- Revision History

- Overview

- Feature Summary

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

- Compensation Spotlight

- External Data

- Grade Step Progression

- Individual Compensation

- Salary

- Stock

- Total Compensation Statement

- Workforce Compensation

-

- Updated Worksheet Page

- Eligibility Date Changed In Workforce Compensation

- Allow Managers to Access Worker Compensation Change Statements

- View Salary Adjustments Posted Report Amounts In Worksheet Decimal Precision

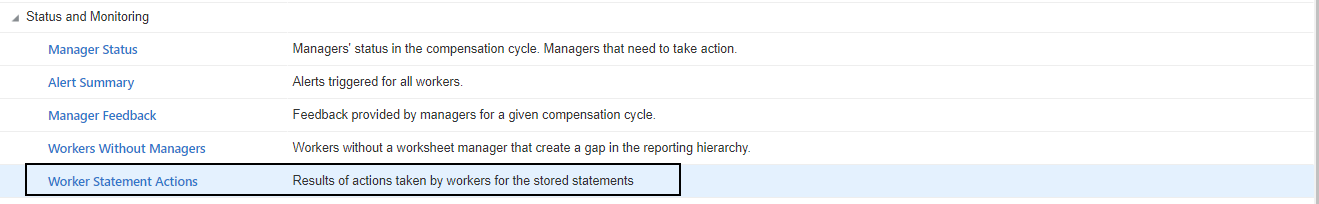

- View Worker Compensation Change Statement Actions

- Export Dynamic Calculations for Review

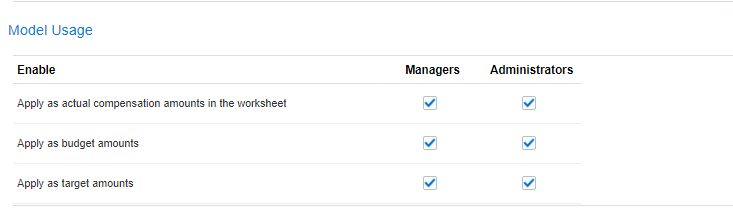

- Limit Managers Model Usages

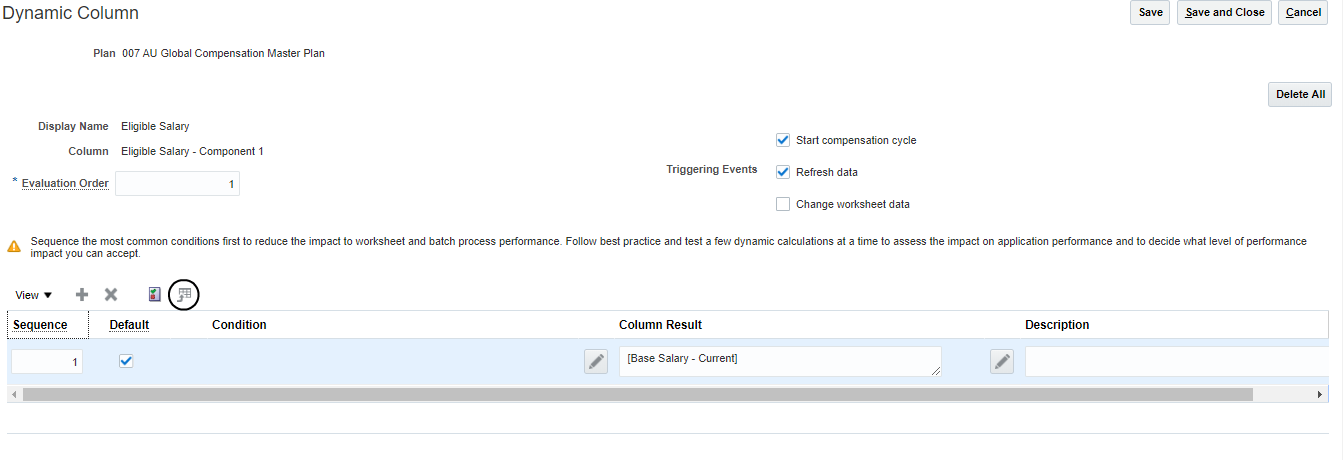

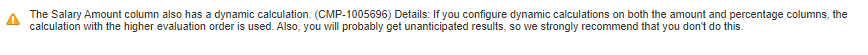

- Use Dynamic Calculations on Percentage Columns

- Reset Budget Amounts When Unpublishing

- Receive Warning When Configuring Rounding Rules on Linked Columns

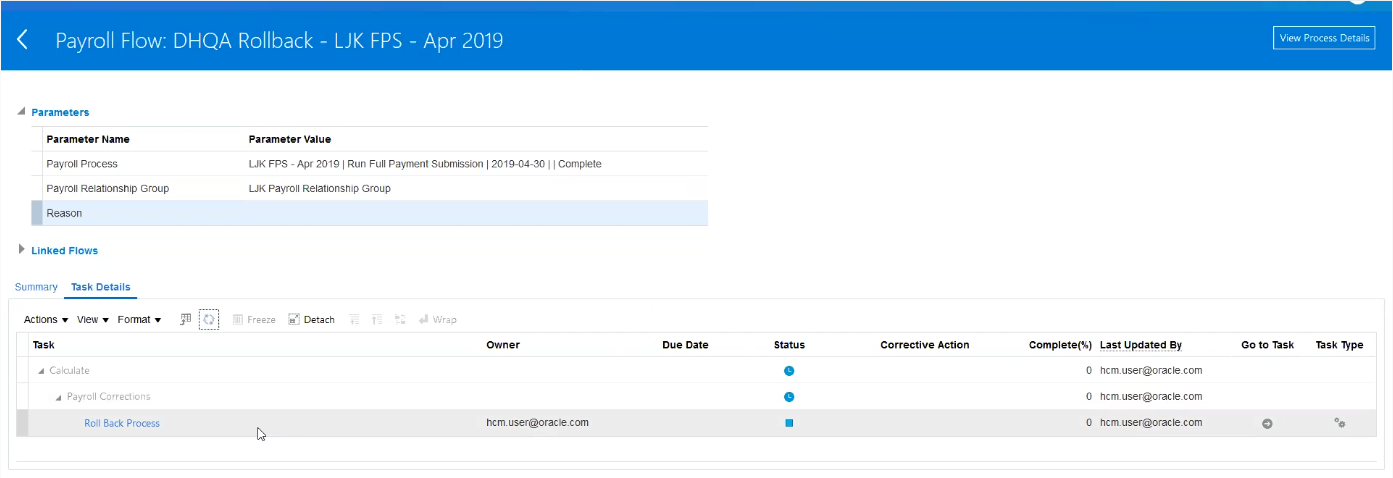

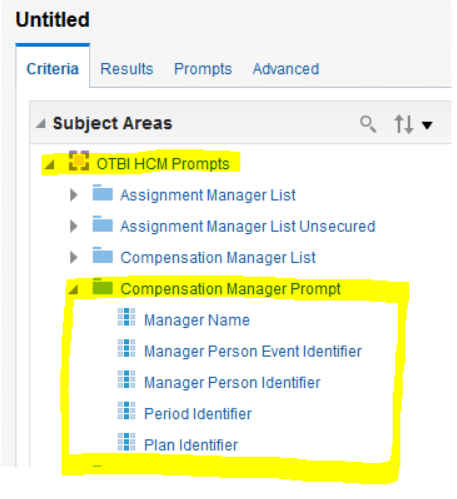

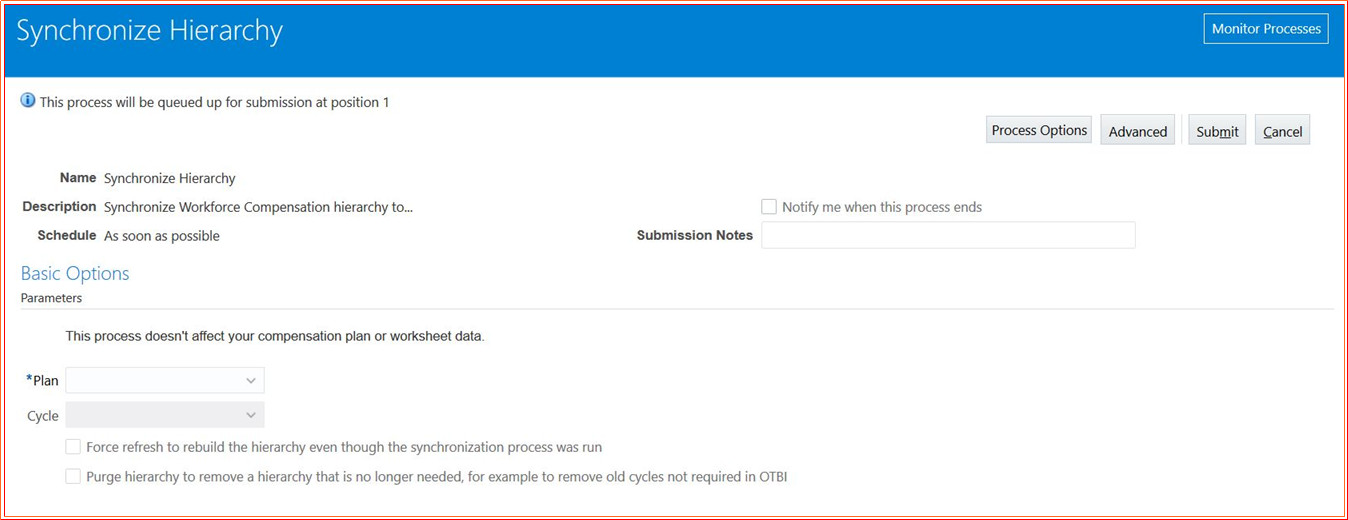

- Purge OTBI Hierarchy Table When Backing Out Associated Workforce Compensation Plan

- Updated Digital Certification For ADF Desktop Integration Excel

- Compensation

- Payroll

-

- Global Payroll

-

- Manage Payroll Frequency in Payroll Employment

- View-Only Version of Element Entries

- View-Only Version of Person Costing

- Global Search

- Set End Date on Element Entries When Deduction Recovered

- Process Results by Person Records or Object-Based Records

- Task Iterations Page

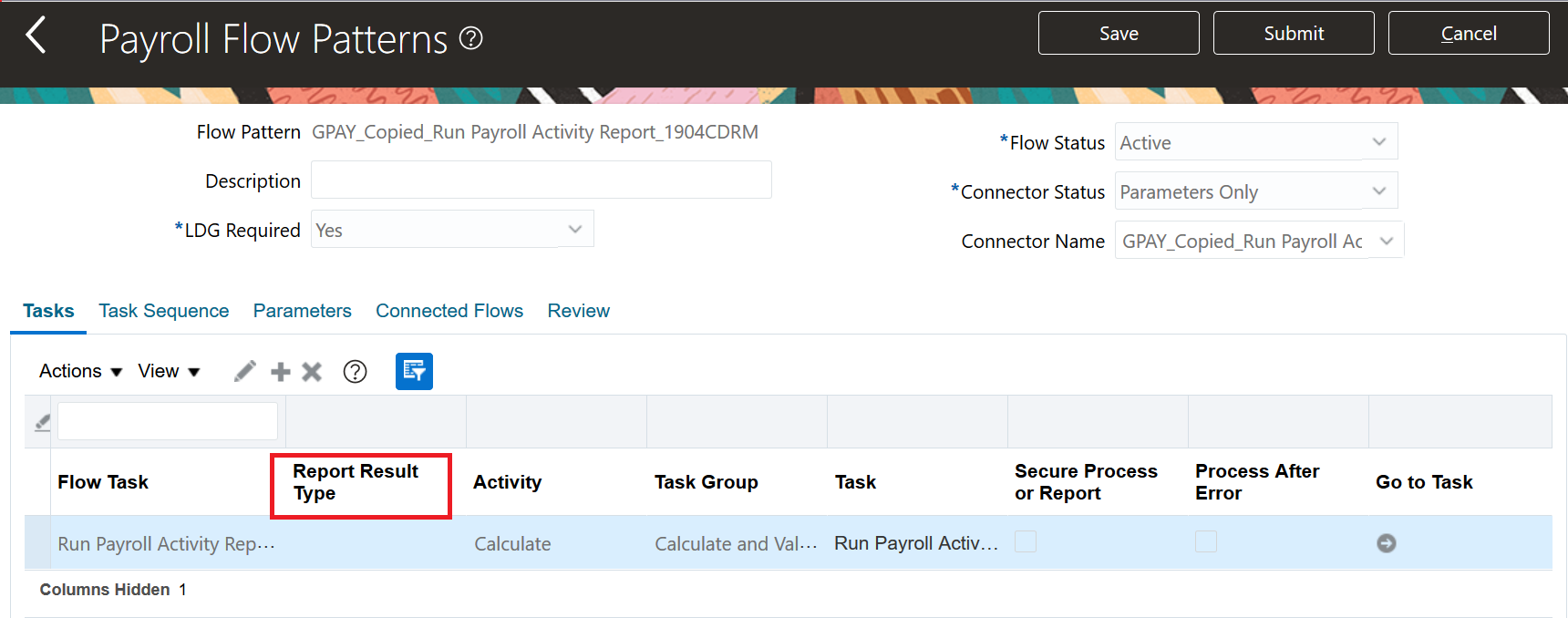

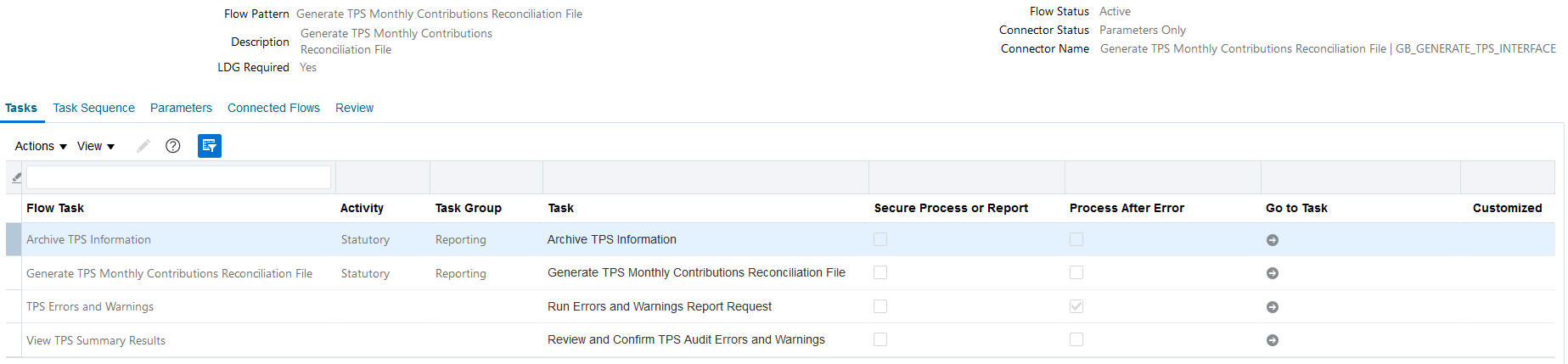

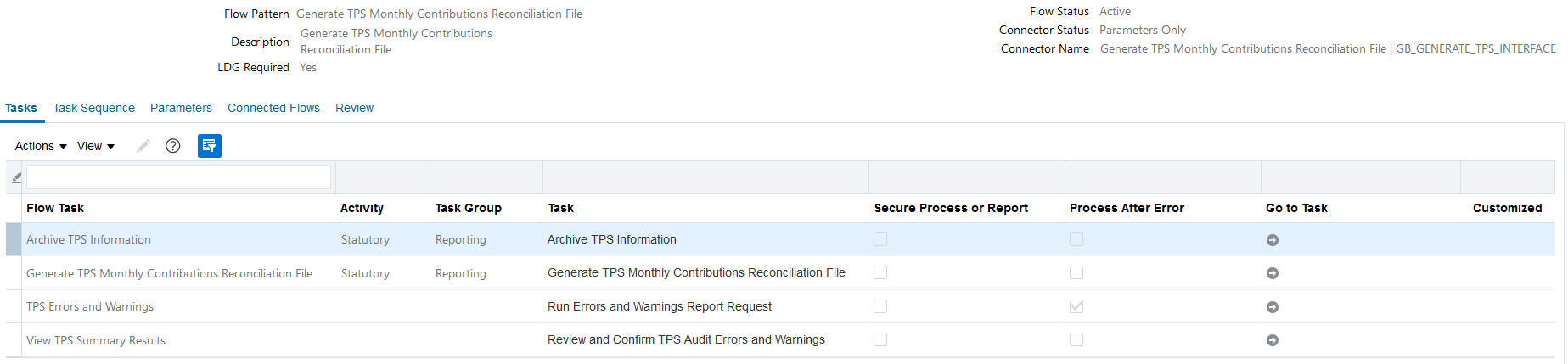

- Flow Connectors Support for User-Defined Payroll Reports

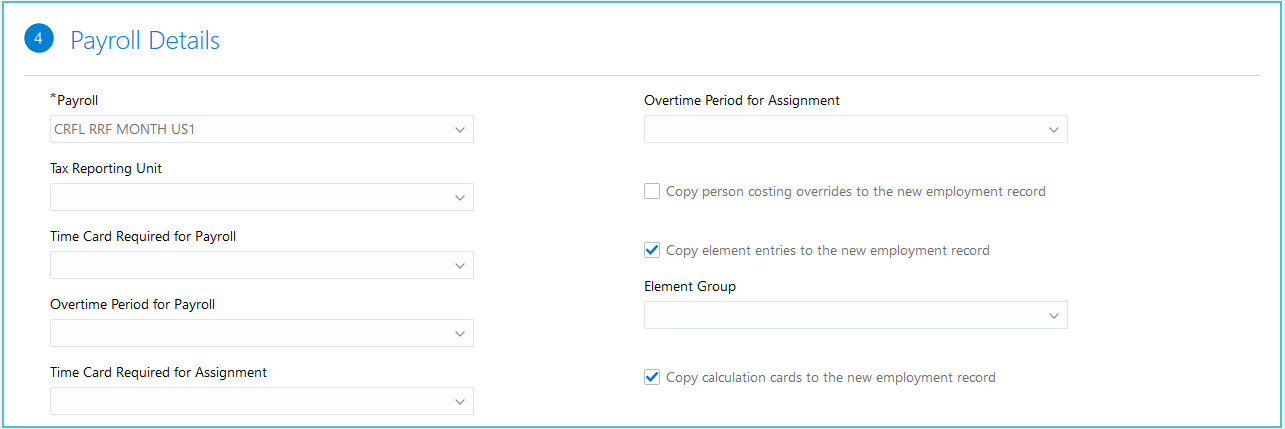

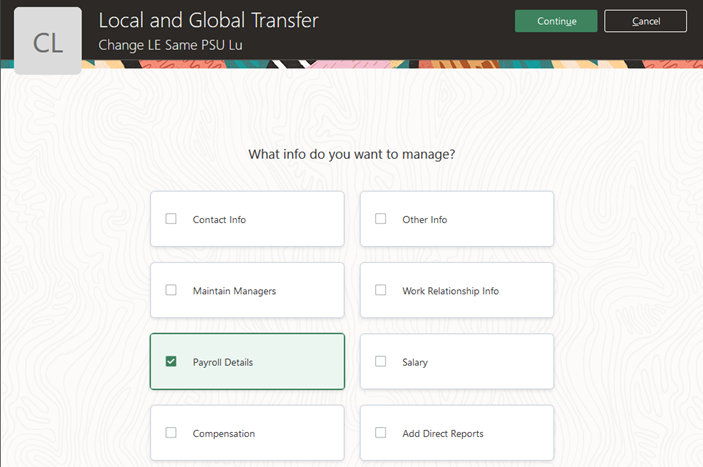

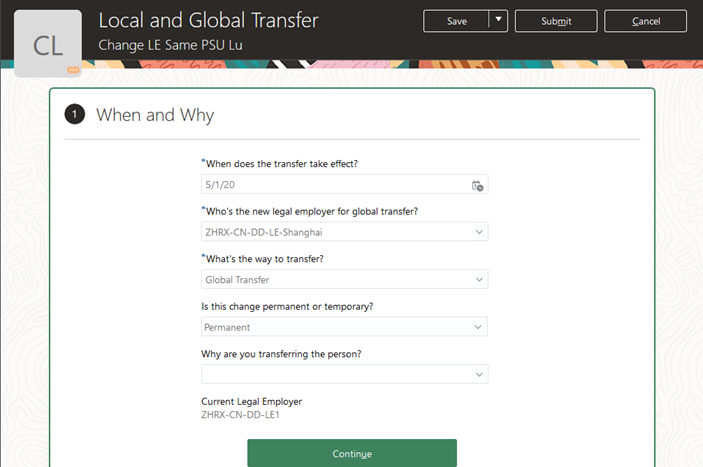

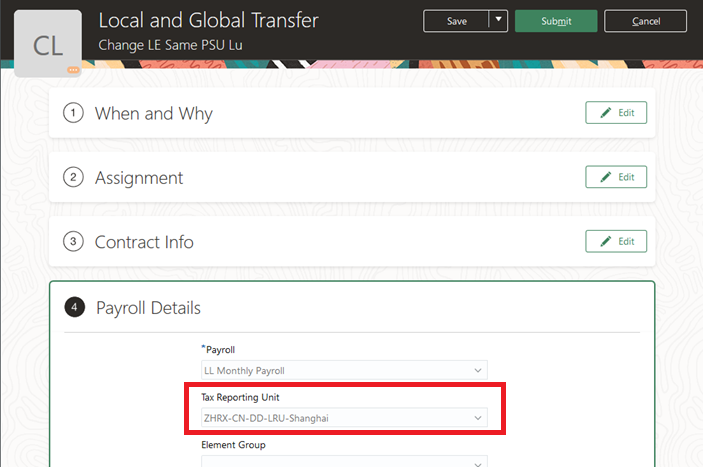

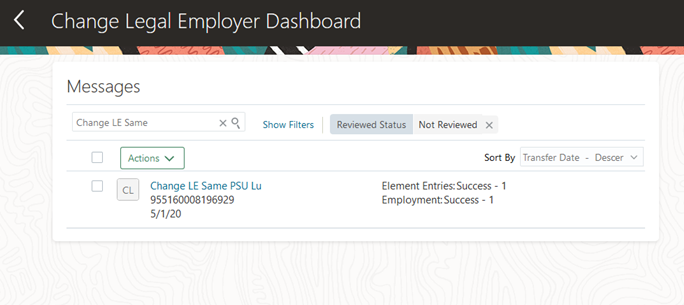

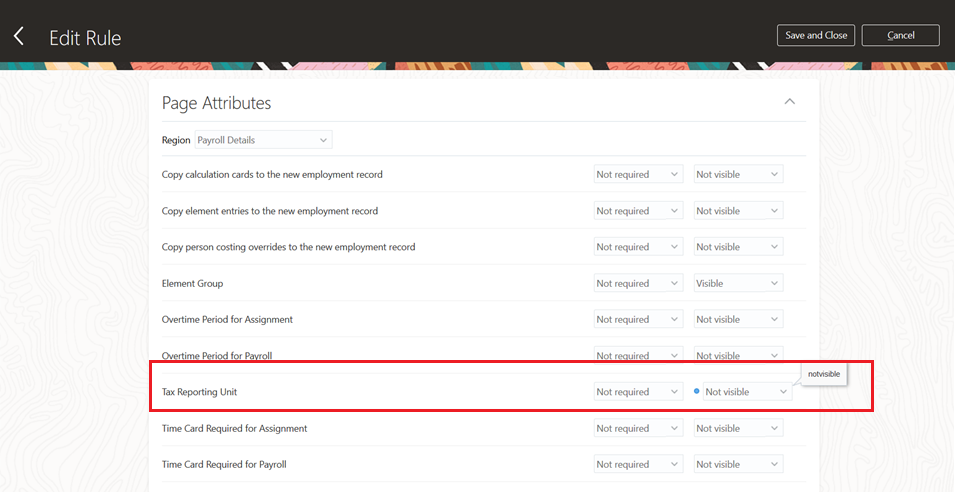

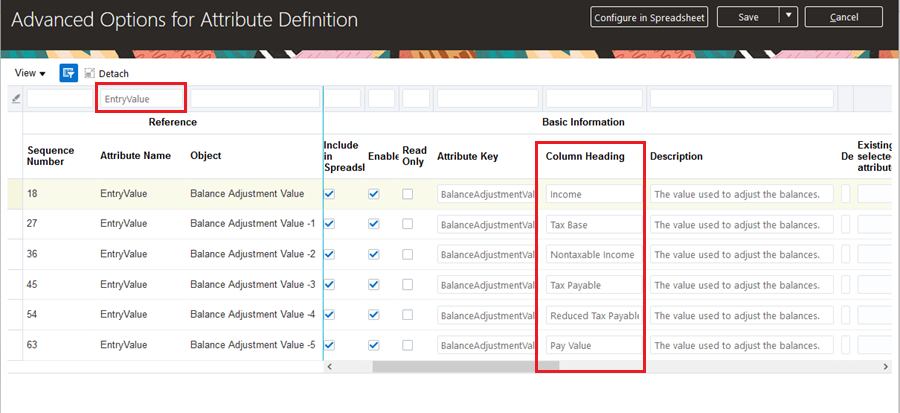

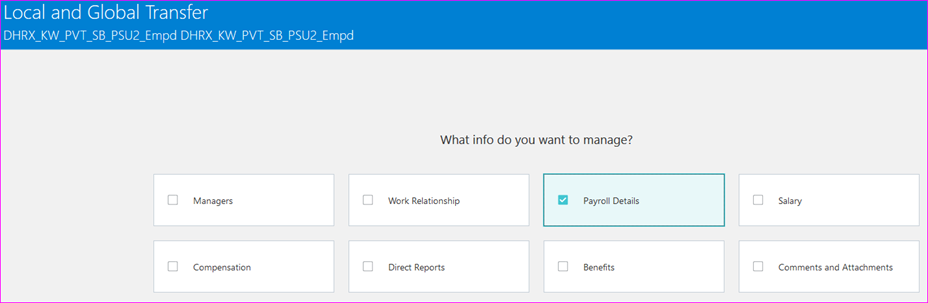

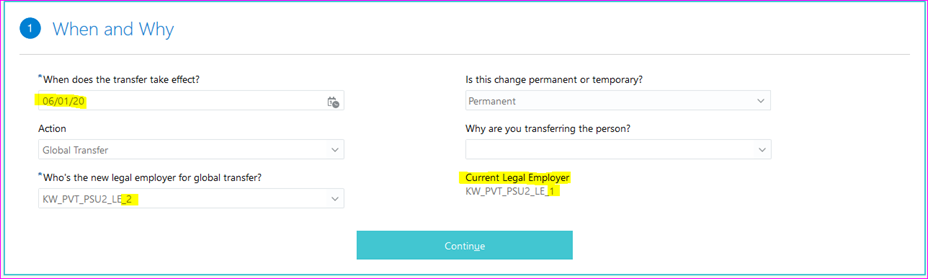

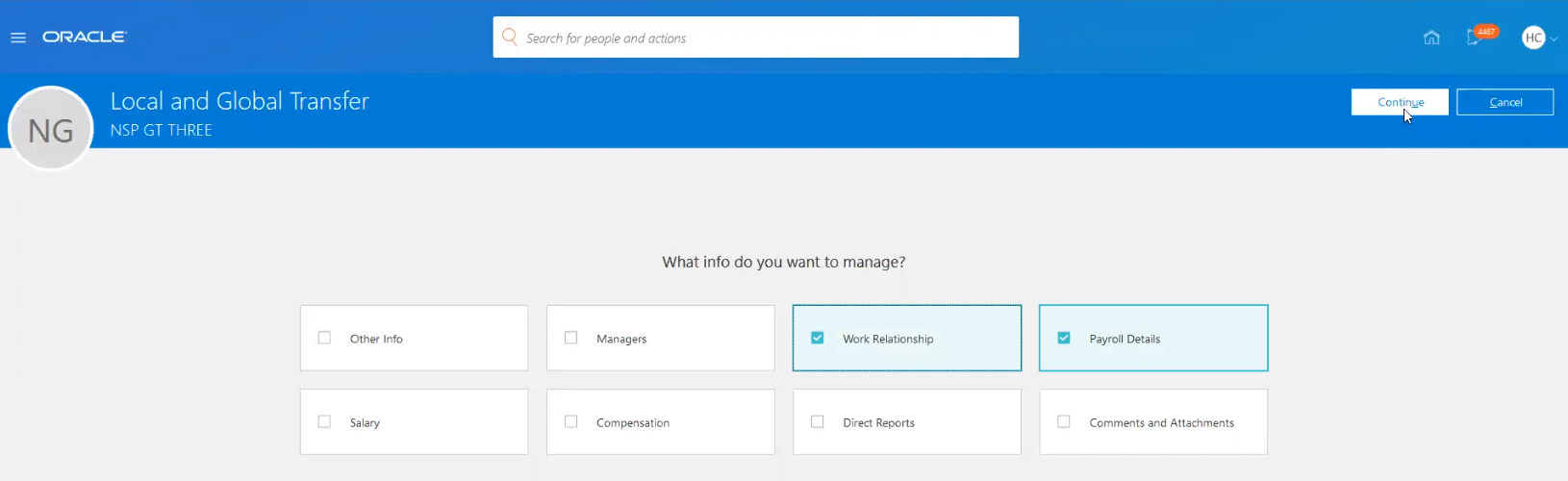

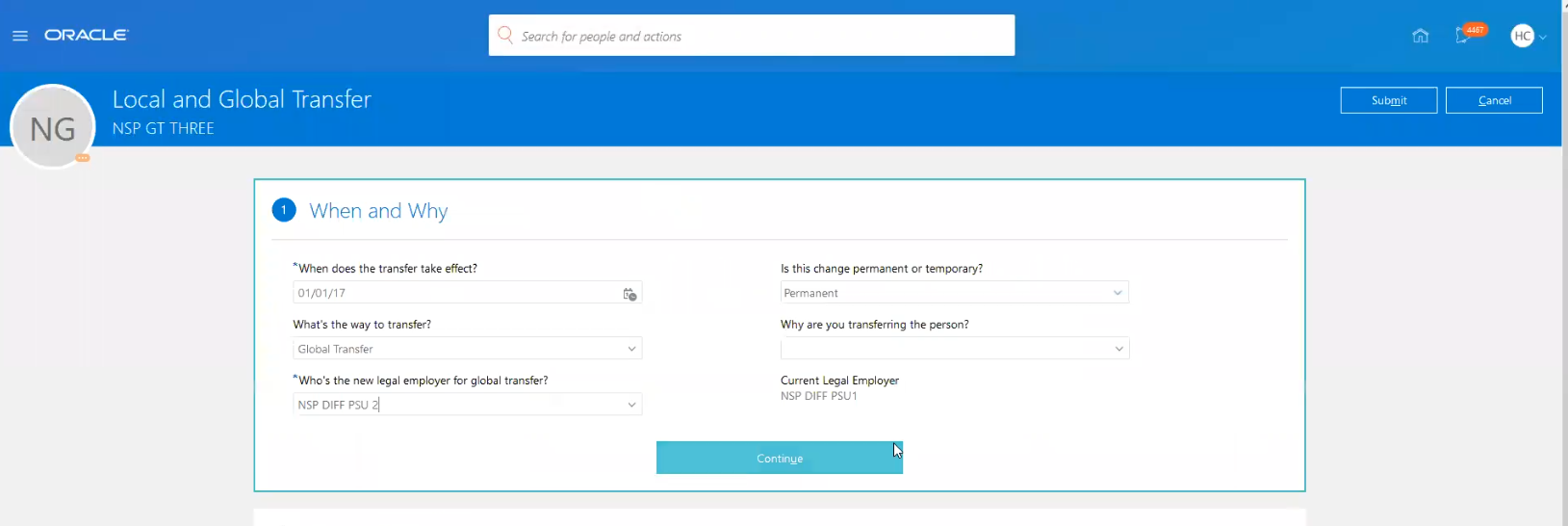

- Legal Employer Change Redesigned User Experience

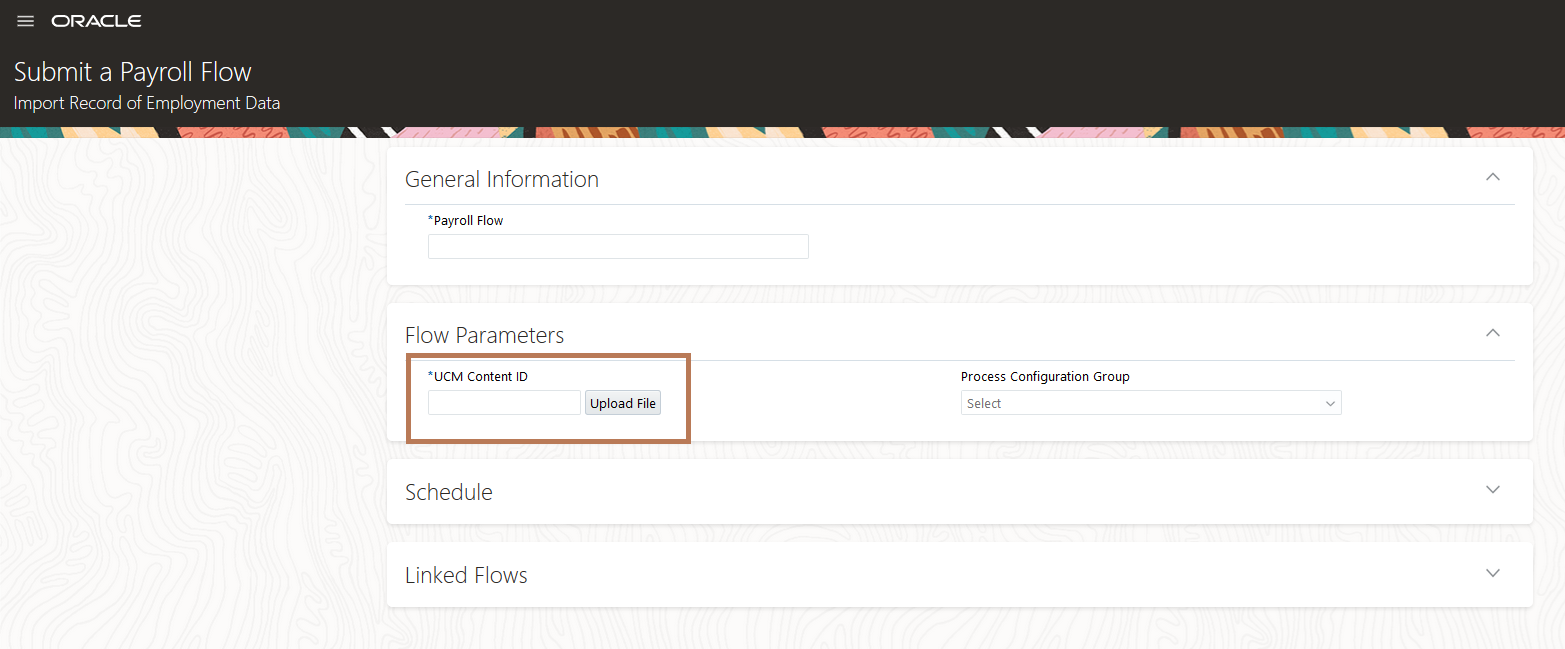

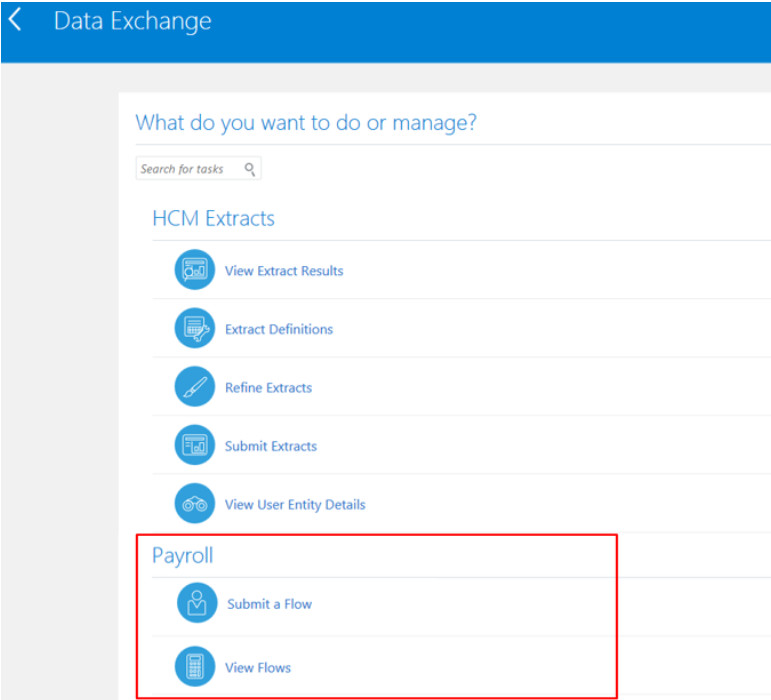

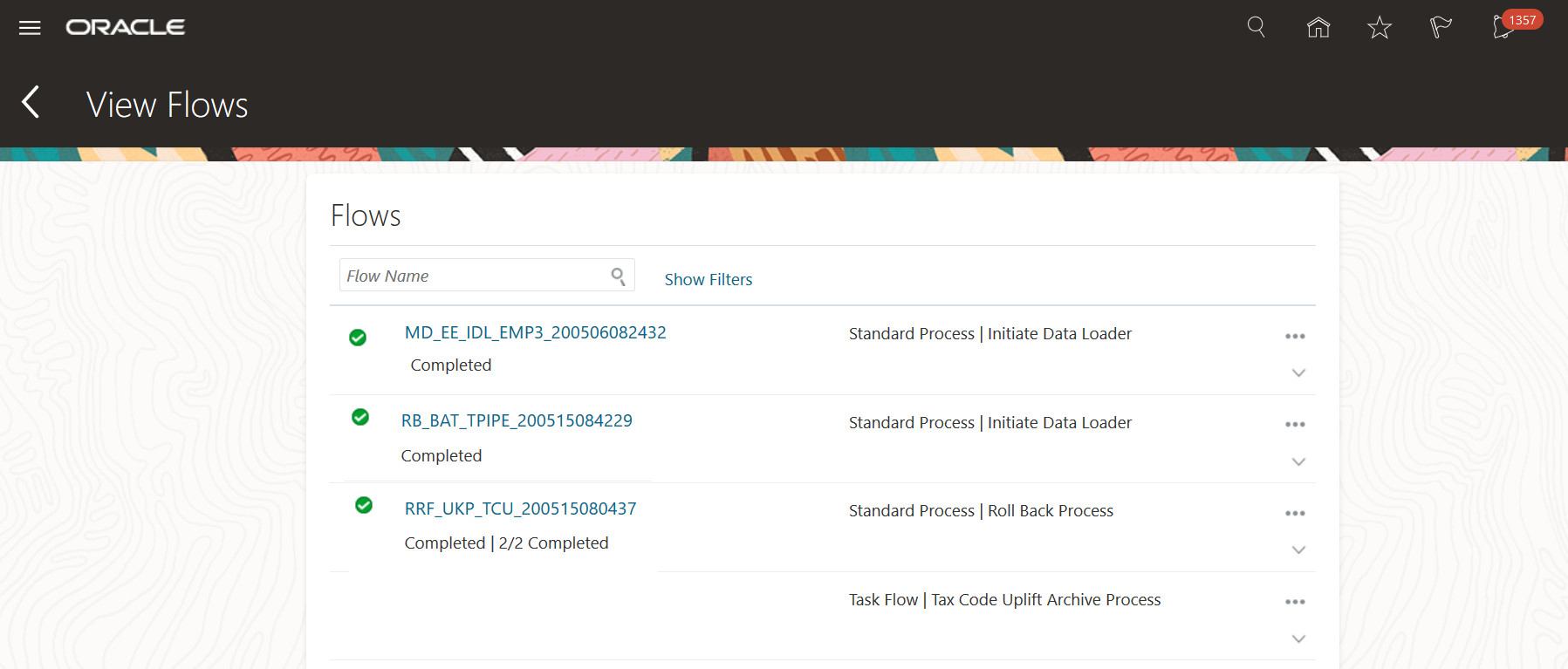

- Payroll Flows Redesigned User Experience

- Costing

- Time and Absences

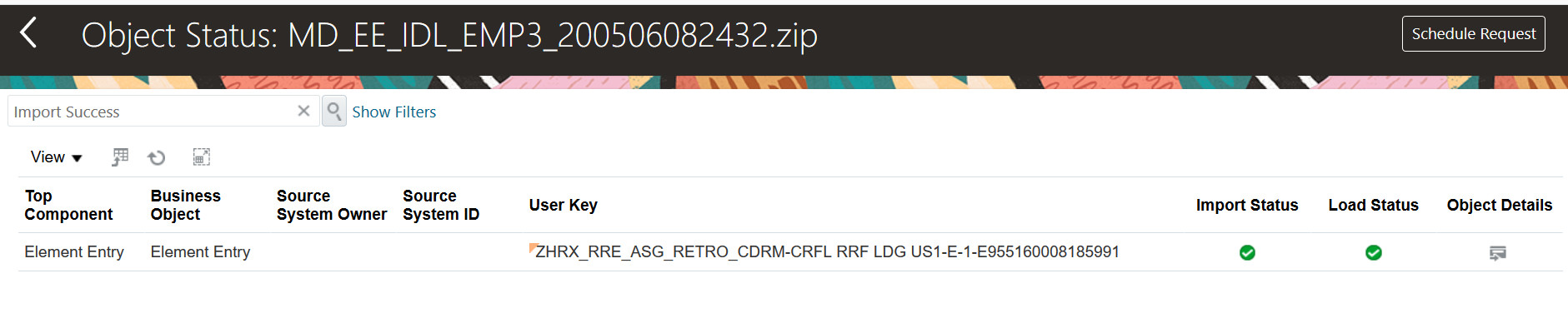

- HCM Data Loader

-

- Payroll for Canada

- Payroll for China

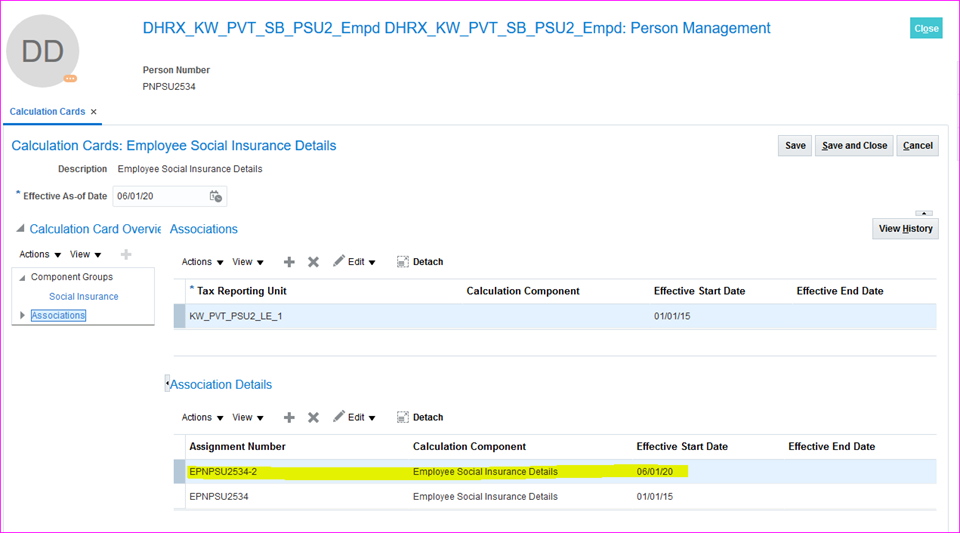

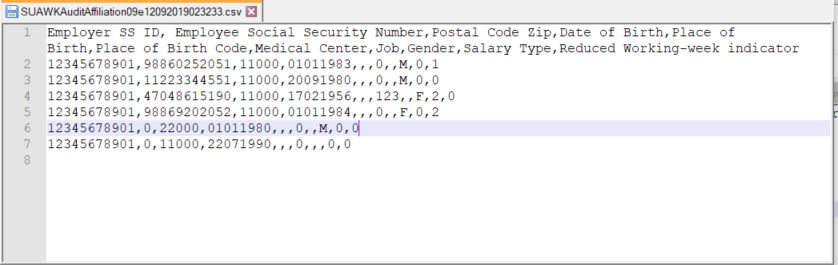

- Payroll for Kuwait

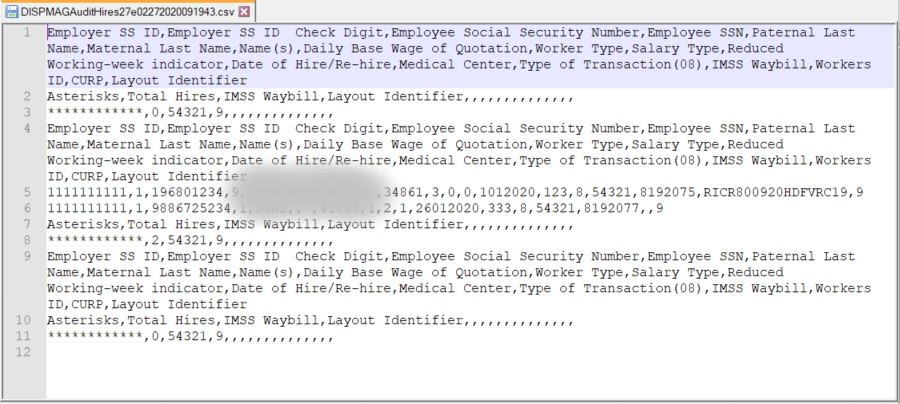

- Payroll for Mexico

- Payroll for Qatar

- Payroll for Saudi Arabia

- Payroll for the United Arab Emirates

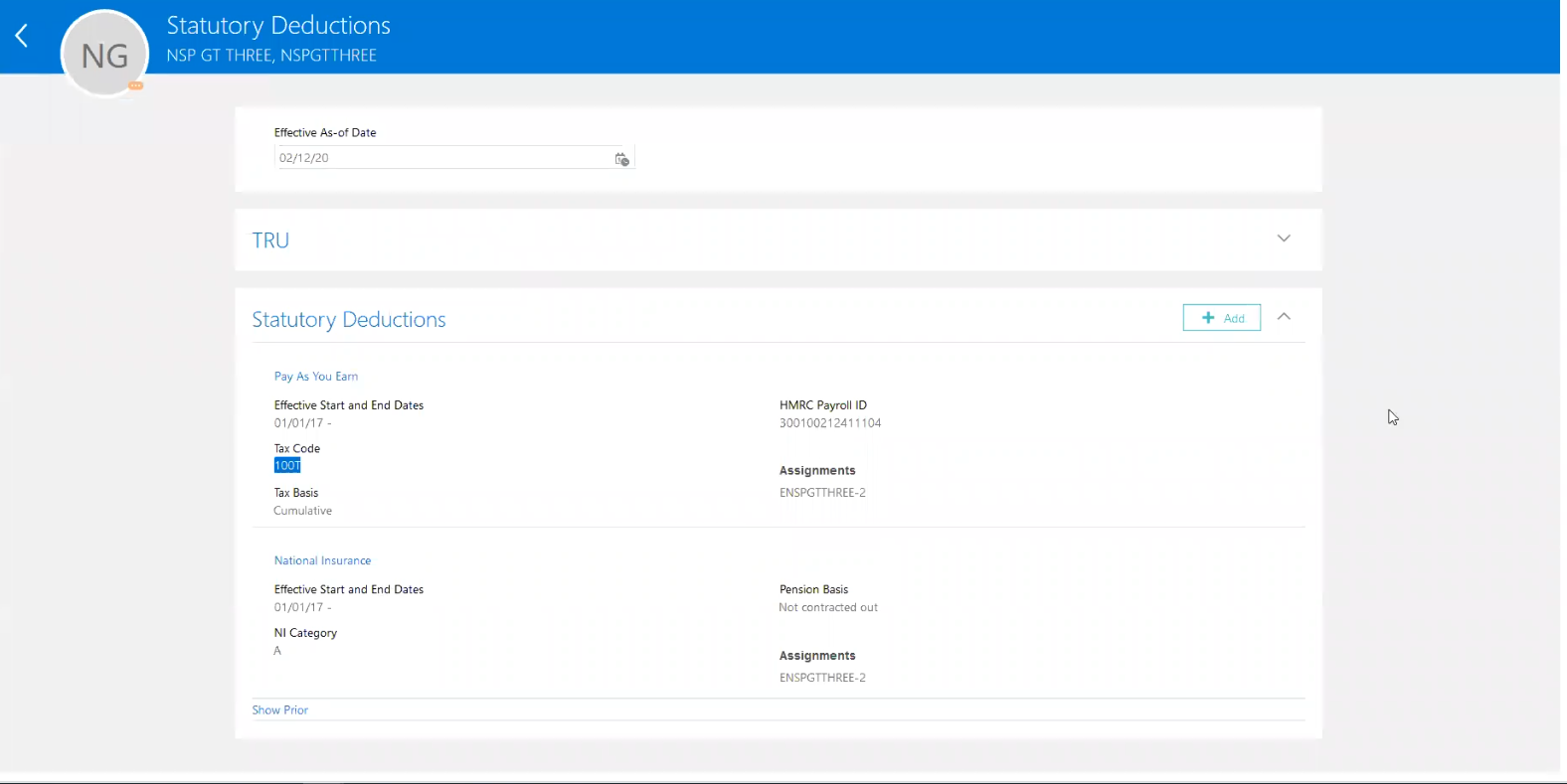

- Payroll for the United Kingdom

-

- Teachers Pension Reporting

- Teachers Pension Errors and Warnings

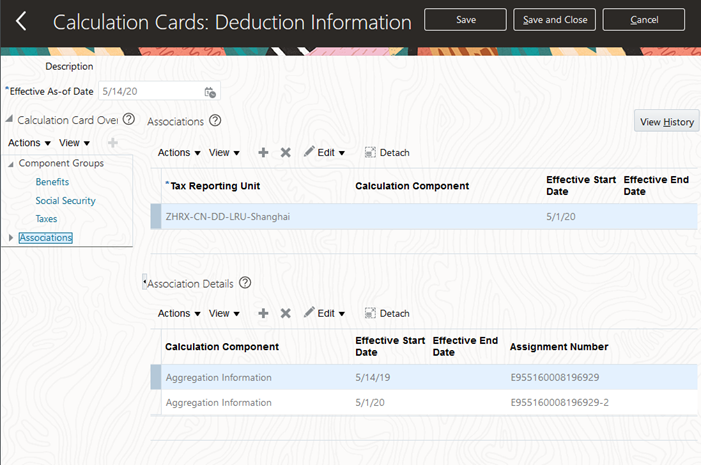

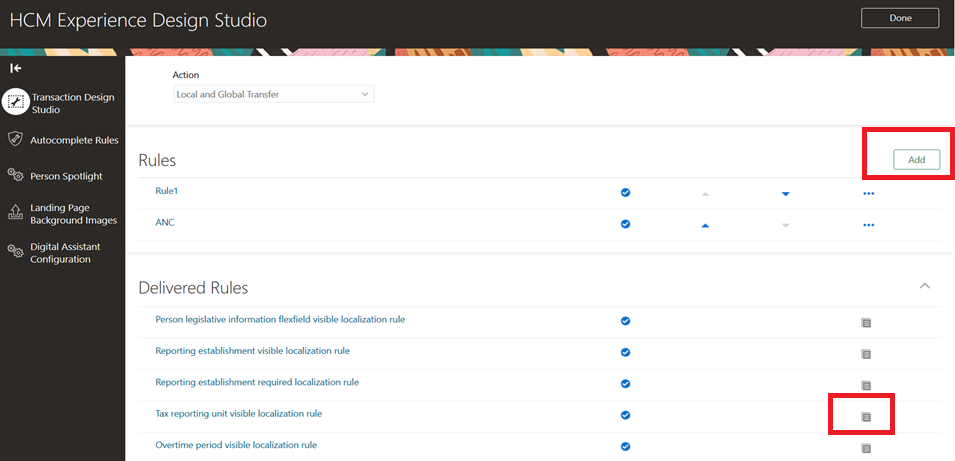

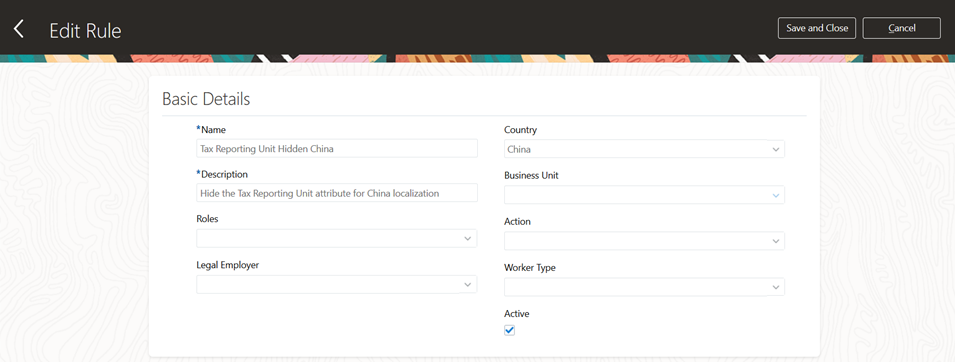

- Global Transfer Uptake for Calculation Cards

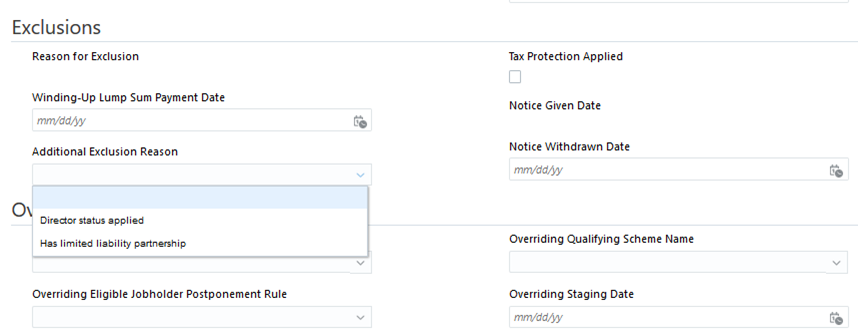

- Pensions Automatic Enrollment Exceptions for Director and Limited Liability Partnerships

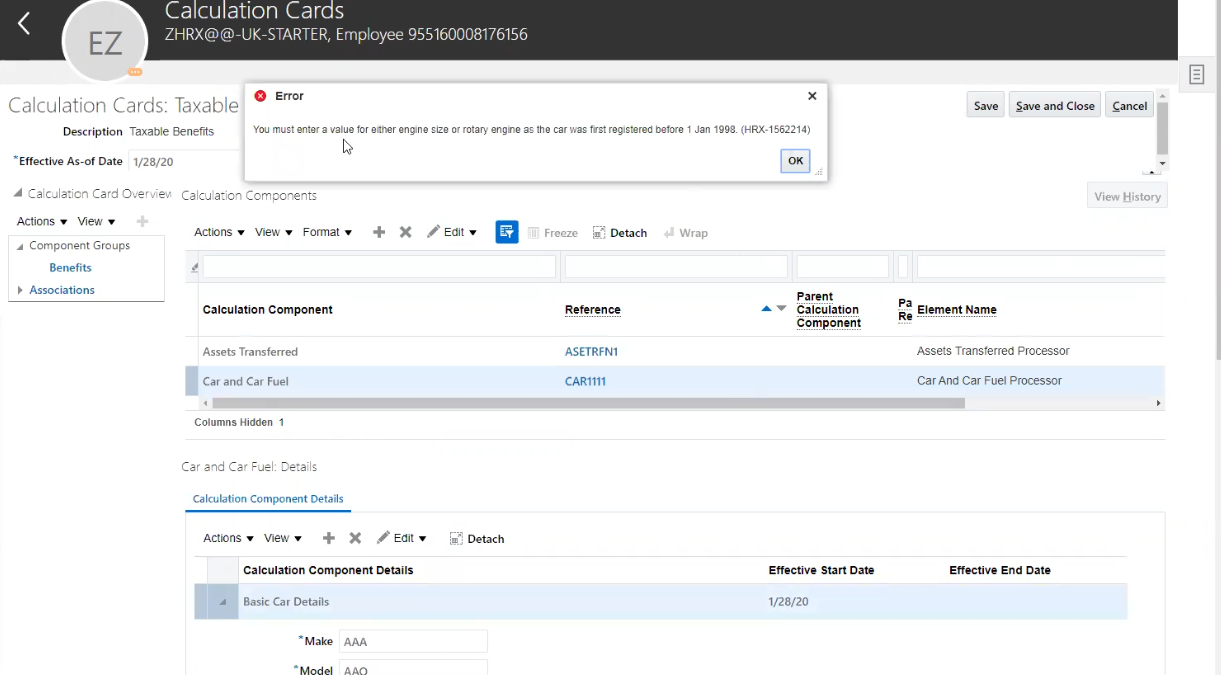

- Additional Validations for P11D Process

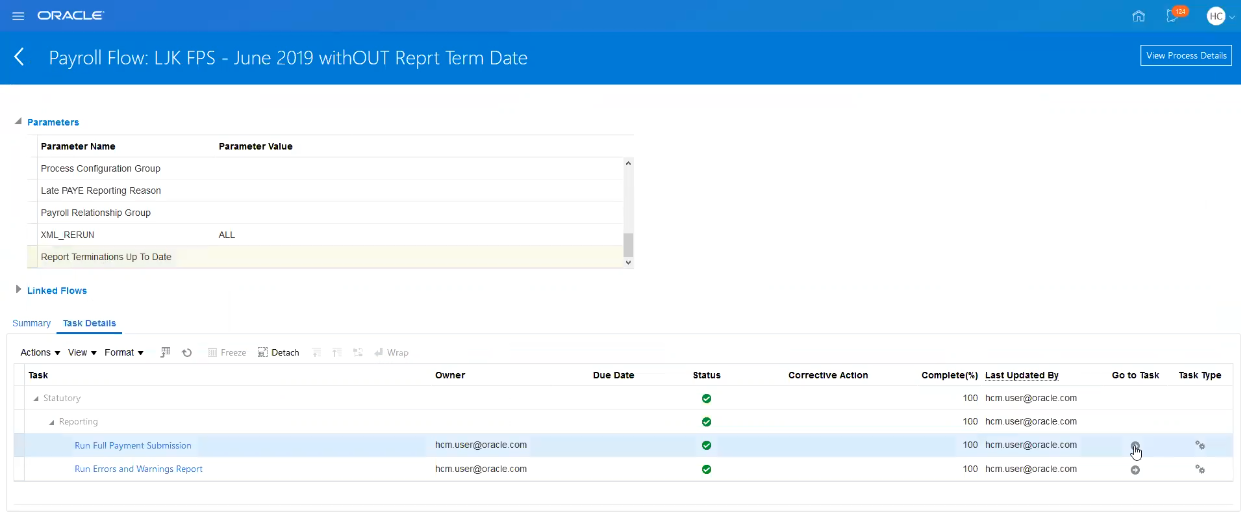

- Full Payment Submission - Additional Features

- LGPS Multiple Employer Rates

-

- Payroll for the United States

- Global Payroll

- HR Optimizations

- IMPORTANT Actions and Considerations

October Maintenance Pack for 20C

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 30 OCT 2020 | Global Payroll | Additional Database Items Support for Salary Rates Using Values Defined by Criteria | Updated document. Delivered feature in update 20C. |

| 25 SEP 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Data Security Support for Personal Payment Method and Payroll Relationship in HSDL |

||||||

Additional Database Items Support for Salary Rates Using Values Defined by Criteria |

||||||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

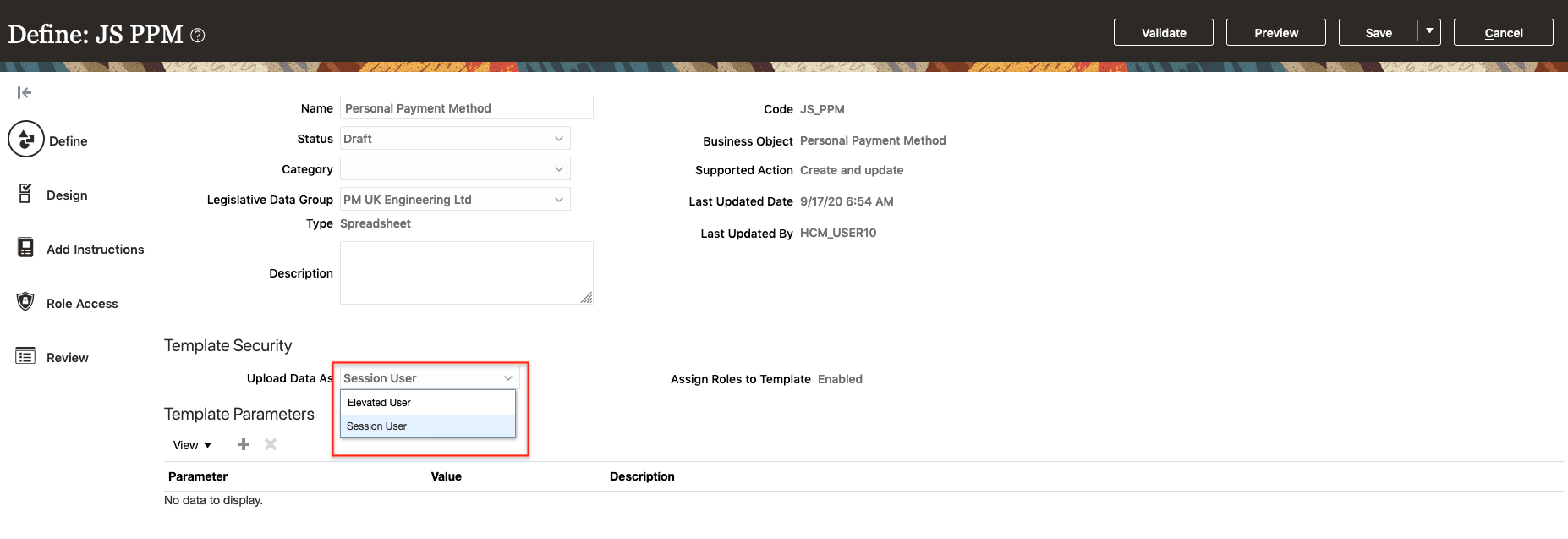

Data Security Support for Personal Payment Method and Payroll Relationship in HSDL

The application maintains data security when you load Personal Payment Method and Payroll Relationship using the HDL Spreadsheet Loader (HSDL).

When defining a template, you can now select whether to apply the logged in user security profiles, or to upload data as an elevated user.

This feature allows restriction for HSDL users to upload data based on their data security profiles.

Steps to Enable

You don't need to do anything to enable this feature.

Additional Database Items Support for Salary Rates Using Values Defined by Criteria

Here's the list of database items that now support salary rates using the values defined by criteria feature. For example, you can now define a salary rate based on the normal working hours of an employee, and the salary value will be displayed on HR flows such as new hires.

| Database Item |

Database Type |

Flex Details |

|---|---|---|

| Assignment Flex |

PER_ASG_DF |

Supports assignment flex attribute, category, date, and number. |

| Grade Flex |

PER_GRADES_DF |

Supports grade flex attribute, category, date, and number. |

| Grade Code |

PER_ASG_GRADE_CODE |

N/A |

| Job Name |

PER_ASG_JOB_NAME |

N/A |

| Job Code |

PER_ASG_JOB_CODE |

N/A |

| Location Flex |

PER_LOCATIONS_DF |

Supports location flex attribute and category. |

| Normal Hours |

PER_ASG_NORMAL_HOURS |

N/A |

| Grade Step Name |

PER_GRADE_STEP_NAME |

N/A |

| Job Family |

PER_JOB_FAMILY_ID |

N/A |

| Enterprise Hire Date |

PER_PERSON_ENTERPRISE_HIRE_DATE |

N/A |

Take advantage of the extended list of database items to calculate salary rates using the values defined by criteria feature. These database items enable you to calculate rates on flows, such as new hires before the assignment details of the employee are submitted.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information about the database items that support the salary rates feature, see the Implementing Payroll for Global guide located in the Oracle Help Center.

September Maintenance Pack for 20C

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 28 AUG 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Element Rate Definition Minimum and Maximum Validation Support |

||||||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

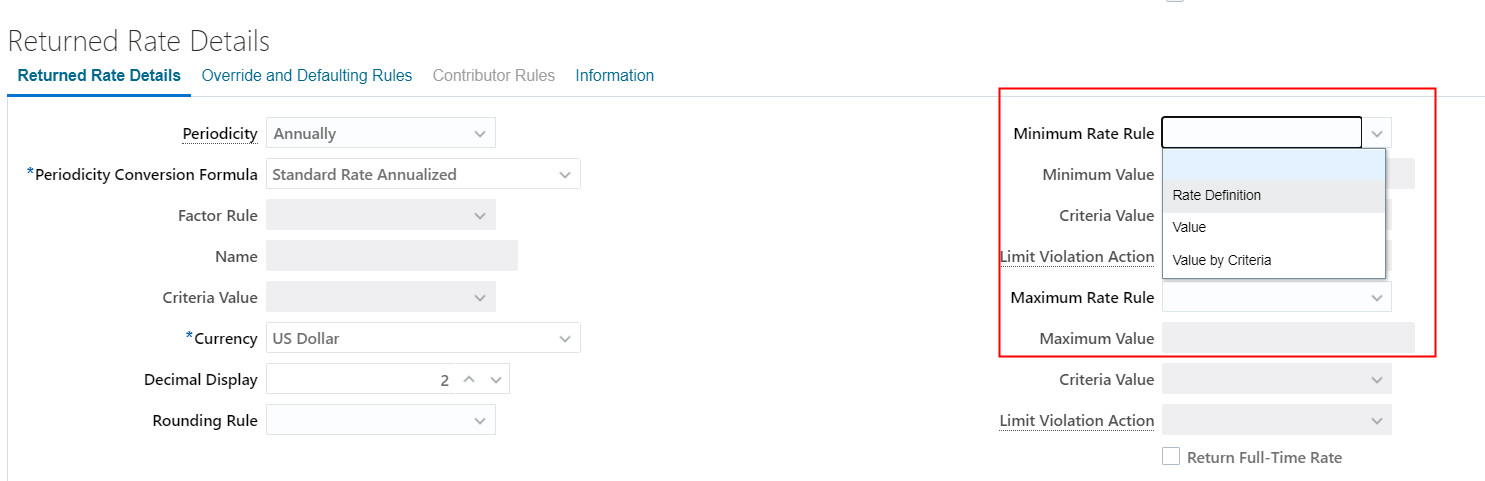

Element Rate Definition Minimum and Maximum Validation Support

You can validate an element rate based on minimum and maximum values. The application triggers the validation rules when the user adds or updates a rate component, such as salary.

Define minimum and maximum validation rules for rate definitions that are based on an element. You can either define a minimum and maximum value or set these rules based on another rate definition, value, or criteria.

Minimum and Maximum Validation Rules

You can now define more complex rate validation rules for features, such as salary rates.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information on Rate Definitions, refer to these topics in the Oracle Help Center:

- Rate Definitions Overview

- Options to Configure Rate Definitions

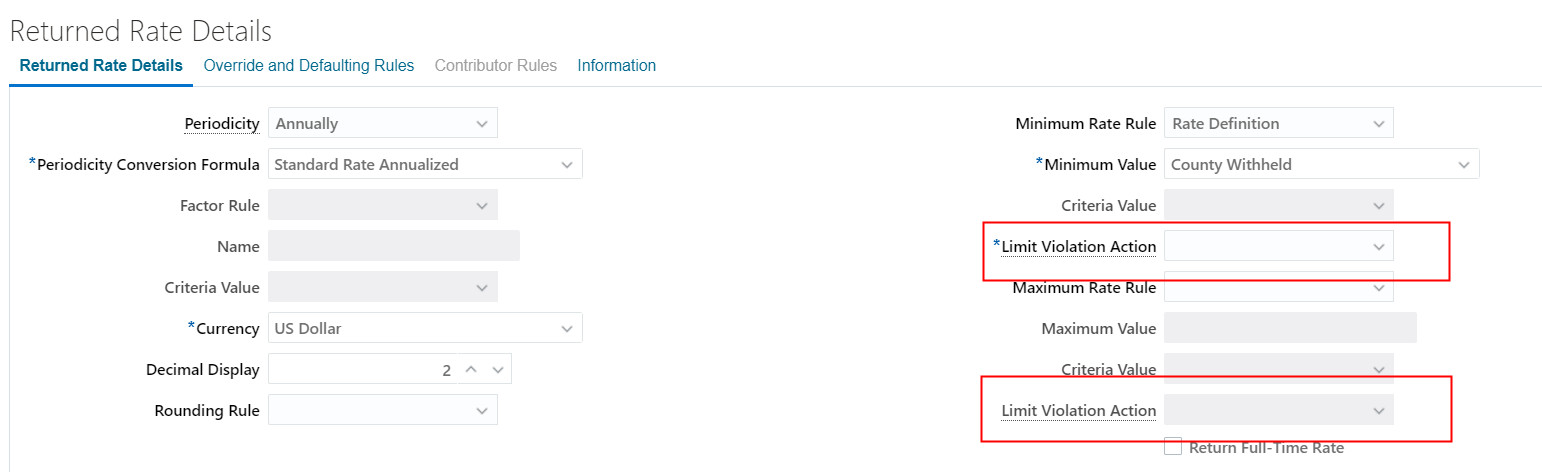

Rate Minimum and Maximum Limit Violation Enhancement

You can now validate rates using minimum and maximum rules. On the Create Rate Definition page, you can define different limit violation actions for the minimum and maximum rules.

For example, you can configure different limit violations so that the application displays a warning message when the rate is below a minimum value. And the application displays an error message when the rate is above a maximum value.

Limit Violation Action

You can now define more complex rate validation rules for features, such as salary rates.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information on Rate Definitions, refer to these topics:

- Rate Definitions Overview

- Options to Configure Rate Definitions

August Maintenance Pack for 20C

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 20 NOV 2020 | Global Payroll | Adjust Cost for a Person in the Responsive Pages | Updated document. Revised feature information. |

| 31 JUL 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Action is Needed BEFORE Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Archive Results Security Enhancement for Non Person Related Reports |

||||||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Archive Results Security Enhancement for Non Person Related Reports

You can view and update non person related archive data before you generate reports, regardless of your person security profile. For example, the UK Employer Payment Summary does not contain person related data and now, regardless of your security profile, you can view and update this information before proceeding.

Non person related archive data can be updated regardless of your person security profile.

Steps to Enable

You don't need to do anything to enable this feature.

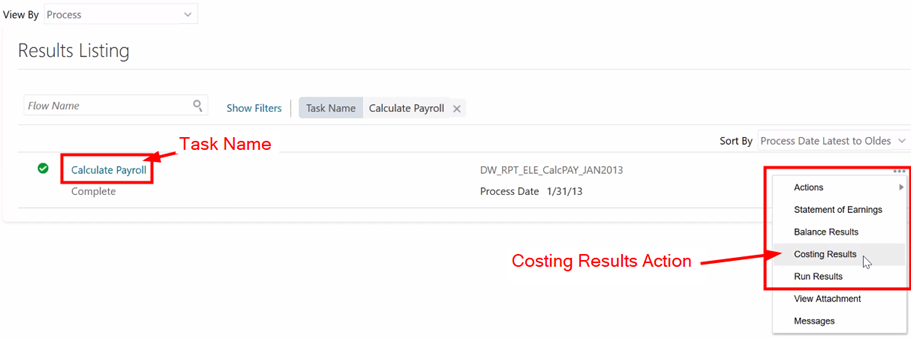

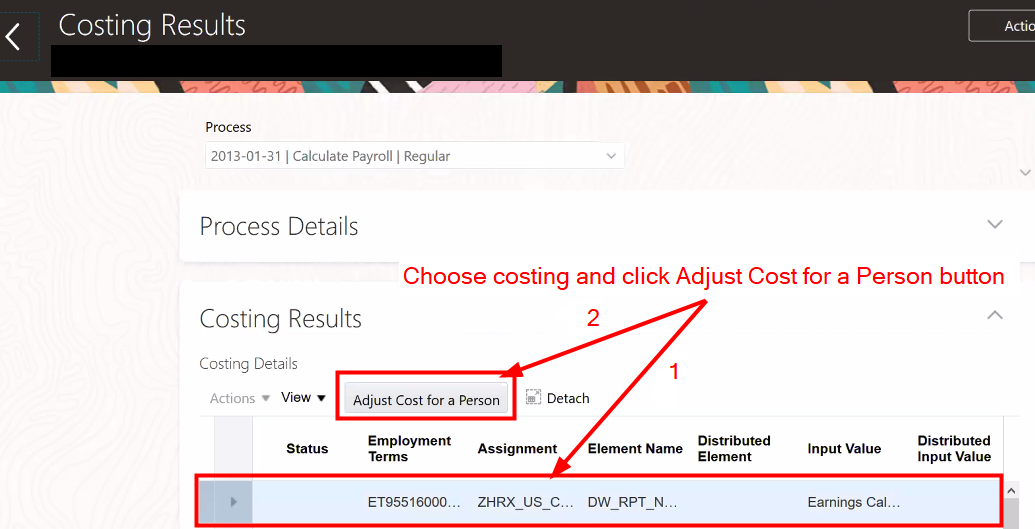

Adjust Cost for a Person in the Responsive Pages

You can now perform the costing adjustments for a person costing results in the responsive pages.

Navigation: My Client Groups > Payroll >

-

Person Results

- Search and select the person

-

Search for the task name Calculate Payroll and take action on Costing Results

-

Click Adjust Cost for a Person button

Steps to Enable

In order to enable you must enable the following profile option and should have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option.

NOTE: This step of enabling profile is for existing customers only. New customers starting with 19D or a later release do not need to setup these profiles, as the new responsive screens are delivered by default.

| Field | Value |

|---|---|

| Profile Option Code |

PAYROLL_ADMIN_RESPONSIVE_ENABLED |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

When the profile option is enabled, the Allocated Checklists self-service actions will take the user to the new self-service flows and the classic flows will no longer be available.

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

P45, P60 and Payslips Sort Sequence

When you run the P45 and P60 processes, the output will be in the same output sequence as the payslips. No additional configuration or parameters are required.

Steps to Enable

You don't need to do anything to enable this feature.

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 18 DEC 2020 | Payroll for the United States | Impose Organization Fees For Arizona Child Support Orders | Updated document. Delivered feature in update 20C. |

| 25 SEP 2020 | Compensation/Workforce Compensation | Updated Digital Certification For ADF Desktop Integration Excel | Updated document. Revised feature information. |

| 28 AUG 2020 |

Payroll for Canada | End Date and Delete Functionality on Professional Tax Card | Updated document. Delivered feature in update 20C. |

| 28 AUG 2020 |

Global Payroll | Flow Connectors Support for User-Defined Payroll Reports | Updated document. Delivered feature in update 20C. |

| 28 AUG 2020 | Compensation/Total Compensation Statement | Total Compensation Statements - Generate Printable Statements (Mass Print) | Updated document. Revised feature information. |

| 26 JUN 2020 | Global Payroll |

Task Iterations Page | Updated document. Delivered feature in update 20C. |

| 26 JUN 2020 | Global Payroll |

View-Only Version of Element Entries | Updated document. Revised feature information. |

| 26 JUN 2020 | Global Payroll |

View-Only Version of Person Costing | Updated document. Revised feature information. |

| 05 JUN 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

Benefits Service Center Improvements

We made improvements to these features in Benefits Service Center to simplify administration:

- Person Type Information

- Enrollment Kit Report

- Beneficiary Override

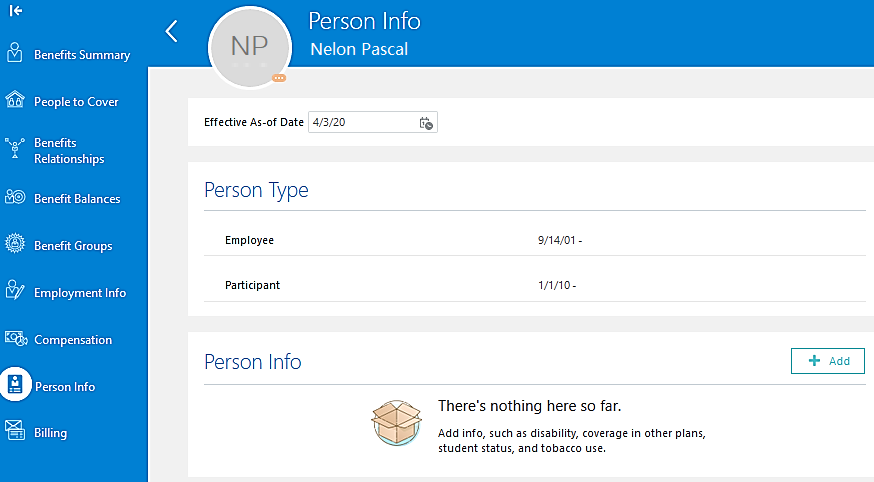

Person Type Information

You can now see participant's person type information, such as Participant, Employee, Ex Worker, Dependent, or Beneficiary in the Person Info page in Benefits Service Center. Person type is dependent on the effective date. You can see the effective date and validity of the person type on the Person Info page. This enables you to easily address eligibility-related and other questions from participants.

For example, consider a person who started as an employee in your organization on September 14, 2001. The person became a participant on January 1, 2010. So, as of April 3, 2020, the Person Info page shows Employee and Participant as the person types along with their validity details. Because both the person types are still active, you don’t see the validity end date.

Person Info Page

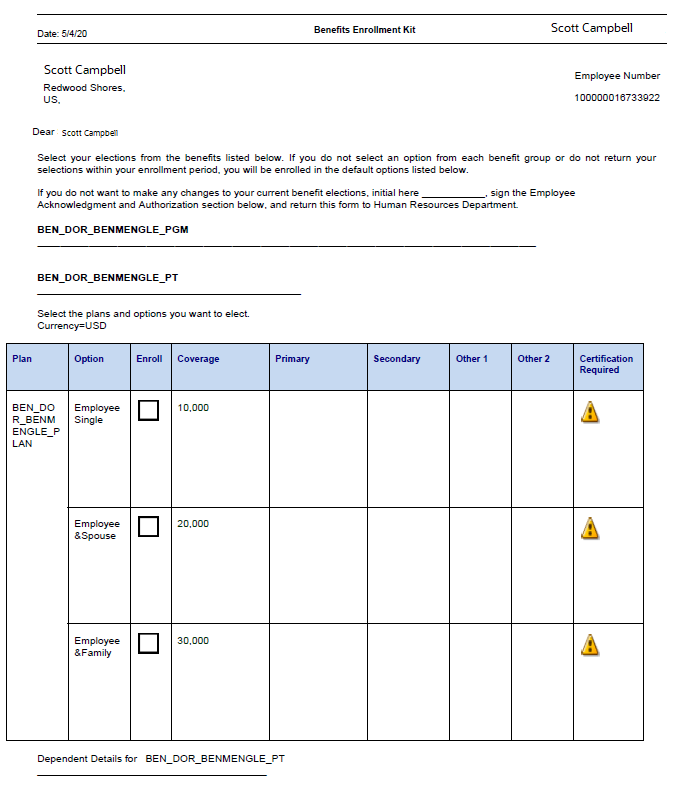

Enrollment Kit Report

Participants who don’t have access to the self-service pages can use the Enrollment Kit report to make their benefit elections manually. Previously, this report was available only in the classic pages. Now it's available in the responsive pages as well.

If you have previously used this report, your setup is retained and you don’t have to do any rework. If you would like to add any additional text or pull any additional data into the report, see the Benefits Customization Guide (Document ID: 2100688.1) for more information.

This report is available when the participant has a life event in the Started status and hasn’t made any explicit enrollments to the eligible programs and plans. You can download and share this report with the participants. When they return the filled up report, you can enter their selections in Benefits Service Center. The report contains the details of the electable choices, list of dependents who can be designated, and the details of the beneficiaries. The report shows electable data until the administrator or the participant makes explicit enrollment.

Enrollment Kit Report

Here's how you view the Enrollment Kit report:

- Open the Benefits Summary page of the participant in the Benefits Service Center.

- In the Evaluated Life Event section, click Actions > Print Enrollment Document.

- Share the report with the participant.

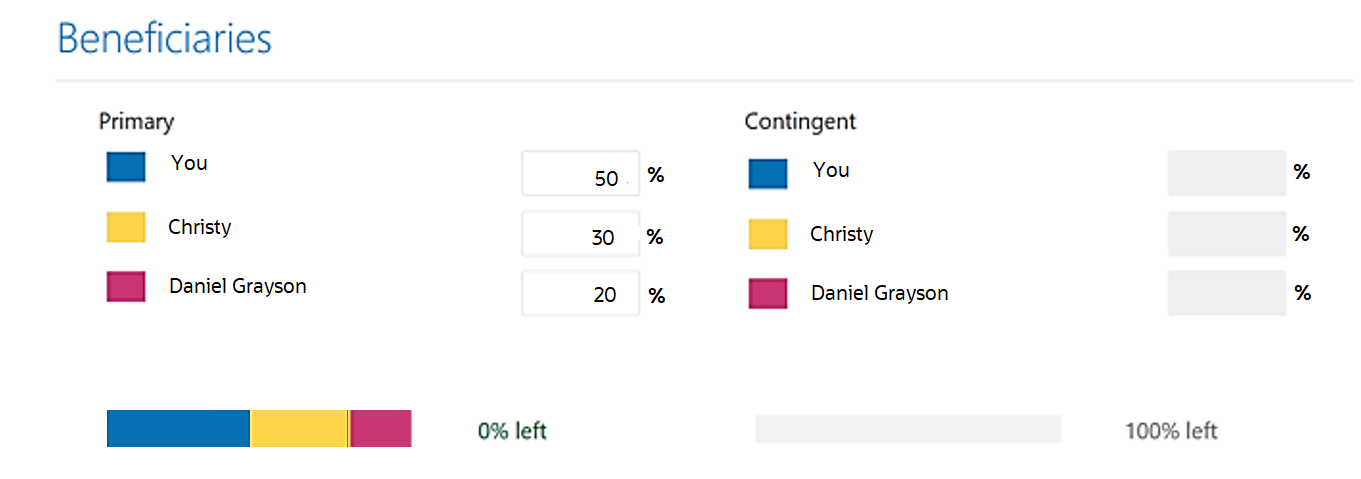

Beneficiary Override

When you close a life event for a participant, the beneficiary percentage allocations for various plans must add up to 100%. If they don’t add up, you must correct the beneficiary percentage allocations for the previously closed life events. You can now correct the incorrect beneficiary percentage allocations using the Override Enrollment option in the Enrollment work area. You no longer need to request or run a script to do this.

Consider the following example where the participant has three beneficiaries with the following allocations:

Before Reallocation:

| Beneficiary |

Type | Allocation |

|---|---|---|

| You | Primary | 50% |

| John Gorman |

Primary | 20% |

| Christy | Primary | 20% |

| Daniel Grayson |

Primary | 10% |

Because of the age factor, John Gorman drops off and the carry forwarded beneficiary allocation looks like this:

After Carry Forward:

| Beneficiary |

Type |

Allocation |

|---|---|---|

| You | Primary |

50% |

| Christy |

Primary |

20% |

| Daniel Grayson |

Primary |

10% |

If you try to close the life event now, you get an error. You must adjust the allocation to add up to 100% as shown below:

After Reallocation:

| Beneficiary |

Type |

Allocation |

|---|---|---|

| You | Primary |

50% |

| Christy |

Primary |

30% |

| Daniel Grayson |

Primary |

20% |

You can’t use this new functionality to create or close any beneficiary action items where primary and contingent allocation changes occur. Also, you can’t use it to undesignate an existing beneficiary or to designate a new beneficiary.

Here's how you correct the allocations:

- In the Enrollments tab in Benefits Service Centre, select Override Enrollment on the Actions menu.

- In the Override Enrollment page, scroll to the Beneficiaries section.

Override Enrollment Page

-

Correct the allocations for each beneficiary until you see 0% left for allocation.

You can back out and reprocess the life event once you correct the beneficiary allocations.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Watch Enhanced Administrative Features Readiness Training

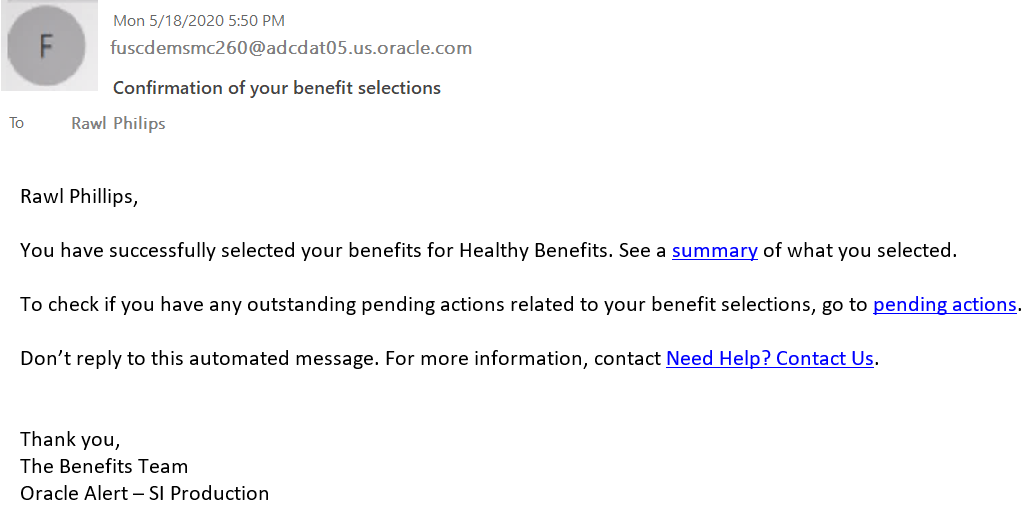

Alert to Remind Participants of Pending Actions

You can now use the improved Summary of Elections at Open Enrollment alert and template to remind participants that they have pending actions. For example, if a benefits enrollment requires participants to upload documents, the email alert reminds them to do so. Along with the summary of the selected benefits, participants can now see the pending actions too. The notification also provides a link to the Pending Actions self-service page so that participants can quickly get to that page and complete their actions.

Sample Email Notification

For first time users of this template:

You can use the template that we provide out of the box or modify it to meet your business needs. For example, you can change the template’s font style and add your company logo and hyperlinks of your website. You can test the modified template to ensure that everything works well before you send it to the participants. You can also change when and how scheduled alerts are sent to the users, and so on.

If you're already using this alert from a previous release, you don't need to do any additional setup. If not, you need to make sure you do these steps to enable the alert:

- Click Navigator > Tools > Alert Composer.

- On the Alert Composer page, you can select and configure the BEN_ELECTIONS_SUMMARY template that we have delivered.

NOTE: You can elect to enable all the notifications we provide or enable only the ones you want to use.

Steps to Enable

If you're already using this alert from a previous release, you don't need to do any additional setup. If not, you need to make sure you do these steps to enable the alert:

-

Click Navigator > Tools > Alert Composer.

-

On the Alert Composer page, you can select and configure the BEN_ELECTIONS_SUMMARY template that we have delivered.

NOTE: You can elect to enable all the notifications we provide or enable only the ones you want to use.

Key Resources

For more information see the following:

- Watch Enhanced Administrative Features Readiness Training

- Overview of Benefits Alerts (Document ID 2632765.1) on My Oracle Support

- Chapter 15 - Alerts Composer in the Implementing Global Human Resources guide in the Oracle Help Center.

More Flexibility in Extract Reporting

You can now have more flexibility in extract reporting by using the new Database Item groups (DBI groups) and the Database Items (DBIs) that we added to the existing 15 user entities. We now support DBI's for the following most common fields in Benefits through HCM Extract:

- Plan

- Program and Option Short Codes

- Short Name

- Person Habits Effective Start Date and End Dates

We’ve also delivered the following WHO columns from the 20 Benefits transaction tables to the same 15 existing user entities:

- Creation Date - CREATION_DATE

- Created by - CREATED_BY

- Last Updated Date - LAST_UPDATE_DATE

- Last Updated By - , LAST_UPDATED_BY

- Last Updated Login - LAST_UPDATE_LOGIN

To see the extract report, submit the extract, and open the Reports and Analytics work area. Check the Last Updated Date and data for the other new columns, such as Last Updated By, Created By, and so on. You have now more flexibility in filtering the data in the reports. For example, you can filter the data to include updates over the last three or six months. Alternatively, you can export historical enrollments up to 24 months.

We added seven new user entities to the Employees DBI:

- Flex Credits Pool Choice Information – BEN_EXT_HIST_ELIG_FLEX_CRDT_POOL_CHC_UE

- Flex Credits Ledger Information – BEN_EXT_HIST_FLEX_CRDT_LDGR_UE

- Potential Life Event Data – BEN_EXT_HIST_PTN_LER_FOR_PER_UE

- Person Life Event Data – BEN_EXT_HIST_PER_IN_LER_UE

- Participant Legal Disclaimer Data

- Person Benefits Balance Date – BEN_EXT_HIST_PBB_UI

- Primary Care Physician Information – BEN_EXT_HIST_PCP_UE

You can use the new fields to build your own carrier extracts to send your enrollment information from your organization or plan sponsor to the carrier or insurance provider. Also, you can now send your enrollment information using the ANSI 834 format.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Watch Enhanced Administrative Features Readiness Training

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

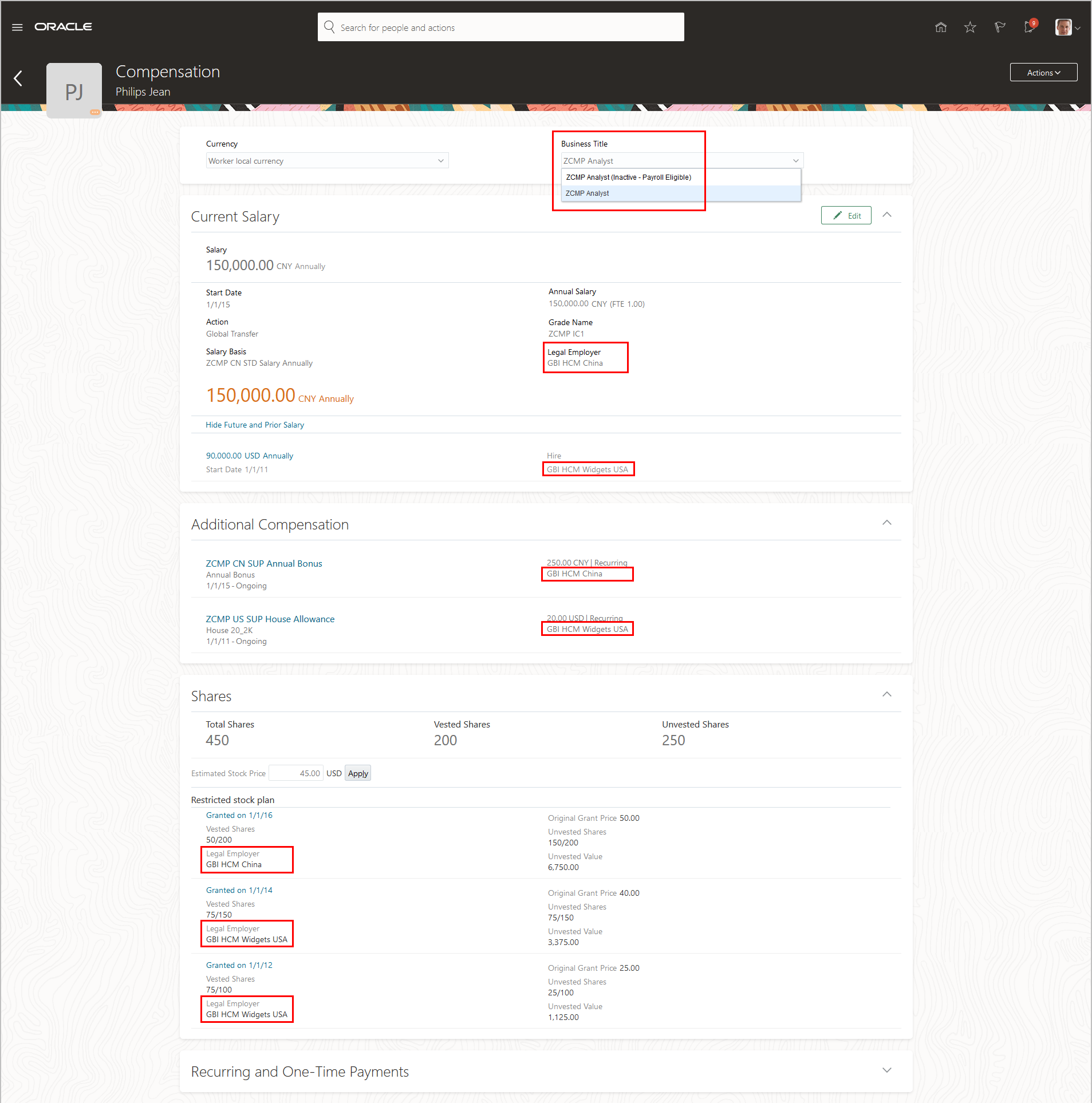

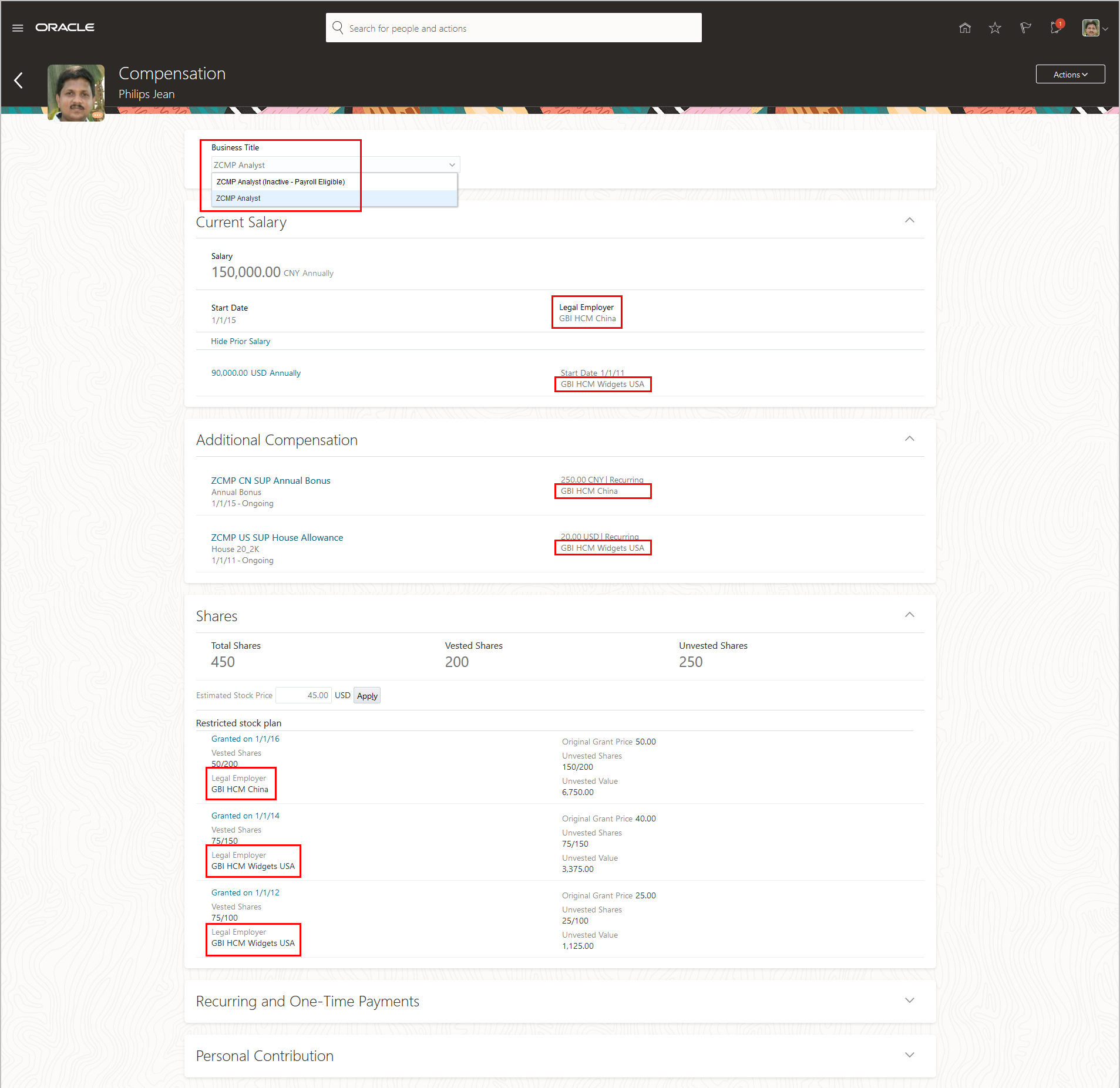

Compensation Info Can Show Changes Across Legal Employers

You can now see compensation info across legal employers. Earlier, you had to use the assignment switcher to view compensation details for previous legal employers.

Compensation Info Action for Line Manager and HR Specialists Showing the Consolidated Details Across Multiple Legal Employers

My Compensation Action Showing the Consolidated Details Across Multiple Legal Employers

Steps to Enable

You need to enable this profile option:

| Field |

Value |

|---|---|

| Profile Option |

ORA_CMP_CARD_DISPLAY_GT_HISTORY |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Set the Level to Site.

- In the Profile Value field, enter Y.

- Click Save and Close.

Tips And Considerations

- For individuals to view their compensation info across changes of legal employer, you need to link their source and target assignments. Refer to the Key Resources section for supporting documentation.

- To differentiate suspended and inactive assignments, the business titles of these assignments end with the status, for example, Inactive – Payroll Eligible.

- This consolidation of information happens in Salary, Individual Compensation, and Stock sections of the My Compensation and Compensation Info actions.

Key Resources

For more information about linking source and target assignments, refer to the Linking Source and Target Assignments for a Legal Employer Change feature in the Global Human Resources What's New for 20B.

We've made it easier for you to load or schedule external data using HCM Data Loader (HDL). Previously only spreadsheet load was available.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information, see the Oracle Human Capital Management Cloud Integrating with HCM chapter about Loading Compensation Objects that can be found in the Oracle Help Center.

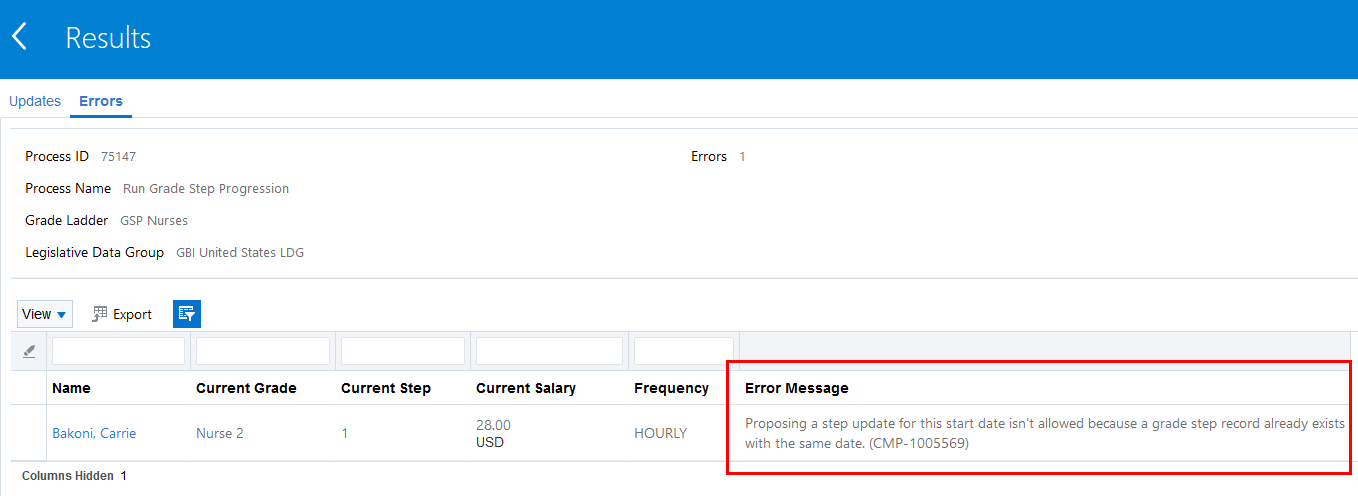

Grade Step Progression: Allow Multiple Step Updates on the Same Date

You can now configure the batch error condition for grade step progression to allow multiple step updates on the same date. Previously, the batch process generated an error message when it found an existing assignment grade step record on the same date as the date of the proposed progression. Here's an example of the error message:

Error Message When There's an Existing Assignment Grade Step on the Same Date as the Proposed Progression

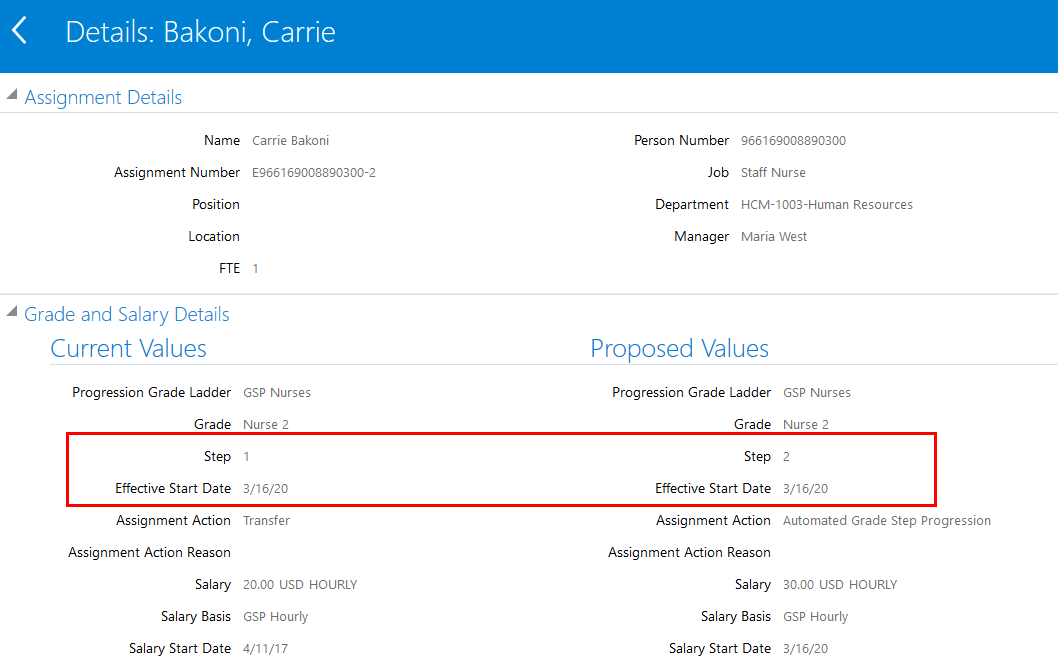

With this update, you can allow step updates on the same date as an existing assignment grade step record. In this case, the existing row is updated with the new information. You can review the information on the Review Proposed Progressions and Salary Updates page. When you look at the details for an assignment, you see the current and proposed values. The Effective Start Date value can now be the same for the current and proposed step. You can see an example of this scenario in this image. The grade is Nurse 2 and the current step is 1. The proposed step for the same effective date is 2.

Proposed Step on Same Date as Existing Grade Step Record

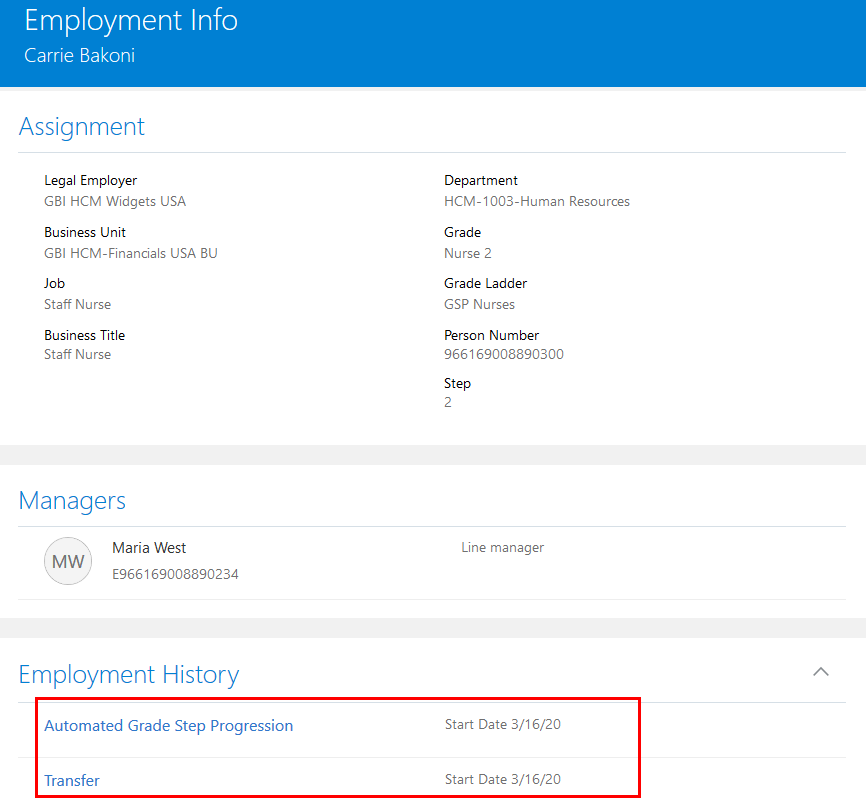

When you accept the proposed progression, or the batch process automatically accepts it, the assignment is updated with same date and a new sequence. After the acceptance, you see two assignments with the same effective date, as shown here.

Employment Info Page, Employment History Section Showing 2 Assignments on the Same Date

You can't see the historical step attribute when you view older records for assignment rows with the same date because you always see the current step for that date. History is maintained for all the attributes stored on the assignment record. The step attribute, however, is stored on the assignment grade step record, which doesn't have a sequence. So, history isn't maintained for the assignment grade step attribute because it was overwritten.

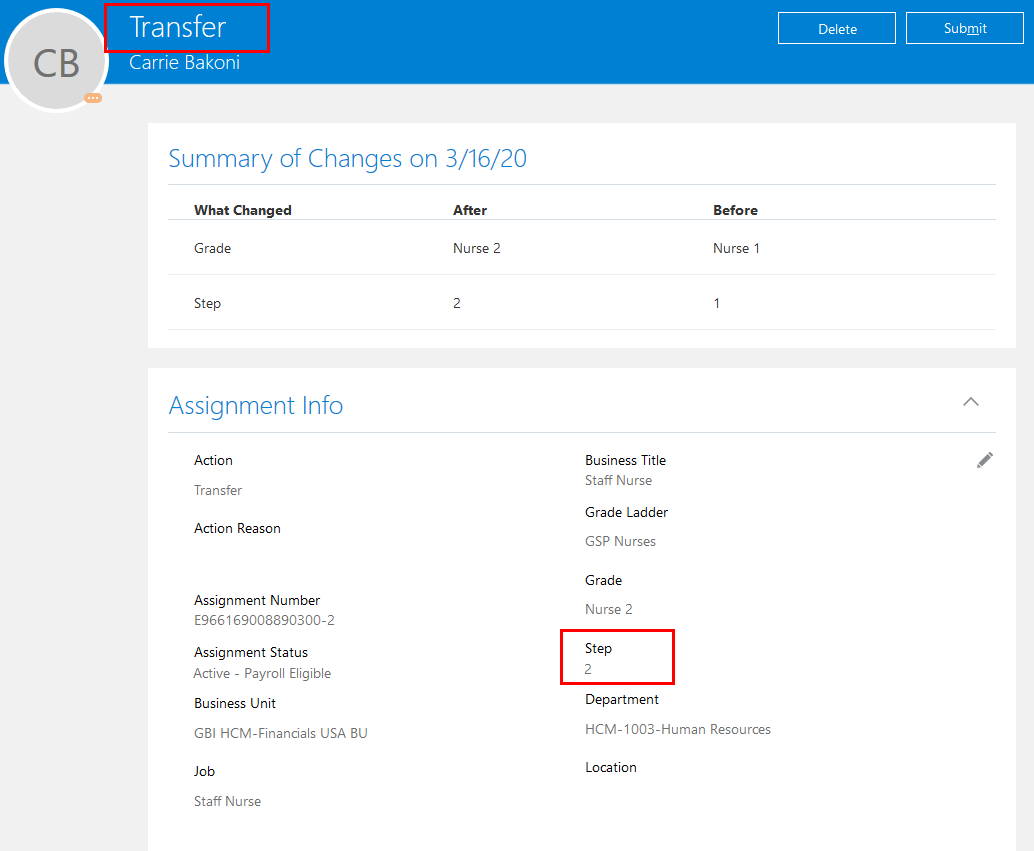

In this example, the employment history row with action Automated Grade Step Progression is the most current assignment row for March 16, 2020. The employment history row with action Transfer is the previous row for March 16, 2020, and had a value of step 1 before the grade step progression process ran. When you view the Transfer row, you see step 2 because it's the step that's associated with the more current Automated Grade Step Progression action.

Historical Assignment Showing Prior Step Value Overwritten with Current Step Value

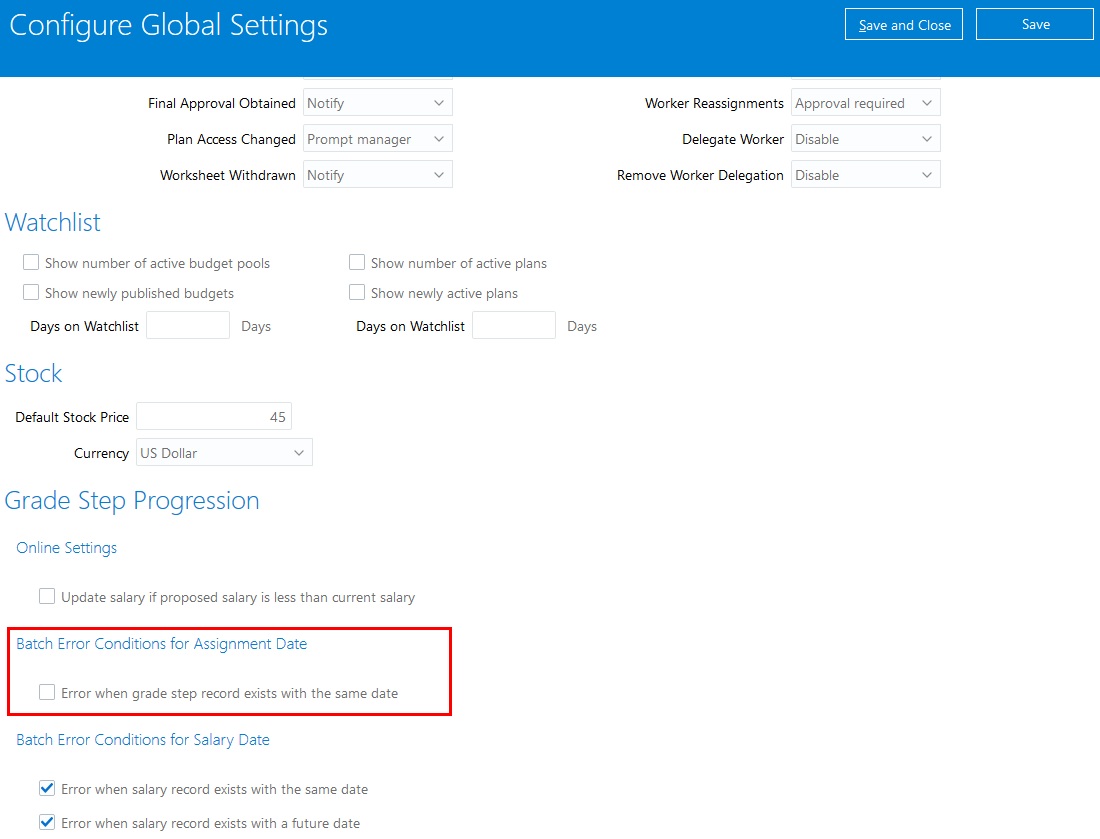

Steps to Enable

- In Setup and Maintenance, click the Configure Global Compensation Settings task:

- Offering: Compensation Management

- Functional area: Base Pay

- Scroll to the Grade Step Progression section of the page.

- Under the heading Batch Error Conditions for Assignment Date, deselect the Error when grade step record exists with the same date check box.

Configure Global Compensation Settings

Key Resources

For more information, see the Implementing Workforce Compensation guide, Chapter 4 - Grade Step Progression in the Oracle Help Center.

Populate Salary from Grade Ladder Rates: Warning Messages

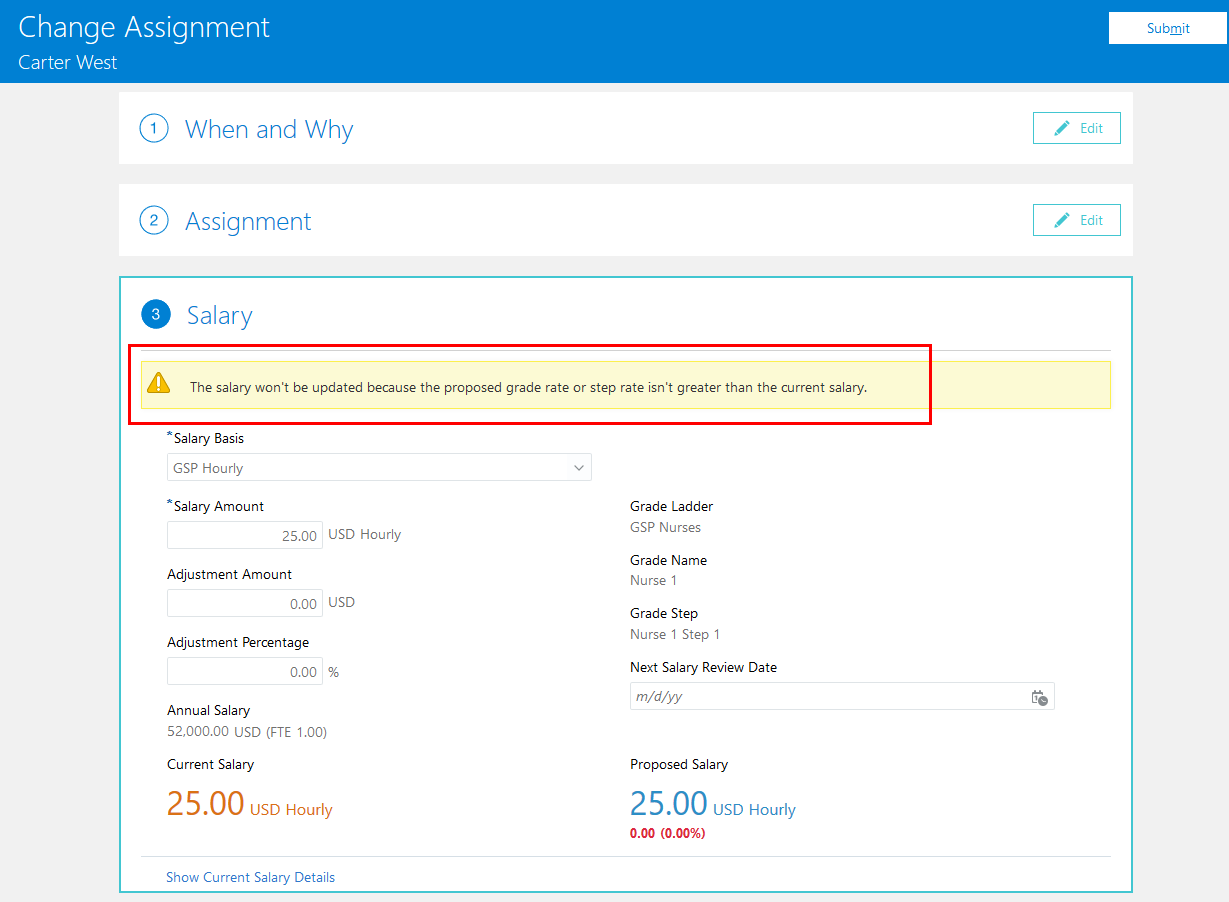

The responsive HR actions now include warning messages that give an explanation about why a salary can't be updated from the progression grade ladder rates. Previously the messages were only included on classic pages.

If a condition prevents the salary from being updated, you see a warning message in the Salary section of the page. When you're performing an action that updates an assignment, such as Change Assignment and Promote, you see the message as soon as you enter the Salary section. When you're performing an action that creates an assignment, such as Hire and Add Assignment, the warning appears after you select the salary basis in the Salary section.

Here's an example of a warning in the Change Assignment action. In this example, the proposed salary is less than the current salary. You can continue by submitting the change without including a salary update. Or, you can manually update the salary before submitting the change.

Change Assignment Action with Salary Warning Message

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Salary can only be populated from grade ladder rates if the Salary section is included in the action. If you don't include the Salary section in your action, you won't see the warning messages.

- If there's more than one reason for the salary not populating, you only see the message for the first reason encountered.

Key Resources

For information on how to populate salary from grade ladder rates, refer to these resources:

- Implementing Workforce Compensation guide, Base Pay (Chapter 3), How You Populate a Salary Amount with a Rate from the Grade Ladder in the Oracle Help Center.

- 20B Workforce Rewards What's New, Populate Salary from Grade Ladder Rate: Proposed Salary Less Than Current

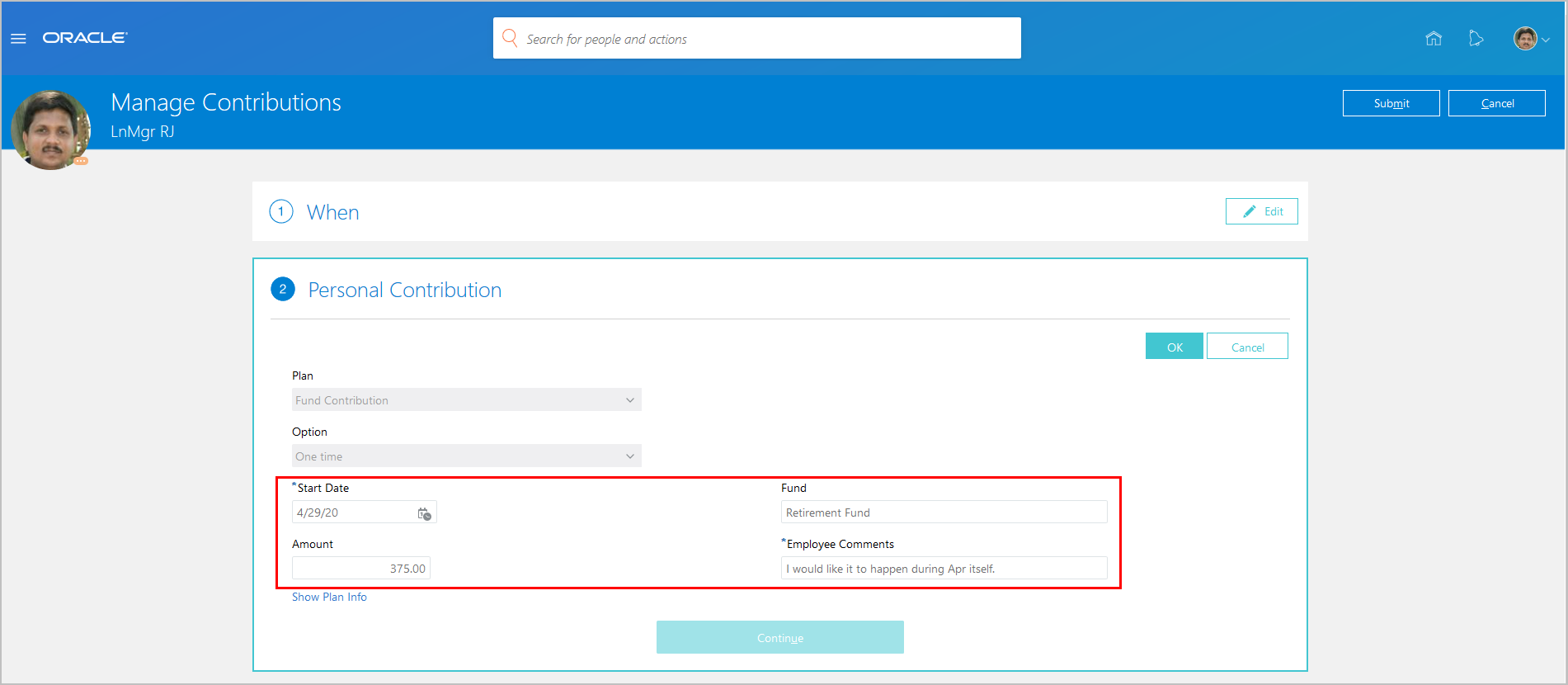

Individual Compensation Approval Notifications Can Show Input Values

You can now include input values in the Oracle Business Intelligence Publisher notifications for individual compensation actions, such as Manage Personal Contribution, Individual Compensation, and Administer Individual Compensation. This way, approvers can view all the proposed input values and not just the value entered for primary input value.

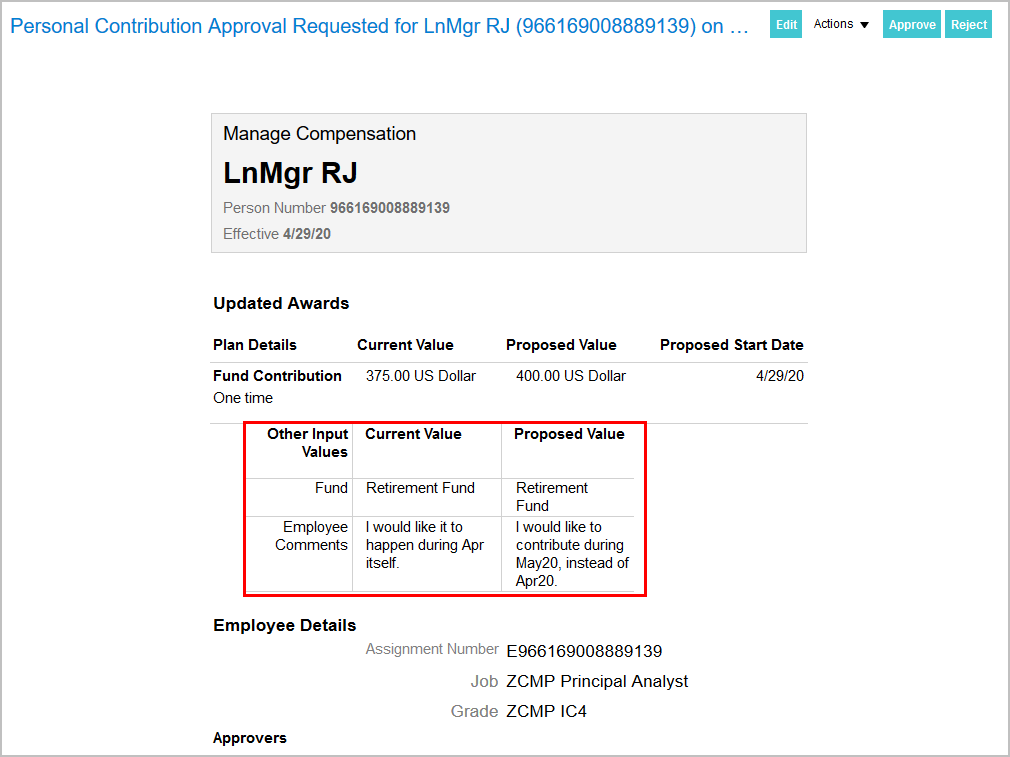

Manage Contributions Page Where an Individual Proposes a Onetime Personal Contribution

Approval Notification with All of the Proposed Input Values for the New Award of the Onetime Personal Contribution

Approval Notification with All of the Input Values for the Updated Award of the Onetime Personal Contribution

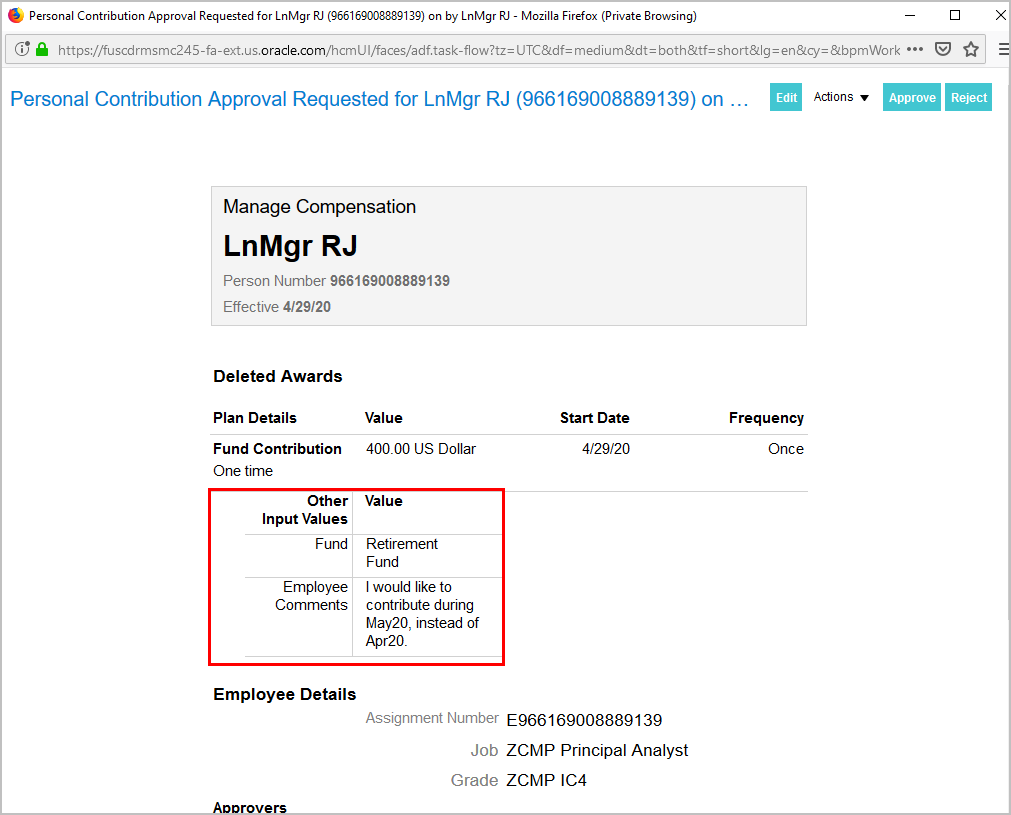

Approval Notification with All of the Input Values for the Deleted Award of the Onetime Personal Contribution

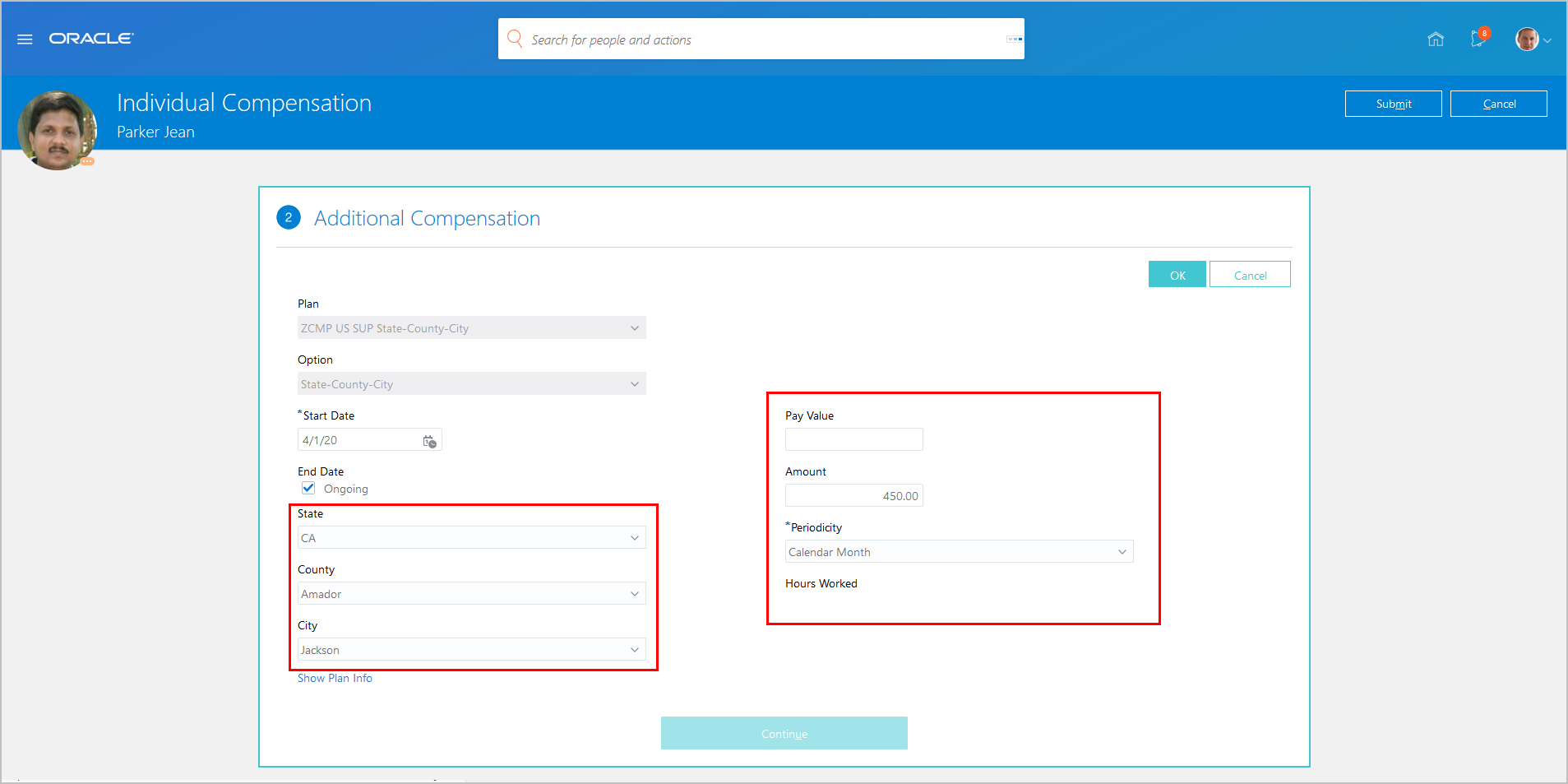

Individual Compensation Page Where a Line Manager Proposes a Recurring Allowance Award

Approval Notification with All of the Proposed Input Values for the New Award of the Recurring Allowance

Steps to Enable

You need to enable this profile option:

| Field | Value | Description |

|---|---|---|

| Profile Option |

ORA_CMP_BIP_IC_SHOW_INPUT_VALUES |

Display all input values in Individual Compensation BI approval notifications |

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Set the Level to Site.

- In the Profile Value field, enter Y.

- Click Save and Close.

Tips And Considerations

The improved notification is part of workflow notifications associated with these tasks: Manage Personal Contribution, Manage Compensation, and Administer Individual Compensation. The notification includes the values stored in the input values columns and not the meaning or descriptions when the values use validations, such as Lookup Type, Value Set, and Validation Source.

Key Resources

For more information, see Workforce Rewards What's New for 20B. Look under Compensation and then at the feature Individual Compensation Approval Notification Enhancements.

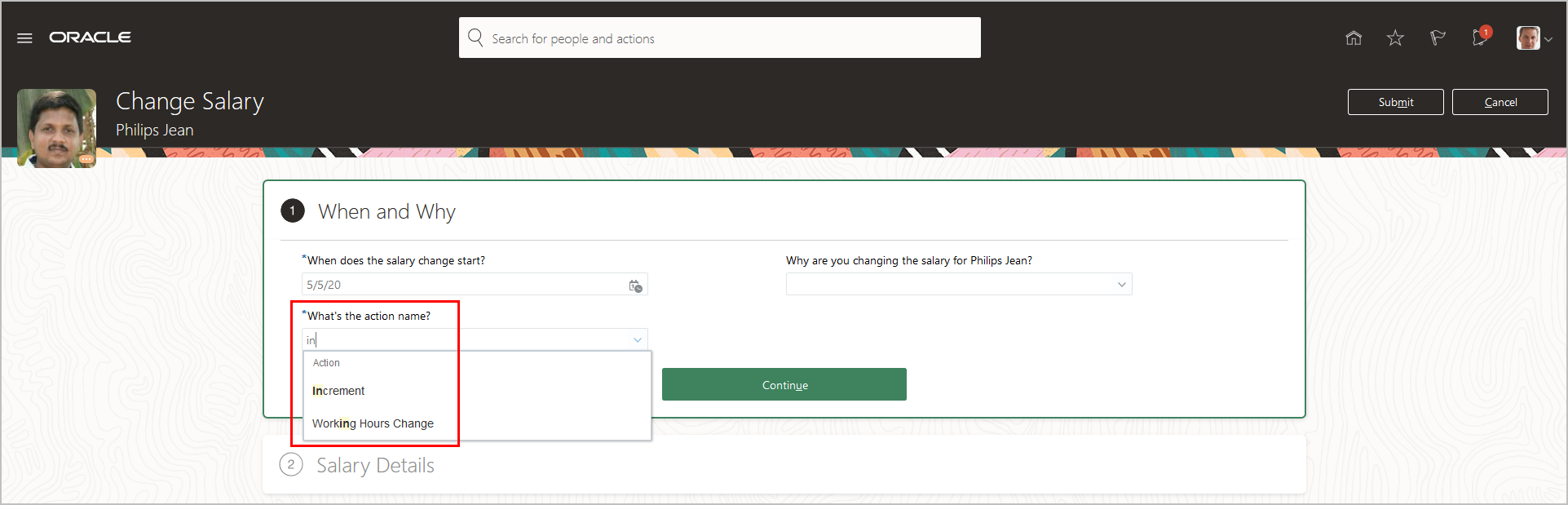

Client List of Values for Action and Action Reason in Salary Actions

You can now get relevant action and action reason suggestions as you start typing in the fields on responsive salary pages.

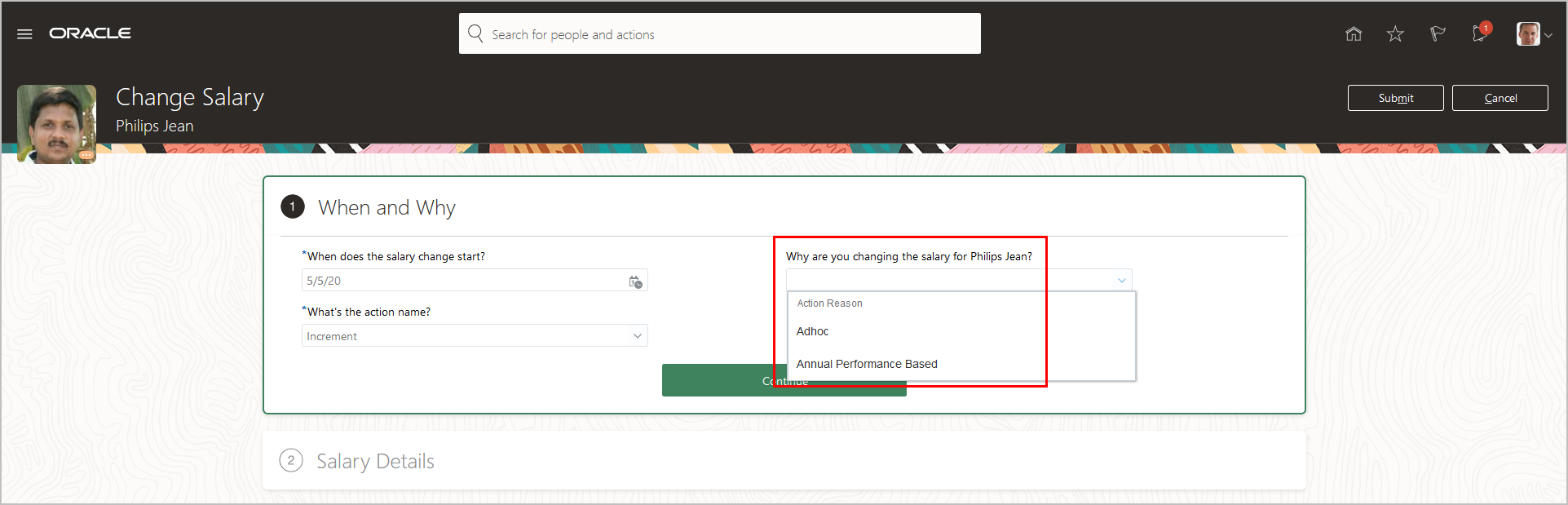

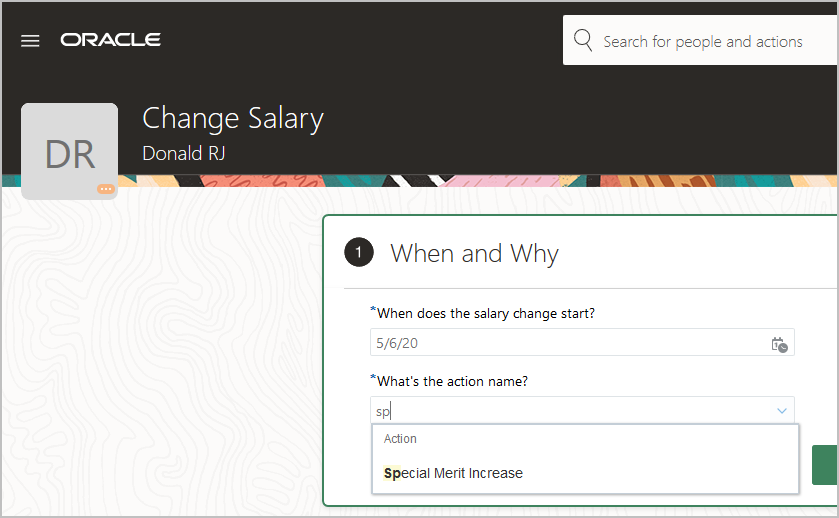

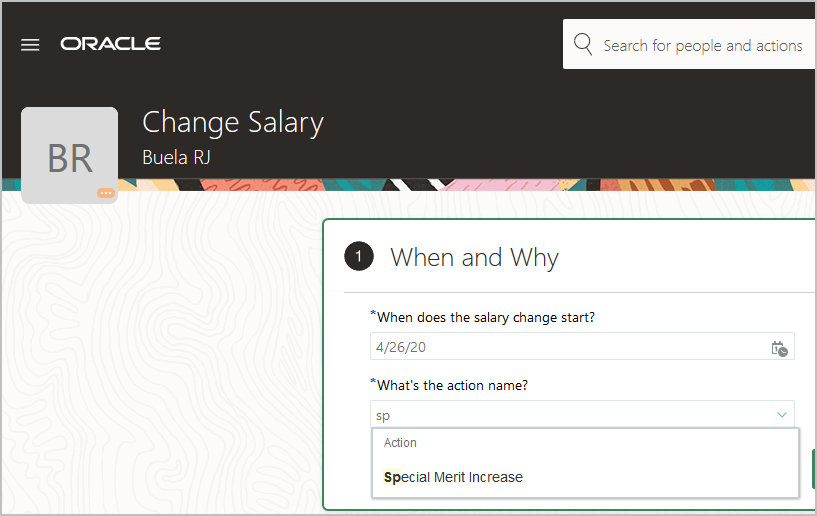

Change Salary Action Page Showing the Action Field Choice List Values That Contain the Typed in Characters

Change Salary Action Page Showing the Reason Field Choice List

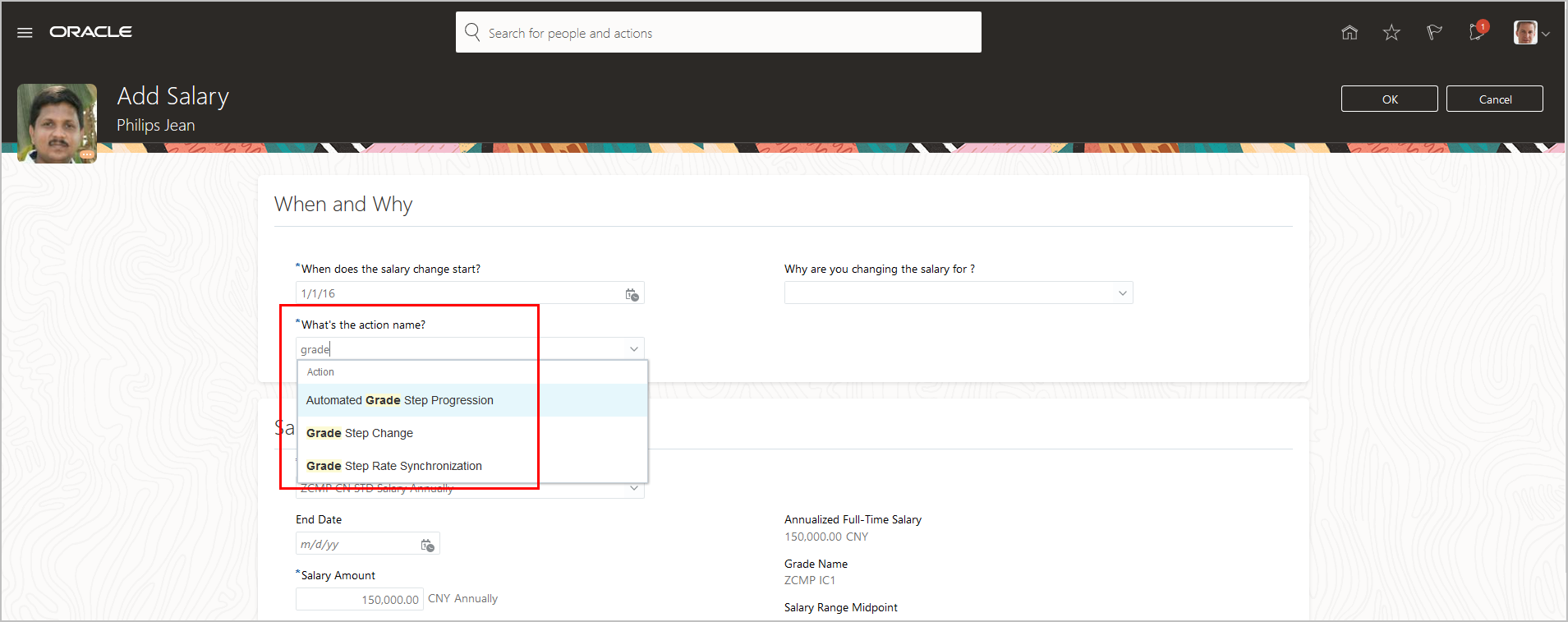

Salary History Action, Add Salary Page Showing the Action Field Choice List Values that Contain the Typed Characters

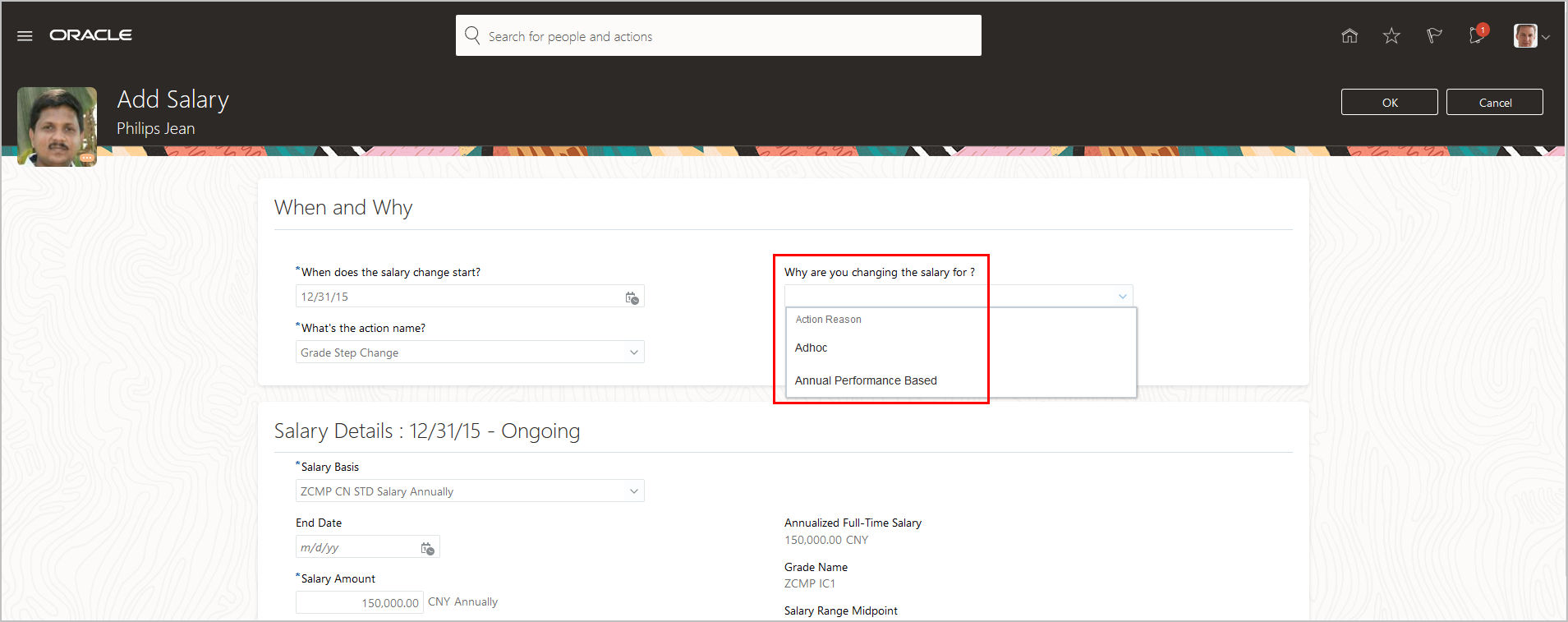

Salary History Action, Add Salary Page Showing the Reason Field Choice List

Also, you see only the values that are mapped to the country of the worker’s legal employer when you change salary on the responsive pages. The same happens when you view salary history on responsive pages.

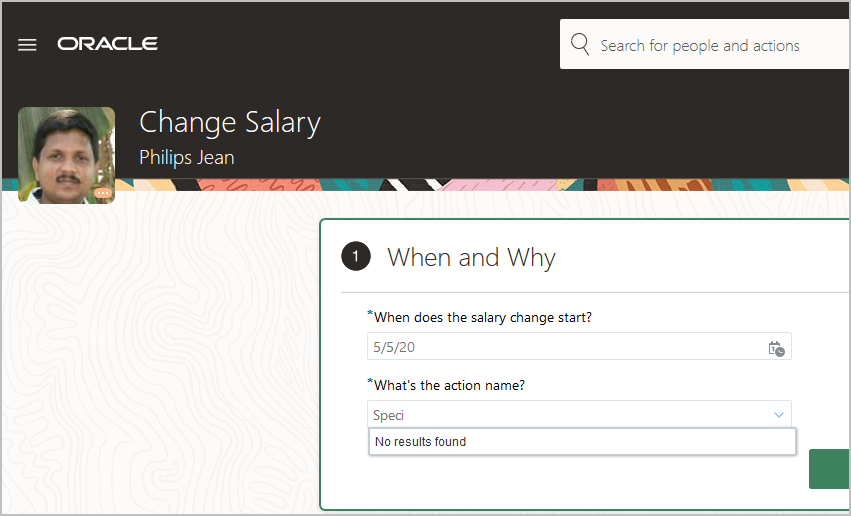

No Action Found Because It's Not Mapped to the Country of Worker’s Legal Employer

Action Found Because It’s Mapped to the Country of Worker’s Legal Employer

And, you see only the values mapped to your role when you change salary or view salary history on responsive pages.

No Action Found When You're Changing Salary Because It’s Not Mapped to Your Role

Action Found When You're Changing Salary Because It’s Mapped to Your Role

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Tips And Considerations

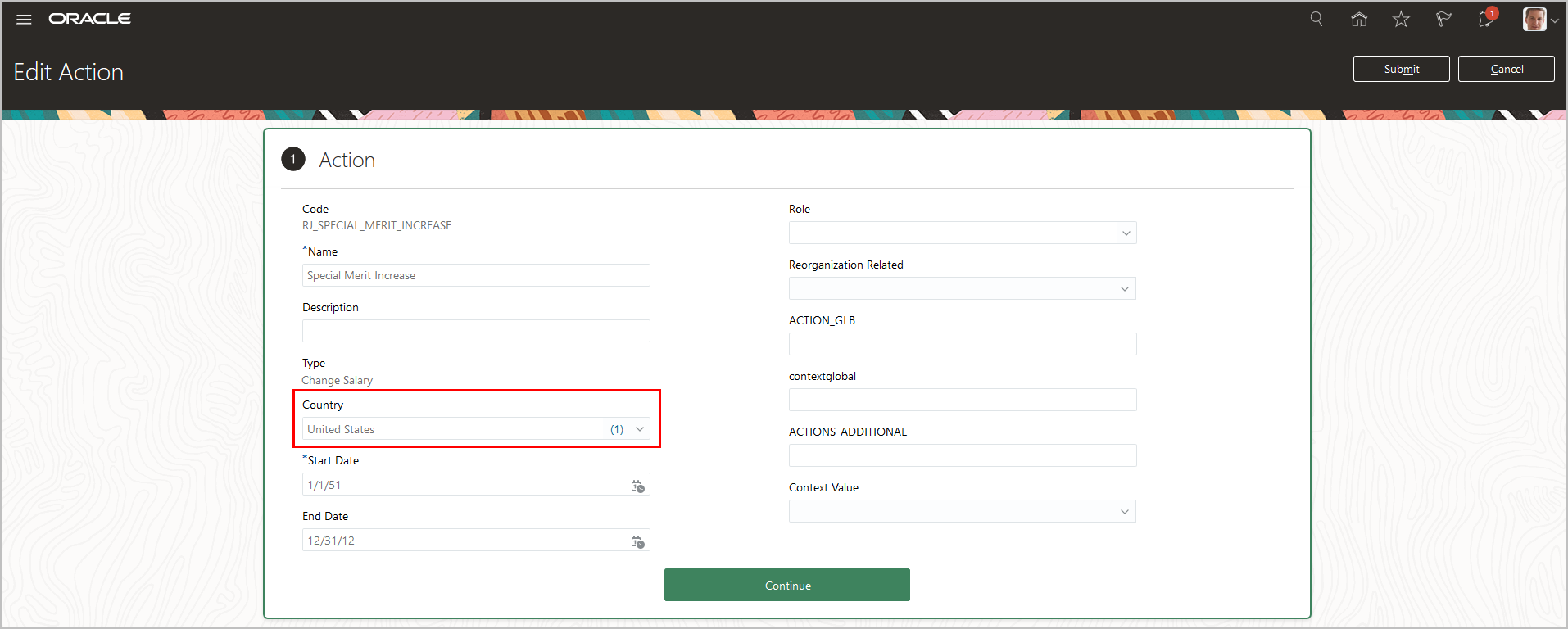

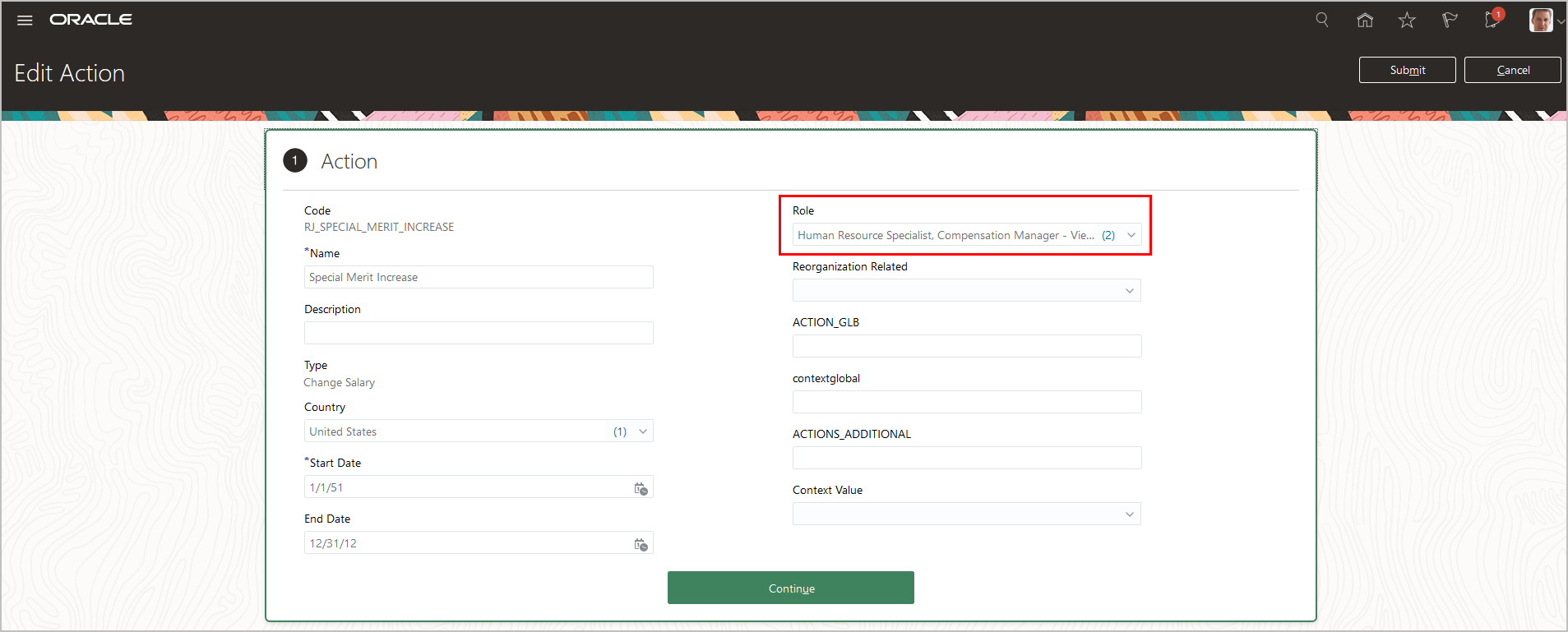

- Edit any actions that are country-specific and identify the applicable country or countries. Use the Configure Actions task in the Compensation work area.

The Edit Action Page for the Special Merit Increase Action Showing That It's for Just the United States

The Edit Action Page for the Special Merit Increase Action Showing That It's for the Human Resource Specialist and Compensation Manager Roles

- Similarly use the Action Reasons task in the Compensation work area, to map a reason to a country, role.

- If you customized the responsive salary pages to make Action or Reason mandatory, you are affected by this enhancement. The old components are replaced with the new client list of values and you need to redo your customizations.

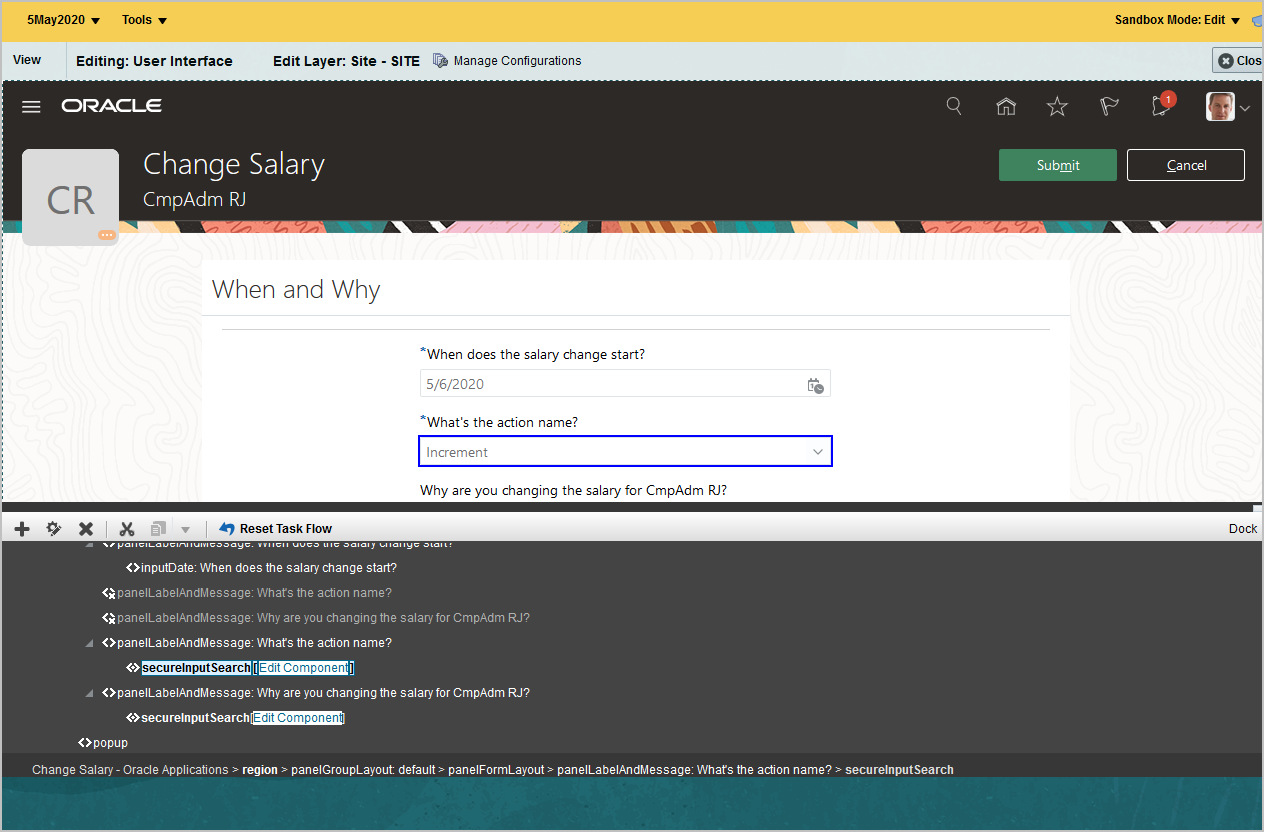

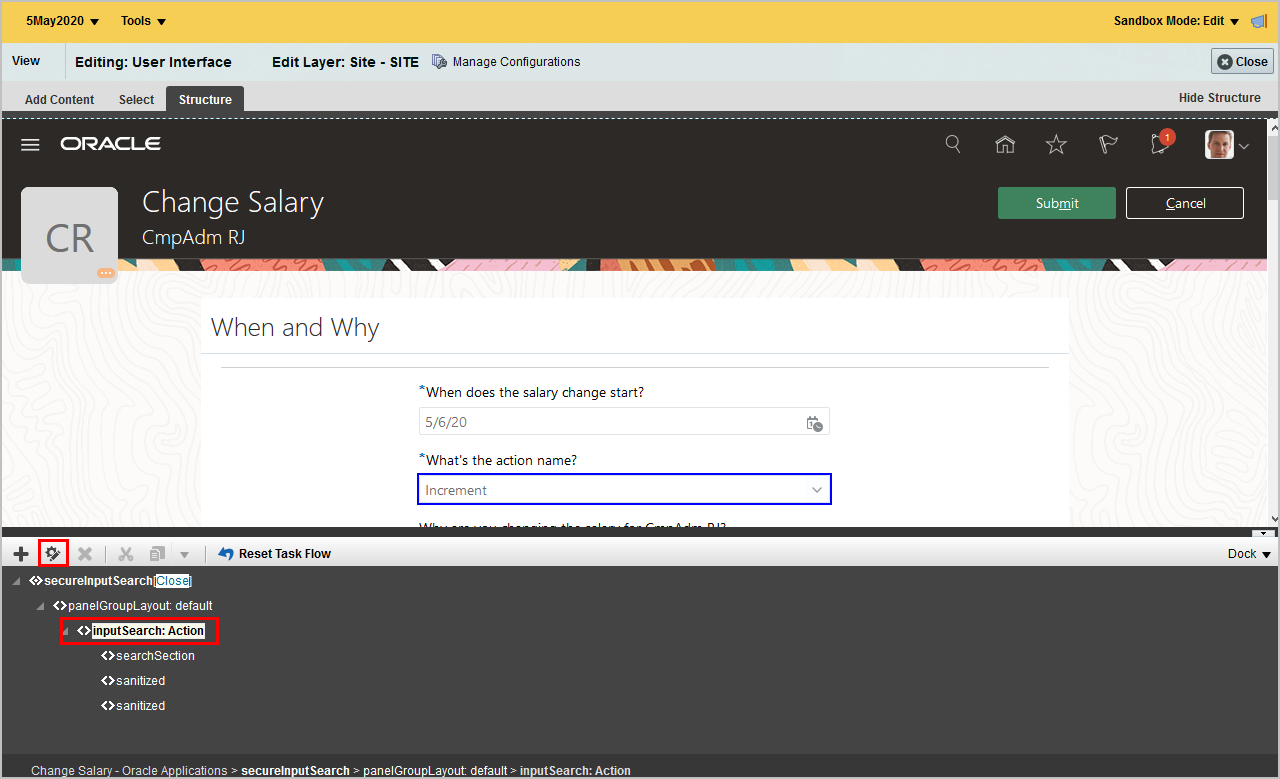

How to make the Action field read-only on the Change Salary action page

- Start in a sandbox, that has HCM Design Studio, Page Composer tools.

- Navigate to My Client Groups > Quick Actions > Change Salary.

- Search for and select a person.

- On the Change Salary page, click Edit Pages.

- In the When and Why section, select the What’s the action name? field.

- Next to secureInputSearch, click Edit Components.

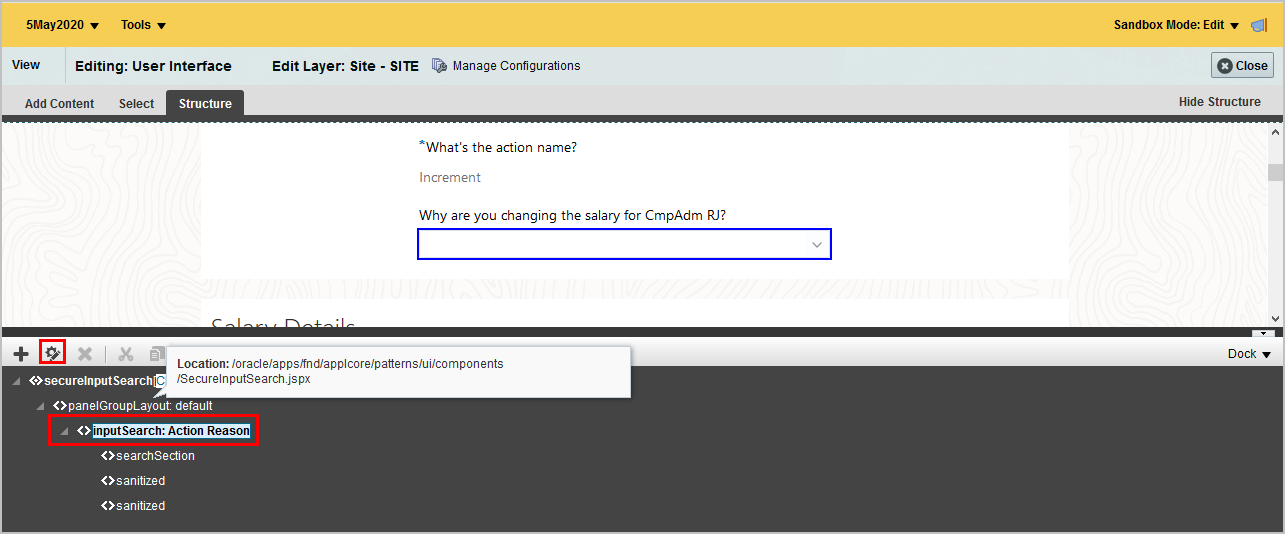

- Click inputSearch: Action.

- On the toolbar, click Edit Components.

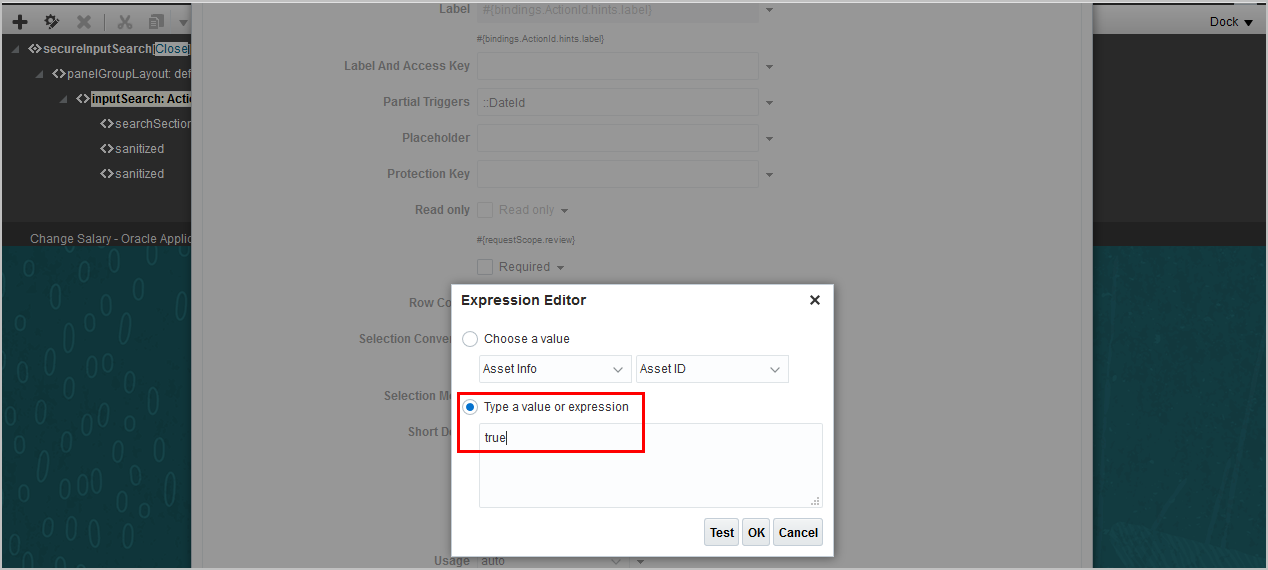

- For the Read Only property, select Expression Builder.

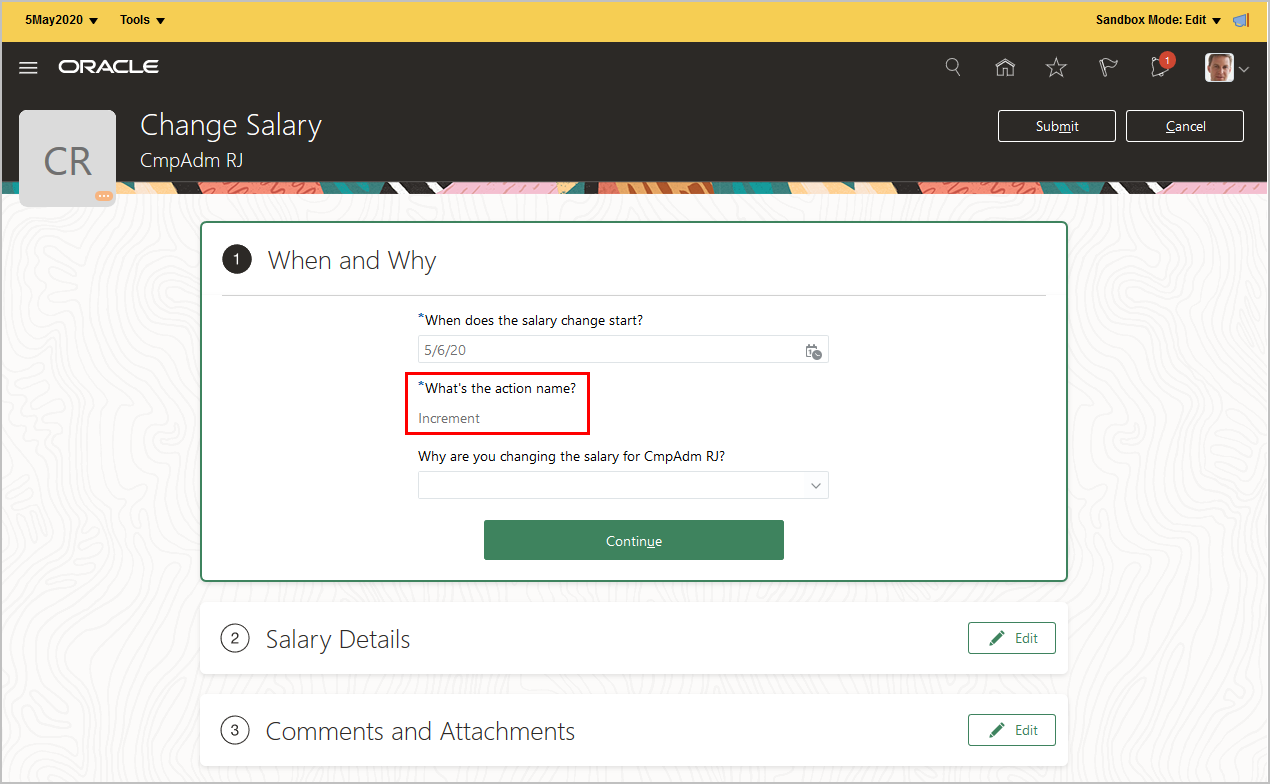

- In the Type a value or expression field, enter true.

- Save and close all.

- Verification

Invoke Change Salary from My Team > Quick Actions

You need to follow similar steps to make the action read-only on the Salary History page too.

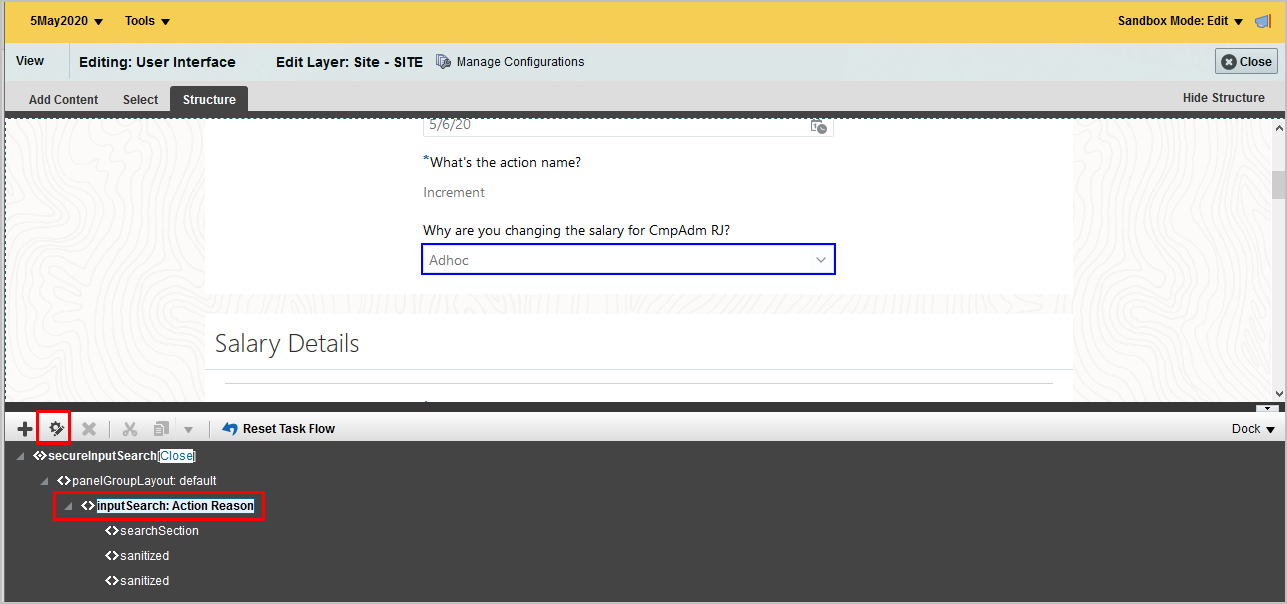

How to make the Action Reason field required on the Change Salary action page

- The trick here is to make the action reason mandatory only after the person selects the action.

- Start in a sandbox, that has HCM Design Studio, Page Composer tools.

- Navigate to My Client Groups > Quick Actions > Change Salary.

- Search and select a person.

- On the Change Salary page, click Edit Pages.

- In the When and Why section, select Why are you changing the salary for CmpAdm RJ?.

- Next to secureInputSearch, click Edit Components.

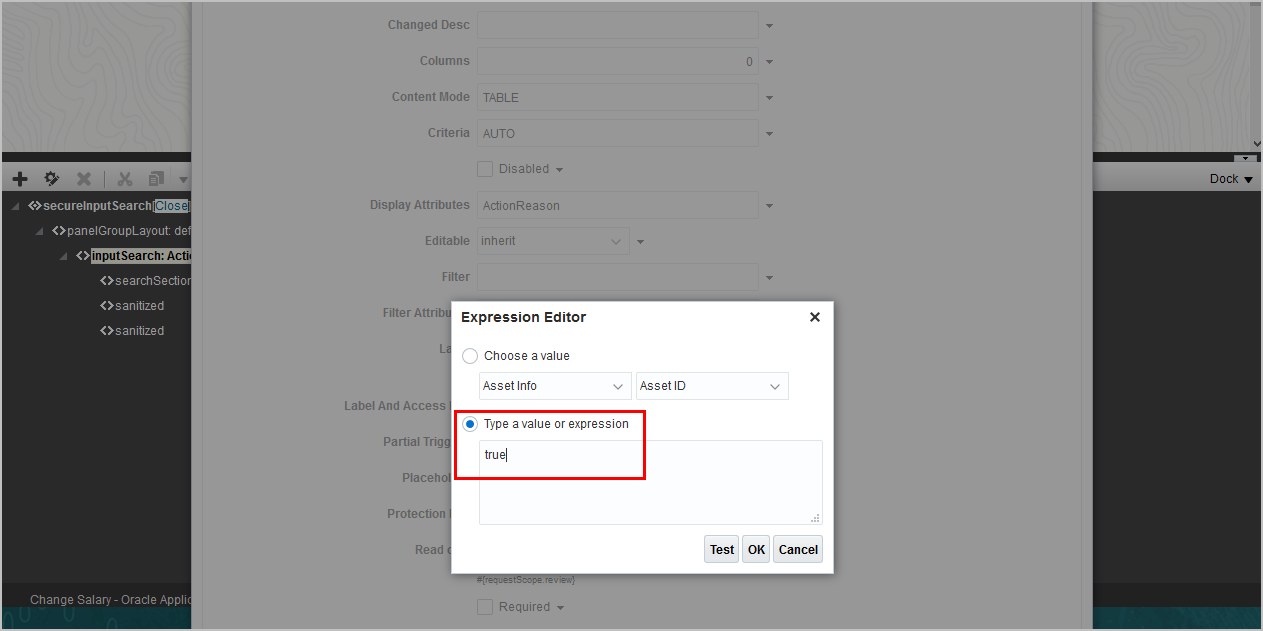

- For the Required property, select Expression Builder.

- In the Type a value or expression field, enter true. An asterisk appears before the label name.

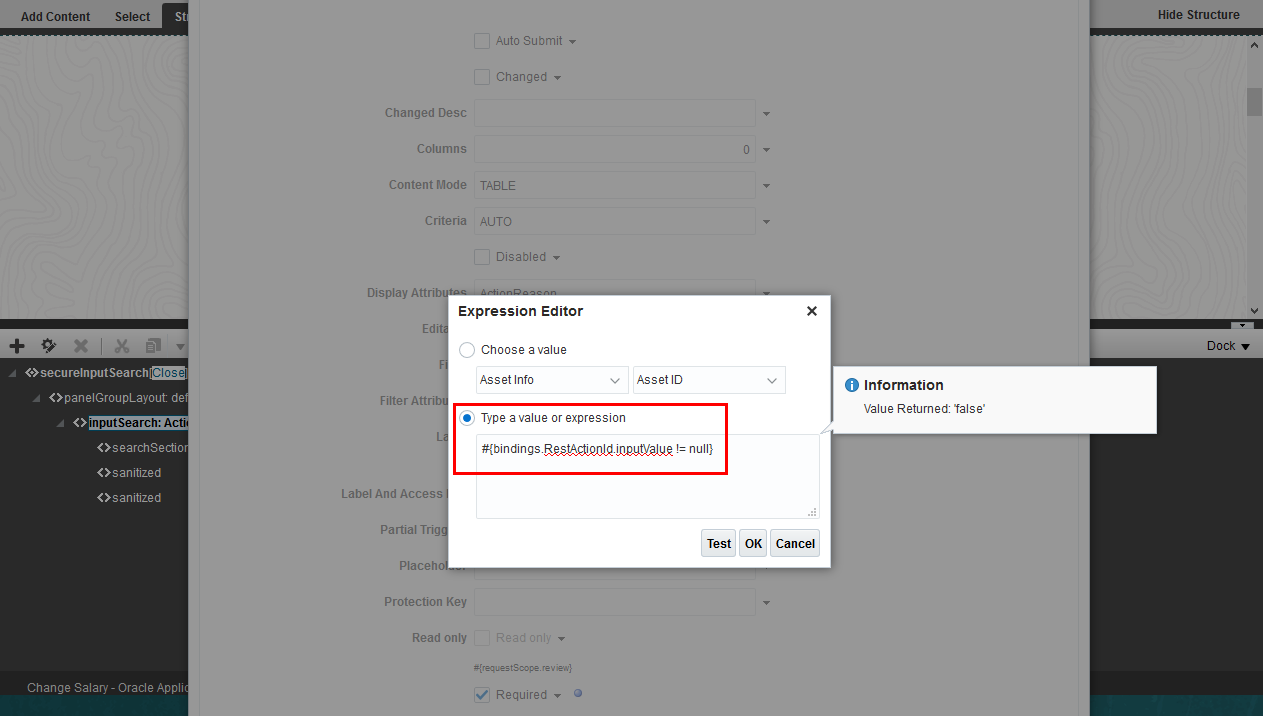

Here's how you make the reason selection mandatory based on action.

- Click the action reason List of Values field.

- On the toolbar, click Edit Components.

- For the Required property, select Expression Builder.

- In the Type a value or expression field, enter #{bindings.RestActionId.inputValue != null}

- Save and close all.

- Verification

Invoke Change Salary from My Team > Quick Actions

You need to follow similar steps to make the reason mandatory on the Salary History page too.

Key Resources

For more information, see these What's New features:

- Global Human Resources What’s New for this 20B feature:

- Client List Of Values For Action And Action Reason

- Global Human Resources What’s New for these 20C features:

- Country-Specific Action and Action Reasons

- Role-Specific Action and Action Reasons

Role Information

When using custom roles, make sure you inherit these privileges:

- Aggregate privilege related to Client List of Values for Action, and Reason.

- Use REST Service - Person Reference Data Lists of Values

- ORA_PER_REST_SERVICE_ACCESS_PERSON_REFERENCE_DATA_LOVS

- Function privilege related to Salary Basis values.

- Use REST Service - Salary Bases List of Values

- CMP_REST_SERVICE_ACCESS_SALARY_BASES_LOV

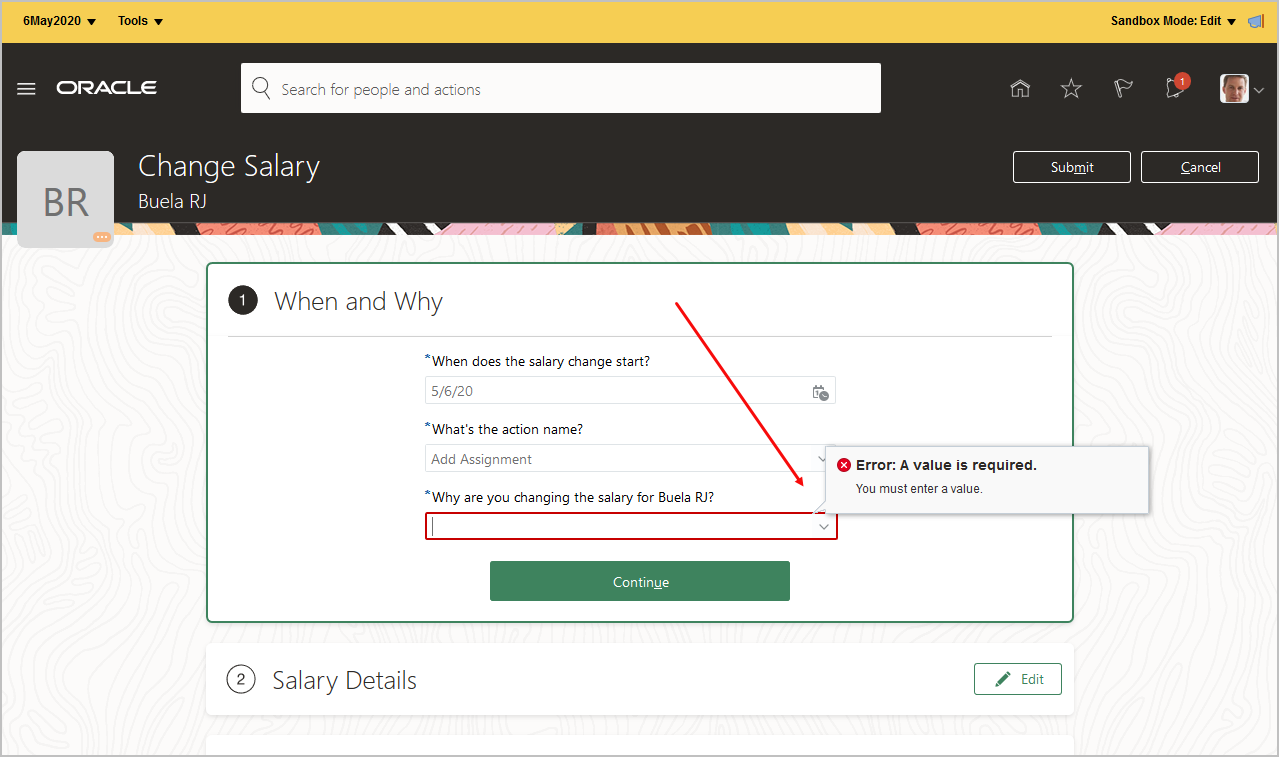

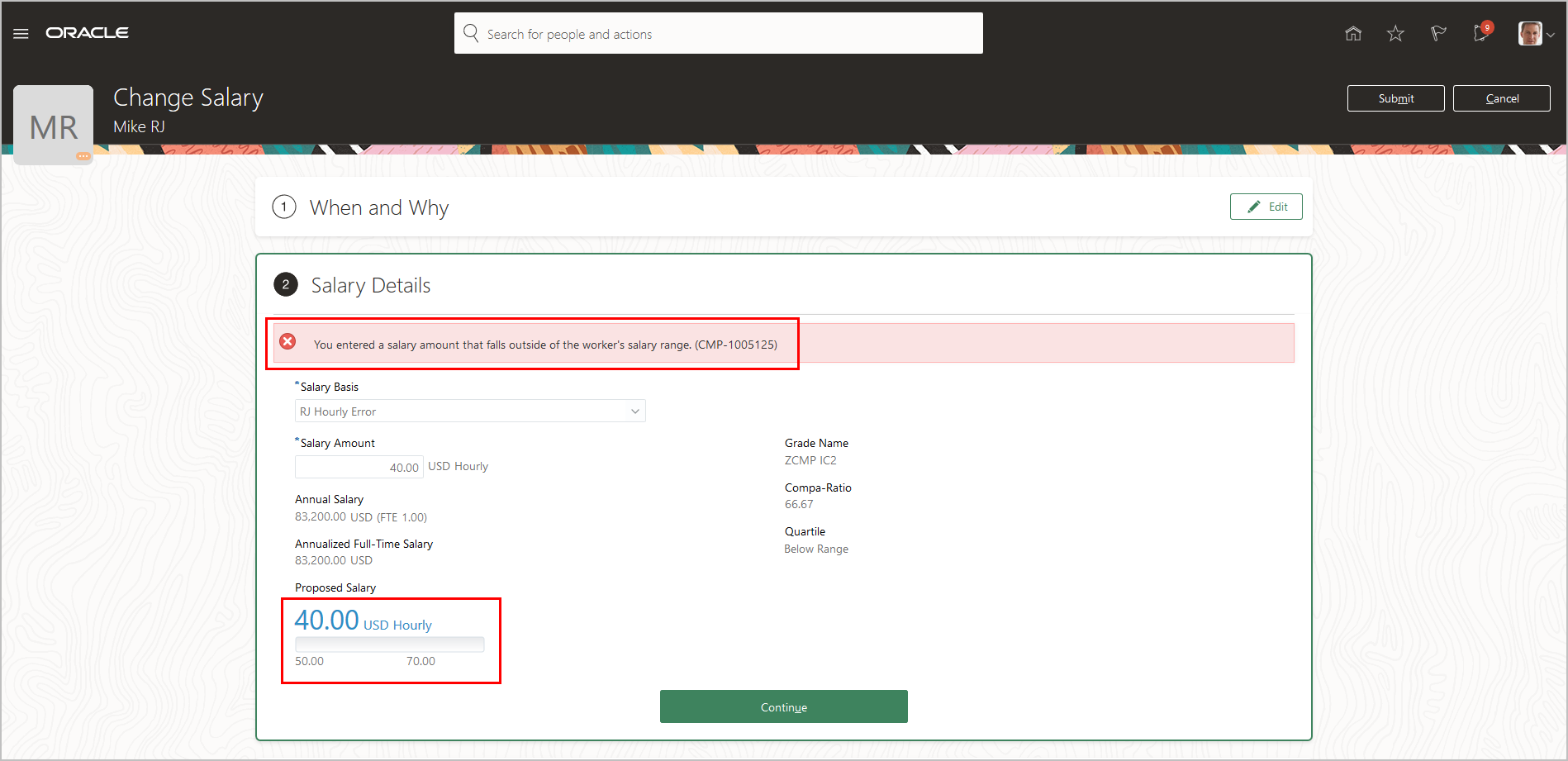

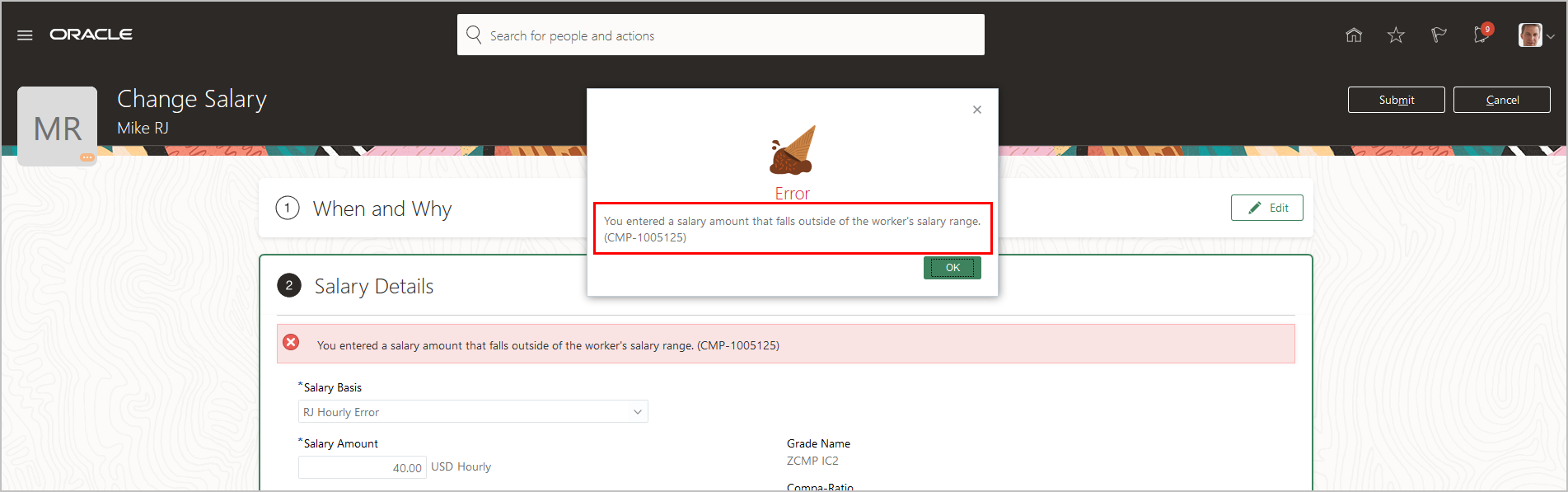

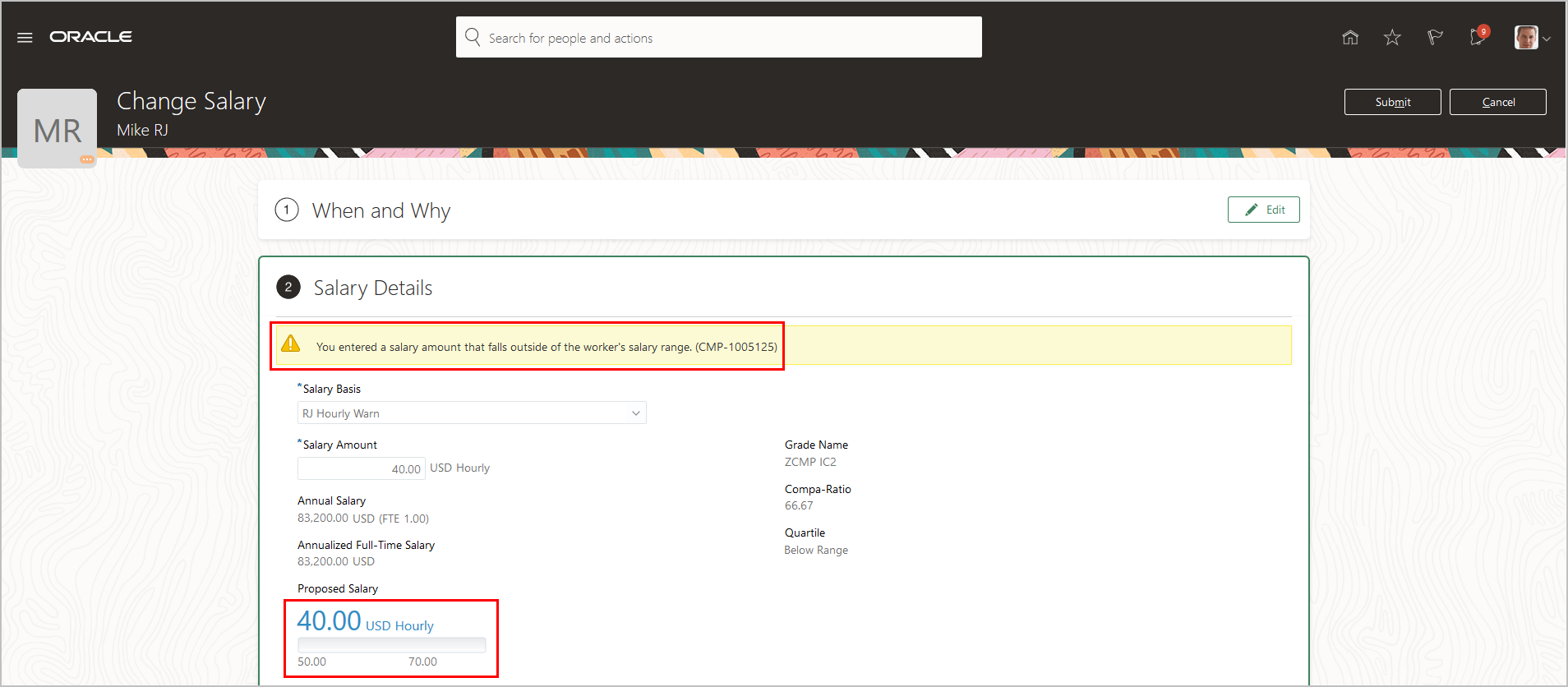

Salary Range Violation Behavior Configuration

You can now specify whether to allow, warn, or disallow proposed salaries that violate the salary range. For example, you don't let anyone propose salaries that are under or over the specified salary range. Or, you warn people when their proposed salaries are under or over the specified salary range.

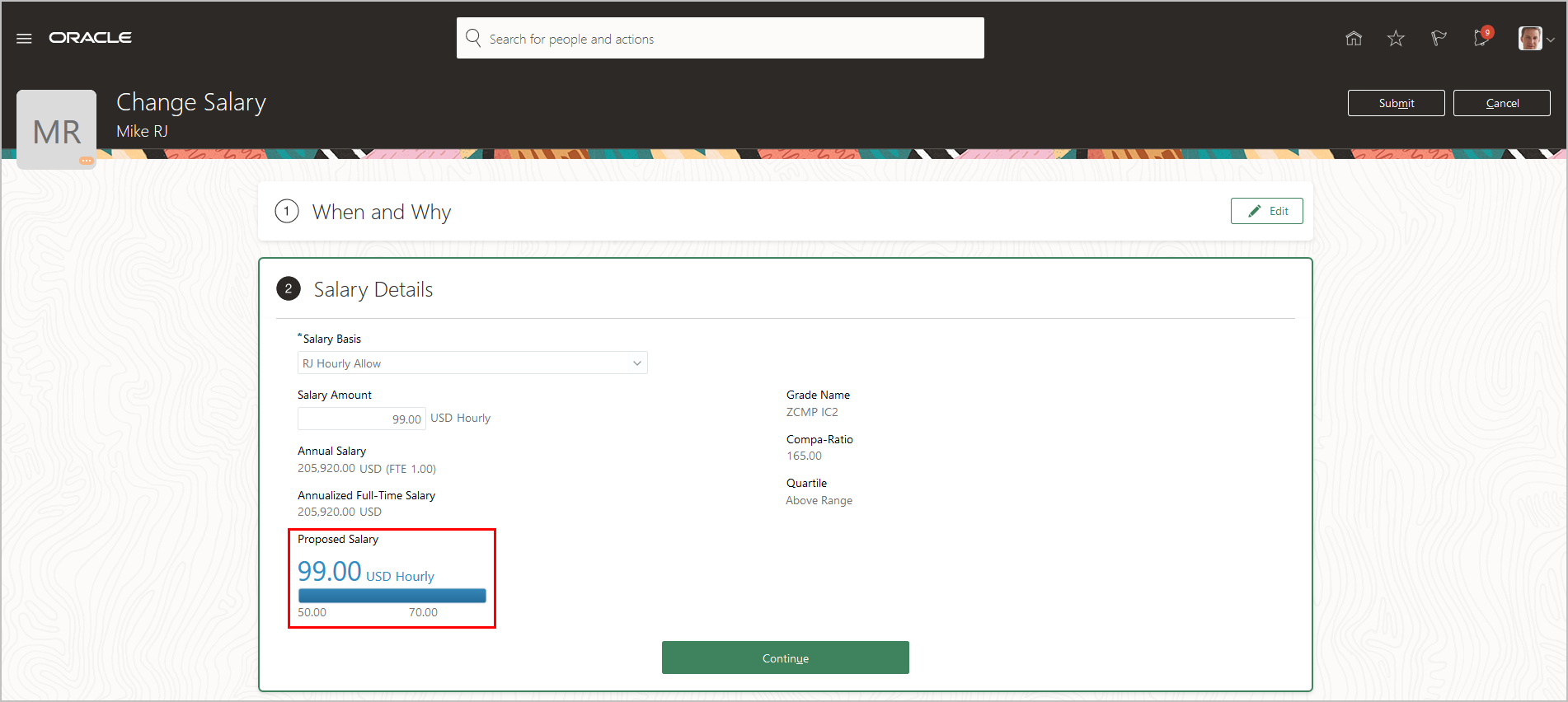

Change Salary Action with the Error that the Proposed Salary Amount Is Outside the Defined Salary Range

Change Salary Action Error Prevents You from Submitting a Proposed Salary Amount that's Outside the Defined Salary Range

Change Salary Action with the Warning that the Proposed Salary Amount Is Outside the Defined Salary Range

Change Salary Action Showing that You Are Allowed to Submit a Proposed Salary Amount that's Outside the Defined Salary Range

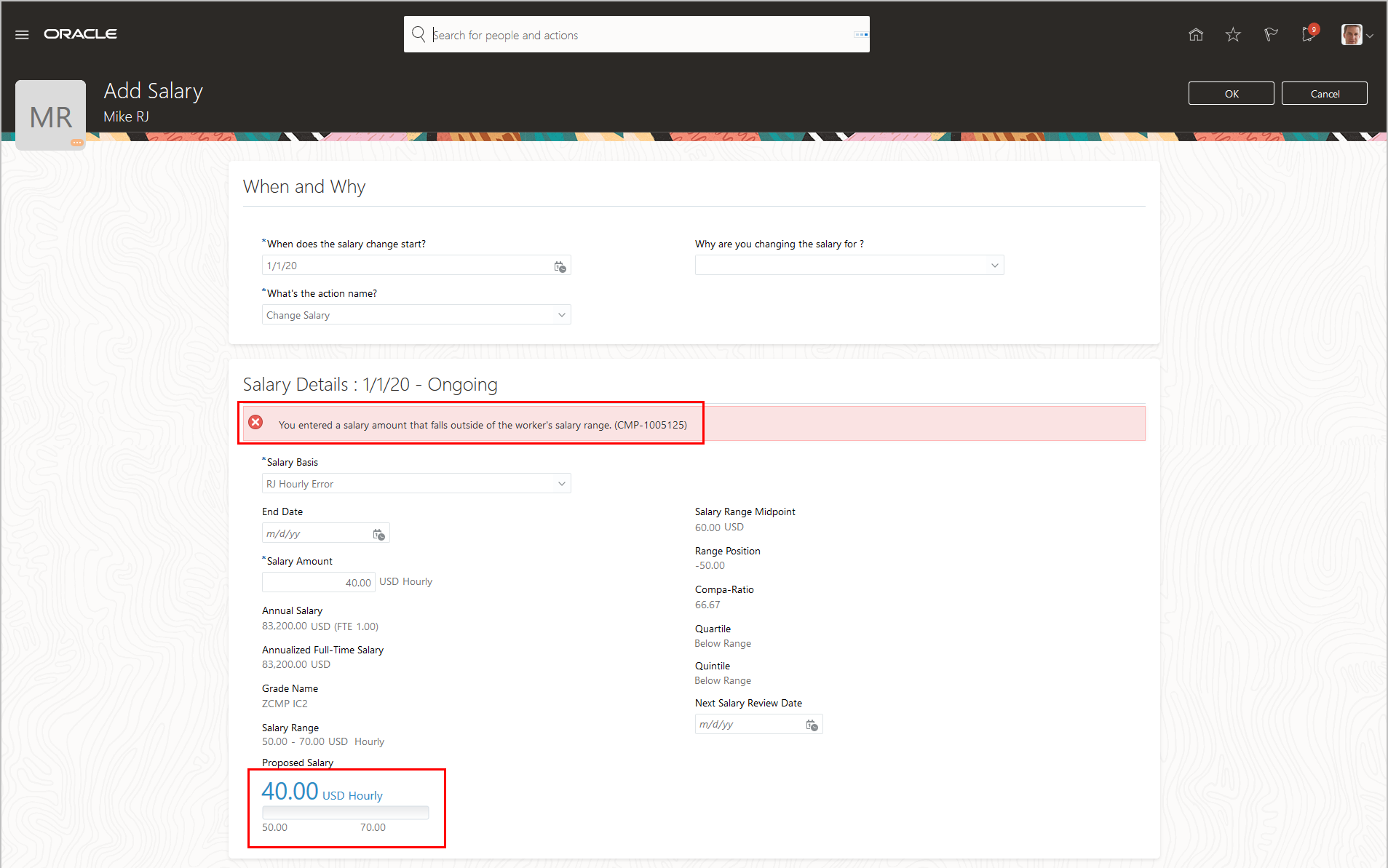

Salary History Action with the Error that the Proposed Salary Amount Is Outside the Defined Salary Range

Steps to Enable

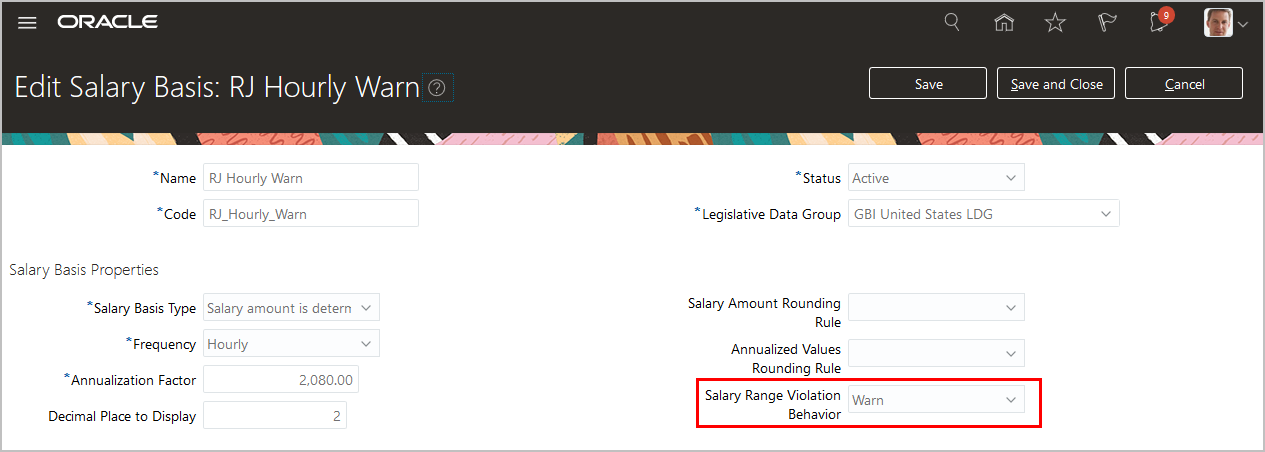

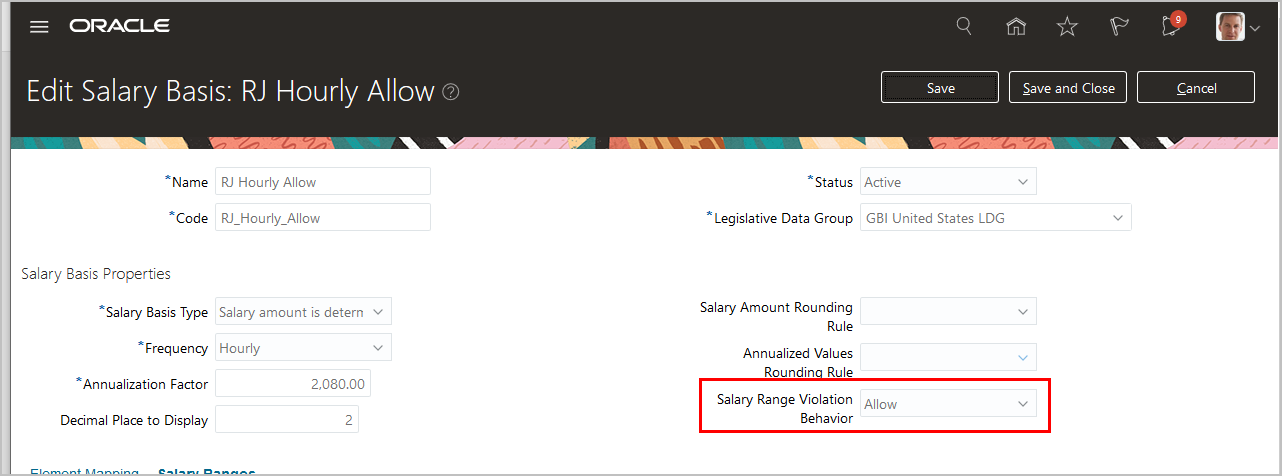

You enable the violation behavior that supports your compensation policies using the Salary Range Violation Behavior field of the salary basis. You can configure the behavior as Allow, Error, or Warn, to handle violations in various actions, such as Change Salary, Salary History. You create and edit salary bases using the Salary Basis task in the Compensation work area.

Configure Salary Range Violation Behavior as Error in Salary Basis

Configure Salary Range Violation Behavior as Warning in Salary Basis

Configure Salary Range Violation Behavior as Allowed in Salary Basis

Tips And Considerations

- You see the violation behavior in actions like Change Salary, Salary History as well as HR actions that include the Salary section, such as Hire, Promote, Transfer.

- The default value for the Salary Range Violation Behavior field of all existing salary bases is Warn. We don't recommend that you change it to Error for existing salary bases because you can get errors with historic data. For example, let’s say you have an existing salary basis with a salary range of $100 to $200. The salary basis is associated with a salary record for 2010 where the salary amount was $95. The salary basis is also associated with a salary record for 2015 where the salary amount was $105. When you change the violation behavior to Error and try to load salary for 2020, you can get the violation error for 2010, even though that's not the record you are correcting.

- If you want to set the violation behavior to Error, then we recommend that you create another salary basis to use with new salaries. This way, you can avoid issues with historic data.

- When you set the violation behavior to Warn, you don't see the warning message when you use salaries REST API, HCM Data Loader and HCM Spreadsheet Data Loader. These tools only show you errors.

- This violation behavior isn't supported in Download Salaries, and Grate Step Progression processes.

You can view and manage certain salaries for an assignment on the new responsive Salary History page. More specifically, you can view and compare salaries as well as see the summary and details of individual records. You can also now create, edit, or delete multiple salary records and submit all of your changes together for approval. And, you can configure the approval rules for the new Salary History to support your salary policies.

You open the Salary History page for people in your client group using the Salary History quick action. You can also use the Salary History task in the Compensation work area. On the Compensation Info page, you can use the Salary History option on the actions menu.

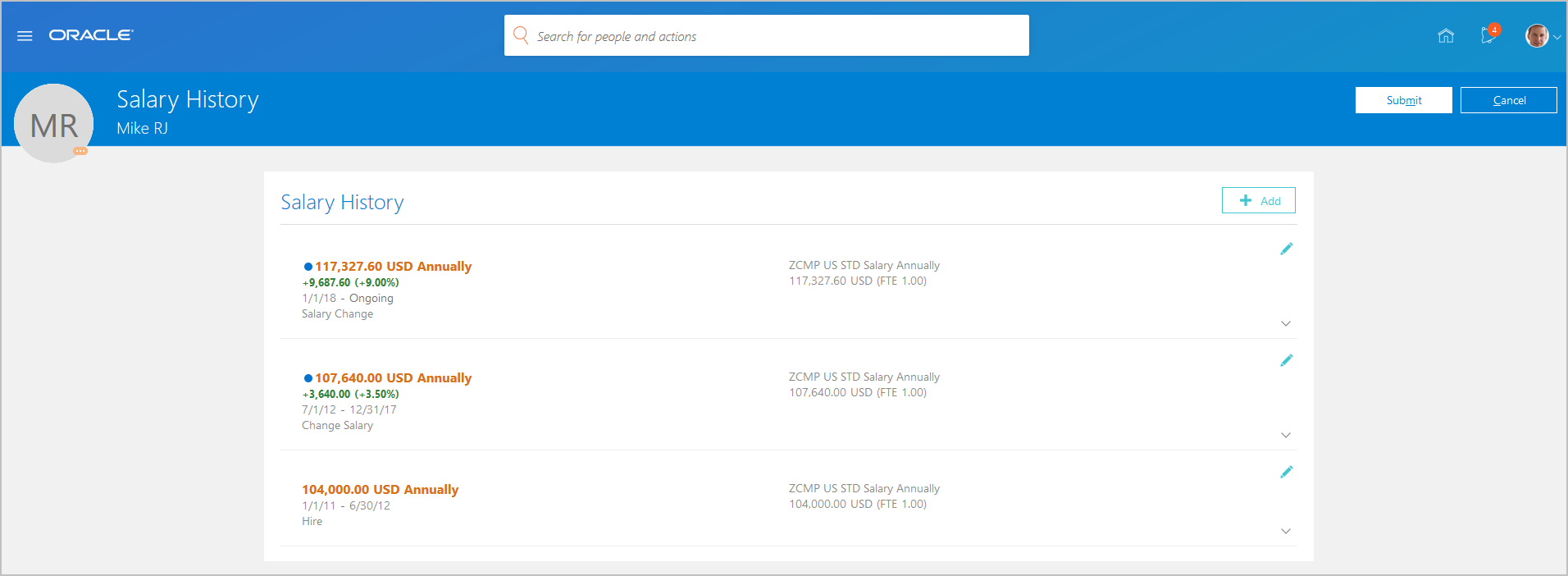

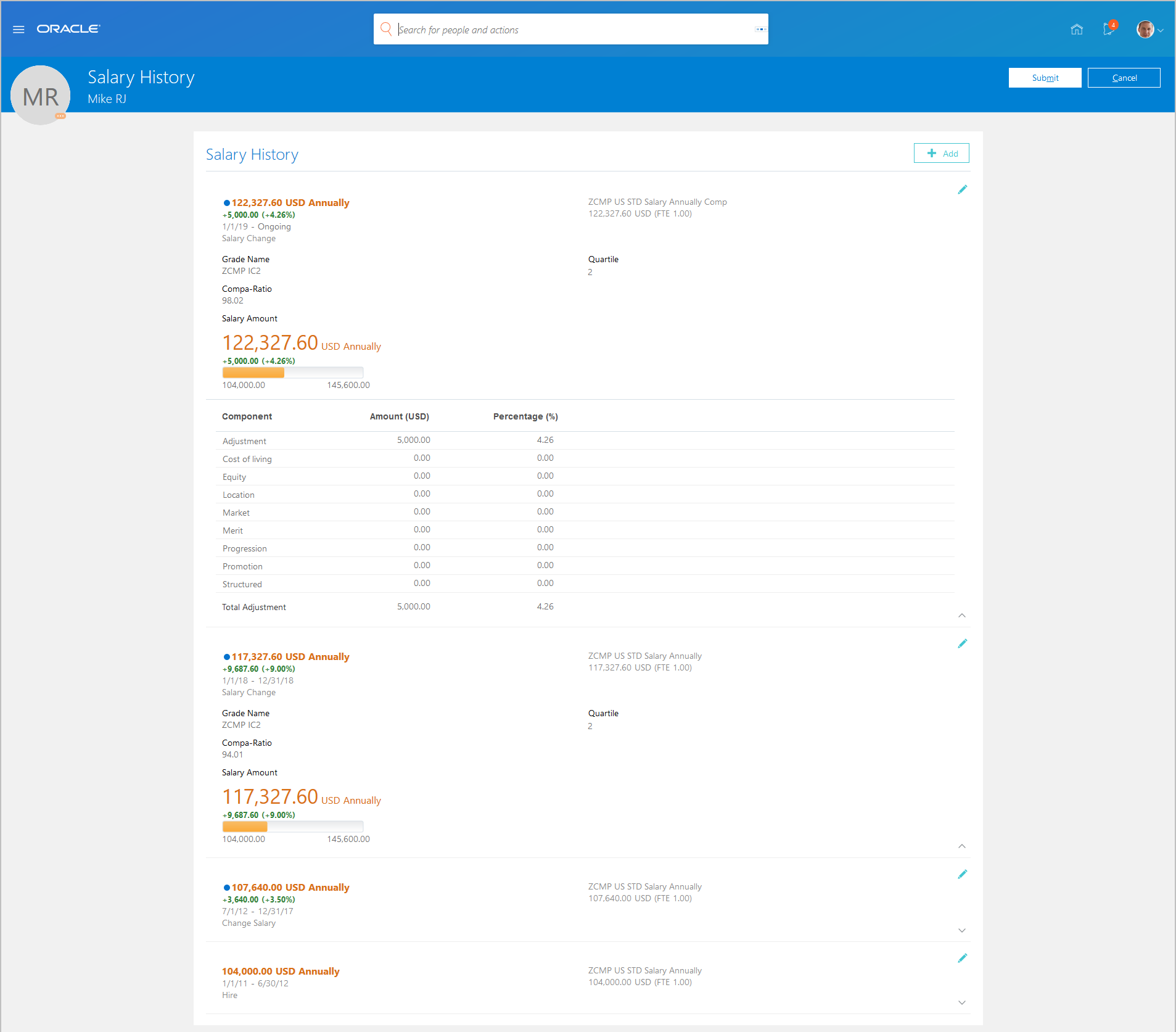

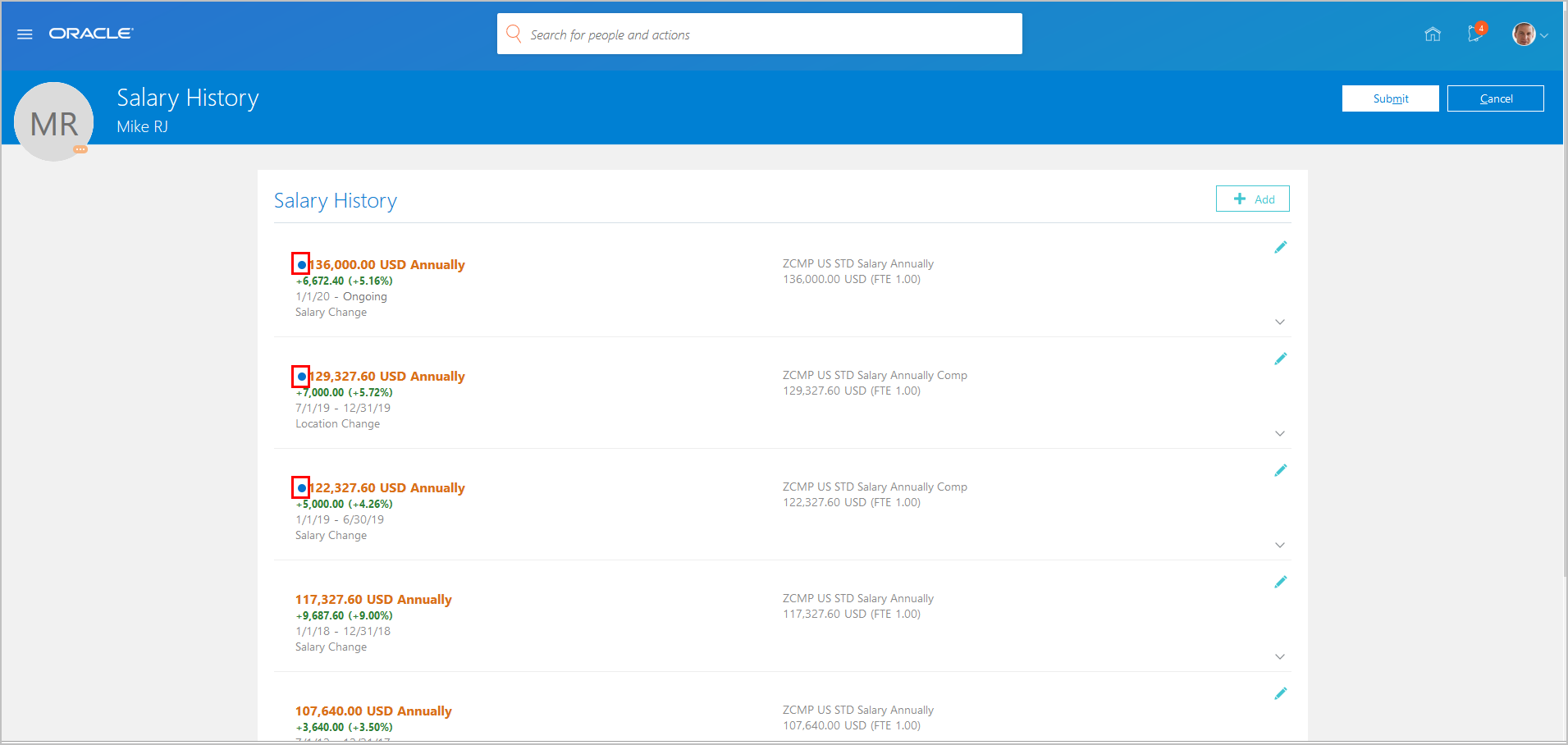

Salary History Page Showing the Existing Salaries

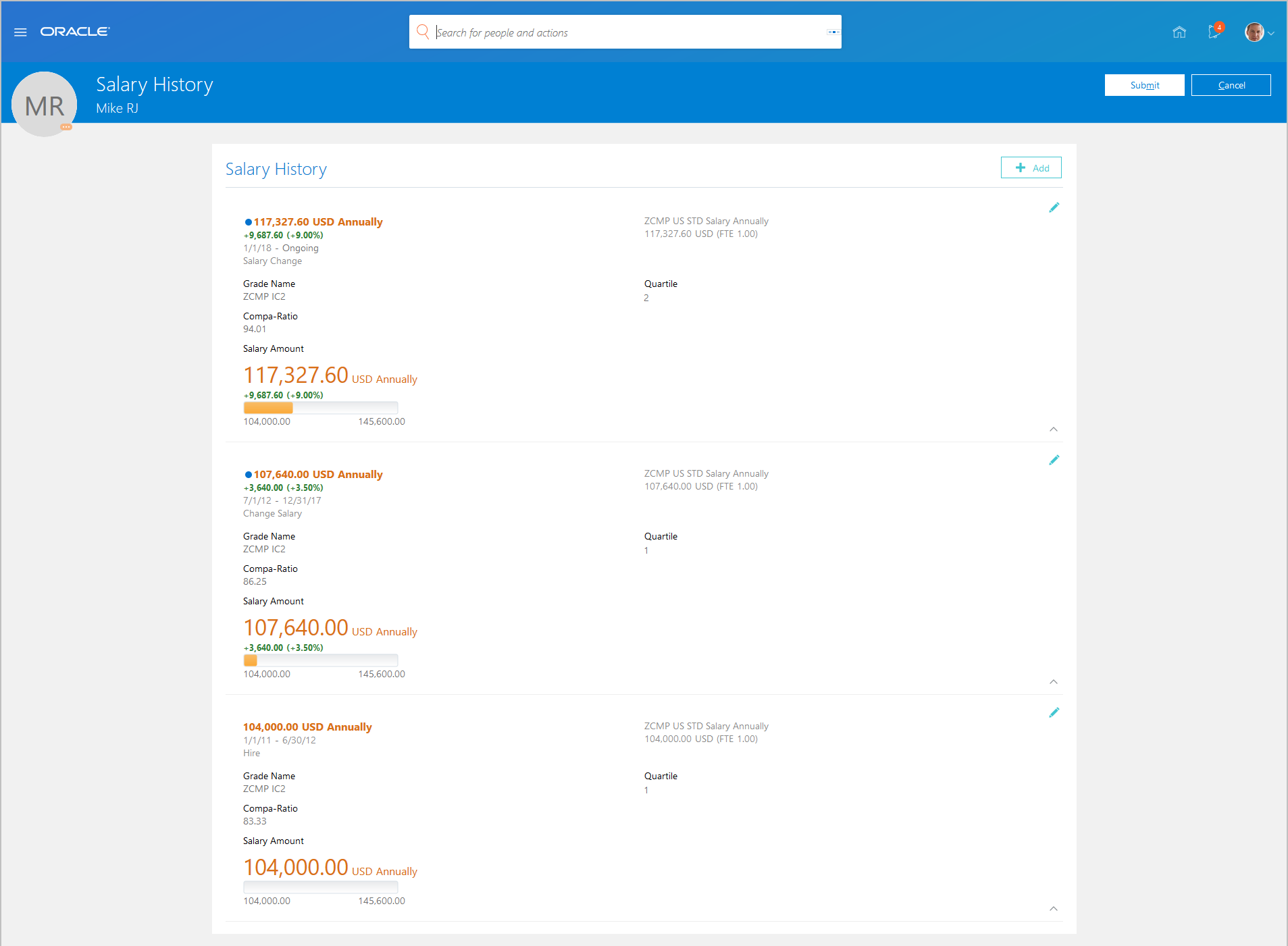

Salary History Page with the Existing Salaries Expanded to Show More Info

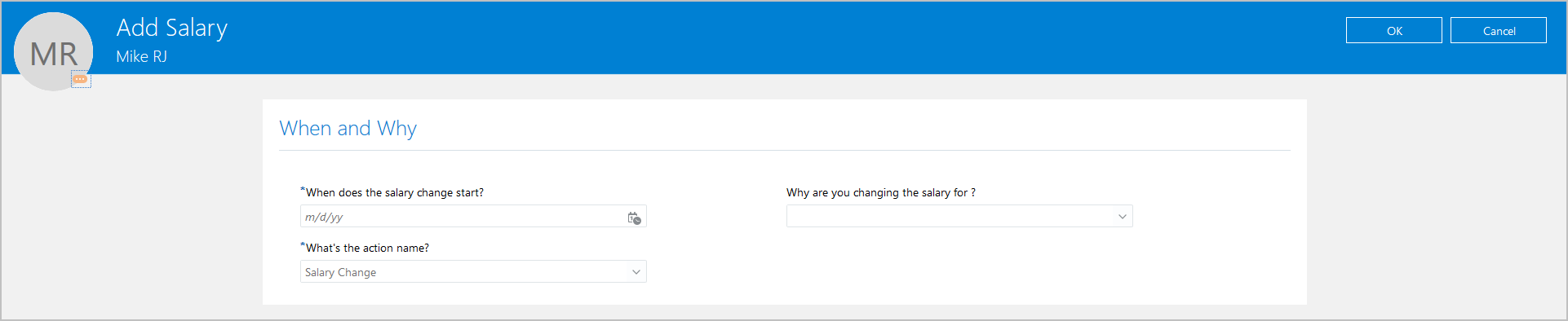

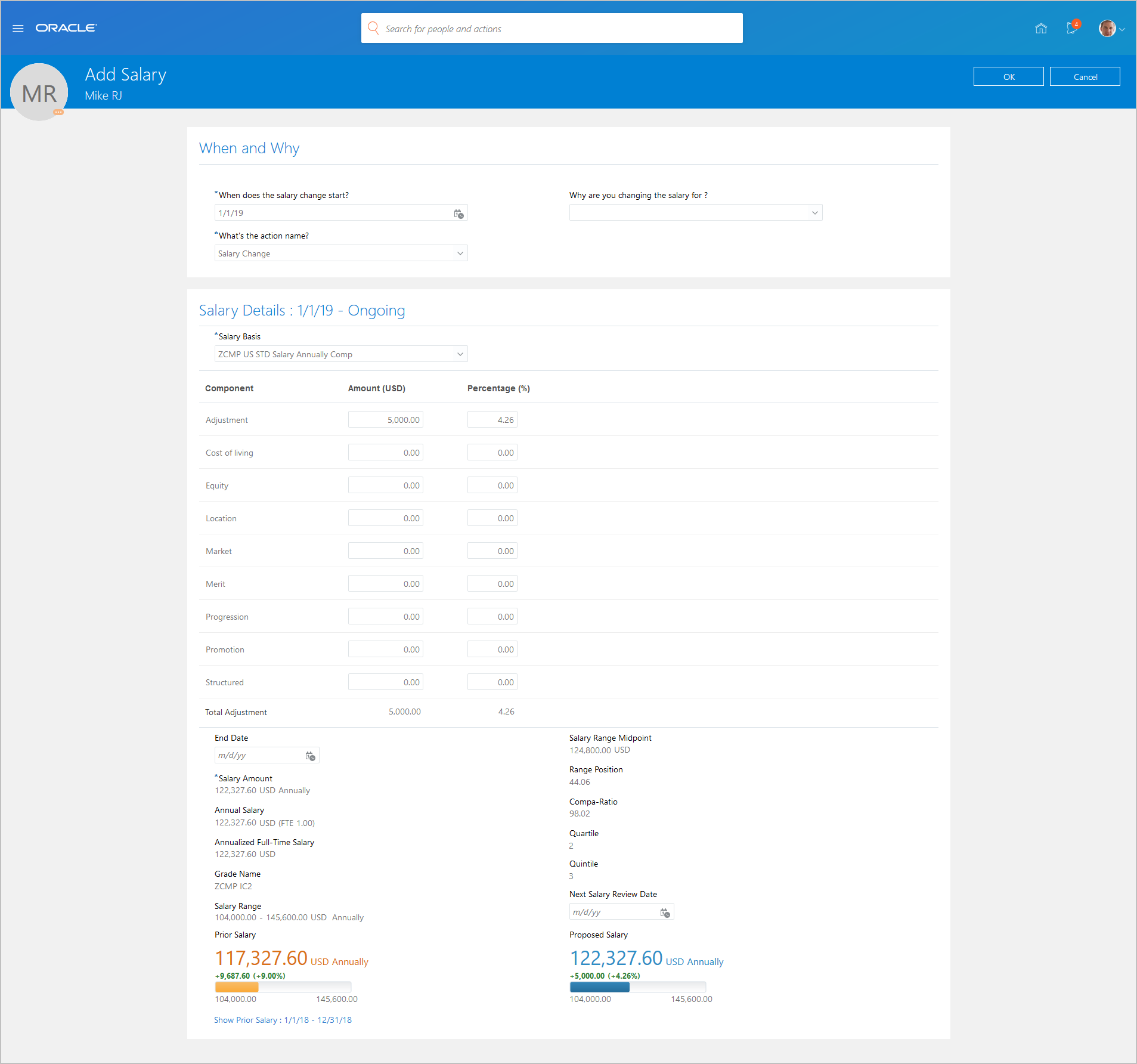

Step 1 on the Add Salary Page, Where You Identify When and Why

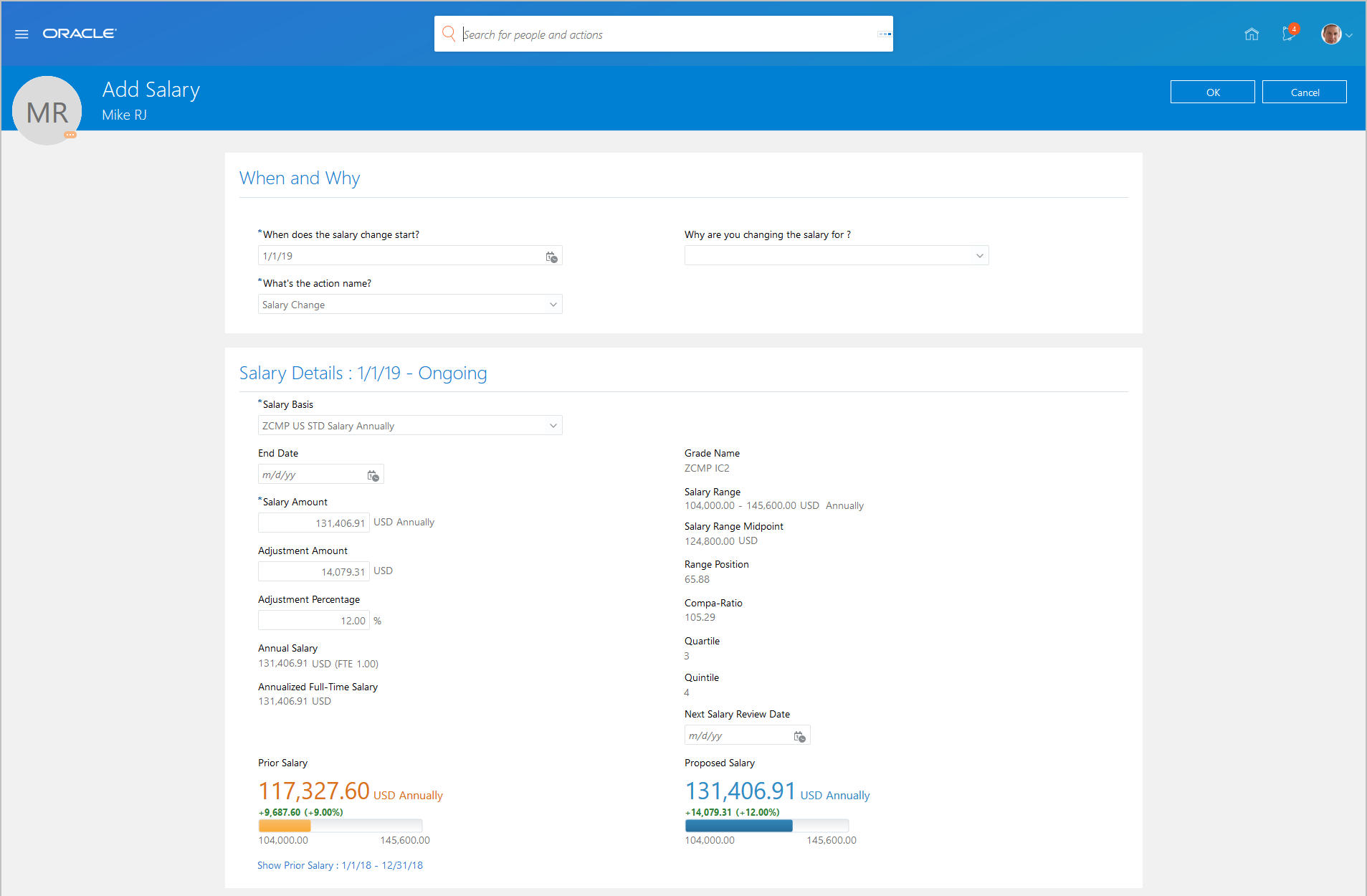

Step 2 on the Add Salary Page Where You Enter the Salary Details

Step 2 on the Add Salary Page Where You Enter the Salary Component Details

Salary History Page with the Existing Salaries Expanded and Showing that Different Types of Salary Bases Are Associated with the Different Salaries

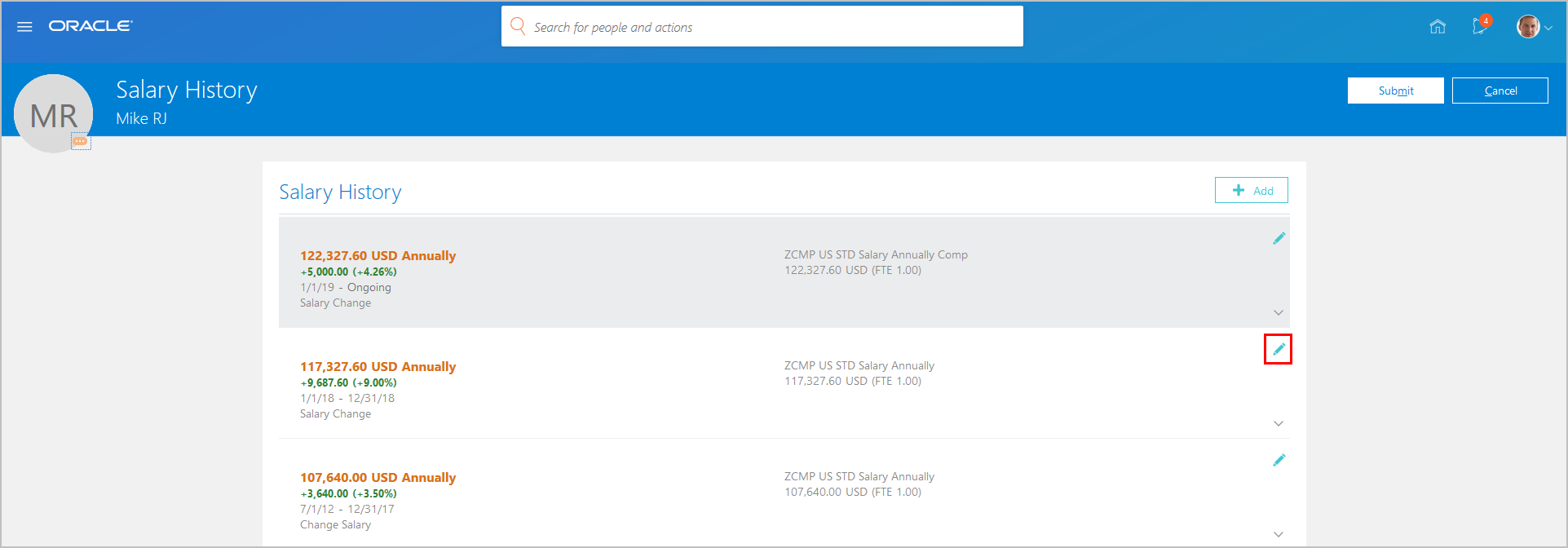

Salary History Page with the Edit Icon Highlighted to Show How You Can Change or Delete a Salary

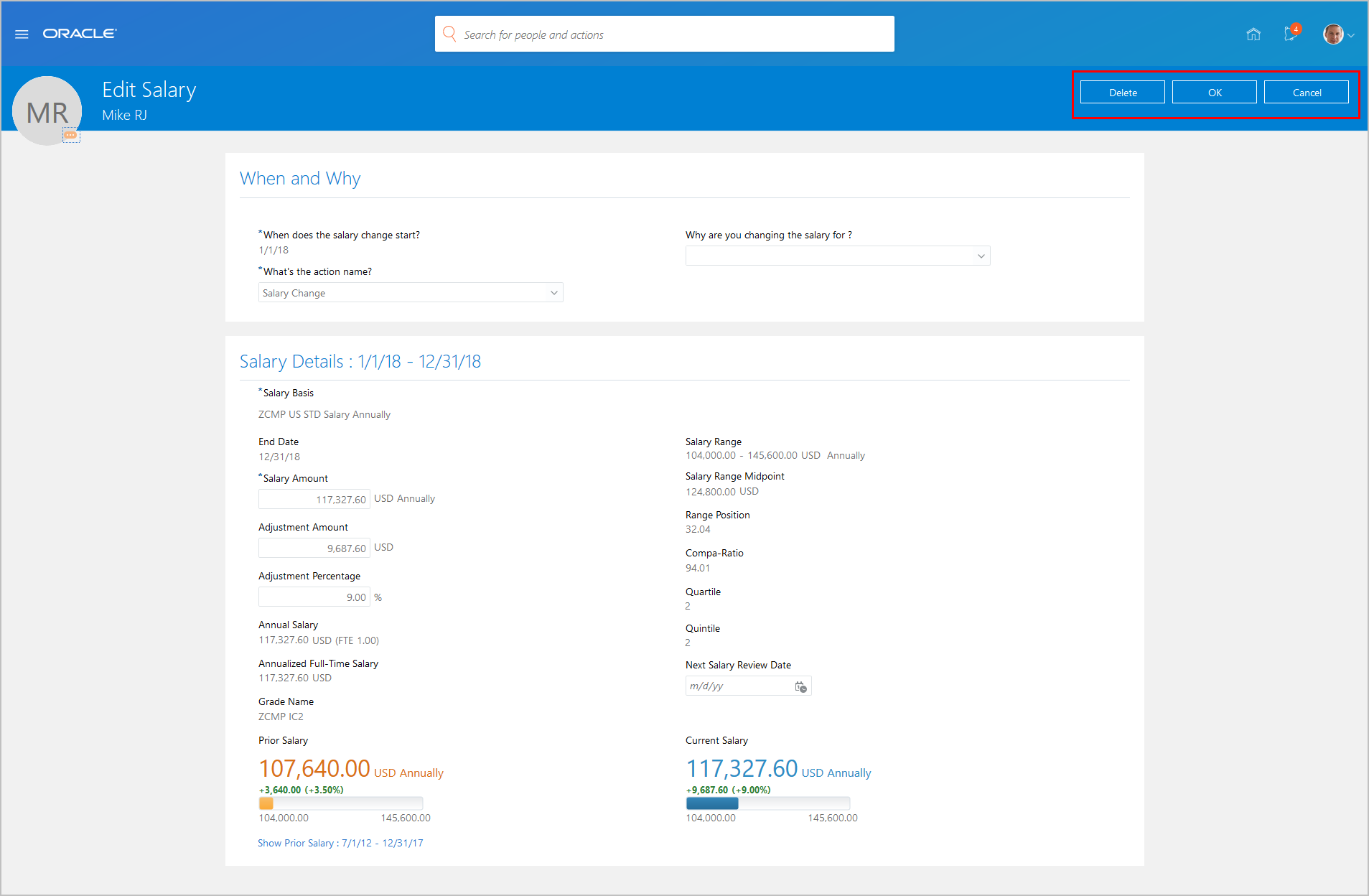

Edit Salary Page Where You Can Review Salary Details and Delete the Salary, if Appropriate

Salary History Page with the Change Icon Highlighted to Show that the Salary Was Changed Somehow

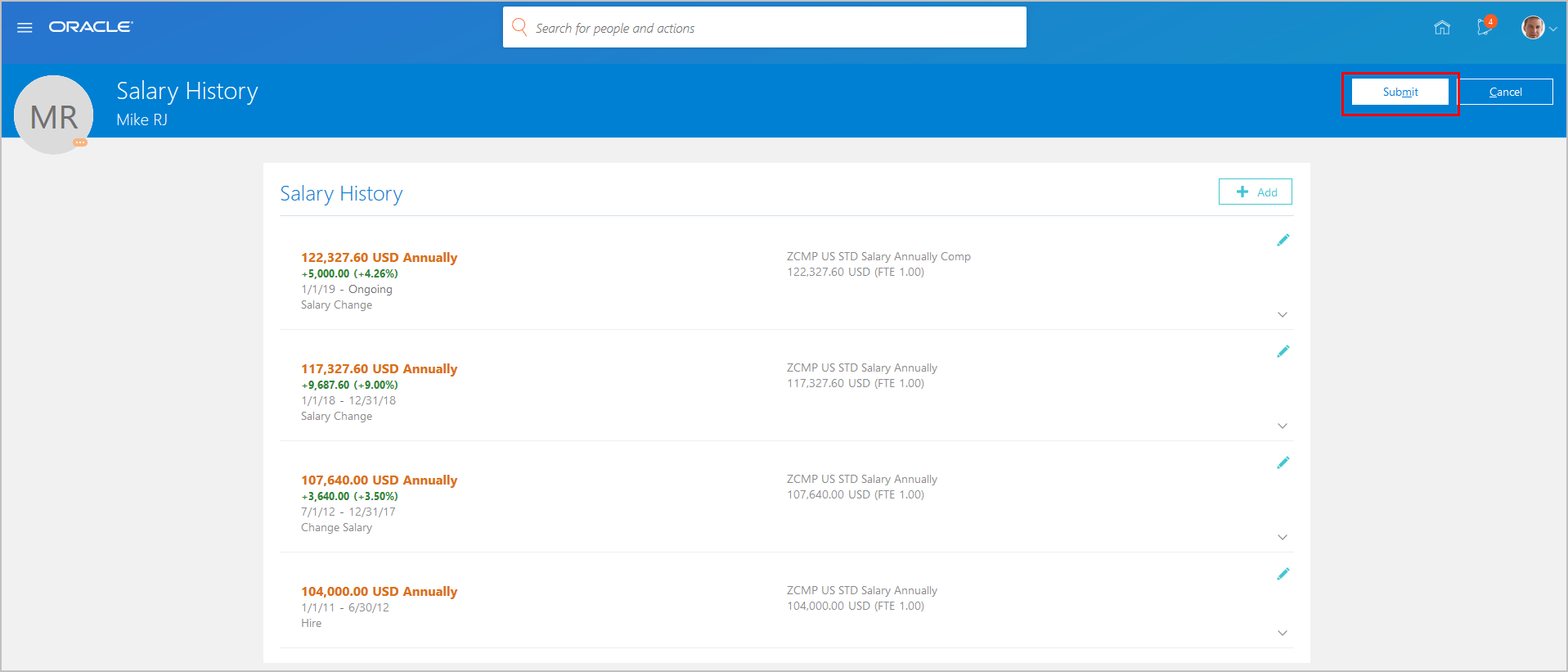

Salary History Page Where You Can Make Multiple Changes and Then Submit All of the Changes Together

You can make the Created By, Created On, Updated By, and Updated On fields visible using Transaction Design Studio rules.

Salary History Page with Created On, Created By, Updated On, and Updated By Fields Visible

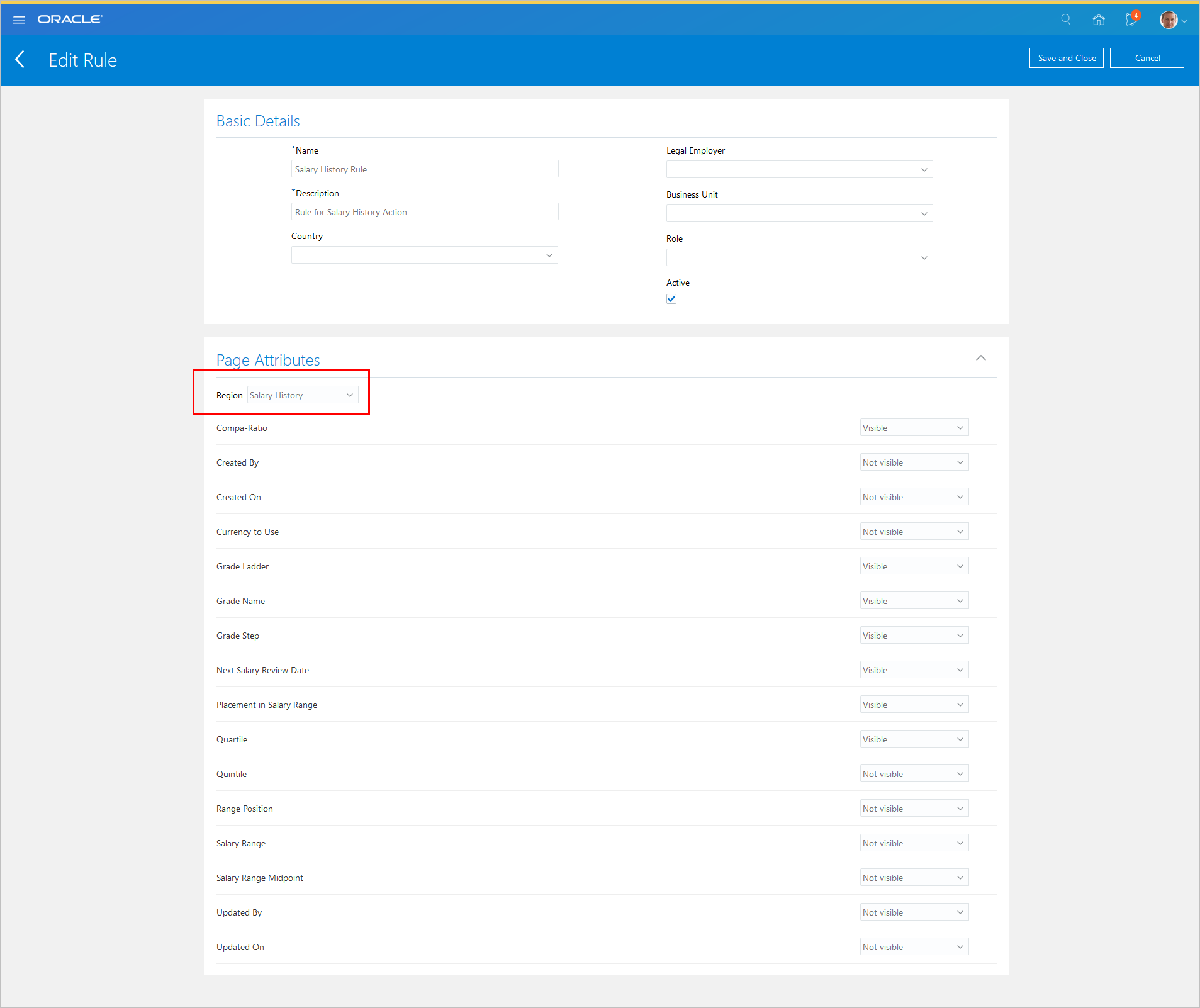

Design Studio Setup for Salary History: Step 1, Define the Salary History Fields that Are Visible on the Landing Page

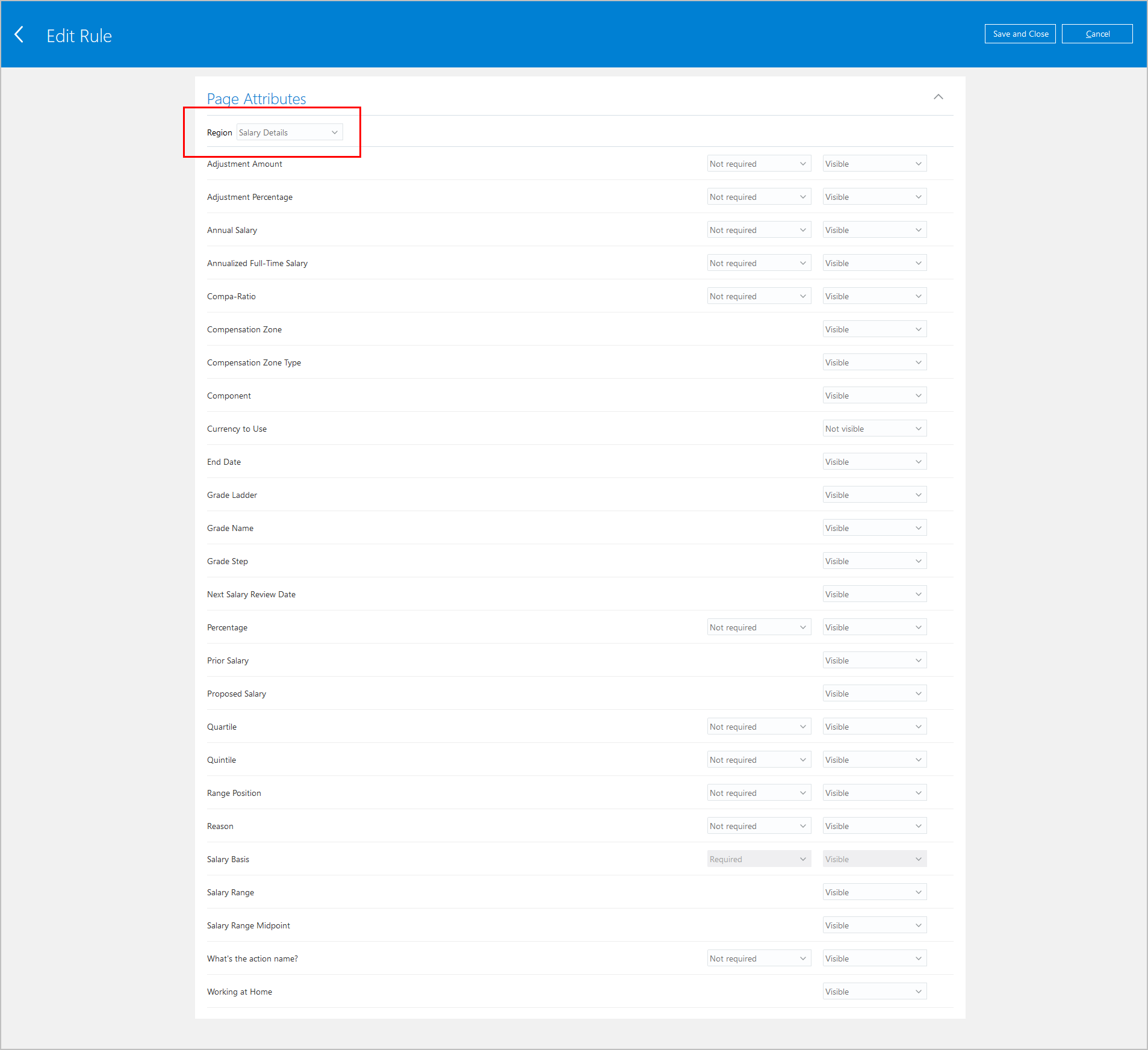

Design Studio Setup for Salary History: Step 2, Define the Salary Details Fields that Are Visible on the Details Page

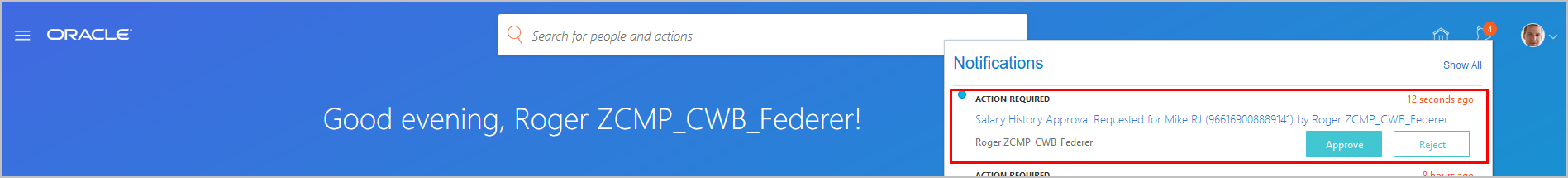

Salary History Approval Notification Seen After You Click the Notification Icon

Salary History Approval Notification

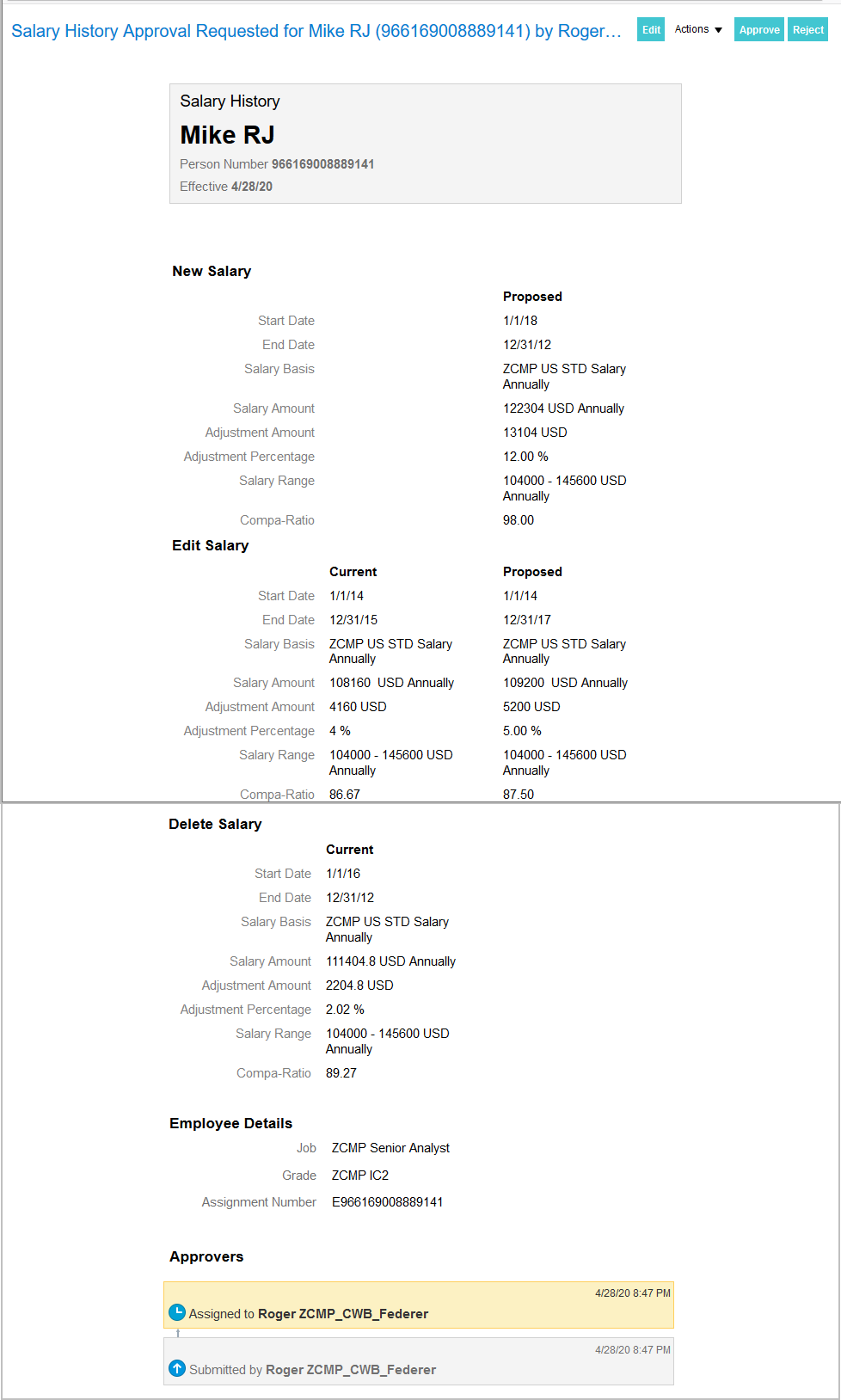

New Approval Process for Salary History Action

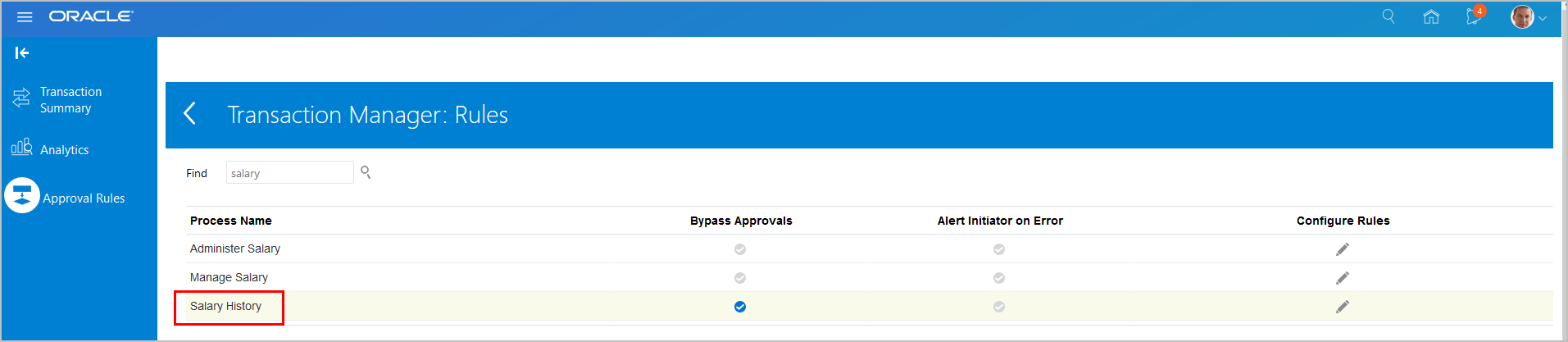

Deep Link That Opens the Salary History Page

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The Salary History page shows salaries with amounts that people enter directly or using components. Also, it's optimized to work best when you have a limited set of components. As the number of components increases, performance decreases.

- You can't enable the Comments and Attachments section of this page, at this time.

- The Human Resource Specialist, Compensation Manager, and Compensation Specialist roles automatically inherit the security required to open this page.

- Name: Manage Salary History

- Short Name: ORA_CMP_MANAGE_SALARY_HISTORY

- A new approval process named Salary History is available to support approval for the Salary History transactions.

- The Change Salary approval infrastructure changed to accommodate the new Salary History approval task. If you customized your change salary approval, either the data model or notifications, you are affected and need to reassess your customizations.

We've made it easier for you to load or schedule loads in Stock Grants using HDL. Previously only spreadsheet load was available.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information, see the following chapter in the Oracle Human Capital Management Cloud Integrating with HCM in the Oracle Help Center:

- Loading Compensation Objects

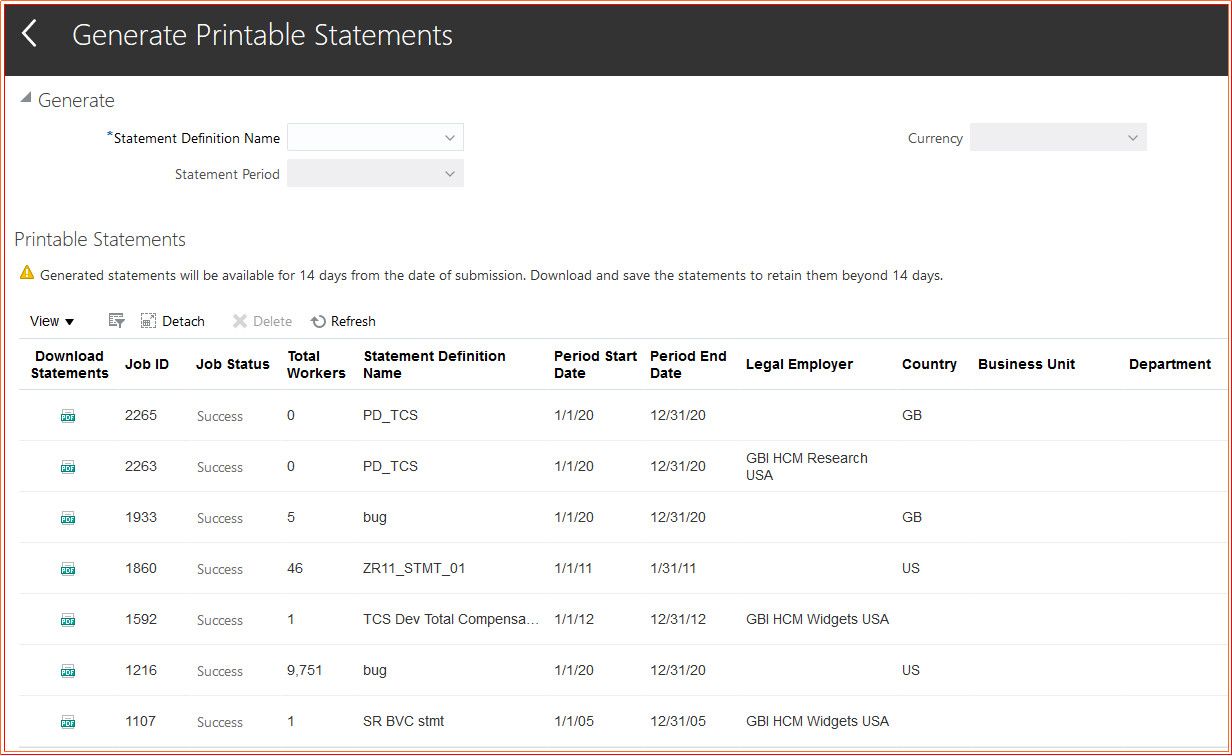

Total Compensation Statements - Generate Printable Statements (Mass Print)

You can now mass generate printable statements. Use the new Generate Printable Statements task that creates files of printable statements for download and printing. Files are made available for two weeks.

Generate Printable Statements

Steps to Enable

You don't need to do anything to enable this feature.

Role Information

If you're not using the predefined reference roles, then you must add aggregate privileges to relevant job and abstract roles to use this feature. This table identifies the required aggregate privileges and suggests target job and abstract roles. You can add the aggregate privileges to different roles if you prefer.

See the Upgrade Guide for Oracle HCM Cloud Applications Security (My Oracle Support document ID 2023523.1) for instructions on implementing new features in existing roles.

| Aggregate Privilege | Job or Abstract Role |

|---|---|

| Generate Printable Compensation Statements CMS_PRINT_TOTAL_COMPENSATION_STATEMENT_IN_MASS |

Compensation Manager |

We made a few improvements to the worksheet. We removed the horizontal line beneath the plan name and changed the collapse summary icon from an "X" to a vertical arrow.

Steps to Enable

You don't need to do anything to enable this feature.

Eligibility Date Changed In Workforce Compensation

The Start Workforce Compensation Cycle and Refresh Workforce Compensation Data batch processes now use the eligibility determination date in plan cycle setup for eligibility. Previously, the batch processes used the HR Data Extraction Date.

Steps to Enable

You don't need to do anything to enable this feature.

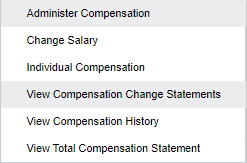

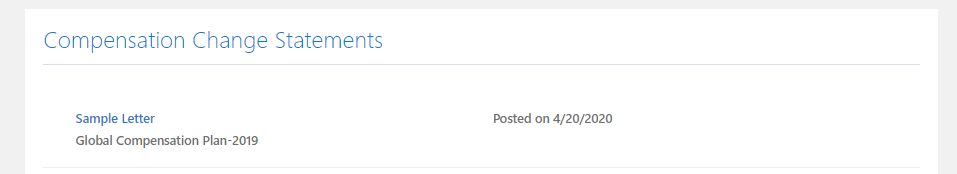

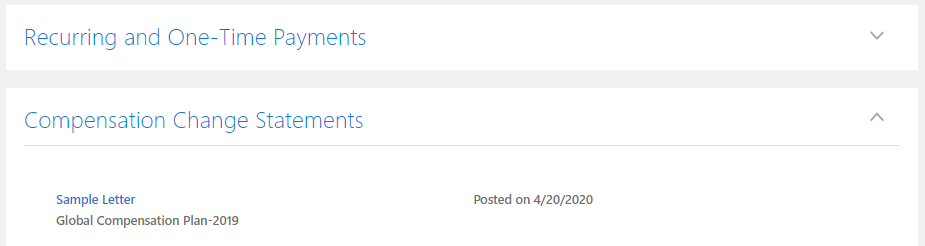

Allow Managers to Access Worker Compensation Change Statements

You can now allow managers to access Compensation Change Statements through My Team. Previously, managers could only access them through the Communicate task in Workforce Compensation.

From My Team> Compensation, there's a new menu action link:

New View Compensation Change Statements Menu Action

It opens a new page for Compensation Change Statements:

New Compensation Change Statements Page

It opens a new section in the responsive page:

New Section In Responsive Page for Managers

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Access this feature by assigning or updating privileges and or job roles. See details in the Role section below.

Role Information

Assign the View Compensation Change Statements (ORA_CMP_VIEW_CMP_CHG_STATEMENT) aggregate privilege to your Line Manager role and regenerate the data role.

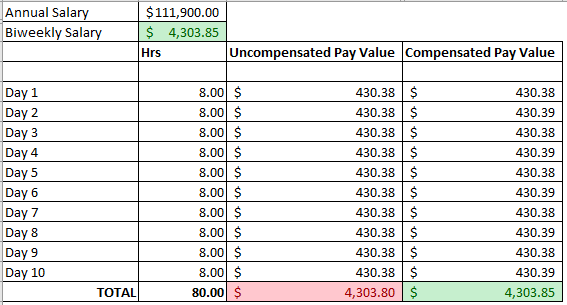

View Salary Adjustments Posted Report Amounts In Worksheet Decimal Precision

You can now view amounts in the Salary Adjustments Posted report in the same decimal precision as in the worksheet. Previously, the report only showed amounts to two decimal places.

Steps to Enable

You don't need to do anything to enable this feature.

View Worker Compensation Change Statement Actions

You can now view the status of the actions taken by workers on their compensation change statements in employee self-service. Previously, you could only do this through a BI or OTBI report.

To open the report: View Administration Reports>Status and Monitoring>Worker Statement Actions

New Worker Statement Actions Report

To use the report, you must configure the workforce compensation plan to use the centrally managed and stored option for statements and run the Process Workforce Compensation Statements process. These columns are available in the detail section of the report:

- Worker Name

- Legal Employer

- Department

- Job

- Template

- Visibility setting

- Expiration Date

- Action

- Result

- Date of Action

- Manager Name

- Manager Email

- Manager Work Phone

You can filter the report by template and worker action results.

Steps to Enable

You don't need to do anything to enable this feature.

Export Dynamic Calculations for Review

You can now use the simple export to review and validate dynamic calculation conditions. Previously, review and validation were only available within the application.

New Simple Export Option

Steps to Enable

You don't need to do anything to enable this feature.

You can now configure which model usages will be available to managers in their workforce compensation plans. Previously, you could only allow managers to create or apply models regardless of usage.

Configurable Model Usages for Managers and Administrators

Steps to Enable

You don't need to do anything to enable this feature.

Use Dynamic Calculations on Percentage Columns

You can now use dynamic calculations on worksheet percentage columns. Previously, you could configure dynamic columns, but they were ignored. The following columns are available to use for all components:

- Percentage of Eligible Salary

- Budget Percentage - Worker

- Compensation Percentage Minimum

- Compensation Percentage Maximum

- Target Compensation Percentage Minimum

- Target Compensation Percentage Maximum

- Target Compensation Percentage

The following columns are not supported and we've removed access to the dynamic column configuration option:

- Percentage of Budget Pool

- Target - Percentage Deviation

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

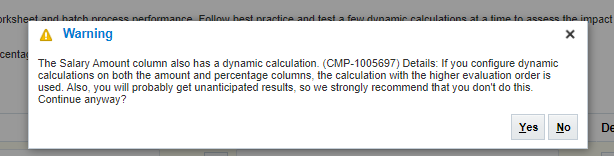

Be careful when you configure dynamic calculations on percentage columns. If there's a dynamic calculation configured on the linked amount and percentage columns, you get this message when you save:

Message When Saving Dynamic Calculation

You get this message when you save and close:

Message When Choosing Save And Close

You get this message when you validate the plan setup:

Message Received When Validating Plan Setup

The dynamic calculation with the higher evaluation order is considered. We strongly recommend that you review your plan set up and remove the dynamic column configuration from one of the columns. Also, if the percentage column supports the ‘Value remains unchanged’ property we recommend you not configure a dynamic calculation on either of the linked columns.

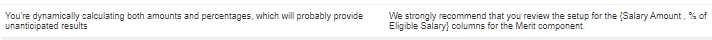

Reset Budget Amounts When Unpublishing

You can now reset the Budget Amount, Percent, and Unpublished Amount values in the detail section of the budget sheet when you unpublish a budget. Previously, this option was not available and the results could cause confusion for budget sheet managers when unpublishing budget amounts. The new configuration option is found in the Budget Pool setup task.

New Budget Pool Setup Option

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Resetting these amounts also affects the Summary Budget Distribution Amount, Budget Distribution Percentage, and Available for Distribution values.

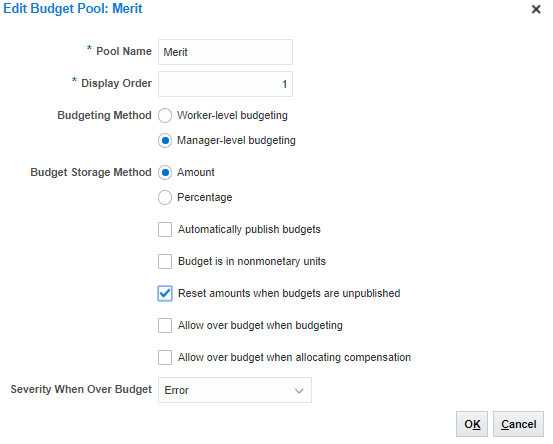

Receive Warning When Configuring Rounding Rules on Linked Columns

You now receive a warning message when you configure a rounding rule on a percentage column when there's already a rounding rule configured on the linked amount column.

New Warning Message on Percentage Column

Steps to Enable

You don't need to do anything to enable this feature.

Purge OTBI Hierarchy Table When Backing Out Associated Workforce Compensation Plan

You can now purge the OTBI hierarchy table when you select the "Full back out" option in the Back Out Workforce Compensation Data process. Previously, you had to run the Synchronize Hierarchy process with the "Purge hierarchy" option selected.

Steps to Enable

You don't need to do anything to enable this feature.

Updated Digital Certification For ADF Desktop Integration Excel

We updated the digital certificate associated with the ADF Desktop Integration Excel plugin. If you have the option "trusted publishers" you may need to add the new certificate to the trusted list on your target desktops. This is a one time action.

Steps to Enable

Follow the steps found in My Oracle Support (Document ID 2149821.1) - The solution cannot be installed because it is signed by a publisher whom you have not yet chosen to trust

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

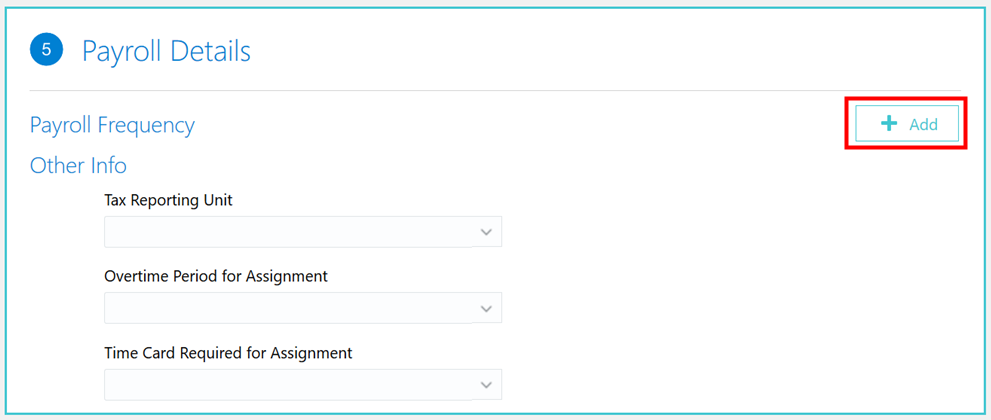

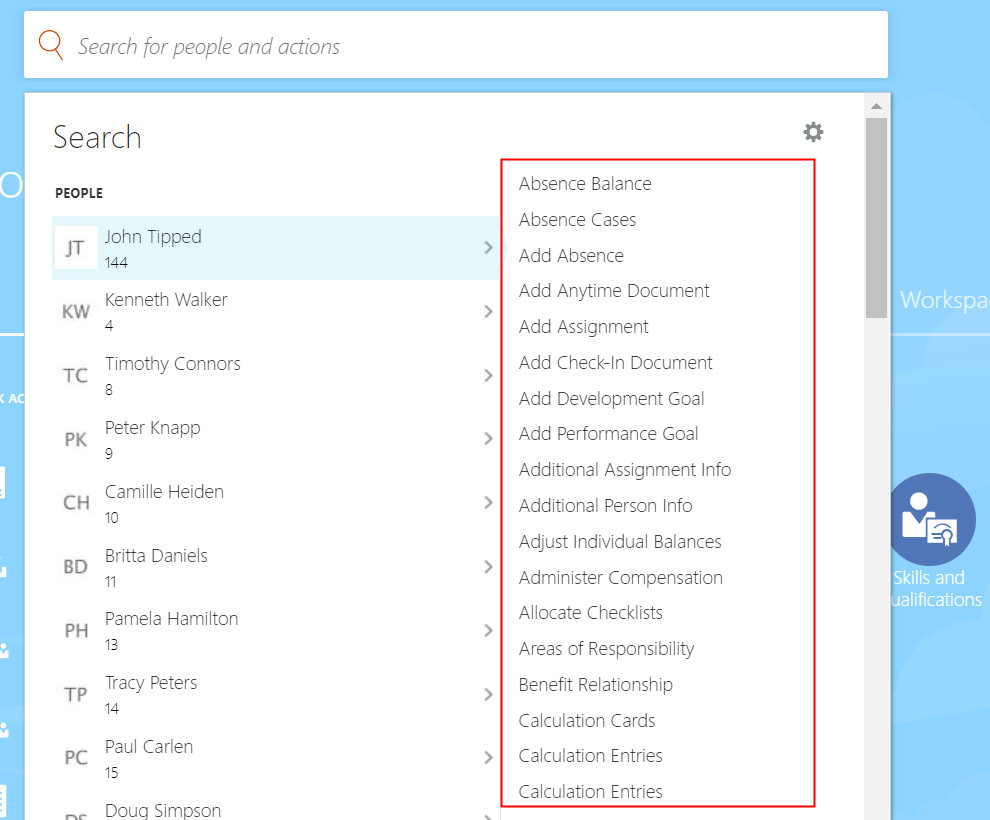

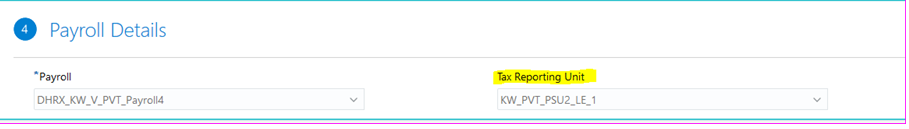

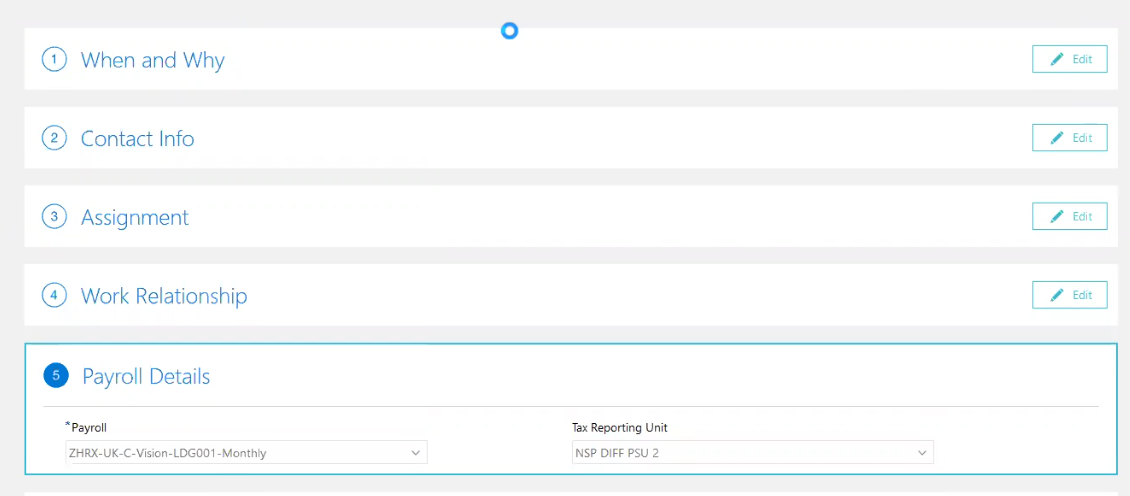

Manage Payroll Frequency in Payroll Employment

Managing payroll frequency in the payroll employment region transactions, such as new hire, allows you to add or delete information when you are required to enter other information before continuing. For example, before assigning a payroll to an employee, you may be required to enter an address but now you can delete the payroll and return to the appropriate page in the new hire flow to enter the information to continue.

Click the add button to enter payroll information on the redesigned pages.

Click the 'x' to delete existing payroll information.

Steps to Enable

You don't need to do anything to enable this feature.

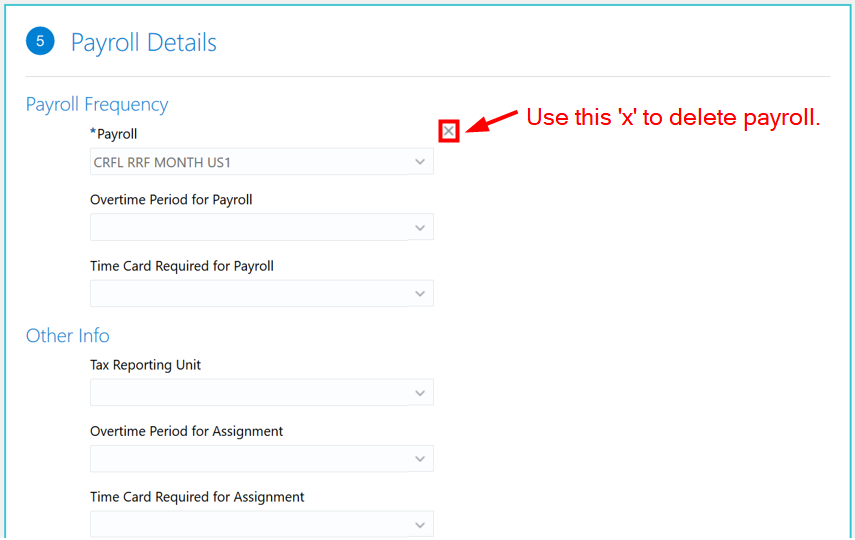

View-Only Version of Element Entries

On the Element Entries page, you can now view the element entries in read-only mode.

Element Entries

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Key Resources

For instructions on implementing new features in existing roles, refer to My Oracle Support for the following document:

-

Upgrade Guide for Oracle HCM Cloud Applications Security (Document ID 2023523.1)

Role Information

The following table shows the aggregate privileges that support this feature and the predefined roles that inherit them.

| Aggregate Privilege Name and Code |

Role |

|---|---|

| View Payroll Element Entry -ORA_PAY_ELEMENT_ENTRY_VIEW_DUTY |

Human Resource Analyst |

NOTE: If you’re using the predefined roles, then you don’t need to perform any further action. However, if you’re using custom versions of these roles, you must add these aggregate privileges to those custom roles to use this feature. If any of your job roles, either custom or predefined, have the Access Element Entry aggregate privilege, then all corresponding data roles must be regenerated.

View-Only Version of Person Costing

You can now access the Person Costing page in a read-only mode.

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Key Resources

For instructions on implementing new features in existing roles, refer to My Oracle Support for the following document:

-

Upgrade Guide for Oracle HCM Cloud Applications Security (Document ID 2023523.1)

Role Information

The following table shows the aggregate privileges that support this feature and the predefined roles that inherit them.

| Aggregate Privilege Name and Code |

Role |

|---|---|

| View Costing for a Person - ORA_PAY_PERSON_COSTING_VIEW_DUTY |

Human Resource Analyst |

NOTE: If you are using the predefined roles, no action is necessary. However, if you are using custom versions of these roles, you must add these aggregate privileges to your custom roles to use this feature.

If any of your job roles, either custom or predefined, have the Manage Costing for a Person aggregate privilege, then all corresponding data roles must be regenerated.

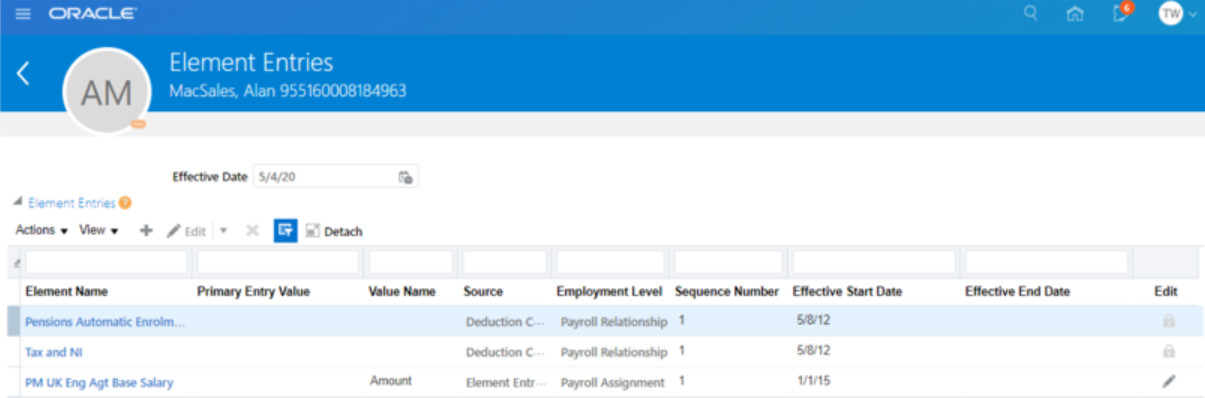

The new global search enables you to search for people and take an action directly from the global search window. On the Home page, when you search for another person, you are presented with suggested actions including payroll tasks for those people. Further, you can initiate any action that is registered as quick action.

Global Search

Steps to Enable

To enable the new HCM Global Search:

- Navigate to the Setup and Maintenance page.

- Search for the Manage Global Search Configurations task.

- Select Oracle HCM Cloud Global Search Configuration and click the Duplicate button.

- Select the Default, Enabled, and Use only Suggestions for Search check boxes.

- Click Save and Close.

Set End Date on Element Entries When Deduction Recovered

The application will now automatically set the end date of deduction entries, such as loan, when the amount is fully recovered from the employee. It checks the total accrued deduction with the total owed and then sets the end dates for the element entry when both amounts are equal.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

NOTE: If the element is processed in the retro pay after you set the end date for the entry, then you must verify the retro pay results and make any necessary corrections.

For example, consider the total owed amount is $100 and 50% of the earnings is the regular deduction. In the first period, if the earnings are $100, then the application deducts $50. Similarly, it deducts the same amount in the second period too. After the second period, the accrued deduction is $100, which is the total owed and it will be end dated. Assume that there is retrospective change in the earnings and they are reduced from $100 to $80 for both periods. In such a case, since the deduction is 50% of earnings, the expected deduction is $40. The retro pay will create two retro entries with $10 each to repay. However, the total deduction will become $80, instead of $100. Also, the application can’t process the regular deduction because it’s already end dated. You need to make the necessary corrections to make sure that the total deduction will be equal to total owed.

Key Resources

For more information about costing, refer to the Oracle Help Center for the following guide:

- Implementing Payroll Costing

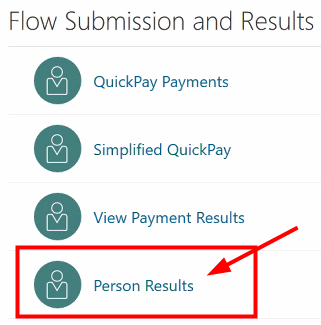

Process Results by Person Records or Object-Based Records

You can view non-person objects on the Person Results and Errors and Warnings messages pages.

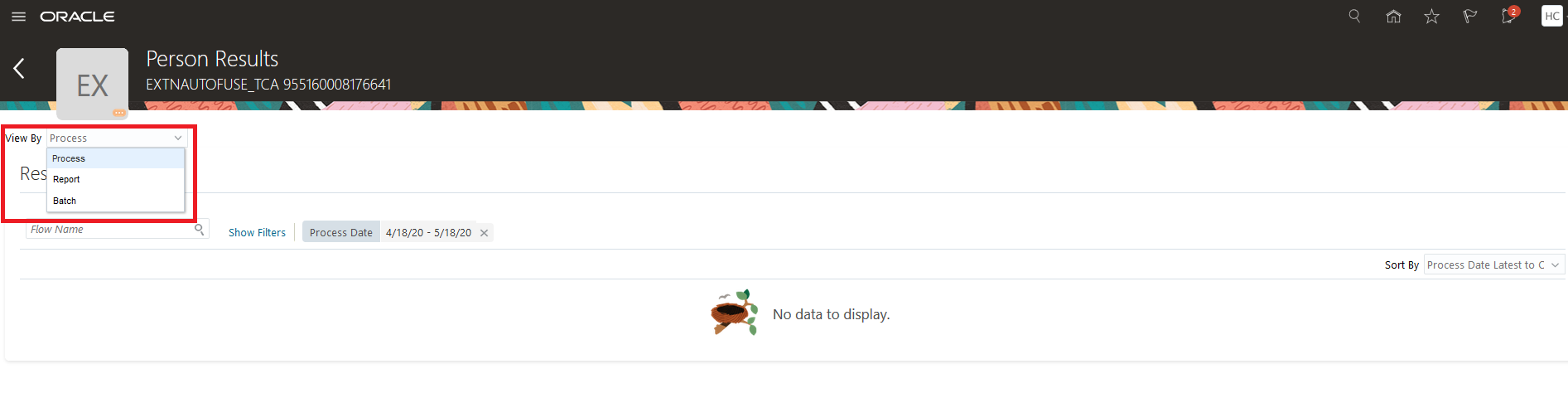

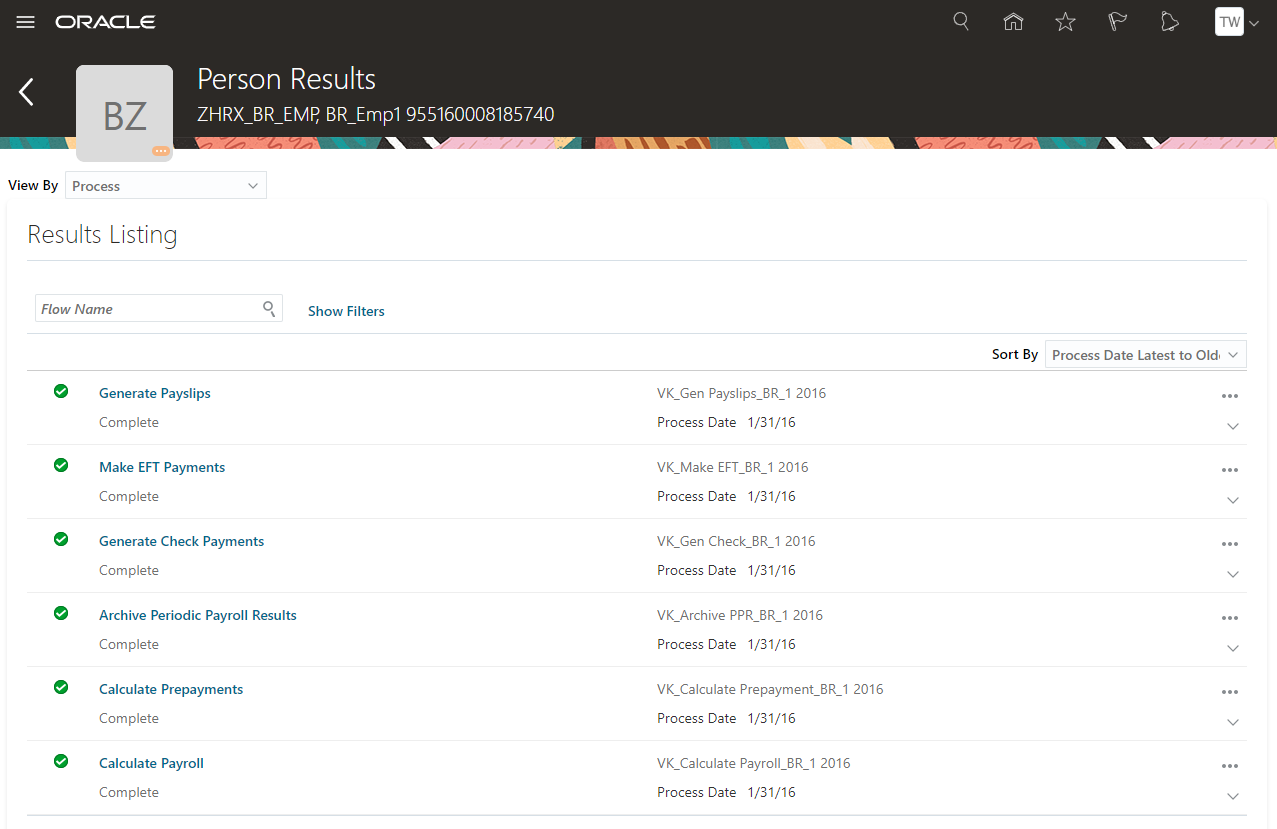

Use the View By field on the Person Results page to filter and view process results by:

- Process, to view the process results for a person by a process, such as payroll run, prepayments, or retroactive pay results. You can also drill down to a person record and view the Statement of Earnings of the person.

- Report, to view the person results by a report, such as the payment summary report, to view the payments made for the person. You can view the process results by payroll objects, for example, view the results by the PAYROLL_REL_ACTION_ID in the Payroll Activity Report.

- Batch, to view the results for a data load, such as Load Absences Batches.

View by Process:

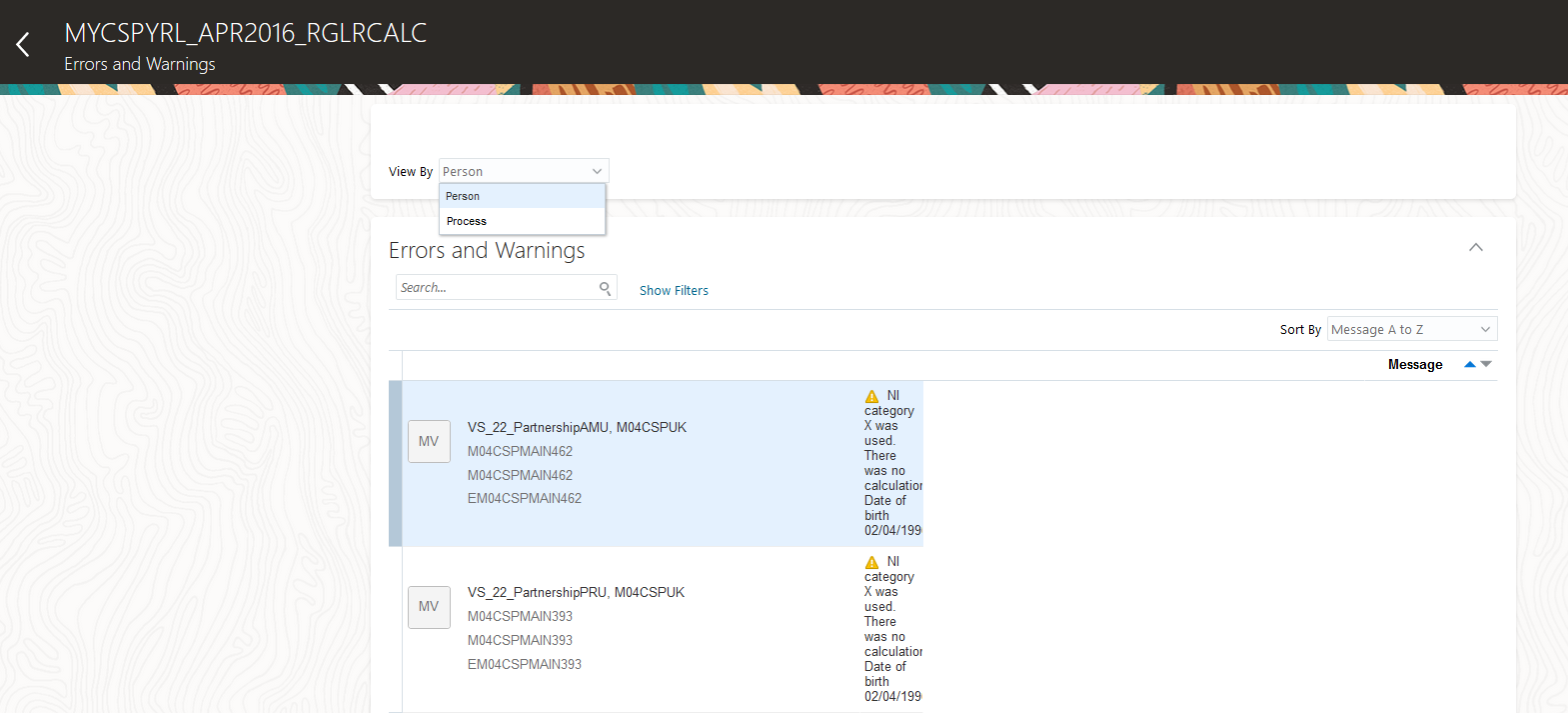

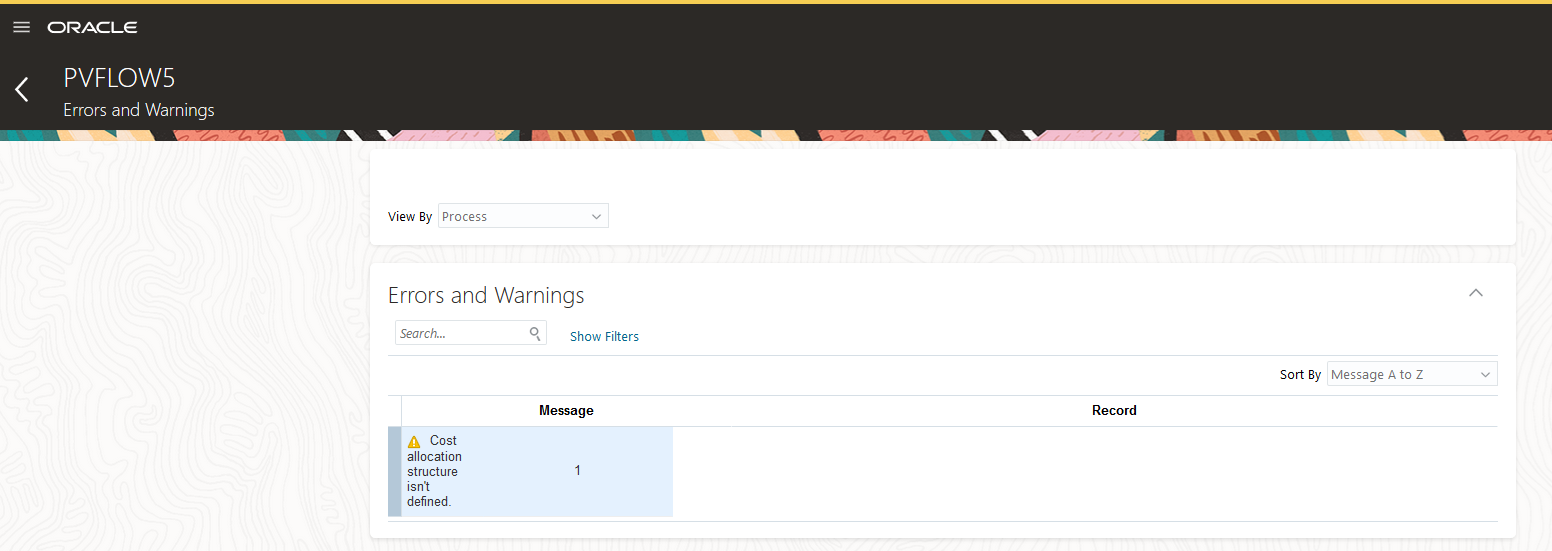

You can also find the View By field on the Errors and Warnings page, accessible from the results pages, such as the Process Results Summary page.

Navigate to My Client Groups > Payroll from your Home page and click Process Results Summary under the Flow Submission and Results section. The Process Results Summary page displays by default processes that have been submitted and completed in the last seven days.

Click on the number of Errors and Warnings on a process to open the Errors and Warnings page for the process. Filter by person or process.

- Person level messages, such as error messages when reporting or processing a person.

You can view the messages by assignment number or payroll relationship number.

- Process level messages, such as process execution errors.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information on creating and enabling the profile options, refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information- (Document ID 2399671.1)

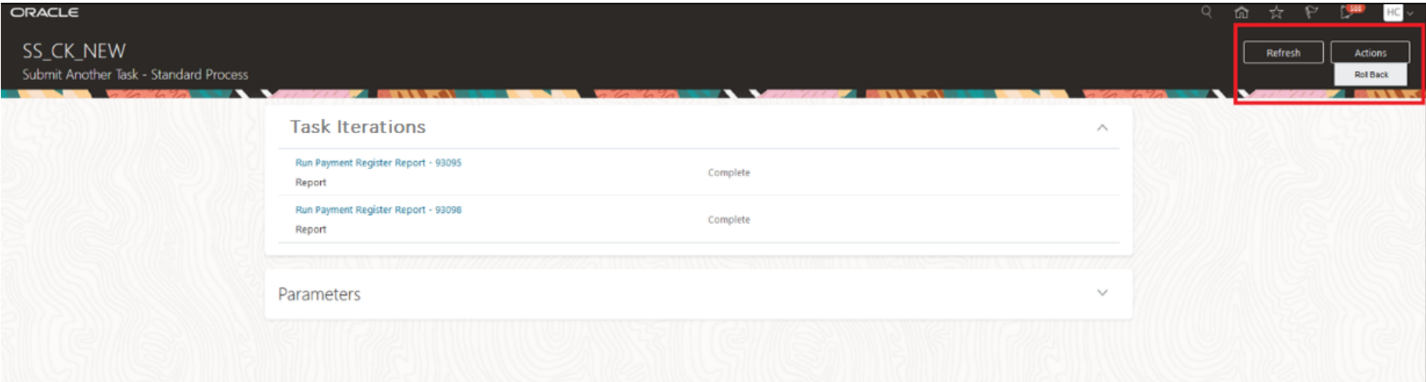

Use the Task Iterations page to review the Submit Another Task task iterations. You can access this page from the Checklist and from the Process Results Summary page.