利用图形分析打击洗钱犯罪

为什么金融机构和监管机构必须打破墨守成规的定势

金融机构正努力跟上全球恶意犯罪网络的步伐,这些网络不断设计出新的、更复杂的手段,通过合法金融系统洗钱。传统的、仅依赖规则的反洗钱 (AML) 系统已濒临极限,不再足以对抗日益复杂的国际洗钱网络。

仅基于规则的 AML 系统的工作原理

- 将 AML 规则应用于交易数据

- 识别可疑活动

- 向人类调查员发出危险信号警报

仅基于规则的 AML 系统的限制

- 不考虑可能有助于预防犯罪活动的其他类型的数据

- 无法在多个实体之间建立连接

- 无法识别更大范围的模式和趋势

- 不灵活,无法跟上不法分子的步伐

- 无法使用机构中存储的大量数据

“The best place to hide is in plain sight, and money launderers know that especially well.They deploy tactics that are difficult to detect without a holistic view of wider networks and relationships.They have broken rules-only AML systems.”

以彼之道还施彼身,利用图形分析击败洗钱者

金融机构必须进入洗钱者的“领地”与其抗衡,摆脱仅依赖规则的 AML 系统的局限性。通过利用图形分析技术,银行可以揭示传统系统可能忽略的复杂的洗钱行为网络。如今,一个全新的时代已然开启,银行可以加强对侵入性犯罪活动的防御能力,更好地保护自身机构、声誉和客户。

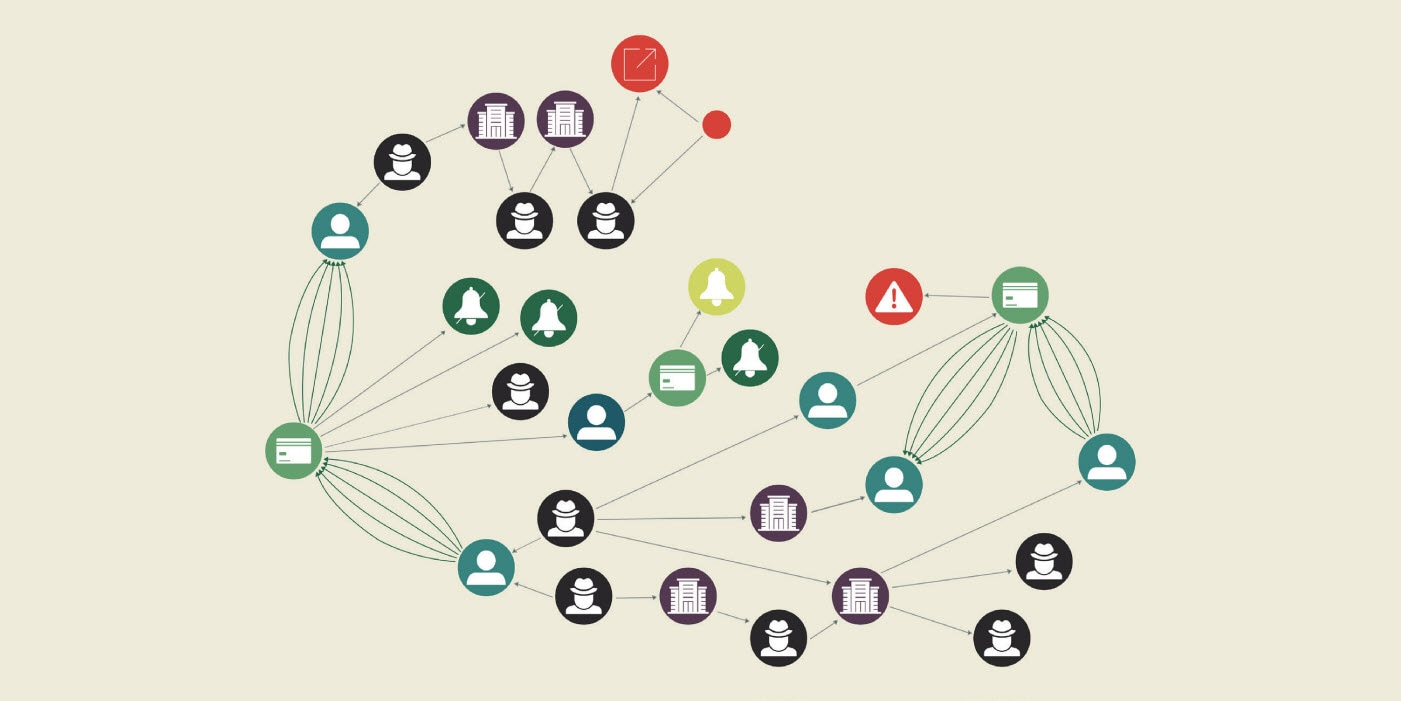

图形分析是一种以图形格式研究信息的数学模型,它将数据点设为节点,数据点之间的关系设为边。该技术能够评估各种连接,无论这些连接多么复杂或遥远,它都能帮助银行拼凑出此前无法识别的模式。

许多行业正在利用这项技术来获得以往难以发现的洞察并遵守 AML 规则。首席合规官可以从图形分析中受益,因为该解决方案可以非常有效地对抗洗钱者的恶意网络,并加强合规管理系统。

“The fight against money laundering has reached a tipping point as effective AML mitigation is becoming more challenging in an ever-evolving regulatory and business ecosystem.With heavy reliance on rules-based detection and highly manual investigative processes, the financial services industry is rapidly embracing graph analytics technology.By visually connecting customers and parties, related accounts and payments, and other data, graph analytics can deliver more-holistic customer profiles, uncover hidden risks, and optimize financial crime detection and investigations while simultaneously easing the burden on staffing and elevating the customer experience.”

Oracle Financial Crime and Compliance Management Cloud Service 的图形分析功能

2018 年,Oracle Financial Crime and Compliance Management 基于 Oracle Labs 的研究成果,添加了图形分析功能。凭借 Oracle 在数据、查询、处理和可视化方面的优势,该技术可帮助机构提高反洗钱合规性。

1. 以数据为核心

- Oracle 的金融犯罪和合规性管理图形分析工具由 Oracle Financial Services Data Foundation 提供支持,其中包含了全面的反金融犯罪数据模型。该解决方案历经 20 多年的打磨。

- Oracle 集成式 Financial Crime Graph Model 与 Financial Services Data Foundation 协同工作,整合并索引数据,以便通过图谱分析实现可视化。Financial Crime Graph Model 相当灵活,无需基于预定义模式运行,即使是在数据量稀疏的情况下也能有效发挥作用。

- 用户可以利用多模型配置(例如 Oracle Database)灵活决定如何查询和管理数据。

- Financial Crime Graph Model 从数据湖、关系数据库、一次性数据集和第三方数据馈送中获取信息。通过帮助用户更全面地了解客户及其关系,该工具允许用户对其所有数据源之间的连接进行建模。

- Oracle 的量化集成可按需提供基于开源智能和外部数据源的风险评级信息。

2. 高级查询语言

- 图形查询语言不仅易于使用,也易于理解。无论数据关系是复杂的、间接的还是遥远的,这类语言都会应用一套能够简化模式表达式的逻辑。

- Oracle 有一种专有的类似 SQL 的语言,称为 Property Graph Query Language (PGQL)。开源项目以简洁的方式表达查询,确保编程和处理工作更轻松、更快捷。

- 运行 PGQL 查询速度比在 SQL 中运行类似查询的速度快一至两个数量级。

“With graphs, data can be managed in more intuitive ways, closer to how people organize their thoughts on a whiteboard.Our system takes advantage of parallel processing and the huge amounts of memory available in modern servers.This allows us to directly model the relationships among all our data.”

3. 加快处理速度

- Oracle 使用一个名为 Oracle Parallel Graph Analytics (Oracle PGX) 的可扩展内存中图形分析引擎。

- Oracle PGX 利用并行处理和大量可用内存来提供快速响应。

- 用户不仅可以访问内置算法来执行常见查询,还可以创建自定义算法和约束条件来满足自己的需求。

- 对于那些想要构建自己的算法的用户,他们也可以利用 API 进行完全定制。

4. 强大的可视化功能

- 用户可以点击节点,以直观的方式查看各个数据点之间的关系。

- 图形分析可视化由开源数据科学记事本提供支持,通过 Oracle Financial Services Crime and Compliance Investigation Hub 模块嵌入到 Oracle Financial Services Enterprise Case Management 应用中。

- 实时更新的可视化结果有助于为风险评分提供背景信息。

- 通过可视化连接,数据科学家可以更轻松地创建算法。重要的是,将图形分析部署到机器学习生态系统中可以提高准确性。

Oracle Financial Crime and Compliance Management

深入了解 Oracle 的反洗钱软件解决方案套件如何保护金融机构的诚信,并提高合规管理的有效性。

注:为免疑义,本网页所用以下术语专指以下含义:

- 除Oracle隐私政策外,本网站中提及的“Oracle”专指Oracle境外公司而非甲骨文中国。

- 相关Cloud或云术语均指代Oracle境外公司提供的云技术或其解决方案。