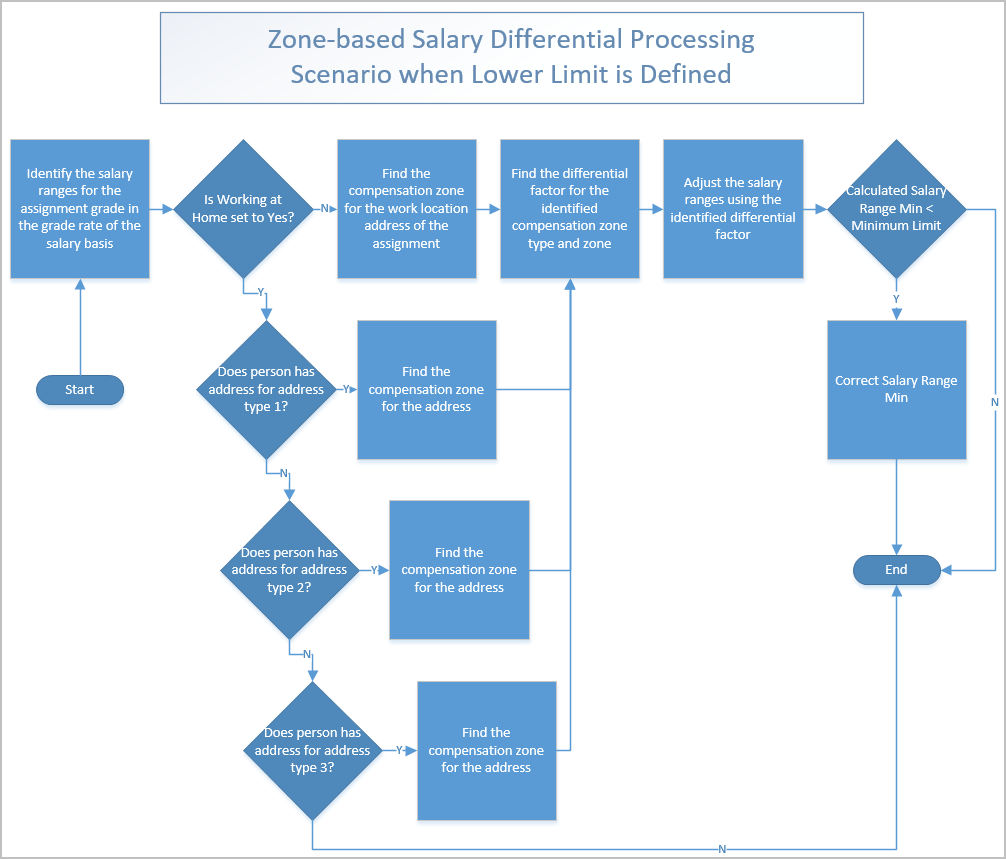

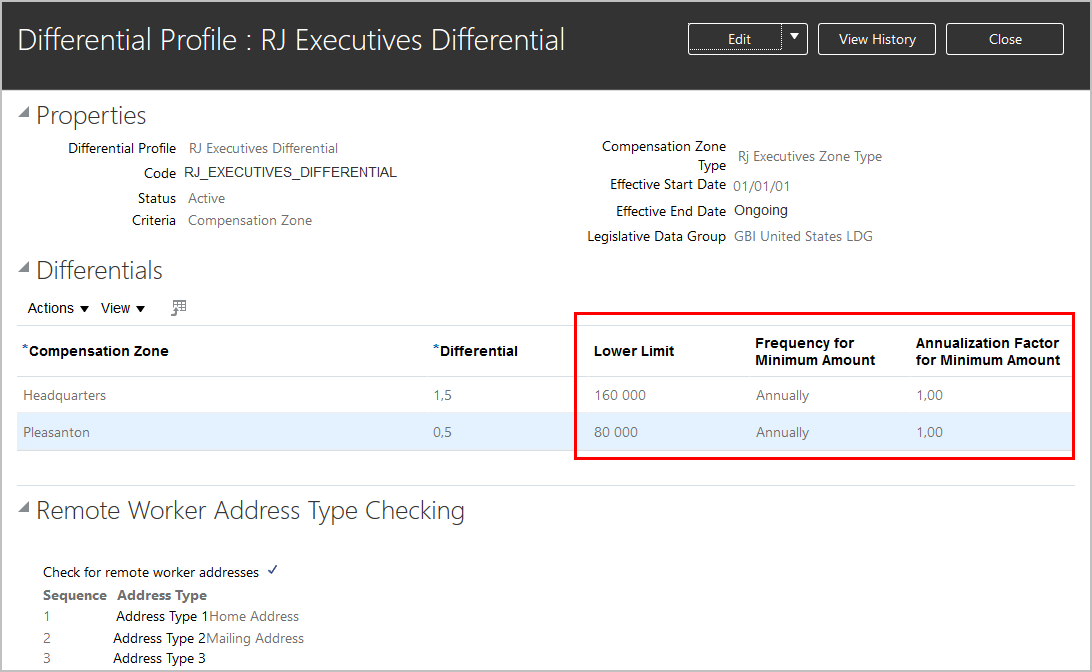

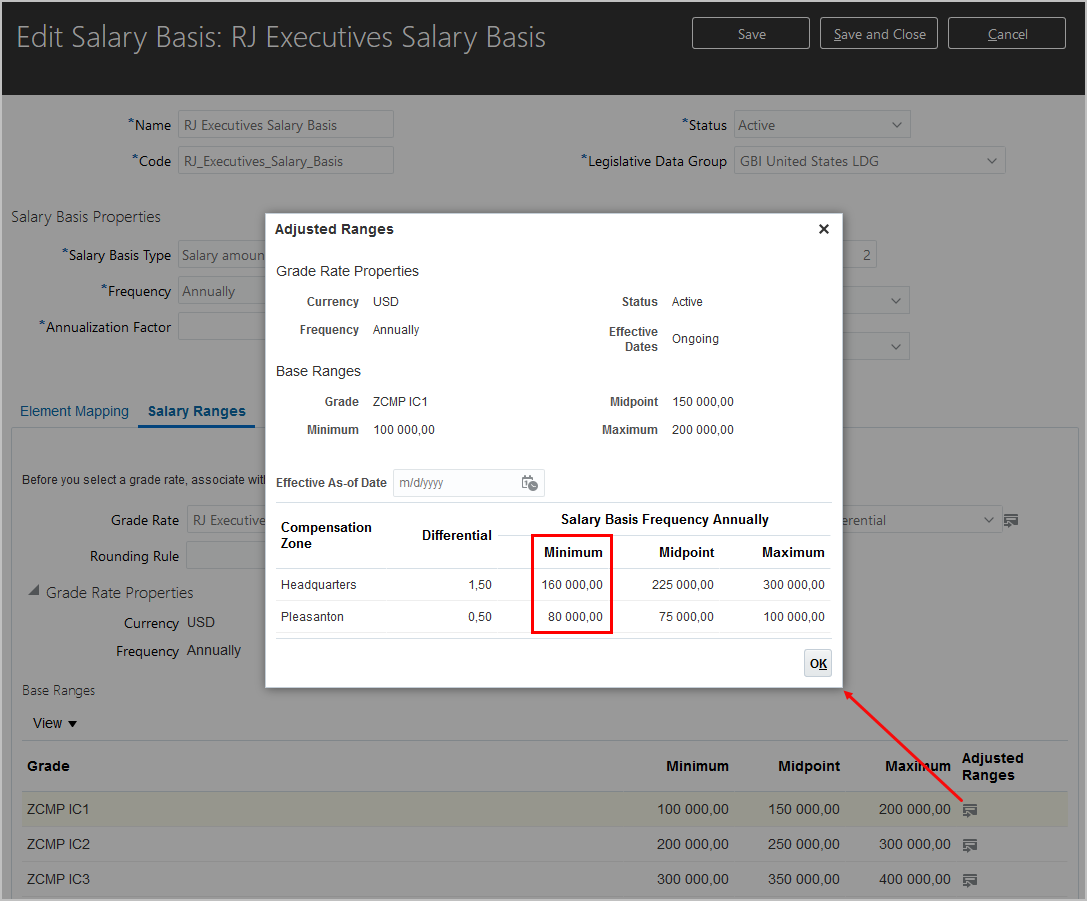

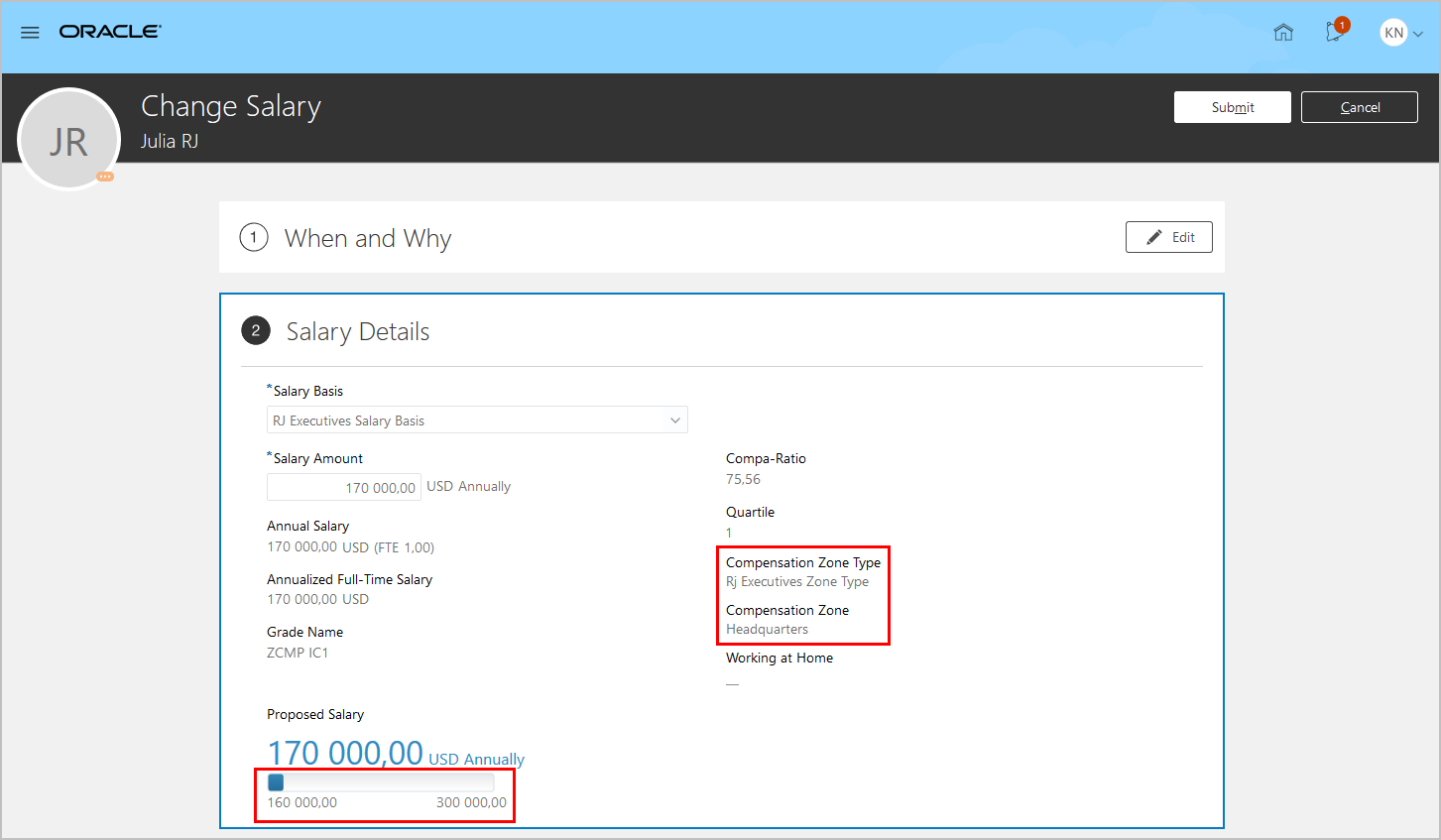

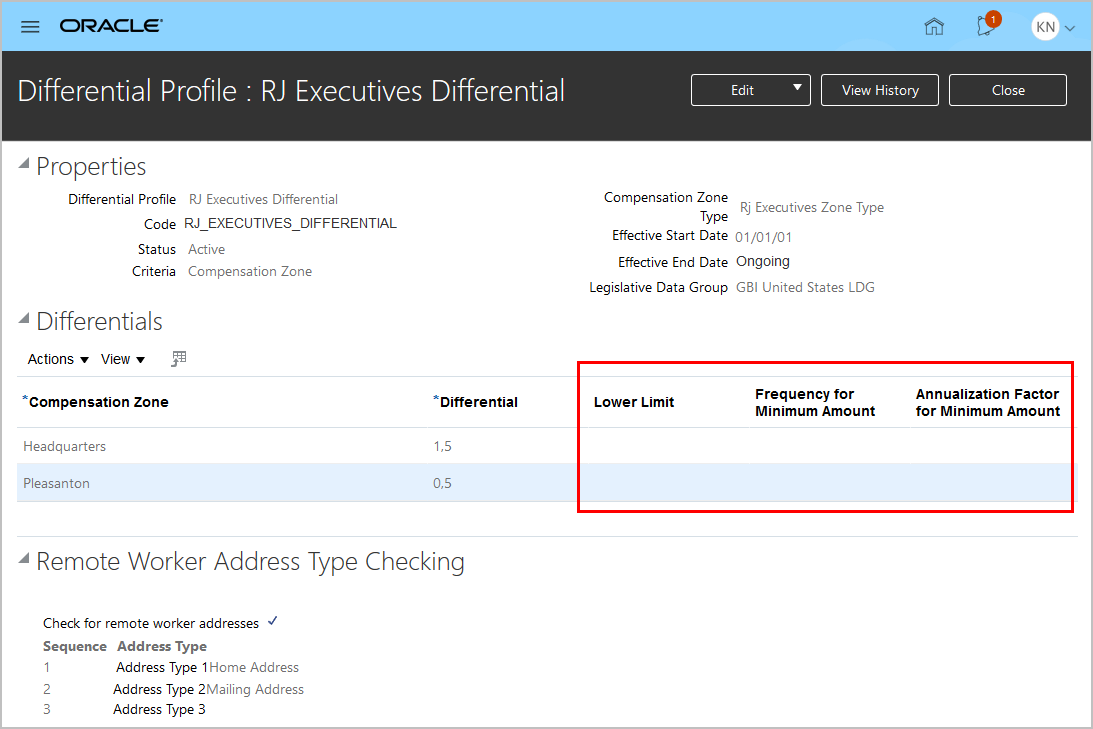

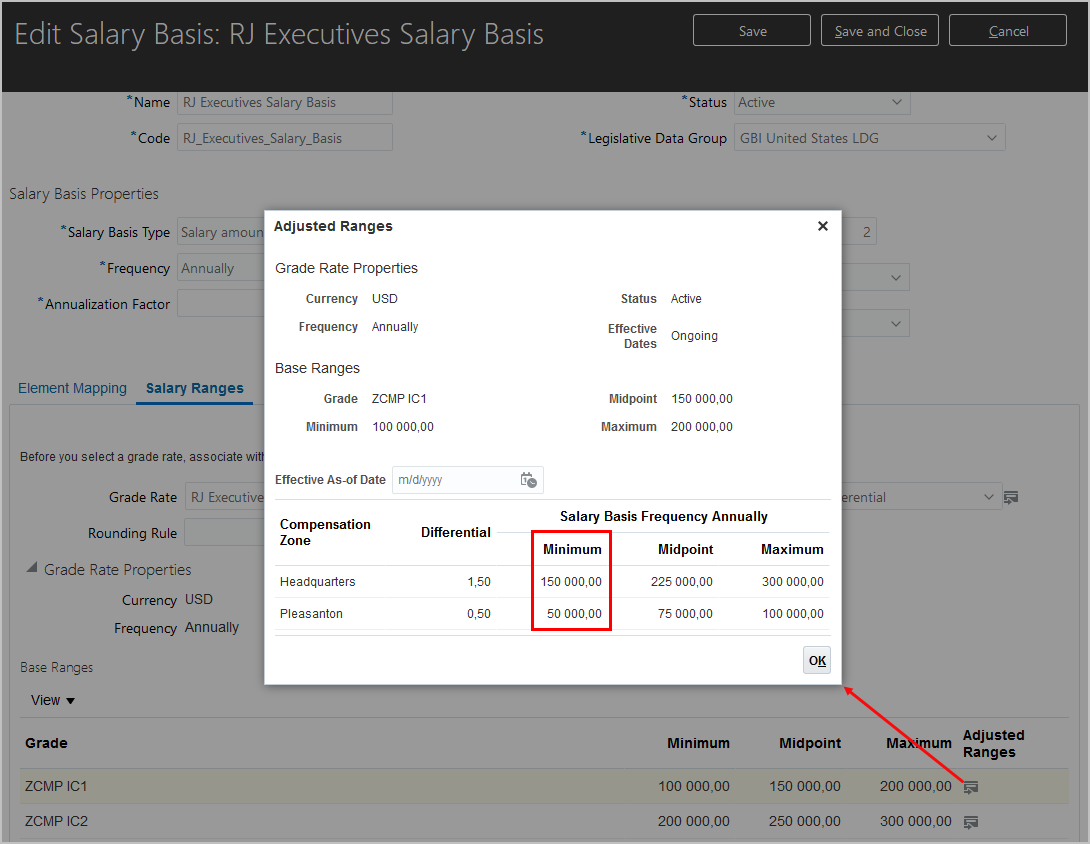

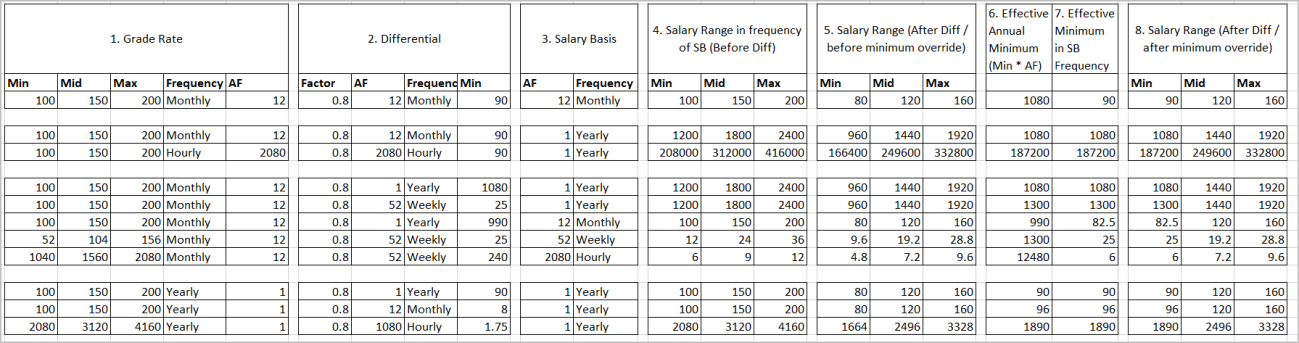

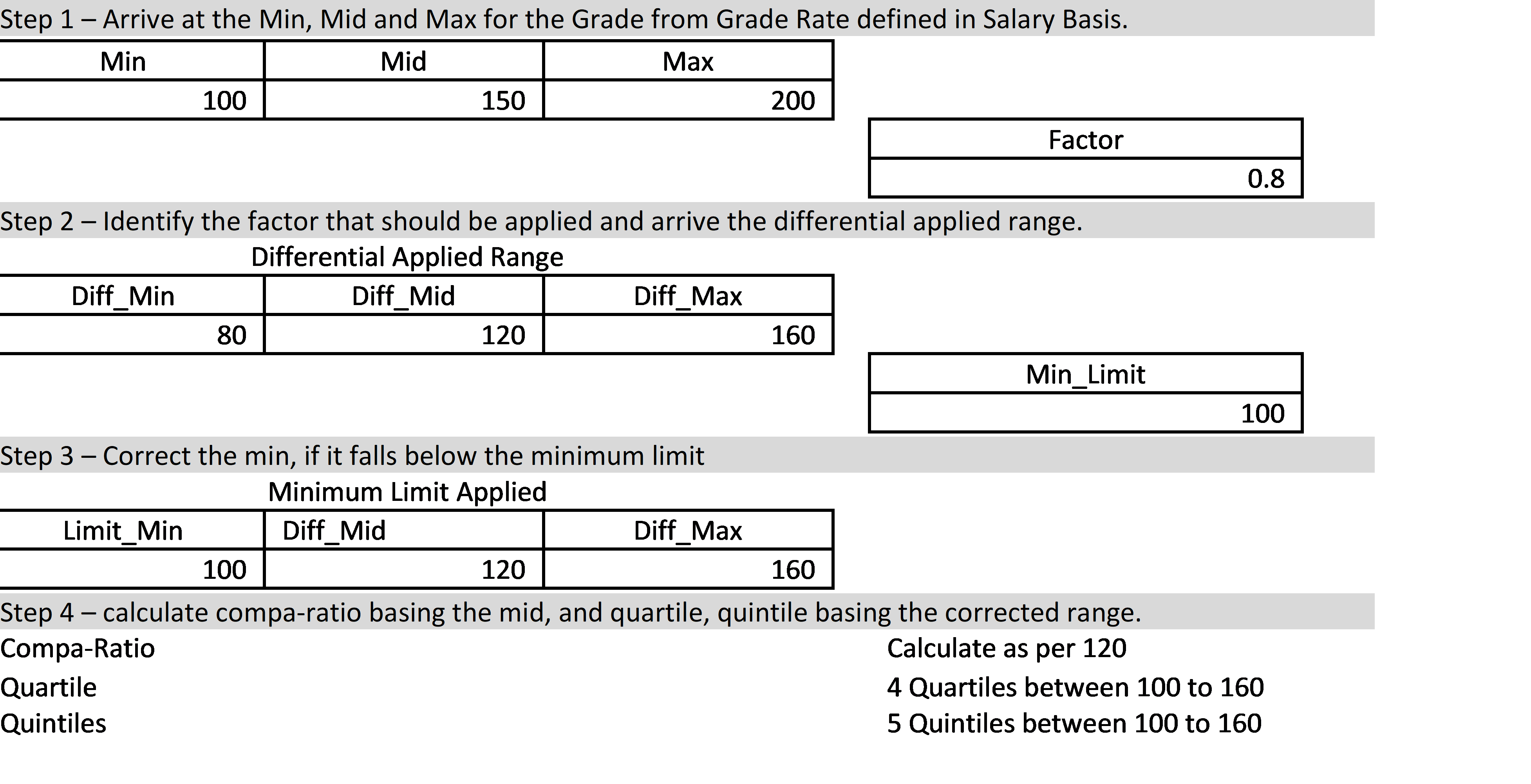

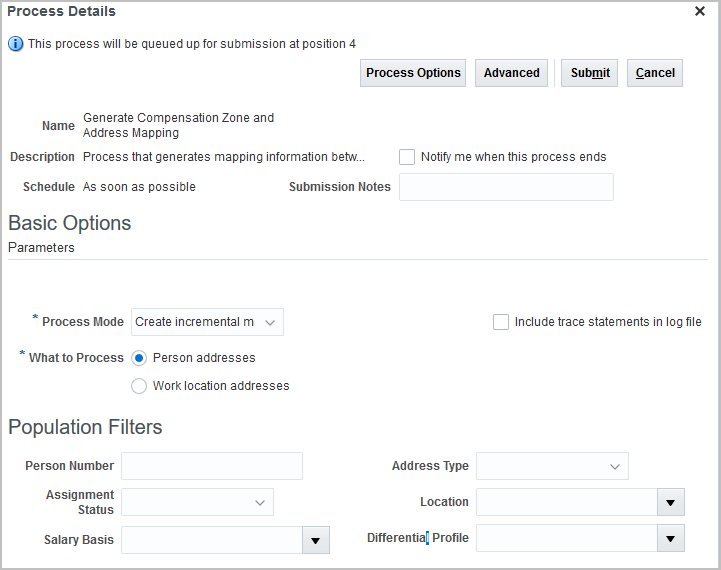

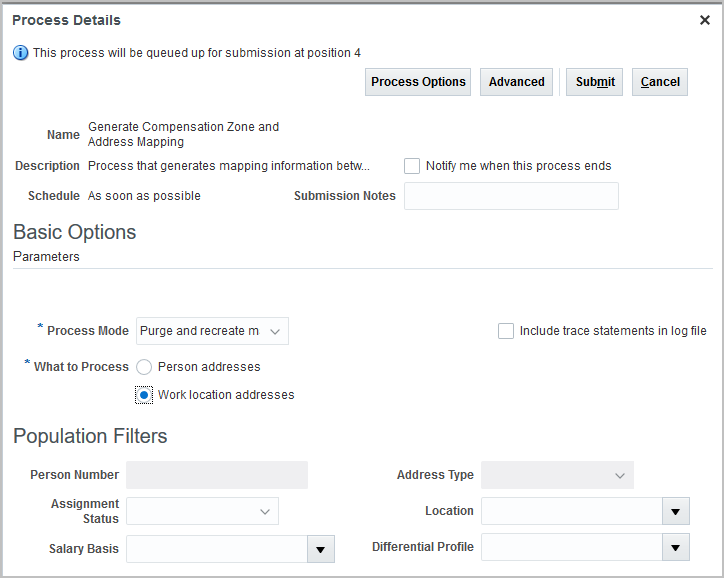

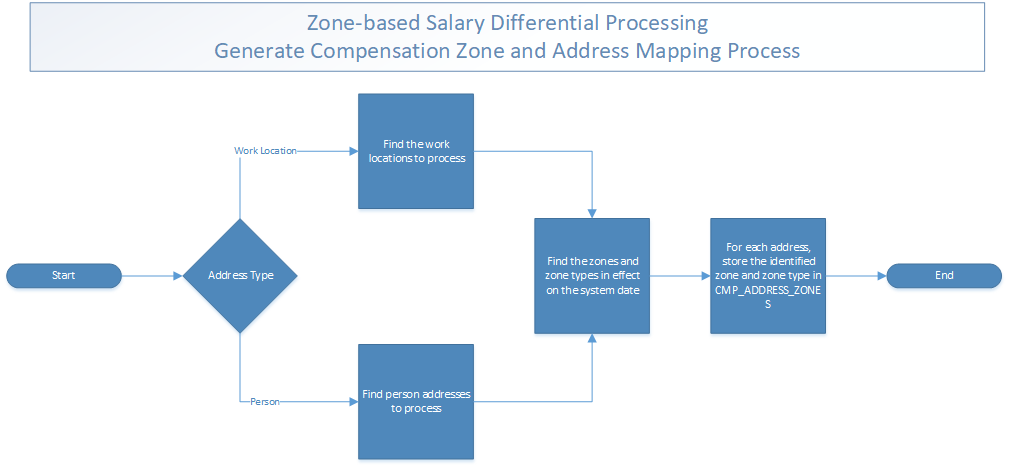

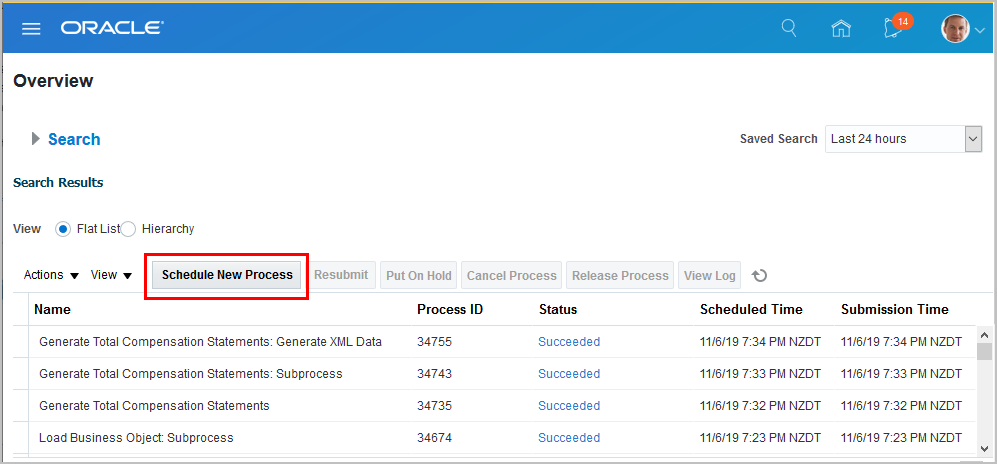

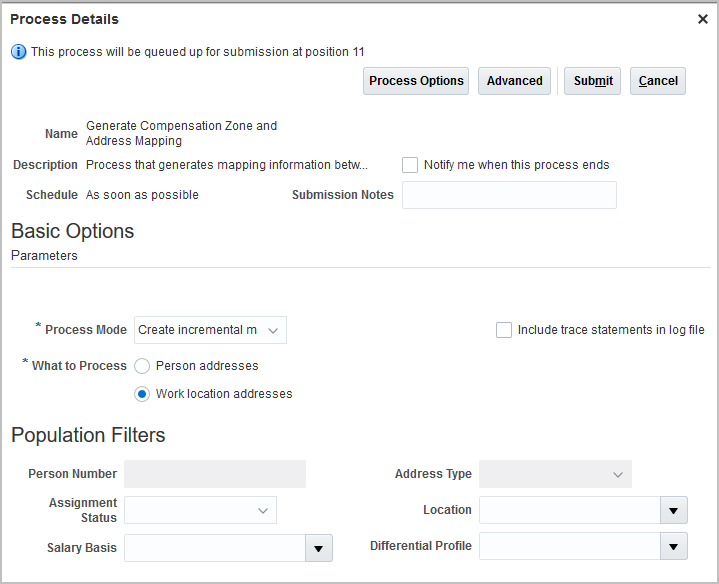

Salary Range Differentials and Compensation Zones

Compensation Zone Introduction

You can now create compensation zone types and zones and use them to define boundaries to use in salary range differential processing. These compensation zones use the geography and zones functionality in Oracle Fusion Trading Community Architecture, including zone types and zones.

You use zone types, such as compensation or wage regions, to categorize zones and group zones together. You need to create your zone types before you define one or more zones for a geographical boundary. You can create a zone type that contains geographical boundaries from anywhere in the world, or a type that contains only geographies in a specified country. When you create a zone type for a specified country, you can define which geography types or geographies that you can select when you create a zone of that zone type.