Oracle Cloud EPM Financial Consolidation and Close

Close your books faster with more accuracy and flexibility.

Oracle Cloud EPM Financial Consolidation and Close

Pre-built best practices

Start quickly

Get up and running fast with built-in best practice functionality, including dynamic calculations.

Meet your needs without customization

Reduce your need for customization, because cash flow, balance sheet, income statement, rollovers, calls to action, and more are automatically calculated.

Readily meet global reporting requirements

Decrease the time it takes to meet global reporting requirements, including International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) with a preconfigured consolidation model.

Global, advanced consolidation and close

Perform complex consolidations

Increase the accuracy and speed of the close process by reclassifying, adjusting, and eliminating data for any hierarchy with pre-built consolidation support. Work easily with the most complex legal and management rollups that may have unique calculations and reporting requirements.

Manage KPIs

Manage the close by automatically tracking key metrics across the organization. You can use out-of-the-box calculations or easily create ones for business-specific requirements.

Automate intercompany eliminations

Reduce manual work by using automatic, standard intercompany eliminations. There are additional capabilities to customize if needed.

Translate currencies

Increase consolidation accuracy by using standard or customizable currency translations.

Consolidate globally

Consolidate your global organization with GAAP-driven applications that have full currency support, intercompany eliminations, equity eliminations, adjustments, and detailed data source tracking.

Intelligent performance management (IPM)

Automate consolidations

Gain efficiencies with AI and ML technologies that automate consolidations in the background, eliminating routine, manual efforts.

Orchestrate a connected and continuous close

Streamline the end-to-end close with automated process monitoring, integration, and workflow capabilities. Centrally manage and post journals directly to any general ledger.

Automate narratives in reports

Reduce time and add insight to reports by generating narrative commentary from GenAI.

Compliance and transparency

Enable audit compliance

Provide transparency and audit compliance for tasks like journal adjustments with enforced segregation of duties, data changes, visible calculations, and user activity logging. Always see what changes have been made and by whom to the data.

Incorporate supplemental data

Provide the full picture for statement balances by gathering supporting detail. Easy-to-create templates help with signoffs, validations, and drill-back from source to create footnotes, statement analysis, and track detailed information.

Financial Consolidation and Close use cases

Manage IFRS 18 compliance

Navigate IFRS 18's new profit and loss presentation requirements with Oracle Cloud EPM's parallel run capabilities, enabling comparative restatements and automated management performance measure disclosures.

Managing IFRS 18 compliance (PDF)

Owned by the business, easily configure financial close processes

Design and configure your financial consolidation and close workflows to support your business needs, without the help of IT.

Move Hyperion to the cloud for greater agility

To stay on top of innovation and remain agile, Oracle Hyperion on-premises customers are moving to Oracle Cloud EPM solution.

Move to Cloud EPM

4 Must-Have Attributes of a Complete Financial Consolidation Solution

Rich Wilkie, VP, EPM Product Management, Oracle | Emma Yu, Director, EPM Product Marketing, Oracle

According to research by Aberdeen, best-in-class companies are more likely to use a complete, integrated enterprise performance management (EPM) solution. Unlike imposters, such an EPM suite includes powerful financial close capabilities like automated reporting with narrative analysis or detailed process orchestration for real-time visibility into close process status.

Read the complete postResources

Learn what's new in the latest EPM release

Review readiness material to learn what's new in your EPM cloud service and plan for quarterly updates.

Access a library of documentation

Oracle Help Center provides detailed information about our products and services with targeted solutions, getting started guides, and content for advanced use cases.

Join a community of your peers

Cloud Customer Connect is Oracle's premier online cloud community. With more than 200,000 members, it's designed to promote peer-to-peer collaboration and sharing of best practices, product updates, and feedback.

Develop your Oracle Cloud EPM skills

Oracle University provides learning solutions to help build cloud skills, validate expertise, and accelerate adoption. Get access to free basic training and accreditation with the Oracle Learning Explorer program.

Learning resources

On-premise products

Oracle Hyperion Planning, an agile planning solution that supports enterprise-wide planning, budgeting, and forecasting, provides a robust modeling framework to help businesses develop reliable financial forecasts and produce cost-effective enterprise alignment.

Pages

Get started with Oracle Cloud EPM

Request a demo

Walkthrough our solution with one of our experts.

Take a tour

Explore Oracle Cloud EPM on your own.

Contact sales

Talk to a member of our team about Oracle Cloud EPM.

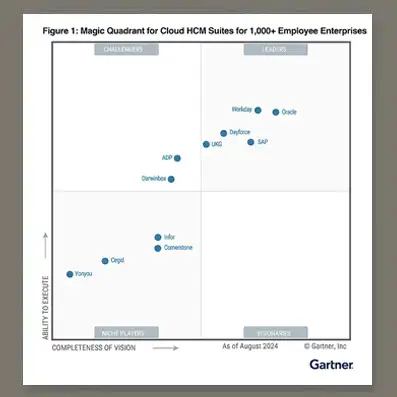

* Gartner® Magic Quadrant for Financial Close and Consolidation Solutions, March 25, 2025. Jeffrin Francis, Nisha Bhandare, Renata Viana, Permjeet Gale.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, MAGIC QUADRANT is a registered trademarks of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document.