Fifteen years after the global financial crisis, regulators and lawmakers on both sides of the Atlantic are revisiting long-standing debates on how to give banks’ customers, shareholders, and overseers a wider window into operations and grant lenders ready access to cash. The failures of four US banks this year, including tech industry go-to Silicon Valley Bank, coupled with the forced sale of Credit Suisse, spread panic and again upended assumptions about the sector’s health.

The situation has settled down since the spring—US and European banks reported strong second-quarter earnings, and European Central Bank stress tests published in July showed the banking system there could survive a prolonged downturn.

Still, regulators are reviving discussions on regulatory reform to head off future crises. Since the 2008-09 financial crisis, which stemmed from banks’ taking on too much credit risk, the sector has been subject to a wider, tiered system of regulations and has needed to hold more capital to absorb potential losses.

This time, the focus is on bolstering banks’ liquidity—the cash and other assets essential to covering customer withdrawals. That’s leading to stricter accounting requirements, more stress tests for the biggest midsized financial institutions, and fresh looks at regulating investment banking and insuring deposits. Banks will need to shore up their risk management, interest rate modeling, and economic stress-testing capabilities. The most astute are laying the groundwork now.

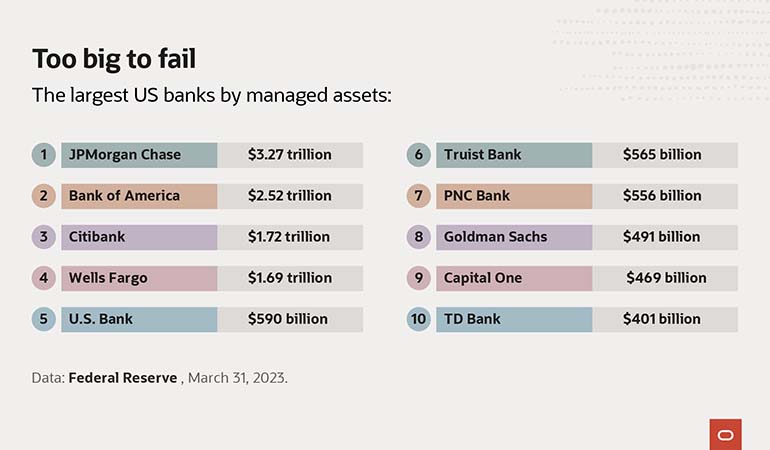

The US Federal Reserve in July unveiled new regulations that require US banks with $100 billion or more in assets to hold additional capital as a buffer against losses and to realize losses from some securities in their capital ratios—a rule that didn’t apply to Silicon Valley Bank.

Other regulations on the table include marking long-term investments to market prices, requiring insight on concentration of deposits, stricter liquidity requirements for midsized banks, and a sharper eye on how institutions’ investing and commercial banking operations coexist.

“It was a mistake for the Fed to say liquidity doesn’t matter so much for regional banks,” says Andreas Dombret, a former ECB supervisory board member, Deutsche Bundesbank executive board member, and banking executive. US banks and regulators would do well to take a page from rules governing smaller German lenders, he says. “You don’t have to report everything every month,” Dombret says. “But that doesn’t mean you don’t need to compile the data.”

The changes come after Silicon Valley Bank, which wasn’t required to report the plunging value of long-term bonds on its balance sheet because it wasn’t a Systemically Important Financial Institution, suffered a bank run and subsequent rescue in March. The panic spread to smaller institutions, Signature Bank and Silvergate Capital (both involved in cryptocurrencies), leading to their respective sale and liquidation.

In May, the US Federal Deposit Insurance Corporation and state regulators closed California’s First Republic Bank after a rash of deposit outflows and sold most of its assets to JPMorgan Chase. Moody's downgraded the credit ratings of 10 regional US banks in August, citing the risk of higher interest rates for loans and mortgages.

Amid the upheaval, here are some key areas banks need to focus on:

Measuring “mark to market”

After years of low interest rates, the Fed has raised them at the fastest clip since the early ‘80s to fight inflation, sinking bond prices. The effect has been especially acute for bonds that don’t mature for many years. Under current regulations, banks don’t need to report unrealized losses on long-dated securities on their balance sheets if they’re designated to hold, letting firms show artificially high capital levels. That’s what happened with Silicon Valley Bank (SVB), a mismatch accounting reformers want to avoid.

By classifying long bonds as “held to maturity” instead of marking them to their fair market price, banks make depositors and investors piece the accounting picture together themselves. Instead, “fair value” accounting advocates want the US Financial Accounting Standards Board (FASB) to compel banks to recognize unrealized securities losses by classifying them as “available for sale,” so changes in their value affect balance sheet reporting and make paper losses clearer, sooner.

“The thing investors have always wanted is a little more about risks that are emerging,” says Sandy Peters, head of financial reporting policy for the CFA Institute, an investor advocacy group, which sent a paper to the FASB arguing for fair-value treatment of long-term securities. “That is something that will likely get talked about more.”

Looking beyond net interest margin

Asset and liability management, a fundamental way banks evaluate profitability and risk, focuses on managing net interest margin (NIM), which compares what a bank earns on its loans to the interest it needs to pay. Reformist investors want banks to look ahead, analyzing the cash flow characteristics of financial instruments to show who’s holding deposits and how likely they are to pull their money. SVB and Signature Bank both had large amounts of deposits concentrated with relatively few investors.

“We need to know the concentration of deposits so we can know how fast depositors can flee,” says the CFA Institute’s Peters, so that disclosures show the amount of deposits exceeding the $250,000 FDIC insurance limit. “In banking it’s how those assets and liabilities act in relation to each other that can set things ablaze,” she says.

“You don’t have to report everything every month. But that doesn’t mean you don’t need to compile the data.”

New rules for superregionals

US midsized banks escaped some of the Fed’s strictest stress tests as part of 2018 rollbacks of the Dodd-Frank Act, enacted following the global financial crisis. Silicon Valley Bank showed that problems at so-called superregionals—midsized financial institutions with a significant presence across multiple states—can still shake markets.

Today, only US banks with more than $250 billion in assets must meet the strictest version of the liquidity coverage ratio (LCR) stress test, which measures a bank’s easily convertible assets that can cover short-term cash needs. Likewise, only banks of that size are subject to requirements of the net stable funding ratio (NSFR), a minimum standard for reducing risk over the course of a year.

The Basel III global banking regulations test banks’ capital and liquidity, and it’s important to run those liquidity ratios to spot problems even at midsized lenders, says Dombret, who was a member of the Basel Committee that drafted Basel III rules after the 2008 to 2009 financial crisis.

The Federal Reserve is tightening capital rules for institutions between $100 billion and $250 billion in size. Under regulatory reforms announced in July, US banks face revisions by the Fed and other regulators under the endgame reforms to Basel III; they have until 2028 to comply with new minimum capital requirements. Midsized banks will need to include unrealized gains and losses on available-for-sale securities in their capital ratios.

Eye on investment banking

Long-festering problems at Credit Suisse with loss-making deals and lax controls culminated in its fast-track, $3.2 billion sale to competitor UBS, completed in June. Swiss regulators brokered the deal to bolster depositor and investor confidence. But Credit Suisse’s plans since last year to spin off its investment banking business, an arrangement UBS halted, may have limited its exit options given uncertainty about its direction.

Global regulators may look to the UK’s Vickers Commission reforms of a decade ago, which separated retail banking from riskier investment banking and corporate finance activities under a requirement known as ring-fencing. UK banks also need to retain more capital and loss-absorbing reserves than required by Basel III rules. Financial institutions outside the UK may want to consider how ring-fencing could be applied to their operations.

Expanding deposit insurance

After Silicon Valley Bank failed, the Fed, FDIC, and Treasury Department said its depositors would be paid back in full, even for accounts exceeding the FDIC’s $250,000 insurance limit. The Fed has also initiated the Bank Term Funding Program to lend at-risk banks money for up to a year to help cover deposits.

US officials are now looking to expand the FDIC insurance limit—even into the millions of dollars or targeting higher coverage for business accounts. The counterargument is that backstopping all deposits could lead banks to take undue risks.

In the EU, regulators have been grappling for years with a common eurozone guarantee on deposits to prevent a run on banks. The European deposit insurance scheme for protecting accounts up to €100,000 has been stalled by debates about its fairness and by opposition from the German government, which says the plan would make liabilities mutual so that southern European countries could tap funds set up to protect German savers.

The European Central Bank in July proposed new rules for closing down failed smaller banks and renewed its call for an EU-wide deposit insurance plan (PDF).

Credit default swaps and shadow banking

A final set of changes that may come as a result of the 2023 failures involves closer scrutiny of “shadow banks” such as hedge fund managers, private equity firms, and mortgage lenders whose activities fall outside banking regulations.

Bank executives and regulators are predicting that more loans will come from institutions that may not back up clients during a crisis—or that pensions and university endowments may buy illiquid products or mismanage their assets if leveraged investments don’t pay off.

Credit default swaps (CDSs) are also under the microscope. The prices of credit derivatives, tradeable insurance for holders of a company’s debt if it defaults, can swing sharply as a result of relatively small trades. The European Central Bank’s supervisory board has called for more transparency in the CDS sector and a review by the international Financial Stability Board.

Aaron Ricadela is a writer for Oracle based in Frankfurt, Germany, and a former journalist who covered finance and technology for Bloomberg News, BusinessWeek, and InformationWeek.

-

Bank failures: 7 Potential regulatory responses to anticipate now

Banks may need to shore up their risk management, interest rate modeling, and economic stress-testing. The most astute are laying the groundwork now.

-

Oracle corporate banking solutions

Help your customers to manage their global operations with product offerings across various functions, including corporate lending, cash and liquidity management, treasury management, and trade finance.