Oracle Order Management

Augmentez les marges bénéficiaires, améliorez le service client et exécutez les commandes plus rapidement. La solution d'un bout à l'autre et omnicanal order-to-cash d’Oracle orchestre les commandes sur plusieurs systèmes, simplifie la configuration des produits, permet une tarification dynamique et des remises de délais pour les commandes à l'échelle globale.

Oracle Fusion Cloud Order Management

Unifier l’expérience client

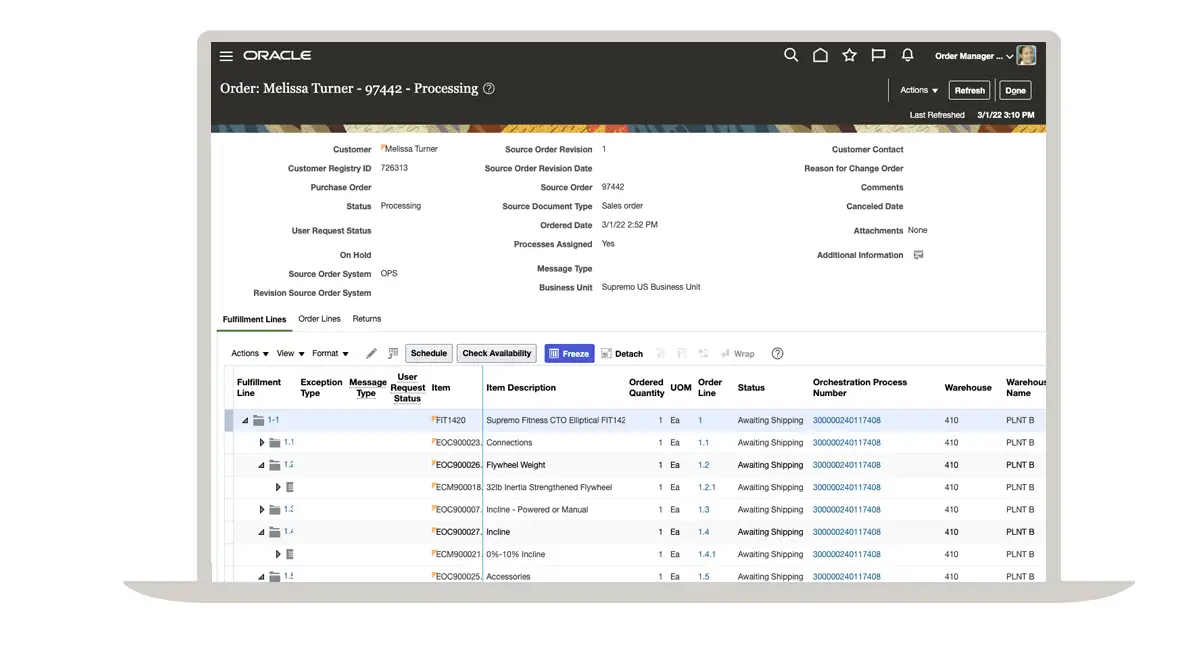

Bénéficiez d’une orchestration et d’un traitement des commandes fluides en rationalisant les processus de flux de commandes d'un bout à l'autre sur plusieurs systèmes ERP et Order Management existants. Automatisez l’ensemble du processus, de la saisie des commandes, du règlement et du suivi après-vente.

Saisir des commandes complexes

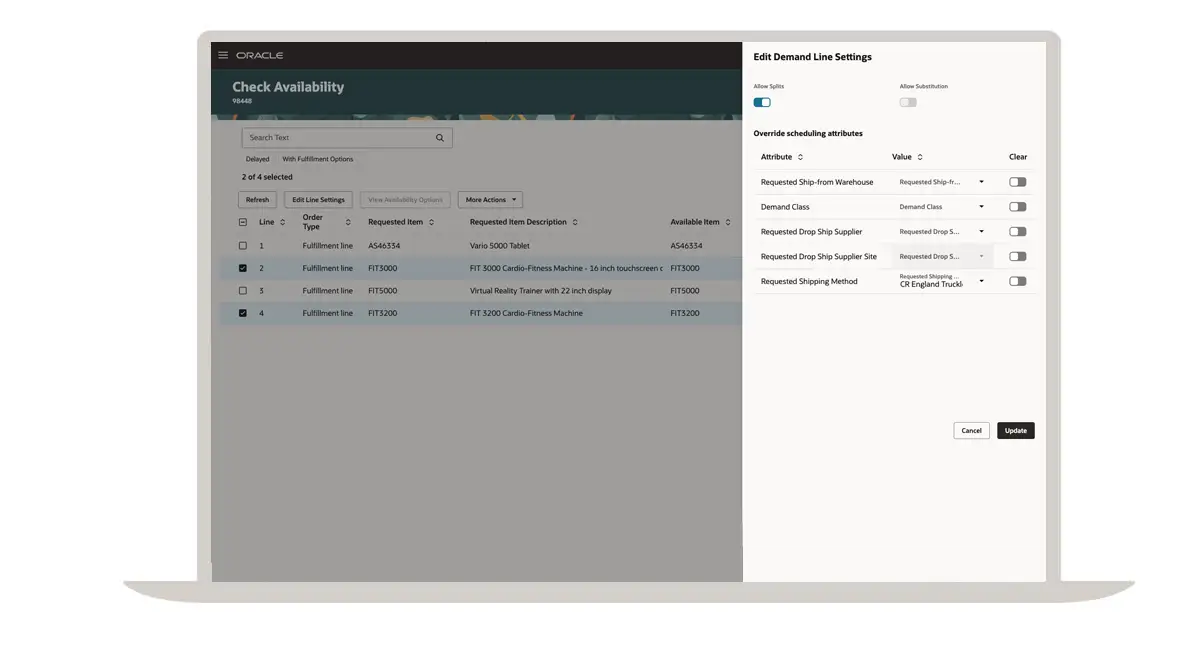

Améliorez la satisfaction client en capturant et en validant les commandes en ligne pour garantir moins d’exceptions de traitement et une exécution plus rapide des commandes. Orchestrez des commandes et des livraisons de produits complexes de façon fluide avec les services associés.

Remplir les commandes avec flexibilité

Répondez aux besoins de vos clients grâce à de multiples options d’exécution telles que les livraisons directes ou consécutives et la configuration sur commande.

Anticiper les évolutions du marché

Répondez aux besoins changeants du marché en configurant facilement vos propres processus uniques pour innover et apporter des modifications. Prenez de meilleures décisions grâce à une visibilité et une analyse d'un bout à l'autre des commandes, des stocks, des expéditions, de l’approvisionnement et des factures.

Gérer les exceptions

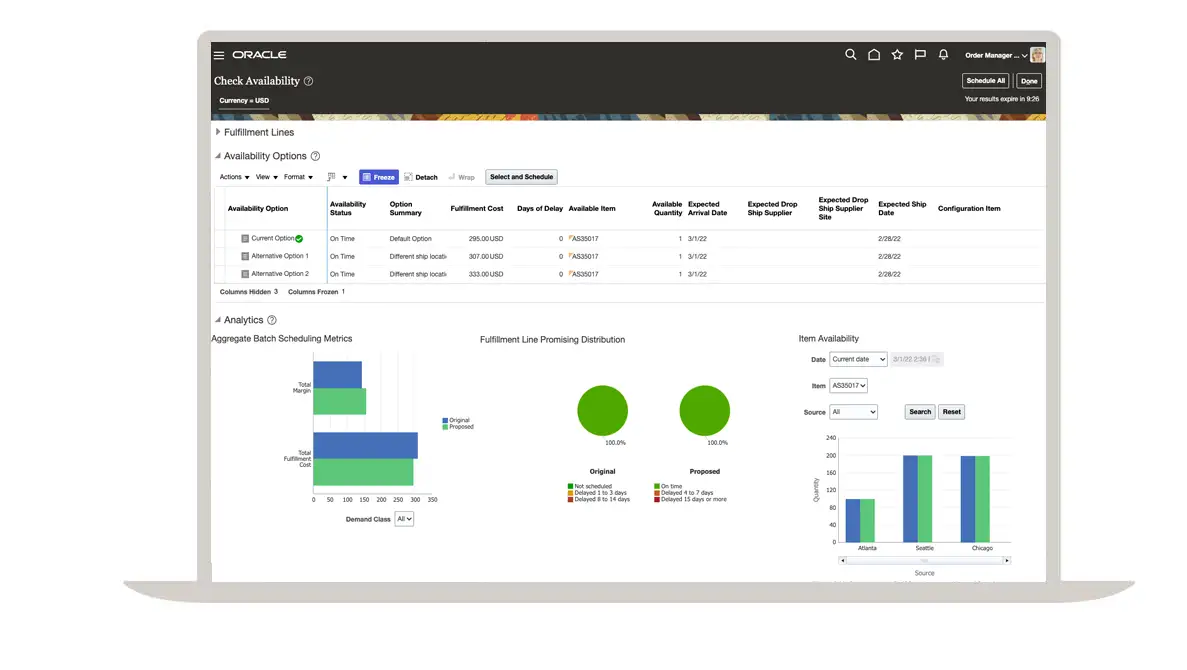

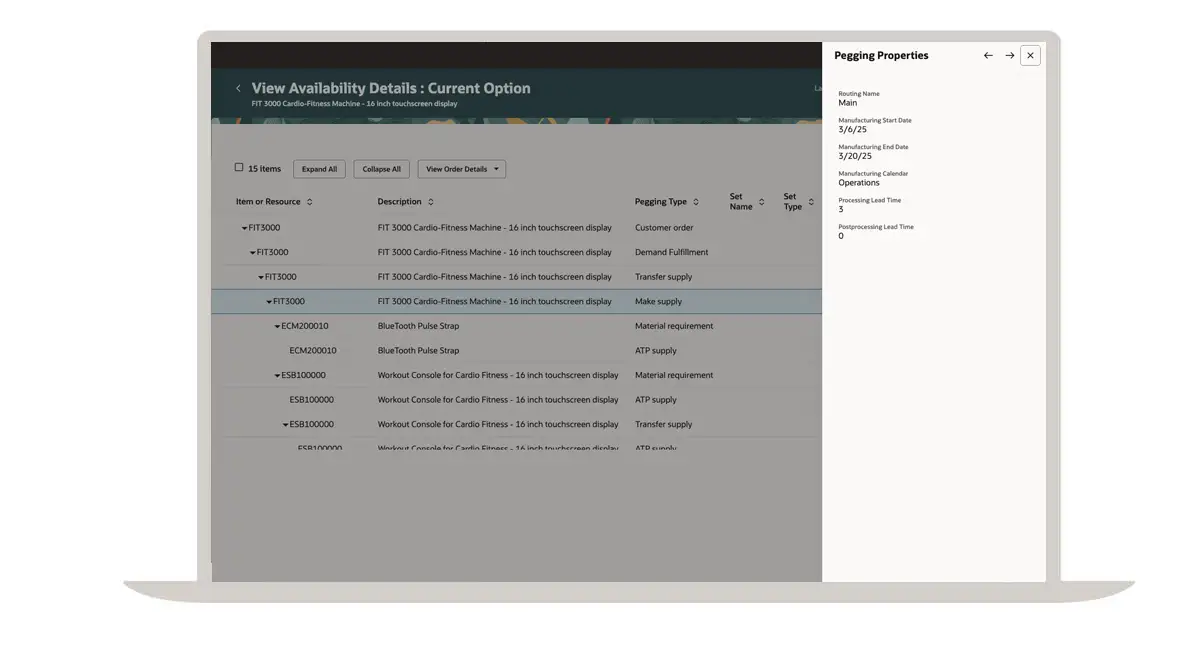

Gardez vos clients satisfaits en traitant de manière préventive les commandes à risque à temps pour prendre des mesures correctives. Bénéficiez d’une visibilité en temps réel sur l’état des commandes et effectuez des analyses hypothétiques pour évaluer et choisir la meilleure option.

Construire une segmentation des prix

Regroupez les clients en fonction de leurs caractéristiques d’achat et de leur sensibilité aux prix afin de mieux positionner vos produits et services. Créez des stratégies de tarification pour une meilleure rentabilité.

Maximiser les marges bénéficiaires

Assurez-vous que vos objectifs de recettes sont atteints en fixant des prix cibles spécifiques à chaque segment qui reflètent la valeur perçue des produits par vos clients. Utilisez une modélisation de prix flexible pour développer des règles de tarification qui correspondent aux objectifs de marge de votre entreprise.

Proposer une tarification dynamique

Déployez des stratégies de tarification dynamique dans toute l’entreprise grâce à un ensemble de fonctionnalités administratives souples et faciles à utiliser. Modélisez des scénarios de tarification complexes pour créer des processus de tarification adaptés aux canaux et aux pratiques commerciales.

Appliquer des stratégies tarifaires

Tirez parti des directives de tarification pour contrôler la discipline en matière d’escompte, protégez la rentabilité et conformez-vous à la stratégie de l’entreprise. Centralisez la tarification pour garantir la cohérence entre les canaux de vente avec une architecture flexible basée sur les services.

Appliquer les changements rapidement

Atteignez vos objectifs commerciaux en mettant en œuvre rapidement des changements de prix. Mettez à jour de gros volumes de données de tarification à l’aide d’outils de maintenance efficaces.

Configurateur de solution

Simplifiez la configuration de produits et services complexes et personnalisables grâce à une expérience utilisateur intuitive et visuelle. La fonctionnalité "Terminez-le pour moi" permet au configurateur de faire les sélections restantes après que les utilisateurs ont effectué un ensemble minimal de sélections.

Optimiser l’offre de produits

Faites correspondre les exigences du client à la meilleure solution possible grâce à une modélisation de configuration guidée, qui adapte les produits et les services aux spécifications uniques de votre client.

Accélérer la commande à la production

Assurez-vous de la validation rapide et précise de la commande à la production en réduisant les étapes manuelles nécessaires pour créer des commandes configurées. Éliminez les erreurs de commande et le coût de modification associé en limitant les choix de configuration du client aux seules options valides.

Prendre de meilleures décisions

Offrez aux utilisateurs la possibilité de prendre des décisions éclairées concernant leurs sélections en fonction de la tarification en temps réel, y compris la tarification des options et le prix total de la configuration.

Assurer la continuité du modèle

Assurez la continuité du modèle tout au long de votre processus de devis en espèces en intégrant Oracle Configurator Cloud dans tous vos canaux de vente.

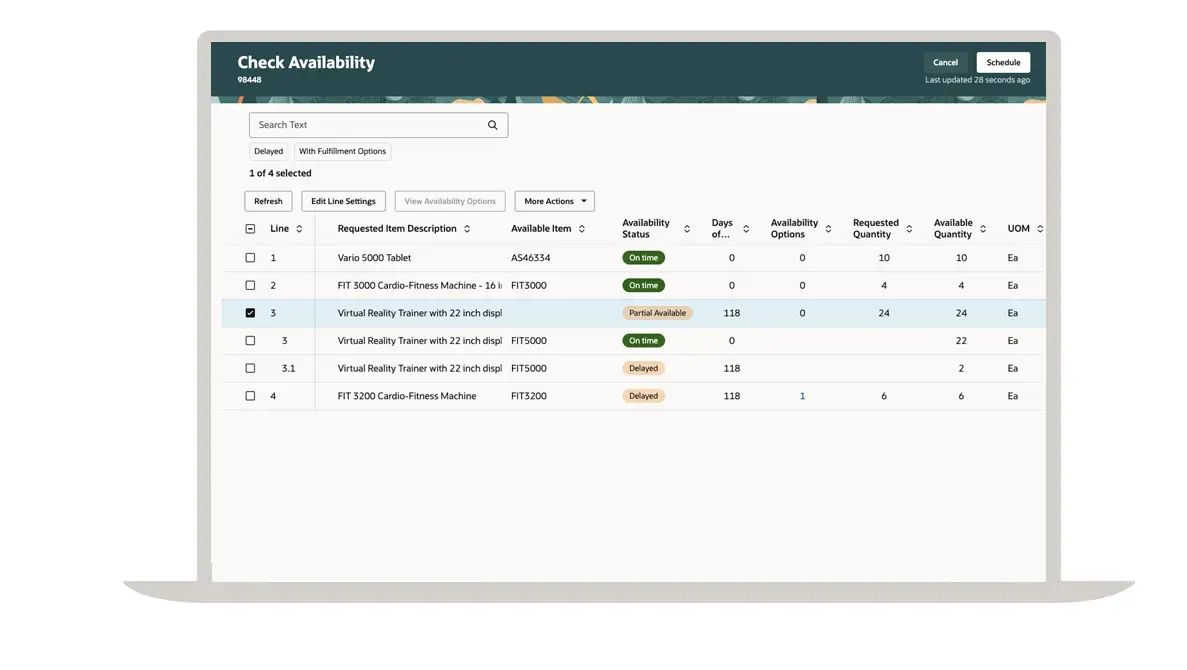

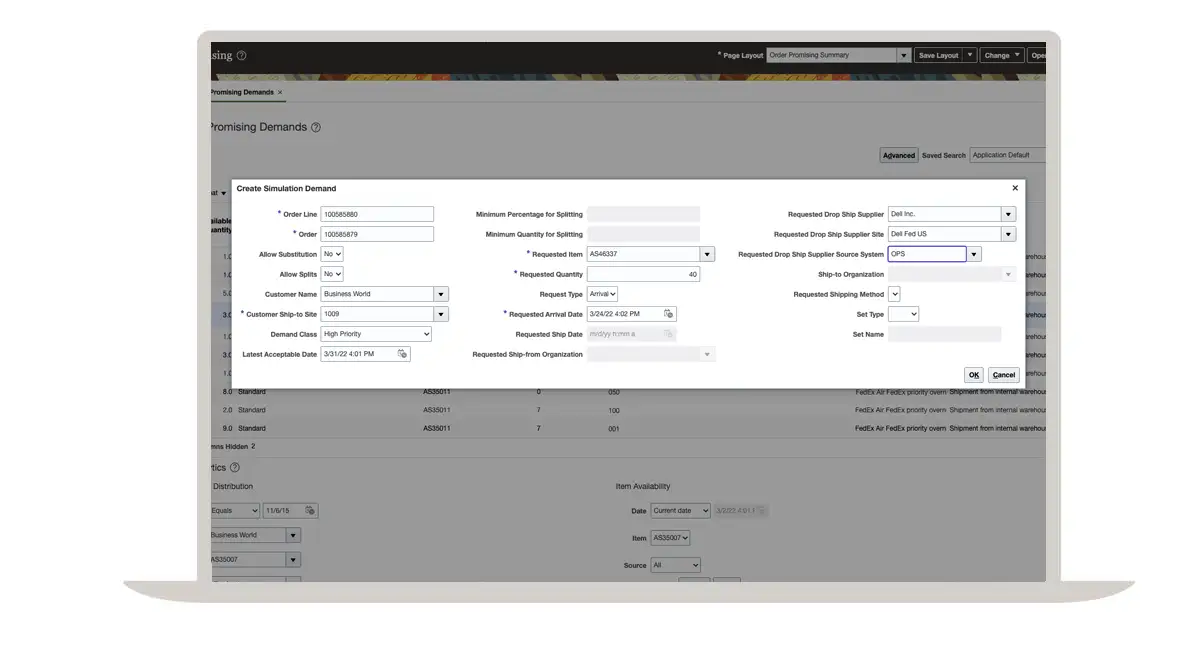

Dépasser les attentes des clients

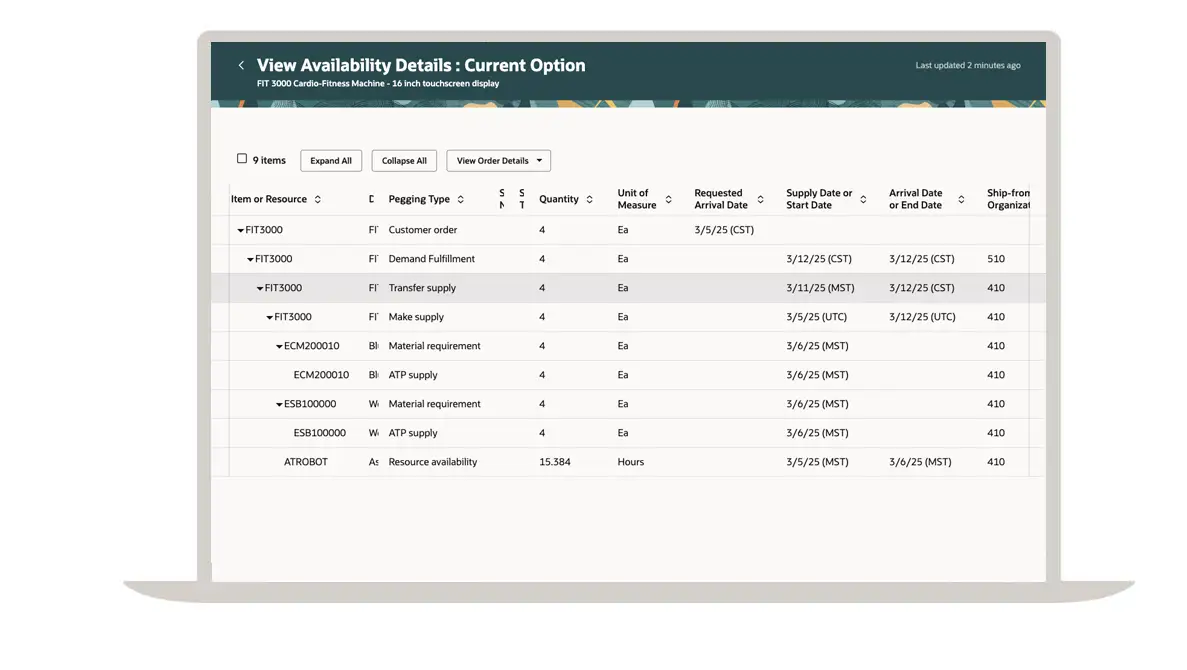

Promettre des dates de livraison rapides et fiables à chaque fois. Programmez l’expédition des articles en stock, en livraison directe et sur commande en fonction de la disponibilité réelle des produits et de la capacité de livraison.

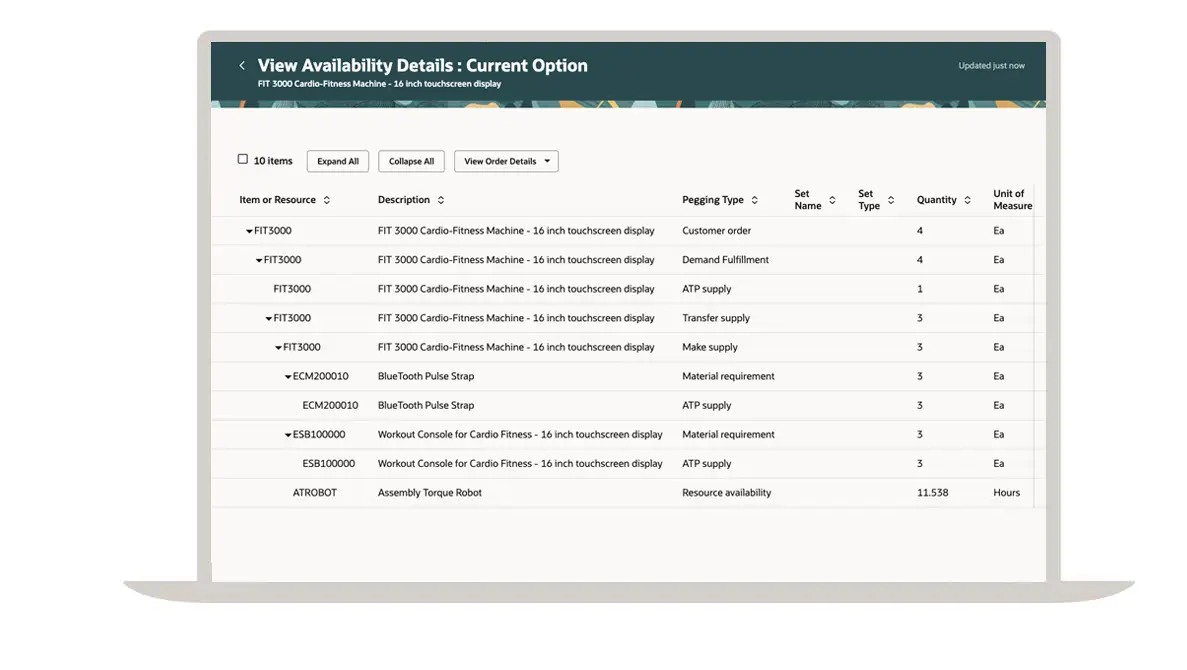

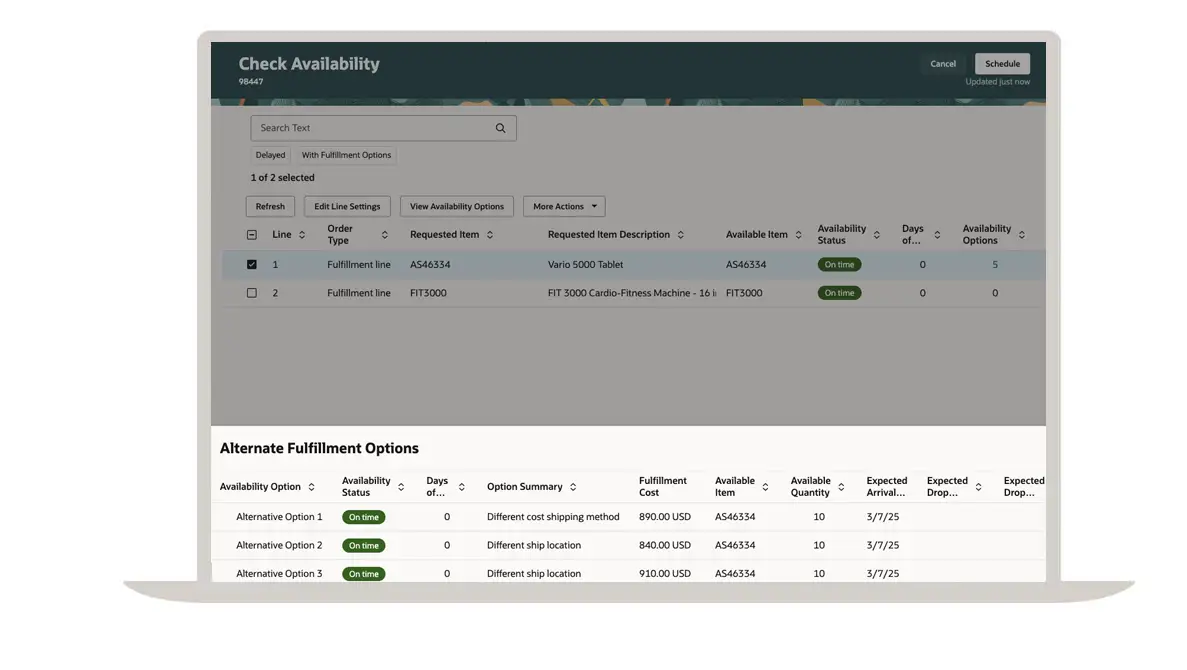

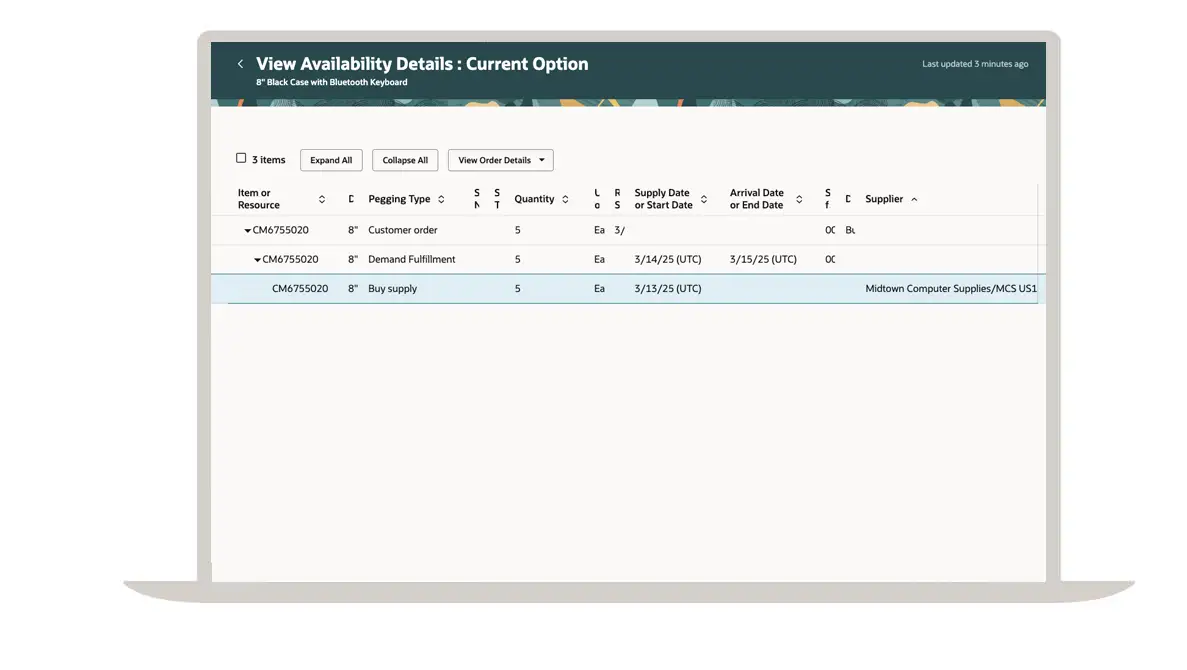

Approvisionnement dynamique

Sélectionnez automatiquement la meilleure source d’approvisionnement qui peut acheter, fabriquer ou transférer des articles pour répondre à la demande. Utilisez l’approvisionnement par zone et la méthode du « rentable à promettre » pour trouver l’offre qui optimise le coût et la livraison dans les délais.

S’engager dans la vente

Augmentez la ponctualité des expéditions et maximisez votre rentabilité en exploitant des bons de commande en cours, de la capacité des fournisseurs et des approvisionnements en transit et planifiés lors de commandes prometteuses.

Exécuter des commandes complexes

Réduisez les frais d’expédition en regroupant les articles à expédier ensemble ou à livrer à la même date. Planifiez les articles configurés à la commande en ajustant les sources d’approvisionnement, les délais et la disponibilité. Gérez les commandes en livraison directe et consécutives.

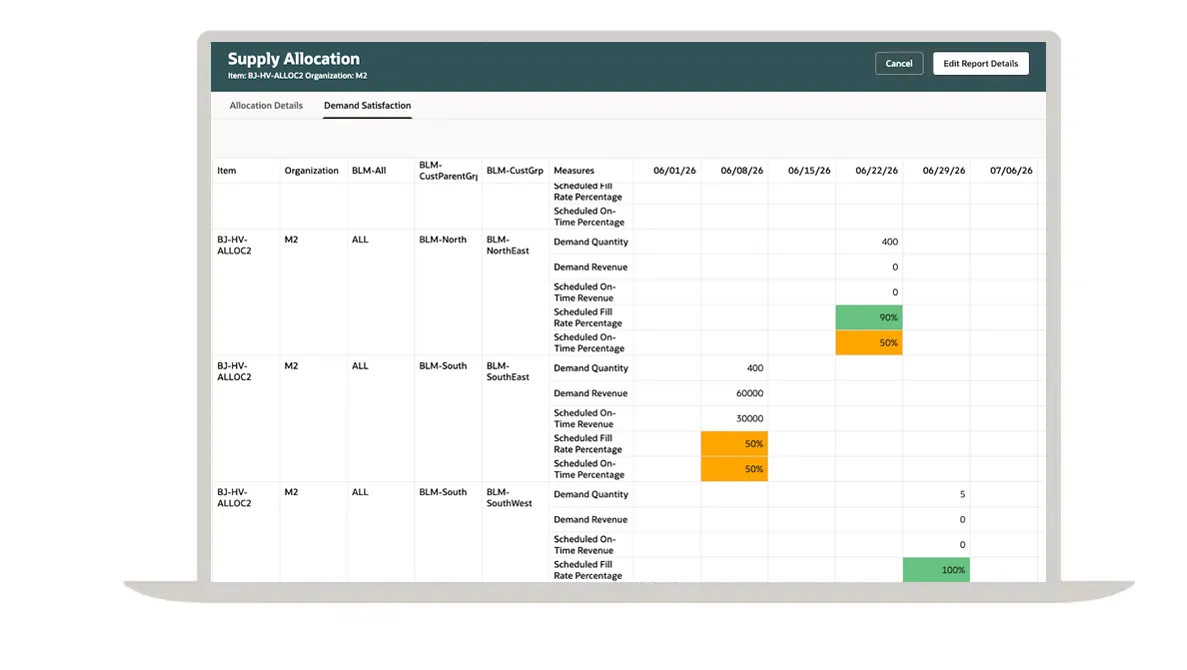

Gérer les commandes en attente de manière proactive

Hiérarchisez et reprogrammez les commandes en attente pour allouer un approvisionnement limité aux clients, canaux ou zones géographiques prioritaires. Réservez l’approvisionnement local pour les commandes à court délai et achetez des commandes à long terme à partir de la capacité en amont.

Gestion des remises client

Maximisez vos bénéfices, économisez grâce à une automatisation centralisée et renforcez les relations avec vos partenaires commerciaux en rationalisant les processus de remise et les demandes.

Déductions et règlement

Simplifiez la gestion des déductions et des règlements grâce à une solution centralisée qui réduit les coûts, accélère le recouvrement des revenus et garantit la conformité sur tous les canaux.

Gestion des remises fournisseur

Prenez le contrôle des remises fournisseur avec une solution automatisée et rationalisée qui maximise vos revenus et améliore votre visibilité. Suivez les performances en temps réel pour renforcer la relation avec vos fournisseurs et s'assurer que chaque remise soit réclamée.

Expédition et débit du fournisseur

Mettez en place des outils d'automatisation pour optimiser vos programmes de remises, améliorer l'efficacité de vos canaux et rationaliser les paiements pour améliorer votre flux de trésorerie, réduire la complexité et faire évoluer vos opérations en toute confiance.

Visite guidée du produit - Global Order Promising

Découvrez Oracle Cloud Order Management dans ces visites de produits.

Avantages du service Order Management

La gestion omnicanal de la commande à l’encaissement unifie votre expérience client

Dans une seule vue, gérez les commandes de tous vos canaux sur plusieurs systèmes. Orchestrez facilement tous les processus de la commande à l’encaissement.

Comment améliorer la satisfaction client avec une livraison parfaite

Optimiser l’efficacité opérationnelle avec une solution de supply chain d'un bout à l'autre

Order Management s’intègre à Oracle CPQ Cloud pour une expérience utilisateur aisé tout au long du processus de soumission à l’encaissement.

Tour d'horizon de Configurator Cloud avec Oracle Configure, Price, and Quote Cloud

Satisfaire les demandes des clients grâce à des capacités de remises de délais pour les commandes à l'échelle mondiale.

Maximisez votre rentabilité tout en répondant aux attentes des clients. Les capacités d’approvisionnement flexibles et d’exécution intelligente vous permettent de planifier un traitement complexe avec la meilleure source d’approvisionnement.

Cleveland Golf augmente son nombre d'expéditions dans les délais (1:32)

Fournissez un service parfait avec des solutions de front-office et de back-office intégrées

Comment fournir un service parfait avec une logistique et un service sur site intégrés (PDF)

Améliorez votre expérience client et vos délais de commercialisation grâce aux solutions du devis au paiement d'Oracle

Carrie West, Directrice principale du marketing produit pour Oracle Advertising and CX

Erin Sun, Directrice du marketing produit SCM chez Oracle

La gestion des revenus d'abonnements représente un véritable enjeu pour les entreprises dont l'intégration entre leurs systèmes de front office et de back office est limitée (voire inexistante). Le lancement récent par Oracle Fusion Cloud Applications de son processus amélioré du devis au paiement a permis de résoudre ce problème. La nouvelle solution prend la forme d'une plateforme intégrée qui connecte Oracle Subscription Management, Oracle Configure, Price, Quote, Oracle Order Management et Oracle Financials.

Lire l’article completRessources

Découvrez les nouveautés de la dernière version du service Order Management

Consultez la documentation de préparation aux mises à jour de Cloud pour connaître les nouveautés de votre service Order Management et anticiper les mises à jour trimestrielles.

Informations complémentaires

Accédez à une bibliothèque de documentation

Le centre d’aide Oracle fournit des informations détaillées sur nos produits et services avec des solutions ciblées, des guides de démarrage et du contenu pour les cas d’utilisation avancés.

Entrez en relation avec vos pairs

Cloud Customer Connect est la première communauté en ligne d’Oracle. Avec plus de 200 000 membres, elle est conçue pour promouvoir la collaboration entre pairs et le partage des bonnes pratiques, des mises à jour de produits et des commentaires.

Développer vos compétences Order Management

Oracle University vous offre gratuitement une formation et une certification sur lesquelles vous pouvez compter pour assurer le succès de votre entreprise, toutes délivrées dans les formats de votre choix.

Pages

Rapports

- Comment le bon mélange de technologie et de stratégie place les fabricants de produits de grande consommation au sommet (PDF)

- La logistique est-elle à un point de basculement pour l'adoption du cloud et des nouvelles technologies ? (PDF)

- Comment les équipes de conception utilisent-elles et planifient-elles la technologie de conception alimentée par les données ? (PDF)

Les ressources suivantes sont également susceptibles de vous intéresser

Cloud Supply Chain Planning

Obtenir de meilleurs résultats, plus rapidement

* Gartner® Magic Quadrant™ pour les ERP cloud destinés aux entreprises orientées service, 13 octobre 2025. Greg Leiter, Tomas Kienast, Johan Jartelius, Denis Torii, Dennis Gaughan.

** Gartner® Magic Quadrant™ les ERP cloud destinés aux entreprises orientées produits, 13 octobre 2025. Greg Leiter, Tomas Kienast, Johan Jartelius, Denis Torii, Dennis Gaughan.

Ce graphique a été publié par Gartner, Inc. dans le cadre d’un document de recherche plus vaste et doit être évalué dans le contexte de l’ensemble du document. Le document Gartner est disponible sur demande auprès d’Oracle. Gartner ne fait la promotion d’aucun fournisseur, produit ou service décrit dans ses publications de recherche et ne conseille pas aux utilisateurs de ces technologies de sélectionner uniquement les fournisseurs disposant des meilleures évaluations ou autres désignations. Les publications de recherche Gartner représentent les opinions du cabinet d'études Gartner et ne doivent pas être interprétées comme des déclarations de fait. Gartner décline toute garantie, explicite ou implicite, liée à cette recherche, y compris toute garantie de valeur marchande ou d’adéquation à une utilisation particulière.

GARTNER est une marque déposée et une marque de service. MAGIC QUADRANT est une marque déposée de Gartner, Inc. et/ou de ses filiales aux États-Unis et à l'international, et sont utilisées avec leur autorisation. Tous droits réservés.

Lancez-vous

Demandez une démonstration en direct

Réalisez une visite guidée avec l’un de nos experts SCM.

Tour d’horizon

Découvrez la suite par vous-même.

Contacter l’équipe commerciale

Discutez d’Oracle Cloud SCM avec un membre de notre équipe.