- Revision History

- Overview

- Feature Summary

- Benefits

- Compensation and Total Compensation Statement

-

- Compensation

- Workforce Compensation

-

- Process Worker Statements By Manager Hierarchy

- Launch Synchronize Hierarchy Process as a Part of the Start Workforce Compensation Plan Process

- Supply Vesting Date for Stock When Transferring Data to HR

- Updated Link in Workforce Compensation Notifications

- Use Assignment Segments to Display Prorated Data in the Worksheet

- Assignment-Level Security in Workforce Compensation

- Grade Step Progression

- Stock & External Data

- Total Compensation

- Compensation

- Payroll

-

- Global Payroll

- Payroll for Canada

- Payroll for China

- Payroll for Kuwait

- Payroll for Mexico

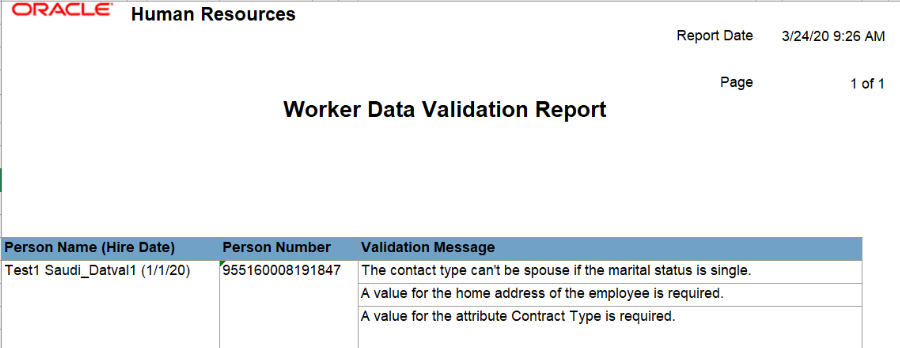

- Payroll for Saudi Arabia

- Payroll for the United Arab Emirates

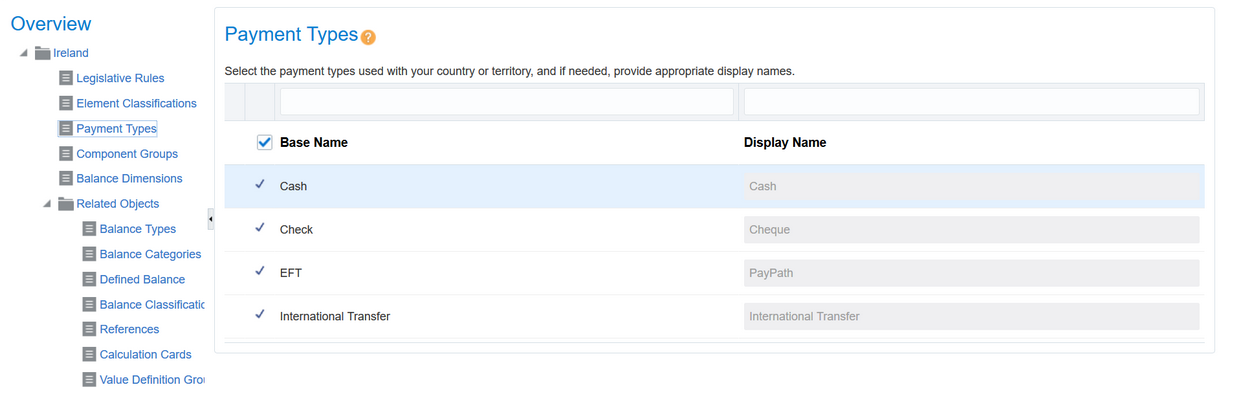

- Payroll for the United Kingdom

-

- Enhanced Load Errors Report in the HCM Data Loader

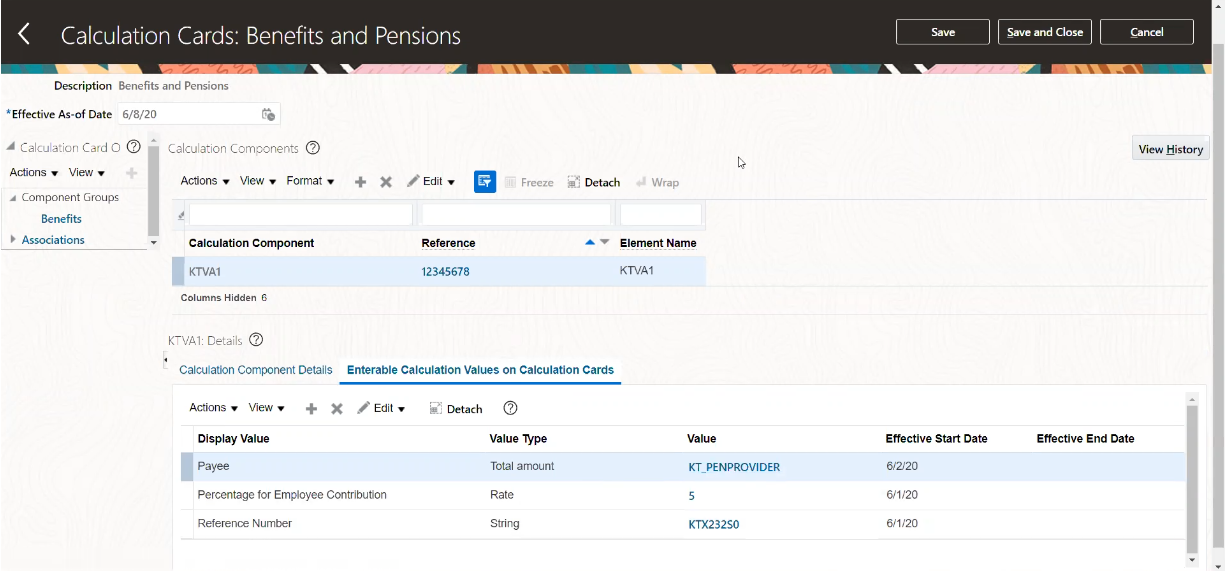

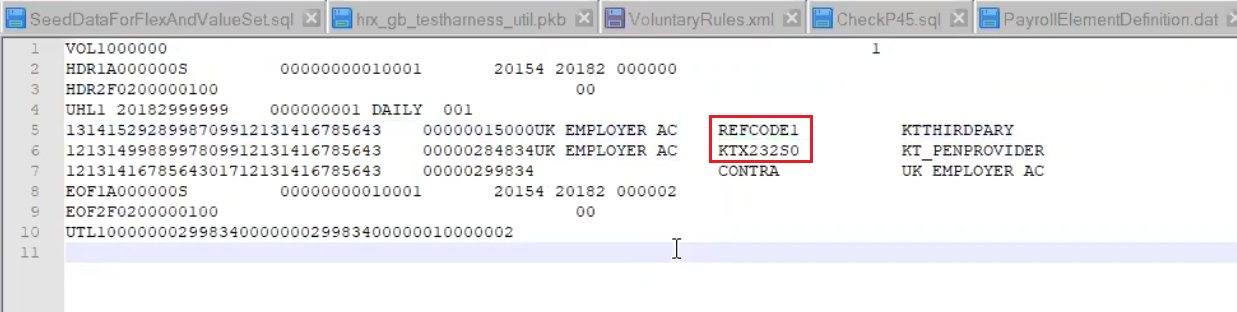

- Voluntary Deductions and Pension Reference Output to BACS File

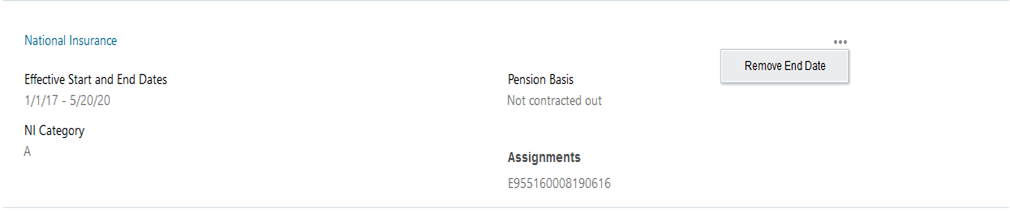

- Remove End Date for Components

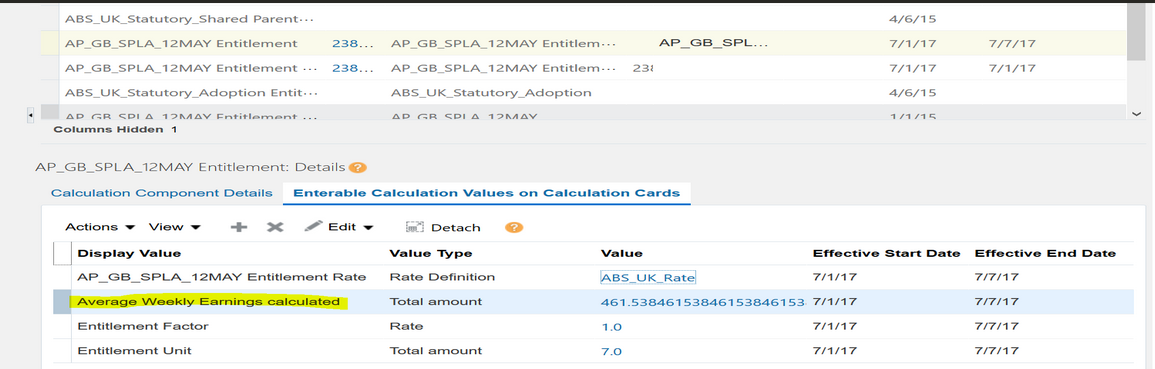

- Display Average Weekly Earnings for Shared Parental Leave

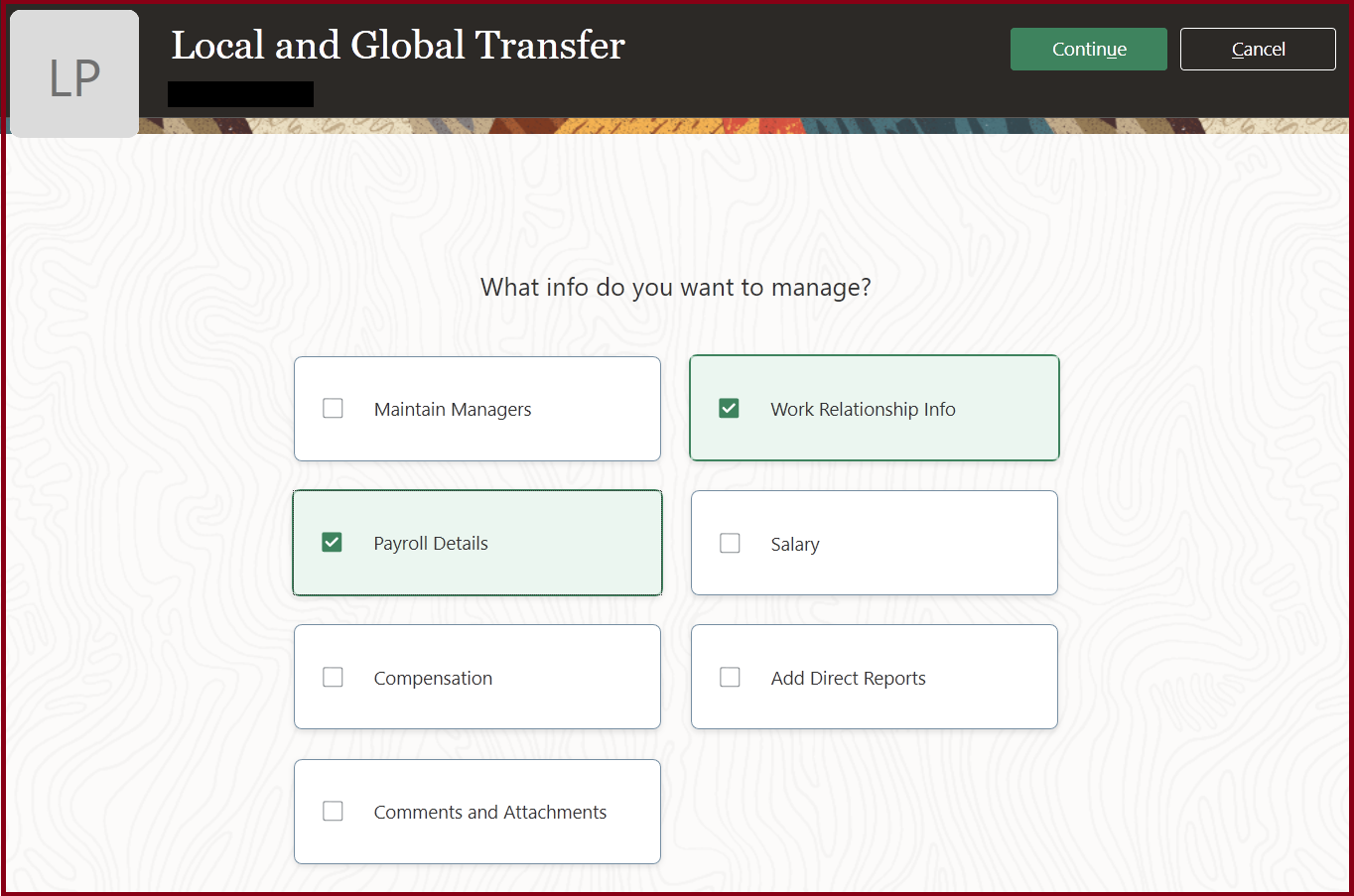

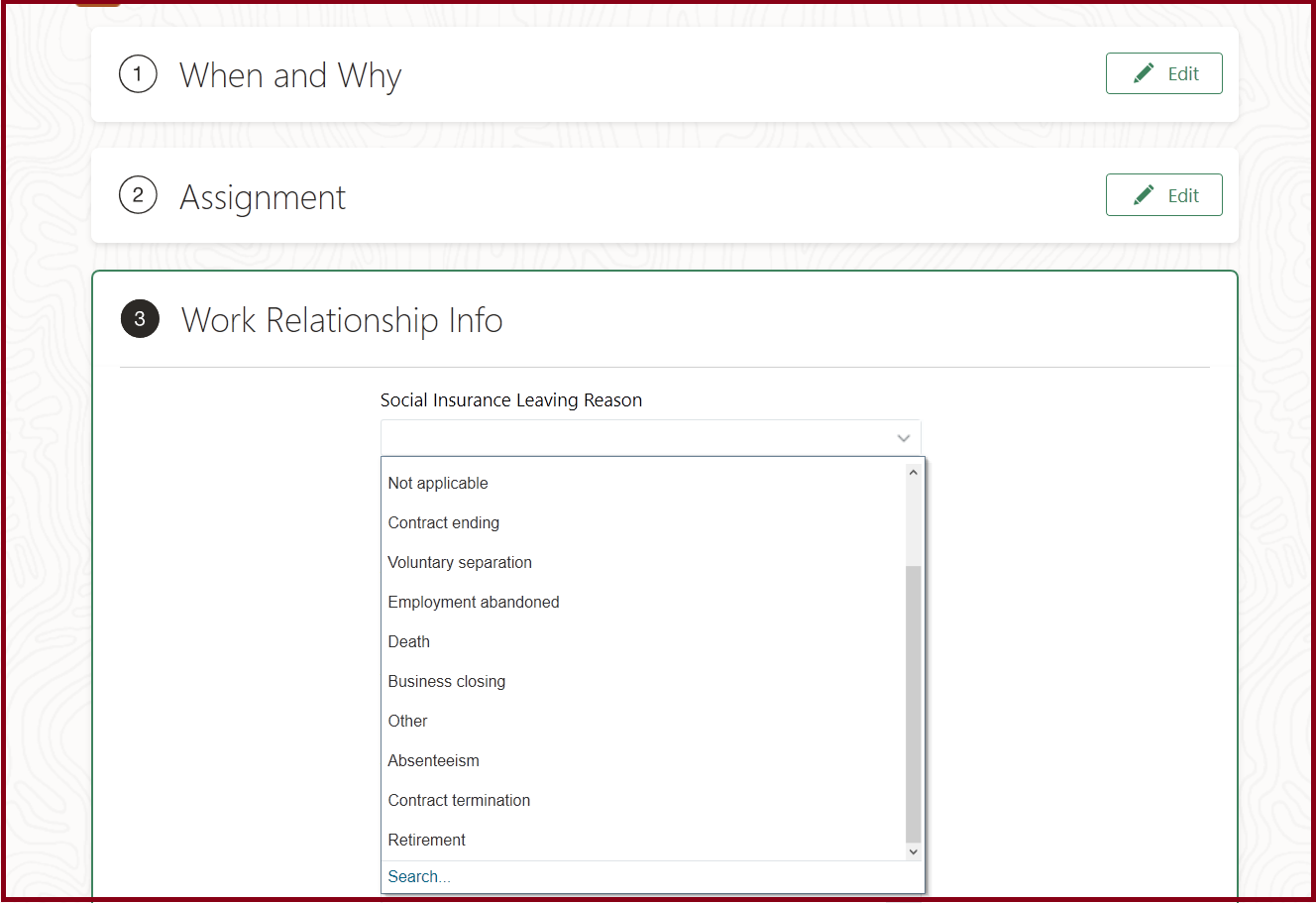

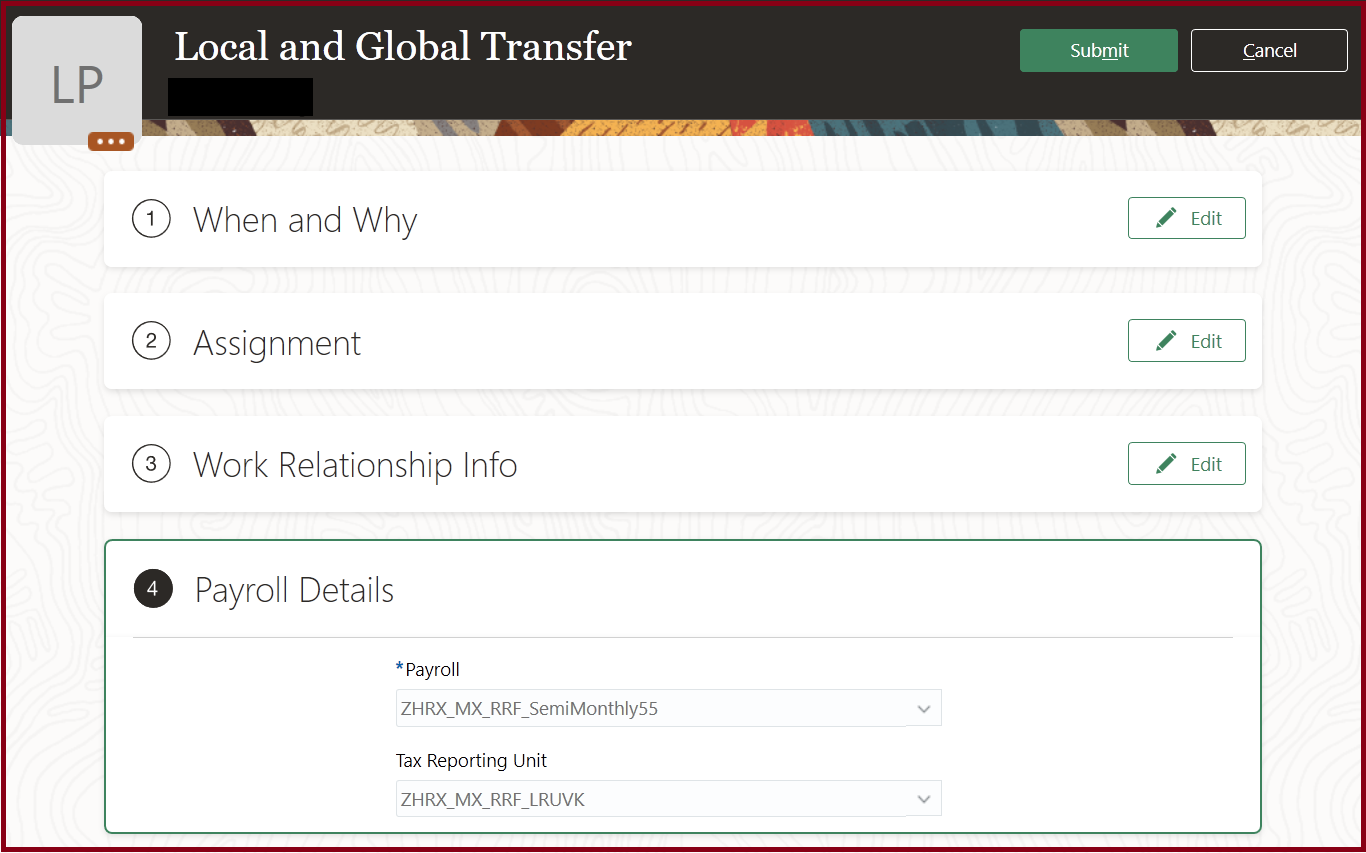

- Mass Global Transfer and Synchronization

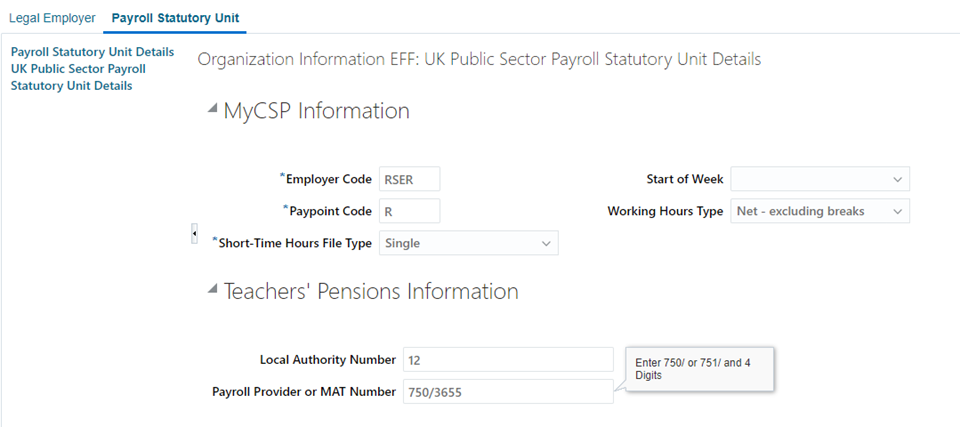

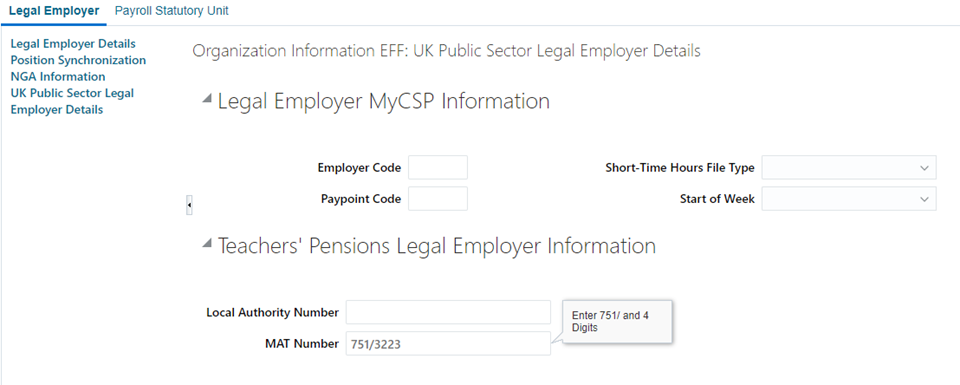

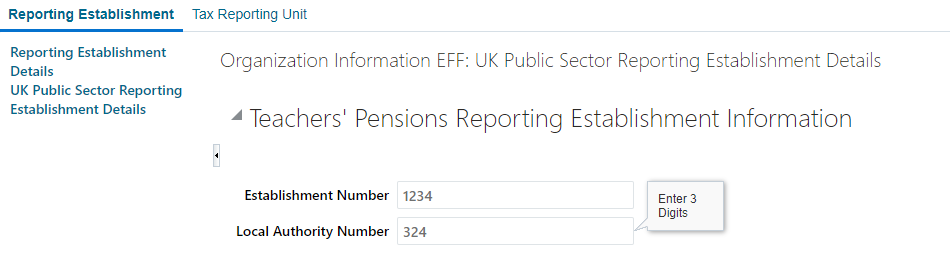

- Organization Level Data Capture for Teachers' Pension MCR Interface

-

- Payroll for the United States

- HR Optimizations

- IMPORTANT Actions and Considerations

January Maintenance Pack for 20D

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 26 FEB 2021 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (21A, 21B, 21C, and 21D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Transfer Payroll Run Costs to SLA Using Payment Date From Payroll Period Definition |

||||||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

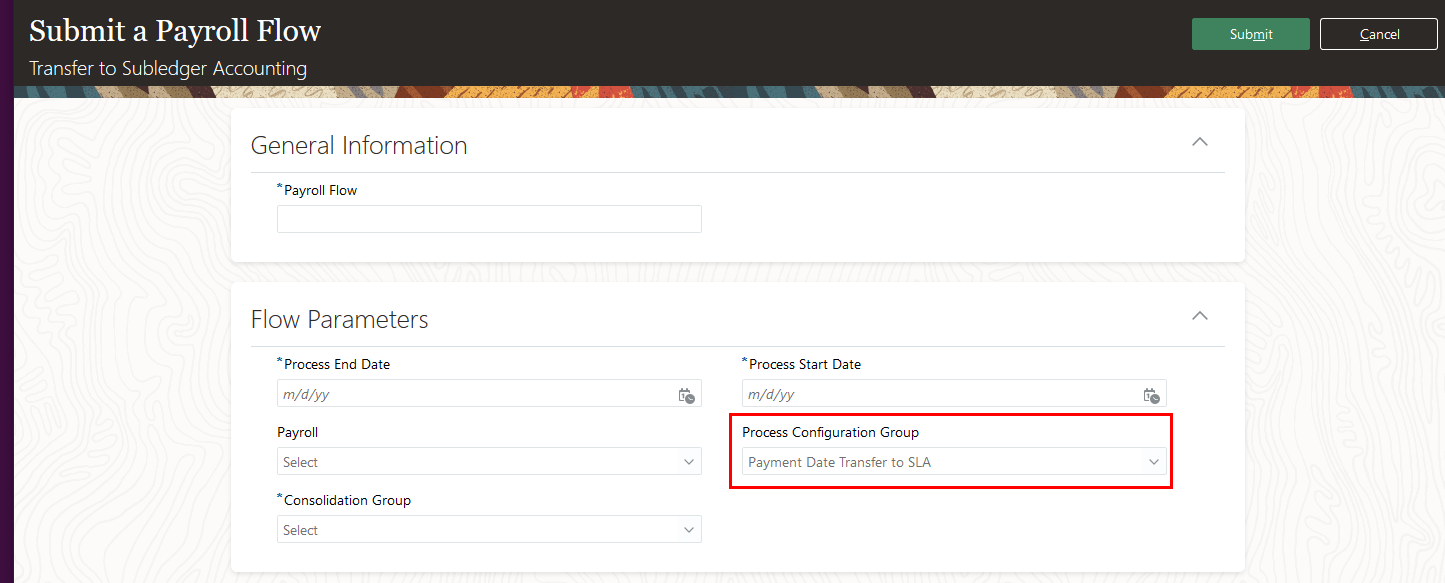

Transfer Payroll Run Costs to SLA Using Payment Date From Payroll Period Definition

You can configure an override value of date paid to use as the Payment Date of the payroll time period definition as the Accounting Date for all the payroll costs that fall within the entered process date range, when you run the Transfer to Subledger Accounting process using the new configuration group name in the Process Configuration Group flow parameter.

This features allows you to transfer costing results for a payroll run by using the payroll time periods date paid in the Accounting Date for Transfer to Ledger configuration parameter.

Steps to Enable

You don't need to do anything to enable this feature.

December Maintenance Pack for 20D

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 18 DEC 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

| Ready for Use by End Users Reports plus Small Scale UI or Process-Based new features will have minimal user impact after an update. Therefore, customer acceptance testing should focus on the Larger Scale UI or Process-Based* new features. |

Customer Must Take Action before Use by End Users Not disruptive as action is required to make these features ready to use. As you selectively choose to leverage, you set your test and roll out timing. |

|||||

|---|---|---|---|---|---|---|

| Feature |

Report |

UI or |

UI or |

|

||

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Define a start date for the Generate HCM Rates process. For example, set the start date to 2020-01-01 to ensure that the application calculates the rates only from 1st January 2020 or a later date.

You can define a start date of the process only in Full and Intermediate modes. If you run the process in Fast mode, the application ignores the date.

Let’s consider these examples.

Example 1: Generate HCM Rates process with a start date that is after the salary change

You update an employee’s salary entry and then run the Generate HCM Rates process with a start date that is after the salary change.

-

Set the start date for Generate HCM Rates to 01 Jan 2020.

-

Enter a salary entry of 20,000 for the employee with effective from 01 Nov 2020.

-

Run the Generate HCM Rates process in full mode.

- The application creates a 20,000 salary rate record for the employee effective from 01 November 2020.

Example 2: Generate HCM Rates process with a start date that is before the salary change

You update an employee’s salary entry and then run the Generate HCM Rates process with a start date that is before the salary change. In this case, the application creates a rate with an effect start date that is the same as the start date defined for the process.

-

Set the start date for Generate HCM Rates to 2020-01-01.

-

Enter a salary entry of 20,000 for the employee with effective from 20 September 2019.

-

Run the Generate HCM Rates process in full mode.

-

The application creates a 20,000 salary rate record for the employee effective from 01 January 2020.

Reduce the time it takes to process Generate HCM Rates. You can set a start date for the Generate HCM Rates process to limit the date range over which rates are calculated. And such a configuration enables you to reduce the volume of rates that are included in the process and thereby reduce the time it takes for the process to complete.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information on HCM Rate Definition, refer to the Rate Definitions help topics on docs.oracle.com.

This document will continue to evolve as existing sections change and new information is added. All updates appear in the following table:

| Date | Product | Feature | Notes |

|---|---|---|---|

| 30 OCT 2020 | Global Payroll/Replaced or Removed Features | HCM Data Loader (HDL) Must Be Used for All Payroll Objects | Updated document. Delivered feature in update 20D. |

| 25 SEP 2020 | Global Payroll | Submitted By Filter | Updated document. Delivered feature in update 20D. |

| 04 SEP 2020 | Created initial document. |

HCM Cloud applications have two types of patches you can receive that are documented in this What’s New:

- Release Updates (20A, 20B, 20C, and 20D)

- Optional Monthly Maintenance Packs to each update

It is important for you to know what Release Update your environment is on. You can find this in your Cloud Portal.

This document outlines the information you need to know about new or improved functionality in Oracle HCM Cloud. Each section includes a brief description of the feature, the steps you need to take to enable or begin using the feature, any tips or considerations that you should keep in mind, and the resources available to help you.

In addition to this document you will also want to review the Oracle Human Capital Management Cloud Functional Known Issues and Maintenance Packs (Document ID 1554838.1). These documents identify bug fixes and possible known issues. You will also need to review these documents based in the release update version you are currently on or will be moving to.

Oracle HCM Cloud release documents are delivered in five functional groupings:

Suggested Reading for all HCM Products:

- HCM Cloud Common Features (This document pertains to all HCM applications. It is the base human resource information for all products and HCM Tools.)

- Global Human Resources Cloud (Global Human Resources contains the base application in which other application use for common data such as workforce structures and person information. Regardless of what products you have implemented you may want to see the new features for Global Human Resources that could impact your products.)

NOTE: Not all Global Human Resource features are available for Talent and Compensation products.

Optional Reading for HCM Products (Depending on what products are in your cloud service):

- Talent Management Cloud (All Talent applications)

- Workforce Rewards Cloud (Compensation, Benefits, Payroll and Global Payroll Interface)

- Workforce Management Cloud (Absence Management and Time and Labor)

Additional Optional Reading:

- Common Technologies and User Experience (This documents the common features across all Cloud applications and is not specific to HCM)

NOTE: All of these documents can be found in Release Readiness under Human Capital Management or via the Oracle Help Center under Cloud Applications > Human Capital Management.

GIVE US FEEDBACK

We welcome your comments and suggestions to improve the content. Please send us your feedback at oracle_fusion_applications_help_ww_grp@oracle.com. Indicate you are inquiring or providing feedback regarding the HCM Cloud What’s New for Release 13 in the body or title of the email.

Column Definitions:

Features Delivered Enabled

Report = New or modified, Oracle-delivered, ready to run reports.

UI or Process-Based: Small Scale = These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

UI or Process-Based: Larger Scale* = These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

Features Delivered Disabled = Action is needed BEFORE these features can be used by END USERS. These features are delivered disabled and you choose if and when to enable them. For example, a) new or expanded BI subject areas need to first be incorporated into reports, b) Integration is required to utilize new web services, or c) features must be assigned to user roles before they can be accessed.

Oracle Benefits is a complete, configurable and flexible global solution that enables organizations to successfully evolve and adapt to the unique needs of their workforce. The solution enables setup of traditional 'one-size fits all' plans to highly complex plans that selectively target different workforce segments with different benefit packages. Self-service capabilities present the user with an out of the box intuitive guided enrollment process with contextual information and embedded analytics.

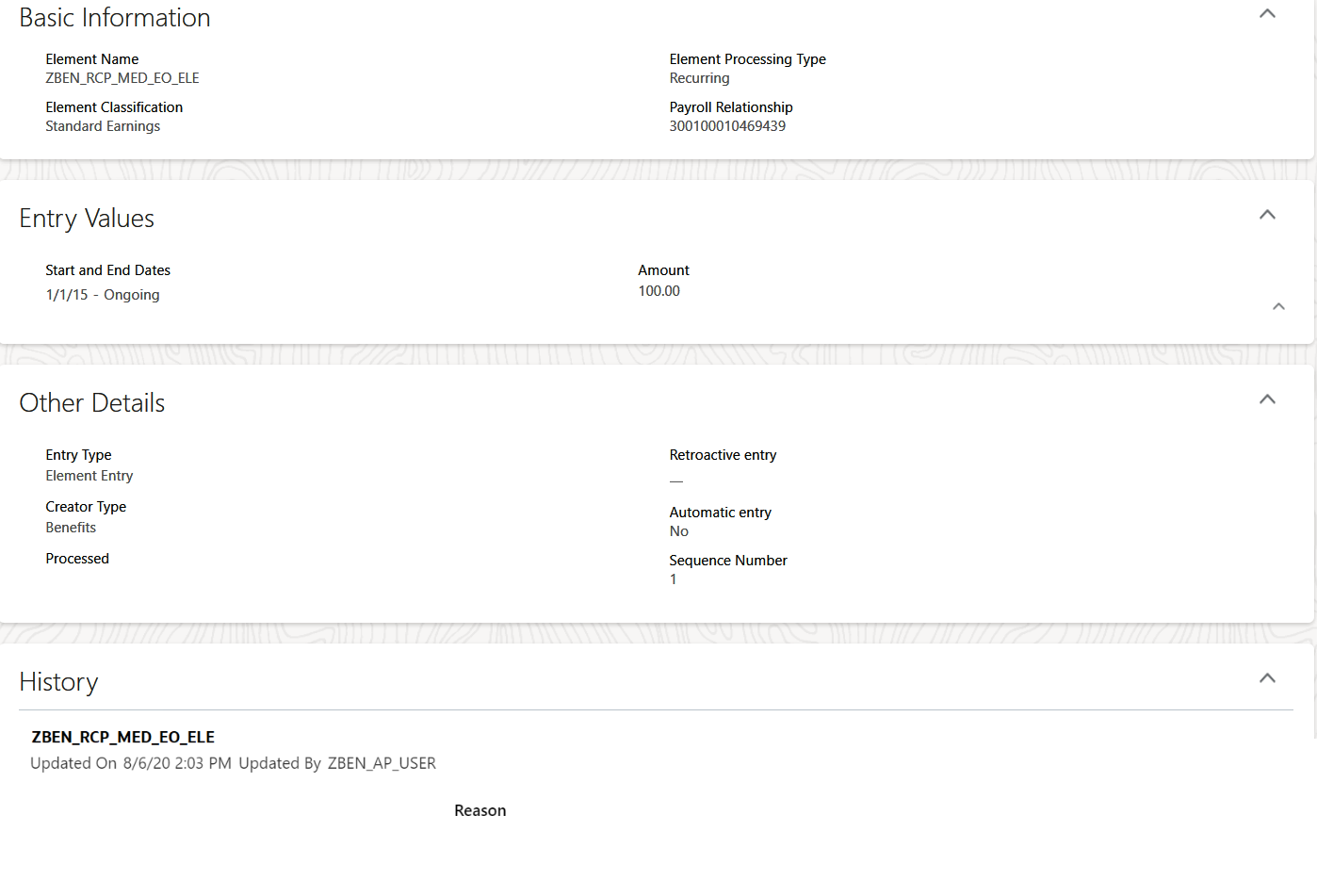

Enhancement to Benefits Service Center, Element Information

You can now review rates and element entry values of participants using the new View Payroll Info option in Benefits Service Center. This helps you easily explain participants how their benefits show up on their paycheck and answer other related questions. Previously, this option was available only in the classic pages. Now it's available in the responsive pages as well.

View Payroll Info Page

Here's what you see after selecting the View Payroll option:

| Section | Details |

|---|---|

| Basic Information |

Displays the element name and the element processing type that helps you answer questions related to earnings or deductions. For example, to answer questions on the recurrence of a payroll element named Educational Loan Repayment for a rate, you can check Element Processing Type. |

| Entry Values |

Displays the start and end date, amount, and the input values. For example, to answer questions on the end date of a payroll element named Educational Loan Repayment for a rate, you can refer to this section. |

| Other Details |

Displays the type of the element entry, how it was created, and so on. |

| History |

Displays the previous history of when and who has updated the element entry. |

NOTE: If required, you can hide the Other Details and History sections using the Transaction Design Studio.

To get to see the View Payroll Info option, you need to associate a payroll element and an element entry with the rate. For example, you have a payroll element named Educational Loan Repayment for a rate. You use order number as the element entry to transfer the benefit rate to payroll.

Here's how you view payroll details of a participant’s benefit rate:

- On the Home page, click Benefits Administration > Enrollment, to open the Benefits Service Center work area.

- Open the Benefits Summary page of the participant in Benefits Service Center.

- In the Enrollments section, select the benefit.

- Navigate to the Rates section on the new page that appears.

- Click the Actions (ellipses) link for the participant’s benefit rate, and click View Payroll Info.

The View Payroll Info option available in Benefits Service Center helps administrators easily explain to participants how their benefits show up on their paycheck and answer other related questions.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Watch Enhancing Administrative Features Readiness Training

- For more information, see Transaction Design Studio -What It Is and How It Works (Document ID: 2504404.1) in My Oracle Support.

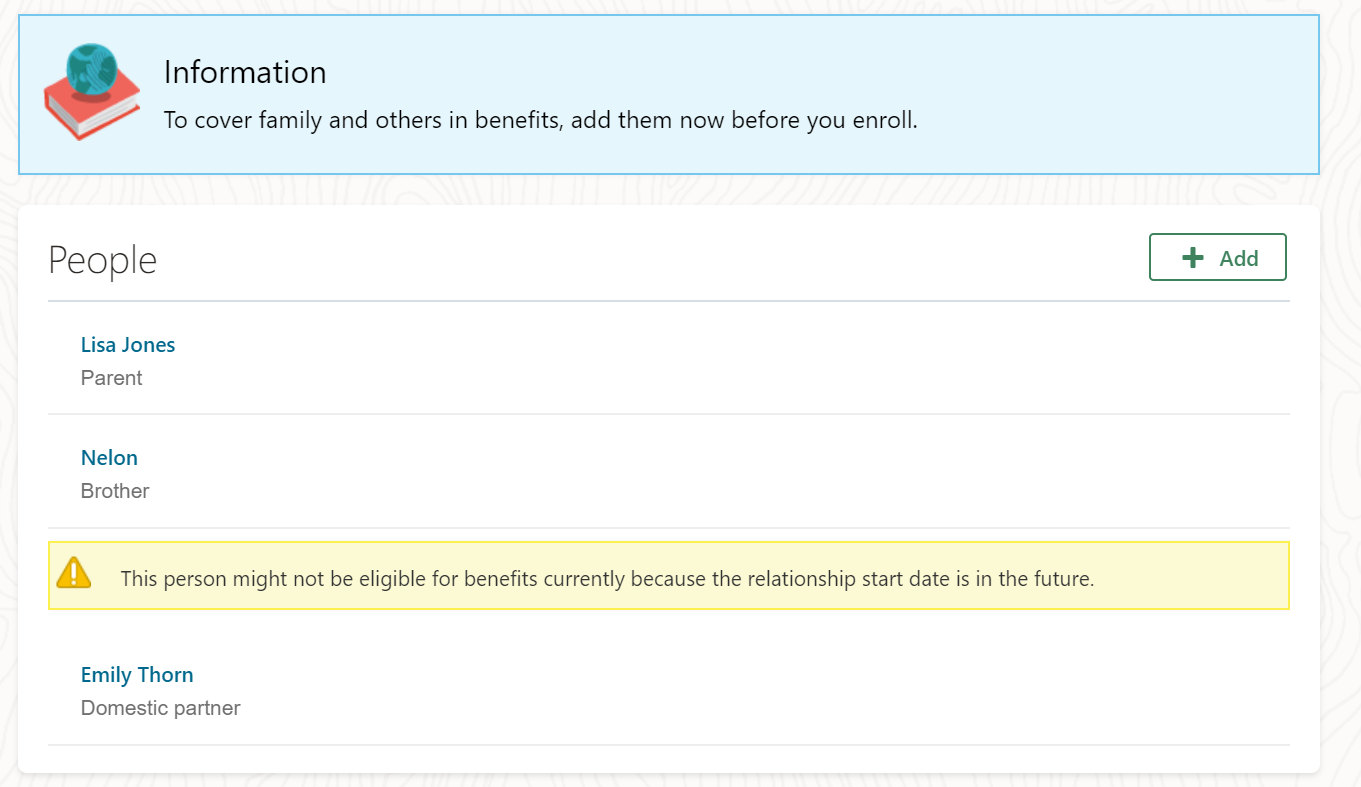

Future-Dated Contacts Appear in the People to Cover Page

Future-dated contacts now appear in the People to Cover page. For example, today, 26th July 2020, an employee adds a domestic partner with a relationship start date of 14th November 2020. The People to Cover page now displays this newly-added domestic partner along with other contacts of the employee. Previously, the saved future-dated contacts were not displayed anywhere. That caused employees to re-create the contacts thinking that the contacts weren’t saved properly.

When participants add future-dated contacts, they can see a banner that states that although they've created the contact, they might not be eligible for enrollment. The message makes it clear that the contact won't appear on the enrollment pages, under the Dependents and Beneficiaries section.

Participants can update the future-dated contact's details in the People to Cover page, which they couldn’t do in the past. For example, they might need to add more detail, change the detail, or even delete the contact. If the participant clicks on the contact’s link to edit the details, the contact’s relationship start date is clearly identified as being in the future.

Future-Dated Contacts Appear on the People to Cover Page

Here's how you can display future-dated contacts in the People to Cover page:

- On the Home Page, click Benefits Administration >Plan Configuration.

- In the Tasks panel drawer, click Self-Service Configuration.

- Select the Display future-dated contacts check box.

- Click Save.

With this new enhancement, participants can get to see their future-dated contacts too. This feature helps stop participants from entering duplicate contacts because they can see the future-dated contacts now. This eliminates the need for administrators to resolve duplicate contact issues during enrollment.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

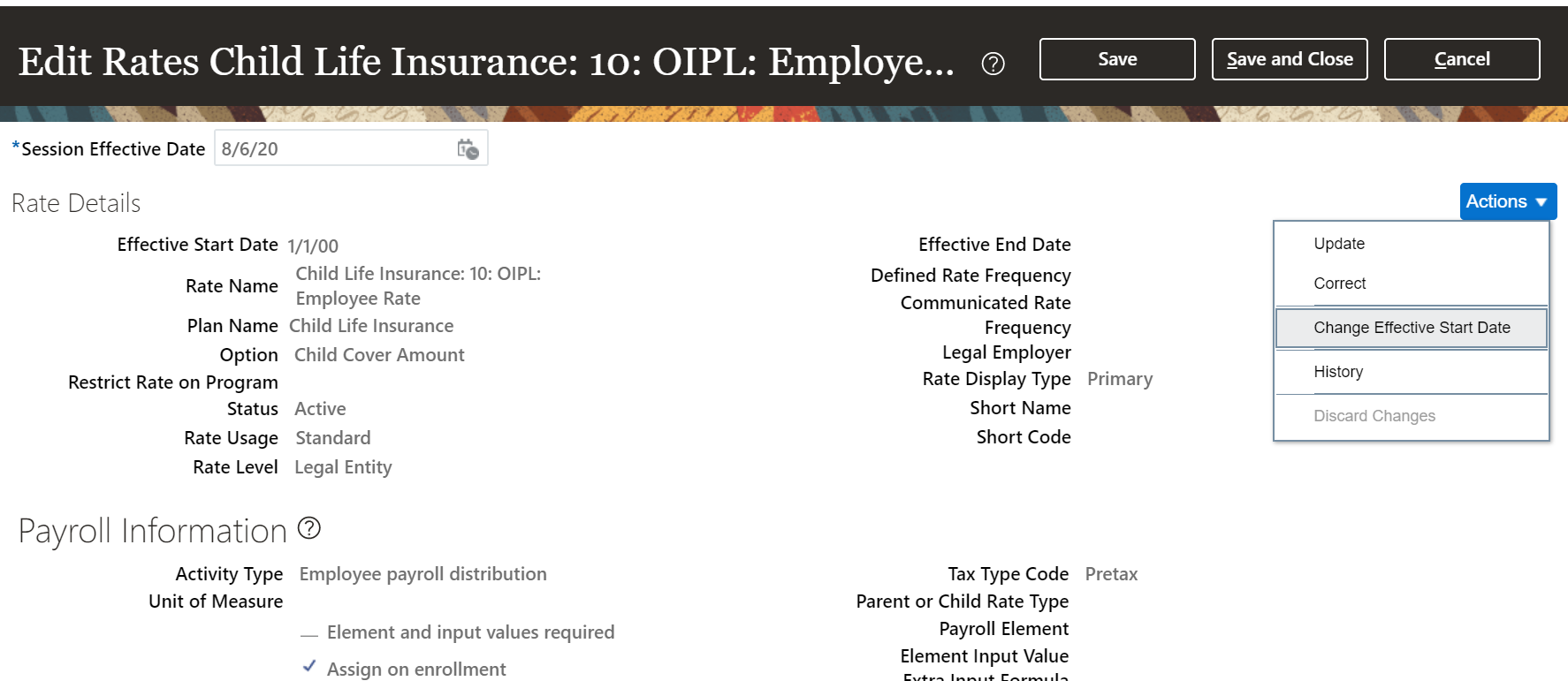

Manage Rate or Coverage Start Dates

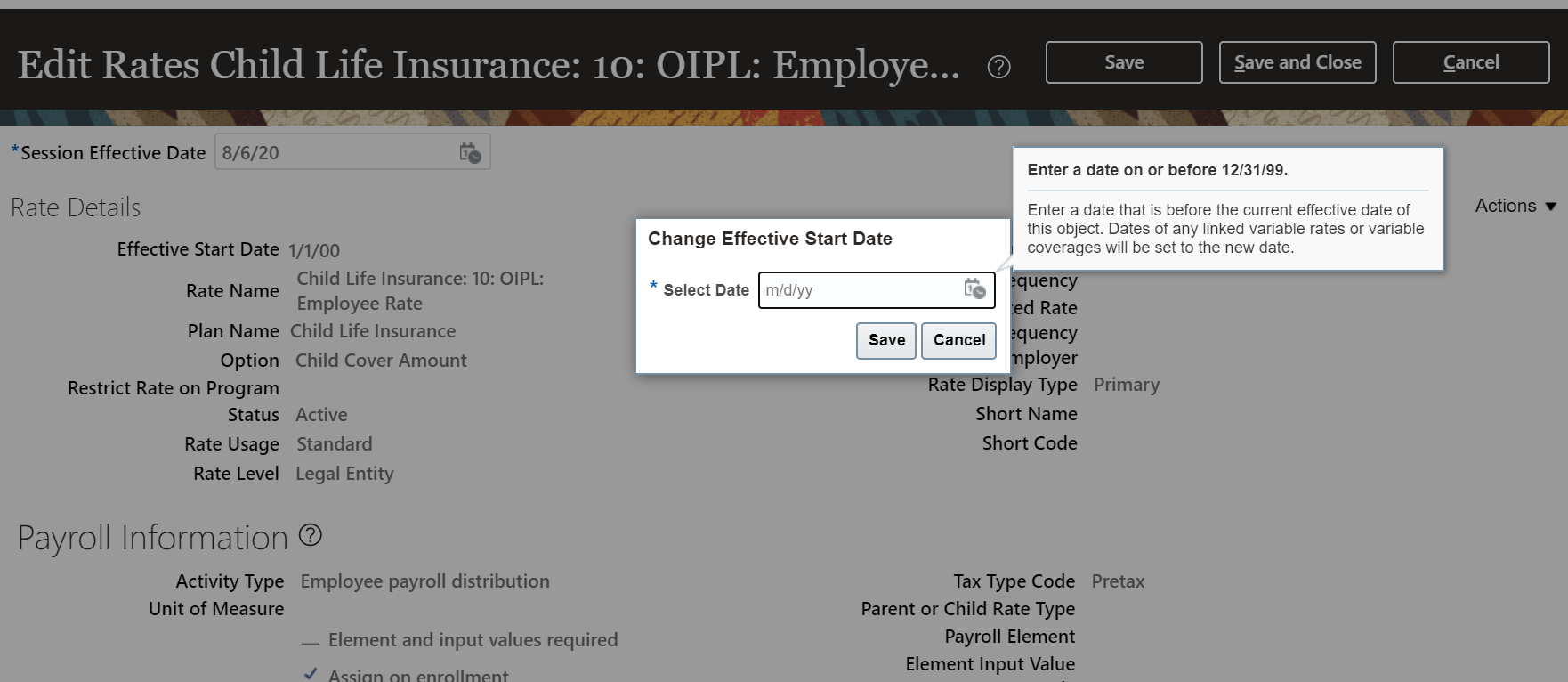

You can now change the effective start date of standard rates or coverages to a date in the past. You need to enter a date that’s before the current effective start date of the rate or coverage. Depending on their validity as of the new effective start date, the change reflects in all of the linked variable rates and variable coverage profiles.

Change Effective Start Date Option on the Actions Menu

Context Menu to Change the Effective Start Date

Here’s how you can change the effective start date of a standard rate or coverage:

- On the Home Page, click Benefits Administration >Plan Configuration.

- On the Overview page, select the Rates and Coverages tab.

- Select the Standard Rates or Coverages subtab based on your requirement.

- Search for and select the rate or coverage that you want to update.

- Select Change Effective Start Date on the Actions menu.

- Change the date and click Save.

- Click Save and Close to return to the Overview page.

You can now correct the effective start dates of rate or coverage from the Rates and Coverages page without having to run a spreadsheet.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Watch Enhancing Administrative Features Readiness Training

- For more information, see Overview of the Benefits Summary topic in the Maintain Benefit Enrollments chapter of the Using Benefits guide in the Oracle Help Center.

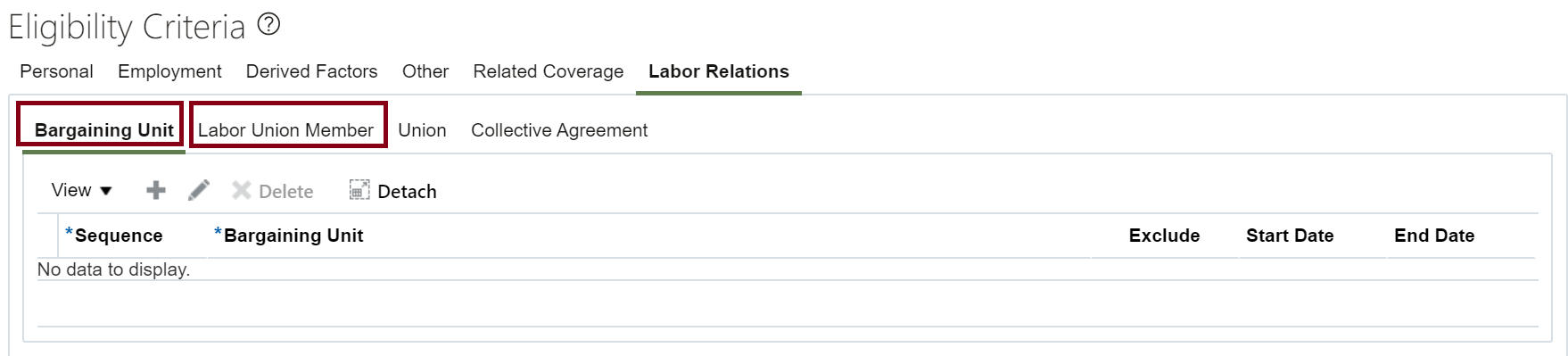

Consolidated Employment Bargaining Eligibility on One Tab

The Bargaining Unit and Labor Union Member subtabs are now moved under the Labor Relations tab from the Employment tab. You can now use the Labor Relations tab to create eligibility criteria based on employment bargaining.

Consolidated Employment Bargaining Eligibility on One Tab

This enhancement consolidates related tasks in one place and enables administrators to manage eligibility criteria on employment bargaining in a single tab.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

Enhanced Benefits Health Check Diagnostic Report

Here are new sections added to the Benefits Health Check Diagnostic report. These sections list data only for people who have life events in Started status.

| Section |

Details |

|---|---|

| Persons with incorrect beneficiary percentages in HDL Format |

Lists the beneficiaries whose percentage amount doesn’t add up to 100 percent. |

| Persons with contingent beneficiary but no primary beneficiary in HDL Format |

Lists the people who have a contingent beneficiary but no primary beneficiary. |

You can copy the data listed in these sections to a .dat file and upload using HDL after correcting the percentages or changing contingent beneficiary to primary beneficiary.

The enhanced diagnostic reports help you easily and efficiently identify and correct the allocation of beneficiary percentages and contingent beneficiaries with no primary beneficiary.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- Watch Enhancing Administrative Features Readiness Training

- For more information, see How You Resolve Issues with Beneficiary Allocations (Document ID: 2656248.1) in My Oracle Support.

Benefits Replaced or Removed Features

Ability to Switch Between New and Old Version of Plan Configuration Export and Import Has Been Removed

Use the improved Export and Import Plan Configuration feature (that was delivered in February 20A) without turning on a profile option. From this release, you can no longer switch back to the old version. The navigation and all the other capabilities released earlier as part of this feature remain intact. You can find the feature information in the 20A February Update in the Workforce Rewards What's New under the feature Enhanced Export and Import Plan Configuration.

With this change, you don’t have to do additional steps to use the export and import functionality.

Steps to Enable

You don't need to do anything to enable this feature.

Compensation and Total Compensation Statement

Oracle Compensation enables your organization to plan, allocate, and communicate compensation using the most complete solution in the market. Make better business decisions using embedded analytics and a total compensation view of workers, regardless of geographic location or pay package components.

Assignment-Level Security in Salary and Individual Compensation

You can now secure salary and individual compensation data access by assignment. The Change Salary, Salary History, Individual Compensation, Administer Compensation, View Compensation History, and Compensation Info pages will restrict access to assignments according to the person's security profile, when you enable and setup assignment-level security.

Improve data security by configuring access according to people's assignments.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to the followings feature in the 20D HCM Cloud Common What's New for the Secure Access for Workers with Multiple Assignments feature.

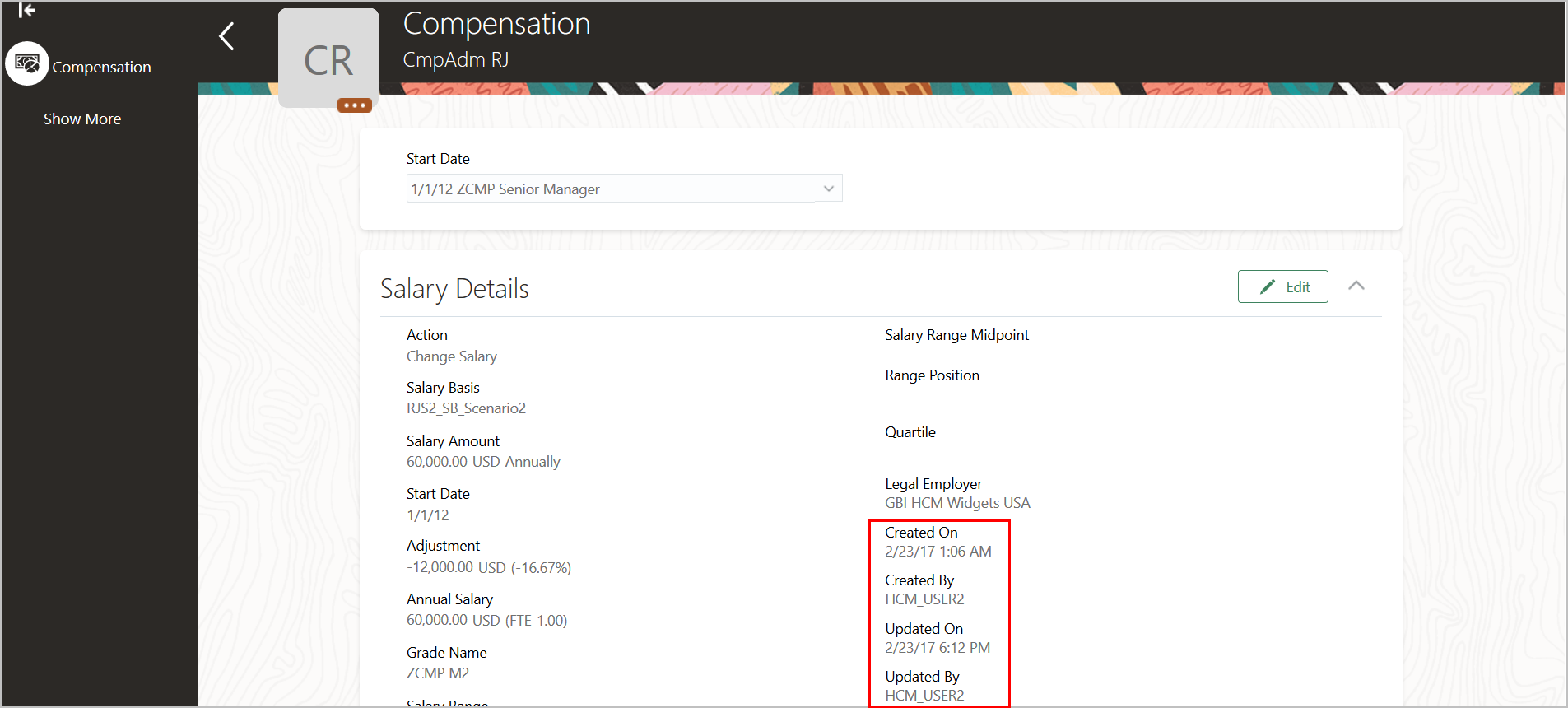

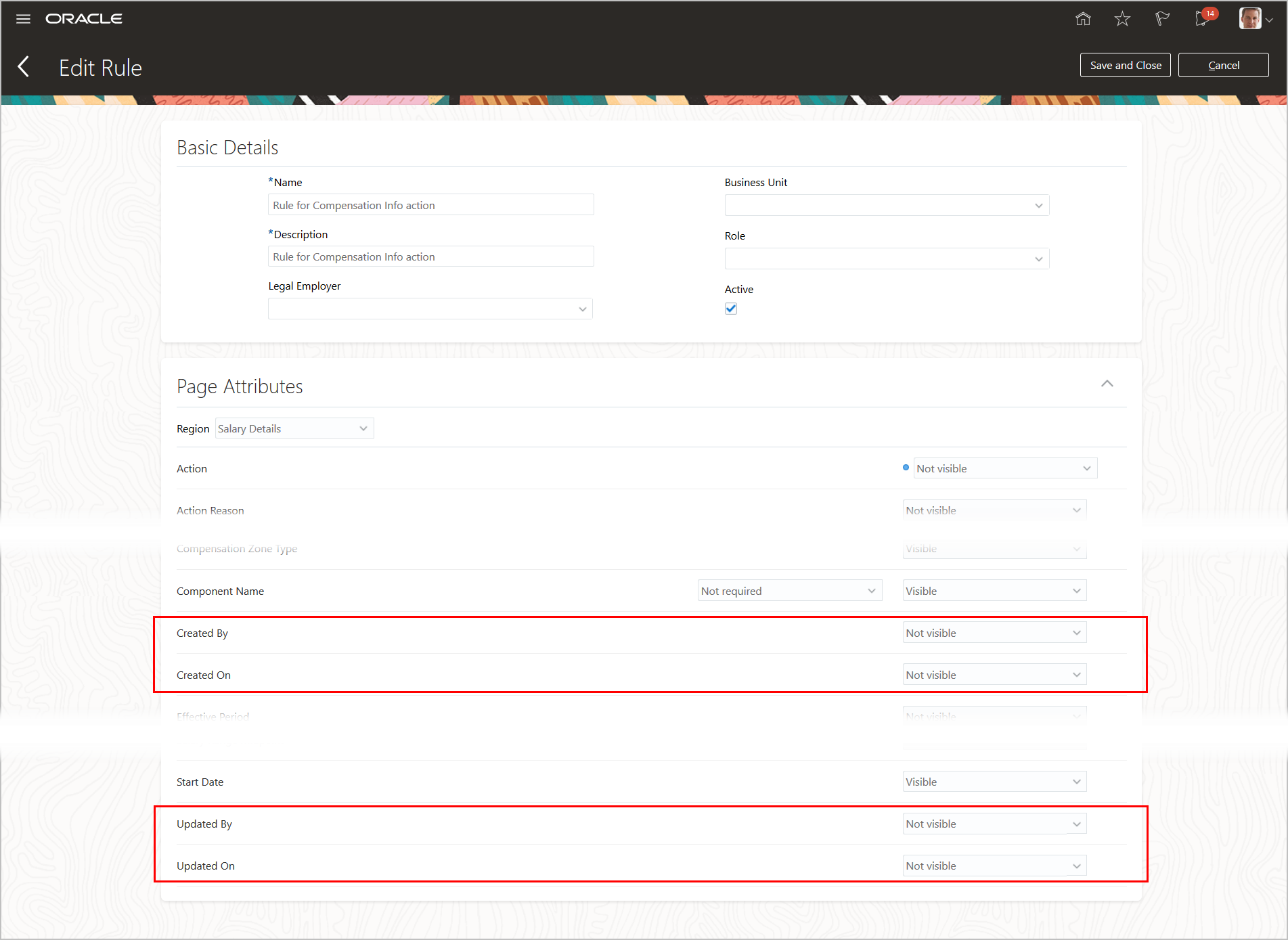

Identify Details of Salary Record Changes

You can now view the salary creation and updated information on the Salary Details page opened with the Compensation Info action. The details now include created by, created date, updated by, and updated date.

Creation and Updated Information When Made Visible in the Compensation Info Action

You now will know who created or last updated the salary data and when.

Steps to Enable

The Created by, Created On, Updated By, Updated On fields aren't visible by default. You can make them visible using HCM Transaction Design Studio.

Design Studio Configuration for Compensation Info Action

Comments and Attachment Section Introduction in Salary History

You can now include comments and attachments when you submit a Salary History action. For example, you want to let the approver know that your changes are because of a salary structure reorganization. So, you attach the relevant communication for the approver to reference.

Comments and Attachments Section in Salary History Action

Approver can take timely and appropriate action because the initiator can now provide relevant background info about the transaction.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

The Comments and Attachments section is visible by default. You can hide it using HCM Transaction Design Studio.

Design Studio Configuration for Salary History Action

Key Resources

- For more information, see the 20C Workforce Rewards What's New, look under Compensation for the feature Salary History Introduction.

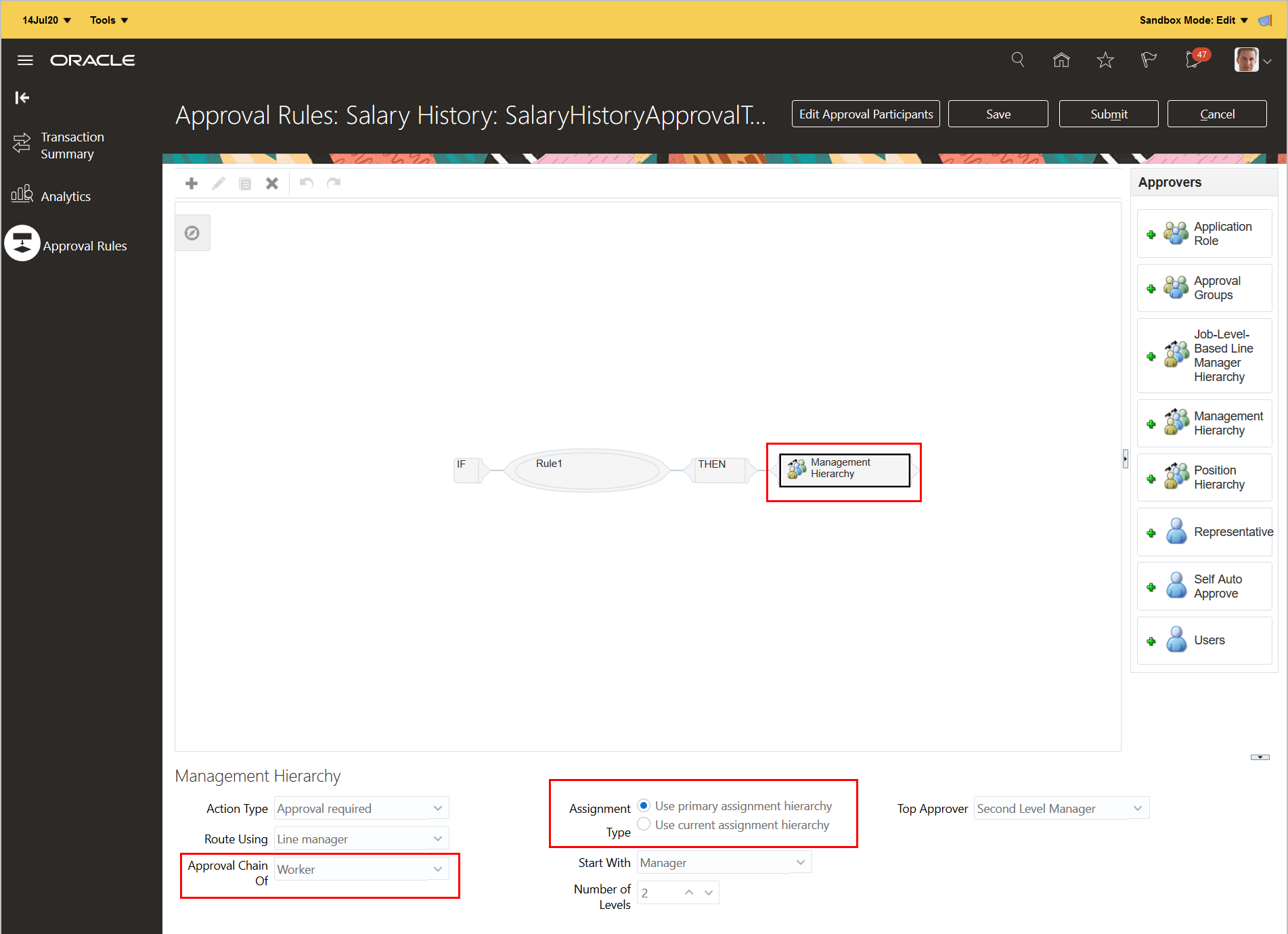

Route Approvals Using Launching Assignment Hierarchy

You can now configure your approval rules and route approvals using the current assignment hierarchy. The default routing uses the primary assignment hierarchy, but now you can route approvals to nonprimary assignment managers, as appropriate.

Now you can route approvals to the appropriate approvers, regardless of assignment.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

This feature doesn't replace your existing application behavior. If you want to leverage the feature, you have to change the assignment type using the HCM Transaction Administration Console.

This feature applies only to these compensation-related approval processes:

- Administer Salary

- Manage Salary

- Salary History

- Manage Personal Contributions

- Manage Individual Compensation

- Administer Individual Compensation

Key Resources

For more information, see these chapters in guides on Oracle Help Center:

- Chapter 3 Approvals in the Implementing Workforce Compensation guide

- Chapter 14 Notifications and Approvals in the Implementing Global Human Resources Guide

Refer to the followings feature in the 20D Global Human Resources What's New:

- Enhanced Global Human Resources Transaction Approvals Support Multiple Assignments

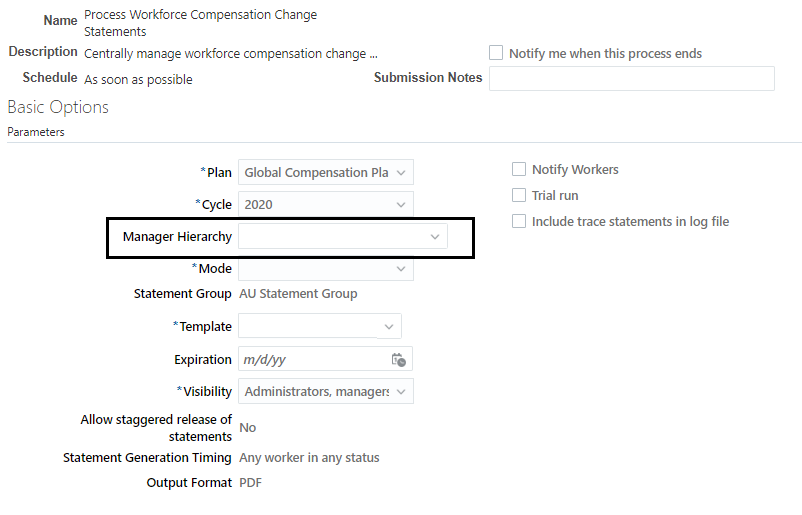

Process Worker Statements By Manager Hierarchy

You can now process worker compensation change statements by manager hierarchy. Previously, this option was not available.

New Batch Process Parameter

This feature lets you stagger the release of statements according to manager hierarchy.

Steps to Enable

You don't need to do anything to enable this feature.

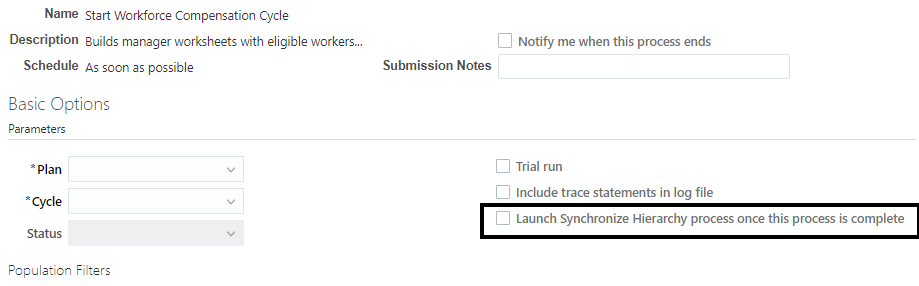

Launch Synchronize Hierarchy Process as a Part of the Start Workforce Compensation Plan Process

You can now launch the Synchronize Hierarchy batch process to populate the OTBI hierarchy tables when you start your workforce compensation plan. Previously, you had to run this process separately after the start process completed.

New Batch Process Parameter

This feature lets you use the OTBI reports built for workforce compensation plans immediately, reducing confusion for people.

Steps to Enable

You don't need to do anything to enable this feature.

Supply Vesting Date for Stock When Transferring Data to HR

You can now supply a vesting date when you transfer stock values back into HR. Previously, this option was not available.

New Vesting Date in Transfer Process

Administrators can apply the vesting date immediately when they transfer stock, instead of having to update the stock tables at a later date.

Steps to Enable

You don't need to do anything to enable this feature.

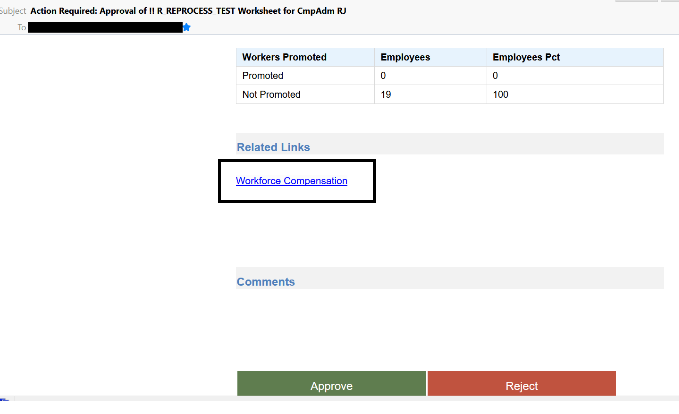

Updated Link in Workforce Compensation Notifications

To reduce confusion, we replaced the "Access this task in Worklist" link with a link to the Workforce Compensation landing page:

Updated Link In Notification

The updated link lets people go to the closest place possible in the application so they can complete their work.

Steps to Enable

You don't need to do anything to enable this feature.

Use Assignment Segments to Display Prorated Data in the Worksheet

You can now show prorated data using Assignment Segments, reducing confusion and freeing up worksheet columns. Previously, this information required multiple fast formulas to display the information in the worksheet. Now, you can load the data into External Data, configure the plan, and show the data for the managers to use.

Worksheet Assignment Segments

The screenshot above shows a person's data divided by time period. There are 2 periods of time that contribute to the overall bonus. You can see the salary and target % changed over time and the bonus amount associated with each. Some columns are enabled for update and others are not, which is configurable in plan setup. There's a row showing the total of the segments which is then passed to a worksheet column. Assignment Segment data can come from HR or from outside of the application and must be stored in External Data for use in this feature.

There's a new task in plan setup called Configure Assignment Segments. Once enabled, you see 65 user-defined columns that you can select from, but only 50 can be used at one time. The user-defined columns are broken out into 50 numeric, 15 text, and 5 date columns. Keep in mind you are repeating data in rows instead of in columns and most likely you will not need all 50. The following columns are also available for use and map directly to the associated External Data column:

- Person Name

- External Worker Data ID

- Assignment Number

- Legal Employer

- Worker Number

- Job

- Record Type

- Start Date

- End Date

- Eligibility Status

- Sequence Number

- Currency Code

In Assignment Segment column configuration, you have the ability to configure the following:

- Properties for columns, such as decimals to display, rounding rules, and visibility/access

- Dynamic calculations

- Apply a static default value

- Information text

You can also select to display rows that are ineligible and allow managers to detach the assignment segment table from the worksheet to have an expanded view of the data.

Assignment segments can have their own eligibility. You can select to use the plan/component eligibility or you can populate a value in the Eligibility Status column to make the row eligible, or leave it blank for the row to be found ineligible.

There are no changes to the Start Workforce Compensation Cycle batch process. You can refresh assignment segment separately from plan data when you update the External Data table data.

New Refresh Workforce Compensation Data Options

Use this feature to free up worksheet columns and reduce the use of fast formula. You can display segmented assignment data and prorate compensation amounts, such as bonuses, and provide managers the ability to update amounts.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- Populate the following columns in External Data to use the row in Assignment Segments:

- Job

- Assignment Number

- End Date

- Convert monetary values to the worker's currency as of the HR Data Extract Date

- Best practice is to keep the number of columns under 10 as scrolling within the assignment segment table reduces user experience

- Close all prior compensation cycles before you set up Assignment Segments in an existing plan.

Key Resources

- For more information about External Data see chapter 33 of the Implementing Workforce Compensation guide in the Oracle Help Center.

Assignment-Level Security in Workforce Compensation

You can now secure access to Administer Workers, Act as Proxy, and View Administration Reports by assignment. These pages restrict access to assignments according to a person's security profile, if you enable assignment-level security.

This feature allows you to more finely tune access to data.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to the following feature in the 20D HCM Cloud Common What's New for the Secure Access for Workers with Multiple Assignments feature.

Grade Step Progression: Assignment Effective Date on Eligibility

We added support for the transaction date On eligibility option in the progression grade ladder definition. Previously, that option used the process run date to populate the assignment date. Now, when you select On eligibility, the assignment transaction date is the actual date when the person met the eligibility criteria.

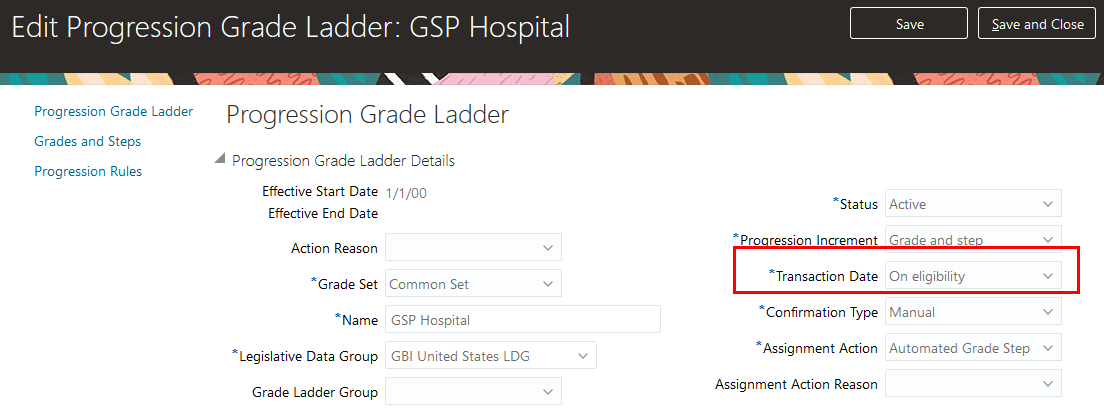

Transaction Date Set to On Eligibility

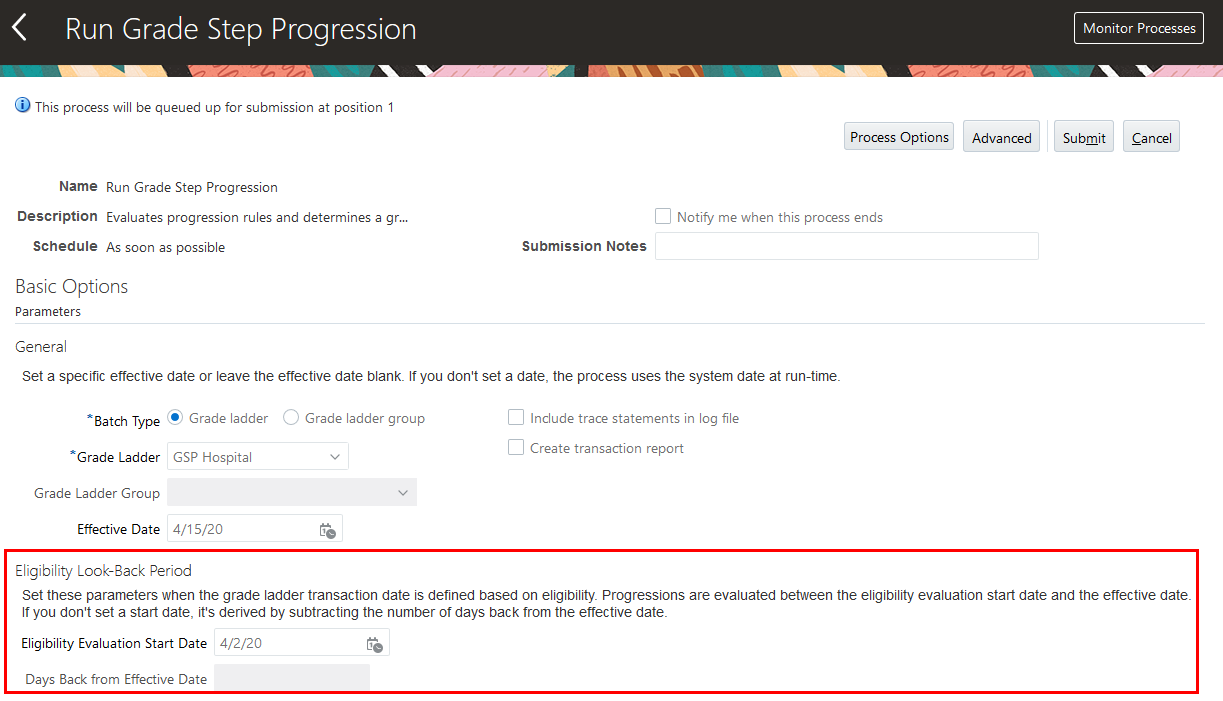

The grade step progression process evaluates people for potential progression within a specified date range, so you don't need to run the process every day. You specify the date range when you submit or schedule the Run Grade Step Progression process. For example, you want to run the process every 2 weeks, just prior to a payroll run. You need to specify a date range that covers the 2-week period since you last ran the process. You specify the start date in a new section on the Run Grade Step Progression page.

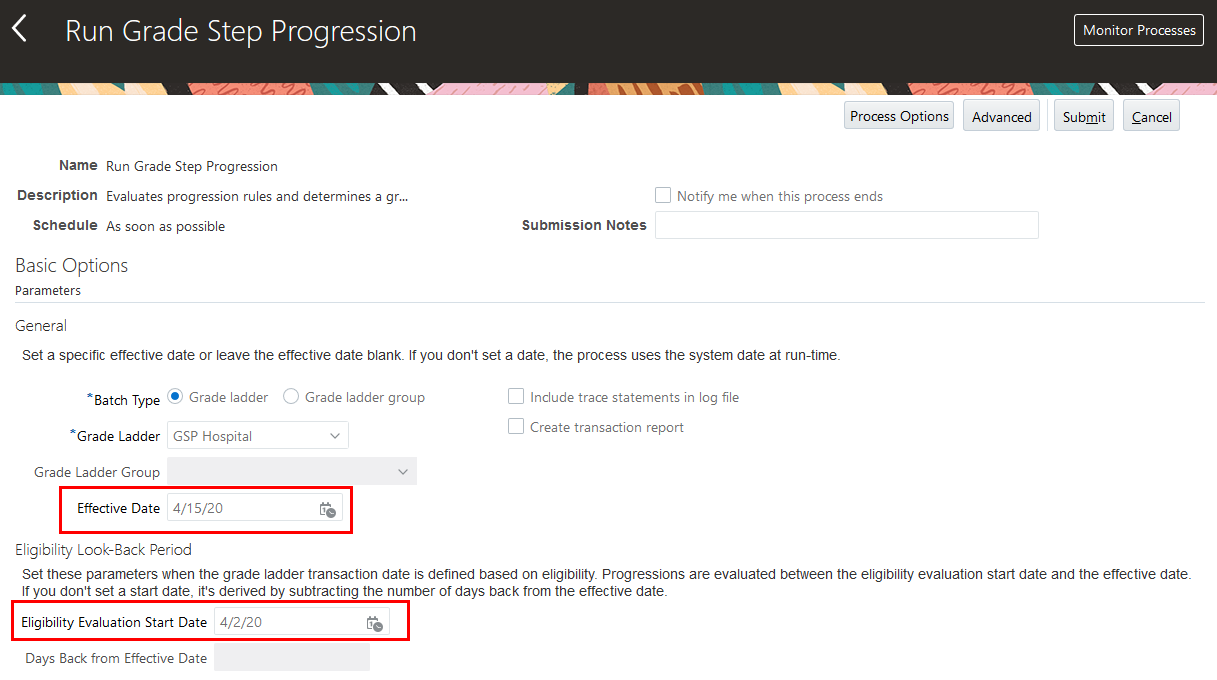

If you set an effective date for your process, then you need to specify an eligibility evaluation start date to define the start of the date range. If you left the effective date blank, then you specify the days to subtract from the effective date at run time. The process uses your setting to derive the start of the date range. Here, we have an effective date of April 15, 2020 and an eligibility evaluation start date of April 2, 2020. With these parameters, the process evaluates people for progression from April 2 to 15.

Specify the Date Range When Running the Process

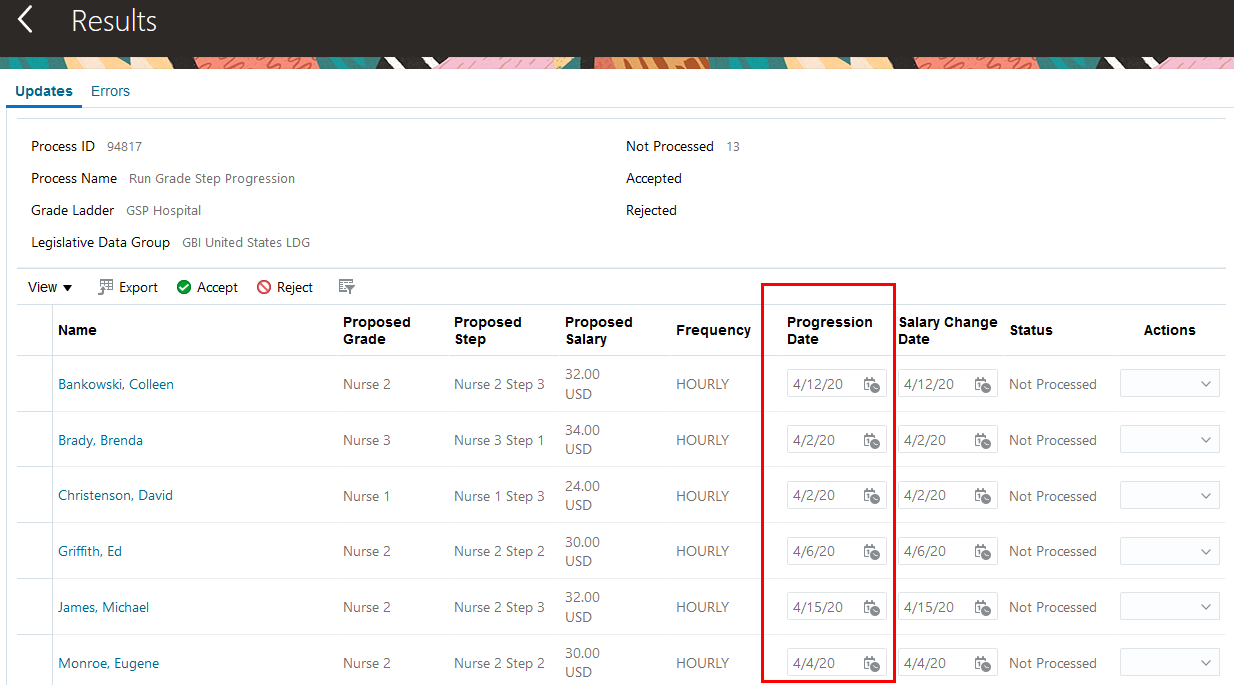

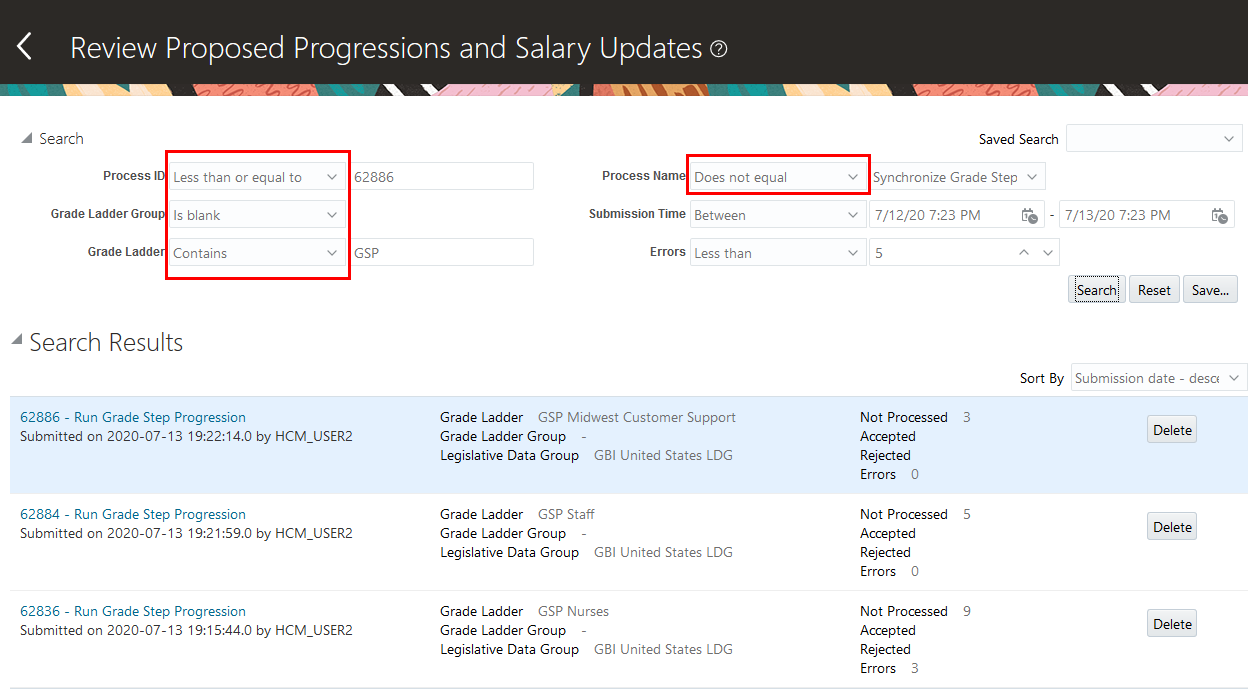

You can view the process results on the Review Proposed Progressions and Salary Updates page. In this example, someone is eligible to move to the next step when they've been in the current step for 6 months. On the page shown here, several people are eligible to move to the next step. Their progression dates differ, within the April 2 to 15 range because each person's step seniority date depends on the date when they entered their current step.

Progression Dates Vary According to Eligibility

Watch a Demo

You can set the transaction date to the date your people become eligible for progression, without having to run the process every day.

Steps to Enable

First, update your grade ladder transaction date attribute.

- On the Progression Grade Ladders page, set the assignment transaction date to On eligibility.

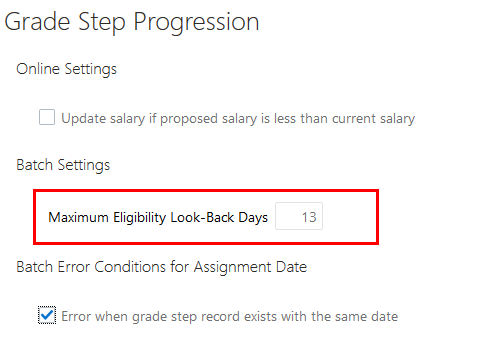

Next, specify the maximum number of days to look back when evaluating eligibility.

- In the Setup and Maintenance work area, click the Configure Global Compensation Settings task:

- Offering: Compensation Management

- Functional area: Base Pay

- Scroll to the Grade Step Progression section of the page.

- Under the heading Batch Settings, in the Maximum Eligibility Look-Back Days field, enter a number between 0 and 40. The value limits the date range for eligibility evaluation.

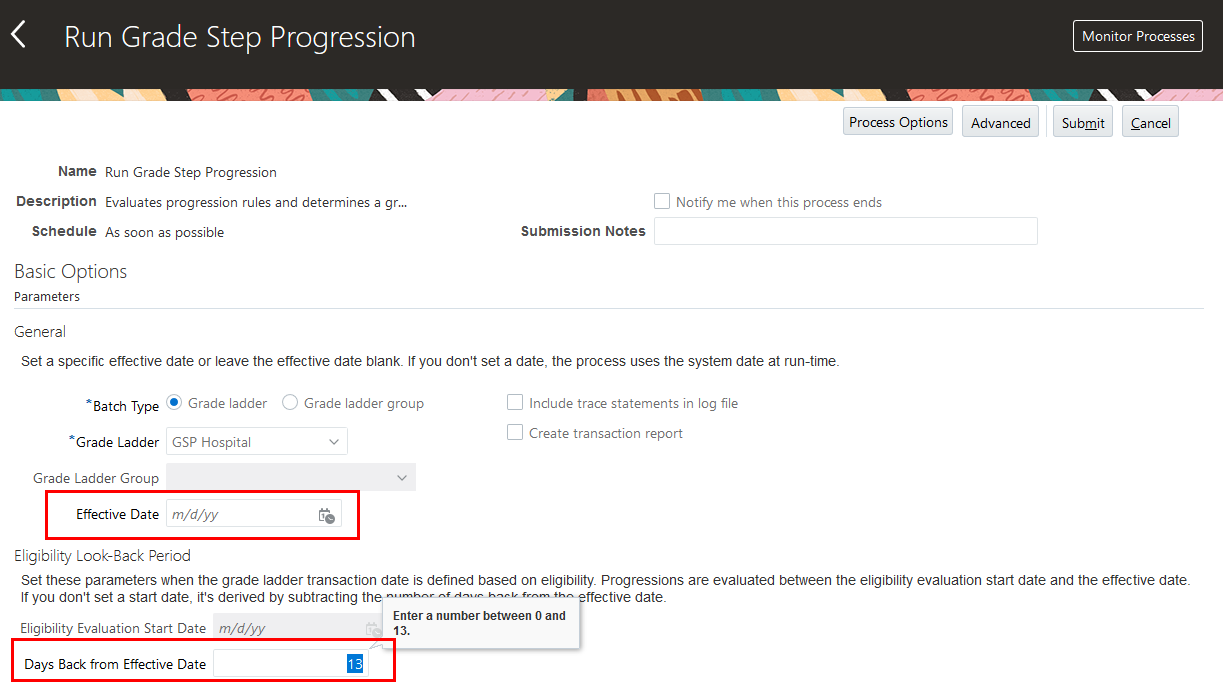

And lastly, specify the date range when you schedule or submit the Run Grade Step Progression process. If you enter an effective date, then you need to enter the eligibility evaluation start date in the Eligibility Look-Back Period section, as shown here.

Scheduling the Process with a Specific Effective Date

Or, if you are scheduling the process, you want to leave the effective date blank so that the process substitutes the system date at run time. You also need to specify the eligibility look-back days, which is used to calculate the start date at run time. The value that you can enter is limited by the Maximum Eligibility Look-Back Days value.

Scheduling the Process with a Blank Effective Date

Tips And Considerations

- For performance reasons, the maximum date range is 40 days. You can evaluate eligibility for a longer date range by breaking the process up into multiple date ranges of 40 days or less.

- The Eligibility Look-Back Period parameters on the Run Grade Step Progression page are ignored for any grade ladder transaction date value other than On eligibility.

- Progression results have assignment transaction dates between the Eligibility Evaluation Start Date and the Effective Date, inclusive. Anyone who met the eligibility criteria on a date before the eligibility evaluation start date, has their assignment transaction date set to the eligibility evaluation start date.

- Make sure that your successive runs of grade step progression cover all dates since the last time you ran the process. For example, if you are running the process biweekly (every 2 weeks), then you need to subtract 13 days from the effective date each time you run.

- The calculated start date is written to the batch log file for assistance with troubleshooting.

Key Resources

- Watch Grade Step Progression: Assignment Effective Date on Eligibility Readiness Training

- For more information, see the Implementing Workforce Compensation guide, Chapter 4: Grade Step Progression in the Oracle Help Center.

Additional Search Options in Grade Step Progression Review Page

You can now use search operators for the Process ID, Grade Ladder Group, Grade Ladder, and Process Name attributes on the Review Proposed Progressions and Salary Updates page. For example, you can search for all Process IDs less than or equal to a certain value. Or, you can search for all results where the Grade Ladder Group is blank.

Review Proposed Progressions and Salary Updates Page

Improve your ability to quickly find the process results you're looking for.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

For more information, see the Implementing Workforce Compensation guide, Chapter 7 - Grade Step Progression, Proposed Progressions and Salary Updates in the Oracle Help Center.

Assignment-Level Security in Grade Step Progression

The Review Proposed Progressions and Salary Updates displays results of grade step progression processes. When you enable assignment-level security for your organization, this page secures the results by assignment, according to the user's person security profile.

To illustrate the difference, let's look at the results of the grade step progression process, first with person-level security enabled and then with assignment-level security enabled. In this example, you're a compensation manager with access to a specific department, 05-Healthcare, in your person security profile. This grade ladder has two people with multiple concurrent assignments: Dorothy, and Christina. Both of Dorothy's assignments are in the 05-Healthcare department. Only one of Christina's assignments is in the 05-Healthcare department.

Here, the process was run with person-level security. You have access to both of Christina's assignments, even though only one of the assignments is in your department.

Compensation Manager View of Multiple Concurrent Assignments with Person-Level Security

Here, the process was run with assignment-level security enabled and for Christina, you see results for only her assignment in your department. You don't see any results for her assignments in other departments.

Compensation Manager View of Multiple Concurrent Assignments with Assignment-Level Security Enabled

Improve security by limiting access to proposed progression and salary updates process results to only assignments inside the person security profile.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to the followings feature in the 20D HCM Cloud Common What's New feature: Secure Access for Workers with Multiple Assignments

You can now upload stock details with the new HSDL. This adds to your loading capabilities and doesn't replace the traditional stock spreadsheet loader. Formerly you could only load using HDL or the spreadsheet loader. Now there are three methods you can use to load stock.

Formerly you could only load using HDL or the spreadsheet loader. Now there are three methods you can use to load stock.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, see the Oracle Human Capital Management Cloud Integrating with HCM chapter about Loading Compensation Objects that can be found in the Oracle Help Center.

You can now upload external data with the new HCM Spreadsheet Data Loader (HSDL). This adds to your loading capabilities and doesn't replace the traditional spreadsheet loader. Formerly you could only load using HCM Data Loader (HDL) or the spreadsheet loader. Now there are three methods you can use to load external data.

Formerly you could only load using HDL or the spreadsheet loader. Now there are three methods you can use to load external data.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, see the Oracle Human Capital Management Cloud Integrating with HCM chapter about Loading Compensation Objects that can be found in the Oracle Help Center.

Assignment-Level Security in External Data and Stock

You can now secure external and stock data access by assignment. The external data and stock pages restrict access to assignments according to the person's security profile, if you enable and setup assignment-level security.

Secure external data and stock access by assignment.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information, refer to the followings feature in the 20D HCM Cloud Common What's New for the Secure Access for Workers with Multiple Assignments feature.

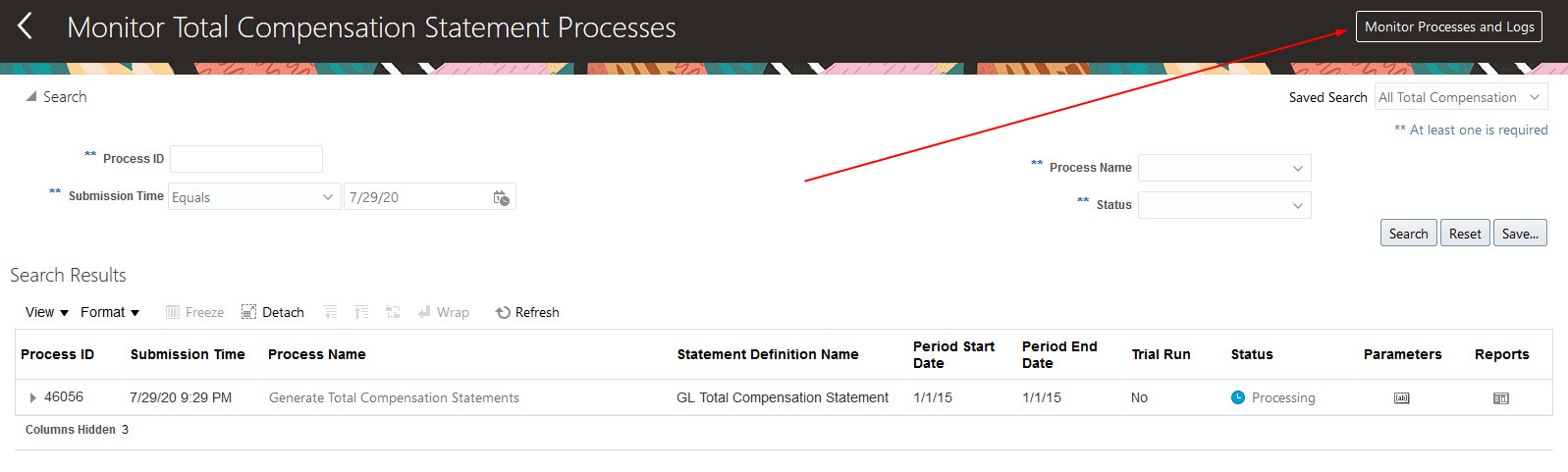

Total Compensation - Monitor Process Logs

You can now see process logs from Monitor Process in Total Compensation. Previously it was only possible to see the logs from the central Process Monitor. Now you can view them in the Total Compensation work area under Monitor Processes.

Monitor Total Compensation Statement Processes

Monitor Processes - Log and Output

You can now see process logs from Monitor Process in Total Compensation.

Steps to Enable

You don't need to do anything to enable this feature.

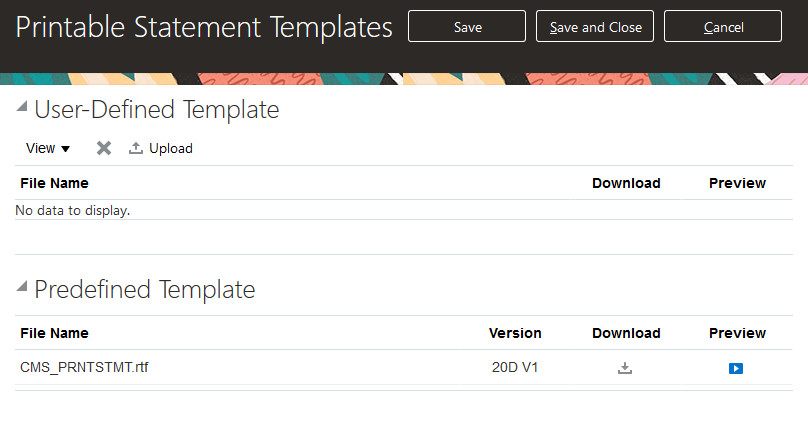

Total Compensation - Printable Statement Templates

You can now maintain and upload your printable statement template from within the total compensation work area. Previously it was necessary to navigate to the catalog in business intelligence to manage your template. Now the process is streamlined within the application, while following upgrade process best practices for business intelligence.

Printable Statement Templates

You can now maintain the printable statement template within Total Compensation.

Steps to Enable

You don't need to do anything to enable this feature.

Oracle Global Payroll is a high-performance, graphical, rules-based payroll management application. It’s designed to keep pace with the changing needs of your enterprise and workforce in order to reduce setup costs, administration, and processing time. It operates globally and consistently in every country supported by Oracle. It uses a highly scalable processing engine that takes advantage of the features of the Oracle database for parallel processing, resulting in optimal performance. In countries with payroll extensions delivered and supported by Oracle, the application delivers the calculations, tax reporting, and regulatory rules required to accurately process payroll and remain in compliance.

Payroll Data Capture Enhanced for Multiple Concurrent Assignments

Use this feature to restrict access to assignments based on the user’s Person Security Profile, if your organization allows workers to have multiple concurrent assignments. You can enable the new assignment-level security profile to ensure that users have access to only those assignments that match the criteria defined in their person security profile.

This behavior applies to a limited set of Quick Actions, such as Payroll Relationship, Element Entries, Calculation Entries, and Costing for a Person. For all other payroll features, the behavior remains the same: if at least one of the employee’s assignment satisfies the criteria in the person security profile, then the application displays all assignments on the search results page.

What's Changed

This table describes how the enhanced data capture applies to these Quick Action tasks:

| Task | Manage Page | View-Only Page | REST | Responsive Person Search | What's Displayed? |

|---|---|---|---|---|---|

| Payroll Relationship |

Yes | Yes | Yes | Assignment in Security Profile |

|

| Element Entries |

Yes |

Yes | N/A | Assignment in Security Profile |

|

| Calculation Entries |

Yes | Yes | N/A | Assignment in Security Profile |

|

| Costing for a Person |

Yes | Yes | N/A | Assignment in Security Profile |

|

Limitations:

- Any other page, process, or report apart from those in the table operate at the payroll relationship level. The current behavior remains the same – you will have access to all assignments, provided at least one of the assignments satisfies the criteria set in the Person Security Profile.

- If you have access to one assignment in Manage and one assignment in view-only pages for the same employee, you can manage both assignments. The Manage access takes precedence over view-only.

- Calculation entries, such as Absence and Time region does not support assignment level security.

- Quick Pay Person Search returns all assignments. If you select an assignment that you're not allowed to view, then the application displays those element entries for the assignments you are allowed to view, which could be a different assignment than the one selected. If you aren’t allowed to view any assignment, then the element entry section is blank. If you submit the Quick Pay, then the application processes all element entries.

- Payroll Person Search is not supported with assignment-level security. When enabling assignment-level security, use the Global Person Search.

Users can now access the correct worker assignments based on their area of access.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Because you run most of the payroll processes at a higher level than the assignment, it’s important for you to have a complete view of the payroll data entry. Take care when defining person security profile as it might restrict access to certain assignments.

Key Resources

- For more information about assignment-level security for workers, refer to the 20D HCM Cloud Common What's New for the Secure Access for Workers with Multiple Assignments feature.

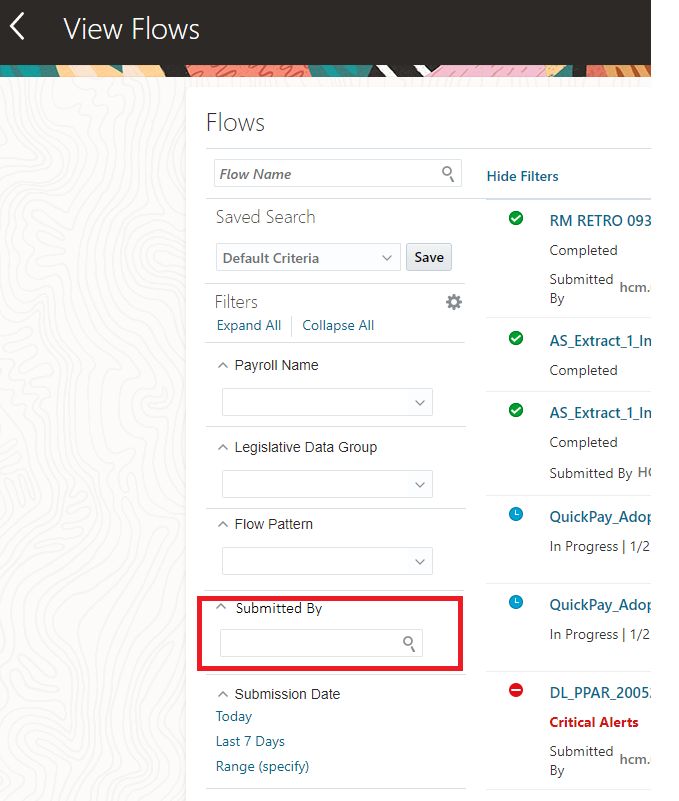

Use the Submitted By field to filter on the person who has submitted a process. This field is available on the View Flows and Process Results Summary pages.

The Submitted By field is a free text field and you can only use the 'contains' filter option, you cannot use any other filter option for this field.

The Submitted By filter helps the user filter and view much faster processes submitted by a person. This filter is available on the View Flows and Process Results Summary UIs.

Steps to Enable

You don't need to do anything to enable this feature.

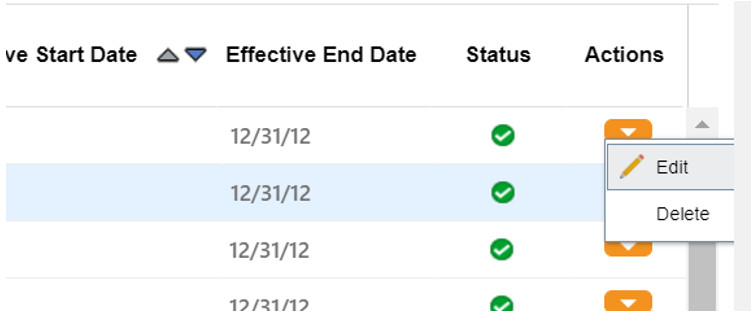

Delete Element from the Search Page When ESS Fails

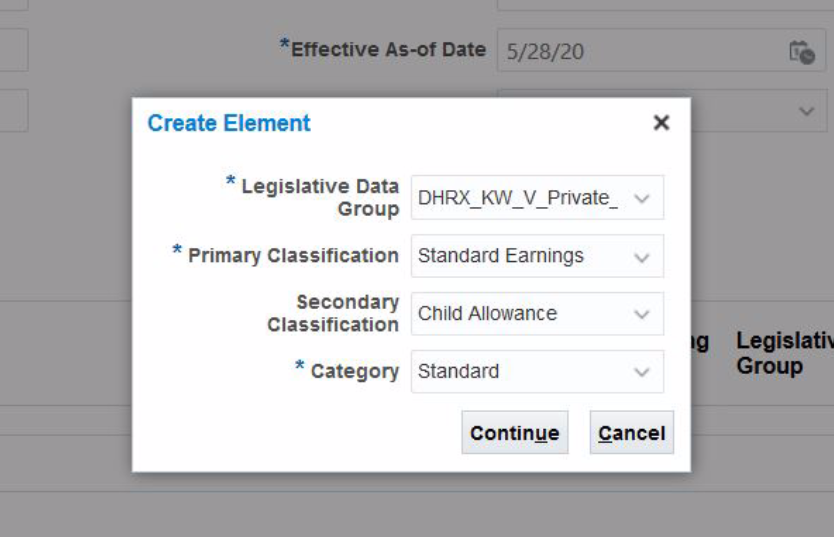

On the Element Search page, you can delete those elements that are in the In Progress status. However, you can delete only those elements for which the corresponding ESS element creation process has errored out.

Element Search

You no longer need scripts for deleting elements and then again creating them with the same details.

Steps to Enable

You don't need to do anything to enable this feature.

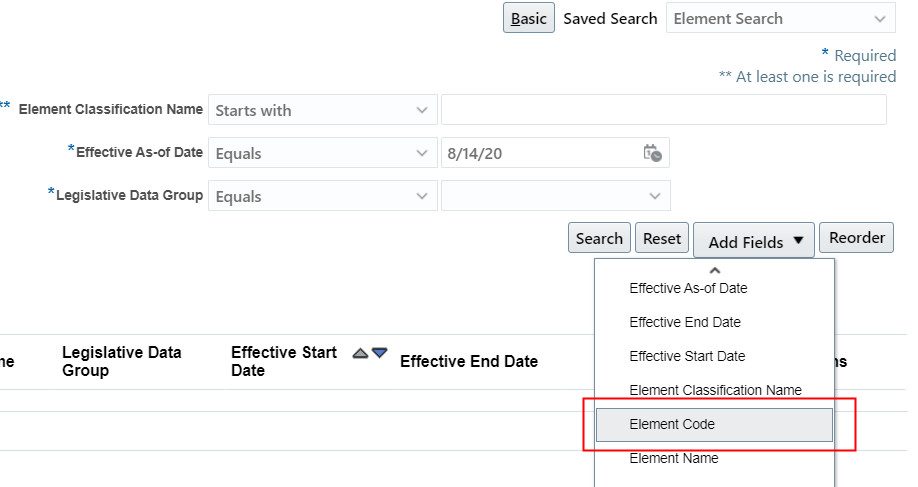

Display Element Code on the Element Search Page

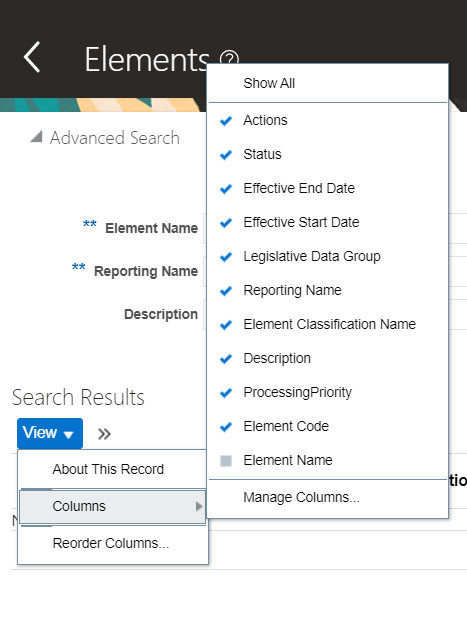

Include the Element Code on the Search Elements page. You can use the Add Fields option in the Advanced Search region to add the Element Code attribute. You can also add the attribute by selecting View > Columns > Element Code to view the Element Code along with other element details. Include the Element Code on the Search Elements page. You can use the Add Fields option in the Advanced Search region to add the Element Code attribute. You can also add the attribute by selecting View > Columns > Element Code to view the Element Code along with other element details.

Element Code Option on the Advanced Search Page

Element Code Option on the Search Results Region

This feature helps you in distinguishing the elements when the displayed element name is same for more than one element. After the element is created, you can override the displayed element name, which might match up with the existing displayed element name. This might create confusion when there are multiple elements with the same name. Because the element code doesn’t change when the displayed element name is changed, you can now easily identify the individual elements. The element code is used in already configured fast formulas, if applicable.

Steps to Enable

You don't need to do anything to enable this feature.

Simplified Stop Rule Creation for Deduction Elements

You can streamline the creation of Voluntary Deduction and Pretax Deduction elements by reducing the number of rules created. The application creates stop rules only if you had selected the total owned option when you created the element.

If you had selected No for the template question Processing Stop when the Total is Reached, the application doesn’t create the stop rule for the element.

This feature helps you in changing the multiple entries allowed flag N to Y for voluntary deduction and pretax deduction elements, provided it meets the other eligibility criteria, described in the 20A Workforce Rewards What's New feature - Flexibility in Element Attributes Update.

Steps to Enable

You don't need to do anything to enable this feature.

Retroactive Pay Process Updates for Change in Hire Date

Retroactive Changes process now calculates retropay when you change an employee's hire date to a date within a payroll period that has been processed. If you have an employee that missed the regular payroll run because the hire date is changed to an earlier date within the same payroll period, to a later date within the same payroll period, or the hire date has two changes in current payroll period, the retropay process will process the employee's payroll as of the new hire date and post the results in the next open payroll period.

For example, an employee's hire date is entered as 15-MAR but the employee actually began working on 15-FEB. It wasn't until after the February payroll had been processed that the data entry error was discovered and corrected by HR. The change to the hire date to 15-FEB will be recognized, processed, recalculated and results will be posted in the appropriate February payroll period.

Now when you change an employee's hire date to a date within a payroll period that has been processed, this change is detected and processed.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For information on retroactive pay, refer to the Implementing Global Payroll, Administering Global Payroll and Administering Payroll Costing guides in the Oracle Help Center.

Role Information

- Payroll Specialist

Payroll Post Processing with Consolidation Group Parameter

You can run Transfer Payments Information to Cash Management, Calculate Costing of Payments and Transfer to Subledger Accounting processes by passing the Consolidation Group parameter to simplify the payroll post processing.

NOTE: If payment processes are run with a value in the Consolidation Group parameter and no value in the Payroll parameter, the Costing of payments process should also be run with no value in the payroll parameter.

Transfer Payments Information to Cash Management process

- Leave Payroll parameter blank

- Choose your consolidation group from the list of values on the Consolidation Group parameter

- Process picks up the payroll payments associated to the consolidation group and transfers to Cash Management

Calculate Costing of Payments process

Without Cost Clearing Account

- Leave Payroll parameter blank

- Choose your consolidation group from the list of values on Consolidation Group parameter

- Process picks up the payroll pre-payments associated to the consolidation group and calculates costing

With Cost Clearing Account

- Leave Payroll parameter blank

- Choose your consolidation group from the list of values on Consolidation Group parameter

- Run this process to pick up the payroll pre-payments associated to the consolidation group and calculates costing

- Run the payment process and cash management reconciliation

- Run this process a second time to pick the payment processes run with Payroll, associated to the consolidation group

Transfer to Subledger Accounting process

- Leave Payroll parameter blank

- Choose your consolidation group from the list of values on the Consolidation Group parameter

- Process picks up the payroll payments associated to the consolidation group and transfers to Subledger Accounting for both the costing results and payment costing results

Simplify the payroll post processing when you run the Transfer Payments Information to Cash Management, Calculate Costing of Payments and Transfer to Subledger Accounting processes by passing the consolidation group parameter.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

All payroll processes, beginning with the Payroll run, must use the same consolidation group to utilize this feature.

Key Resources

- For information on using configuration groups, refer to the Implementing Global Payroll, Administering Global Payroll and Administering Payroll Costing guides in the Oracle Help Center.

Role Information

- Payroll Specialist

New Reports for Payroll Activity and Statutory Deductions

You can now run the following enhanced reports to extract the periodic payroll balances for large volumes of data:

- Periodic Payroll Activity Report

- Periodic Statutory Deduction Register

The new reports use a much lighter report template with enhanced performance and scalability capabilities to handle high volumes of data. You can now run the reports to produce CSV/text output that is easily imported into the Excel format. This is in addition to the PDF and Excel outputs we already support.

In addition to Current and YTD, you can also extract payroll balances for the following:

- Month to Date

- Period to Date

- Quarter to Date

- Inception to Date

The above two reports produce the same output as running the existing reports with the ‘Latest Process YTD Totals Only’ field set to ‘No’. However, for large volumes of data, the enhanced report runs much faster.

Process high volumes of data with minimal time, with the option to display Run, Year-to-date, Month-to-date, Quarter-to-date, Inception-to-date, and Period-to-date balances.

Steps to Enable

The new reports are enabled out-of-the-box but produce an output with Current and YTD balances only. However, if you want to extend the report to display one or more of the 4 additional dimensions, additional steps need to be followed as documented under the help topic listed in the Key Resources section.

Tips And Considerations

- These new periodic reports complement the corresponding Latest Process reports released a few releases ago. Together, they should effectively replace the old reports, namely Payroll Activity Report and Statutory Deduction Register. It is therefore recommended to use the enhanced reports instead of the old reports.

- If you have configured changes to your existing extract definition, including but not limited to delivery options, report templates, and so on, then those must be reapplied to the new reports, if required.

- For very large data sets, it is quicker to run the Text (CSV) format and then import it into Excel instead of producing an Excel directly.

Key Resources

For more information see the Auditing and Reporting chapter of the Administering Global Payroll guide in the Oracle Help Center for the following topic:

- Latest Process Year-to-Date Reporting

Global Payroll Redesigned User Experience

Increase user satisfaction with the redesigned pages that now have the same look and feel on desktop and mobile devices. These redesigned pages are both responsive and easy to use on any device, with a modern look and conversational language. Clutter-free pages, with clean lines and just the essential fields, can be personalized to suit.

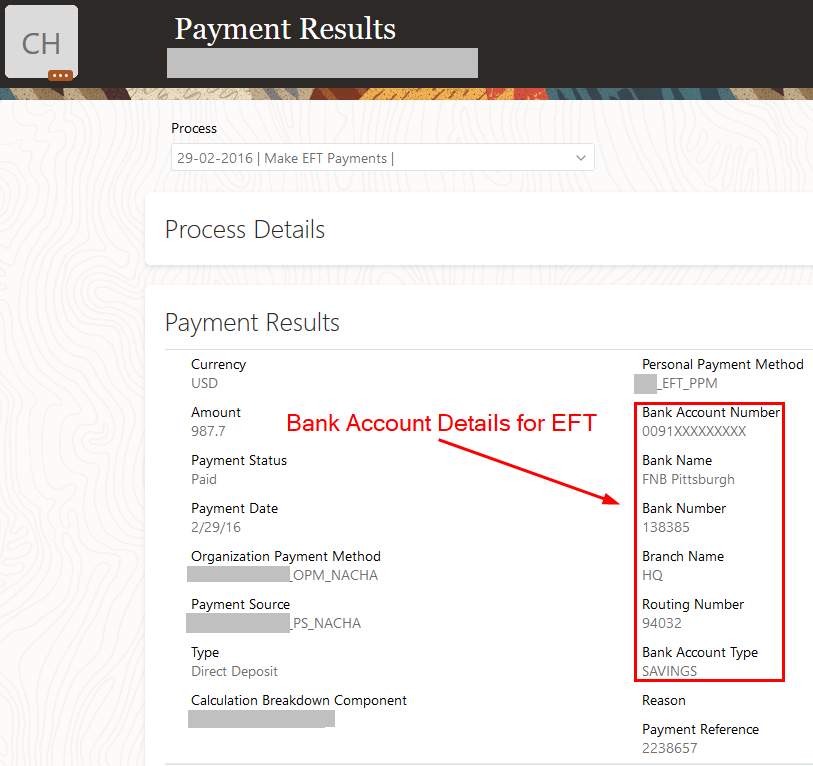

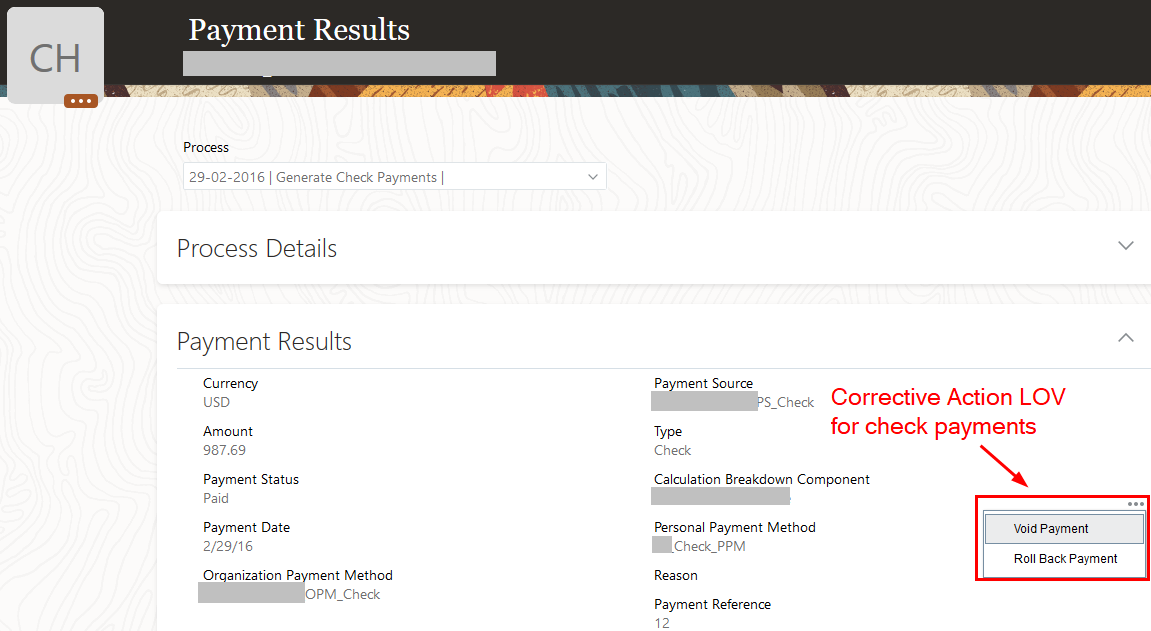

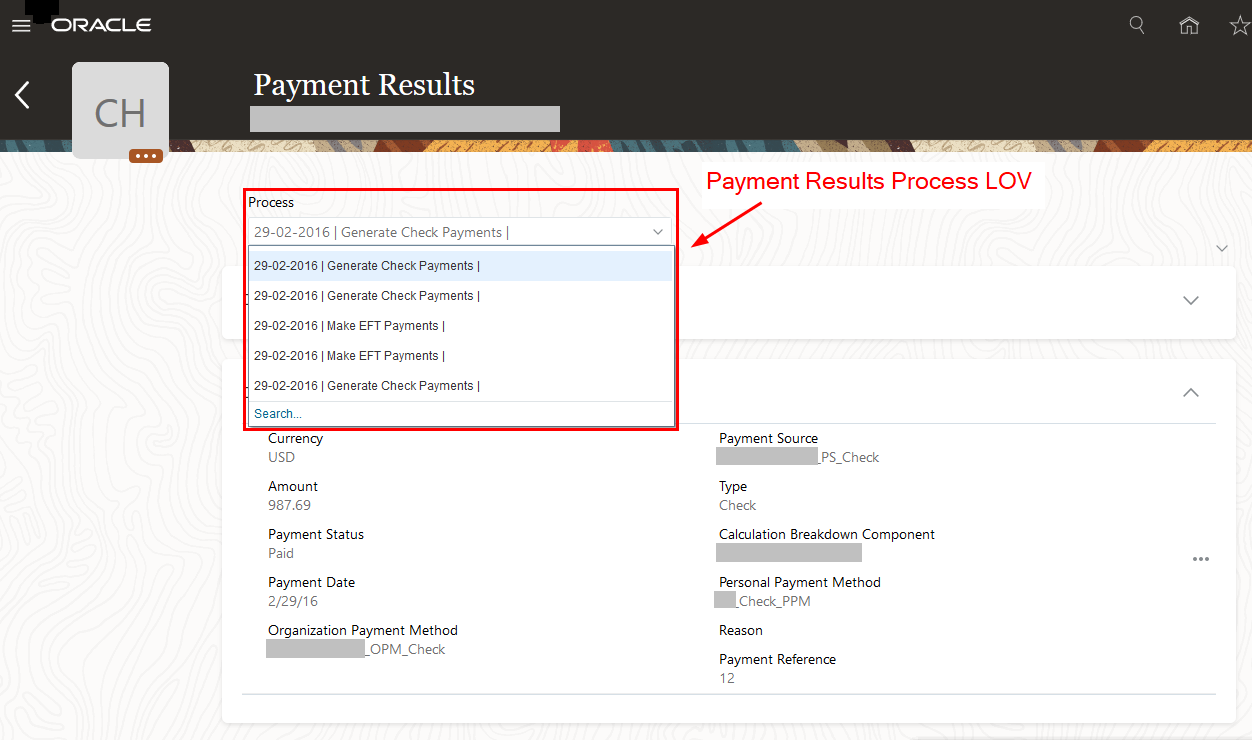

Prepayment and Payment Results Responsive Pages

Prepayment and payment results pages allow you to see details of the payments, such as check number, status of payment and bank account details and take corrective actions, such as mark a payment as void.

The Process LOV on these pages allows the user to switch between different payroll periods and processes without having to return to the person results page. The Process Details region is where you view the details of the payroll process run.

Navigation options to view the payment results responsive page:

- Payroll Work Area > Process Results Summary > Payments Process > Drill down to an employee

- Payroll Work Area > Person Results > Search for person > Drill down onto a payments process

This feature allows you to use your mobile device to manage the details of an employee's prepayment and payment results with the same look and feel as your desktop.

Steps to Enable

In order to have access to the new responsive pages, you must have enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option. If you have not enabled the HCM_RESPONSIVE_PAGES_ENABLED profile option, please see the HCM Responsive User Experience Setup Information in My Oracle Support (Document 2399671.1).

NOTE: This step of enabling profile is for existing customers only. New customers starting with 19D or a later release do not need to setup these profiles, as the new responsive screens are delivered by default.

To enable the profile option, navigate to the Setup and Maintenance work area:

- Search for and click the Manage Administrator Profile Values task.

- Search for and select the profile option.

- Click to add a new Profile Value.

- Select the Level as Site.

- Enter a Y in the Profile Value field.

- Click Save and Close.

Tips And Considerations

When the 'ORA_PAY_PAYROLL_ADMIN_PHASE_2_RESPONSIVE_ENABLED' profile option is set to 'Y', the 'View Payment Results' task is appearing in the following areas and taking the user to the classic version of the page: My Client Groups>Quick Actions, Payroll Work Area, Global Search.

Oracle Bug Reference: 31646662

Key Resources

For more information on enabling profile options, displayed and hidden fields and other setup information for the Redesigned User Experience, please refer to the following document on My Oracle Support:

- HCM Responsive User Experience Setup Information (Document 2399671.1)

For information on prepayments and payments, refer to the Implementing Global Payroll, Administering Global Payroll and Implementing Payroll Costing guides in the Help Center.

Role Information

- Payroll Specialist

Payroll Relationship HCM Data Loader Enablement

Use HCM Data Loader to load the Payroll Relationship information. For example, UAE MOHRE Employee ID and WPS Details.

This feature helps you to manage Payroll Relationship data using HCM Data Loader. For example, you can now load the statutory information required for the Wage Protection System in the United Arab Emirates.

Steps to Enable

You don't need to do anything to enable this feature.

Key Resources

- For more information on how to load payroll data using HCM Data Loader, refer to the HCM Business Objects guide, in the chapter on Loading Payroll Relationships for the Overview of Loading Payroll Details topic, located in the Oracle Help Center.

ATOM Feeds for Assigned Payroll Updates

When you assign a payroll or update a payroll assignment to an employee, an ATOM feed is generated for the employee. The ATOM feed includes the details of the newly-assigned payroll and the effective date for this change.

Atom feeds are organized into workspaces and collections. A collection can exist within multiple workspaces. You can subscribe to a workspace or a collection.

As the table describes, the employees workspace is organized into payupdate collection.

| Workspace |

Collection |

Attributes |

Trigger |

Old / New Values |

Event Title |

Event Name |

Event Summary / Description |

|---|---|---|---|---|---|---|---|

| employee |

payupdate |

Payroll Relationship IdPayroll NamePerson NumberStart DateEnd Date |

Create, Update, Delete |

For the listed attributes |

XXX's Assigned Payroll Details Updated |

PersonPayrollDetailsUpdated |

Person Payroll Details Updated |

Let's consider this example:

{

"Context": [ {

"PersonId": "100100150129313",

"AssignmentId": "300100212700171",

"PersonName": "ExtRTIUAT002LN,ExtRTIUAT002FN",

"EffectiveStartDate": "2020-08-04",

"EffectiveDate": "2020-08-17",

"PayrollId": "300100192343424"

} ],

"Changed Attributes" : [

{ "PayrollId": {

"old": "",

"new": "300100192343424"

} ,

"FSED": {

"Old" : "",

"New" : "2020-08-04" },

}

}

]

You can now get an ATOM feed in real-time when an employee’s payroll assignment is updated to process the changes in any downstream systems. For example, whenever a change is made in the HCM Cloud, external payroll processing systems can be alerted of it immediately.

Steps to Enable

You don't need to do anything to enable this feature.

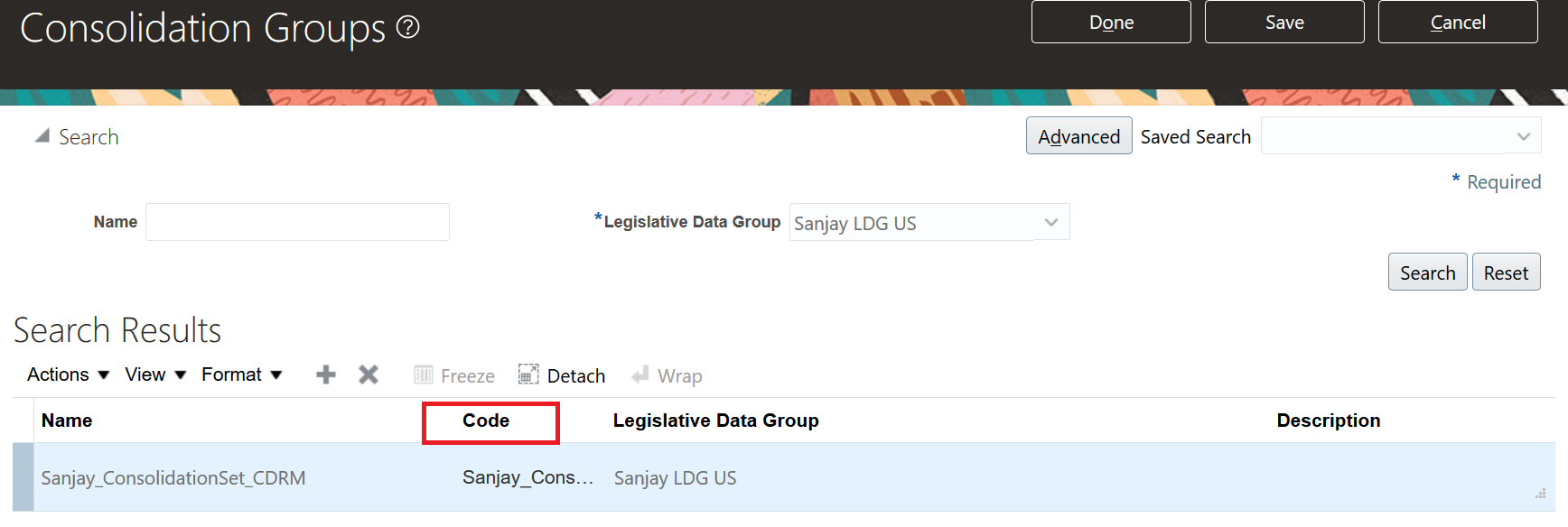

You can now associate a consolidation set code with a consolidation group name. Use this code to identify the consolidation group on the page or when you load the consolidation group using services or the HCM Data Loader.

Once created, you cannot change the consolidation set code. However, the consolidation group name is now editable. Any changes made to the consolidation group name, does not have any impact on the payroll process, because the process is stamped with the consolidation set code, and hence can be identified by the code for future references.

Use the consolidation group set code to identify the consolidation group on the page or when you load the consolidation group using services or the HCM Data Loader.

Steps to Enable

You don't need to do anything to enable this feature.

Global Payroll Replaced or Removed Features

From time to time, Oracle replaces existing features with new features, or removes existing features.

Replaced features may be put on a path of removal, the features below will let you know what update you will have to have moved to the newer feature. As a best practice, you should move to the newer feature as soon as possible for full support and to stay up with the latest updates that the product offers.

Any feature that is removed, will have an Update in which that feature is no longer available. Please make necessary plans to move off the feature by the Update indicated, as it will no longer be available.

HCM Data Loader (HDL) Must Be Used for All Payroll Objects

Take note that Payroll Batch Loader (PBL) objects are supported in HCM Data Loader (HDL). Loading of payroll objects through PBL is no longer supported starting with Update 20D. All Integrations must use the HDL tool for loading payroll objects.

Fast Formula Transformation is supported with HDL and can be used to transform the incoming file and output the data in the HDL .zip format.

HCM Spreadsheet Data Loader (HSDL) is a single generic spreadsheet to support all Business Objects. HSDL provides:

- Metadata driven approach

- Flexible layout

- User designs the spreadsheet based on their requirement/columns

- Configurable fields

Payroll Business Objects supported by HDL also means that HSDL is available.

With the support of the Payroll objects, HCM Data Loader now supports a single loader for all HCM objects.

Steps to Enable

You don't need to do anything to enable this feature.

Payroll for Oracle Human Capital Management for Canada supports country specific features and functions for Canada. It enables users to follow Canada's business practices and comply with its statutory requirements.

Process third-party cheques for employee involuntary deductions. Third-party payments are available for all classifications of involuntary deductions:

- Garnishments

- Maintenance and Support

- Tax Levy

Prior to generating a third-party cheque, you must first:

- Create an organization payment method of type “Third-party cheque"

- Create a third-party payee (organization or person)

- Create a third-party payment source

- Create the involuntary deduction element

- Create the involuntary deduction card for the employee, and add payee

Use the Generate Cheque Payments for Employees and Third-Parties process to initiate third-party payments. The new process generates the following as output:

- Third-Party Cheque Payment

- Third-Party Cheque Payments Audit Report

Prerequisite processes of the Generate Cheque Payments for Employees and Third-Parties process are:

- Calculate Payroll

- Generate Prepayments

- Archive Periodic Payroll Results

- Third-party Payment Rollup (if applicable)

Third-Party Cheque Payment

The third-party cheque payment displays the payment details on the cheque stub, along with the physical cheque payable to the third-party.

The maximum number of payment detail lines included on the cheque stub is 17. If more than 17 are present in the payment, a message is displayed to refer to the audit report for details and no detail lines are displayed on the cheque stub.

The Third-party Payment Rollup process provides the ability to provide one cheque for each third-party payee to rollup multiple employee payments. Rollup provides the ability to combine multiple payments of different employees to one payee, or multiple separate payments of one employee to one payee. If payments are not rolled up, individual cheques are created for each employee payment for each third-party payee.

Third-Party Cheque Payments Audit Report

The cheque payment audit report displays the employee payment details of each third-party cheque generated. This report is produced automatically as part of the process.

This feature provides benefit to your business by providing the ability to generate third-party cheque payments automatically in Oracle Cloud.

Steps to Enable

In order for the process to access the balances required for the new feature, you must create a new involuntary deduction element.

Tips And Considerations

The new “Generate Cheque Payments for Employees and Third-Parties” process replaces the “Generate Cheque Payments” process.

You may exclude third-party payments from the rollup process by selecting the ‘Exclude from Third-Party Rollup Process’ when setting up the Third-Party Payment Method in the Payment Method page. By running the rollup process prior to the new Generate Check Payments for Employees and Third-parties process, each payment to the third-party marked for exclusion will not be included in the rollup and will be paid separately.

Key Resources

Refer to the documents below on the Canada Information Center for additional information.

Canada Information Center

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Product Documentation > White Papers > Implementation and Use

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature

Payroll for Oracle Human Capital Management for China supports country specific features and functions for China. It enables users to follow China's business practices and comply with its statutory requirements.

Enhanced Mass Legal Employer Change

You can now use the enhanced Mass Change Legal Employer task to automatically manage the personal deduction card information for multiple employees in a single process within the same mainland China legislative data group.

Create Mass Legal Employer Change Page

Mass Legal Employer Change When the Tax Reporting Unit Attribute is Hidden (Ready-To-Use Functionality)

- If both the legal employers share the same payroll statutory unit, and if the Tax Reporting Unit attribute is hidden in the mass change legal employer flow, the application makes no changes to the existing personal deduction card.

- If both the legal employers are associated to different payroll statutory units and the transfer-in legal employer is a newly set up company, the application does the following:

- After the flow is submitted for all the employees covered in the flow, a new payroll relationship is created for them on the transfer date

- A new personal deduction card with the card details is copied over except association information

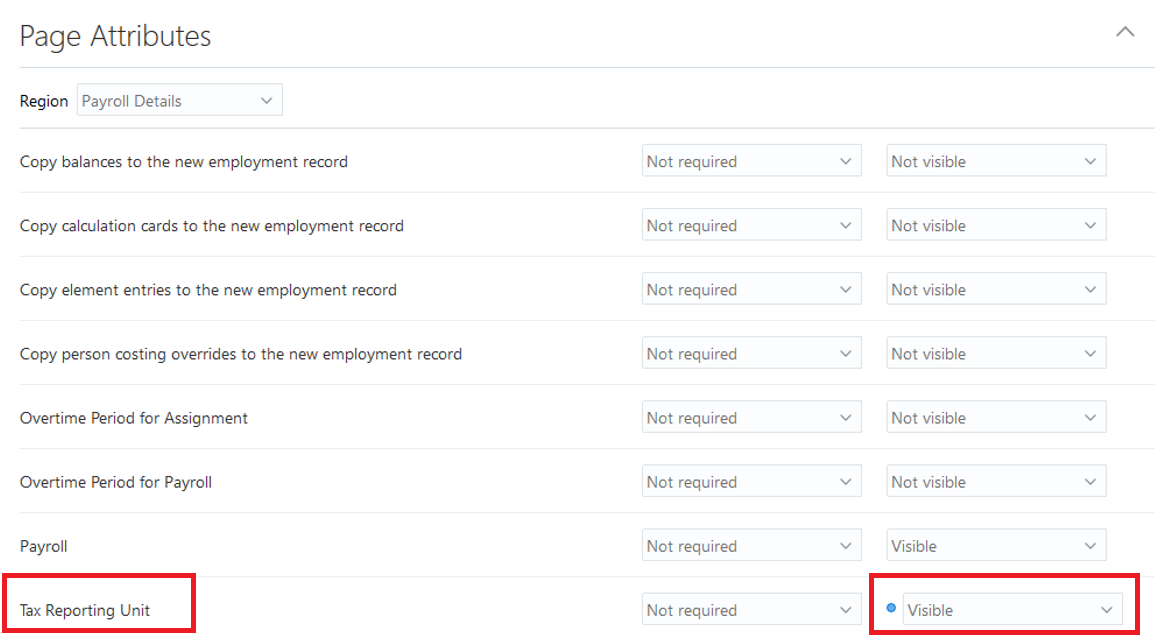

Mass Legal Employer Change When the Tax Reporting Unit Attribute is made Available via HCM Experience Design Studio

- If both the legal employers share the same payroll statutory unit, and you specify a value during the transfer, the application does the following:

- After the flow is submitted for all the employees included in the flow, their tax reporting unit association information is updated with the specified tax reporting unit value as of the transfer date on their existing personal deduction card

- An association detail record is created for their newly added assignment with effective start date set to the transfer date on their existing personal deduction card

- If both the legal employers are associated to different payroll statutory units and the transfer-in legal employer is a newly set up company and you specify a value for the Tax Reporting Unit attribute, the application does the following:

- After the flow is submitted for all the employees included in the flow, a new payroll relationship is created for them on the transfer date

- A new personal deduction card with the card details is copied over except association information

- Both the association and association details information is created for them as of the transfer date

Improve the productivity in managing mass legal employer changes.

Steps to Enable

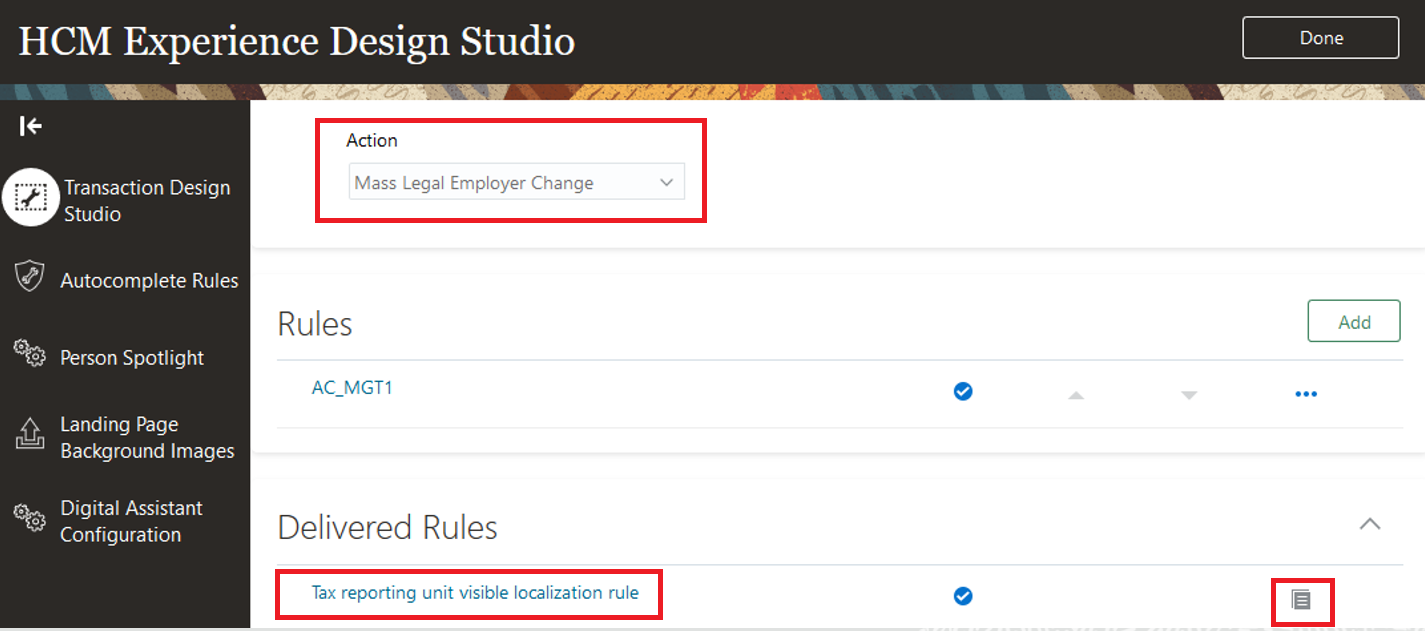

Do these steps to make the Tax Reporting Unit field visible in the Mass Legal Employer Change task:

- Click Navigator > Configuration > Sandboxes to create and enter a sandbox with the HCM Experience Design Studio configuration option.

- On the Home page, click My Client Groups > Quick Actions > Employment > HCM Experience Design Studio.

- From the Action list, select Mass Legal Employer Change.

- In the Delivered Rules section, select the existing Tax reporting unit visible localization rule and click the Duplicate icon beside the rule to reuse it.

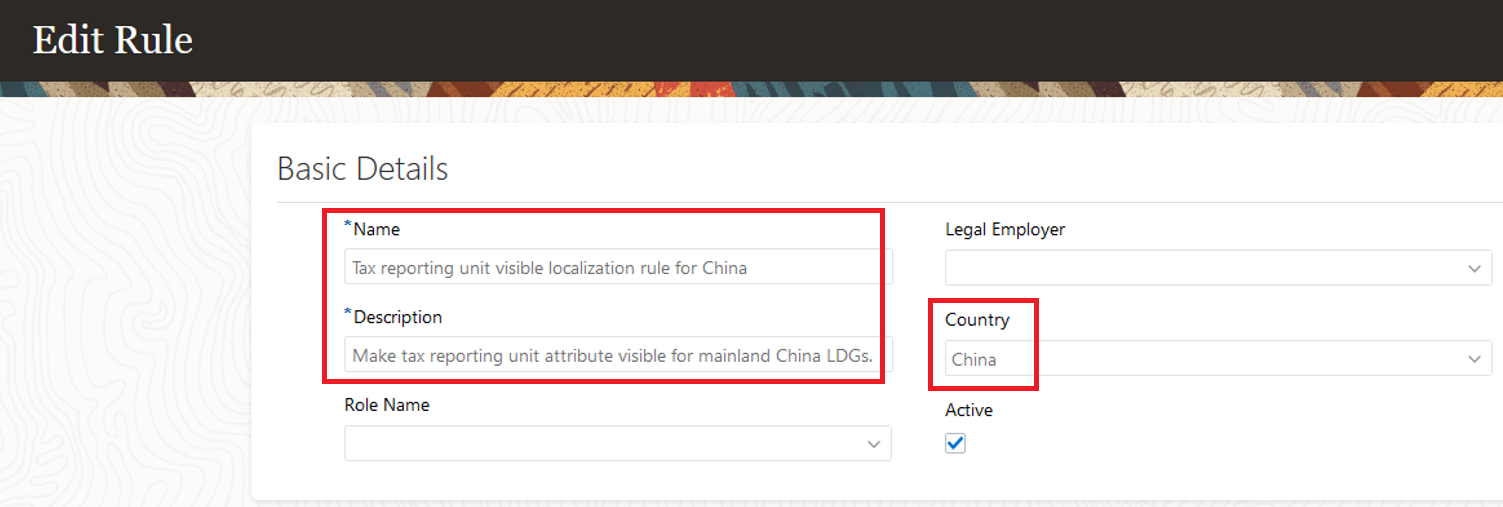

- On the Edit Rule page, in the Basic Details section, do the following: