Oracle Enterprise Resource Planning (ERP)

Continuous change requires continuous innovation

Tomorrow’s leaders are those most capable of adapting to change today. Oracle Fusion Cloud ERP is a complete, modern, cloud ERP suite that provides your teams with advanced capabilities, such as AI to automate the manual processes that slow them down, analytics to react to market shifts in real time, and automatic updates to stay current and gain a competitive advantage.

-

![]() AI agents: How CFOs will automate almost every finance process

AI agents: How CFOs will automate almost every finance process

See how embedded AI agents power touchless operations so you can boost efficiency, cut costs, and lead with data-driven insights.

-

![]() AI-Driven Finance: Capitalizing on an Agentic Landscape

AI-Driven Finance: Capitalizing on an Agentic Landscape

Watch this on-demand webinar to discover how AI can drive real business outcomes and prepare your organization for the future of finance. Make AI your competitive edge.

-

![]() Empower financial excellence with AI agents for ERP

Empower financial excellence with AI agents for ERP

Learn how Oracle AI agents can empower your organization to improve financial operations, decision-making processes, and overall business performance.

Oracle Fusion Cloud Enterprise Resource Planning

Get a clear financial picture to make better decisions

Oracle Financials gives you a complete view of your financial position and results so you can respond quickly to an ever-changing business environment.

Features

- Accounting hub

- Reporting and analytics

- Payables and Assets

- Revenue management

- Receivables

- Collections

- Expense management

- Joint venture management

- U.S. Federal Financials

Align your projects with your business strategy

Oracle Project Management helps you plan and track your projects, assign the right talent, balance capacity against demand, and scale resources up or down quickly as needs change.

Features

- Plan, schedule, and forecast

- Resource management

- Cost management and control

- Billing and revenue management

- Grant management

- Project asset management

Optimize savings and reduce risk with streamlined procurement

Oracle Procurement simplifies and integrates source-to-pay with an intuitive user experience, built-in AI, analytics, and collaboration that simplifies supplier management, enables best supplier selection, enforces compliant spending, and improves profitability.

Features

- Supplier Management

- Supplier Portal

- Sourcing

- Procurement Contracts

- Self Service Procurement

- Purchasing

- Payables

- Procurement Analytics

Build trust and reduce risk with automated monitoring

Oracle Risk Management and Compliance uses AI and ML to strengthen financial controls to help prevent cash leaks, enforce audit, and protect against emerging risks—saving you hours of manual work.

Features

- ERP role and security design

- Separation-of-duties automation

- Continuous access monitoring

- User access certification

- Configurations controls

- Transactions controls

- Audit and SOX/ICFR workflows

- Business continuity planning

Outperform with agility

Oracle Enterprise Performance Management enables you to model and plan across finance, HR, supply chain, and sales. Streamline your financial close and gain insight to drive better decisions.

Features

Predict and analyze with AI

Oracle Analytics for Cloud ERP complements the embedded analytics in Oracle Cloud ERP to provide prepackaged use cases, predictive analysis, and KPIs based on variance analysis and historical trends.

Features

- KPI management

- Best practice metrics library

- Prebuilt analytic models

- Extensible architecture

- Business content areas

- Self-service data discovery

- Augmented analytics

- Collaboration and publishing

- Enterprise architecture and security

- Mobile exploration

Choose the analyst report for your industry

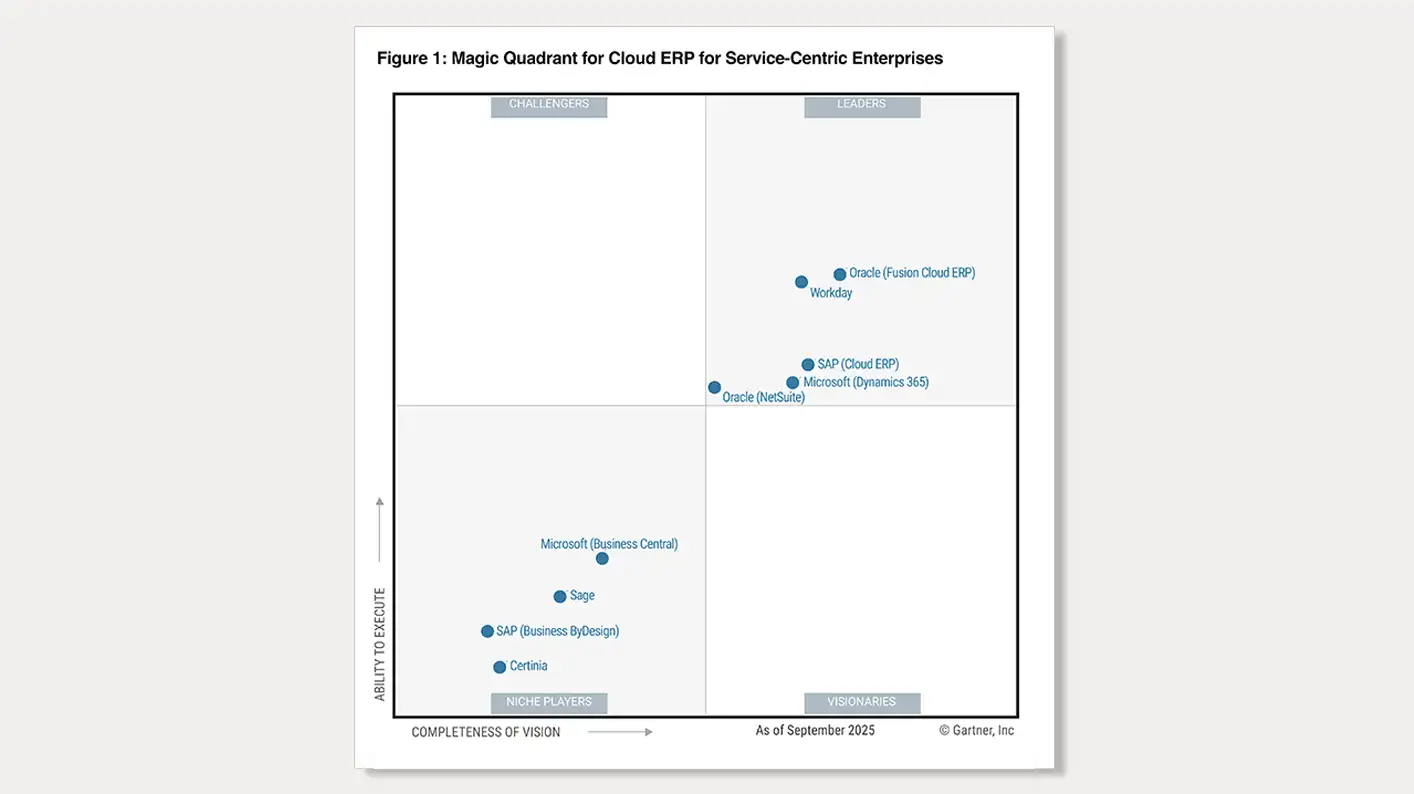

Find out why Oracle was named a Leader in the 2025 Magic Quadrant™ for Cloud ERP for Service-Centric Enterprises, placing highest in “Ability to Execute” and furthest right in “Completeness of Vision.”*

Find out why Oracle was named a Leader in the 2025 Magic Quadrant™ for Cloud ERP for Product-Centric Enterprises.**

Complete cloud ERP with built-in artificial intelligence

Predict, detect, and act on new situations

No one likes big deltas between forecasts and actuals. Most models though are too limited, relying on sample datasets or just gut feel. Oracle Cloud ERP introduces machine-learning to predictive planning and forecasting so you can utilize broader datasets, reveal hidden bias, uncover significant deviations, and speed your overall response time.

Automate and eliminate your manual business processes

Spend less time compiling data and more time understanding what it tells you. Whether preparing your narrative for the street or assessing potential M&A activity, Oracle Cloud ERP gives your team more time for strategic work by automating the most time-consuming, mundane business processes. With AI, up to 96% of transactions can be automated.

Simplify and speed everyday work

Oracle’s AI-powered digital assistant simplifies and speeds common tasks, allowing you to ask simple questions like “what’s the status of my open purchase requisitions?” and “what reconciliations are due today?” Personalized tasks like invoices or over-budget notifications are delivered to you proactively, so approvals move faster too.

Streamline procure-to-pay processes with document IO agent in Cloud ERP

Oracle's document IO agent helps automate and simplify onboarding of complex integrations for third parties, such as suppliers, customers, and financial institutions. This AI agent improves efficiency as well as capture and generation of documents across all transactions, electronic channels, document standards, formats, and languages.

ERP customer successes

Learn why almost 10,000 leading corporations worldwide trust Oracle to run their mission-critical business functions.

Enterprise resource planning resources

See what’s new in Oracle Cloud ERP

Check out the Cloud ERP readiness section for updates, documentation, and tutorials.

See why Oracle Fusion Cloud ERP is the leader

Our ERP solutions have been cloud-based from the beginning. They’re intelligent, fully connected, and built for flexibility.

Commitment to our customer community

We run our entire business on Oracle Cloud and partner with you to share our experiences and help you be successful.

Raise Your Game with the Oracle Cloud Applications Skills Challenge

Now through May 15, join our skills challenge to access free training and certifications on the latest in Oracle Fusion Cloud ERP. Build a strong foundation in Oracle Cloud Applications, Oracle Modern Best Practice, and Oracle Cloud Success Navigator. Raise your game, earn rewards, and compete for prizes along the way.

Learning resources

Get started with Oracle Cloud ERP

Request an ERP demo

Take a walkthrough with one of our experts.

Take an ERP product tour

Explore Oracle Cloud ERP on your own.

Contact SaaS ERP sales

Talk to a member of our team about Oracle Cloud ERP.

* Gartner® Magic Quadrant™ Cloud ERP for Service-Centric Enterprises, October 13, 2025. Robert Anderson, Johan Jartelius, Tomas Kienast, Sam Grinter, Denis Torii, Chaithanya Paradarami.

** Gartner® Magic Quadrant™ for Cloud ERP for Product-Centric Enterprises, 13 October 2025. Greg Leiter, Tomas Kienast, Johan Jartelius, Denis Torii, Dennis Gaughan.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Oracle. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademarks and service mark, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

AI agents: How CFOs will automate almost every finance process

AI agents: How CFOs will automate almost every finance process

AI-Driven Finance: Capitalizing on an Agentic Landscape

AI-Driven Finance: Capitalizing on an Agentic Landscape

Empower financial excellence with AI agents for ERP

Empower financial excellence with AI agents for ERP