Innovating Today for India's Tomorrow

Oracle has helped HDFC Bank take several necessary steps forward by contributing to cutting-edge technology and infrastructure that has taken the Indian banking ecosystem to the next level, with an eye on digital India and positive social change.

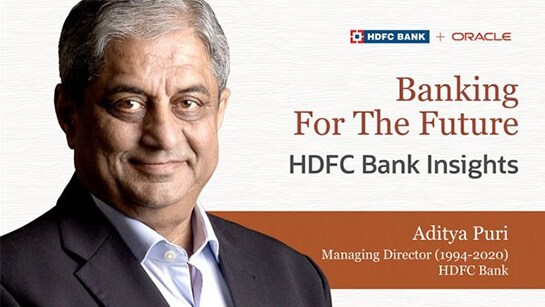

"If you don’t dream, what are you going to do?"

Managing Director (1994-2020), HDFC Bank

Towards a Digital Future

HDFC Bank and Oracle’s long-standing partnership has spurred a series of ground-breaking innovations that have propelled the Indian banking industry to new heights. The deep-rooted digital ideology that these organizations share underpins their long-term desire to innovate. Digitalization has allowed the partnership to offer customers cost efficiency and security at scale, while making every customer interaction an exceptional one.