Oracle Enterprise Resource Planning (ERP)

Il cambiamento continuo richiede innovazione continua

I leader del futuro sono quelli maggiormente capaci di adattarsi al cambiamento di oggi. Oracle Fusion Cloud ERP è una suite ERP cloud completa e moderna che offre ai propri team funzionalità avanzate, come l'intelligenza artificiale che è in grado di automatizzare i processi manuali che rallentano il tutto, l'analisi dei dati per reagire ai cambiamenti del mercato in tempo reale e gli aggiornamenti automatici per rimanere aggiornati e ottenere un vantaggio competitivo.

-

![]() Finance guidato dall'intelligenza artificiale: sfruttare un ambiente con agent

Finance guidato dall'intelligenza artificiale: sfruttare un ambiente con agent

Guarda questo webinar on-demand per scoprire come l'AI può generare risultati di business reali e preparare la tua organizzazione al futuro del finance. Rendi l'AI il tuo vantaggio competitivo.

-

![]() AI agent: in che modo i CFO automatizzeranno quasi tutti i processi finanziari

AI agent: in che modo i CFO automatizzeranno quasi tutti i processi finanziari

Scopri come gli AI agent integrati supportano le operazioni touchless in modo da poter aumentare l'efficienza, ridurre i costi e guidare con insight basati sui dati.

-

![]() Serie di demo sulle Oracle Cloud Applications

Serie di demo sulle Oracle Cloud Applications

Scopri di più sulle Oracle Fusion Cloud Applications che possono aiutarti a risolvere le principali sfide della tua organizzazione.

Oracle Fusion Cloud Enterprise Resource Planning

Ottieni un quadro finanziario chiaro per prendere decisioni migliori

Oracle Financials ti offre una visione completa dell'andamento e dei risultati finanziari in modo da poter rispondere rapidamente ai continui cambiamenti del business.

Funzionalità

- Hub di contabilità

- Reporting e Analytics

- Debiti e asset

- Revenue management

- Receivable

- Collection

- Expense management

- Gestione di joint venture

- U.S. Federal Financials

Allinea i tuoi progetti con la tua strategia aziendale

Oracle Project Management ti aiuta a pianificare e monitorare i tuoi progetti, assegnare i talenti giusti, equilibrare capacità e domanda, nonché ridimensionare rapidamente le risorse in base alle necessità.

Funzionalità

- Pianifica, programma ed effettua previsioni

- Gestione delle risorse

- Gestione e controllo dei costi

- Gestione di fatturazione e ricavi

- Gestione delle sovvenzioni

- Gestione degli asset del progetto

Ottimizza i risparmi e riduci i rischi con un procurement semplificato

Oracle Procurement semplifica e integra i processi source-to-pay con una user experience intuitiva, AI integrata, analytics e una collaborazione che semplifica la gestione dei fornitori, consentendo una migliore selezione degli stessi, garantendo la compliance in termini di spesa e migliorando la redditività.

Funzionalità

- Gestione dei fornitori

- Portale per i fornitori

- Approvvigionamento

- Contratti di Procurement

- Self-Service Procurement

- Acquisti

- Contabilità fornitori

- Analytics di procurement

Costruisci la fiducia e riduci i rischi con il monitoraggio automatizzato

Oracle Risk Management and Compliance utilizza AI e ML per rafforzare i controlli finanziari al fine di prevenire perdite di liquidità, applicare audit e proteggere da rischi emergenti, facendoti risparmiare ore di lavoro manuale.

Funzionalità

- Il ruolo dell'ERP e il design di sicurezza

- Automazione della separation-of-duties

- Monitoraggio continuo degli accessi

- Certificazione di accesso dell'utente

- Controlli delle configurazioni

- Controlli delle transazioni

- Flussi di lavoro audit e SOX/ICFR

- Pianificazione della continuità aziendale

Migliora le prestazioni con agilità

Oracle Enterprise Performance Management ti consente di modellare e pianificare le funzioni Finance e HR, la supply chain e le vendite. Semplifica la chiusura finanziaria e ottieni insight per prendere decisioni migliori.

Funzionalità

Prevedi e analizza con l'intelligenza artificiale

Oracle Analytics per Cloud ERP completa Oracle Cloud ERP con analytics integrati per fornire casi d'uso preconfezionati, analisi predittive e KPI basati sull'analisi della varianza e sui trend storici.

Funzionalità

- Gestione dei KPI

- Library delle best practice

- Modelli analitici predefiniti

- Architettura estensibile

- Aree di contenuti aziendali

- Rilevamento autonomo dei dati

- Augmented analytics

- Collaboration e pubblicazione

- Architettura e sicurezza aziendale

- Esplorazione da mobile

Scegli il report degli analisti per il tuo settore

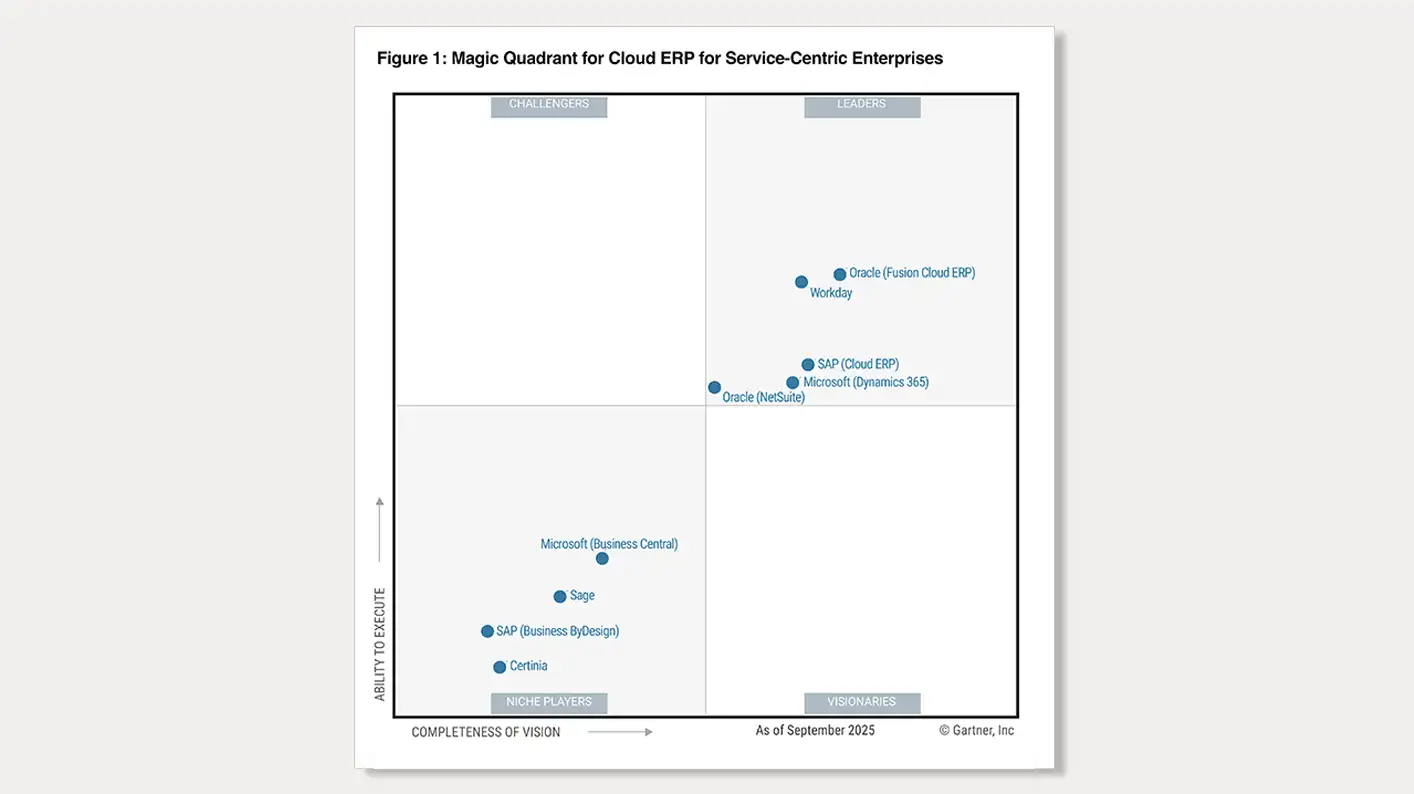

Scopri perché Oracle è stato nominato leader nel Magic Quadrant™ 2025 per il Cloud ERP per le aziende focalizzate sul servizio, posizionandosi il più in alto in "Ability to Execute" e il più a destra in "Completeness of Vision".*

Scopri perché Oracle è stata nominata leader nel Magic Quadrant™ 2025 per l'ERP cloud per le aziende focalizzate sul prodotto.**

ERP cloud completo con intelligenza artificiale integrata

Prevedi, rileva e agisci su nuove situazioni

Nessuno ama i grandi delta tra previsioni ed effettivi. La maggior parte dei modelli sono troppo limitati e fanno affidamento su set di dati di esempio o semplicemente sulle intuizioni. Oracle Cloud ERP introduce il Machine Learning nella pianificazione predittiva e nelle previsioni, il quale ti permette di utilizzare set di dati più ampi, generare distorsioni nascoste, scoprire deviazioni significative e velocizzare il tempo di risposta complessivo.

Automatizza ed elimina i processi di business manuali

Dedica meno tempo alla compilazione dei dati e più tempo a comprendere gli insight. Che si tratti di preparare le descrizioni per le strade o di valutare le potenziali attività di M&A, Oracle Cloud ERP offre al tuo team più tempo per il lavoro strategico automatizzando i processi di business più dispendiosi e banali. Con l'AI, è possibile automatizzare fino al 96% delle transazioni.

Semplifica e velocizza il lavoro quotidiano

L'assistente digitale basato sull'AI di Oracle semplifica e velocizza le attività comuni, consentendoti di rispondere a semplici domande come "Qual è lo stato delle mie richieste di acquisto aperte?" e "Quali riconciliazioni sono in scadenza oggi?" I task personalizzati come le fatture o le notifiche con budget eccessivo vengono inviati in modo proattivo, quindi anche le approvazioni procedono più rapidamente.

Semplifica i processi procure-to-pay con l'agente IO dei documenti in Cloud ERP

L'agente I/O dei documenti di Oracle aiuta ad automatizzare e semplificare l'onboarding di integrazioni complesse per terze parti, come fornitori, clienti e istituti finanziari. Questo agente AI migliora l'efficienza, l'acquisizione e la generazione di documenti in tutte le transazioni, i canali elettronici, gli standard dei documenti, i formati e le lingue.

Risorse sull'enterprise resource planning

Novità di Oracle Cloud ERP

Controlla la sezione di Cloud ERP Readiness per aggiornamenti, documentazione e tutorial.

Scopri perché Oracle Fusion Cloud ERP è il leader

Le nostre soluzioni ERP sono nate in cloud. Sono intelligenti, completamente connesse e progettate per essere flessibili.

Impegno per la nostra community di clienti

Gestiamo il nostro business su Oracle Cloud e vogliamo condividere le nostre esperienze e supportarti nel tuo percorso di innovazione.

Mettiti in gioco e migliora le tue competenze con la sfida Oracle Cloud Applications

Da oggi fino al 15 maggio, partecipa alla nostra sfida abilità per accedere a formazione gratuita e certificazioni per le ultime novità di Oracle Fusion Cloud ERP. Costruisci solide basi su Oracle Cloud Applications, Oracle Modern Best Practice e Oracle Cloud Success Navigator. Mettiti in gioco, guadagna premi e competi per i riconoscimenti che ti attendono lungo il percorso.

Risorse per la formazione

Inizia subito con Oracle Cloud ERP

Richiedi una demo dell'ERP

Scopri la soluzione con uno dei nostri esperti.

Effettua un tour del prodotto ERP

Esplora Oracle Cloud ERP autonomamente.

Contatta il team di vendite SaaS ERP

Parla di Oracle Cloud ERP con un membro del nostro team.

*Gartner® Magic Quadrant™ per Cloud ERP per aziende focalizzate sui servizi, 13 ottobre 2025. Robert Anderson, Johan Jartelius, Tomas Kienast, Sam Grinter, Denis Torii, Chaithanya Paradarami.

**Gartner® Magic Quadrant™ per Cloud ERP per aziende focalizzate sui prodotti, 13 ottobre 2025. Greg Leiter, Tomas Kienast, Johan Jartelius, Denis Torii, Dennis Gaughan.

Questo grafico è stato pubblicato da Gartner, Inc. come parte di un documento di ricerca più ampio e dovrebbe essere valutato nel contesto dell'intero documento. Il documento di Gartner è disponibile su richiesta ad Oracle. Gartner non promuove alcun fornitore, prodotto o servizio illustrato nelle proprie ricerche e non consiglia agli utenti di selezionare soltanto i fornitori con le valutazioni o le nomine più alte. Le ricerche di Gartner rappresentano le opinioni del team di ricerca Gartner e non devono essere considerate come affermazioni di fatto. Gartner non fornisce alcuna garanzia, espressa o implicita, in relazione a questa ricerca, incluse le garanzie di commerciabilità o idoneità ad esigenze specifiche.

GARTNER è un marchio registrato e un marchio di servizio e MAGIC QUADRANT è un marchio registrato di Gartner Inc. e/o delle sue affiliate negli Stati Uniti e a livello internazionale ed entrambi vengono utilizzati nel presente documento previa autorizzazione. Tutti i diritti riservati.

Finance guidato dall'intelligenza artificiale: sfruttare un ambiente con agent

Finance guidato dall'intelligenza artificiale: sfruttare un ambiente con agent

AI agent: in che modo i CFO automatizzeranno quasi tutti i processi finanziari

AI agent: in che modo i CFO automatizzeranno quasi tutti i processi finanziari

Serie di demo sulle Oracle Cloud Applications

Serie di demo sulle Oracle Cloud Applications