-

Estimated reading time: 1 minute

Utility Industry Viewpoints

The utility industry is transforming. Arguably, it’s the greatest transformation since electricity, gas, and water were first delivered to the doorsteps of homes and workplaces. Historically, utility companies have been risk-averse, slow to change, and encumbered by legacy operating frameworks, outdated processes, and aging workforces. However, that is all changing due to the overwhelming volumes of data generated by applications, devices, and sensors. Today, utility companies are being forced to move quickly to digital business models, reinvent their processes, and reskill their workforces.

“If you want to do something new, you have to stop doing something old.” Peter Drucker, Management Consultant, Educator, and Author

The digital world has fundamentally shifted consumer behavior, which calls for an industry-wide mindset change. With a sharp and urgent focus on service, value, convenience, choice, and trust, utility companies must rapidly digitize, decentralize, and democratize the ways they distribute gas, electricity, and water. If they don’t, they will struggle to attract and keep customers, and compete with agile market disrupters.

But competition is fierce and coming from unfamiliar places. In some countries, nonutility companies are seizing as much as 20 percent of the retail energy market, so the pressure on utility companies to change their business models is set to escalate. This combination of competitor diversity and consumer power is forcing change. As a result, utility companies are rapidly reinventing; devising new strategies, adopting new processes, and developing innovative new models.

In this ebook, we’ll cover the most pressing challenges and most promising opportunities for utility companies. These include the drive toward customer centricity and how dual innovation is the blueprint for success that utility companies are looking for.

-

Estimated reading time: 4 minutes

Utility Companies and Customer Centricity

In the past, utility companies had a limited view of each customer—they were often seen as simply consuming “loads” on the network. But, today, customer centricity is a top priority for utility companies. Rather than providing a universal, one-size-fits-all service, utility companies are learning to personalize their service offerings to engage with customers. They know loyalty is fragile and that customers in retail markets can and will switch providers with ease.

What do customers actually want?

Are customer expectations and levels of satisfaction different to other industries? Jeremy Heath, innovation manager at SES Water, describes the company’s view on its customers.

“Our customers don’t compare us to other water companies—they have no concept of what other water companies are doing. They would say that they expect us to work like Amazon, and know if something has gone wrong before the customer has to call.”1

Yet, for some industry commentators, what customers want from utility companies is not so clear-cut.

While views on customer expectations differ, there’s more consensus on the key components of customer experience. For utility companies, these boil down to service, value, choice, convenience, and trust:

- The service needs to be reliable and of high quality. When there’s a problem with a utility, it needs to be communicated and resolved quickly and effectively. More and more, there is also a demand for efficiency and environmentally friendly services.

- Value is key when choosing a utility provider. Comparison sites simplify choice for prospective retail customers by making pricing more transparent.

- Today’s customers expect an anytime, any-channel service—the most convenient for them. However, utility companies are just starting to respond to demands in near real time and make use of communication omnichannels, such as social and mobile.

- Trust is essential when transactions and relationships become data-driven. Customer centricity relies on accurate data that’s handled securely at all times. And customers need to be able to trust their utility is committed to helping them manage energy usage and minimize cost. Customers view the utility as the trusted advisor for assistance on their utility needs along with the promise to deliver that service safely and affordably.

Physical meets digital, old meets new.

Why are digital technologies changing the world? The answer is simple: The customer is the overriding design point. Technology is serving human needs and solving genuine problems.

For the majority of customers of utility companies, self-service apps are proving hugely popular. In the UK, OVO Energy is a 100-percent digital utility and its entire customer experience is guided through its app. Customers like the control that self-service gives them—for example, the ability to manage their account how and when they like, take meter readings to understand their usage, and track bills and payments.

- How can utility companies deliver digital and physical experiences?

- Can old processes coexist alongside developing new digital services?

- Are these two goals compatible in one innovation strategy?

For the industry to become truly customer centric, it must simultaneously serve diverse demands. There’s the customer who is satisfied with the way things have always worked. For example, they’re happy manually writing a check at the utility payment center for their consumption each month. These traditional customers must experience the same high-quality service as prosumers who are active participants at the bleeding edge of the grid, generating energy and selling it back to the utility and/or their neighbors.

The rise of the prosumer.

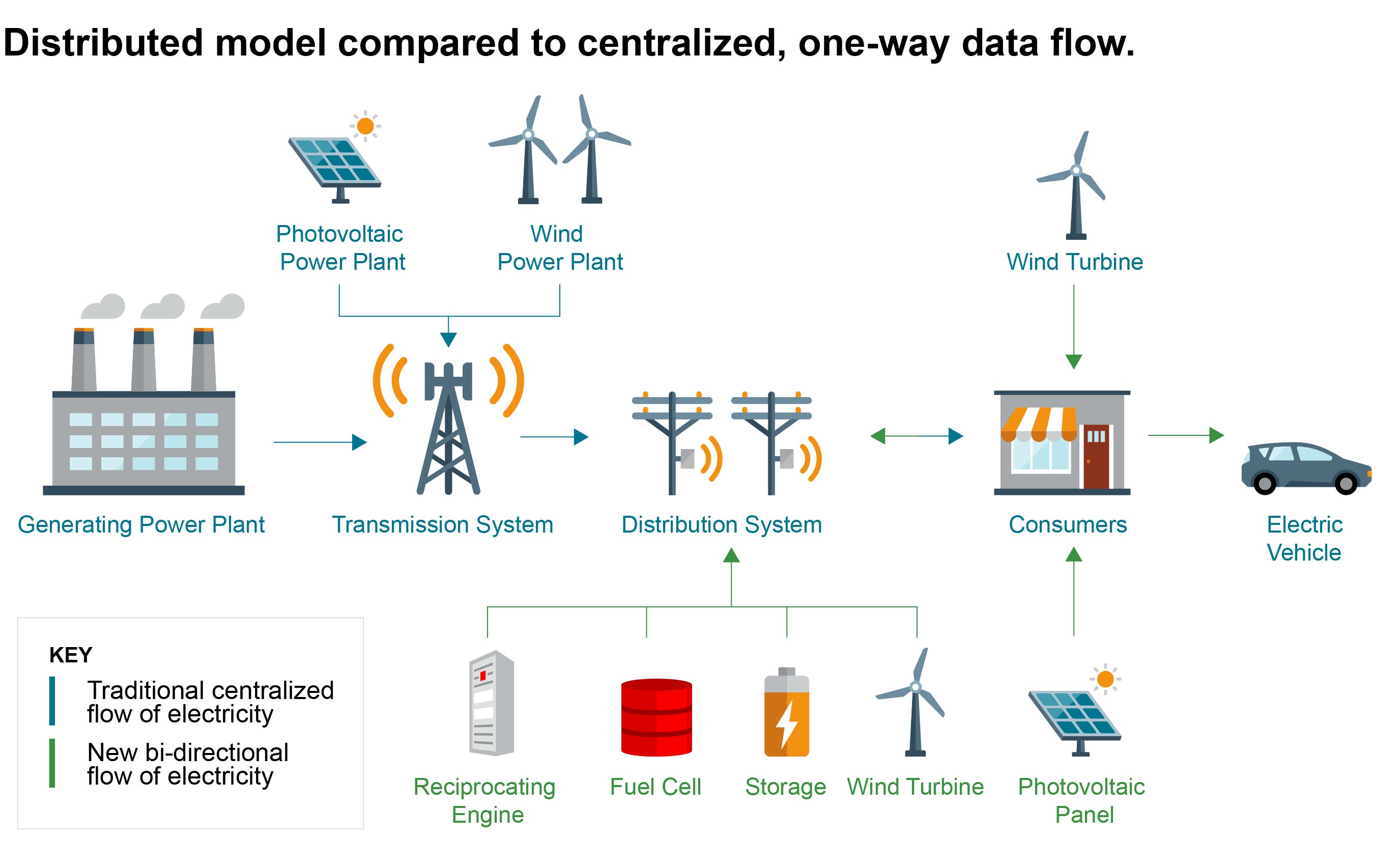

In utility terms, customers are not only consuming services, they are also becoming prosumers able to generate energy themselves, usually from cleaner, renewable sources.

They’re individuals and businesses. And they’re proactive, not passive with their energy consumption. Examples of grid-connected, customer-owned distributed energy resources (DER) technologies include solar rooftops, home/building energy management systems, and smart devices, such as appliances.

“Active customer participation is putting the customer at the center of the grid equation like never before, and a fundamentally different approach to the electricity distribution grid is needed to accommodate this change…While DER and other customer-initiated technologies may seem more like new challenges to be overcome, they offer excellent opportunities to bring the needs of your customers back to the center of your business. A customer-centric business focus stimulates increased business value now and long into the future.”2 Bradley Williams, Vice President, Oracle Utilities

Utility companies must quickly find ways to accommodate the prosumer. For example, DER that generate and store electricity are growing exponentially. Utility companies need to re-examine plans for DER technology integration. An integrated approach to address DER planning should include future customer demands, grid operations, asset management, and workforce enablement as well as modified service agreements that account for net-metering. DER lifecycle management is one way to illustrate the importance of a customer-centric approach. And it’s a good example of the disruption facing utility companies and how it’s creating opportunities to embrace customer-centric digitization as well as new business models.

1 Round Table: Digital Transformation and Operational Efficiency

2 A Vision of the Customer-Centric Grid -

Estimated reading time: 5 minutes

Disruptive Digital Forces

Strong transformational forces are disrupting the utility industry. On one side, there’s the empowered customer. And on the other, the rapid rise of digitization.

Utility and consumer technology are both becoming more data-driven, connected, automated, and mobile. Smarter systems, sensors, devices, and digital ways of working enable utility companies to forecast, track, and control consumption, and optimize their resources and processes accordingly. But they also mean exponentially more data to manage securely and effectively—and that often results in added IT complexity and large investments.

However, the legacy on-premise investment model that many utility companies currently operate is leaving many of them playing catchup. Harnessing technologies relies on IT investments that constantly keep pace. In other words, reversing a situation where more is spent on maintenance, integration, and routine tasks than on innovation and ideas. This starves the business of the time and space to innovate. Creating this flexibility and agility is at the heart of moving to the cloud and dual innovation.

“40 percent of respondents who identified their companies as heavy cloud users said their companies’ revenues are growing much faster than their competitors’, as compared with only 13 percent of light users. Similarly, 34 percent of heavy cloud users are more profitable than their competitors while only 11 percent of light users are.”3 Economist Intelligence Unit

The growth of data and DERs.

Utility companies are transforming the way they operate through digitization and data. Insights from smart meters and sensors will enable utility companies to monitor consumption, operate more efficiently, and optimize performance at the edges of their systems. Digitization offers huge potential for savings, but managing digital assets and data is a major challenge—from storage to analytics. And data is only effective when the right person accesses the right information at the right time—to address the right need or demand.

Smart examples include DERs. In the electric utility space, these grid-connected devices that generate and store electricity are growing exponentially. In addition, demand-response systems enable utility companies to remotely control customer devices and manage energy demand. Both of these innovations challenge traditional one-way models—the delivery of electricity is becoming bidirectional.

The team every utility company needs.

Utility companies also face disruption from within, and an increasingly competitive talent market. Inside many utility companies, the culture has remained static and resistant to change. With up to half of the traditional utility workforce set to retire within the next 5 to 10 years, there’s more pressure to attract a new generation of employees.4 In addition, automation will change job roles, so the skill sets required will also shift. Utility companies will need people who thrive in a data-driven, customer-centric environment. And those who have the leadership, teamwork, and creative skills to drive the insights into action.

“We are no longer looking for somebody who can change a hard drive. We’re looking for people who know how to look at data and turn that into information.”5 Dan Rainey, CIO of Detroit Water and Sewerage Department

This is a reskilling challenge and a cultural shift, because a lot of the critical information to manage systems currently resides in the heads of seasoned workers instead of being readily available in a database. To compete in the digital world, utility companies must capture organizational knowledge and insights while making them more accessible. And attracting the best talent with the right skill sets—a tech-savvy workforce—must be a priority.

Why is a workforce so crucial for every company’s growth and success? According to analysis from Accenture Strategy, cross-industry research shows that a 10 percent increase in employee satisfaction drives an increase of up to 2 percent in customer satisfaction—in turn driving approximately 0.5 percent increase in revenue growth.6

The competitive landscape.

The rise of new entrants in the utility market is significantly increasing competition. Analysts predict that by 2020, a fifth of Fortune 500 companies will generate 2.5 gigawatts of electricity annually, and distribute excess power through utility-independent subsidiaries.7

- Will Google challenge the utility to become the trusted energy/utility advisor?

- Will home and business energy-management systems overtake the utility knowledge and allow customers full control of their own systems?

In the UK, recent government figures revealed that for the first time, solar panels and wind farms produced more electricity than the UK’s eight nuclear power stations. This resulted in a three percent reduction in greenhouse gas emissions.8 In 2019, for the third year in a row, Google purchased enough renewable energy to match 100 percent of their annual global electricity consumption.9

Walmart flipped the switch on a 72-megawatt solar farm in Lafayette, Alabama, in January 2018, to help the retailer meet its renewable energy goals. Facebook announced a new data center, nearly a million square feet, in Newton County, Georgia, southeast of Atlanta, powered entirely by renewable energy.10

Apple’s new office in Cupertino—the so-called “spaceship”—underlines the off-grid ambitions of many of the world’s biggest companies. Around the 175-acre campus sits 805,000 square feet of solar arrays. The 17 megawatts of solar panels on the spaceship’s roof and 4 megawatts of fuel cell storage will provide 75 percent of the building’s daytime electricity, with the rest coming from a nearby solar farm.11

The determination of nonutility companies to move off-grid, take control of their energy usage, and become players in the energy retail market is clear. As a result, the pressure on utility companies’ business model is set to escalate.

3 Complexity: The Enemy from Within Most Organizations

4 Preparing for the Aging Utility Workforce

5 To Better Understand Detroit’s Revival, Look at Its Water and Sewerage Department

6 Customer Centricity: Must-Have or a Waste of Energy?

7 IDC FutureScape: Worldwide Utilities 2017 Predictions

8 What’s Driving Utilities to Cloud?

9 Google Data Centers: Renewable Energy

10 How Google and Walmart Work with Utilities to Procure Clean Power

11 Going Off Grid: The Companies Generating Their Own Energy

-

Estimated reading time: 6 minutes

The Digital Opportunity

Data-driven insights.

Today’s time-limited, digital- and mobile-first consumers demand better, cheaper, more-personalized, and convenient services. However, utility companies have found it difficult to adapt or derive insights from data that can be used to innovate their offerings as quickly as many customers want. Business-as-usual thinking and legacy solutions have contributed to the inertia.

Data management is fundamental to how forward-thinking utility companies are meeting demand and transforming the way they operate. Insights from smart meters and sensors will enable utility companies to monitor energy consumption, operate more efficiently, and optimize performance at the edges of their systems. In addition, data insights provide more-accurate forecasting. For example, demand-response systems already enable utility companies to remotely control customer devices and manage energy demand more effectively.

A cautionary note on data.

Digitization offers potential for revenue generation and efficiency savings. However, managing digital assets and data securely and cost-effectively can be a major challenge—from storage to analytics—without the right systems and processes in place. Knowledge of how to move data across the enterprise is critical. And data is only effective when the right person accesses the right information at the right time—to address the right need or demand.

On the road to success.

Electric vehicles provide unique opportunities for utility companies in a fast-growing market. The number of electric vehicles on the road around the world will hit 125 million by 2030, the International Energy Agency forecasts. Globally, there are more than 5.1 million electric cars on the roads. Nearly two million electric cars were sold in China, Europe, and the US last year.12

As they become mainstream, utilities can gain insights into the most efficient use of electric vehicles and surrounding infrastructure required. This will help them optimize the profitability, simplify the experience, minimize the cost, and maximize the convenience of metered charging stations. This is an example of a value-added service, with wider societal benefits, that customers will expect from their utility provider in the near future.

Smart, connected, automated.

The next generation of utility and consumer technologies presents utility companies with a golden opportunity. Smart sensors, the Internet of Things, artificial intelligence, and predictive analytics will give utility companies much greater visibility into usage, minute by minute, so they can be more responsive to each individual customer need.

The Internet of Things opens the possibility of remote management of network equipment and distribution automation. The vast amount of data that can be collected from connected devices, such as sensors for monitoring the reliability of cables and pipelines, can be used to enhance productivity and to improve efficiency.

Reliability and efficiency.

Utility companies are no longer simply suppliers or providers. They’re shifting to service-based business models that center on individual needs. Innovative, more-efficient processes are key to this consumption model—and crucial to meeting regulators’ continued core demands to make energy reliable and more affordable for all.

Embracing new software and tools will help utility companies be more efficient, reliable, and customer centric. Cloud technology, fully integrated back-office systems, and deep vertical solutions are all ready to maximize visibility of the utility system. But utility companies need help from regulators.

For example, better incentive mechanisms for customers who generate and sell energy, and those who demand eco-friendly or renewable energy. Utility companies need to be compensated or rewarded for reliability and efficiency; in effect, for selling less product. And to encourage utility companies to venture into unproven or unknown areas, there needs to be new customer satisfaction metrics and innovation incentives. Unless utility companies are allowed to take uncontrolled risks, they won’t be able to innovate.

Seamless customer experiences.

Automation can save money, time, and effort, and help utility companies provide a better customer experience. Six out of 10 energy consumers value the convenience of automation.13 For example, at UK-based Anglian Water, more than 25 percent of customers can now self-serve. Average call handling time has been reduced by 20 seconds, leaving 88 percent of customers “very satisfied.”14 Artificial intelligence is on the rise in chatbots and digital assistants, which are helping utility companies manage customer requests.

PSEG is a gas and electric company based in New Jersey. It knew that an infrastructure upgrade to replace 250 miles of gas line would result in a lot of upheaval for local residents. So, it used microtargeted Facebook ads to let people know how it would affect them. When customers clicked, they were taken to a web page where they could see the likely disruption. Demonstrating transparency and pre-empting customers’ needs helped build brand reputation—which is vital in such a competitive industry.15

“We’re able to give people options for working with our agency in the way that works best for them. People can use phone apps and web portals to check usage, pay bills, and make appointments for in-person visits—without waiting in line. We even offer water account updates through Alexa.”16 Dan Rainey, CIO of Detroit Water and Sewerage Department

Living in an omnichannel world.

Research reveals that UK consumers are increasingly using omnichannel customer service to communicate with their utility. A survey of 2,011 consumers found 92 percent regularly use more than one channel. The percentage of respondents who said they used a channel were as follows: landline, 66 percent; online, 50 percent; mobile, 22 percent; and live chat, 5 percent.17

Around one in five of respondents said they are frustrated when their utility company does not know who they are or what their issue is, despite having already communicated via another channel. Another one in five expect the utility to know what they want based on previous contacts. This underlines the customer-centricity argument that customers expect their utility to deliver an Amazon-like level of satisfaction and intuitive experience.

“Omnichannel is becoming an important element of customer service in many industries, and utilities is no exception. Utility firms hold enough data on their customers to understand and predict customer intent, and enable them to move seamlessly across a variety of channels.” Mike Hughes, Managing Director, [24]7.ai

12 Electric Cars May be Powering Ahead, but it Will be a Long Way Before They Go Mainstream

13 New Energy Consumer: New Paths to Operating Agility

14 Modern IVR Puts Anglian Water at #1 for Customer Experience

15 How Utilities Brands Use Social Media for Reputation Management

16 To Better Understand Detroit’s Revival, Look at Its Water and Sewerage Department

17 Utility Customers Going Omnichannel -

Estimated reading time: 5 minutes

Cloud: Enabling Dual Innovation

Oracle believes in dual innovation—innovating to improve reliability to the core business today while also innovating for agility to prepare for future business models. Together, these create options for the utility to be able to pivot as needed.

Dual innovation in three steps.

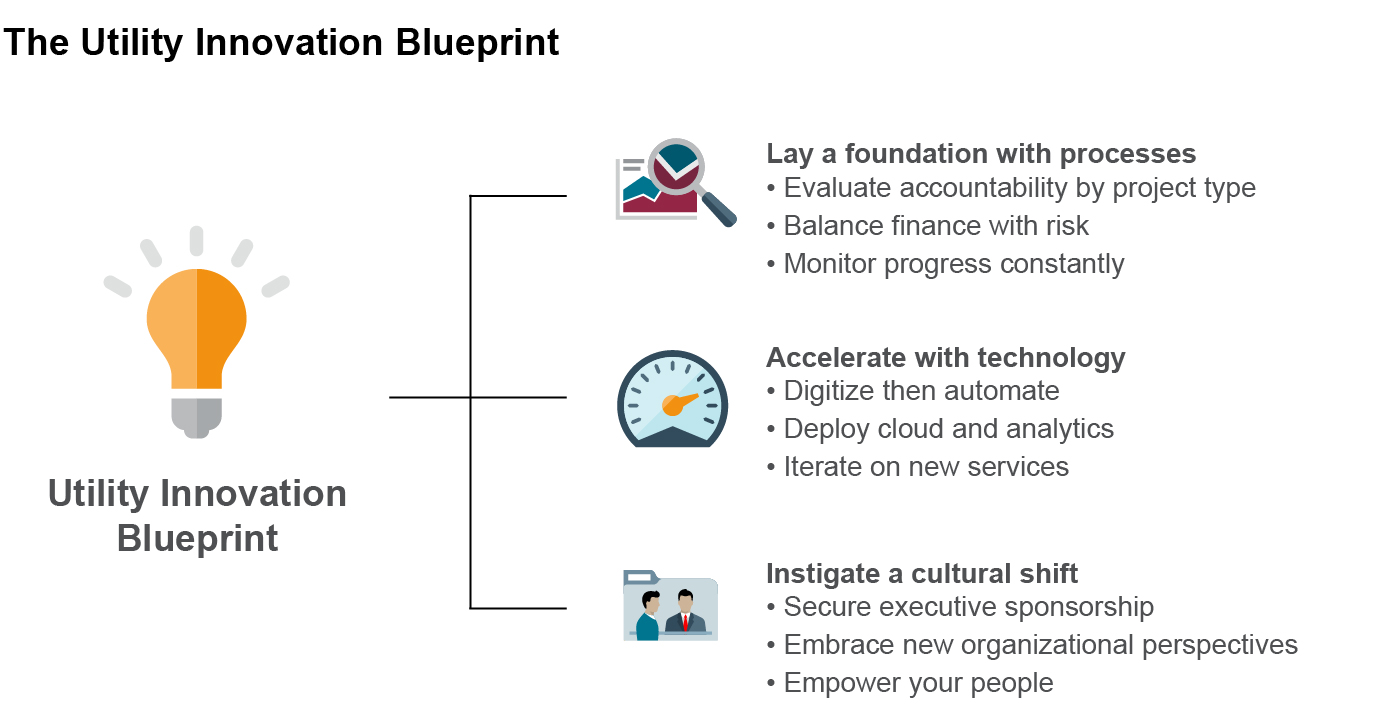

Transformation programs don’t currently have a great track record in any industry. That’s why Oracle has commissioned research to develop an innovation blueprint for utility companies. This is a comprehensive plan—based on qualitative research—that details how utilities must adopt the right processes, understand which technologies will deliver innovation, and create a culture for innovation and ideas to thrive.

In short, process, technology, and people—with cloud at its heart. Ultimately, this will help to strike a balance between innovation projects, which focus on existing business process improvements, and those that develop the products and services that will serve customers’ future requirements.

“Utilities must adopt a set of processes that will optimize the success of innovation projects, understand which technologies will enable innovation, and create a culture in which innovation can flourish. To optimize success and the incorporation of innovation into everyday operations, it is important to adopt a dual approach to innovation, which differentiates between projects that improve existing business processes and those that create new products and services.”18 Utility Innovation Blueprint, Navigant Research

Process: the single view.

The as-a-service and on-demand features of the cloud are transformational. And the biggest boost to processes is integrating systems within a single platform. This way, utility companies ensure all of the data they generate is accurate, manageable, and accessible within the organization—to the right people, at the right time.

Adopting cloud also enables utility companies to improve efficiency and reliability through predictive analytics. No matter which disruptive technology is next—whether it’s blockchain, artificial intelligence, or something not yet conceived—utility companies will have the technology in place to both maintain service and performance reliability, but also respond nimbly to changes. And a single, complete view of the network all the way down to the customer will deliver the predictive capabilities needed to anticipate impact on the system.

Technology: the clear view.

Many utility companies today feel hampered by aging systems. They want the flexibility to adapt to new requirements and evolve new business models. But they’re faced with a bewildering choice of vendors and technologies. And they’re always playing catchup, because their investment model—like their business model—is outdated. They are also trying to piecemeal systems together versus relying on a complete and comprehensive platform.

One way to become more agile is to have a clearer understanding of which technologies will enable innovation. For example, let’s assume that utility companies are currently spending 75 percent on IT maintenance versus 25 percent on innovation. What if they could use cloud technology to reverse the ratio—with 25 percent on IT maintenance versus 75 percent on innovation for every dollar of global IT spend. Adopting cloud technology can help utility companies become leaner and drive operational efficiencies.

Moving to the cloud also delivers on scalability, flexibility, and security. For example, Pacific Gas and Electric Company (PG&E) provides natural gas and electric service to approximately 16 million people throughout a 70,000-square-mile service area. The company recently adopted a cloud-first strategy.

“Moving data to the cloud provides many business benefits, from greater flexibility to anywhere-anytime access. As the chief privacy officer for the company, I believe our data can be just as secure in the cloud as it is on premises. We continue to look for opportunities to do business with cloud providers that meet our cybersecurity and privacy standards.” Laurie Giammona, Senior Vice President and Chief Customer Officer, PG&E

Culture: the people view.

Process and technology challenges can throw utility companies off course, but that’s not all utility companies must navigate. Their aging workforces and talent management challenges add yet more complexity when it comes to cultural change. For example, if attracting the right talent in the UK wasn’t already tough—with 35 percent of vacancies deemed hard to fill—the industry will need to recruit another 221,000 people by 2027.19

The Utility Innovation Blueprint underlines the importance of cultural change to successful dual innovation. It specifically highlights Yarra Valley Water—Melbourne’s largest retail water utility—and its people- and customer-centric approach to innovation.

“Yarra Valley Water spent significant time developing a culture in which innovation can thrive. Importantly, its managing director has created a culture that is not an innovation culture, but a culture that has innovation as an outcome. This is an important distinction: The imperative for security and reliability will remain, irrespective of what the future may hold. Therefore, it is necessary to create a culture where a workforce is committed to their jobs and will seek to make improvements while never losing focus on the customer experience.”

Only Oracle offers an award-winning, comprehensive set of cloud applications for utility companies and a dedicated, global team of industry experts. No other cloud vendor has the breadth and depth in applications and cloud technology, or can match the caliber of people and resources focused on software designed to help utility companies.

Cloud: the future view.

Cloud offers flexibility and modularity, providing a scalable, reliable platform for every utility company’s core business. At the same time, it enables greater efficiency of existing systems and innovation for the future. Cloud is also a quicker route to new features and functionality, so it’s simpler to stay ahead of industry trends and challenges. And in the long term, cloud saves money by helping to attract a new generation of employees and delivering a seamless and consistently higher level of customer experience.

18 Utility Innovation Blueprint

19 The Connected Employee: The Utility’s Most Important Asset -

Estimated reading time: 2 minutes

What's New

The latest assets and resources on utility companies’ digital transformation.

Oracle Cloud Suite for Utilities

Oracle is uniquely placed to meet the changing needs of utility companies. Our comprehensive set of solutions covers customer and operational technology, and enterprise technology suites. At the same time, our focus on emerging and transformational technologies, including artificial intelligence and the Internet of Things, is enabling more advanced capabilities for every utility’s cloud platform. View our solutions and find out how we can help your utility company succeed—now and in the future.

Painting the Picture of the Fully Digital Utility

Rodger Smith, senior vice president and general manager, Oracle Utilities, highlights that the transformation of utility companies is threefold: the transformation of technology and information, the transformation of the workplace, and the transformation of the customer experience. He explores the kind of value-added products customers will be buying from utility companies in the future.

McKinsey, “Accelerating Digital Transformations: A Playbook for Utilities”

This playbook explores how utilities trying to reinvent themselves as digital enterprises have found it hard to scale up from digital pilots. The article explores how digital adoption, talent management, and modernizing IT are all key to transformation. It also discusses how utility companies can stand a better chance of securing market share against digital attackers and transformed incumbents.

Accenture, “Utilities at a Crossroads”

Utility companies have squandered opportunities to grow over the last few decades, according to this paper. Today, they’re at a “do-or-die” moment. This is largely due to the rise of self-generating and other energy-efficiency technologies that are making it easier for customers to manage their consumption and get their power elsewhere. They call for competitive utilities to transform traditional thinking and ways of working, and embrace the new.

-

Estimated reading time: 5 minutes

Customer Stories

Three Utilities Talk Tomorrow, Today

Ashling Cunningham, CIO of Ervia in Ireland; Michael Britt, VP of Energy Innovation Center at Southern Company in the US; and Brian Bentz, president and CEO of Alectra Utilities in Canada, discuss how their utilities are planning ahead.

How a Huge Utility Is Innovating with Chatbots for Better Customer Connections

Electric utility company, Exelon, is using the latest, cutting-edge innovations—built-in artificial intelligence, machine learning, and natural language processing capabilities—to power a chatbot. The blog explores how the chatbot can improve customer experience and make more efficient use of its customer service resources.

Fysiko Aerio Hellenic Energy Company Transforms with Oracle

The Hellenic Energy Company is the main gas supplier in the Attica region of Greece. With Oracle Eloqua, this utility company is improving how it interacts and communicates with customers. It chose the Oracle solution because it’s designed for growth, and will help the company respond to changing markets.