Oracle Enterprise Resource Planning(ERP)

지속적인 변화는 지속적인 혁신을 필요로 합니다

내일의 리더는 현재의 변화에 가장 잘 적응하는 기업입니다. Oracle Fusion Cloud ERP는 완벽한 최신 클라우드 ERP 제품군으로, 속도를 늦추는 수동 프로세스를 자동화하는 AI, 시장 변화에 실시간으로 반응할 수 있는 분석, 최신 상태를 유지하고 경쟁우위를 확보할 수 있는 자동 업데이트 등 고급 기능을 제공합니다.

-

![]() AI 기반 재무: 에이전트 활용하기

AI 기반 재무: 에이전트 활용하기

온디맨드 웨비나를 통해 AI를 활용한 실질적인 비즈니스 성과 도출 방법, 재무의 미래를 위한 조직적 준비 방법을 살펴보세요. AI를 새로운 경쟁력의 원천으로 만들어 보세요.

-

![]() 재무팀과 AI: 효율성의 미래

재무팀과 AI: 효율성의 미래

AI가 비접촉 방식 예측 운영을 통해 전통적인 재무 프로세스를 대체하는 방식을 확인해 보세요.

-

![]() ERP용 AI 에이전트로 재무 역량 강화하기

ERP용 AI 에이전트로 재무 역량 강화하기

Oracle AI를 사용해 기업 조직의 재무 운영, 의사결정 프로세스, 전반적인 비즈니스 성과를 개선하는 방법을 확인해 보세요.

Oracle Fusion Cloud Enterprise Resource Planning

더 나은 결정을 내릴 수 있도록 명확한 재무 상황 파악

Oracle Financials는 재무 상태와 결과에 대한 전체 보기를 제공하므로 끊임없이 변화하는 비즈니스 환경에 신속하게 대응할 수 있습니다.

기능

- Accounting Hub

- 보고 및 분석

- 미지급금 및 자산

- 매출 관리

- 미수금

- 수금

- 경비 관리

- 합작 투자 관리

- U.S. Federal Financials

비즈니스 전략에 맞게 프로젝트 조정

Oracle Project Management는 프로젝트를 계획 및 추적하고, 적절한 인재를 할당하고, 용량을 수요와 균형을 이루며, 필요에 따라 빠르게 리소스를 확장하거나 축소하는 데 도움이 됩니다.

기능

- 계획, 일정 수립 및 예측

- 자원 관리

- 비용 관리 및 제어

- 청구 및 수익 관리

- 보조금 관리

- 프로젝트 자산 관리

조달 간소화를 통한 비용 최적화 및 리스크 절감

Oracle Procurement는 공급업체 관리 간소화, 최고 공급업체 선정 지원, 규제를 준수하는 수준의 지출 보장, 수익성 개선을 지원하는 직관적인 사용자 경험, 내장형 AI, 분석 및 협업 기능을 통해 소싱에서 결제에 이르는 전 과정을 간소화 및 통합합니다.

기능

- 공급업체 관리

- 공급자 포털

- 발굴

- 조달 계약

- 셀프 서비스 조달

- 구매

- 미지급금

- Procurement Analytics

자동화된 모니터링으로 신뢰 구축 및 위험 감소

Oracle Risk Management and Compliance는 인공 지능(AI) 및 머신 러닝(ML) 기술을 활용해 재무 관리를 강화함으로써 현금 누출을 방지하고, 감사를 실시하고, 새로운 위험요인들로부터의 보호를 제공할 뿐 아니라 오랜 시간을 할애해야 했던 재무 분야의 각종 수작업을 줄여 줍니다.

기능

- ERP 역할 및 보안 설계

- 직무 분리 자동화

- 지속적 액세스 모니터링

- 사용자 액세스 인증

- 구성 제어

- 트랜잭션 제어

- 감사 및 SOX/ICFR 워크플로

- 비즈니스 지속성 계획

민첩성으로 뛰어난 성능

Oracle Enterprise Performance Management를 사용하면 재무, HR, 공급망 및 영업 전반에서 모델링하고 계획할 수 있습니다. 재무 결산을 간소화하고 인사이트를 확보하여 더 나은 결정을 내리세요.

기능

AI를 활용한 예측 및 분석

Oracle Analytics for Cloud ERP는 Oracle Cloud ERP의 내장 분석을 보완하여 분산 분석 및 과거 추세를 기반으로 사전 패키징된 사용 사례, 예측 분석 및 KPI를 제공합니다.

기능

- KPI 관리

- 모범 사례 메트릭 라이브러리

- 사전 구축된 분석 모델

- 확장 가능한 아키텍처

- 사업 내용 영역

- 셀프 서비스 데이터 검색

- 증강 분석

- 협업 및 퍼블리싱

- 엔터프라이즈 아키텍처 및 보안

- 모바일 탐색

Choose the analyst report for your industry

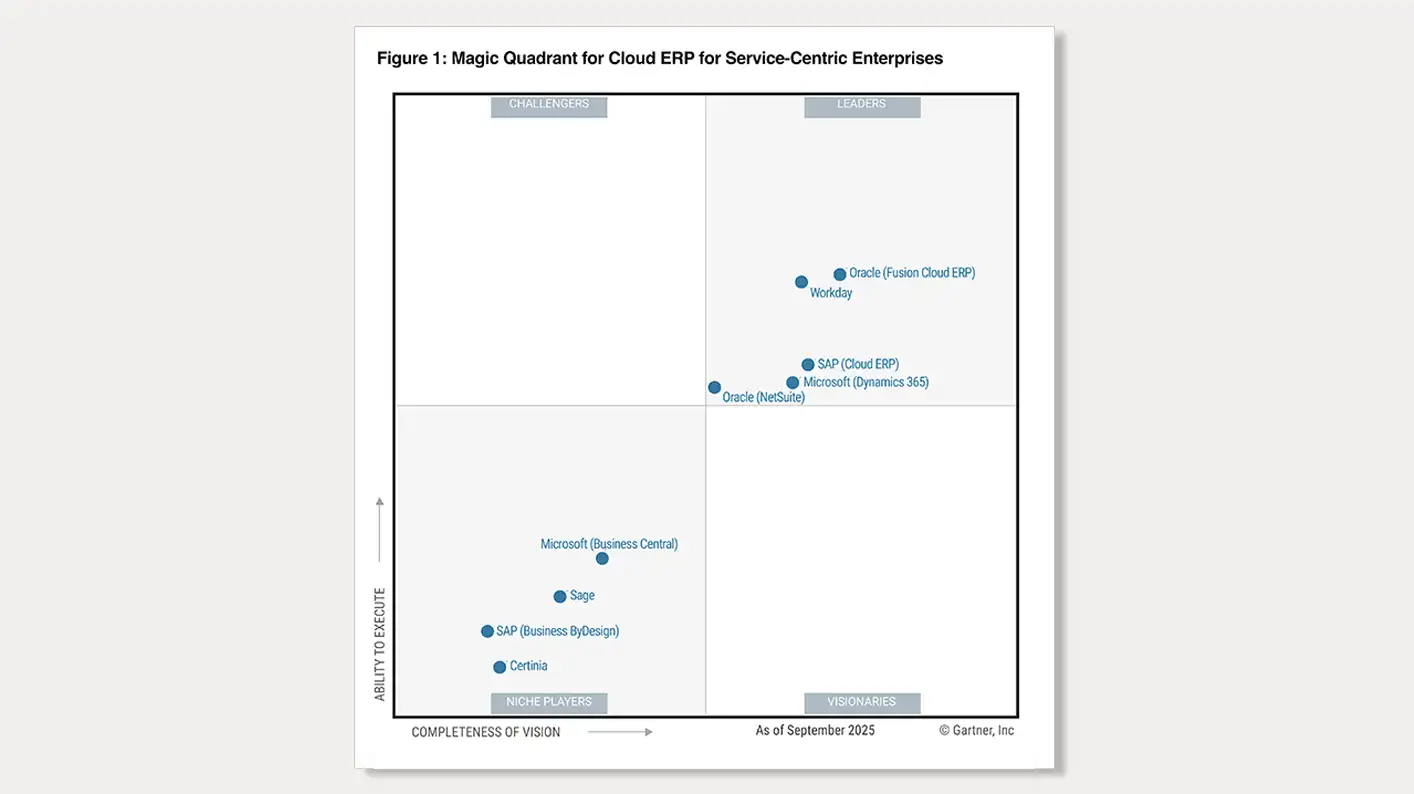

Find out why Oracle was named a Leader in the 2025 Magic Quadrant™ for Cloud ERP for Service-Centric Enterprises, placing highest in “Ability to Execute” and furthest right in “Completeness of Vision.”*

Find out why Oracle was named a Leader in the 2025 Magic Quadrant™ for Cloud ERP for Product-Centric Enterprises.**

내장된 AI(인공 지능)를 통한 완벽한 클라우드 ERP

새로운 상황에 대한 예측, 탐지, 대응

예측과 실제 값 사이의 오차가 큰 것을 좋아하는 사람은 없습니다. 그러나 대부분의 모델은 샘플 데이터세트를 이용하거나 추측에 의존하기 때문에 너무 제한적입니다. Oracle Cloud ERP는 예상 계획 및 예측을 위한 머신 러닝을 도입하여 더욱 폭넓은 데이터세트를 활용하고, 숨겨진 편향 및 큰 편차를 발견하며 전체 응답 시간을 단축합니다.

수동 비즈니스 프로세스 자동화 및 제거

데이터 컴파일 시간을 줄이고 데이터 분석에 더 많은 시간을 투자하십시오. 주식 시장에서의 평판을 준비하거나 잠재적 M&A 활동을 분석하는 경우에도 Oracle Cloud ERP는 시간 소요가 큰 반복적 비즈니스 프로세스를 자동화함으로써 팀이 전략적 작업에 더 많은 시간을 할애할 수 있도록 합니다. AI를 활용하면 최대 96%의 거래를 자동화할 수 있습니다.

일상 작업의 간소화 및 가속화

Oracle의 AI 기반 디지털 어시스턴트는 일반 작업을 간소화, 가속화하며 '진행 중인 구매 요청 상태는?', '오늘 만기되는 조정은?' 같은 간단한 질문에도 답해 드립니다. 송장이나 예산 초과 알림 등의 개인화된 작업이 사전에 전달되어 더 빠르게 승인할 수 있습니다.

Cloud ERP의 문서 IO 에이전트로 구매조달 절차 간소화하기

Oracle의 문서 IO 에이전트는 공급업체, 고객, 금융 기관 등 제3자를 대상으로 한 복잡한 통합 온보딩의 자동화 및 간소화를 지원합니다. 이 AI 에이전트는 효율성을 높이고, 모든 트랜잭션, 전자 채널, 문서 표준, 양식, 언어 전반에서의 문서 수집 및 생성 방식을 개선합니다.

엔터프라이즈 자원소요계획 자료

Oracle Cloud ERP의 새로운 기능을 확인하세요.

Cloud ERP 준비도 섹션에서 업데이트, 설명서 및 튜토리얼을 확인할 수 있습니다.

Oracle Fusion Cloud ERP가 리더인 이유 확인하기

Oracle의 ERP 솔루션은 처음부터 클라우드에 기반을 두고 만들어졌습니다. 또한 스마트하고, 완벽하게 연결되어 있으며, 유연성 제공을 염두에 두고 구축되었습니다.

고객 커뮤니티에 대한 약속

Oracle 역시 Oracle Cloud에서 우리의 전체 비즈니스를 운영하고 있습니다. 또한 우리는 귀사와의 파트너십을 통해 우리의 경험을 공유하고 귀사의 성공을 돕습니다.

Oracle Cloud Applications 스킬 챌린지로 경쟁 우위 확보하기

5월 15일까지 Oracle의 스킬 챌린지에 참여해 Oracle Fusion Cloud ERP의 최신 버전에 대한 무료 교육 및 인증을 받아보세요. Oracle Cloud Applications, Oracle Modern Best Practice, Oracle Cloud Success Navigator와 관련된 강력한 기반을 구축할 수 있습니다. 게임을 플레이하고, 보상을 받고, 경쟁하며 상품을 획득해 보세요.

Oracle ERP 시작하기

ERP 데모 요청하기

전문가와 함께 제품을 자세히 둘러보세요.

ERP 둘러보기

직접 Oracle Cloud ERP를 살펴보세요.

SaaS ERP 영업 팀에 문의하기

Oracle Cloud ERP에 대한 문의사항이 있다면 Oracle 팀원과 이야기 나눠보세요.

* Gartner® Magic Quadrant™ Cloud ERP for Service-Centric Enterprises, October 13, 2025. Robert Anderson, Johan Jartelius, Tomas Kienast, Sam Grinter, Denis Torii, Chaithanya Paradarami.

** Gartner® Magic Quadrant™ for Cloud ERP for Product-Centric Enterprises, 13 October 2025. Greg Leiter, Tomas Kienast, Johan Jartelius, Denis Torii, Dennis Gaughan.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Oracle. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademarks and service mark, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

AI 기반 재무: 에이전트 활용하기

AI 기반 재무: 에이전트 활용하기

재무팀과 AI: 효율성의 미래

재무팀과 AI: 효율성의 미래

ERP용 AI 에이전트로 재무 역량 강화하기

ERP용 AI 에이전트로 재무 역량 강화하기