Oracle Cloud EPM Financial Consolidation and Close

事前に構築されているベストプラクティス

すぐに開始

動的計算をはじめとする組み込みのベストプラクティス機能を使用し、すばやく起動して実行します。

カスタマイズを必要とせずにニーズに対応

キャッシュ・フロー、貸借対照表、損益計算書、ロールオーバー、行動喚起などが自動的に計算されるため、カスタマイズの必要性が少なくなります。

グローバルなレポート要件にただちに対応

事前構成した連結モデルを使用して、国際会計標準(IFRS)や一般会計原則(GAAP)などのグローバルな報告要件への対応に要する時間を短縮します。

グローバルで高度な連結と決算処理

複雑な連結を実行する

事前に構築した連結サポートを使用して、任意の階層のデータを再分類、調整、および除去することにより、決算処理プロセスの精度と速度の向上を図ります。独自の計算とレポートの要件が考えられる、きわめて複雑な法的および管理上のロールアップを容易に扱うことができます。

KPIを管理する

組織全体の主要な指標を自動的に追跡することにより、決算処理を管理します。すぐに使用できる計算を使用できるほか、ビジネス固有の要件に適した計算を容易に作成することもできます。

会社間消去を自動化する

自動の標準的な会社間消去を使用して、手作業を削減します。必要に応じてカスタマイズできる追加機能があります。

通貨を換算する

標準の通貨換算またはカスタマイズ可能な通貨換算を使用して、高精度な連結を実現します。

グローバルに連結する

あらゆる通貨のサポート、会社間消去、資本消去、調整、および詳細なデータ・ソース追跡を備えたGAAP主導のアプリケーションを使用して、グローバルな組織を連結します。

インテリジェントなパフォーマンス管理 (IPM)

連結を自動化

AIや機械学習テクノロジーにより、統合を自動化して透過的に実行し、日常的な手作業を排除することで効率性を向上させます。

つながりのある継続的な決算を実現

自動化したプロセス・モニタリング、プロセス統合、およびワークフロー機能により、エンドツーエンドの決算処理を合理化します。仕訳を一元管理し、すべての総勘定元帳に直接転記します。

レポートのナラティブを自動化

分かりやすい解説を生成AIに作成させることで、レポート作成にかかる時間を短縮し、より深いインサイトを得ることができます。

コンプライアンスと透明性

監査のコンプライアンスを有効化

職務、データ変更、目に見える計算、ユーザー・アクティビティのログ記録の強制的な分離による仕訳修正などのタスクに透明性と監査のコンプライアンスを提供します。データを誰がどのように変更したかをいつでも把握できます。

補足データを取り込み

裏付けとなる詳細を収集することにより、残高明細の全体像が得られます。作成が容易なテンプレートは、サインオフ、検証、およびソースからのドリルバックによって、脚注の作成、分析の説明、および詳細情報の追跡を進める際に効果的です。

Financial Consolidation and Closeのユース・ケース

IFRS 18に対するコンプライアンスを管理

Oracle Cloud EPMの並列実行機能により、IFRS 18の新しい損益表示要件をナビゲートし、比較再表示と自動管理パフォーマンス測定の開示を可能にします。

IFRS 18コンプライアンスの管理(PDF)

ビジネス・オーナーが所有し、決算処理プロセスを容易に構成

IT部門の助言を必要とすることなく、ビジネス・ニーズに対応できるように財務連結と決算処理のワークフローを設計および構成します。

Hyperionをクラウドに移行してアジリティを向上

オンプレミスのOracle Hyperionのお客様は、イノベーションの最先端の位置と俊敏性を維持するために、

Oracle Cloud EPMソリューションに移行しています。

完全な財務連結ソリューションに必須の4つの属性

オラクル、EPM製品管理担当バイスプレジデント(VP)、Rich Wilkie | オラクル、EPM製品マーケティング担当ディレクター、Emma Yu

Aberdeen社の調査によると、クラス最高の企業ほど、完全に統合されたエンタープライズ・パフォーマンス管理(EPM)ソリューションを使用する傾向が強くなっています。まがい物の競合製品とは異なり、このようなEPMスイートは高機能な決算処理機能を備えています。そのような機能として、ナラティブ分析による自動レポートや、決算処理プロセスのステータスをリアルタイムで可視化するための詳細なプロセス・オーケストレーションなどがあります。

投稿全体を読むリソース

ドキュメント・ライブラリにアクセスする

オラクル・ヘルプ・センターでは、対象のソリューション、スタート・ガイド、最新のユース・ケースのコンテンツを含め、当社の製品とサービスに関する詳細情報を提供しています。

仲間が集まるコミュニティに参加する

Cloud Customer Connectはオラクルの主要なオンライン・クラウド・コミュニティです。20万人以上のメンバーで、ピアツーピアでのコラボレーションや、ベストプラクティス、製品の最新情報、フィードバックの共有を促進することを目的としています。

Oracle Cloud EPMのスキルを高める

Oracle Universityは、クラウドスキルの構築、専門知識の検証、導入の促進に役立つ学習ソリューションを提供します。Oracle Learning Explorerプログラムを使用して、無料の基本トレーニングと認定にアクセスしてください。

オンプレミス製品

Oracle Hyperion Planningは、企業全体の計画、予算編成、および予測をサポートする俊敏な計画ソリューションであり、企業が信頼できる財務予測を開発し、費用対効果の高い企業の調整を生み出すのに役立つ堅牢なモデリング・フレームワークを提供します。

ページ

Oracle Cloud EPMを使い始める

デモのリクエスト

当社のエキスパートによるウォークスルーをご体験ください。

ツアーを見る

Oracle Cloud EPMの詳細をご確認ください。

営業へのお問い合わせ

Oracle Cloud EPMについて当社チームの担当者がご案内します。

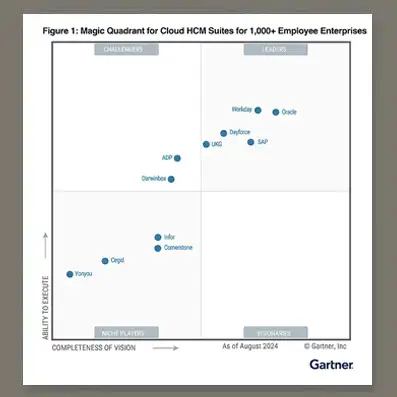

* Gartner® Magic Quadrant for Financial Close and Consolidation Solutions、2025年3月25日Jeffrin Francis、Nisha Bhandare、Renata Viana、Permjeet Gale。

GARTNERは、GARTNER, Inc.および/または米国とその他の国におけるその関連会社の登録商標およびサービス・マークであり、MAGIC QUADRANTは、GARTNER, Inc.および/またはその関連会社の登録商標であり、本書では許可を得て使用されています。All rights reserved.

Gartnerは、Gartnerリサーチの発行物に掲載された特定のベンダー、製品またはサービスを推奨するものではありません。また、最高のレーティング又はその他の評価を得たベンダーのみを選択するようにテクノロジーユーザーに助言するものではありません。Gartnerリサーチの発行物は、Gartnerリサーチの見解を表したものであり、事実を表現したものではありません。Gartnerは、明示または黙示を問わず、本リサーチの商品性や特定目的への適合性を含め、一切の責任を負うものではありません。

この図表は、Gartner, Inc.がリサーチの一部として公開したものであり、文書全体のコンテクストにおいて評価されるべきものです。