Fusion Cloud Financials

Financial management innovation with Oracle

Give your finance team better data to increase forecasting accuracy, shorten reporting cycles, simplify decision-making, and better manage risk and compliance. Oracle Fusion Cloud Financials is a global financial platform that connects and automates your financial management processes, including payables, receivables, fixed assets, expenses, and reporting, for a clear view into your total financial health.

-

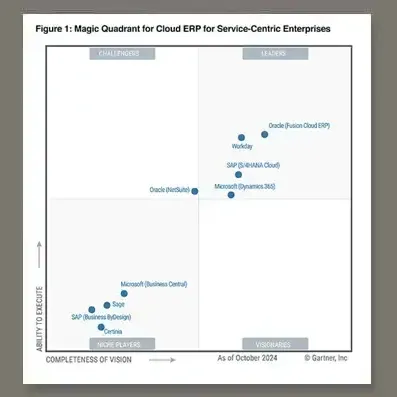

![]() Oracle named a Leader in the Gartner® Magic Quadrant™ for Service-Centric Enterprises

Oracle named a Leader in the Gartner® Magic Quadrant™ for Service-Centric Enterprises

Find out why Oracle was placed furthest in "Completeness of Vision" and highest in "Ability to Execute".*

-

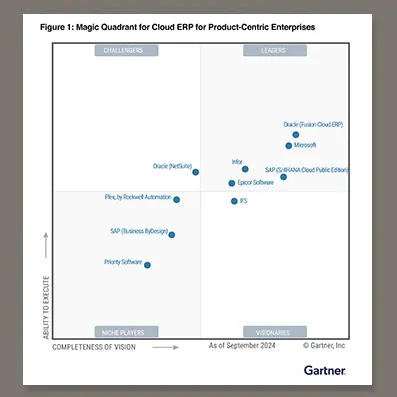

![]() Oracle named a Leader in the Gartner® Magic Quadrant™ for Product-Centric Enterprises

Oracle named a Leader in the Gartner® Magic Quadrant™ for Product-Centric Enterprises

Find out why Oracle is a Leader yet again.**