- Revision History

- Overview

- Feature Summary

- Workforce Rewards

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

- Individual Compensation

- Salary

- Workforce Compensation

-

- Use Population Filters to Submit Workforce Compensation Cycle Notifications

- View Note Count In Approvals Task

- Preview Worksheet Task Configuration

- Hide The Print Icon In the Communications Task Type

- Enhanced Communications Task

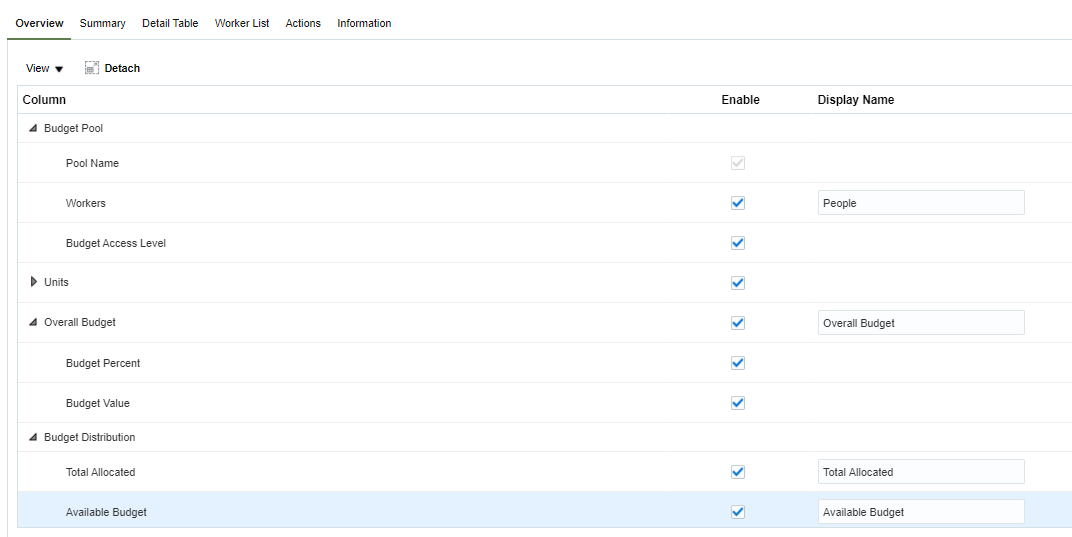

- Configure Budget Pool Overview

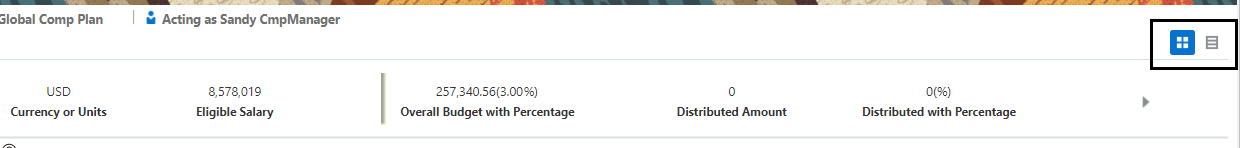

- Switch Budget Summary Views

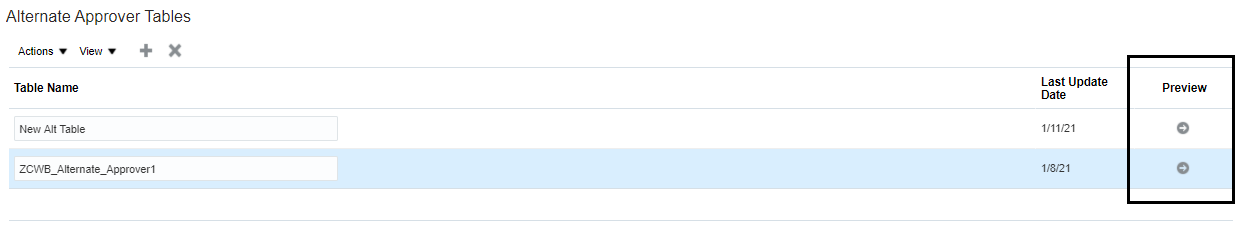

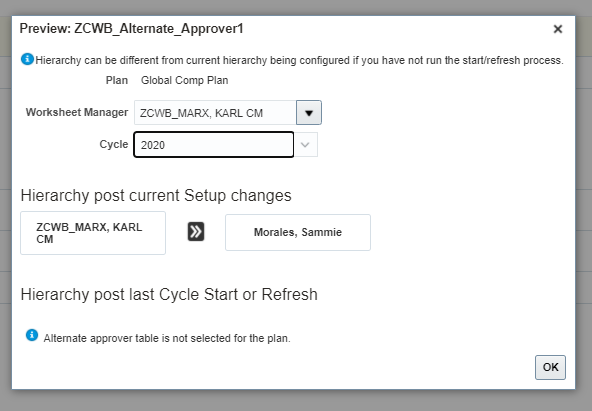

- Preview Alternate Approver Configuration

- Improved Alternate Approver Configuration

- Review Apply Model Batch Processing Information

- Configure Performance Rating Display Order

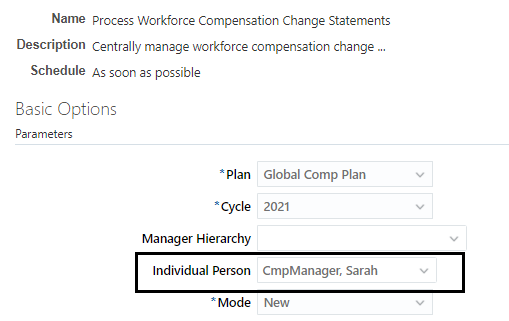

- Process Compensation Change Statements By Individual Person

- Grade Step Progression

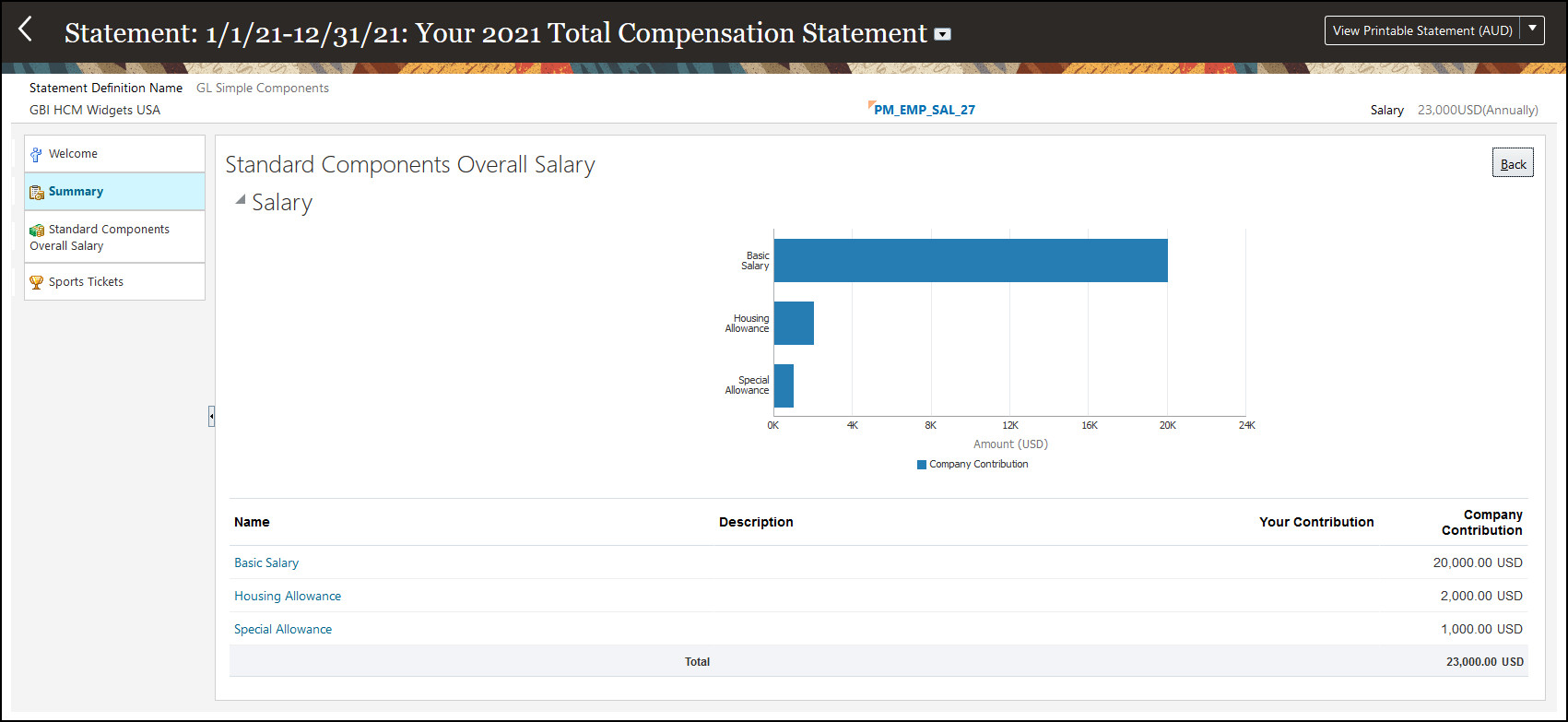

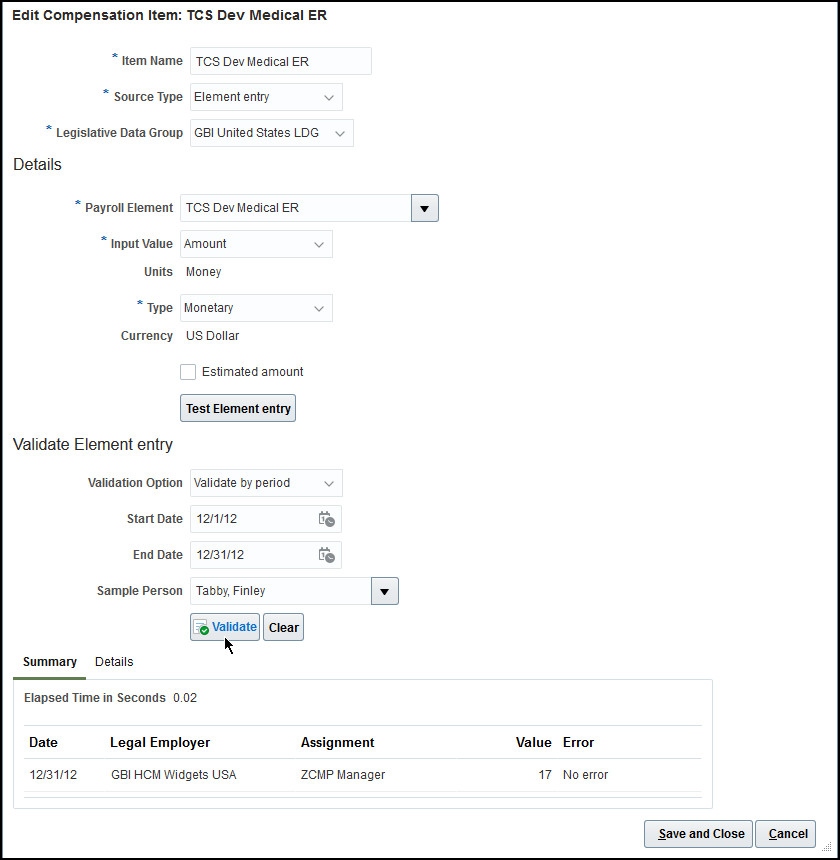

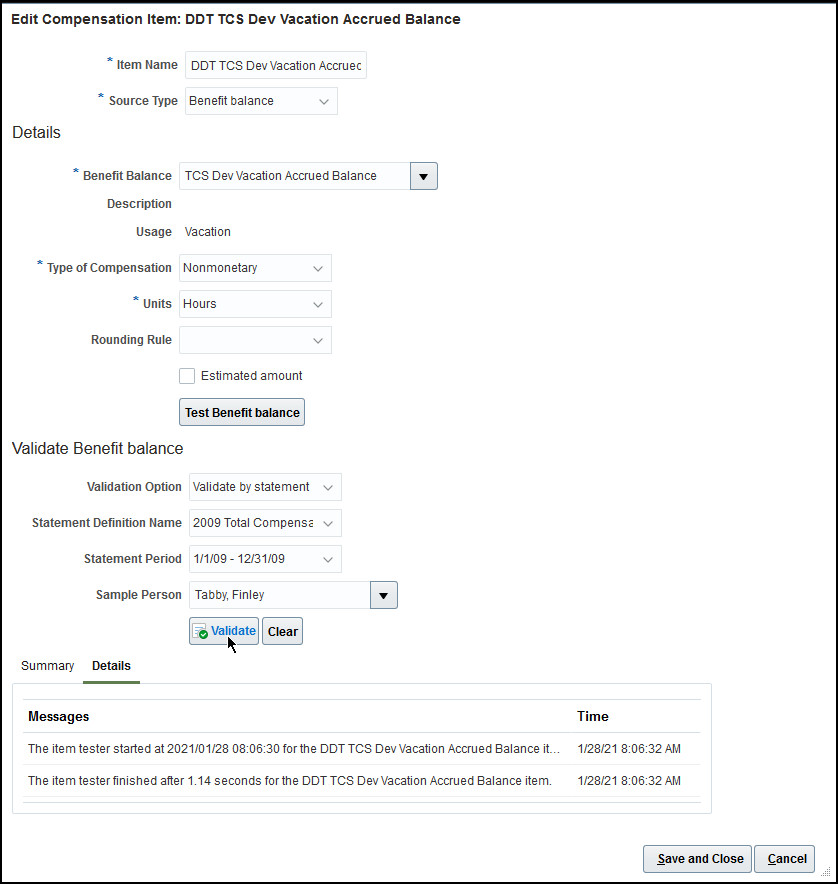

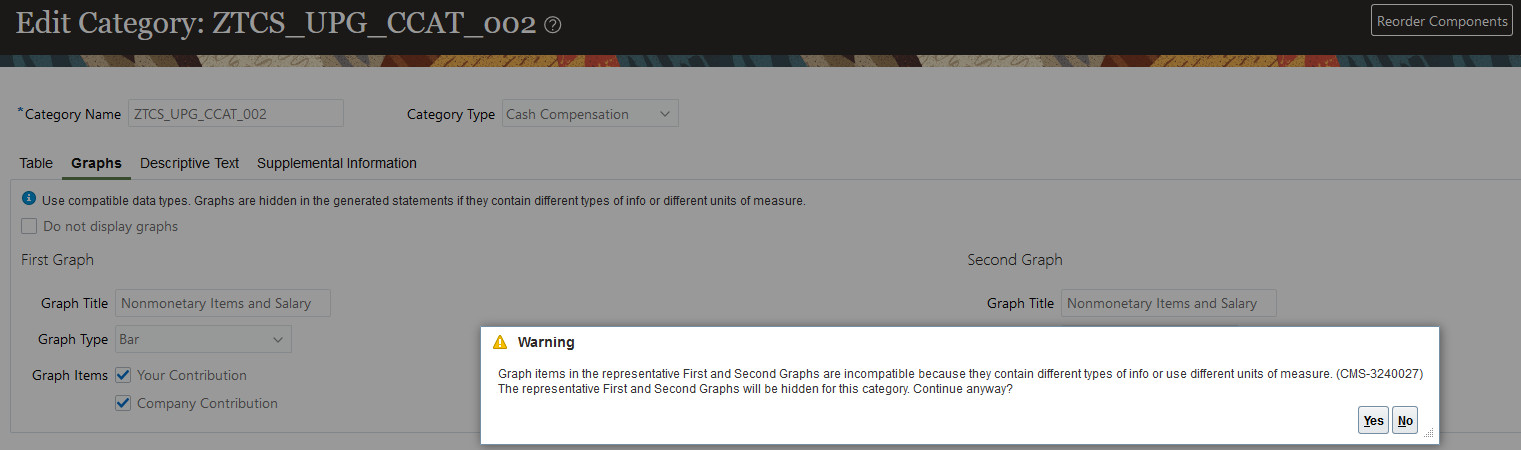

- Total Compensation Statement

- Compensation

- Payroll

- HR Optimizations

- IMPORTANT Actions and Considerations

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 25 JUN 2021 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (21A, 21B, 21C, and 21D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

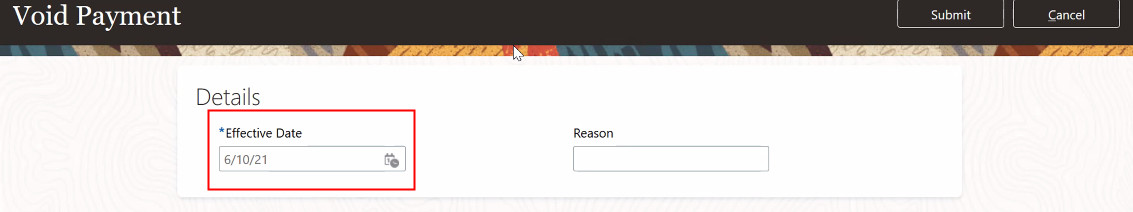

Effective Date for Payment Corrective Actions

You can now enter an effective date for void and cancel payment corrective actions. This field is still defaulted to the day you are taking action, or today's date, but now it is available to update when needed.

When you choose to void or cancel a payment from the employee’s process results page, the pop-up now has an Effective Date and a Reason field.

Steps to Enable

You don't need to do anything to enable this feature.

Payroll for the United Kingdom

Payroll for Oracle Human Capital Management for the United Kingdom supports country specific features and functions for the United Kingdom. It enables users to follow the United Kingdom's business practices and comply with its statutory requirements.

England School Workforce Census

Here are the supported modules for the England School Workforce Census:

- School Workforce

- Staff Details

- Contracts or Service Agreements

- Absences

- Qualifications

- School

- Staff Information

- Local Authority

- Headcount Information

The Curriculum and Vacancies modules are not supported.

Before You Start

- You must have set up your enterprise structure as described for Teachers' Pensions Scheme. This includes recording Local Authority Numbers and Establishment Numbers.

Ensure that you are using either of these contracts based models:

- Multiple Contracts with Single Assignment

- Single Assignment with Contract

You can record additional information that is reported in the census at these levels:

- Organization - payroll statutory unit and reporting establishment

- Contract

- Person

- Assignment

- Grade

- Absence

You can configure payment-related information, including:

- Mapping salary actions (or actions and reasons) in Extended Lookups to report pay review dates.

- Feeding predefined balances to report additional payments and safeguarded salary amounts. A new census year balance dimension supports this.

You can validate your setup using the School Workforce Census Diagnostics report to identify any configuration issues prior to generating the census. To do this, go to Settings and Actions > Troubleshooting > Run Diagnostic Tests.

Generate your census XML files using the Generate England School Workforce Census flow from the Payroll area. You can submit the flow for one, all, or a range of reporting establishments within a selected local authority.

NOTE: At the reporting establishment level, identify any establishments that you want to exclude from the census.

The flow also generates validation and school summary reports using the data in your XML files. Review and fix any errors (and queries, where necessary), then regenerate the census. You can repeat this cycle as often as you need to throughout the census year and prior to final submission.

NOTE: The upload of census XML files to the COLLECT portal is a manual process and it must be externally managed.

The submission of the annual England School Workforce Census to the Department for Education is a statutory requirement for schools and local authorities.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information see:

- Oracle Cloud HCM (UK): School Workforce Census England (Document ID 2738829.1)

- Public Sector Pensions: Teachers’ Pension Scheme (Document ID 2687236.1)

- 19B Human Resources What's New for the Enhanced Worker Contract Management feature

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 25 MAY 2021 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (21A, 21B, 21C, and 21D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Anytime Pay Navigation and Personal Payment Method Options Enhancements |

||||||

Payroll for Oracle Human Capital Management for the United States supports country specific features and functions for the United States. It enables users to follow the United States business practices and comply with its statutory requirements.

Anytime Pay Navigation and Personal Payment Method Options Enhancements

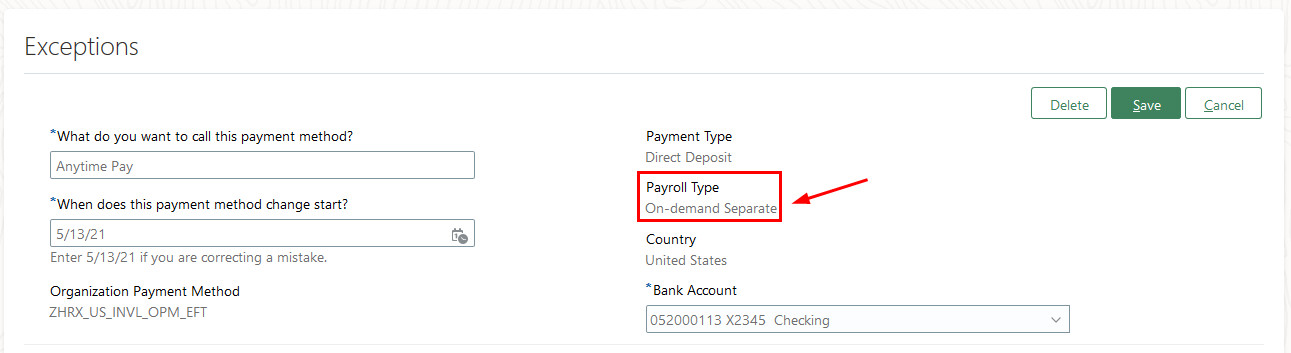

You can now easily access Anytime Pay in Pay area from the Me tab by selecting the Pay Advance quick action. And, when you have multiple Personal Payment Methods (PPMs) set up to split payments of your regular pay, add a ppm exception for the new payroll type On-demand Separate to direct deposit your advance payment into a single account.

Anytime Pay verifies you have a valid bank account and a direct deposit personal payment method type set up before you can proceed. And, because Anytime Pay is designed for a one-time payment into a single account, if you have multiple PPMs you must have a PPM exception for payroll type On-demand Separate before you can continue your request.

Easy access to Anytime Pay and new a ppm exception for the pay advance to be paid as a single payment into a single bank account.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Use the Transaction Design Studio (TDS) to make the Exceptions section visible on the Personal Payment Method and Payment Method pages.

Key Resources

For information on making the Exceptions section visible on the Personal Payment Method and Payment Method Pages, refer to Use Transaction Design Studio to Configure Field Displays these guides located in the Oracle Help Center.

- Implementing Payroll

- Administering Global Payroll

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 27 AUG 2021 | Benefits | Enable Plan Comparison | Updated document. Revised feature information. |

| 25 Jun 2021 | Compensation/ Workforce Compensation |

Configure Performance Rating Display Order | Updated document. Revised feature information. |

| 25 MAY 2021 | Benefits | Enable Plan Comparison | Updated document. Revised feature information. |

| 25 MAY 2021 | Global Payroll | Costing When the Sum of the Retroactive Distribution Group Entries Is Zero | Updated document. Revised feature information. |

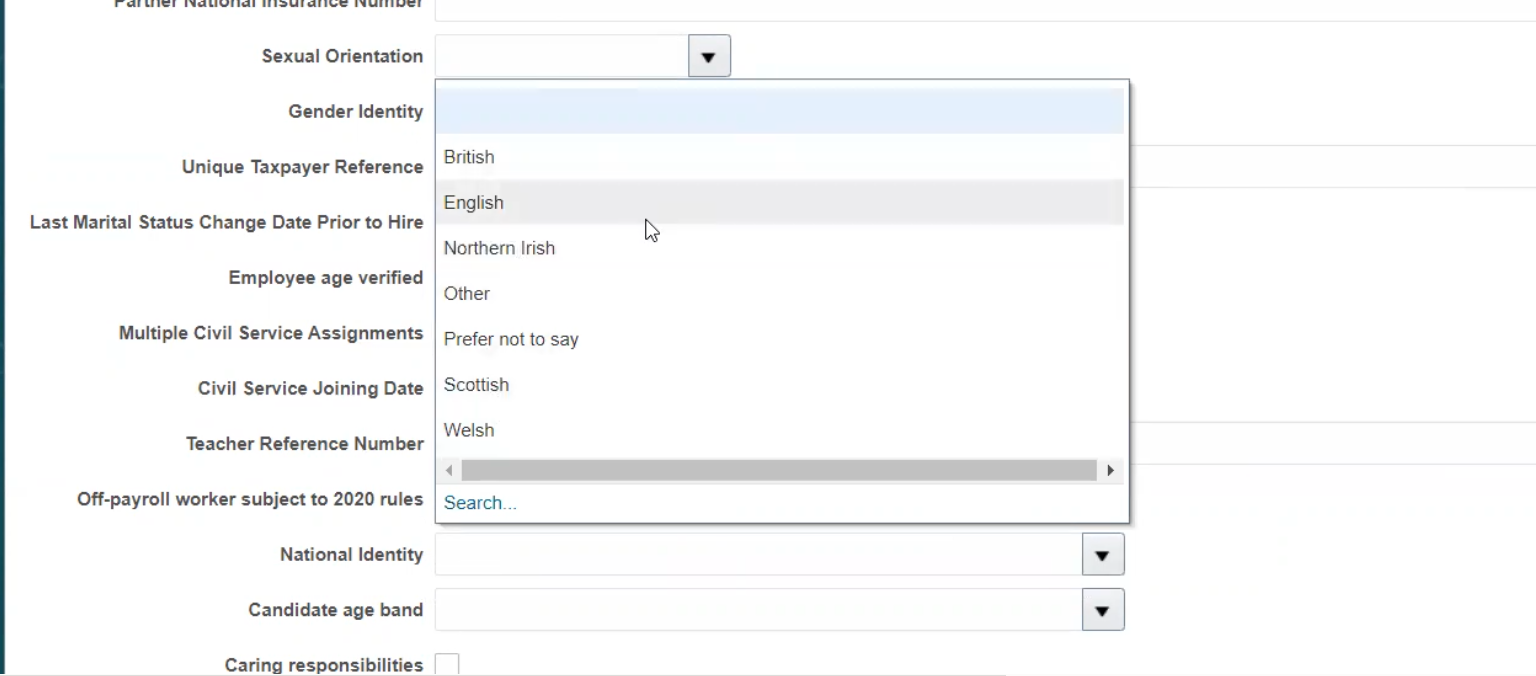

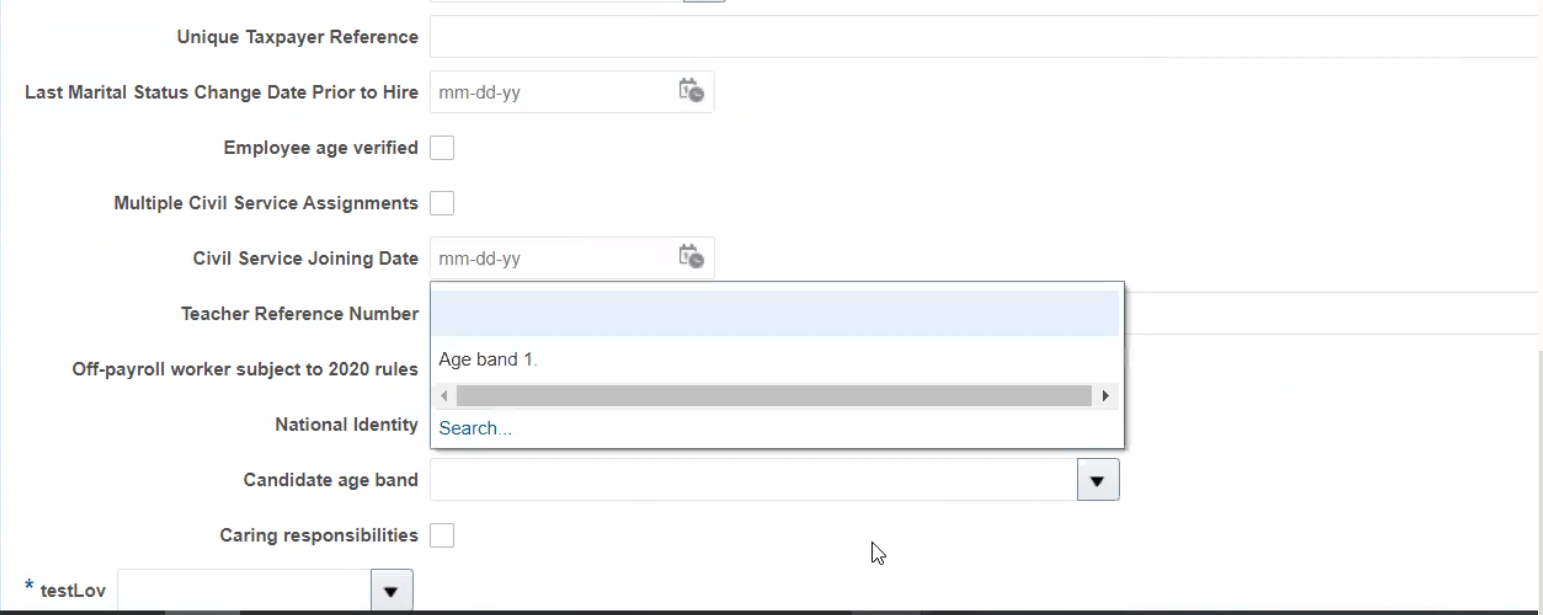

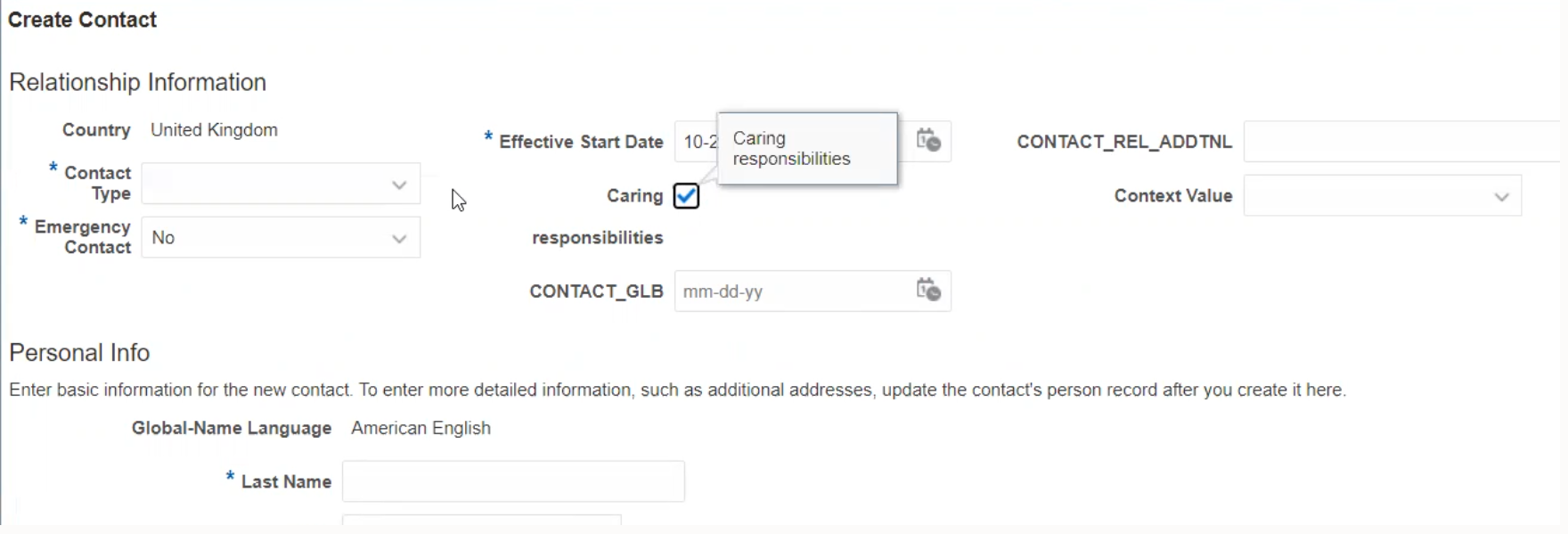

| 25 MAY | Payroll for the United Kingdom | Protected Characteristics - Legislative fields | Updated document. Revised feature information. |

| 30 APR 2021 | Benefits | Enable Plan Comparison | Updated document. Revised feature information. |

| 30 APR 2021 |

Compensation/Individual Compensation | Client List of Values for Plan and Option in Individual Compensation Introduction | Updated document. Revised feature information. |

| 30 APR 2021 |

Compensation/Salary | Future Salary Updates Move During Legal Employer Change Introduction | Updated document. Revised feature information. |

| 30 APR 2021 |

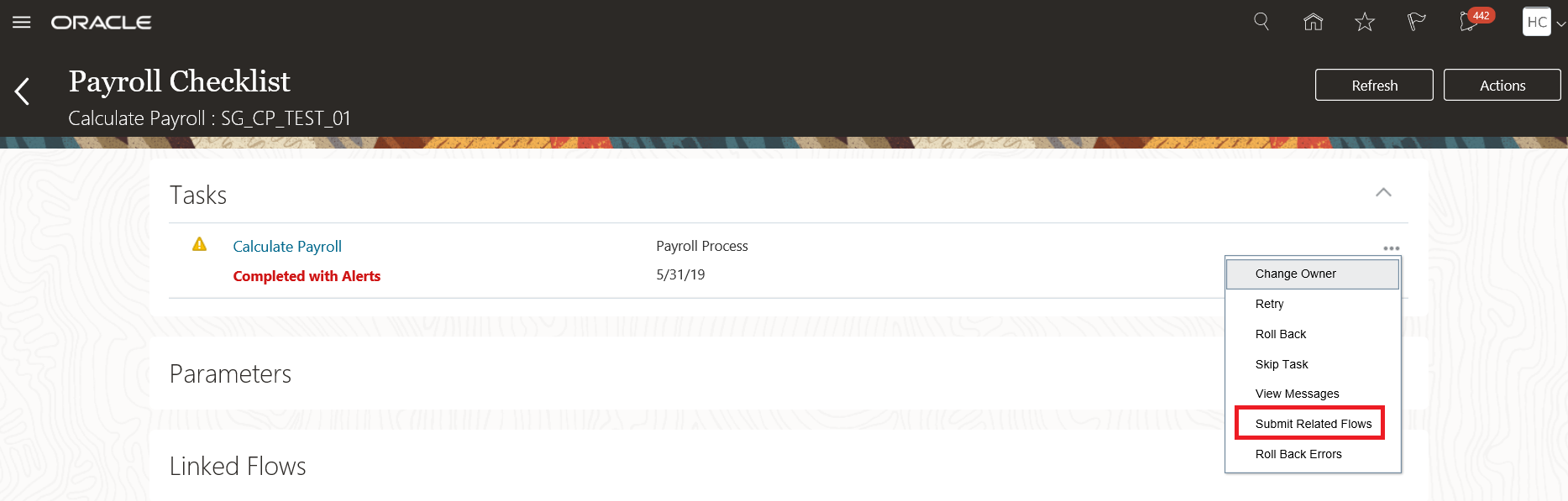

Global Payroll | Submit Related Flows | Updated document. Revised feature information. |

| 30 APR 2021 |

Payroll for the United Kingdom | Protected Characteristics - Legislative fields | Updated document. Revised feature information. |

| 30 APR 2021 |

OTBI/ Compensation | New Subject Area - Individual Compensation Real Time | Updated document. Revised feature information. |

| 26 MAR 2021 | Compensation/ Workforce Compensation | Use Population Filters to Submit Workforce Compensation Cycle Notifications | Updated document. Feature delivered in update 21B. |

| 26 MAR 2021 |

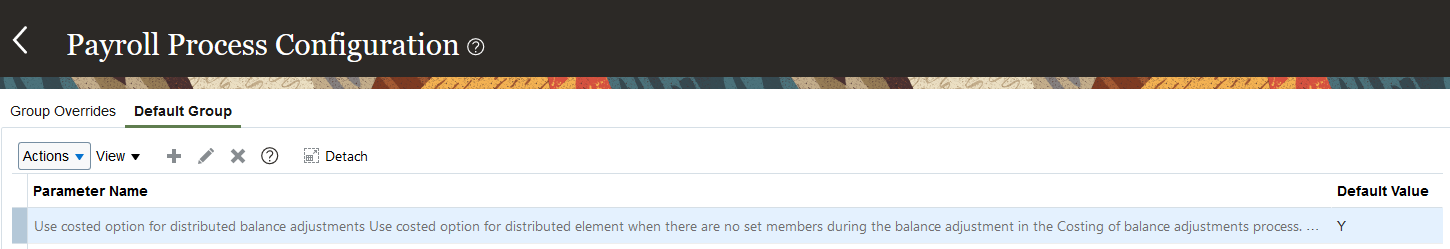

Global Payroll | Balance Adjustments Costing for a Distributed Element | Updated document. Revised feature information. |

| 26 MAR 2021 |

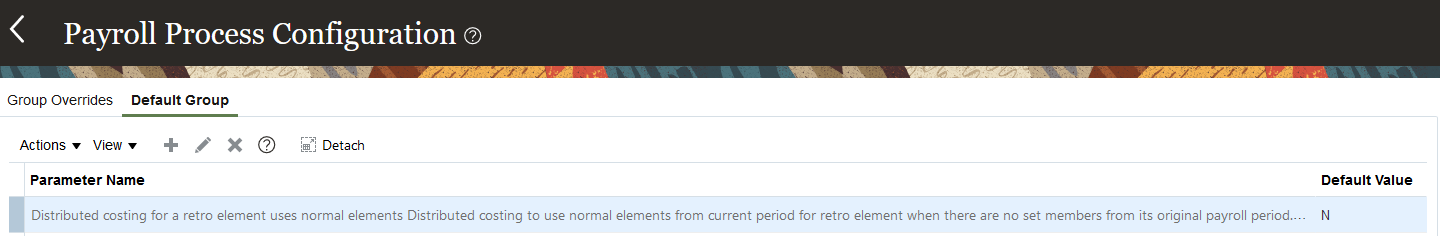

Global Payroll | Costing When the Sum of the Retroactive Distribution Group Entries Is Zero | Updated document. Revised feature information. |

| 26 MAR 2021 |

Global Payroll |

Records Counts |

This feature was not delivered, so it has been removed from update 21B. |

| 26 MAR 2021 |

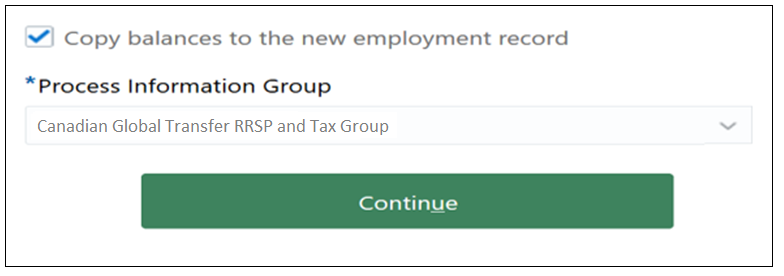

Payroll for the United States | Global Transfer Enhancement for Predefined Deferred Compensation Balances | Updated document. Feature delivered in update 21B. |

| 05 MAR 2021 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (21A, 21B, 21C, and 21D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

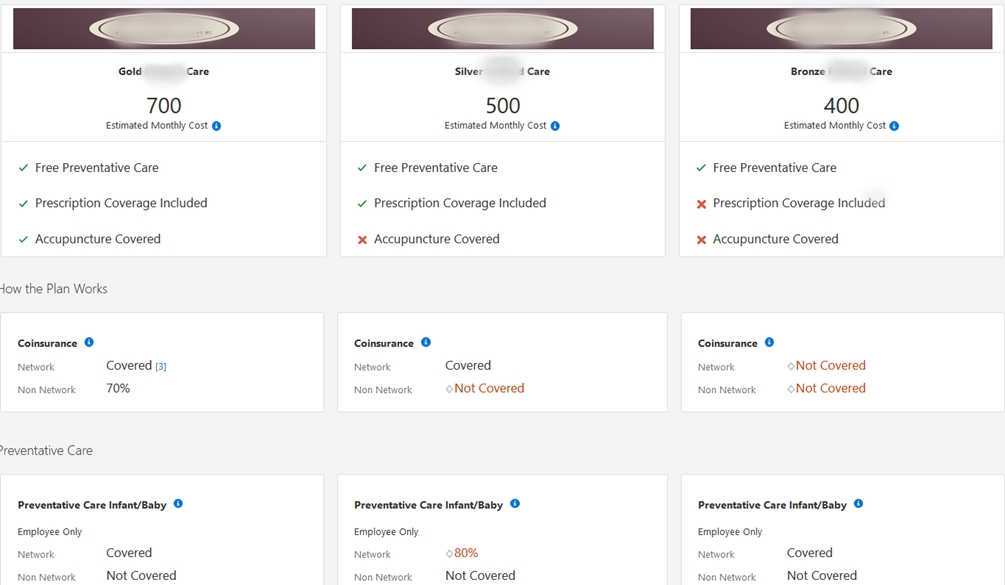

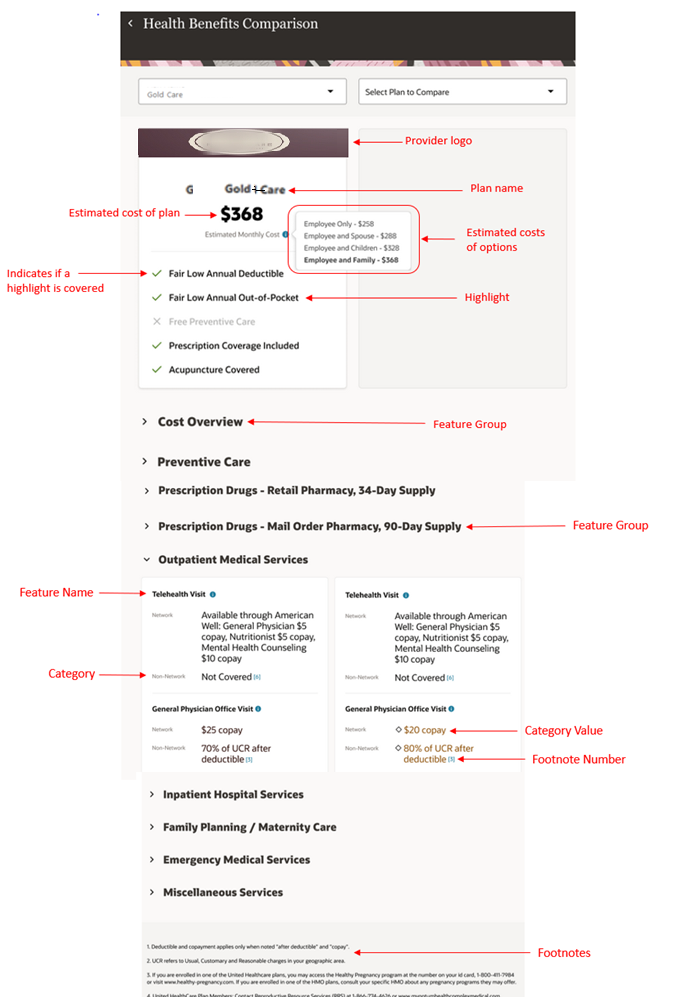

Participants can now compare their plans for health, vision, and dental to decide on the best plan before they enroll. They can compare different features that each plan offers. For example, they can compare the cost of the plans and options, how they work, and the coinsurance.

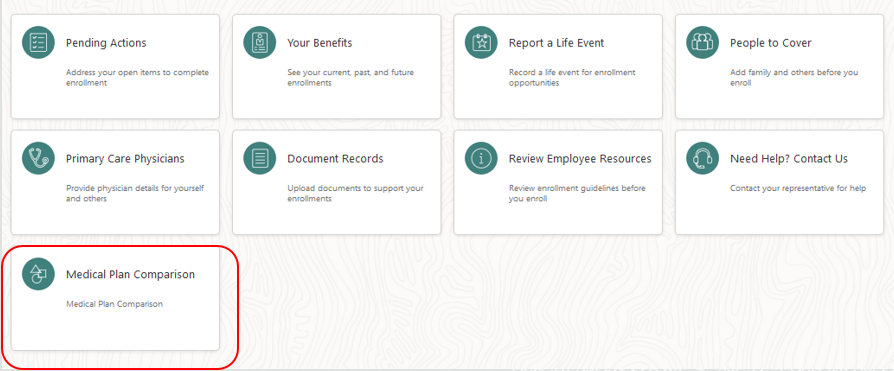

Participants can view and launch plan comparison from the self-service landing page or from quick actions. The number of tiles or quick actions that are available will depend on how many different types of plans you offer for comparison. You need to enable tiles and quick actions for each benefit type that you want to provide for comparison. For example, if you have plans for medical, dental, and vision, you need to enable 3 tiles.

Self Service Page to Launch Plan Comparison

After the participants launch plan comparison, they can select and deselect the plans to compare. When the participants enter the page first, all the 3 columns appear blank. Up to 3 plans can be compared at a time.

Comparison of 3 Plans

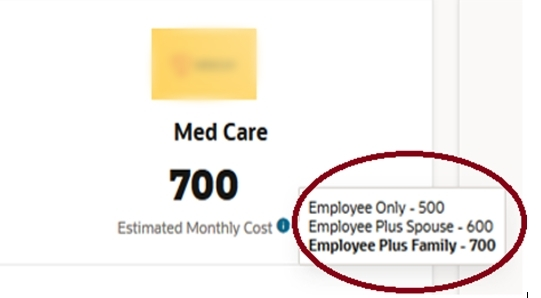

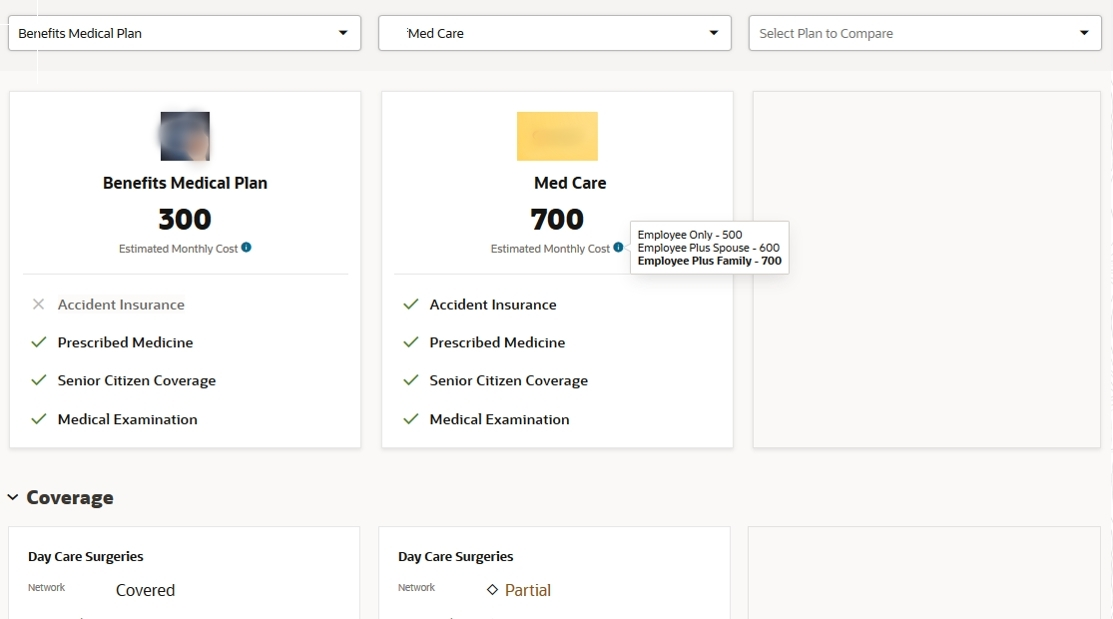

Here’s an example of 2 medical plans to compare, Benefits Medical Plan and Med Care. You can see a summary of the plan highlights, if you have identified them during setup. In our example, the highlights are Accident Insurance, Prescribed Medicine, Senior Citizen Coverage, and Medical Examination. A simple tick or a cross mark indicates whether that highlighted feature is offered by that plan or not. You can also see the estimated cost of the plans and the cost by option.

Example of Comparing 2 Medical Plans

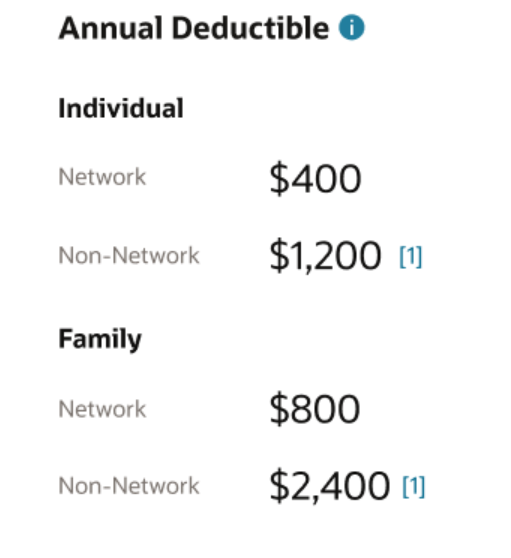

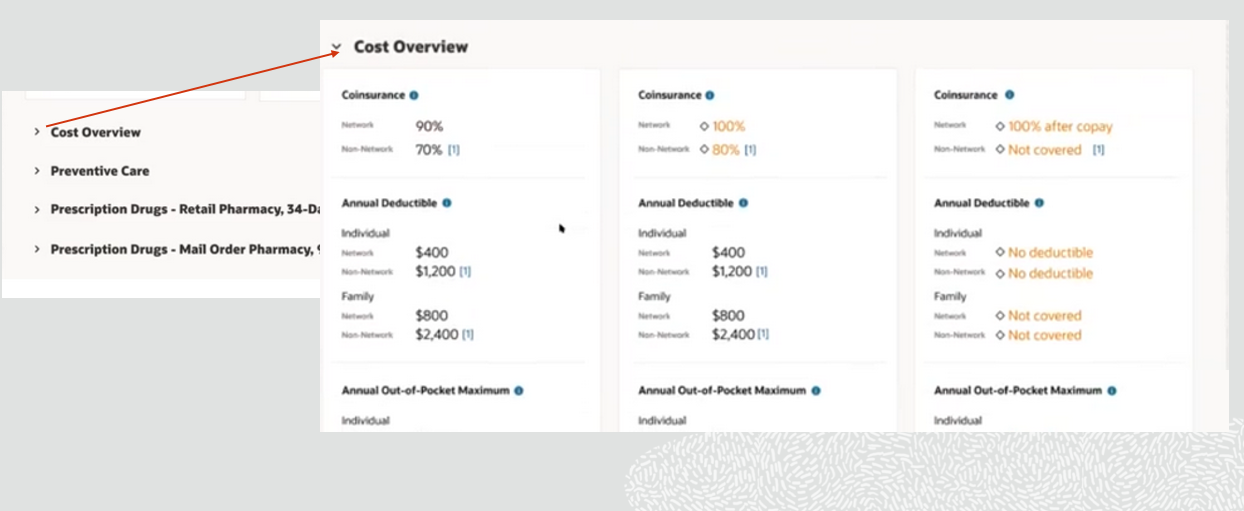

Based on your setup, participants can expand the various sections to see more detail as per their requirement. In the following example, the Cost Overview section is expanded so that the participants can see the coinsurance, annual deductions, and the annual out of pocket maximum. Also, the features that differ from the first plan you are comparing are highlighted in a different color, so you can see the differences easily.

Cost Overview Section

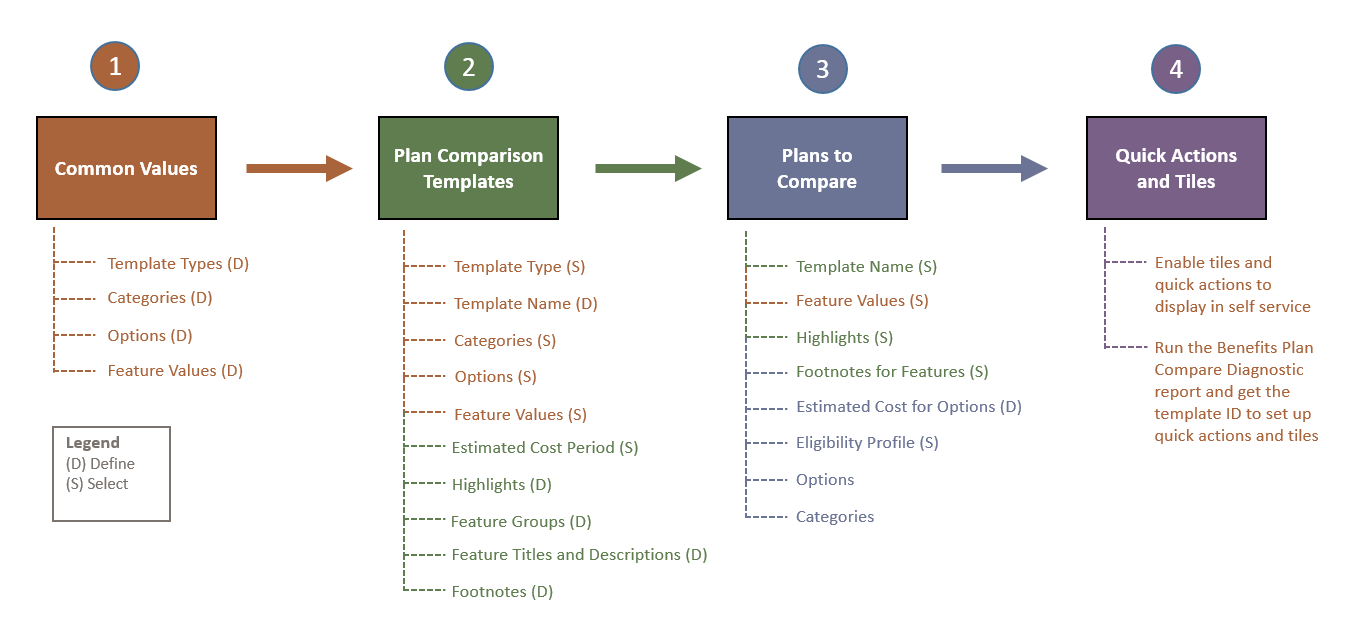

PLAN COMPARISON COMPONENTS—HOW THEY WORK TOGETHER

To enable your participants to view and launch plan comparison from self-service landing page, you need to do the following:

- Set up plan comparison values.

- Set up templates.

- Add plans to the templates.

- Get the template ID from the Benefits Plan Compare Diagnostic test report and enable tiles and quick actions.

Here’s an overview of the components and the sequence in which you set it up:

Overview Diagram

Here’s an example that shows how the different components of plan comparison appear for your participants:

Illustration of Plan Comparison Components.

Implementation Considerations

Consider these points before you implement this feature:

| Aspect | Implementation Advice |

|---|---|

| How many different plans of the same type do you have that you want participants to compare? |

We recommend that you use the plan comparison feature when you have 2 or more plans of the same type to compare. |

| Does your organization offer plans in more than one country? |

If your organization offers plans in different countries, you’ll need to create templates and plans all of those countries. |

| Do you want to use eligibility? |

When participants compare plans outside the open enrollment period, regular eligibility checks won't apply. Remember, participants will anyway see plans that apply only for the country that's set for the template. So you don't need an eligibility profile that checks for country. But depending on your requirements, you can still set up a basic eligibility profile for plan comparison, especially if you're offering a lot of plans to compare. For example, you might want your participants to see only those plans that apply for a specific region or state, such as California. |

| What features do the plans offer? |

Look at your plans and identify the features that they offer. For example, a medical plan may have coinsurance, annual deductible, and prescription drugs as the features. If you identify these features in advance, it will be easy for you to set up the plan comparison. |

| Do you want to group the features? |

Consider if the features should appear as a long list in the comparison or if they should be grouped together. If you group features, participants can expand or hide those groups based on their significance. If you set up groups and you have some features left that don’t fit into any of the groups, you need to create a generic group to include those features. You can’t have a mixture of grouped and ungrouped features. |

| Do you want to showcase any of the features to your participants? |

You need to identify any highlights of your plans that you want to showcase to your participants. For example, free preventative care or prescription coverage included. You need to enter these in the Highlights section of the setup page. When your participants compare plans, these highlights appear at the top of the comparison. |

| What's the time period of your estimated cost? For example, do you want to display monthly costs or annual costs |

We deliver an extensible lookup named Estimated Cost Period (ORA_HRC_COMP_HD_TYPE) with these values:

You need to extend the lookup before you start to set up your plans if you want to use a different estimated cost. |

| Do your features have common elements that you need to define? |

If you have common elements for your features, you need to group those under a category. For example, in the US these might be network and non-network. You can set them up once so that they are included in all your features. |

| Do you know the options offered for each feature? |

Think about the options offered for each feature. You need to identify the options along with the cost. For example, you may have Employee Only option and Employee Plus Family option for your medical plans. You can set them up once so that they are included in all your features. These options are not associated with the ones that you create in the Plan Configuration work area. These options are meant only for plan comparison. |

| Are there any footnotes that you need to add to a particular plan or feature? |

You may plan for meaningful footnotes for your plan or feature. It gives a short description of the plan or feature to the participants when they compare plans. |

| Do you want your participants to search for plans to compare by ‘startsWith’ criteria? |

When you select plans for comparison, the default search uses the ‘contains’ criteria. If you want the search to use the ‘startsWith’ criteria, turn on the profile option Benefits Plan Comparison List of Values Start with Search Enabled. |

Watch a Demo.

Participants can now quickly and easily compare their health-related plans. It enables them to see the features side-by-side. This information helps them make informed decisions on their enrollment selections for the current and upcoming plan years.

Steps to Enable

At a high level, here's what you need to do set up plan comparison:

- Set up plan comparison values.

- Set up templates.

- Add plans to the templates.

- Get the template ID from the Benefits Plan Compare Diagnostic test report and enable tiles and quick actions.

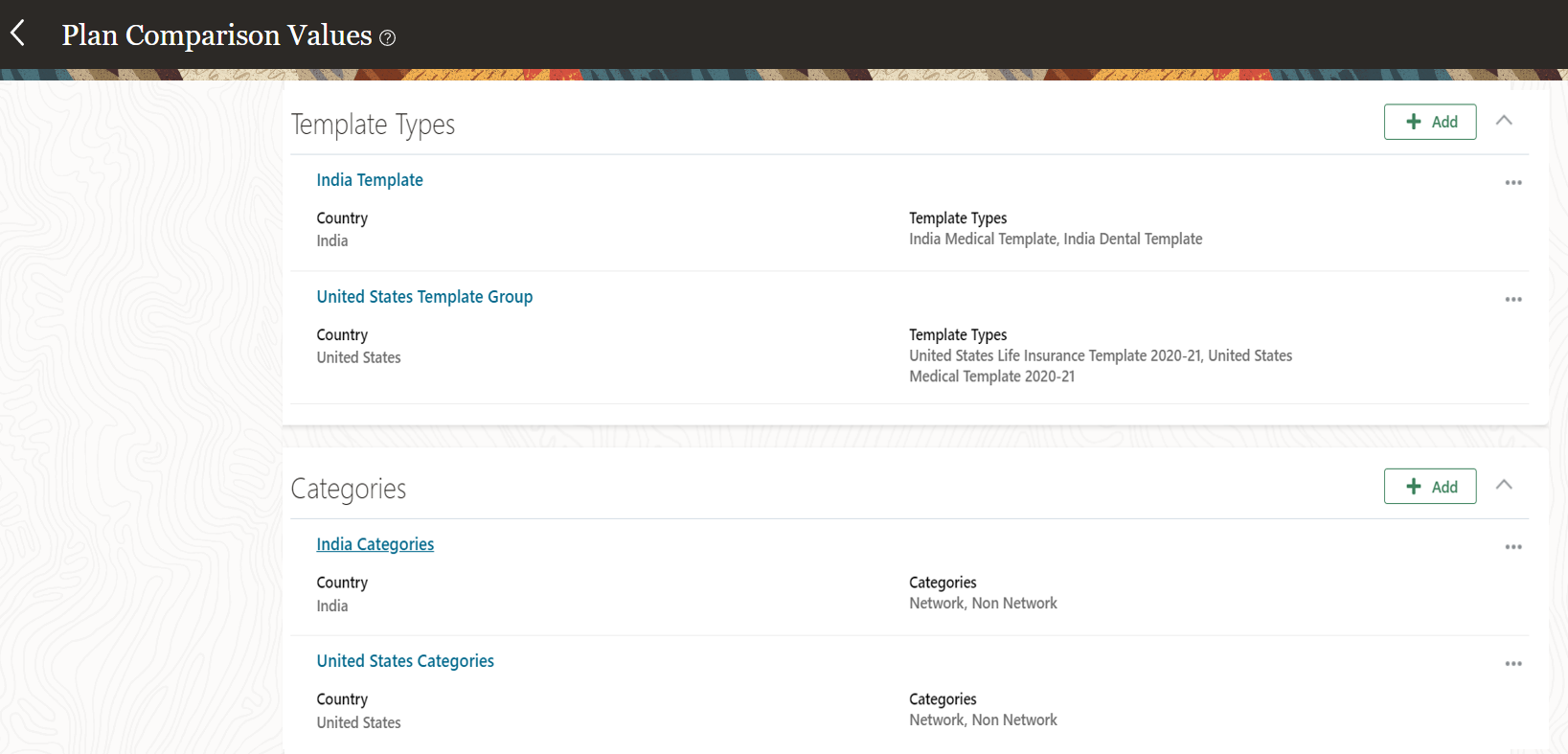

SET UP PLAN COMPARISON VALUES

You define the plan comparison values such as template types, categories, plan options, and feature values. You use these values when you create your plan comparison templates. You can reuse these values across various comparison templates and plans so that the participants see a consistent set of values during the comparison. Subsequently, any changes you make to the values apply to the related templates and plans automatically.

Here’s how the values appear on the Plan Comparison Values page:

Values on the Plan Comparison Values Page

Values on the Plan Comparison Values Page

Use the Configure Plan Comparison Values task from the Setup and Maintenance work area or from My Client Groups to define plan comparison values. You need to set these values up only once so that you can simply select and include them in all your features. And you can just exclude them from specific features where they are not needed. Some of these values are optional. For example, you need to create categories only if you want to include them in your plans. See the earlier figure to find out how these components appear on the plan comparison page.

All plan comparison values that you create here are country specific. This lets you easily configure your comparison plans with accurate country-specific features so that participants see data that's applicable only for their country. Even if your organization offers plans only in one country, you need to define country-specific values and templates.

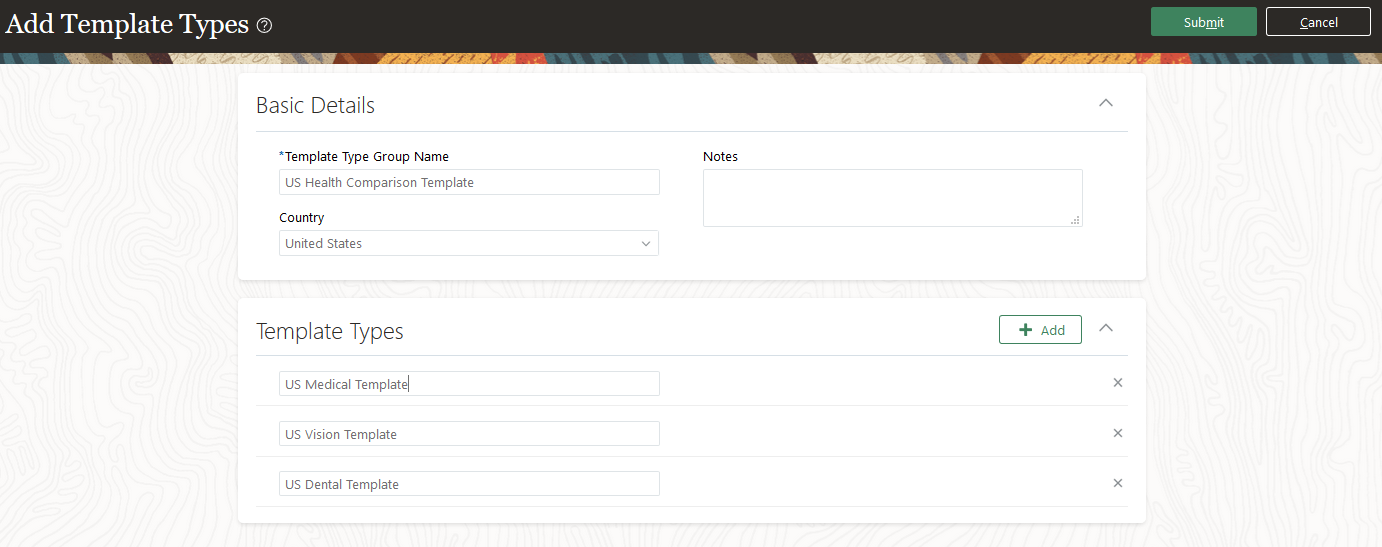

Here’s where you create the template type:

Section Where You Create Template Type

Here’s where you create the categories:

Section Where You Create Categories

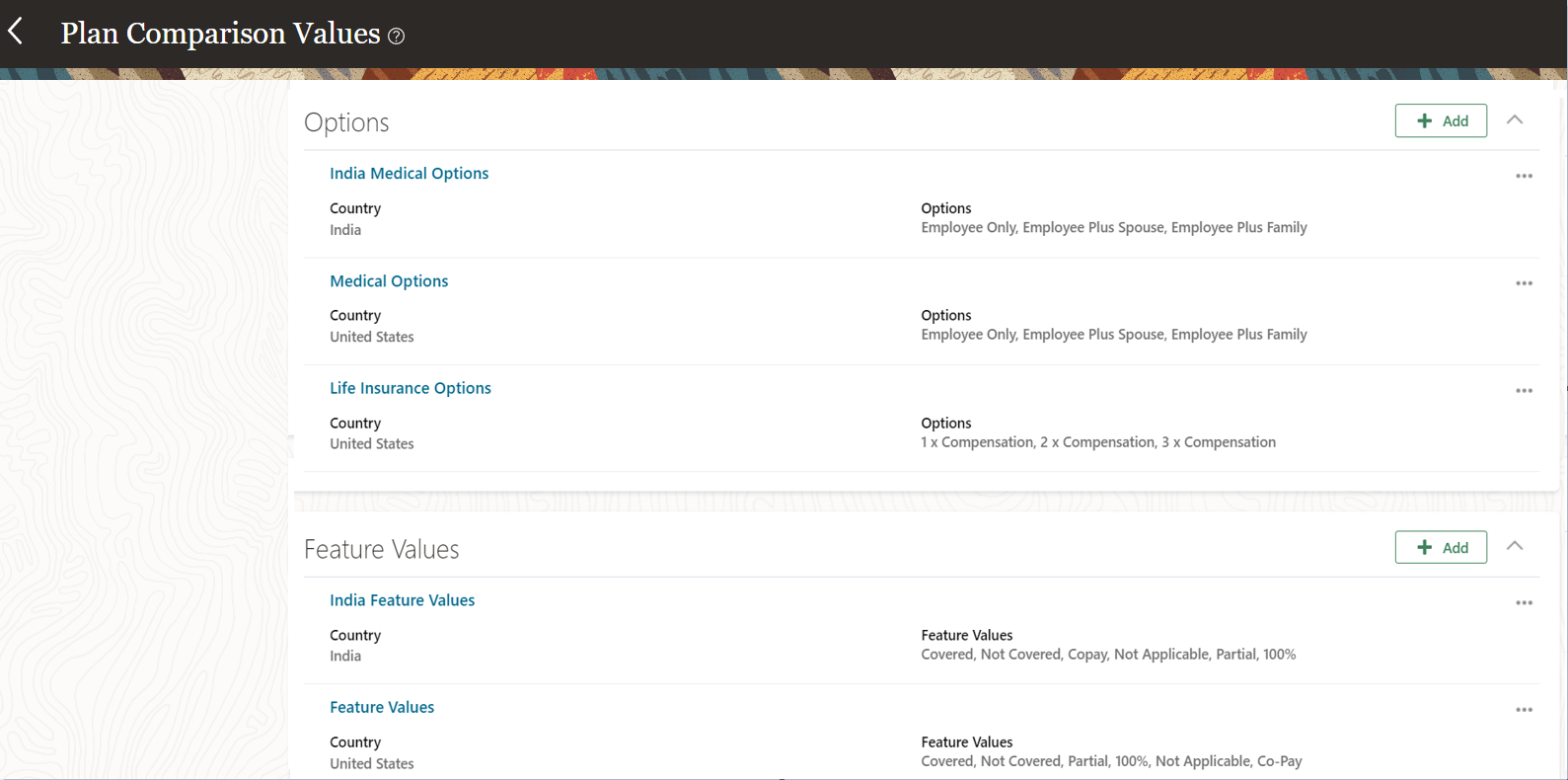

Here’s where you create the options:

Section Where You Create Options

Here’s where you create the feature values:

Section Where You Create Feature Values

You need to set up these values:

| Plan Comparison Value |

Details |

|---|---|

| Template Type |

Your organization may offer different types of plans, for example, medical, dental, and vision. For each of these plan types, you create country-specific template types. For example, to compare 3 plan types offered in the US, you can create the following template types:

|

| Template Type Group Name |

You create template type groups to group related template types together. Your organization may offer plans in one or more than one country. You create template type group for each country. Here are some examples:

|

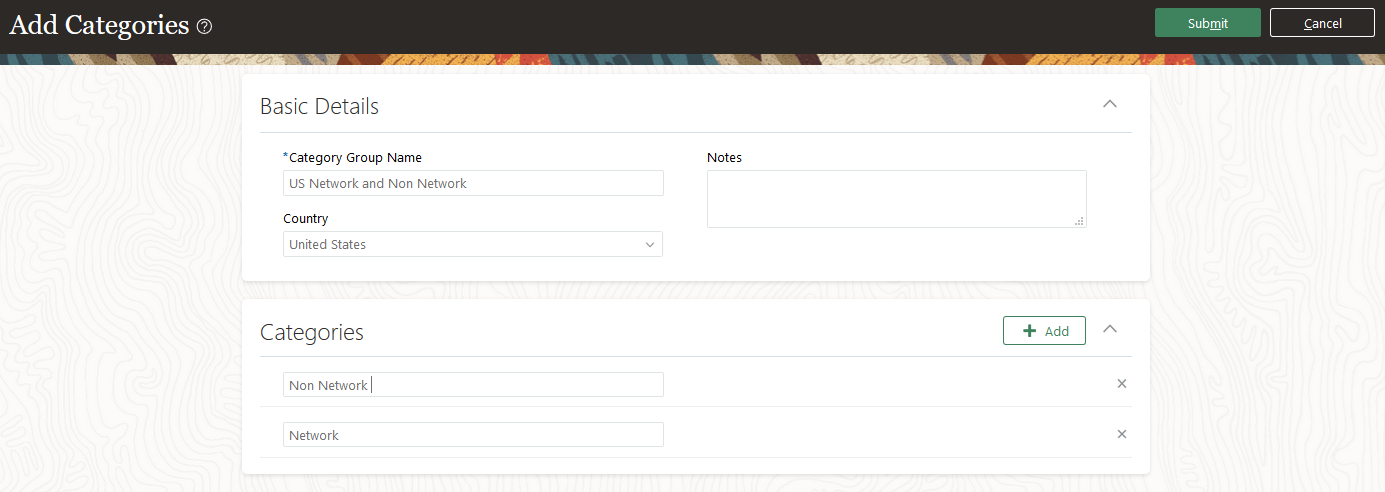

| Categories (Optional) |

A category allows you to further classify a feature, if required, so participants understand the differences. For example, the feature "General Physician Office Visit" might have two categories:

|

| Category Group Name (Optional, if you don’t have a category) |

When you set up a plan comparison template, you select the category group to include its categories in that template. Here are some examples:

|

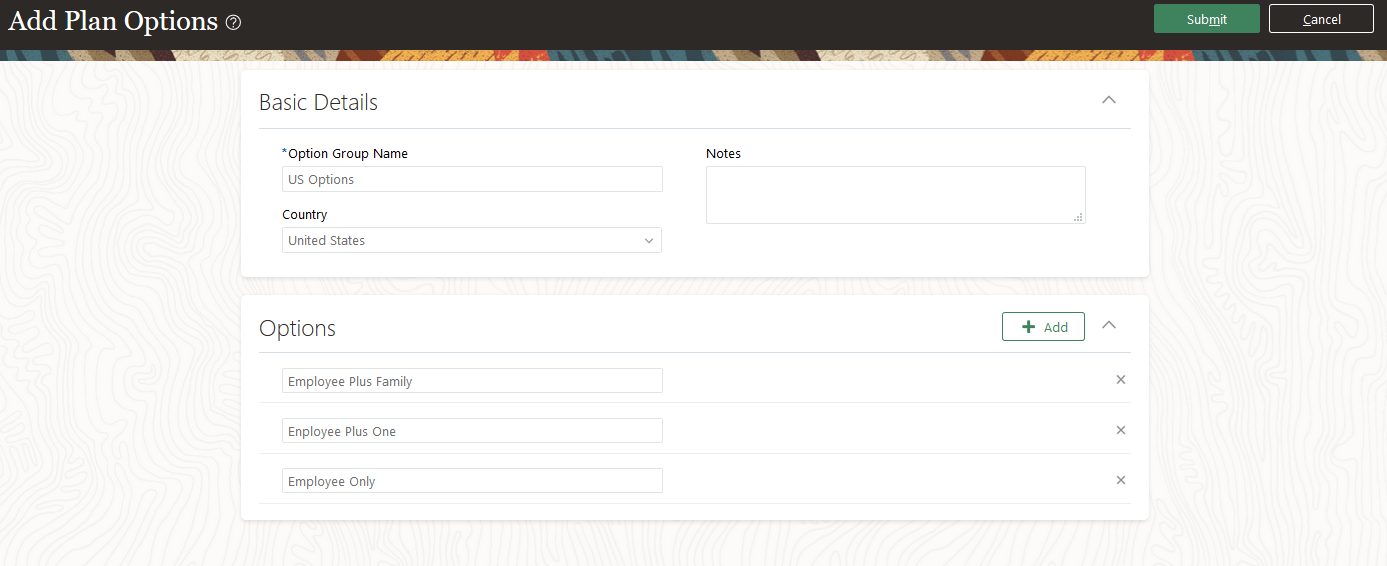

| Options |

Options are electable choices that are common across all plans for comparison. The options that you create here are not associated with the ones that you create in the Plan Configuration work area. Plan comparison requires the options to be common across all plans that you select for comparison. So, the options you create here are meant only for plan comparison. You typically define options if you've designed your plan to offer different rates for different options, and you want to display those during plan comparison. Participants can see the estimated cost of the options by clicking on the Information icon that's next to the Estimated Cost value. You also define options if some features that you're offering vary by option. For example, you offer an Annual Deductible feature where you want to provide display Network and Non-Network rates for each option, such as Employee Only. Here are more examples:

|

| Option Group Name |

When you set up a plan comparison template, you select the option group to include its options in that template. Here are some examples:

|

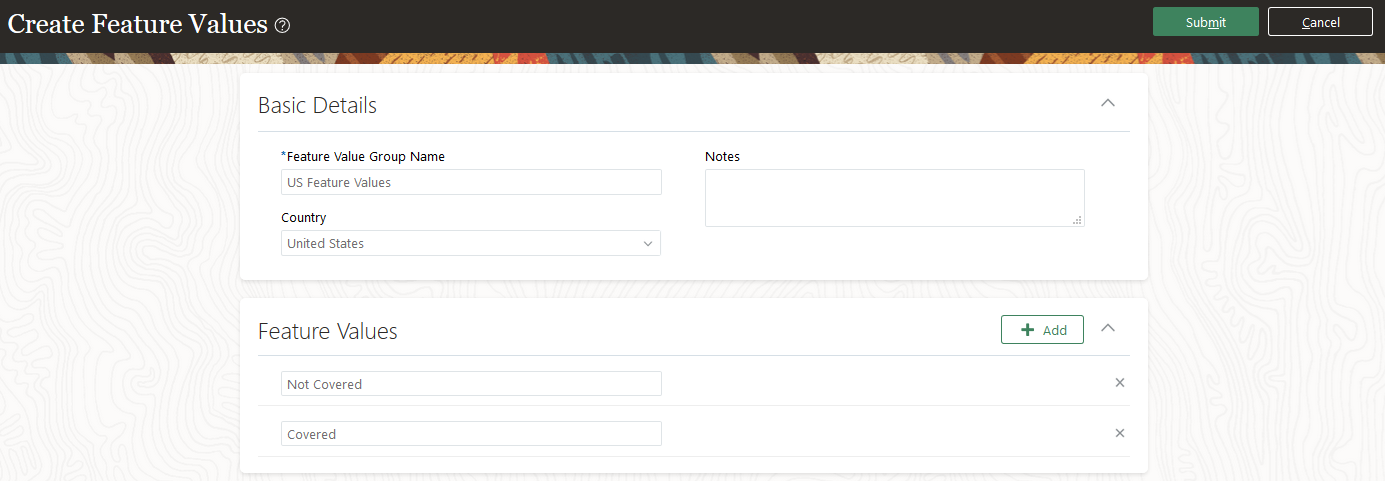

| Feature Values |

During plan comparison, you compare different features that each plan offers. For example, if the feature name is Prescription Drugs, it can have values such as Covered and Not Covered. Here are more examples:

|

| Feature Value Group Name |

When you set up a plan comparison template, you select the feature group to include its features in that template. Here some the examples: US Feature Values Canada Feature Values |

If needed, you can make changes to the values, such as changing the template types, adding or removing new categories and options. You can now proceed to set up your templates.

SET UP PLAN COMPARISON TEMPLATES

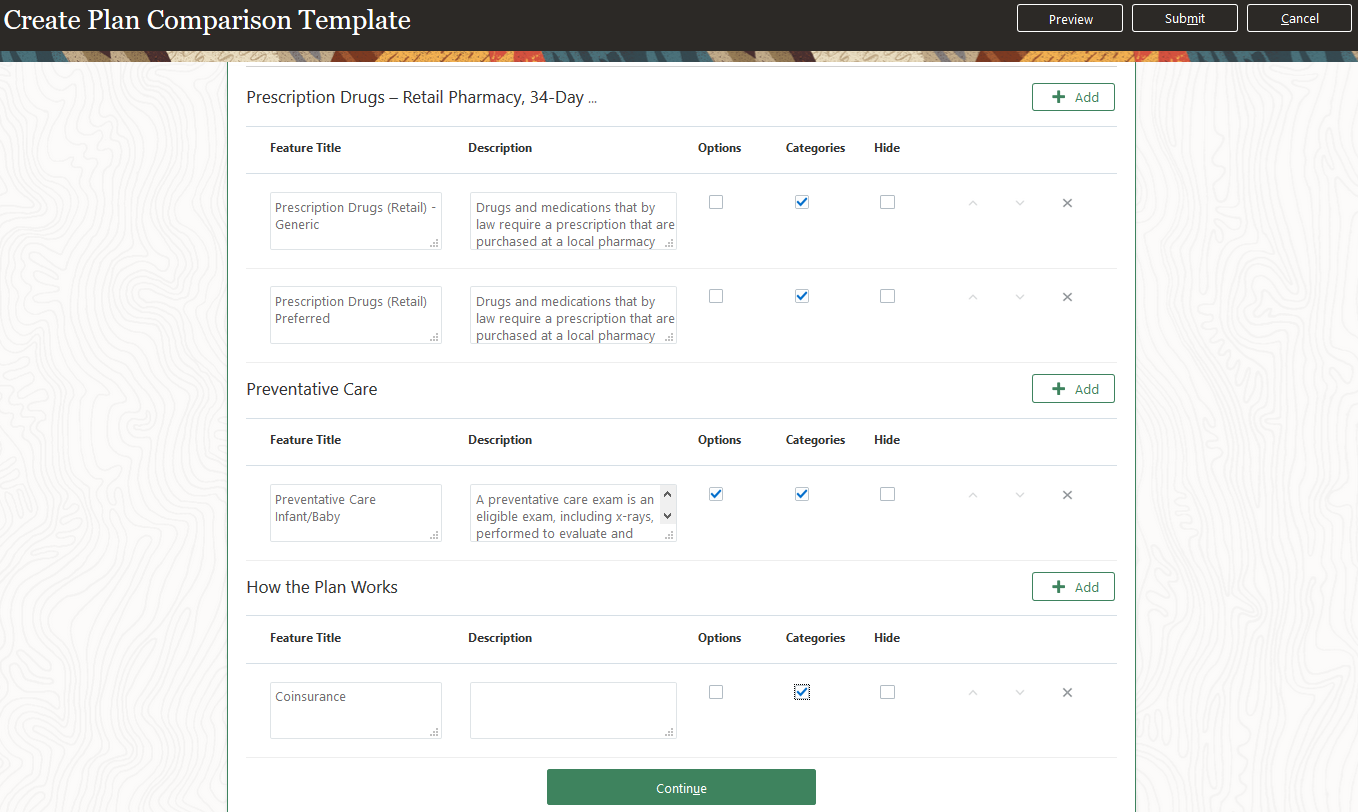

You create a template to compare similar plans, such as your medical plans. In the template, you define and organize a basic comparison structure that participants see when they compare plans. You can showcase the plan highlights, decide their sequence, add and group features, and provide footnotes.

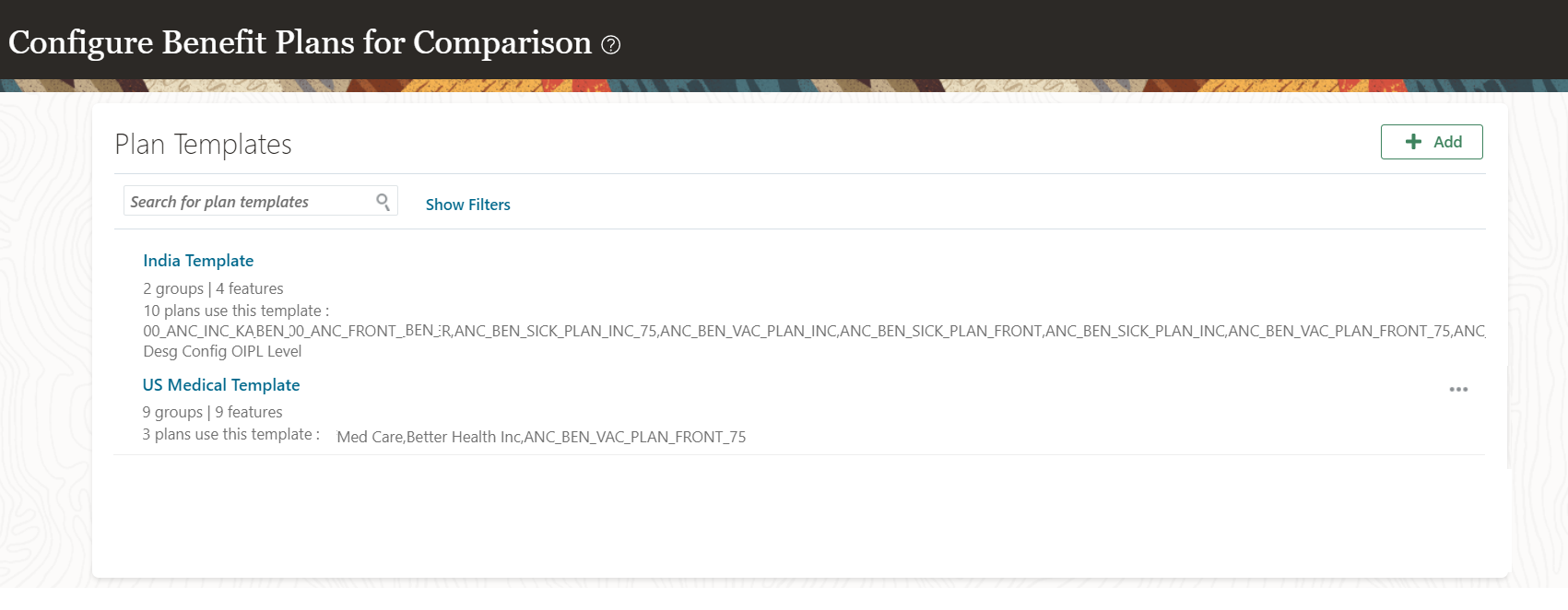

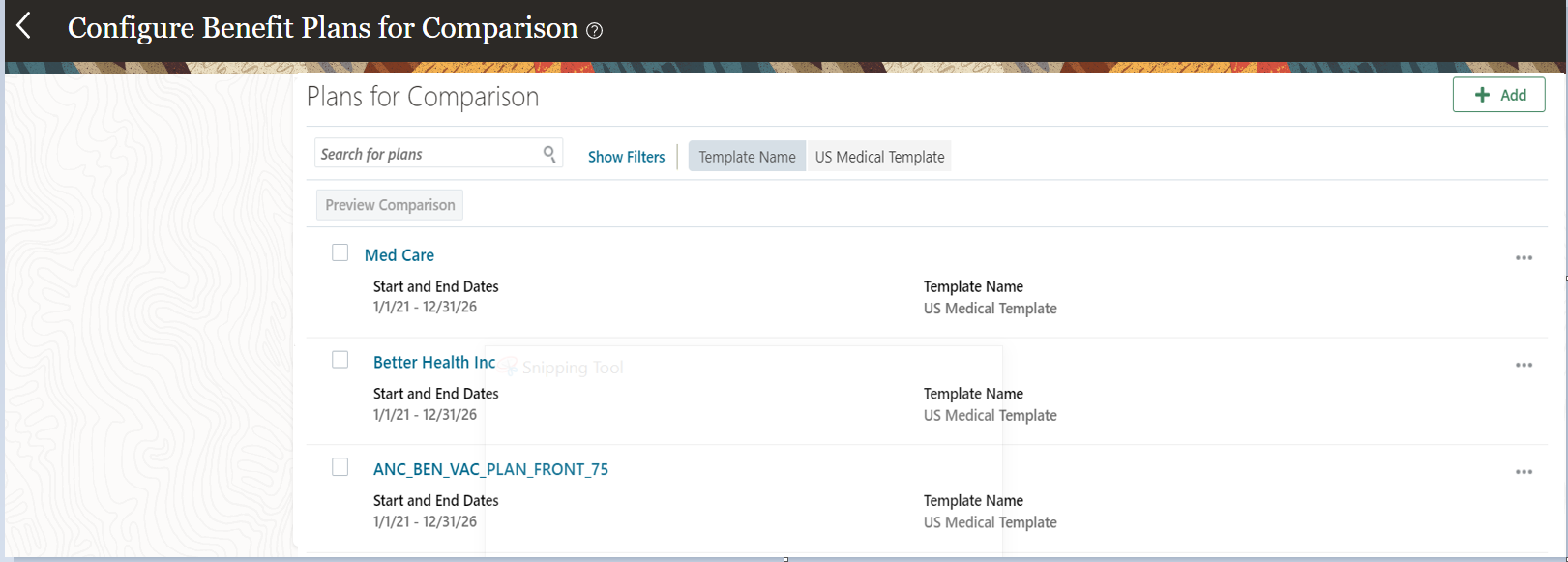

Here’s how the plan templates appear on the Configure Benefit Plans for Comparison page:

Configure Benefit Plans for Comparison Page

Use the Configure Benefit Plans for Comparison task from the Setup and Maintenance work area or from My Client Groups to define the plan comparison template.

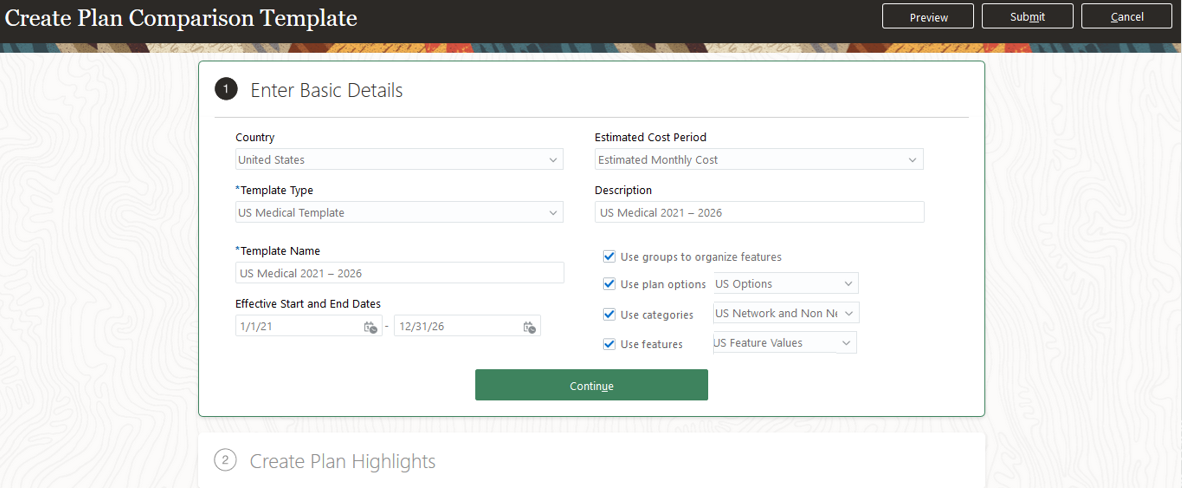

Here’s where you create the template values:

Section Where You Create Template Values

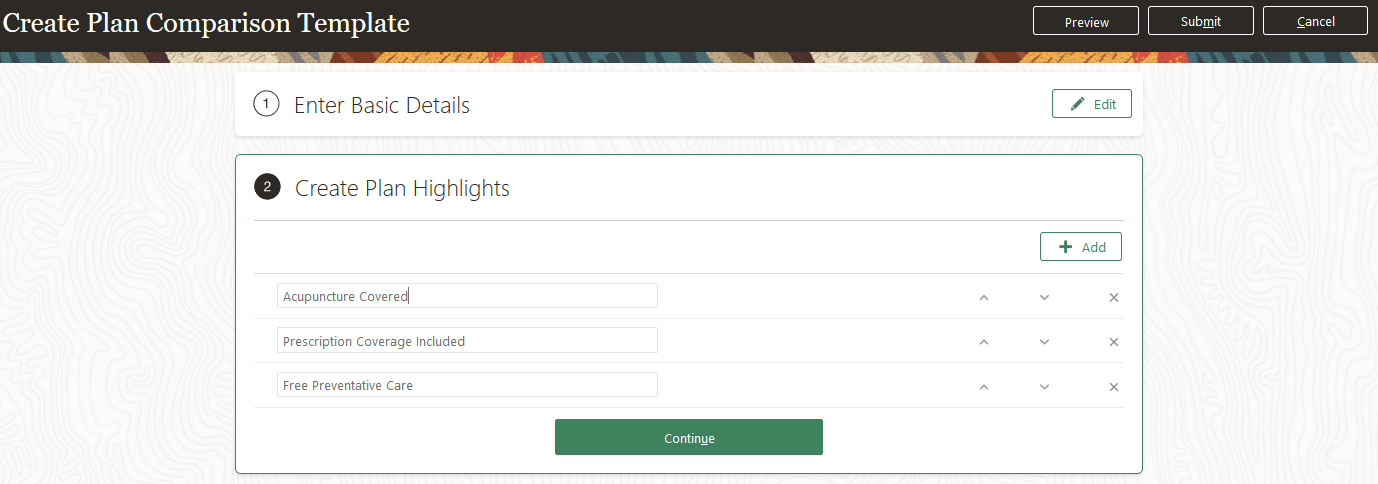

Here’s where you create the highlights:

Section Where You Create Highlights

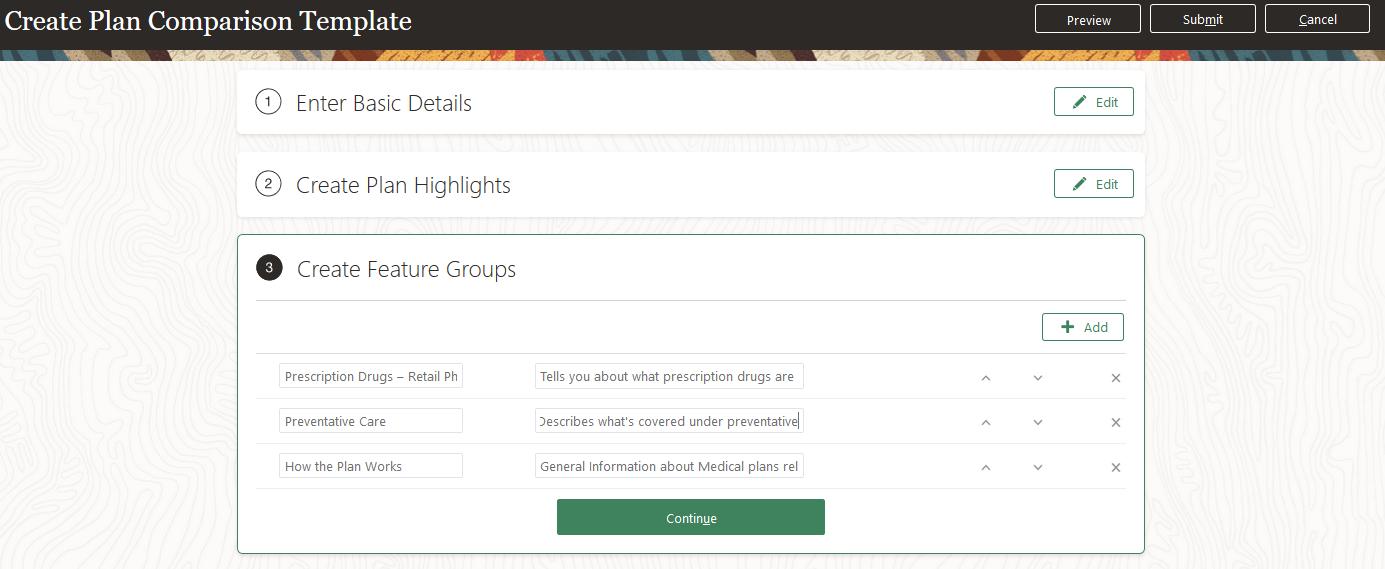

Here’s where you create the feature groups:

Section Where You Create Feature Groups

Here’s where you create the features:

Section Where You Create Features

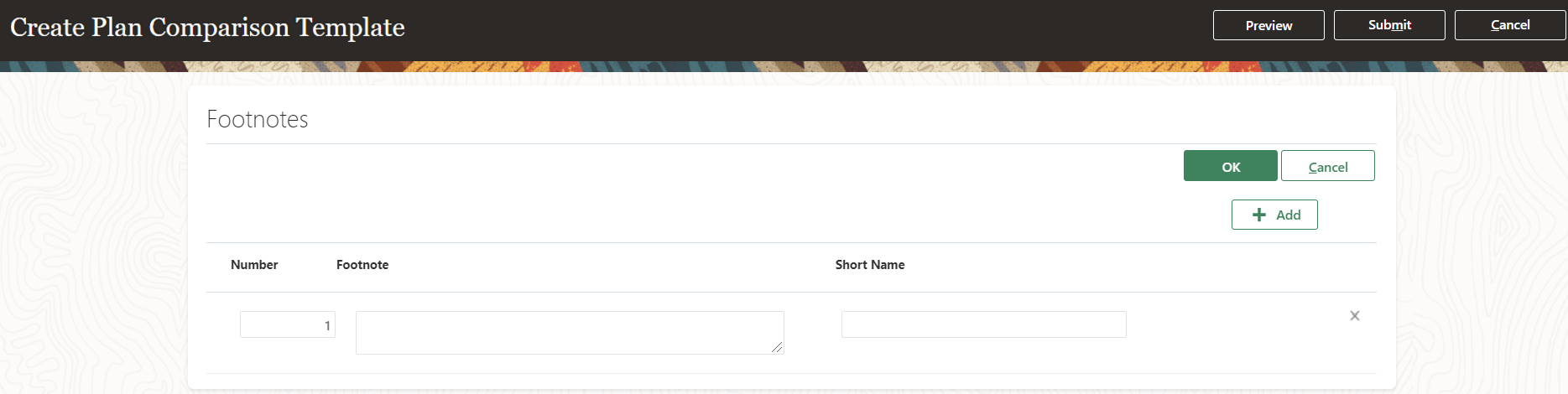

Here’s where you create the footnotes:

Section Where You Create Footnotes

You need to set up these values:

| Value | Details |

|---|---|

| Country |

Select the country for which you want to create the template. |

| Template Type |

Based on the country that you have selected, select the template type that you previously created, for example, US Medical Template type. |

| Estimated Cost Period |

This is the frequency of how you want the estimated cost to display for the participants in plan comparison. For example, if you want your participants to see a monthly representation of the estimated cost, select Estimated Monthly Cost from the drop-down list. If you want to see a new estimated cost in the drop-down list, add it to the extensible lookup. |

| Description |

Enter a description for your template. |

| Template Name |

Give your template a meaningful name, such as US Medical 2021 – 2026. A meaningful name and description that includes the dates will help you identify the template later if you create several templates over the years. |

| Start and End Dates |

Enter Start and End Dates to define the period for which the template is valid. Because the templates won't change that often, we suggest that you create templates that span a number of years, say five years. If there are no significant changes to the templates and you want to continue using them, you can extend the end date of the template. |

| Use groups to organize features |

Select this check box if you want to group features for your participants. |

| Use plan options |

Select this check box if you want to include options when you define plans and enter an amount for each option. |

| Use categories and Use features. |

Select this check box, if you want to include categories and features in plans within a template. |

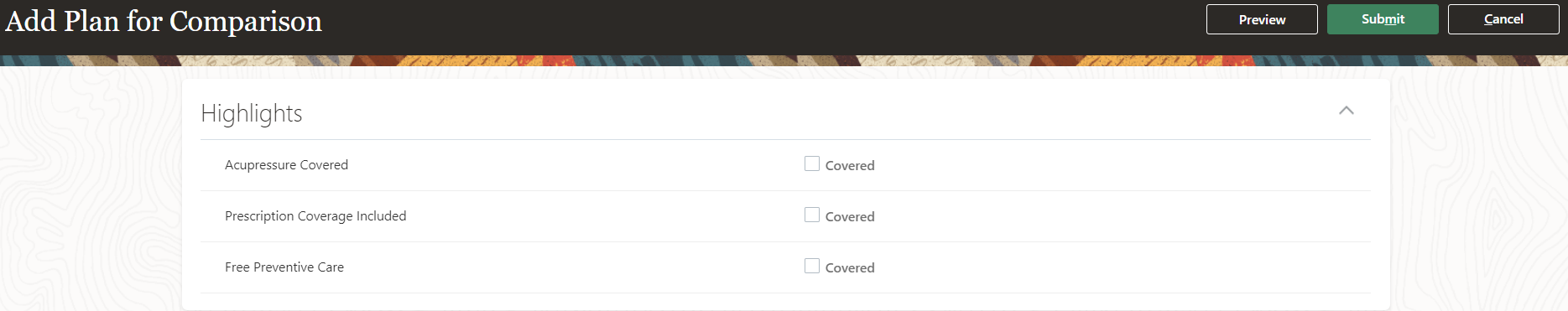

| Highlight |

Create plan highlights, if you have a plan feature that you want to showcase, such as Preventive Health Care. Participants see these highlights first during the comparison. Click the Add button to add more highlights. You can add up to five highlights for a plan. You can reorder the highlights using the Move Up and Move Down arrows. The highlights appear in the same sequence during plan comparison. |

| Feature Groups |

Enter a name and description for the feature group, if you want to group the features for your participants. All features must be included under a group. Ensure that you have selected the Use groups to organize features check box in the Enter Basic Details tab to create the feature group. Participants see the description during plan comparison. Enter a meaningful text, for example, Medical exams to evaluate overall wellness. You can reorder the feature groups using the Move Up and Move Down arrows. The feature groups appear in the same sequence during plan comparison. |

| Feature Title, Description |

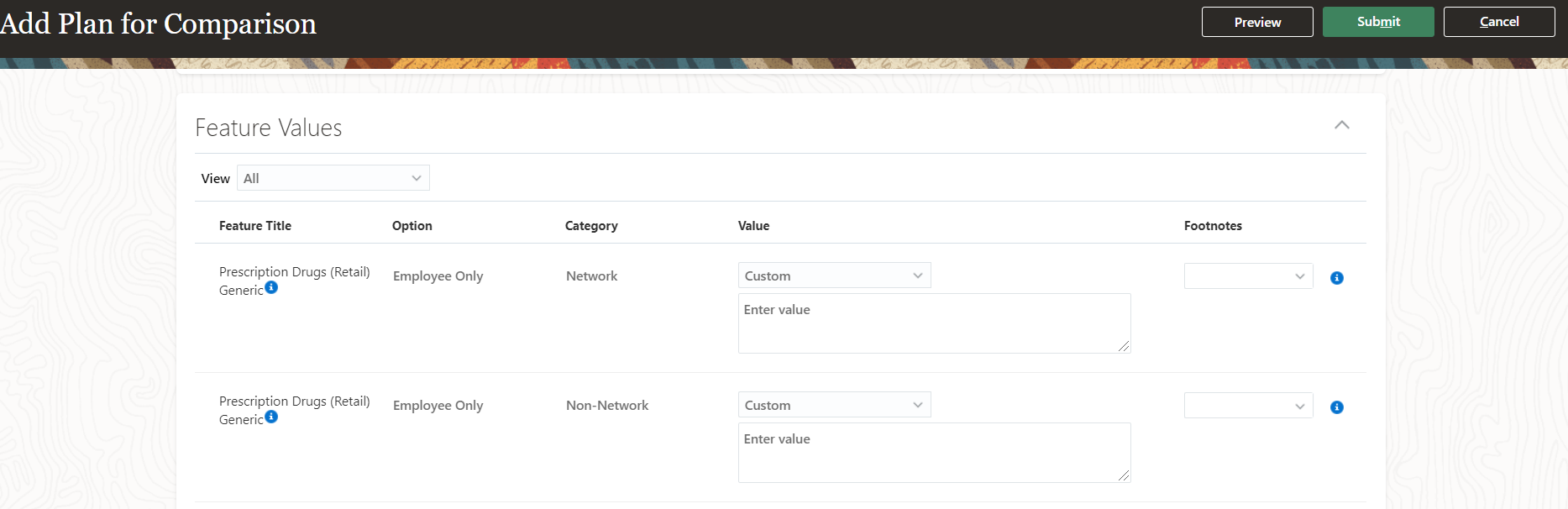

Create the features that your plans offer. The features depend on factors like the type of plans being offered and the country. For example, the typical features for US Medical plans under the grouping Prescription Drugs – Retail are:

The description that you enter appears when participants click Help during the comparison. You can reorder the features using the Move Up and Move Down arrows. The features appear in the same sequence during plan comparison. Also, you can hide a feature if you don’t want to display it during the comparison. |

| Options |

Select the Options check box if you want to display the options at the feature level. For example, if you enter the feature Annual Deductible and select Options, you can enter the values for those options when you create the plans within this template. Here’s how you see options at the feature level:

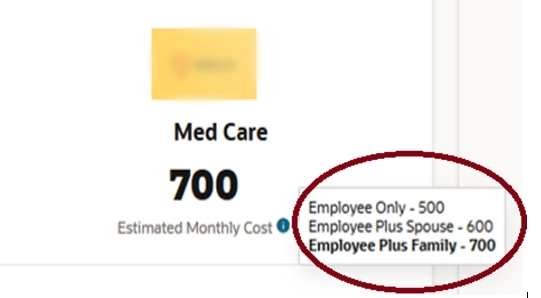

Options at the Feature Level Also, the participants can see the estimated costs for each of the options, such as Employee Only, Employee Plus One, when they compare their plans. You need to enable this at the feature level when you set up the plans for comparison. Here’s how you see estimated costs for each of the options:

Estimated Costs for Each of the Option Ensure that you have selected the Use plan options check box in the Enter Basic Details tab to display the options at the feature level. |

| Categories |

Select the Categories check box if you want to display the categories at the feature level. For example, if you create a feature for Calendar Year Deductible, and select Category, you can enter the values for those categories, such as Network and Non Network, when you create the plans within this template. Ensure that you have selected the Use categories check box in the Enter Basic Details tab to display the categories at the feature level. You can define some features with options and the others with categories. Though this is valid, the definition of the individual feature needs to be the same across your plans for you to compare the plans. For example, the feature Calendar Year Deductible could have the following options:

The feature Coinsurance could have the following options:

But, ensure that those definitions work for all your Calendar Year Deductible and Coinsurance features. |

| Footnotes, Short Name |

Enter footnotes to provide additional information to the participants during plan comparison. For example, you might need a footnote on a particular feature across all plans, or only one plan. Enter a meaningful title and short name for the footnote. You use the short name to link this footnote to the relevant feature when you add a plan. |

Except for the future-dated templates, all other templates that you created appear in the Plan Templates region. You can search for future-dated templates by changing the effective date of your template.

You can now proceed to add plans to the templates.

SET UP PLANS TO COMPARE

You can add relevant plans to the templates and provide plan-specific details. Here’s how the plans appear on the Configure Benefit Plans for Comparison page:

Configure Benefit Plans for Comparison Page

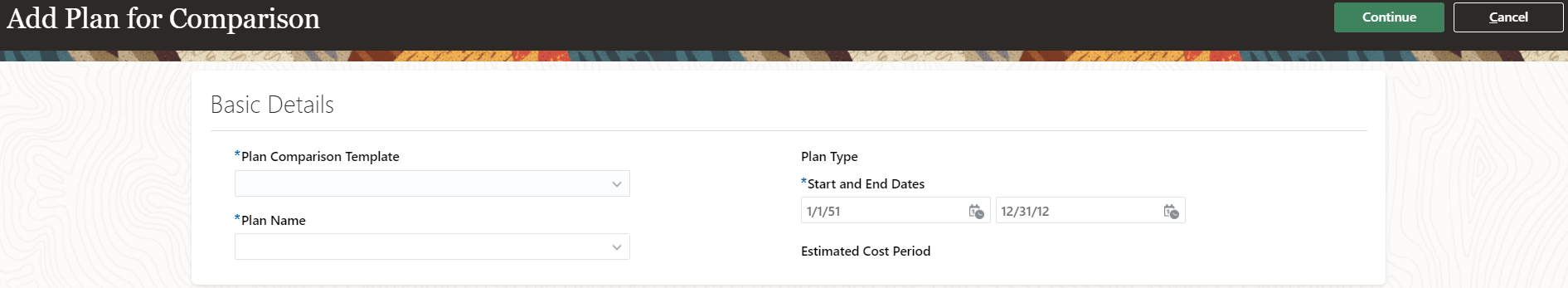

Use the Configure Benefit Plans for Comparison task from the Setup and Maintenance work area or from My Client Groups to define a plan.

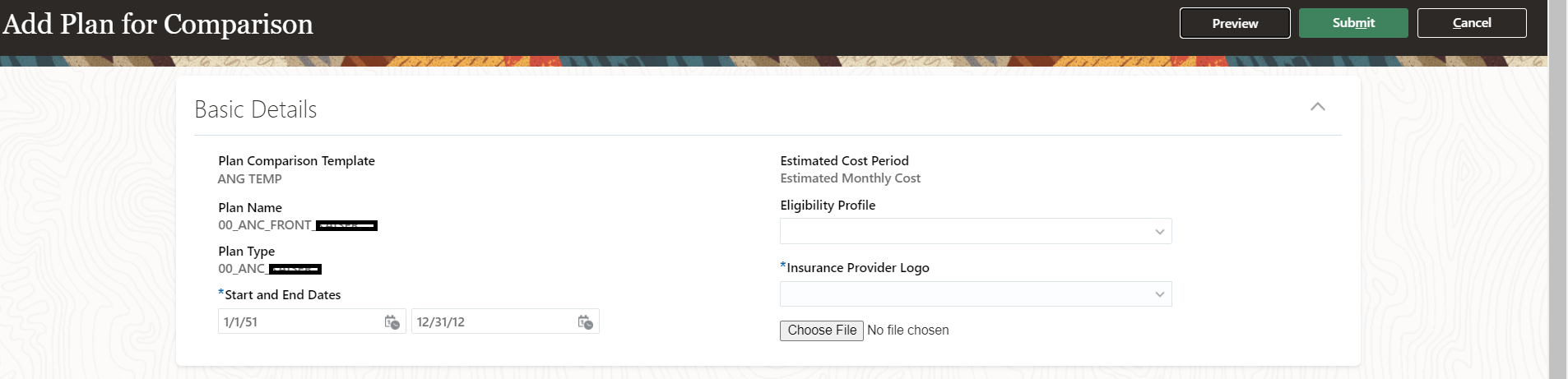

Here’s where you create the plan details:

Section Where You Create Plan Details

Here’s where you define the eligibility and insurance provider details:

Section Where You Enter Insurance Provider Details

Section Where You Enter Insurance Provider Details

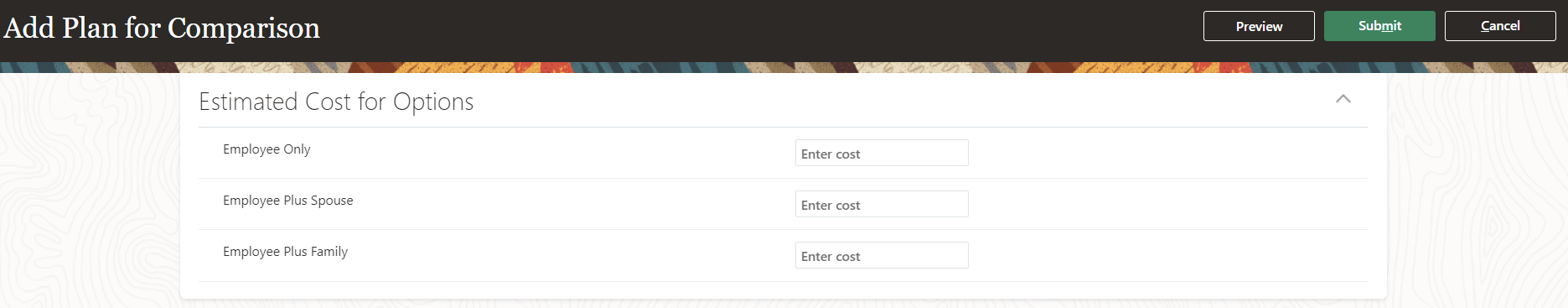

Here’s where you create the estimated cost for options:

Section Where You Enter Estimated Cost for Options

Here’s where you select the highlights:

Section Where You Select Highlights

Here’s where you select the feature values:

Section Where You Select Feature Values

You need to set up these values:

| Value | Details |

|---|---|

| Plan Comparison Template |

Select the template to which you want to add your plans. |

| Plan Name |

Select the name of the plan that you want to add to the template. You can see the list of plans that are available in your regular plan design. The plan type inherits from the plan name you selected. |

| Start and End Dates |

The dates inherit from the template dates. You can change the start and end dates if required. Ensure that the dates are within the template dates. Because the plans won't change that often, we suggest you create plans that span a number of years, say five years. You are creating templates and plans just for comparison. The components like actual rates and eligibility are set up in your plan design. |

| Eligibility Profile |

Select the eligibility profile if you want to use eligibility when the participant compares their plans. |

| Insurance Provider Logo |

Upload a logo of the insurance provider either in .png or in .jpeg format so that the participant can easily identify the provider. If you already have a logo used in your plan, you can select it from the list. |

| Estimated Cost for Options |

Enter the estimated cost for the options in line with the estimated cost period you selected. For example, if you selected Estimated Monthly Cost as the period, you enter monthly values. When you click the Information icon beside the Estimated Cost Value on the plan comparison page, you can see the estimated cost for your options:

Estimated Costs for Each of the Option |

| Highlights |

If the plan covers highlights, select the Covered check box for each highlight. |

| Value |

The feature values you set up and the plan comparison values appear here—select value for each feature. |

| Footnotes |

Select the short name of the footnote to link it with the plan. |

PREVIEW YOUR COMPARISON PLANS

Before you save your entries and selections, click Preview to see how the template looks like. Also, you can select up to 3 plans and click Preview Comparison to see the experience of your participants while comparing the plans.

RUN BENEFITS PLAN COMPARE DIAGNOSTIC TEST

You can use the Benefits Plan Compare Diagnostic test to address issues that may arise while setting up and using the plan comparison feature. The report can help you address issues around plan instance and instance values, definition types and values, and display or removal of unused plan comparison images. Also, to set up quick actions and tiles for your participants, you need to get the template ID using the Benefits Plan Compare Diagnostic test.

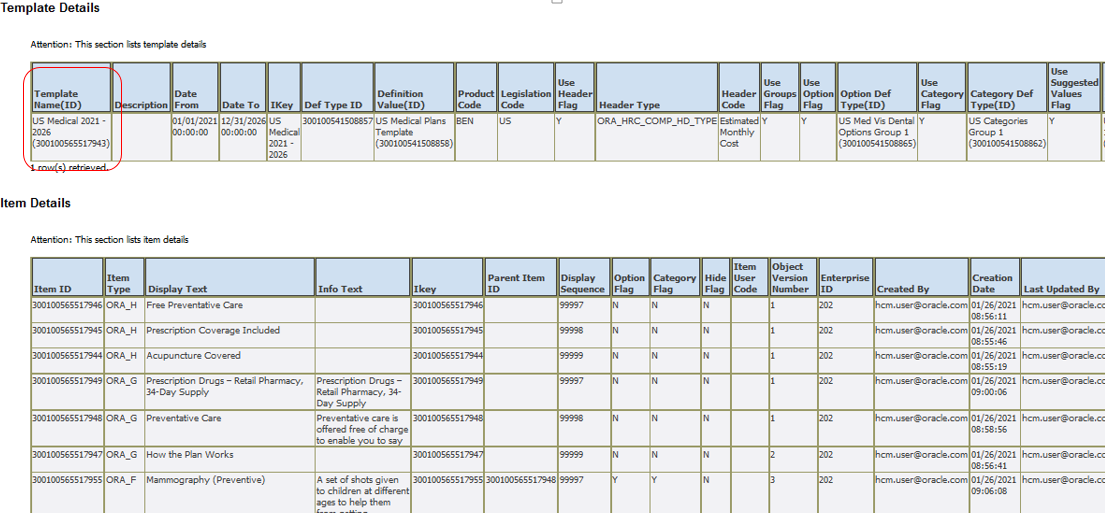

Benefits Plan Compare Diagnostic Test Report

Here's how you run this diagnostic test:

- Click the logged-in user's icon, and click Run Diagnostics Tests in the Troubleshooting section.

- In the Diagnostic Dashboard page, search for Benefits Plan Compare Diagnostic Test, select it, and click Add to Run.

- In the Choose Tests to Run and Supply Inputs section, click the Input Status icon to enter the details. Configure these parameters to run the report:

- Template Name (Required)

- Language Code (Required)

- Plan Name

- Remove Unused Plan Compare Images(Y/N) Default - N

- Remove Orphan Plan Compare Data(Y/N) Default – N

- Click Save and enter Name and Display Name for the test.

- Click OK.

- Click Run in the Choose Tests to Run and Supply Inputs section.

- In the Diagnostic Test Run Status table, click the Refresh button to see the latest status.

- When the execution status reads Complete, click the Report icon to view the report.

SET UP TILES AND QUICK ACTIONS

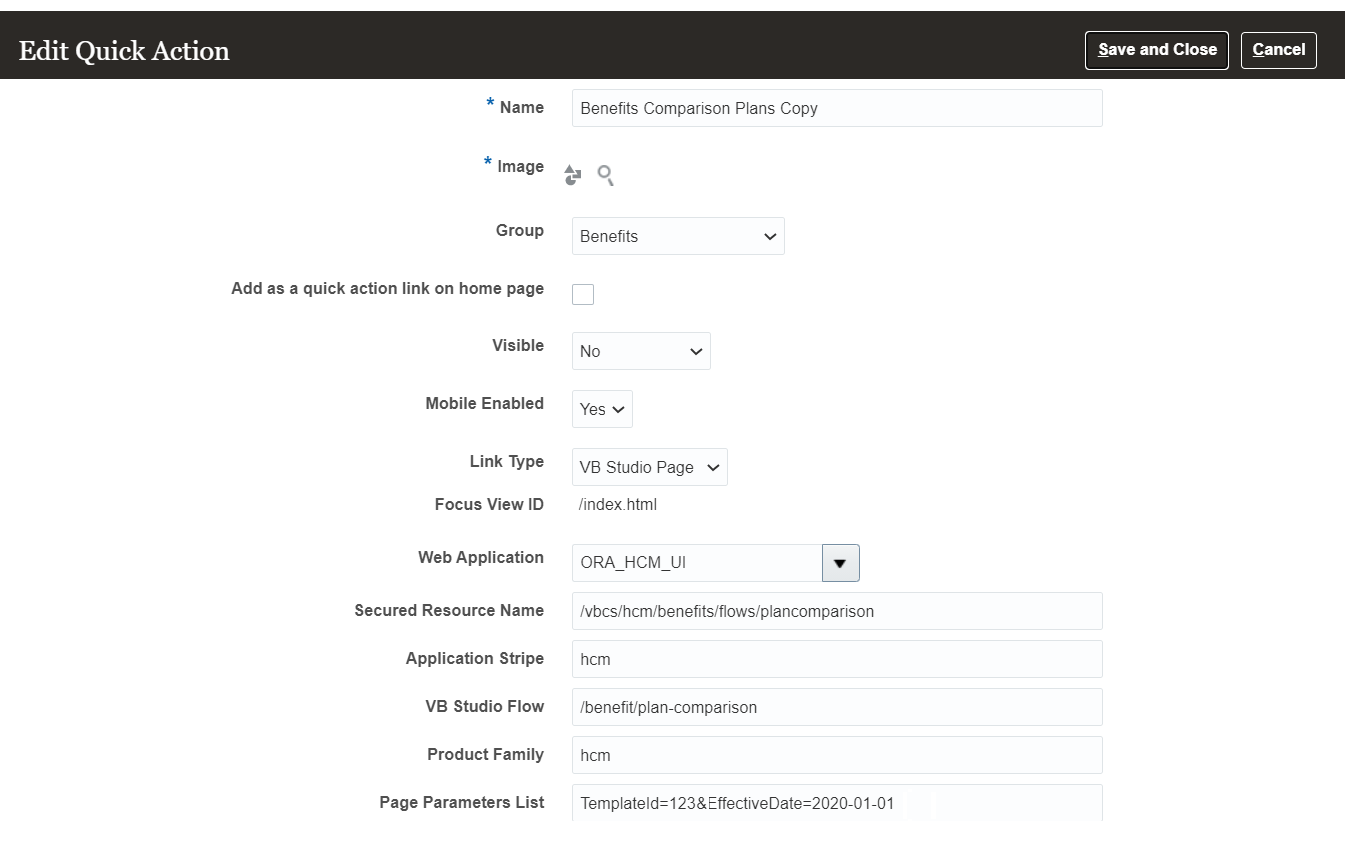

You need to set up quick actions and tiles for each benefit type that you want to provide for plan comparison. This will help participants launch plan comparison from the self-service landing page and from the Home page. For example, if you’ve set up templates and plans for Medical, Dental, and Vision plans, you need to enable 3 tiles. Enabling the tile also enables the quick action to appear on the Home page. There is already a predefined tile. You can use that as a sample to create your own. You need to duplicate it, modify parameter values like template ID, and set the Visible property to Yes.

Set Up Tiles and Quick Actions

Set Up Tiles and Quick Actions

Here’s how you duplicate the sample tile to create more tiles as per your requirement:

- On the Home Page, click Configurations > Structure.

- Create a Sandbox with Structure and Page Composer as tools.

- Launch and enter into the sandbox.

- Navigate to the Structure page, and click Me.

- Select the Quick Actions tab, Benefits.

- Select Benefits Comparison Plan.

- Click Create Duplicate. You need to duplicate the sample action we deliver to create each of the tile and quick action that you require. For example, you may create tiles and quick actions for Medical and Dental plans.

- Enter or change the name of the quick action. For example, enter Medical Plan Comparison. Alternatively, enter something like Medical 2022 if you are also passing the date to enable participants to compare future plans.

- Select Add as a quick action link on home page.

- Change the Visible property to Yes.

- Select Yes for Mobile Enabled.

- Update the TemplateId value in the Page Parameters List with the value that you copied from the Benefits Plan Comparison Diagnostic test report. For example, TemplateId=300100565517943. If you want to display the tile for a specific year, you need to mention the effective date too along with the template ID in the YYYY-MM-DD format. For example, TemplateId=300100565517943&EffectiveDate=2022-01-01.

- Click Save and Close.

- Repeat the steps for each tile and quick action that you want to enable.

NOTE: To remove a tile from Self-Service Benefits, set its Visible property to No.

HOW PARTICIPANTS GET TO ACCESS PLAN COMPARISON USING SELF SERVICE

Here’s how the participants compare different plans:

- Click Me - Benefits on the Home page.

- Select the appropriate tile for plan comparison.

- Select the plans that you want to compare from the Select Plan to Compare drop-down list.

Launch Plan Comparison from Self Service Landing Page

Watch a Setup Demo.

Tips And Considerations

BEST PRACTICES FOR MAINTAINING YOUR PLANS

| Scenario |

Recommendation |

|---|---|

| Your plans change slightly every year. |

You can just update the plan. For example, you can change the cost or add or delete a feature. If the changes are more significant, you can copy the plan and make your changes to the copy. If there are changes like change in provider and the plans are different, you can even create a new template and plans. |

| If you need to maintain the yearly history of the plans shown to the participants and if your plans change slightly every year. |

We suggest that you don’t maintain plan history for ease of maintenance. You can update the existing plans for comparison to keep the maintenance to a minimum. Though the plan history is not maintained, you could add a footnote on plan comparison to let the participants know about the change. However, if needed, you can maintain plan history. |

| What is the significance of when should you update the plans? |

When to make changes to your plans for comparison is important because it has an impact on when your participants can see the new information. For example, you set up your plans for five years, say from 1st January 2021 to 31st December 2026. The data in the plans is the same throughout the whole period. But the details change slightly yearly, such as changes in the estimated cost for the upcoming open enrollment. You want the new estimated cost to be in the plans for your participants to compare on the build-up to the open enrollment in December 2021. You could make the changes in early October 2021 or future-date them to October 2021 for your benefits roll out from October 2021 onwards. If you do this, the old detail is overwritten and the participant sees only the new details for the new enrollment. |

Key Resources

Role Information

- Applications Implementation Consultant

- HCM Application Administrator

- Benefits Administrator

- Employee

If you are using custom roles, you must add the following new privileges:

- To access the new Setup tasks:

-

- Configure Benefit Plans for Comparison: Allows configuration of templates for comparing benefit plans.

- Configure Benefit Plan Comparison Values: Allows configuration of comparison values in benefit plan comparison templates.

- To access the self-service plan comparison tile:

-

- Use REST Service - Benefit Plans Comparison Read-Only: Allows users to call the GET method associated with the benefit plans comparison REST service.

- Use REST Service - Benefit Plans Comparison List of Values: Allows users to call the GET method associated with the benefit plans comparison list of values REST service.

- Compare Benefit Plans: Allows comparison of eligible benefit plans.

OR

-

- Compare All Benefit Plans: Allows all benefit plans to be compared, regardless of whether the user is eligible for the plans.

Use the Benefits Batch Process Diagnostic Test

You can use the new Benefits Batch Process Diagnostic Test report to enable you to resolve problems with submitted batch processes. When batch processes get stuck, become slower, run for longer after setup changes, and encounter unexpected delays in processing, you can use this report to provide the information to Oracle support and development. The information is also useful to determine issues if the outcomes of the batch processes are not as expected, such as the number of people expected in the results of a batch process.

Here's how you run this diagnostic test:

- Click the logged-in user's icon, and click Run Diagnostics Tests in the Troubleshooting section.

- In the Diagnostic Dashboard page, search for Benefits Batch Process Diagnostic Test, select it, and click Add to Run.

- In the Choose Tests to Run and Supply Inputs section, click the Input Status icon to enter the details. Configure these parameters to run the report:

- Request Id

- Compute Statistics (Y/N)

- Click Save and enter Name and Display Name for the test.

- Click OK.

- Click Run in the Choose Tests to Run and Supply Inputs section.

- In the Diagnostic Test Run Status table, click the Refresh button to see the latest status.

- When the execution status reads Complete, click the Report icon to view the report.

Instead of relying on custom SQL queries, you can run the Benefits Batch Process Diagnostic Test report to provide required information to Oracle support and development to help resolve problems. This in turn will reduce the turnaround time resolving customer-reported issues.

Steps to Enable

You don't need to do anything to enable this feature.

Use the Person Benefits Eligibility Test Diagnostic Report

You can use the new Person Benefits Eligibility Test diagnostic report to show eligibility results. You can run this report for a person for a program. The report helps determine if people are eligible for certain plans. It can tell you, for an individual, which eligibility profile caused the worker to be Ineligible. You can use this report to identify if the profile was optional, required, or whether the criteria within the profile caused ineligibility.

Here's how you run this diagnostic test:

- Click the logged-in user's icon, and click Run Diagnostics Tests in the Troubleshooting section.

- In the Diagnostic Dashboard page, search for Person Benefits Eligibility Test, select it, and click Add to Run.

- In the Choose Tests to Run and Supply Inputs section, click the Input Status icon to enter the details. Configure these parameters to run the report:

- Effective Date

- Person Number

- Program Name

- Click Save and enter Name and Display Name for the test.

- Click OK.

- Click Run in the Choose Tests to Run and Supply Inputs section.

- In the Diagnostic Test Run Status table, click the Refresh button to see the latest status.

- When the execution status reads Complete, click the Report icon to view the report.

This report evaluates the eligibility of persons and provides the results in a structured manner. Based on the report, you can decide if the eligibility profile should be changed or not.

Steps to Enable

You don't need to do anything to enable this feature.

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

Client List of Values for Plan and Option in Individual Compensation Introduction

You can now get relevant plan and option suggestions as you start typing in the fields with choice lists. For example, you want to add the US Flexible Benefit Plan, so you type US. The list of values dynamically updates to show the plans with names that contain the characters you’re typing.

Individual Compensation Page Showing the Plan Field Choice List Values That Contain the Typed Characters

Individual Compensation Page Showing the Option Field Choice List Values That Contain the Typed Characters

With this new feature, you can improve people's productivity by letting them more quickly locate the appropriate plan and option.

Steps to Enable

Make the feature accessible by assigning or updating privileges and/or job roles. Details are provided in the Role section below.

Tips And Considerations

You see the client list of values behavior in actions, such as Manage Personal Contribution, Individual Compensation, and Administer Individual Compensation. You also see them in HR and Recruiting actions that include the Individual Compensation section, such as Hire, Promote, Transfer, and Create Job Offer.

Role Information

If you use custom roles for individuals, managers, and HR specialists who work with individual compensation, make sure the roles inherit the Use REST Service - Individual Compensation Lists of Values (CMP_REST_SERVICE_ACCESS_INDIVIDUAL_COMPENSATION_LOV) function privilege. This privilege is already inherited by these bundled roles: Compensation Specialist, Compensation Manager, Use REST Service - Job Offers, Recruiter, Contingent Worker, Employee, Line Manager, Human Resource Analyst, and Human Resource Specialist.

Because this is a new privilege, run the Import User and Role Application Security Data process to see the privilege in the security console. You need to run the process at least once to pick up new privileges.

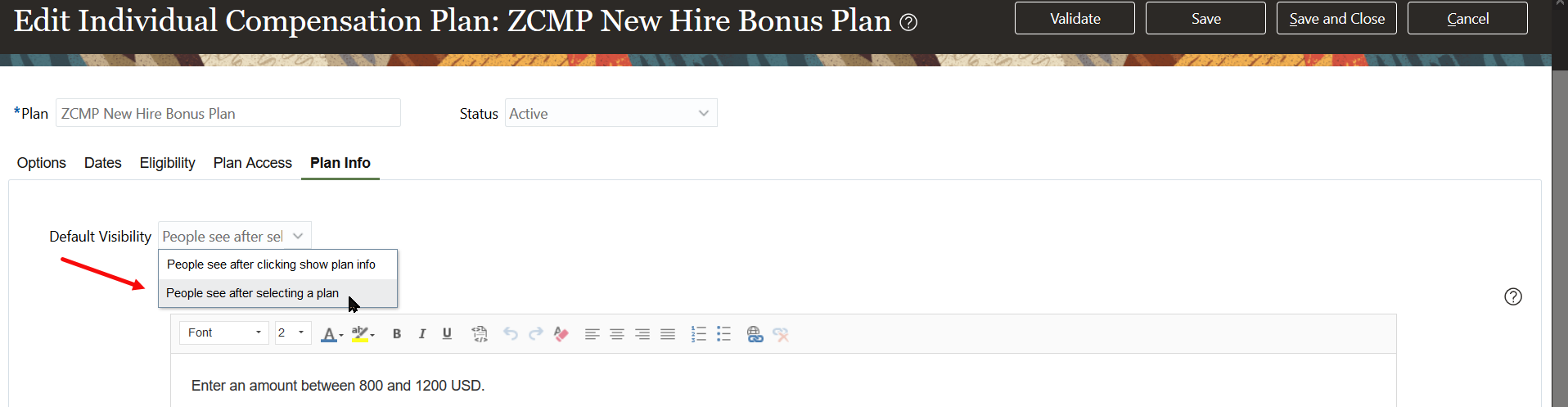

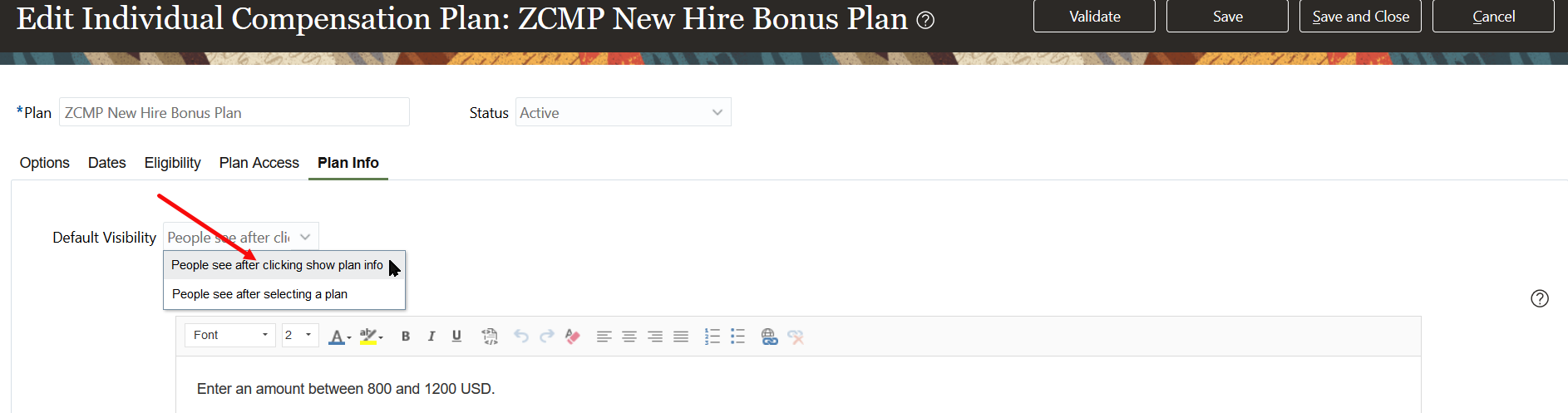

Visibility of Plan Info Introduction

You can now specify whether to show or hide individual compensation plan information, by default. People making individual compensation plan submissions or contributions can then hide or show the information as they want. The standard default setting hides the information.

Plan Info That Appeared Immediately After You Selected a Plan

Plan Info Didn't Appear After You Selected a Plan

Improve productivity by immediately showing people important information.

Steps to Enable

When you're configuring the plan info for individual compensation plans, set the default visibility.

Option That Lets People See Plan Info Immediately After Selecting a Plan

Option That Lets People See Plan Info After Selecting a Plan and Clicking Show Plan Info

Prevent New Individual Compensation Submission when Previous Submissions are Pending Approval

Keep people from starting new individual compensation submissions when another submission using the same action is pending approval. Examples of these submission actions are Manage Personal Contribution, Individual Compensation, and Administer Individual Compensation.

Before, when a personal contribution was pending approval, you couldn’t start individual compensation or administer individual compensation submissions. Similarly, when an individual compensation submission was pending approval, you couldn’t start personal contributions or administer individual compensation submissions.

Now, you can start a personal contribution after all other submitted contributions are approved. You don't have to wait on any individual compensation or administer individual compensation submissions that are pending approval. You can start an individual compensation submission after all other individual compensation submissions are approved. You don't have to wait on any administer individual compensation or personal contributions submissions that are pending approval. And, you can start an administer individual compensation submission after all other administer submissions are approved. You don't have to wait on any individual compensation or personal contributions submissions that are pending approval.

Increase compensation administration efficiencies and improve employee satisfaction.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

People can still submit a personal contribution even though another personal contribution is pending, when you enable the CMP_DISABLE_PENDING_APPROVALS_CHECK_IN_MANAGE_CONTRIBUTION profile option.

Key Resources

- For more information about submitting additional personal contributions when others are pending approval, see the 19C feature New Personal Contribution Submission While an Existing Contribution is Pending Approval.

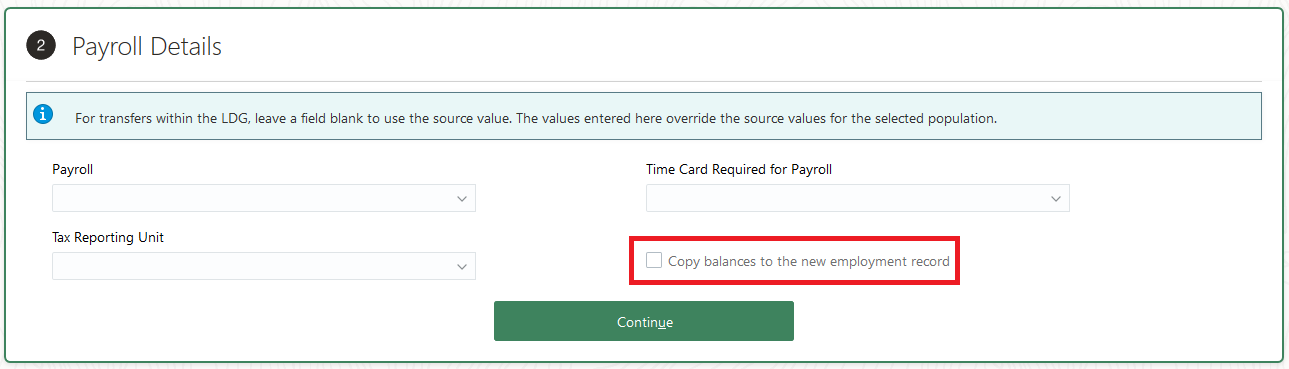

Future Salary Updates Move During Legal Employer Change Introduction

You can now move future salary updates when you're changing someone's legal employer and both the source and destination employers have the same legislative data group. You can automatically copy future salary from the source to destination assignment for people who have these types of salary basis:

- Amount determined by user

- Amount determined by incremental components

- Amount determined by standard components

When you use the responsive Local and Global Transfer action, a batch process copies the future salary rows after final approval of the transfer. You can see any issues that the process found on the Change Legal Employer dashboard.

Compensation Page Showing Past, Current, and Future Salaries for the Source Legal Employer

Compensation Page after Global Transfer, Showing Current and Future Salaries Copied to the Destination Legal Employer

With this new feature, you can improve productivity by avoiding redundancy and duplicate effort in recreating the future salary for the new legal employer.

Steps to Enable

By default, the profile option isn't enabled, which means the future assignment and salary updates won't move to the new assignment during a legal employer change. To move the future assignment to the new assignment, you need to enable the profile option.

| Field | Value |

|---|---|

| Profile Option Code | ORA_PER_CLE_COPY_FUT_ASG |

- In the Setup and Maintenance work area, on the Tasks panel tab, click Search.

- On the Search page, search for and click the Manage Administrator Profile Values task.

- On the Manage Administrator Profile Values page, search for and select the ORA_PER_CLE_COPY_FUT_ASG profile option code.

- In the Profile Values section, Profile Value field, enter Y.

- Click Save and Close.

Tips And Considerations

- This feature is available in the responsive version of Local and Global Transfer and Mass Legal Employer Change flows.

- Future salary updates are salary changes on the source assignment that have a start date after the change legal employer effective date.

- The future salary updates copy to the destination assignment in the chronological order of the effective date of those updates on the source assignment.

- Future salary updates don't copy to the destination assignment from the point the copy process encounters an error.

- The Change Legal Employer dashboard has all of the confirmation and error messages from the copy future salaries process.

- If you're using the responsive Local and Global Transfer flow, you need to visit the salary section so that the person's current salary is copied. Then, depending on the profile option, the future salary is also copied.

- If someone edits the current salary record while they're using the responsive Local and Global Transfer action to change the legal employer, the future salary rows are still copied with the same values as on the source assignment. In certain scenarios, such as when the future salary is of standard or incremental components type, it can also impact future component values copied later. Be sure to review those future salary records and fix as required.

-

The current salary is copied to the destination assignment and the proposer can immediately review and edit the salary, as needed. But any future salary is copied by a background process after the action is approved. Supported salary basis types vary for current and future salary.

Supported Salary Basis Types for Copying Current Salary

Supported Salary Basis Types for Copying Future Salary

- Amount determined by user

- Amount determined by incremental components, with setting: Enable component selection during allocation

- Amount determined by rates (advanced)

- Amount determined by simple components (standard)

- Amount determined by user

- Amount determined by incremental components

- Amount determined by simple components (standard)

- When current salary is of an unsupported type, future salaries of any type won't be copied.

Key Resources

For more information about moving future salary updates while changing the legal employer, see the following resources:

- Changing a Worker's Legal Employer in HCM Cloud (My Oracle Support document ID 2649381.1)

- The Local and Global Transfer topic in Chapter 9 of the Using Global Human Resources guide on Oracle Help Center

- Move Future Assignment Updates During Legal Employer Change feature in the 21A What's New for HCM Global Human Resources

Compensation Zone Type, Zone Identification for a Past or Future Date Introduction

You can now identify the compensation zone type or zone for a specific date in the past, current, or future. Earlier, both the salary pages and processes were identifying zone type and zone as of the system date. Now you can use the differential rules and calculations applicable for the duration of salary. The Generate Compensation Zone and Address Mapping process was also enhanced to identify zone type and zones as of the applicable past, current, or future dates.

Let's look at a scenario where a person remains in the same location, but the corresponding zone changes over time.

Employment Info Shows the Person Has Been working from a California Location Since January 1, 2011

Zone Setup Page Showing the State of California Linked with Different Zones for Different Periods

Salary Basis Configuration That Indicates Different Differential Factors Per Zone

For the California location, Zone 1 Shows Up for the Past Period with a Differential of 1.1

The Same Location Shows Zone 2 for the Current Period with a Differential of 1.2

The Same Location Shows Zone 3 for a Future Period with a Differential of 1.3

Provide accurate reporting of compensation zone type and zone.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information about the new compensation zones, see "Salary Range Differentials and Compensation Zones" (Document ID 2605772.1)

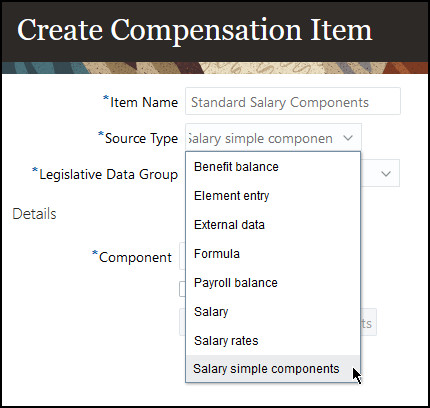

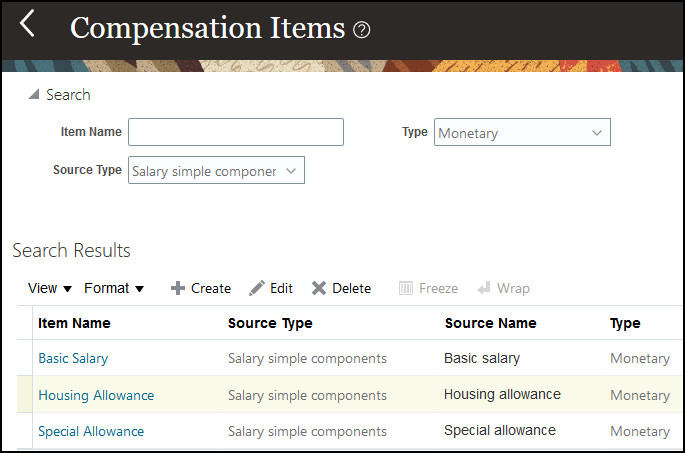

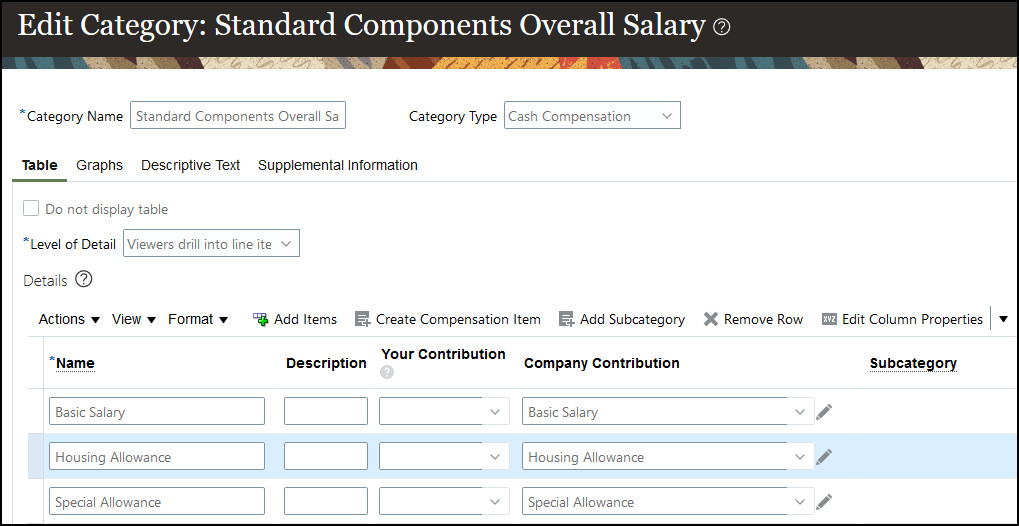

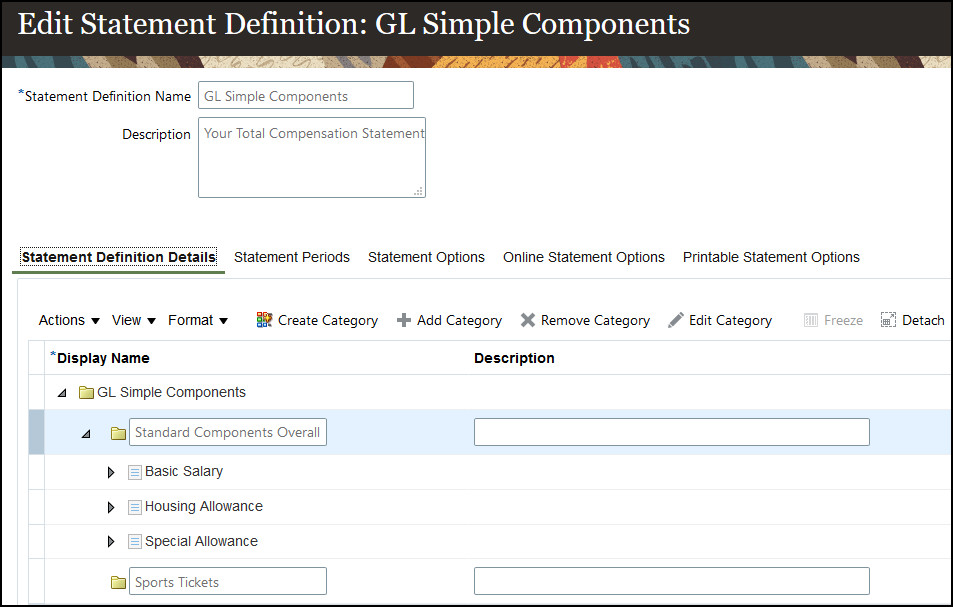

Standard Salary Components User Entities Introduction

You can now define HCM Extracts and fast formulas that make use of these new user entities, which can return salary standard components allocation data:

- ORA_CMP_ASSIGNMENT_SALARY_SIMPLE_COMPONENT_UE

- ORA_CMP_ASSIGNMENT_SALARY_SIMPLE_COMPONENT_RGE_UE

Improve productivity by efficiently extracting salary component data and creating relevant fast formula calculations.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information about standard salary components, see Standard Components Salary Basis Introduction (My Oracle Support document ID 2717145.1)

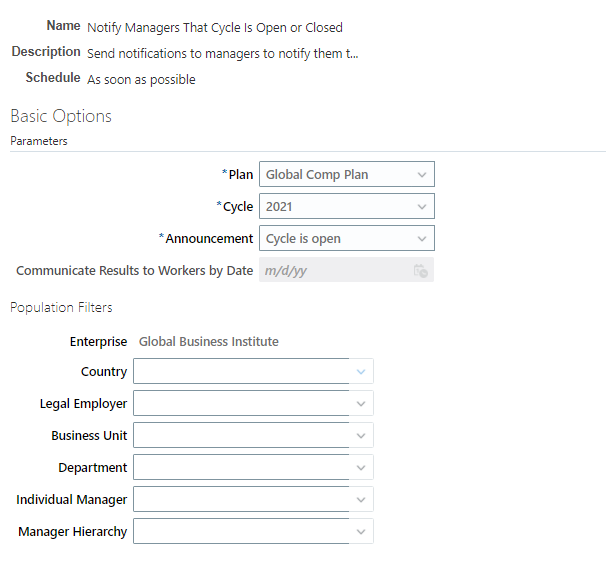

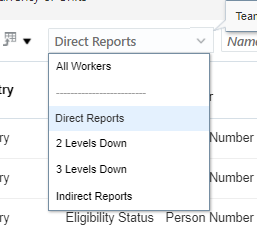

Use Population Filters to Submit Workforce Compensation Cycle Notifications

You can now submit the Notify Managers That Cycle Is Open or Closed batch process using a population filter. The filter lets you notify specific groups of managers that the workforce compensation cycle is open or closed. Previously, you couldn't specify the managers to notify. Here are the newly added population filters:

- Country

- Legal Employer

- Business Unit

- Department

- Individual Manager

- Manager Hierarchy

Parameters for the Notify Managers That Cycle Is Open or Closed Process

Improve productivity and satisfaction by notifying only affected managers when the compensation cycle opens or closes.

Steps to Enable

You don't need to do anything to enable this feature.

View Note Count In Approvals Task

You can now view the number of notes created for a person in the Approvals task type. Previously, this information was not available.

Visible Note Count In Worker Details In Approvals Task

Allows people to see that there are notes created for a person in the Approvals task.

Steps to Enable

You don't need to do anything to enable this feature.

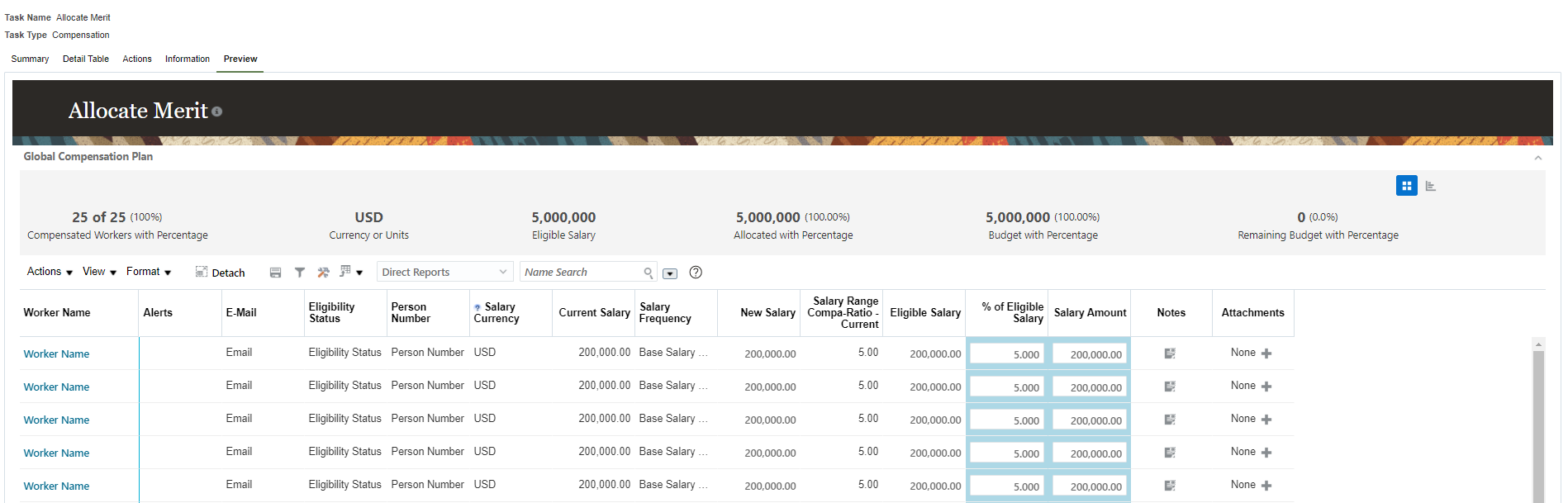

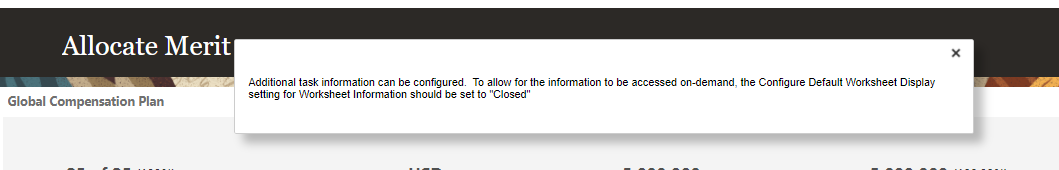

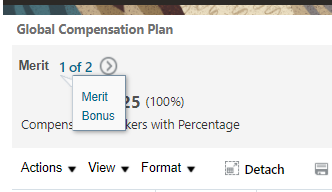

Preview Worksheet Task Configuration

You can now preview the worksheet task configuration for the following task types:

- Compensation

- Detail table only

- Performance

- Promotion

Previously, you had to run the Start Workforce Compensation Cycle batch process to view this configuration. In the task setup in Configure Worksheet Display, there is a new tab to the right of the Information configuration tab.

New Worksheet Configuration Preview

PAGE-LEVEL DATA

View the task name and, if configured in the information tab, the task instructions.

Task Name and Instructions Icon

You can select the instructions icon and show the configured text.

Configured Task Instructions or Information

SUMMARY DATA

All the properties, such as display name, default sequence, and others, that are configured in the summary tab are displayed in the preview tab. You can also navigate between the configured summary view options. Component names in the summary appear as configured.

Component Preview

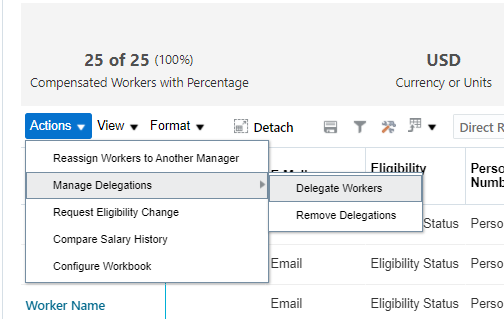

TOOLBAR - ACTIONS MENU

You can view the configured Actions menu items. The actions are for information only and not actionable. For example, you can see the Manage Delegations action when enabled but you can't perform the actions.

Actions Preview

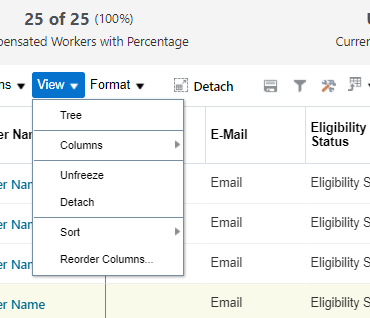

TOOLBAR -VIEW MENU

If a column is initially hidden, you can enable it to see in preview.

View Menu Preview

You can switch between Tree and List view. In this example, when you select the Tree view, the page shows 3 managers with 4 workers beneath one manager.

Tree Preview

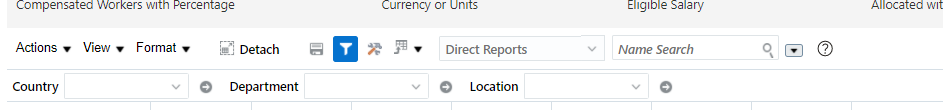

TOOLBAR - OTHER

You can detach the table from the preview page to get a fuller view of the configuration. The first 4 filters enabled appear in the filter toolbar, however the values in the filters don't appear in the preview. The Start Workforce Compensation Cycle batch process must be run to populate the worksheet data and use the filters.

Filter Preview

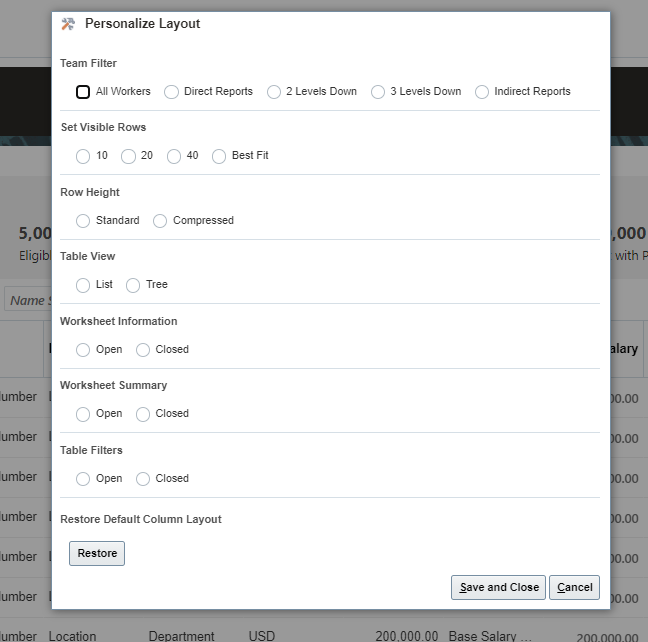

You can view the configured options in Personalize Layout.

Personalize Layout Preview

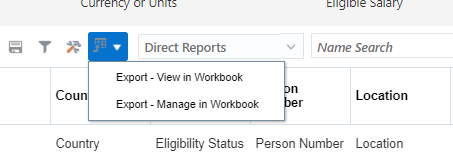

You can see the configured export worksheet options.

Worksheet Export Preview

You can view the configured options to let managers to switch between populations.

Population Switcher Preview

This example shows the configured search options.

Search Options Preview

WORKSHEET DATA

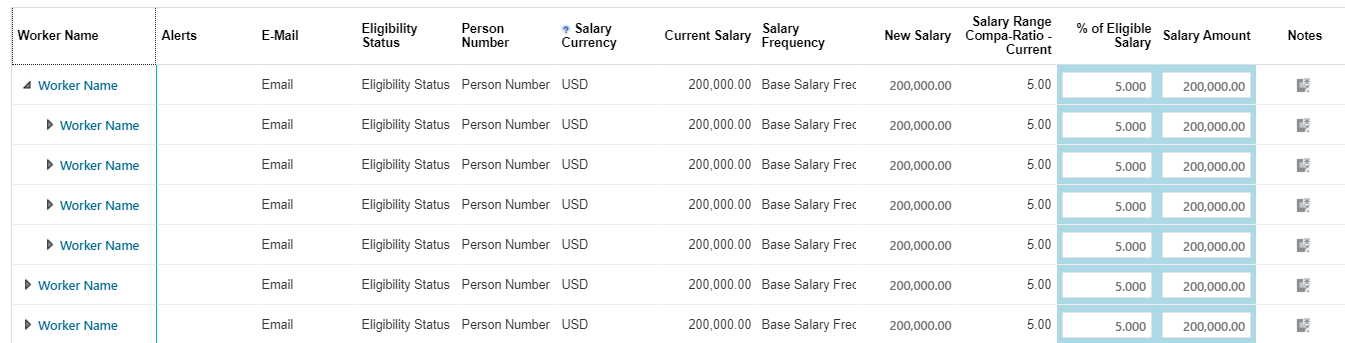

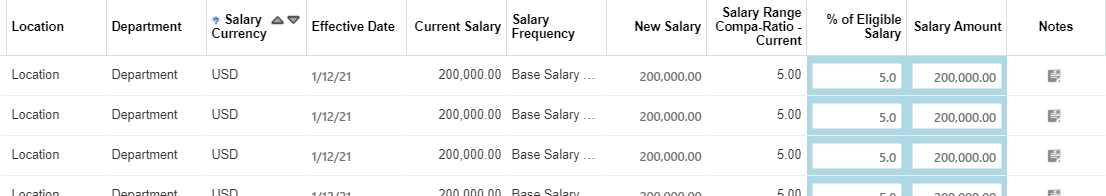

The preview doesn't show any actual data. The numbers, text, dates displayed are fixed, and the same column values appear for all the worksheet rows.

- Text columns display the column header name, not the user-defined display name.

- Numeric columns, numbers such as 200000, 5, 25, 100, etc. are shown. You are able to see the configured decimals to display. In the example below, the % of Eligible Salary columns shows with 1 decimal. The Salary Amount and Current Salary show with 2 decimals.

- Date columns show the current date.

- The currency columns in both the summary and detail table show the corporate currency.

- Columns, such as Individual Worker Display, that have a link enabled are shown with the link but the link doesn't redirect to any page or perform any action.

- List of value/choice-list type fields show a blank list.

- The Alerts column and summary analytic doesn't show any alerts.

- Any column shading and user-defined help appears in the preview.

- Icon columns are displayed, but you can't select them.

- Sort icons are displayed, but you can't select them.

- You can view the Assignment Segment configuration.

Worksheet Data Preview

You can preview the configured right-click menu items.

Right-Click Menu Preview

Allows administrators to quickly update and view configuration without leaving the Compensation Administration work area.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Changes you make in Preview aren't reflected in the worksheet. You need to make the changes in the corresponding setup tab.

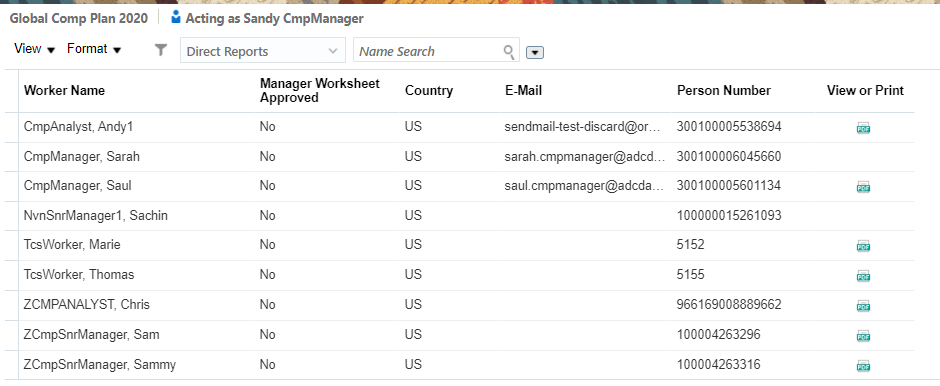

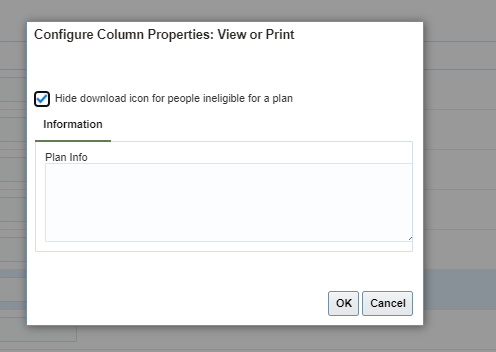

Hide The Print Icon In the Communications Task Type

You can now hide the print icon for people who aren't eligible for the plan in the in the Communications task type.

Communications Task With Plan Ineligible People

There is a new check box in the properties of the View or Print column in the Communications task called "Hide download icon for people ineligible for a plan".

New Setup Property

This feature helps to reduce confusion for managers when they generate individual statements.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

If you use the statement delivery method of "Printed and delivered by managers" and select to generate statements for a population that includes ineligible people, a statement is created for those people unless you include eligibility criteria in the statement template.

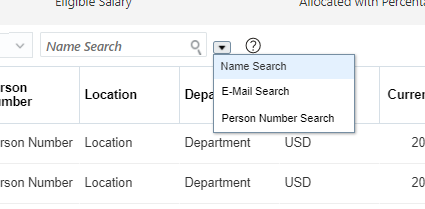

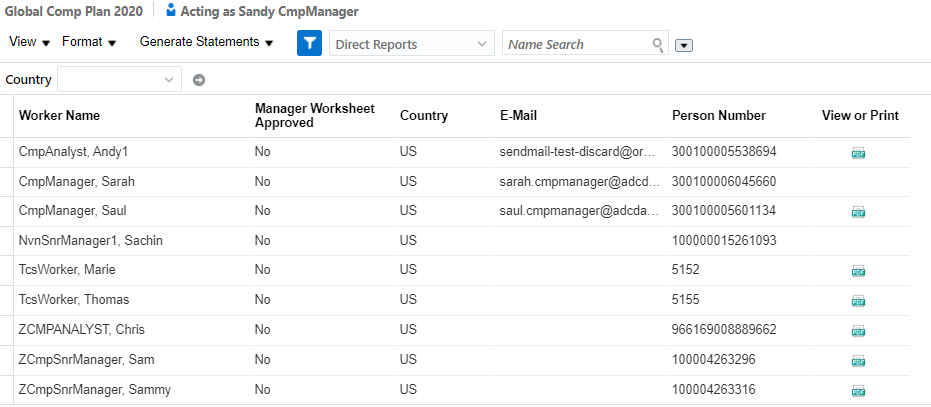

You can now view people in the Communications task in a list rather than the previous tree view. Also, you now have the ability to switch populations, use filters, and search using name, email or person number.

New Communications Task View

Managers can search for specific people and generate statements for the same more easily.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

As with the Compensation task, the corresponding column must be enabled to use filters and search options.

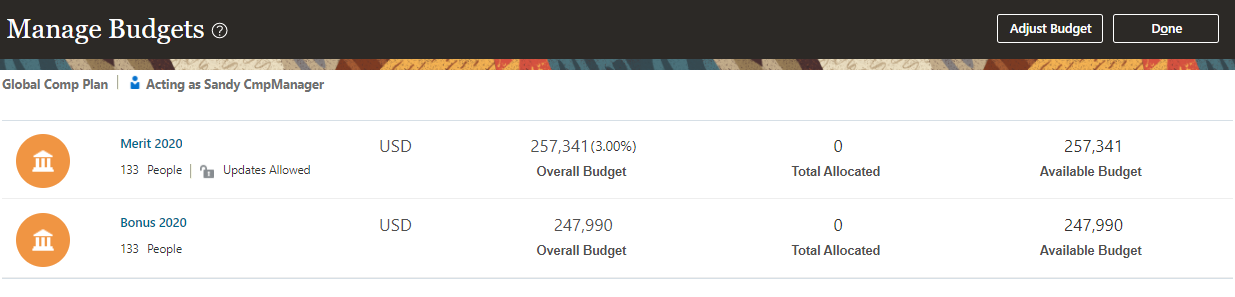

Configure Budget Pool Overview

You can now configure the budget overview for each budget pool in a Workforce Compensation plan. Previously, you had to use personalizations to hide or change the view. In the example below, you can see that the workers label is renamed to "People" for both budget pools. The percentage and access level is hidden for the Bonus budget pool.

Budget Pool Overview

To support this feature, we added a new configuration tab in Configure Budget Display.

Configure Budget Pool Overview

You can change the following labels:

- Workers

- Overall Budget

- Total Allocated

- Available Budget

You can enable and disable the following labels:

- Workers

- Budget Access Level

- Units

- Overall Budget

- Budget Percent

- Budget Value

- Total Allocated

- Available Budget

This allows administrators to tailor the information displayed for a budget pool and reduce manager confusion.

Steps to Enable

You don't need to do anything to enable this feature.

You can now enable both summary views in the budget sheet and let managers toggle between the views. Previously, you could enable only one view. Here, you can see that both summary views are enabled.

Summary Icons

To use this feature, you need to enable the summary view that isn't currently in use since previously you could select only one view as the default.

Provide managers better insight into their budget numbers by letting them view summary data the way that works best for them.

Steps to Enable

You don't need to do anything to enable this feature.

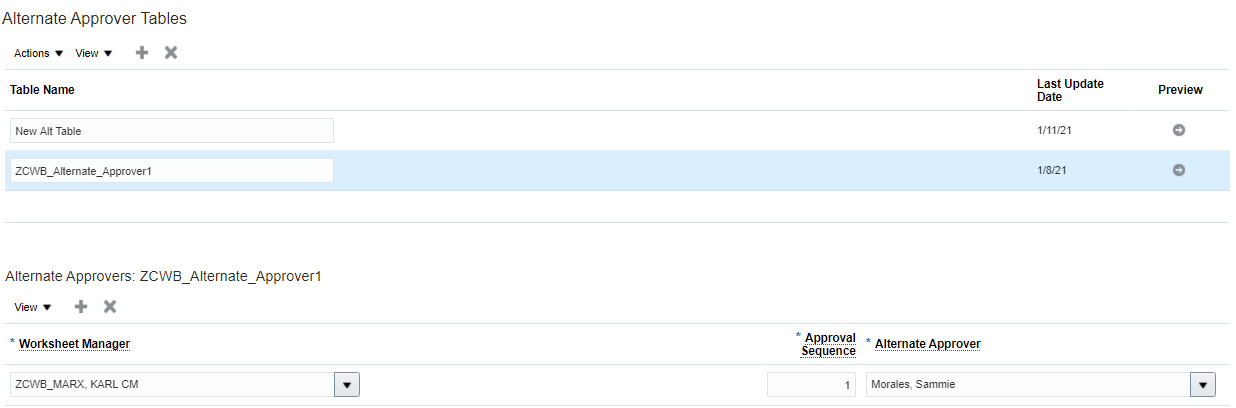

Preview Alternate Approver Configuration

You can now preview your alternate approver configuration before you run the Start Workforce Compensation cycle batch process or before you apply changes by running the Refresh Workforce Compensation Data batch process. Previously, you had to review the hierarchy. In the example below, you can see the new Preview button to the right of the Alternate Approver Table.

Preview Alternate Approver Setup

To preview the changes, select an Alternate Approver Table and then the Preview button. You need to select a worksheet manager and cycle before you can see the data. In the example below, you are able to see the impact of the alternate approvers table if you apply it. If you previously applied an alternate approvers table, you are also able to see how the setup has changed between what is active in the plan, and what could happen if you apply the current table.

Preview Alternate Approvers Changes

This provides administrators the ability to preview alternate approver configuration and troubleshoot the alternate hierarchy before they apply the changes to an open cycle.

Steps to Enable

You don't need to do anything to enable this feature.

Improved Alternate Approver Configuration

You can now view the alternate approver configuration on the same page as the alternate approver table. Previously, you navigated to another page to view the configuration. In the screenshot below, when the Alternate Approver table is selected, the configuration is viewed in the table directly below.

Updated Alternate Approver Configuration Page

This change simplifies navigation for administrators and reduces confusion.

Steps to Enable

You don't need to do anything to enable this feature.

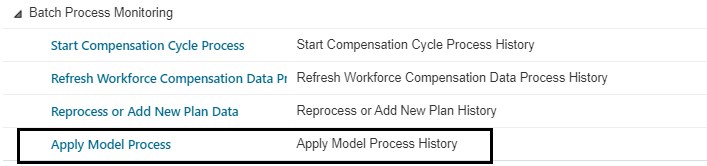

Review Apply Model Batch Processing Information

We made it easier to understand the performance of the Apply Model batch process with a new report in View Administration Reports. The report shows information such as who submitted the model, including models submitted in batch mode by worksheet managers. It also shows the number of workers included, how many dynamic calculations in the plan, and information about any threads associated with the batch process that were unsuccessful.

New Apply Model Process Report

This allows administrators to track and troubleshoot models when they apply them through the batch process mode.

Steps to Enable

You don't need to do anything to enable this feature.

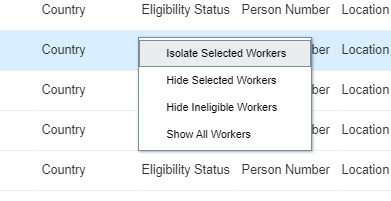

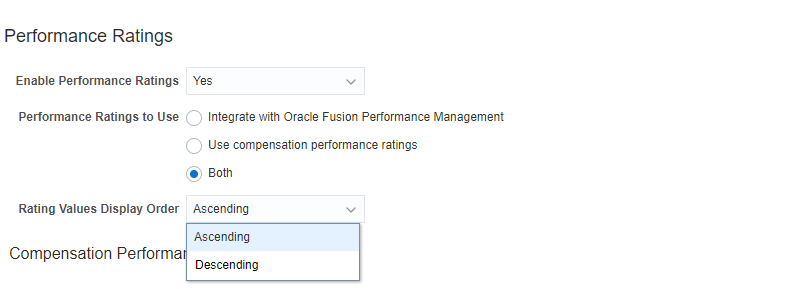

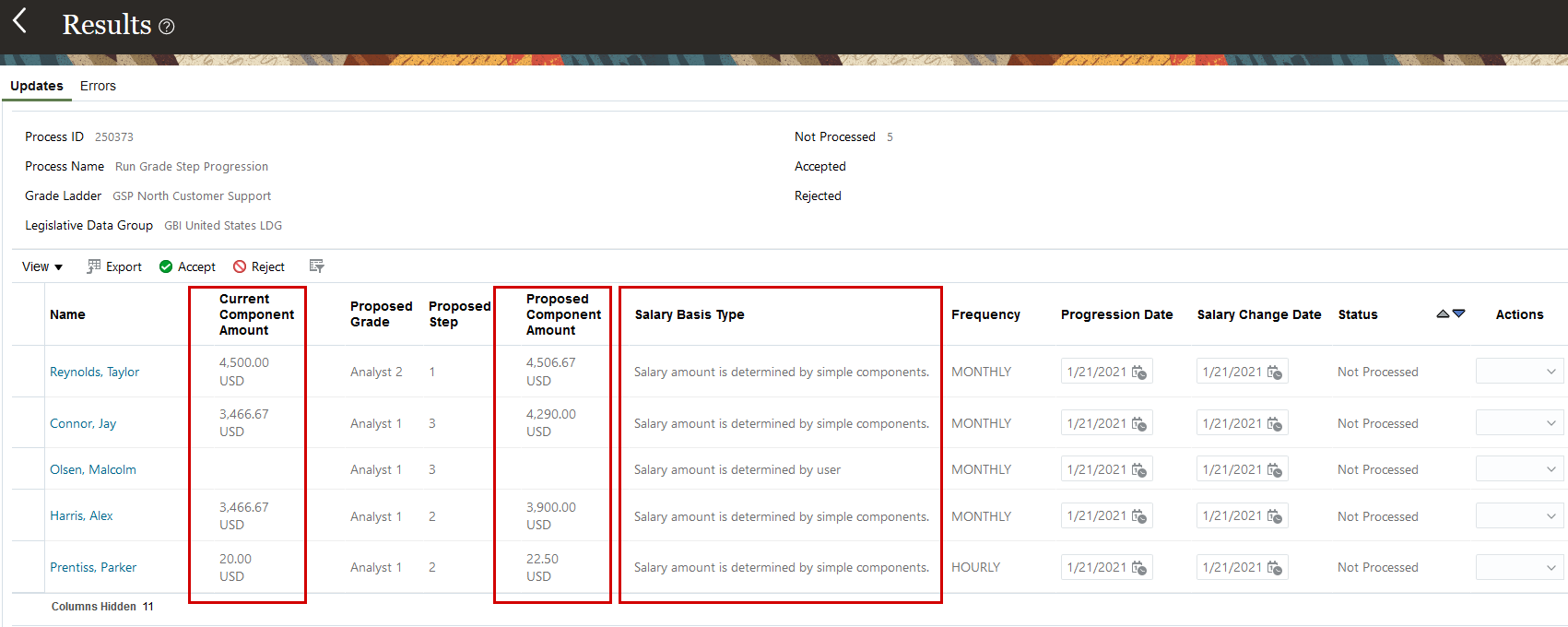

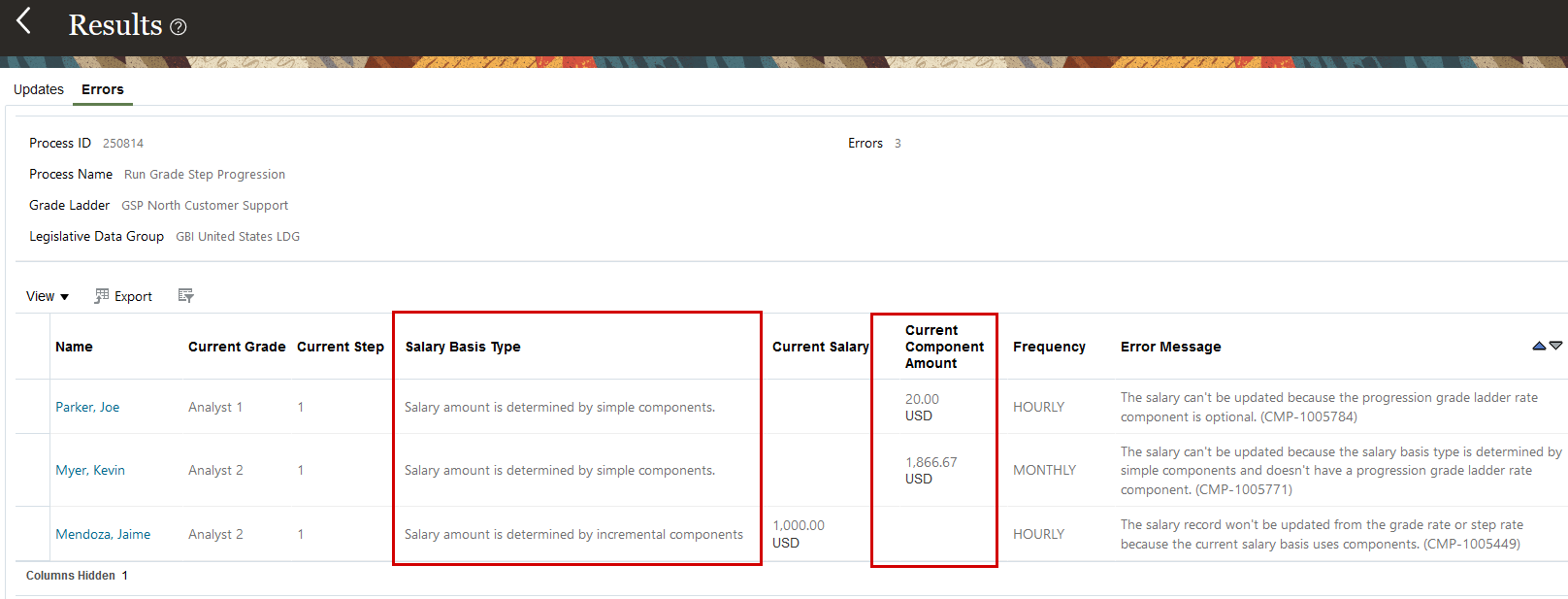

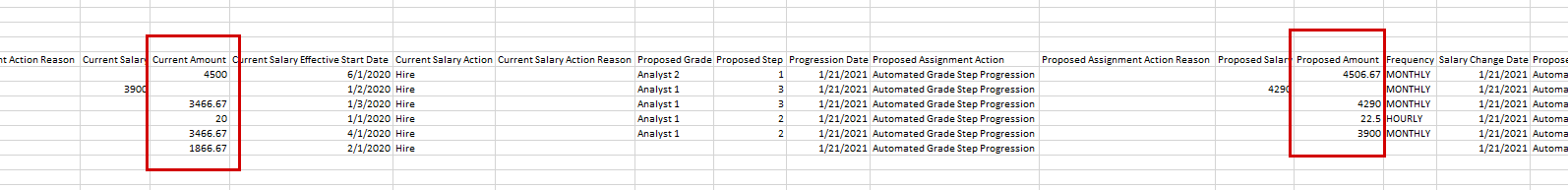

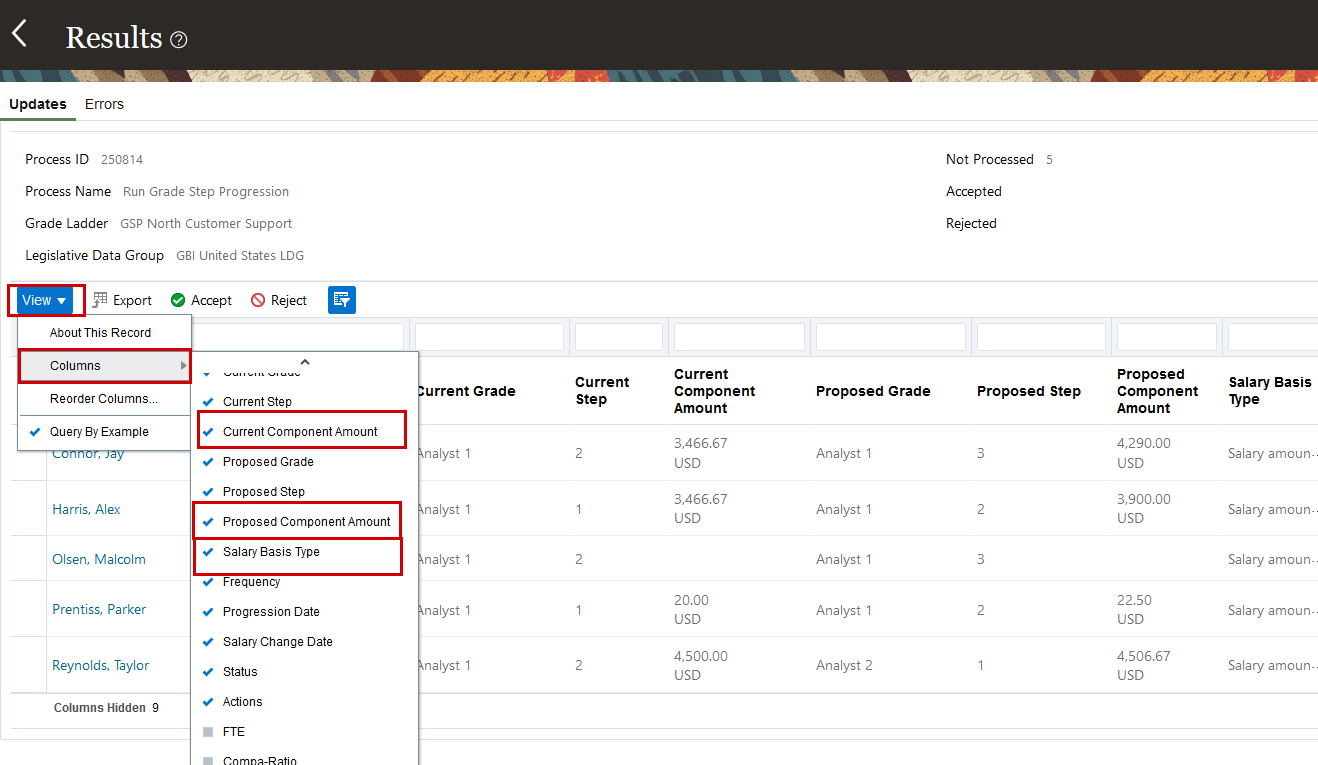

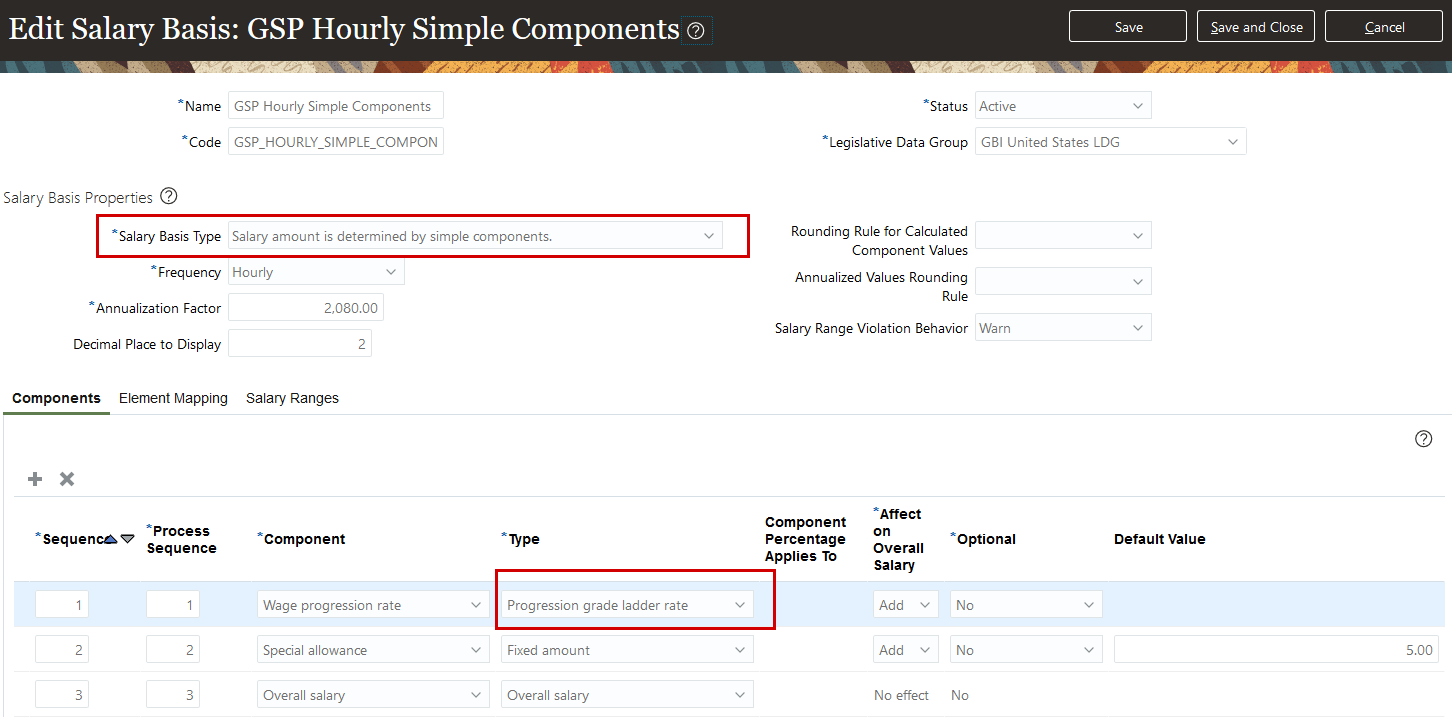

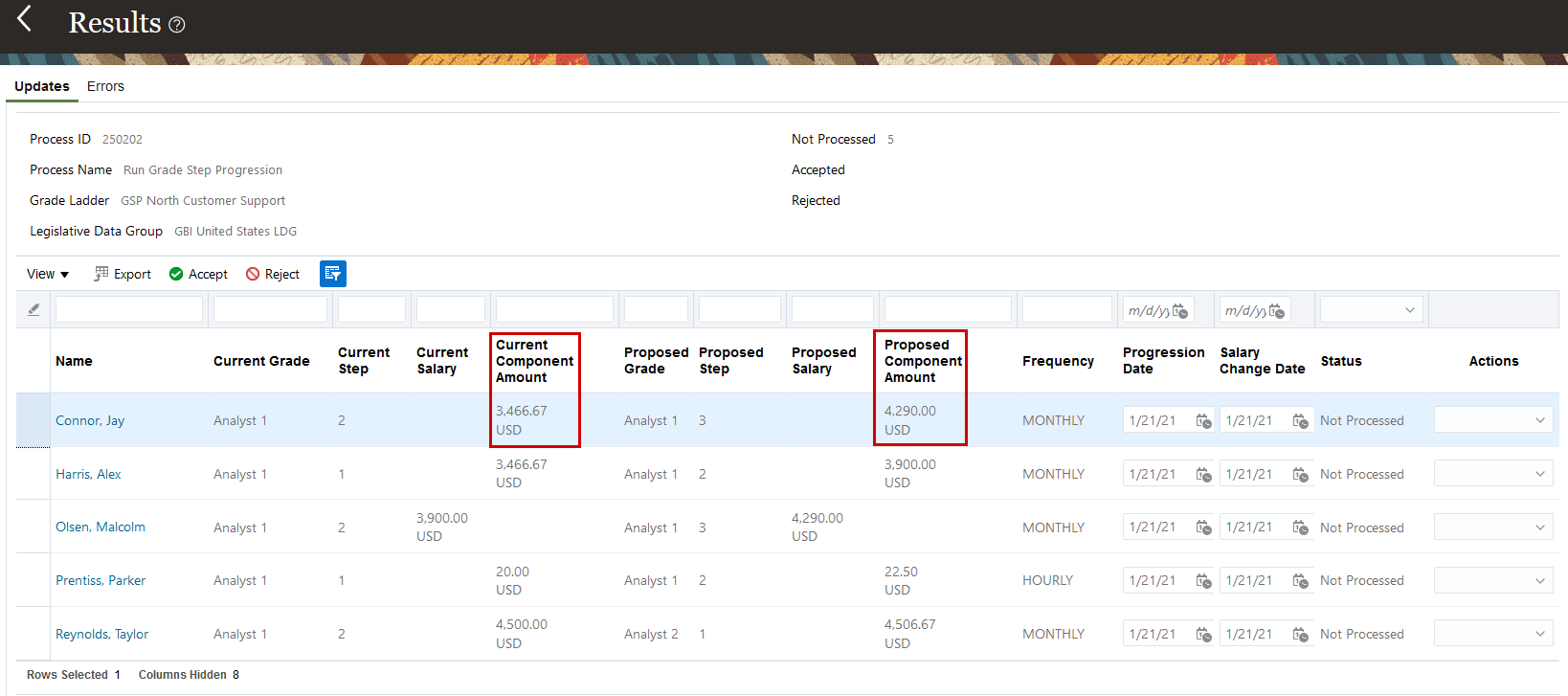

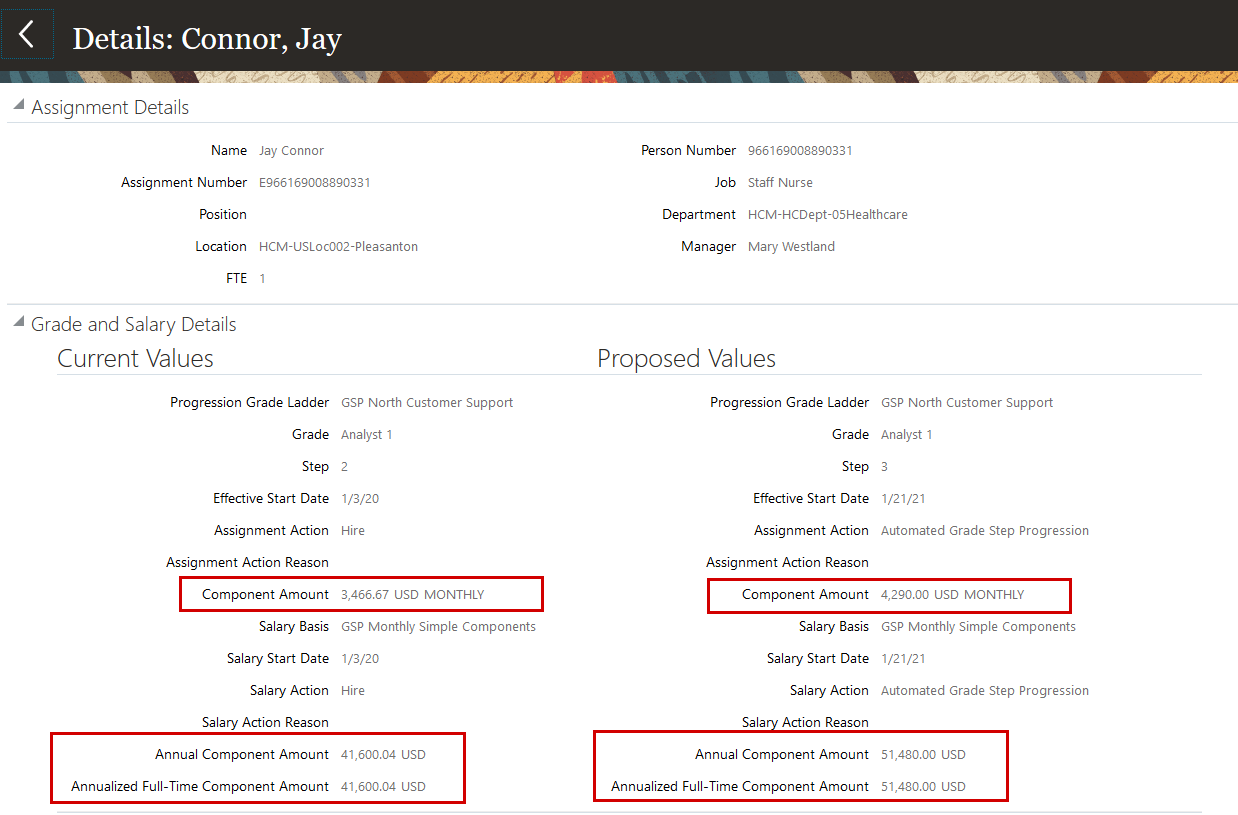

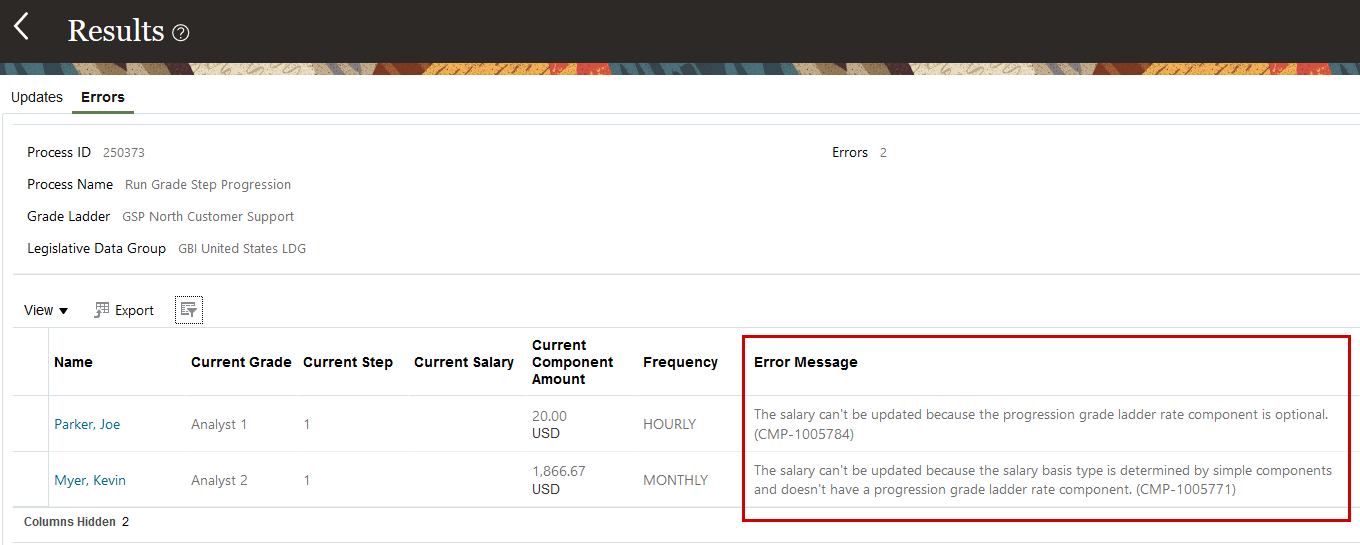

Configure Performance Rating Display Order